Sensor Tower: PC and Console Market in 2025

Electronic Arts is the top publisher by games downloads (sales are included); and Steam is approaching it's new record in Premium game sales.

The company released a report based on VG Insights data, which recently became part of Sensor Tower.

❗️The report came out at the end of August and covers the period from the beginning of 2025 up to August 3, 2025.

State of the PC and Console Market

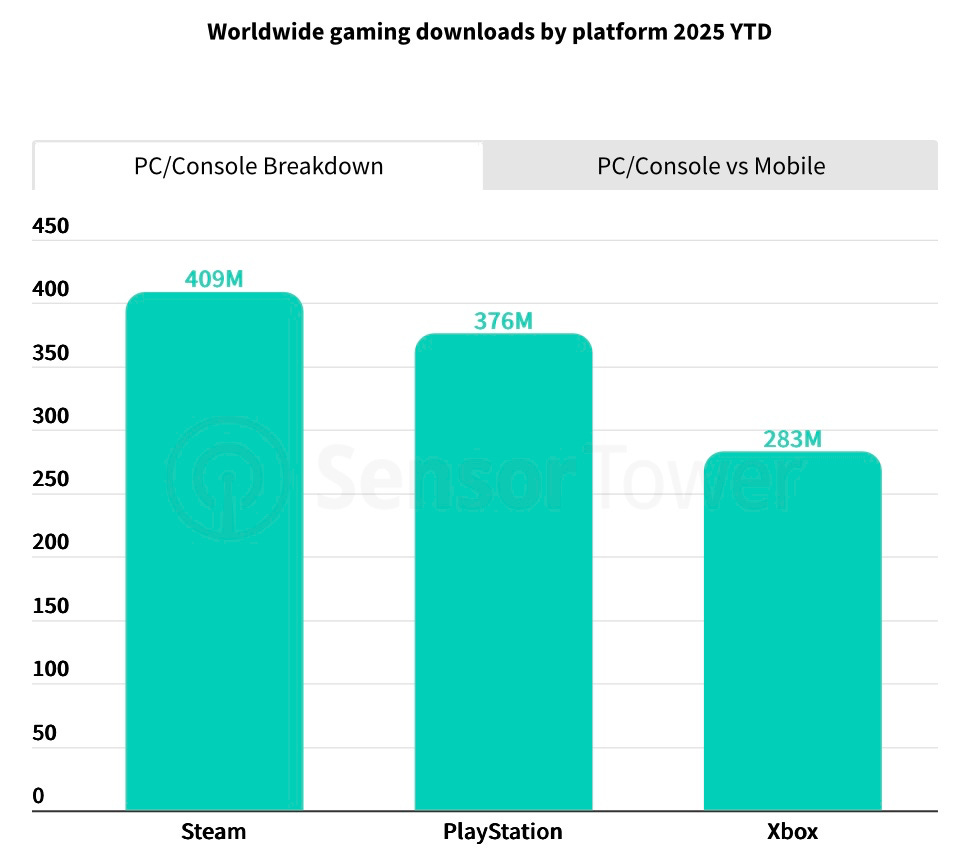

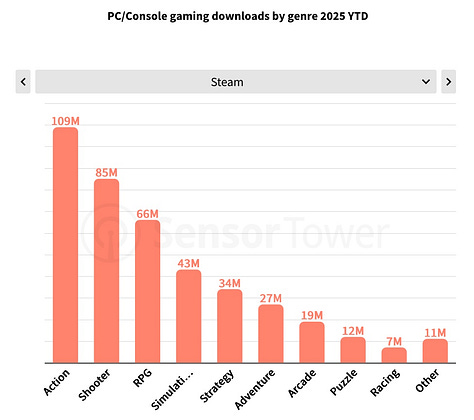

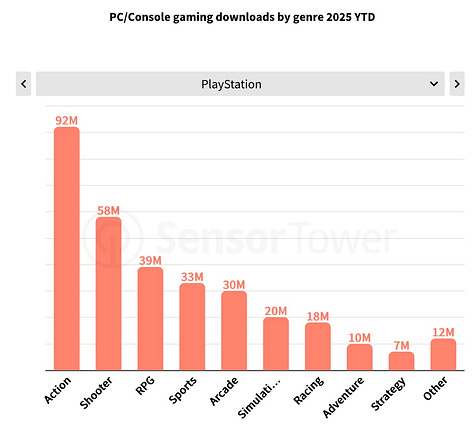

1.1 billion games were downloaded on PC and consoles in the first 7+ months of 2025. Steam accounted for 409 million downloads, PlayStation had 376 million, and Xbox had 283 million.

That 1.1 billion downloads may look like a big number on paper, but compared to 30.4 billion mobile installs in the same period, it is relatively small. However, a significant portion of PC and console downloads are paid games.

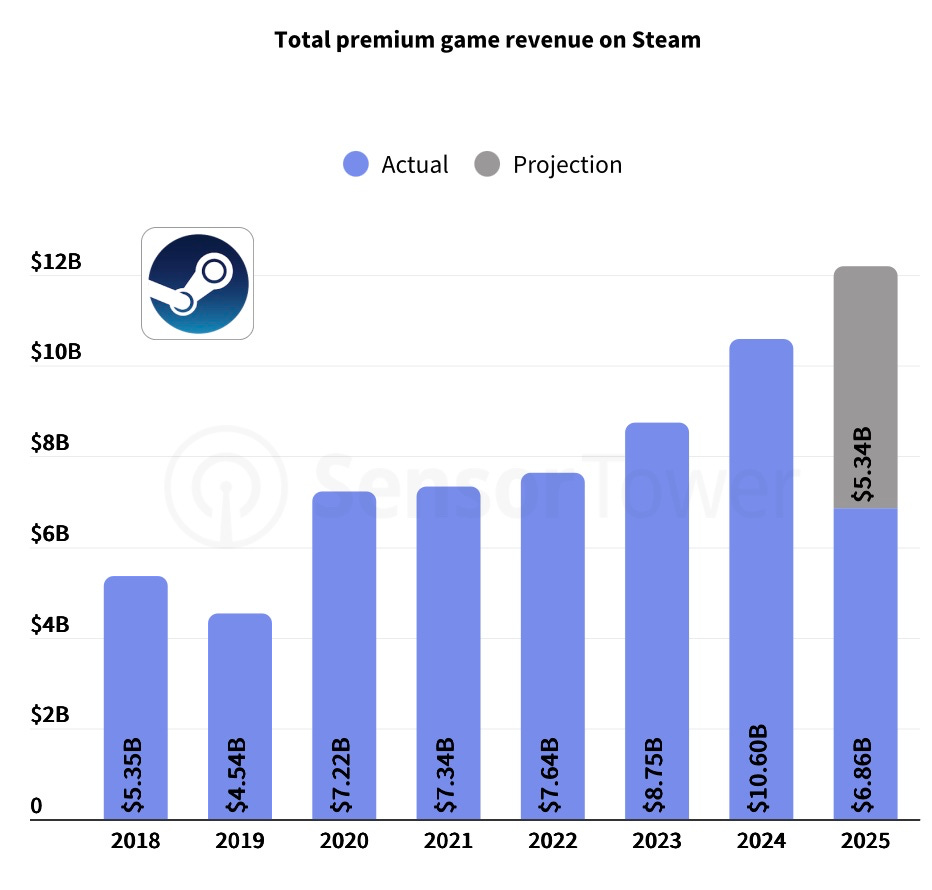

Paid games on Steam in 2025 are on track to hit a record. Already, sales are 15% higher than last year (also record-high). By the end of the year, paid games on Steam are expected to generate more than $12 billion.

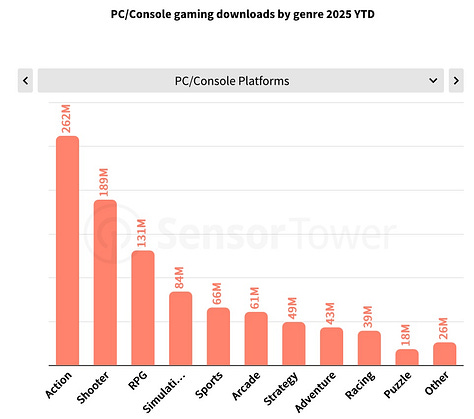

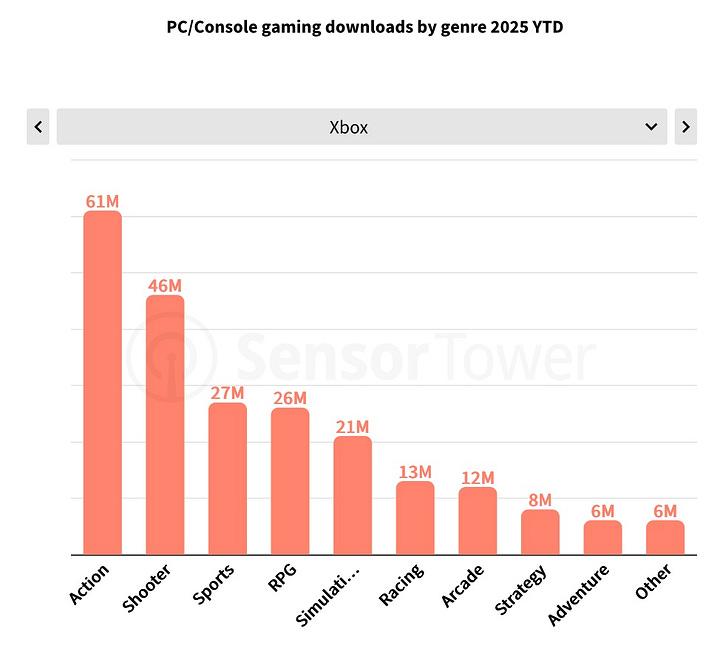

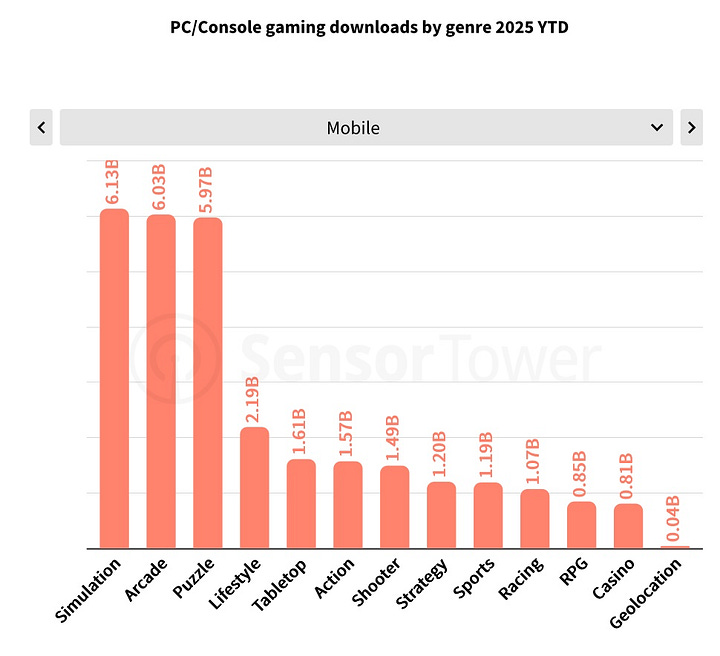

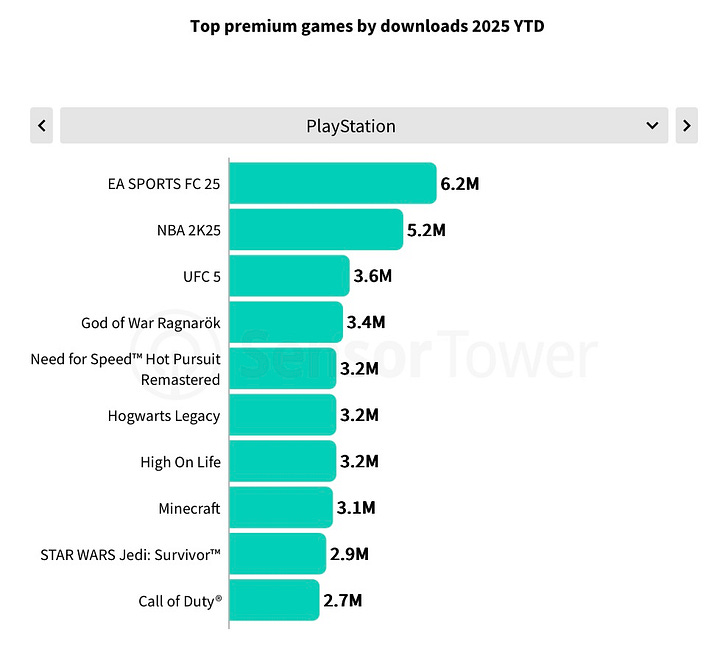

Action, shooters, and RPGs are the most popular genres on PC and consoles by downloads. Sports titles also perform strongly on consoles. On mobile, however, top genres are simulators, arcades, and puzzles, a very different split.

Webshop experience shouldn’t be static. That’s why Xsolla provides:

Adaptive Offer Chains that evolve with each purchase. Helps to increase spending.

A Discord Bot that brings commerce capabilities directly into Discord servers to communicate with the audience through many surfaces.

Browser-based push notifications (told you about many surfaces?). This particular feature brings up to a 30%+ conversion increase in real cases!

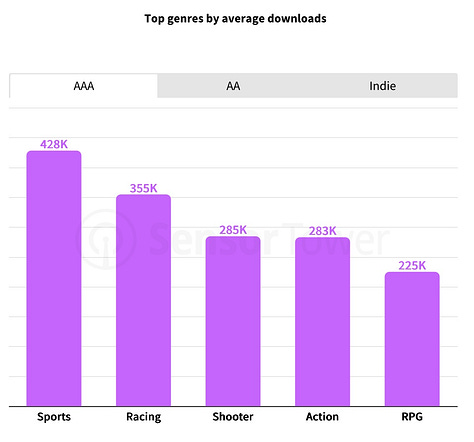

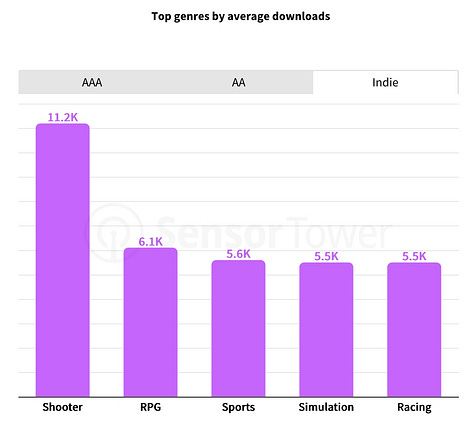

Among AAA games, sports titles (EA Sports FC, NBA 2K, UFC), racing (Forza, Need for Speed, F1), and shooters lead in average downloads.

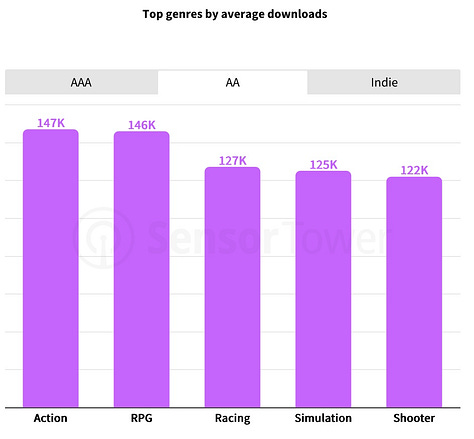

In the AA segment, action and RPGs are the strongest (Clair Obscur: Expedition 33, Kingdom Come: Deliverance II).

In indie projects sample, shooters are way ahead. Examples listed include Splitgate 2, High on Life, and Ready or Not.

❗️Calling a game like Splitgate 2, which is developed by a studio that raised over $100 million, an “indie project” is debatable. There’s no perfect taxonomy.

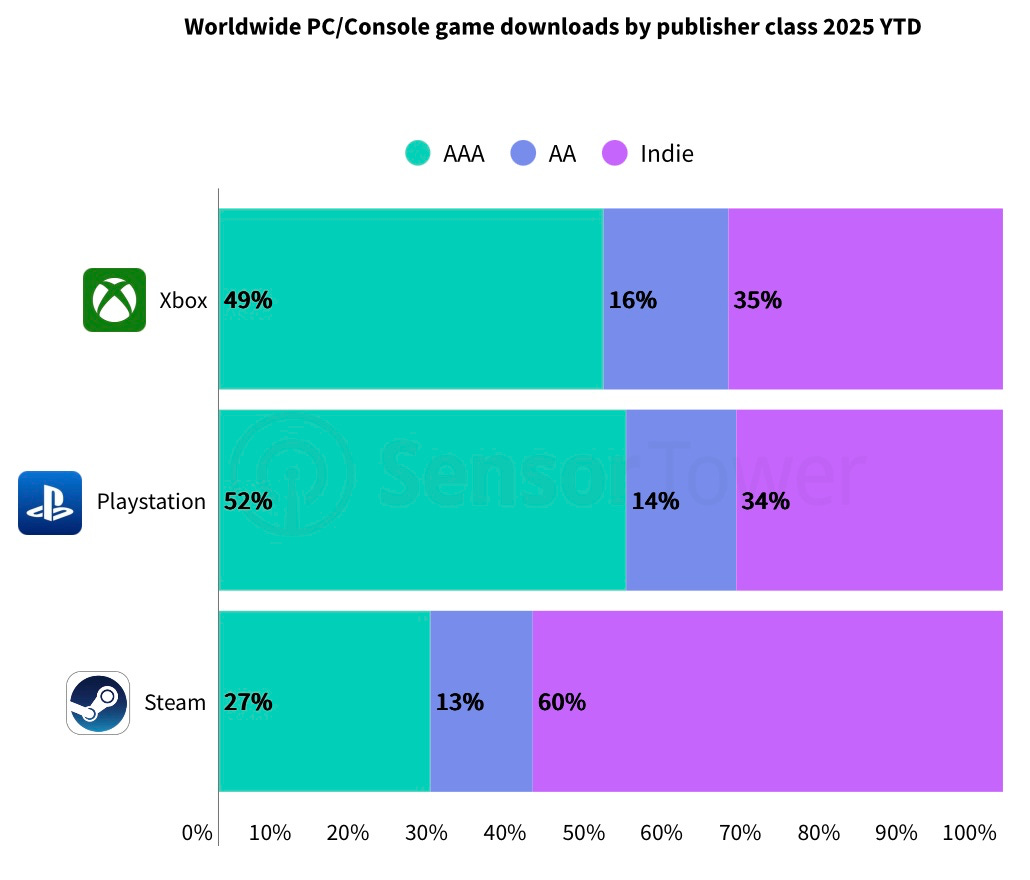

According to Sensor Tower, the share of F2P titles by downloads is: PlayStation – 17%; Steam – 21%; Xbox – 39%. The rest are paid projects. Slightly surprising, considering the dominance of Fortnite, Roblox, CS 2, and other live-service heavyweights.

Looking at scale, Steam is the main platform for indie developers by downloads: 60% of Steam downloads are indie titles, compared to 34–35% on PlayStation and Xbox.

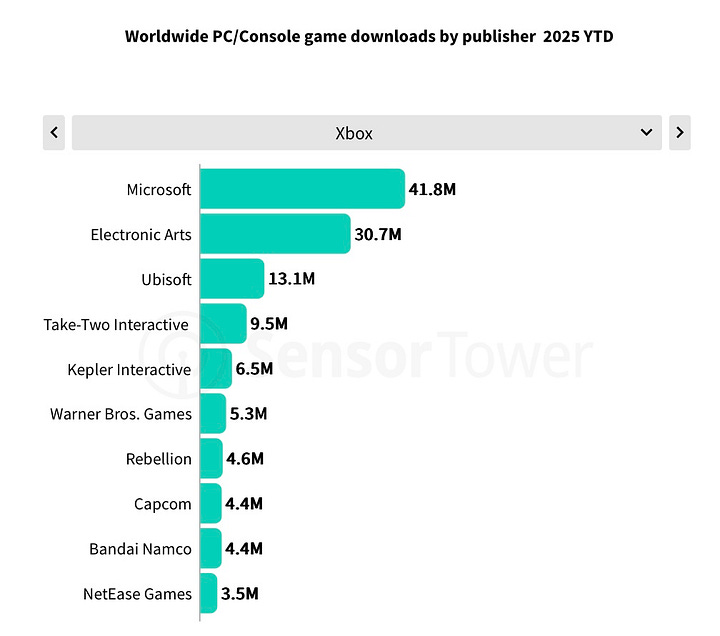

Top PC/Console Publishers

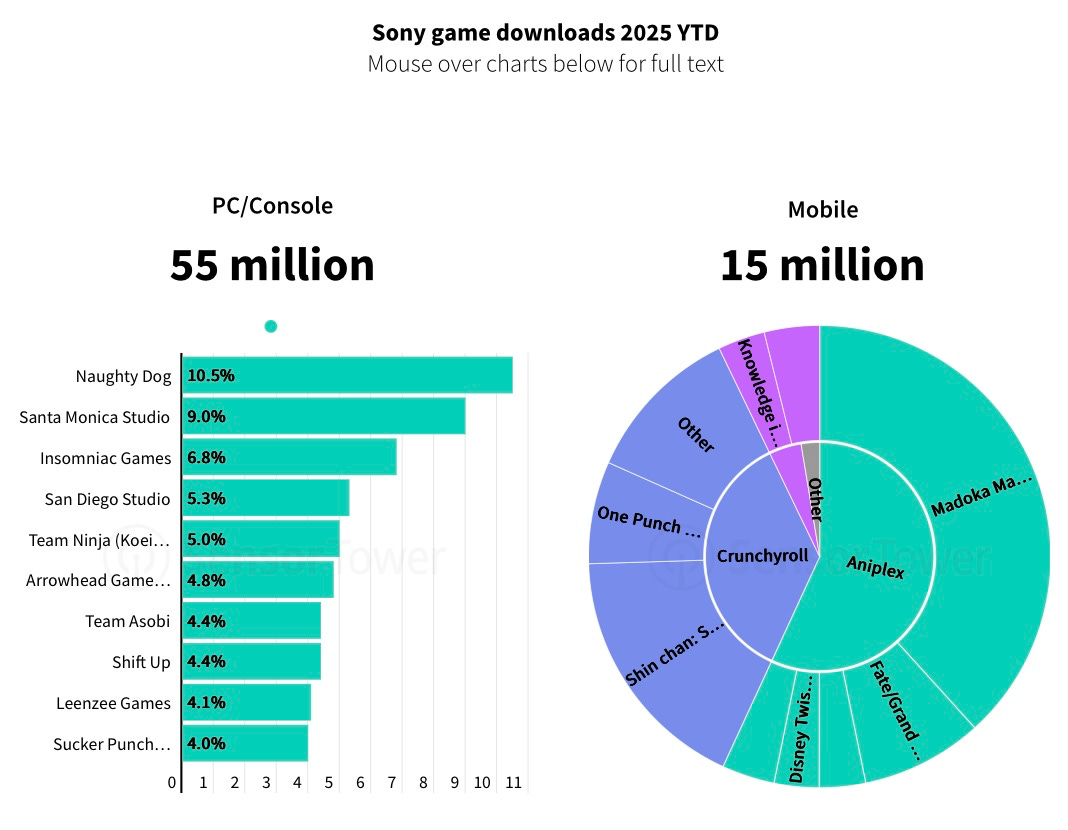

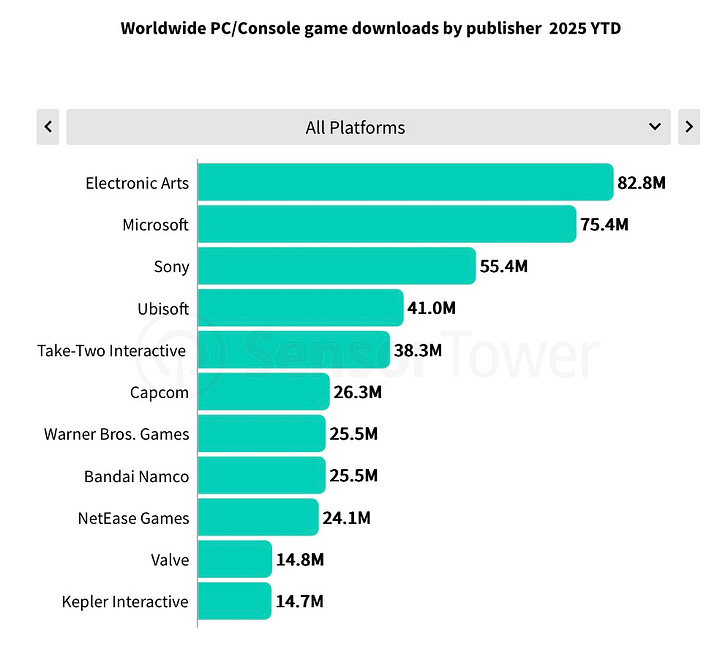

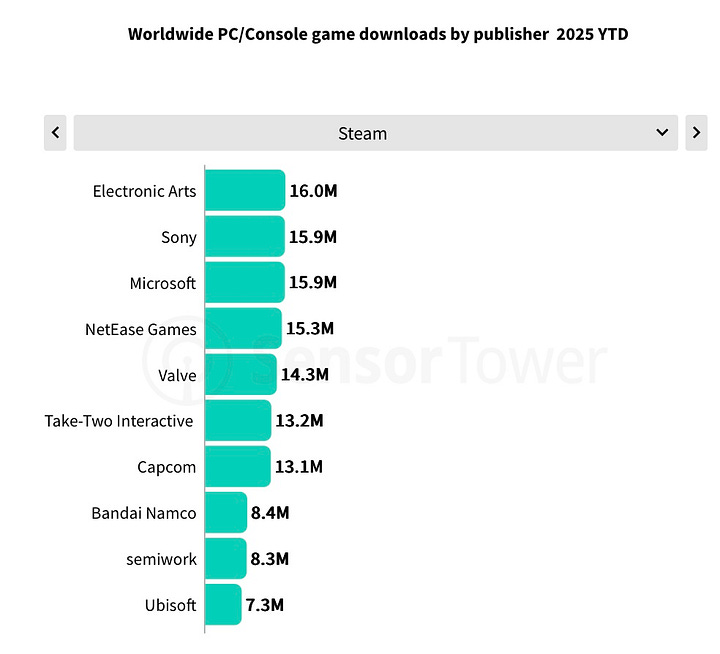

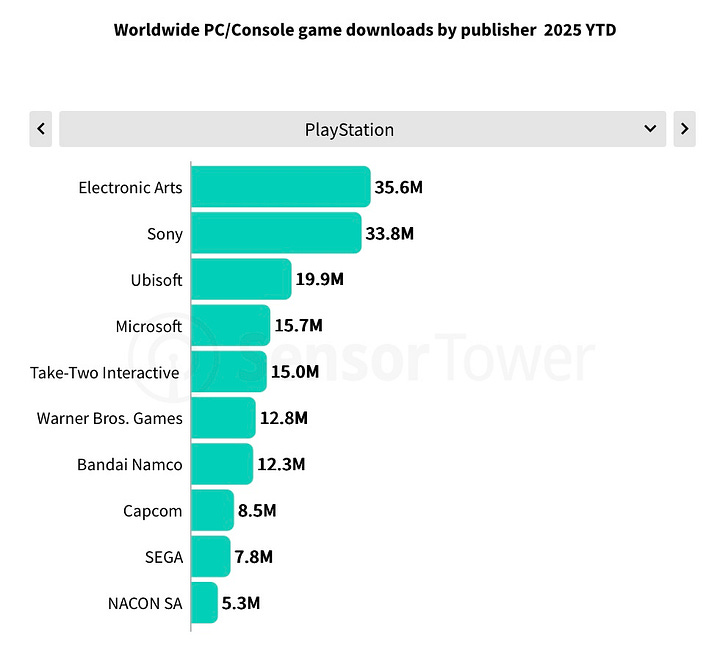

Electronic Arts was the most popular publisher from January to August 3, 2025, with 82.8 million downloads. For comparison, Microsoft had 75.4 million and Sony had 55.4 million. EA’s number will grow by year-end thanks to major sports releases traditionally dropping in late summer–early fall.

Besides strong PC/console performance (downloads include purchases), EA’s mobile business is also doing well, with 380+ million downloads in just over 7 months of 2025.

Microsoft shows a similar picture: 75 million PC/console installs plus 452 million on mobile, with more than half from King titles.

Sony’s mobile footprint is much smaller: mobile downloads are nearly 4x fewer than its PC and console installs.

Microsoft spent the most on advertising in the US during this period - $44.2 million. They’re followed by Epic Games ($40.6 million) and Take-Two ($26.3 million).

Most leading publishers are diversified, although some specialize (EA – sports, Capcom – RPG). NetEase is an outlier, with 93% of revenue coming from shooters.

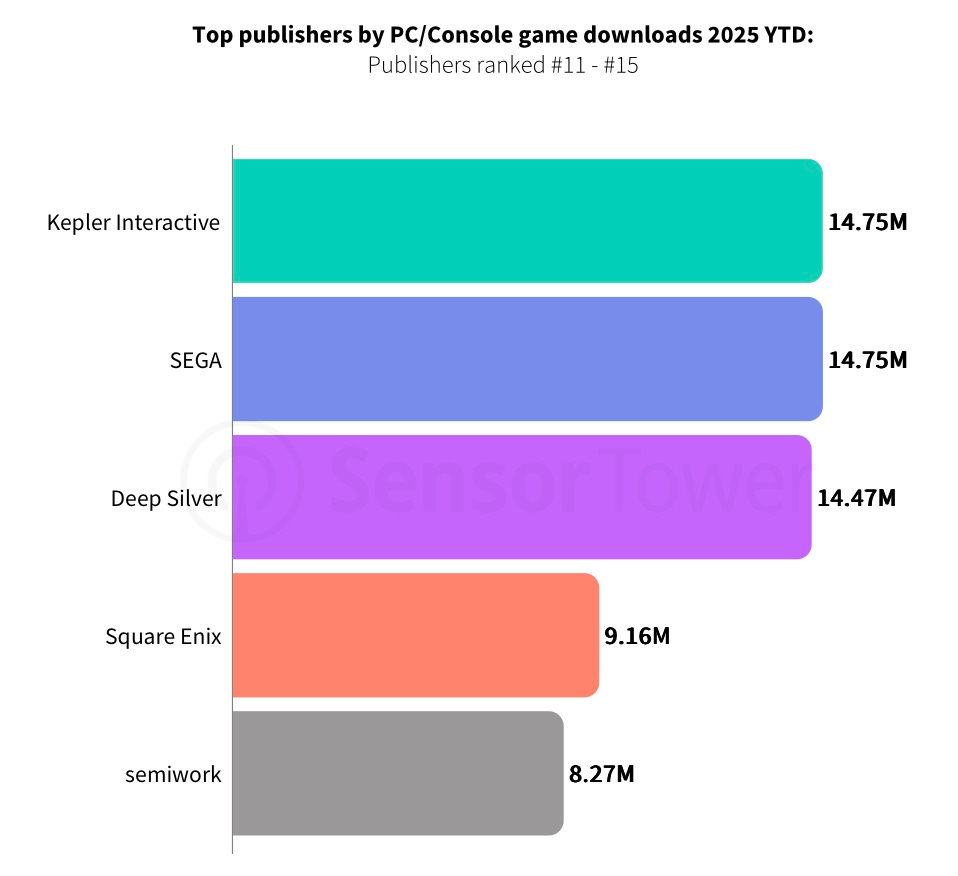

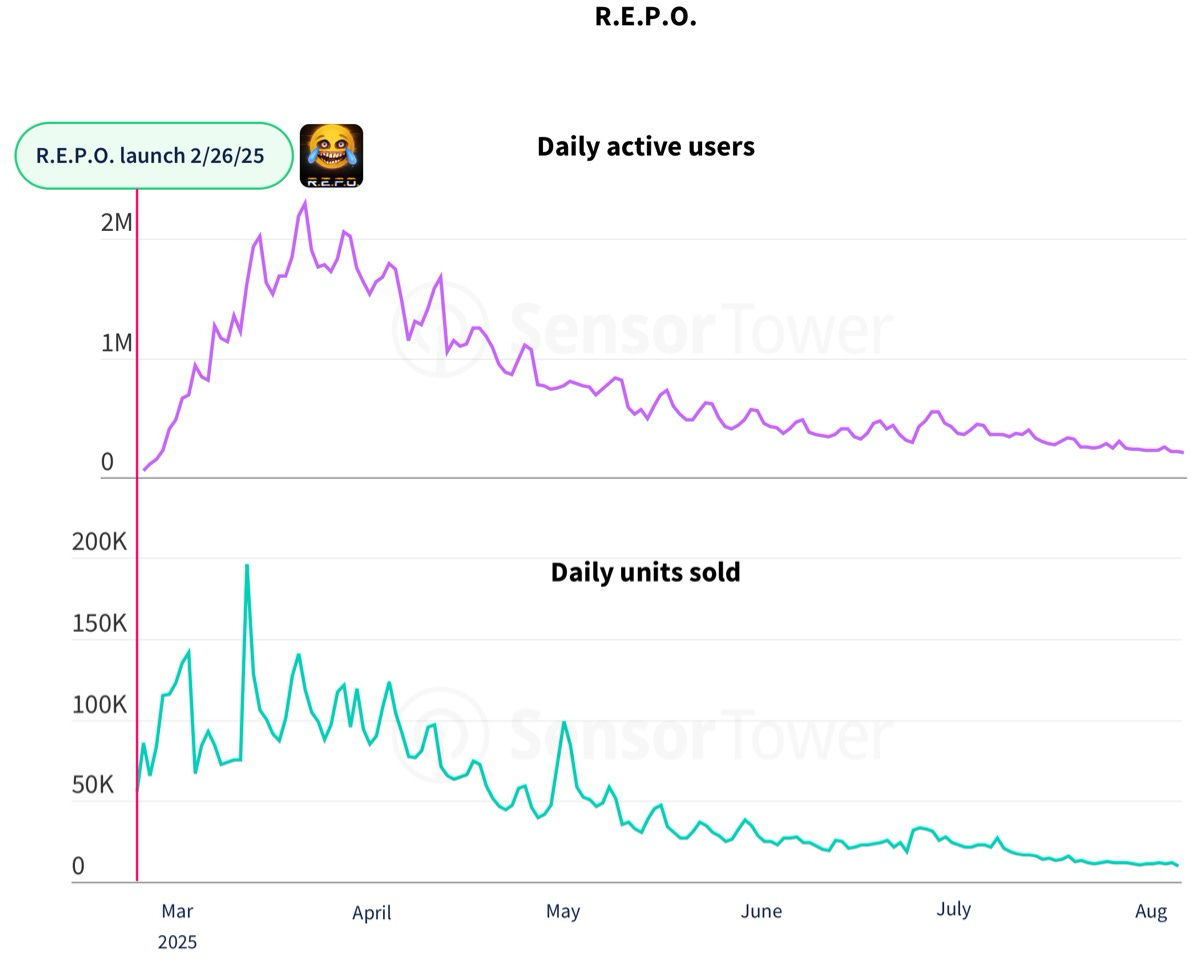

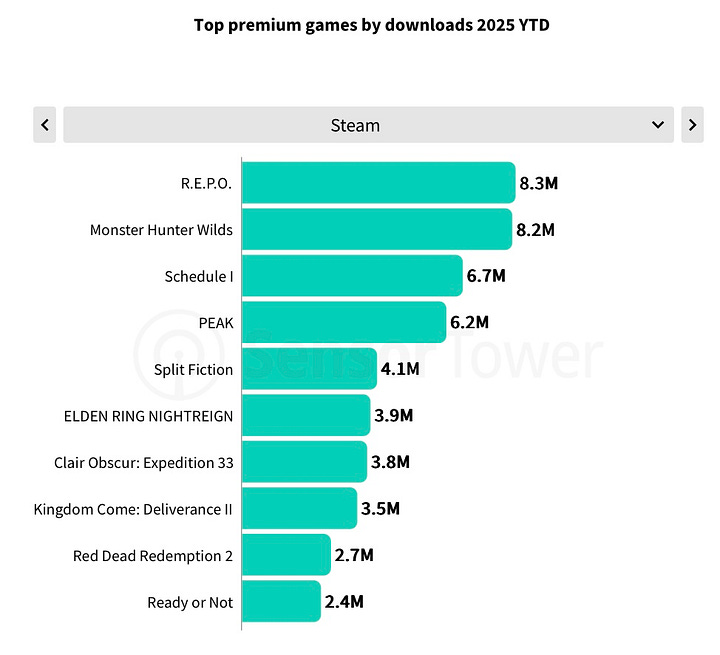

Outside the top 10, publishers with strong download figures include Kepler Interactive (14.75 million), SEGA (same), Deep Silver (14.47 million), Square Enix (9.16 million), and unexpectedly semiwork, creators of R.E.P.O (8.27 million).

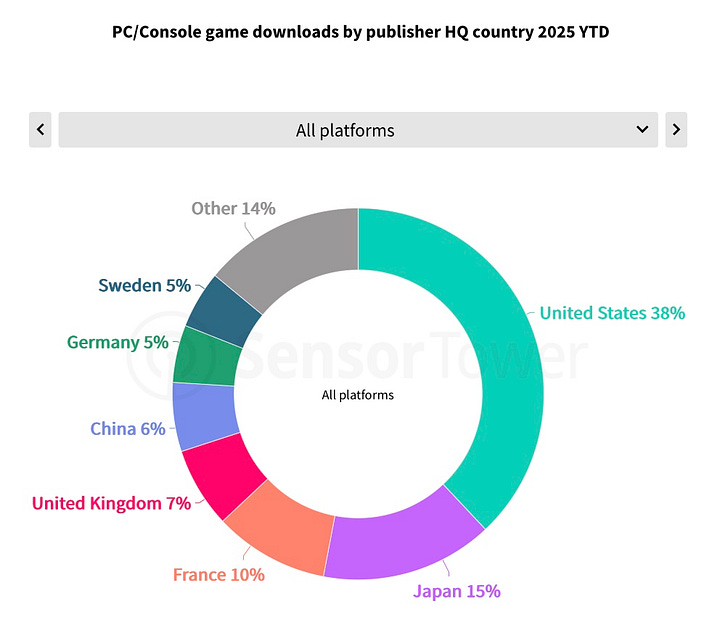

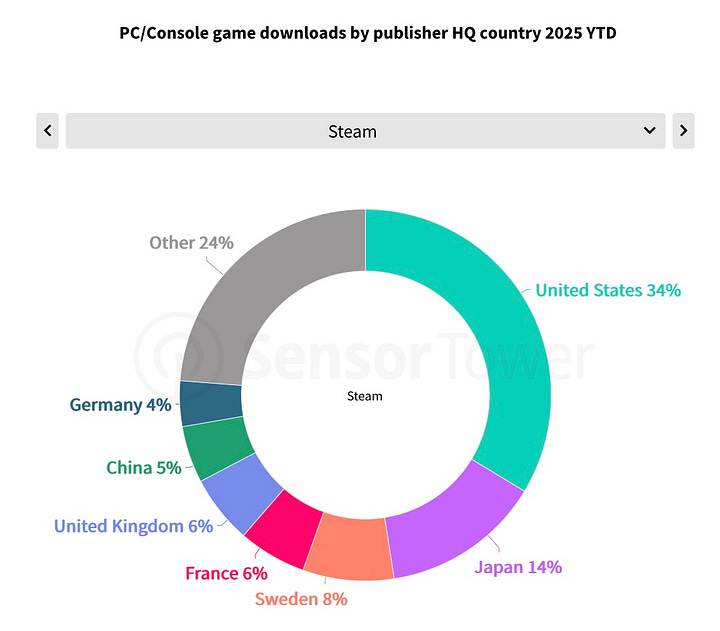

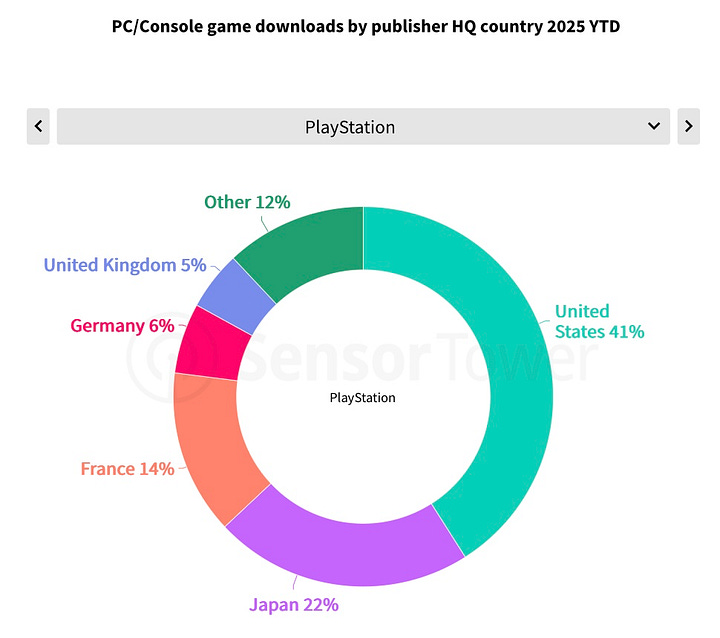

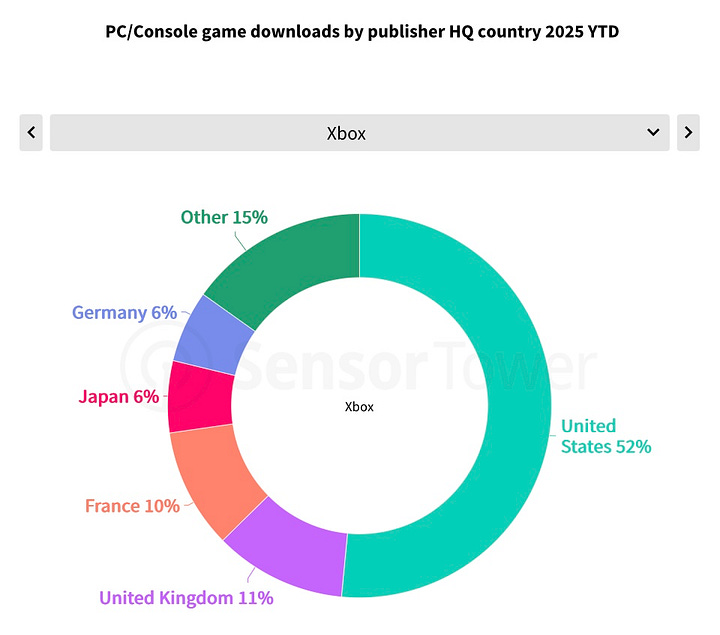

Regionally, US publishers dominate with 38% of all PC/console downloads. Japan holds 15%, and France 10%.

Top PC/Console Titles

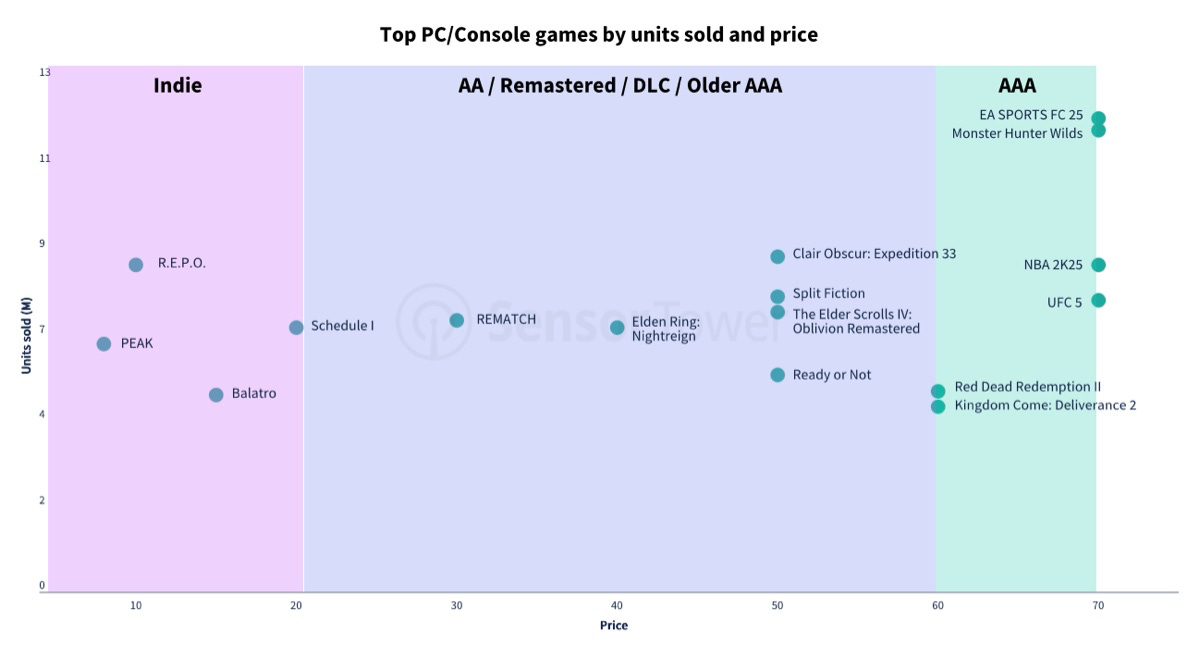

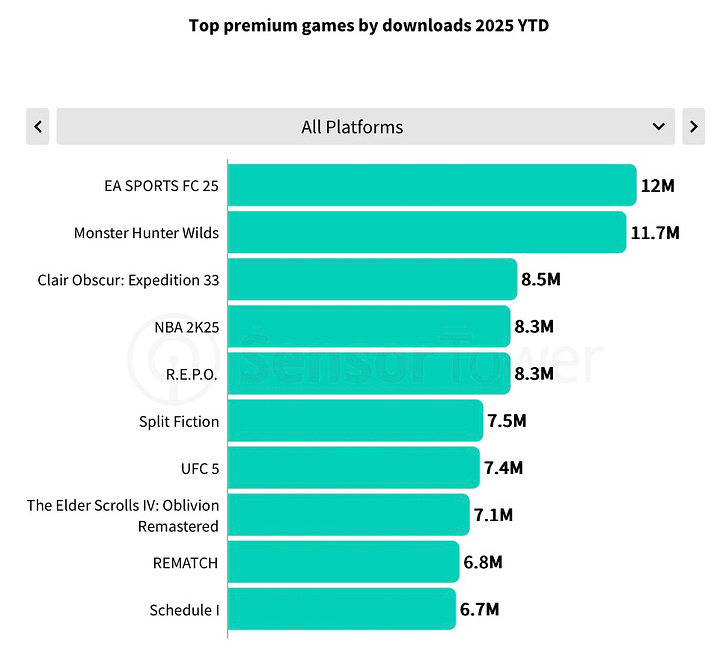

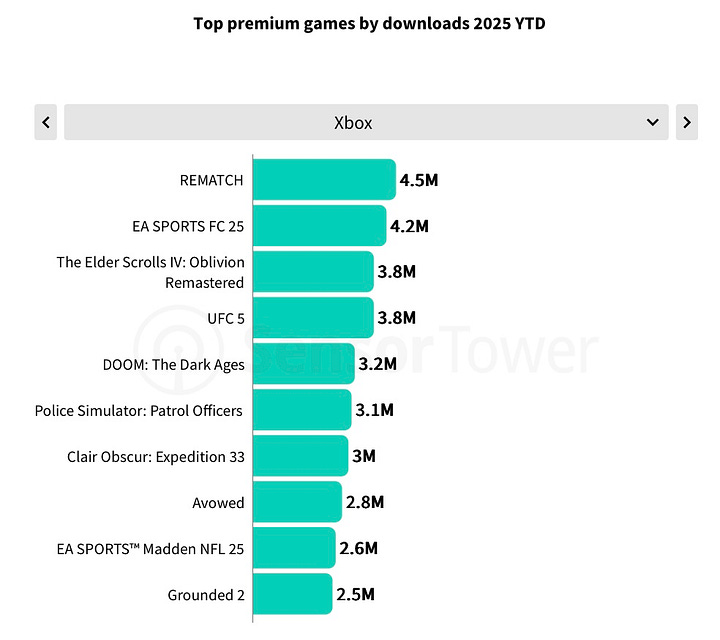

EA Sports FC 25 was the most popular PC/console title in the first 7+ months of 2025.

❗️There may be a mistake in the chart: for example, Clair Obscur: Expedition 33 had sold 4.4 million copies by September 15. The graph likely counts Xbox Game Pass downloads, meaning it shows overall downloads, not sales.

EA Sports FC 25 (12M copies), Monster Hunter Wilds (11.7M), and Clair Obscur: Expedition 33 (8.5M installs) were the top premium titles by downloads in 2025.

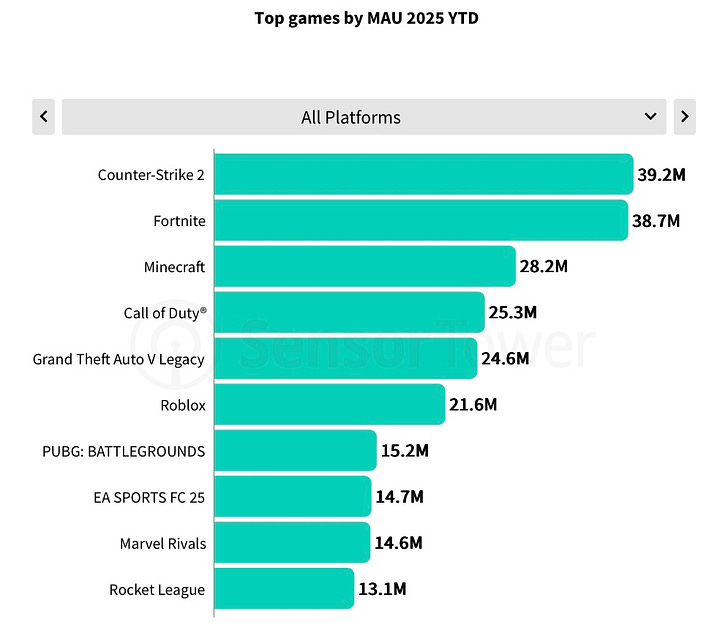

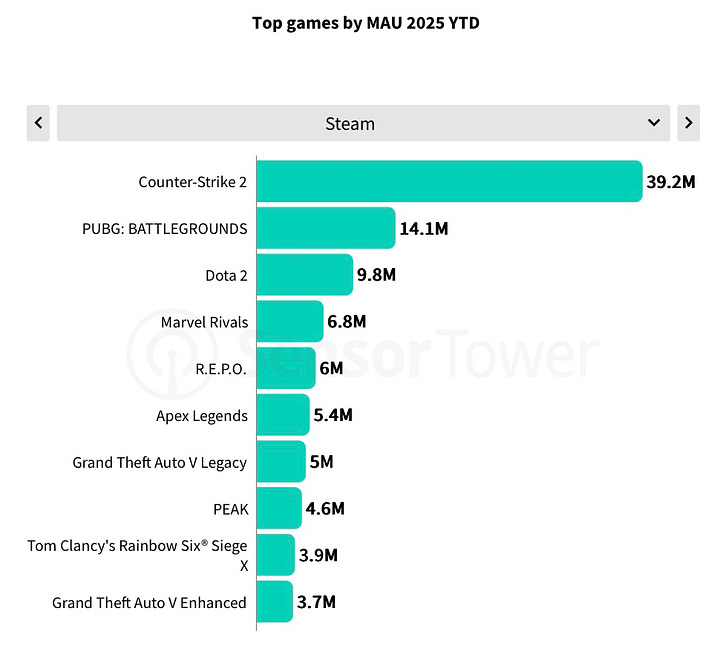

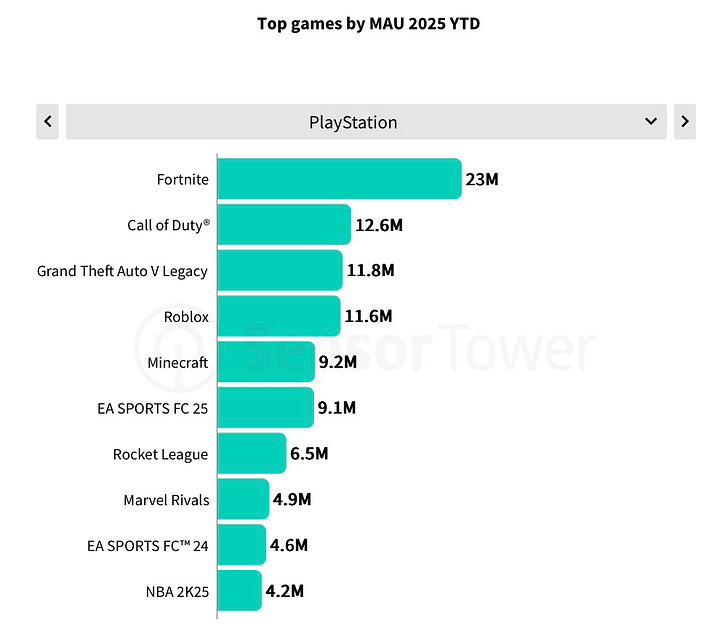

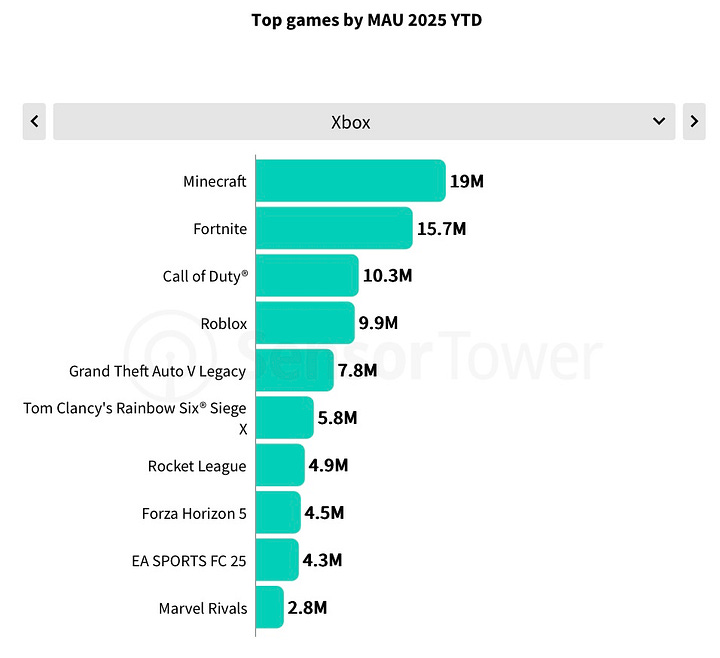

By MAU, the leaders were Counter-Strike 2 (39.2M), Fortnite (38.7M), and Minecraft (28.2M).

Among F2P titles, top US ad spenders were Fortnite ($17.8M), Roblox ($9.6M – PC/console only), and Valorant ($8.1M). For premium projects, Splitgate 2 ($9.3M), Assassin’s Creed Shadows ($8.6M), and Civilization VII ($8M) led the way.

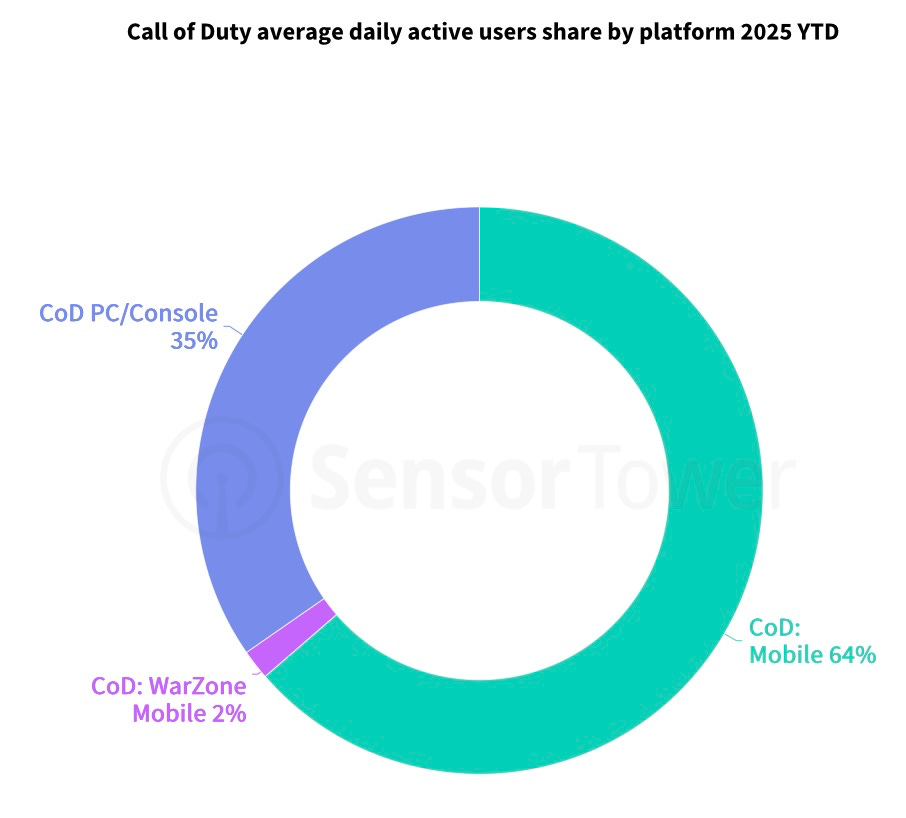

Sensor Tower notes that Call of Duty has more DAU on mobile than on PC/console - 64–65% vs 35%. A reminder of how crucial good mobile adaptation is for franchises.

Webshop experience shouldn’t be static. That’s why Xsolla provides:

Adaptive Offer Chains that evolve with each purchase. Helps to increase spending.

A Discord Bot that brings commerce capabilities directly into Discord servers to communicate with the audience through many surfaces.

Browser-based push notifications (told you about many surfaces?). This particular feature brings up to a 30%+ conversion increase in real cases!

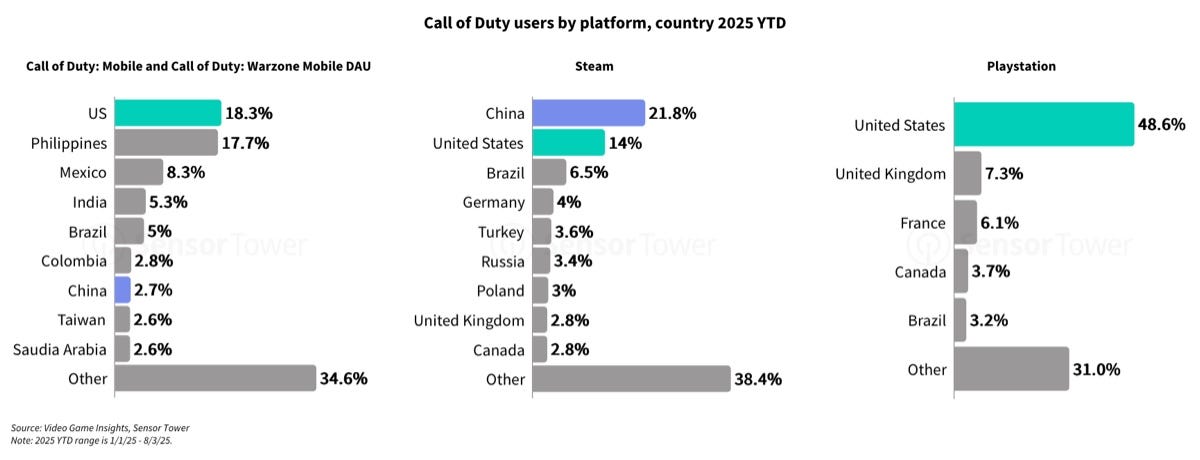

On mobile DAU, the US (18.3%), the Philippines (17.7%), and Mexico (8.3%) lead. On PlayStation, US players dominate (48.6%). On Steam, China is #1 with 21.8% DAU, followed by the US at 14%.

Call of Duty players are most likely to also engage with other shooters, American football, and…Rooftops & Alleys: The Parkour Game.

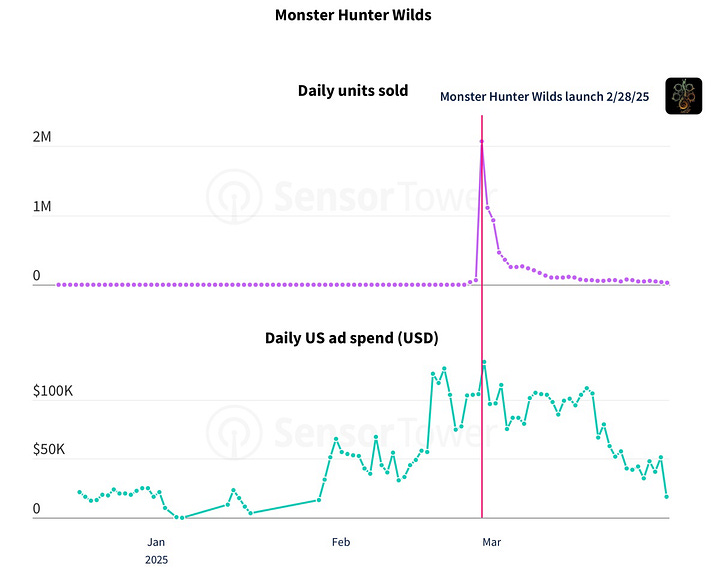

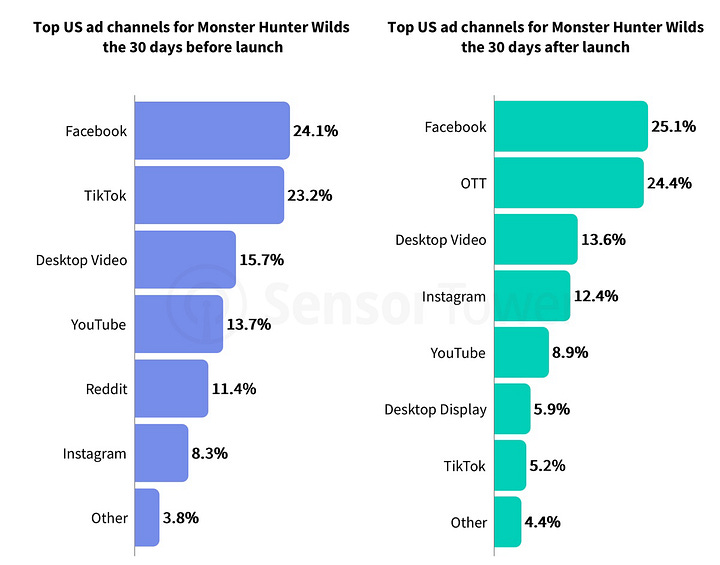

In marketing, Monster Hunter Wilds ramped up US advertising about a month before launch, shifting from TikTok/Reddit pre-launch to OTT post-launch, with ads focused on epic gameplay showcases.

Another success story is R.E.P.O. - it grew strongly due to virality, retaining over 200K DAU after 5 months. The game sold 50K+ copies right at launch, an excellent start for an indie project.

VGI and Sensor Tower highlight franchise power. For example, the Shadow of the Erdtree update brought back more than half of Elden Ring’s launch CCU. Meanwhile, Elden Ring Nightreign, though smaller in CCU, seems to keep retention better.

As of writing, Hollow Knight: Silksong hasn’t been released yet, making it the most wishlisted project on Steam. Other big wishlist titles include Deadlock (2.97M), Subnautica 2 (2.2M), and Arena Breakout: Infinite (1.96M, already out too).