Sensor Tower: RPG Revenue Declines in South Korea

The market is changing, and even evergreen genres can't stand.

The share of RPGs in the revenue structure of the South Korean mobile market has been declining since 2022. In May 2024, their revenue share fell below 50% for the first time in recorded history.

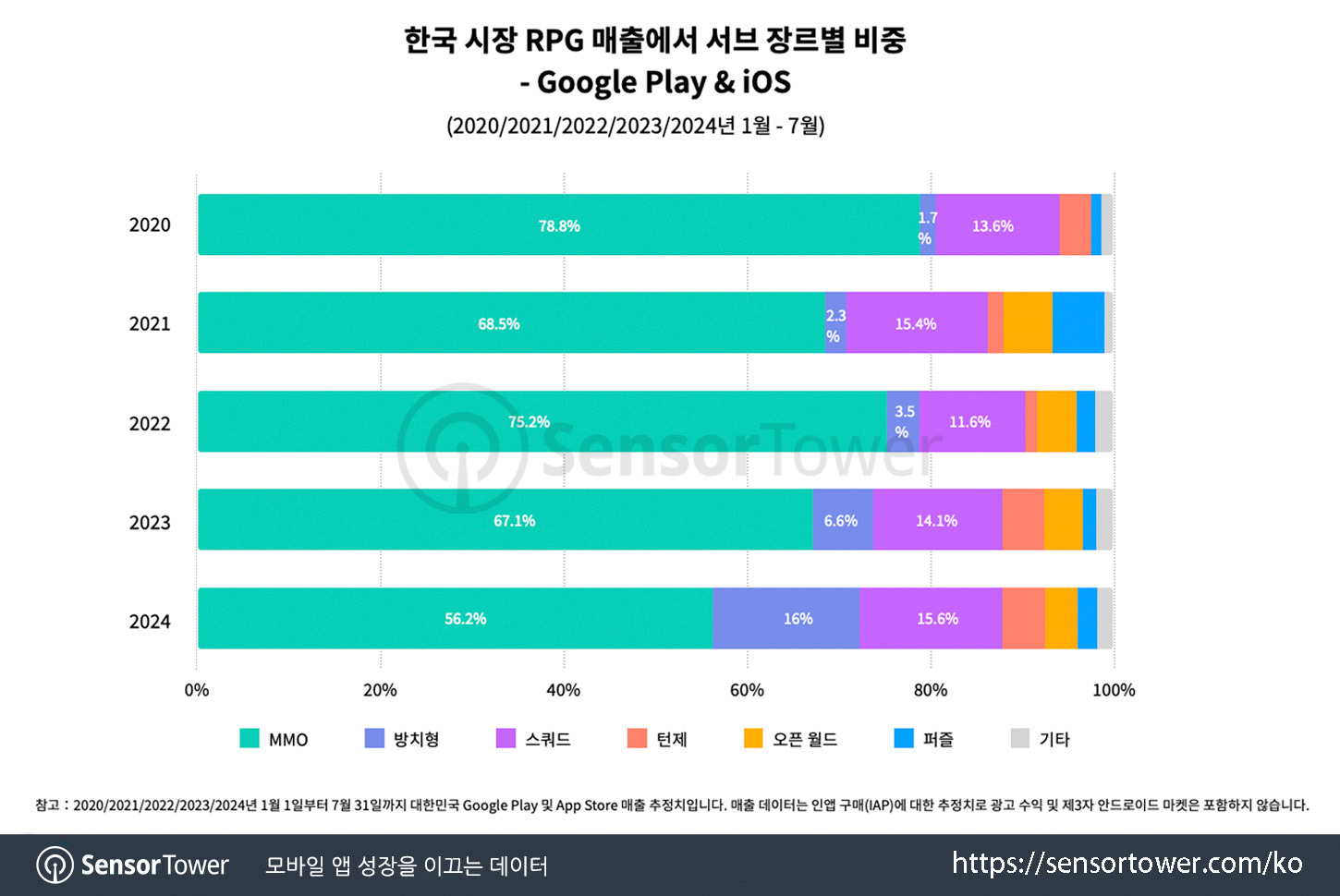

MMORPGs are significantly losing popularity. Their revenue share in the RPG genre was 78.8% in 2020, but by 2024, it had decreased to 56.2%.

Meanwhile, the Idle RPG segment is showing significant growth. In 2020, they accounted for only 1.7% of the genre's revenue, but by 2024, this had risen to 16%. Squad RPGs also hold a considerable share (11-15%). The launch of Honkai: Star Rail and Reverse: 1999 contributed to the share of turn-based RPGs growing to 4.7%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

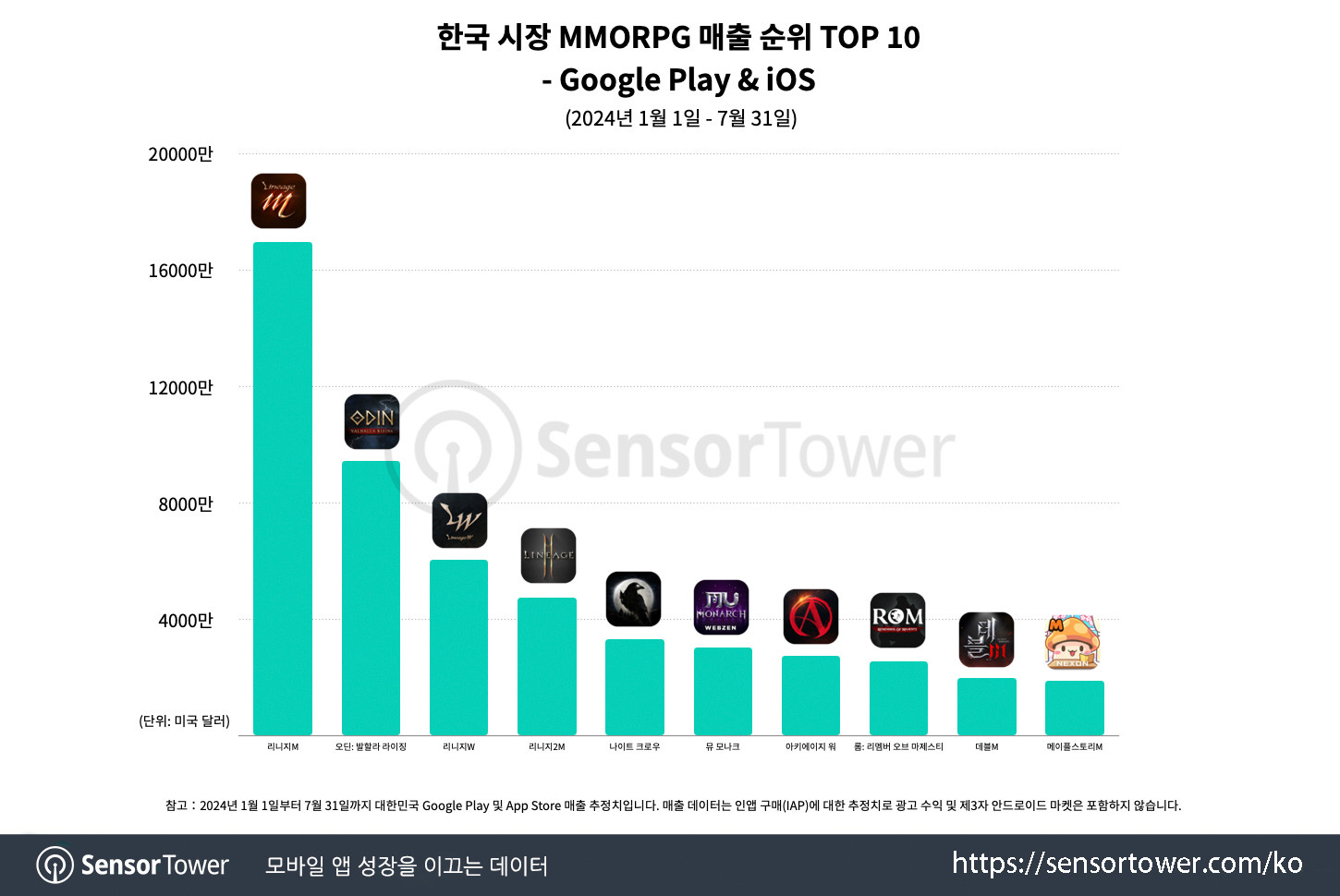

Despite the significant decline, MMORPGs still dominate the South Korean market. In 2024, four MMORPG projects made it into the top 10 (compared to 7 in 2023, 5 in both 2021 and 2022, and 7 in 2020). Lineage M, Odin: Valhalla Rising, Lineage W, Lineage 2M, Night Crow, and MU Monarch are the most popular MMORPGs in the country.

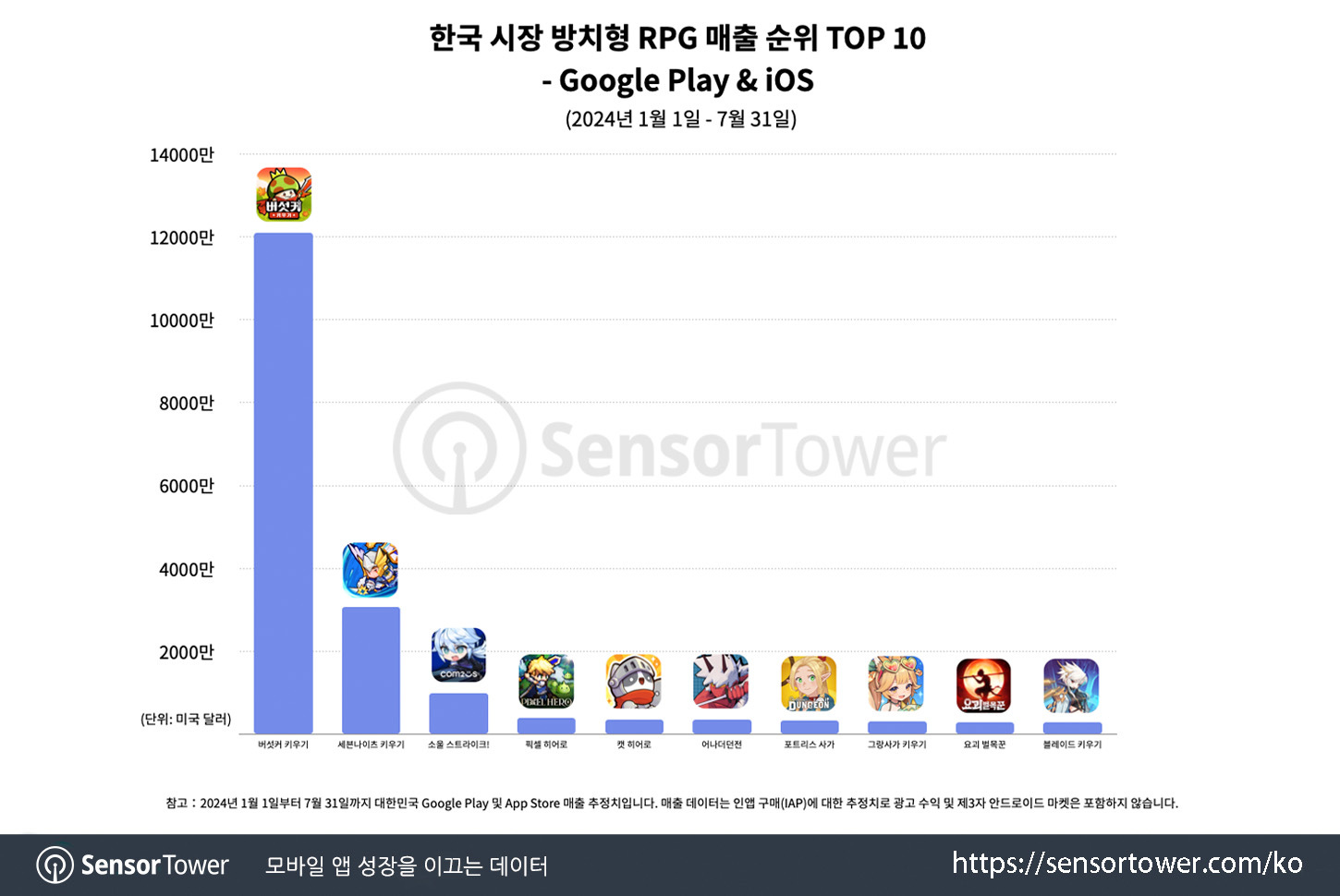

Legend of Mushroom became the third highest-grossing game in South Korea in the first half of the year, and it is by far the most popular Idle RPG.

Sensor Tower notes that user habits limit MMORPG growth. In Idle RPGs, people spend less time—5.21 sessions per day with a total duration of 50.42 minutes. In contrast, people spend 135 minutes per day in MMORPGs (5.4 sessions). People simply don’t have enough time for other games. Additionally, the Idle RPG audience is slightly younger (32 years old on average versus 36 for MMORPGs), and there is a higher percentage of people under 25 years old (16% versus 10% for MMORPGs).