Sensor Tower: Southeast Asia Mobile Game Market in 2025

Vietnam is a hotbed of new, highly viral hits.

General Market Overview

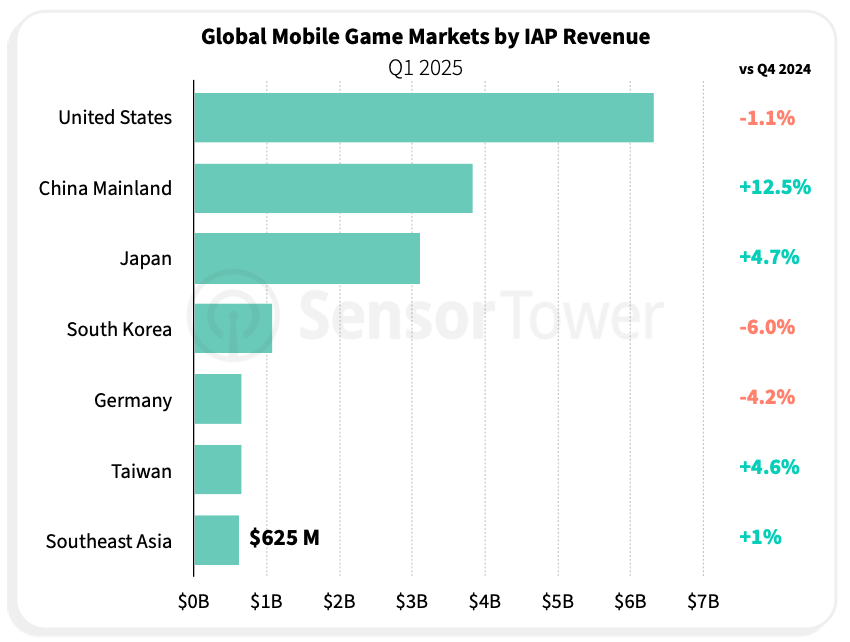

In Q1'25, the region ranked second globally by downloads, accounting for 1.93 billion installs. This represents a 3% quarter-over-quarter increase.

❗️However, Sensor Tower is being a bit misleading here—comparing a region to individual countries isn’t entirely accurate.

Southeast Asian users spent $625 million on games in Q1'25, up 1% QoQ. This is the seventh-highest figure worldwide, and again, it’s a region being compared to individual countries.

Indonesia leads Southeast Asia in downloads. In Q1'25, Indonesians downloaded games 870 million times (+9% QoQ). The Philippines is second with 366 million installs (-1% QoQ), and Vietnam is third with 329 million installs (+2% QoQ).

In terms of revenue, Thailand leads with $162 million (-6% QoQ). Indonesia is second with $118 million (+1% QoQ), and Malaysia is third with $103 million (+7% QoQ).

❗️Note that this is only about IAP purchases. D2C payments, which are quite common in Southeast Asia, aren’t reflected in these stats.

Looking at the most popular genres in Southeast Asia, platformers/runners (+16% QoQ), simulators (+0.1% QoQ), and arcade games (+12.2% QoQ) lead in downloads.

For revenue, 4X strategy games (+17.6% QoQ), MOBA (+20.1% QoQ), and MMORPG (-17.1% QoQ) are on top.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Top charts in Southeast Asia are quite stable. Hyper/hybrid casual projects lead downloads, mixed with Battle Royale, MOBA, and 4X strategy games.

For revenue, shooters and Battle Royale, as well as 4X strategies, are clear leaders. 7 out of the top 10 games are either developed by Chinese companies or owned by them. 9 out of 10 in the top 10 are Asian companies, with the exception being Coin Master from Moon Active.

❗️Western companies face a cultural barrier when entering the Southeast Asian market. For Asian companies, business in the region is more familiar and accessible. Business relationships in the region are also heavily based on personal connections.

Major Southeast Asian Markets

Indonesia

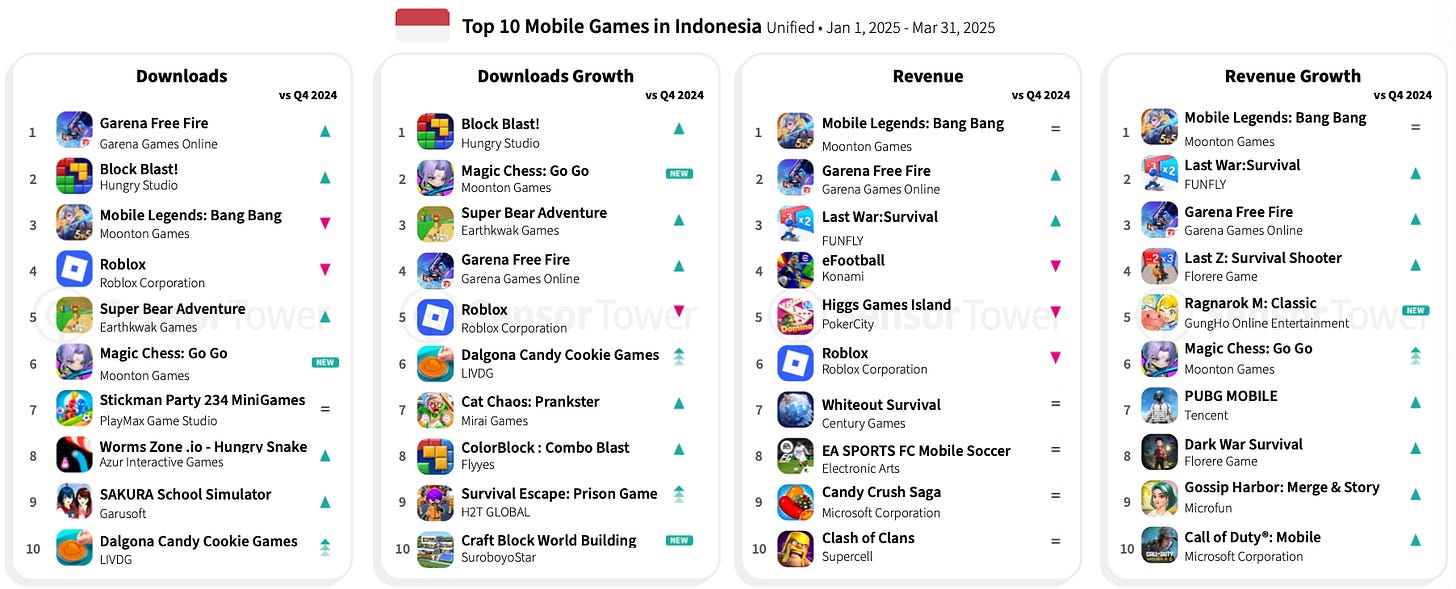

Top genres by downloads in Indonesia: simulators (+4.9% QoQ), platformers/runners (+38.2% QoQ), and arcade projects (+18% QoQ).

For revenue, MOBA (+32.7% QoQ), 4X strategy (+21.1% QoQ), and sports games (-22.6% QoQ) lead. Battle Royale shows significant growth (+50% QoQ).

New projects in Indonesia in Q1'25: Magic Chess: Go Go entered the download rankings, and Ragnarok M: Classic led in revenue.

Thailand

Top genres by downloads: simulators (-14.1% QoQ), platformers/runners (-18.6% QoQ), and sandbox projects (-17.5% QoQ).

For revenue, realistic sports games (-7.8% QoQ), MMORPG (-27.4% QoQ), and 4X strategies (-5.6% QoQ) lead in Thailand.

In Q1'25, Go Go Samkok and Papa Restaurant (casual simulators), as well as Ragnarok M: Classic, entered the download charts. For revenue, new entries include Ragnarok M: Classic and Dragoon Academy from Korea’s NewCube Games.

Vietnam

Platformers and runners (+3.2% QoQ), simulators (-6.7% QoQ), and other arcade games (+9.1% QoQ) lead in downloads. For revenue, 4X strategies (+51.5% QoQ), MMORPG (+8.2% QoQ), and Squad RPG (-1.8% QoQ) are on top.

Vietnam is a unique market for downloads. Roblox leads, and Trò Vẽ Vui Tuổi Thơ—a local casual game—leads download growth. Last War: Survival is also rapidly growing in downloads.

For revenue, Last War: Survival and local RPG Big Bang Thời Không are leaders.

Philippines

Top genres by downloads remain platformers/runners (+6.8% QoQ), simulators (+0.7% QoQ), and various arcade projects (+9.6% QoQ).

For revenue, MMORPG (-19.7% QoQ), 4X strategies (+18.7% QoQ), and MOBA games (+19% QoQ) lead.

The Philippine market is more dynamic than others. Five new projects entered the download rankings (Magic Chess: Go Go, Hapunan Horror Game, I Am Security, Good Coffee, Great Coffee, Color Game-color game), and two Ragnarok series games (Ragnarok M: Classic, Ragnarok Idle Adventure Plus) led in revenue.

Local Operation of Mobile Legends: Bang Bang

Sensor Tower highlights Mobile Legends: Bang Bang from China’s Moontoon Games as a successful example of regional operations.

The team adds localized content, characters inspired by Southeast Asian cultures, hosts tournaments, and actively engages with the community. This has kept the game in the top 5 for both revenue and downloads since 2017.

Mobile Legends: Bang Bang’s developers work not only with the audience but also with influencers. Their strong local presence - with offices in Indonesia, Malaysia, Singapore, and the Philippines - helps a lot.

Southeast Asian Publishers

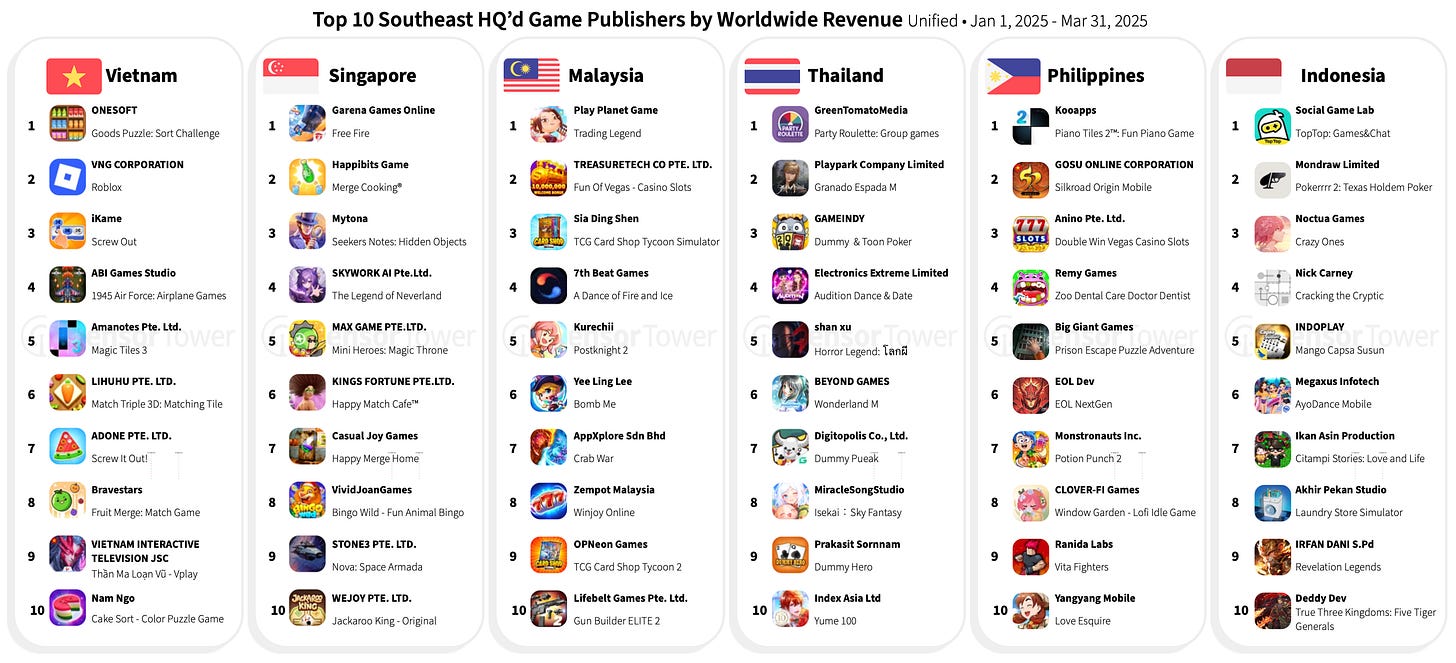

In 2024, games from Southeast Asian publishers were downloaded 5.8 billion times, more than publishers from China, Cyprus, or the US. Again, Sensor Tower is comparing a region to individual countries.

Vietnamese publishers deserve special mention: 3 of the top 15 publishers in 2024 are from Vietnam.

Vietnamese publishers also performed well in Q1 2025. One project (456 Run Challenge: Clash) made the top 10 overall downloads, and two others (Survival Escape: Prison Game and Prison Survival: Tap Challenge) led in download growth.

Sensor Tower notes that Vietnamese developers are quick to create projects based on popular trends, helping them gather large amounts of organic traffic.

Singapore and Vietnam are the two engines of Southeast Asian game development. Other countries lag behind their neighbors.