Sensor Tower: The Japanese mobile gaming market declined in H1'24

Analytics blaming the weak local currency for this.

Sensor Tower only considers Gross IAP revenue.

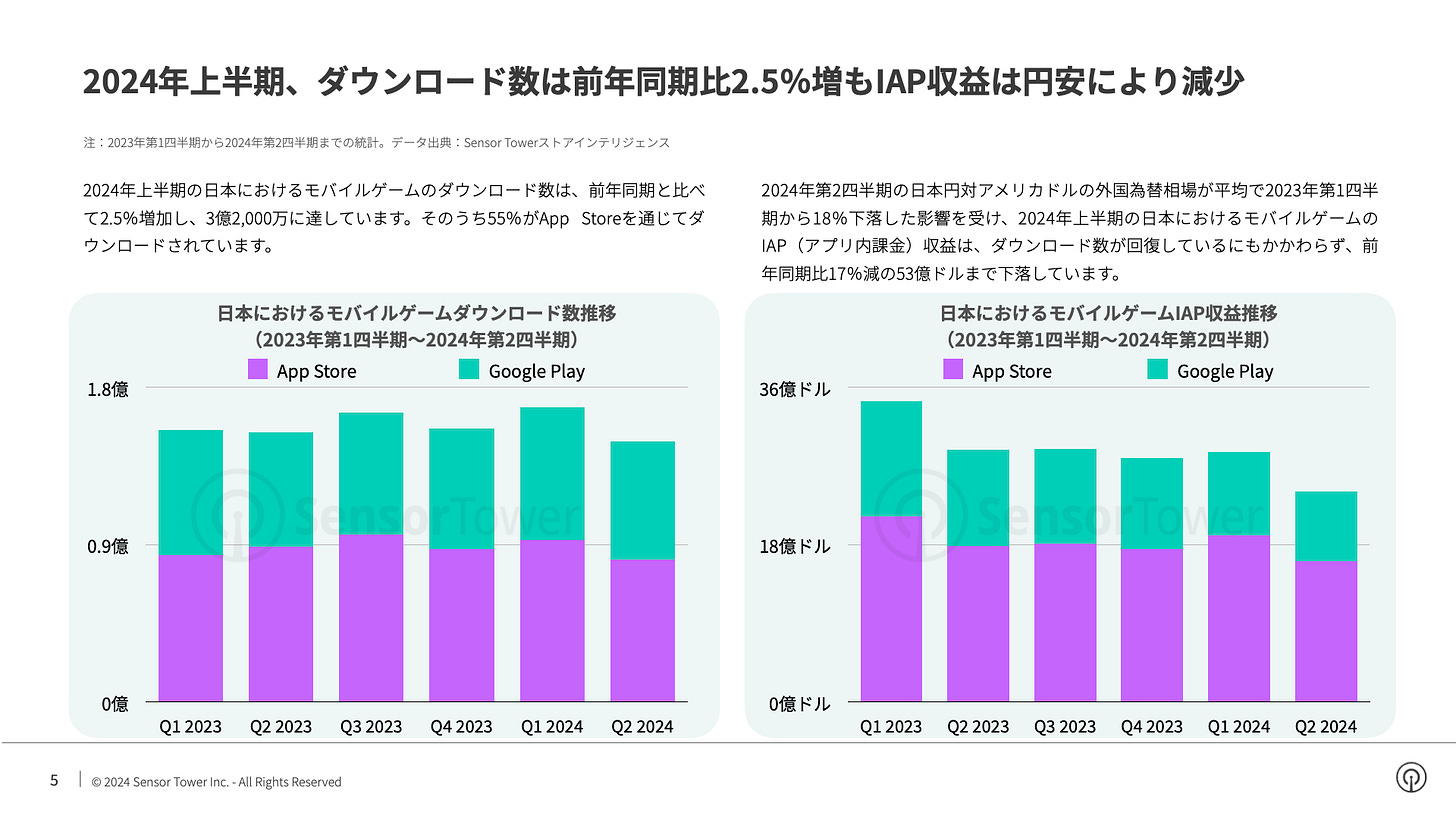

Revenue from the Japanese market in dollar terms dropped by 17% in the first half of 2024, down to $5.3 billion. The wakened yen caused this.

Game downloads in the first half of 2024 increased by 2.5%, reaching 320 million. 55% of the installs came from the App Store.

The biggest mobile games in Japan from January to July this year were Monster Strike (over $290 million in revenue during the period; cumulative revenue over 11 years – more than $11 billion), Umamusume: Pretty Derby, and Puzzle & Dragons.

There is one newcomer in the chart – Legend of Mushroom, which earned over $100 million in the 4 months after its release. At the end of May, Bandai Namco Entertainment also launched The Idolmaster Gakuen, which topped the monthly ranking. However, the project has not yet entered the top 10.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Bandai Namco Entertainment became the most successful mobile publisher in Japan. Its revenue grew by 3.5% in the half-year to $390 million. Outside its home country, the company earned $270 million over the same period. Konami ranks second in revenue, and mixi is third.

Dragon Quest is the most popular IP in the mobile market. Games from this franchise earned $170 million in the first half of the year. However, when it comes to individual games, the leader is Umamusume: Pretty Derby (over $160 million in revenue; total project revenue is nearing $2.5 billion).

Japan accounts for 49% of all revenue from 3D anime games.