Singular: Trends in Mobile Game Marketing in Q2’25

Global advertising spend, CTR, CPM, IPM trends inside.

Data is based on trillions of ad impressions, tens of billions of clicks, billions of installs, and user spending. This report covers the overall mobile market, but I will only cover figures relevant to the gaming sector.

General Trends

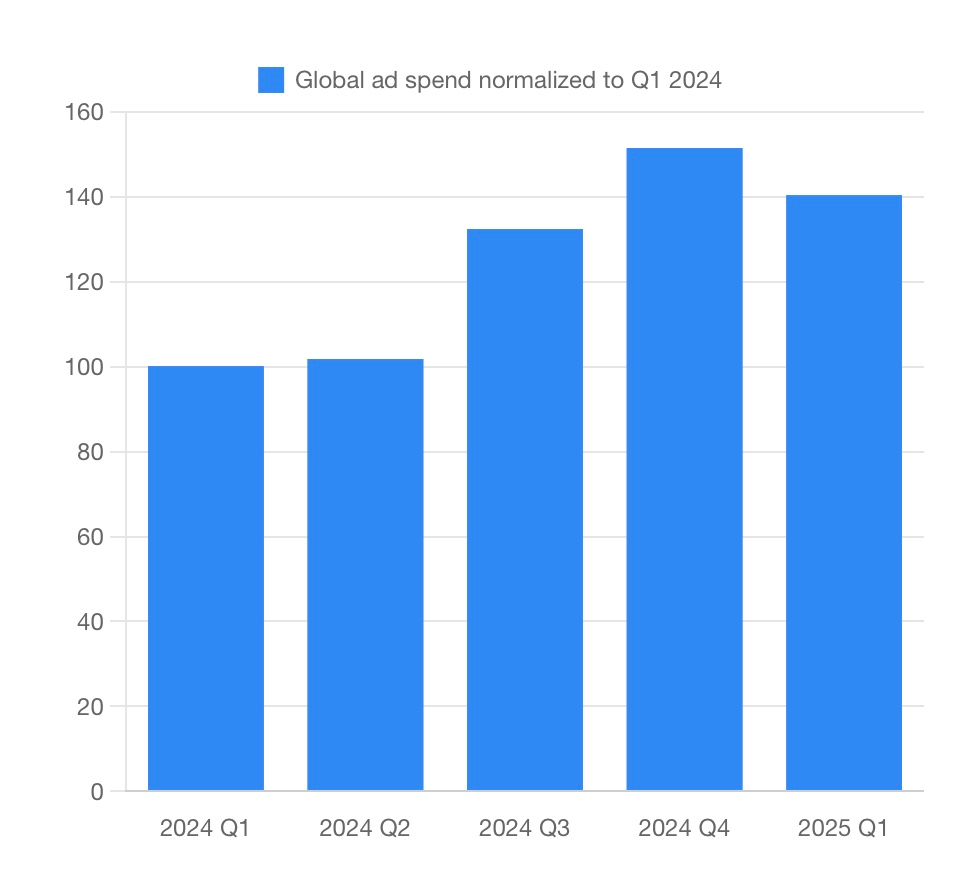

Singular reports that user spending on mobile marketing grew by 40.3% YoY.

Growing segments are entertainment, finance, travel, and education apps. Marketing spend is declining in shopping, health, fitness, and games.

In Q1’25, marketing spend for games dropped by approximately 15% YoY.

According to Singular, 89.5% of all game installs are on Android devices. However, iOS devices account for 89.6% of total revenue.

Game-Specific Figures

Puzzle, simulation, and action games are the leaders in downloads on Android, accounting for 76% of all installs.

Top growth by downloads genres: match games (+171% YoY); puzzles (+150% YoY); action (+140% YoY); sports (+135% YoY); kids’ games (+132% YoY).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Simulation, puzzle, and sports games are the leaders in downloads on iOS, making up 63% of all downloads.

Fastest-growing genres by iOS downloads in Q1’25: action (+218% YoY), educational (+210% YoY), card/board (+177% YoY), simulation (+154% YoY), gambling (+136% YoY).

Games have one of the highest ATT opt-in rates on iOS at 26.5%.

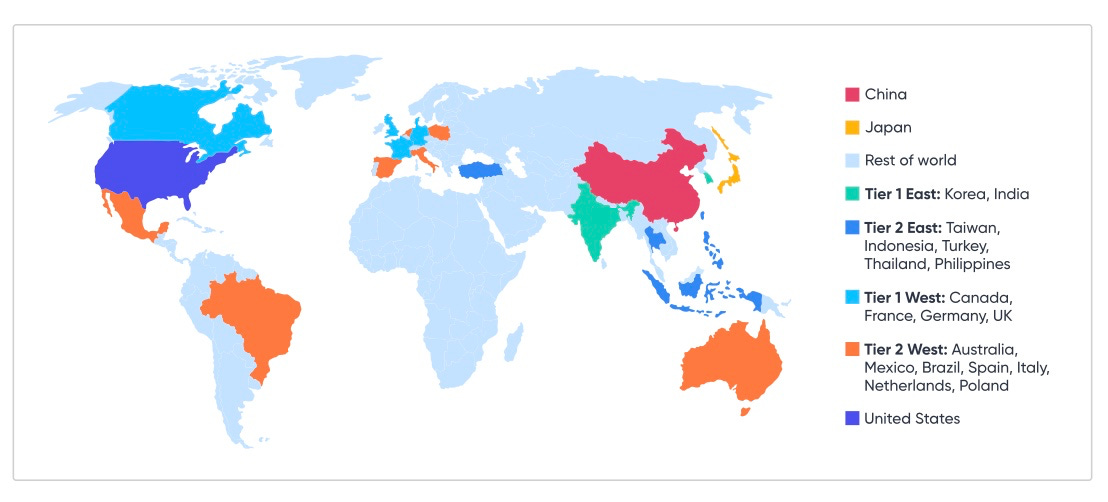

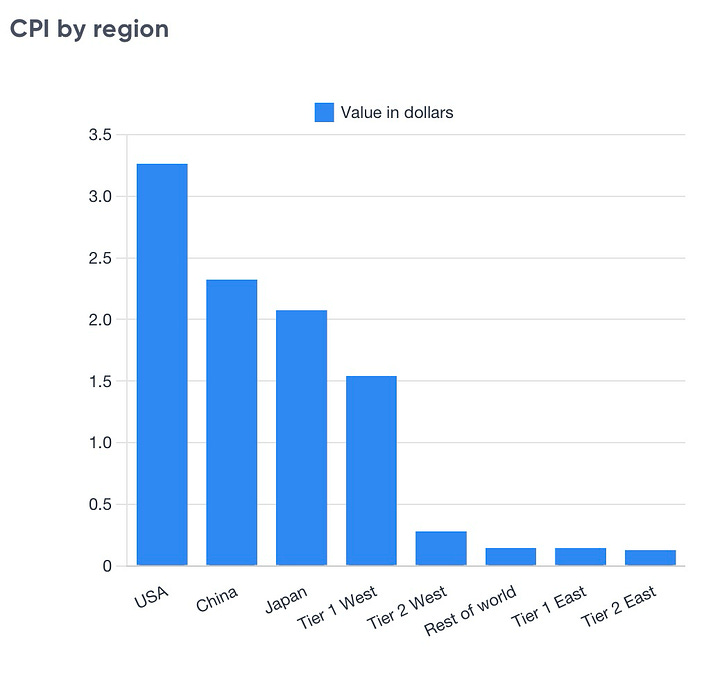

On Android, the highest CPI is in the US ($3.25), China ($2.3), and Japan ($2.05). China has the lowest CTR, while Tier-3 markets have the highest.

The US has by far the highest CPM. The average IPM by country is 3–5 installs, with China showing a significant statistical drop (IPM much lower).

On iOS, RPG is the most expensive genre (CPI – $36.5), followed by casino ($16.69).

❗️Since Singular uses SKAN data for this report, there is no regional breakdown.

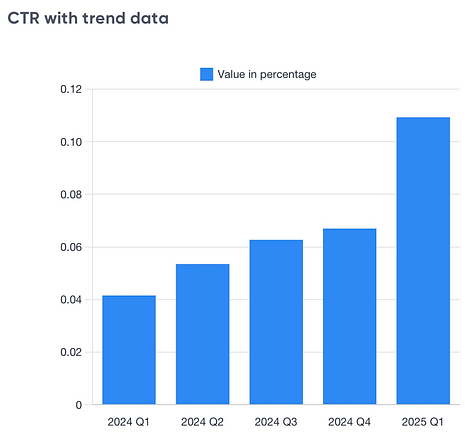

CTR on iOS grew by 250% in Q1’25. CPM increased slightly by 2%, but is 27% lower than the previous quarter. IPM dropped by 4% YoY.

Google, Meta, AppLovin, Apple Ads, and TikTok are the five most popular ad networks for games.