SocialPeta & SuperSonic: Marketing in Casual & Puzzle Games in Q1 2024

Number of advertisers increased YoY - does it speak for an increased interest in mobile?

General Trends

The number of advertisers in Q1’24 increased by 28.9% YoY to 51.3k.

The average number of creatives per advertiser dropped by 18% to 109.

In Q1’24, the share of new creatives in the market was 74.7% - slightly below the 2023 average. The share of advertisers with new creatives was 84.2% - lower than in the past two years.

63.92% of creatives in Q1’24 were videos; 23.37% were static images; 6.14% were Playable ads; 5.66% were HTML creatives; 0.91% were carousel ads.

The share of iOS advertisers has been growing for three consecutive quarters - in Q1’24, the share of iOS advertisers was 31.9%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The number of advertisers in the casual and puzzle segments increased by 0.83% and 2.1% respectively in Q1’24. The number of creatives grew by 1.97% YoY in the casual segment and by 1.17% in the puzzle segment.

Casual and Puzzle Games in Q1’24

❗️SocialPeta has its taxonomy. For example, Legend of Mushroom (Idle RPG) or 1945 (shoot ’em up) are classified as casual games. I would argue.

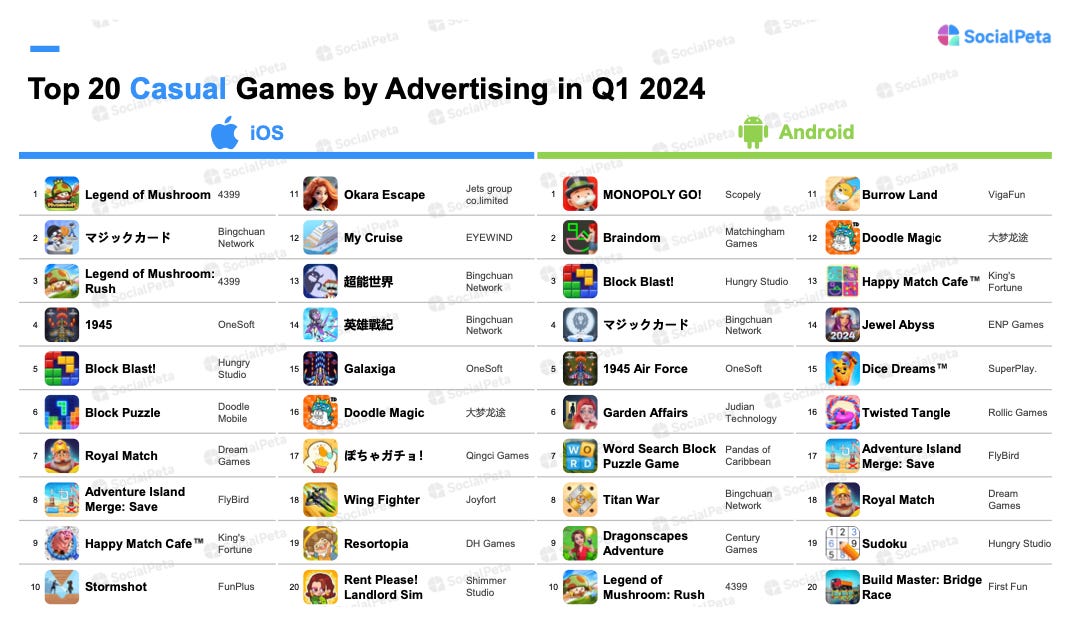

Legend of Mushroom, Magic Card, and 1945 led the casual segment by advertising on iOS. On Android, the leaders were Monopoly GO!, Braindom, and Block Blast!

The top puzzle advertisers were Block Blast!, Block Puzzle, and Royal Match on iOS; and Braindom, Block Blast!, and Garden Affairs on Android.

The most competitive markets for casual games are Europe, the US, Southeast Asia, and Latin America.

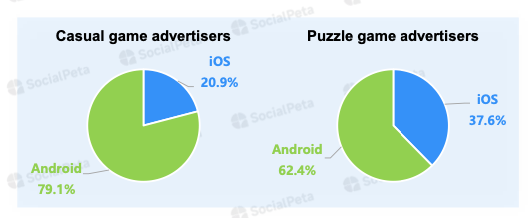

Speaking of the casual market, the share of advertisers on iOS is 20.9%. For puzzles, the situation is quite different - 37.6% of advertisers are on iOS.

The most popular languages for ad creatives in casual (and puzzle) games are English, Traditional Chinese, Japanese, Portuguese, and Korean.

Marketing Approaches of Top Genre Games

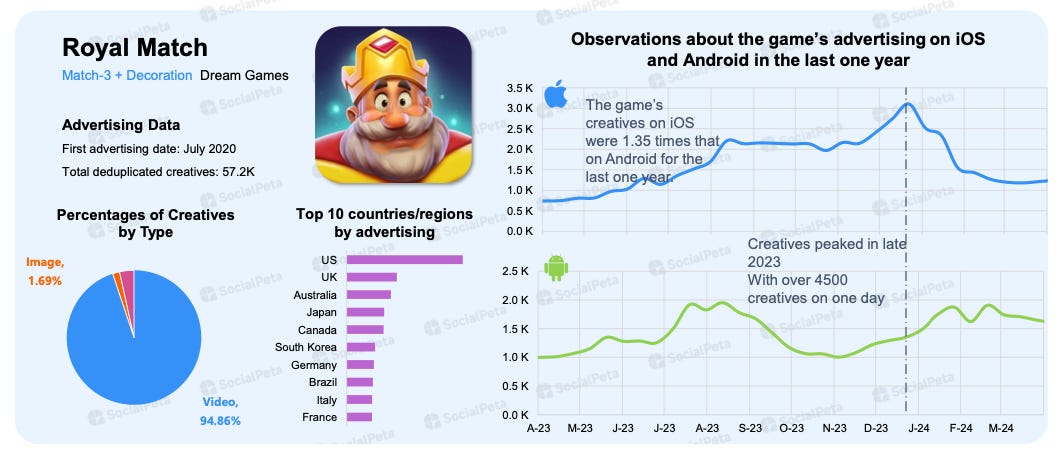

Royal Match: At the end of 2023, Royal Match had more than 4,500 creatives in operation. The average number of creatives on iOS was 1.35 times higher than on Android. 94.86% of all creatives were videos. The main markets for the project were the USA, the UK, Australia, Japan, and Canada. However, since the beginning of 2024, the number of creatives on iOS has been decreasing, while on Android it has been increasing.

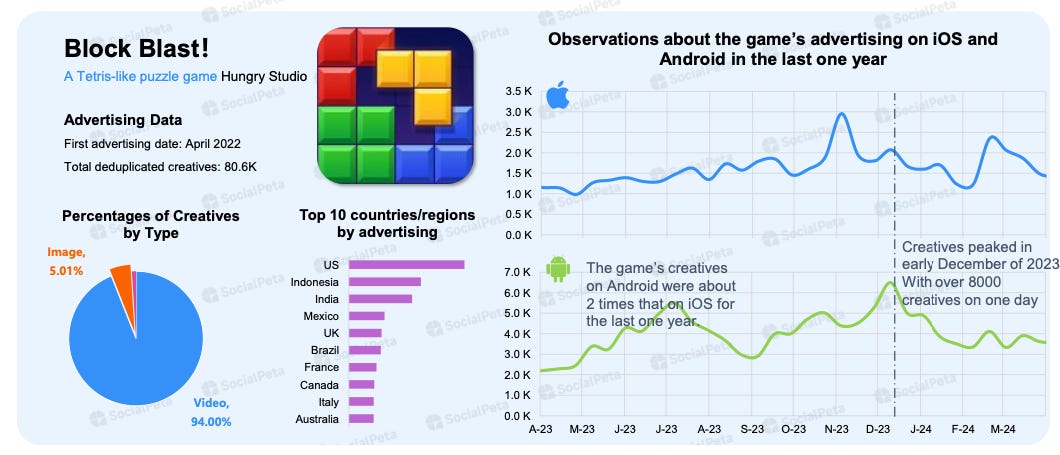

Block Blast!: At the end of 2023, Block Blast! had more than 8,000 active creatives. There were 2.5 times more creatives on Android than on iOS.

Twisted Tangle by Rollic Games: This game was primarily advertised on Android for a long time. Growth on iOS occurred almost a year after testing. The main market for advertising was the USA.