SocialPeta: Mobile gaming marketing trends in Southeast Asia in 2024

Android is dominating; the number of advertisers is increasing.

The number of active advertisers increased by 9.5% in 2024 compared to the previous year.

63.8% of advertisers in 2024 released new creatives every month. This is 0.8% less than the year before.

The average monthly share of new creatives is 39.6%. This is 1.5% more than the previous year.

The largest number of advertisers in the Southeast Asian market are in casual games (28.4%), casino (13.9%), and puzzles (11.3%). The fastest-growing categories in terms of advertisers are casual games (+1.4% YoY) and RPG (+1.1% YoY). Most creatives are for casual games (29.6%), RPG (16%), and puzzles (10.7%). The highest growth is shown by RPG (+3.8% YoY) and SLG (+1.7%).

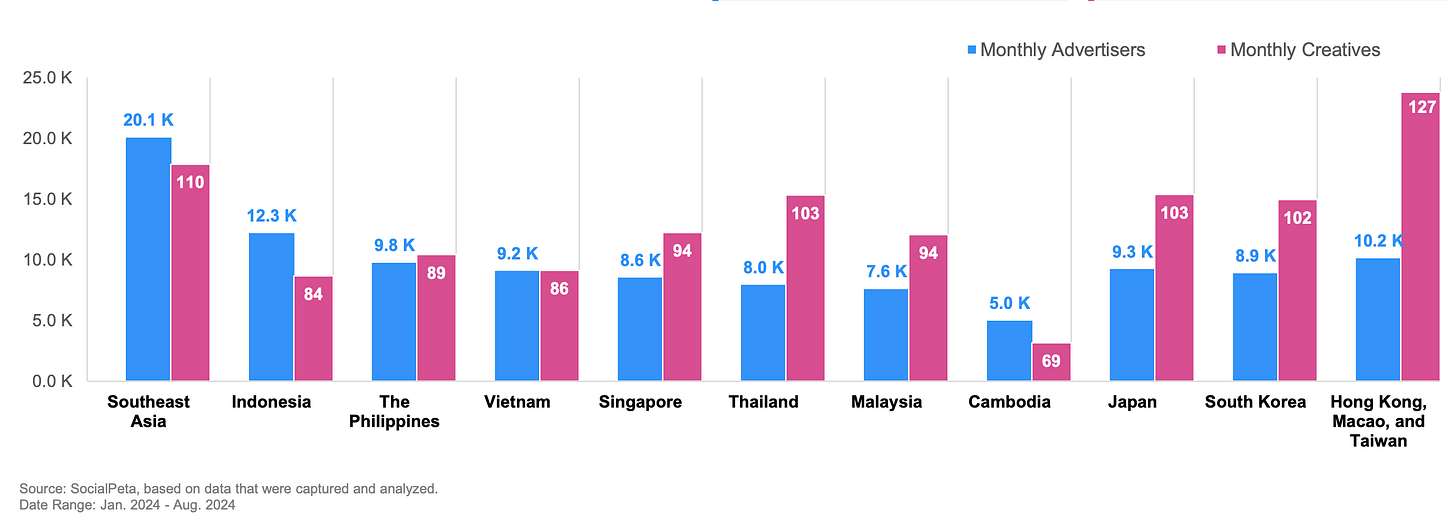

The largest number of advertisers are in Indonesia, the Philippines, and Vietnam. The highest average monthly number of creatives is in Thailand, Singapore, and Malaysia.

75.5% of advertisers are on Android; significantly fewer on iOS - 24.5%. In some countries (Indonesia), the share of iOS advertisers has fallen below 20%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

65.8% of creatives in the region are video; 31.7% are static images. Compared to the world, the popularity of video creatives in Southeast Asia is higher.

The leaders in advertising activity on iOS are Pesta Ludo: Permainan Papan; Draconia Saga and Legend of Mushroom. On Android - Bắn Cá Vui, Braindom and Draconia Saga.

In creatives, companies actively use AI; make references or collaborations with IP; use mini-games; show gameplay with comments from real people or actors. The use of cosplayers is also popular.