Unity: Gaming in 2024 Report

The grand report of one of the leading game industry players.

Data was collected from Unity Engine; Unity Cloud, and ironSource. All platforms were taken into account. In addition, Unity conducted a survey with more than 7,000 respondents.

5 Key Trends

Developers are integrating AI into their processes to accelerate development.

Studios are changing their approaches to monetization. More attention is being paid to advertising amid the decline in IAP revenue.

Studios of all sizes are releasing more cross-platform projects.

Developers are prioritizing multiplayer projects despite the complexity in their development.

Developers are now trying to build strong franchises rather than just games.

AI Usage in Games

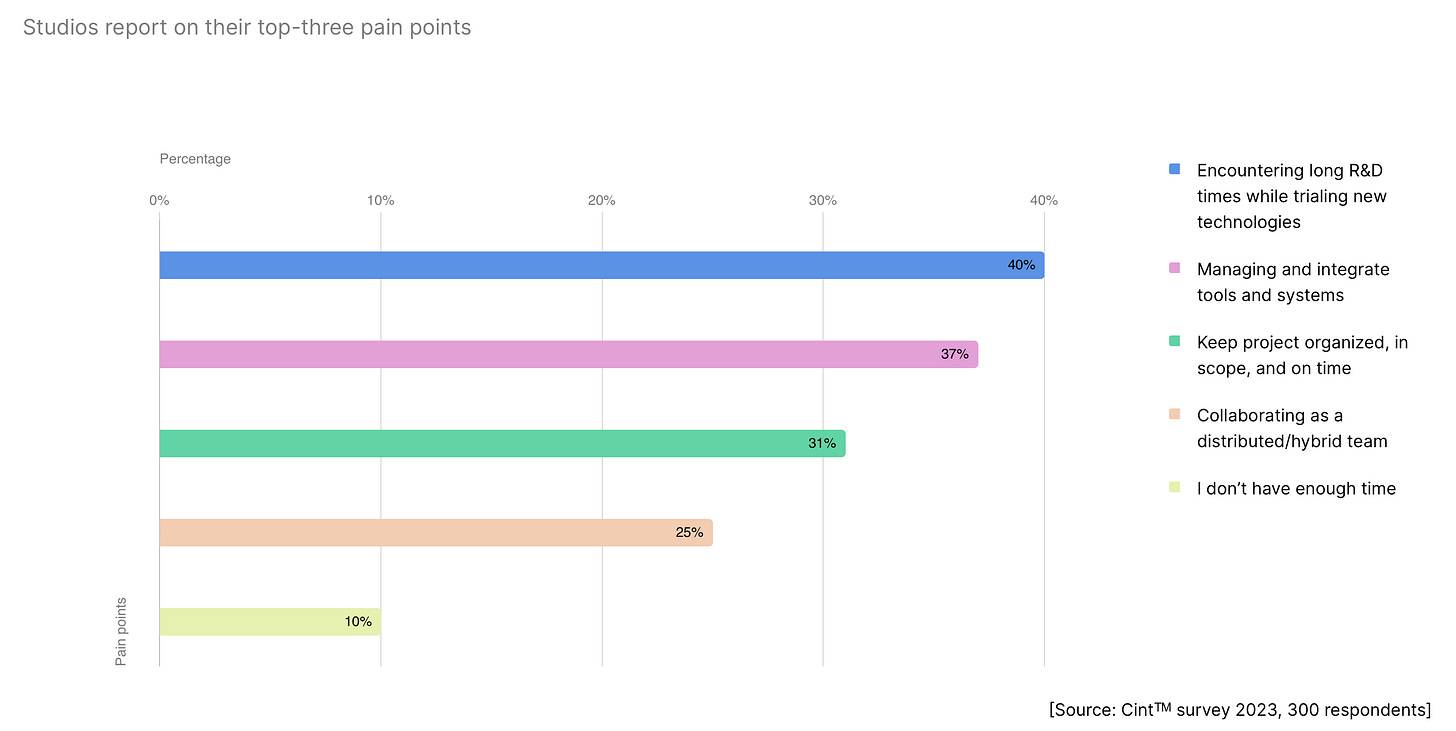

The average game development time has increased from 218 days in 2022 to 304 days in 2023. To speed up processes, studios are seeking new solutions - but they still face difficulties. 40% spend a lot of time in the R&D process; for 37%, a significant amount of time is spent on integrating new technologies; for 31%, it is challenging to maintain project deadlines and scope when applying new technologies.

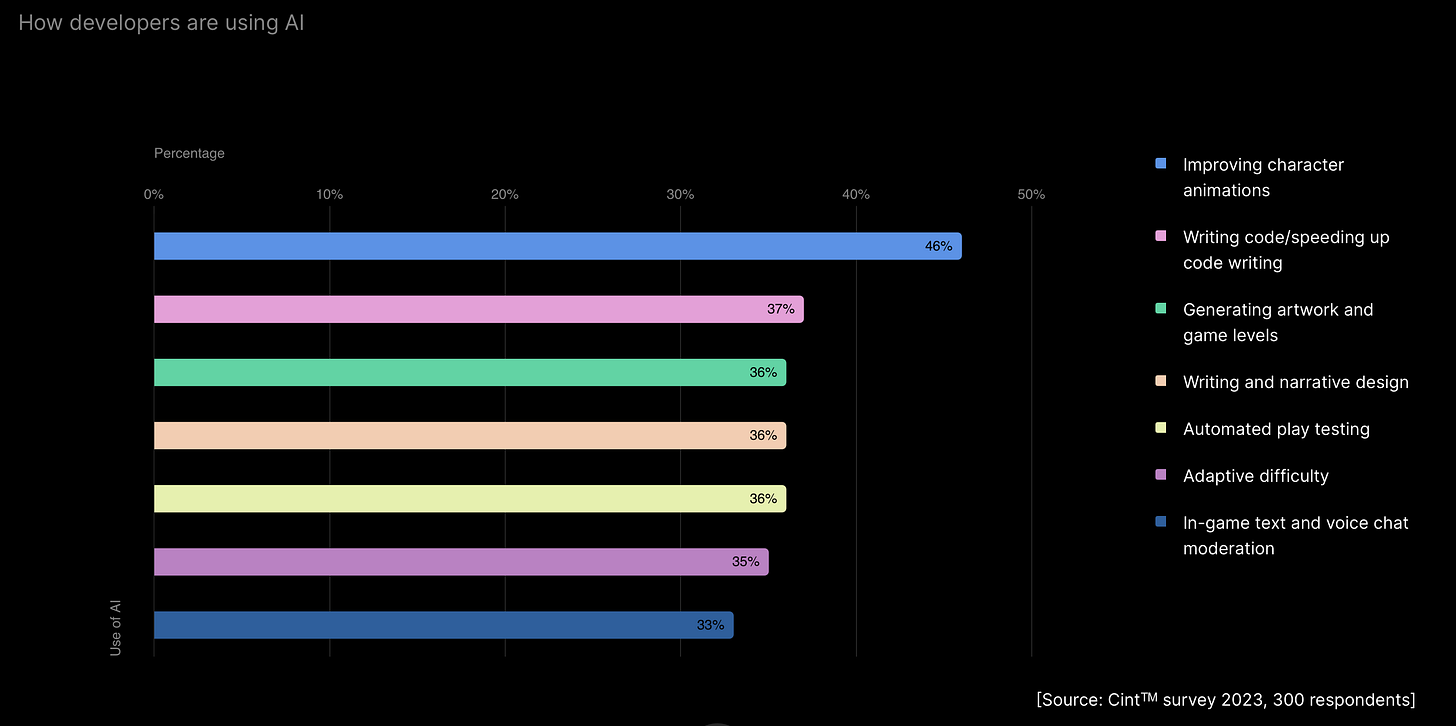

The most common areas of AI application in development are improving animations (46%); writing code (37%); generating art and levels (36%); narrative design (36%); automated playtests (36%); difficulty adaptation (35%); moderation of voice and text chats (33%).

Prototyping takes less than 3 months for 96% of studios. For 42%, it takes less than one month. 68% of respondents noted that AI helps speed up this process. This is confirmed by the numbers - in 2022, 85% of studios prototyped in less than 3 months.

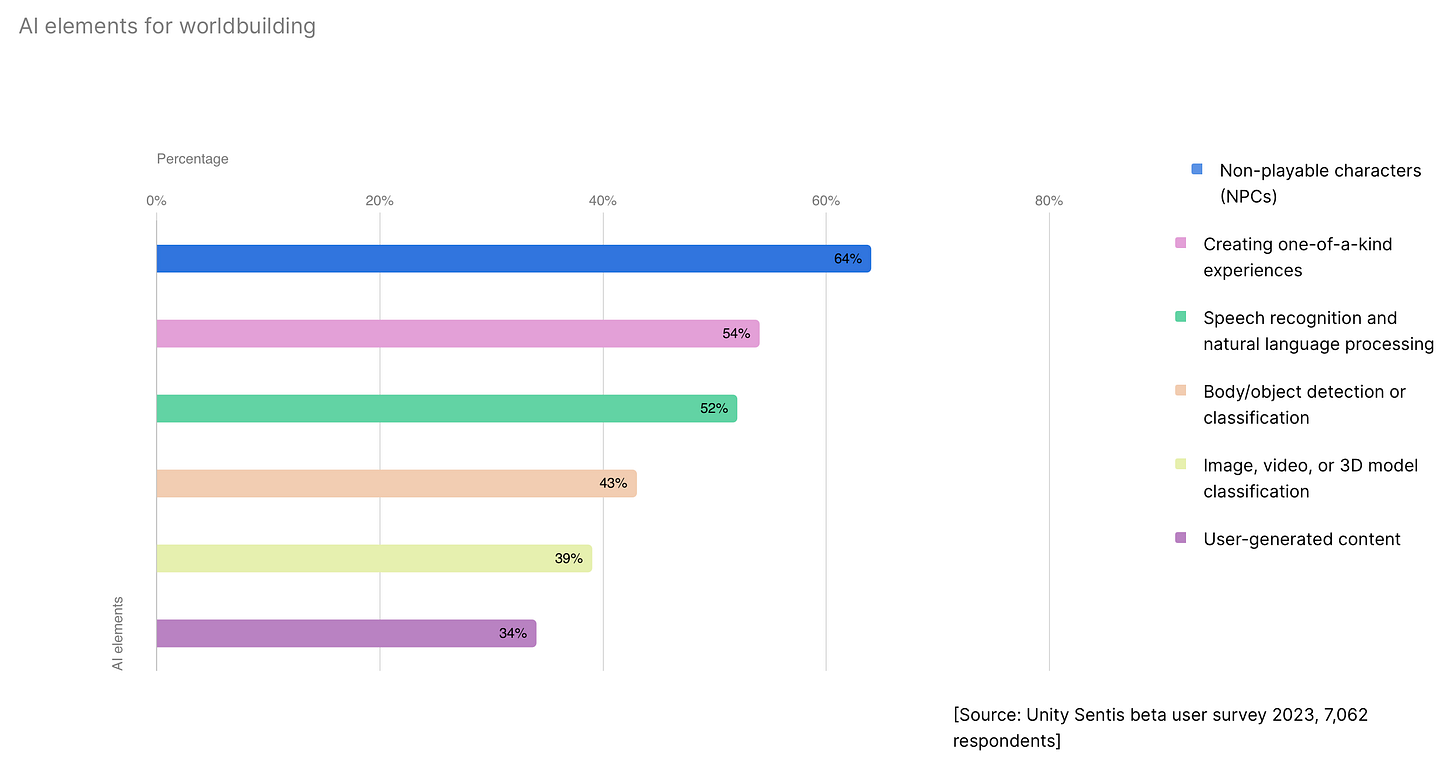

56% of studios that have integrated AI into their processes use the technology for world-building. Among the most popular use cases are creating NPCs, generating unique gameplay moments, speech recognition, and contextual NPC responses.

AI is most commonly used by AR/VR developers (29%), multiplayer game creators (28%), casual developers (27%), open-world projects (25%), and RPG games (25%).

The main challenges in integrating AI are lack of time (43%), lack of technical skills (24%), and unawareness of AI capabilities (20%).

51% of studios have fewer than 1000 assets; 35% have between 1001 to 5000; 9% have between 5001 to 50,000; and 5% have over 50,000. According to developer surveys, 20% spend more than 4 hours per week structuring asset bases. AI can help with this.

Mobile Market Status and Revenue Sources

According to Unity data, DAU (Daily Active Users) in mobile games increased by 4.5% in 2023 compared to 2022.

The average figures for D1 Retention decreased by 1%; D7 Retention decreased by 0.1%.

IAP revenue is declining. The median IAP ARPDAU (Average Revenue Per Daily Active User) was $0.015 in 2023 compared to $0.018 in 2022, a 13% decrease.

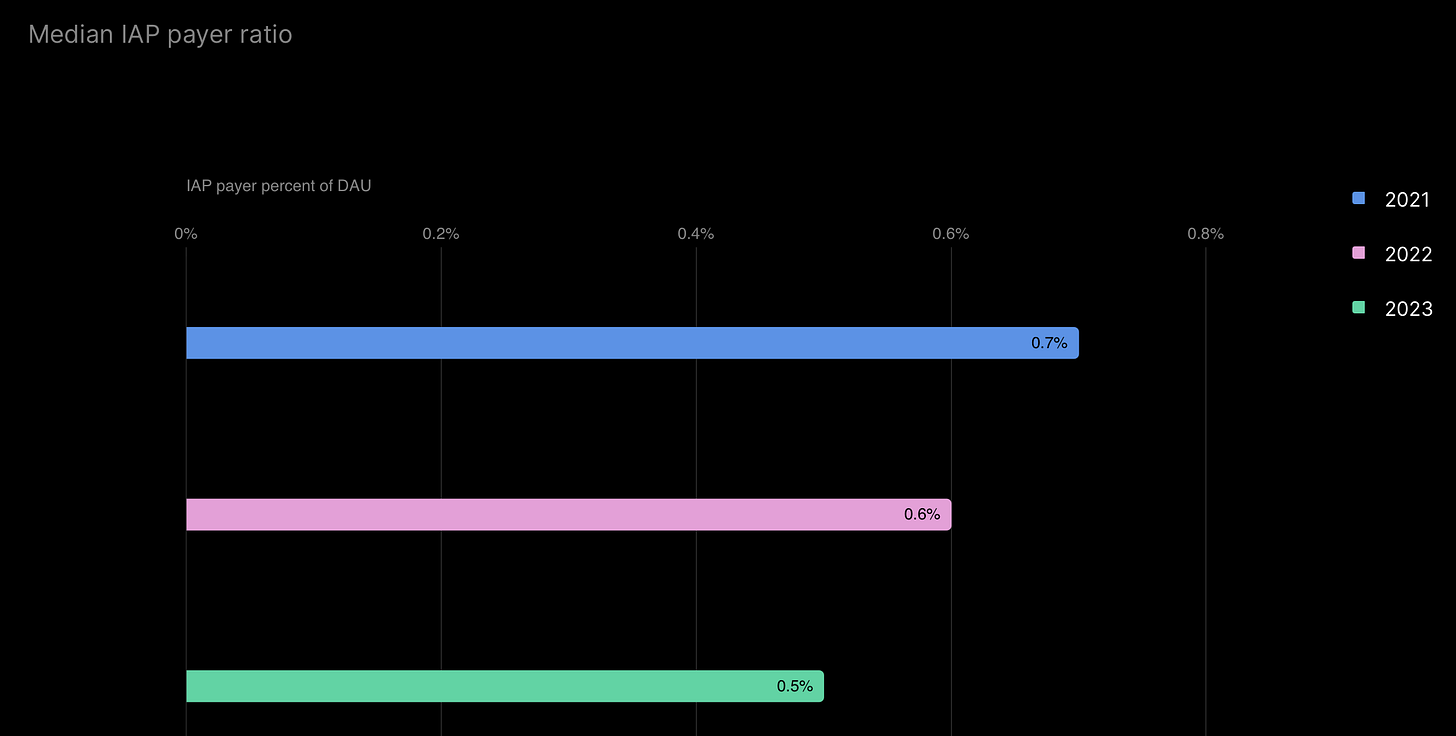

The median percentage of paying users in mobile games is also decreasing annually. In 2021, this figure was 0.7%; in 2022 - 0.6%; in 2023 - 0.5%.

However, the behavior of paying users has remained unchanged over the years. On average, one paying user accounts for 1.46 transactions, and the average revenue per transaction increased from $7.89 in 2022 to $8.15 in 2023.

In contrast, advertising revenue showed significant growth - by 26.7%. In 2022, IAA (In-App Advertising) ARPDAU was $0.03, while in 2023, it reached $0.038.

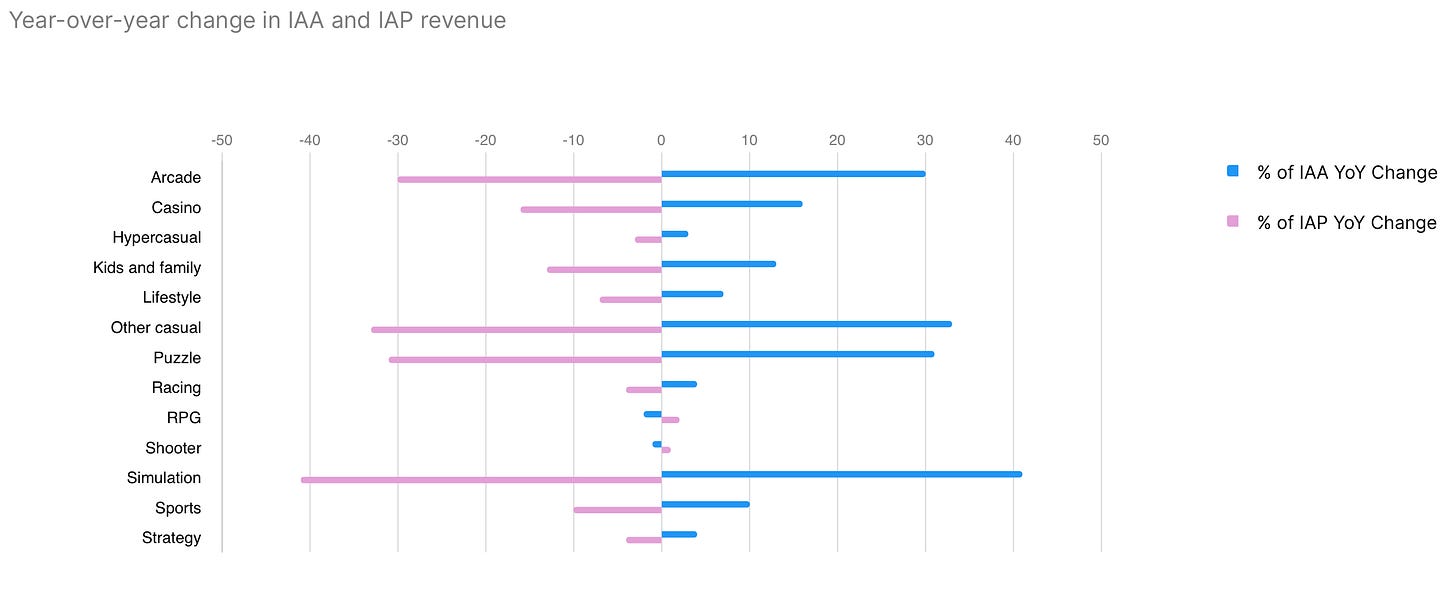

Simulation games, casual projects, and puzzles saw the most significant growth in IAA revenue. IAP revenue increased only for RPGs and shooters, while all other genres were in the negative.

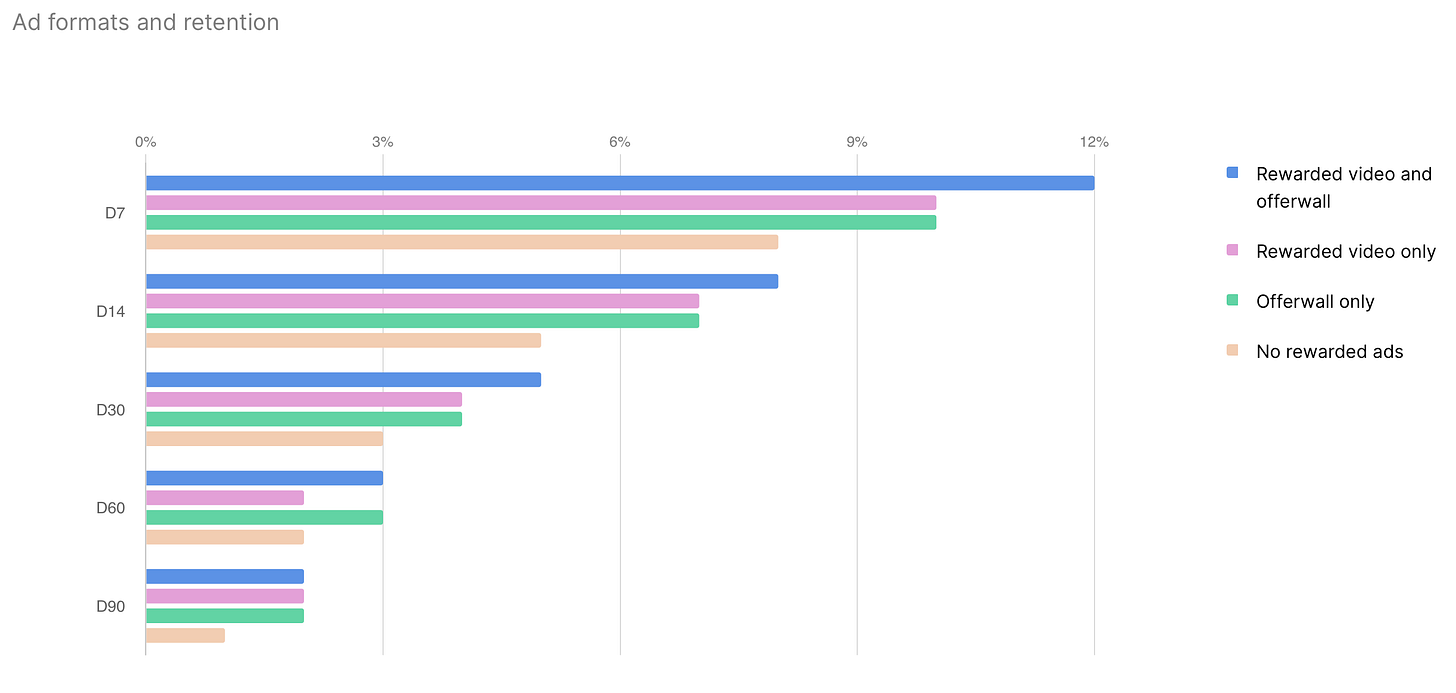

According to Unity data, projects with Rewarded Video and offerwalls have more daily sessions (3.12) than projects with only Rewarded Video (2.62), only offerwalls (2.58), or neither (2.1).

❗️There may be bias here because projects with more monetization mechanics are likely developed by large teams for big games. And besides monetization, these projects may have a large number of mechanics for audience retention.

Unity presents a similar picture regarding Retention. Projects without additional monetization systems generally have poorer retention. The best performance is seen in projects with comprehensive advertising monetization.

Cross-Platform Projects

Since 2022, small studios have released 71% more cross-platform projects.

In 2023, there was a 34% increase in projects on three or more platforms compared to 2022.

Most studios incorporate cross-platform support at the pre-production stage.

The primary platforms for studios with fewer than 50 employees are mobile (66%), PC (62%), and consoles (47%).

40% of studios release their projects on all platforms simultaneously; 40% do it gradually; and 20% have no specific strategy.

The most popular cross-platform genres are RPGs (38%), shooters (33%), fighting games (33%), and strategies (30%).

The larger the studio, the more likely they are to add cross-play. This is done by 95% of studios with over 50 employees.

Multiplayer Games

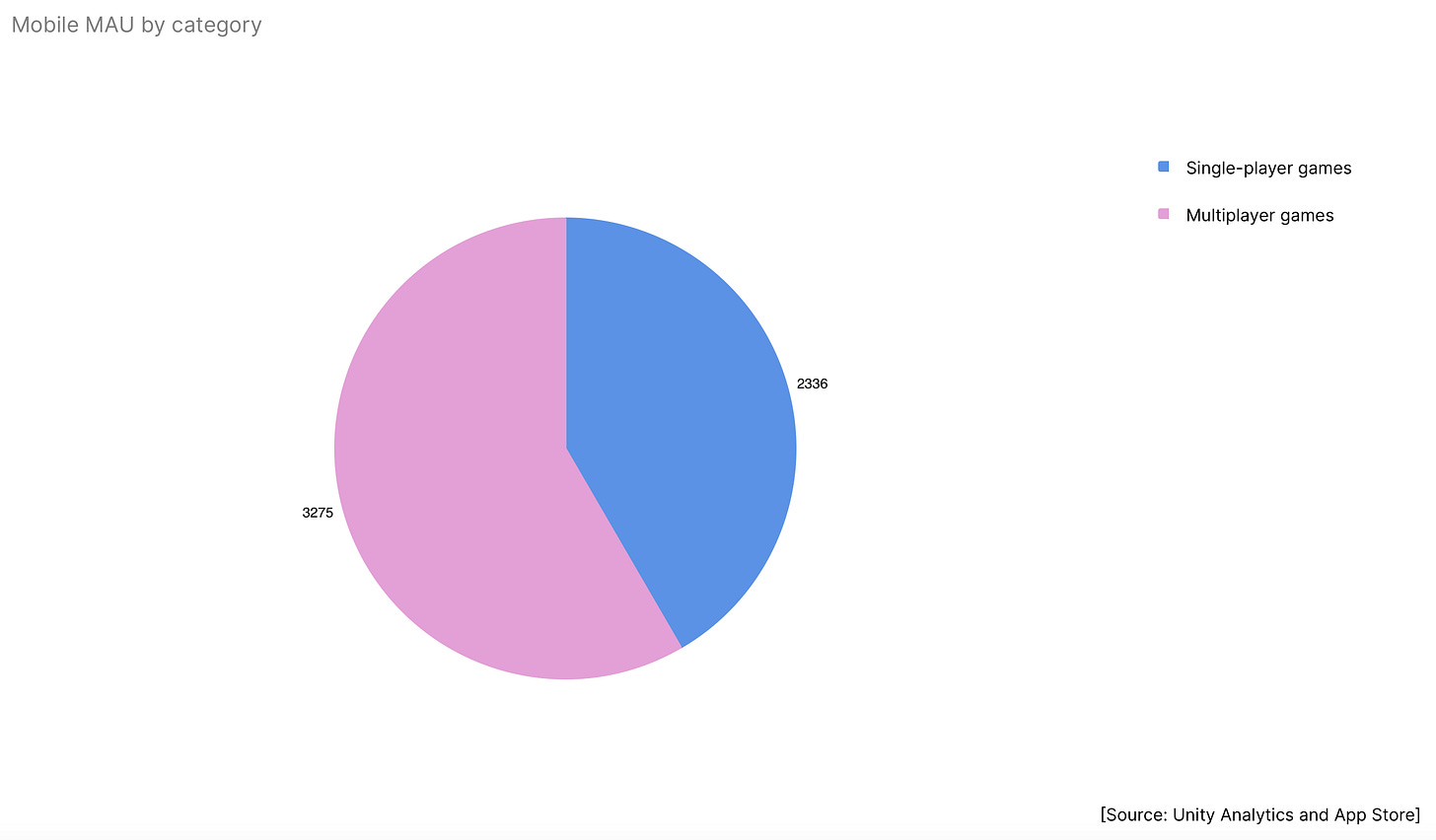

Mobile multiplayer games have a 40.2% higher MAU (Monthly Active Users) than single-player games.

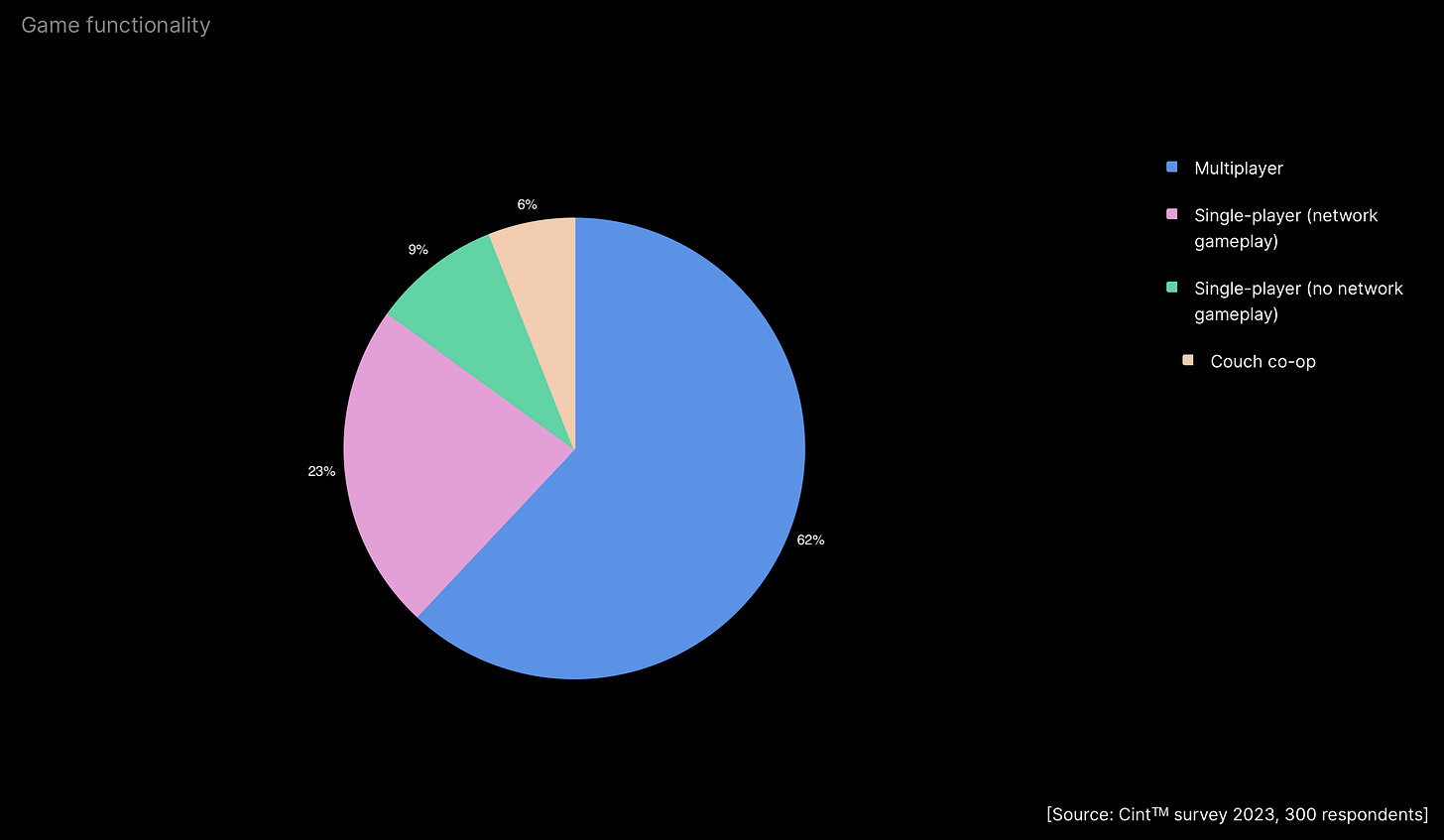

68% of surveyed studios reported working on a multiplayer project. 6% of these are working on projects with cooperative gameplay on a single screen.

69% of cross-platform games are multiplayer. Another 7% offer local cooperative play.

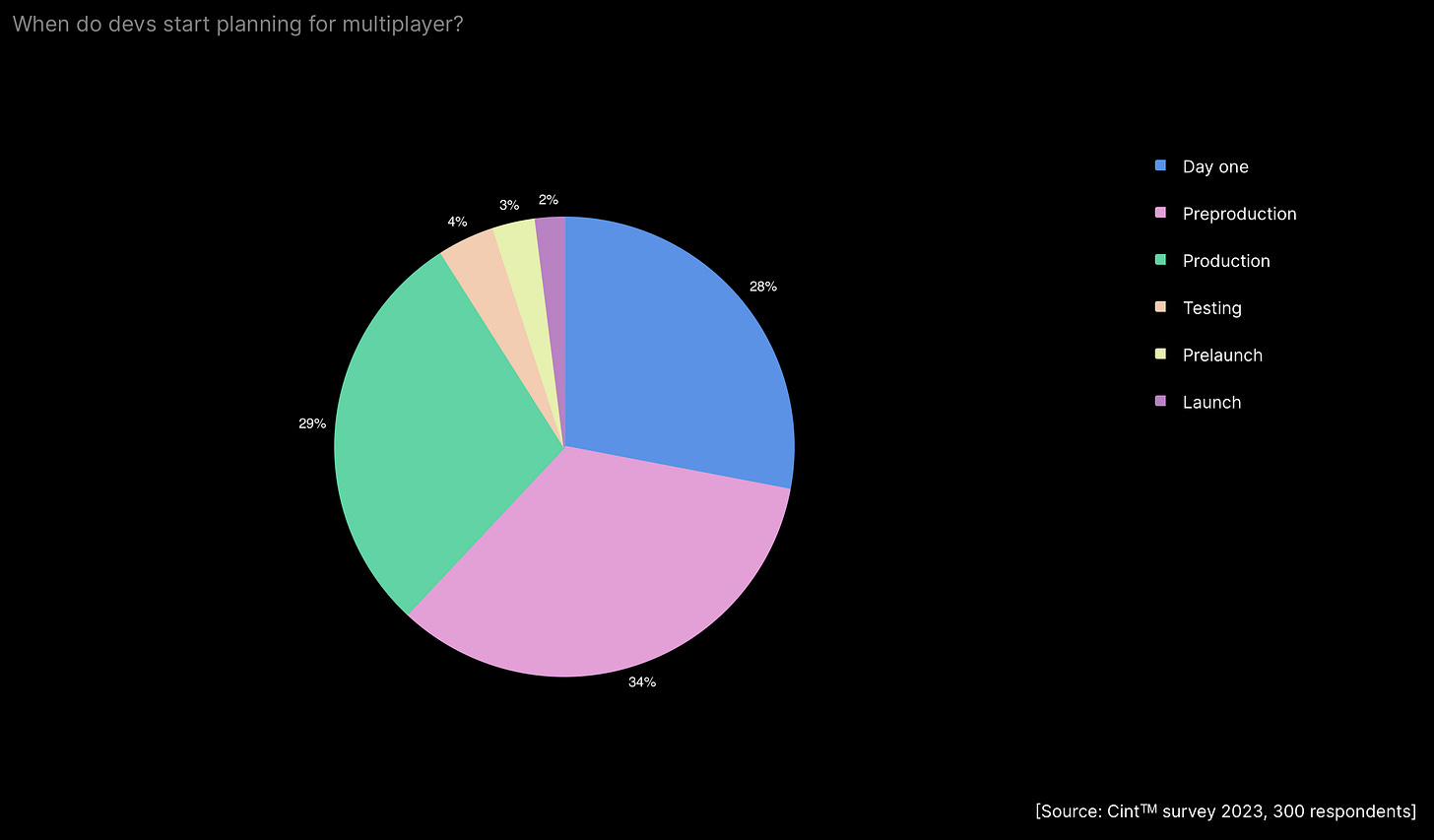

62% of developers plan multiplayer functionality at the idea or pre-production stage. Interestingly, 5% of developers decide to add multiplayer just before the game's launch.

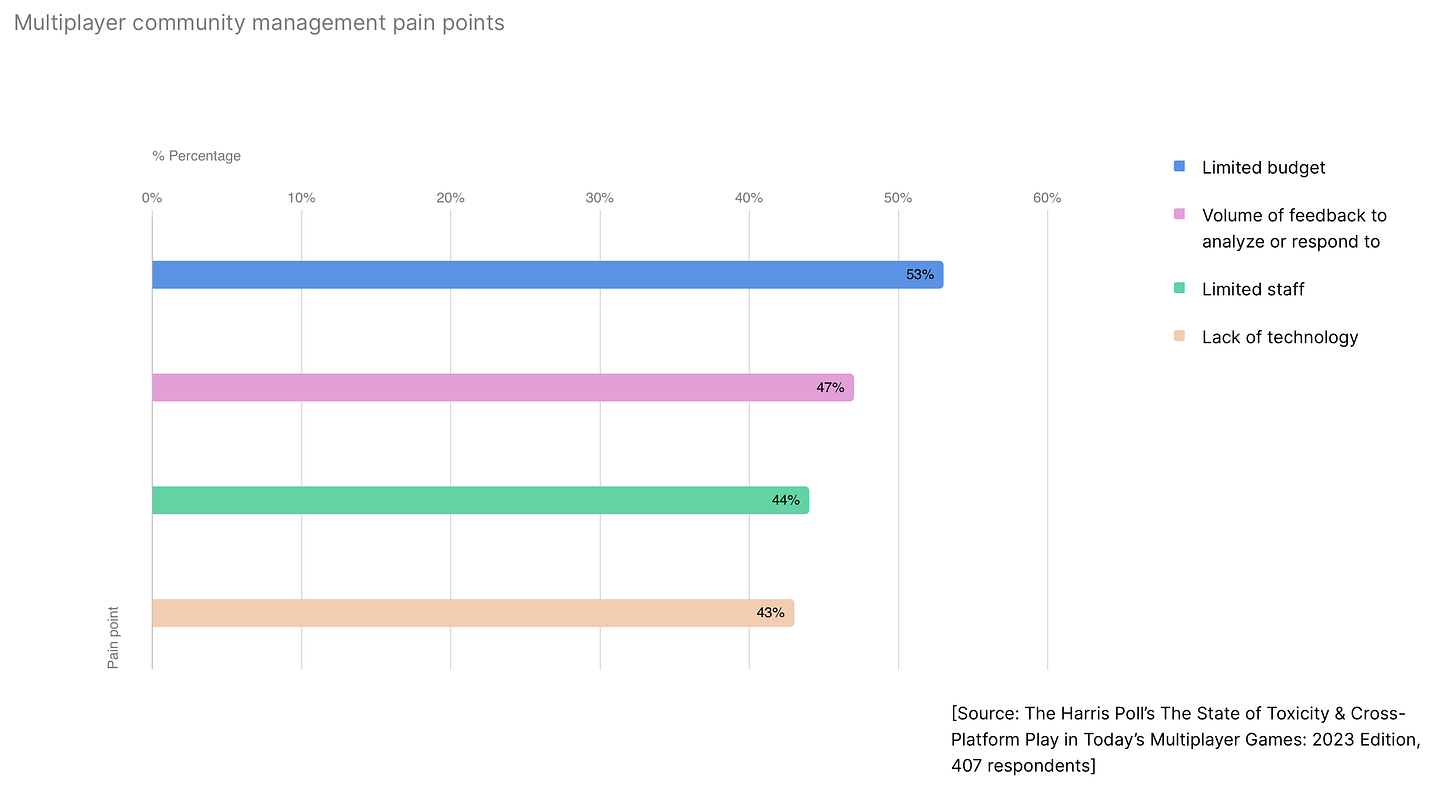

The main challenges in dealing with the audience of multiplayer projects are limited budgets (53%), managing a large amount of feedback (47%), staff limitations (44%), and lack of technology (43%).

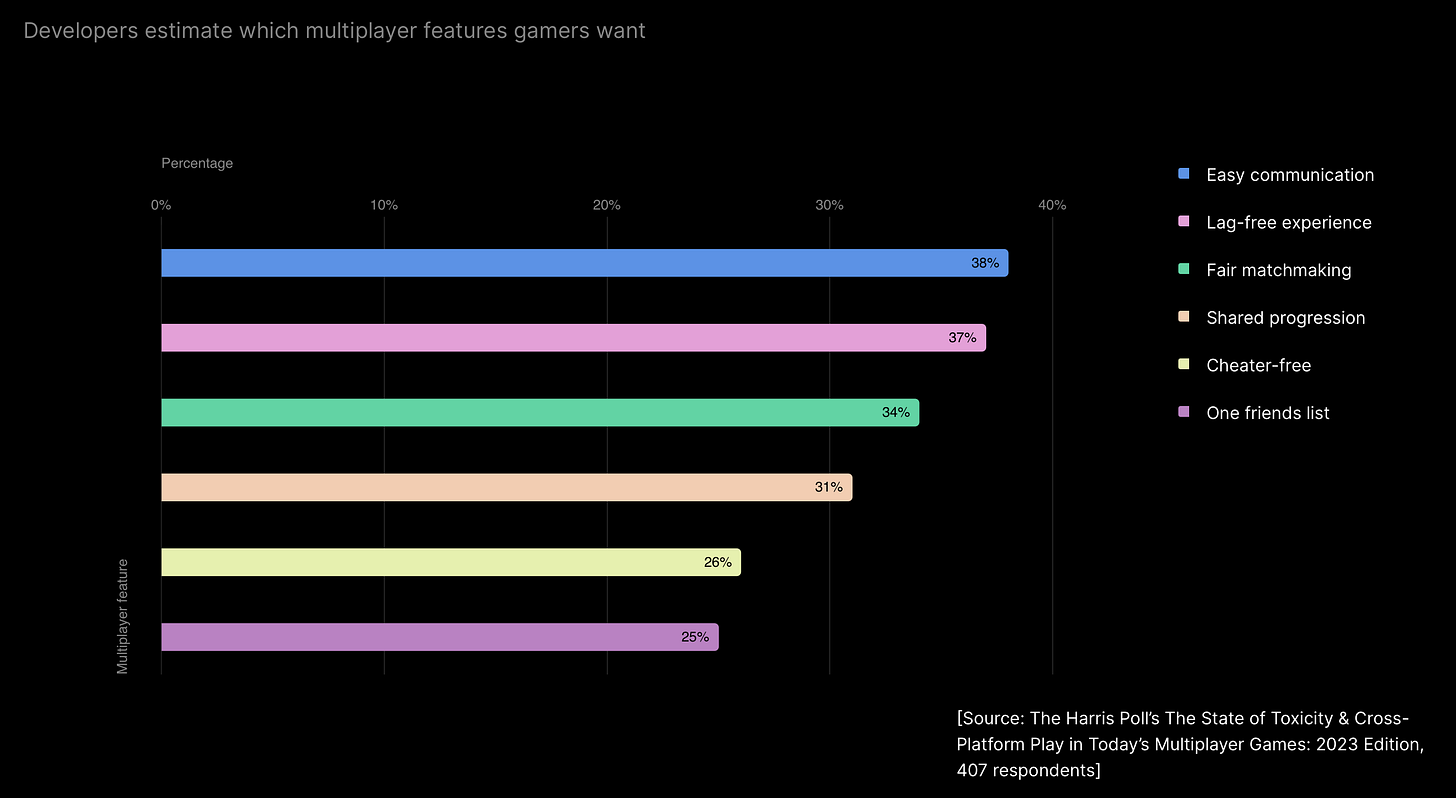

Developers believe that users expect multiplayer games to allow free communication (38%), lack lag (37%), fair matchmaking (34%), and shared progress (31%).

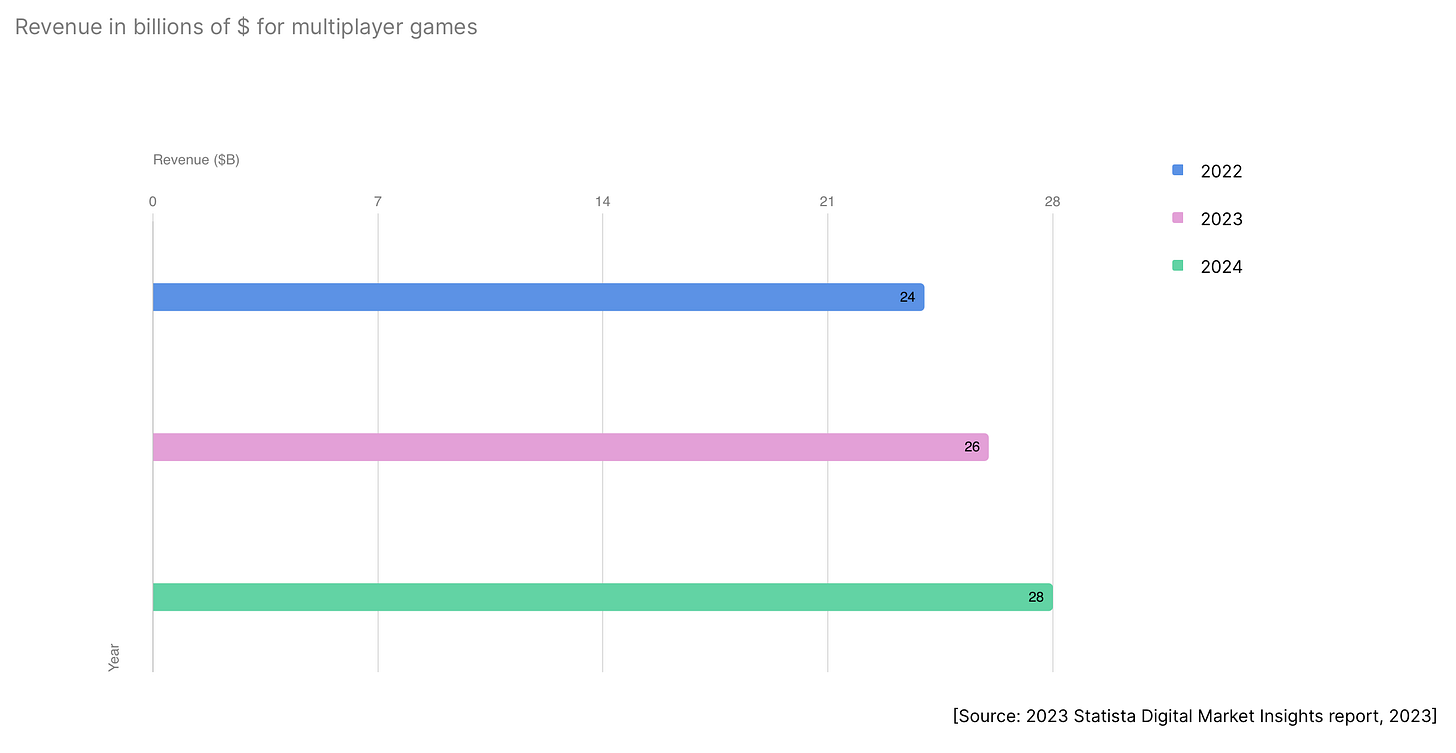

The revenue from multiplayer games continues to grow. In 2022, it was $24 billion; in 2023 - $26 billion, and in 2024, it is forecasted to reach $28 billion.

❗️Here, Unity refers to Statista data, but it's not very clear which specific games are included. Therefore, the figure is questionable.

Developers and their Live-Ops Approach

83% of developers understand how they will operate the game before releasing the first public versions.

To cope with market challenges, studios try to enter new markets with existing projects (53%); constantly create new content (52%); seek opportunities to work more efficiently (50%); diversify their game portfolios (47%); focus on player retention (35%); and invest in monetization and user acquisition (26%).

7% of games are supported for less than 6 months; 39% - from six months to a year; 49% - from one to two years; 5% - from three to five years.

Users pay attention to toxic behavior in games. 46% of players block toxic users, and 34% simply leave the game.

Developers consider daily missions and rewards (67%), achievements and challenges (59%), Rewarded ads and in-app purchases (40%), leaderboards (33%), and PvP (31%) as the most effective mechanics for increasing retention.

❗️Again, it's not very clear how the presence of Rewarded Ads and in-game purchases can directly impact retention.

39% of developers are considering adding user-generated content to their games; 27% have already done so. 34% do not plan to add player content.