Unity: The Gaming Industry in 2025

Risk reduction; people are positive about AI; and many-many other things.

Back from the GDC - and straight to the important reports!

Trend 1: Developers are Reducing Expenses—and Risks

45% of developers are trying to use tools more efficiently (and use tools to increase efficiency). 24% note that they focus more on achieving results through operations and additional monetization.

The majority of developers—62%—prefer to develop existing projects. 23% plan to move into new genres; 10% plan to make games in the same genre, and 5% want to build their own IP.

The request for what should change in the industry is diverse. There are calls for more advanced end-to-end technology stacks (55%), better tools (51%), and larger audiences (44%).

Emerging markets where surveyed developers see the greatest growth are Latin America (55%) and Southeast Asia (24%).

Brazil, Mexico, India are leaders in the list of most interesting countries for developers.

55% of developers plan to support their projects with content after release. 27% do not plan to do this (likely premium games developers), and 18% are still unsure, as it depends on the project's success.

A word from the newsletter sponsor

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

Trend 2: Studios are experimenting with multiplayer gaming experiences

58% of developers are working on projects with full multiplayer capabilities. 32% are making single-player games with network functionality. 6% are working on cooperative projects that allow play on a single screen. Only 4% of developers do not see multiplayer in any form in their projects.

Multiplayer projects are being made by teams of all sizes. 20% of teams with 1-2 people include multiplayer functionality in their games.

Unity highlights the genre diversity of multiplayer projects. There are more multiplayer shooters or adventure games, but this is due to the overall number of games in these genres.

Studios are experimenting with multiplayer formats. 69% of teams offer asymmetric multiplayer in their projects.

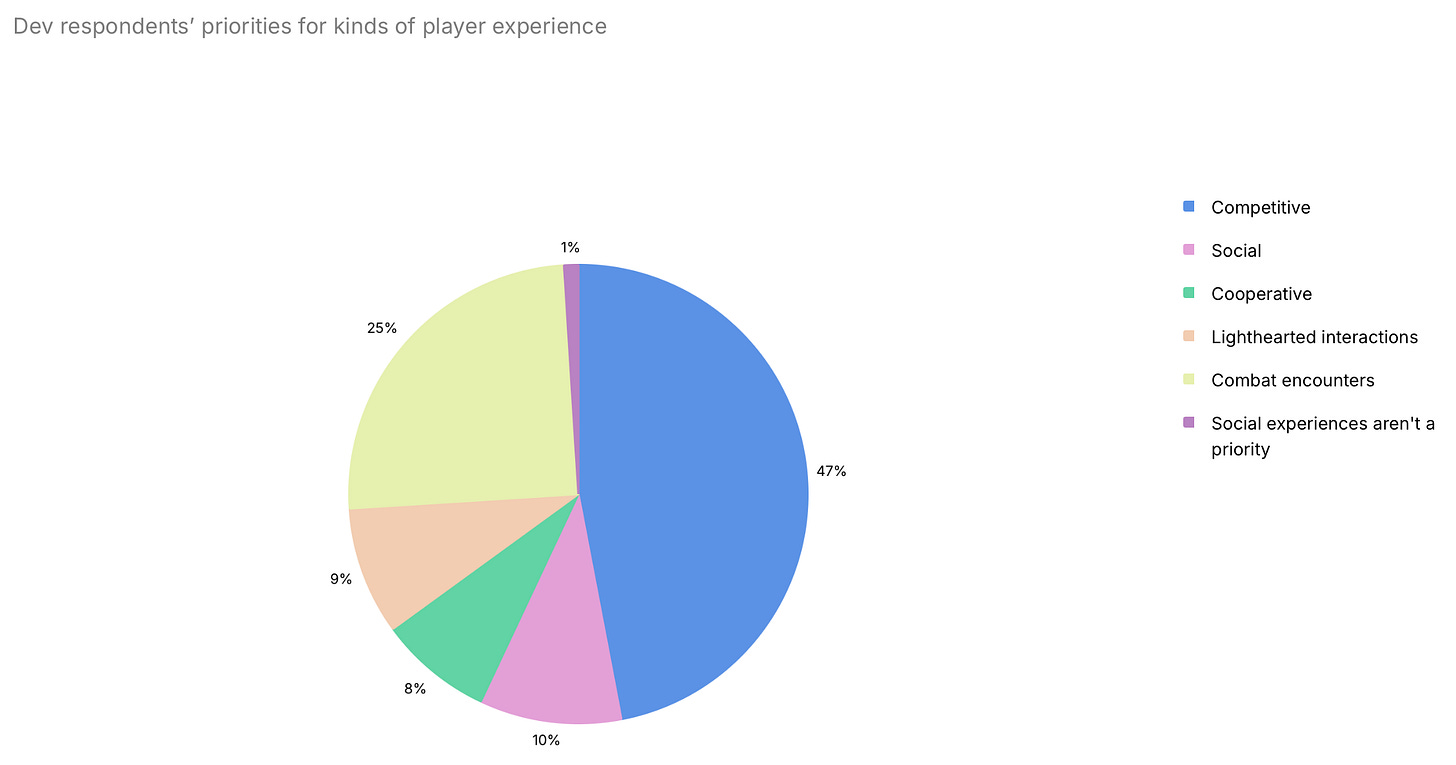

47% of the multiplayer experiences created by developers are competitive. Multiplayer today is about both shared experiences and socialization.

Developers believe that in 10 years, users will be playing RPGs, strategies, MMOs, MOBAs, and shooters.

Trend 3: Studios continue to work with proven platforms

Mobile devices and PCs are the most popular platforms for developers regardless of studio size. Console releases, however, depend directly on the size of the studio. 84% of large companies release games on consoles, while only 19% of studios with fewer than 10 employees do.

Developers believe that most of the money (84%) is on mobile devices and consoles.

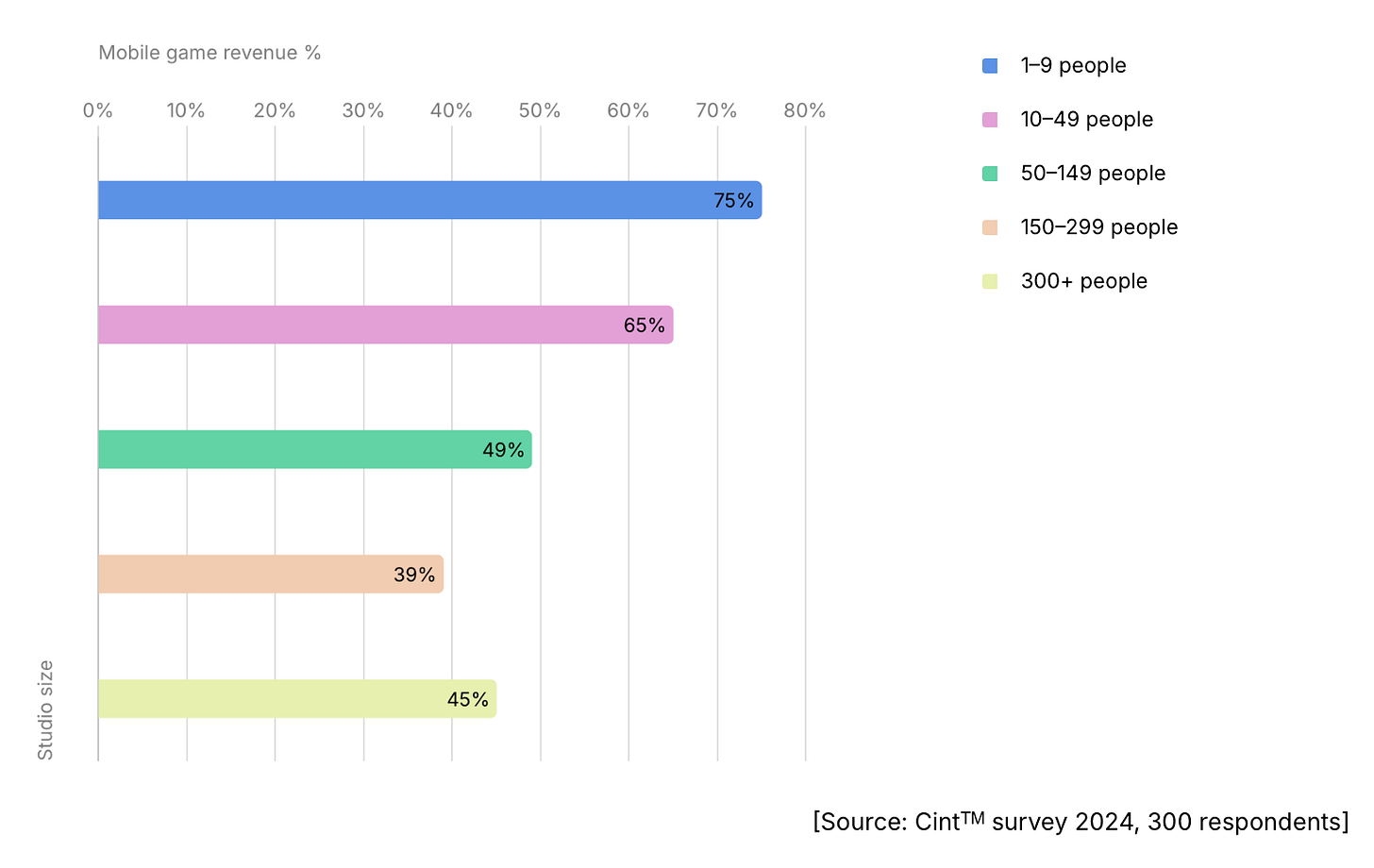

Mobile revenue often accounts for the largest share among small studios.

The situation with console revenue is the opposite. The larger the studio, the more frequently console revenue has the largest share.

❗️Picture has a mistake - it is about console revenue.

Only 11% of developers plan to make games for web platforms, so despite overall positivity, web games are not yet mainstream.

Most of those making web games plan to release them within the next 18 months.

Developers who do not plan to release projects for web platforms are concerned about technological limitations and limited browser support. There are also questions about mobile device support.

Trend 4: Games are getting larger

The median build size on Unity over the past three years has increased by 67% to 167MB.

32% of developers noted that people are spending much more time playing games; 56% saw a small increase.

Developers use different strategies to retain users, but the most effective (and complex) way is producing new content.

A word from the newsletter sponsor

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

Trend 5: Developers are seeking for a new technological solutions

In addition to the challenges of finding a unique game idea, 21% of developers get stuck in R&D for a long time; 20% have problems releasing projects on time and with the right scope. Another 15% face issues with tool management.

Developers actively use live ops tools. It's surprising that only 25% use Unity's advertising and monetization tools.

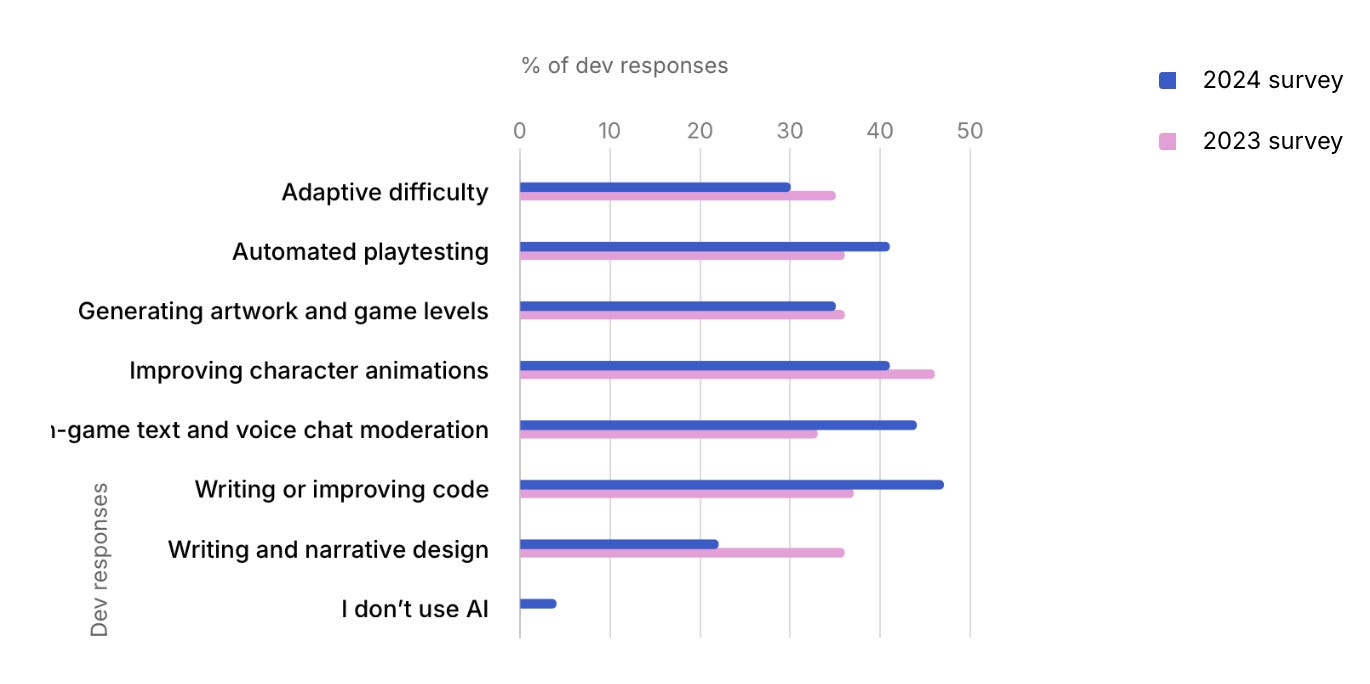

79% of surveyed developers have a positive attitude towards new AI tools.

Only 4% of those surveyed noted that they do not plan to use AI tools in 2025.

Despite the growing popularity of AI tools, most developers continue to use old and proven tools.