VideoGamesEurope & EGDF - Facts about the European Game Industry in 2024

The European gaming industry is growing, both in revenue and number of employees (yes, despite layoffs).

Before we start, I’m happy to announce that in the upcoming months, the newsletter will be powered by Xsolla! It’s a big step for the newsletter, and I appreciate the support of the Xsolla team, their belief in the work I do!

For those who don’t know, Xsolla is a global leader in video game commerce that empowers game developers and publishers to promote, distribute, and monetize their games with ease. From launching a custom web store in just a few clicks to providing secure payment solutions across 1,000+ methods and 200+ regions, Xsolla offers all the things needed to grow a gaming business worldwide. Check the new website to see how it works!

The content of the newsletter won’t change, and I will continue to cover the gaming market numbers as usual. Thanks to Xsolla for the support in these endeavors! ❤️

In the report, survey data is used (1,000 people offline per year; 1,000 people online per month). It also includes data from GSD, which accounts for both physical and digital actual sales, reported by developers and publishers.

European Players

54% of Europeans aged 6 to 64 play games. 75% of people in Europe over 18 play games.

The average age of a player is 31 years old.

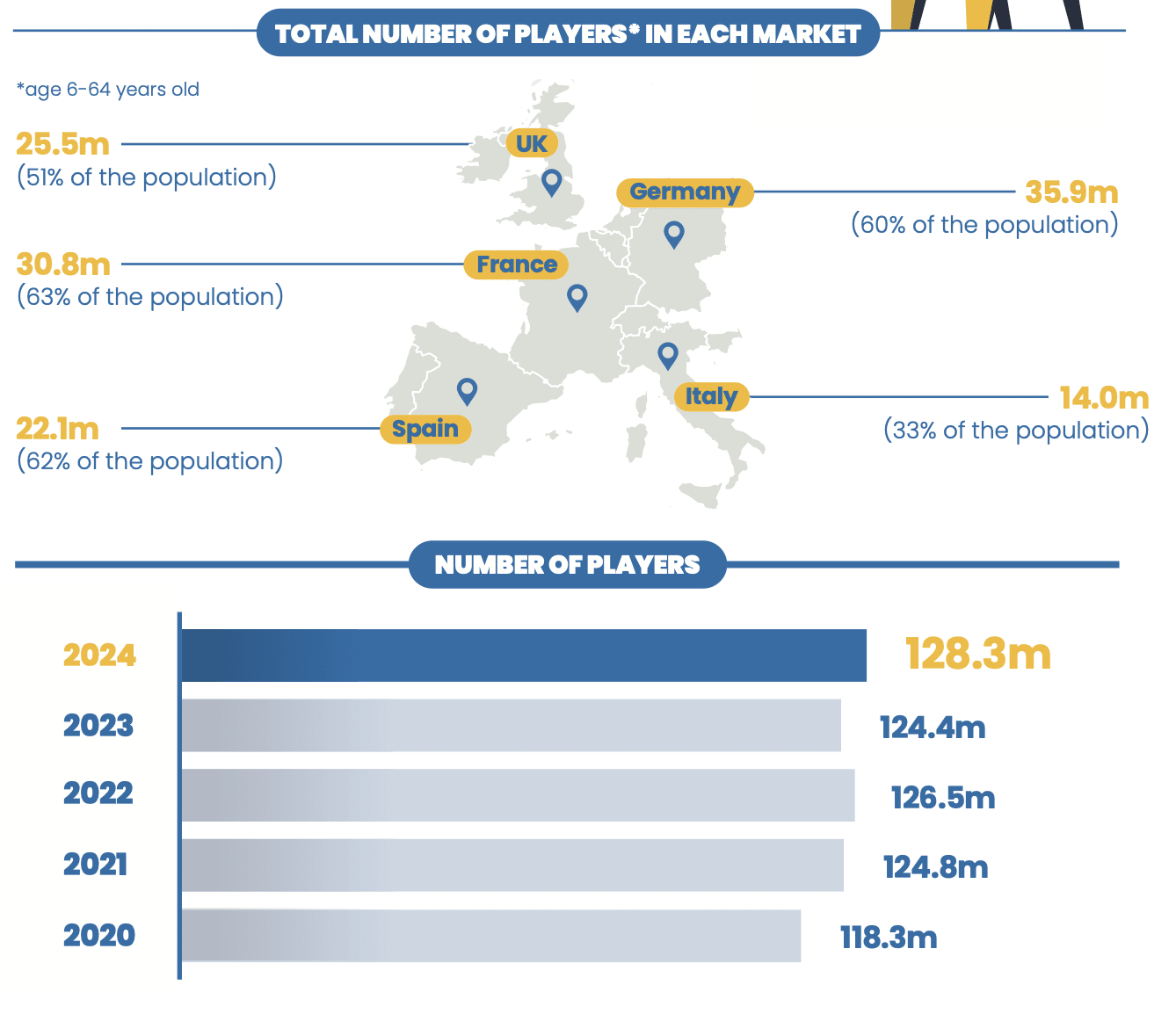

The total number of players in Europe reached 128.3 million. This is a new record and the largest figure in the last 5 years.

France has the highest percentage of its population playing games - 63% (30.8 million people). The lowest among Central and Western European countries is Italy, with 33% of the population (14 million people).

45% of all players are women. The average age of female gamers is 32.

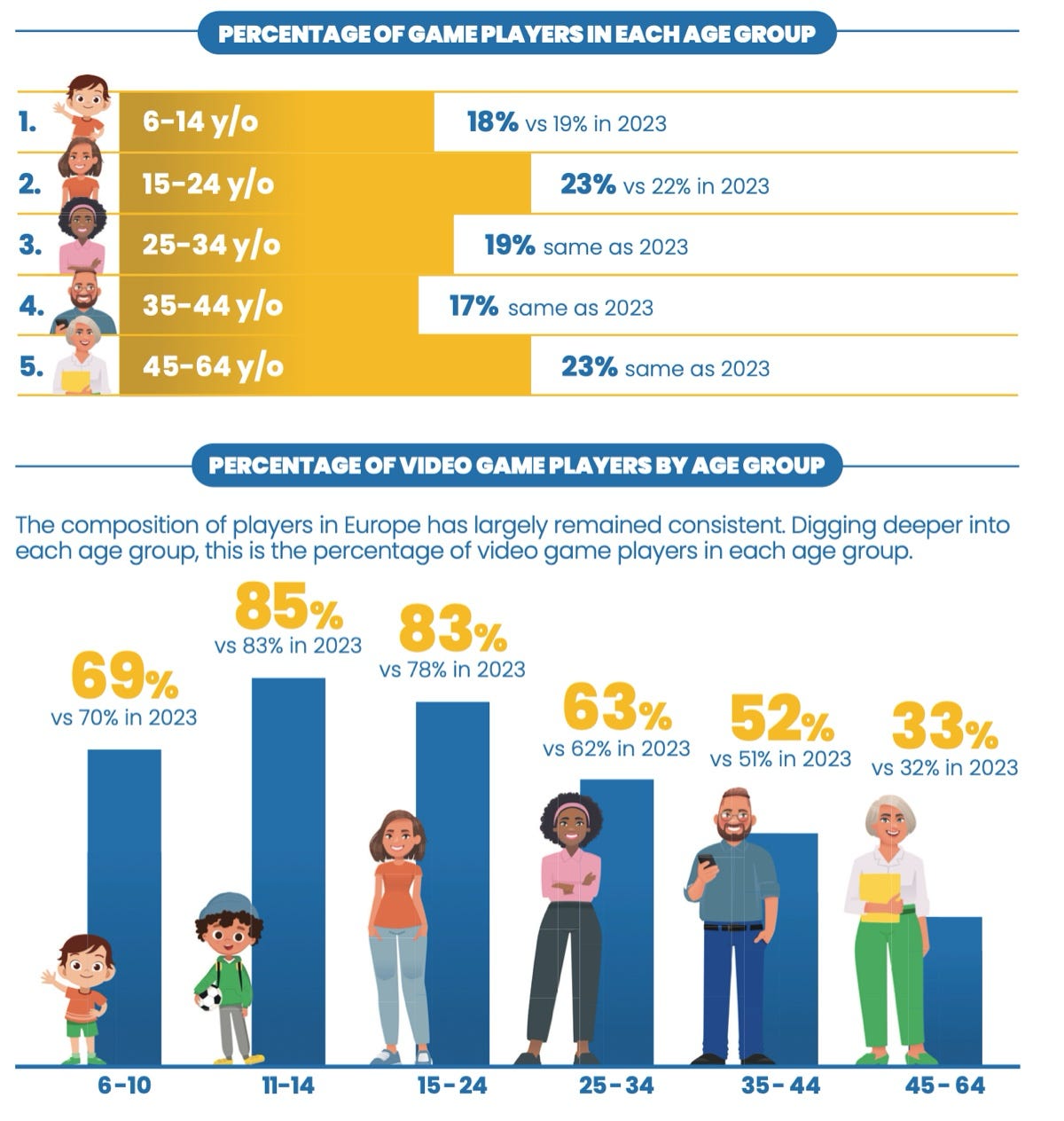

The age composition of players has hardly changed compared to 2023. There are 1% more players aged 15–24 and 1% fewer players aged 6–14. Overall, gaming penetration is growing across all ages except the 6–10 segment.

75% of players in Europe spend at least 1 hour per week playing. 15% play less than 1 hour, and 10% play just a few times a year (almost not at all).

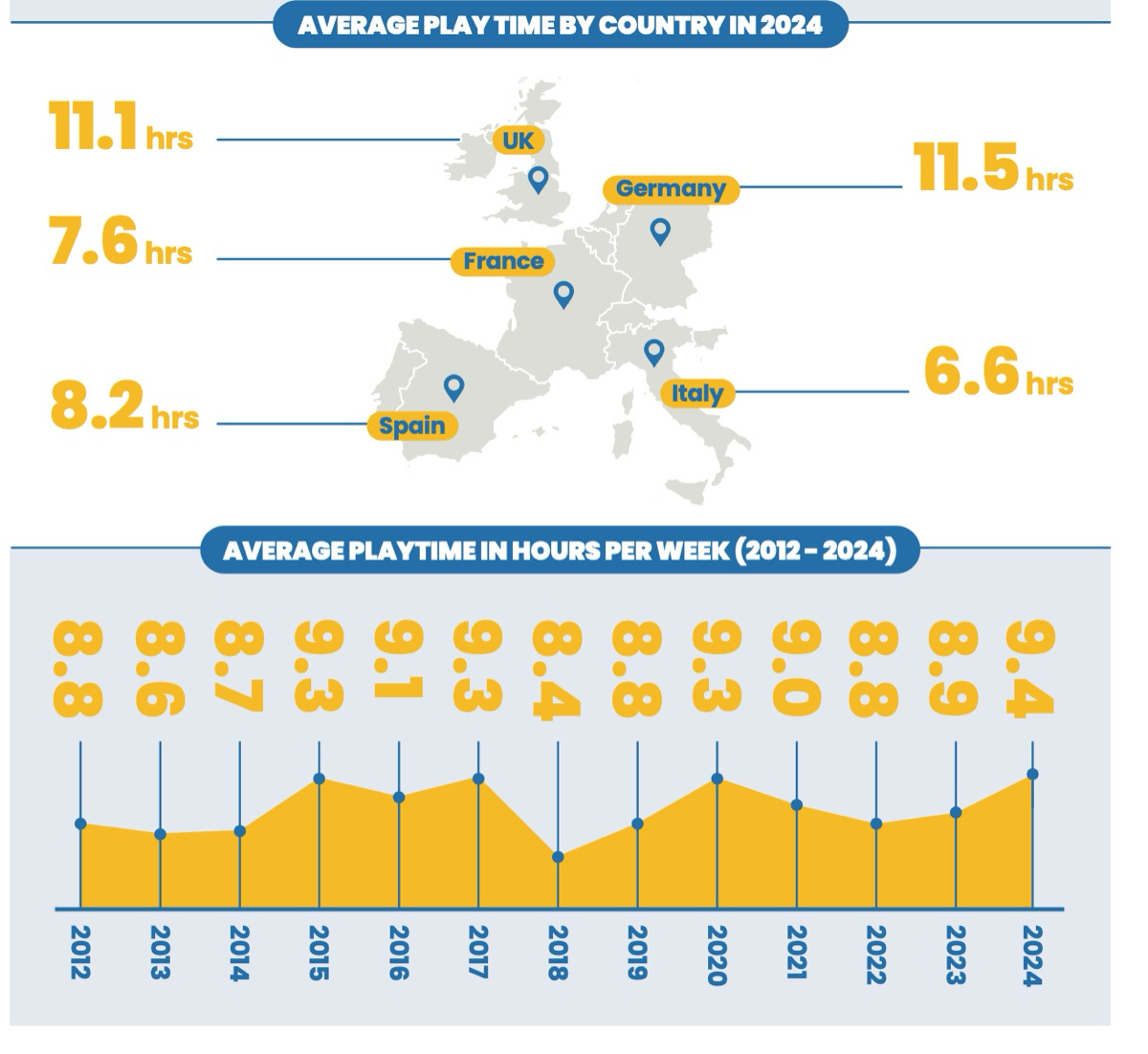

The most active players are in Germany, averaging 11.5 hours per week. Italians play the least, averaging 6.6 hours per week.

Interestingly, 2024 set a record since 2012 (when tracking began) for average weekly playtime. People now play an average of 9.4 hours per week.

Games are still behind other media. People spend more time on social networks (16.75 hours per week) and watching television (23 hours per week).

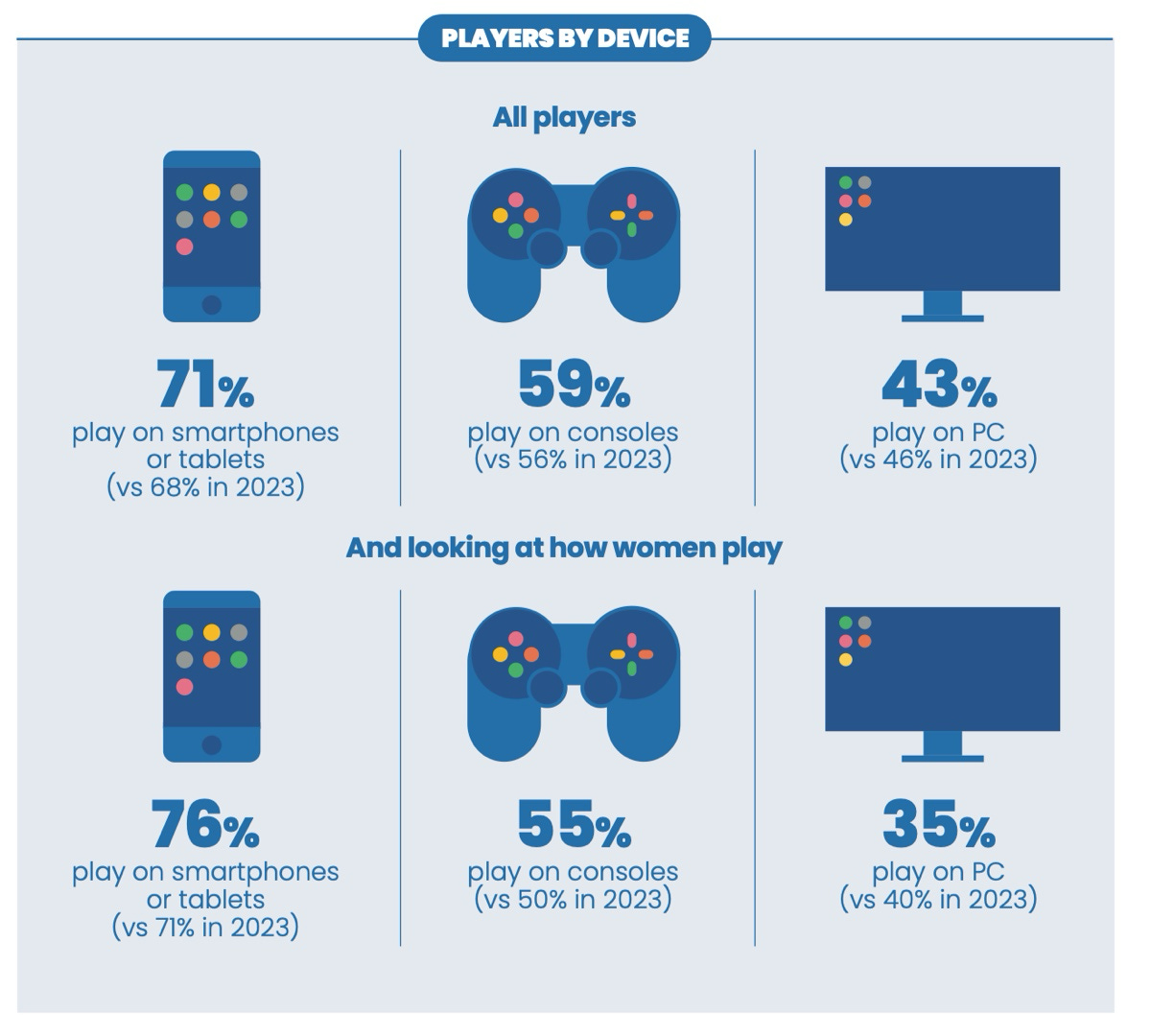

People played more on smartphones and consoles in 2024 compared to 2023, and less on PC. Interestingly, this contrasts with the growing PC platform revenue.

Top mobile genres in the 5 biggest European markets are puzzle (25%), RPG & strategy (17%), and word games (17%). On consoles, players mostly play racing (31%), sports (28%), and adventure (28%). On PC, adventure (23%), shooters (20%), and strategy (20%) dominate.

74% of people say games are a good way to "stretch the brain." 67% say games help them distract from daily problems. 68% say games help cope with stress. 75% agree that games are entertainment for all ages.

The Game Industry in Europe

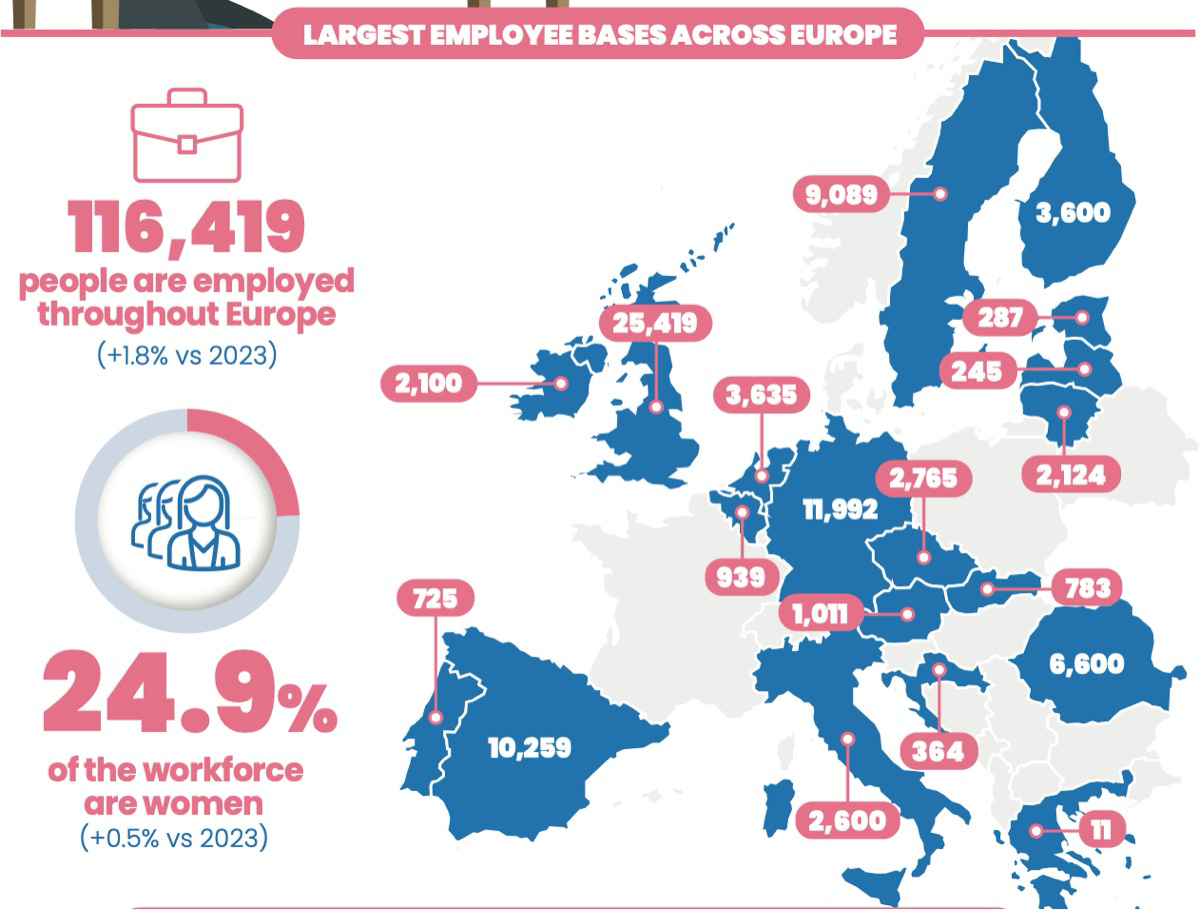

As of the end of 2024, 116,419 people work in European game companies. This is up 1.8% from 2023. This confirms recent reports stating that most layoffs affected U.S. studios.

24.9% of all employees in Europe are women.

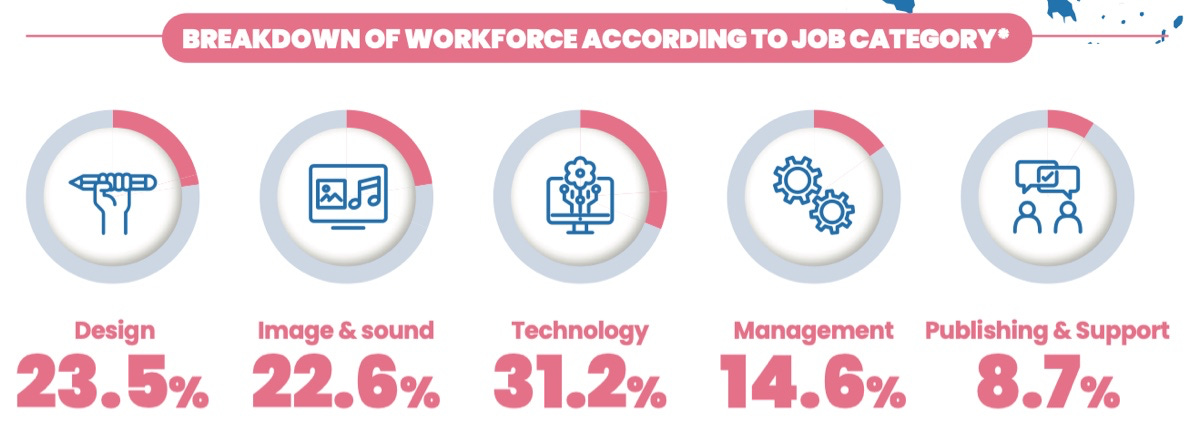

23.3% of all employees are in management, publishing, or customer support. The rest are directly involved in development.

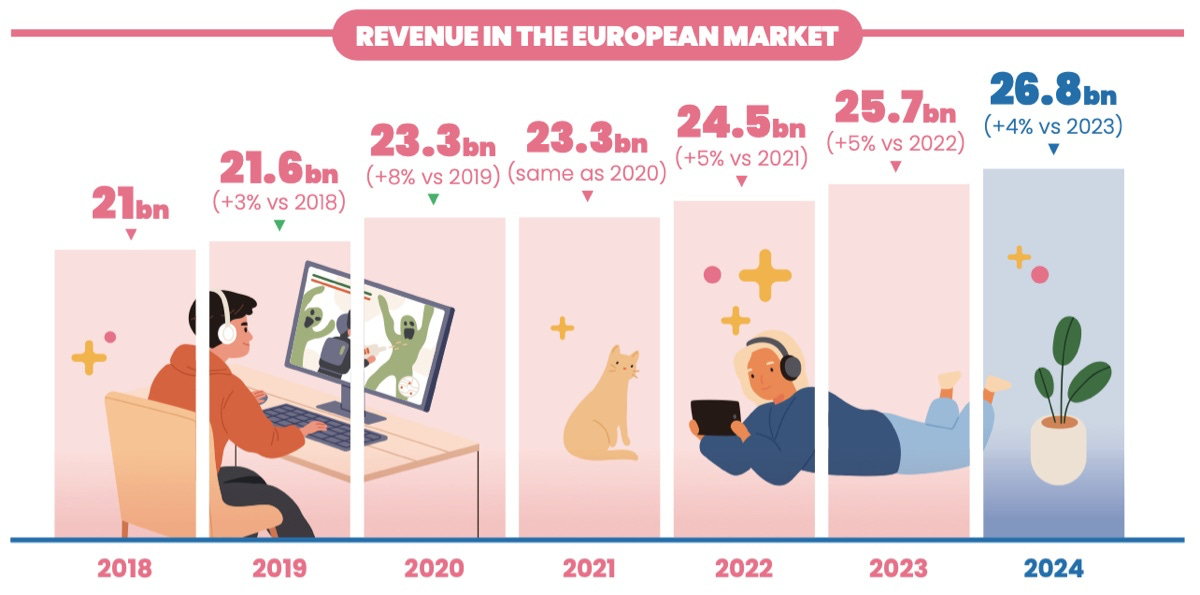

Revenue of the European game market continues to grow. In 2024, the European markets reached €26.8 billion (+4% YoY).

Mobile’s share in revenue grew (44% vs. 41% in 2023), while PC (15% vs. 14% in 2023) and streaming services (4% vs. 3% in 2023) also increased slightly. The share of consoles decreased (38% vs. 41% in 2023).

Digital revenue share continues to grow (90% in 2024 vs. 85% in 2023). Accordingly, physical distribution revenue was 10% in 2024. Digital segments on PC, consoles, and especially mobile keep growing.

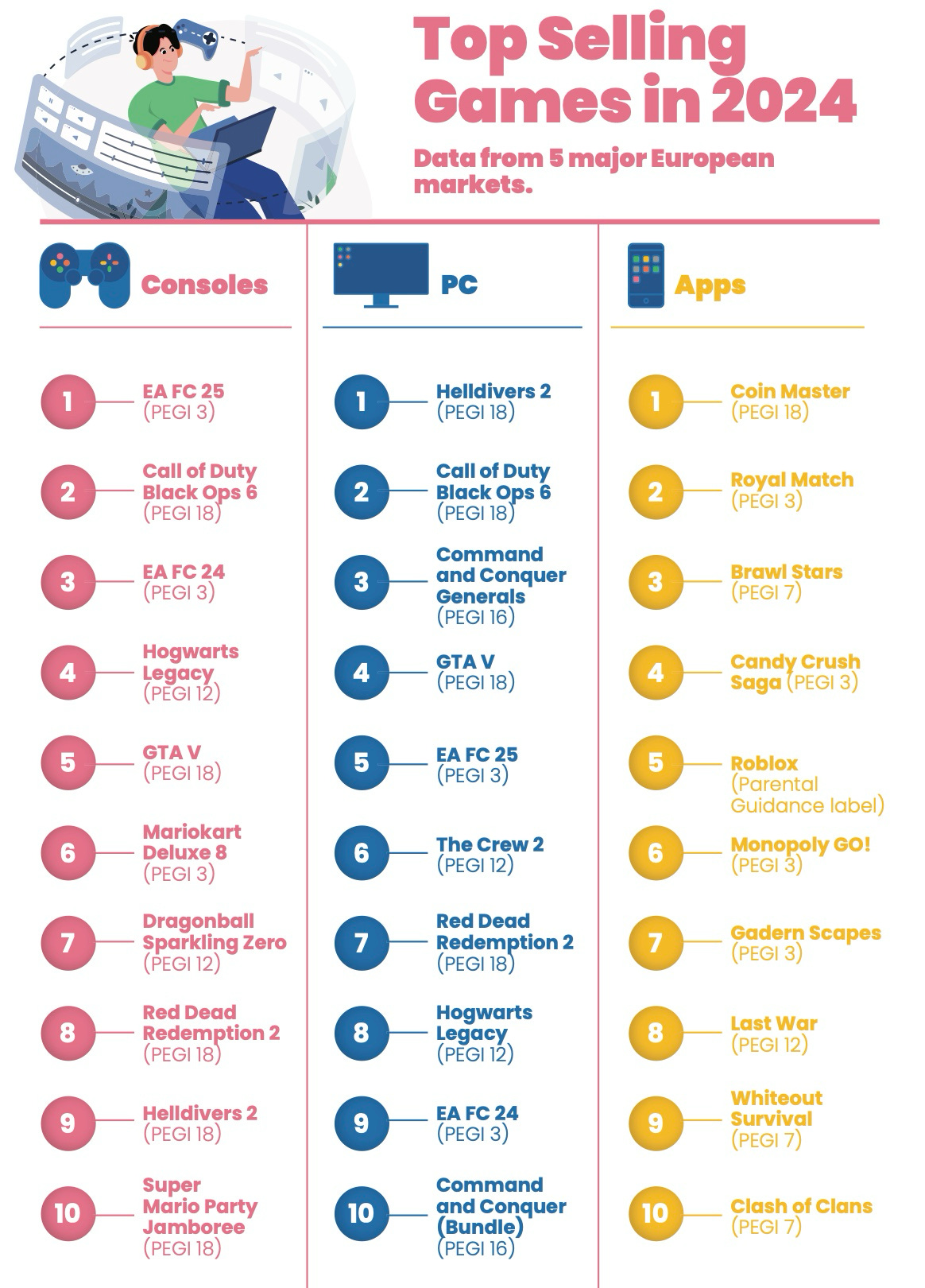

Top console hits in 2024: EA FC 25, Call of Duty: Black Ops 6, and EA FC 24. On PC: Helldivers 2, Call of Duty: Black Ops 6, and C&C Generals (surprisingly). On mobile: Coin Master, Royal Match, and Brawl Stars.

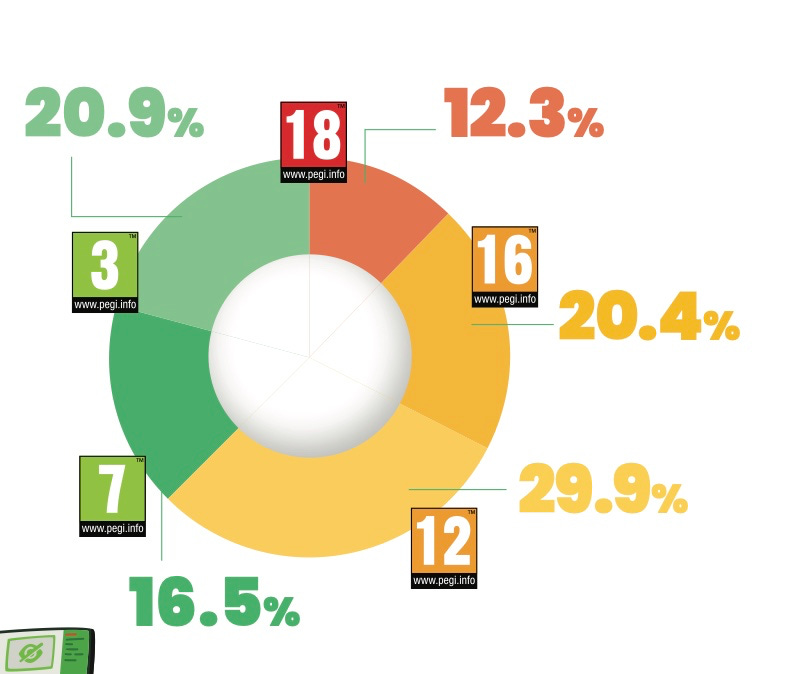

On PC and consoles, 12.3% of games released in 2024 were aimed at audiences over 18. Most projects (67.3%) had a PEGI rating of 3–12 years.

According to the report, 80% of parents make game purchase decisions for their children based on ratings.

Kids and Games

95% of parents actively monitor how their children spend money in games.

76% of parents say their children do not buy in-game content. An interesting number, considering Roblox stats.

Children’s spending in games dropped by 21% compared to 2023.