Weekly Gaming Reports Recap: April 7 - April 11 (2025)

Two remarkable reports been released this week - by Aream about the investment market in Q1'25, and by Newzoo about the PC/Console market in 2025.

Reports of the week:

Games & Numbers (March 26 - April 8, 2025)

Newzoo: PC and Console market in 2025

Aream & Co.: Gaming Investment Market in Q1'25

Games & Numbers (March 26 - April 8, 2025) - sponsored by Neon

The newsletter sponsor is Neon - a high-performance direct-to-consumer solution built for games.

PC/Console Games

The total number of players in Death Stranding has surpassed 20 million. This figure does not represent sales, as the game was distributed through subscription services.

PowerWash Simulator has been played by over 17 million people. Again, this is not sales, but the number is impressive.

Monster Hunter Wilds sold 10 million copies in its first month, with 8 million sold within the first three days of release.

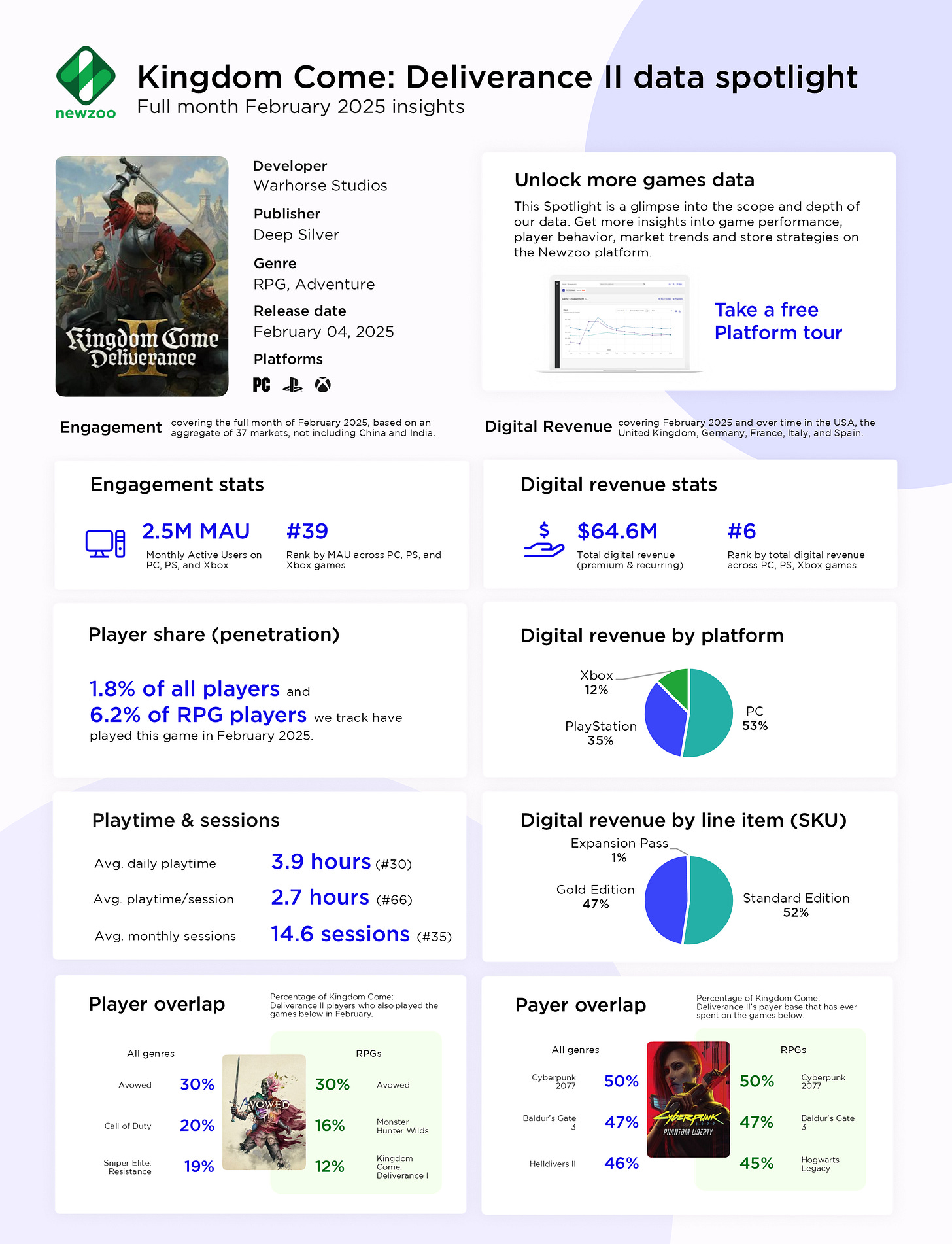

Newzoo shared some insights on the launch sales of Kingdom Come: Deliverance IIacross six countries (USA, UK, France, Spain, Italy, and Germany). In February, the digital version generated $64.6 million. The leading countries by MAU were the USA (37%), Germany (9%), UK (7%), Russia (5%), and France (5%).

Over 3 million people have played Assassin's Creed Shadows. The game is available for free in Ubisoft+'s highest tier, so these are not sales figures. Ubisoft also noted that it was their second-best D1 launch sales-wise and their largest PlayStation Store launch in history.

Since its release on March 27 this year, Atomfall has been played by over 1.5 million people, according to an official account announcement.

A word from our sponsor

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

InZOI sold over 1 million copies within a week of release. Krafton is satisfied with this result, noting that their other projects usually took longer to reach this milestone.

Cataclismo, published by Hooded Horse, sold 250,000 copies. This was shared via the publisher's official Twitter account.

Developers of Heroes of Might & Magic: Olden Era announced via Twitter that the game has reached 500,000 wishlists.

Mobile Games

Pokemon TCG Pocket has surpassed $600 million in net revenue (post fees and taxes) since its release, according to AppMagic data. Japan accounts for 46% of the total revenue, while the USA contributes 27%.

Newzoo: PC and Console market in 2025 | Sponsored by Neon

Market overview

Newzoo predicts that the console segment will be the primary growth driver for the market by 2027. Between 2021 and 2024, the PC market grew by 1.2%, while the console market increased by 2.1%. From 2024 to 2027, the company expects PC growth to reach 2.6% and console growth to hit 7%, with the market projected to grow to $92.7 billion.

In 2024, premium game sales on PC dropped by 2.6% year-over-year, while microtransactions grew slightly (+1.4% YoY) alongside DLC sales (+0.8% YoY). The PC segment was valued at $37.3 billion by the end of 2024.

The rising popularity of premium monetization models does not lead to overall PC market growth, as established free-to-play (F2P) projects generate most of the revenue. Additionally, the number of PC players is not increasing, making monetizing the existing audience a major challenge. There is hope for increased spending among Gen Z and Alpha users, but they currently spend less compared to how much they play.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

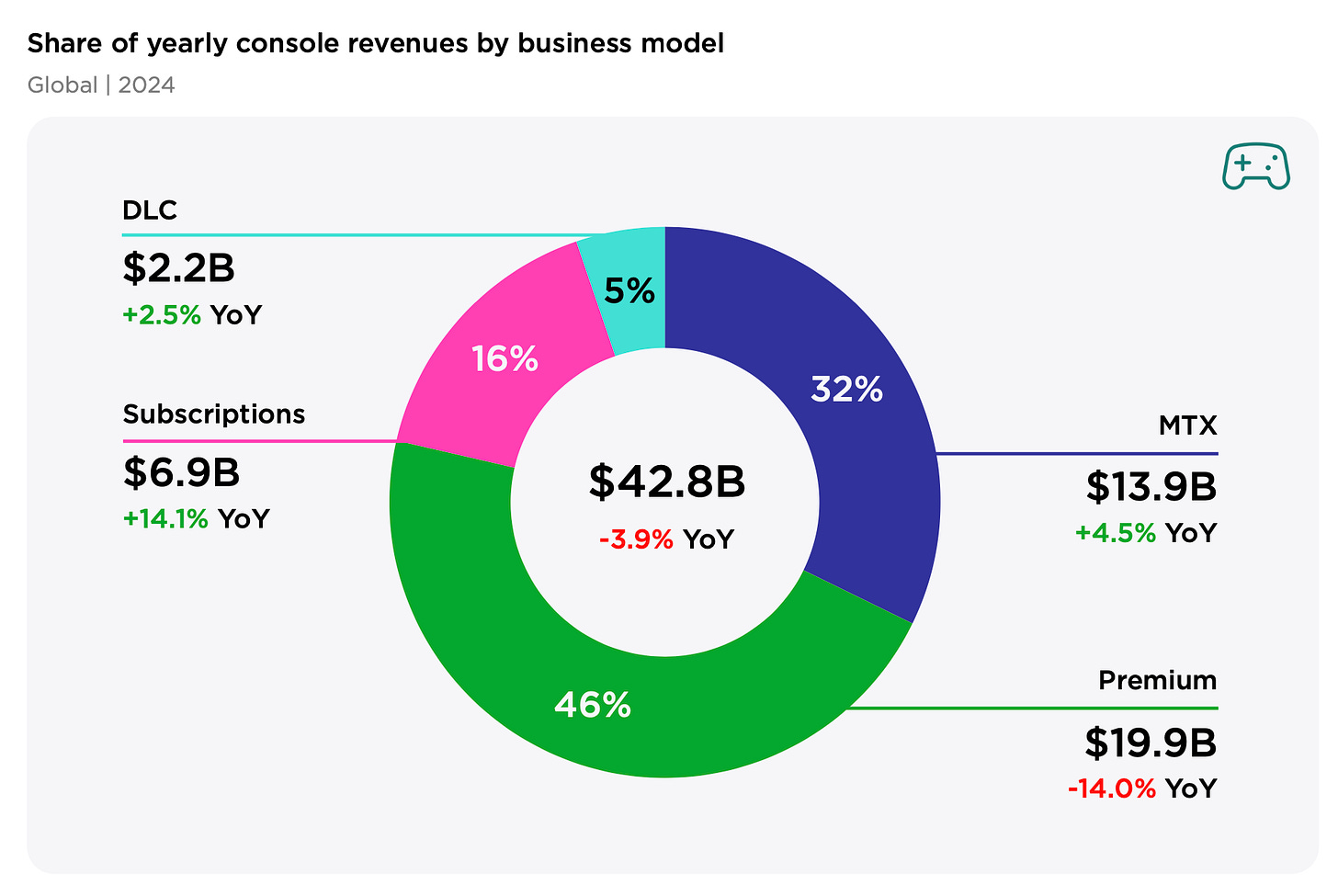

The console segment declined by 3.9% in 2024, reaching $42.8 billion. Game sales dropped by 14% (to $19.9 billion). However, subscriptions grew (+14.1%, reaching $6.9 billion), along with microtransactions (+4.5%, reaching $13.9 billion) and DLC sales (+2.5%, reaching $2.2 billion).

Newzoo attributes the drop in game sales to post-pandemic corrections and a strong lineup of releases in 2023. Growth is expected from this year onward, driven by factors such as the release of GTA VI, Nintendo Switch 2, and a new console cycle.

The player base for both PC and consoles has been growing at approximately the same rate since 2021.

Player Playtime Analysis

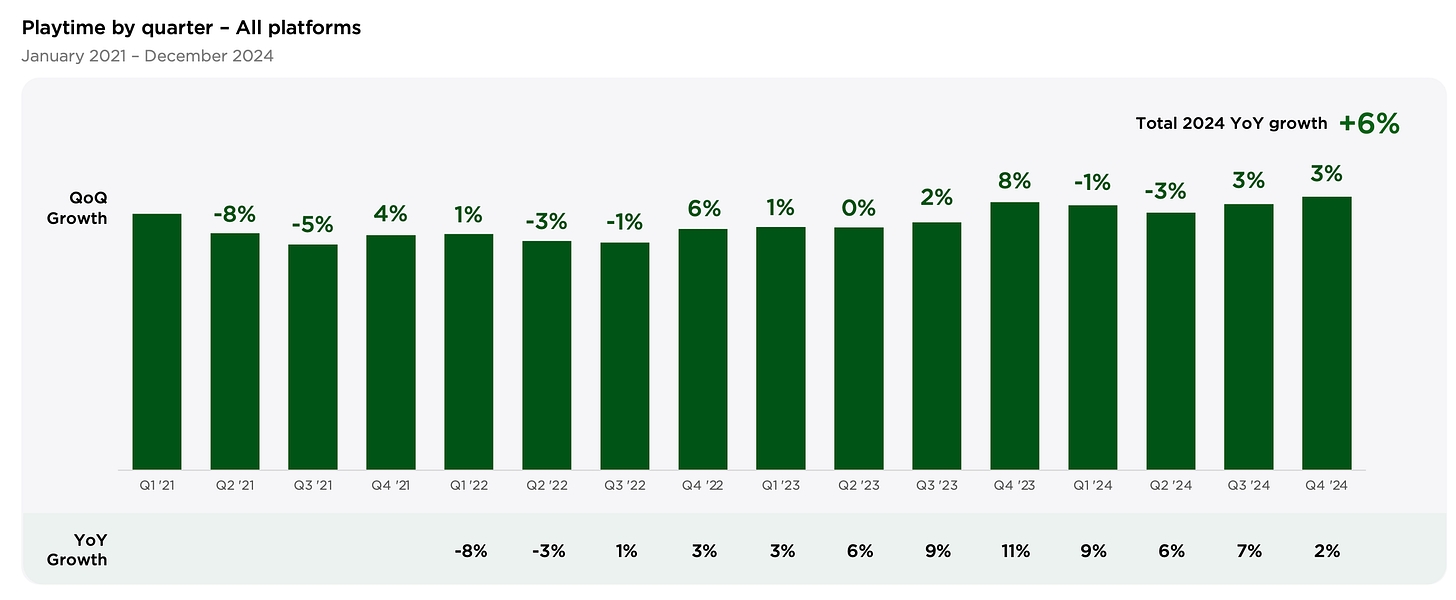

Q4'24 marked a record month for total player playtime since Q1'21.

Increased user engagement primarily came from buy-to-play (B2P) monetization projects and Call of Duty. This game is so influential that it can single-handedly impact trends.

Playtime for F2P projects also increased significantly, with Roblox growing by +21%, Fortnite by +8%, and Marvel Rivals capturing audience share from Overwatch 2.

While playtime on PC and Xbox remained stable, PlayStation saw a significant increase (+21%) in 2024. After a +12% growth in playtime in 2023, the PC segment stabilized.

On PlayStation, Call of Duty accounted for 16% of total playtime; Fortnite for 15%; and Roblox for 3%.

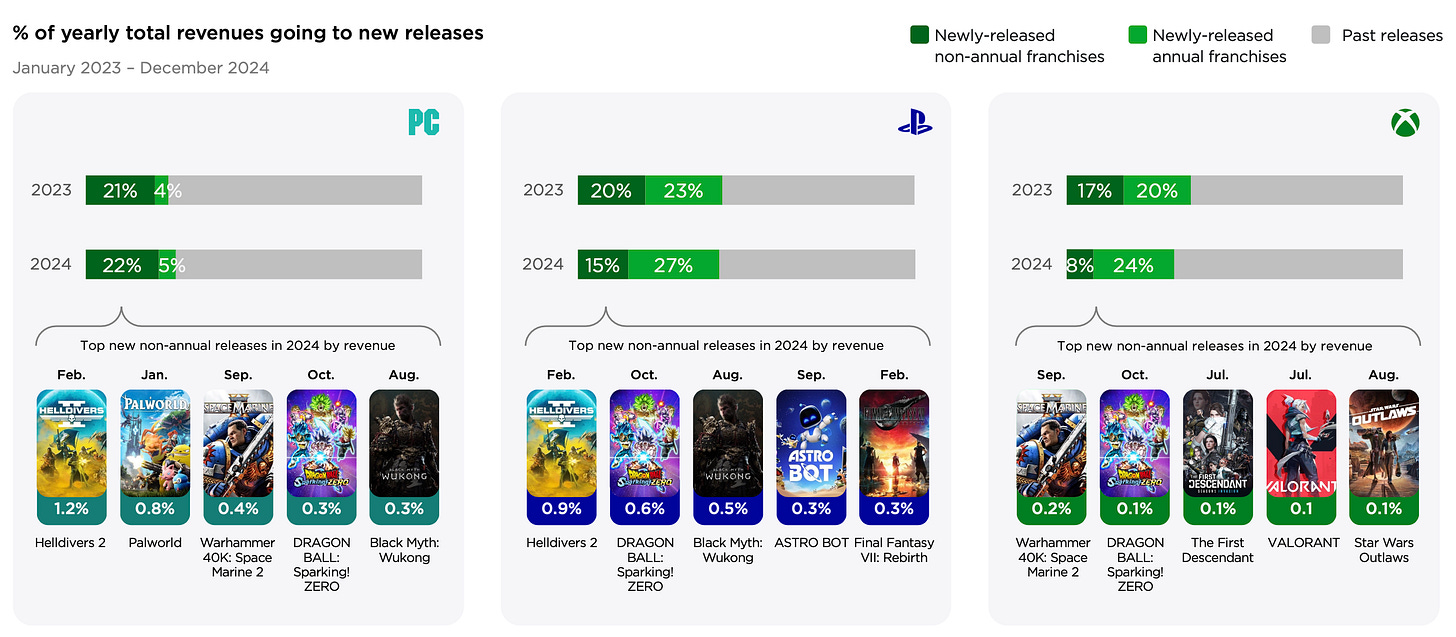

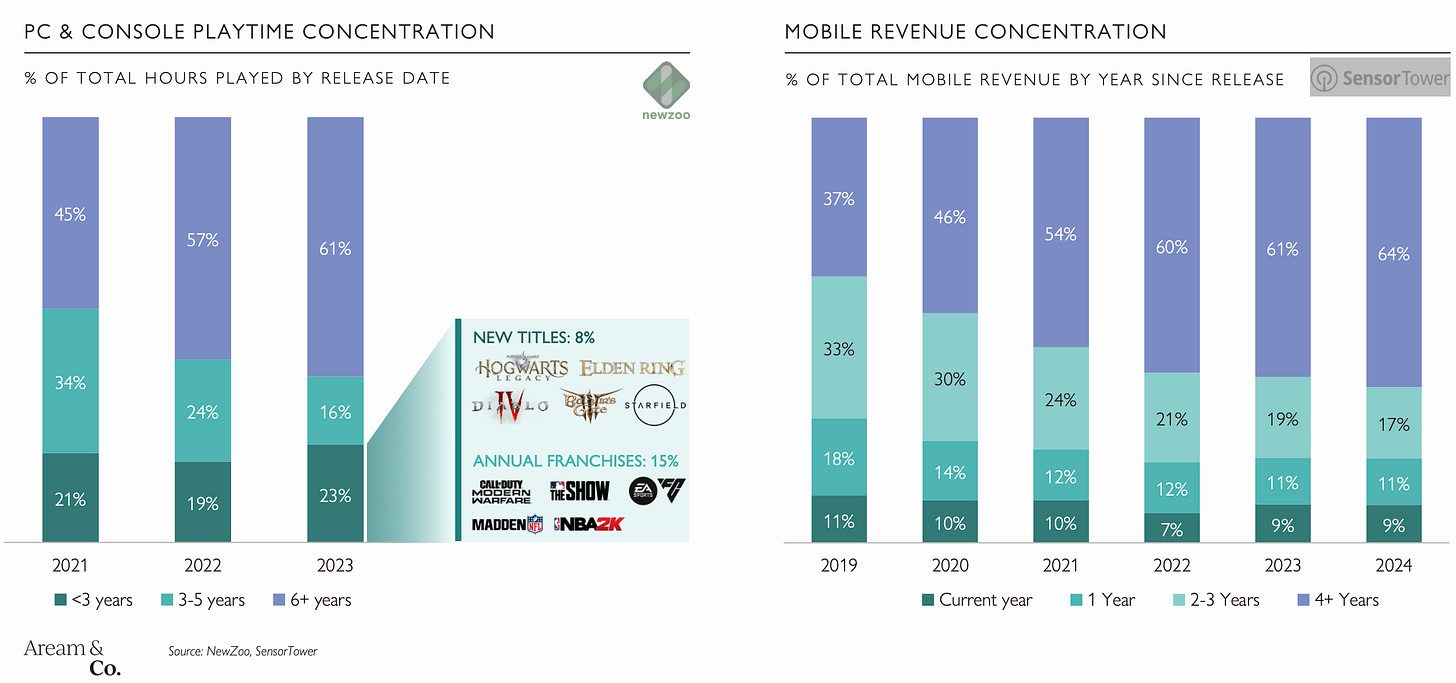

New releases accounted for only 12% of total playtime in 2024—a modest improvement compared to previous years since 2021—but older projects (over six years old) dominated with 57% of total playtime.

When we’re speaking of new projects, annual franchises like Call of Duty and EA Sports FC are included. And they take a lion's share of the playtime.

On consoles, new games accounted for a higher share of total playtime (15%) compared to PC (8%). However, non-annual release projects perform better on PC than consoles (7% vs. 6% on PlayStation and 5% on Xbox).

On PC the situation is better for projects that are not part of annual releases (such as Call of Duty, EA Sports FC, Madden NFL, and others). These new games perform better on PC, accounting for 7% of total playtime compared to 6% on PlayStation and 5% on Xbox.

Revenue-wise, the PC remains the best platform for new games, while annual franchises sell better on PlayStation and Xbox due to sports game releases for which many people are buying hardware.

12 games on PC, 9 games on PlayStation, and 11 games on Xbox account for 50% of total playtime.

On PlayStation, the number of B2P projects contributing to 50% of playtime is increasing.

When considering 90% of total playtime, the number of games included in this selection on consoles is growing, giving more projects a chance. However, on PC, the number of B2P projects within the 90% playtime category is decreasing.

Shooter games and RPGs are growing in audience engagement, while Battle Royale has been declining in audience share since 2021.

In 2024, sports games, shooters, and Battle Royale were the most popular genres on consoles. On PC, shooters led by a significant margin.

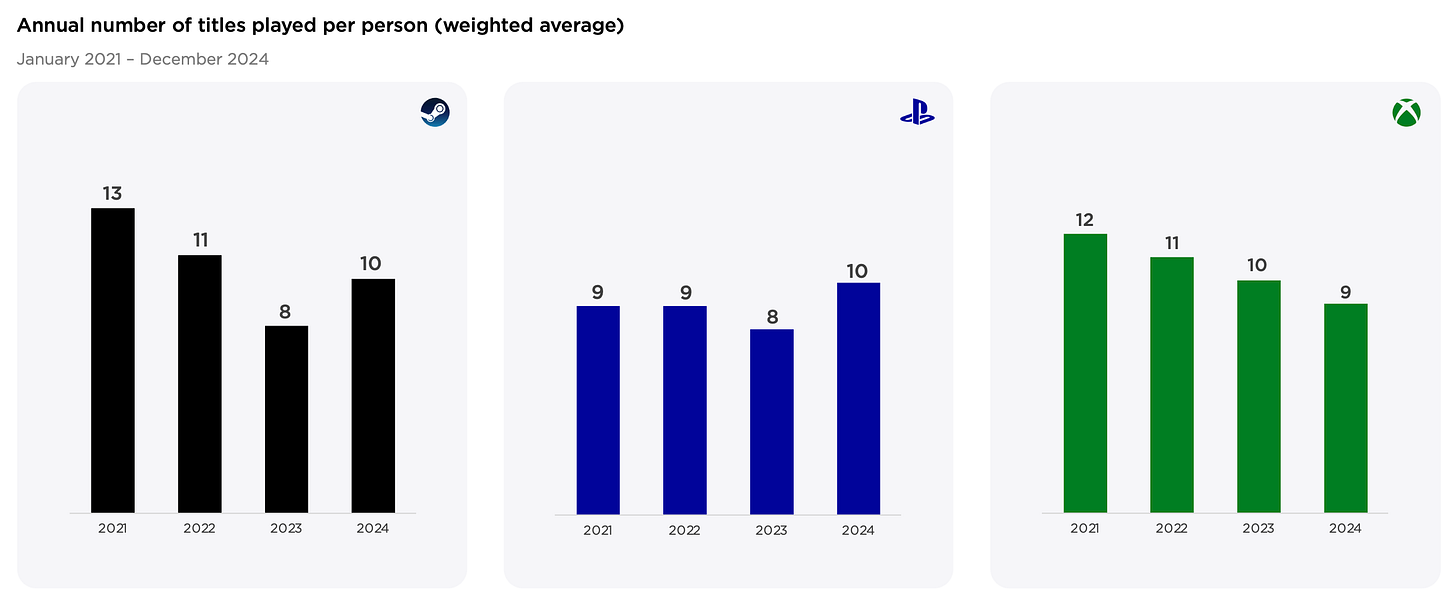

How many games do people play?

Newzoo analyzed over one million users; games were counted if players spent more than two hours in them and if total player numbers exceeded ten.

Over time, people tend to play fewer games on average. However, there was growth in Steam and PlayStation engagement in 2024, while Xbox saw declines.

User attention continues to focus on a small number of products; between 31-34% of players engage with only one to three games annually across platforms.

On each platform, over 95% of users play titles within the top 50.

PlayStation is the only platform where the number of games that people play has grown since 2021.

On consoles, the share of newer games (less than two years old) has been declining since 2021; Steam saw growth in this area during 2024 due to indie and AA projects.

When looking at the bigger picture, people on consoles tend to play free-to-play and AAA projects more often, while indie and AA projects are more likely to appear in the top rankings on Steam.

Users who play a larger number of projects tend to prefer the B2P monetization model. This can be easily explained by the fact that F2P games often require significant time investments.

Interestingly, PvE games are more popular on Steam than on consoles. Moreover, the more games a user plays, the higher the likelihood that they engage with PvE games.

Regarding genres, Steam has seen an increase in RPG popularity since 2021. On consoles, however, Battle Royale is declining in popularity, while adventure games, RPGs, shooters, and sports titles are gaining traction.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

Additionally, the more projects a player engages with in a year, the less they tend to play shooters and Battle Royale games.

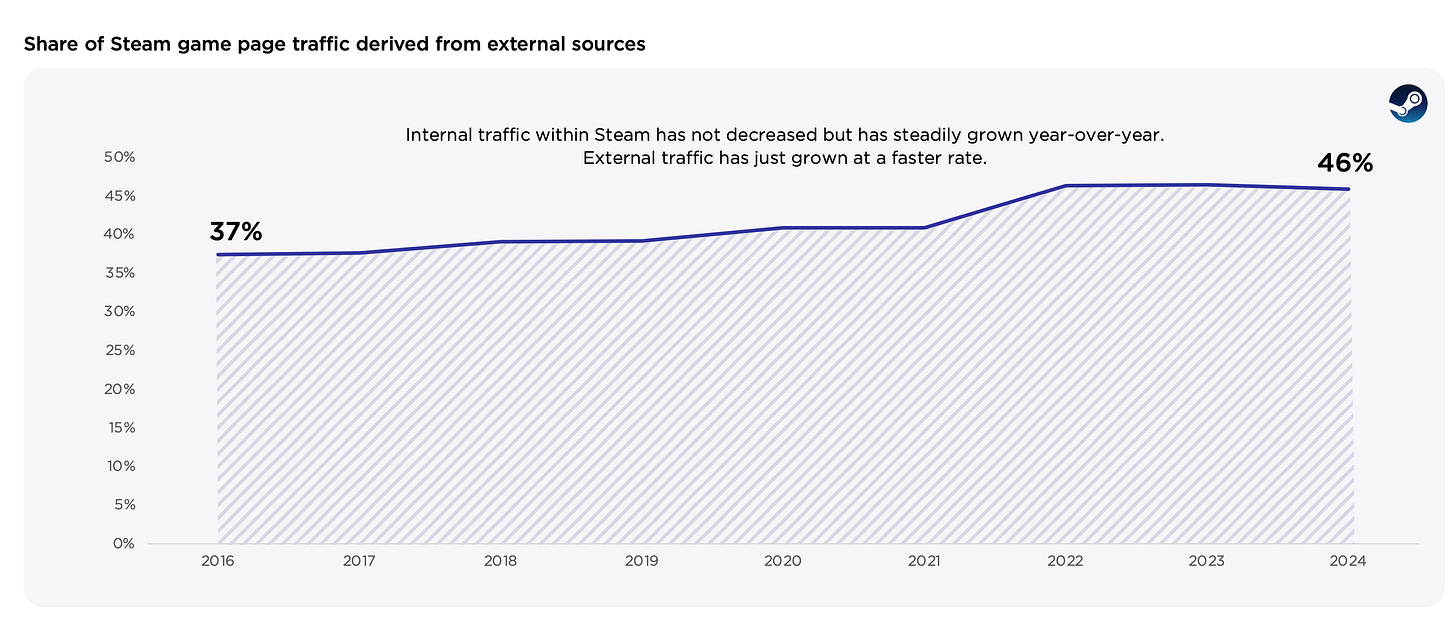

Steam Visibility

External traffic share in Steam grew from 37% in 2016 to 46% in 2024.

Popular projects rely less on external traffic as platform algorithms likely favor them.

Individual Steam promotions (e.g., Weekend Deals) became four times less effective since 2019; viewership increases dropped from a multiplier of x38 to x7.4 as of late 2024 figures.

Launch discounts reportedly boost game views up to 38x.

❗️I don’t understand what is used for benchmarking here.

Aream & Co.: Gaming Investment Market in Q1'25 | Sponsored by Neon

Aream & Co. collaborated with InvestGame to release this report.

Overall market condition

In Q1'25, 42 M&A deals were made, totaling $6.6 billion. This amount includes the sale of AppLovin's gaming division and Niantic's acquisition.

There were 12 deals involving public companies in Q1'25, with a total volume of $5.1 billion. This includes the Tencent and Ubisoft transaction.

In Q1'25, 81 private investments were made — the worst indicator in the past five years. The deal volume — $0.4 billion — is also at its lowest since early 2020.

M&A in Q1’25

The situation in the M&A market is gradually improving, with an increasing number of deals.

A word from our sponsor

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

Most major M&A deals over the past year were focused on mobile studios.

The number of medium and large deals (where upfront payment exceeds $100M) has surpassed pre-pandemic figures.

Private equity funds are showing interest in the gaming market. Over the past year alone, they participated in several major deals.

Public Market transactions in Q1’25

The number of various types of deals conducted by public companies reached 12 in Q1'25. The most notable ones include Asmodee's public spin-off and the transaction between Tencent and Ubisoft. Additionally, the number of deals over the past six months is a record for three years.

Gaming companies indexes in Q1'25 are performing better than S&P and NASDAQ indexes. Both international gaming companies and Chinese gaming indexes show similar growth. However, the effect of U.S. trade tariffs will materialize in upcoming quarters. Nintendo has already announced a pause to pre-orders for Nintendo Switch 2, while Chinese companies are cautious about operating within the US.

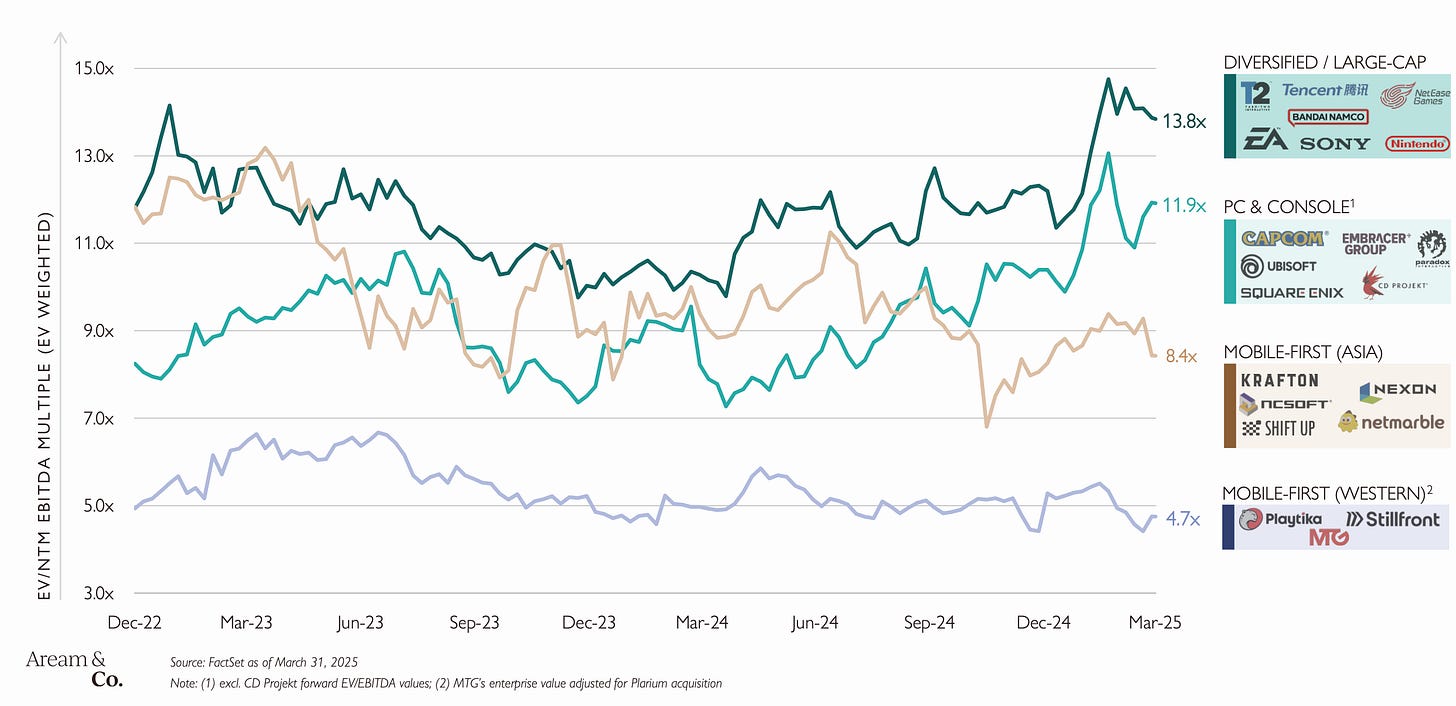

Looking at dynamics since December 2022, diversified large companies (Take-Two; EA; Sony; NetEase) showed the most significant growth. PC/console developers also ended slightly positive, while mobile developers from Asia and Europe lost value.

Accordingly, diversified large companies have the highest valuations based on NTM EBITDA - 13.8x. Western mobile developers have the lowest - 4.7x.

In Q1'25, stock prices of major holdings and PC/console developers increased. Mobile companies mostly remained in negative zone.

Most companies that saw a valuation increase did not report corresponding revenue growth in 2024. On the contrary, many showed worse results compared to 2023. There is cautious optimism for mobile companies.

Growth and profitability are key drivers for company valuation increases.

Private Investments in Q1’25

The volume of private investments reached a multi-year low (in terms of deal count, only Q2’20 had fewer). In terms of volume, it's a five-year minimum.

Early-stage deals show similar trends, with all metrics at their lowest since early 2020.

The largest rounds in Q1’25 mainly consisted of seed rounds.

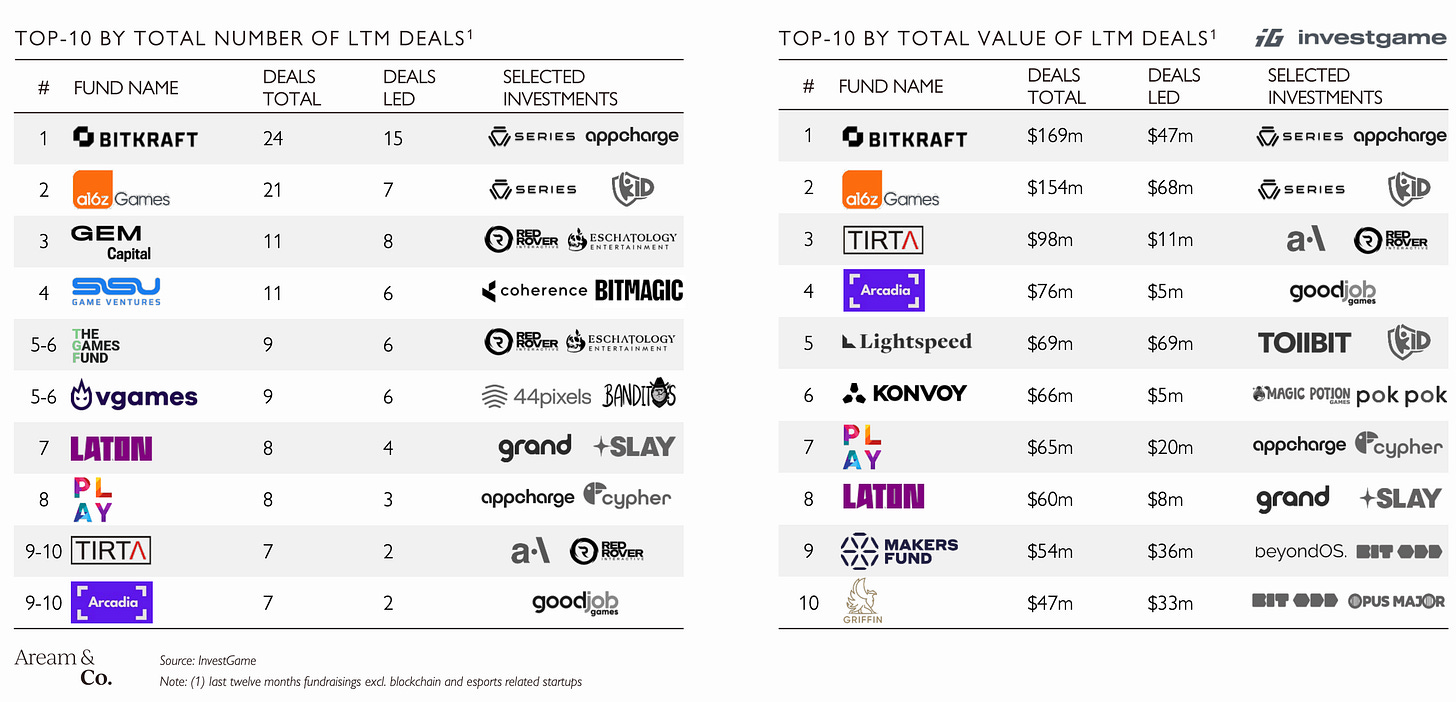

Bitkraft, a16z Games, and GEM Capital have been the most active early-stage investors over the past year. In terms of total investment over 12 months, Bitkraft, a16z Games, and Tirta lead.

Despite a rather grim market situation, 4 new VC funds were launched in 2024–2025. Additionally, several funds secured additional financing.

Market Trends

Mobile gaming has stabilized after its decline, although game downloads are at multi-year lows. Asian publishers lead revenue growth.

A word from our sponsor

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

Steam shows steady growth — in Q1’25, the platform reached 41.2 million concurrent users.

Active audiences on PlayStation Network and Nintendo are growing. There is no data for Xbox metrics; however, judging by sales figures, if its audience is growing at all, it's not due to console sales.

Interest in UGC and games as platforms (Roblox, Fortnite) remains strong. Streaming trends are more intriguing — while the number of games featured on streams grows, viewership continues to decline steadily from pandemic peaks.

The number of new projects released on mobile devices hit a seven-year low in 2024. Preliminary indicators for Q1'25 suggest little change. Meanwhile, competition on PC (Steam) continues to grow yearly.

The share of older games in revenue structure remains high for both PC and mobile platforms. On mobile platforms especially, this trend has worsened over the past five years — players prefer established game projects and universes.