Weekly Gaming Reports Recap: August 5 - August 9 (2024)

Circana shared the June US market data; Sensor Tower looked at the Mobile Market in Q2'24.

Reports of the week:

Circana: The US Gaming Market in June 2024

Games & Numbers (July 24 - August 6)

Sensor Tower: Mobile Market in Q2 2024

Circana: The US Gaming Market in June 2024

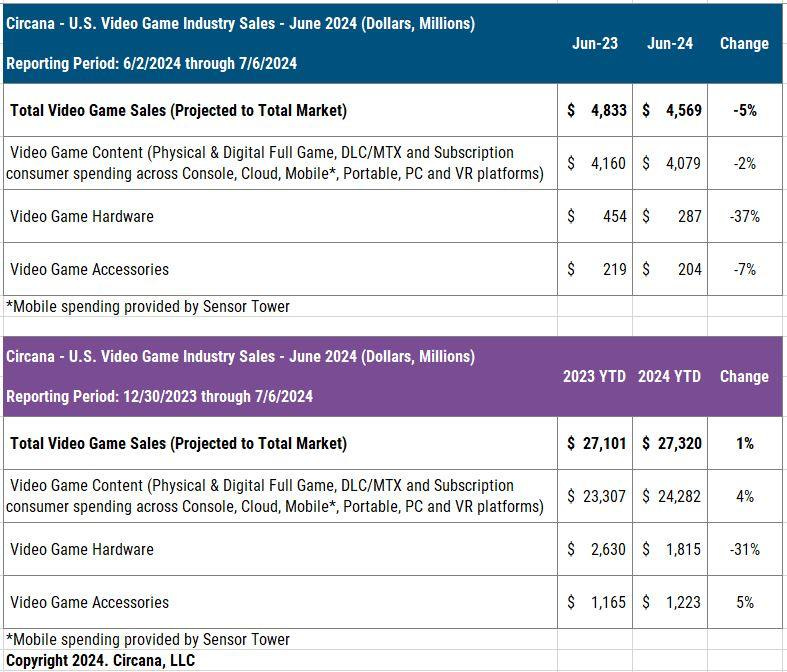

The total revenue of the gaming market in June 2024 was $4.569 billion. This is 5% less than the previous year.

The revenue for the first half of 2024 was $27.320 billion, 1% more than the same period in 2023. From April to June 2024, the market has been below 2023 results.

Revenue from game sales in June was $4.079 billion, 2% less year-over-year. Hardware sales plummeted by 37% to $287 million. Sales of gaming accessories decreased by 7% to $204 million.

The American mobile market grew by 12% in June; subscription sales on PC and consoles grew by 4%. However, the growth of these segments could not offset the 26% drop in console game sales.

Nintendo Switch sales fell the most, by 48%. PlayStation 5 sales were down 28% in June, and Xbox Series S|X sales decreased by 18%. Nevertheless, PS5 became the leader in both the number of systems sold and revenue.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The PlayStation Portal became the most successful accessory in terms of revenue in the first half of 2024.

Best-selling Games

Elden Ring, following the release of the Shadow of the Erdtree DLC, topped the June chart. There are many interesting titles in the rankings, with Kingdom Hearts: Integrum Masterpiece taking 3rd place. Shin Megami Tensei V: Vengeance took 4th place. The Elder Scrolls: Online returned to the charts in 18th position.

For the first half of 2024, the top sellers remained the same - Helldivers II, Call of Duty: Modern Warfare III, and Dragon’s Dogma II. Elden Ring has risen significantly and is currently in 5th place.

The leaders of the mobile market in June were MONOPOLY GO!, Royal Match, Roblox, Candy Crush Saga, and Last War: Survival. Roblox's revenue in June increased by 15% compared to May, and downloads rose by 22%.

PC/Console Charts

Elden Ring became the top-selling game on PlayStation in June. EA Sports FC 24 also entered the top 10 in the US. There is a new entry - Shin Megami Tensei V: Vengeance.

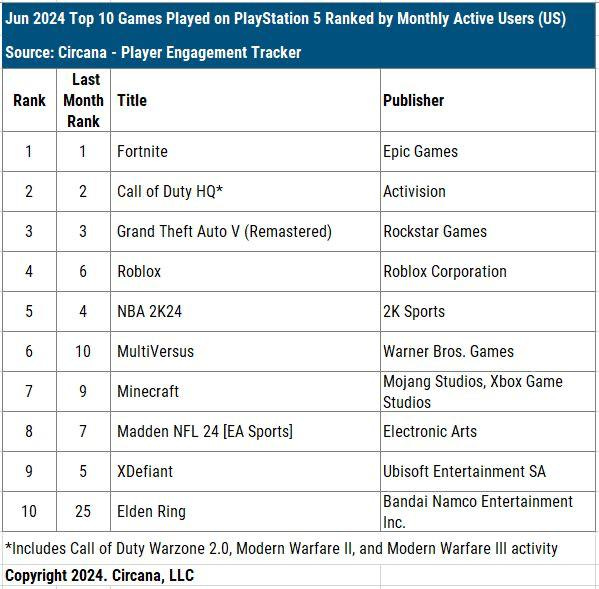

There are no major changes in MAU on PlayStation; the leaders remain the same - Fortnite, Call of Duty, GTA V. Notably, Helldivers II dropped out of the top 10.

The Elder Scrolls: Online entered the top 10 sales on Xbox. UFC 5 also showed significant growth.

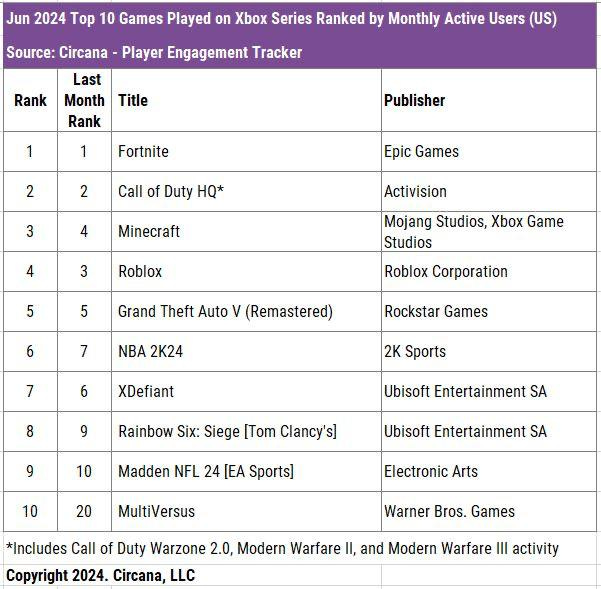

For Xbox MAU, the rankings are almost identical to May. The only change is the entry of MultiVersus into the top 10.

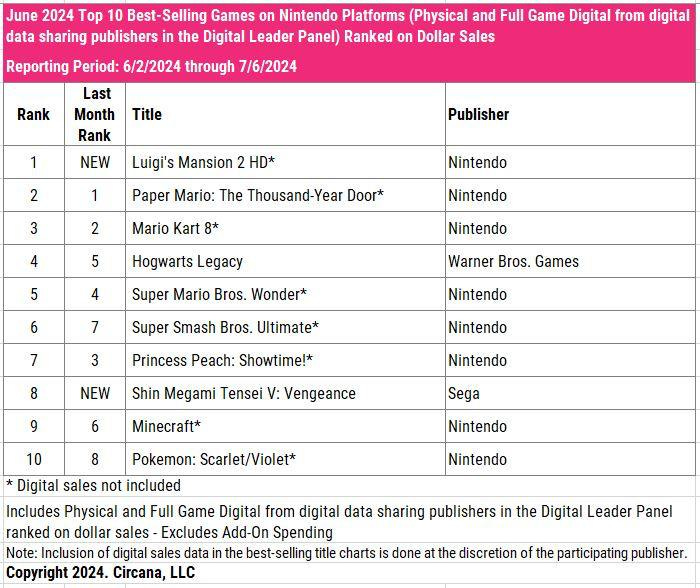

In June, there were two new entries in the top 10 sales for Nintendo Switch - Luigi’s Mansion 2 HD and Shin Megami Tensei V: Vengeance. Note that digital versions of all Nintendo games are not included in the sales.

The top MAU leaders on Steam were Elden Ring, Counter-Strike 2, and Helldivers II. There are several new entries - Dark and Darker (5th place) and Chained Together (8th place). Deep Rock Galactic and Balatro also made it into the top 10.

Games & Numbers (July 24 - August 6)

PC/Console Games

The cumulative sales of Pokemon Scarlet and Violet have reached 25 million copies. The game was released in November 2022 and has become the third game in the Pokemon series to achieve this milestone.

EA has released a new hit - EA Sports College Football 25. Over 5 million people bought the game at launch, with another 500,000 joining through the EA Play Trial. Of these 5 million, 2 million purchased the $100 version to get early access to the project.

Sales of Armored Core VI have reached 3 million copies. The game achieved this mark in less than a year.

Manor Lords earned $60 million in 3 months of early access. The publisher is very pleased with the result.

The Fallout series has influenced how much time users spend playing the series' games. The number of hours in Game Pass for the Fallout line increased 5 times in the second quarter of 2024 compared to the first, according to Satya Nadella.

More than 500,000 people have played Flintlock: The Siege of Dawn by Kepler Studio.

The free Silent Hill: The Short Message has been downloaded over 3 million times.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Mobile Games

Revenue from MONOPOLY GO! has surpassed the $3 billion mark, as reported by Hasbro in its report. The game achieved this in 473 days, faster than any other in the history of the mobile market.

Games in the Talking Tom series have been downloaded over 23 billion times. The projects’ MAU is at 470 million. The company has more than 20 projects in its portfolio, with 70% of the audience accounted for by the Tamagotchi-like games - My Talking Tom and My Talking Angela.

Hero Wars: Alliance has earned more than $1.5 billion since its launch in 2017. During this time, the game has been downloaded over 150 million times. In the fall of 2023, GDEV reported revenue of $1.2 billion.

According to Sensor Tower, Whiteout Survival has reached $1 billion in revenue. Among games released in 2023, it trails only MONOPOLY GO! and Honkai: Star Rail in revenue growth. 35% of the revenue comes from the US, followed by South Korea, Japan, and Taiwan. Interestingly, Saudi Arabia is second in downloads.

GachaRevenue reports that Zenless Zone Zero earned $99.8 million on mobile devices in its first month. The portal relied on Sensor Tower data and calculated revenue from Chinese Android stores by multiplying the Chinese iOS revenue by 1.75. The methodology is understandable, but I cannot vouch for its accuracy.

Sensor Tower reports that Solo Leveling: Arise earned over $100 million in the three months after its release. South Korea accounts for 33% of the revenue, while the US accounts for 19%.

Game of Thrones: Legends by Zynga earned its first million dollars in revenue. The game took 11 days to achieve this, and its current daily revenue is $100,000. The data is based on AppMagic figures.

The daily audience of ROBLOX reached 79.5 million people in the second quarter of 2024, a 21% increase from the previous year.

Blood Strike by NetEase has received over 50 million installations in less than a year. The game was released in soft launch on October 28, 2023.

Seekers Notes by MYTONA has been downloaded 43 million times in its 9 years of operation. AppMagic notes that in the second quarter of 2024, the game earned $8.7 million in IAP (figure after store fees and taxes).

Sensor Tower: Mobile Market in Q2 2024

Revenue - IAP, Gross (before commissions and taxes)

Overall State of the Mobile Market

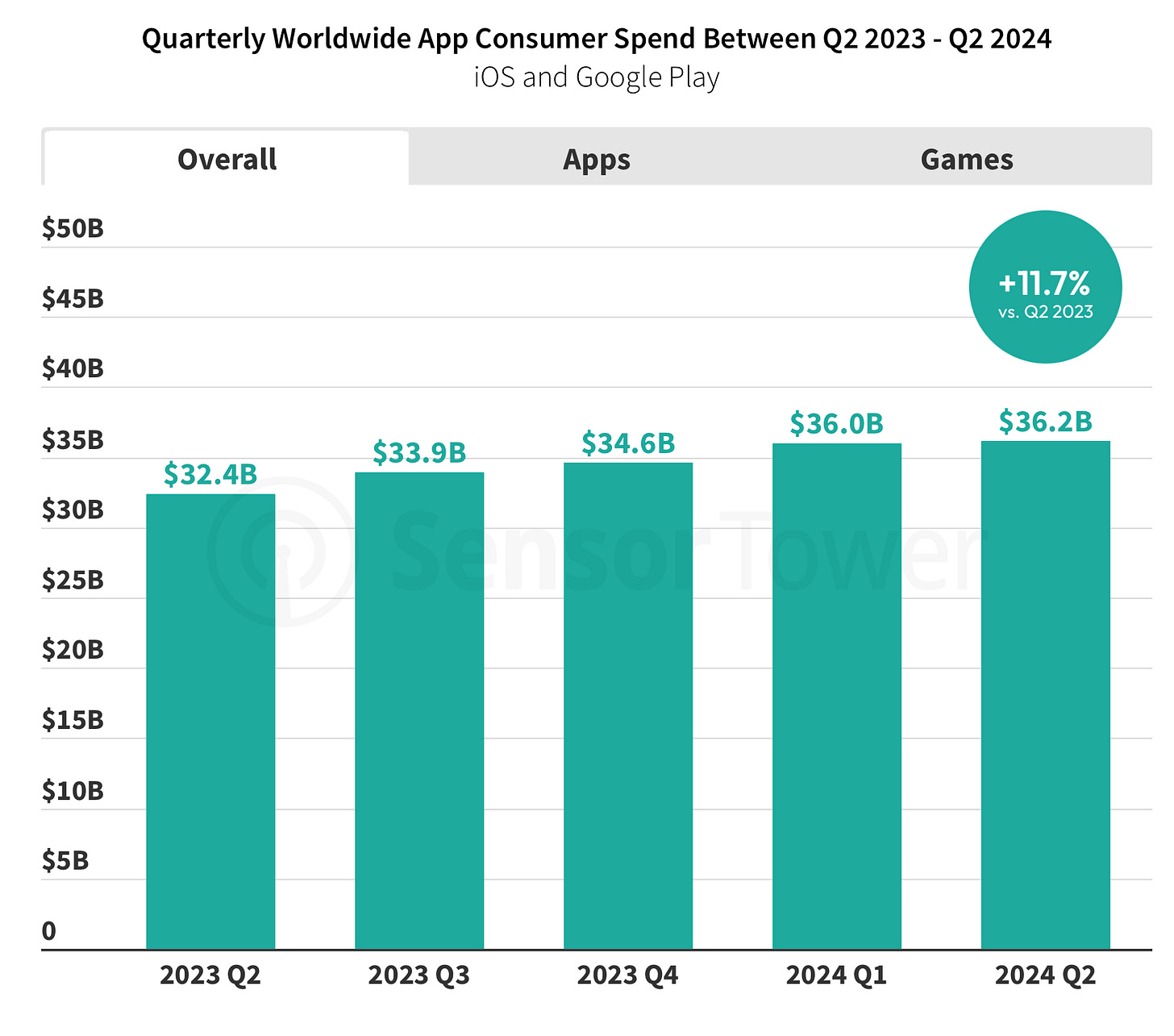

The total IAP revenue of the mobile market amounted to $36.2 billion in Q2 2024. Growth compared to Q2'23 is 11.7%. Non-gaming apps grew by 21.8% year-on-year to $16.5 billion, while gaming apps grew by 4% year-on-year to $19.7 billion.

Non-gaming revenue grew on both iOS and Android. However, gaming revenue grew only on iOS, from $11.97 billion in Q2'23 to $12.85 billion in Q2'24. On Android, gaming revenue fell from $6.97 billion to $6.84 billion over the same period.

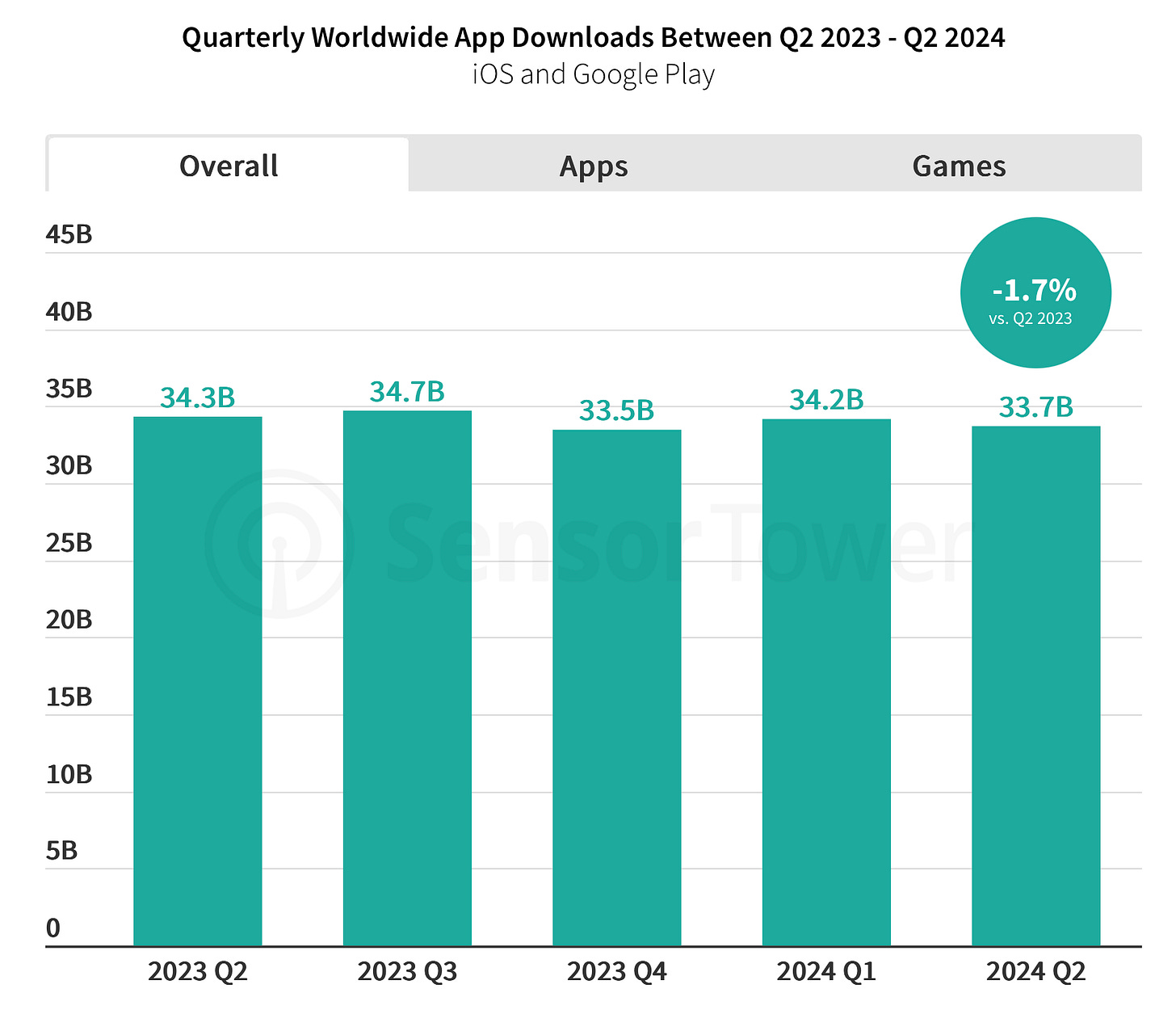

Downloads in Q2 across all apps fell by 1.7% YoY to 37.7 billion. Non-gaming app downloads increased by 0.9% (to 21.1 billion), while game downloads fell by 6.4% YoY to 12.6 billion. For instance, downloads in the US reached their lowest level since 2018, indicating that the market has matured according to Sensor Tower.

iOS downloads dropped from 1.95 billion in Q2 2023 to 1.84 billion in Q2 2024. On Android, downloads decreased from 11.47 billion to 10.72 billion over the same periods.

Gaming Market State

For the first time since 2017, RPG is not the highest-grossing genre. It was overtaken by strategy games (up 12% YoY in Q2'24), while RPGs saw a 15% drop in revenue. Arcades (-24% YoY) and sports games (-8% YoY) also saw declines.

GameDev Reports Newsletter offers promotion opportunities to gaming companies. Reach out to learn more.

Revenue growth in Q2'24 compared to Q2'23 was seen in action games (+50%), lifestyle projects (+23%), casino games (+20%), and puzzles (+12%).

However, the download situation is less positive. Only strategy (+19% YoY), shooter (+3% YoY), and simulation games (+3% YoY) saw growth in downloads in Q2'24.

Most Successful Games

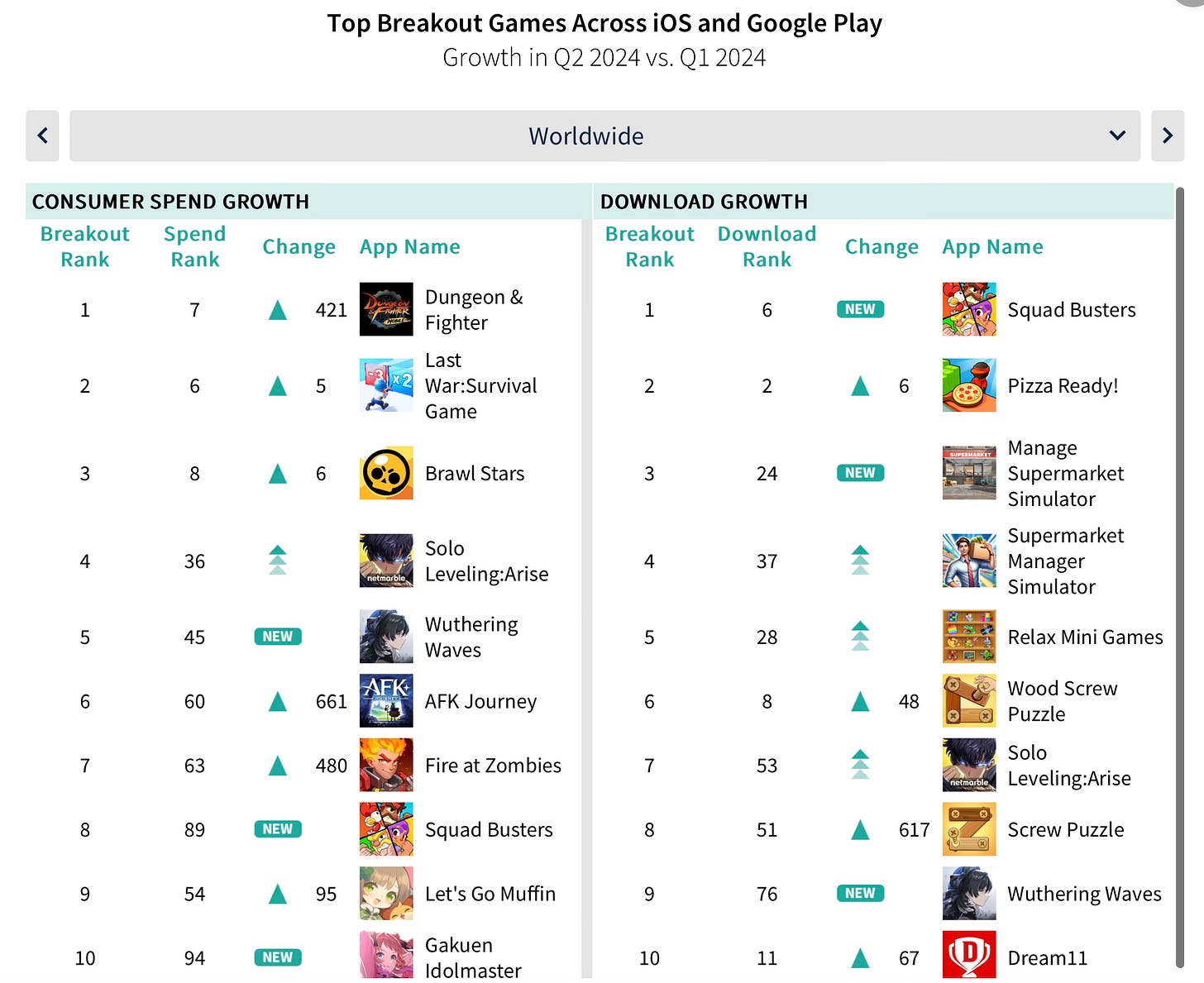

The leaders in Q2'24 by revenue were MONOPOLY GO!, Honor of Kings, Royal Match, Roblox, and Candy Crush Saga. Dungeon & Fighter, which was released in May, also made it into the top 10.

The leaders by downloads were Garena Free Fire, Pizza Ready!, Roblox, Subway Surfers, and Ludo King. Squad Busters also entered the ranking at 6th place.

The leaders in revenue growth for the quarter were Dungeon & Fighter, Last War: Survival Game, Brawl Stars, Solo Leveling: Arise, and Wuthering Waves. In terms of downloads, the leaders were Squad Busters, Pizza Ready!, Manage Supermarket Simulator, Supermarket Manager Simulator, and Relax Mini Games.

Advertising Market Overview

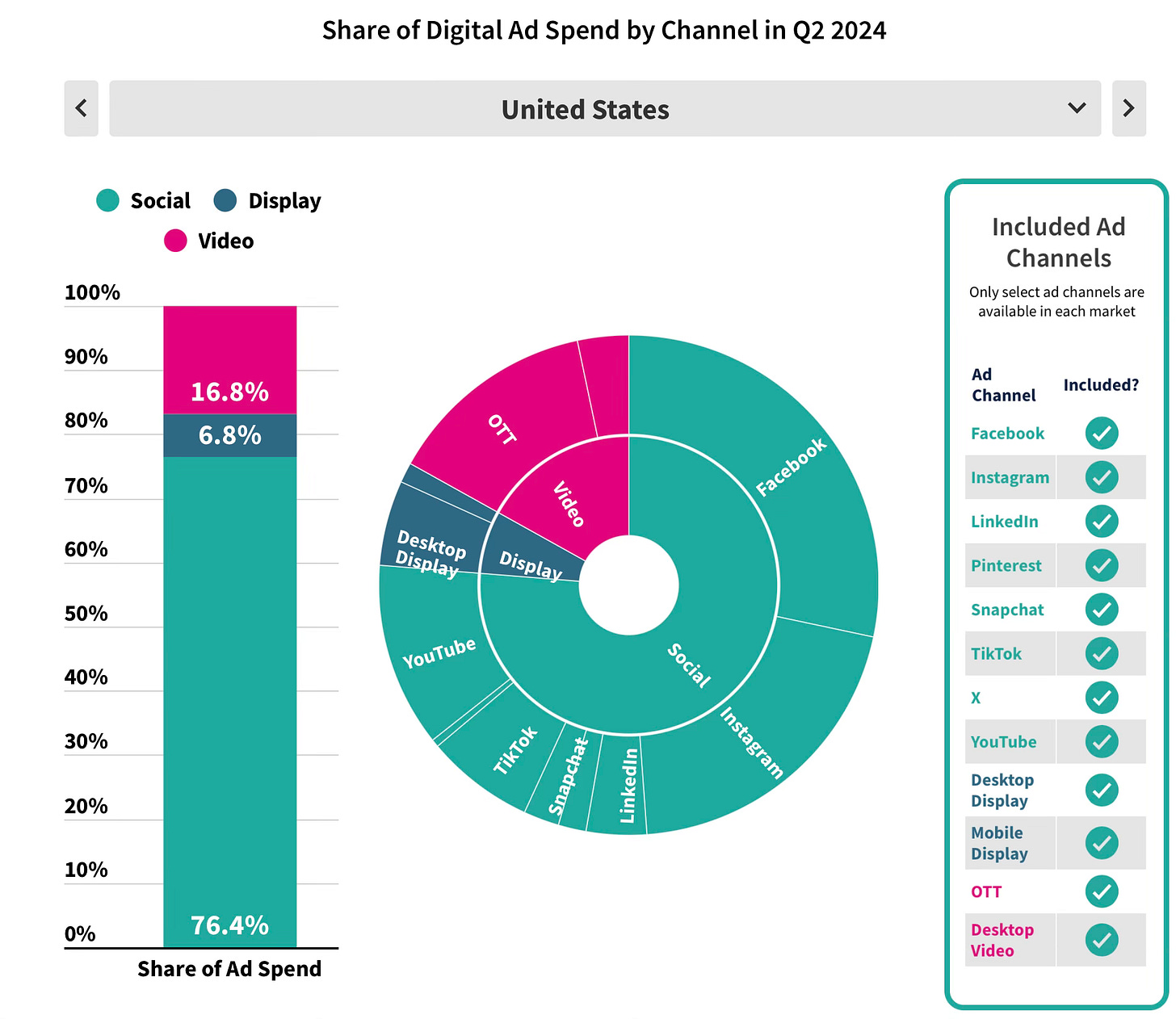

Digital advertising spending grew by 10-25% in North America, Europe, and Latin America in Q2 2024.

Social networks account for 3/4 of marketing spending in the US, Latin America, and Europe.

Meta's products dominate the advertising market in the US. However, TikTok showed an impressive 28% growth when comparing Q2'24 with Q2'23. The video advertising segment, especially OTT, grew significantly, up 35% over the same period.

The only platform that saw a decrease in ad volume in Q2'24 was X (Twitter), which fell by 35% YoY.

The growth in spending is driven by non-gaming apps. Spending on gaming apps is falling in North America, Latin America, and Europe.

Noteworthy is the case of Squad Busters. Supercell's large-scale advertising campaign allowed Tencent to become the leader in advertising growth in Q2'24. More than 70% of the advertising spending for the Squad Busters campaign was on YouTube. Supercell also actively invested in advertising for Brawl Stars.