Weekly Gaming Reports Recap: August 18 - August 29 (2025)

The German market declined for the first time in 5 years; the July gaming market performance in the US, according to Circana, is quite positive.

Reports of two weeks:

GAME: German Games Industry in 2025

Games & Numbers (August 14 – August 26, 2025)

Google Cloud: AI in the Gaming Industry in 2025

Circana: The U.S. Games Market in July 2025

Alinea Analytics: Co-op games generated over $4 billion on Steam in H1’25

GAME: German Games Industry in 2025

Market Status

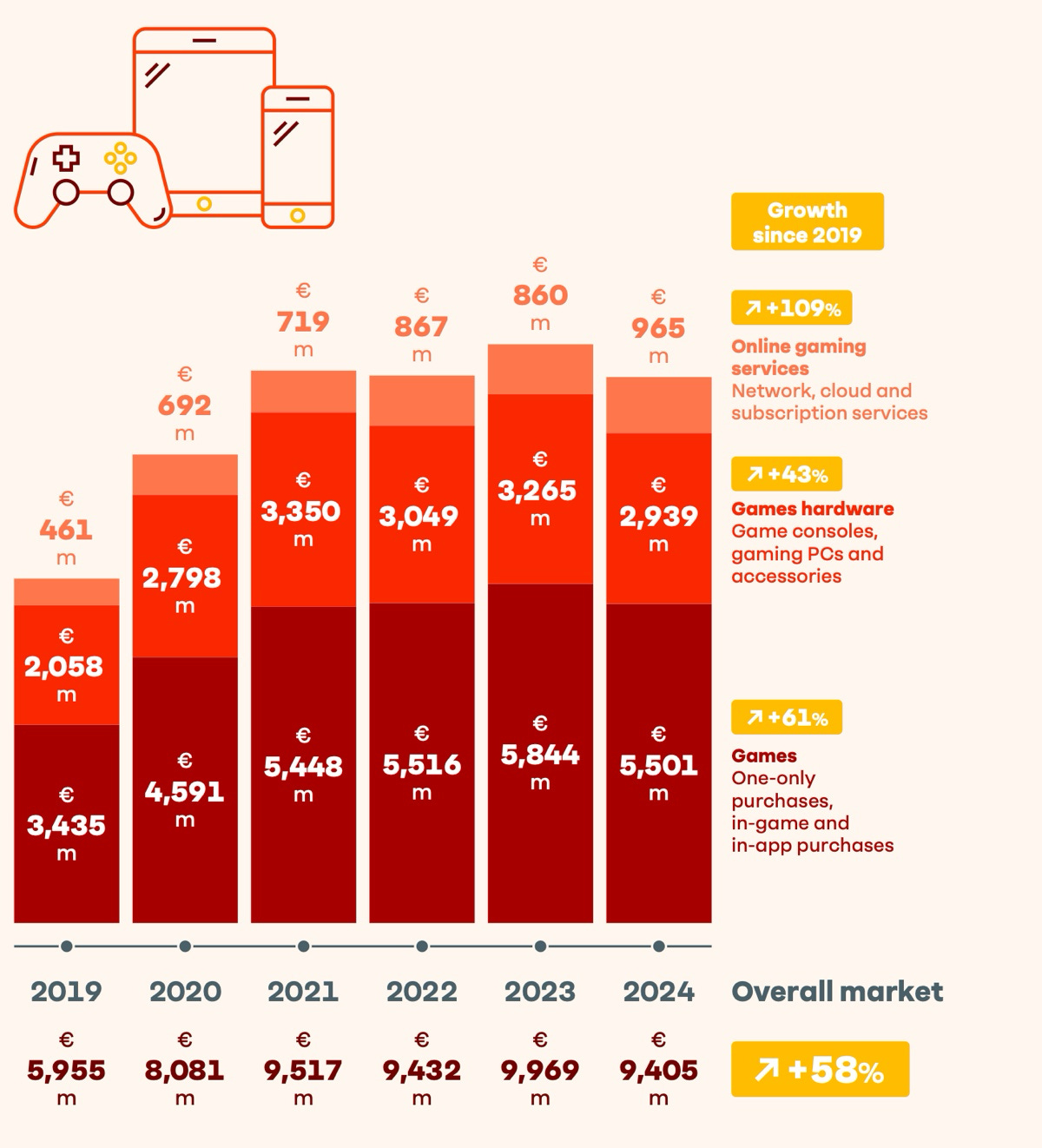

The German games industry generated €9.405 billion in 2024. That’s 6% less than in 2023 (€9.969 billion).

Game sales brought in €5.501 billion – 6% less than last year. Hardware sales dropped by 10% to €2.939 billion. Meanwhile, spending on cloud gaming and subscriptions grew by 12% to €965 million.

The market has grown by 58% since 2019, but it’s clear that revenues have stagnated since 2021. The biggest growth since 2019 has come from online services (+109%), game sales (+61%), and hardware sales (+43%).

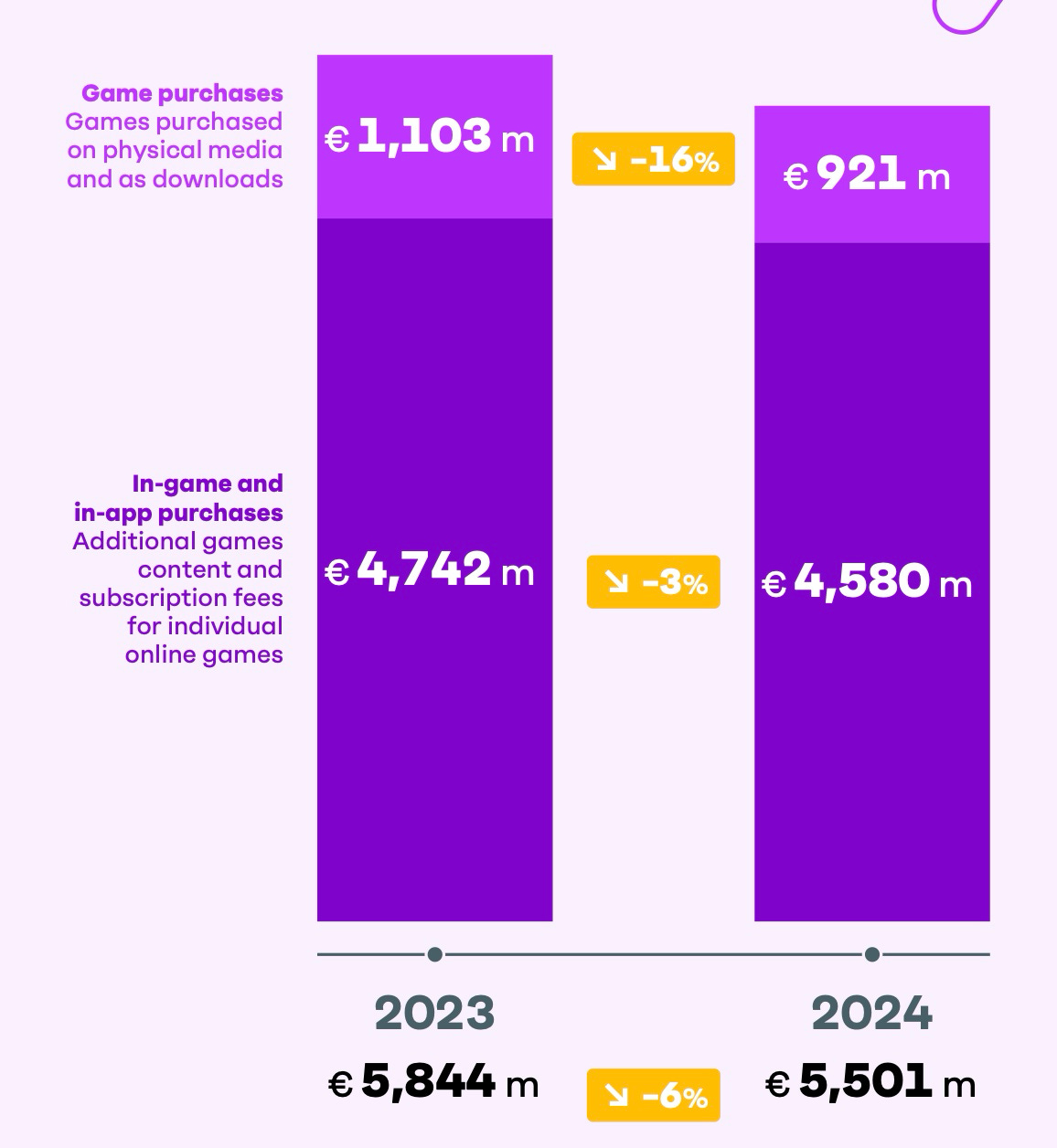

In 2024, microtransactions and DLC dropped by 3% compared to last year, reaching €4.58 billion. Meanwhile, sales of full-price titles (both physical and digital) fell by 16%, down to €921 million.

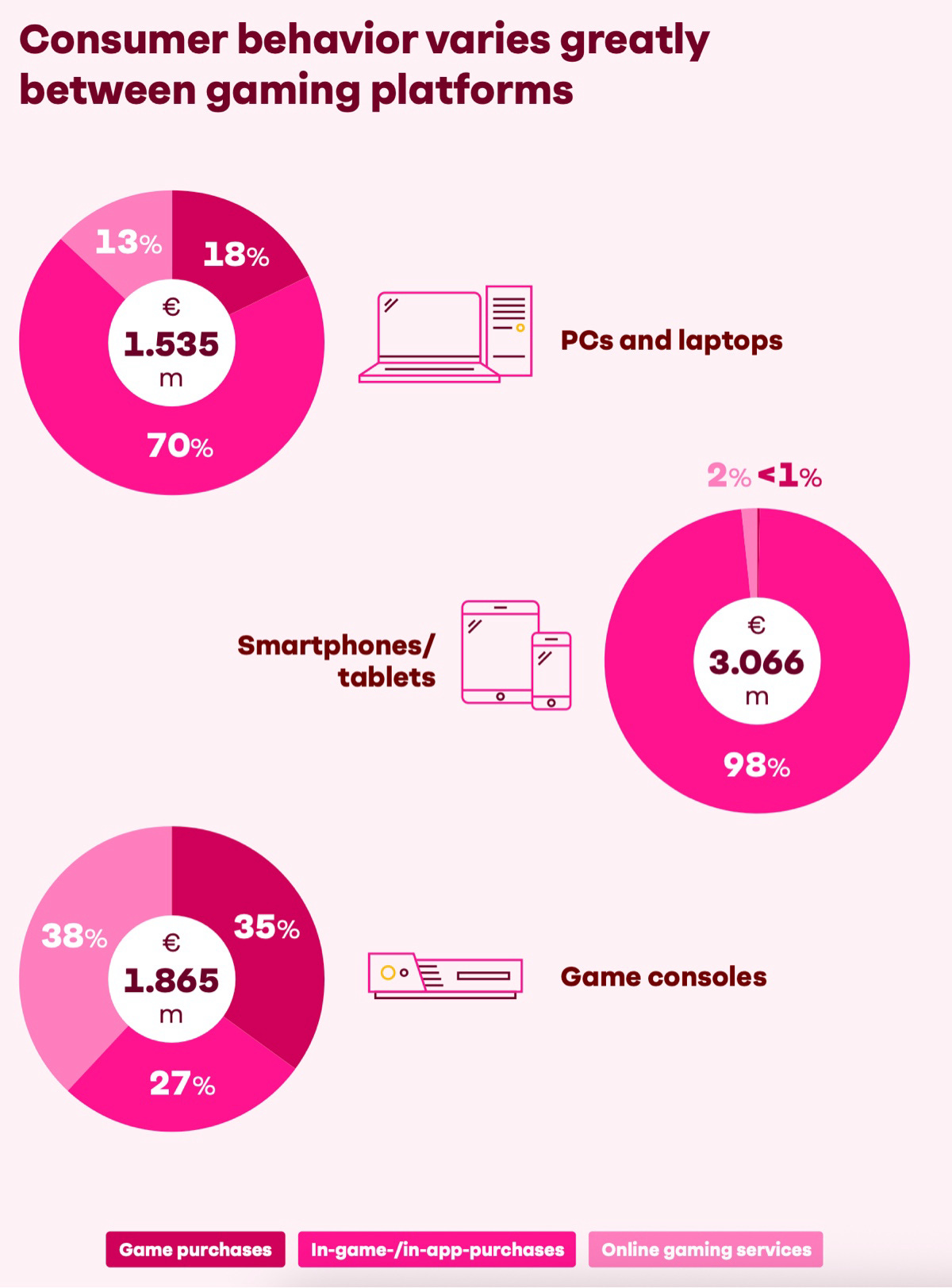

On PC, microtransactions make up 70% of all revenue. Full-price title purchases account for 18%, and online services for 13%. That’s 101% – rounding magic.

On smartphones and tablets, microtransactions make up 98% of total revenue; online services (cloud gaming, subscriptions) 2%, and full-price game purchases less than 1%.

On consoles, spending is the most balanced: 35% of all revenue comes from game sales, 38% from online services, and 27% from in-game purchases.

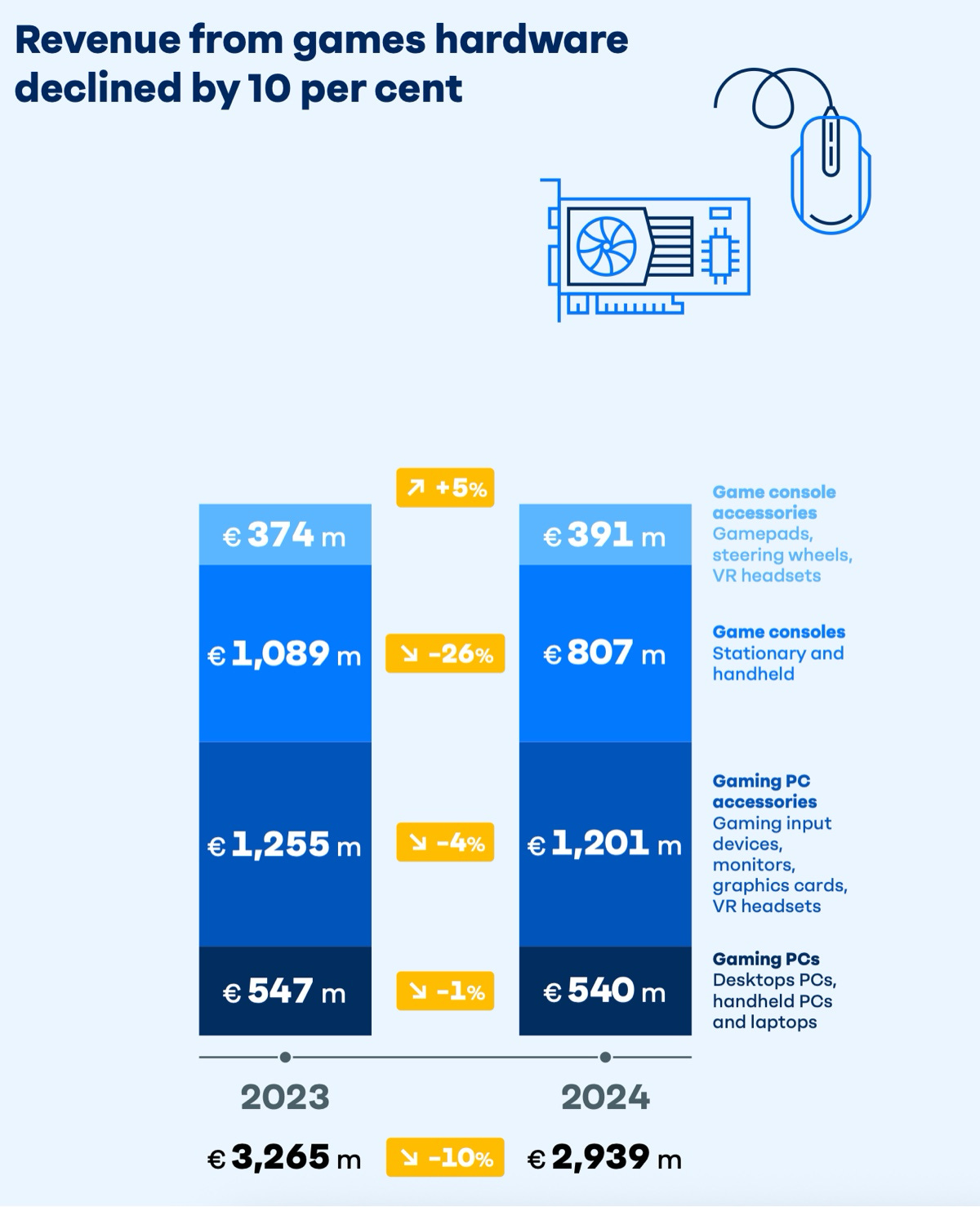

Gaming PC accessories are the largest segment of hardware sales in Germany. In 2024, they brought in €1.201 billion – 4% less than the previous year.

Second place goes to console sales: €807 million in 2024 – a drop of 26%. Third: gaming PCs at €540 million (-1% YoY). Fourth place – but the only growing segment (+5% YoY) – is console accessories, worth €391 million.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The share of digital game purchases rose sharply in Germany in 2024, reaching 68%. On PC, 99% of games are purchased digitally, while on consoles, players still prefer physical editions (44% of purchases are digital).

Younger players tend to prefer digital purchases, while older players stick to physical ones.

37.5 million Germans play games. The average age of a German gamer is 39.5. 79% of all players in the country are over 18.

48% of German gamers are female.

The number of players over 60 grew to 7.7 million in 2024.

Smartphones (22.9 million players) and consoles (20.5 million) are the most popular platforms in the country. Interestingly, the console audience grew significantly in 2024, and since 2019 has increased by 29%.

PC gamers in Germany decreased in 2024 (from 13.5 million to 13.1 million). The platform has been losing audience in the country since 2019.

Tablet players in Germany number 10.3 million. This audience has stayed stable for the past 6 years.

Most Popular Games

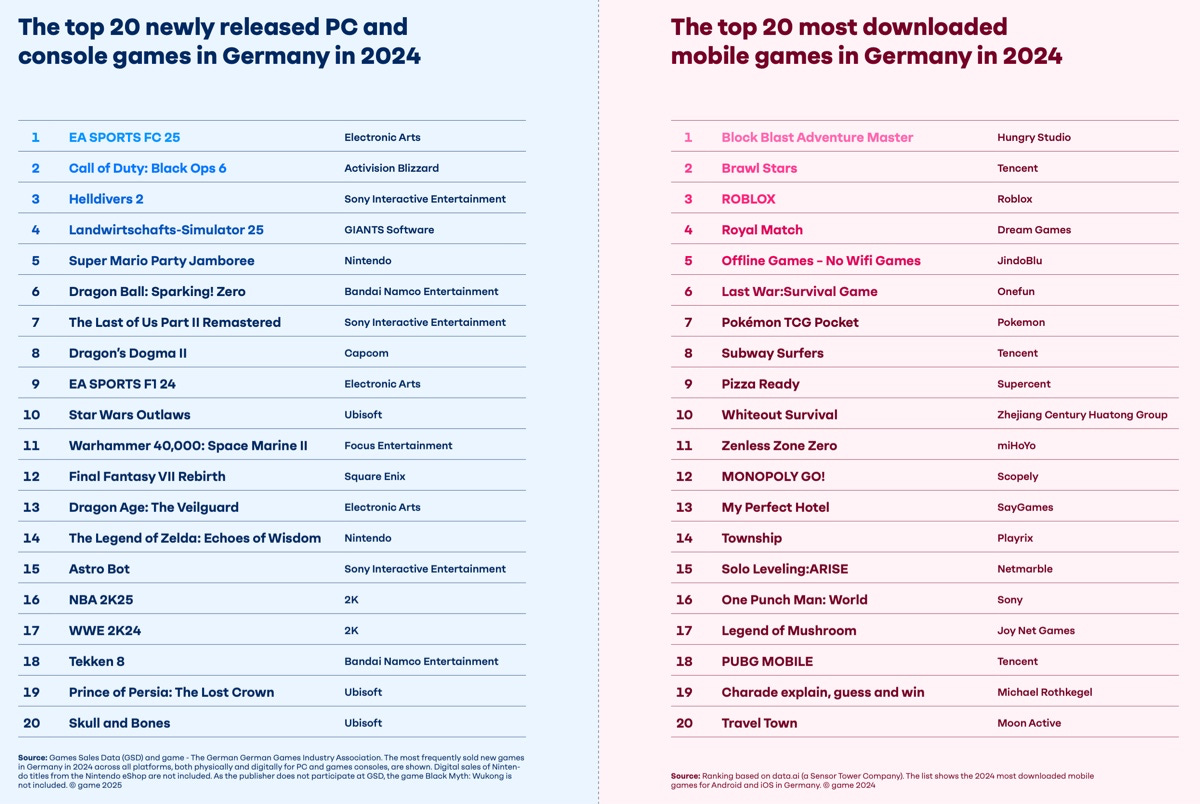

EA Sports FC 25, Call of Duty: Black Ops 6, and Helldivers 2 were the top sellers among new PC/console games in Germany in 2024.

Block Blast Adventure Master, Brawl Stars, and ROBLOX were the leaders in downloads.

The Games Industry in Germany

As of 2025, there are 910 game companies in Germany. 454 act only as publishers, 404 both develop and publish, and 52 only develop. The total number of game companies in the country has decreased for the first time since 2020.

The number of employees in game companies has also declined. In 2025, the German games industry employs 12,134 people – 2% fewer than last year.

Nintendo of Europe (935 employees), Ubisoft (660), and InnoGames (350) are the largest employers in Germany’s games industry.

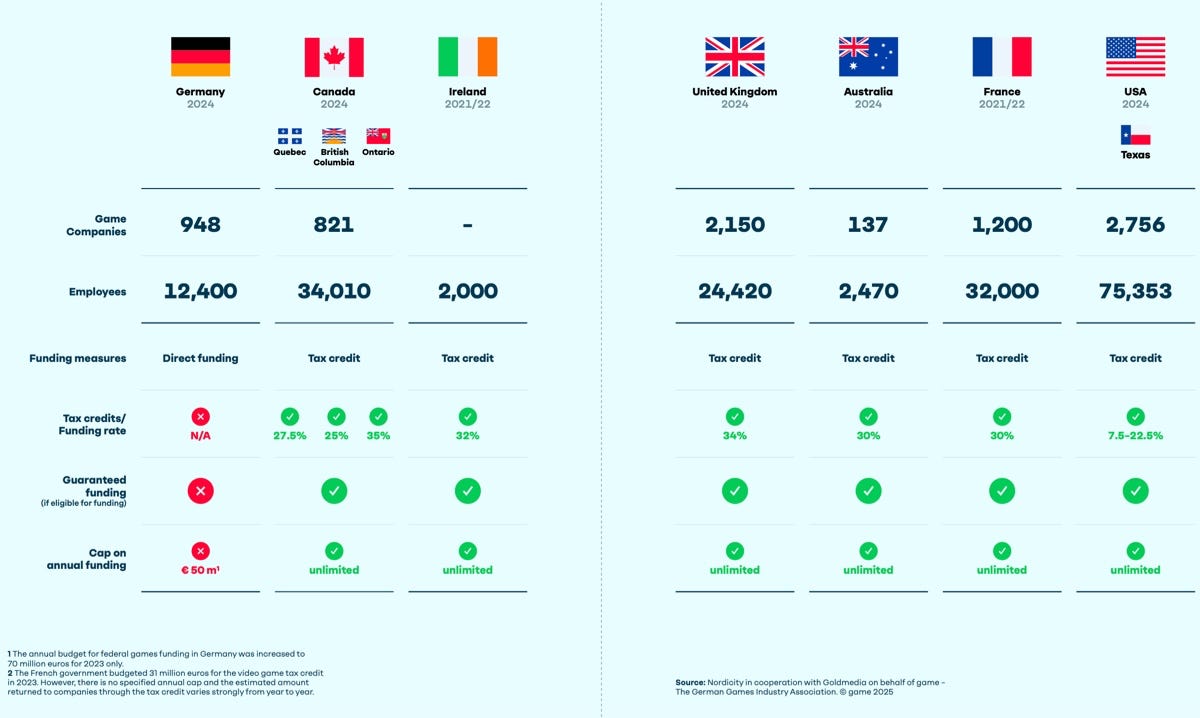

Report authors criticize the German government’s games support system, noting that other countries have much stronger frameworks.

This is confirmed by a survey of game companies: 87% stated that Germany performs poorly as a competitive location for game development.

The report also includes an interesting infographic on the development of the German games market since 1995.

Games & Numbers (August 14 – August 26, 2025)

PC/Console Games

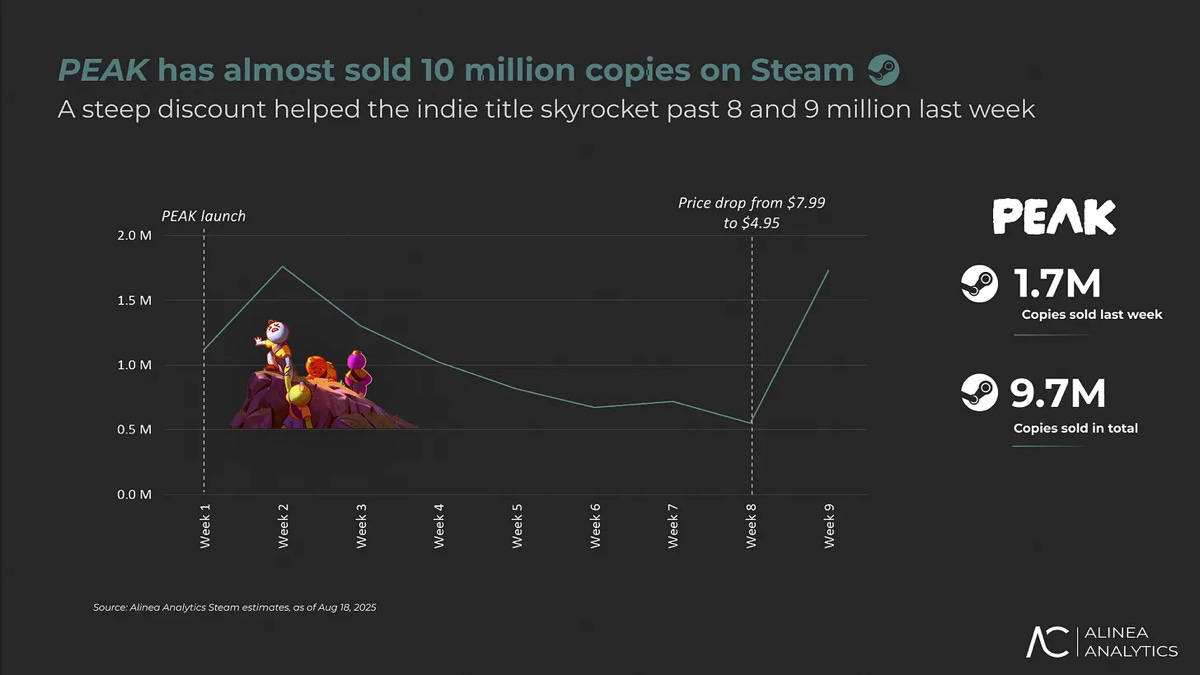

According to Alinea Analytics, PEAK sales are close to 10 million copies. The game has generated over $55 million in revenue to date.

Glen Schofield, former head of Striking Distance Studios, revealed sales figures for The Callisto Protocol. He estimates the game sold 6–7 million copies. Despite its development cost (over $100 million), Glen believes the game broke even.

VG Insights reports that Mafia: The Old Country sold over 800K copies in its first 5 days. Platform split: 48.67% PlayStation, 37.86% Steam, and 13.47% Xbox.

Publisher Marvelous announced that Rune Factory: Guardians of Azuma has sold over 500K copies.

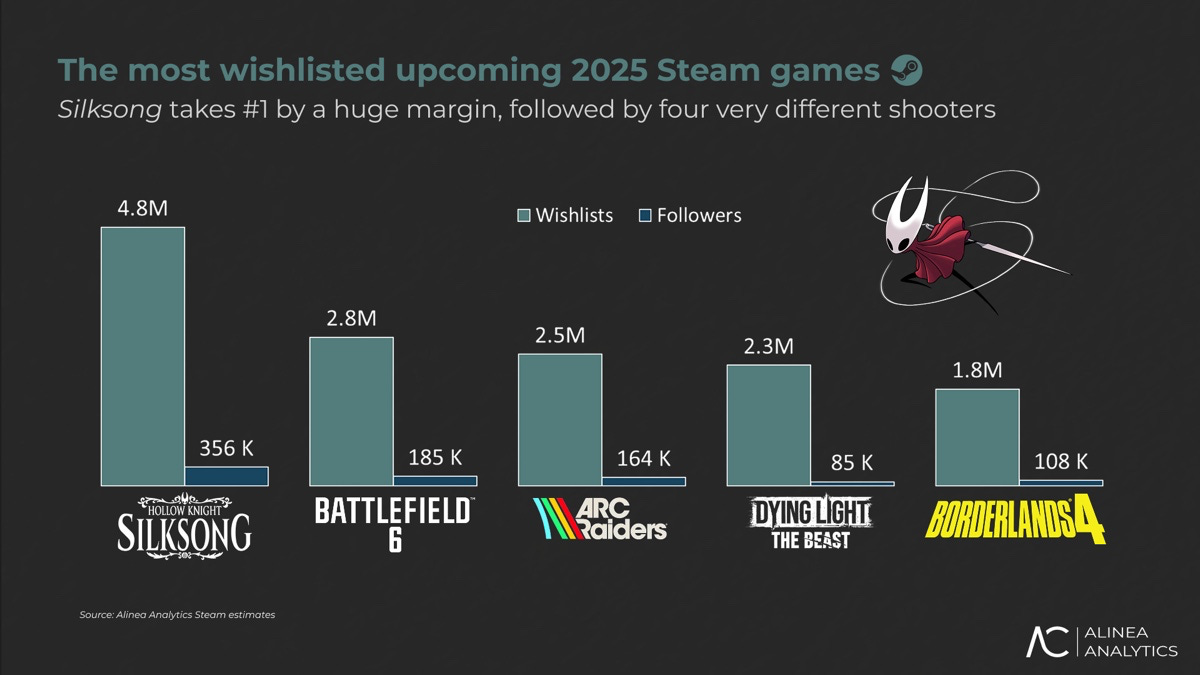

Alinea Analytics notes that Hollow Knight: Silksong has reached 4.8 million wishlists.

Mobile Games

Valorant Mobile launched in China on August 19. On iOS alone, it made over $1M on day one.

Avakin Life, launched in 2013, recently celebrated 200M registered users. Current MAU is 1.5M, and the team is preparing for a PC release.

DAU of the Chinese version of Delta Force has surpassed 20 million players.

Events

Opening Night Live 2025 was watched by 72M viewers live, which is 80% more than last year.

Google Cloud: AI in the Gaming Industry in 2025

The report is based on a survey of 615 game industry professionals from the US, South Korea, Finland, Norway, and Sweden.

97% of respondents believe that gen AI is transforming the gaming industry.

95% said AI helps with routine tasks at work. 94% noted that AI drives innovation.

29% are convinced that AI tools are making the gaming industry more democratic.

87% use AI agents in their work. Most often, they are used for asset or content optimization (44%) and automated tutorials (38%).

Workflow transformation

56% said their work already involves AI.

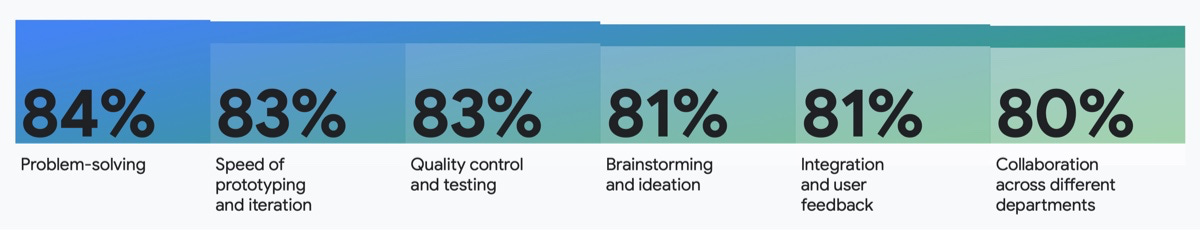

Many agree that using AI allows them to solve tasks more efficiently, speed up prototyping, and deliver higher-quality products. AI also helps with cross-department collaboration.

30% believe AI will lead to better graphics and more detailed worlds. Beyond democratizing tools, 28% believe AI will accelerate pipelines, make them more data-driven, and increase competition for new entrants.

62% noted the emergence of new AI-related job roles. 41% say AI helps with analytics, and 37% believe their experiments became more efficient.

AI also contributes to creative tasks. 36% said they use AI to write dialogues. Many also use it for basic game design, concept creation, and narrative development.

37% believe that ultimately AI will make game worlds more alive and believable.

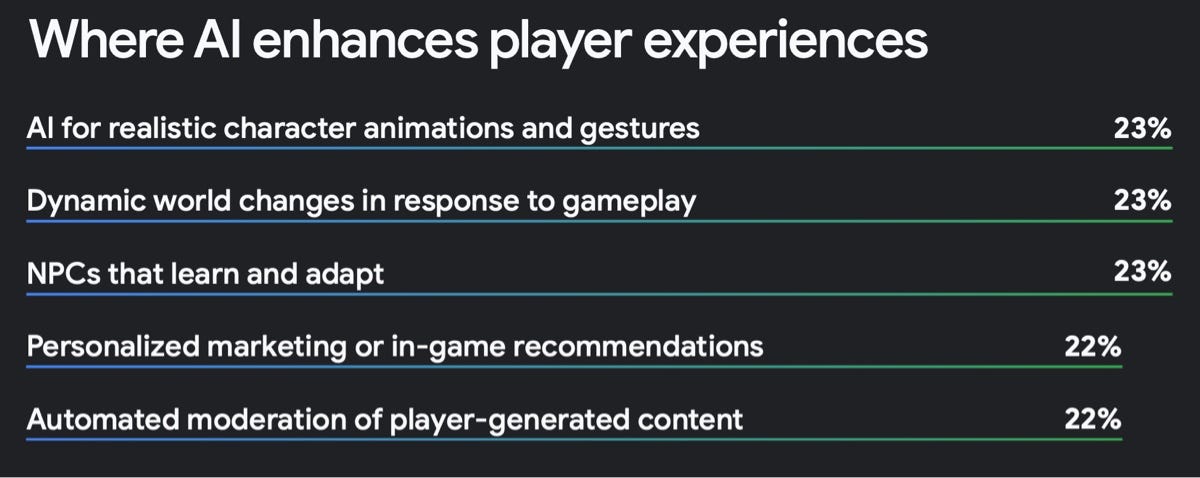

89% believe that player standards are rising due to AI. In particular, they see expectations for higher quality animations, responsive worlds that react to players, and NPCs that remember context.

Business impact

94% believe that making games will become cheaper within the next 3 years. 40% are confident that AI will create opportunities for new businesses and business models.

The main challenges companies face when adopting AI are difficulty in measuring efficiency (25%), cost of AI integrations (24%), limited data for AI training (23%), data privacy issues (23%), and the need for additional employee training (23%).

Questions remain about the proper use of AI. Concerns are mostly around personal data, licensing complexity, and ownership doubts regarding AI-generated works.

Circana: The U.S. Games Market in July 2025

State of the Market

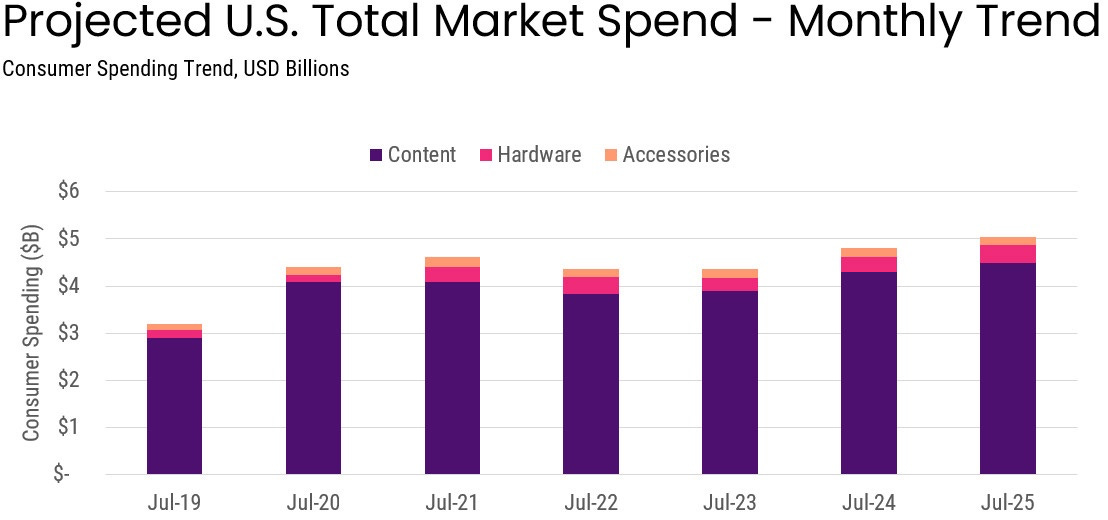

In July 2025, the U.S. video game industry generated $5.051 billion, up 5% compared to July 2024.

For the first 7 months of 2025, revenues are down 1% compared to the same period in 2024.

Game sales grew by 4% to $4.48 billion.

The strongest growth came from mobile gaming revenue (+7% YoY to $2.3 billion) and non-mobile subscriptions (+21% YoY to $0.5 billion). Spending on console games fell by 9%.

Subscription service spending across the first 7 months of 2025 grew by 19%. U.S. players spent $3.6 billion on them.

Hardware sales jumped 21% to $384 million, driven by strong Nintendo Switch 2 performance. This was the best July since 2008 (when revenue hit $441 million). Switch 2 was the top-selling system, both in units and in dollar sales.

Nintendo Switch 2 has already sold over 2 million units in the U.S. Within the same time frame, the original Nintendo Switch sold 75% fewer.

PlayStation 5 sales dropped 47%, Xbox Series S|X fell 69%, and the original Switch declined 52%, compared to July 2024.

Accessory sales fell 8% YoY to $187 million. The Nintendo Switch 2 Pro Controller is the best-selling accessory of 2025 so far, both in units sold and total revenue.

Game Sales

The July top 20 chart featured five new entries: EA Sports College Football 26, EA Sports MVP Bundle (2025), Donkey Kong Bananza (excluding digital sales), Tony Hawk’s Pro Skater 3 + 4, and Grounded 2.

Monster Hunter: Wilds remains the best-selling title in the U.S. for the first 7 months of 2025. But EA Sports College Football 26 immediately landed at #3.

MONOPOLY GO!, Royal Match, and Last War: Survival were the leaders in U.S. mobile game revenue. Also notable in the top 10 were Garena: Free Fire and Kingshot.

Platform Rankings

The top 10 lists for PlayStation and Xbox look nearly identical. EA Sports College Football 26, EA Sports MVP Bundle (2025), and Tony Hawk’s Pro Skater 3+4 all had strong launches on both platforms.

Nintendo dominates the sales charts for the Switch.

On PC, Grounded 2 debuted at #1 by revenue. Minecraft also climbed back into the top 10.

Alinea Analytics: Co-op games generated over $4 billion on Steam in H1’25

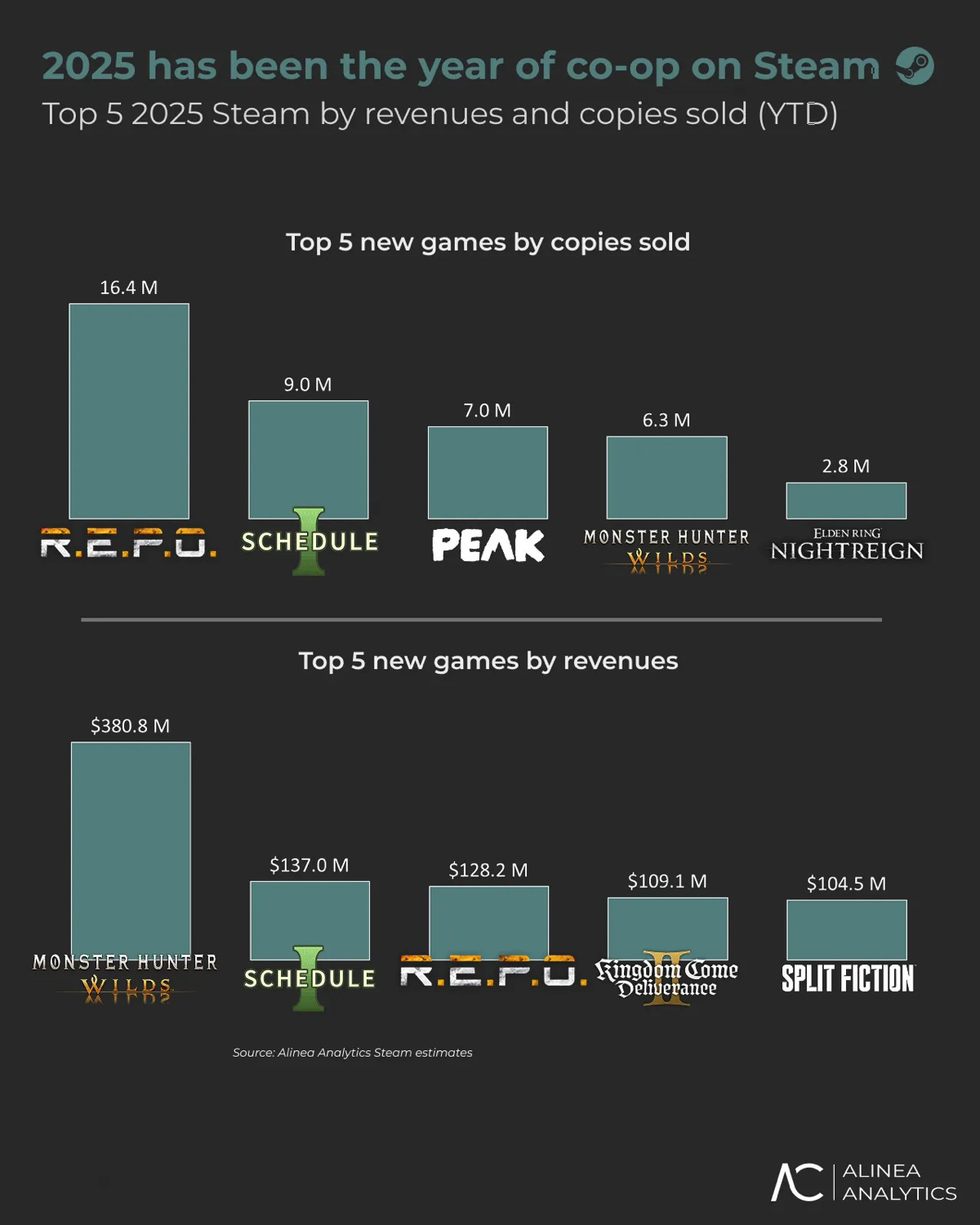

The top five sellers (by copies) on Steam in H1’25 have one thing in common - they’re all co-op titles. We’re talking about R.E.P.O. (16.4 million copies), Schedule I (9 million copies), Peak (7 million copies), Monster Hunter: Wilds (6.3 million copies), and Elden Ring: Nightreign (2.8 million copies).

One exception in the revenue ranking is Kingdom Come: Deliverance II, which pulled in $109.1 million and landed at number 4 in the ranking. Otherwise, the revenue chart is also dominated by co-op releases.

According to Alinea Analytics, co-op games on Steam grossed $4.1 billion in the first half of 2025. This is an all-time high and a YoY growth of 11%.

Steam revenue from co-op games has actually been climbing since 2020. Despite some down periods, the overall trend is positive.