Weekly Gaming Reports Recap: August 26 - August 30 (2024)

July was perfect for the US market thanks to EA Sports College Football 25; AppsFlyer released a report about the mobile gaming market in 2024; new titles in Steam top-20 H1'24.

Reports of the week:

GSD & GfK: Sales of PC/Console Games in Europe suddenly rose in July 2024

Games & Numbers (August 7 - August 23)

Circana: The US Gaming Market grew by 10% in July 2024

Stream Hatchet: Gaming Streaming Market in Q2'24

GameDiscoverCo: Top-Grossing Games on Steam in H1'24

GameRefinery: Key Mobile Game Updates for July 2024

Omdia: Gaming Accessories market reached $10.1B in 2023

AppsFlyer: The Mobile Gaming Market in 2024

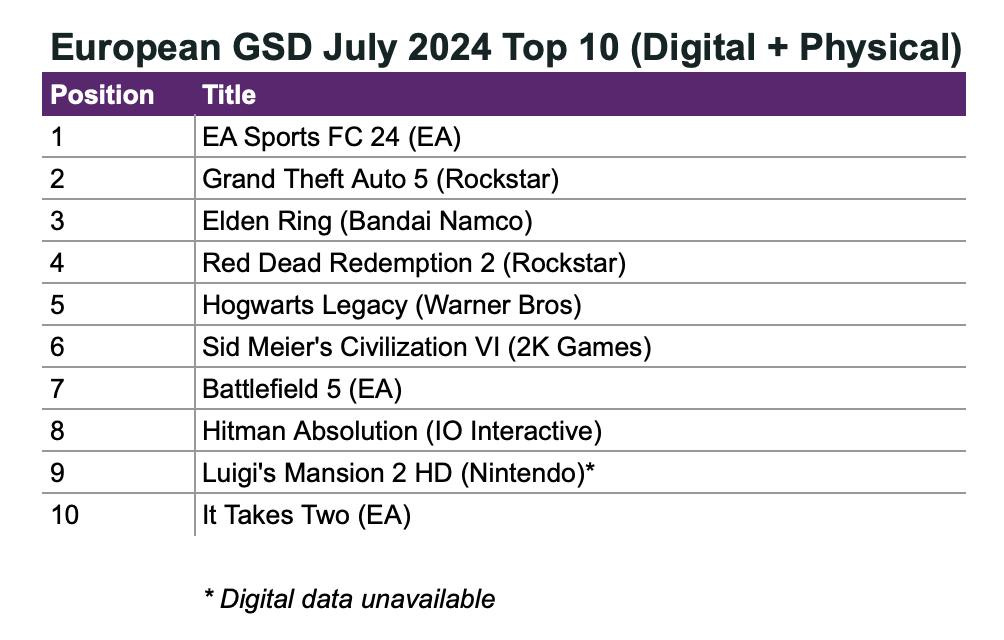

GSD & GfK: Sales of PC/Console Games in Europe suddenly rose in July 2024

Game Sales

2.4M games were sold in Europe in July. This is 3.4% more than last year.

Out of all the titles in the top 10, the only game released in 2024 is Luigi's Mansion 2 HD. The leaders are EA Sports FC 24 (released in 2023), Grand Theft Auto V (released in 2013), and Elden Ring (released in 2022).

EA Sports FC 24 sold 69% better in July than FIFA 23 did in July of last year. That's the power of branding. However, it's worth noting that last year, there was no European Championship.

Hitman Absolution became a free game on Amazon Prime in July, which helped it jump to the 8th spot on the sales chart.

❗️It’s a bit unclear, though, if those “free” copies are getting into overall equation. Might it be that the market is “up” because a great game has been giving away? I do not remember any such cases previously.

EA Sports College Football 25 is the main new release of the month, debuting at the 39th spot.

Hardware and Accessories Sales

Console sales do not include the UK and German markets.

263,000 consoles were sold in Europe in July. This is 46% less than a year earlier.

PlayStation 5 sales plummeted by 56% YoY. Nevertheless, it remains the best-selling console.

The number of Nintendo Switch units sold fell by 29% YoY, while Xbox Series S|X dropped by 42% over the same period.

1.08M gaming accessories were sold in July. DualSense was the leader, but overall sales fell by 20% compared to last year.

Games & Numbers (August 7 - August 23)

PC/Console Games

Black Myth: Wukong has been purchased over 10 million times. The simultaneous number of players across all platforms exceeded 3 million people. On Steam, the peak online count reached 2.41 million. All these are real figures, not calculations or approximations.

Warner Bros. Discovery and NetherRealm Studios reported 4 million sales of Mortal Kombat 1. The game was released on September 19, 2023.

The audience of Enshrouded exceeded 3 million people. The game was released in early access on January 24, 2024. The first million players were reached after four days; the second after the first month.

Balatro was purchased by 2 million people. The developer promises to release a major gameplay update in 2025.

Abiotic Factor was bought 600,000 times in 3 months. The first 250,000 sales were reached 8 days after release. The USA accounted for 38% of sales, and China for 21%.

Another Crab’s Treasure crossed the mark of 500,000 copies sold. The game took 3.5 months to achieve this.

Cataclismo, which launched in Early Access at the end of July, has already sold 120,000 copies. The game is published by Hooded Horse.

The free Once Human was downloaded more than 10 million times. It took just over 1 month to reach this milestone. The mobile version is set to be released at the end of September.

Hunt: Showdown set a CCU record 5 years after its release. Players were drawn by the new update, and CCU on Steam reached 60,000 users.

Delta Force: Hawk Ops has over a million wishlists. The game does not yet have a release date.

Mobile Games

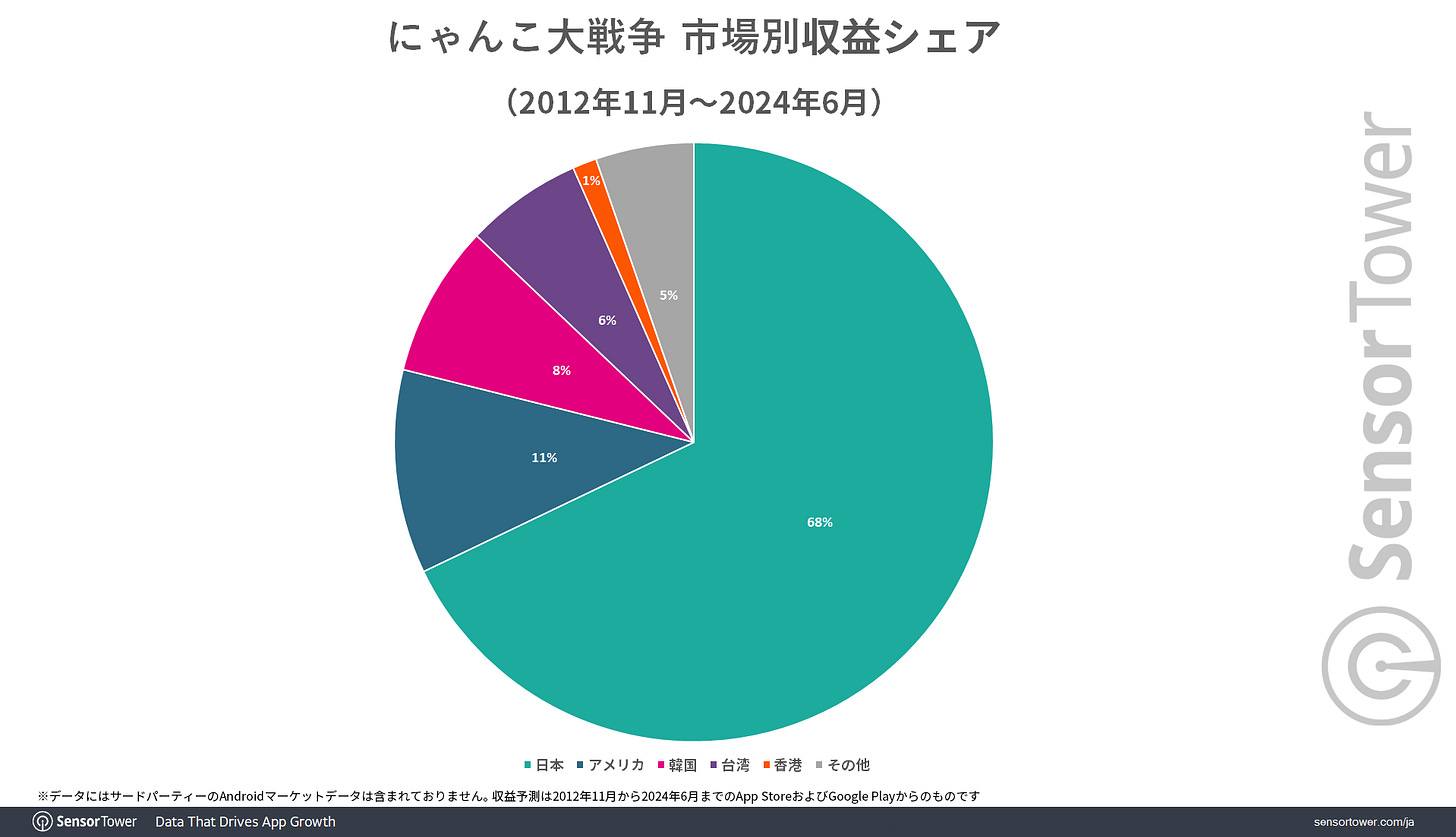

The Battle Cats from the Japanese studio PONOS has earned more than $700 million, according to Sensor Tower. 68% of the project's revenue came from Japan, 11% from the USA, and 8% from South Korea. The game has over 78.3 million installs, and MAU has not fallen below 1 million people since June 2021.

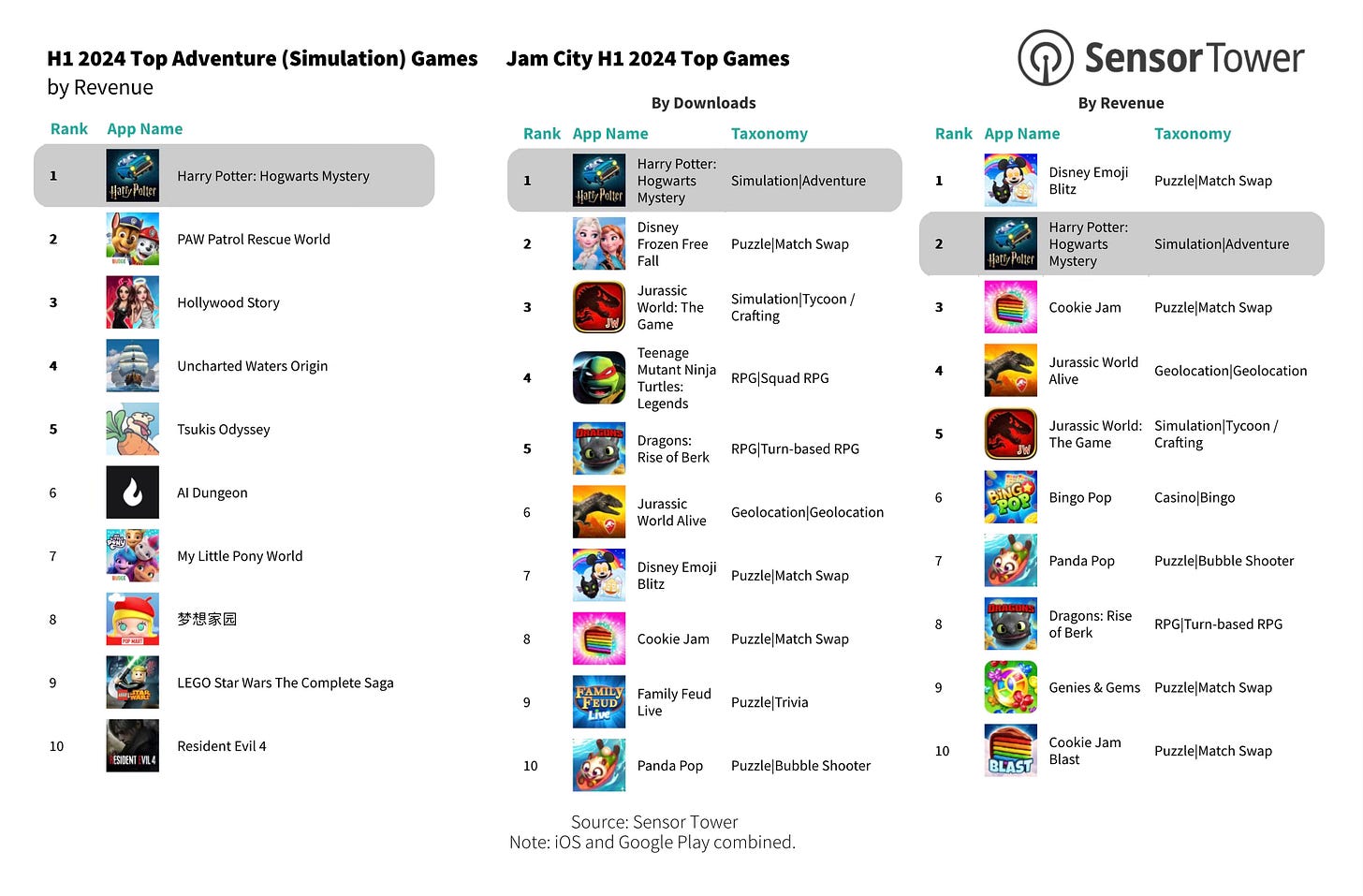

Players have spent over $500 million in Harry Potter: Hogwarts Mystery. The game has been working towards this figure since April 2018. Most of the revenue comes from the USA, Germany, the UK, and France.

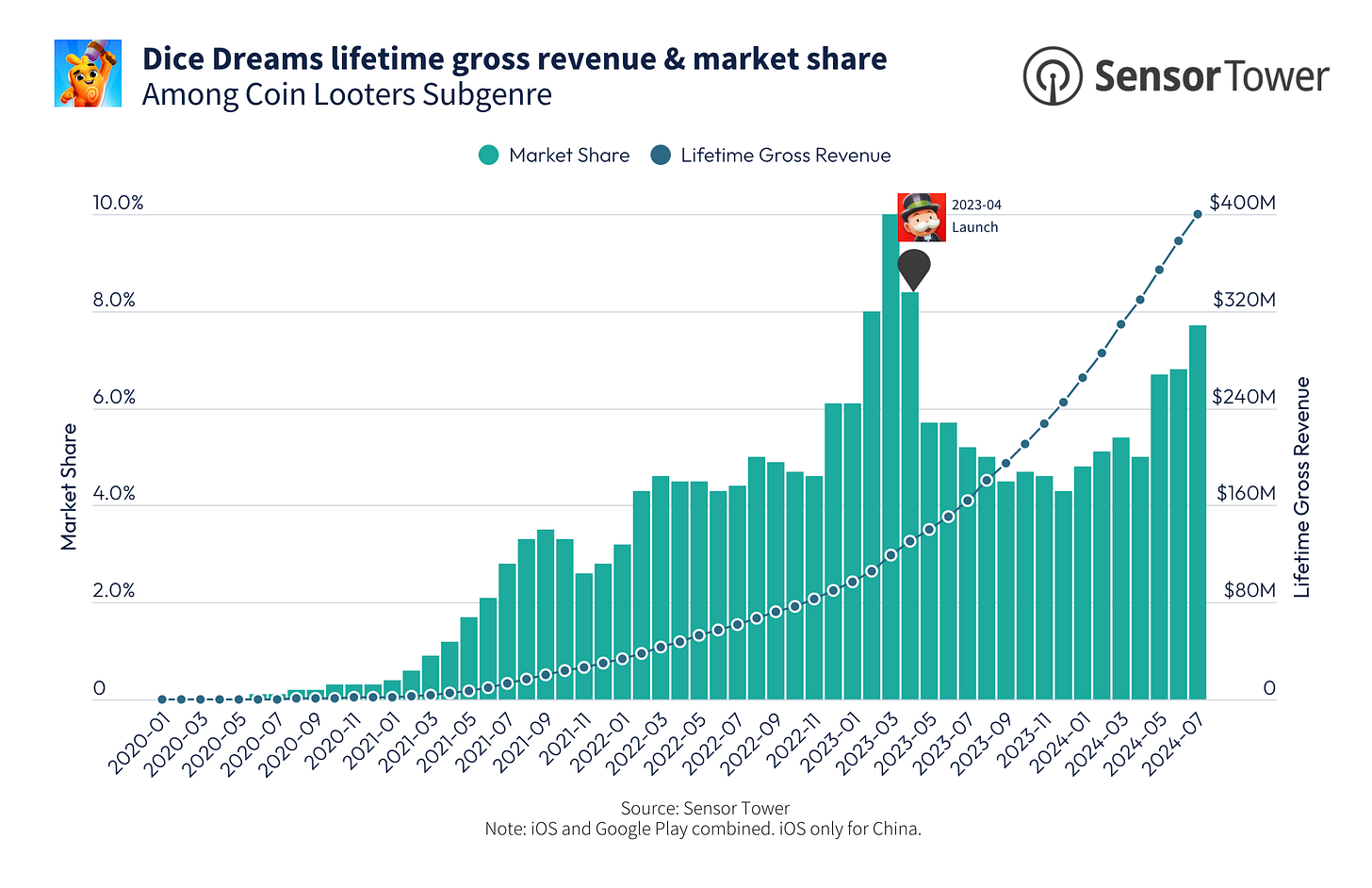

Dice Dreams has surpassed $400 million in gross revenue, according to Sensor Tower. For three years before the release of MONOPOLY GO!, the game earned $125 million, and the remaining $275 million was earned after the release of the hit from Scopely. The main market for the project is the USA.

AFK Journey launched in China, and in the first 5 days, users spent $5.1 million in the game, according to AppMagic. This is already 7% of the game's total revenue of $78.8 million.

The head of Epic Games, Tim Sweeney, estimated the losses due to the removal of Fortnite from the App Store and Google Play at $1 billion. However, he believes that this is a "small price for freedom."

Circana: The US Gaming Market grew by 10% in July 2024

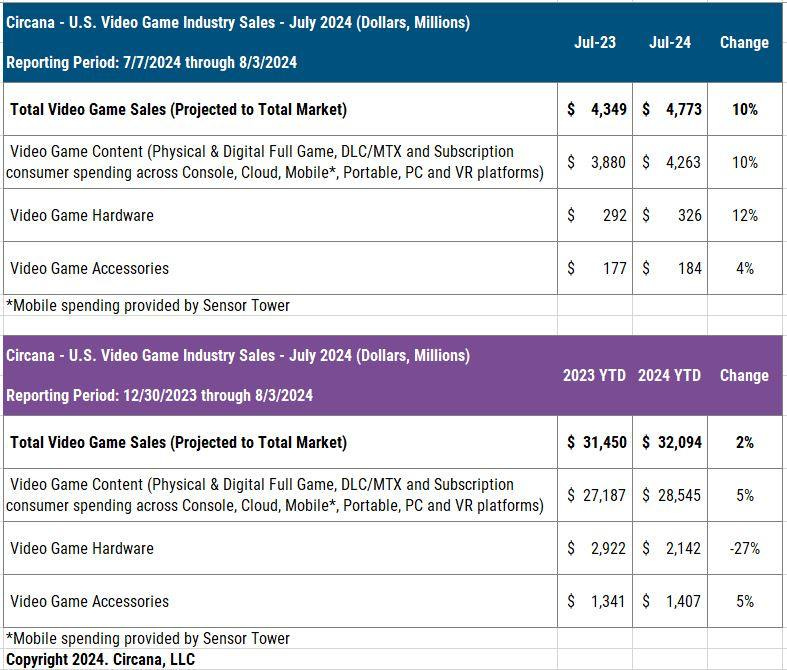

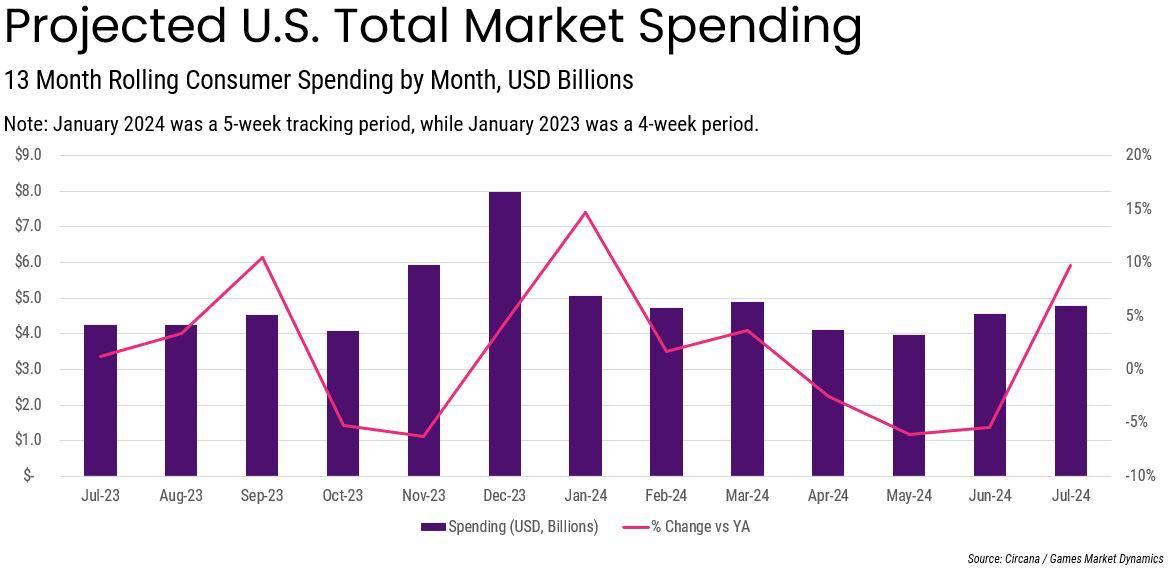

The American audience spent $4.773 billion on games in July 2024, which is 10% more than in July of the previous year.

All segments experienced growth: game sales increased by 10% (to $4.263 billion); hardware sales grew by 12% (to $326 million); accessory sales rose by 4% (to $184 million).

PlayStation 5 sales increased by 25% year-over-year; Xbox Series S|X sales rose by 48%. However, Nintendo Switch sales decreased by 44%. A total of 771,000 consoles were sold. PS5 was the best-selling console both in units and in dollar terms. Xbox Series S|X was second.

The best-selling accessory in the US remains the PlayStation Portal. The black DualSense leads in terms of units sold.

Console game sales grew by 29% in July; the mobile market increased by 7.6%. However, sales on PC, in the cloud, and non-console VR declined by 6%.

Comparing the first seven months of 2024 with the same period in the previous year, there is a 2% growth ($32.094 billion versus $31.450 billion in 2023). The growth is due to increased game and accessory sales (up by 5%); however, hardware sales in the first seven months of 2024 were 27% lower.

❗️Despite all great news, Mat Piscatella forecasts a 2.2% decline in the US market by the end of the year.

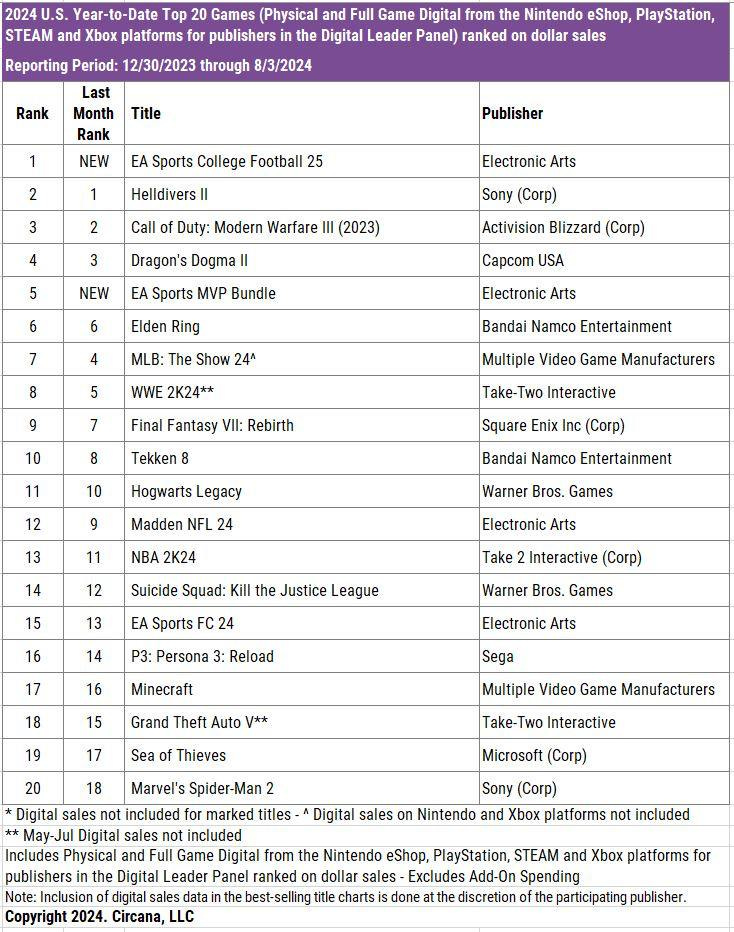

Top-selling Premium games in the US in July

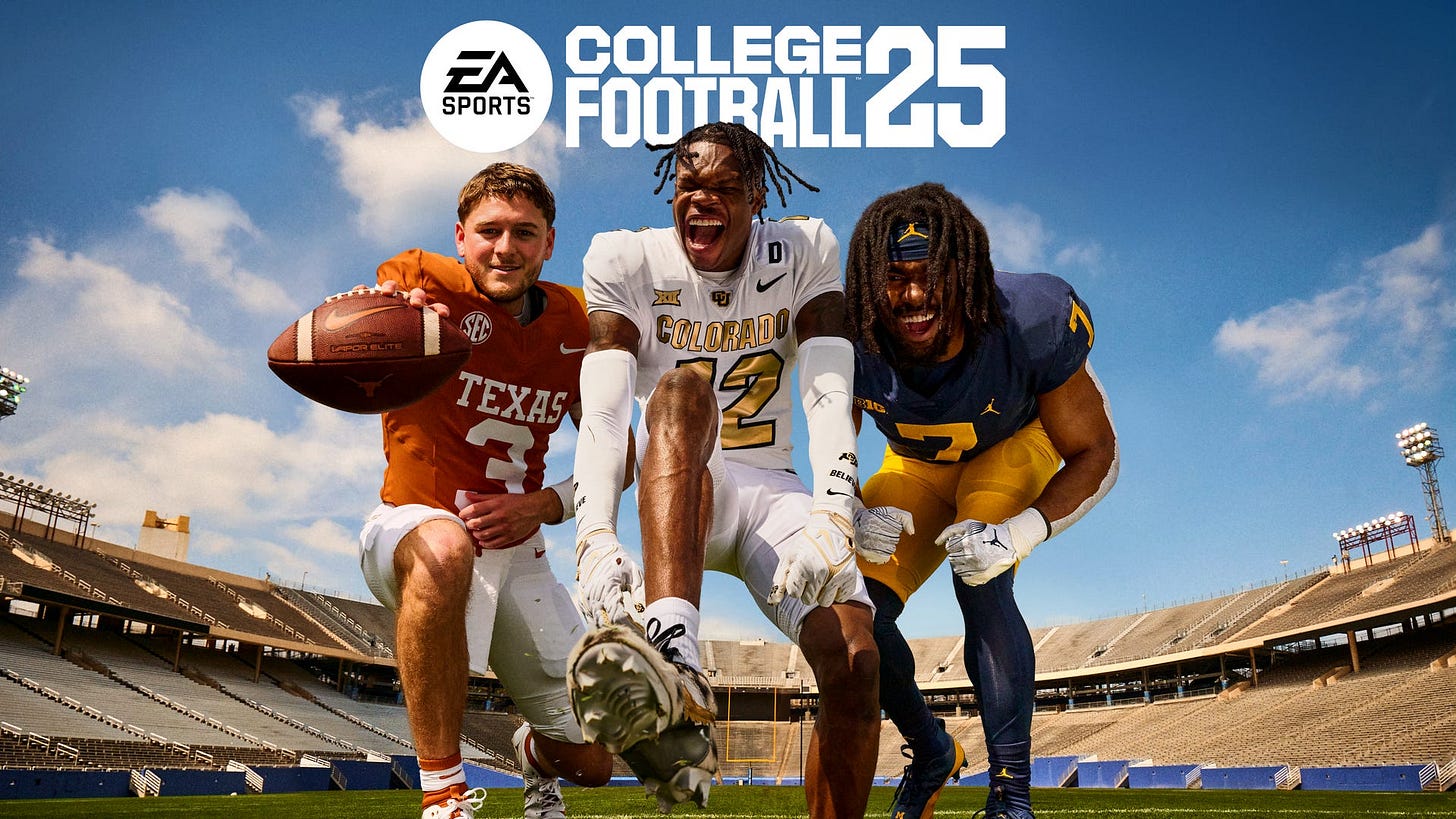

EA Sports College Football 25 had a fantastic debut. The game became the top seller in July and also jumped to the first spot among the best-selling games in the US in 2024 in dollar terms. It surpassed Helldivers II in dollar sales in less than two weeks. EA Sports College Football 25 sold three times better in dollar terms in the first couple of weeks than the previous entry in the series, NCAA Football 07.

EA Sports MVP Bundle (which includes EA Sports College Football 25 and Madden NFL 25) was the second best-selling game in July; it ranked 5th overall for 2024.

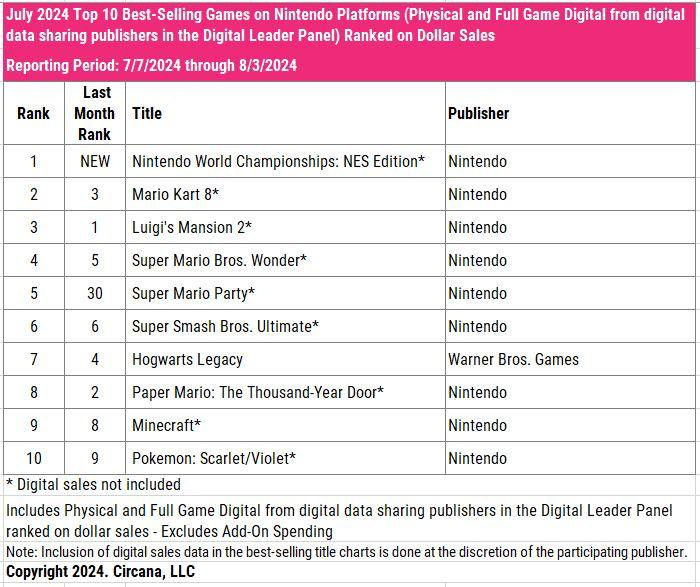

Another new entry in the rankings was Nintendo World Championships: NES Edition. Based on physical copies alone, the game ranked 6th in July sales.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The top-grossing mobile games in July were MONOPOLY GO!, Roblox, Royal Match, Candy Crush Saga, and Pokemon GO. Simulator games (such as Township, Roblox, Minecraft) saw a significant revenue increase in July—up by 38%. Shooter games also saw a substantial revenue rise in the US market—Garena: Free Fire, PUBG Mobile, GODDESS OF VICTORY: NIKKE grew by over 50%. Call of Duty: Mobile grew by 32% in July. All figures are compared to June.

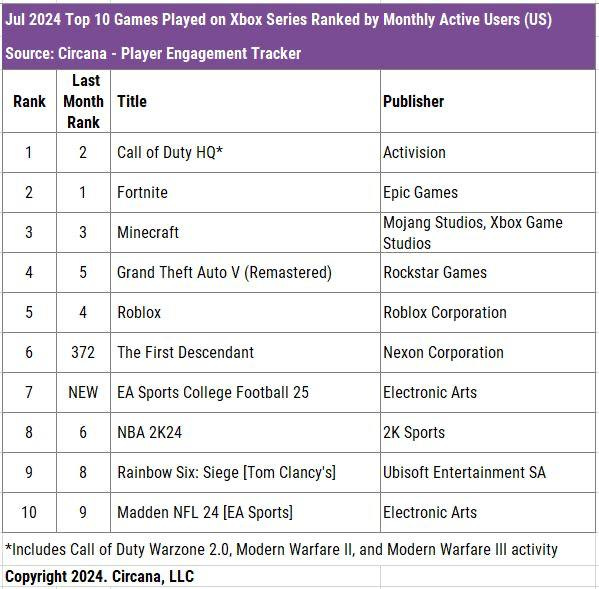

PC/Console Charts

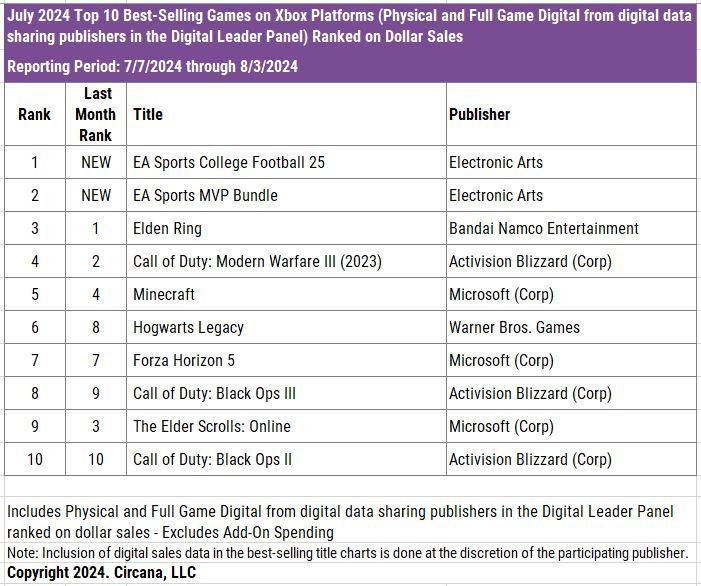

EA Sports College Football 25 and EA Sports MVP Bundle were the top sellers on PlayStation in July. Elden Ring took third place.

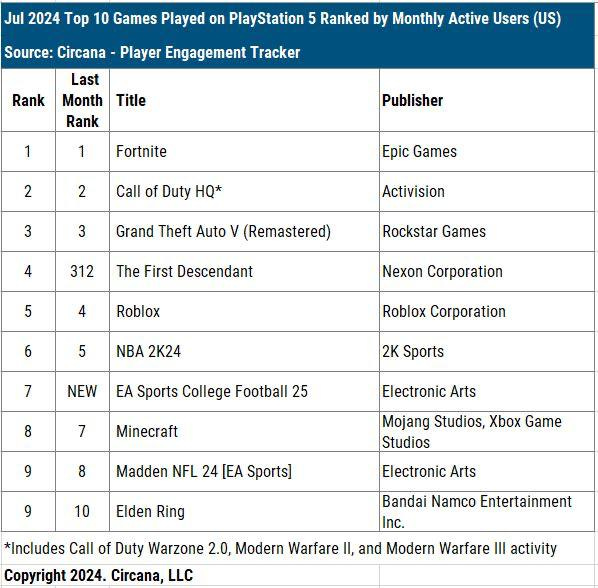

There are changes in the PlayStation MAU rankings. The First Descendant made it into the top 10 for the first time (ranked 4th); EA Sports College Football 25 also ranked 7th.

Sales on Xbox Series S|X are almost similar to PlayStation 5.

The First Descendant ranked 6th in MAU on Xbox; EA Sports College Football 25 ranked 7th.

Nintendo World Championship: NES Edition was the best-selling game on Nintendo Switch in July. Super Mario Party also returned to the top 10.

There were changes on Steam as well. The First Descendant ranked 3rd in MAU, and Once Human ranked 4th. 7 Days to Die returned to the top 10.

Stream Hatchet: Gaming Streaming Market in Q2'24

Market Situation

Gaming stream views in Q2 2024 reached 8.5 billion hours, a 10% increase from the previous year. After two years of decline, the second quarter is positive again. Experts attribute this to the growth of Kick, Rumble, and CHZZK. Interestingly, the number of hours watched surpassed the pandemic year of 2020 by 4.8%.

Esports event views in Q2 2024 dropped by 1% to 654 million hours, marking the first decline since 2019. However, the Q2 2024 results are still the second highest in history. The most-watched tournament was the 2024 Mid-Season Invitational for League of Legends (70 million hours, accounting for 10.7% of the total).

Twitch held 60.3% of the market in Q2 2024 (down from 70% in Q2 2023); YouTube Gaming had 23.4% (up from 17% in Q2 2023); Kick held 5.5%. Facebook fell out of the top 5 in terms of audience, with AfreecaTV in 4th place (3.4%); and the new South Korean platform CHZZK in 5th place (2.1%).

Twitch views in Q2 2024 fell by 5% compared to Q2 2023. All other platforms in the top 5 saw growth. YouTube Gaming grew by 50% YoY; Kick by 163% YoY; AfreecaTV by 13%; no growth data is available for CHZZK as it is a new platform. Facebook Live dropped by 69% YoY, ranking 8th in popularity in Q2 2024.

Seasonality in Twitch and YouTube Gaming

The biggest difference between weekday and weekend viewing hours occurs in the fall, with 13.1% more hours watched on weekends. The smallest difference is in the summer at 9.7%, likely due to many people going on vacation.

In summer, people watch streams less on weekdays than in winter or spring, but more than in autumn. On weekends, summer viewing is similar to autumn but still less than in spring or winter.

Most Popular Games in Q2 2024

Grand Theft Auto V (510 million hours, -13% YoY), League of Legends (439 million hours, -17% YoY), and Valorant (299 million hours) were the leaders in viewership.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Elden Ring saw the largest growth in Q2 2024, with views up by 331% (reaching 161 million hours), driven by the release of a DLC.

Mobile Legends: Bang Bang also saw significant growth in the top 10, influenced by esports.

The best launches in Q2 2024 were Elden Ring: Shadow of the Erdtree (81.2 million hours), Destiny 2: The Final Shape (24.8 million hours), and Wuthering Waves (19.2 million hours). Interestingly, expansions outperformed full games in popularity. It's also worth noting XDefiant in 4th place with 16.7 million hours.

Most Popular Genres in Q2 2024

FPS (1.2 billion hours, -4% YoY), Action-Adventure (831 million hours, -24% YoY), and MOBA (812 million hours, +3% YoY) were the most popular genres on streaming platforms. The decline in Action-Adventure is due to the lack of major new games, unlike last year when Diablo IV and The Legend of Zelda: Tears of the Kingdom were released.

The share of FPS dropped to 13% in Q2 2024 from 16% in Q2 2020. MOBA's share fell from 11% to 9% over the same period. However, views for Action games rose from 4% in Q2 2020 to 8% in Q2 2024. RPG views increased from 3% to 7%.

Streamer Statistics

KaiCenat was the most popular streamer in Q2 2024, with 43.8 million hours watched.

Over the years, the share of top channels has been declining. This allows new faces to emerge on the scene.

In Q2 2024, the top 5% of channels accounted for 86% of all hours watched. The top 0.01% of channels accounted for 33% of all hours watched.

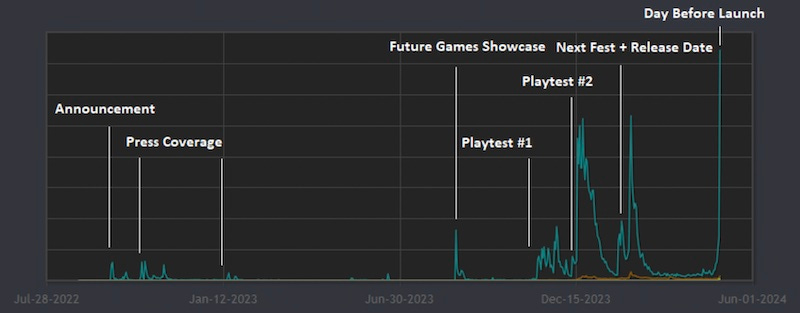

GameDiscoverCo: Top-Grossing Games on Steam in H1'24

GameDiscoverCo provides a Gross Revenue estimate, not actual figures.

According to the service, the leaders in revenue for the first half of 2024 are Counter-Strike 2 ($610 million), Helldivers II ($458 million), and Palworld ($378 million).

F2P (Free-to-Play) games make up less than 50% of the total revenue in the top 20.

There are 7 new games in the top 20 by revenue. In addition to Helldivers II and Palworld, the list includes Dragon’s Dogma 2 ($108 million), Manor Lords ($56 million), Enshrouded ($49 million), Granblue Fantasy: Relink ($40 million), and Tekken 8 ($40 million). In some sense, Ghost of Tsushima: Director’s Cut ($48 million) can be considered a new game, as it had not been released on PC before.

The share of new games that earned up to $5 million in the first half of the year is around 15%. Among the most successful projects (those with revenue over $25 million), the share of new games is over 30%.

On Steam during H1 2024, 20% more games earned between $500,000 and $1 million YoY. There were 15% more games earning between $5 and $10 million. And one more game earned over $50 million in the half-year period. At the same time, there were 22% more games on Steam overall in H1’24 compared to the H1’23. This indicates that while users are spending more, the offering has increased even more sharply.

❗️However, it's important to assess how high-quality these new games are to understand the actual competitive landscape.

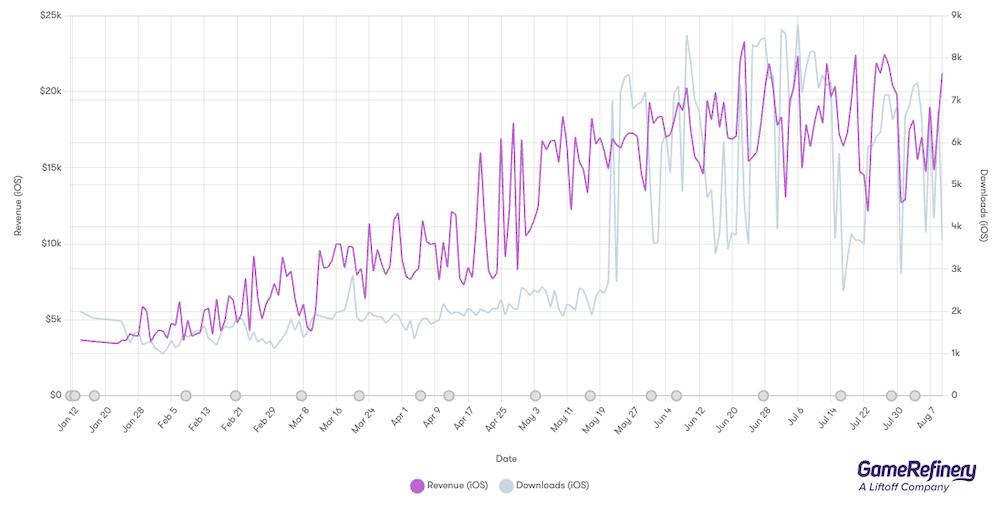

GameRefinery: Key Mobile Game Updates for July 2024

Marvel Snap released several live events tied to the release of Deadpool & Wolverine. The game achieved its peak revenue (+300% DoD) on July 10, the day after the release of the Battle Pass featuring Deadpool. However, the game had previously achieved similar results without the addition of content from popular movies.

The launch of a new game by Zynga based on Game of Thrones can barely be called successful. The game just made it into the top 200 for revenue in the U.S.

Naraka: Bladepoint Mobile successfully launched in China. The project debuted at 4th place in revenue and 1st place in downloads.

Goddess of Victory: NIKKE launched a collaboration with Dave the Diver. Interestingly, the developers recreated the gameplay of Dave the Diver within the game, where players need to catch fish and manage their own restaurant. In November 2023, the developers of Goddess of Victory: NIKKE added a mini-game in the style of Vampire Survivors. It seems the experiment was successful.

SuperPlay, the creators of Dice Dreams, continue to grow revenue for Domino Dreams. In July, the game made it into the top 100 for revenue on iOS.

Omdia: Gaming Accessories market reached $10.1B in 2023

The company forecasts that the market will grow to $11.8 billion by 2029.

Spending on gaming accessories in 2023 surpassed the pandemic peak levels of 2021.

In 2023, 44.3% of this spending was on game controllers. User spending on headphones and keyboards in 2023 exceeded $1 billion.

Omdia analysts expect that by 2029, the strongest growth will be in the categories of specialized gaming accessories such as chairs, steering wheels, and joysticks.

Omdia analysts note that the demand elasticity for gaming peripherals is higher than for games. For example, the DualSense Edge shows excellent sales despite its high cost.

Omdia predicts that by 2029, Sony will earn more than $2 billion annually from game controllers. This is influenced by both the popularity of the Japanese company's consoles and the growing popularity of DualSense on PC. Meanwhile, Xbox controllers are the most popular on Steam, accounting for 59% of all sessions.

AppsFlyer: The Mobile Gaming Market in 2024

The company analyzed over 15,000 gaming apps (with at least 3,000 non-organic installs per month); 21.2 billion non-organic installs from January 2023 to June 2024; and 1.5 billion remarketing conversions.

Key Trends

Games in genres with IAP monetization are integrating ads; games in genres with IAA are integrating IAP monetization. For example, RPGs have seen an increase in ad revenue but a decrease in IAP revenue. The overall trend is as follows: the share of games with hybrid monetization grew from 36% in Q2 2023 to 43% in Q1 2024; the share of games with ad-only monetization decreased from 47% in Q2 2023 to 43% in Q1 2024; the share of games with IAP-only monetization decreased from 17% in Q2 2023 to 14% in Q1 2024.

Acquisition in casual games is growing; in mid-core and hyper-casual games, it is declining. In H1 2024, non-organic installs in mid-core games decreased by 5% on Android and by 15% on iOS. In hyper-casual games, ad spending decreased by 6%. Meanwhile, casual games are trending upward—Match games (+13% on Android); action games (+18% on iOS); simulation games (+25% on Android); board games (+29% on iOS). Puzzle and sports games are also showing growth on iOS.

Game ad revenue increased by 4% in Q2 2024 compared to Q2 2023. Android grew by 12%, while iOS dropped by 10%. Year-over-year, ad revenue grew by 3%. However, IAP revenue decreased by 15% on Android and by 35% on iOS.

The first week is crucial for assessing a project's monetization potential. On iOS, 22.99% of all paying users within the first 10 days make a purchase on Day 1. On Android, this figure is 21.11%.

It's becoming harder to find "whales" on iOS. The share of revenue from top-paying users in North America dropped from 34% in Q1 2023 to 27% in Q1 2024. On Android, however, it slightly increased—from 34% to 35% over the same period. On both iOS and Android, the top 5% of paying users generate about 50% of total revenue.

Installs on Android increased by 3% (both overall and non-organic installs) in the first half of 2024. On iOS, however, there was a 9% overall decline and a 2% drop in non-organic installs. The biggest declines in installs on iOS were in RPGs (-36% overall; -25% in paid traffic) and strategy games (-15% overall; -48% in paid traffic).

Growing Genres

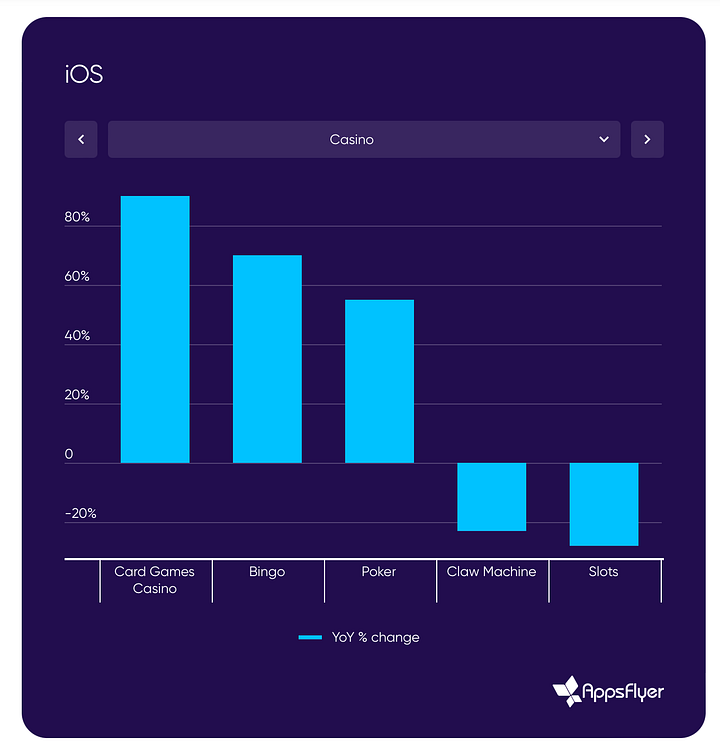

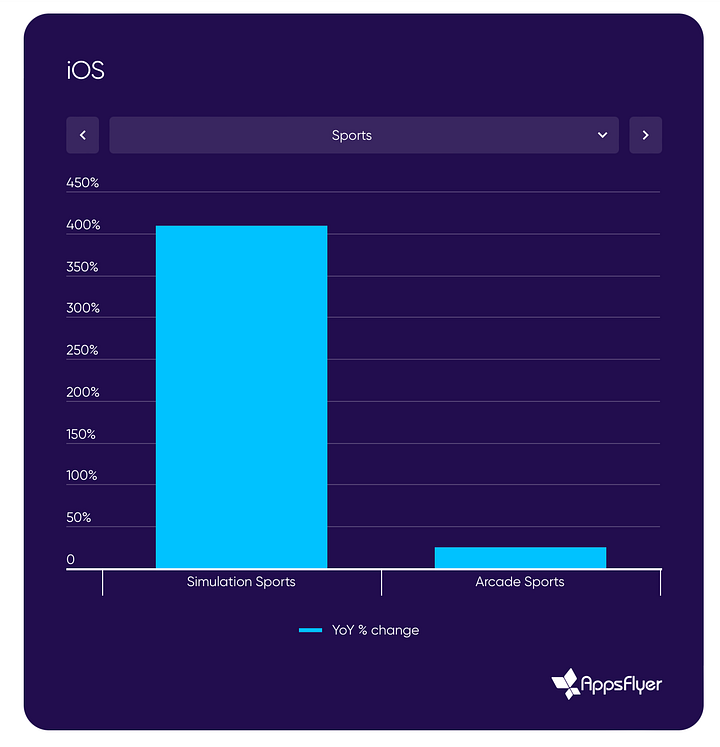

The strongest growth in non-organic installs on iOS was seen in sports games, racing games, and merge games. Casino and bingo games are also growing.

On Android, puzzles showed the strongest growth in non-organic installs. Among subcategories, Sudoku saw the highest growth.

Acquisition by Region

AppsFlyer has a positive outlook on the marketing market over the past year and notes that the number of non-organic installs increased on both iOS and Android.

The U.S., the largest market for iOS, grew by 1%. The number of non-organic installs in the U.K. on iOS increased by 9%; on Android, by 14%. There were also significant declines—installs in South Korea fell by 39%; in Australia by 15%; in Japan by 15%. Mexico showed a strong growth trend, with non-organic installs in the country increasing by 21%.

On Android, things are better, with growth across all key markets. The leaders in non-organic traffic growth are the Philippines (26%); the U.K. (18%); Japan (16%); and Indonesia (13%). The U.S. market grew by 5%.

Marketing Spending

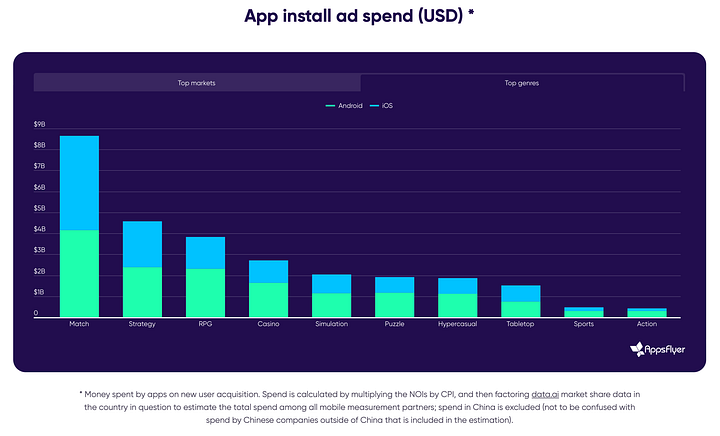

In 2023, mobile gaming companies spent $29 billion on marketing their games.

The U.S. accounted for $6.6 billion in iOS spending and $5.5 billion in Android spending in 2023. This is more than the next 10 markets combined.

The second-largest market in the world for marketing spending is Japan ($1.8 billion on iOS and $1.2 billion on Android). South Korea ranks third. The largest European markets are the U.K., Germany, and France.

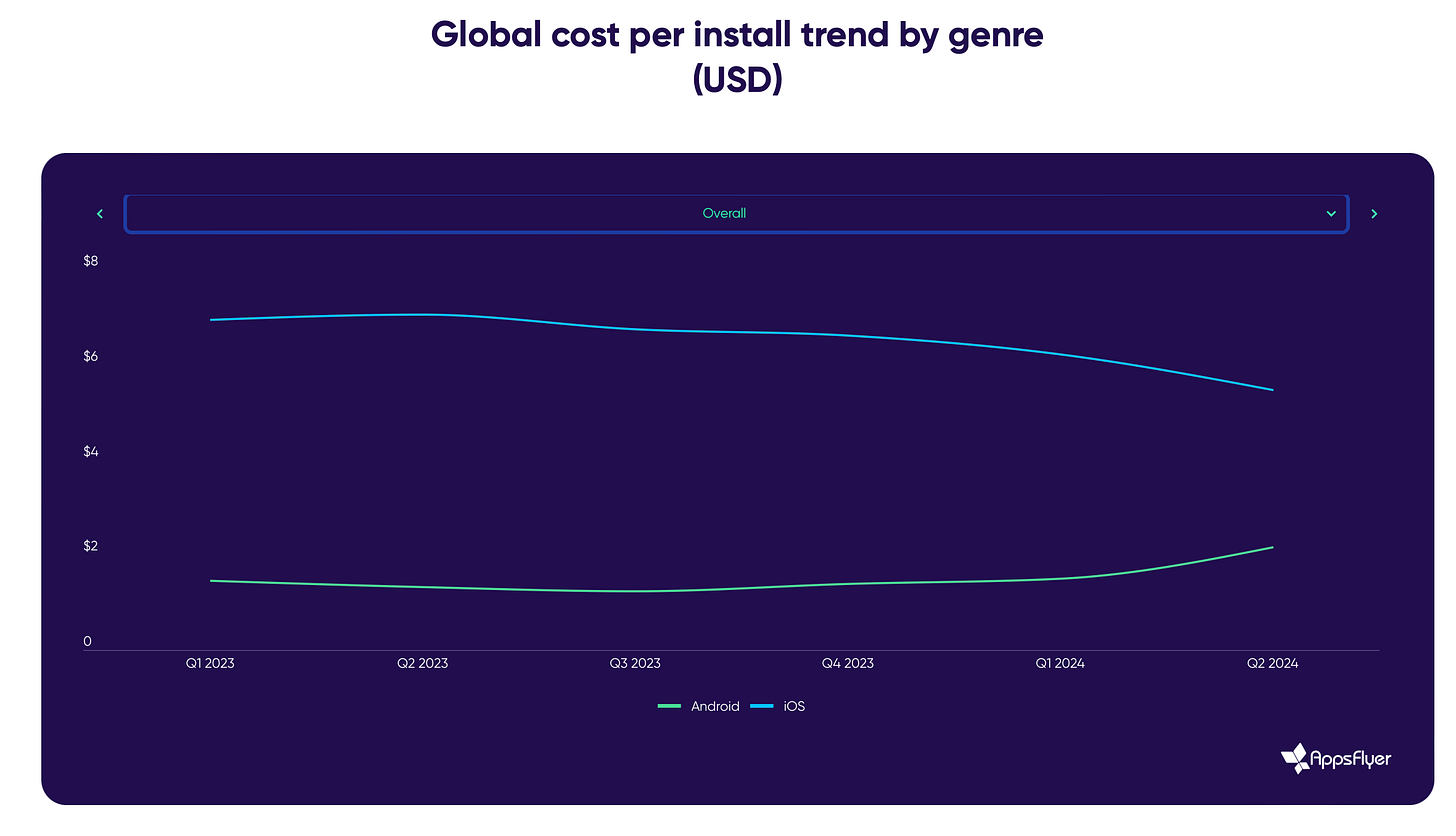

One of the key trends in 2023 was the decrease in installation costs on iOS and the increase on Android. This was especially noticeable in puzzles, the Match genre, hyper-casual games, and the simulation genre.

Top Creatives

UGC (User-Generated Content) creatives generally perform well on ad networks, DSPs, and social media.

AppsFlyer analyzed D30 Retention for different types of creatives across various ad channels. It was found that for hyper-casual games, the best combination is UGC with real or animated scenes. For mid-core projects, both UGC and gameplay videos—whether with real or animated scenes—work well.