Weekly Gaming Reports Recap: August 4 - August 8 (2025)

Newzoo, together with UKIE, shared insights about the Japanese market; the Chinese gaming market grew by 14.08% in 2025; Niko Partners shared insights about Eastern Asia Markets.

Reports of the week:

Newzoo & UKIE: Japanese Gaming Market in 2025

China Daily: Revenue of the Chinese gaming market grew by 14.08% in H1’25

Niko Partners: Japan and South Korea Markets in 2025

Playgama: Most Popular Engines for HTML5 Games in H1'25

Newzoo & UKIE: Japanese Gaming Market in 2025

Market Overview

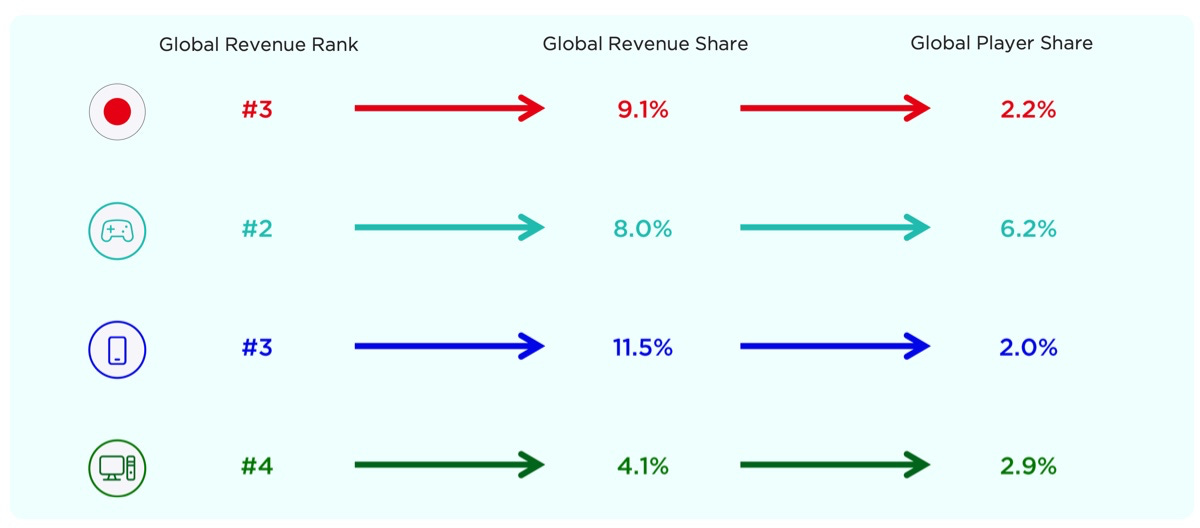

Japan is the #3 gaming market worldwide by revenue. It accounts for 9.1% of all spending, but only 2.2% of the global gaming audience.

By platforms, Japan is the #2 console market in the world (8% of global revenue, 6.2% of audience), the #3 mobile market (11.5% of revenue, 2% of audience), and the #4 PC market (4.1% of revenue, 2.9% of audience).

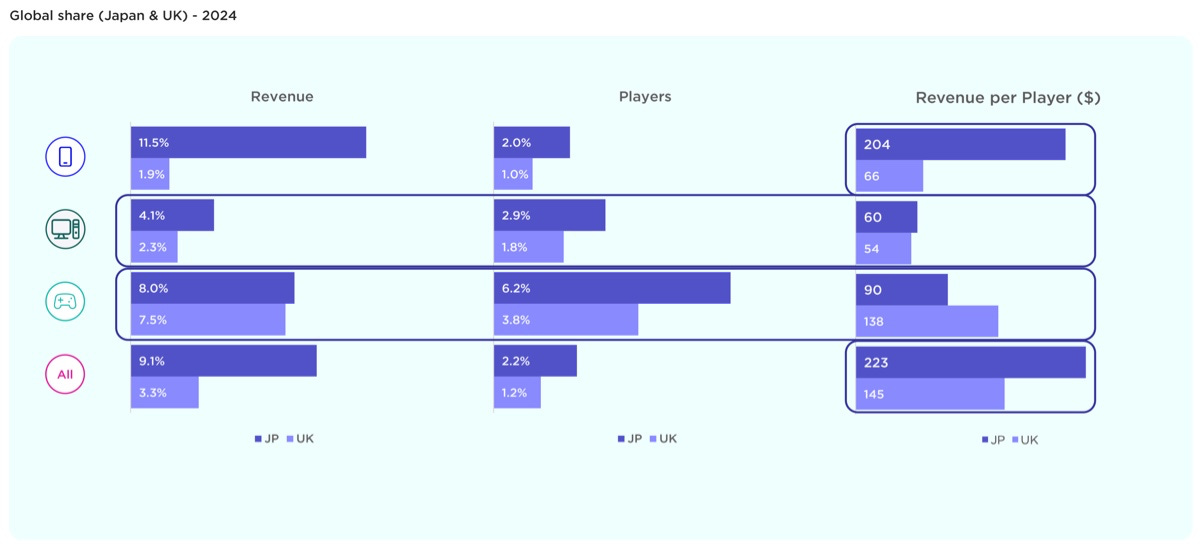

The average Japanese mobile gamer spends 3 times more on mobile games than UK people do. On console, the pattern is reversed: despite the popularity of consoles in Japan, the average British user spends more on console games. All of this reflects the results at the end of 2024.

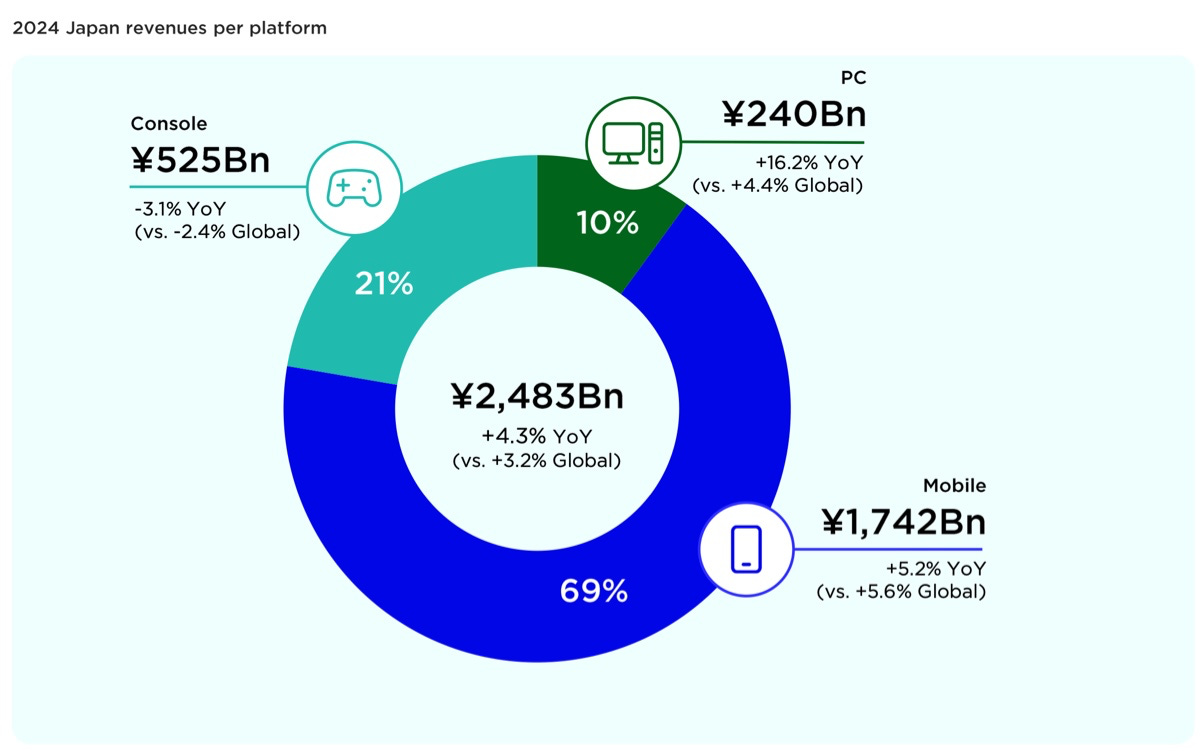

In 2024, the Japanese gaming market reached ¥2.483 trillion, up 4.3% from 2023.

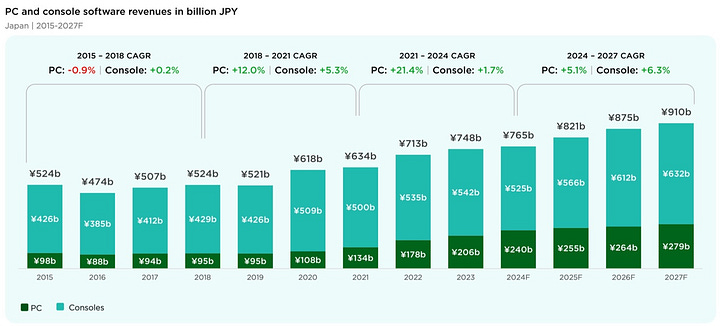

The mobile segment grew 5.2% YoY to ¥1.742 trillion. The PC market grew 16.2% to ¥240 billion. The console market declined 3.1% YoY to ¥525 billion, linked to weaker premium game sales and the end of the Nintendo Switch lifecycle.

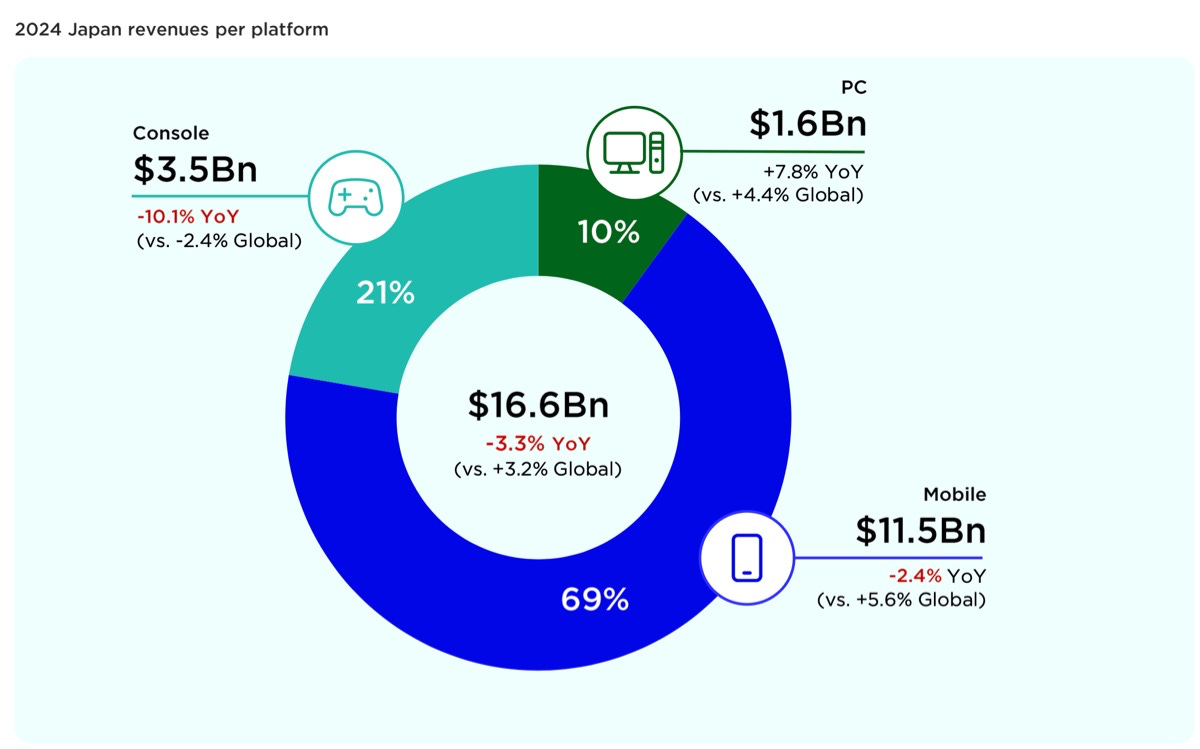

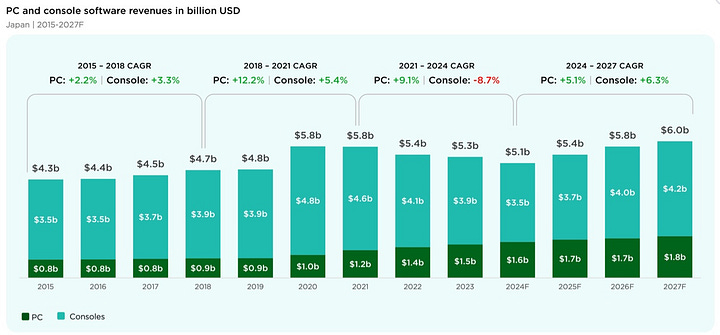

Macroeconomic factors played a role. Due to the weakening yen, in dollar terms, the Japanese market dropped 3.3% to $16.6 billion. Mobile fell 2.4% to $11.5 billion. Console declined 10.1% to $3.5 billion. PC market grew 7.8% YoY to $1.6 billion.

Japan’s PC segment has been growing strong since 2019, accelerated by the pandemic years. However, Newzoo expects growth to slow from 2024–2027.

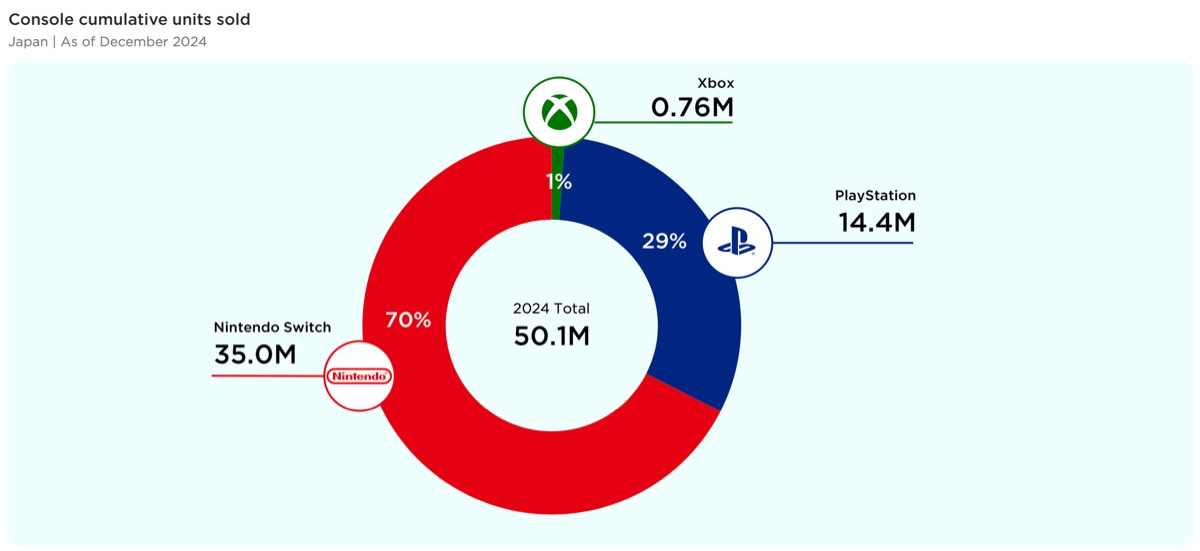

By the end of 2024, 35 million Nintendo Switch consoles had been sold in Japan (70% market share). PlayStation held 14.4 million units (29%). Xbox: 0.76 million, 1% market share.

Players in Japan

60% of Japanese gamers played on PC and console in the past 6 months, less than the U.S. (66%) and Europe (71%).

YouTube (67%), LINE (62%), and X (59%) are the top social platforms among Japanese PC/console gamers.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

60% of Japanese PC/console gamers are male. Their average age is 34.7, higher than America (30.9) and Europe (33.1).

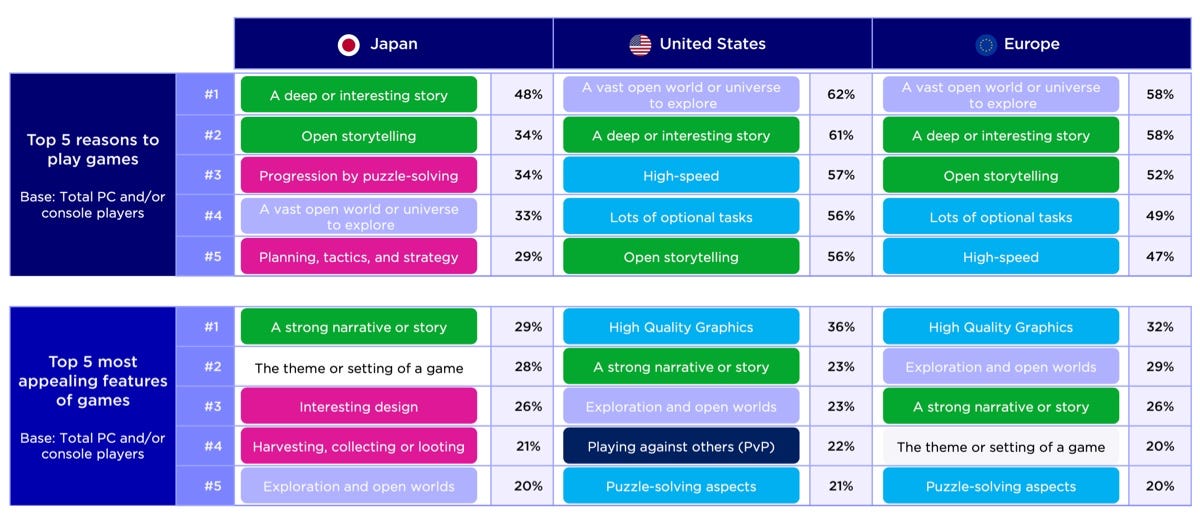

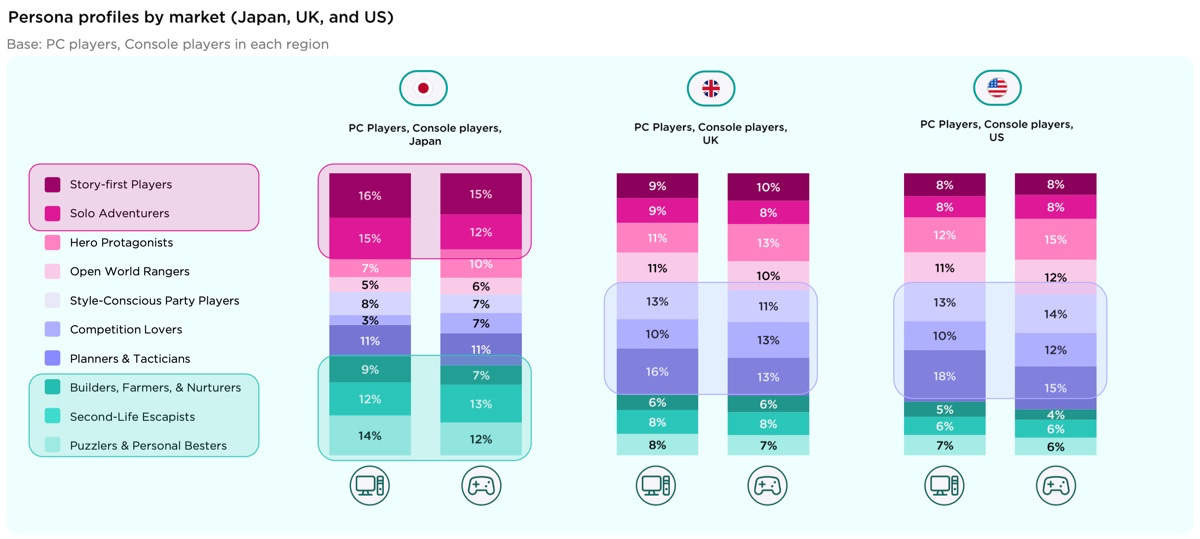

Japanese PC/console gamers value story and narrative more than gamers in the U.S. or Europe. Open worlds are less appealing to Japanese players than Western audiences.

As a result, Japanese PC/console gamers play single-player games more often than U.S. or European gamers.

Games in Japan

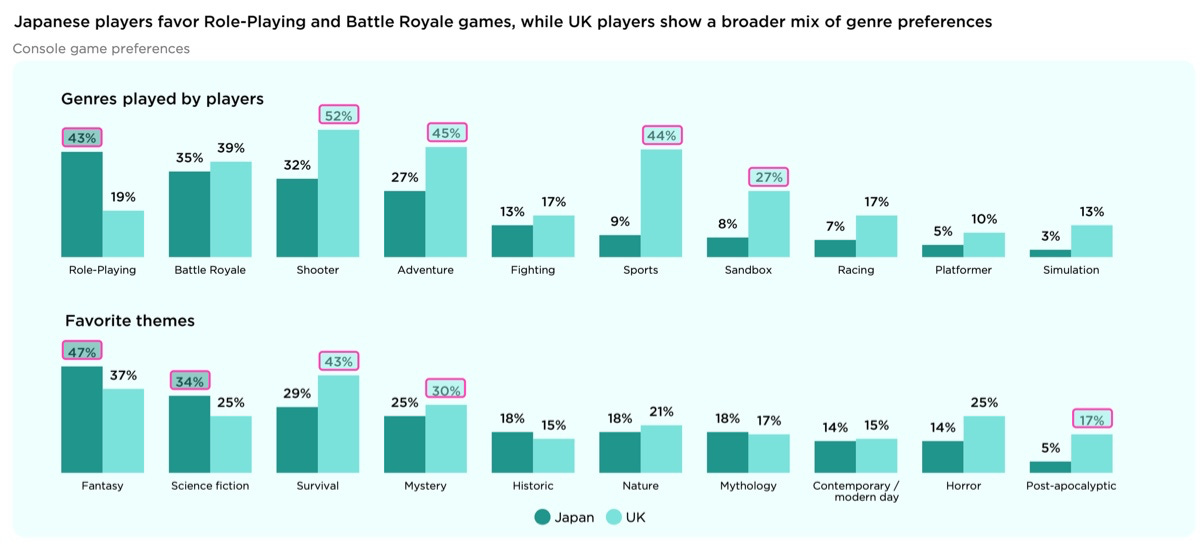

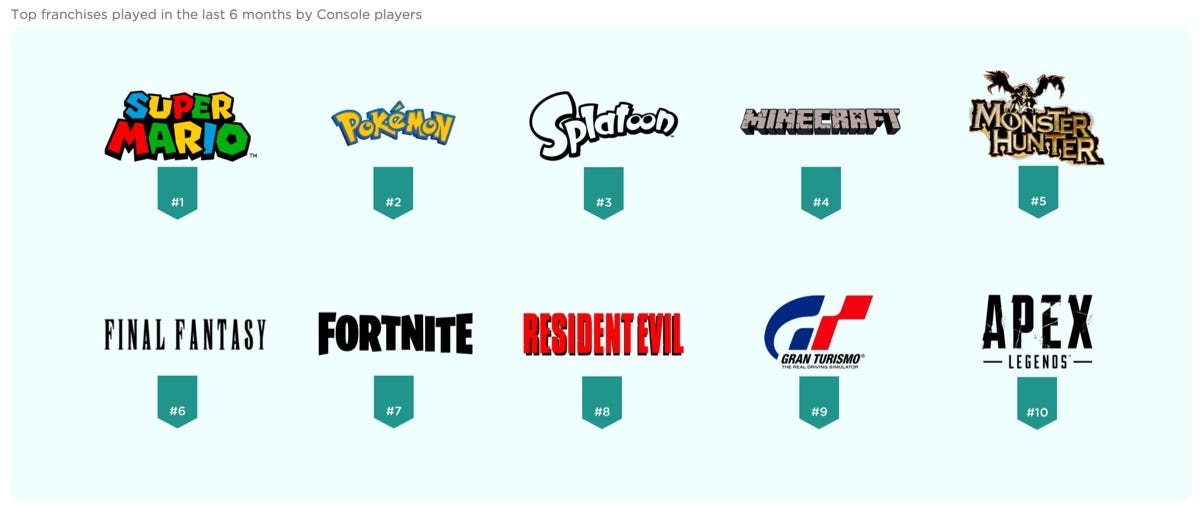

RPGs, Battle Royales, and shooters are the most popular console genres in Japan. Despite a preference for single-player, competitive multiplayer games are also popular.

Compared to UK gamers, the Japanese play fewer sports and sandbox games.

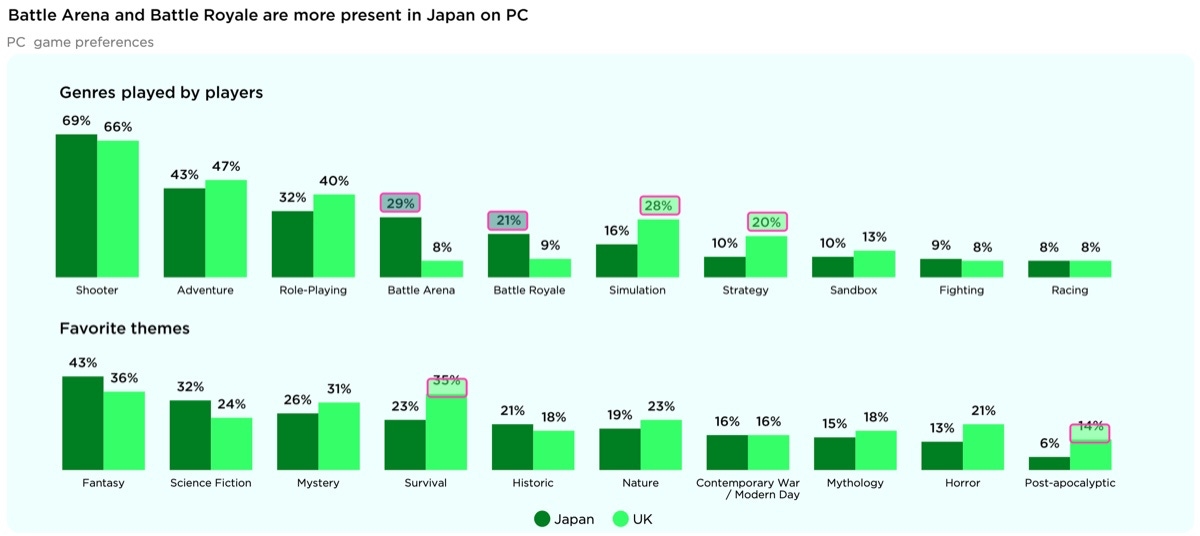

On PC, shooters, adventure, and RPGs lead among Japanese players. Japanese gamers play some shooters genres on PC (Battle Arena / Battle Royale) several times more than British gamers do.

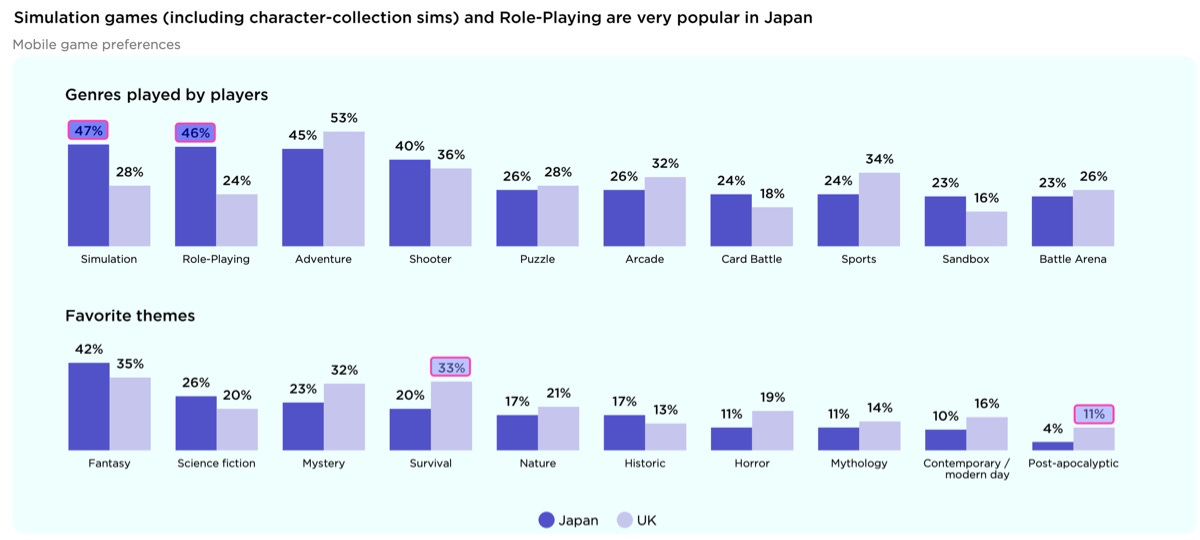

On mobile, the top genres are simulation, RPG, and adventure. There's some ambiguity around what's included in the simulation segment.

Across all platforms, fantasy and science fiction are the most loved settings for Japanese gamers.

Super Mario, Pokemon, and Splatoon are the top three console franchises for Japanese players. Among Western IPs, only Minecraft, Fortnite, and Apex Legends made it to the list.

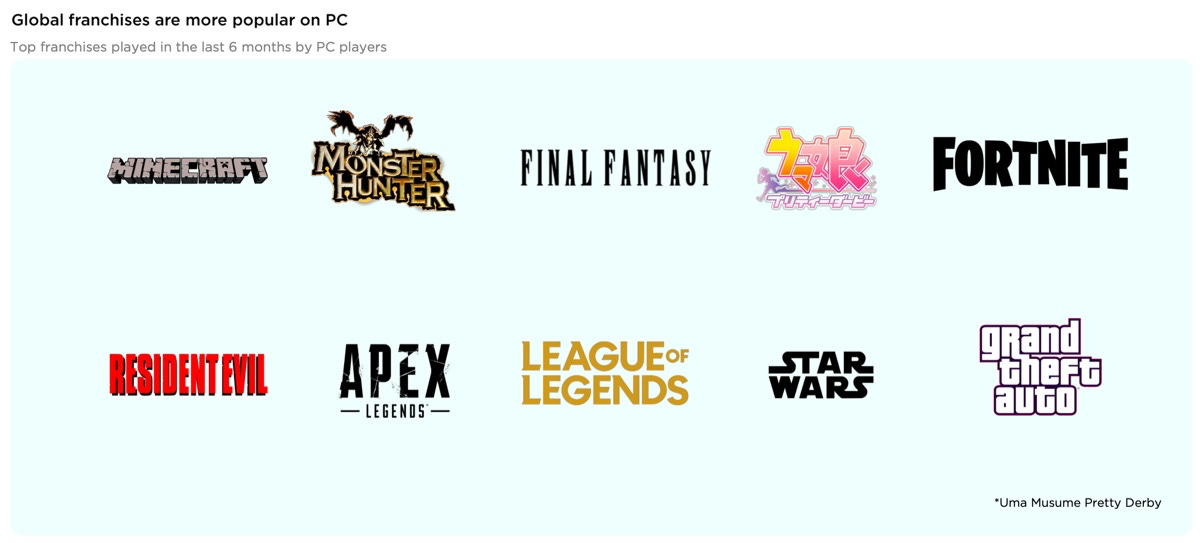

On PC, more Western franchises are among the most popular.

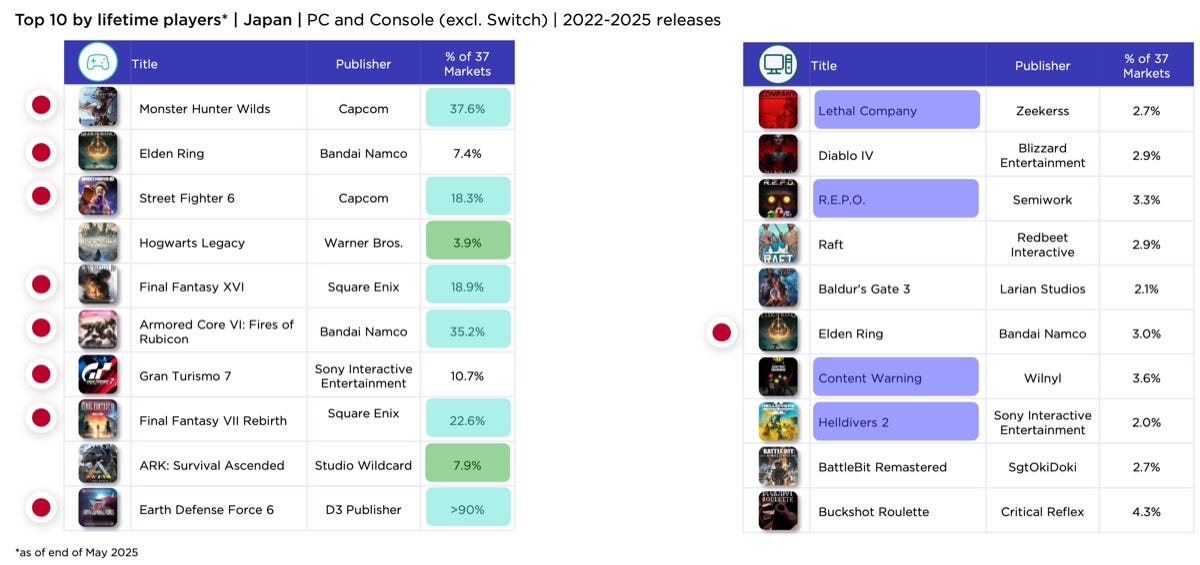

Among paid console releases in the last 3 years, 8 out of the top projects by player numbers in Japan were made by local developers, led by narrative-driven single-player titles. On PC, more of the top are co-op games with only one domestic leader (Elden Ring).

Apex Legends, Fortnite, and Rainbow Six: Siege are the leading F2P console titles by user count. On PC, the leaders are Counter-Strike 2, DOTA 2, and PUBG.

China Daily: Revenue of the Chinese gaming market grew by 14.08% in H1’25

The figures were shared by the state agency overseeing video games at China Joy’25. All numbers are for the first half of 2025.

China’s domestic gaming market grew by 14.08% YoY to ¥168 billion ($23.4 billion) in the first half of 2025.

Mobile game revenue in China rose by 16.5% to ¥125.3 billion ($17.4 billion). MOBA titles (Honor of Kings and League of Legends: Wild Rift are the largest) accounted for 20.4% of all revenue.

Revenue from WeChat Mini-Games increased by 40.2% to ¥23.3 billion ($3.2 billion).

Console game sales rose by 29.78% to ¥1.03 billion ($139M).

The total number of players in China increased by 0.72% to 679 million.

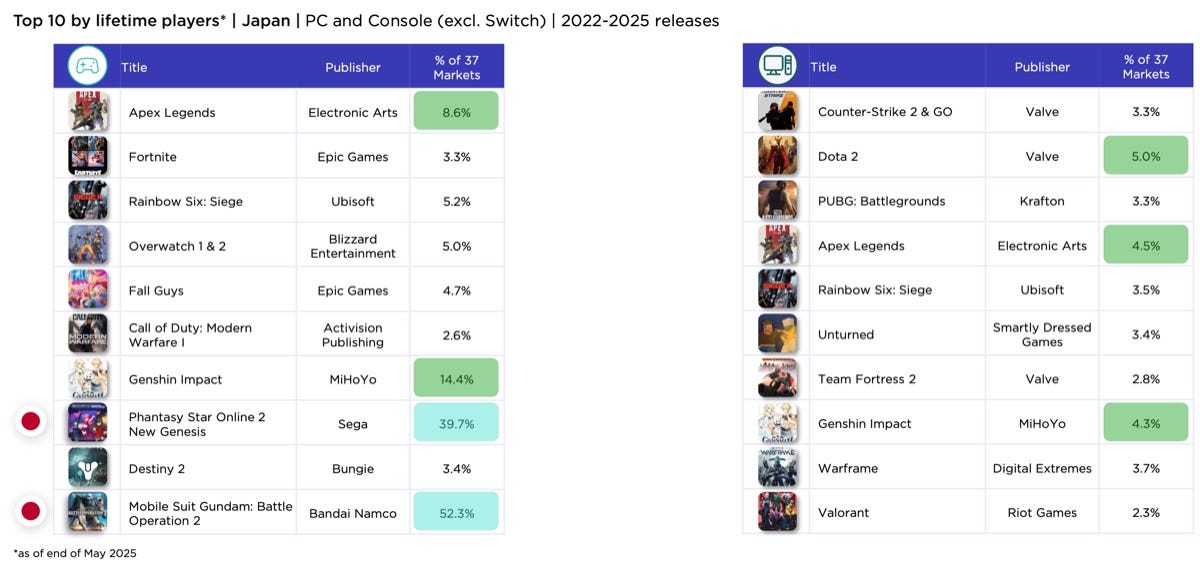

Chinese developers earned $9.5 billion in international markets – up 11.07% year-on-year. The United States (31.96% of all revenue), Japan (16.2%), and South Korea (7.47%) were the main foreign revenue sources for Chinese companies.

Niko Partners: Japan and South Korea Markets in 2025

Market figures

In 2024, the combined markets of Japan and South Korea (Niko Partners refers to them as "East Asia") generated $29.1 billion (-3.1% YoY). In 2025, the decline will continue to $28.5 billion (-2.3% YoY). The reasons include both external factors (local currency exchange rates vs the dollar) and the overall cooling of the games industry.

Despite the decline, Niko Partners expects the markets to reach $30.3 billion by the end of 2029. The average annual growth rate is projected at 0.8%.

The number of players in East Asian countries will grow by 1.3% in 2025 to 98.4 million. The forecast is positive up to 2029, with the player base expected to reach 101.7 million (CAGR – 0.9%).

ARPU for Japanese players: $21.82. South Korean ARPU is higher at $30.77. This is the highest ARPU among all Asian markets researched by Niko Partners.

User preferences

Niko Partners surveyed 1,090 players from Japan and South Korea.

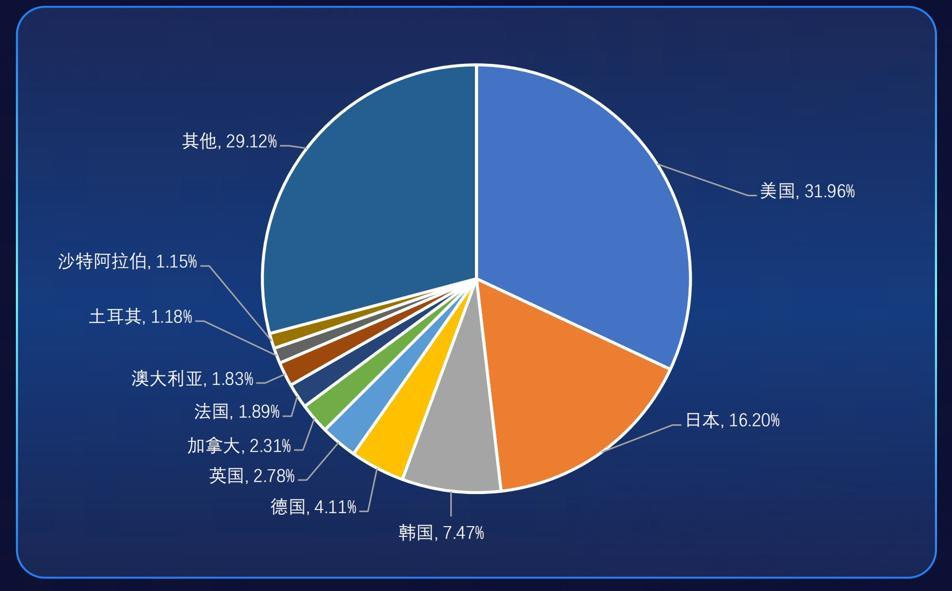

67.8% of Japanese players prefer anime-style games.

The main motivations for making purchases among local users are to enhance their enjoyment of the game (51%) or to progress faster (30%).

MY.GAMES released the business modelling tool for AdsAdvisor - previously internal (many years of development), and now a public marketing platform.

The platform is a one-stop shop for marketing operations, marketing creatives management, predictions, and business modelling. You can check for more details here or book the demo here. Don’t hesitate to refer to GameDev reports in case you’re speaking with the AdsAdvisor team!

Hardcore South Korean players are irritated by inaccurate cultural references, poor localization, and stereotypical characters in games.

Esports tournaments are an effective marketing channel in South Korea, watched by 24.4% of men. Fewer women are interested in esports—only 11.4% watch tournaments.

46.6% of Japanese players and 37.8% of South Korean gamers watch streams and game-related content.

Users from East Asian countries are the least likely to make purchases through web shops.

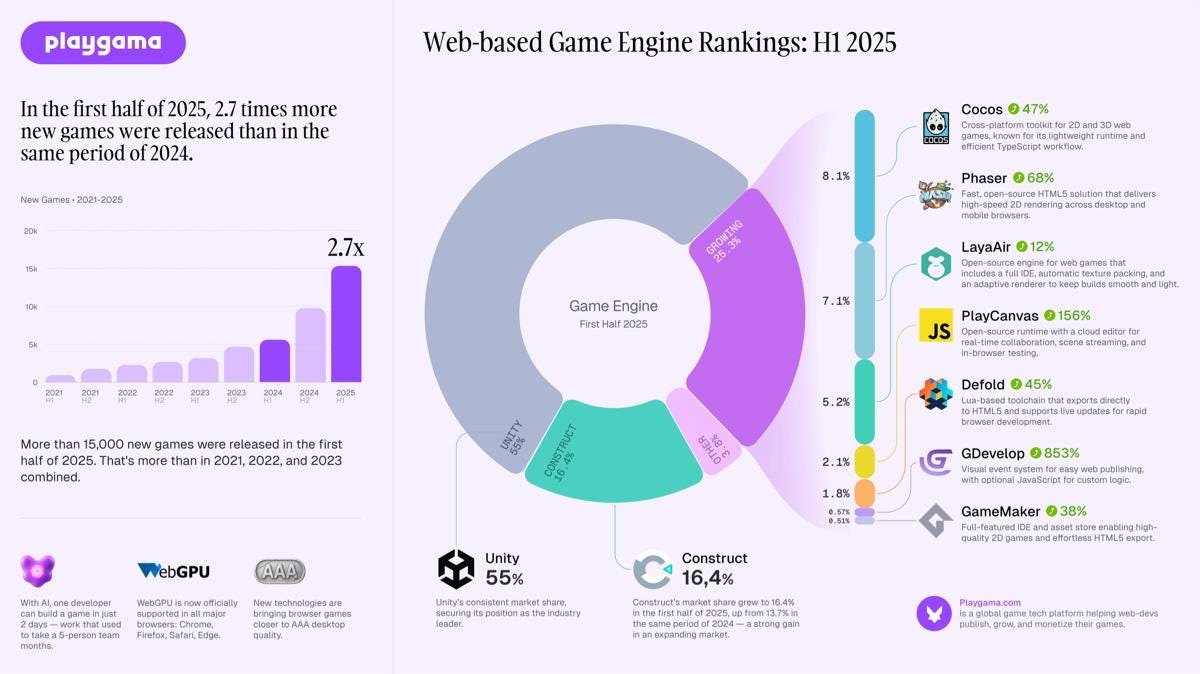

Playgama: Most Popular Engines for HTML5 Games in H1'25

According to Playgama, more than 15,000 games were released in the first half of 2025. This is 2.7 times more than in H1’24.

55% of all HTML5 games are made with Unity, making it the leading engine by a large margin. Construct takes second place with 16.4% of the market.

There are several growing engines that account for 25.3% of all releases. The most popular among them are Cocos (8.1% market share, +47% YoY), Phaser (7.1% market share, +68% YoY), and LayaAir (5.2% market share, +12% YoY).