Weekly Gaming Reports Recap: December 30 - January 3 (2024)

Streaming results for 2024; Social Peta marketing insights, and the top mobile games of December 2024 by Revenue & Downloads.

Reports of the week:

StreamHatchet: 2024 Streaming Results

SocialPeta: Mobile Game and Mini-Game Marketing Trends in 2024

AppMagic: Top Mobile Games by Revenue and Downloads in December 2024

StreamHatchet: 2024 Streaming Results

Data is provided for the period from January to November 2024.

Platforms

Kick showed the most impressive growth. The number of watched hours reached 1.7 billion in 2024 - 176% more than in 2023. At the same time, the number of watched hours by Spanish-speaking viewers increased from 56 million in 2023 to 364 million in 2024 (546% growth).

Other significant new platforms - are SOOP Korea (1.1 billion watched hours), Chzzk (585 million hours), BIGO Live (217 million hours), and SOOP (international version of SOOP Korea - 9.6 million hours).

Due to changes in platform collaboration terms with streamers, they began streaming on multiple platforms simultaneously. When top streamers broadcast on multiple platforms, the growth in average viewership ranges from 27% to 491%.

Twitch Results

Twitch Drops significantly affect the growth in watched hours. Growth ranges from 47% (Minecraft) to 1353% (Diablo IV). Moreover, many projects see noticeable growth in views even after the campaign ends.

Streamers

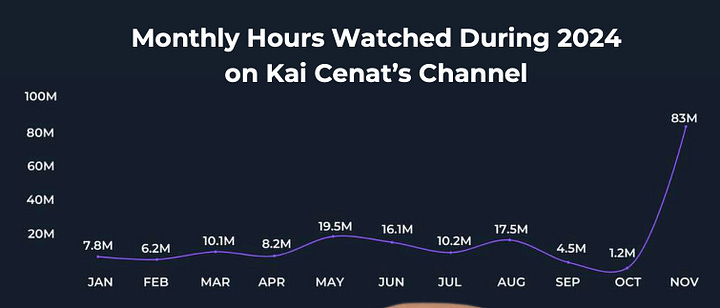

Kai Cenat (185 million hours) and iShowSpeed (47 million hours) are global leaders of streaming platforms.

The growing popularity of VTubers on the English-speaking streaming scene is worth noting separately. In 2024, the number of viewing hours with virtual streamers reached 294 million hours. Their most popular games are GTA V, League of Legends, and Minecraft.

Games

The RPG genre flourished in 2024 on streaming platforms. In total, games of this genre received over 2 billion viewing hours. The most popular game is Elden Ring (293 million hours). Path of Exile (90 million hours) and Monster Hunter: World (66 million hours) show good results.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

DLCs have become on par with full-fledged games. Elden Ring: Shadow of the Erdtree was watched for 127 million hours. World of Warcraft: The War Within (55 million hours), Destiny 2: The Final Shape (26 million hours), and Diablo IV: Vessel of Hatred (22 million hours) have many views. After The Game Awards organizers announced that DLCs and expansions could also be nominated, mentions of the word DLC in chats increased by 45%.

Stream Hatchet notes that people actively watch remakes and remasters. Leaders are Silent Hill 2 Remake (27 million hours), Final Fantasy VII: Rebirth (16 million hours), and Dragon Quest 3 (5.7 million hours).

Transmedia

Fallout 76 stream views increased by 1128% a week after the series release. A positive effect was also observed for League of Legends streams.

Gaming Events and Esports

The eSports World Cup gathered over 103 million viewing hours. At its peak, 2.8 million viewers watched the competitions in Saudi Arabia. DOTA 2 and Mobile Legends: Bang Bang are the leaders in viewer interest.

People started watching more mobile esports competitions. Views in 2024 increased by 41%. The main games are Mobile Legends: Bang Bang (340 million viewing hours), PUBG Mobile (82 million hours), Honor of Kings (72 million hours), and Garena: Free Fire (17 million hours).

Co-streaming (streaming esports events outside the main broadcast) accounted for 44% of all views in 2024.

SocialPeta: Mobile Game and Mini-Game Marketing Trends in 2024

The report doesn’t cover the Q4’24.

Mobile Games

The average monthly number of advertisers in 2024 reached 63,500 companies, which is 31.6% higher than the previous year. However, throughout 2024, the share of new advertisers in the market decreased. On average, in 2024, their share was 8.2% (6% less than last year).

❗️This may indicate several reasons: the difficulty for new companies to enter the market and a decrease in the number of new mobile studios overall.

Since March 2024, advertisers have begun to increase the share of new advertising creatives. From June onwards, new creatives accounted for more than 55% of the total volume.

Leaders in the number of advertisers are casual games (27.2%), casino games (16.8%), and puzzles (12.3%). In terms of creative volume, casual games lead with 31.2%, followed by RPGs (12.3%) and puzzles (12.2%). Notably, the casual games segment stands out from others with a higher proportion of new creatives.

Mini-Game Trends

SocialPeta notes a trend in the launch of new Asian projects. They first appear in H5 format (WeChat Mini-Games; Douyin). After that, they are launched as full-fledged applications in Hong Kong, Macau, and Taiwan. Then, the launch occurs in Japan and South Korea, followed by Southeast Asia. Finally, the game reaches international markets. For example, the acclaimed Legend of Mushroom followed this path. Capybara Go! experienced a shortened path (after China - directly worldwide).

Genres that launch well under this scenario are RPGs (or games with RPG elements). Most often, they are united by a simplified but cute visual style. They also feature chibi heroes - mushrooms, capybaras, and kittens.

AppMagic: Top Mobile Games by Revenue and Downloads in December 2024

AppMagic provides revenue data after deducting store commissions and taxes. Revenue from Android stores in China is not included.

Revenue

Last War: Survival set its revenue record and took first place in December with $147 million. 42% of revenue came from the US, 24% from Japan, and 17% from South Korea. Interestingly, China is not on the list of countries at all.

Royal Match ($126.2 million) and Whiteout Survival ($122.8 million) performed well in December. Both projects rose to the top 3 in revenue charts.

Honor of Kings showed its worst result since December 2021 - $100.7 million. However, it’s worth remembering that the game’s main audience is in China, and the main in-game events will coincide with the Chinese New Year (which happens in late January). For the past 3 years, the game’s revenue has grown significantly during this period.

Love and Deepspace is far ahead of all visual novels/dating sims. The game earned $42.7 million in December, 10 times more than its closest genre competitor and also the best month in the project’s history. It’s important to note that the game has RPG elements and Action combat - not typical features for this genre.

Downloads

The leaders in the download rankings remained the same - Block Blast! returned to first place (35.8 million installations); Roblox is second (20.4 million); Pokemon TCG Pocket moved to 3rd place (15.3 million installations).

Downloads increased for Garena: Free Fire (14.7 million for the MAX version; 12.8 million for the regular version).

Real Moto Driving Racing World made it into the top 10 with 11.3 million installs. The majority (37%) came from India.