Weekly Gaming Reports Recap: December 8 - December 12 (2025)

Reports of the week:

Newzoo: DLC in Single-Player Games

InGameJob & Values Value: BIG Games Industry Employment Survey (2025)

Newzoo: DLC in Single-Player Games

The report is based on data from the Newzoo Game Performance Monitor and Revenue Add-on for the period from April 2020 to May 2025 across six major Western markets: the United States, the United Kingdom, Germany, France, Spain, and Italy. The analysis focuses on single-player games on PC, Xbox, and PlayStation that offer post-launch content (DLC).

The role of DLC in single-player games

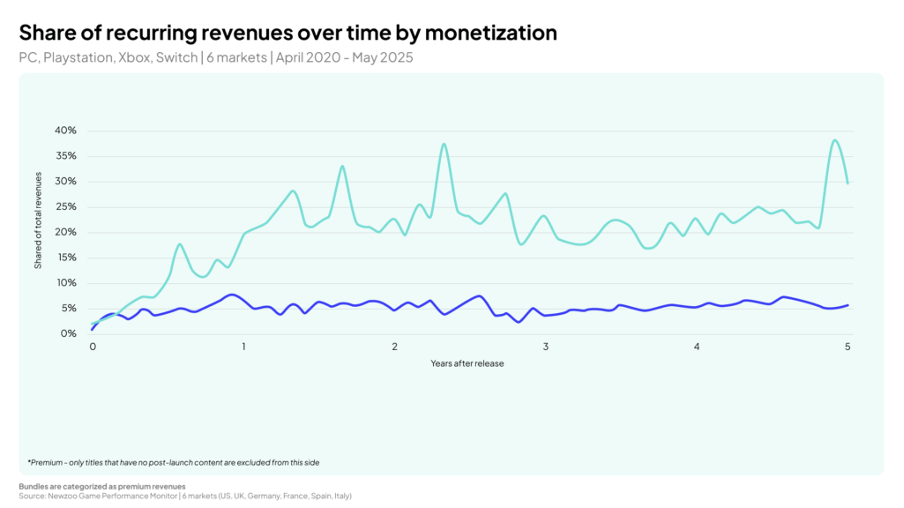

The share of DLC within revenue grows throughout the first year of a game’s life, with peaks around month 6 and month 12, and then stabilizes at about 20–25% of total live content revenue.

In the first year, DLC accounts for around 9% of the game’s total revenue, including base game sales.

From year two to year five, the average share of DLC in total revenue is 23%.

Microtransactions, most often cosmetic ones, follow a different pattern. Revenue from them is smoother and does not spike as sharply on release days.

How genre affects DLC revenue

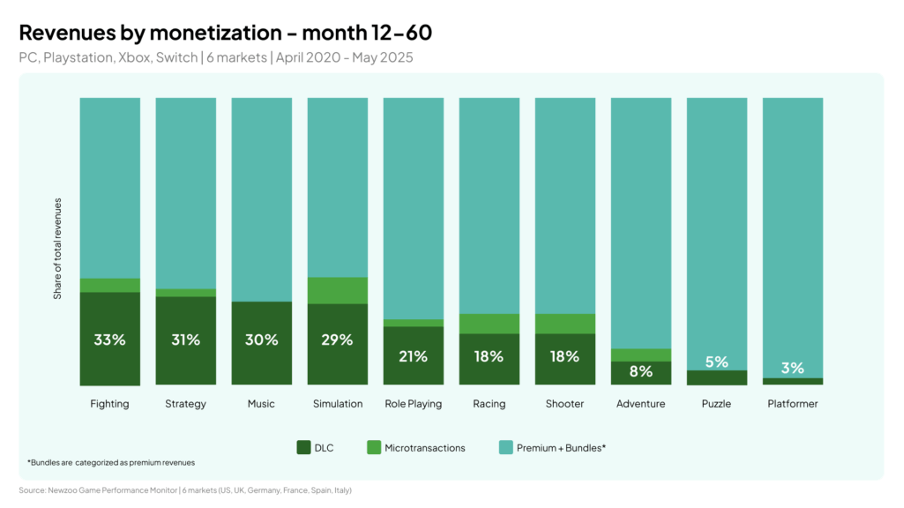

From month 12 to month 60 after release, the share of revenue coming from DLC varies significantly by genre.

DLC has the largest revenue share in fighting games (33%), strategy titles (31%), and music games (30%). All three genres are highly extensible through additional content.

In RPGs, narrative DLC makes up a particularly significant share. Other genres tend to lean more heavily on seasonal updates and DLC with new gameplay content.

DLC helps projects both maintain genre dominance and compete with other titles. Games like The Hunter: Call of the Wild or Planet Zoo, for example, stay relevant to their audience thanks to ongoing DLC. In fighting games, new fighter packs are a critical part of live ops.

A word from our sponsor.

Transform your online store into an LTV powerhouse with Xsolla’s LiveOps tools - run dynamic, segmented campaigns to drive an 80% repeat purchase rate, and boost player retention by 15%+ using in-game synchronized offers and loyalty shops.

Time-limited promos, login bonuses, and referral programs can lift player engagement and help grow ARPPU by 20%+, all through an intuitive interface built for fast campaign launches, deep personalization, and maximum revenue impact.

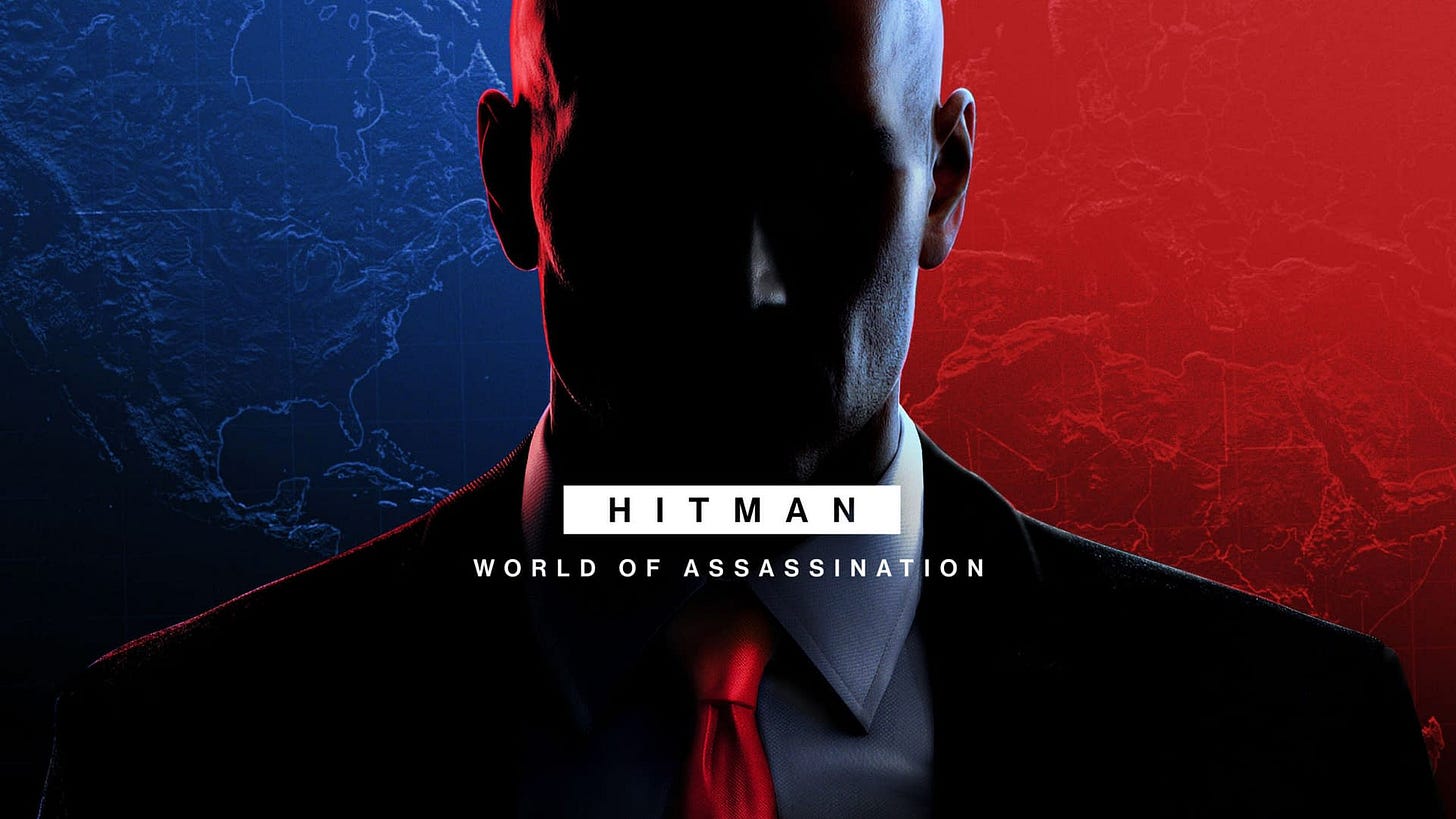

Case study: HITMAN World of Assassination

Hitman: World of Assassination had a challenging start, as it originally launched with an episodic model. Today, the developers combine several types of content. The game receives new narrative content, such as the Sarajevo Six campaign, new modes like Freelancer and Elusive Target Arcade, cosmetic packs, and seasonal star collaborations, including DLC with Jean-Claude Van Damme, Conor McGregor, and Eminem.

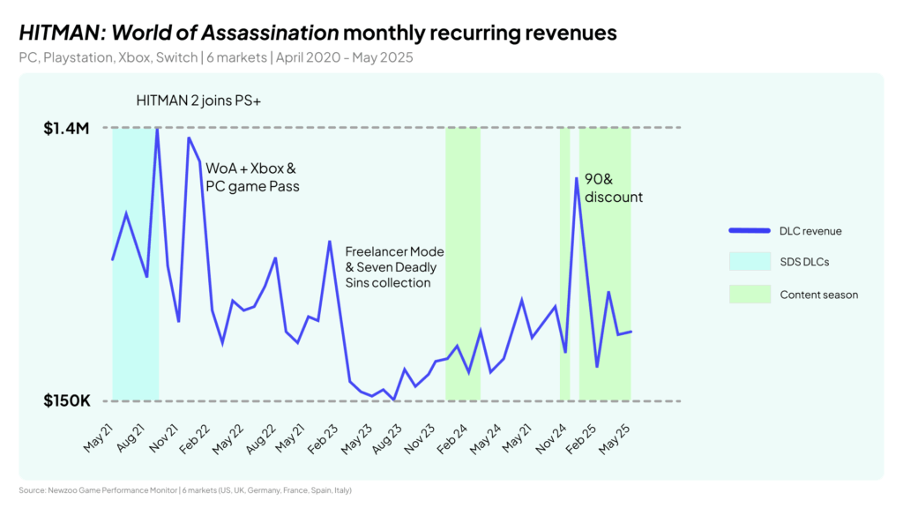

According to Newzoo, DLC for Hitman: World of Assassination generated between 150,000 and 1.4 million dollars per month over four years. That represents roughly 21% of the project’s total revenue.

As total revenue for the game declined over time, the share of DLC within that revenue increased.

Adding Hitman 2 to PlayStation Plus in September 2021 led to a 97% increase in DLC revenue. Launching the trilogy in Xbox Game Pass in January 2022 drove a 168% spike in DLC revenue in December 2021, apparently because the announcement reactivated interest among the existing audience.

Despite heavy discounts on the base game (up to 90% off in 2024) and the game’s presence in subscription services, average LTV per paying player reached 28.7 dollars.

Newzoo emphasizes that not all DLC directly drives revenue. Some of it, such as seasonal content or new modes, exists primarily to bring players back into the game.

InGameJob & Values Value: BIG Games Industry Employment Survey (2025)

The survey was conducted from March to June 2025. More than 1,650 respondents from 85 countries took part.

European countries are split into segments. The Europe (EU+UK+Switzerland) segment includes Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, and the United Kingdom. Sample size: 709 people.

The Europe (Non-EU) segment includes Armenia, Belarus, Georgia, Moldova, Bosnia and Herzegovina, Montenegro, North Macedonia, Serbia, and Ukraine. Sample size: 543 people.

56% of respondents are men, 25% women, and 19% did not answer the gender question. 8% are juniors, 24% middle-level, 35% senior, and 29% top management.

Salaries in the games industry

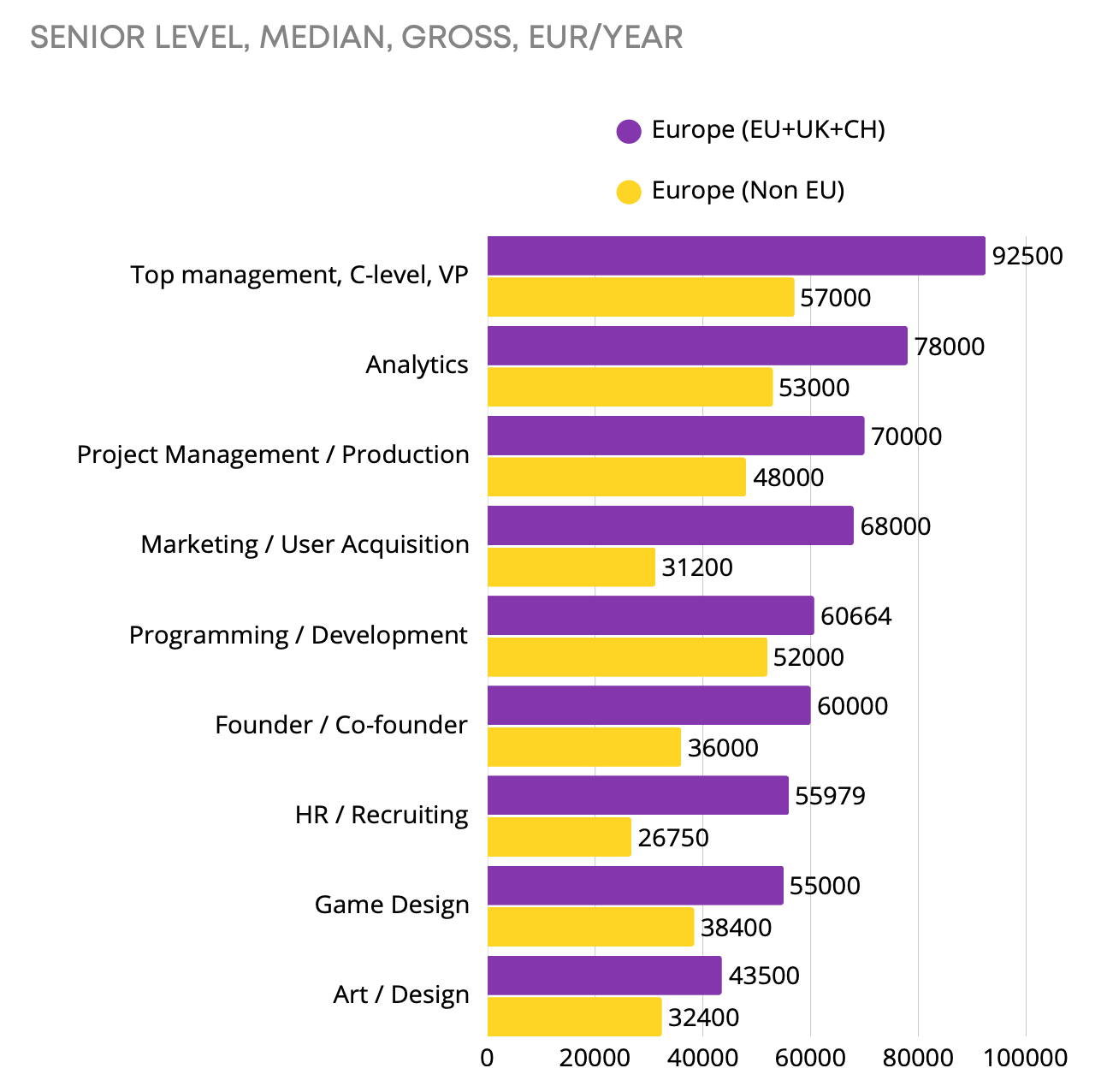

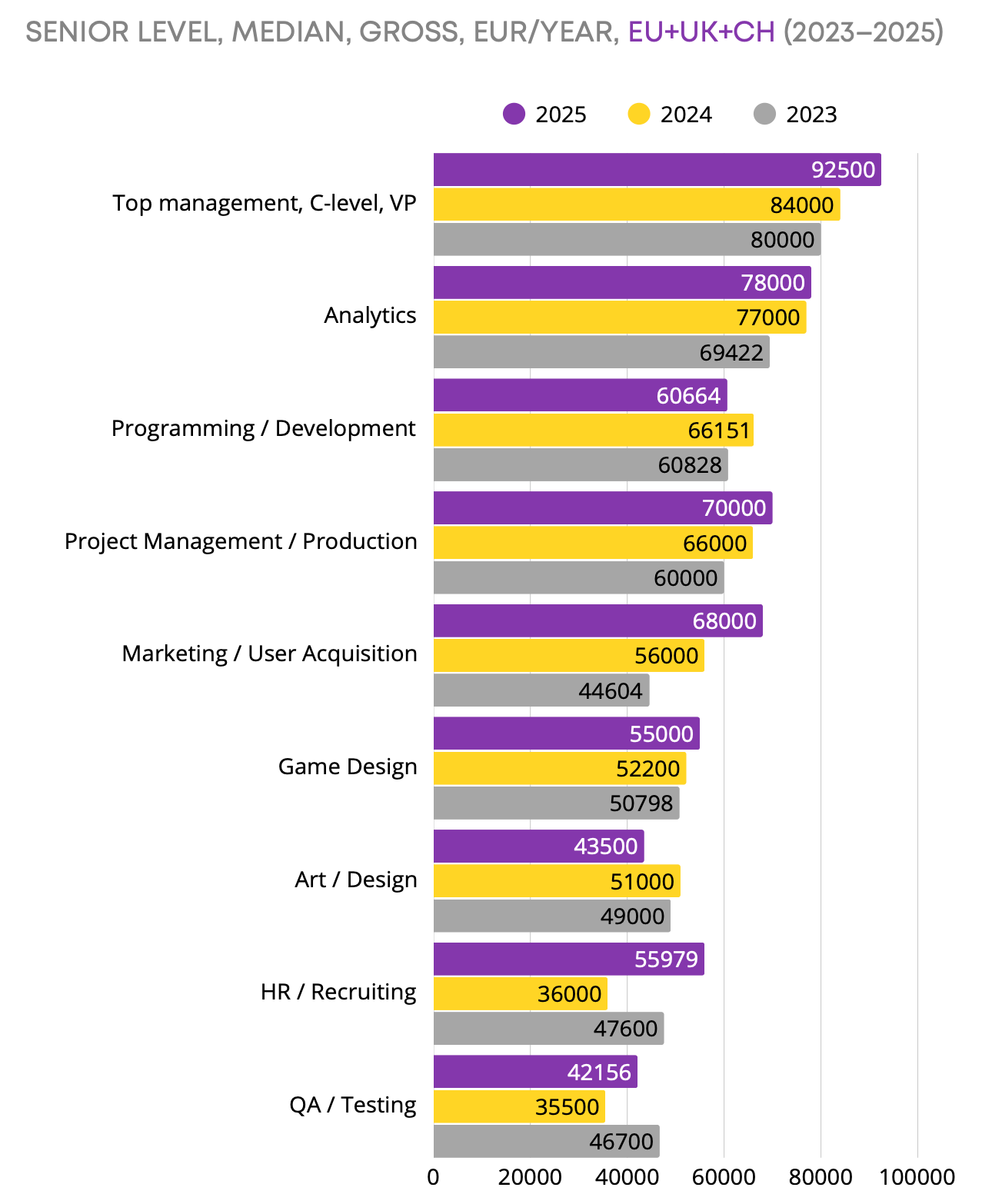

The median salary for senior specialists in Europe (EU+UK+CH) ranges from 43,500 euros gross (for artists and designers) to 92,500 euros gross (for top managers).

In European countries outside the EU, salaries are significantly lower. The gap is especially large for HR and recruitment roles and in marketing.

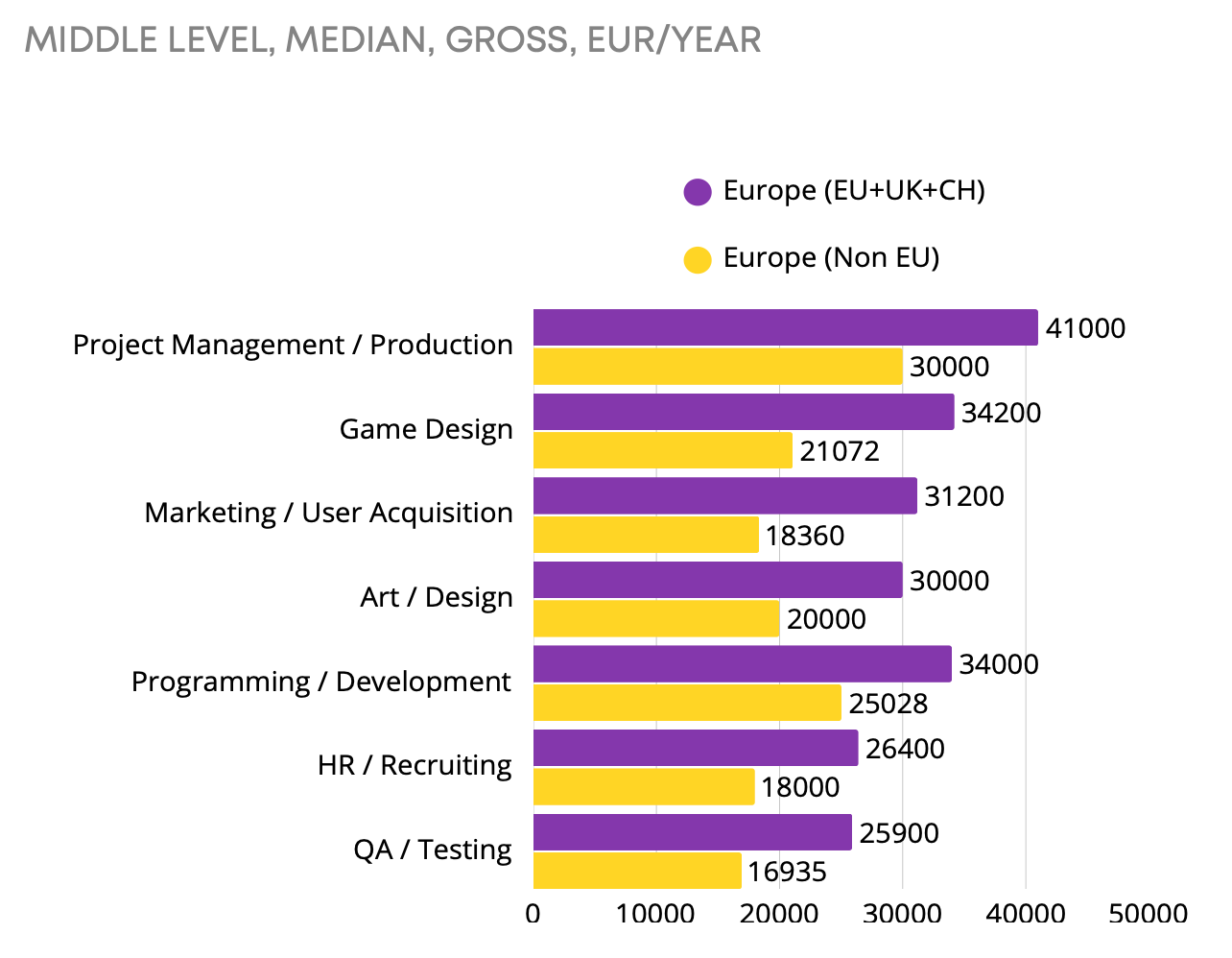

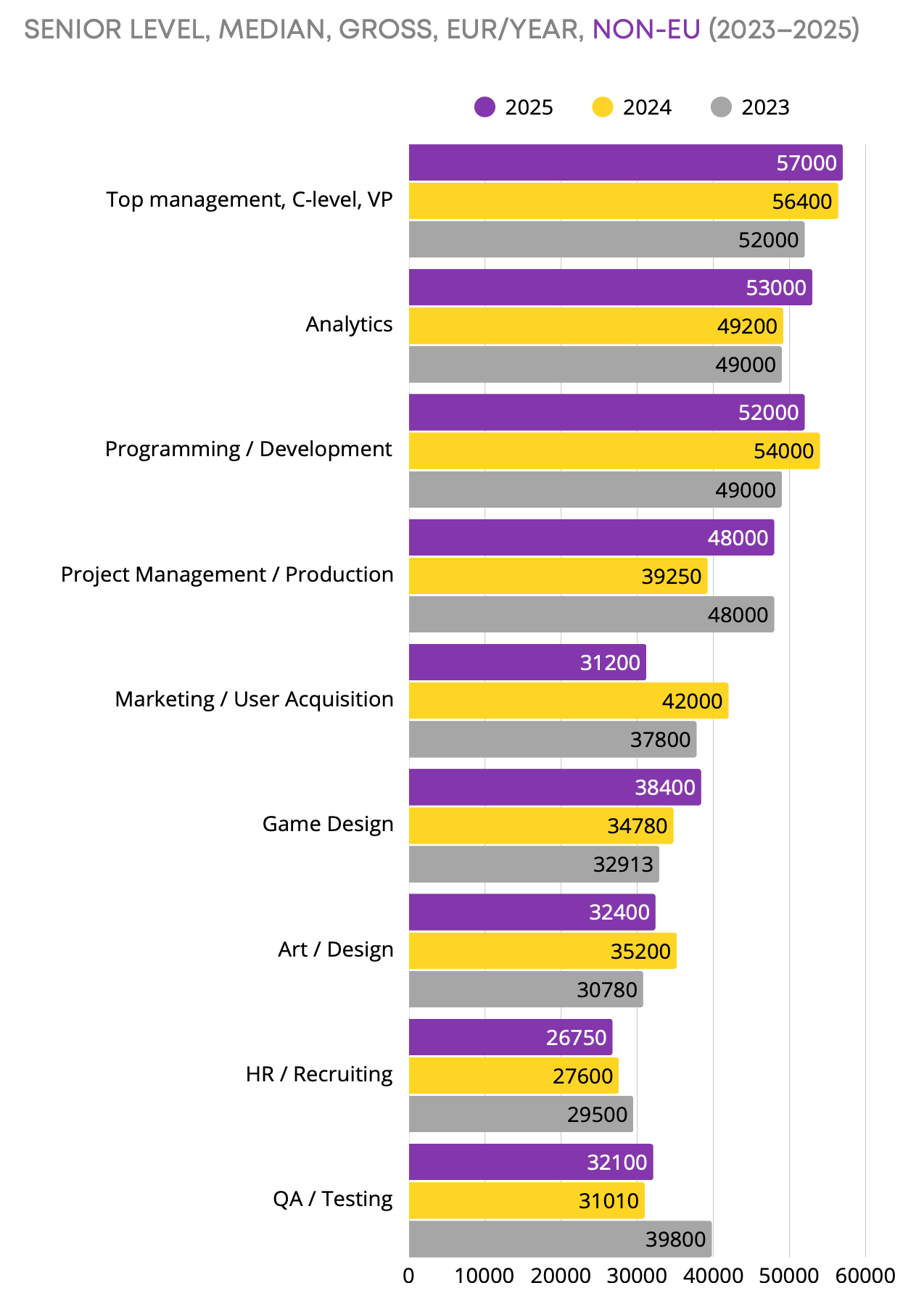

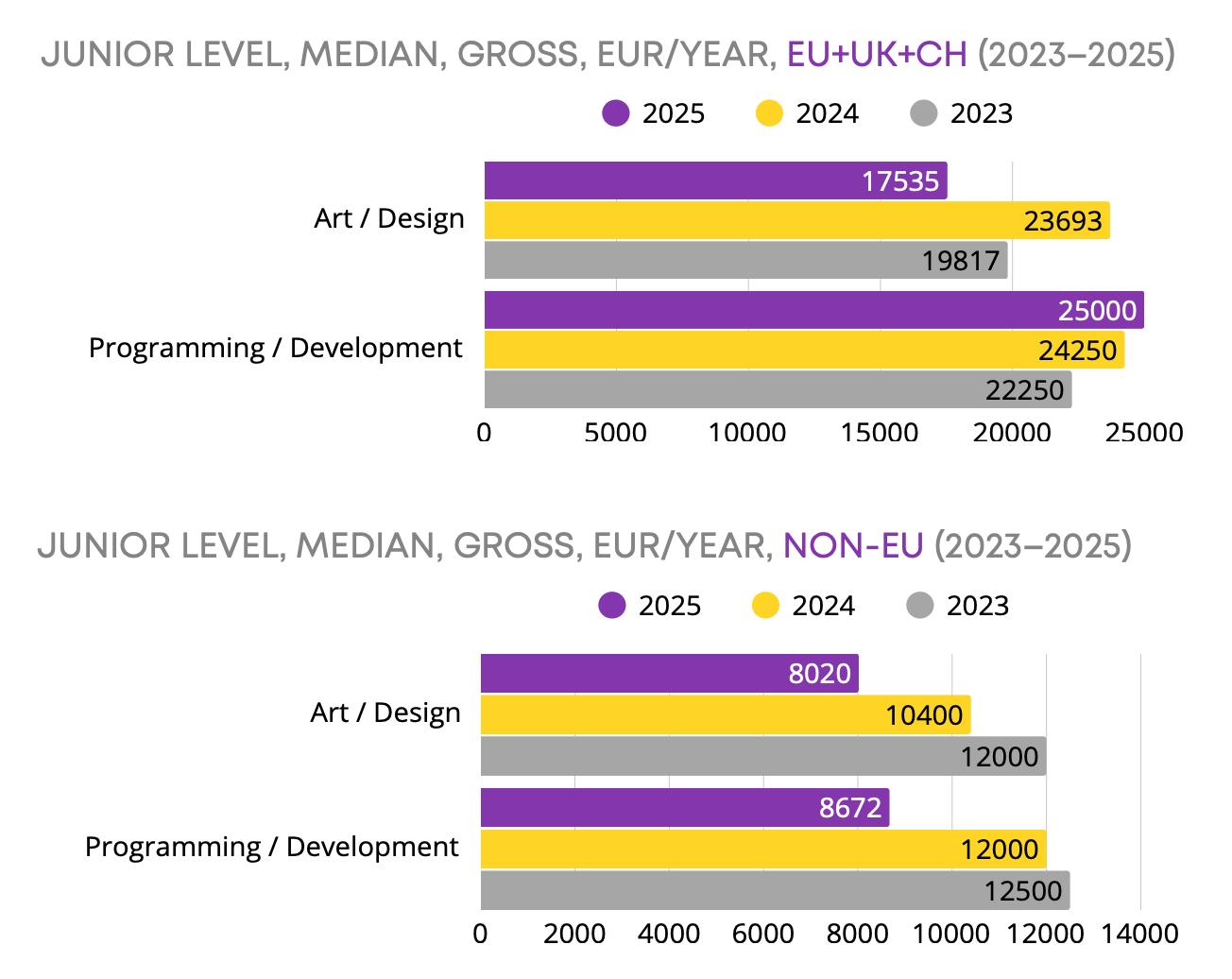

Median salaries for middle-level specialists in Europe (EU+UK+CH) reach 41,000 euros gross. Product and project managers have the highest salaries.

QA specialists are paid the least. In European countries outside the EU, their median salary is 16,935 euros.

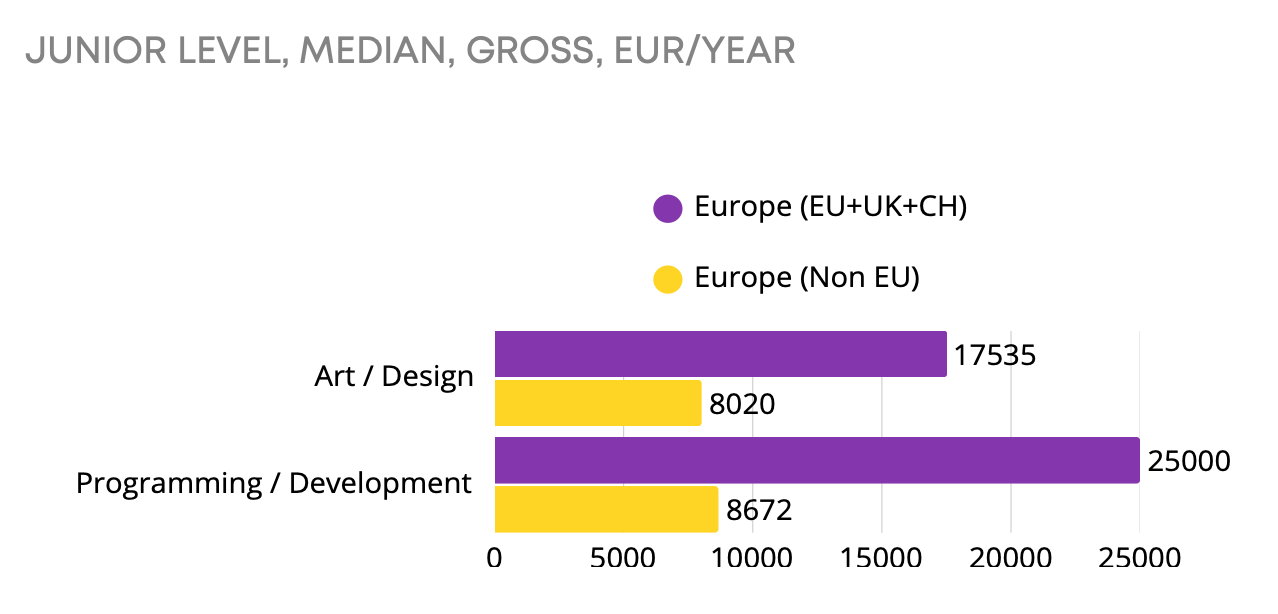

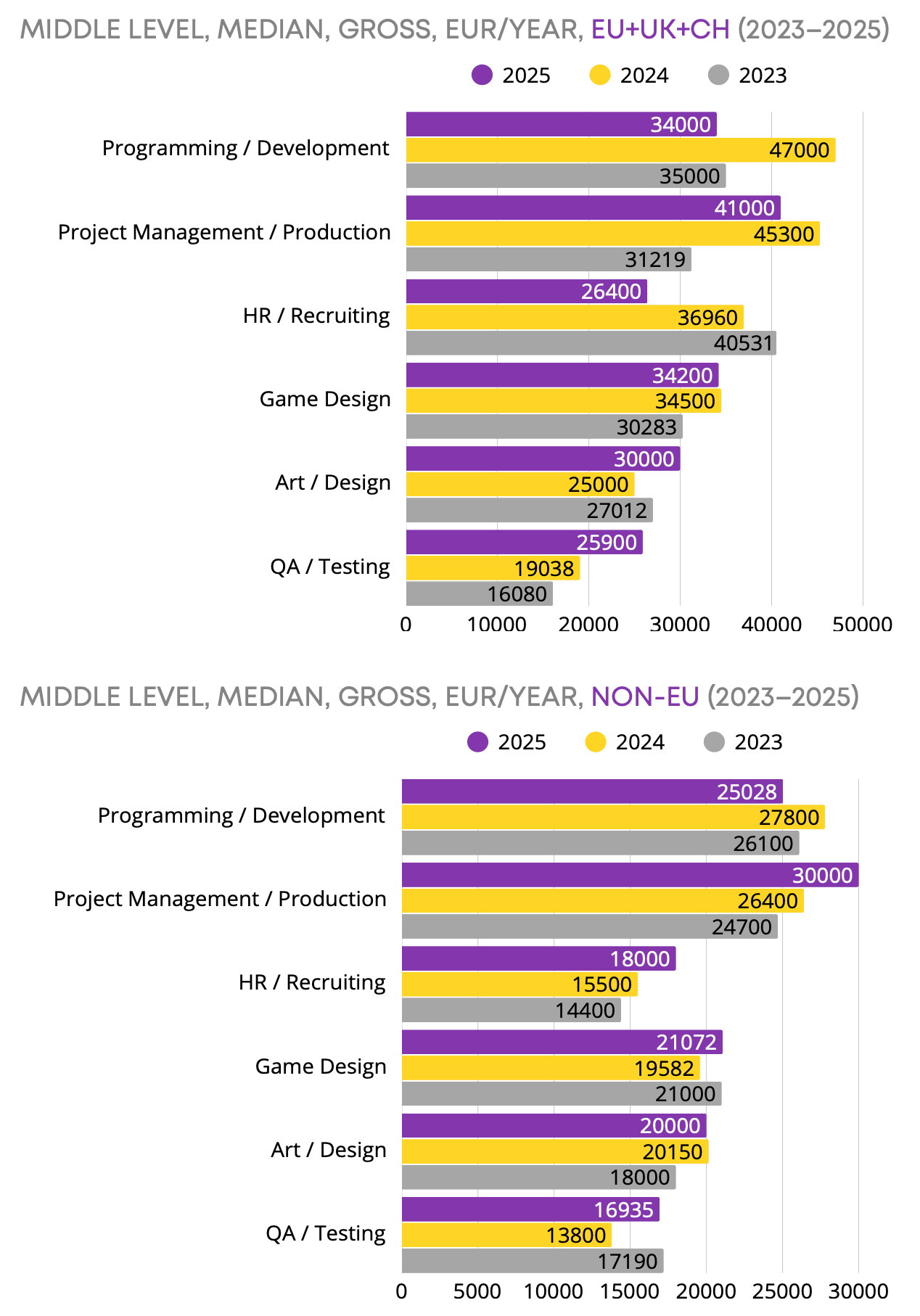

The gap between the salaries of junior specialists and more experienced staff in Europe (EU+UK+CH) is much smaller than in Europe (Non-EU). In non-EU countries, the median salary for junior employees is under 1,000 euros gross per month.

A word from newsletter sponsor

Maximize your game’s global revenue with Xsolla’s Global Payments - offering seamless, localized checkout in multiple languages and integrating 1,000+ local payment methods to boost conversion rates.

Protect your income with advanced machine-learning anti-fraud, cross-game blocklisting, and 3DS 2.0, while Xsolla handles tax, compliance, support, refunds, and chargebacks for you. Deliver a smooth, secure payment experience optimized for all devices and expand your reach with confidence!

Make payments easy with Xsolla!

Salaries by company type

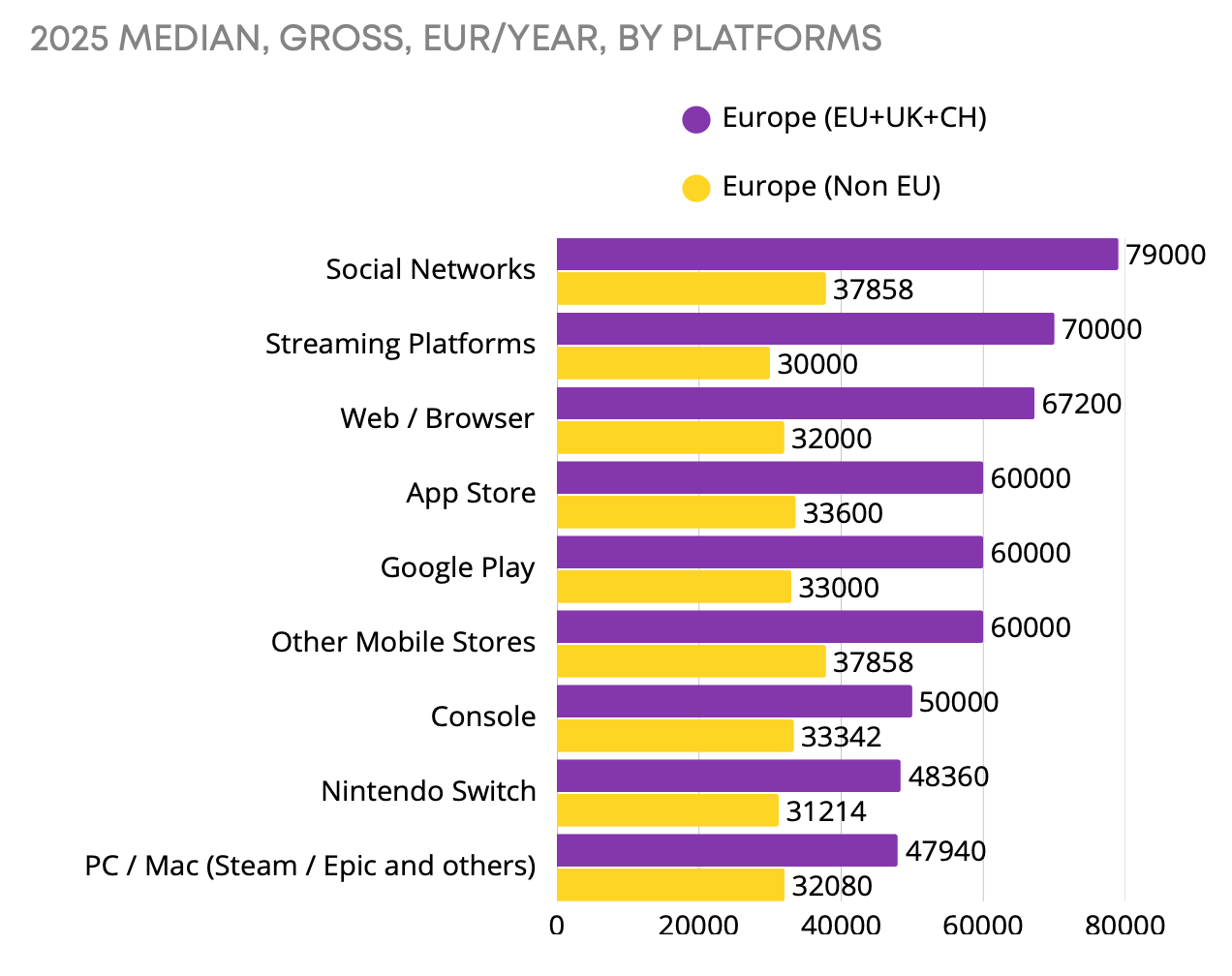

The best salaries are offered by companies working with social networks, streaming platforms, and the web. I assume this category includes large companies such as TikTok or Meta, which significantly influence the median.

In European countries outside the EU, pay is consistently around two times lower.

PC developers earn the least. I assume there are many indies in the sample, which drags the result down.

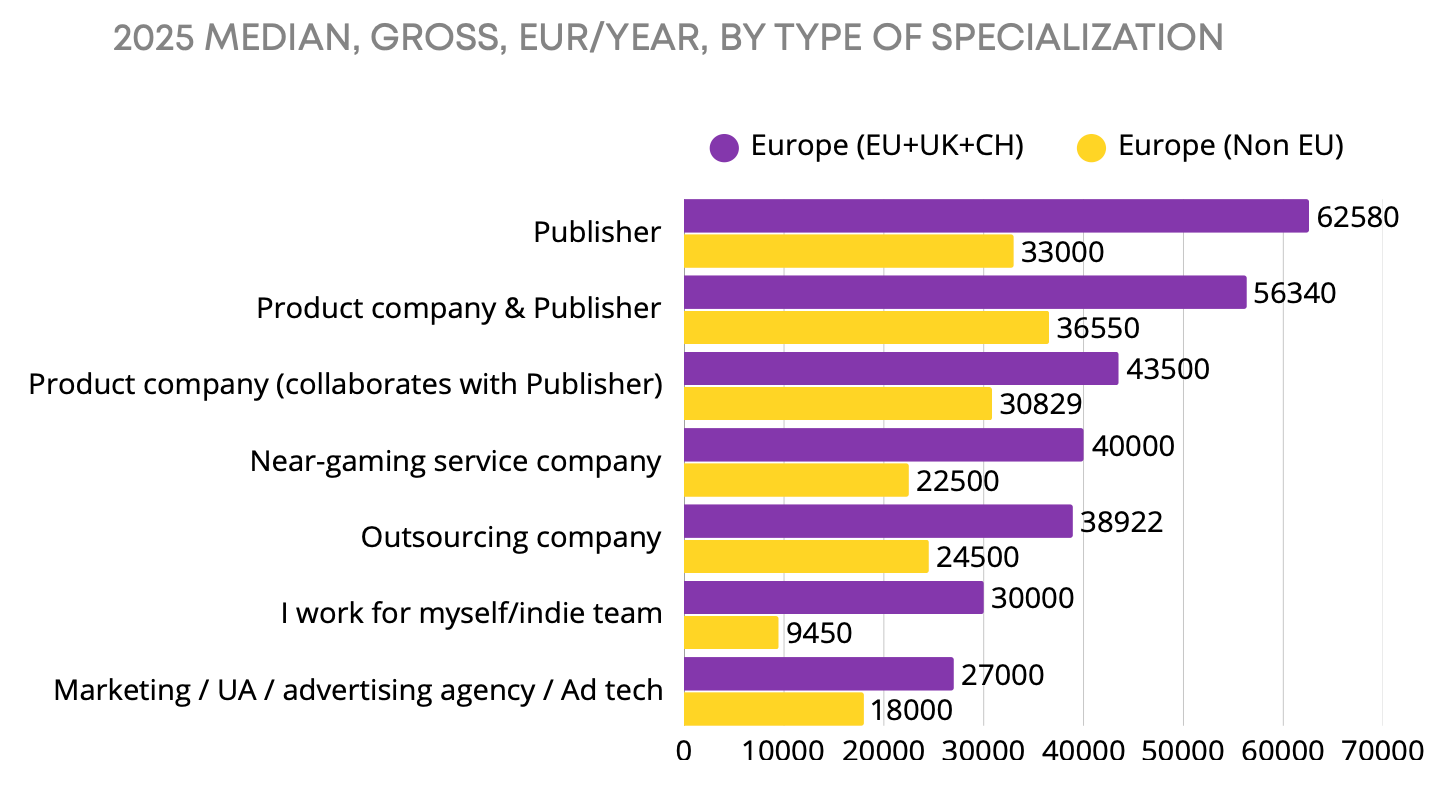

Publishers and product companies pay the best. The worst pay is in marketing agencies and ad tech companies. My perception was that ad tech companies pay a good salary.

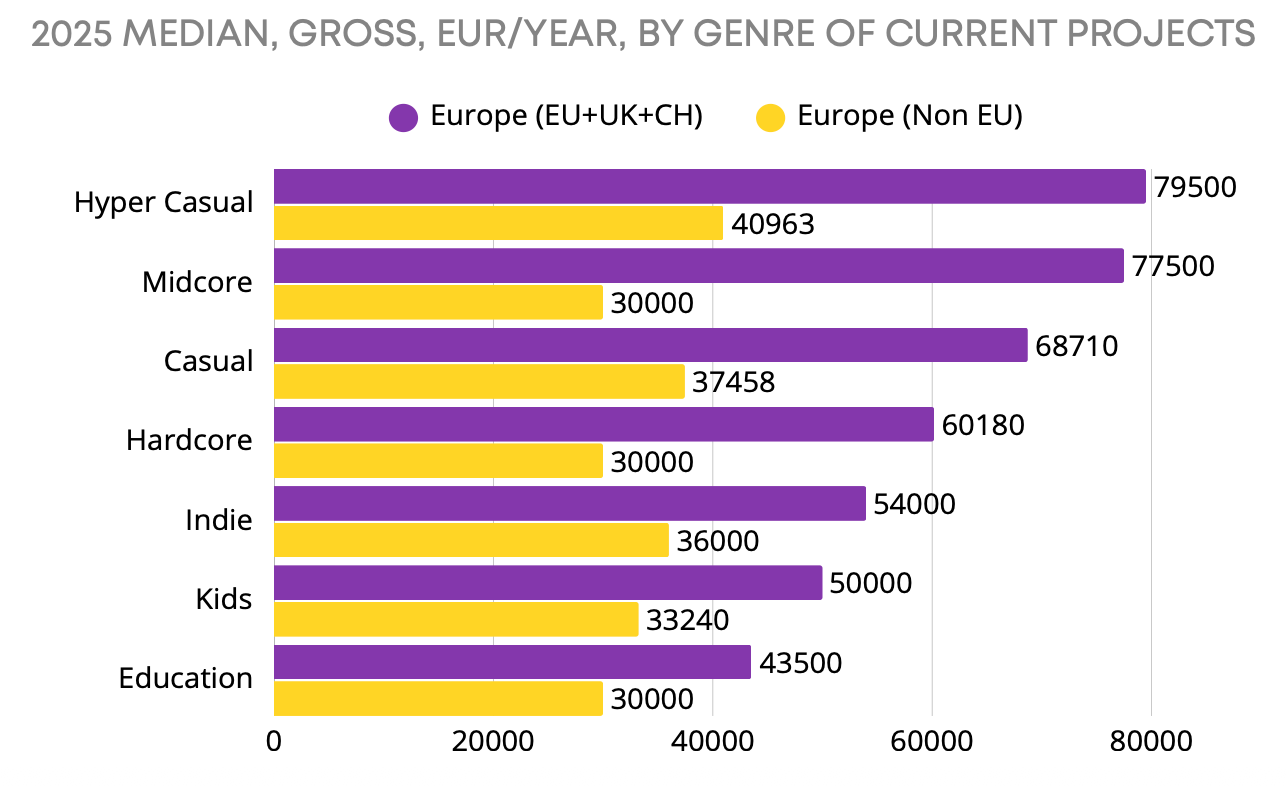

Genres-wise, the highest salaries are offered by companies operating in the hypercasual and midcore segments.

People working on educational and kids’ games earn the least. That is unfortunate, but this is the market.

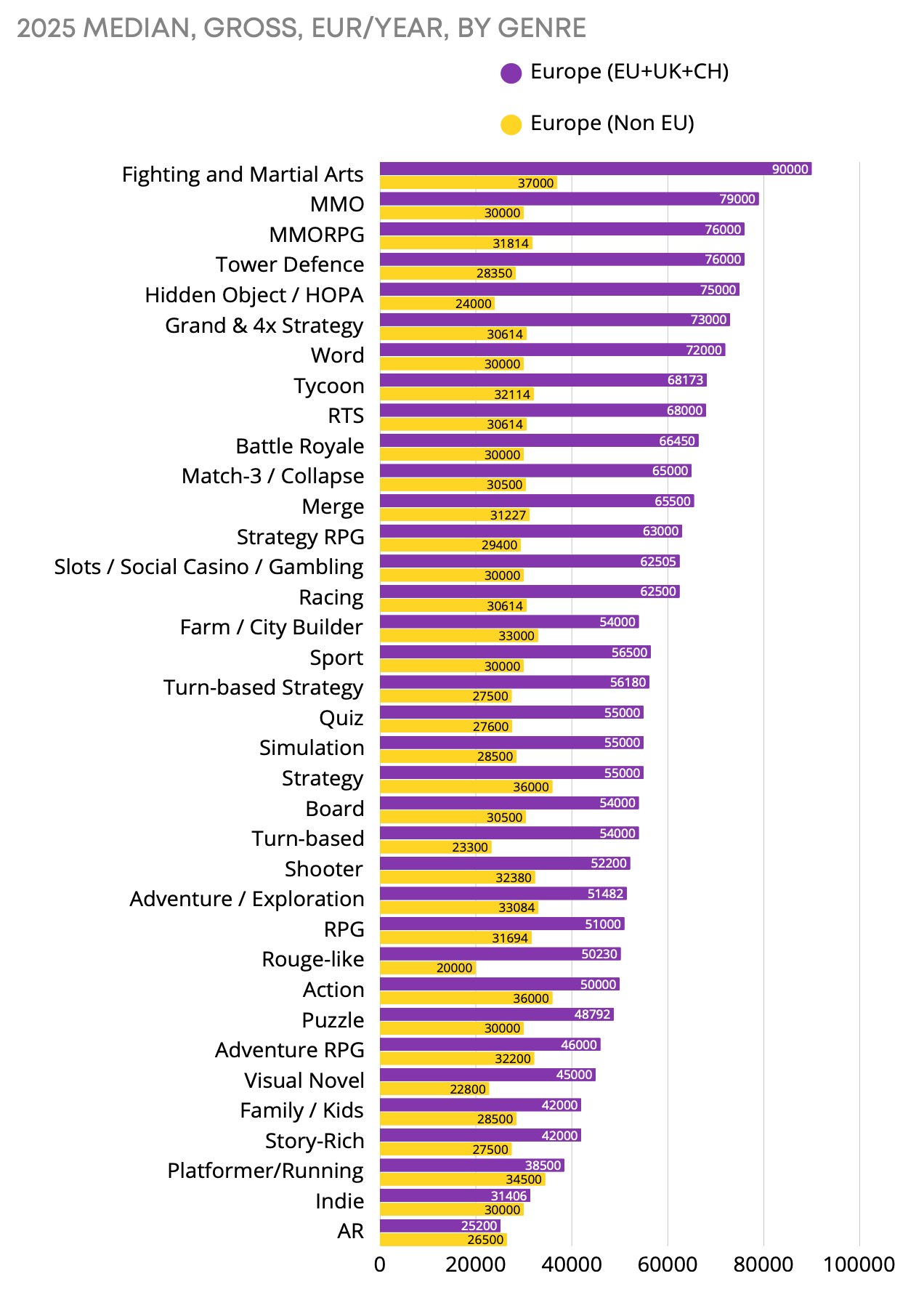

If you break it down by genre, employees at companies making fighting games, MMO, MMORPG, tower defense, and hidden-object titles earn the most.

AR developers are paid the worst.

How salaries are changing

In Europe (EU+UK+CH), over the last three years, the strongest growth came for senior marketing professionals. Top-management salaries are also steadily rising.

Developers’ salaries, on the other hand, decreased.

In Europe outside the EU, the situation is worse. Salaries are either flat or declining. Marketers’ salaries dropped the most. This could be a sampling issue or a sign of structural market changes.

Mid-level specialists have seen salary decreases almost everywhere and across almost all disciplines. Pleasant exceptions are artists (their median salary grew in Europe (EU+UK+CH)) and QA specialists.

“Salaries for programmers, especially Unity developers, have been going down. There just aren’t enough open roles for them, and the market’s become highly competitive. In some cases, dev specialists even lower their salary expectations by half just to land a job. Another big factor is AI — copilots, cursors, and similar tools. Development really is speeding up thanks to them, and that changes the whole landscape.

This isn’t just happening in the games industry. It’s a broader trend across mobile development as a whole. The only developers whose rates are going up right now are AI specialists. In fact, many job descriptions now explicitly expect candidates to be able to work faster with AI tools,” comments Tania Loktionova, founder of Values Value and co-founder of inGameJob.

For junior specialists, things were already tough, and in 202,5 it became even worse. The entry threshold to the profession is rising in European countries outside the EU. I assume that to survive and stay in the profession, many people have to juggle multiple jobs.

Salary satisfaction has declined across all professional categories, regardless of experience.

The most dissatisfied with their income are junior artists and mid-level and senior QA specialists.

Those most satisfied with their salaries are junior programmers, mid-level programmers, and marketers in Europe (EU+UK+CH), and senior analysts, HR, and top managers in Europe (EU+UK+CH).

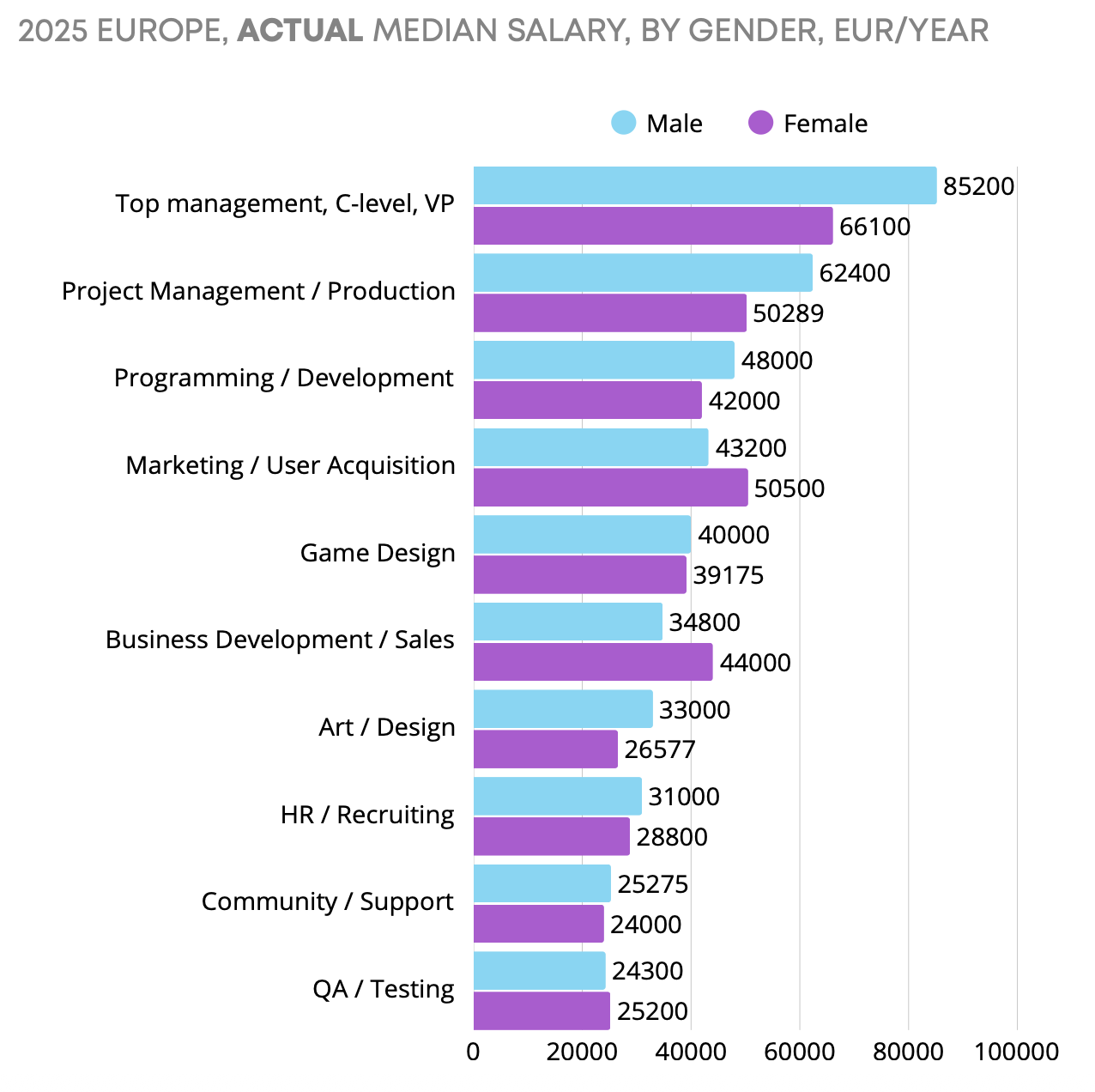

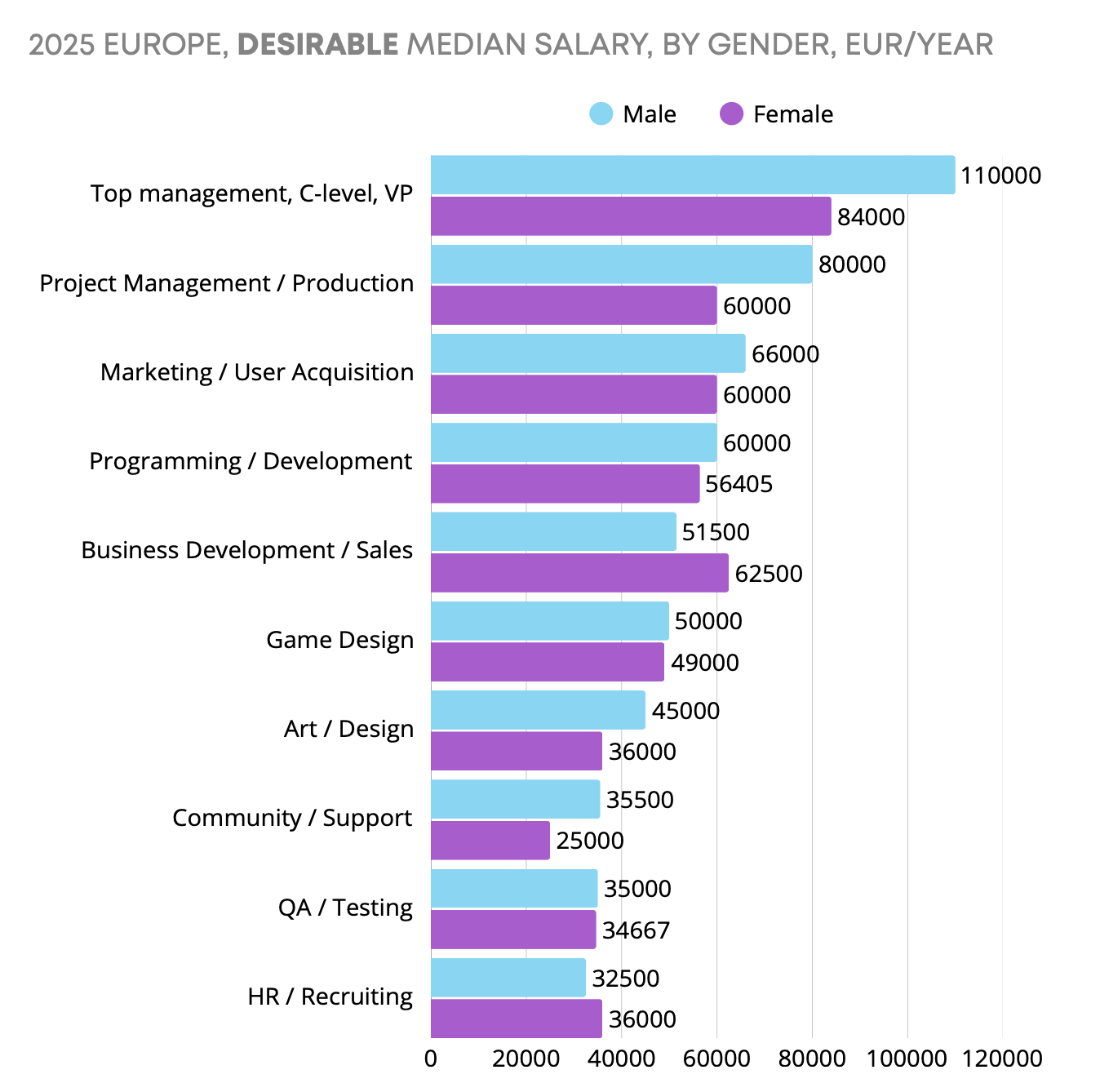

Gender Pay Gap

Women, on average, earn less than men. This is especially pronounced in top-level roles and project management. But there are exceptions: women earn more in some marketing, business development, sales, and QA positions.

The pay gap is partly explained by the fact that men tend to state higher salary expectations than women.

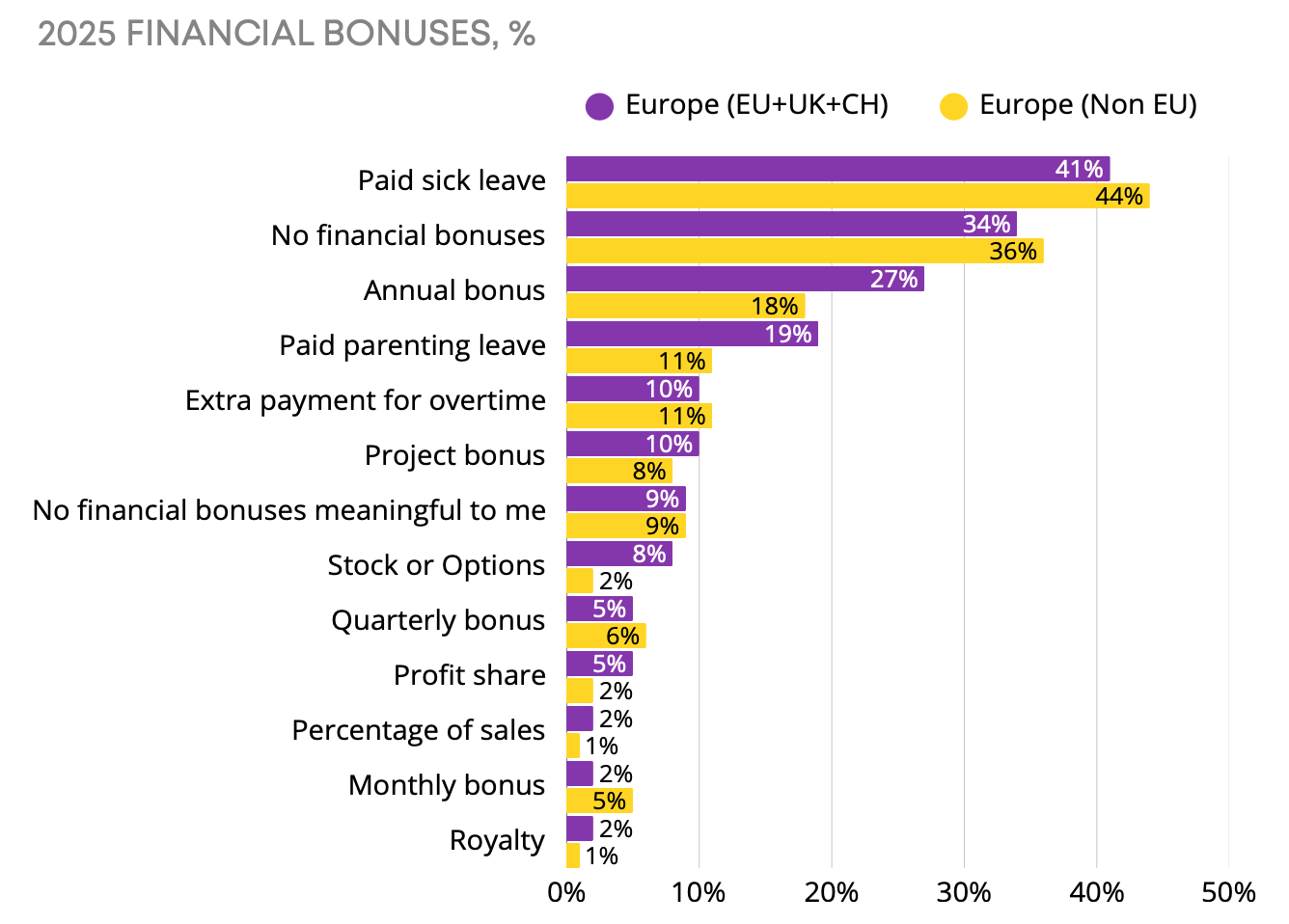

Bonuses and forms of compensation

The most common company benefits are paid sick leave (though in fewer than 50% of cases) and annual bonuses (available at 27% of companies in Europe (within the EU) and 18% of European companies outside the EU).

Financial bonuses are more common in Europe (EU+UK+CH), but their size (relative to salary) is usually higher in European countries outside the EU.

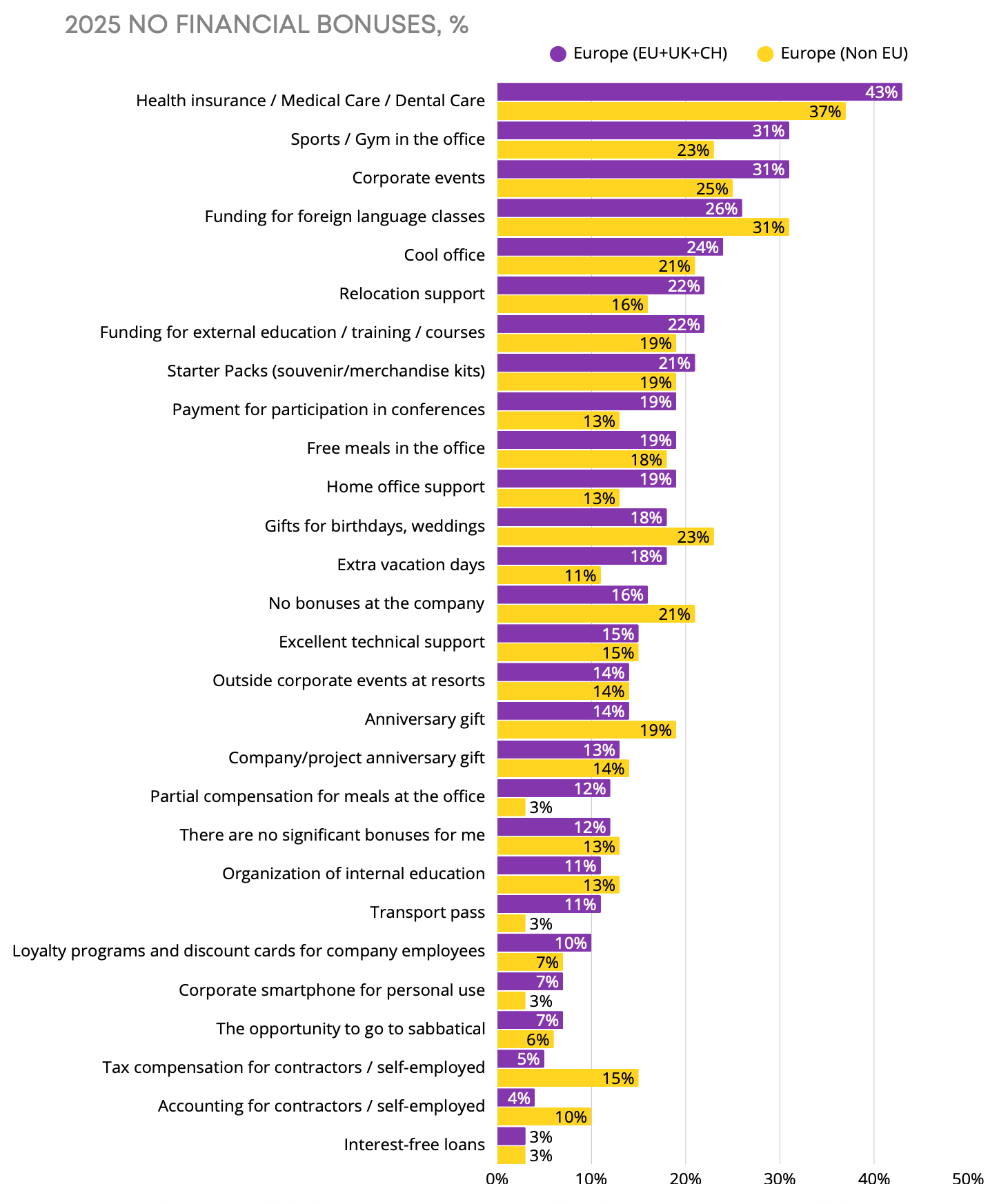

Among non-financial benefits, the most common are health insurance, sports/fitness, and corporate events. It is funny that a “cool office” still appears in the top five perks.

eNPS and engagement

eNPS is Employee Net Promoter Score. It measures employee loyalty to the company on a scale from -100 to +100.

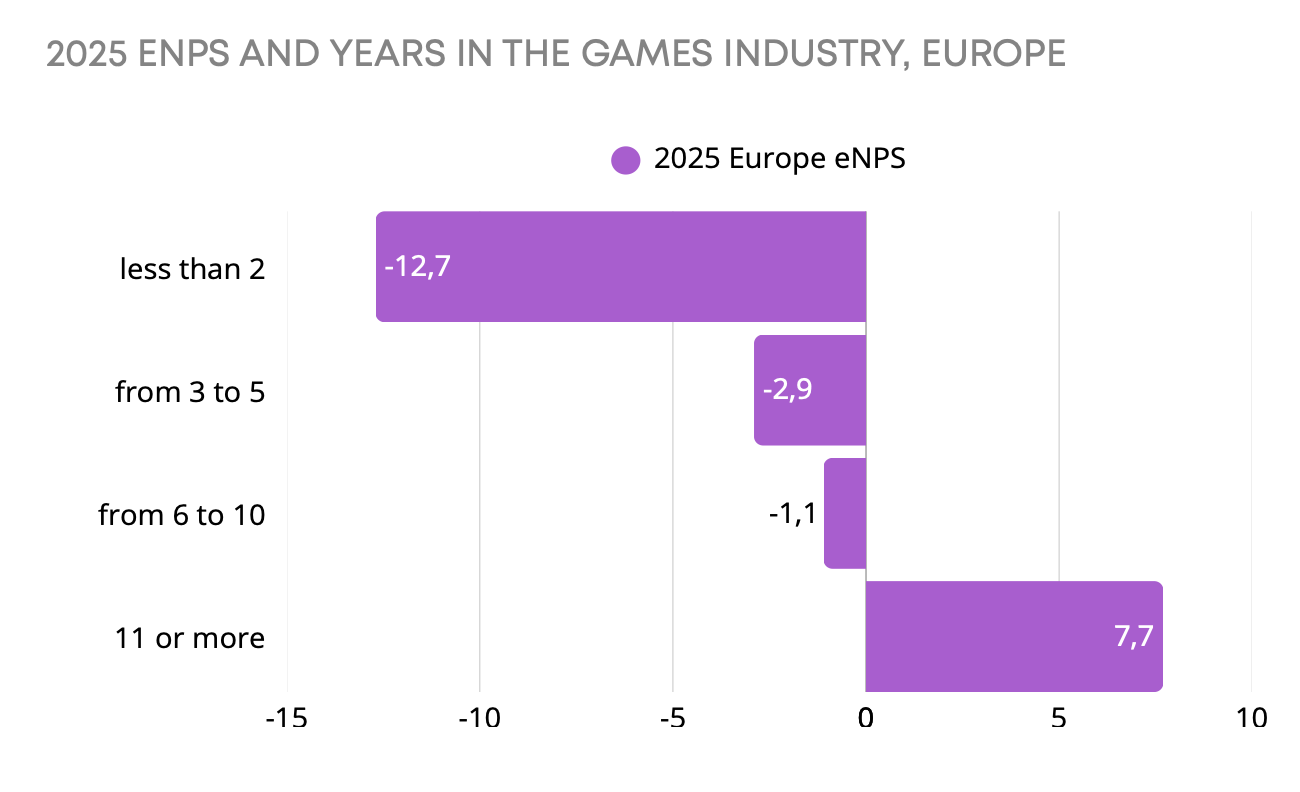

Employee loyalty to companies fell in 2025. The most loyal employees are those who have been in the industry for many years. The least loyal are junior specialists, which is easy to explain: it is hard for them to find a job, hard to get onto a stable project, and in case of problems, they are the first to be laid off.

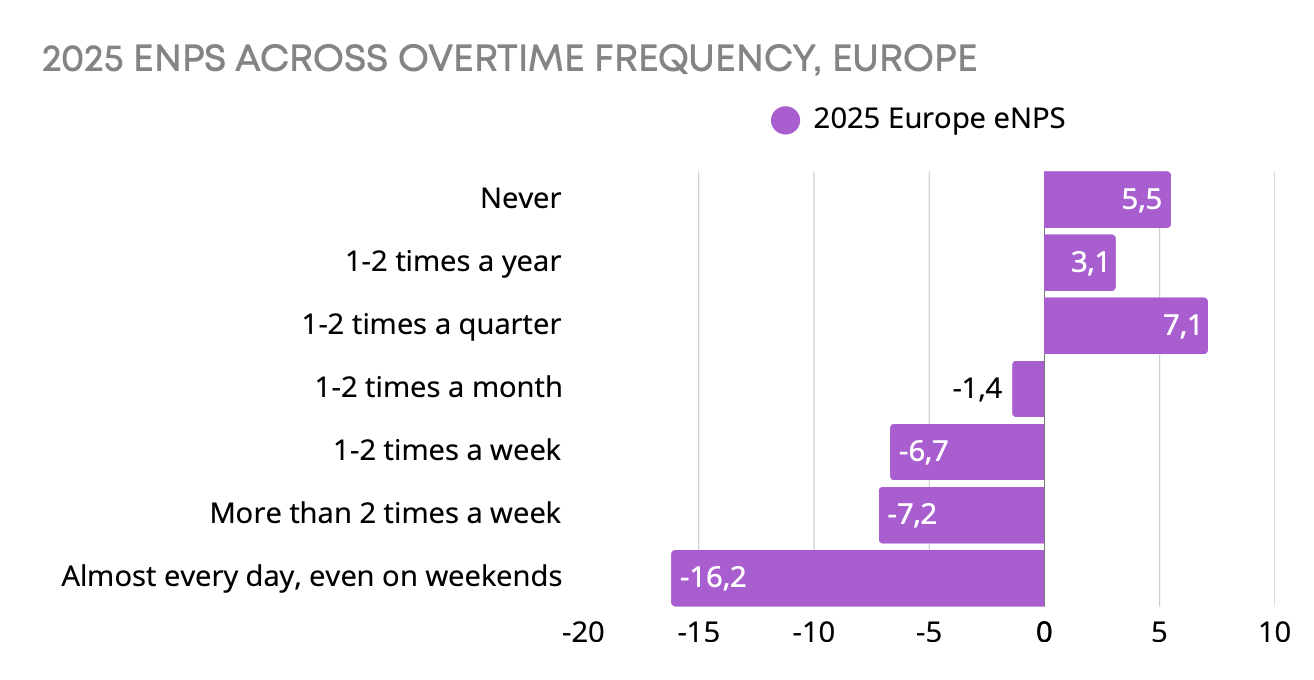

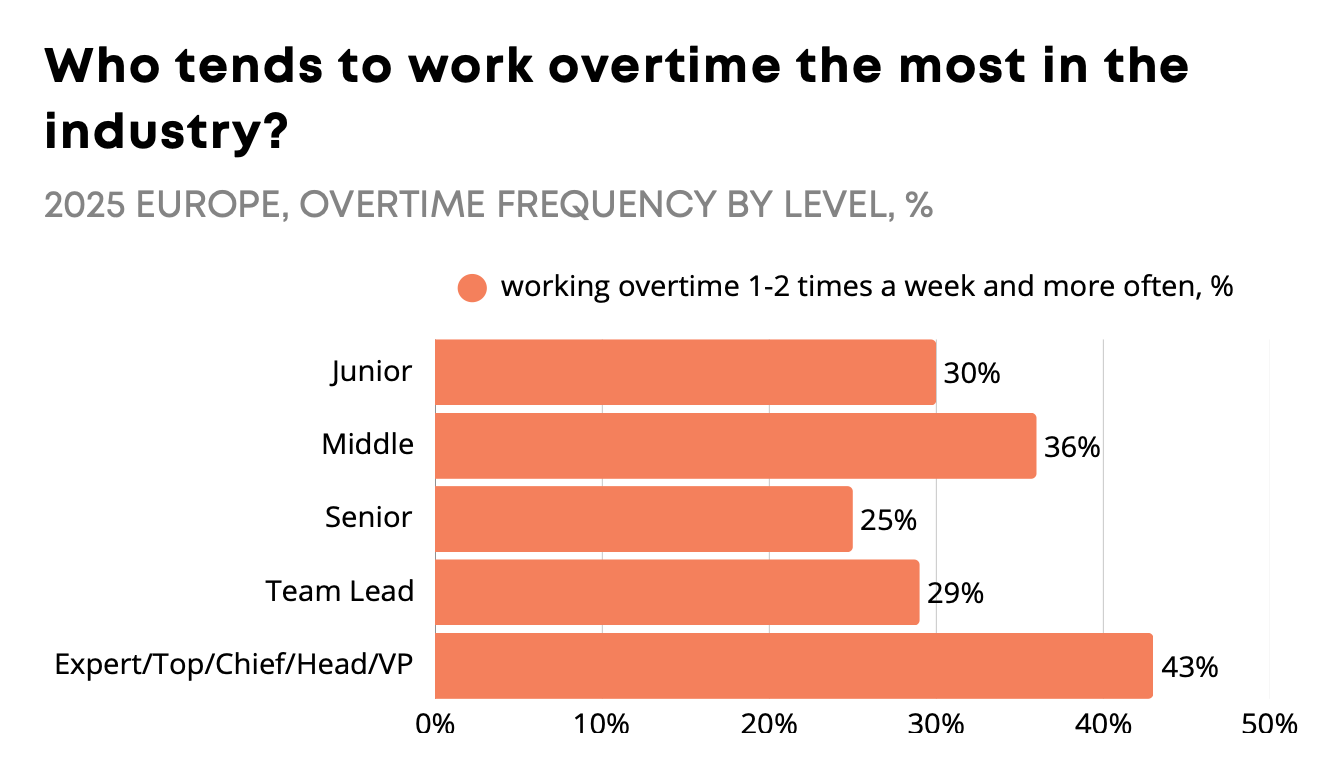

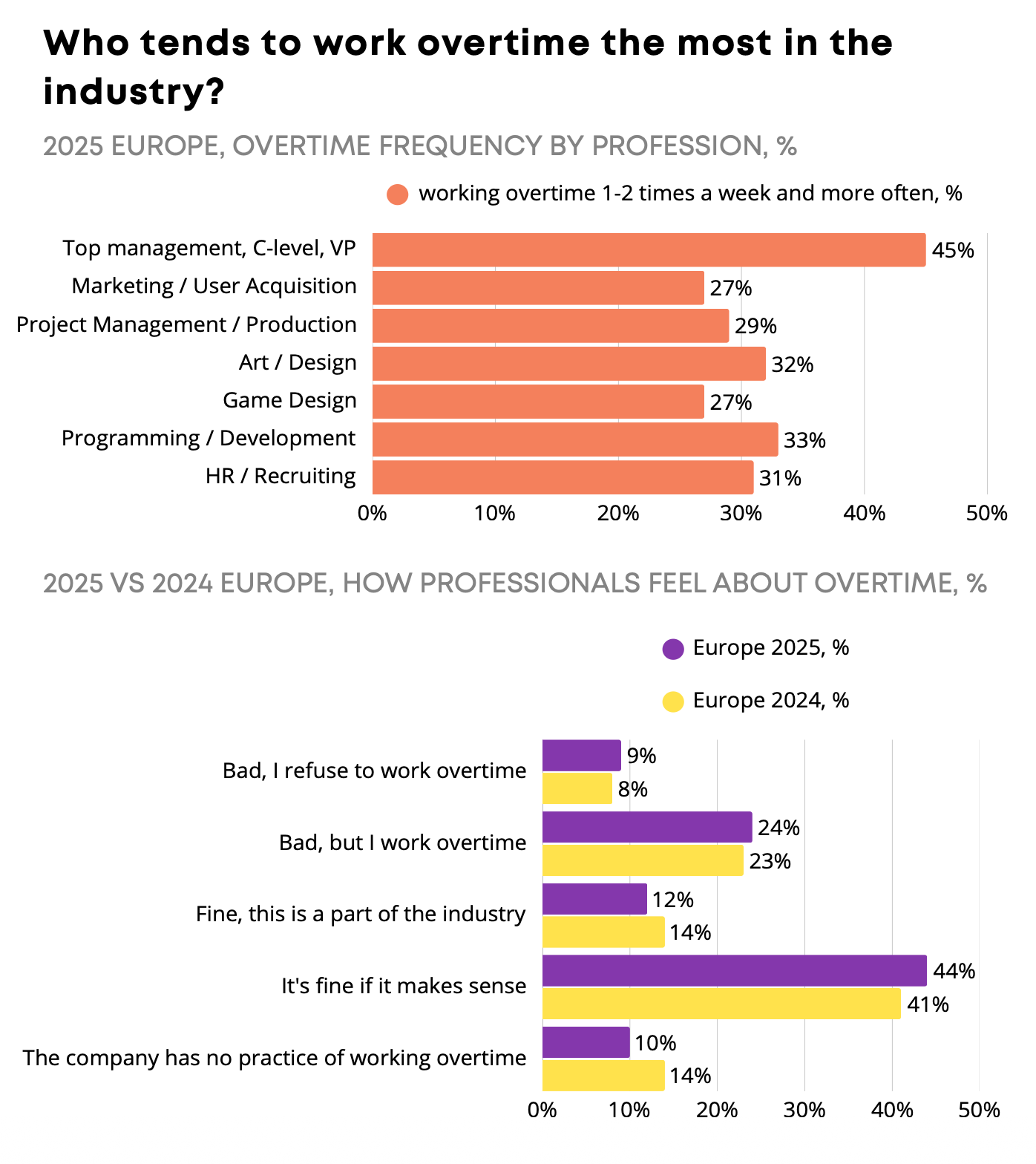

There is a direct correlation between overtime and loyalty. The more frequent the overtime, the lower the employee’s loyalty to the company. At the same time, respondents with a moderate amount of overtime (1–2 times per quarter) are actually more loyal than those who never (or almost never) work overtime.

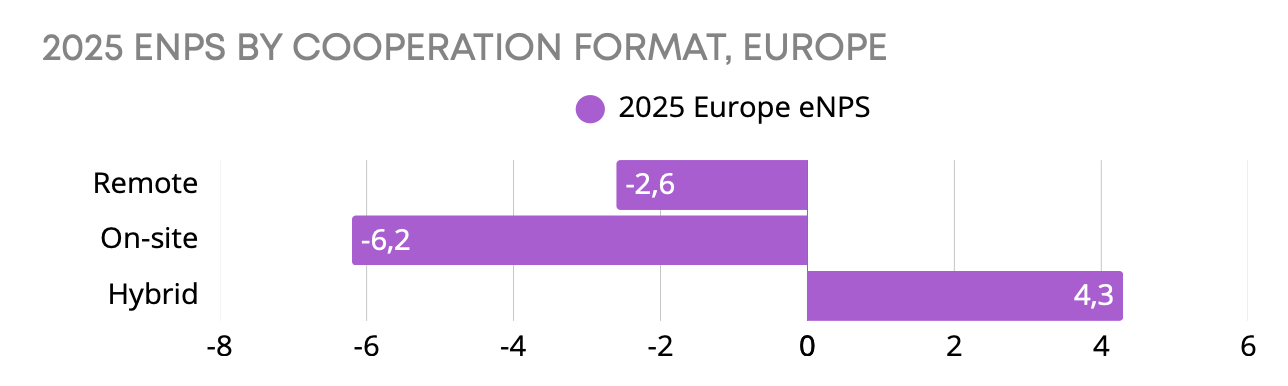

Employees with a hybrid work model show the highest loyalty. The least loyal are those who work in the office every day.

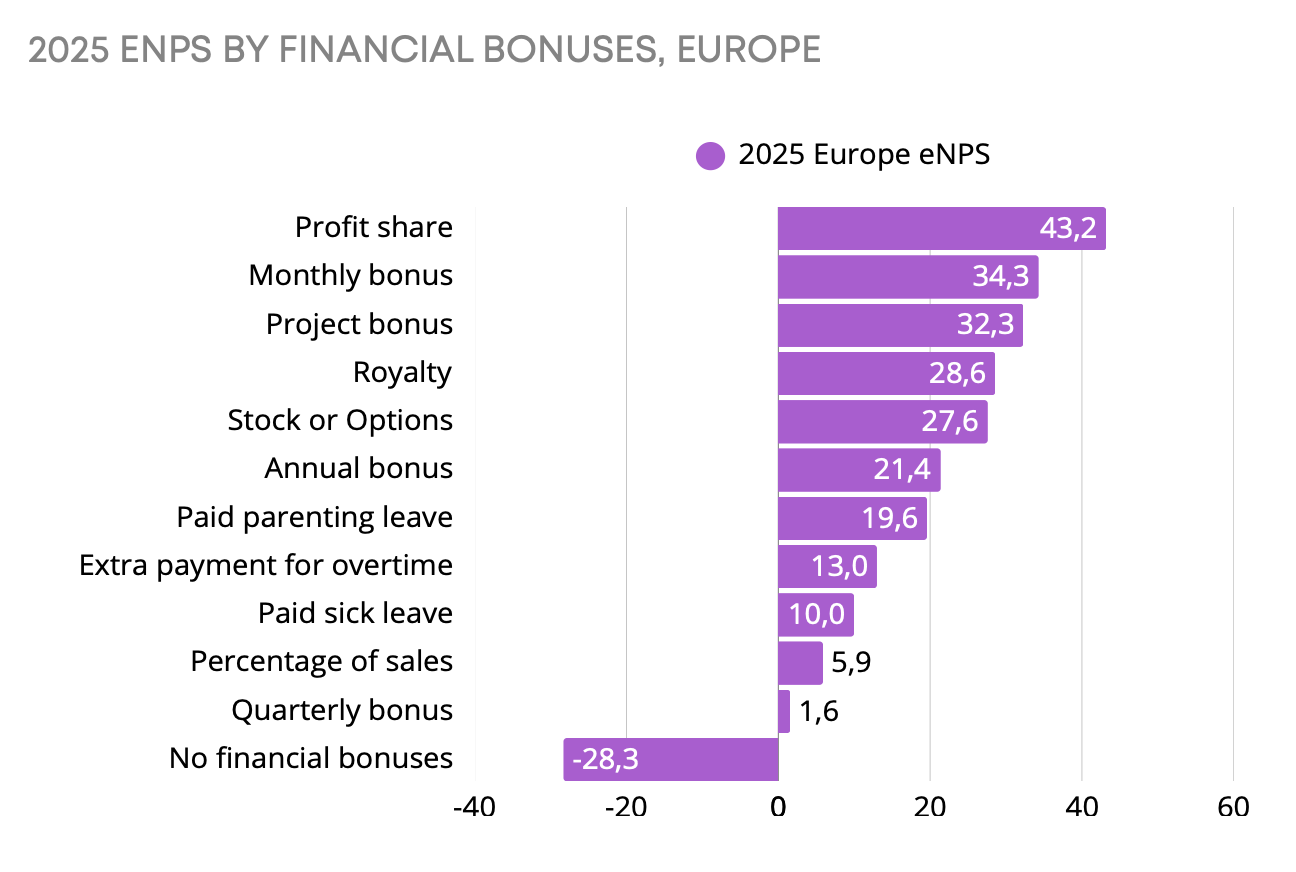

The highest loyalty is among people who receive profit-sharing, monthly bonuses, project-based bonuses, royalties, or stock options. In general, any kind of financial upside works well for loyalty.

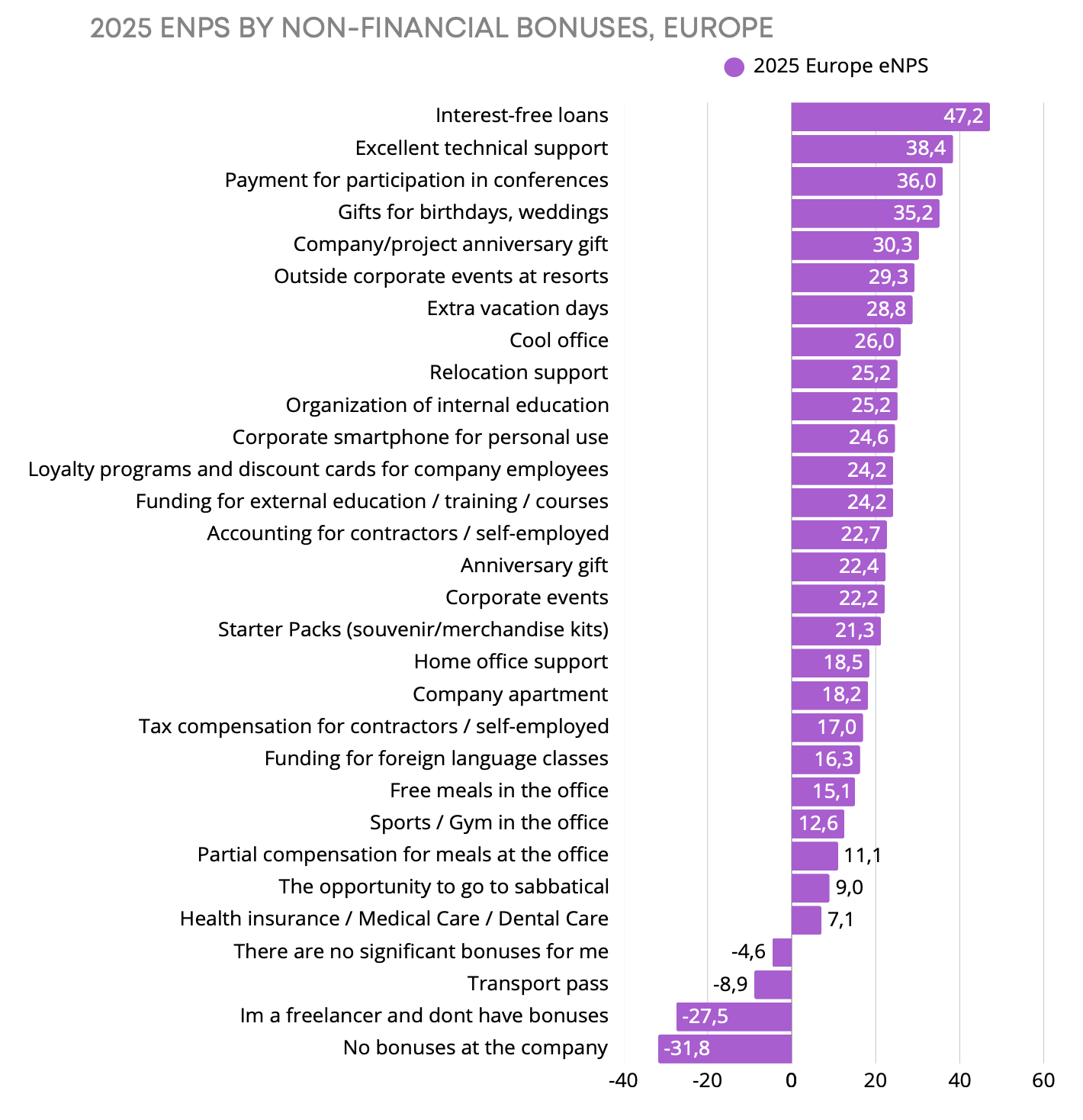

Interest-free loans, technical support for employees, and paid conference attendance also have a positive effect on loyalty.

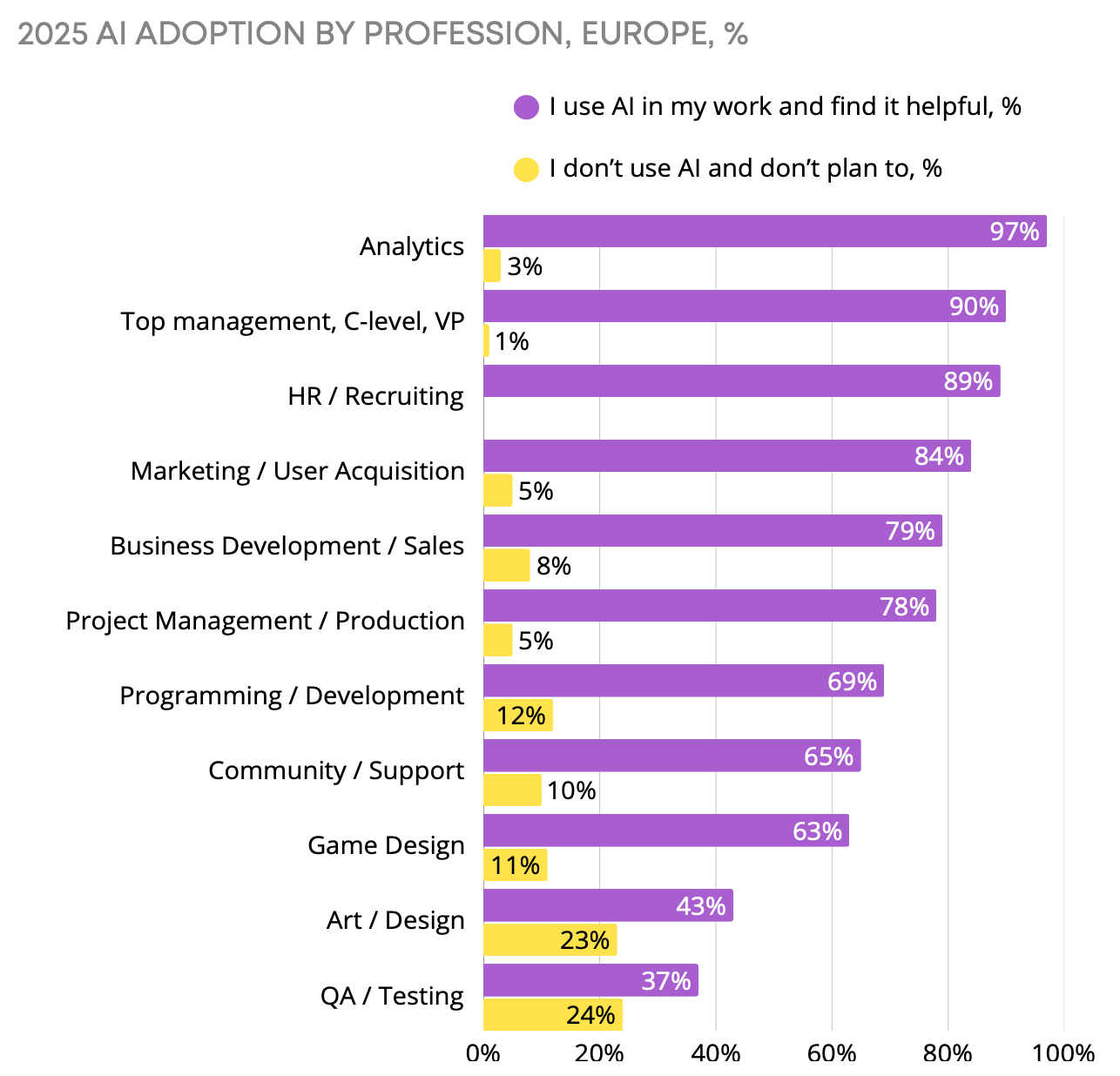

The impact of AI on professionals’ work

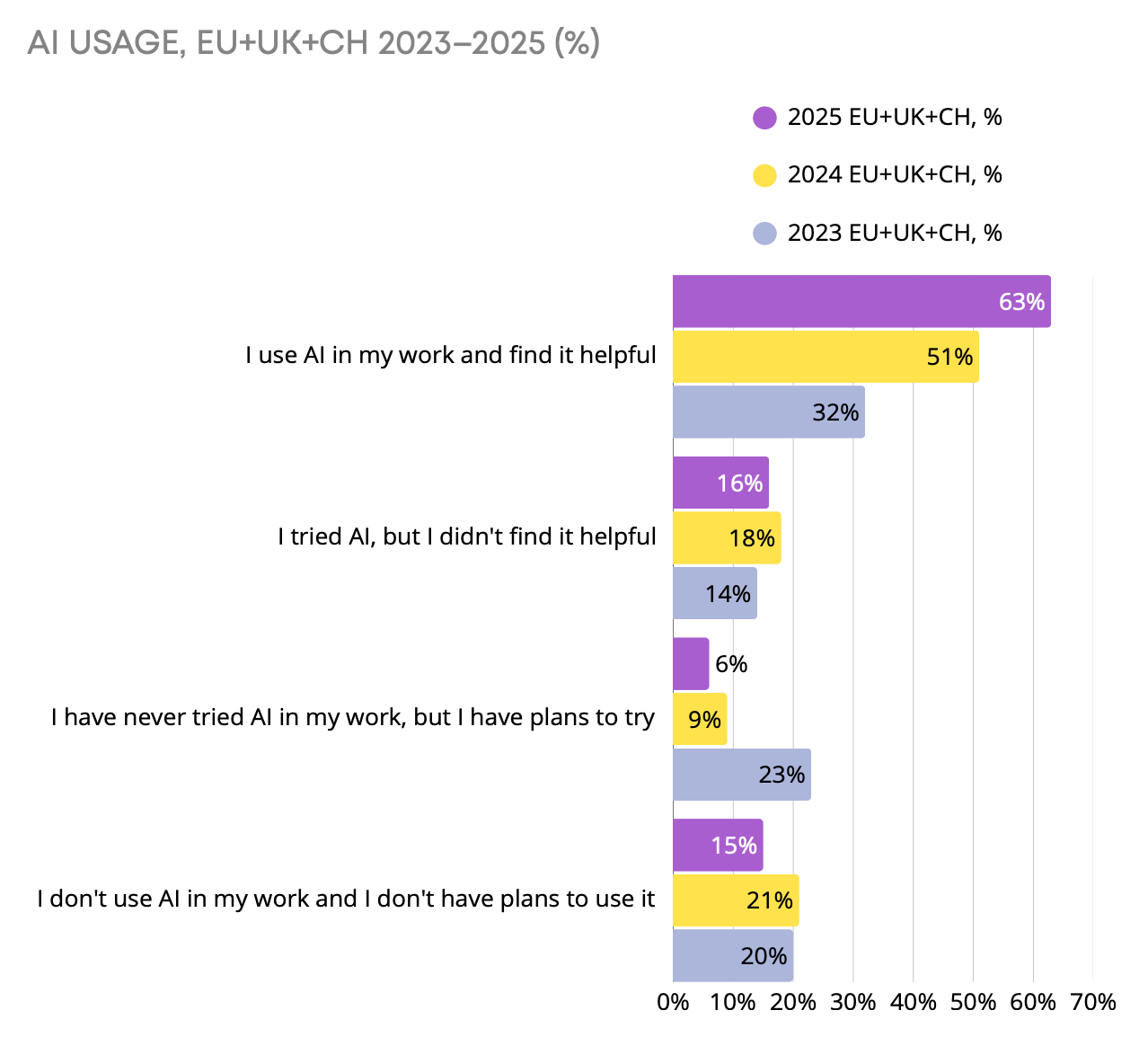

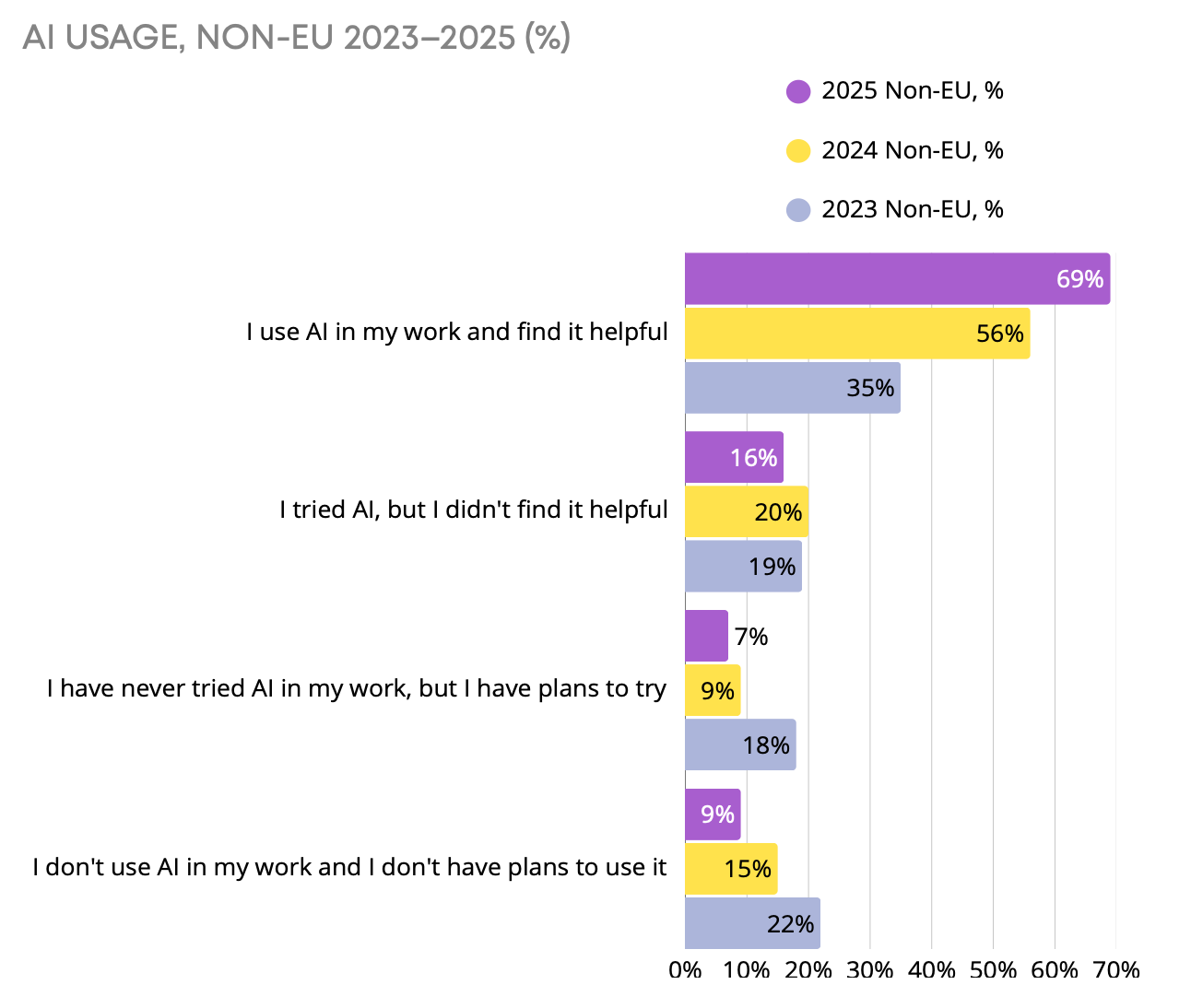

Use of AI in day-to-day tasks has doubled over the past couple of years. Adoption has reached 63% in Europe (EU+UK+CH) and 69% in European countries outside the EU.

Analysts, top managers, HR, and recruiters use AI the most. Surprisingly, artists and QA specialists use AI the least.

Work format and sense of security

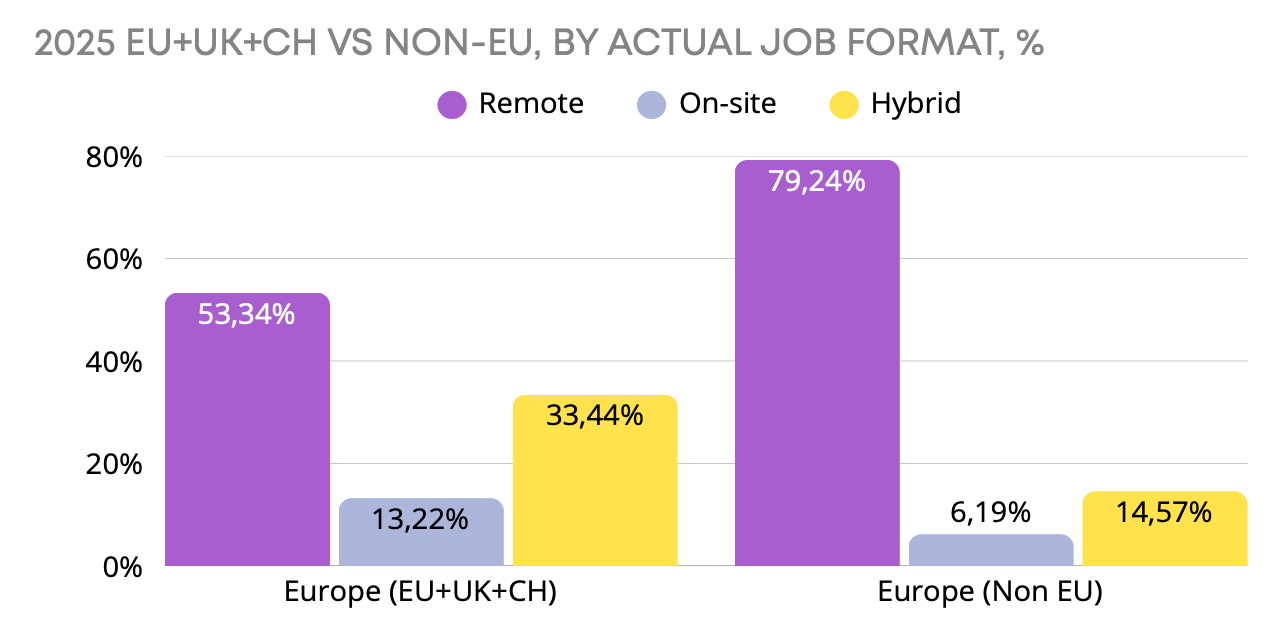

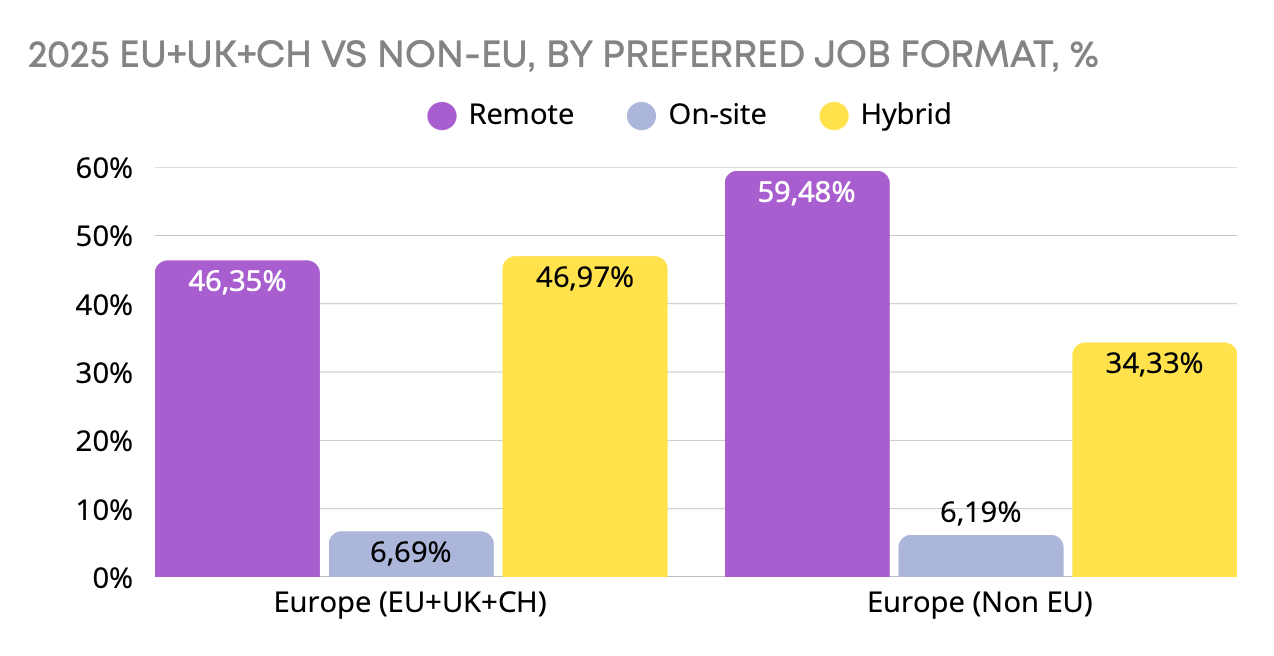

Among respondents, remote work has become the most common format. It is more prevalent in European countries outside the EU.

However, most people actually prefer a hybrid format. Many want to see colleagues in person from time to time – it helps the work and makes it more effective.

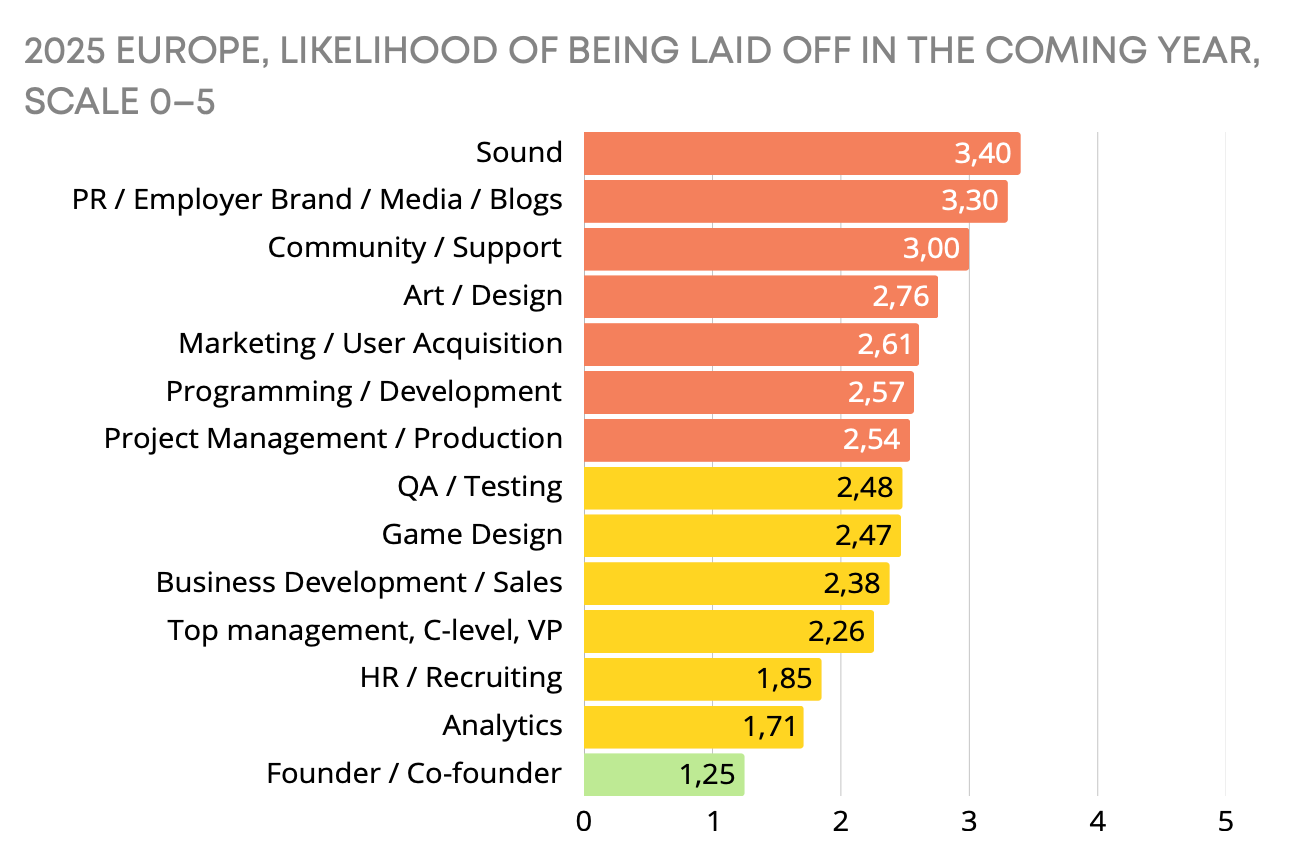

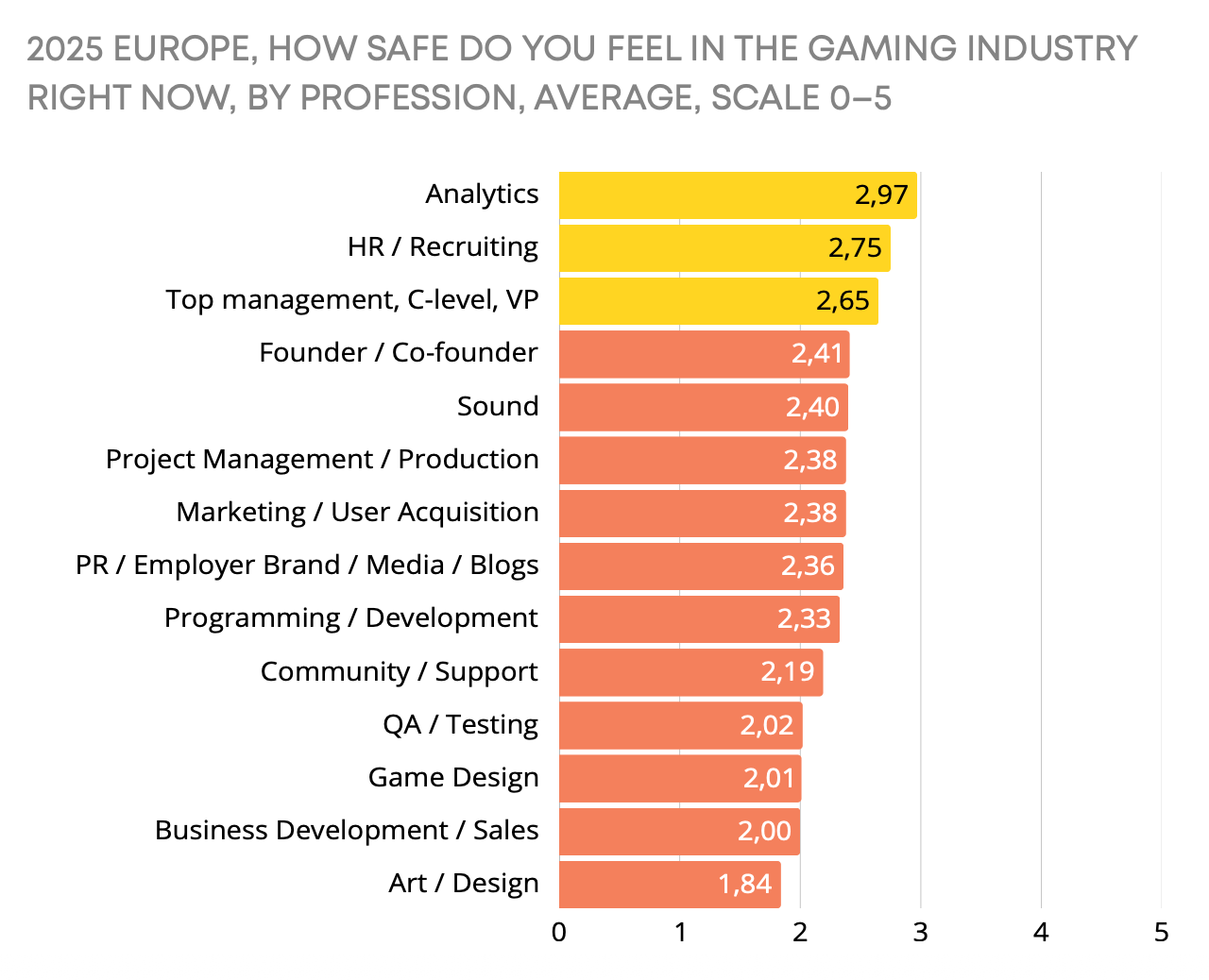

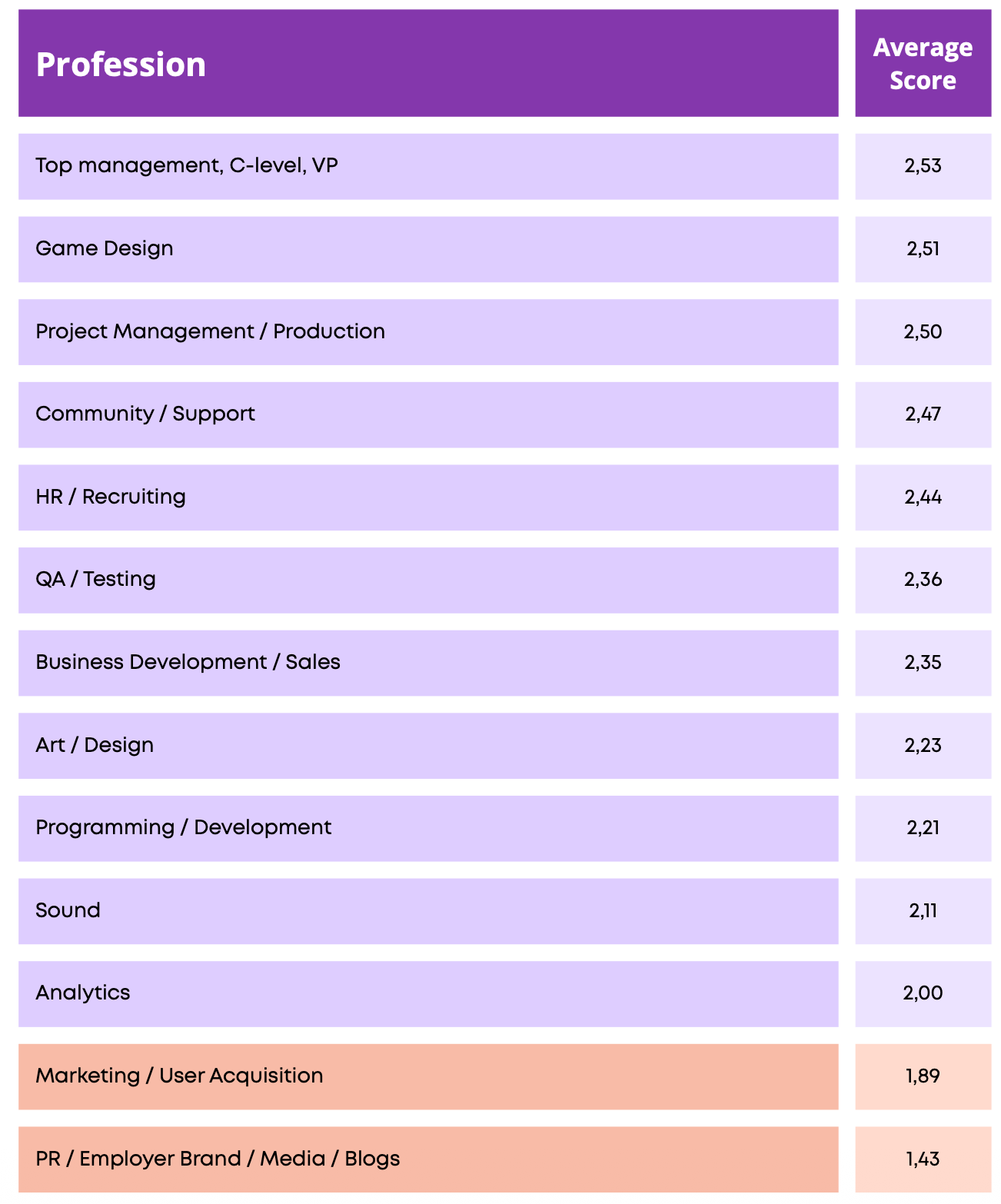

Anxiety about the future rose sharply in 2025. The most worried about their future are audio specialists, PR and media professionals, community managers, and support staff.

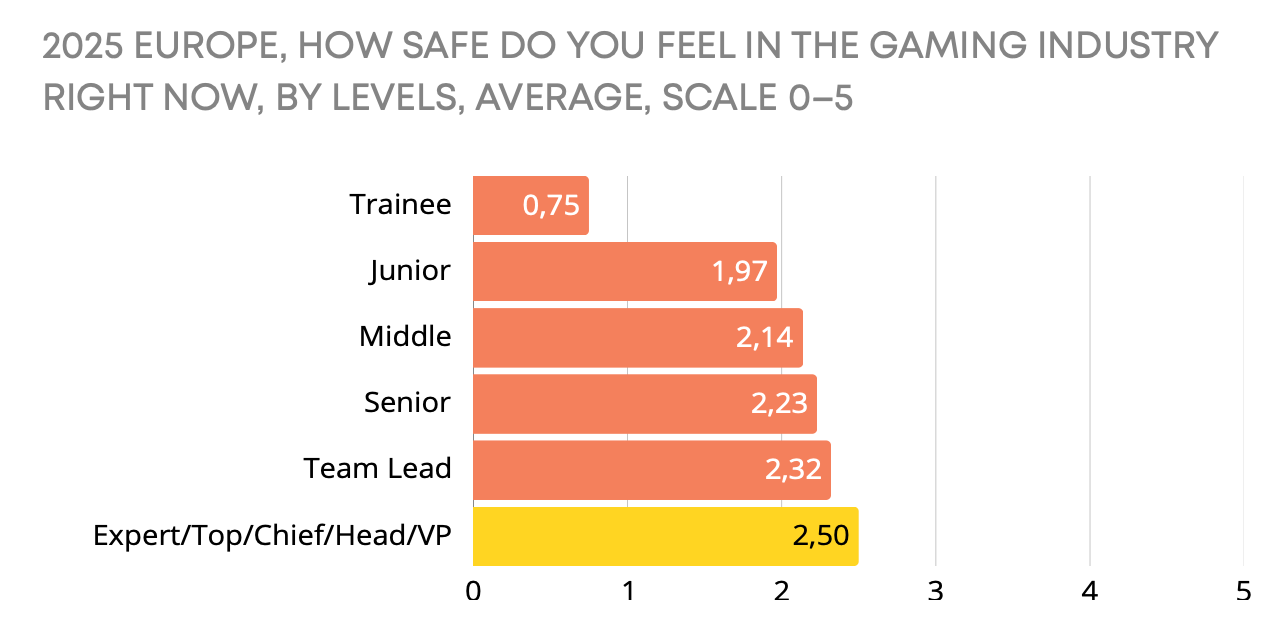

The higher a person’s position, the calmer they are about their future.

Analysts, HR/recruitment, and top managers have a more positive view of the state of the industry than, for example, artists and designers or business development people.

A word from newsletter sponsor

Transform your online store into an LTV powerhouse with Xsolla’s LiveOps tools - run dynamic, segmented campaigns to drive an 80% repeat purchase rate, and boost player retention by 15%+ using in-game synchronized offers and loyalty shops.

Time-limited promos, login bonuses, and referral programs can lift player engagement and help grow ARPPU by 20%+, all through an intuitive interface built for fast campaign launches, deep personalization, and maximum revenue impact.

Workplace situation, career intentions, and job search

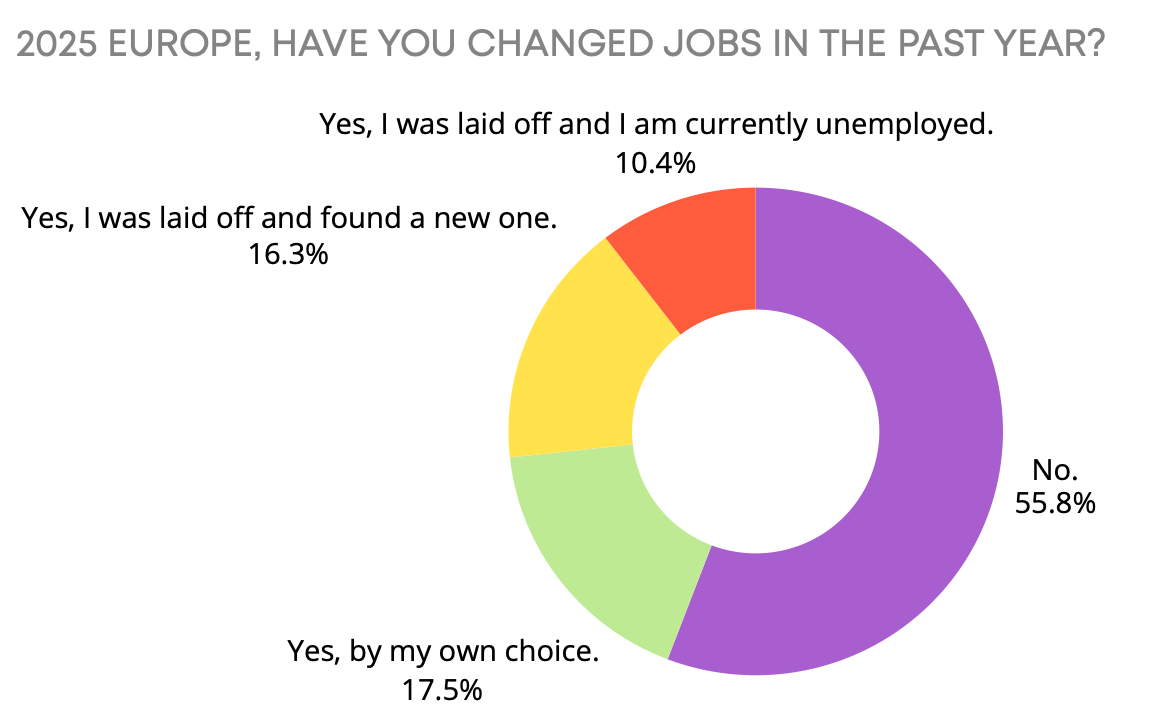

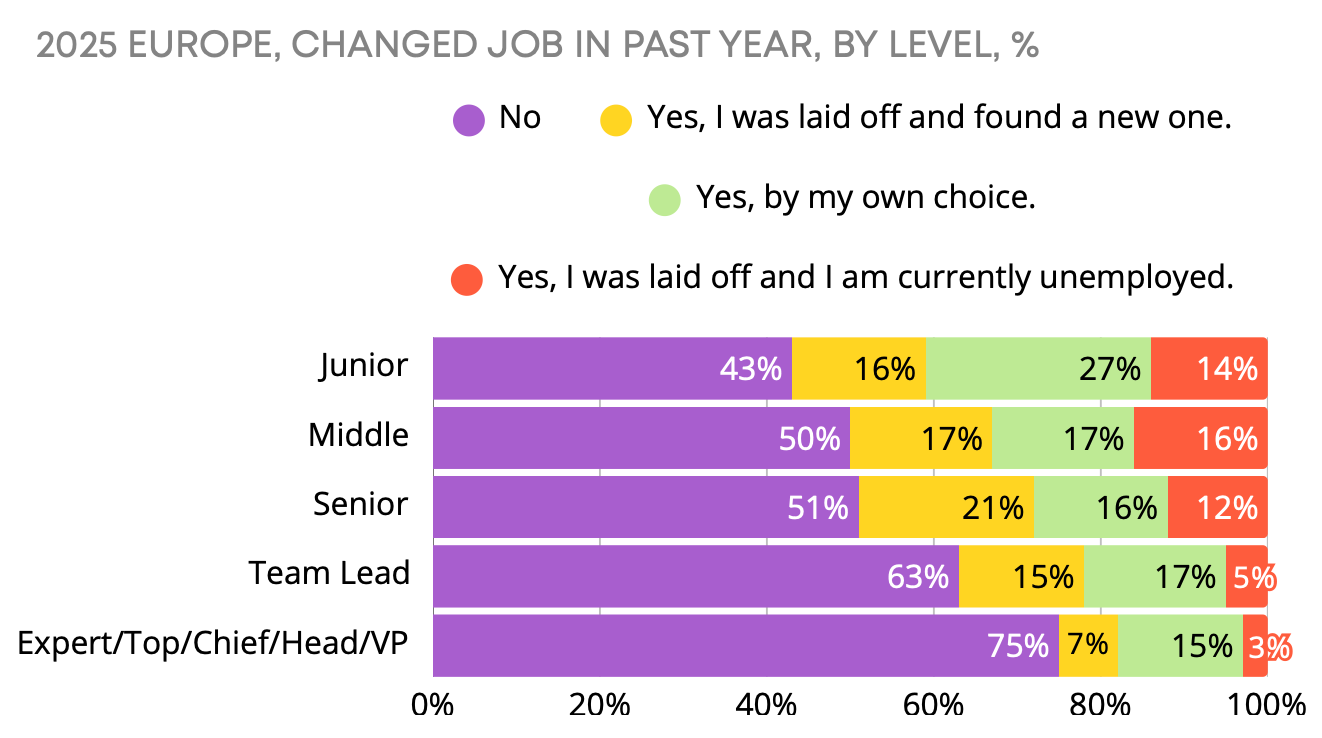

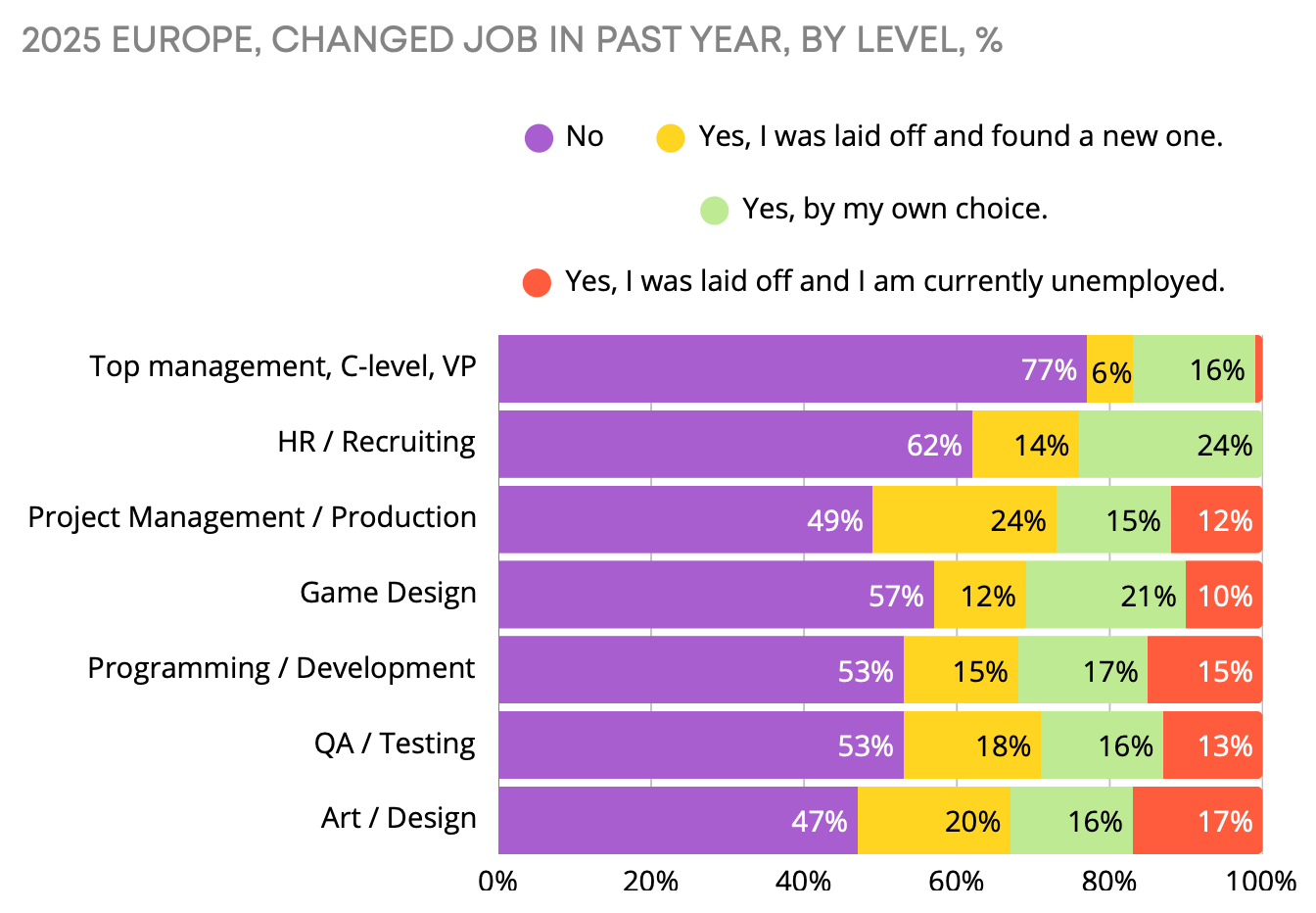

In 2025, the share of people who voluntarily changed jobs dropped significantly (17.5% versus 23.2% in 2024). 10.4% experienced a layoff and have not yet found a new position. 16.3% were laid off but did find new jobs.

Employee mobility decreases as people move up the career ladder.

HR and recruiters are the most active in terms of voluntary transitions. Artists, as well as project and product managers, are the ones who most often face layoffs.

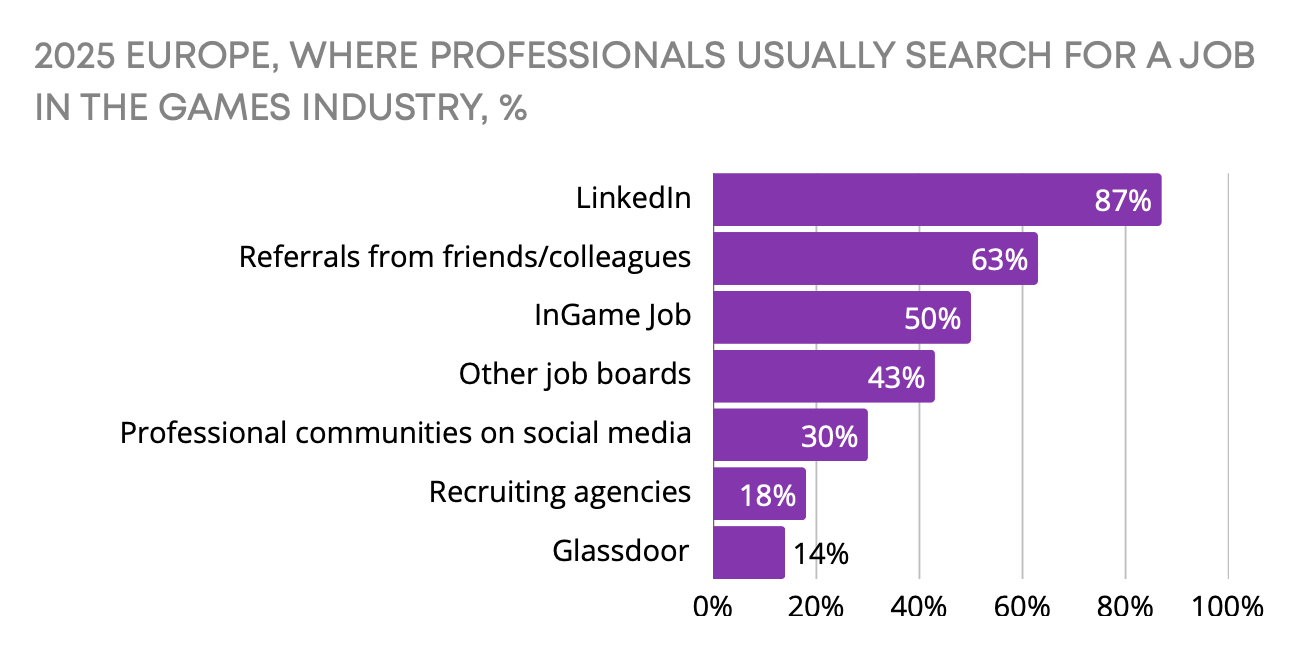

LinkedIn and referrals from friends and colleagues are the most popular job search channels.

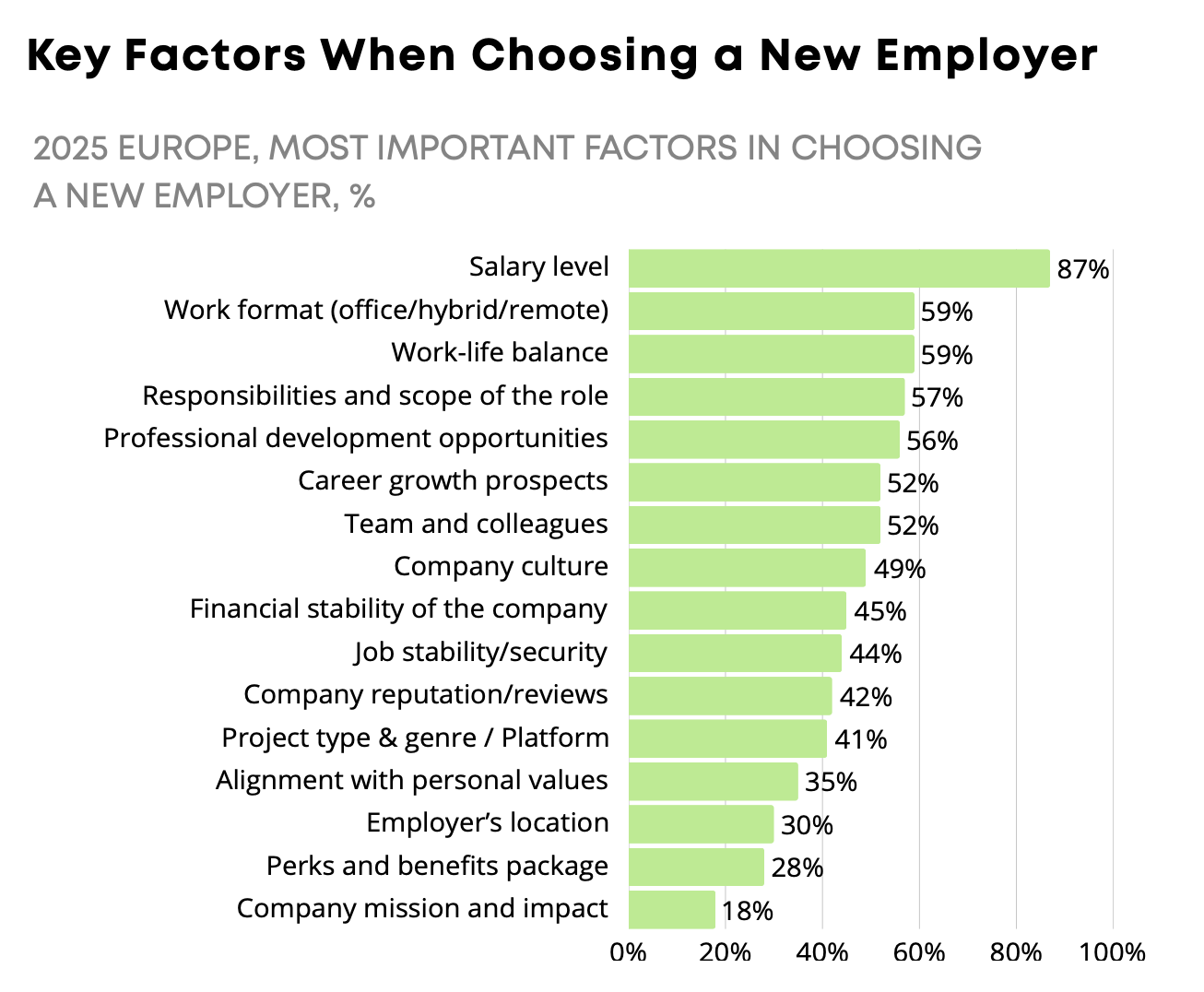

Salary remains the decisive factor when choosing a new employer. The company’s mission and its impact on the world matter to only 18% of candidates.

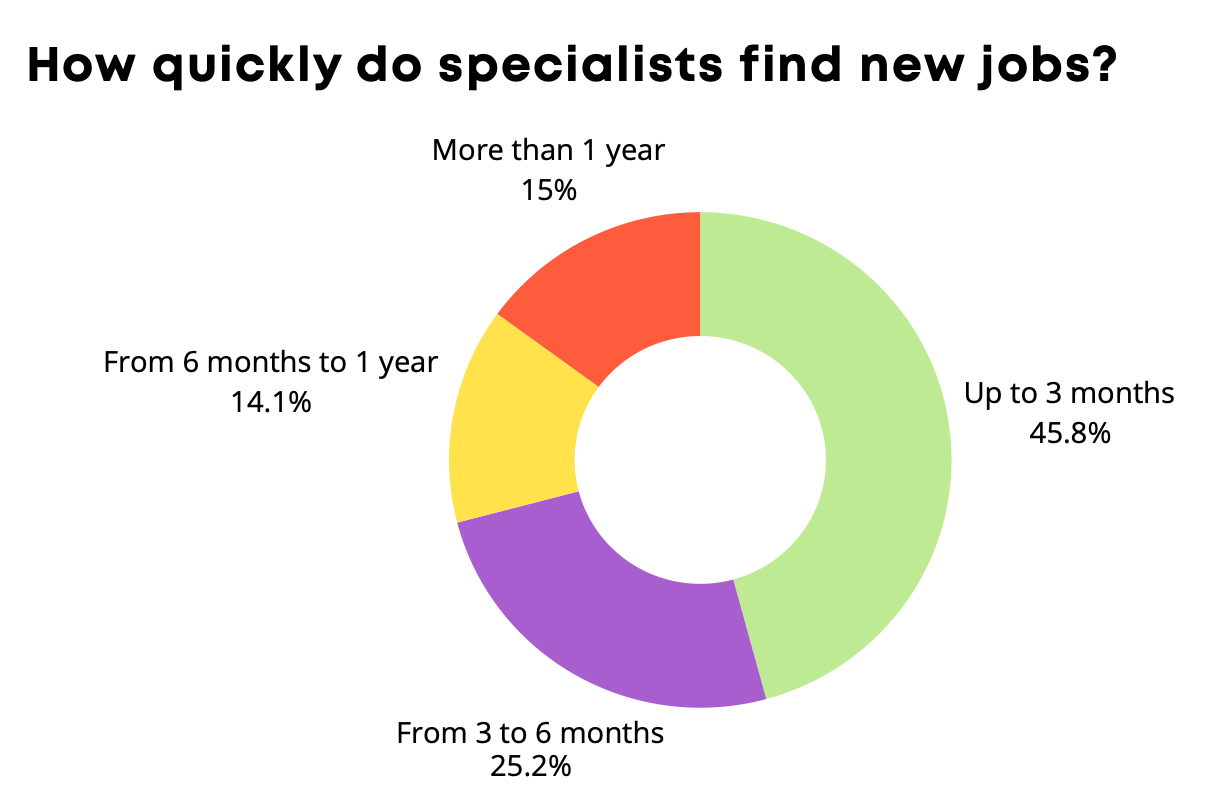

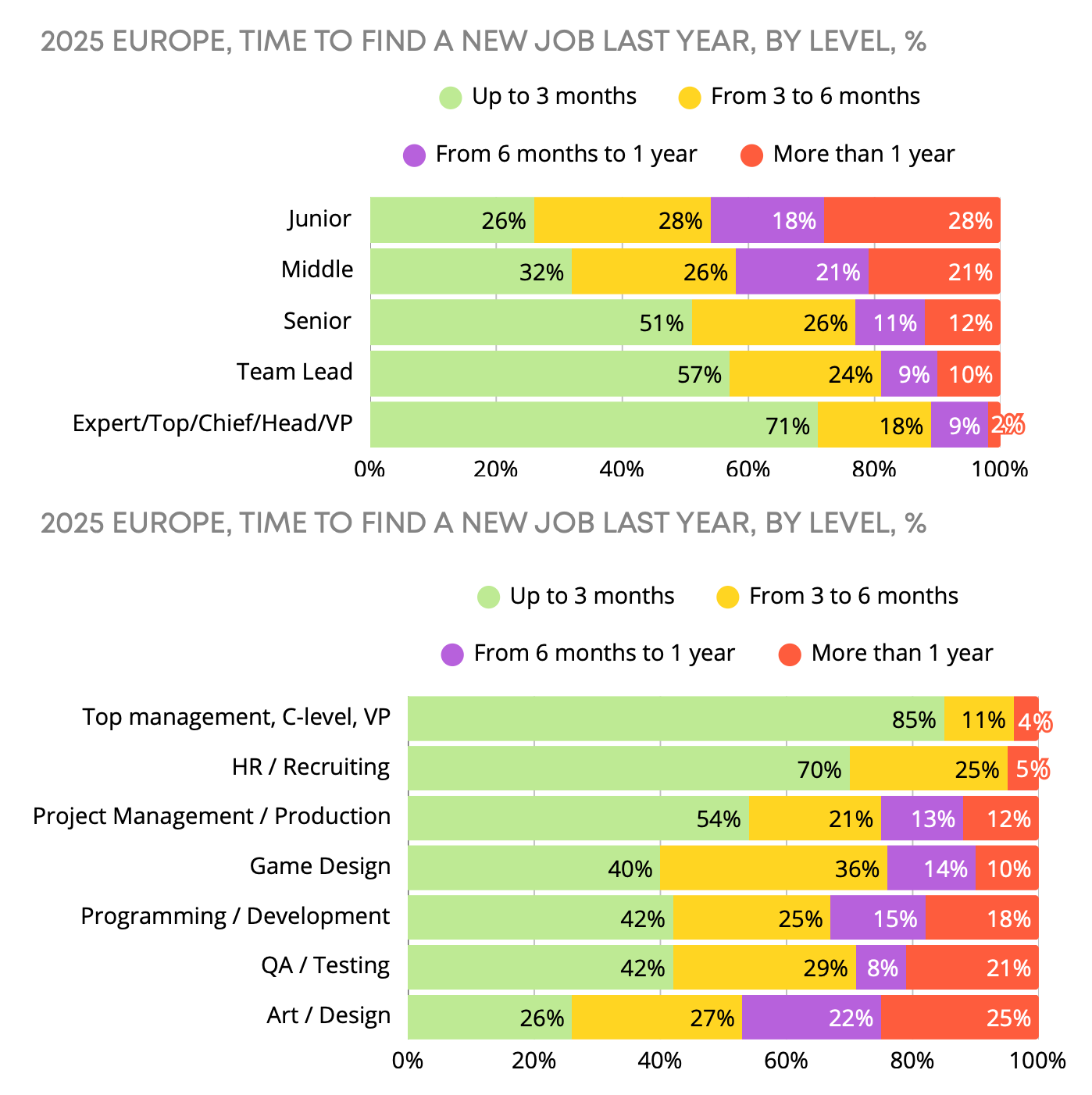

For most European job seekers, the job search lasts up to a year. However, 15% of respondents said they were unable to find work for more than a year.

Junior specialists spend the most time looking for work, while top managers and senior leaders spend the least.

Artists, designers, and QA specialists have the hardest time finding new positions.

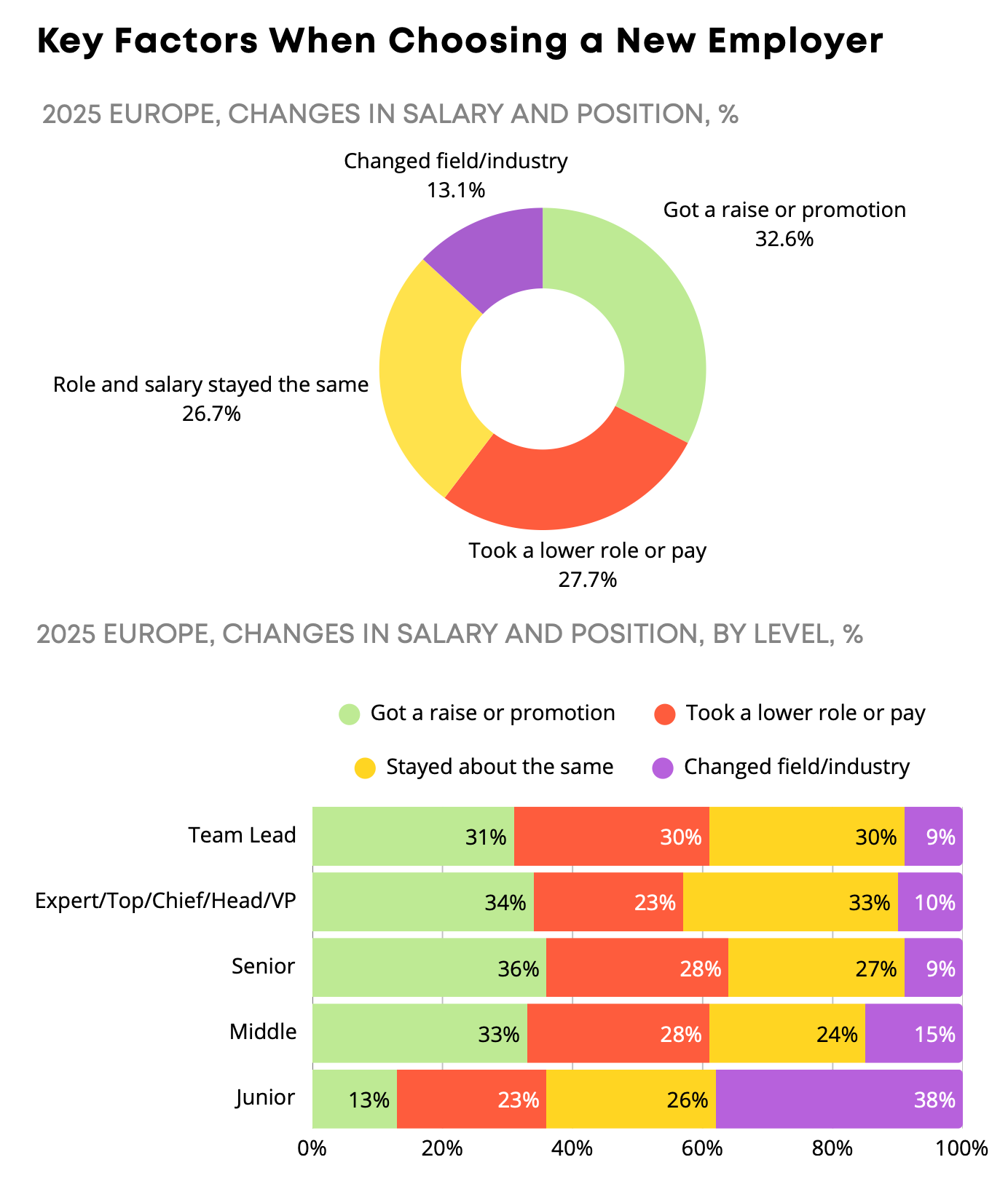

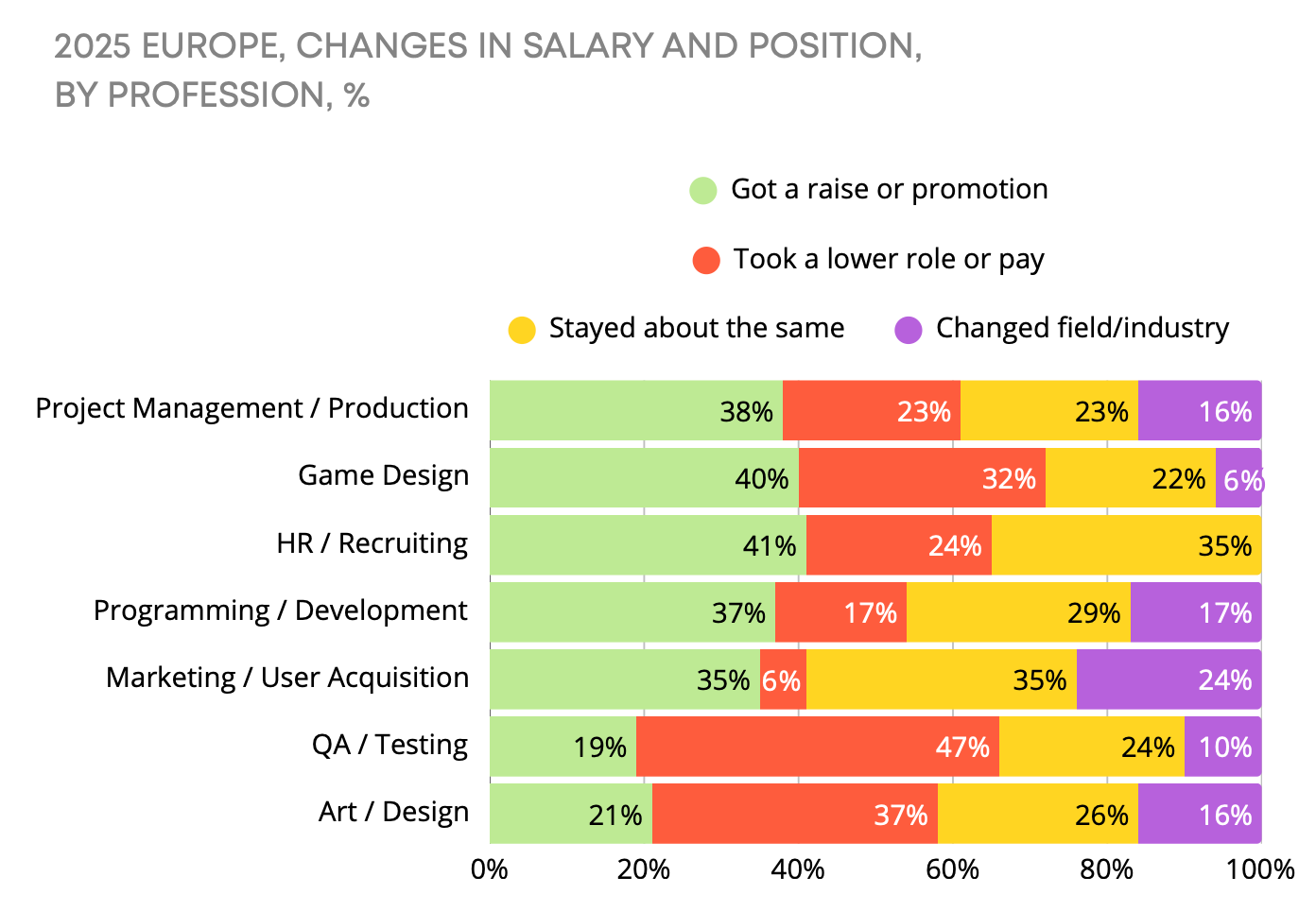

Moving to a new employer results in a promotion in only 32.6% of cases. In 27.7% of cases, candidates accepted a lower salary or position; in 26.7%, salary and title stayed the same. In 13.1% of cases, candidates left the games industry altogether.

The picture looks particularly grim for junior specialists. Not only do they earn the least, but when they change jobs, their chances of getting a promotion are much lower (13%) than for more experienced colleagues. As a result, 38% of junior specialists ended up leaving the games industry.

Openness to relocation is highest among top managers. The least willing to move are marketers, UA specialists, brand managers, and PR professionals.

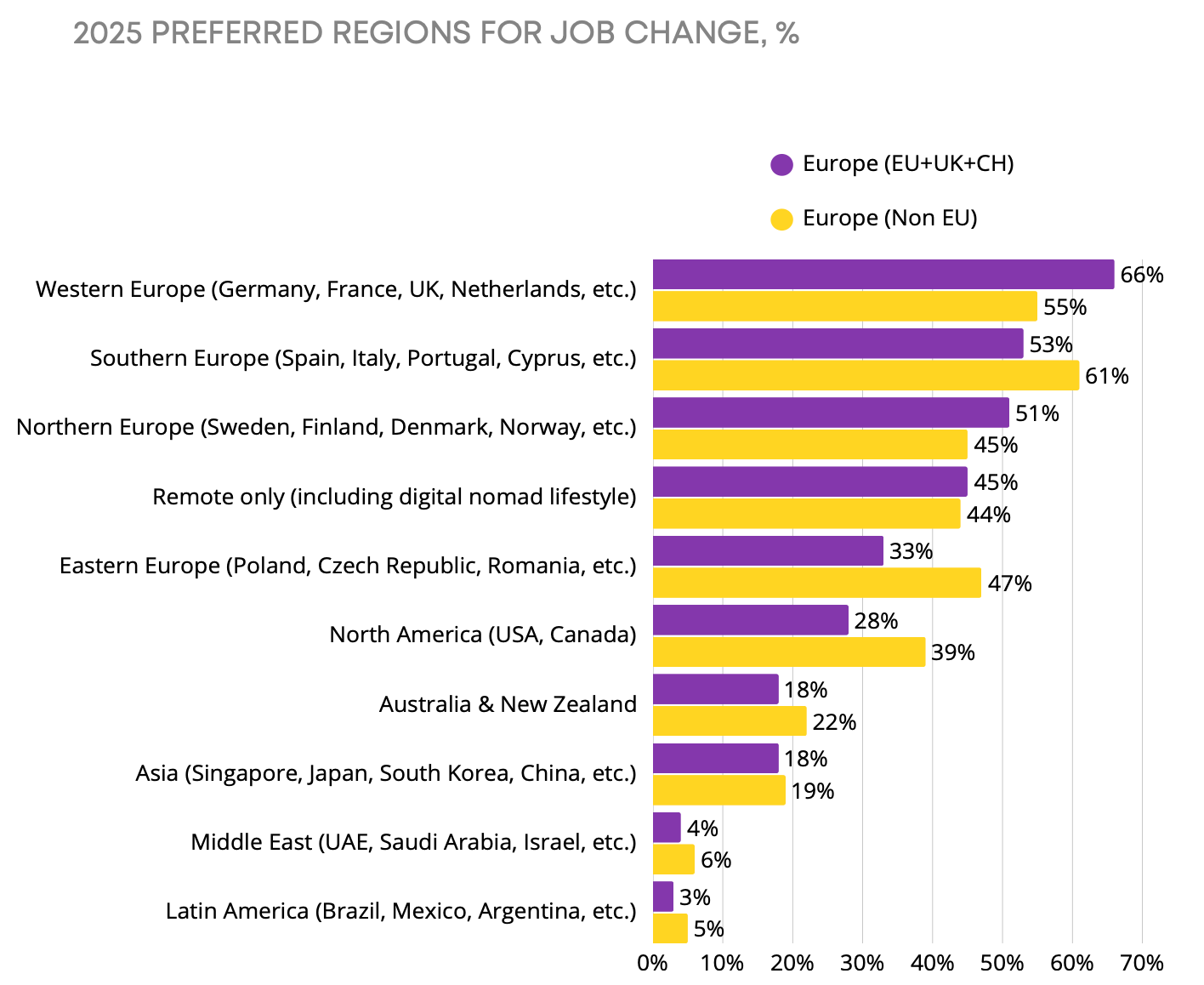

For specialists from Europe (EU+UK+CH), the preferred relocation destinations are Western Europe (66%), Southern Europe (53%), and Northern Europe (51%).

Candidates from European countries outside the EU show a stronger preference for Eastern Europe and the U.S., and are less interested in moving to Western Europe.

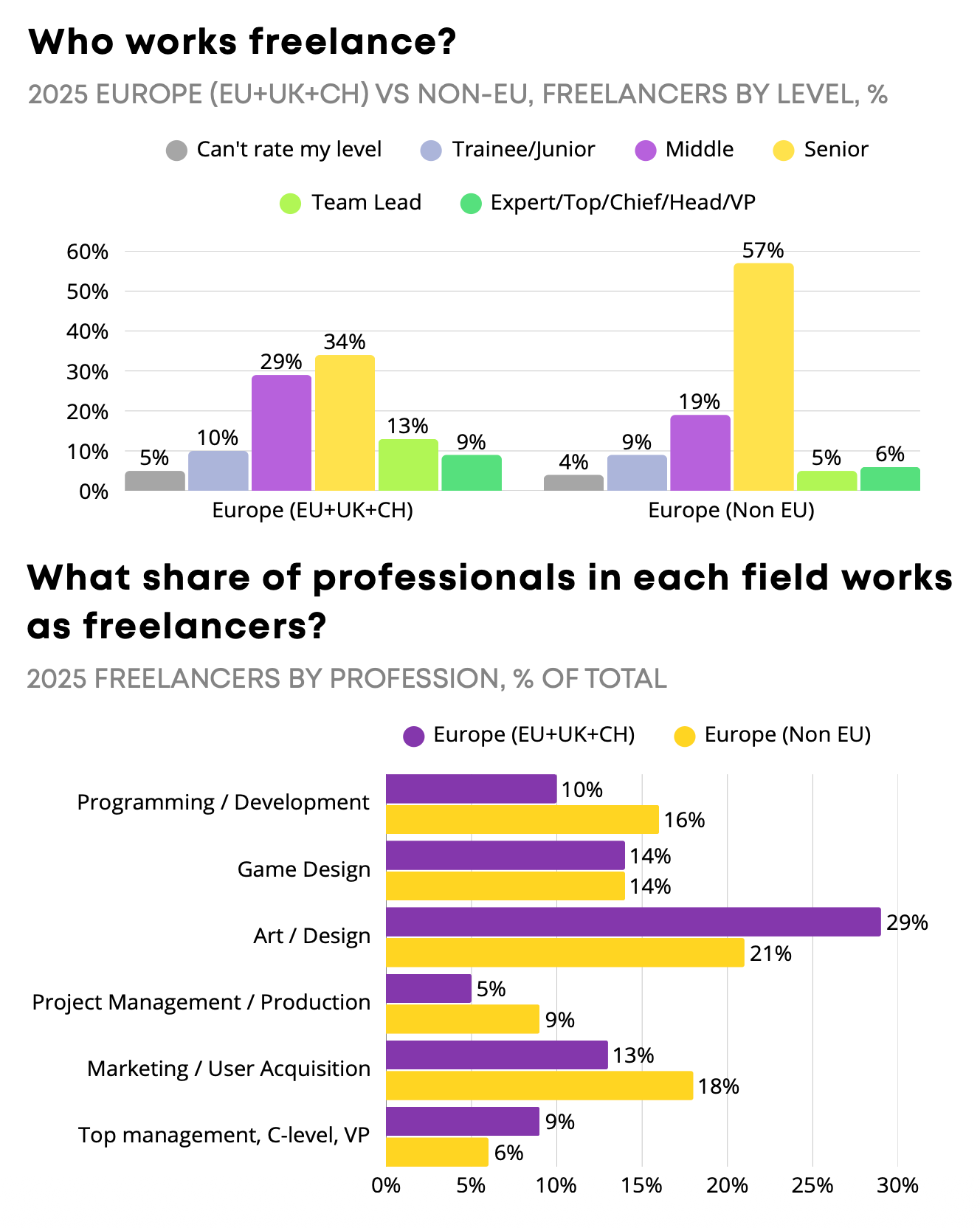

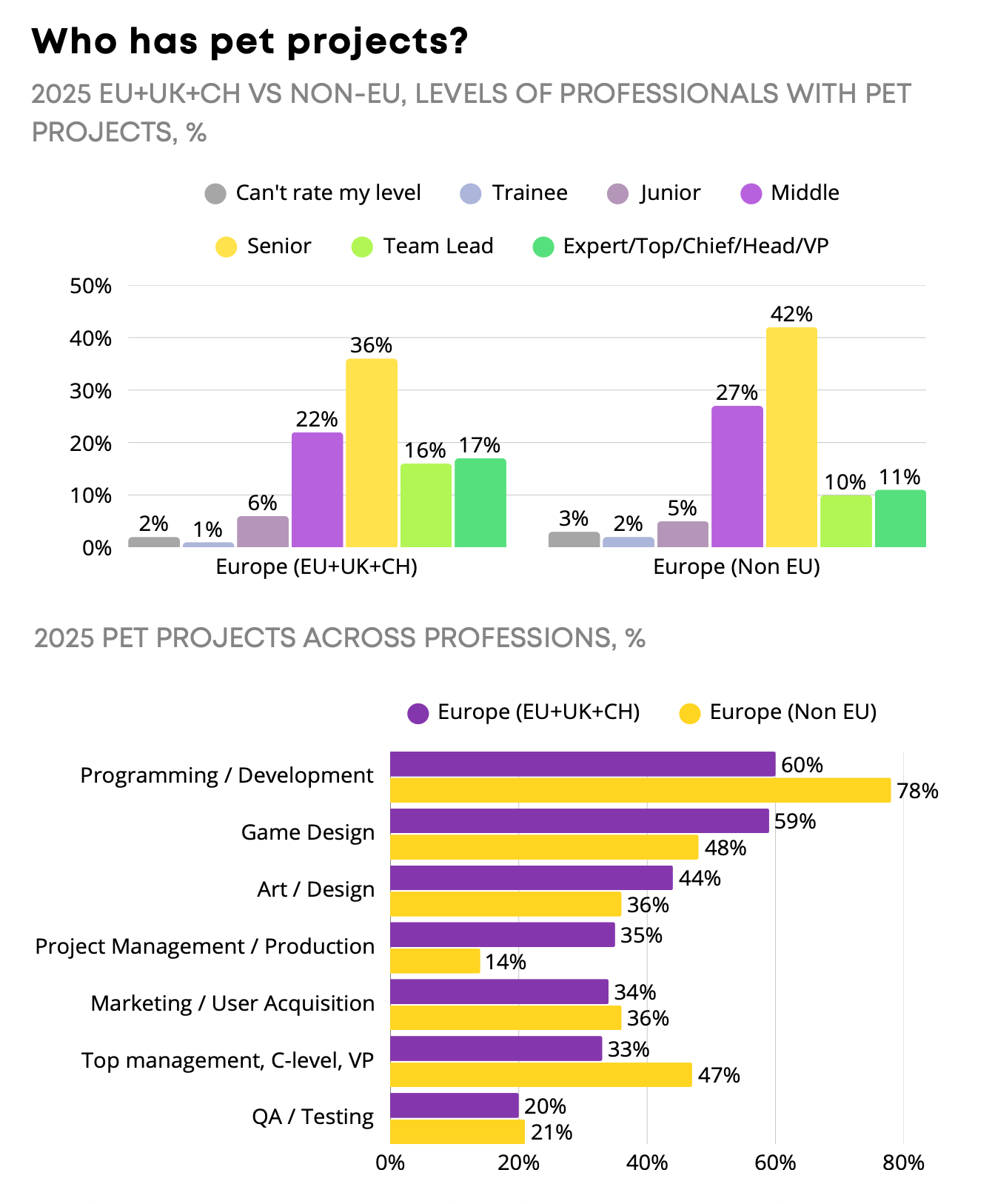

Freelance and side projects

A large number of professionals work freelance, especially artists and developers.

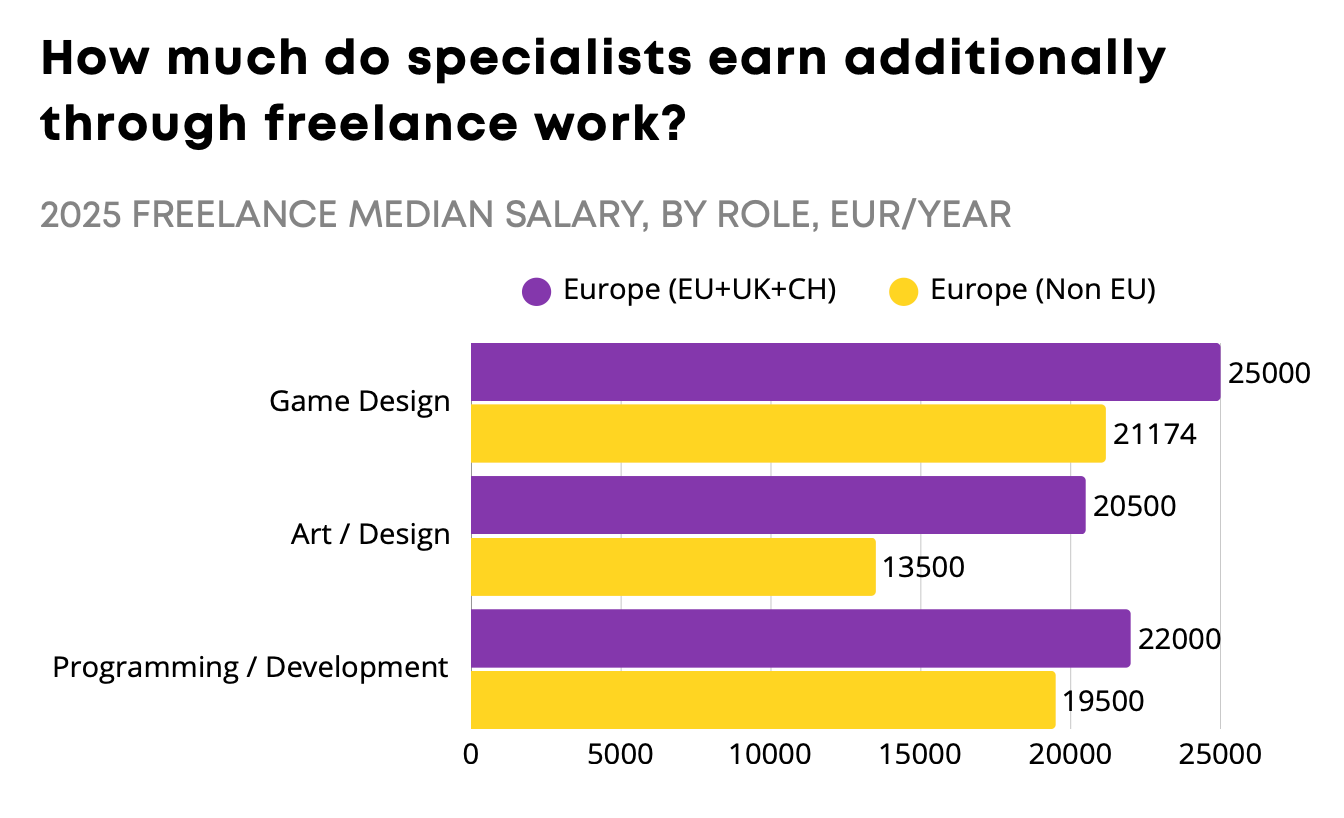

Median income from side projects ranges from 13,500 euros (for artists from European countries outside the EU) to 25,000 euros (for game designers from Europe (EU+UK+CH)).

Almost half of senior-level employees have their own side projects. Naturally, people without experience rarely have personal projects, but it is interesting that leads and top managers also have them less often. I think this is related to the high workload and greater financial involvement (those roles more often come with bonus systems and royalties).

Well-being, overtime, and working conditions

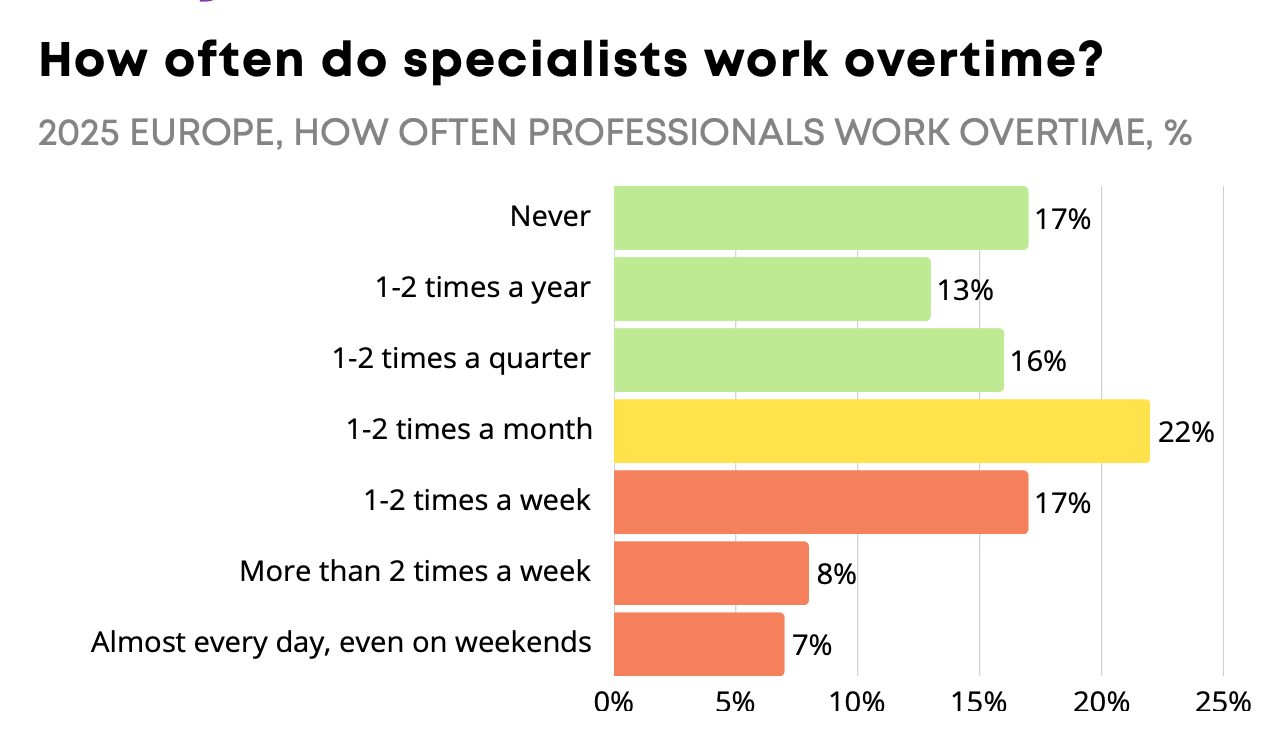

32% of respondents work overtime more than once a week. At the same time, 46% work beyond their contracted hours no more than 1–2 times per quarter.

Managers and top management work overtime the most often (43%). In second place are mid-level specialists. Senior-level employees work overtime the least (25%).

Attitudes toward overtime in Europe have barely changed since last year. 44% of respondents are okay with overtime if there is a reasonable justification.

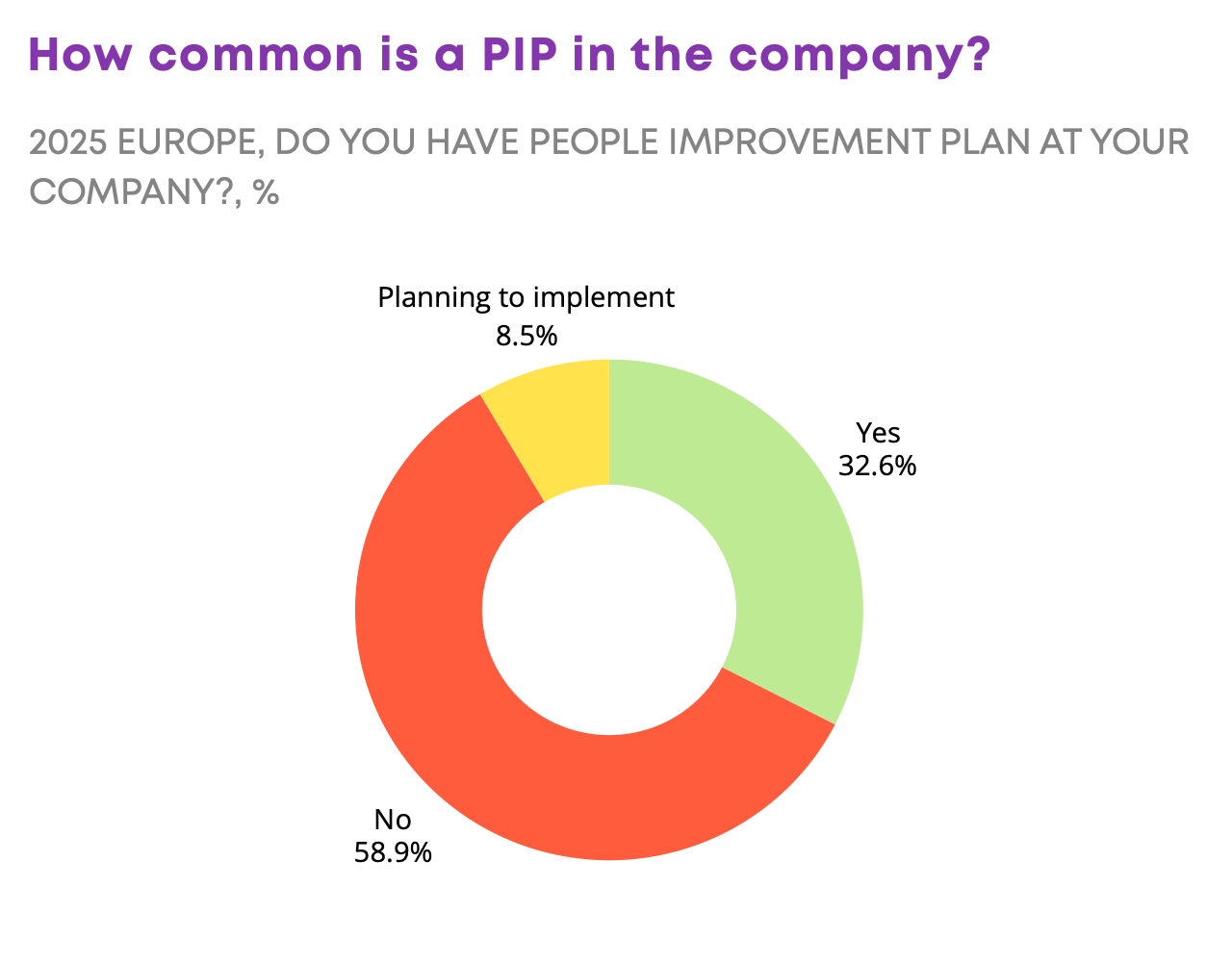

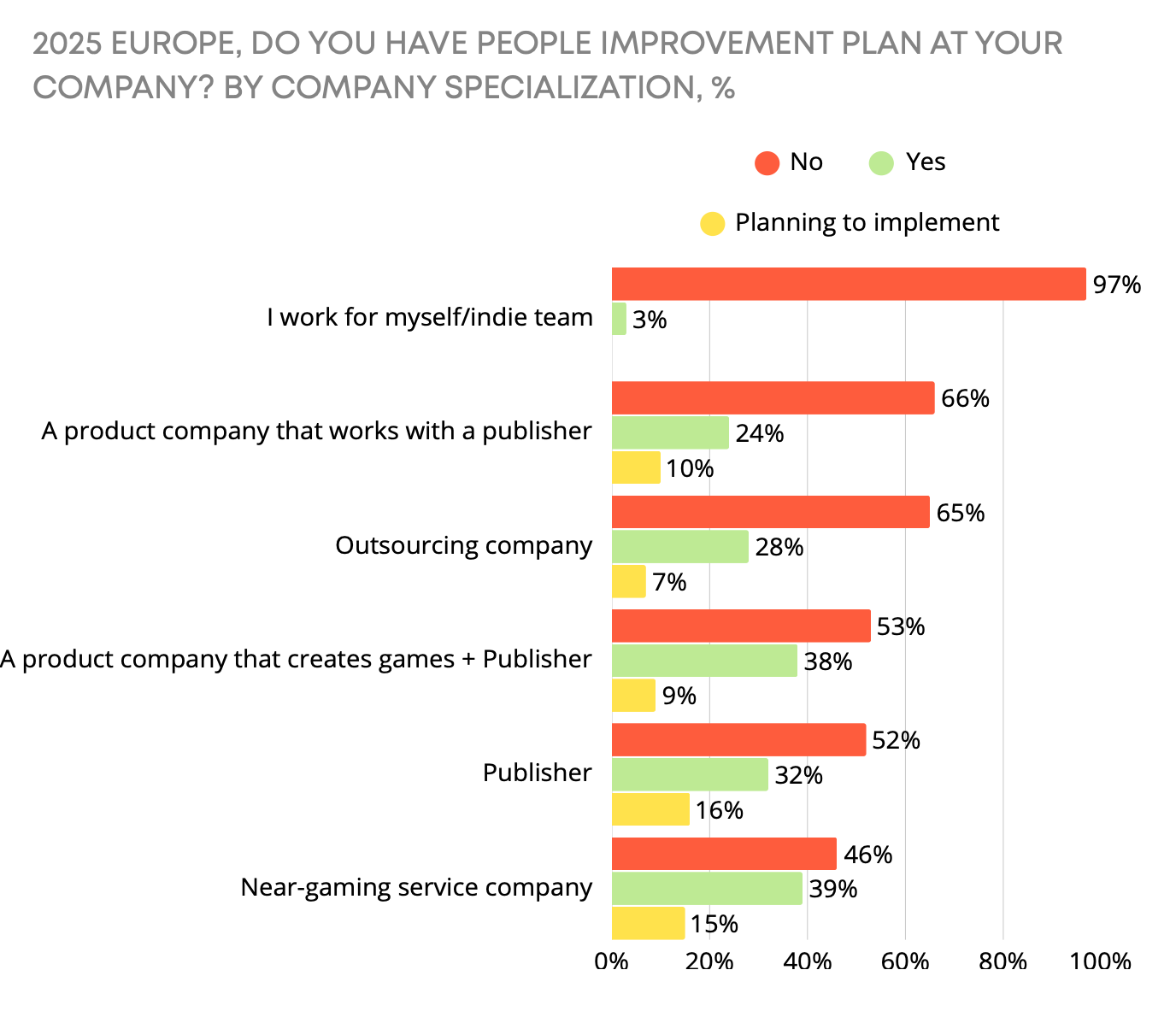

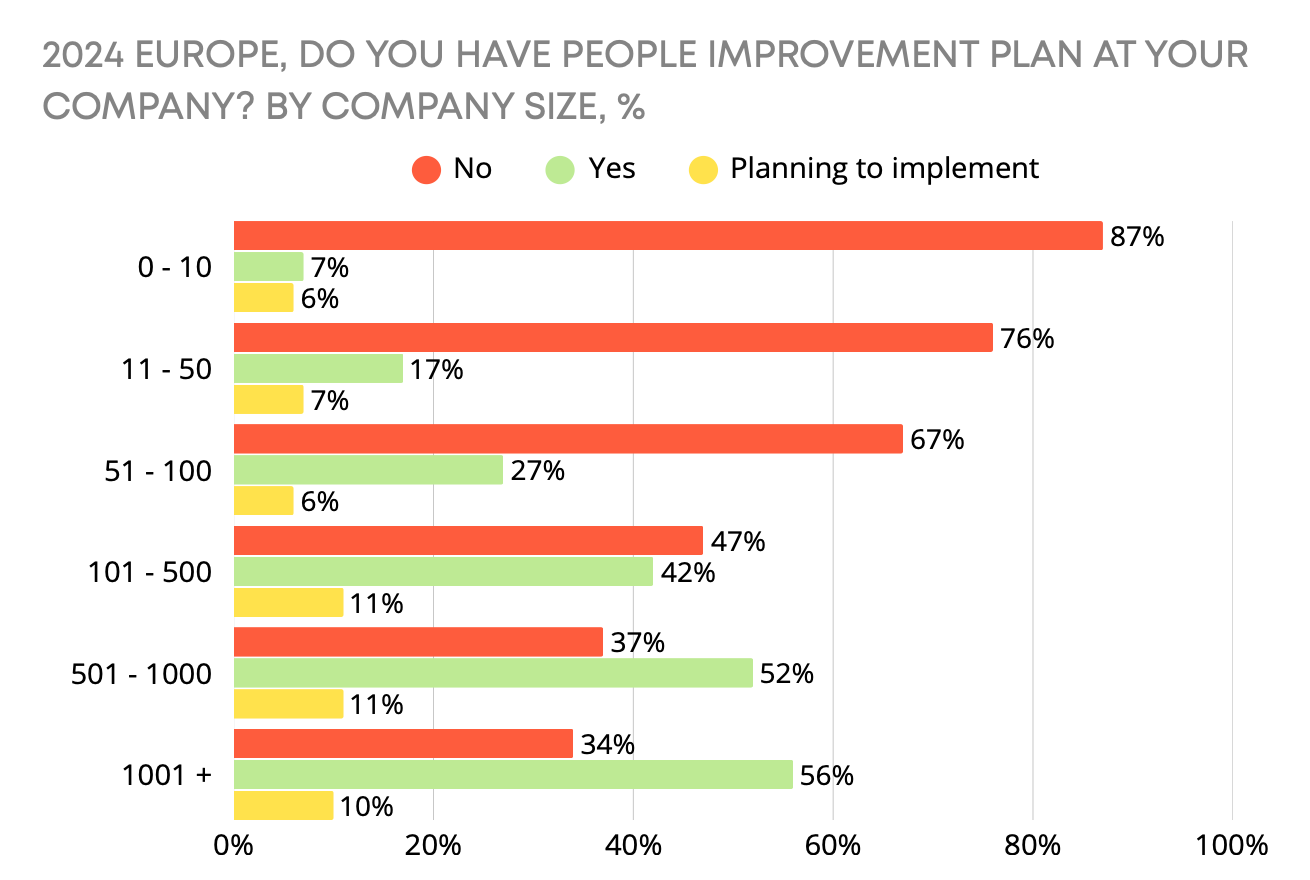

In 58.9% of companies, there is no employee development plan. This is most common in small teams and outsourcing companies. The larger the company, the higher the chance that such a program exists.

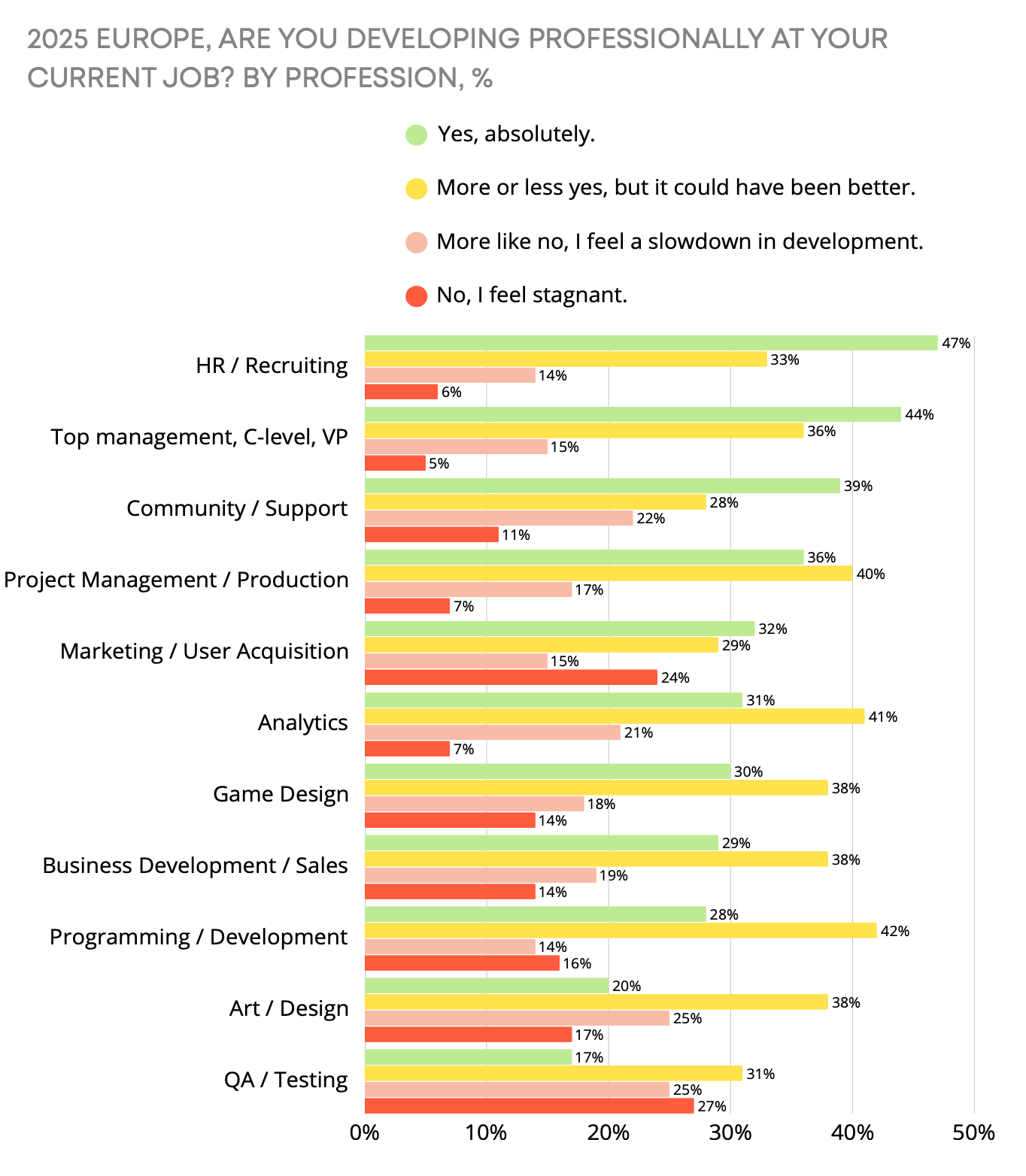

Those who report feeling professional growth are mainly HR/recruitment staff, top managers, support, and community teams.

QA specialists, artists, designers, and developers report more problems. Many respondents said they are either stagnating or their growth has slowed significantly.

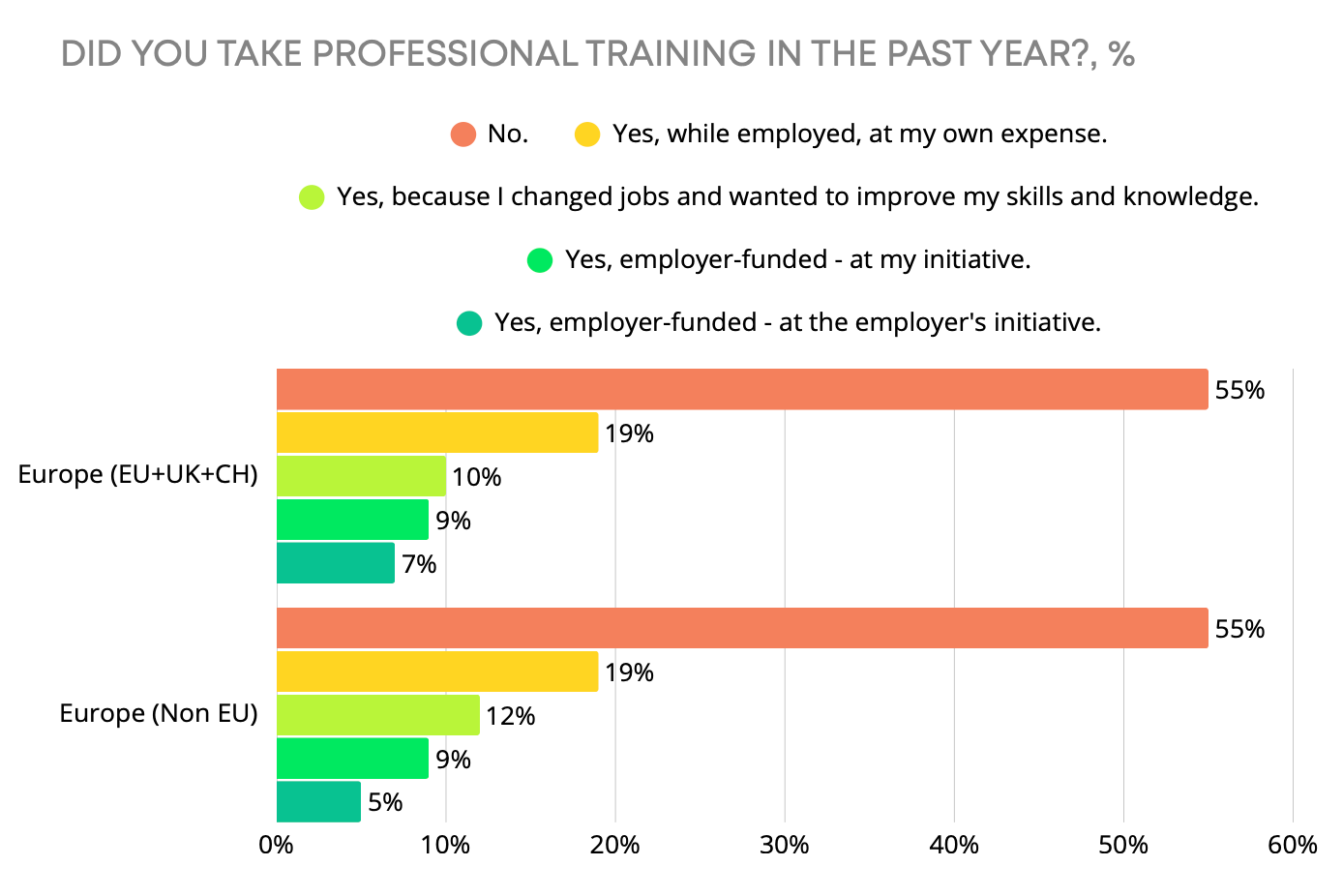

55% of employees in Europe did not receive any training in the last year.

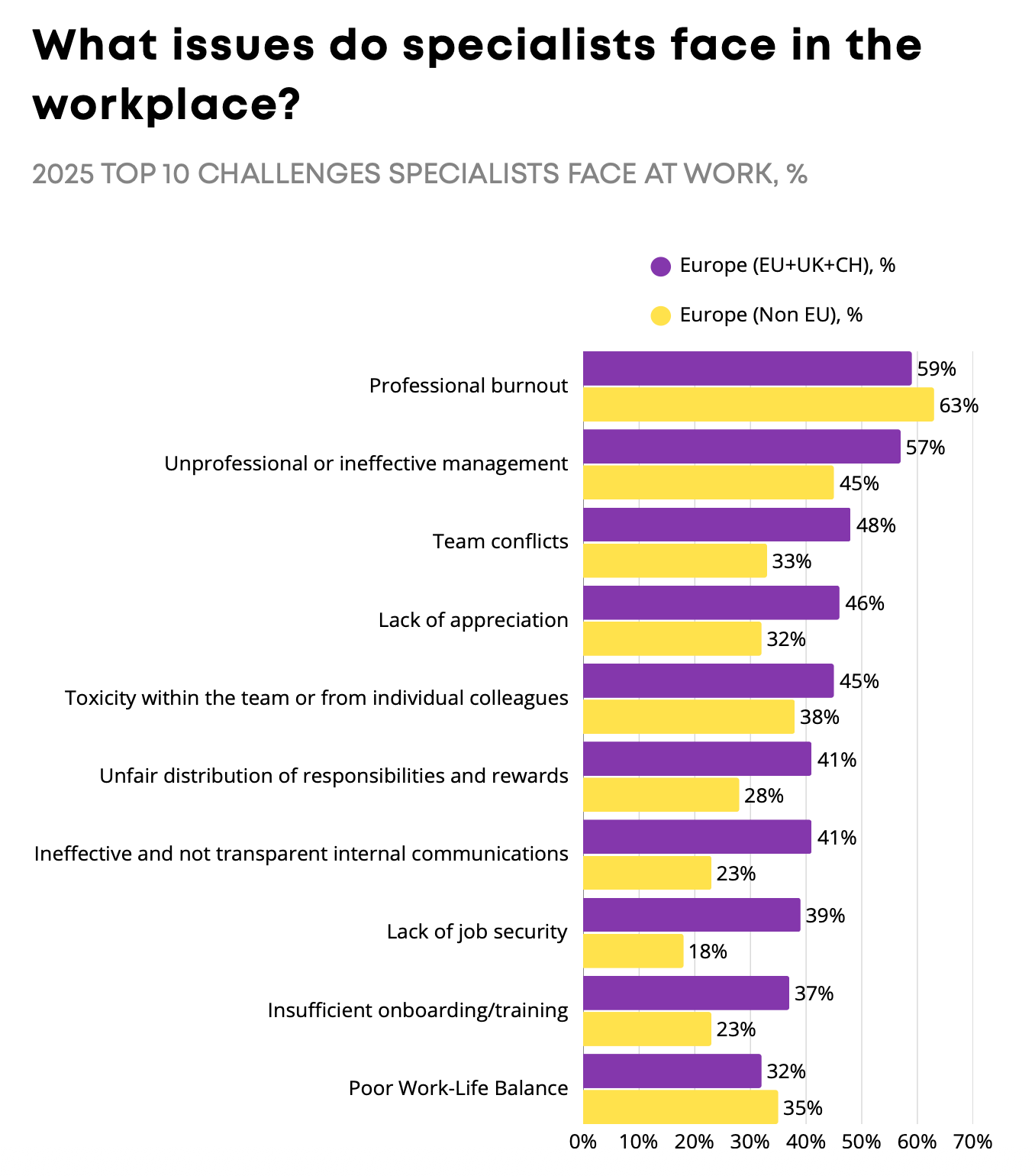

The main problems employees face at work are professional burnout, ineffective (or unprofessional) management, and conflicts within the team.

Diversity and Inclusion (D&I)

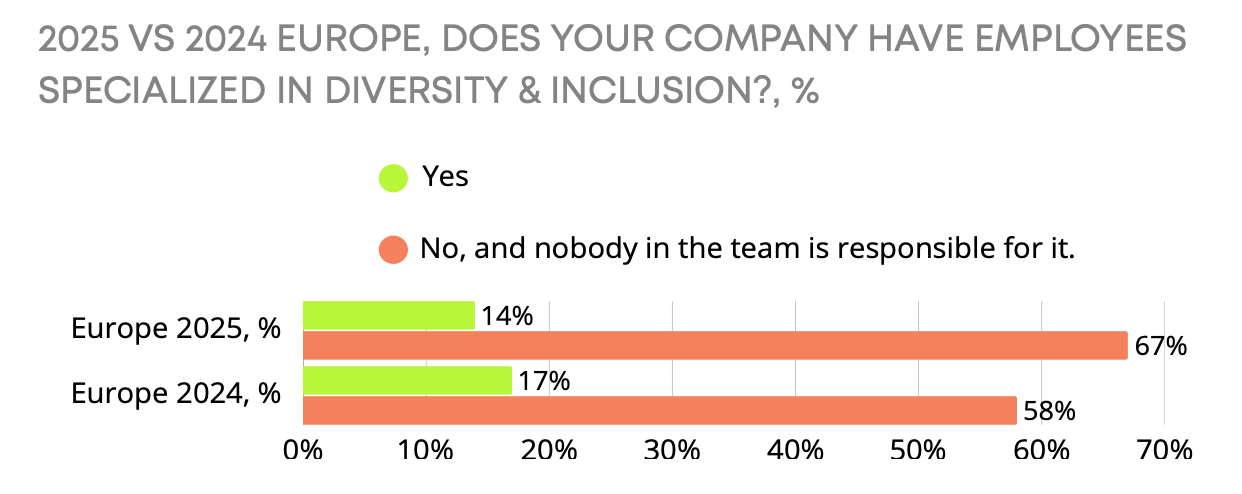

The number of D&I specialists in companies decreased in 2025.

Where people want to work

CD Projekt RED, Larian Studios, and Blizzard Entertainment are the top three companies among respondents.

Most respondents want to work on large-scale RPGs. Often, their preferences do not match the genres they currently work in.

Great data synthesis on the employment landscape. That correlation between overtime frequency and eNPS is brutally clear, especially the sweet spot at 1-2 times per quarter. I've watched teams burn out when crunch becomes the default, and this survey data really backs up what everyone intuitively knows but companies keep ignoring.