Weekly Gaming Reports Recap: February 10 - February 14 (2025)

Investments in Turkiye in the last 5 years from InvestGame, and a lot of Steam data including the most popular engines on Steam.

Reports of the week:

Video Game Insights: Game Engines on Steam in 2025

InvestGame: Investment activity in Turkiye in the last 5 years

GameDiscoverCo: Top PlayStation and Xbox games by DAU in 2024

How to Market a Game: Steam in 2024

Video Game Insights: Game Engines on Steam in 2025

The sample size is over 13,000 games on Steam.

Overall state of engines in the market

51% of all games released on Steam in 2024 were made with Unity. 28% were made with Unreal Engine, 5% - with Godot, 4% - with GameMaker.

However, when it comes to revenue, the situation changes dramatically. 41% of all money was earned by games on custom internal engines (mainly AAA projects). Games on Unreal Engine earned 31%, while on Unity - 26%. The shares of other engines in revenue are minimal.

When looking at projects by category, several dependencies are visible. Smaller projects are most often made with Unity, Godot, and GameMaker. The more successful the project, the more likely it's made with a custom engine. It's also evident that Unreal Engine is more popular among developers working on medium-sized and larger projects.

Trends in engine usage over the past 13 years

The popularity of custom engines is decreasing. In 2012, 71% of all games were released on them, while in 2024 - only 13%. This is due to the growth in the number of indie projects, increased accessibility of public engines, as well as high costs of maintaining proprietary engines.

Unreal Engine has been gradually capturing a larger market share since 2015. Unity, on the other hand, has started to lose some ground since 2021.

The popularity of Godot and GameMaker has grown over the past few years, mainly among small teams.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

When looking at engines in the revenue structure, custom engines account for 42% of all money earned. For the first time since 2014, they accounted for less than half of all revenue on Steam.

❗️This was likely influenced by two factors: firstly, there are AAA developers who have completely switched to Unreal Engine 5. Secondly, there's pressure from small developers and their financial success on the platform.

2024 turned out to be extremely successful for games on Unreal Engine. Projects on this engine account for 31% of all money earned on Steam. For the first time since 2018, more than projects on Unity.

Video Game Insights predicts that the share of custom engines in the market will continue to fall while the role of Unreal Engine will grow.

The transition from a proprietary engine to a public one is associated with many factors - both positive (develops faster; large community; often - turns out cheaper than maintaining an internal team; easier to hire people) and negative (pricing can be unpredictable; the engine needs to be customized for own needs; lack of control; cost of transitioning from one engine to another).

The share of Unreal Engine 5 reached 72% in 2024. Adaptation is taking a bit longer than with Unreal Engine 4.

Some of the biggest games of 2024 were made with Unreal Engine - Black Myth: Wukong, Palworld, Manor Lords, Final Fantasy VII: Rebirth; S.T.A.L.K.E.R. 2.

Godot is the only small engine that has grown significantly in recent years.

Statistics show that the choice of game engine heavily depends on the genre. Unity is popular among creators of city builders, turn-based RPGs, Roguelike projects. Unreal Engine's popularity is significantly higher among FPS, Souls-like projects, Action RPGs.

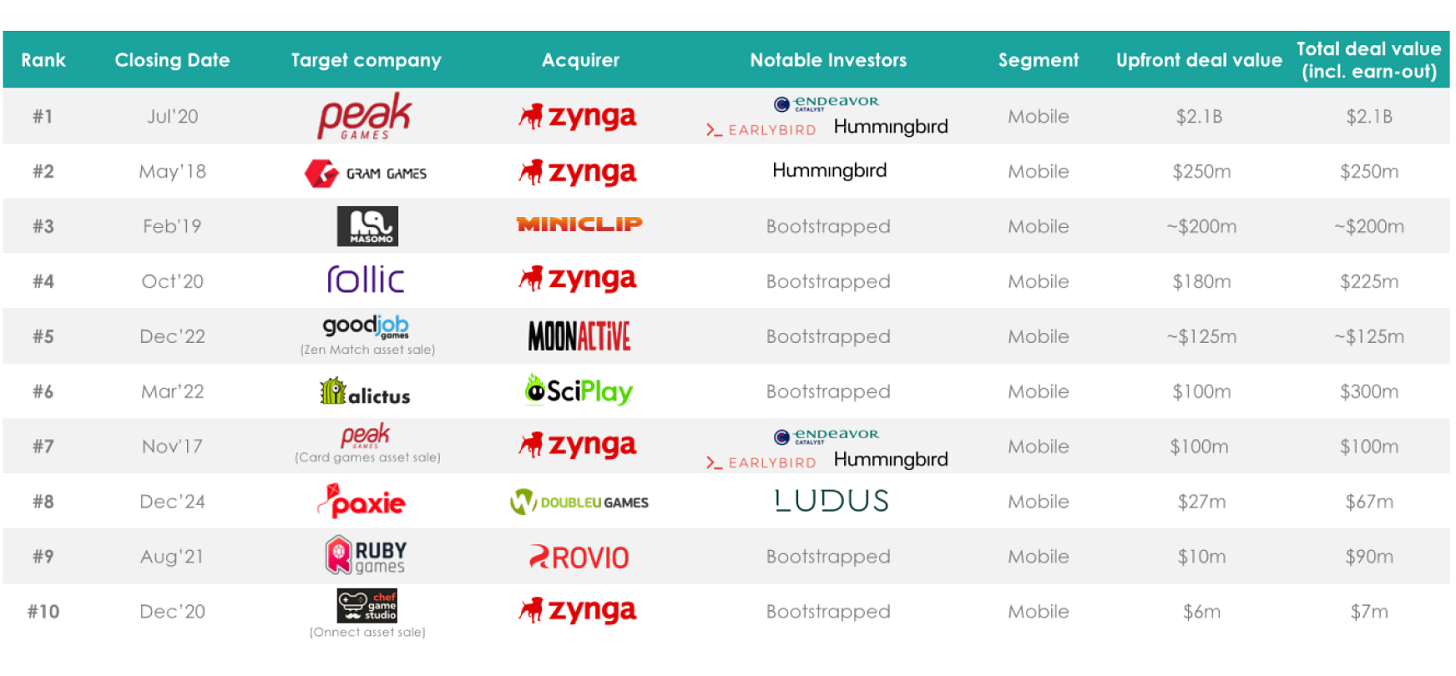

InvestGame: Investment activity in Turkiye in the last 5 years

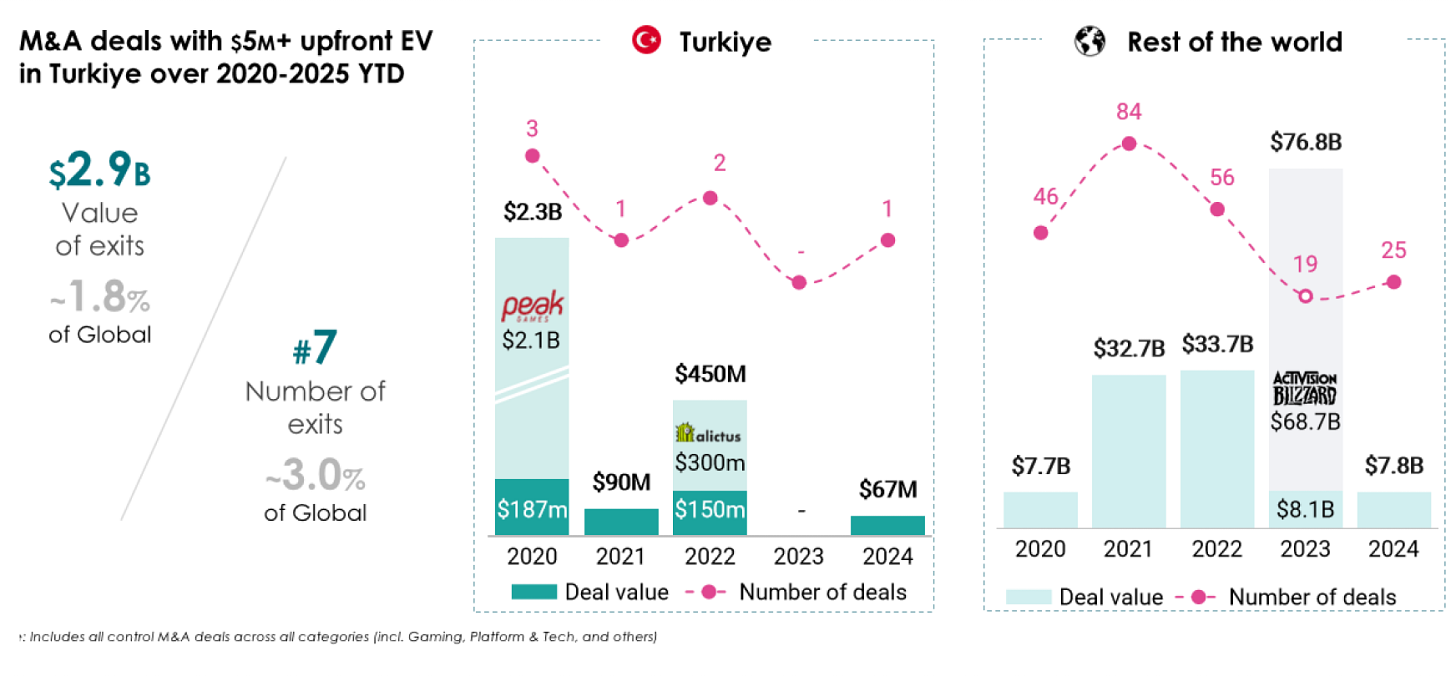

The InvestGame team studied the state of one of the most active countries for game investments in the world - Turkiye. Data is collected from 2020 until now.

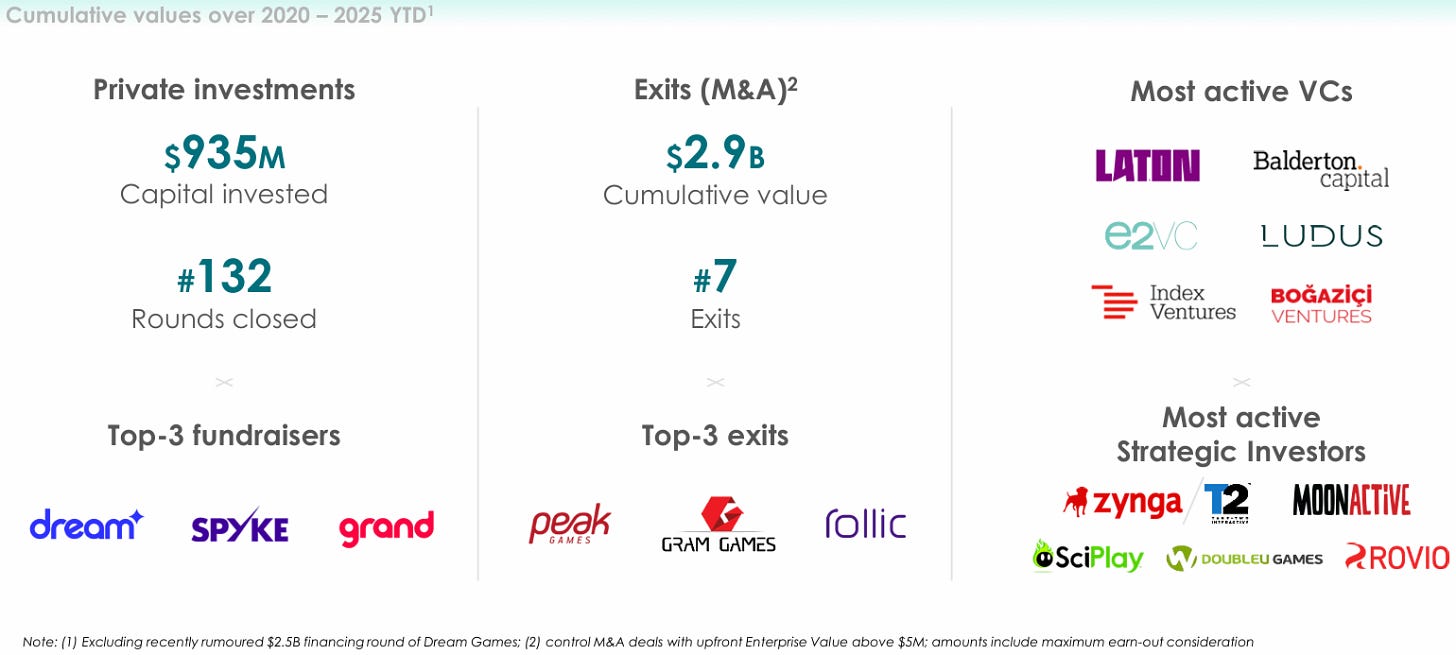

Since 2020, Turkish companies have raised $935 million through 132 rounds. The leaders in funds raised are Dream Games, Spyke Games, and Grand Games.

Since 2020, Turkish companies have made 7 exits totaling $2.9 billion (this figure includes earn-outs). The leaders are Peak Games, Gram Games, and Rollic.

Laton Ventures, Balderton Capital, e2VC, Ludus Ventures, Index Ventures, and Bogazici Ventures are the most active VC funds in the country. Among strategic investors, the greatest interest in the market is shown by Zynga (Take-Two Interactive), Moon Active, SciPlay, DoubleU Games, and Rovio.

Since the beginning of 2020, Turkiye has accounted for 1.8% of the total volume of M&A transactions and 3% of all exits.

If you’re in mobile marketing or working with creatives, here’s something worth checking out — a tool built for all marketing operations. It predicts campaign performance (on iOS too), provides full metrics transparency (more than 200 of them), allows you to operate creatives easily, and has many other cool features. Details are available on the website.

All MY.GAMES’ marketing teams have been using it internally for years and are happy with how it simplifies the entire marketing cycle. If you’re interested in making your UA journey easier and more efficient, you can book a demo to see. For a better price, refer to my name!

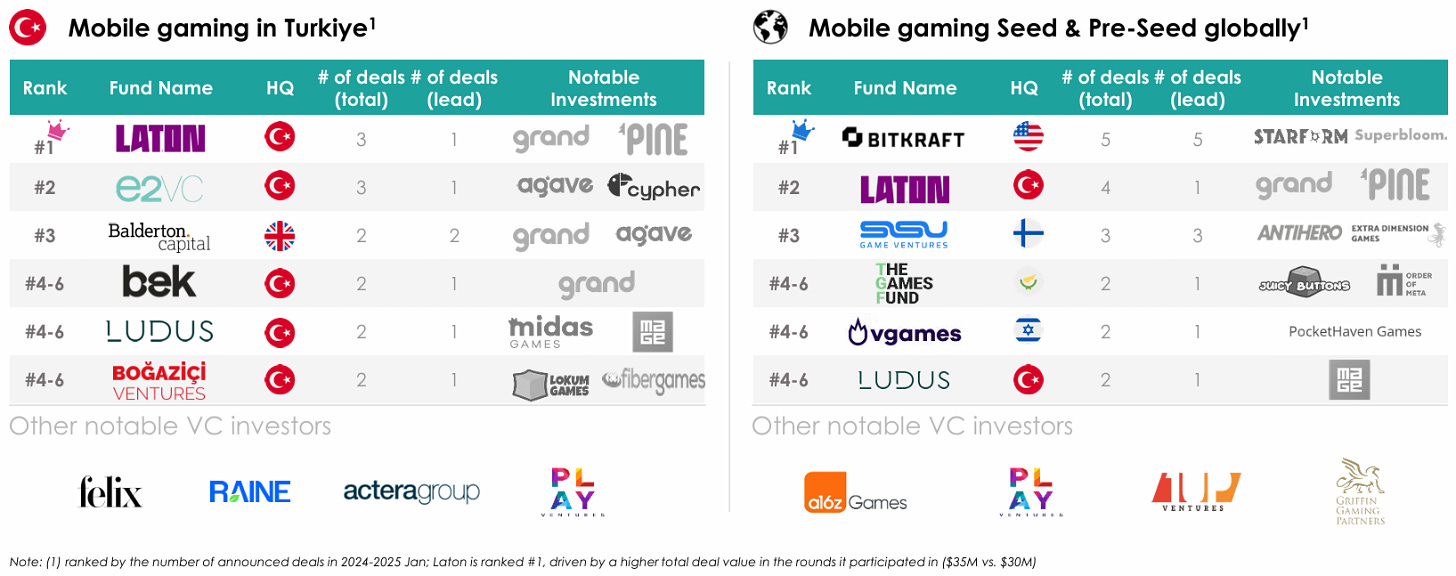

VC activity in Turkiye is noteworthy. The country has a developed investment infrastructure that allows attracting both small rounds (up to $1M) with the help of specialized investors, accelerators, and business angels and large rounds (more than $1M) with the participation of a large number of VC funds.

New players are also appearing on the market; for example, Laton Ventures began operations in Turkiye in 2024 and immediately became the leader in the number of deals in which it acted as the lead investor.

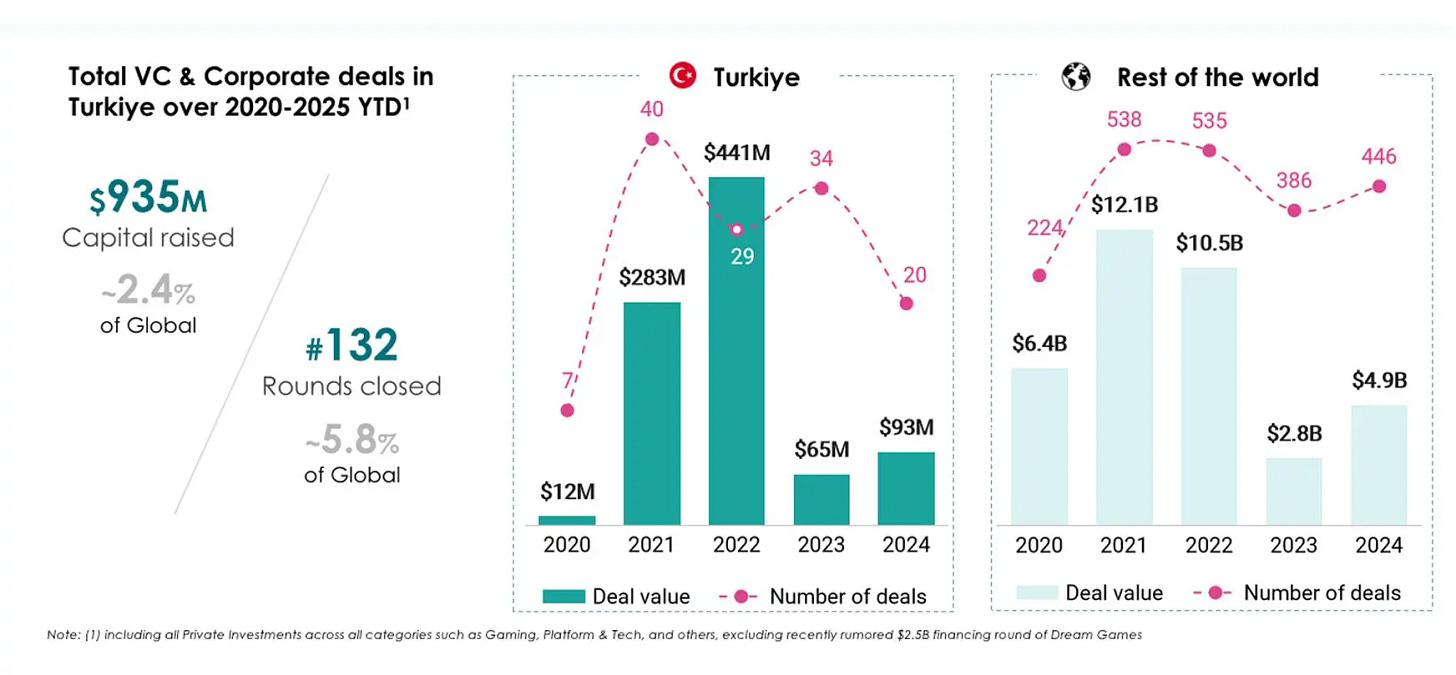

From the point of view of business activity, since 2020, Turkiye has accounted for 5.8% of all global deals in games and 2.4% of the total volume. It is noteworthy that even after the “big” years of 2021 and 2022, business activity in 2023 did not slow down - 33 early-stage deals were made. The average round size decreased (to $1.9 million per round).

In the list of the most notable Turkish startups, all are engaged in the development of casual projects. There is not a single midcore project in the top 10.

Turkiye is one of the leaders among the countries of Europe and the MENA region both in terms of the number of rounds and in terms of the volume of funds raised. Turkiye stands out from other countries in terms of investment activity at an early stage and occupies a leading position in terms of the number of M&A transactions.

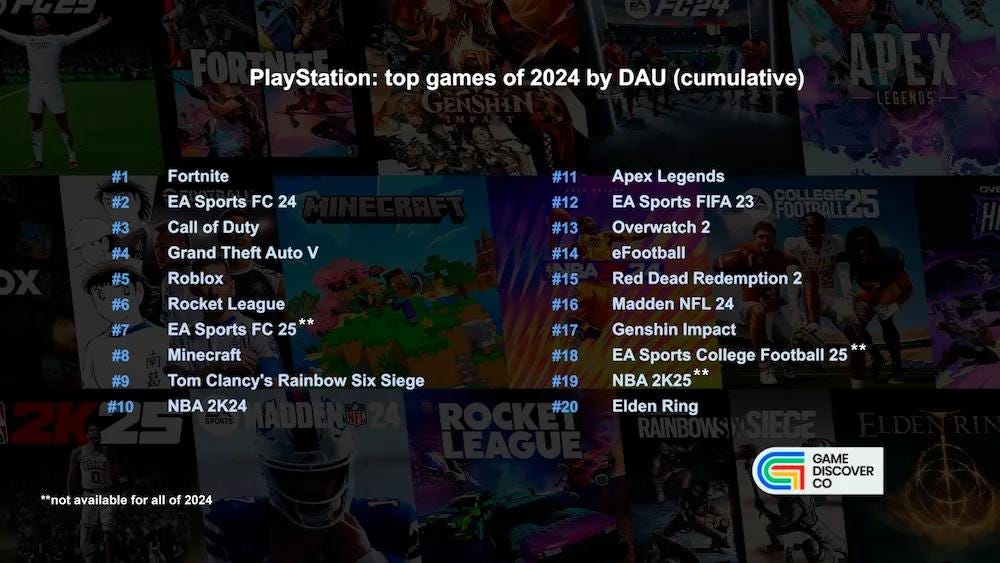

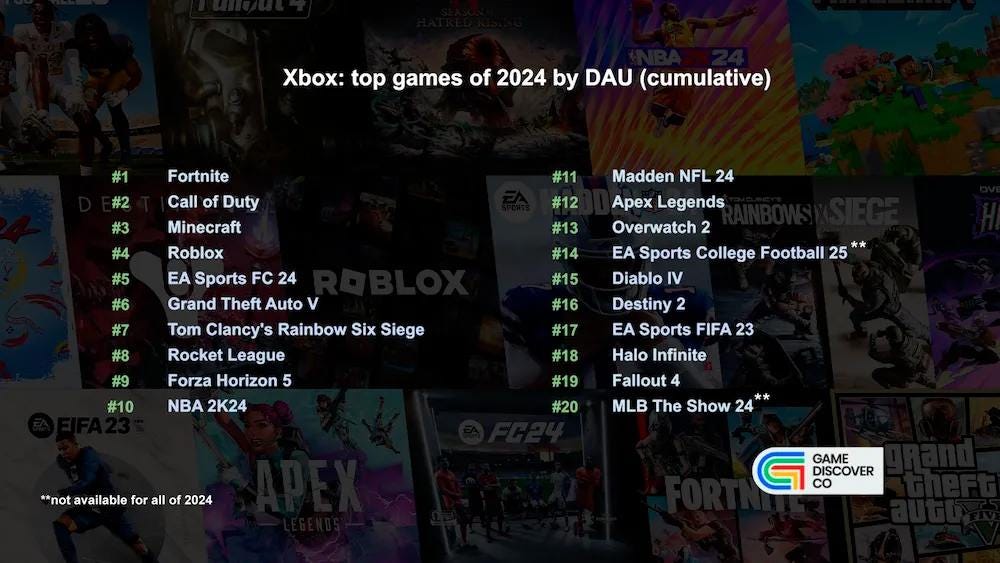

GameDiscoverCo: Top PlayStation and Xbox games by DAU in 2024

Fortnite is the clear leader on both platforms. Simon also highlights Rocket League's ability to retain its audience, ranking 6th on PlayStation and 7th on Xbox.

On PlayStation, free-to-play games eFootball and Genshin Impact made it into the DAU top list.

Sports simulators dominate, with 8 out of the top 20 games on PlayStation and Xbox being from this genre.

The list features few new projects. Among the newcomers, Marvel Rivals stands out. On Xbox, Indiana Jones and the Great Circle attracted significant audience attention (but being a single-player game, this is probably a one-time spike). All other titles are either annual releases, major franchises, or well-established games.

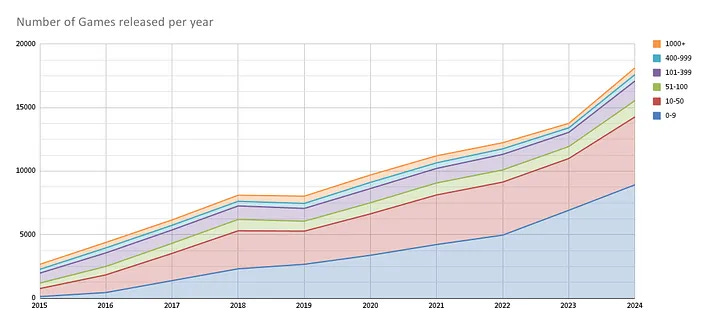

How to Market a Game: Steam in 2024

Chris Zukowski examined the state of Steam in 2024.

Figures are provided by VG Insights. Chris removed projects based on major IPs and projects not translated into English. The list includes games classified by VG Insights as AA or indie. Some projects associated with large companies (like Tencent) were manually removed from the list.

Overall market status

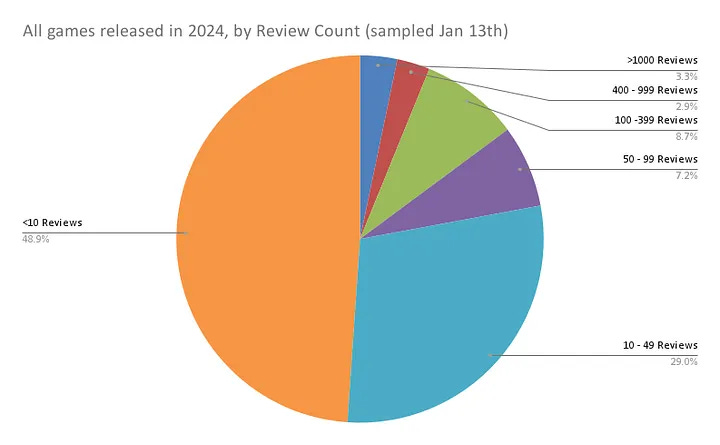

In 2024, 18,324 games were released on Steam. This is a historical record and 30.8% more than the previous year.

However, upon closer inspection, 75% of these projects have fewer than 50 reviews. There's a high probability that these are very small projects that never managed to break through the platform's information noise.

At first glance, the year seems successful for indie developers. In the 2024 calendar year, 445 indie game and AA project developers surpassed the 1,000 review mark. This is 25% more than last year.

❗️In Chris's methodology, 1,000 reviews is the benchmark at which a game can be considered successful. Of course, this is a very conditional figure.

However, considering the number of projects released to the market, the actual success rate fell to 2.44%.

Genres and Trends

Chris suggests distinguishing between trends and working genres on the platform. Many genres popular now were also popular 20 years ago. In particular, simulators have been in the top 10 for "success" for the last 3 years.

But a trend example is Vampire-Survivor-like projects. It quickly appeared at the top and just as quickly left it.

Speaking of interesting genres, horror is the #1 genre on Steam in the last 3 years in terms of "success" (number of projects that exceeded 1,000 reviews) for small developers.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

However, the above refers to absolute numbers. What's important is the probability of success. Here, Open World Survival Craft projects lead by a large margin (24.47% exceeded 1,000 reviews), followed by farming games (20.83% chance of success).

To better illustrate the picture, Chris removes from the sample all projects with fewer than 700 followers (which, according to statistics, should equal about 7,000 wishlists). In other words, the list below excludes very small projects from the sample.

The ranking, in this case, didn't change much, but it's evident that the Success Rate across all genres increased.

In 2024, 1,640 games were released on Steam in the 18+ category. Despite the large number of released projects, the share in the total volume is the lowest in the last 6 years - 8.77%.