Weekly Gaming Reports Recap: February 3 - February 7 (2025)

The US gaming market in 2024 by Circana; casual games performance in Tier-1 West countries by AppMagic.

Reports of the week:

Circana: The US gaming market in December'24 and the entire 2024

Games & Numbers (January 23 - February 4, 2025)

AppMagic: Top Mobile Games by Revenue and Downloads in January 2025

AppMagic: Casual Games Tier-1 West performance in 2024

Circana: The US gaming market in December'24 and entire 2024

General market condition

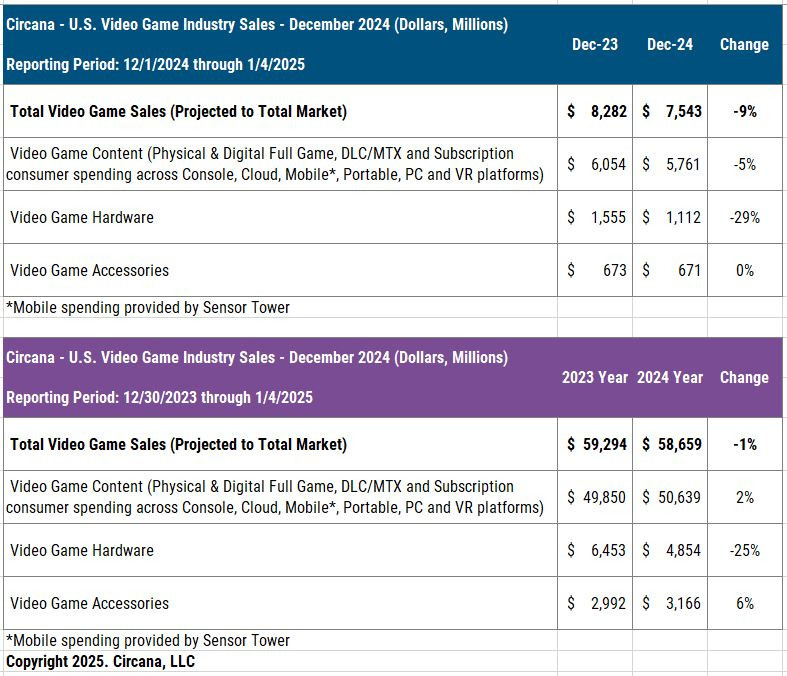

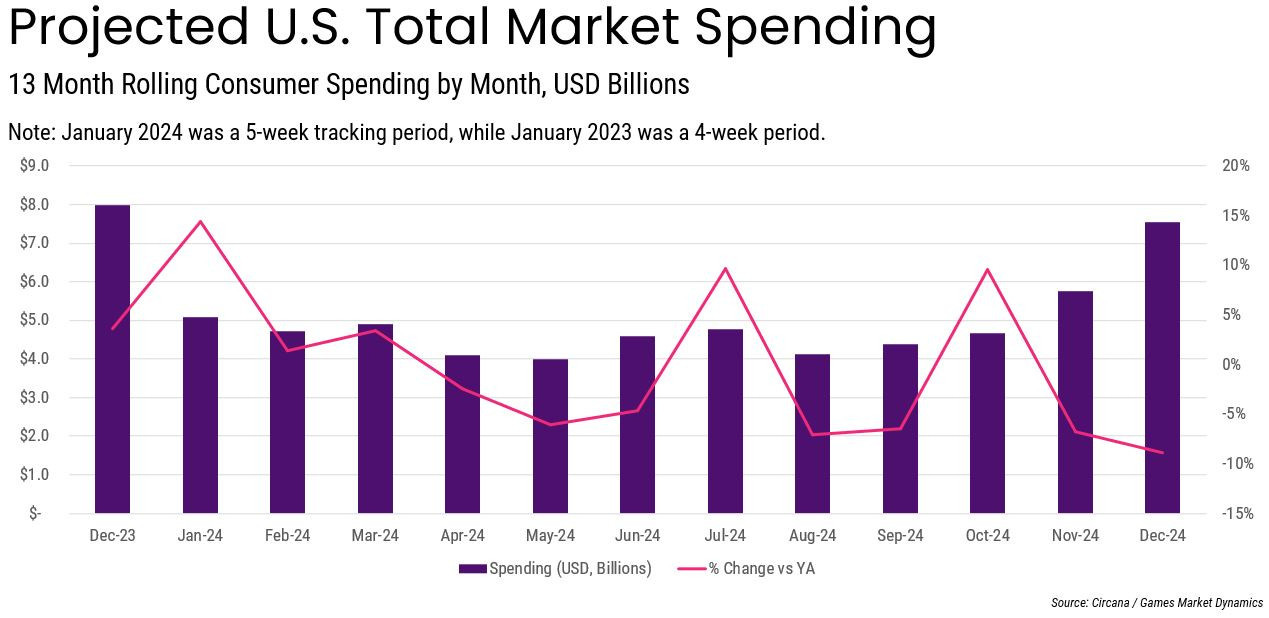

The American gaming market in December 2024 fell by 8.9% compared to the previous year - to $7.54 billion.

Gaming hardware sales dropped the most in December - by 29% YoY. Game sales fell by 5% YoY; by segments - console games fell by 21%, mobile games fell by 1%, and PC games grew by 13%. Revenue from subscription services also increased by 11%.

PlayStation 5 sales in December fell by 18% compared to December 2023. The situation is even worse for Xbox Series S|X and Nintendo Switch - sales decreased by 38%. PlayStation 5 became the most successful console in December and 2024 overall, with Nintendo Switch in second place.

After the first 50 months on the American market, PlayStation 5 is outpacing PS4 in the number of systems by 7%. And Xbox Series S|X is behind Xbox One by 18%.

49% of PlayStation 5 and 43% of Xbox Series S|X sold in December did not have a disc drive. In 2024, 45% of all PS5 purchased were without a disc drive and 44% of all Xbox Series S|X.

User spending on accessories in December remained almost unchanged - $671 million. PlayStation Portal became the most successful accessory both in December and throughout 2024, in terms of dollar sales. 4% of the PlayStation 5 audience in the US bought the accessory.

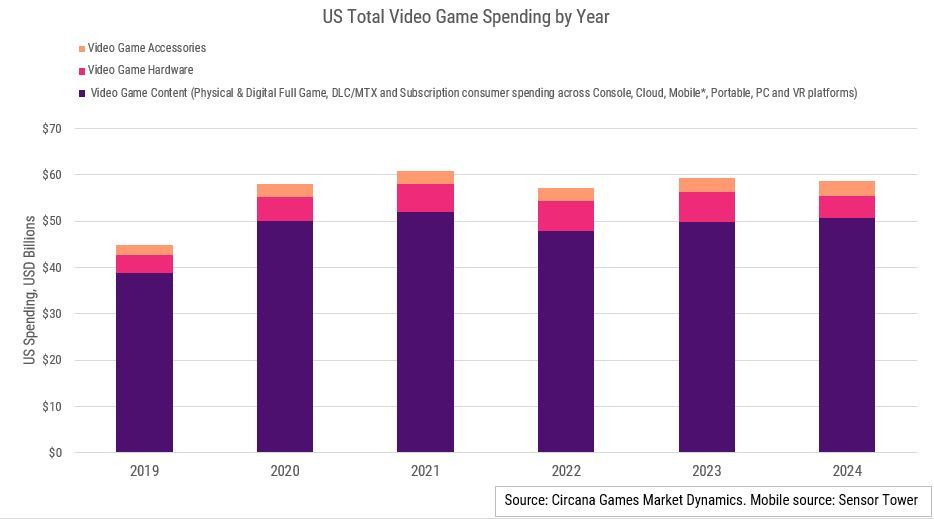

In 2024, the American gaming market also declined. The decrease was 1.1%, with a total volume of $58.7 billion.

The volume of spending on gaming content in 2024 increased by 2% compared to 2023 and reached $50.6 billion. It was only higher in 2021 ($52 billion). Growth across all categories, except for console game sales (this segment fell by 11% in 2024).

In 2024, user spending on gaming subscriptions increased by 4%. Most of the growth, it seems, comes from Game Pass.

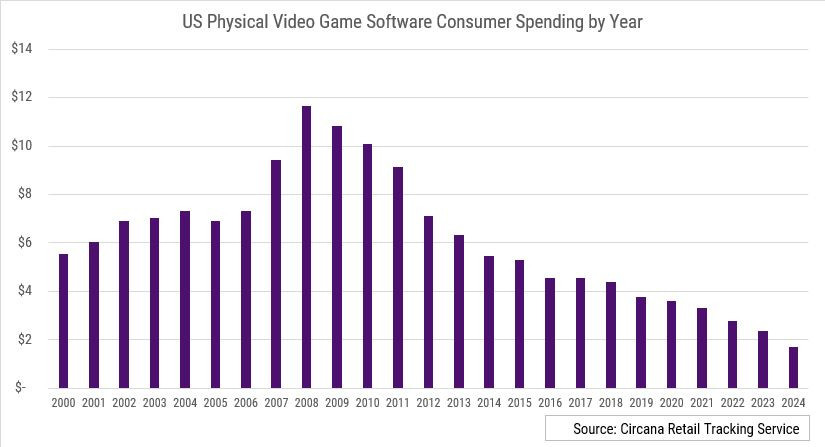

Spending on physical copies of games in the US is actively declining. The decrease compared to 2008 (peak year) in 2024 is 85%.

Total spending on gaming hardware by the end of 2024 decreased by 25% - to $4.85 billion.

PlayStation 5 is now in 3rd place in terms of hardware sales revenue. Only Nintendo Switch and Xbox 360 are ahead. At the same time, in terms of the number of systems sold, the console is in 11th place.

Spending on gaming accessories in 2024 in the US increased by 6% to $3.16 billion. The best-selling accessory in units is DualSense.

In fact, the American gaming market has been on a plateau since 2020. However the jump in revenue from 2019 to 2020 outpaced the normal growth by far.

Game sales

Call of Duty: Black Ops 6, Madden NFL 25, and EA Sports College Football 25 are the most successful games in December in terms of dollar revenue.

Indiana Jones and the Great Circle is the only December release that made it into the top 20 in revenue. The game took 14th place. At the same time, despite appearing in Xbox Game Pass at launch, the game is in 4th place in Xbox sales in December.

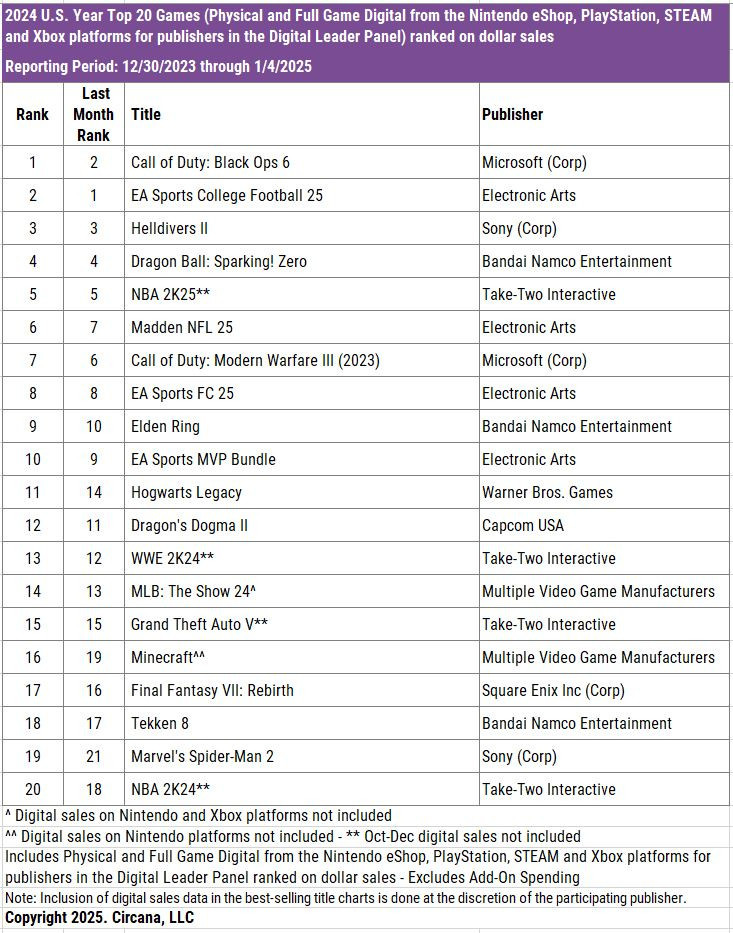

Call of Duty: Black Ops 6, EA Sports College Football 25, and Helldivers II became the best-selling games of the year. The Call of Duty series remains the revenue leader in the American market for the 16th year in a row. And EA Sports College Football 25 is the best-selling sports game in US history, if measured by dollar revenue.

MONOPOLY GO!, Roblox, and Royal Match became the highest-earning games in the US in December 2024. The data was shared by Sensor Tower. Roblox (+24% revenue compared to November) and Call of Duty: Mobile (+20% revenue compared to November) showed strong growth.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Platform rankings for 2024

Top 5 in sales on PlayStation in 2024 - Call of Duty: Black Ops 6, EA Sports College Football 25, Helldivers II, Dragon Ball: Sparking! Zero, and NBA 2K25 (for which digital sales in November-December are not accounted for). The latest hit from PlayStation - Astro Bot - is in 13th position.

On Xbox, the leaders are almost similar - EA Sports College Football 25, Call of Duty: Black Ops 6, Call of Duty: Modern Warfare III, Madden NFL 25, and NBA 2K25 (again - without digital sales in November-December).

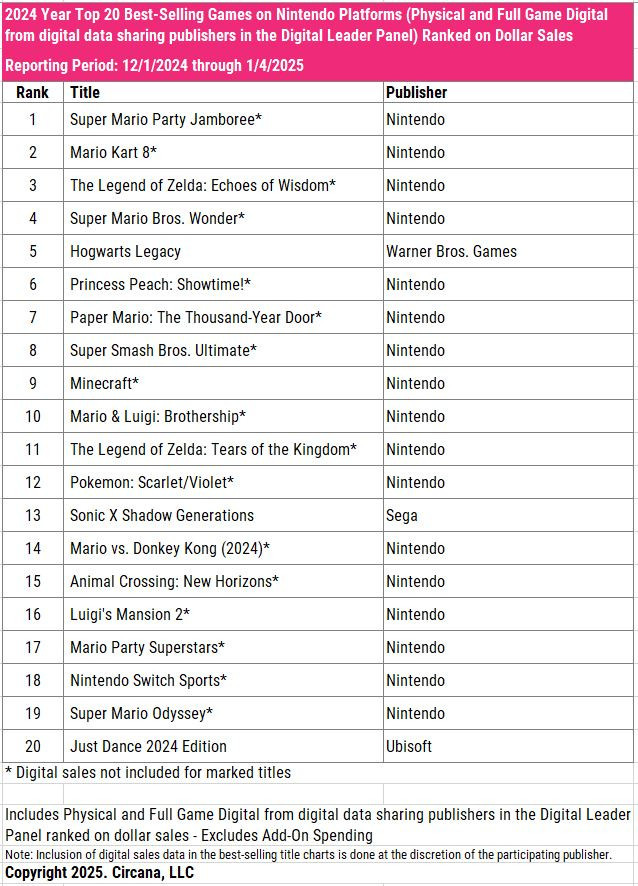

Super Mario Party Jamboree, Mario Kart 8, The Legend of Zelda: Echoes of Wisdom, Super Mario Bros. Wonder, and Hogwarts Legacy are the best-selling games on Nintendo Switch in 2024 in the US. It's important to note that for all Nintendo games, only physical copy sales are accounted for. And in the top 20 - only 3 games released by third-party developers.

Platform rankings - December 2024

The top 3 on PlayStation and Xbox by revenue are the same - Call of Duty: Black Ops 6, Madden NFL 25, and EA Sports College Football 25. On Xbox, a newcomer appeared - Indiana Jones and the Great Circle.

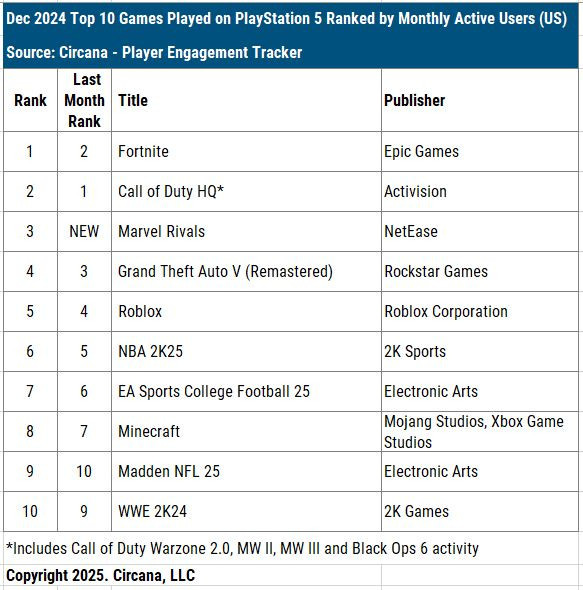

Marvel Rivals burst into the December PlayStation charts by MAU. The game took 3rd place on both platforms. On Xbox, Indiana Jones and the Great Circle also ranked 4th.

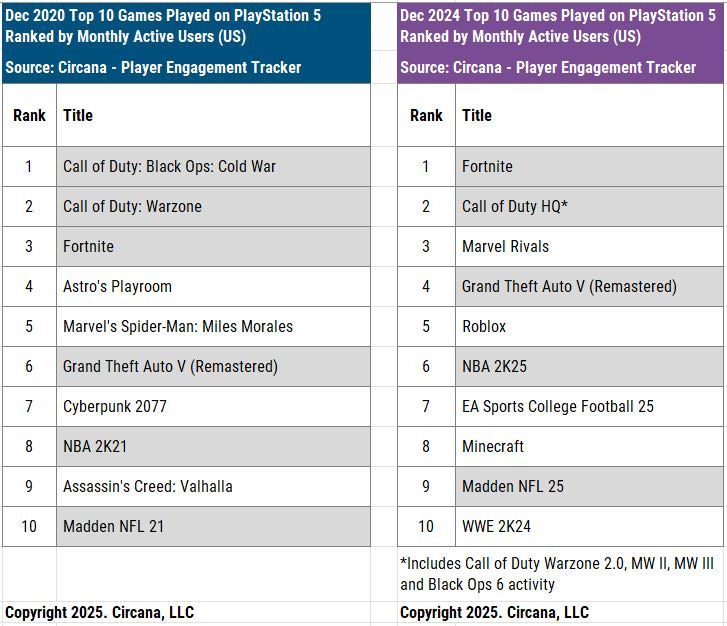

Mat Piscatella (Circana’s Executive Director, Video Games and segment analyst) showed an interesting comparison of the top MAU chart for December 2020 and 2024 on PlayStation. Look at how many major annual franchises are on the list.

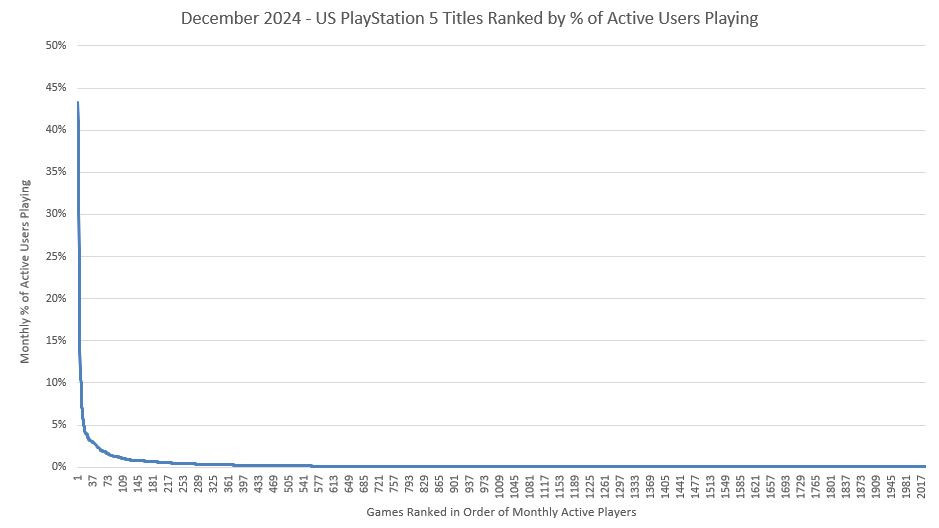

Mat also showed the distribution by active users on PlayStation in December 2024 to demonstrate how difficult it is for new games to launch. "Your new soda didn't flop because the can was the wrong color or the ads weren't great. Your new soda flopped because Coke and Pepsi suffocated them.". The analyst notes that more than 60% of players in the US buy a new game once every six months - or less frequently.

The most successful games in December on Nintendo Switch are Super Mario Party Jamboree, Mario Kart 8, and Mario & Luigi: Brothership.

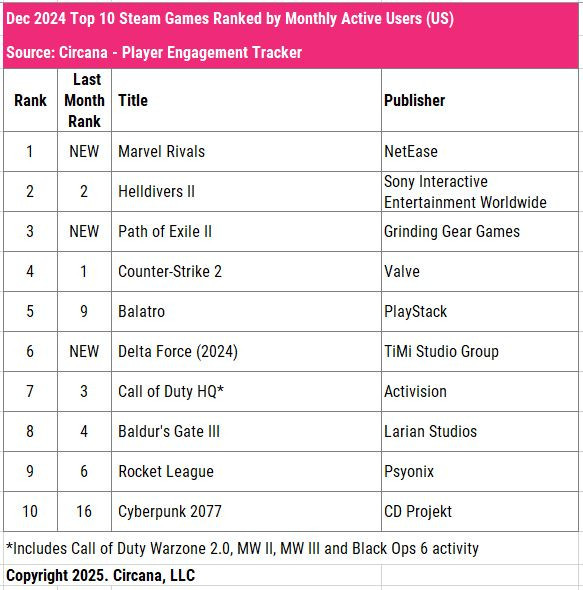

On Steam, the situation is much more vivid. Marvel Rivals is in 1st place by MAU, Path of Exile II is 3rd, Delta Force is 6th. Three newcomers!

Games & Numbers (January 23 - February 4, 2025)

PC/Console Games

Capcom reported that sales of the Monster Hunter series have exceeded 100 million copies.

Human: Fall Flat has been purchased by 55 million people. The game was released in 2016, and the developer is currently working on a sequel.

The Dying Light series has attracted more than 45 million players. In January 2023, the company reported selling 30 million copies.

Niko Partners estimates that the global sales of Black Myth: Wukong have already exceeded 25 million copies. The game was released in August 2024.

Games based on The Walking Dead franchise have earned more than $1 billion. This includes both PC/console and mobile adaptations of the series.

Fortnite creators received $352 million from Epic Games in 2024. 7 teams received more than $10 million, 14 teams - more than $3 million, 37 - more than $1 million.

DRAGON BALL: Sparking! ZERO has surpassed 5 million copies sold, which took just under 4 months. This is the best-selling part of the series, with 3 million copies sold in the first 24 hours.

Mortal Kombat 1 has been purchased more than 5 million times. The studio noted that it will continue to develop the project.

Satya Nadella reported that more than 4 million people have played Indiana Jones and the Great Circle. This is not about sales, as the game was available on Game Pass from day one.

Sales of the Silent Hill 2 remake have surpassed 2 million copies.

Pathfinder: Kingmaker has exceeded 2 million copies sold. The first million was announced in August 2021.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Prince of Persia: Lost Crown sold 1.3 million copies in its first year. However, the team that worked on the project no longer exists—some people left Ubisoft, and some switched to other projects.

Konami's eFootball has been downloaded more than 800 million times, including installs on PCs, consoles, and mobile devices.

The creators of Neopets (a browser game about collecting virtual pets) boasted an achievement of 400,000 MAU and a peak DAU of 250,000 users. An important detail: the first version of the project was launched in 1999. So it's a solid achievement!

The off-road driving simulator over the hill received more than 100,000 wishlists in the first 5 days of being on Steam. This is not the developers' first game, and they also worked with the audience on Instagram and TikTok before the launch of the Steam page, as well as secured publications in several leading media outlets together with a partner.

Mobile Games

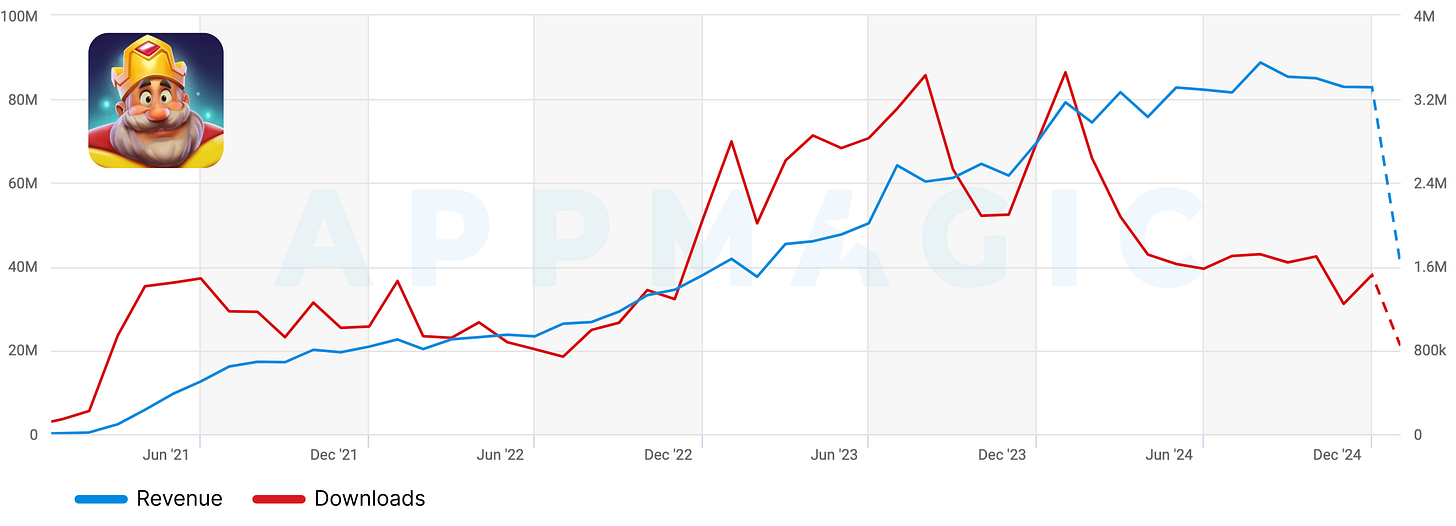

According to AppMagic, people have spent more than $5 billion on Royal Match throughout its operation. In May 2024, the same AppMagic reported $3 billion in Gross Revenue.

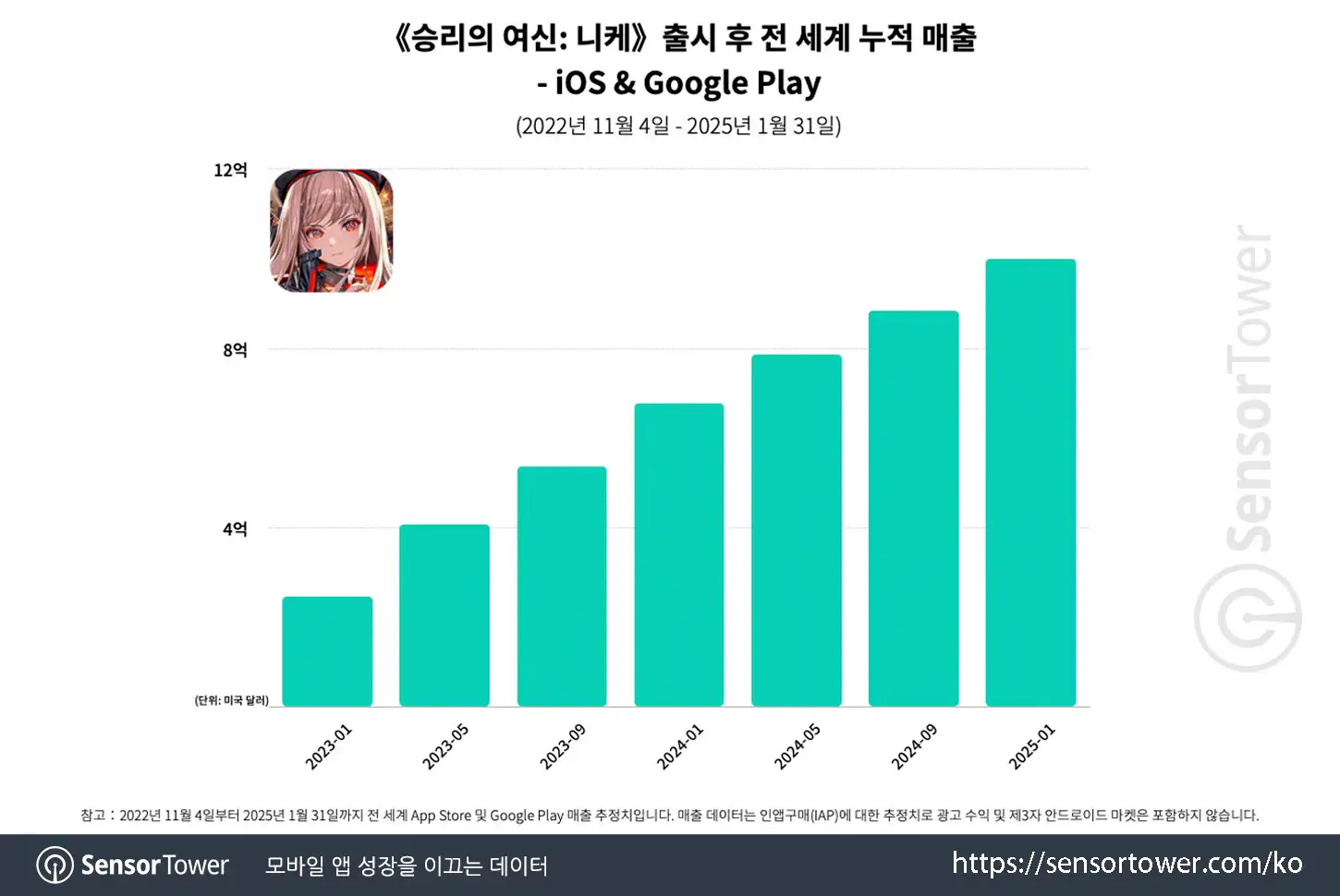

Goddess of Victory: Nikke has earned more than $1 billion on mobile devices. In Japan, the game collected 54% of revenue, in South Korea - 16.2%, in the USA - 16%. The game is also available on PC.

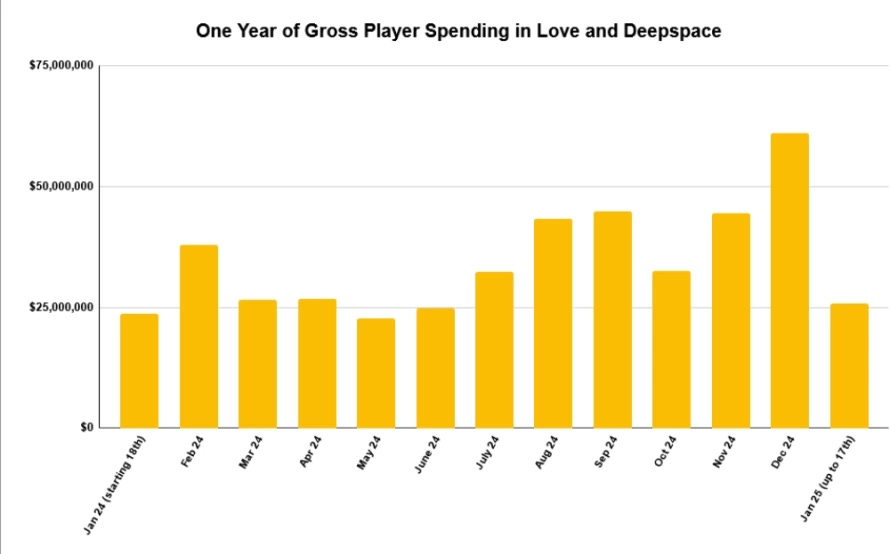

Love and Deepspace earned $400 million in its first year on mobile devices. Data from AppMagic, means the figures are without taxes and store commissions. In December, the game set a revenue record - $61 million ($10.5 million of this amount was paid by users on December 31). The developers reported in official channels that the game has been downloaded by more than 50 million people.

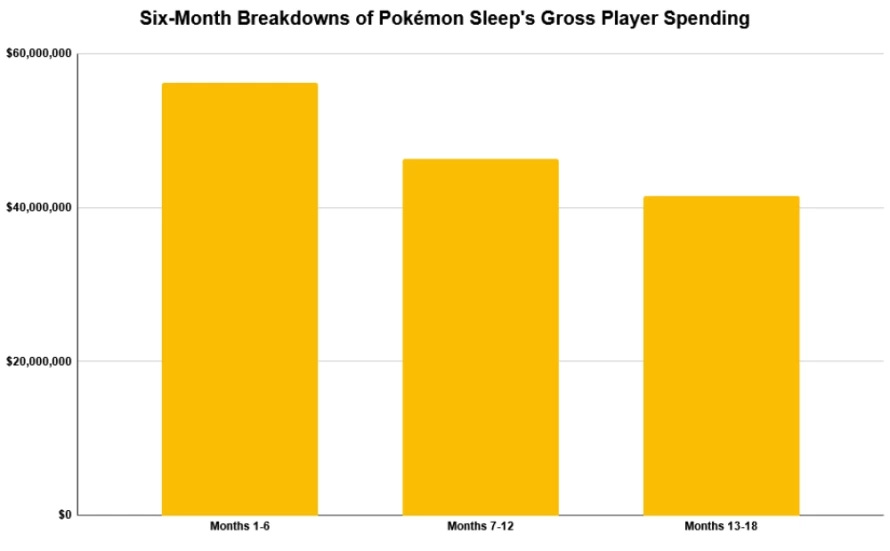

Pokemon Sleep has earned $140 million in 1.5 years. 73% of all revenue came from Japan. The trend is negative.

Hypercasual publisher Homa boasted that its games have been downloaded more than 2 billion times. Sky Roller, Merge Master, and Attack Hole account for 21% of all downloads.

AppMagic: Top Mobile Games by Revenue and Downloads in January 2025

AppMagic provides revenue data after deducting store commissions and taxes. Revenue from Android stores in China is not included.

Revenue

Honor of Kings reclaimed the top revenue spot, earning $193.19 million in January. The game also reached a milestone by earning its first million dollars net in the US market.

Last War: Survival ($148.3 million) and Royal Match ($144.8 million) took the 2nd and 3rd positions in the chart.

PUBG Mobile saw significant revenue growth, earning $135.1 million, its highest in the last two years.

Genshin Impact ($66.6 million) and Teamfight Tactics ($49.9 million) had a good month.

CrossFire: Legends deserves special mention. The game earned $57.9 million in January, a historic record for the project launched in 2015. All revenue came from China. This year, as in the previous two, revenue peaks coincided with the Chinese New Year celebrations.

Downloads

A new hit appeared in the download charts - Cat Chaos: Prankster by Vietnamese studio Mirai Studio. In the game, players cause mayhem as a cat, as simple as that. The game was downloaded 18.7 million times in a month.

The download leaders remain the same - Block Blast! (32.5 million installs) and Roblox (23.3 million).

Squid Game: Unleashed had a good month of downloads, with 10.8 million installs. However, the trend is discouraging—by the end of January, daily installs dropped to 75-80 thousand, 6-8 times less than at the end of December.

AppMagic: Casual Games Tier-1 West performance in 2024

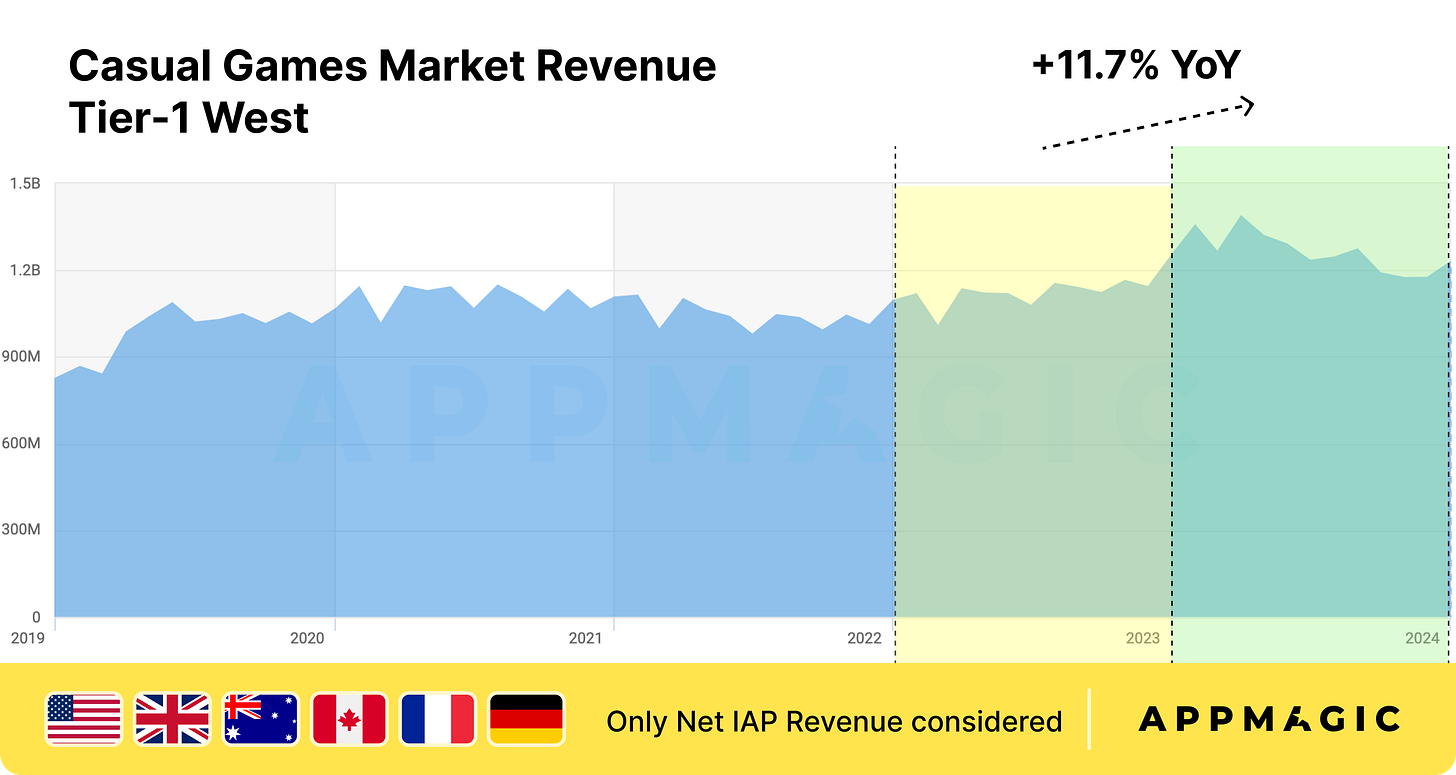

In the study, AppMagic focuses on Western Tier-1 markets - USA, UK, Australia, Canada, France, and Germany. Five key genres will be examined: Match-3 with complex meta, Merge-2 with complex meta, Match 3D, Sort Puzzle, and Casual Casino.

❗️Hereafter, all metrics are only for the 6 countries mentioned above. IAA revenue is not included. Please, consider that some Asian-focused products might not appear in this research.

Market State

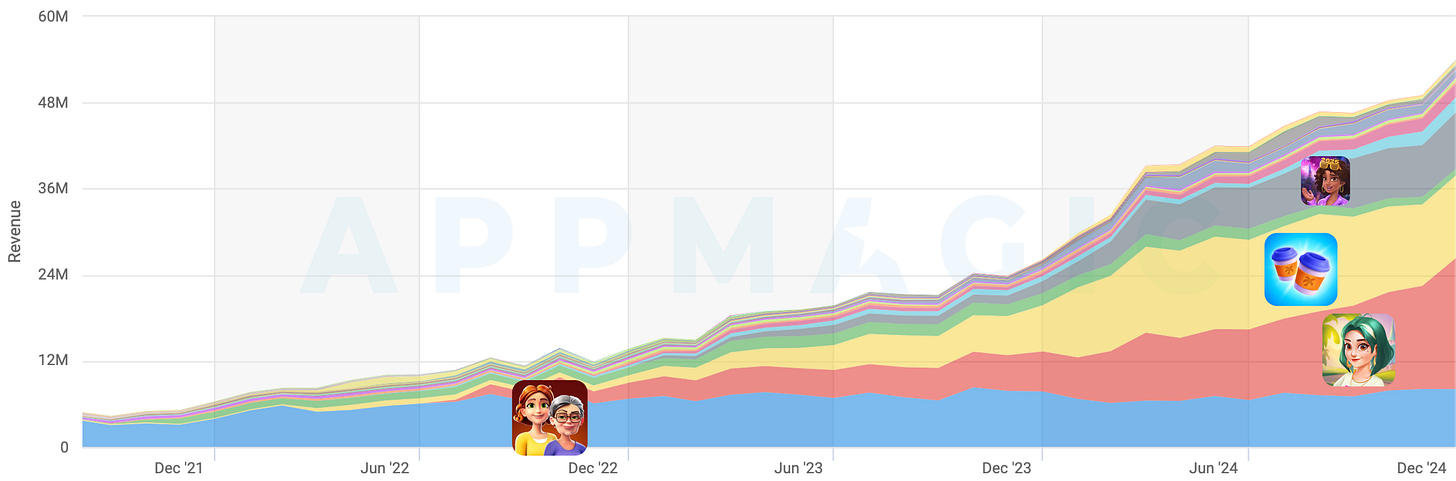

Casual game revenue in Western Tier-1 countries grew by 11.7% to $15.2 billion. Downloads for the same period increased by only 4.1%.

Match-3 with Complex Meta

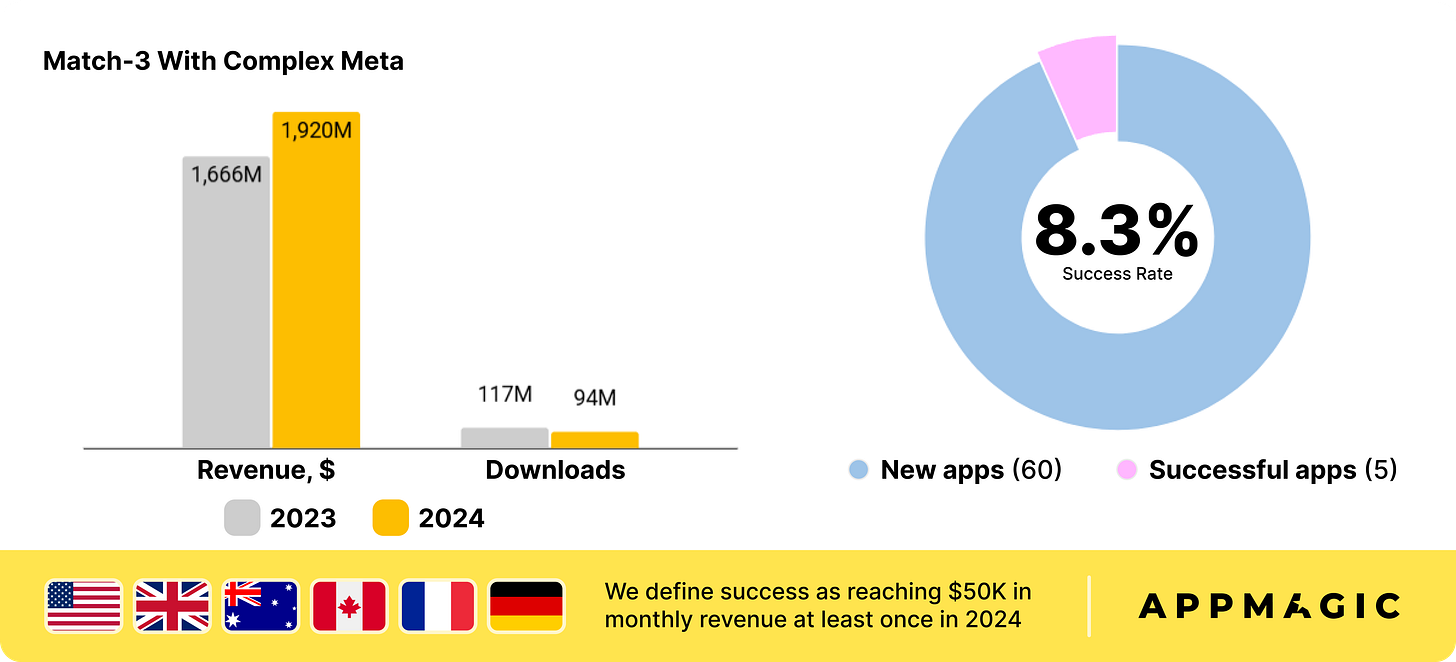

In 2024, games in this genre earned $1.92 billion in selected markets (13% growth). However, downloads decreased by 21%.

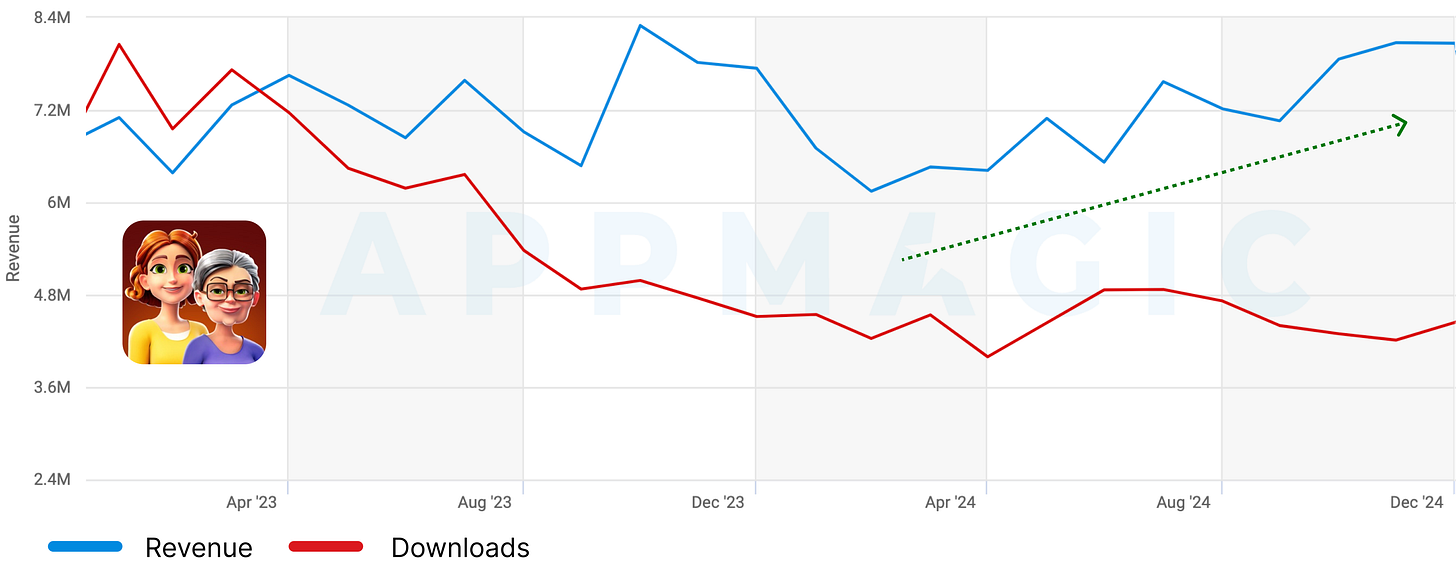

Royal Match is the genre leader. The game accounts for 51% of all genre revenue in T1 West countries.

If Royal Match is removed from the overall equation, the genre’s revenue will decline by 8% in 2024.

In 2024, Royal Match's audience growth mainly occurred in the first half of the year. Then, the dynamics slowed down, and the number of installs returned almost to 2022 figures. However, the project's revenue grew - the team actively worked on Live-ops and monetization. AppMagic notes that Dream Games also worked on the social component of the project.

The 4 largest projects in the genre's top 10 in 2024 remained unchanged - Royal Match, Gardenscapes, Homescapes, and Project Makeover. However, there are two newcomers: Matching Story - Puzzle Games (Vertex) and Mystery Matters (Playrix). Both projects were launched in 2023.

In total, 60 projects were launched in 2024, 5 of which managed to reach $50,000 in monthly revenue (which AppMagic considers the minimum mark for assessing success). These are Truck Star (Century Games), Hollywood Crush: Match 3 Puzzle (YOTTA Games), Ellen's Garden Restoration (Storm8), Christmas Match: Home Design (Narcade), and Roomscapes (Playrix). Work on the latter is likely suspended. 8.3% of all launched projects can be called somewhat successful.

AppMagic specifically notes Truck Star. The game has an atypical gender distribution for the genre - 74% men versus 26% female audience. Since its release in May 2024, the game has earned more than $10 million.

Formally, the Royal Kingdom can also be added to the list. But the game had been in soft launch since April 2023 and was already earning more than needed to achieve the minimum required "success" assessment.

Merge-2 with Complex Meta

In 2024, Merge-2 grew in revenue by 106% (to $527 million), and downloads increased by 43%, reaching 60 million.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Unlike the previous genre, there is no clear leader in Merge-2 with meta. Merge Mansion, Travel Town, Gossip Harbor, and Seaside Escape compete for audience and revenue.

AppMagic notes that all projects in the genre have increased their expertise in operations. This can be traced, for example, by the frequency of live-ops events in Gossip Harbor.

Competition in the top 10 in the genre is active. Travel Town broke into first place, and 3 new projects appeared in the chart - Adventure Island Merge (FlyBird), Taylor's Secret: Merge Story (Merge Story), and Road Trip: Royal (Vizor Games).

As AppMagic notes, the authors of Merge Mansion are not ready to accept the loss of the leading position. Throughout 2024, the team actively worked on increasing their revenue against the falling downloads and achieved certain successes.

This year, 2 out of 64 games released in the genre managed to exceed $50,000 in monthly revenue. These are Merge Prison: Hidden Puzzle (Blue Ultra Game) and Merge Adventure: Merging Games (Green Pixel. The success rate is 1.6%. In 2023, no project managed to cross this mark, so there is a progress.

Match 3D

Match 3D games revenue in the listed countries grew by 97% to $381 million. Downloads also increased by almost 59% - to 46 million.

The genre is actively developing, and most of the revenue is generated by new projects. The veteran - Triple Match 3D - started earning less in 2024. Match Factory! positioned itself as a leader and now generates 42% of the entire genre's revenue.

The top 10 is very active. Four new projects appeared in 2024 - Joy Match 3D, Match Villa: Makeup ASMR, Match Mania 3D - Triple Match, and Blitz Busters. AppMagic notes that two projects in the genre (Match Frenzy - ASMR Tycoon and Match Villa: Makeup ASMR) use the theme of "gross aesthetics," like popping pimples.

The same theme is used in one of the successful newcomers of 2024 - Match Rush 3D: ASMR Care (AlphaPlay). In 2024, the game earned $575 thousand. Two other projects that broke through the $50,000 monthly revenue mark are Match Party - Tile 3D and Triple Pile 3D.

Sort Puzzle

This is the fastest-growing genre among casual games. In 2024, revenue grew 5.6 times - to $112 million. Installations also almost doubled (178 million installations).

AppMagic correctly points out that the genre has long attracted an audience in the West, but the breakthrough is related to user monetization.

The revenue development dynamics of the genre resemble what happened with Match 3D.

The genre is developing. Therefore, in the top 10 by revenue, there are 5 newcomers at once, including the leader - Hexa Sort.

4 out of 10 games in the top 10 are dedicated to arranging various household items or products on store shelves. This is the most popular theme in the genre.

In 2024, 227 projects were released in the genre, 6 of which exceeded the $50,000 monthly revenue mark. 2.6% Success Rate, but it's important to consider that the genre has a large share of advertising monetization. Therefore, part of the revenue (quite substantial) is missed.

Casual Casino

The genre's revenue grew by 146% compared to the previous year, reaching $2.19 billion. However, downloads fell by 24% to 68 million. At the same time, the level of influence of Monopoly GO! on the genre is so high that when we evaluate the genre's performance, we are largely looking at the game's performance.

In 2024, MONOPOLY GO! generated 55% of the entire genre's revenue, Coin Master - 18%, Dice Dreams - 7%. This is one of the most monopolized genres in the industry.

The situation in the top 10 is stable. The only new project is Coin Tales. And 4 projects belong to Playtika - Coin Master, Dice Dreams, Animals & Coins Adventure Game, and Board Kings: Board Dice Games.

In 2024, 17 projects were released in the genre, and only 1 of them managed to exceed the $50,000 per month mark. Fishing Travel from Ark Game succeeded.