Weekly Gaming Reports Recap: January 13 - January 17 (2025)

Nintendo dominated the Japanese market in the last 20 years; Steam reviews became more negative in the last 5 years; AppsFlyer shared the mobile market report of 2024 & more.

Reports of the week:

AppsFlyer: Mobile market trends in 2024

A16Z Games: Use of AI in Gaming in 2024

Steam reviews have become more negative over 5 years

ERA: UK gaming market in 2024 fell behind the video market in size

Games for Nintendo have dominated the retail gaming market for the last 20 years in Japan

Stream Hatchet: Most popular launches on streaming platforms in 2023-2024

AppsFlyer: Mobile market trends in 2024

The report was prepared using data from over 35,000 apps. The total number of analyzed installations is 140 billion; and re-marketing conversions - 53 billion.

UA spending

Overall UA spending in 2024 increased by 5% to $65 billion. The market is recovering after a 6% decline in 2023.

However, there’s no good news for games. Spend on non-gaming apps increased by 8% while spend on gaming apps fell by 7%.

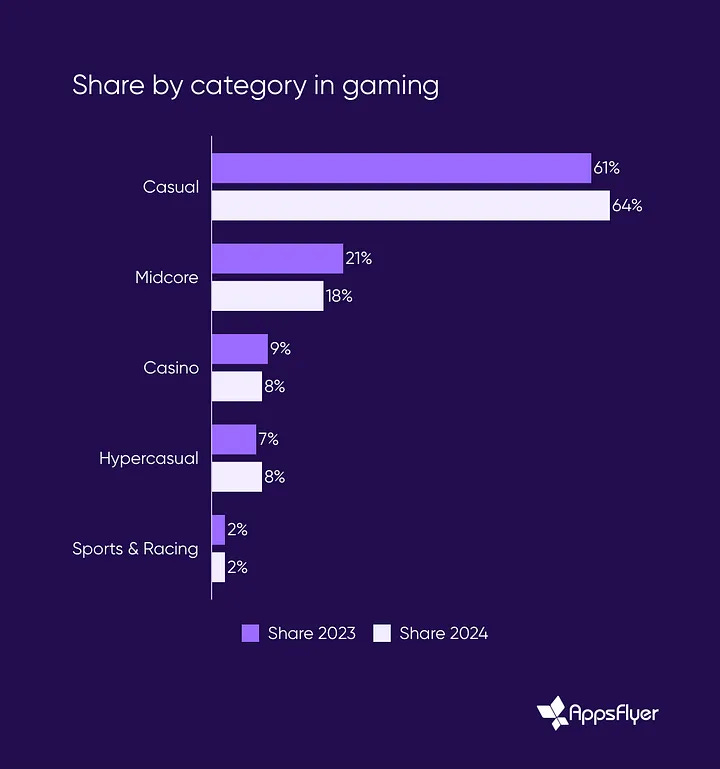

In the volume of gaming spending, the share of casual projects increased from 61% to 64%. The volume of UA on mid-core games (-21% YoY, share in total spend fell to 18%) and social casinos (-12% YoY, share in total spending fell to 8%) significantly decreased.

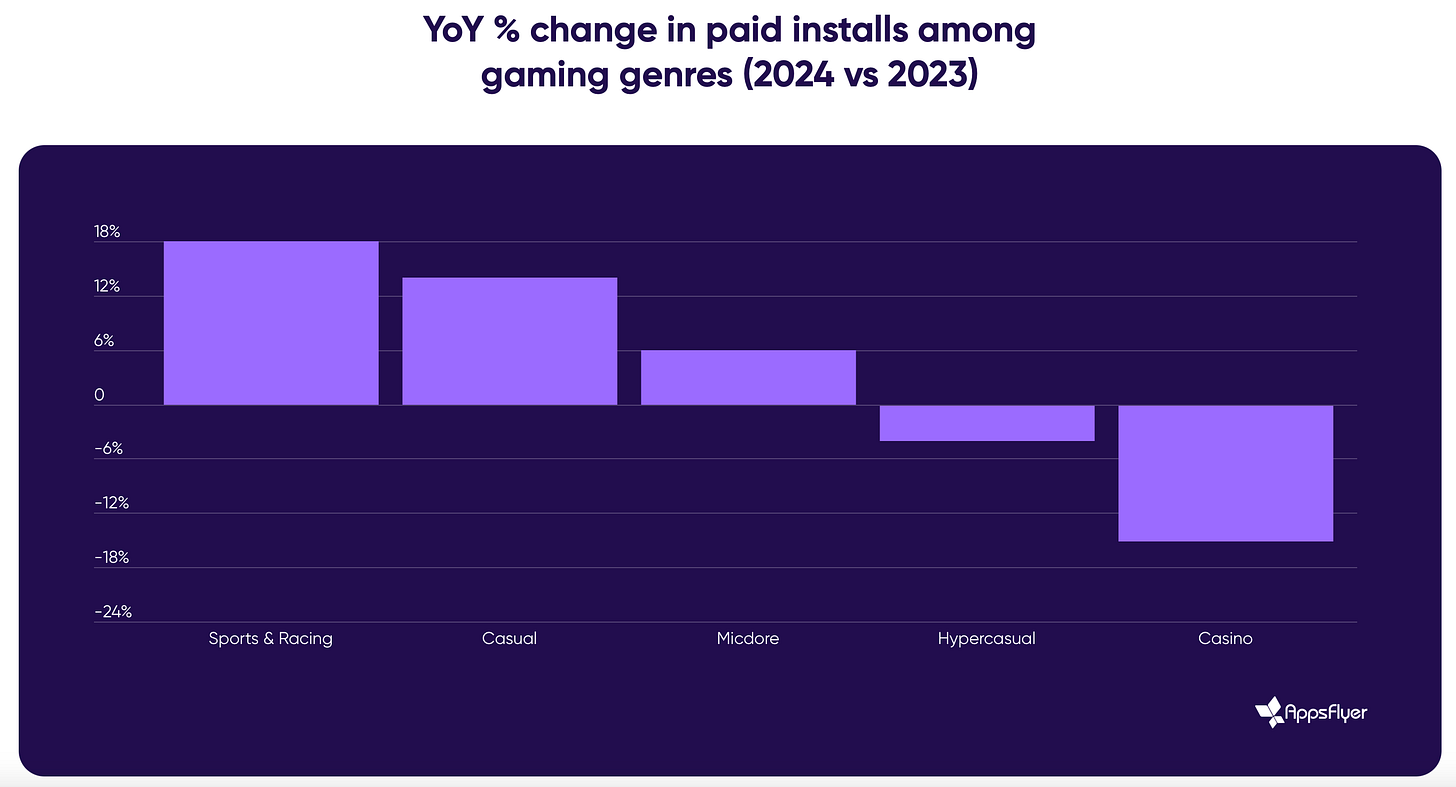

The number of attracted paid users increased in sports and racing projects (by 18% YoY), casual games (+14% YoY), mid-core projects (+6% YoY).

❗️AppsFlyer notes that due to the decrease in CPI, the mid-core genre, for example, managed to attract more users while spending less money.

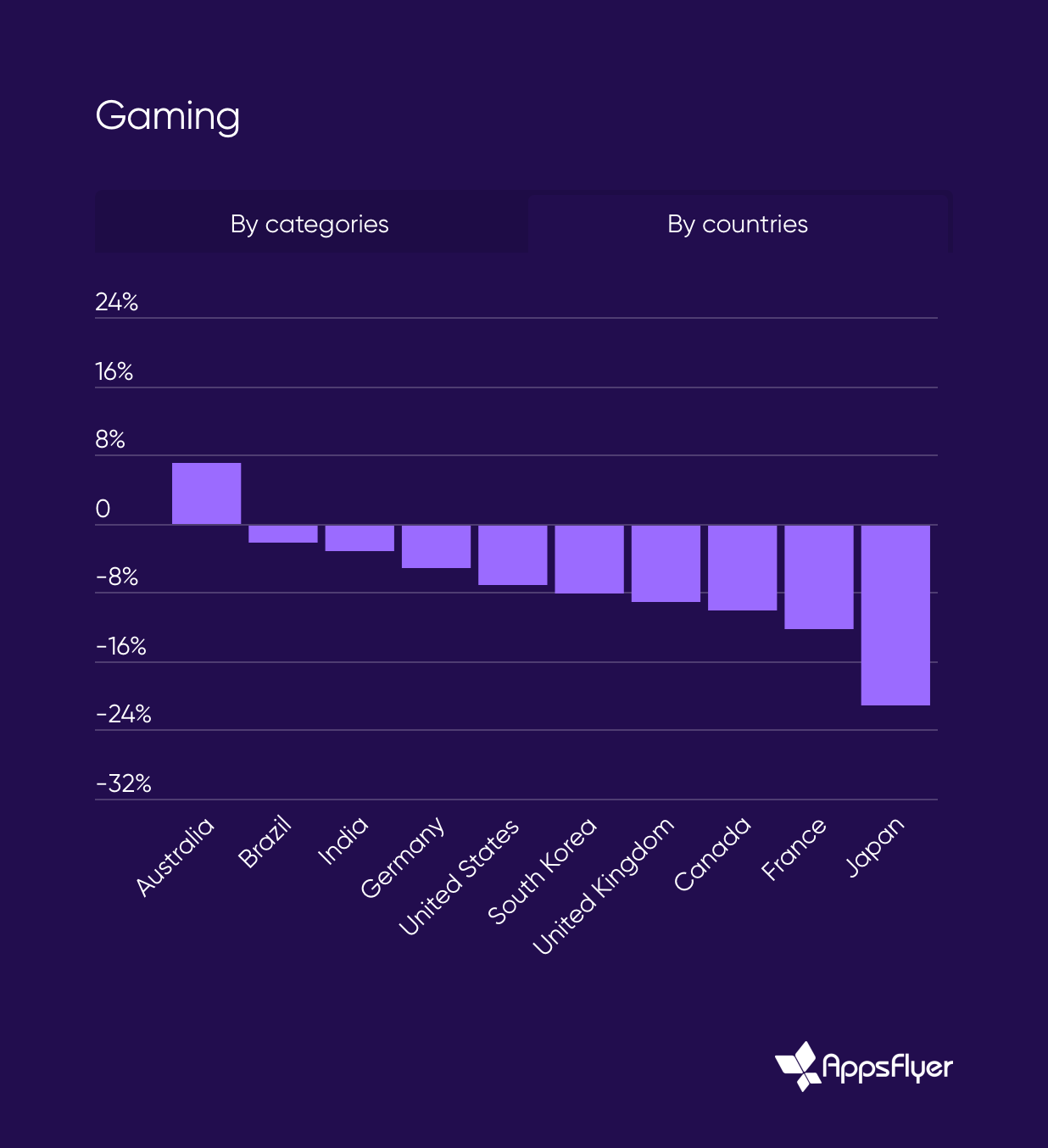

Looking at the regional breakdown, a decline is observed worldwide. This has affected developed countries the most.

AppsFlyer reports that the UA by non-gaming apps in “gaming” ad networks (such as Unity Ads) increased by 38% in 2024, while investments from gaming companies in these networks fell by 19%. Games still dominate in terms of purchase volume, but the trend is interesting.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Revenue

Non-gaming apps grew by almost 20% in IAP revenue in 2024. Among gaming apps, social casinos showed growth (+4% YoY), while mid-core projects fell by 2% YoY, and casual apps’ revenue fell even more (-5% YoY).

❗️The report doesn’t mention whether web shops were taken into account.

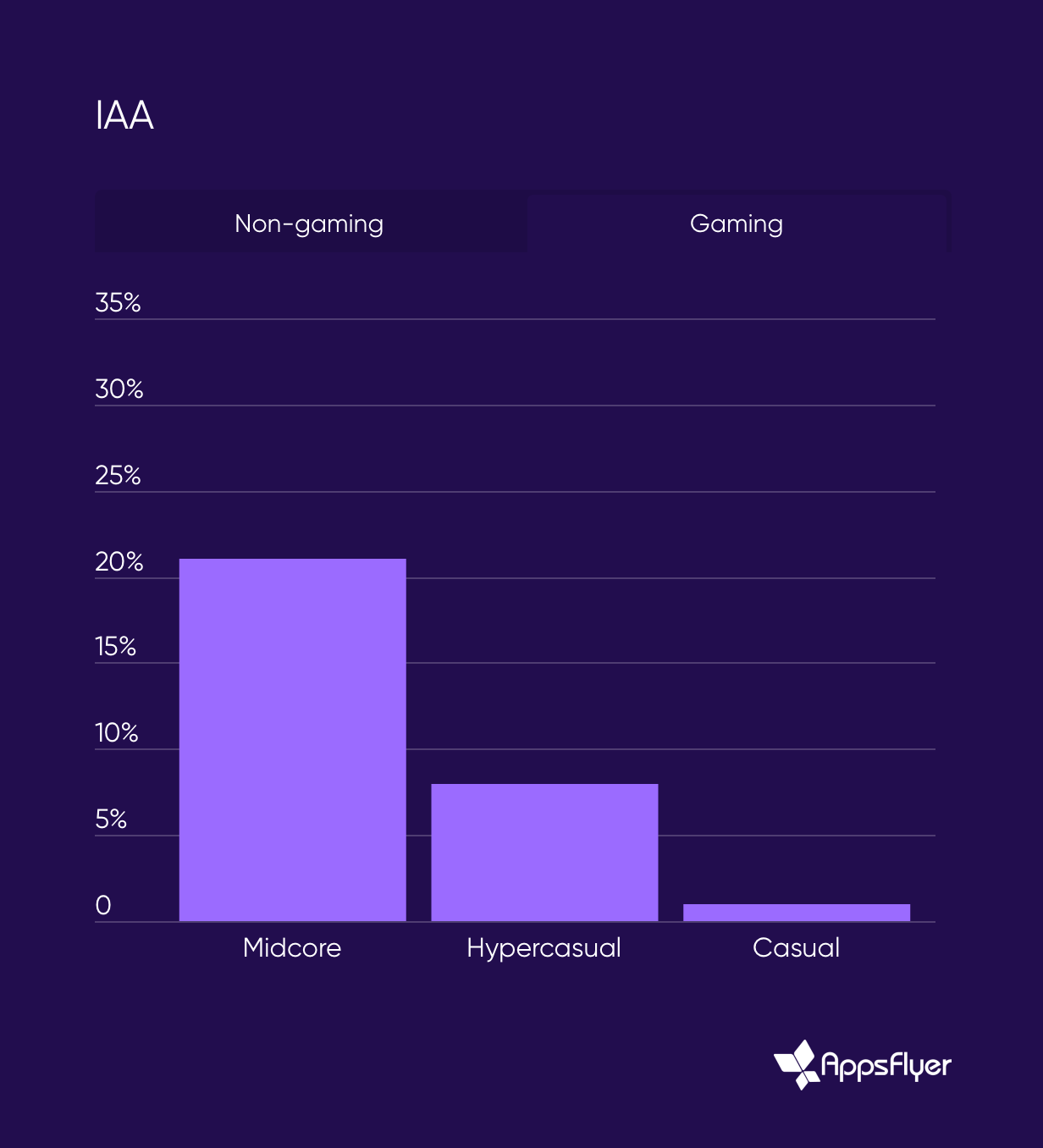

Advertising revenue is growing in both non-gaming (+26% YoY) and gaming (+7% YoY) segments. Advertising revenue grew the most in mid-core projects, by 21% compared to the previous year.

Downloads

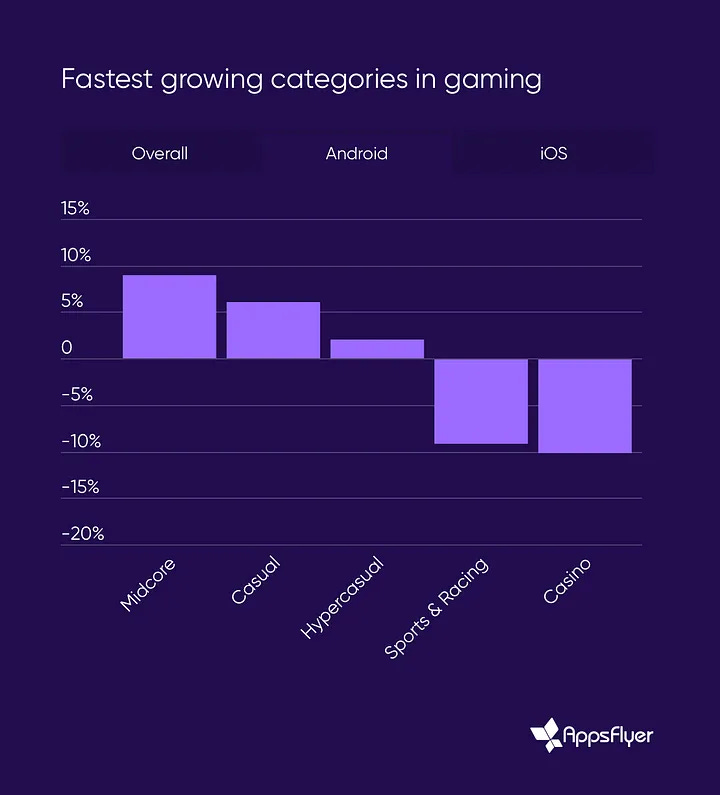

The number of installs increased by 5% in mid-core genres, by 4% in casual, and by 1% in sports and racing projects. The number of users decreased by 5% in social casinos and by 10% in hypercasual projects. All compared to 2023.

The picture differs on Android and iOS. On Android, mid-core projects grew in downloads (+9% YoY), casual games (+6% YoY), and the hypercasual segment (+2% YoY). On iOS, only social casinos have a positive balance (growth of 22% compared to the previous year).

Creative Production

In 2024, the number of creatives produced increased by 40%. Among the largest apps (with revenue over $1 million per month), the number of monthly creatives nearly doubled.

❗️This includes all versions of creatives, including those where only the icon color is changed.

A16Z Games: Use of AI in Gaming in 2024

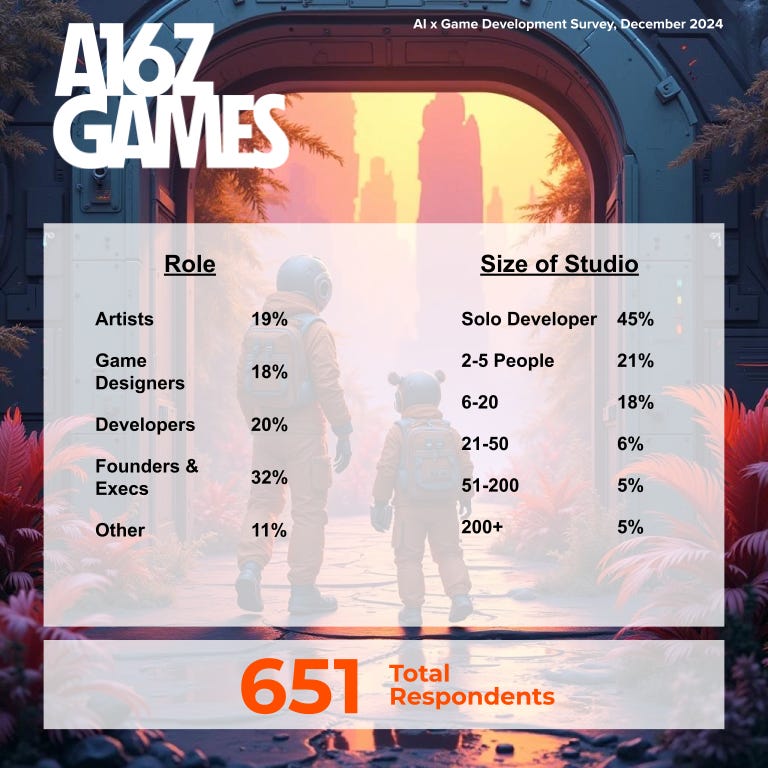

The company surveyed 651 employees from game industry companies of various sizes. 84% of respondents work in teams of fewer than 20 people.

73% of game studios are already using AI in their processes. 88% plan to do so in the future. A16Z Games notes that company founders are the most positively inclined (85% reported using AI), while artists are the most cautious (58% use AI).

The majority of studios saw both increased productivity and reduced costs after integrating AI. However, some were unsuccessful - 16% of respondents did not notice productivity growth, and 35% did not see cost reductions.

67% of respondents are interested in AI. Among artists, there is the highest proportion of those who view the new technology negatively (27%).

Some people believe AI will destroy their jobs. 36% of artists consider the technology a threat to themselves; 24% of game designers and programmers feel threatened. Company founders are the least concerned, with only 15% feeling AI will replace their jobs.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The main problems companies face when integrating AI into their processes are the quality and accuracy of models (53%); legal risks (12%); integration issues (11%); team members discomfort and risk of negative reactions (8%).

53% of respondents are exploring how to apply AI in real-time. This likely refers to AI-controlled NPCs.

54% of studios plan to work with their own models. This allows them to eliminate legal risks and increase the consistency of produced content.

Currently, most AI application cases are in the early stages of development (pre-production, prototyping). AI is actively used in narrative, music and voice creation, and advertising creative production.

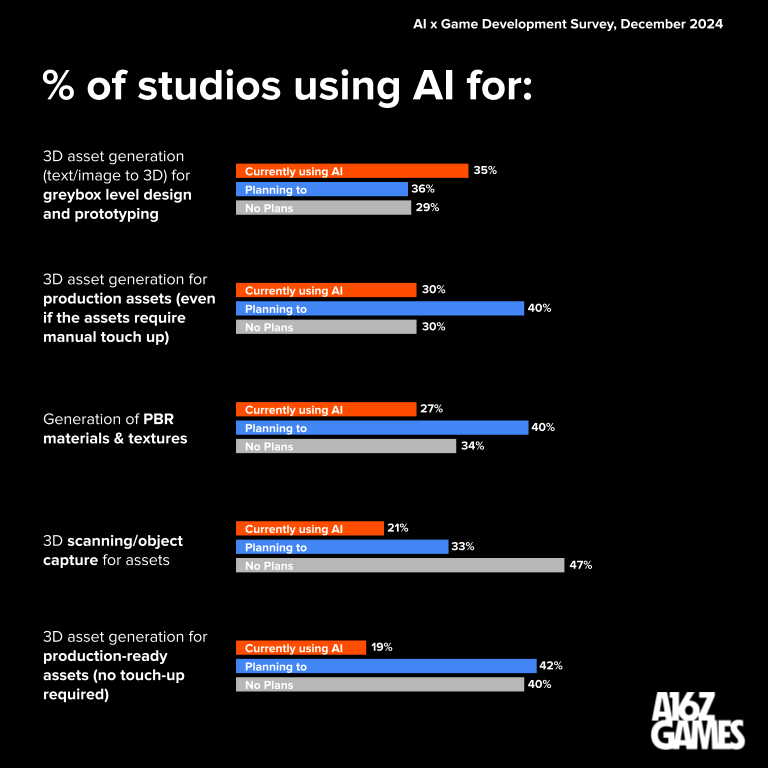

70% of respondents indicated that they either used or plan to use AI for generating 3D assets. Last year, only 48% reported this. It’s evident that there is industry demand for this.

The ten most popular AI tools (or companies) among game developers are Claude, Flux, ChatGPT, Cursor, Eleven Labs, GitHub Co-pilot, Meshy, Midjourney, Stable Diffusion, and Suno.

Steam reviews have become more negative over 5 years

The study was conducted by Will McCahill, director of World’s Edge studio (responsible for developing the Age of Empires series), which Microsoft owns.

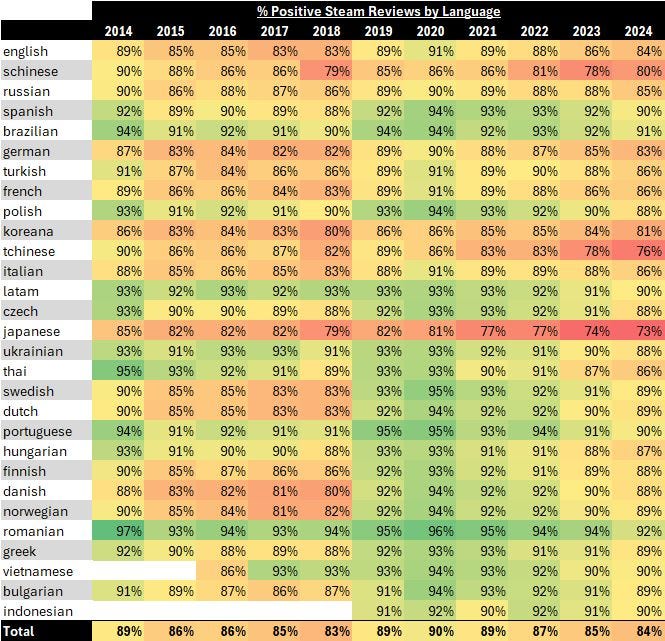

The percentage of positive reviews over the past 5 years has dropped from 90% to 84%. However, it cannot be said that users have become angrier - in 2018, positive reviews were at 83%.

The most positive reviews are published in Spanish, Portuguese, Romanian, Vietnamese, and Indonesian languages.

The least positive reviews are published by users from Japan, China, and South Korea.

Black Myth: Wukong accounts for about 30% of all positive reviews in Simplified Chinese on Steam (which is about 1 million reviews). If these are excluded from the overall picture, the share of positive reviews from Chinese players in Simplified Chinese decreases from 80% to 74%.

The leading languages for reviews on Steam are English, Simplified Chinese, and Russian.

ERA: UK gaming market in 2024 fell behind the video market in size

ERA - Entertainment Retailers Association in the UK.

Overall state of the entertainment market

The total volume of the music, film, streaming, TV series, and games market in 2024 exceeded £12 billion.

The largest market segment is digital video (including subscriptions to Netflix, Amazon Prime Video, Apple TV, etc.), with a volume of £4.46 billion. Growth - by 8.3%. The total volume of the video market in the UK is just over £5 billion (growth of 6.9%). This is larger than the gaming market.

❗️It was reported that the video market had overtaken the gaming market in terms of volume based on the results of 2023. However, from the updated results table published this year, it’s clear that this only happened in 2024. It’s possible that the figures were adjusted.

Interestingly, sales of physical copies of musical works increased by 6.2%. Overall, the music industry in the UK hasn’t generated this much revenue since the CD era.

UK Gaming Market

The volume of the UK gaming market in 2024 decreased by 4.4% to £4.62 billion.

Digital PC game sales fell by 5%, digital console game sales decreased by 15%, and physical copy game sales plummeted by 35%. Subscription services showed growth - by 12% compared to the previous year.

The largest segment of the UK gaming market is mobile (£1.56 billion), which grew by 2.6% in 2024.

The best-selling game of the year in the country is EA Sports FC 25. It was purchased 2.9 million times, with 80% of sales being digital copies.

Games for Nintendo have dominated the retail gaming market for the last 20 years in Japan

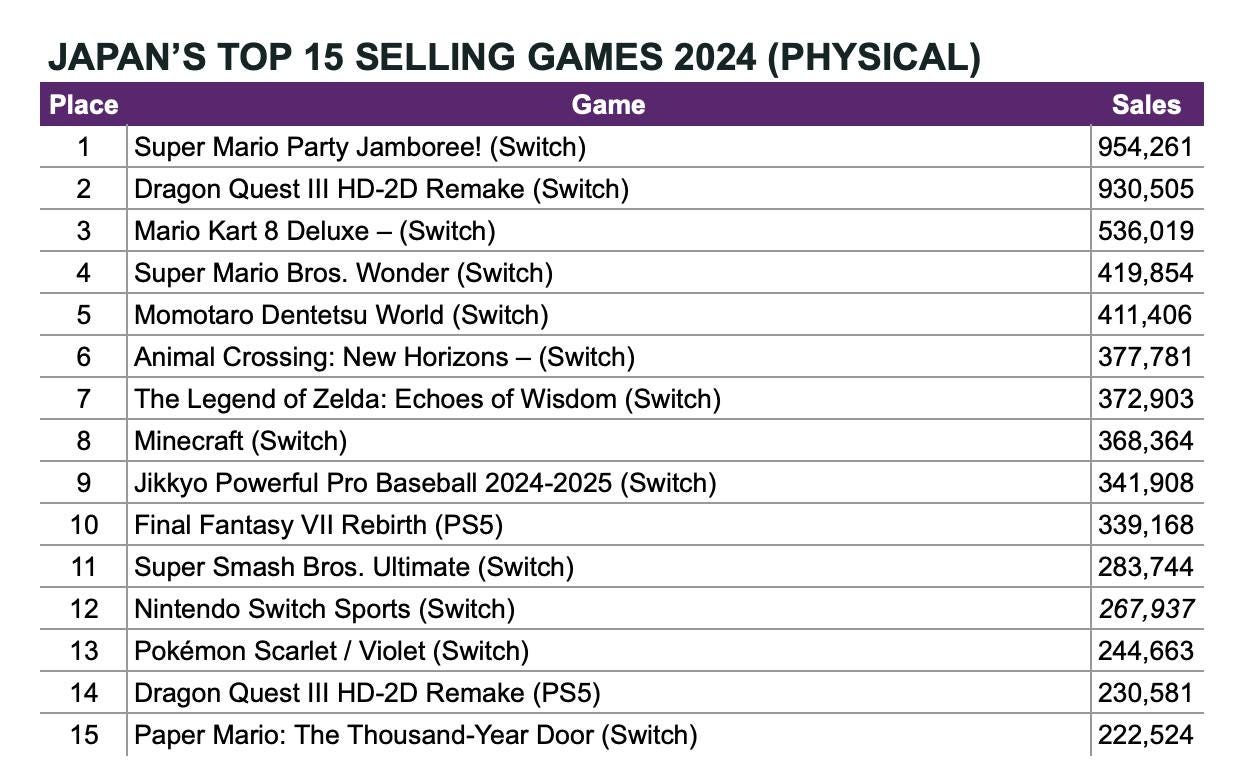

According to 2024 results, 13 out of 15 best-selling retail games were for Nintendo Switch. The top three for 2024 are Super Mario Party Jamboree!; Dragon Quest III HD-2D Remake; and Mario Kart 8 Deluxe.

Since 2005, most games in the year-end top 10 have been released on Nintendo consoles.

A similar situation exists with consoles. Since 2005, Nintendo DS, Nintendo 3DS, and Nintendo Switch have led the console charts. In 2004, the best-selling system in Japan was the PlayStation 2.

In 2024, Japanese consumers purchased over 3 million Nintendo Switch units; PlayStation 5 sold 1.4 million systems; and Xbox Series sold 118,000 units.

Stream Hatchet: Most popular launches on streaming platforms in 2023-2024

❗️Below is the analysis of the first 30 days after the project launch, and metrics on streaming platforms (Twitch, YouTube Gaming, Kick).

Leaders in Hours Watched

Diablo IV (168 million hours in the first 30 days), Palworld (92.7 million hours), and Path of Exile 2 (92 million hours) are the leaders among new launches in the last 2 years.

The Stream Hatchet team notes that the leaders are mainly continuations of already established franchises. The only exceptions are Palworld and Black Myth: Wukong.

Leaders in Viewership Growth

In this category, Stream Hatchet compares the ranking position in hours watched after 7 days with the ranking position at 30 days. Thus, analysts want to exclude large projects (which immediately soar to the top) and look at smaller-scale projects.

Only Up!, Lethal Company, and Pico Park 2 are the leaders of the "indie rating". They grew the most on day 30 compared to the first 7 days - this is the viral effect.

Interestingly, there are 2 mobile games in the ranking at once - Pokemon TCG Pocket and AFK Journey.

Also on the list, despite the very recent release, MiSide is presented - the game is on the 7th line in the list of popularity growth.

Leaders in Peak Viewership

Path of Exile 2 (1.4 million peak viewers), Diablo IV (992 thousand peak viewers), and Sons of the Forest (909 thousand peak viewers) are the leaders in peak online viewership for the first 30 days. The list also includes The Day Before (645 thousand viewers, 4th place) despite the sad story.

Leaders in Streaming Hours

24 games over the past 2 years have been streamed for more than 1 million hours. The leaders are Call of Duty: Black Ops 6 (4.4 million hours); Diablo IV (3.6 million hours); Call of Duty: Modern Warfare 3 (3.4 million hours).