Weekly Gaming Reports Recap: January 6 - January 10 (2025)

Major research about exits in the industry by InvestGame, South Korean Mobile market in H2'24; Gaming CEO's expectations from 2025 are also there.

Reports of the week:

InvestGame & GDEV: Major exits in the Gaming Industry over the last 10 years

Game Industry Layoffs: 14,600 people lost their jobs in 2024

Games and Numbers (December 25, 2024 - January 7, 2025)

Aream & Co.: Gaming Company CEOs on expectations for 2025

Sensor Tower: South Korean Market in H2'24

In 2024, China issued 1,416 game licenses - a record since 2019

InvestGame & GDEV: Major exits in the Gaming Industry over the last 10 years

The InvestGame team defines “major” exits as those valued at $500 million and above. Data from the past 10 years is considered. Only companies for which such a deal is the first are included (which is why Jagex or Activision Blizzard, for example, are not on the list).

Top 5 Largest M&As and Public Offerings

4 out of 5 largest M&A deals in the last 10 years involved mobile companies. Mojang Studios stands out, as at the time of the Microsoft deal, most of its revenue came from PC and consoles. Two companies (Mojang Studios and SpinX Games) were built without external investors.

The leaders in valuation at the time of public offering are companies working with the mobile market. All of them generated most of their revenue from mobile devices at the time of listing (including Krafton). It's also worth noting that VC funds financed all the companies on the list.

Deals timeline

2021 proved to be the most productive year in terms of large M&As and public offerings. There were 7 M&A deals totaling $9.5 billion and 7 public offerings with a total valuation of $90.7 billion at the time of listing.

The industry median is one M&A deal and one public offering larger than $500 million per year.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

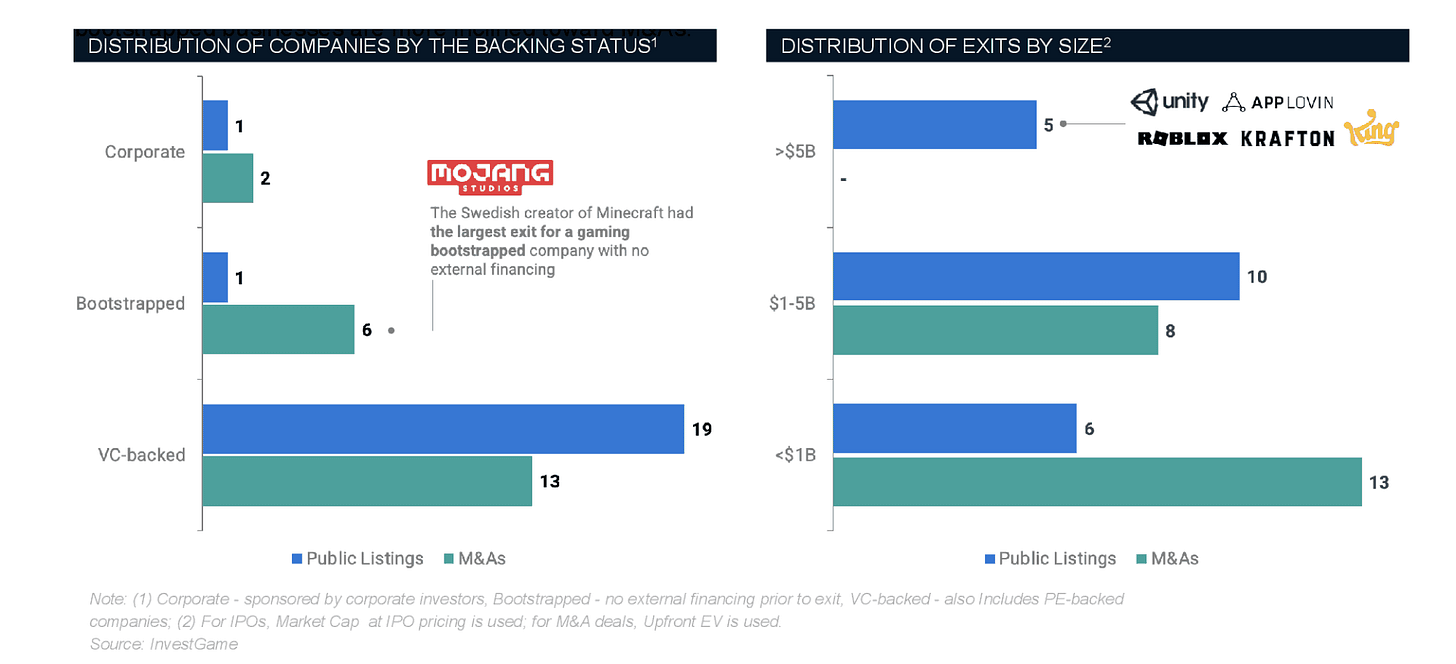

Deals by backing method

Companies with VC fund involvement account for 75% of all major deals (valued over $500 million). 60% of VC-funded companies went the public offering route.

Among companies founded with their own funds, only 1 out of 7 went public - GDEV. All the others were bought by larger players. Interestingly, out of 7 companies, 5 had a valuation exceeding $1 billion at the time of the deal.

When looking at companies financed by corporate funds, 3 companies made it into the sample. One was bought, and the other two went public.

❗️The goal of many corporate funds is to consolidate successful companies in their early stages. This might be why there aren't many of them on the list. The valuation simply doesn't have time to "grow".

Deal Sizes and Time to Completion

Only companies that went for an IPO have valuations above $5 billion. M&A deals dominate in the category of deals up to $1 billion.

Mobile gaming companies, on average, exit 40% faster compared to PC/console studios.

Statistically, companies that raised funds from corporations take the longest to exit (10 years). Companies with VC funding take 9.5 years. The fastest to reach the point of sale or public offering are companies without external financing - they take an average of 7 years.

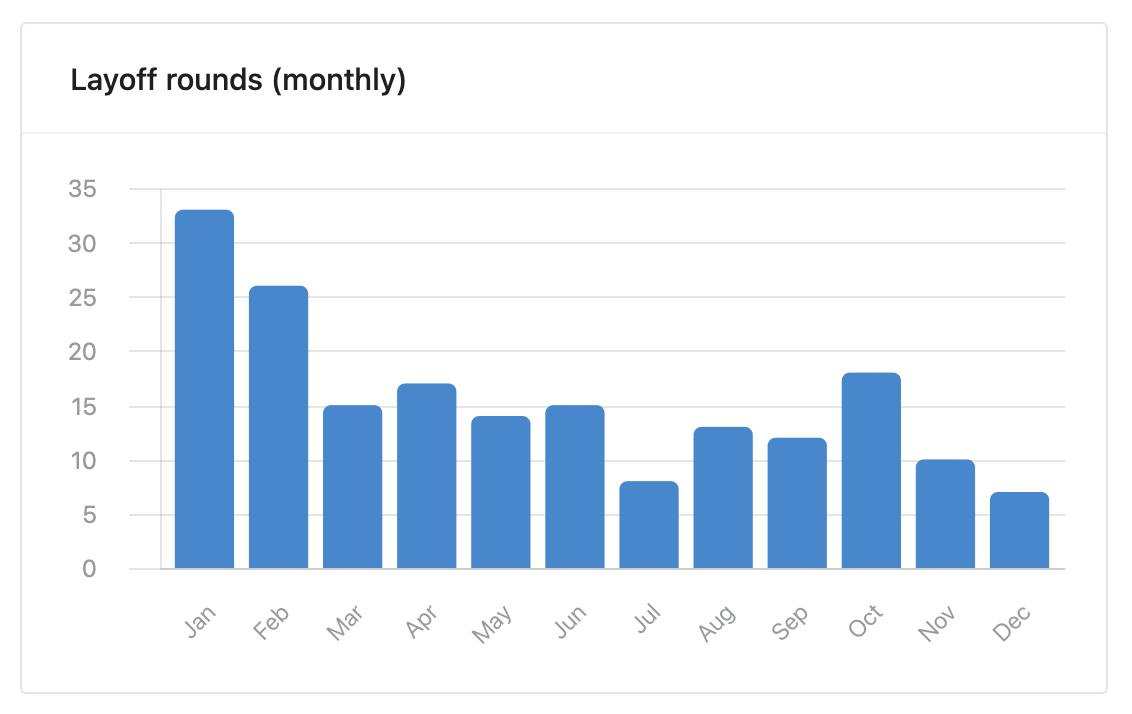

Game Industry Layoffs: 14,600 people lost their jobs in 2024

Game Industry Layoffs only report public cases of layoffs in the industry. When the number of affected individuals is unknown, the portal provides its estimate.

In 2024, 14,600 people lost their jobs. The largest rounds of layoffs occurred at Microsoft (2,800 people), Unity (1,800 people), and Sony (1,339 people).

The peak of layoff announcements occurred in January 2024 - 33 cases were reported. In February, an additional 26 rounds of layoffs were announced. In the remaining months, there were no more than 18 announcements.

Layoffs in 2024 were 39% more extensive than in 2023. At that time, 10,500 people lost their jobs.

In 2022, 8,500 people lost their jobs.

Games and Numbers (December 25, 2024 - January 7, 2025)

PC/Console Games

In December 2024, Stardew Valley sales surpassed 41 million copies. The developer announced this on the website. 26 million copies were sold on PC and Nintendo Switch accounted for another 7.9 million.

NieR: Automata has been sold over 9 million times. The game was released on February 23, 2017.

Sales of the Resident Evil 4 remake have reached 9 million copies. Only 3 games in the series’ history have sold more than 10 million copies - Resident Evil 7 Biohazard, Resident Evil 2: Remake, and Resident Evil: Village.

The indie horror game MiSide from a small Russian studio (2 people) became a December hit on Steam. According to VG Insights estimates, the game has already earned almost $15 million.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Mobile Games

Scopely has earned over $10 billion in its history, as the company wrote in its blog. The company’s games have been downloaded more than 1 billion times, with users spending 15 billion hours playing them.

Pokemon TCG Pocket has earned more than $300 million, according to Sensor Tower. 41.5% of the money comes from Japan, 21.7% from the USA, and 7.3% from France.

ARK: Ultimate Mobile Edition launched on mobile devices on December 18, with over 1 million downloads in the first 24 hours after release. Currently, AppMagic shows almost 2 million installs and $500 thousand in revenue (after taxes and platform fees).

Transmedia

The box office for the Sonic movie trilogy has exceeded $1 billion. The third installment of the film has grossed more than $336.3 million since its release on December 20. The fourth part of the film is already in development.

Aream & Co.: Gaming Company CEOs on expectations for 2025

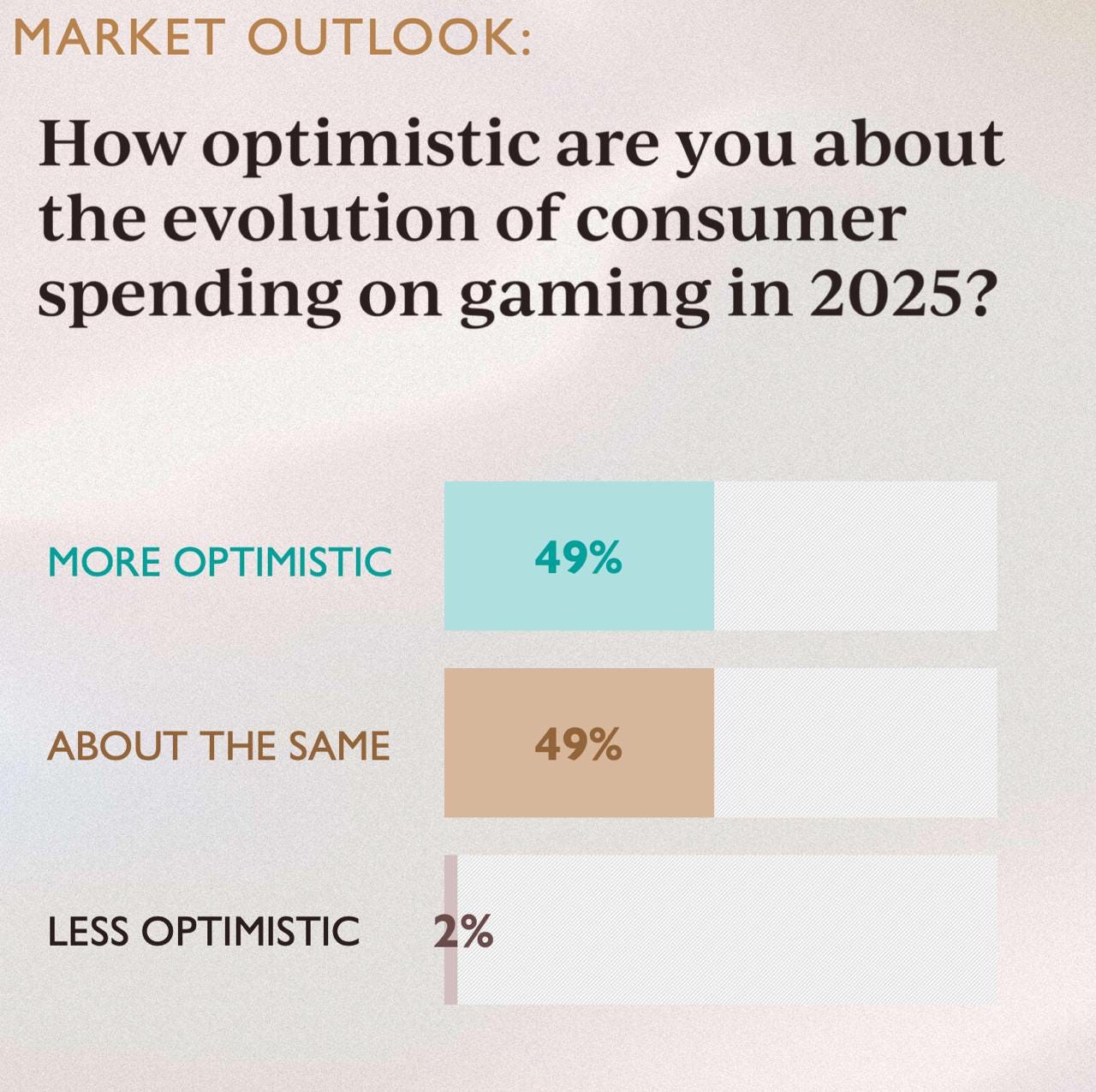

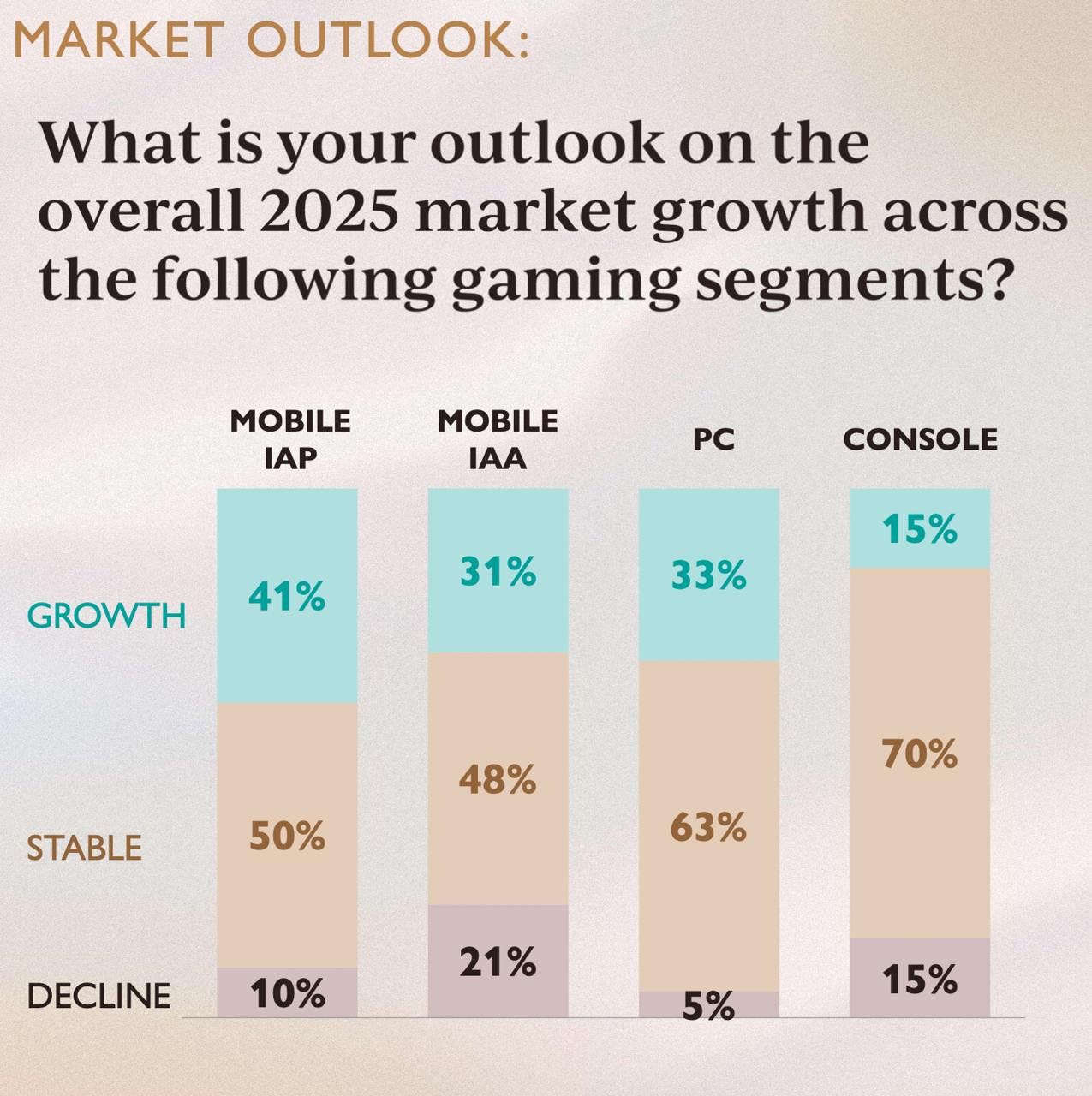

The survey included about 50 gaming company executives; conducted in December 2024.

Aream & Co. has advised deals such as the sale of Superplay ($2 billion); Easybrain ($1.2 billion); Plarium ($620 million) and many others. It’s the world’s leading investment bank focusing on games.

Market Condition

49% of respondents believe users will spend more on games in 2025. 49% think spending levels will remain unchanged. Only 2% are pessimistic and expect people to spend less on games.

The mobile segment is viewed most positively (41% expected growth in IAP payments; 31% growth in advertising revenue). The PC segment comes second (33% anticipated growth). The console market is seen as most static (70% predict no growth; 15% each forecast growth or decline). Interestingly, PC has the least negative outlook.

The most common problems in the gaming industry, according to CEOs, are too much content (33% noted this point); difficulties in attracting audience (31%); macroeconomic environment and consumer demand (17%); rising development costs (12%). A small portion noted regulatory changes (5%) and lack of innovation (2%).

Plans for 2025

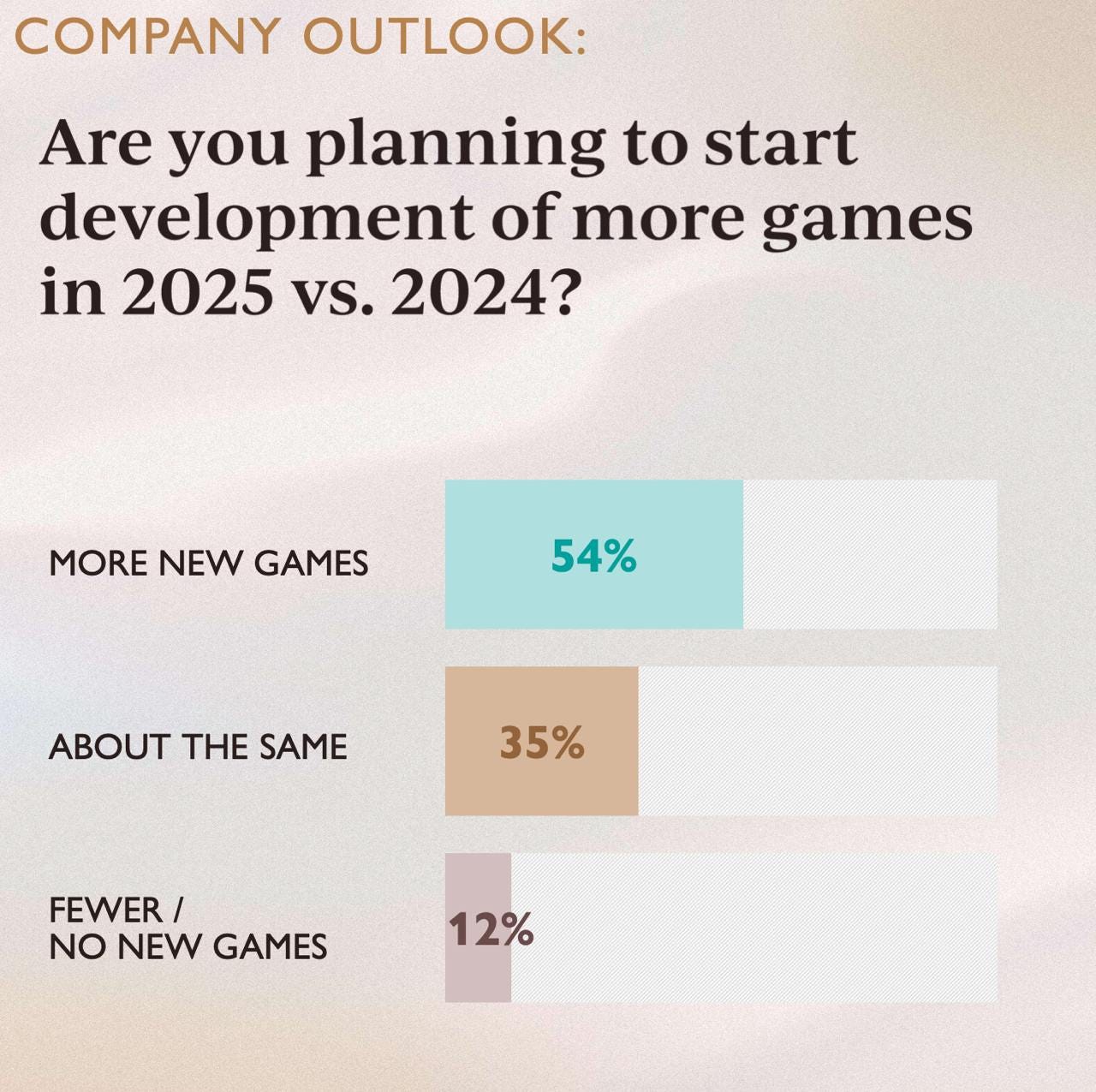

54% of executives plan to start working on more games than in 2024. 35% plan to work on the same number of projects, while 12% want to reduce the number of games in development.

Meanwhile, 37% are ready to increase budgets; 49% plan to maintain them at the same level; 14% plan to reduce spending on new development.

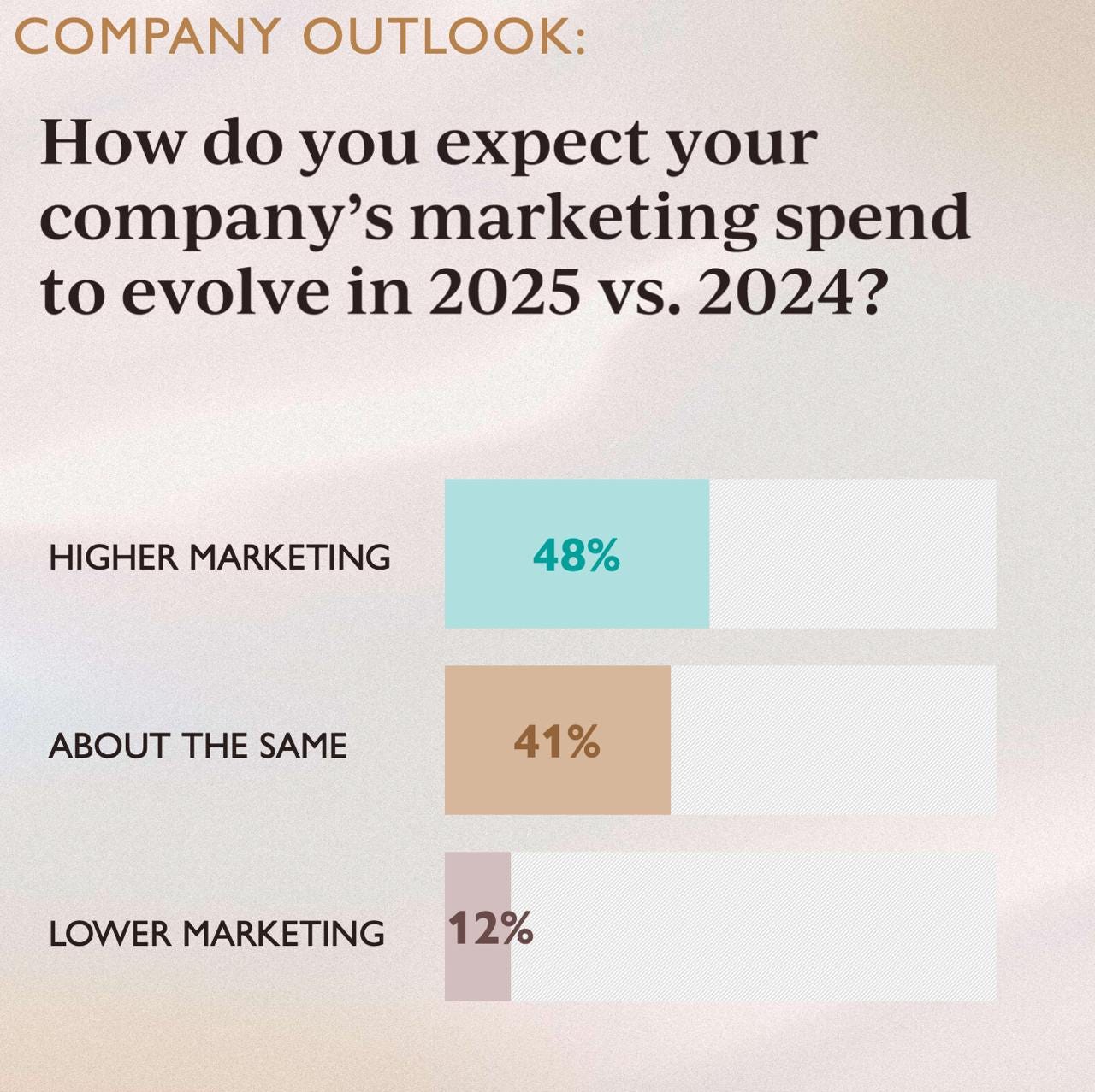

In 2025, 48% of company executives plan to increase marketing spending. 41% want to stay at the same level, while 12% want to reduce expenses.

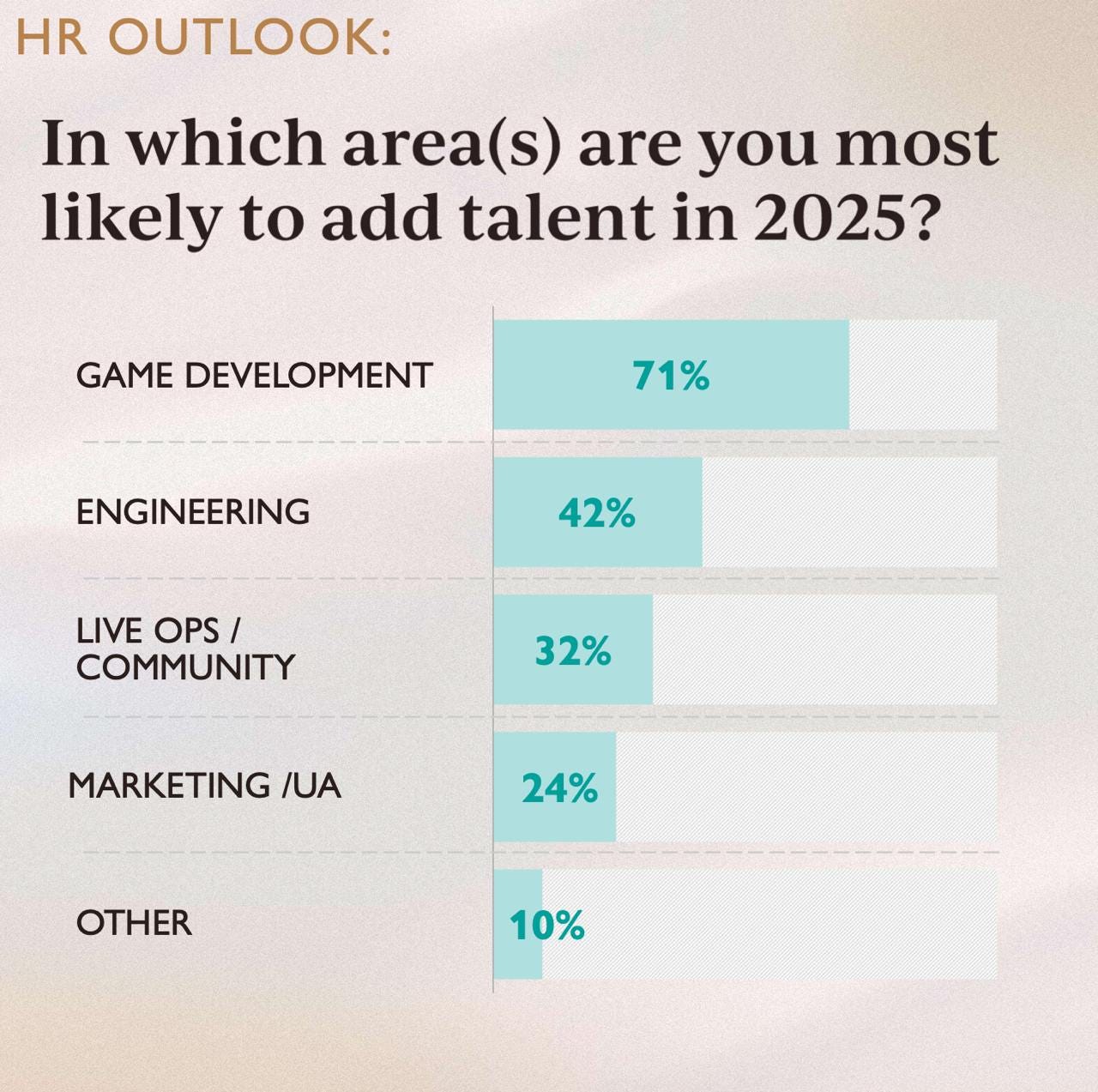

In terms of hiring, executives are most interested in game developers (71%), engineers (42%), Live Ops and community building specialists (32%), as well as marketing and UA specialists (24%).

❗️Live Ops and community management are combined in the survey - I would argue that they should be in one basket.

Working with AI

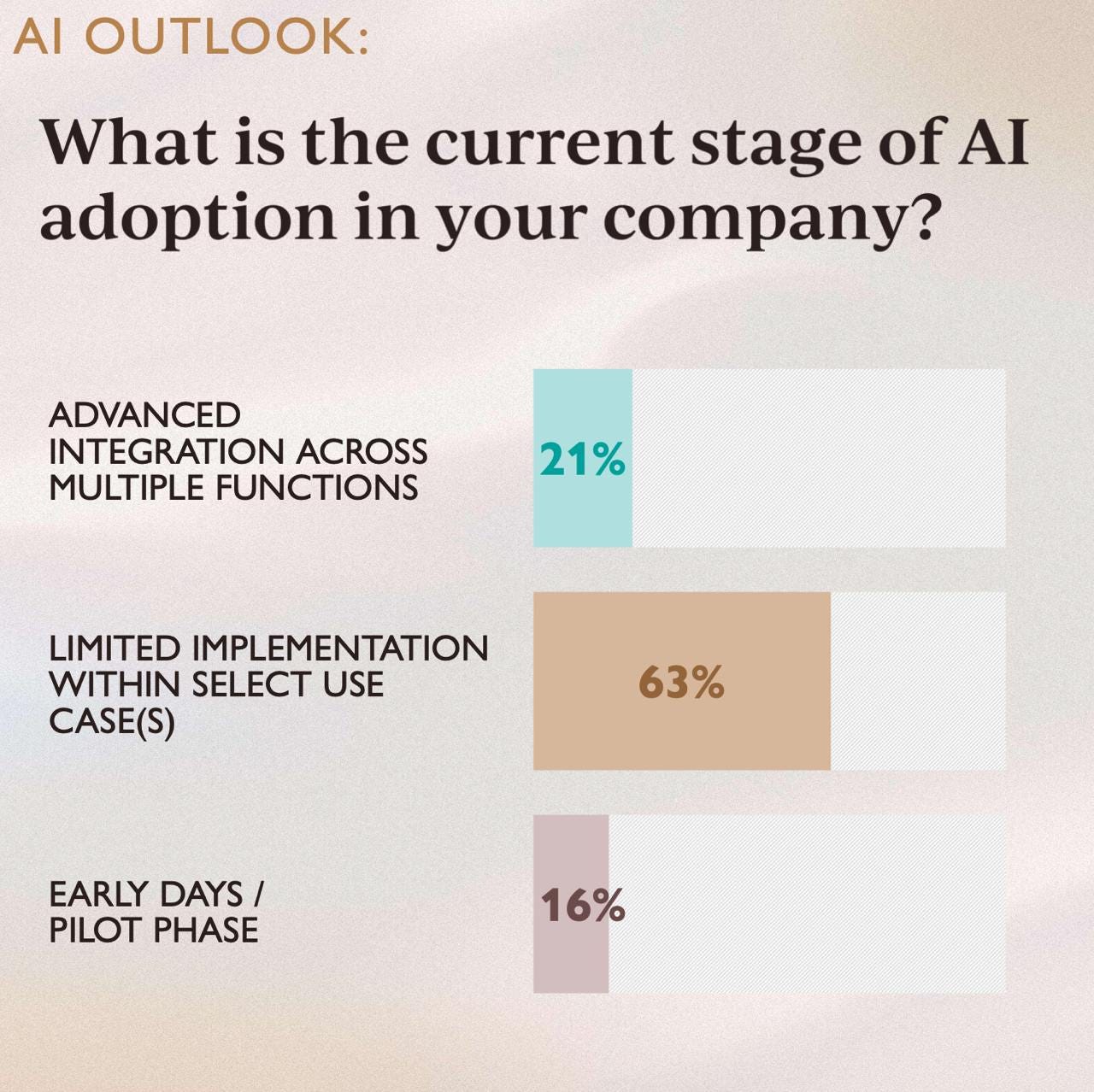

21% of executives reported AI implementation across several teams. 63% apply it in rare cases. 16% either haven’t started integration or are conducting tests.

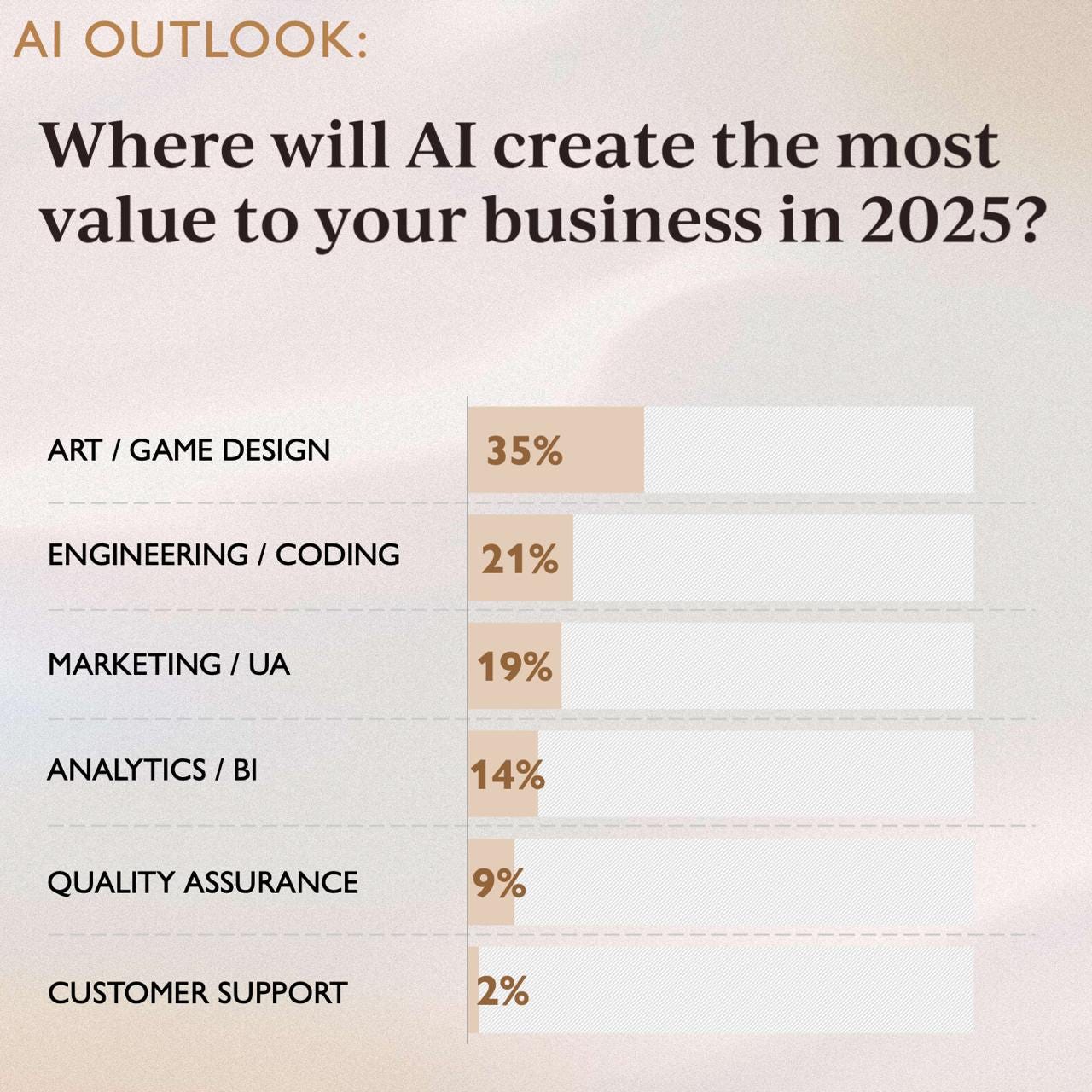

AI finds the most application in creating art and game design documents (35%); in writing code (21%); in marketing (19%); in analytics (14%); in QA (9%) and in user support (2%).

Investment Opportunities

71% of executives believe more M&A opportunities will emerge in the market in 2025. 29% think the market won’t change. No one said there would be fewer opportunities.

Sensor Tower: South Korean Market in H2'24

Overall Market Condition

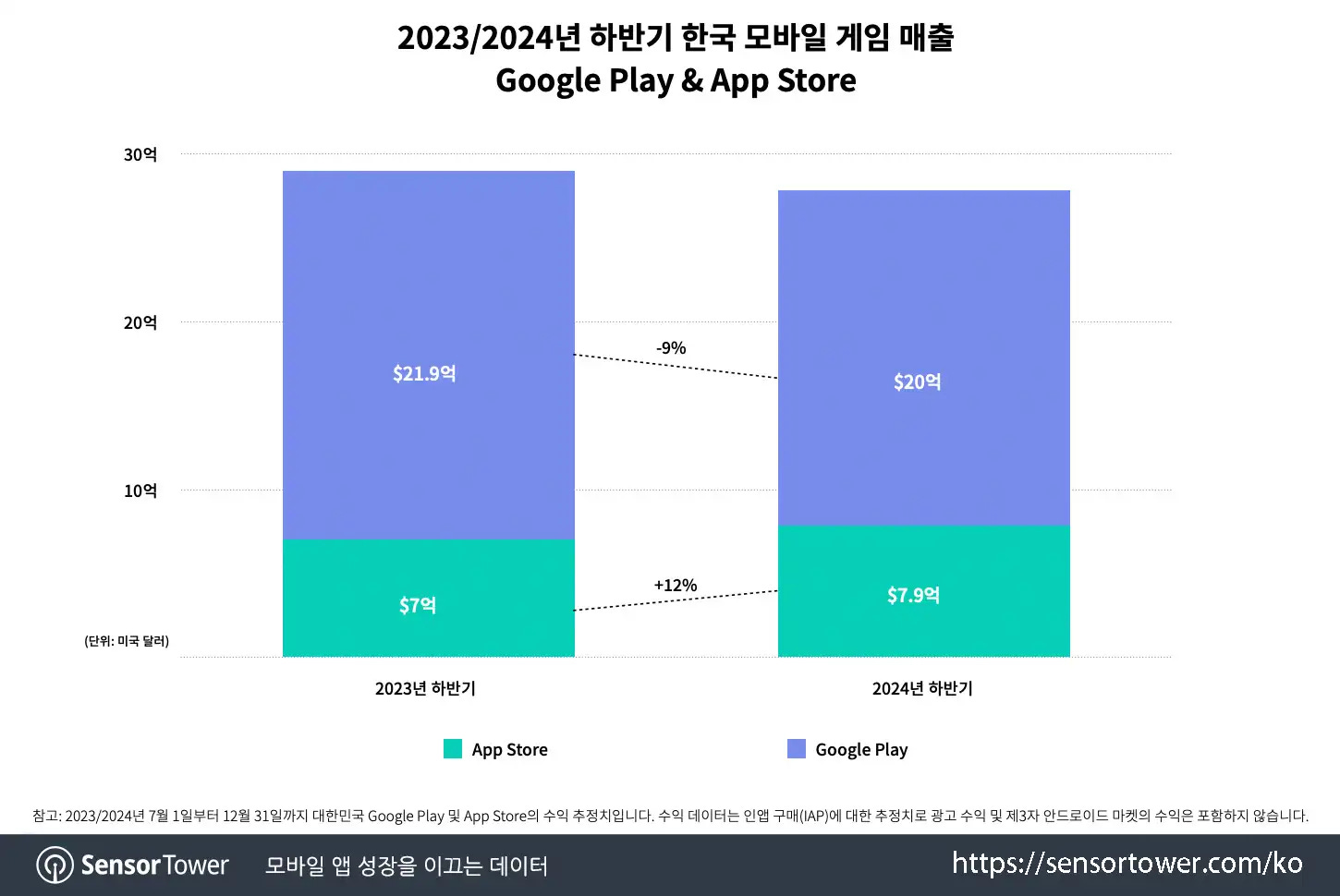

The second half of 2024 results in dollars were slightly worse than in the second half of 2023, but not significantly. Considering the exchange rate (the Korean won began to weaken against the dollar in September), revenue in the national currency may be in the positive zone.

Android accounted for 71.8% of all revenue; iOS - 28.2%. Compared to the previous year, Android's share decreased by 9%, while iOS increased by 12%.

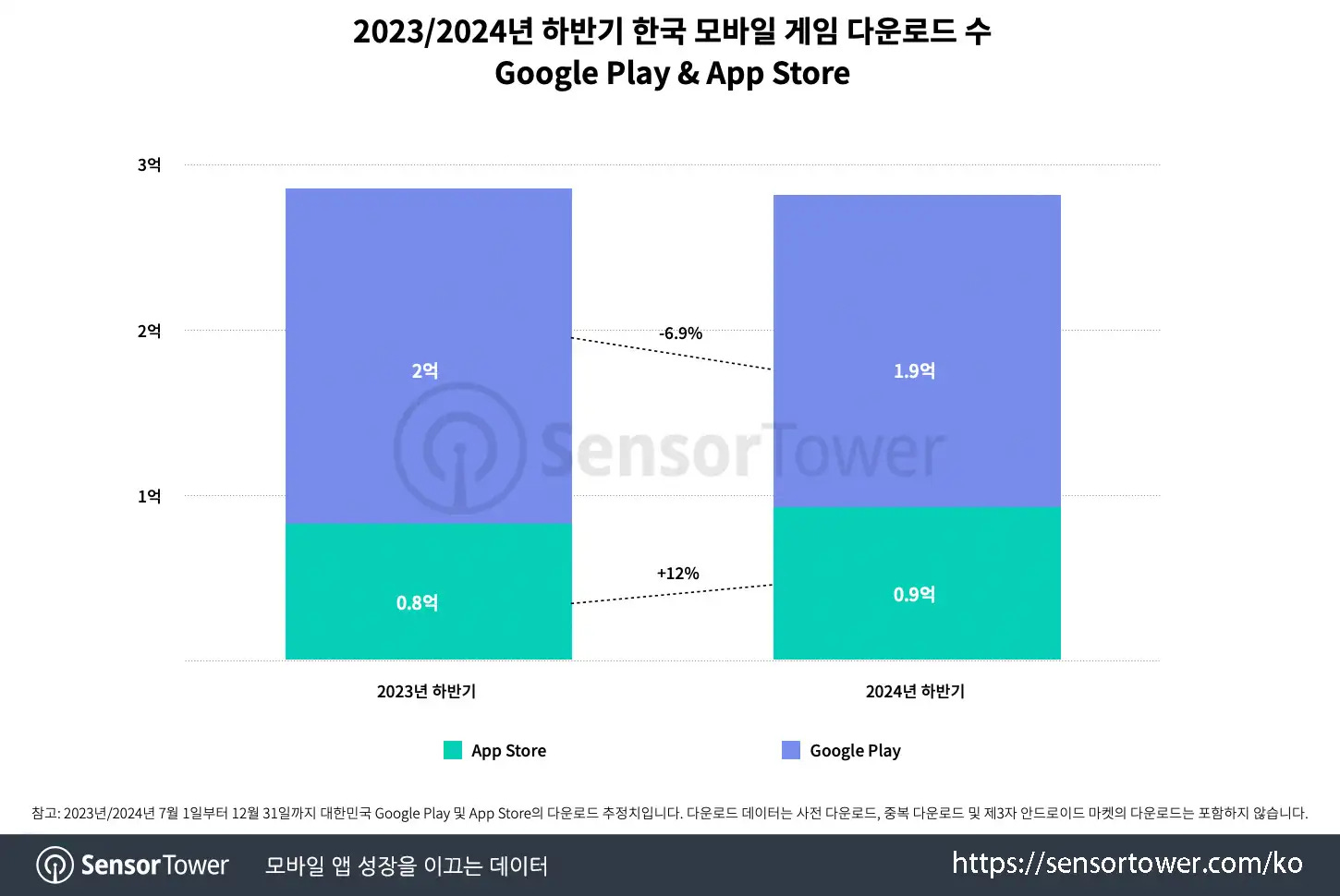

In the second half of 2024, Koreans downloaded 280 million games - slightly less than in the same period of 2023. The share of Android downloads fell by 6.9%, while the share of iOS installations increased by 12%. The trend of strengthening iOS positions continues throughout 2024.

Most Successful Games in the H2’24

Lineage M returned to first place in revenue (in August 2024, the game earned a record $45 million, thanks to events for the 7th anniversary), and Last War: Survival is in second place.

Road Nine from Smilegate is the only newcomer in the revenue chart for the second half of the year in the South Korean market. The game took 5th place.

There is significantly more movement in the download charts. Lucky Defense! by 111 percent, is in first place. GoStop 21 and Capybara Go! are also among the leaders in downloads. Among the new projects are Pokemon TCG Pocket, Block Game by Moca; Zombie.io - Potato Shooting by Joy Net Games, and Devil Athena: Dark Olympus by EFUN.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Leaders in Revenue and Download Growth

Road Nine is the fastest-growing revenue project in the second half of 2024.

The fastest dynamics in new downloads are for Capybara GO!; Pokemon TCG Pocket and Pikmin Bloom. Interestingly, the latter is the only non-new game that made it into the chart (it was released in October 2021).

Publisher Revenue Rankings

NCSOFT is the most successful publisher by revenue in the second half of 2024. Success comes from Lineage 2M; Lineage W and Lineage M.

For the first time since the first half of 2020, foreign publishers made it into the top 5. This time, there are two - FirstFun (Last War: Survival) in 2nd place and Century Games (Whiteout Survival) in 4th place. Both companies are based in China.

Dream Games (Royal Match) made it into the top 10 for the first time, and Smilegate (Road Nine) returned after a 6-year break.

Looking at the top 10, the list includes 5 Korean companies; 4 Chinese and 1 from Turkey.

In 2024, China issued 1,416 game licenses - a record since 2019

Among the 1,416 licenses, 1,306 were issued for local projects (made by Chinese developers). Consequently, 110 licenses were given to foreign projects.

In 2023, 1,075 licenses were issued (977 for local games; 98 for foreign); in 2022 - 512 (468 local games; 44 foreign); in 2021 - 755 (679 local games; 76 foreign); in 2020 - 1,411 (1,314 local games; 97 foreign); in 2019 - 1,570 licenses (1,385 local games; 185 foreign); in 2018 - 2,095 licenses (2,040 local; 55 foreign).

China stopped issuing licenses in July 2021. Restrictions were lifted for local developers in April 2022 and for foreign developers in December 2022.