Weekly Gaming Reports Recap: January 27 - January 31 (2025)

Two big and important reports inside - Sensor Tower about the Mobile gaming market in 2025, and InvestGame about the investment climate in 2024.

Reports of the week:

Sensor Tower: Mobile Market in 2025

InvestGame: Gaming Investment Market in Q4'24 and 2024

Sensor Tower: Mobile Market in 2025

The report is based on data from iOS and Google Play from January 1, 2014 to December 31, 2024. Revenue figures are Gross. Only iOS is counted in China.

❗️In the report analysis, I will focus on games, while providing general data on the mobile market. For more detailed data, please read the full report.

Mobile Market in 2024

Throughout 2024, 136 billion apps were downloaded. This is 1% less than in 2023.

Users made purchases worth $150 billion in mobile applications. This amount is Gross, before the deduction of commissions and taxes. The figure is 12.5% higher than last year.

Engagement metrics are growing - a total of 4.2 trillion hours were spent in mobile applications (+5.8% YoY). On average, a person spends 3.5 hours daily in apps (+2.9% YoY). The average user uses 26 apps per month (+9.2% YoY).

The leading countries in downloads are still the same - India, the USA, and Brazil. However, all three countries have been declining in downloads over the past 3 years.

The leaders in download growth in the top 20 are Indonesia, China, and Pakistan.

Revenue leaders are the USA, China, and Japan. While revenue in the US and China is growing, IAP revenue in Japan is falling.

Germany, the UK, and France are actively growing in IAP revenue.

In terms of time spent in apps, the leaders are India, Indonesia, and the USA.

Russia, the Philippines, and Nigeria show the most intensive growth in time spent.

Games vs non-game applications

Non-game app revenue grew from $3.5 billion in 2014 to $69 billion in 2024, a 25% year-over-year increase.

Games still account for the majority of revenue ($80 billion in 2024), but growth was only 4%.

Social networks, streaming services, and shopping apps are leaders in downloads. Downloads of AI chatbots are actively growing.

In 2024, 4 games joined the “billionaire club” for the first time - Dungeon & Fighter; Whiteout Survival; Last War, and Brawl Stars. This is a record among games since 2020. A total of 17 apps broke this mark in 2024 - 11 games and 6 non-game apps. This is the best result since observations began in 2014.

In China, 90% of all downloads and revenue come from local publishers. A large share of local companies is in Japan, South Korea, USA. But if you look at the world as a whole, local publishers account for 21-22% of all revenue and downloads.

2024 in games - markets

Mobile game revenue in 2024 reached $80.9 billion - an increase of 4% over the previous year.

At the same time, downloads fell by 6% year-on-year - to 49.6 billion.

Strong growth in revenue is shown by the markets of Turkey (+28% YoY); Mexico (+21% YoY); India (+17% YoY); Thailand (+16% YoY); Saudi Arabia (+14% YoY).

Among established markets, the US has normal dynamics (9% revenue growth, but a 7% drop in downloads). The Japanese market fell by 7% YoY.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Most markets are falling in downloads in 2024. Exceptions are Indonesia (+4% YoY) and Saudi Arabia (+5% YoY).

Emerging markets are growing in the structure of total revenue and downloads. And although their volume remains relatively small, these are potential growth points.

2024 in games - downloads

Simulators (9.8 billion installs; growth of 0.4% YoY), puzzles (9.7 billion; drop of 3% YoY), arcades (9.6 billion; drop of 12.5%) are market leaders in downloads.

The strongest growth in downloads was shown by strategies - by 12.5% compared to last year. At the same time, despite the fact that they account for only 4% of all downloads, strategies generate 21.4% of all mobile game revenue.

If we consider sub-genres by downloads, the leaders are platformers/runners (8.34% of all downloads). In second place are simulators (6.17%), in third place are racing games (4.98%).

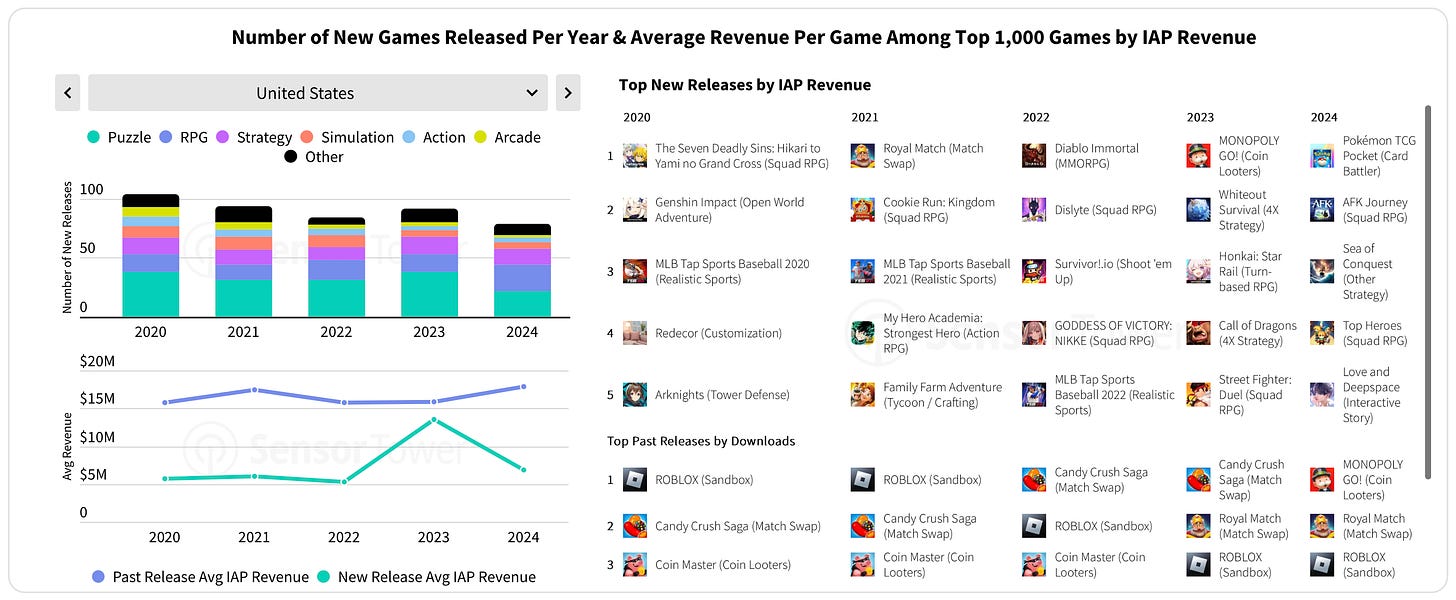

The share of new games in the US in the top 1000 by downloads has been falling since 2020. If 5 years ago there were 200 new projects in the top, then in 2024 - just over 100. At the same time, the average number of downloads continues to remain at the level of 1-2 million installs.

But the situation is not same everywhere. For example, in China in 2024, downloads of new games increased. The situation is similar in Indonesia, South Korea.

The most concentrated genres by downloads in the US are geolocation games (the top 3 games have 72.1% of all installations), shooters (21.5% of downloads for the top 3 games).

Old projects (older than 2 years) still generate most of the downloads in all genres. Among RPGs, only 47.9% of downloads are for projects older than 2 years. But among geolocation games, 86.7% of downloads are for old projects. Sports projects have a similar state (85% of downloads for games older than 2 years).

World leaders among genres in download growth are Battle Royale, MOBA, Sort Puzzle, simulators, physical puzzles.

The biggest drop in downloads was for platformers/runners, lifestyle customization games, slots, arcade racing and Match games.

2024 in games - revenue

Strategies ($17.5 billion revenue in 2024 - growth of 16.2%); RPG ($16.8 billion - drop of 17.3%) and puzzles ($12.2 billion - growth of 14%) are the largest genres by revenue on mobile devices.

Revenue is falling for sports games (-6.3% in 2024). But Action games are showing active growth (revenue soared by 46% at the end of 2024).

4X strategies are the world leader among genres in terms of revenue. They account for 9.98% of the entire market volume. Next are Match projects (8.67% of the market), Squad RPG is in third place (6.14%).

The competitive environment in the US in the top 1000 by revenue is getting tougher over the years. Fewer and fewer projects make it into the ranking. At the same time, after a serious increase in the revenue of new projects in 2023, there was an almost equally sharp drop in 2024.

The situation, again, is not the same across countries. For example, in China, both the number of new projects and their revenue increased - the dynamics were positive in 2022 and 2023. In Mexico, the revenue of both new and old projects has been growing since 2021. In France, the largest number of new games since 2020 entered the top 1000 in revenue, although the total revenue of new products was less than in 2023. Each market has its own dynamics.

The most concentrated genres by revenue in the world are geolocation games (62.5% of revenue for the top 3), strategies (9.4% for the top 3; 33.2% for the top 20), shooters (8.3% for the top 3; 29.6% for the top 20). The least competition is in arcade games, racing, board games. However, the chart shows IAP monetization, and these genres are most often monetized through advertising.

The role of old games in the revenue structure is colossal. In most genres, projects older than 2 years account for 80%+ of revenue. In casinos, shooters, puzzles, board games, racing - more than 90% of revenue comes from projects older than 2 years.

The sub-genre Coin Looters (where Sensor Tower includes MONOPOLY GO!) showed the strongest revenue growth in 2024, followed by 4X strategies, Beat’em Up (Dungeon & Fighter Mobile almost single-handedly pulled the genre), MOBA and interactive stories.

The largest decline by revenue were in MMORPG, Squad RPG, turn-based RPG, adventure games and Puzzle RPG.

Leaders in Time Spent

Battle Royale (12.69% of all time in mobile games) and MOBA (10.61%) lead in terms of the amount of time users spent in them. People also spend significant time in Sandbox projects, sports games and Match.

The most successful Games & Companies in 2024

Download Leaders - Garena Free Fire, ROBLOX, and Black Blast Adventure Master.

IAP Revenue Leaders - MONOPOLY GO!, Honor of Kings, Royal Match.

Top 3 by MAU - ROBLOX, Garena Free Fire, and Subway Surfers.

Azur Interactive, Supersonic Studios, and SayGames - the most successful publishers of 2024 in terms of downloads. Tencent, Scopely, and Activision Blizzard earned the most.

InvestGame: Gaming Investment Market in Q4'24 and 2024

You can download the full InvestGame report here. The team is doing a fantastic job, and I highly recommend subscribing to their newsletter.

2024 results

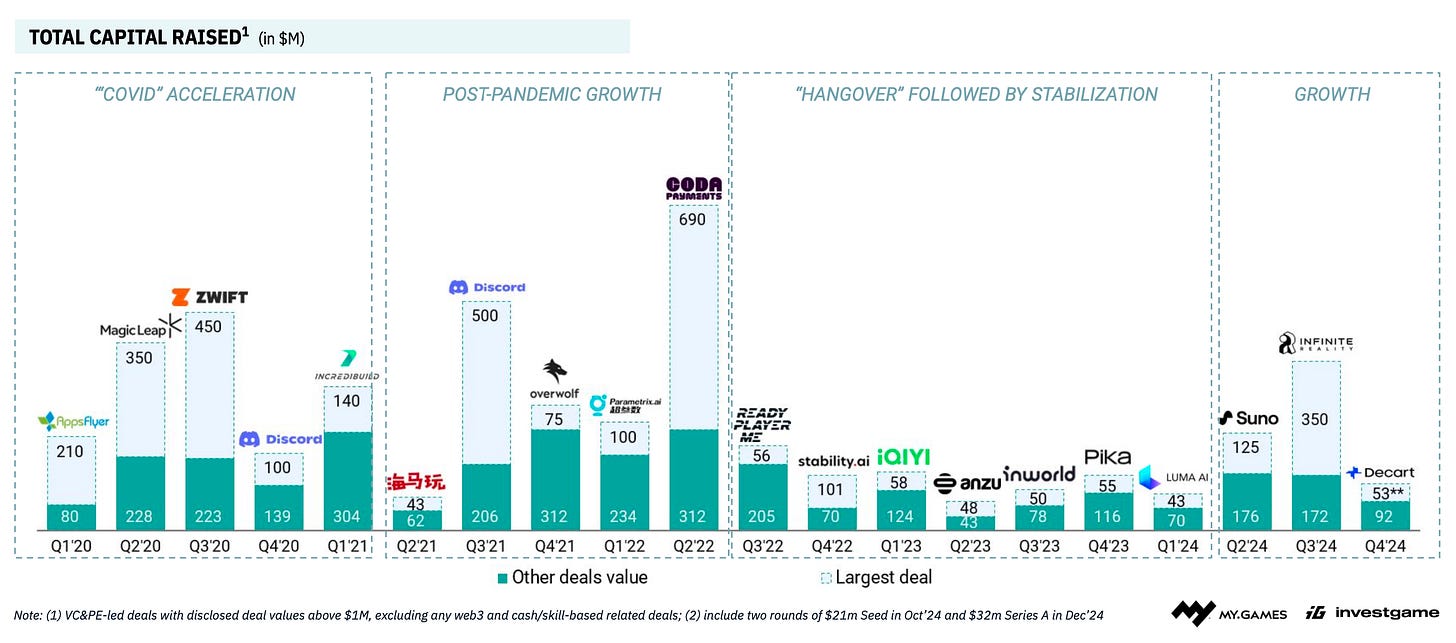

The volume of private investments in 2024 increased compared to 2023. The total deal value was $5 billion across 466 deals.

The number of M&A deals in 2024 increased (147 deals versus 124 in 2023). However, the transaction volume slightly decreased to $8.6 billion. If we consider the closed Activision Blizzard and Microsoft deal, the volume dropped significantly.

❗️InvestGame only accounts for closed deals, including earn-outs. Therefore, some announced but not yet closed deals (Easybrain, Plarium, Paxie Games) are not included.

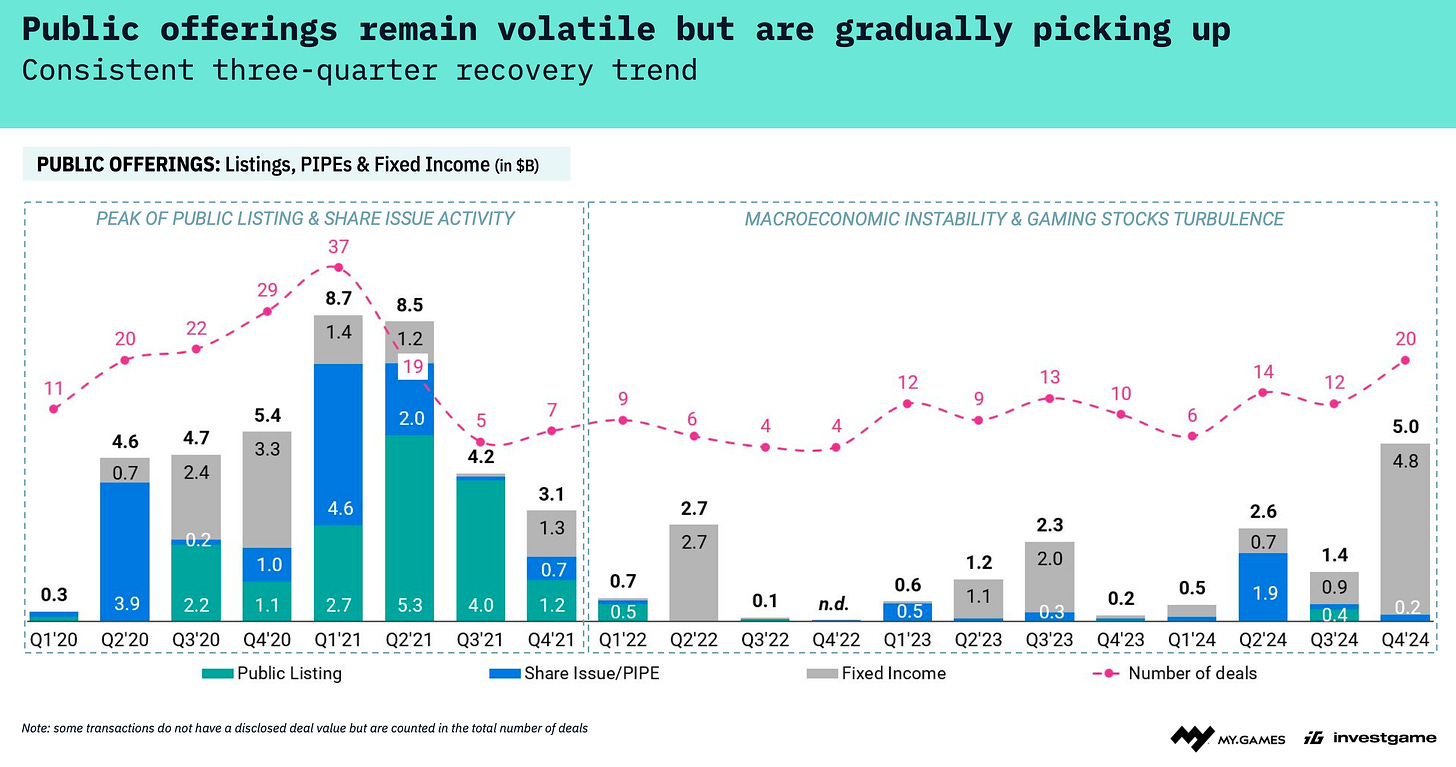

In 2024, 52 public companies made transactions (or went public). The total volume of these deals amounted to $9.6 billion. Growth in both quantity and money has continued since 2022.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

In 2024, investor interest in platforms and technical solutions nearly doubled compared to the previous year.

The total volume of investments in technological solutions in 2024 surpassed investments in content itself, although the total number of deals with such companies is smaller.

Private Investments in details

This section includes investments from VC funds, corporate investment funds, and PE funds.

In Q4’24, the number and volume of private deals were below the year’s average. However, growth compared to last year was 22% in deal volume and 12% in the number of rounds.

Epic Games ($1.5 billion), Aonic ($157 million), and Build a Rocket Boy ($110 million) were the most notable deals of 2024 when it comes to game studios (Epic Games is included here as most of its revenue is generated by games).

Infinite Reality ($350 million), Zentry ($140 million), and Suno ($125 million) were the leaders in 2024 in the platforms and game technologies sector. 9 out of 10 largest deals in the list are AI or Web3 companies.

Deals with game studios

It’s becoming more difficult for game studios to raise money in initial rounds (up to Series A). The number of deals decreased throughout 2024, while their volume plateaued.

The US (47 deals - $244 million) and Europe (44 deals - $200 million) are world leaders in financing startups at early stages among game studios.

There’s cautious optimism regarding the later stages. Compared to 2023, 30% more deals were closed, and the volume of these transactions increased by 43%. Nevertheless, InvestGame analysts note that the market remains volatile.

Corporate VC funds have a stable interest in deals. In Q3 and Q4, the number of joint deals with traditional VC funds and deals that corporate VC funds made alone increased.

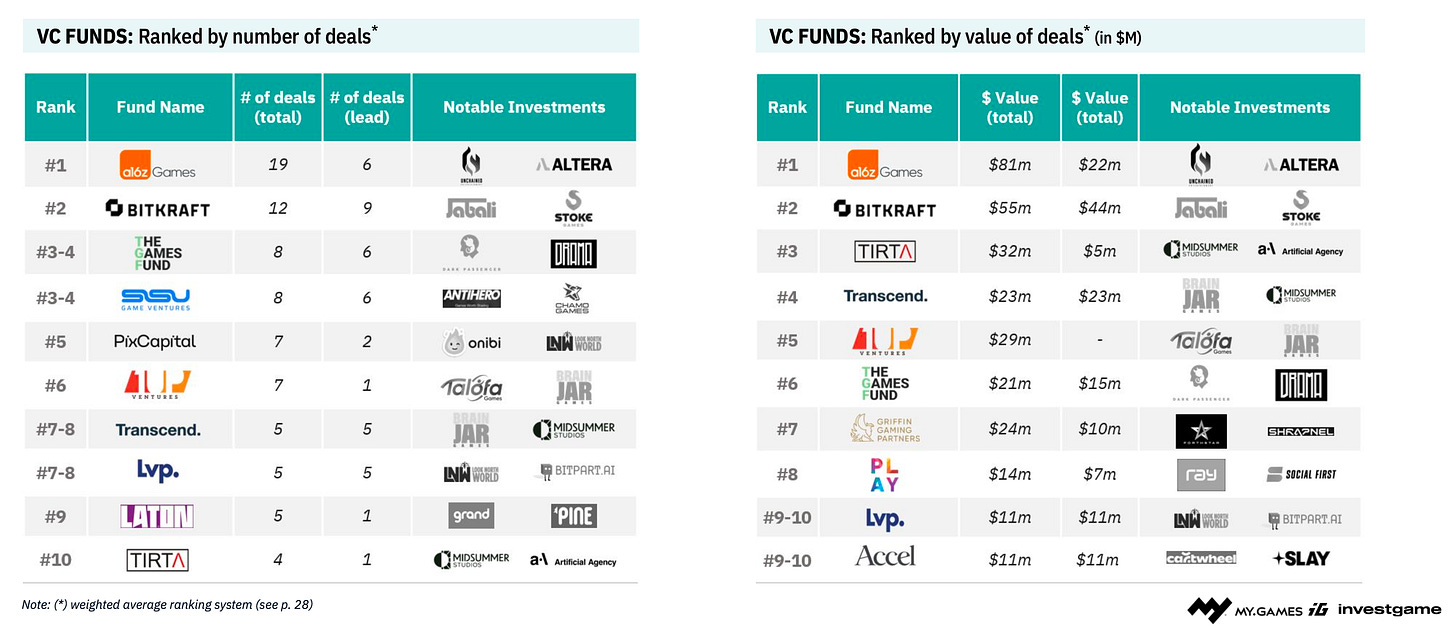

a16z Games, Bitkraft, and The Games Fund were the most active VC funds in 2024 by the number of early-stage deals. a16z Games, Bitkraft, and Tirta Ventures are leaders in investment dollar value.

GEM Capital, Bitkraft, a16zGames, vGames were the most active VC funds in Series A by the number of deals. In terms of deal sizes, Bitkraft, a16z Games, and Lightspeed are in the lead.

Regarding later stages, Lightspeed, Makers Fund, Bitkraft, and Galaxy are leaders both in the number of deals and investment volume.

M&A in details

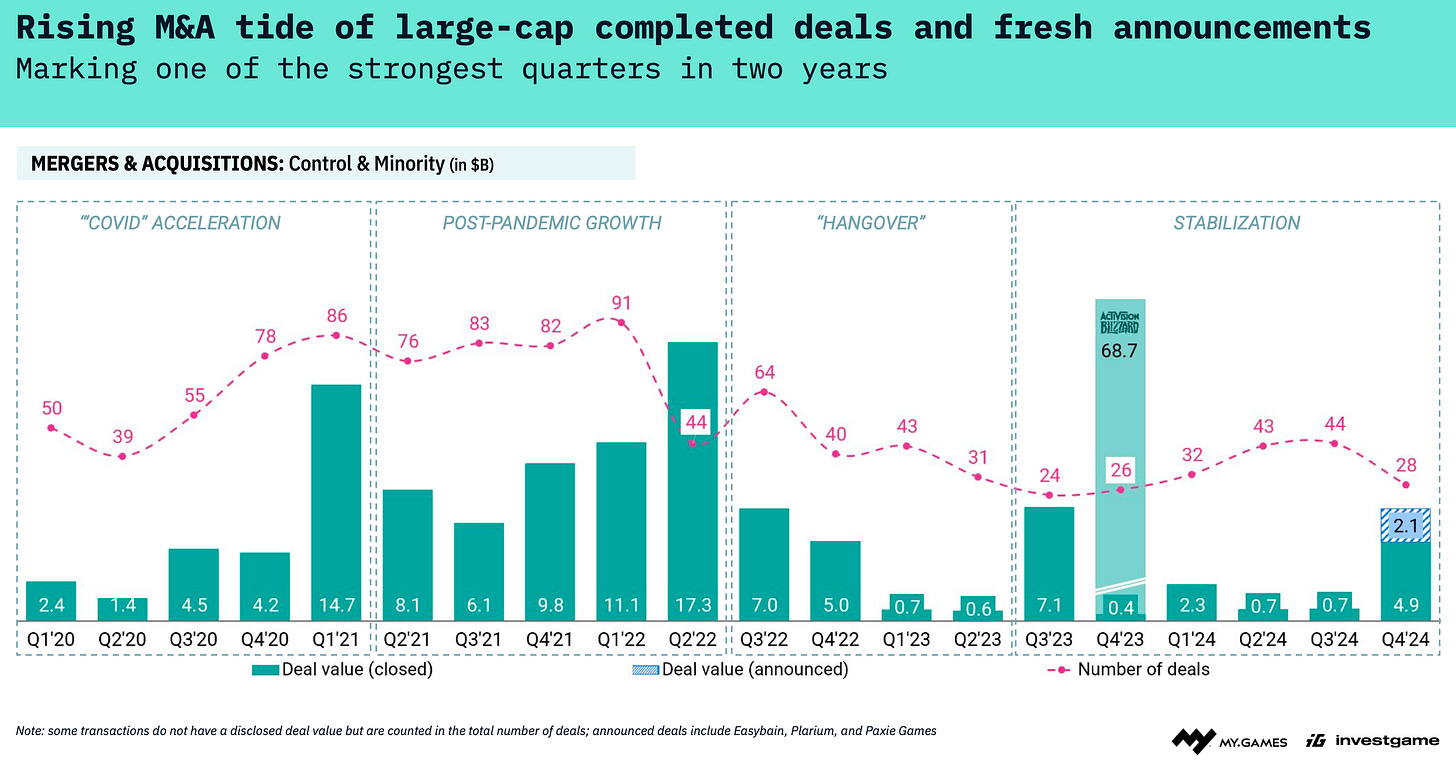

Q4’24 became one of the most successful quarters in the last two years. There were 28 deals of $4.9 billion in total size. Deals worth $2.1 billion were also announced, which should close in 2025.

The most notable deals of 2024 were the acquisition of Keywords Studios by a consortium of investors ($2.8 billion), the purchase of Jagex ($1.1 billion), and the acquisition of SuperPlay ($700 million). Large deals for Easybrain ($1.2 billion) and Plarium ($620 million) were also announced, but they will be closed in 2025.

Looking at the last decade, 2024 ranks 6th in deal volume and 6-7th in the number of deals.

Aream is the leader by a large margin among investment banks in the number of deals completed in 2024. The company has 5 deals with a total volume of $3.3 billion.

Public offerings in details

In Q4’24, there were 20 deals related to public companies, with a total volume of $5 billion. Most of these deals ($4.8 billion) were the issuance of fixed-income debt instruments.