Weekly Gaming Reports Recap: July 1 - July 5 (2024)

Co-op games are performing better than singleplayer titles in Steam; the Chinese time regulation law for minors had the reverse effect; Newzoo shared a report of how people engage with games in 2024.

Reports of the week:

Game Developer Collective: 59% of game developers pessimistic about the current state of the industry

Newzoo: How people engage with Games in 2024

AppMagic: Top Mobile Games by Revenue and Downloads in June 2024

VG Insights: Cooperative Games on Steam in 2024

Niko Partners: Chinese Gamers in 2024

Game Developer Collective: 59% of game developers pessimistic about the current state of the industry

In May 2024, more than 600 game developers were surveyed.

The overall attitude towards the state of the industry is negative, with 59% expressing this view. Only 13% of those surveyed said everything is going well in the industry.

25% are optimistic and believe that things will get better soon. 49% do not expect improvements in the next six months, and 19% think things will only worsen.

Developers also pointed out who they think is to blame for this situation. Among those dissatisfied with the state of the industry, 61% blamed unrealistic investor expectations. 58% cited poor management. Other reasons mentioned include increasing budgets (41%), competition from other games (22%), and the need for high marketing expenses (21%).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Currently, 48% of workers report that they are not meeting their revenue/sales targets. 40% are on target, and only 12% are ahead of plan.

Workers are more optimistic about the future. 34% believe they will exceed their targets in the next quarter (Q3’24); 43% plan to meet their targets; and 33% think they will not meet their goals.

Newzoo: How people engage with Games in 2024

The study is based on a survey of 73,000 people from 36 countries.

General Stats

80% of people play games.

64% of people watch gaming content; 35% engage in other ways (discuss with friends, are part of the communities, etc.).

The most engaged segments in gaming are Generation Alpha and Generation Z (over 90% of them interact with games). 94% of Generation Alpha plays games.

Generation Alpha is the first to spend more time on games (5.2 hours per week) than on social media (5.1 hours per week).

Adventure games are the most popular genre among Generation Alpha, Generation Z, and millennials. Older people prefer puzzle games.

Generation Z also loves shooters and fighting games.

Minecraft, Call of Duty, and Grand Theft Auto are the most popular franchises among Generation Z users.

PC and Console Players

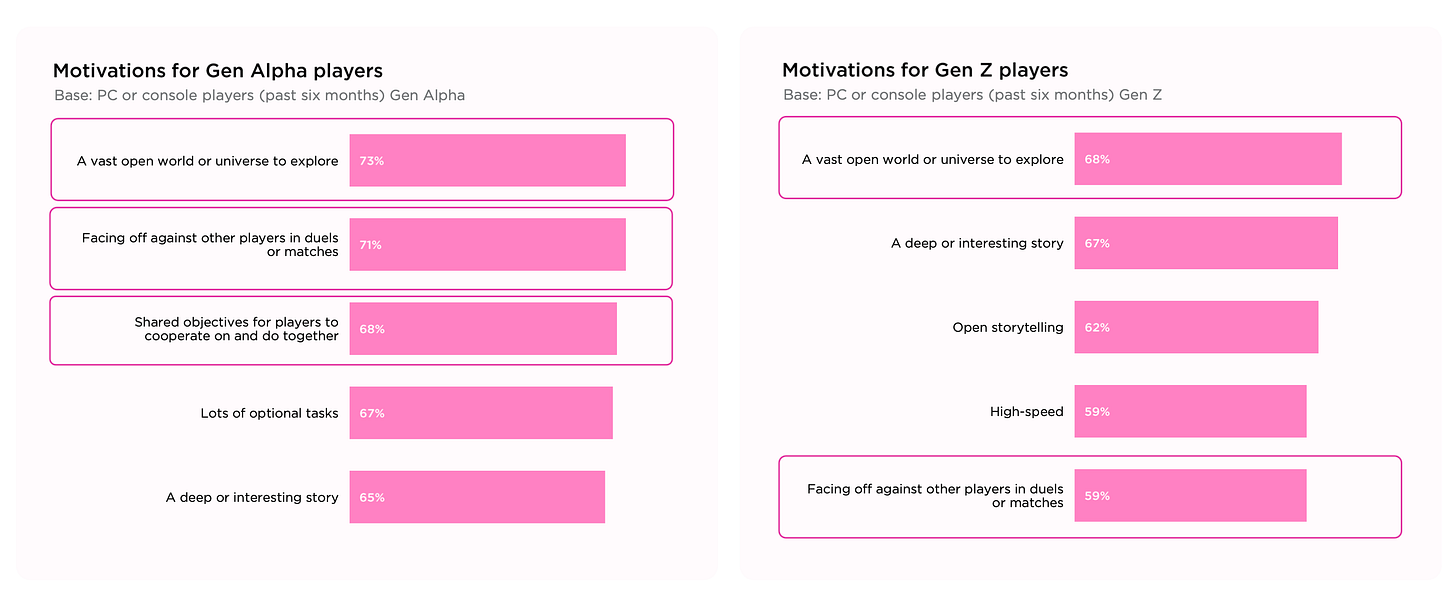

For PC and console players, a large open world (66%) and an interesting story (65%) are important.

For younger players, motivations also include the ability to complete tasks with friends, fight with them, and socialize.

Time and Money Spent by Users

PC and console players play more per day on average — 2.1 hours, compared to mobile device players — 1.6 hours. However, on mobile devices, people play an average of 3.4 days a week, while on PC/consoles — 2.6-2.7 days a week. As a result, the total number of hours spent playing per week is almost equal.

More than half of console players spend more than average. 22% of them spend more than $25 per month on games. On PC, this figure is 15%; on mobile devices — 8%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Half of mobile device players do not pay for games.

Newzoo shows that 47% of PC players; 71% of mobile device players, and 36% of console players mainly play free games. For example, only 26% of people are willing to pay for games on consoles, and only 7% on mobile devices.

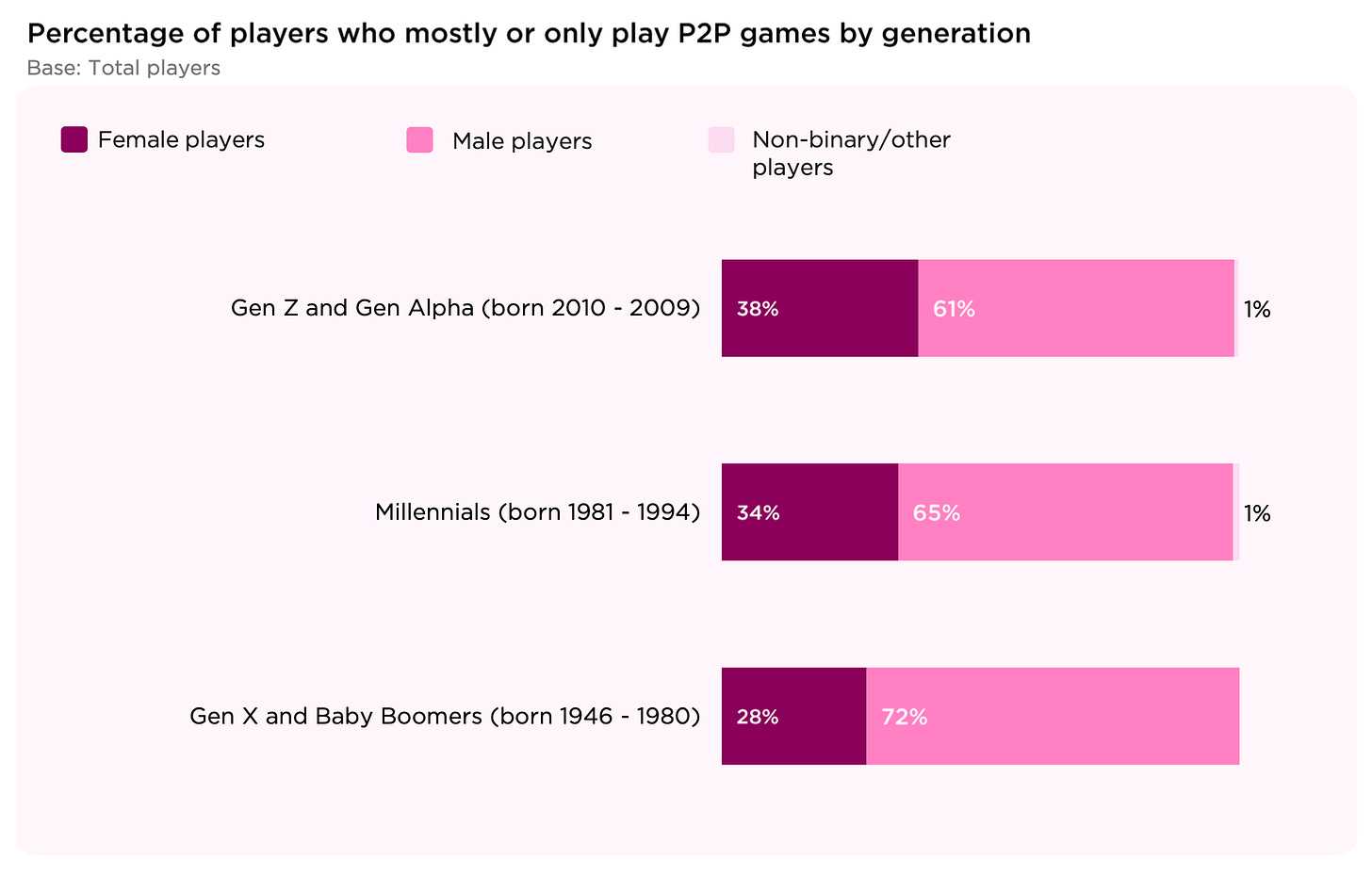

The percentage of the female audience willing to pay for games grows from generation to generation.

The audience that is looking for new titles

31% of PC and console players note that they are constantly looking for new games.

One-third of such active audience have 3 platforms; 45% have two. They are distinguished by the fact that they spend almost twice as much time playing games per week as the average player. The average age is 27.4 years, and 62% of such players are male.

82% of this audience have paid for games in the last six months. The majority of high spenders are on console.

These users prefer adventure games (59%); good graphics are important to them (38%); and among gameplay aspects, survival elements are important (42%).

At the same time, this audience continues to play global blockbusters.

More than 90% of this audience watches gaming content; 73% communicate with the community. Instagram (67%); YouTube (65%); Facebook (65%) are the main social networks.

Most users in search of new gaming experiences are in China, India, Thailand, Egypt, Saudi Arabia, and Vietnam (more than 35% of the total volume). There are also many in the UAE, Philippines, Brazil, Singapore, Indonesia, Taiwan, Mexico, and South Africa. Overall, players from emerging markets (SEA; MENA; LATAM) tend to be more open to new projects.

AppMagic: Top Mobile Games by Revenue and Downloads in June 2024

AppMagic provides revenue data excluding net of store commissions and taxes.

Revenue

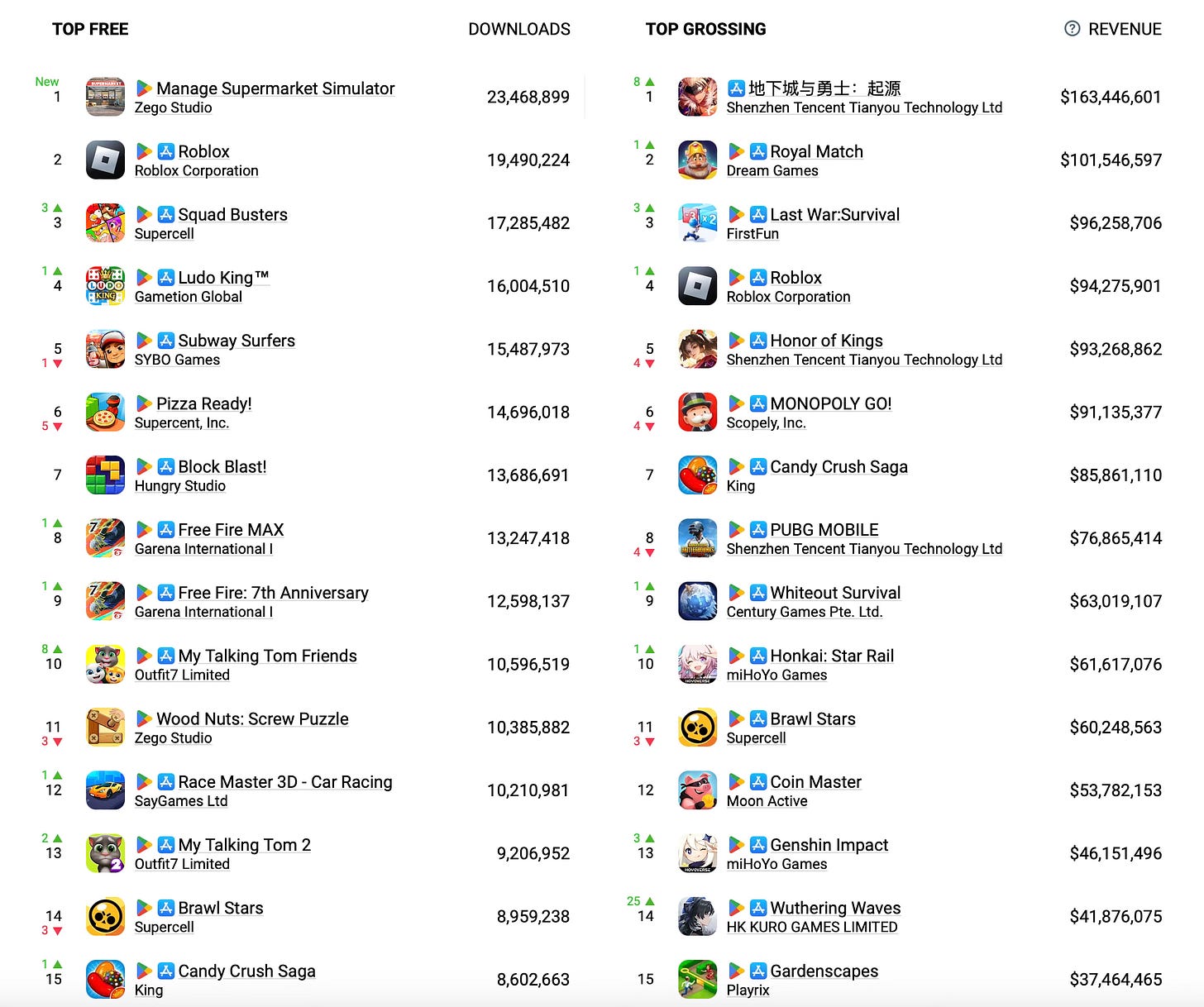

Dungeon & Fighter Mobile earned $163.4 million in June, ranking first in revenue by a significant margin. Previously, Sensor Tower reported $270 million in revenue (including commissions and taxes). Importantly, this data refers only to iOS and only to China.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Royal Match came in second place with $101.5 million in (net) revenue. Last War: Survival ranked third with $96.3 million. The project has been growing since October 2023, when scaling began.

Honor of Kings showed its lowest revenue level since October 2019 - $93.2 million.

Monopoly GO! also saw a decline in revenue, earning the same amount as in July 2023 - $91.1 million.

❗️As usual, it's important to note that we are not seeing the full revenue of these projects. A significant portion of payments might be made through off-store methods.

Wuthering Waves is showing excellent results. The game almost matched the revenue of Genshin Impact, earning $41.9 million in June, which is 2.5 times more than the previous month.

Downloads

The download rankings are less dynamic but still interesting. There is a new leader - Manage Supermarket Simulator. The game was downloaded 23.5 million times in June.

However, if you consider both versions of Free Fire (Max and the regular one), it becomes the leader in downloads - 25.8 million installations in June.

Squad Busters continues its triumphant march, with 17.3 million downloads.

VG Insights: Cooperative Games on Steam in 2024

Co-op titles are games with predominantly PvE mechanics.

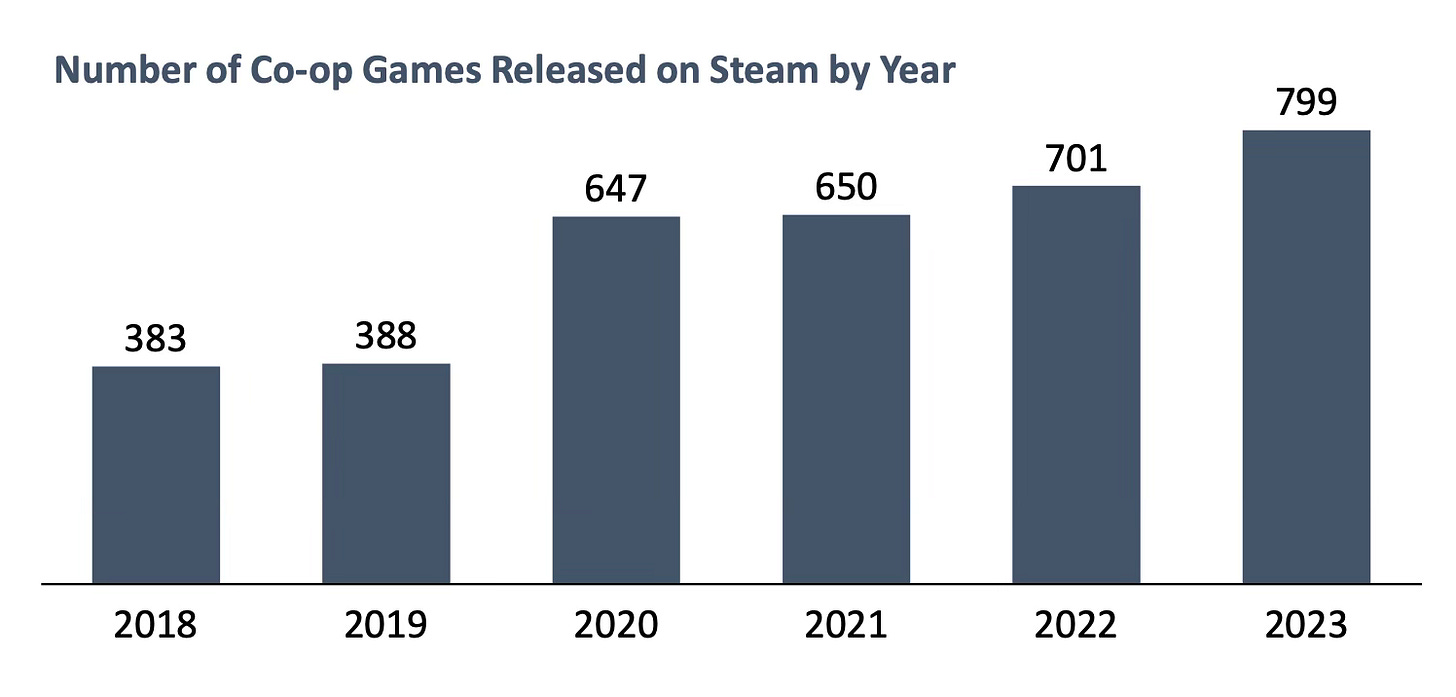

The number of cooperative games released surged in 2020 (from 388 in 2019 to 647). It seems developers recognized the importance of socialization during the pandemic. Since then, the number of cooperative games released each year has only increased. In 2023, 799 such projects were released.

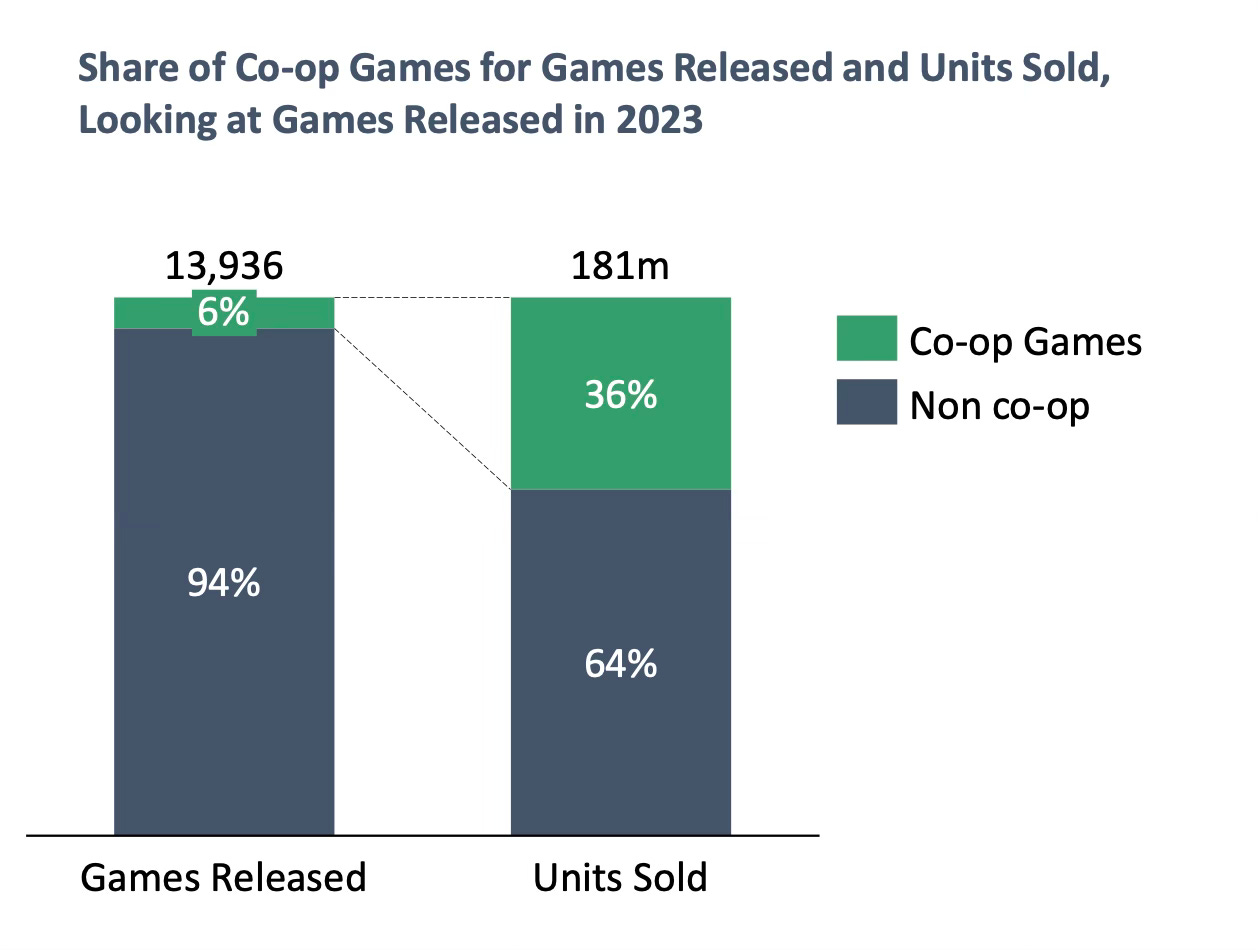

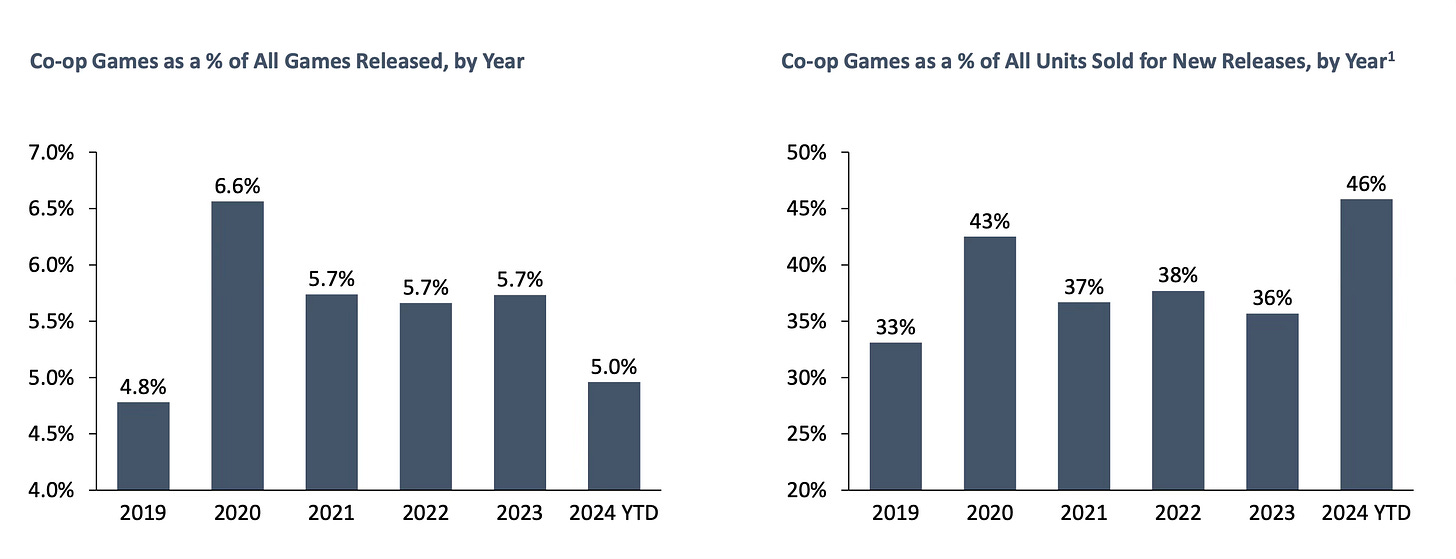

In 2023, cooperative games accounted for 6% of the total number of games released on Steam. At the same time, they made up 36% of all units sold.

In 2024, the situation looks even more disproportionate. Cooperative games make up 5% of all released games; they account for 46% of all copies sold. Of course, this is significantly influenced by titles like Helldivers II, Palworld, and Content Warning. Nevertheless, the share of sales for cooperative games has not dropped below 33% over the past five years.

❗️The consumption pattern has a major influence here. Cooperative games are often played with friends, hence the high virality factor.

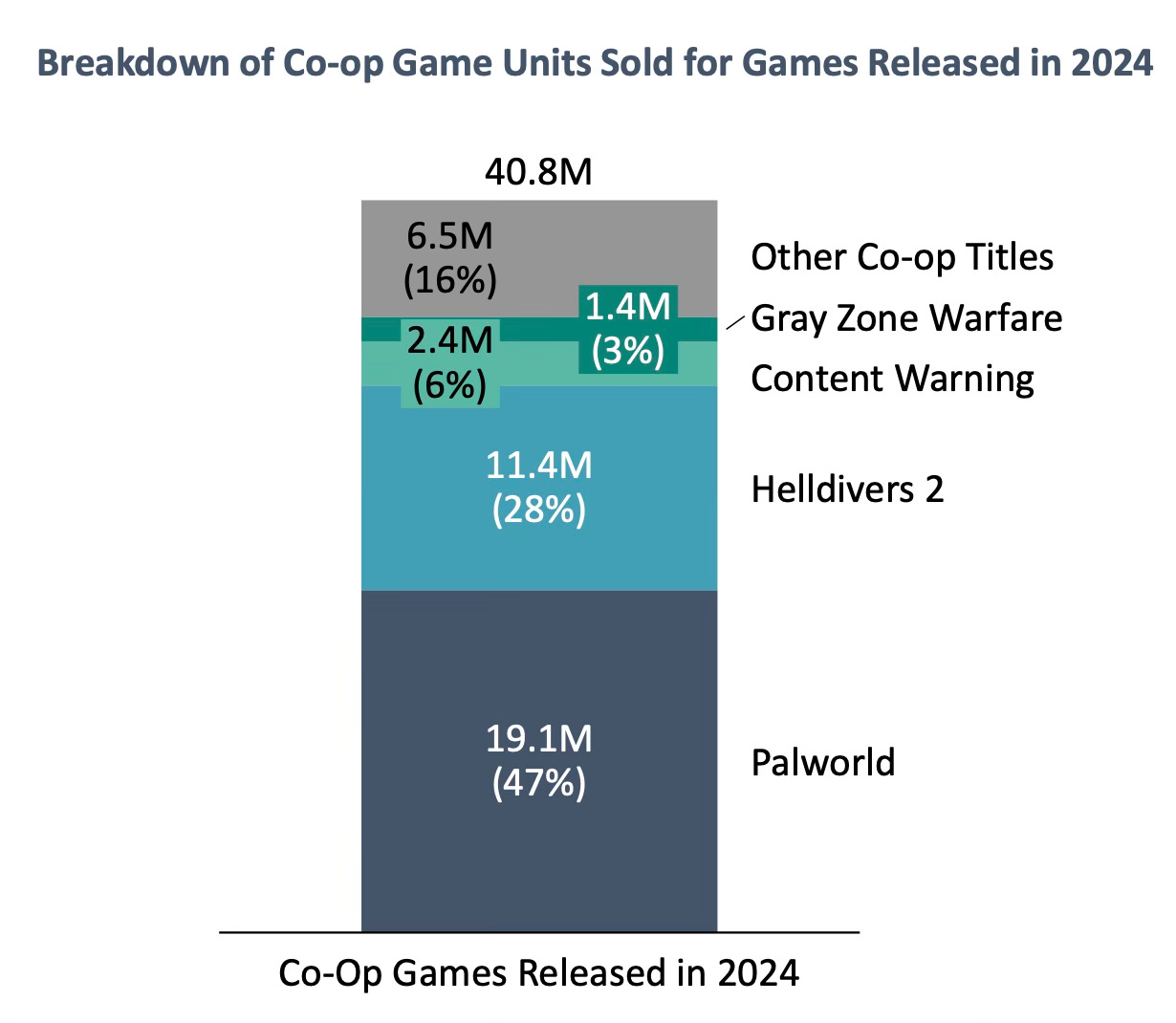

According to VGI, the largest cooperative games in 2024 are: Palworld (19 million copies; peak CCU - 2.1M); Helldivers II (11 million units; peak CCU - 459k); Content Warning (2.5 million copies; peak CCU - 204k); Gray Zone Warfare (1.4 million copies; peak CCU - 73k).

❗️In my opinion, Gray Zone Warfare doesn't quite fit this list. It’s more of an Extraction Shooter, although it does have cooperative missions.

In 2024, more than 40 million copies of co-op games were sold. Palworld accounts for 47% of this volume; Helldivers II for 28%. The other projects make up 16%.

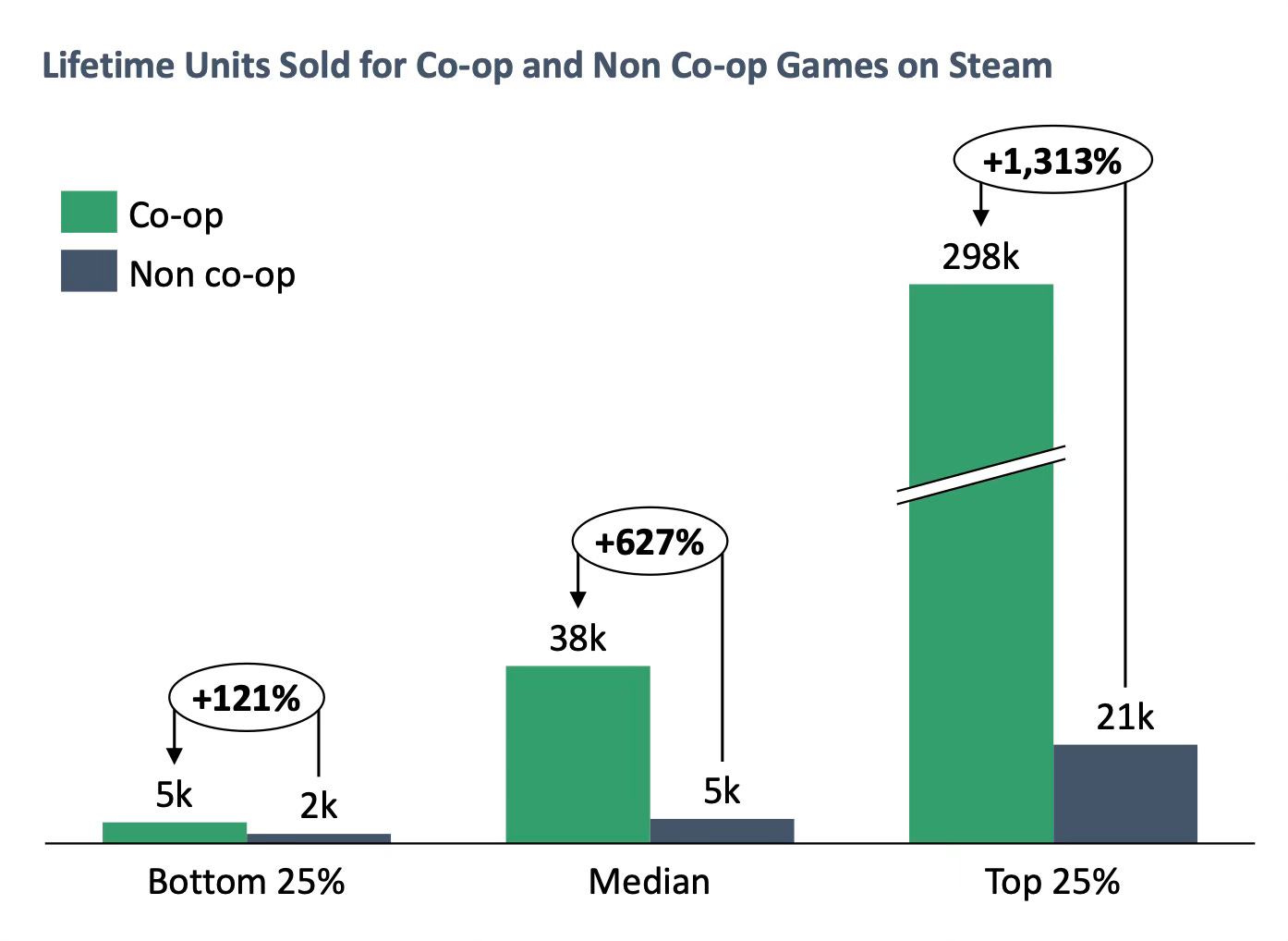

Cooperative games on Steam outperform single-player games in terms of sales. A typical cooperative game sells around 40,000 copies compared to 5,000 for a single-player game.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

When considering the worst 25% of representatives, cooperative games sell 121% better. When comparing the top 25% in terms of copies sold, cooperative games sell 1313% better. Taking the median, cooperative games sell 627% better.

VGI notes that 106 cooperative games on Steam have sold more than 5 million copies.

Key features of cooperative games: they are viral; generate memes and absurd situations; are fun to stream; and most of them have high replayability.

Niko Partners: Chinese Gamers in 2024

Daniel Ahmad, Director of Research & Insights at Niko Partners, shared this information on his LinkedIn.

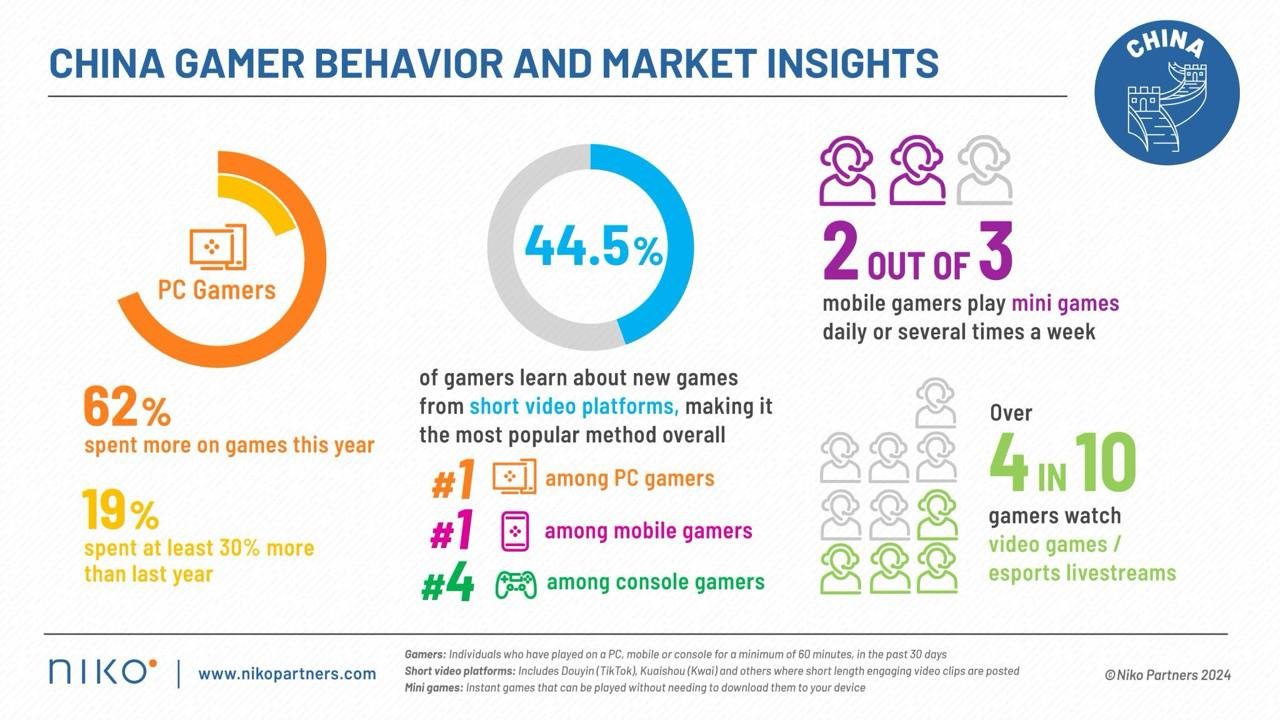

62% of PC users have spent more this year compared to the previous one. 19% noted that they spent at least 30% more.

Two-thirds of mobile gamers in China play mini-games on WeChat. This is the fastest-growing mobile segment in the country.

There are 650 million gamers in China.

44.5% of Chinese PC & Mobile gamers learn about new games through short video services. For console players, it ranks 4th on the list (apparently, console players rely on more comprehensive sources).

43.9% of gamers watch streams or esports competitions. 68.6% of them do so on Douyin.

Gamers aged 18 to 22, who experienced restrictions on gaming time for children and adolescents, play more than those not affected by this legislation. It turns out that the ban had the opposite effect once players reached adulthood.

Companies from Japan, the US, and South Korea are the main suppliers of gaming content to the Chinese market. Interestingly, three years ago, no South Korean games had a license in China.