Weekly Gaming Reports Recap: July 22 - July 26 (2024)

Japanese Mobile Market Insights from Sensor Tower; Steam Q2 releases data (more games are coming to the platform than ever); American audience insights by Comscore & Anzu.

Reports of the week:

Comscore & Anzu: Study of the American Gaming Audience

Monthly Audience of WeChat Mini Games Reached 500M Users

Games & Numbers (July 11 - July 23)

How to Market a Game: Results of the H1'24 and Q2'24 in Steam for Indie Games

Sensor Tower & Adjust: Trends of the Japanese Mobile Market in 2024

Comscore & Anzu: Study of the American Gaming Audience

The study was conducted in March 2024 among people aged 18 to 65 in the US. The sample size was 4570 people. Gamers are those who typically play games several times a week and have played at least once in the past month.

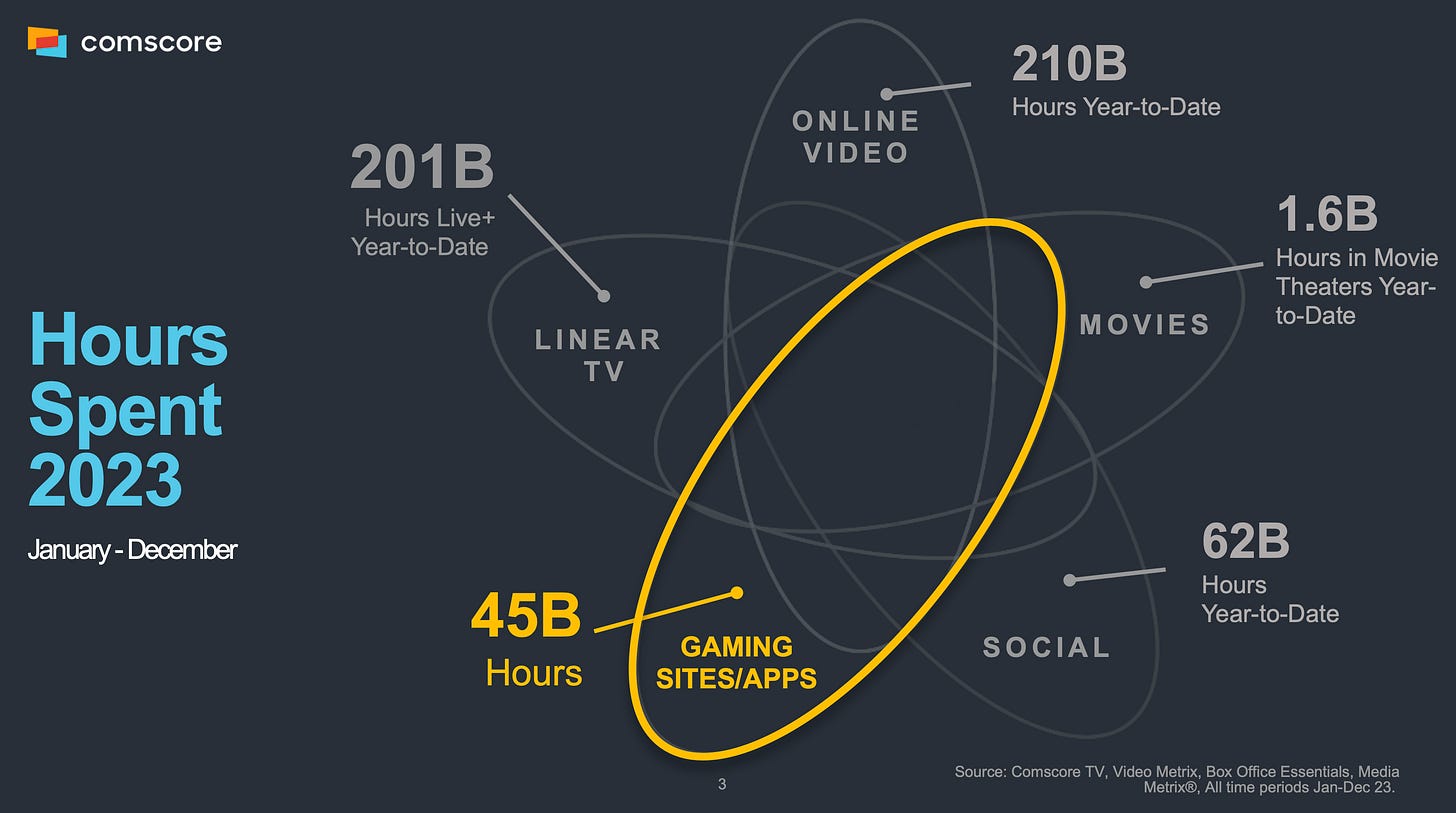

In 2023, American users spent 45 billion hours on games and related activities. This is less than the time spent watching online videos (210 billion hours); television (201 billion hours); and time on social media (62 billion hours).

62% of Americans over 18 years old play games.

40% of households in the USA play on a console at least once a month.

77% of American gamers play on more than one platform. 40% play on all platforms (mobile, PC, consoles).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

49% of American gamers are millennials. This is the largest group. 28% are Generation X; 13% are Generation Z; 11% are boomers.

63% of gaming households earn between $25,000 and $100,000 a year. 16% earn less than $25,000; 20% earn more than $100,000.

PC and console gamers traditionally are willing to pay more for games. 45% spent more than $41 on the last game they bought. 32% of mobile gamers in the USA are not willing to pay for games.

The most popular genres on PC are FPS (49%); Action/Adventure (47%); and RPG (47%). On consoles - Action/Adventure (65%); FPS (59%); and sports games (46%).

Monthly Audience of WeChat Mini Games Reached 500M Users

The MAU of WeChat mini-games reached half a billion people. It was not specified in which month this milestone was reached or how long it has been maintained.

The total audience of the platform currently exceeds one billion people.

55% of the audience are male. 85% of players are over 24 years old.

In 2023, 240 games earned more than $1 million per quarter.

The platform hosts over 400,000 developers. 80% of the teams have fewer than 30 people.

Games & Numbers (July 11 - July 23)

PC/Console Games

Terraria is a super hit. The game has sold over 58.7 million copies in 13 years. Out of this, the last 23.7 million copies were sold from 2021 to the present.

More than 2.2 million people purchased early access to EA Sports College Football 25 for $100. Additionally, 600 thousand people played the game through the EA Play subscription. Analysts did not expect this result and have already doubled their sales forecasts for the project.

The summer sale on Steam helped Arma 3 increase its sales by 500 thousand copies. 100 thousand people bought the game on the first day of the discounts. The game is already more than 10 years old.

The First Descendant launched successfully with 10 million players in the first week. The peak concurrent users (CCU) on Steam reached 264 thousand.

Sales of Pacific Drive exceeded 600 thousand copies. The game was released in February this year on PlayStation 5 and PC.

The cooperative horror game Murky Divers sold 100 thousand copies in the first two weeks after its release in Early Access.

The crime scene cleaner simulator, Crime Scene Cleaner, has over 490 thousand wishlists. This great news was shared by the head of PlayWay, Krzysztof Kostowski.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Mobile Games

Wuthering Waves’ revenue exceeded $100 million in its first two months. 23% of it came from Japan; 22% from China; 17% from South Korea; and a similar percentage from the USA.

Zenless Zone Zero earned more than $50 million in gross revenue in the 11 days after its release. The figures were shared by AppMagic. 47% of the revenue came from China; 27% from Japan. And yes, this is only about mobile devices - the game is also available on PC and PlayStation 5.

The second attempt at a global launch for Honor of Kings helped the game achieve more than 50 million installs outside of China in its first month. However, revenue figures are not as encouraging yet.

Mobile downloads of Loop Hero exceeded 1 million copies. The publisher called the percentage of purchases "significant," without specifying the exact number.

How to Market a Game: Results of the H1'24 and Q2'24 in Steam for Indie Games

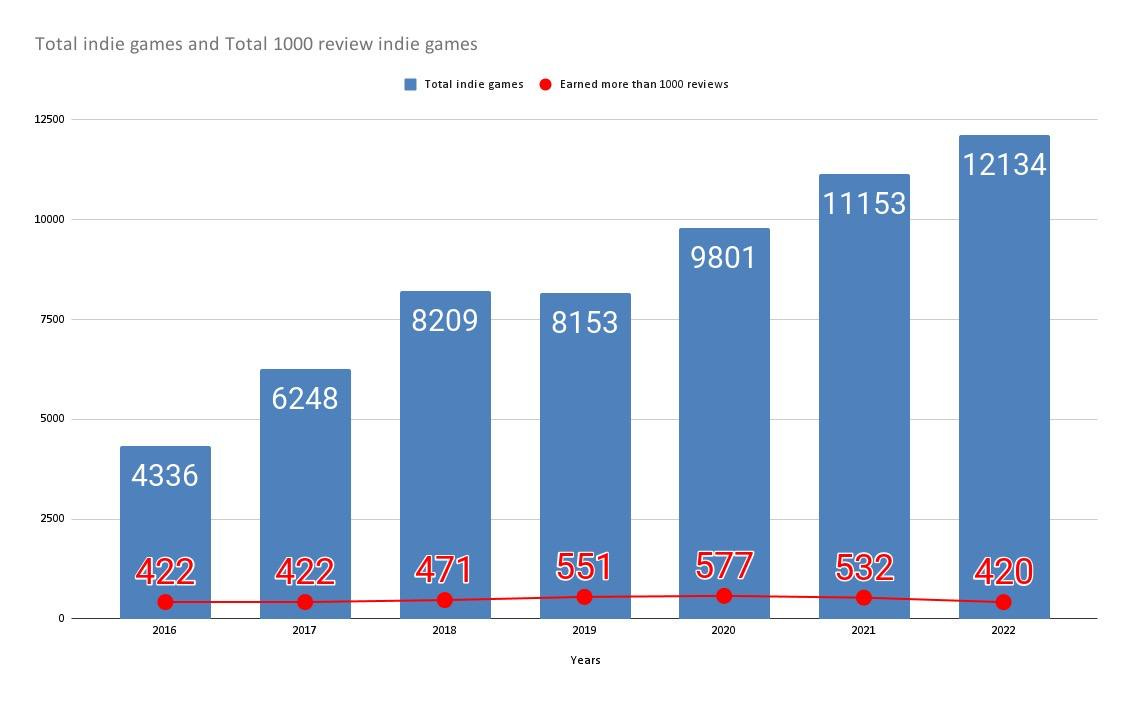

Chris Zukowski (blog author) highlights games with at least 1000 reviews on Steam. AAA projects and games based on major IPs have been removed from the sample. Niche projects for different markets (like Chushpan Simulator) have also been excluded.

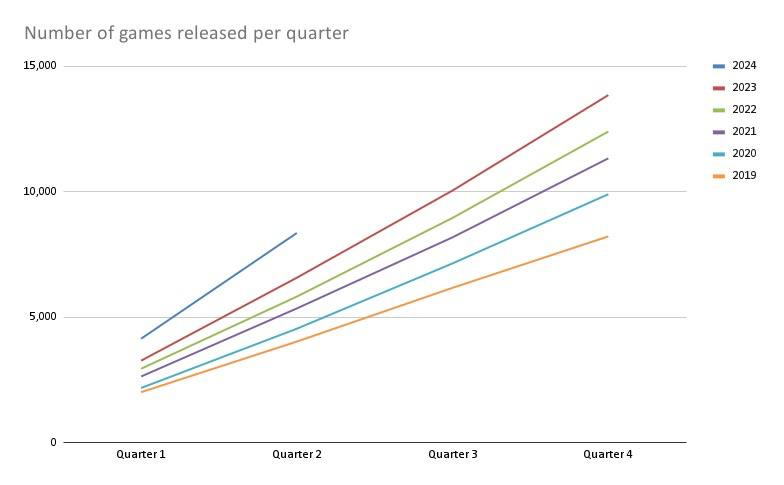

In the first half of 2024, 8362 games were released on Steam. This is 27% more than the same period in 2023.

❗️ Over the past 5 years, the number of new games on Steam has only grown.

In the first quarter of 2024, 72 games reached the milestone of 1000 reviews. In the second quarter, another 160 games were added to them (119, excluding AAA and major IP projects).

For the past 8 years, the number of games on Steam with more than 1000 reviews has remained roughly the same - about 500 games per year. This is bad news because competition increases as the number of released games grows.

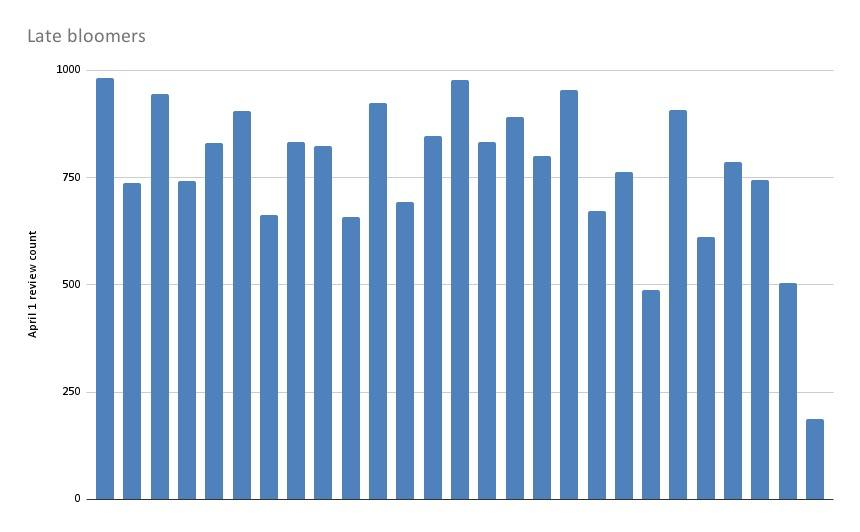

Chris also counted the number of “sleeper hits” - projects that did not receive 1000 reviews in the quarter of their release but did so in the following quarter. There were 28 such games in Q2 2024. Most of them were close to this mark in the release quarter.

❗️ The overall conclusion is that if your game sells poorly at the start, it is highly likely to continue selling poorly.

The popularity of Action Roguelikes inspired by Vampire Survivors has declined. In 2022, 10 projects reached the 1000+ review mark. In 2023, there were 17. But in 2024, there was only 1, Deep Rock Galactic Survivors.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Horror games continue to be popular. Also successful are games where you need to build something; simulate something; or craft something.

10% of all projects on Steam that reach 1000+ reviews are for adult audiences. This was the case in 2022, 2023, and seems to be the case in 2024.

Only 1 VR game in the past couple of quarters has exceeded 1000 reviews - UNDERDOGS.

Sensor Tower & Adjust: Trends of the Japanese Mobile Market in 2024

Overview of the Japanese Market

In 2023, more than 73% of Japan’s population used smartphones, and internet penetration reached 93%.

The total spending by Japanese users on mobile applications amounted to $179 billion, with only China and the USA ahead.

In Q1’24, 8 out of the top 10 apps by revenue were games. The only non-gaming apps in the top 10 were piccoma (a manga app - ranked 1st) and LINE (a messaging app - ranked 4th).

ATT opt-in rates in Japan have been growing year by year. The highest rate in Q1’24 was for games at 30%, the same as the previous year.

Overall app downloads declined in 2023 but saw a 3% increase at the beginning of 2024 (Q1’24 compared to Q4’23).

Revenue-wise, the market has plateaued, though there was a 3.5% increase in Q1’24 compared to the previous quarter.

Japanese Mobile Market

Revenue in the Japanese mobile market has been relatively flat since the start of 2023. However, there was a 2.23% increase in Q1’24 compared to the previous quarter.

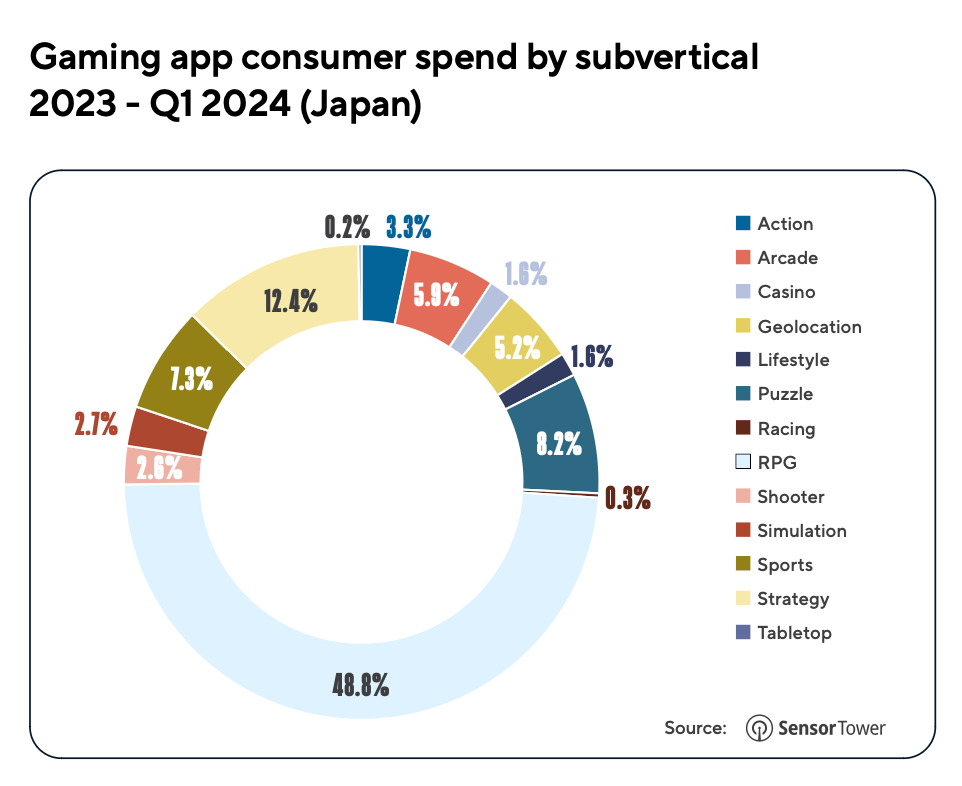

RPGs accounted for 48.8% of total market revenue, followed by strategy games (12.4%) and puzzle games (8.2%).

Action games saw the highest revenue growth in Q1’24 with a 21.6% increase. Puzzle games also grew significantly by 13.8%.

Monster Strike, Uma Musume Pretty Derby, and Fate/Grand Order topped the revenue charts in Q1’24.

Fat Goose Gym, Legend of Mushroom, and Locked Rings led in downloads in Q1’24.

The gaming audience in Japan is predominantly male (63.6%). In certain genres (e.g., sports games), the male audience reaches 91.8%, while in arcade games, the majority are female (58.9%).

The largest segment of Japanese mobile gamers (35.5%) is aged 25-34, making it the most active demographic.

Downloads and Sessions in the Japanese Mobile Market

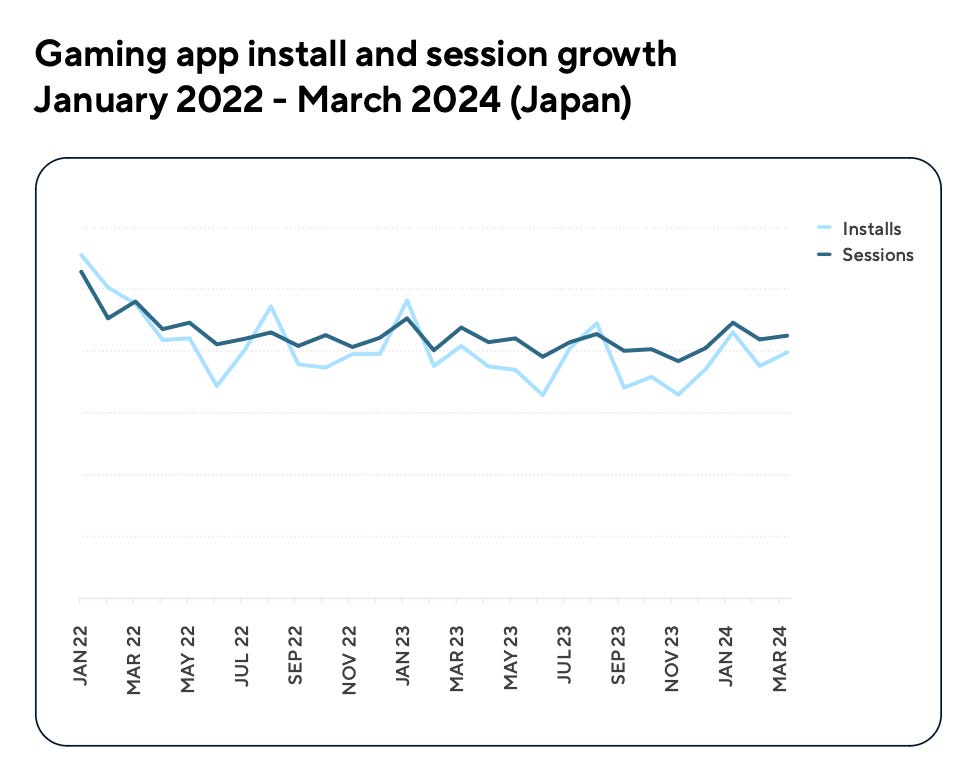

Game downloads in Japan began to decline in early 2022, with the drop stabilizing by 2023. In Q1’24, according to Adjust, downloads increased by 18% compared to Q4’23. The number of sessions also increased by 1% over the same period.

Comparing Q1’24 to the average figures for 2023, downloads rose by 7% and sessions by 6%. Globally, downloads fell by 1% while sessions increased by 4%; in the US, downloads decreased by 2% while sessions grew by 10%.

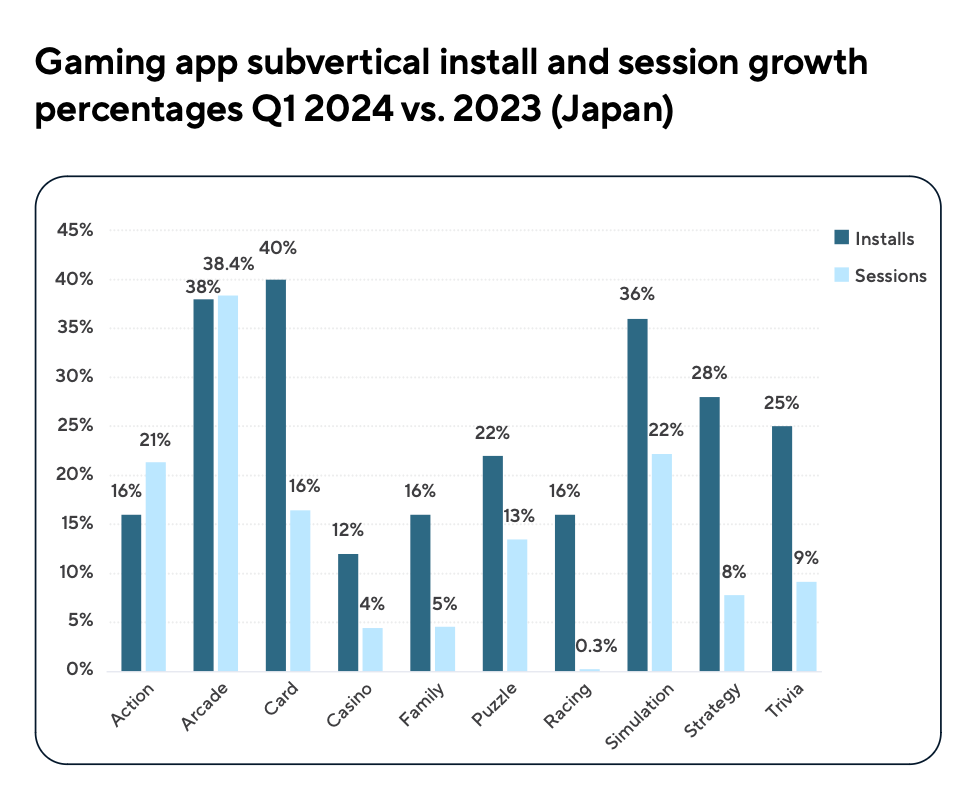

The growth leaders in Q1’24 were arcade games (sessions up by 38.4%, downloads by 38%), card games (downloads up by 40%, sessions by 16%), and simulation games (downloads up by 36%, sessions by 22%), compared to the average values of 2023.

Since the beginning of 2023, the highest percentage of installations has been for puzzle games (16%), RPGs (11%), and action games (11%). In terms of sessions, puzzles lead (23%), followed by RPGs (16%) and sports projects (11%).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

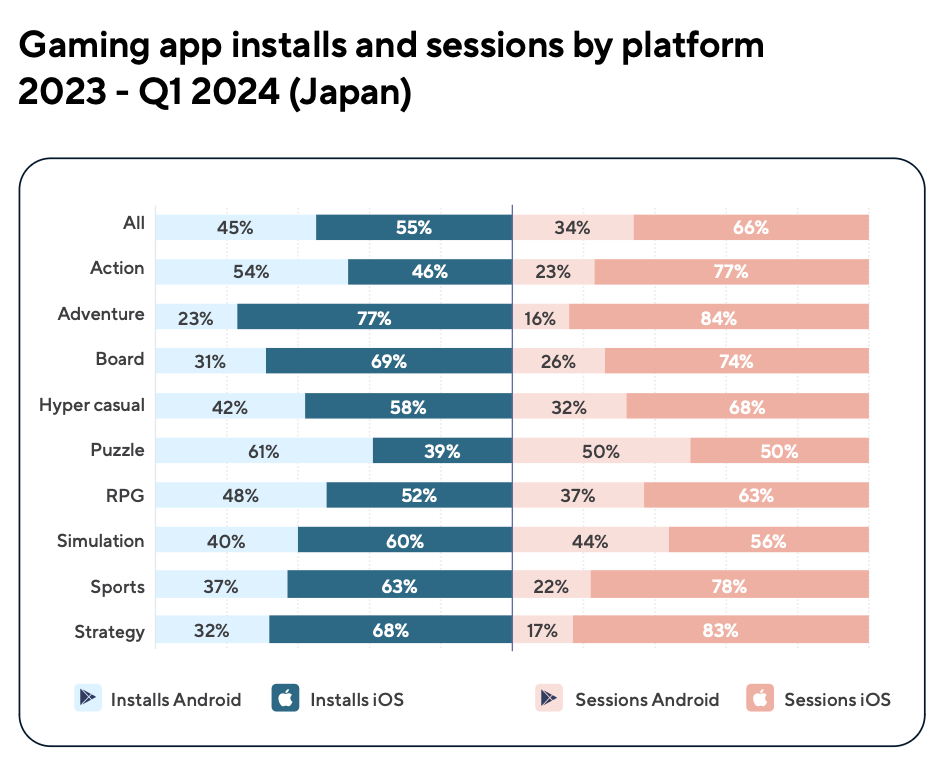

Overall, game app downloads in Japan are balanced between devices, with 55% on iOS and 45% on Android. Some genres, such as adventure games, are dominated by iOS (77%).

In terms of session share, iOS leads, accounting for 66% of the total volume. The average session length increased from 26.37 minutes in 2022 to 27.37 minutes in Q1’24.

The ratio of paid to organic traffic in Japan increased in Q1’24. The average for 2023 was 1.82, rising to 2.31 in Q1’24, indicating an increase in paid traffic. Spending grew the most on hyper-casual projects, board games, and the simulation genre.

The number of advertising partners remained stable, slightly decreasing from an average of 10.9 in 2023 to 10.8 in Q1’24. This suggests companies prefer to spend more on established channels.

Japanese Market Benchmarks - Retention, ARPMAU, eCPI, and more

In 2023, the average D1 Retention was 28%; by day 7, it is dropping to 14%. In Q1’24, the average D1 Retention was 27%, and D7 Retention was 13%. The weakest metric was for hyper-casual games (D1 Retention - 25%; D30 Retention - 5%). RPGs (32%) and simulation games (31%) had the strongest 1-day retention.

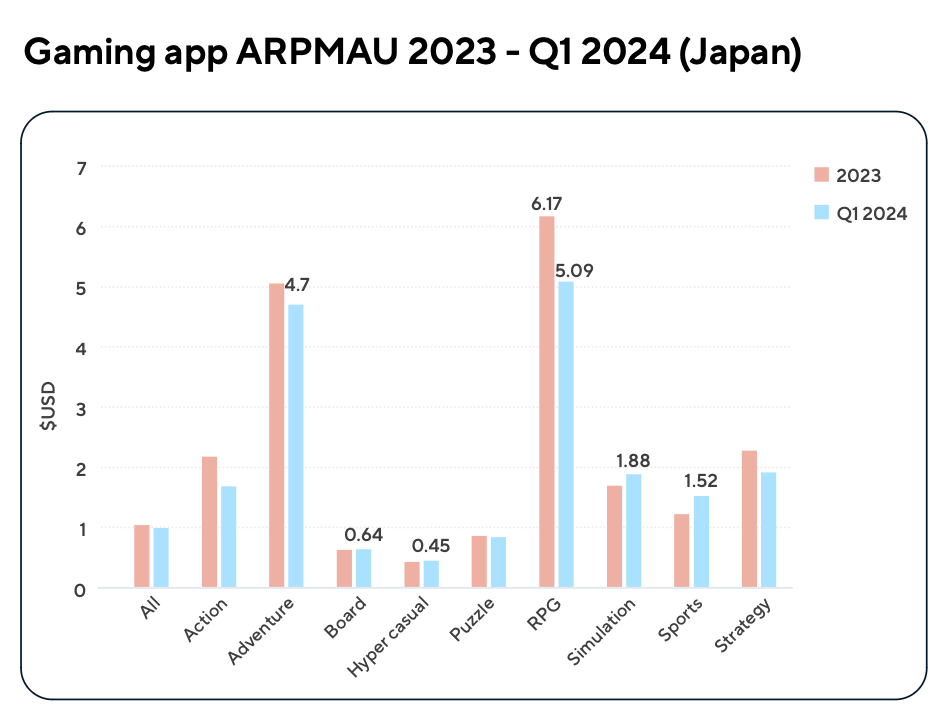

ARPMAU (average revenue per monthly active user) fell from $1.04 in 2023 to $0.99 in Q1’24. RPGs had the highest ARPMAU - $6.17 in 2023 and $5.09 in Q1’24; adventure games followed with $5.06 in 2023 and $4.7 in Q1’24. Hyper-casual games had the lowest ARPMAU - $0.43 in 2023 and $0.45 in Q1’24.

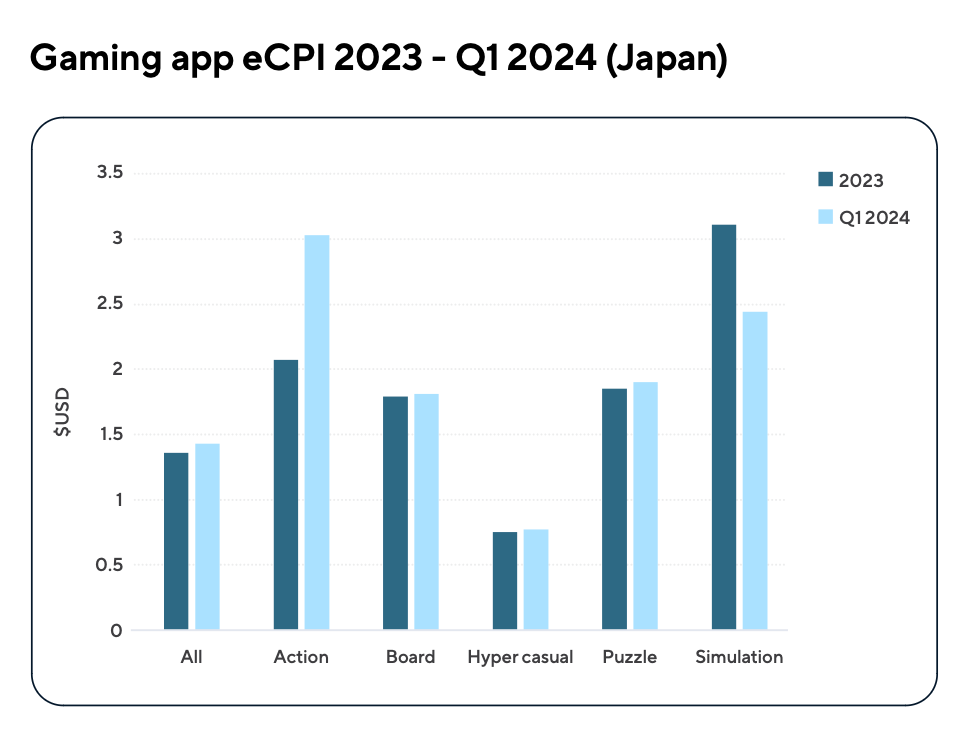

eCPI (effective cost per install) in Japan increased from an average of $1.36 in 2023 to $1.43 in Q1’24. The most significant growth was in action games ($2.07 in 2023 vs. $3.03 in Q1’24). However, eCPI in simulation games decreased from $3.11 in 2023 to $2.44 in Q1’24.

The highest first-month cumulative LTV was for RPGs ($2.32) and adventure games ($1.9). The first-day LTV for hyper-casual games was comparable to that of RPGs in Japan.

PC and Console Market

Adjust and Sensor Tower report that Japanese youth prefer consoles (72%). Mobile devices follow in popularity (64%), with PCs at 15%.

Companies note that given the high competitiveness of the mobile market, expanding to new platforms could bring additional revenue sources.