Weekly Gaming Reports Recap: July 15 - July 19 (2024)

InvestGame shared the game investment market status in Q1'24; Game sales are down in the UK & Europe; Layer Licensing shed some light on IP collaborations in games.

Reports of the week:

Layer Licensing: IP Collaborations in Games in recent years

Brightmine: The average salary of females in the UK is £8,000 less than that of male

ERA: Game Sales in the UK Dropped by 29.4% in the First Half of 2024

Sensor Tower: Korean Mobile Gaming Market in H1'2024

Splitmetrics: VR games Downloads on Android grew by 40% in H1'24

Famitsu: Game Sales in Japan in June 2024 and the H1'2024

InvestGame: Gaming Investment Market in Q2'24

Nintendo Switch - the longest-lasting home (?) console in Nintendo's history

Sensor Tower: Mobile Games by Korean Developers Worldwide

GSD & GfK: PC & Console Games Sales in Europe in June 2024 and H1'24

AppMagic: Peak Games Earned Over $5B - and Returned to Growth

Layer Licensing: IP Collaborations in Games in recent years

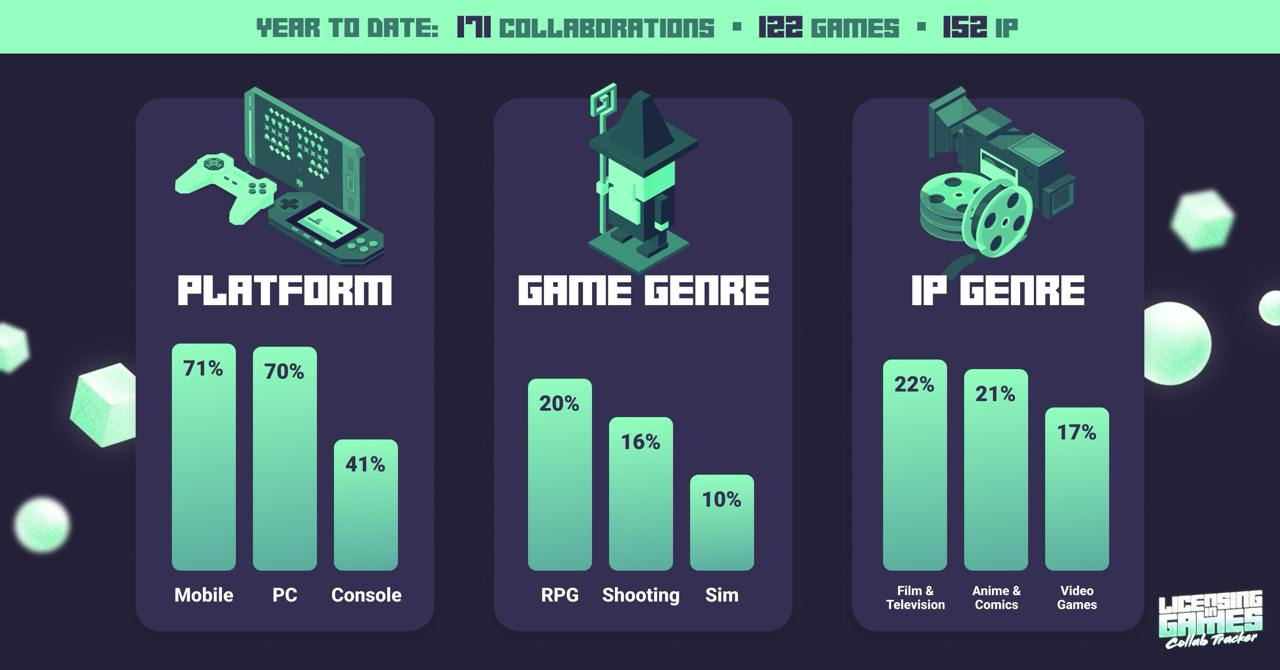

Layer Licensing has launched a tool to track collaborations in games and share statistics about them. Data has been collected since May 2023, accounting for 171 collaborations in 122 games using 152 IPs.

Out of the total volume of collaborations, 71% were in mobile games, 70% in PC games, and 41% in console games.

❗️If a collaboration was in a game available on multiple platforms, it was counted for each platform.

The most popular genres for IP collaborations are RPGs (20%), shooters (16%), and Simulation games (10%; this category includes Minecraft and Roblox).

Collaborations are least common in adventure and arcade games.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Movie and TV IPs are the most frequently featured in games (22%). Following are anime and comics (21%) and collaborations with other games (17%).

Collaborations with musicians make up 6% of the total number of collaborations, and those with luxury and fashion brands account for 3%.

Brightmine: The average salary of females in the UK is £8,000 less than that of male

The study is based on data from more than 25 companies with a total of over 3,000 employees.

The average base salary for males in the UK is £49,695; for females, it is £41,174.

The wage gap is 17.1%. This is higher than the national average gap (14.7%) but lower than the gap in technology industries (25.8%).

According to Brightmine, the highest proportion of women is found among office managers (98%); and in management (77%).

Men are most represented among game artists (97%); marketers (97%), and QA specialists (96%).

❗️The gender distribution by profession does not reflect the subjective picture of what I see in studios. It would be interesting to have a look at the sample.

ERA: Game Sales in the UK Dropped by 29.4% in the First Half of 2024

ERA only accounts for sales of physical and digital versions of games. DLC, microtransactions, and mobile game revenue are not included.

In the first half of 2024, game sales reached £348.6 million. This is 29.4% less than the previous year.

Sales of physical copies of games fell by 40% (to £111.7 million); digital sales fell by 23% (to £236.9 million).

ERA also shared results from other industries. Revenue in the video segment, which includes streaming, is growing - up 5.4% YoY (£213.7 million) in the first half of the year.

The music segment (excluding streaming) saw the most growth in the first half of 2024 - up 7.9% to £163.8 million. Despite ERA not accounting for streaming revenue, the association notes an 11% increase in consumption.

Sensor Tower: Korean Mobile Gaming Market in H1'2024

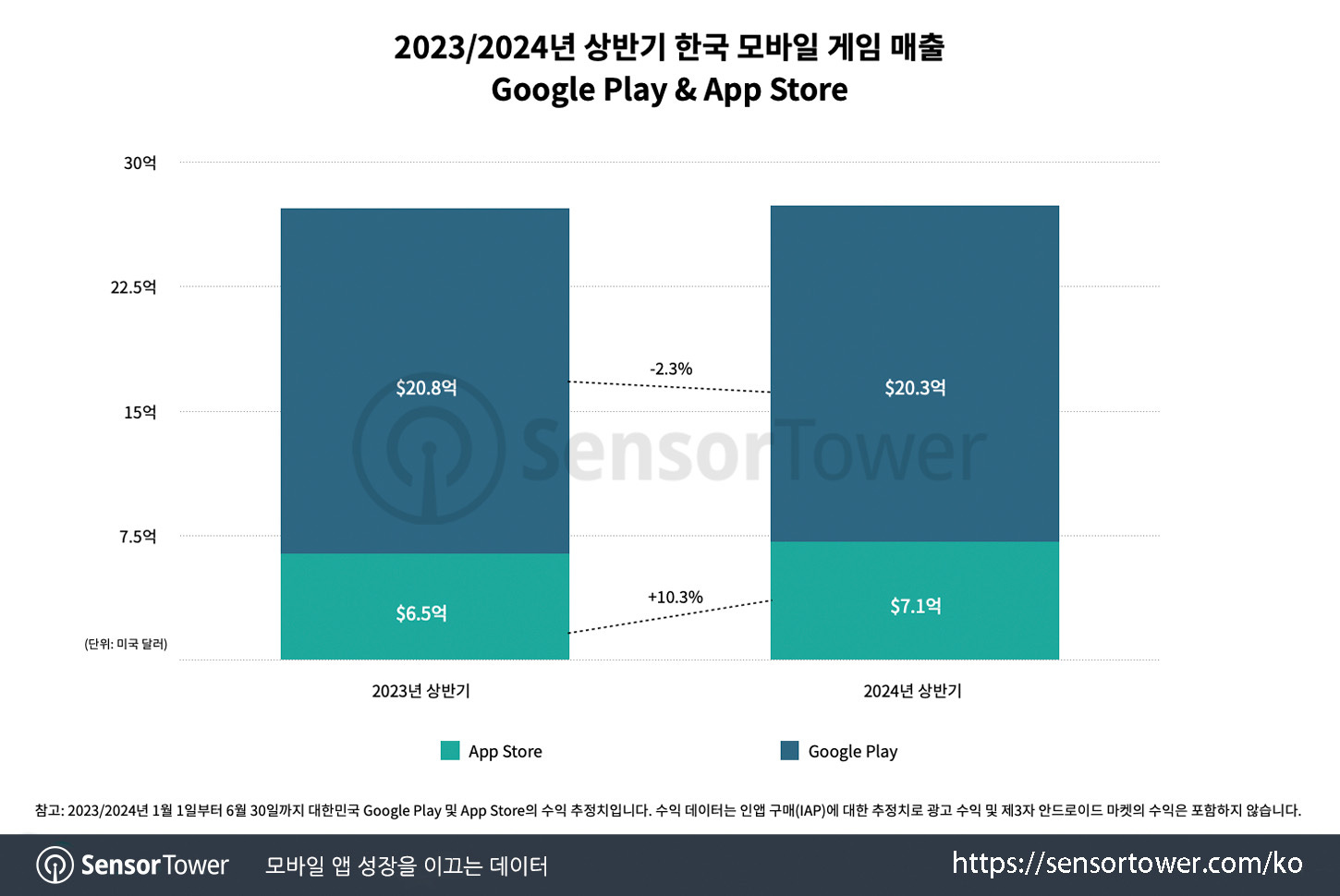

Revenue from mobile games in South Korea in the first half of the year reached $2.75 billion. This is $30 million more than the same period in 2023.

Google Play revenue decreased by 2.3% YoY; however, on iOS, it increased by 10.3%.

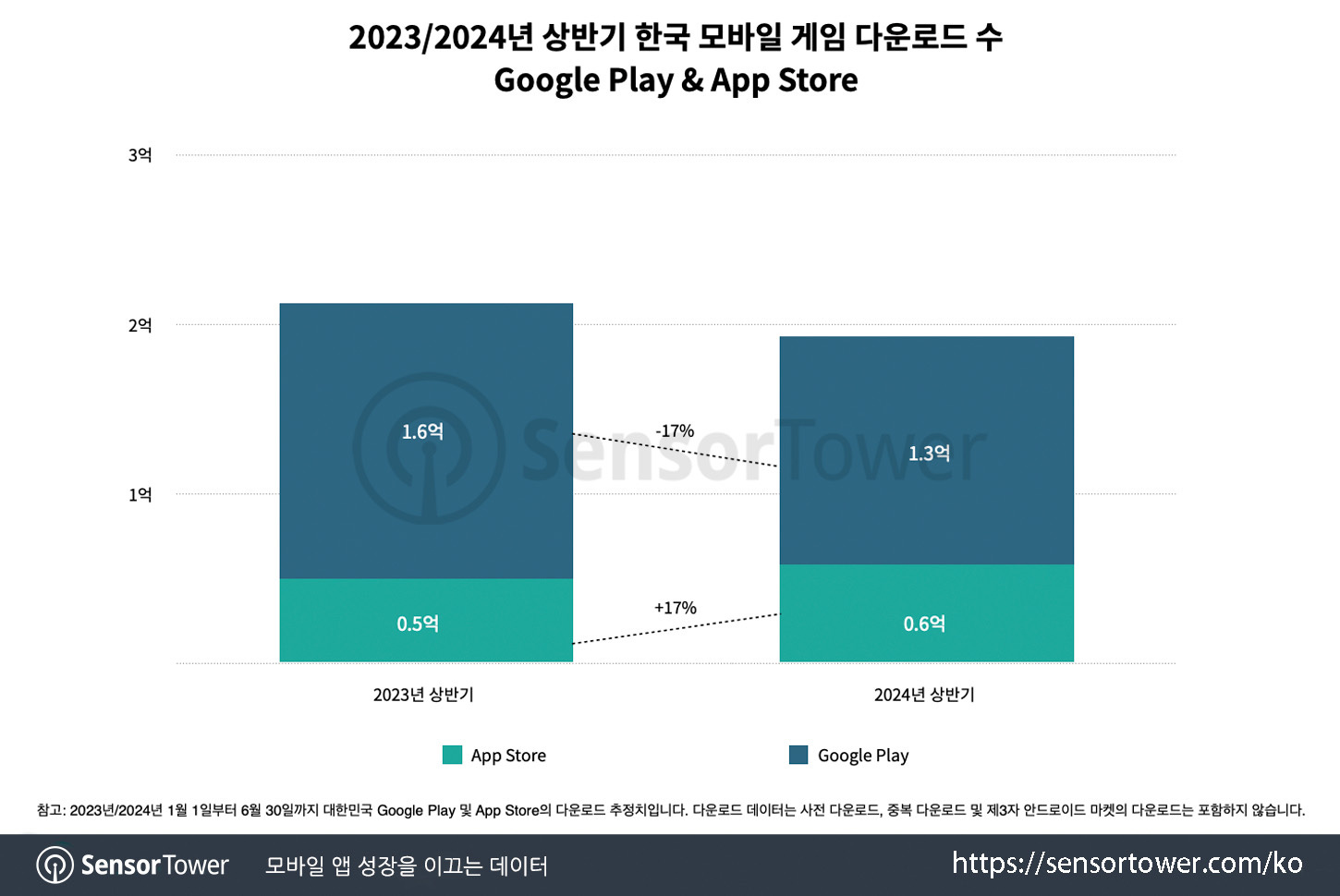

The Korean market saw a decline in downloads in the first half of 2024. Google Play downloads fell by 17%, but App Store downloads increased by the same percentage.

Successful Games

Last War: Survival became the market leader in revenue and ranked second in downloads in the first six months. The game has earned over $600 million worldwide since its launch, with 26% of that amount coming from South Korea.

Legend of Mushroom ranked third in revenue and first in downloads in the first half of 2024. Since its release, the game has generated $350 million in revenue, with South Korea accounting for 34%.

Games from the Lineage series and Odin: Valhalla Rising continue to perform strongly.

Brawl Stars performed well in South Korea in the first half of the year. The game ranked 7th in revenue and 8th in downloads. In May 2024, the game earned more than $10 million in the local market, the highest amount since May 2019. It also has the highest retention rates (7, 30, and 60 days) among all top games in the country.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Supercell's new game, Squad Busters, entered the top downloads list (4th place) despite being released on May 29.

In the first half of 2024, 5 out of the top 10 games by revenue were foreign. This hasn't happened in South Korea since 2017.

Most Successful Publishers

NCSoft maintained its leadership in revenue among publishers. Kakao Games ranked second, and FirstFun (creators of Last War: Survival) ranked third.

5 out of the top 10 publishers by revenue were foreign, marking the first time this has happened in the past 10 years.

Splitmetrics: VR games Downloads on Android grew by 40% in H1'24

App Radar was used to calculate the installs.

The 28 most successful VR games in the year's first half were downloaded 5.5 million times. This is 40% more than the previous year.

Splitmetrics notes that the total number of downloads for the year was 10 million in 2022; in 2023 - 8 million.

The top five most successful VR games by downloads are Rec Room (2.7 million installs); VR Thrills: Roller Coaster Game (470 thousand installs); VR Roller Coaster 360 (335 thousand downloads); Sky on Fire: 1940 (313 thousand downloads), and Fulldive VR (295 thousand downloads).

The most downloaded VR game on Google Play by a large margin is Rec Room (32 million lifetime downloads). In second place is VR Thrills Roller Coaster Game (23 million); in third place is Fulldive VR - Virtual Reality (11 million).

However, the rankings do not include app stores - Cardboard (37 million downloads) and Meta Quest (17 million).

InvestGame: Gaming Investment Market in Q2'24

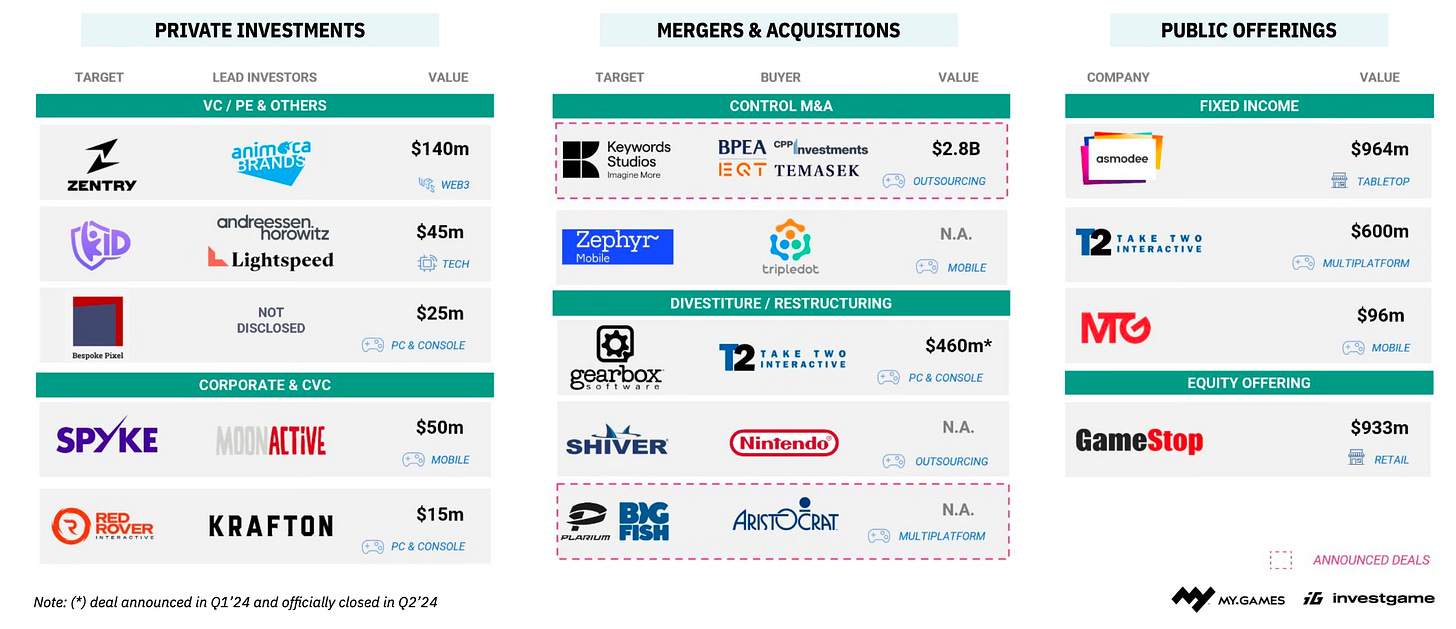

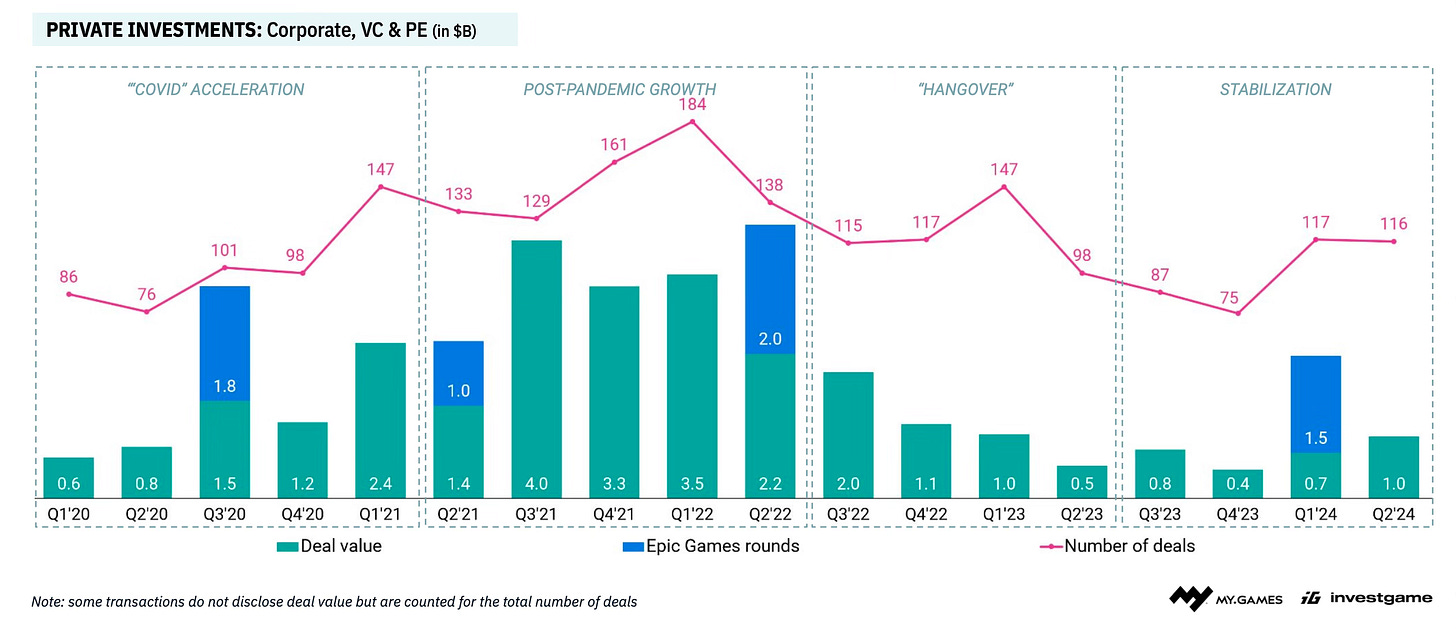

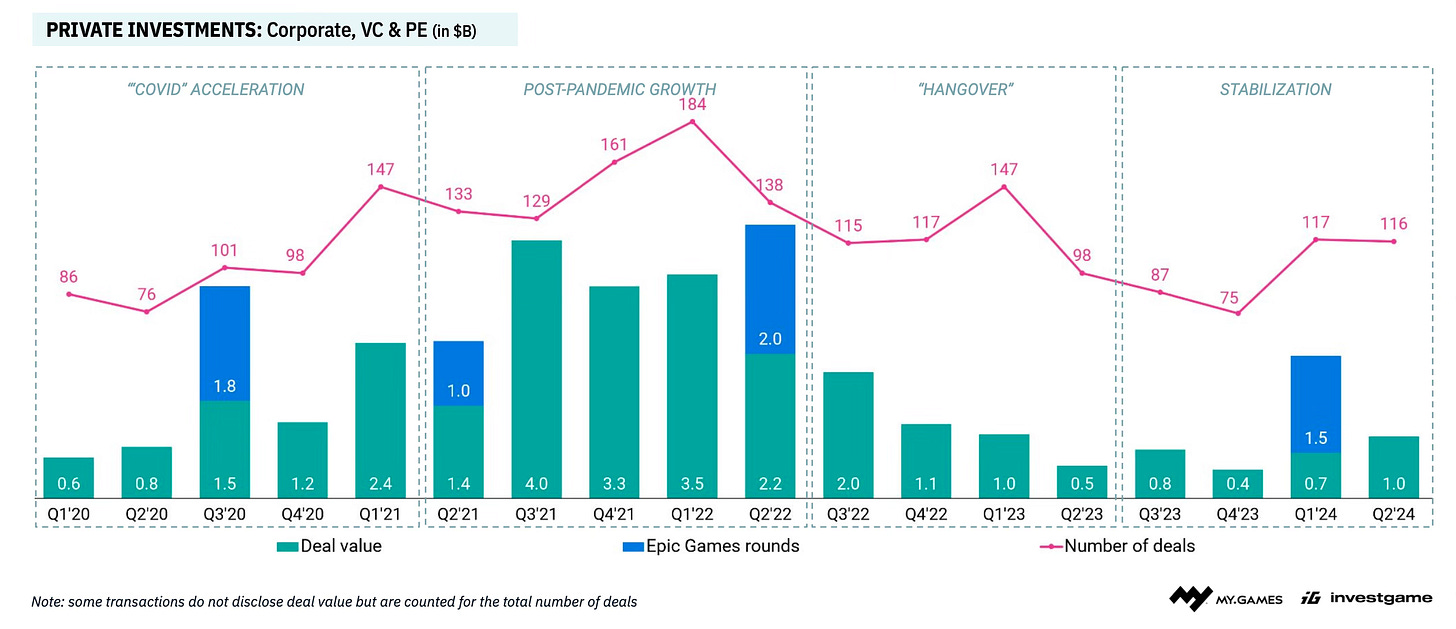

Investment activity is growing compared to the second quarter of the previous year. In the case of private investments and public offerings, both the number and volume of deals have increased. Number of M&A deals have also increased, although their volume has slightly decreased (InvestGame notes that the $2.8 billion purchase of Keywords Studios is not included).

Private Investments

In Q2’24, 116 deals were made with a total volume of $1 billion. In terms of volume, this is (almost) the annual maximum, excluding Q1’24 quarter, which involved the Epic Games transaction. In terms of the number of deals, it's one less than in Q1'24 (which had a record number of deals for the year).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

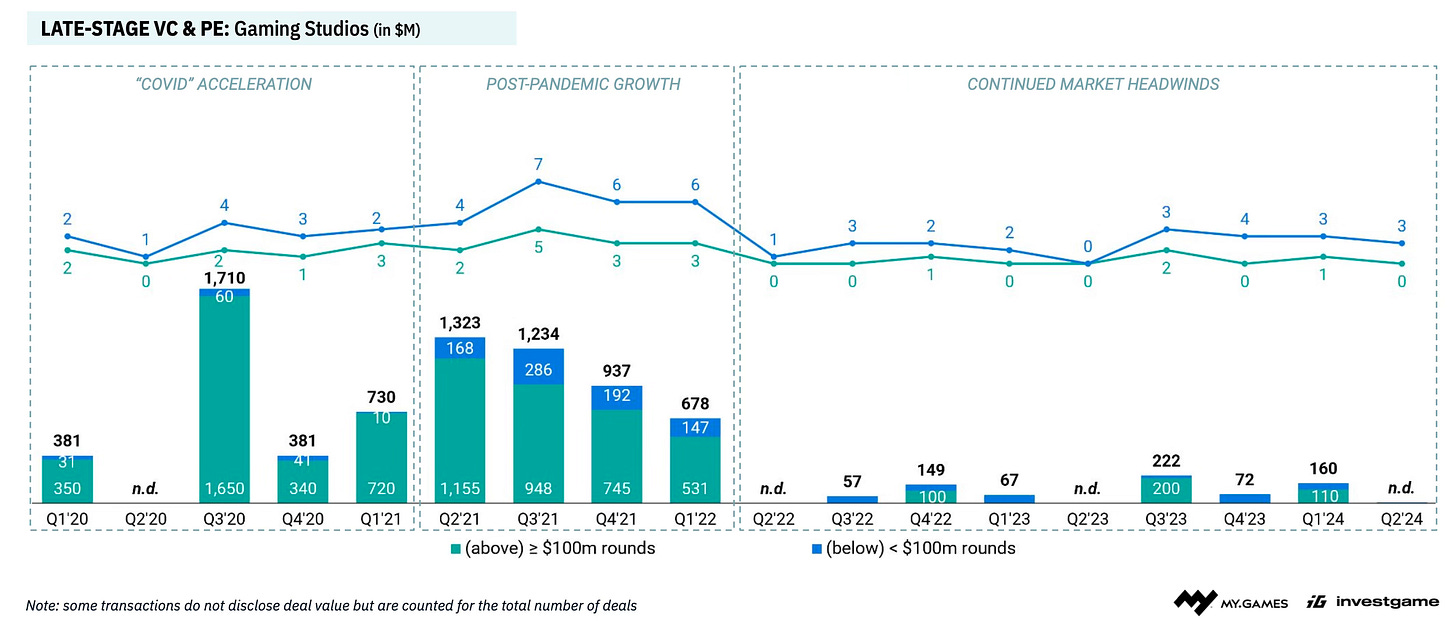

There were 30 early-stage gaming deals in Q2'24, amounting to $125 million ($73 million for pre-seed; $52 million for Series A). It looks like the market is reaching a new plateau in terms of the volume and number of such deals.

The number of late-stage investment deals is minimal - not a single one was publicly announced in Q2'24. However, InvestGame experts note 3 deals with a volume of less than $100 million.

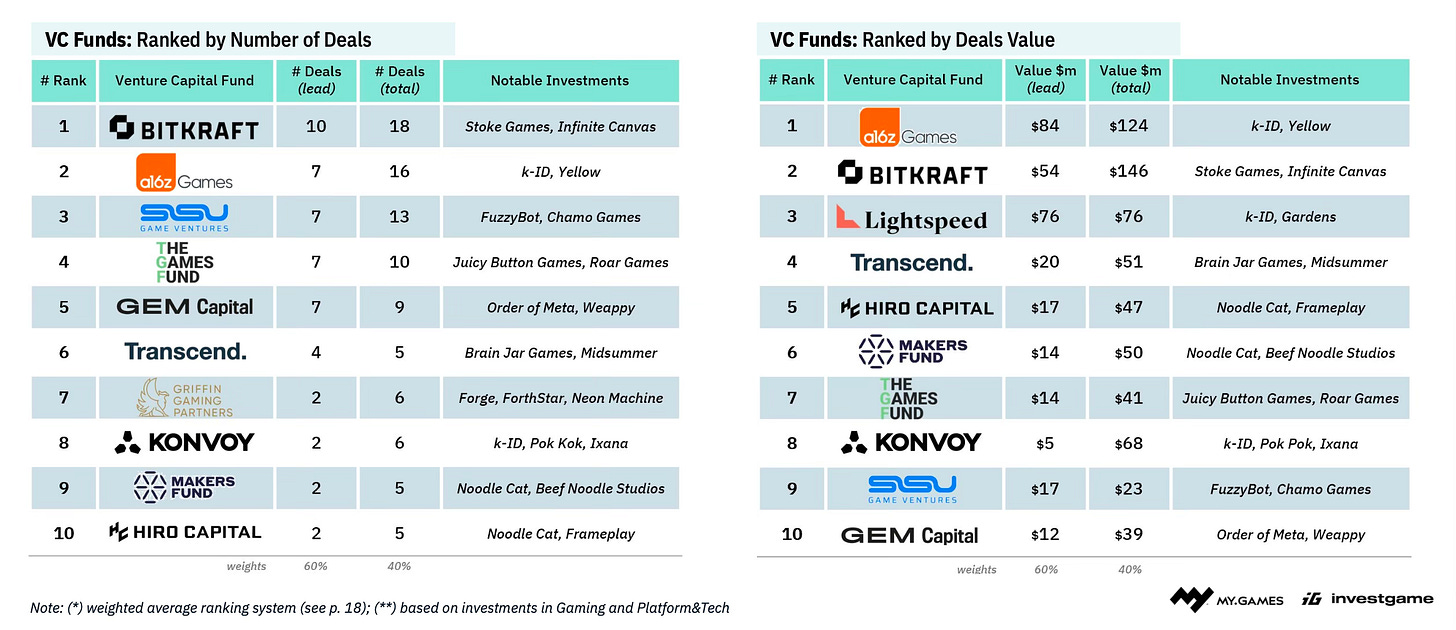

Bitkraft, A16Z Games, Lightspeed, Sisu Game Ventures, Transcend, The Games Fund, GEM Capital, and Hiro Capital are the most active VC funds both in terms of deal volume and quantity.

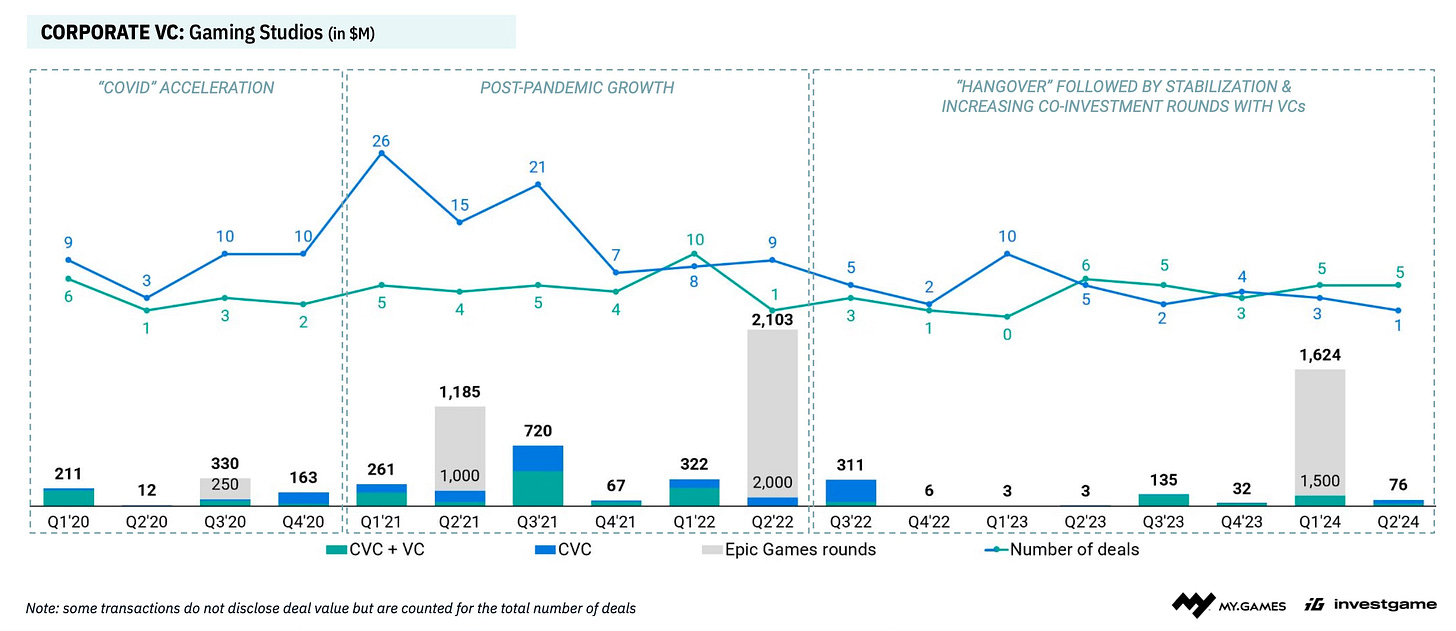

The activity of corporate VC funds remains low. In Q2'24, $76 million was spent. There were several joint deals with traditional VC funds, which can be explained by the desire to reduce risks in the deal.

The number of early-stage VC deals in the US, Europe, and Asia is almost equal.

M&A

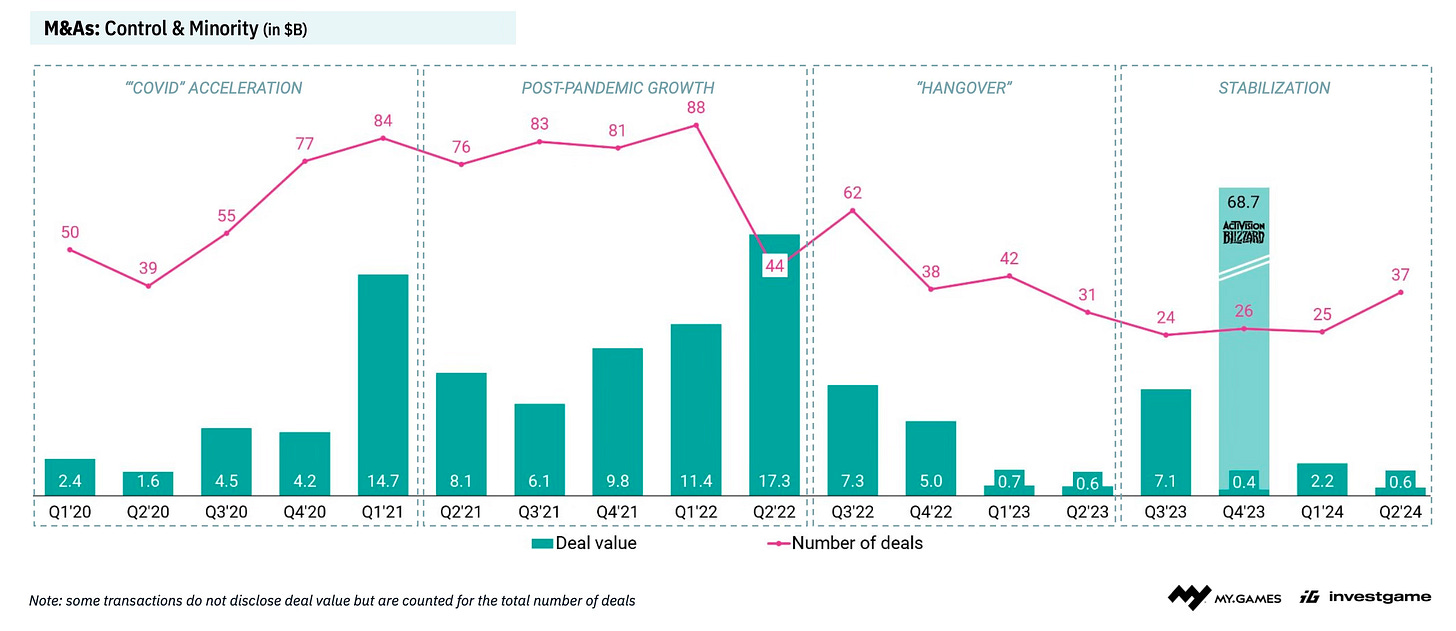

The number of deals in Q2'24 increased to 37 - the maximum since Q1'23.

However, the volume of deals is one of the lowest since Q1'20 and matches the result of Q2'23. The only lower volume was in Q4'23, excluding the closed Microsoft and Activision Blizzard deals.

Public Offerings

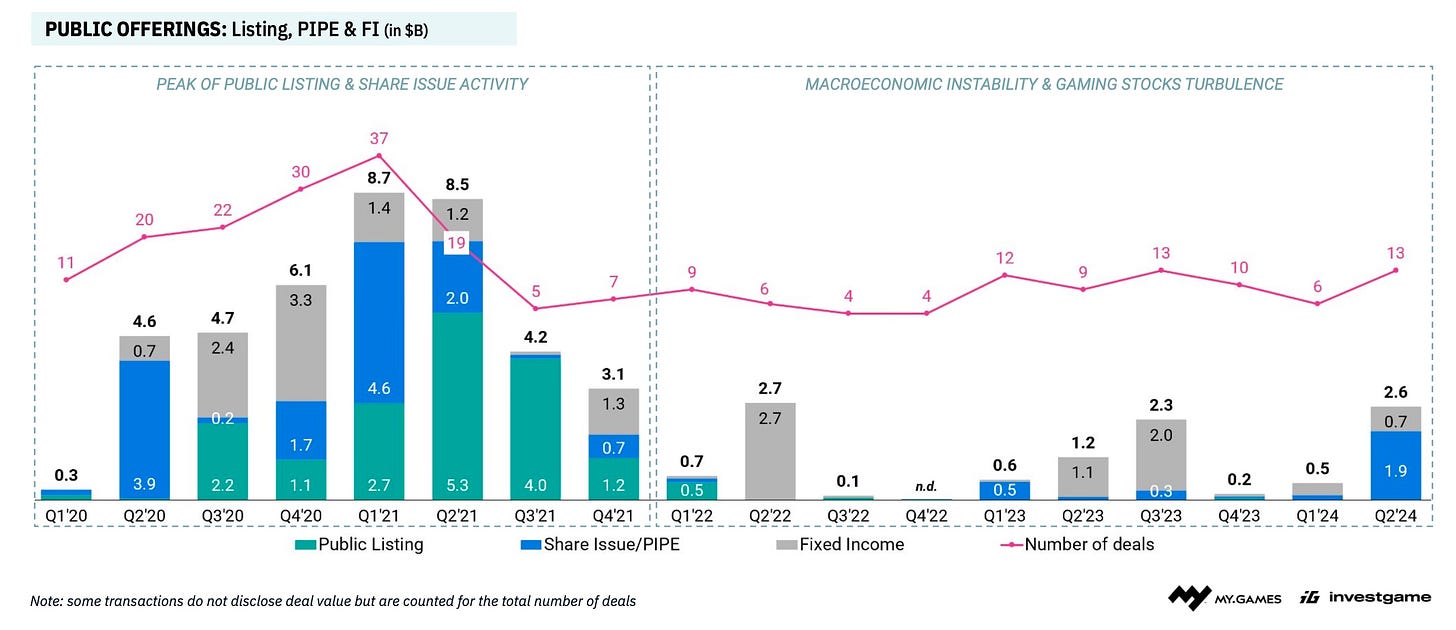

In Q2'24, the number of transactions with public companies increased, but as noted by InvestGame, this growth is not due to public offerings. Most of the transactions are related to investments through additional share issuance and raising funds using fixed-income instruments (bonds, preferred shares, etc.).

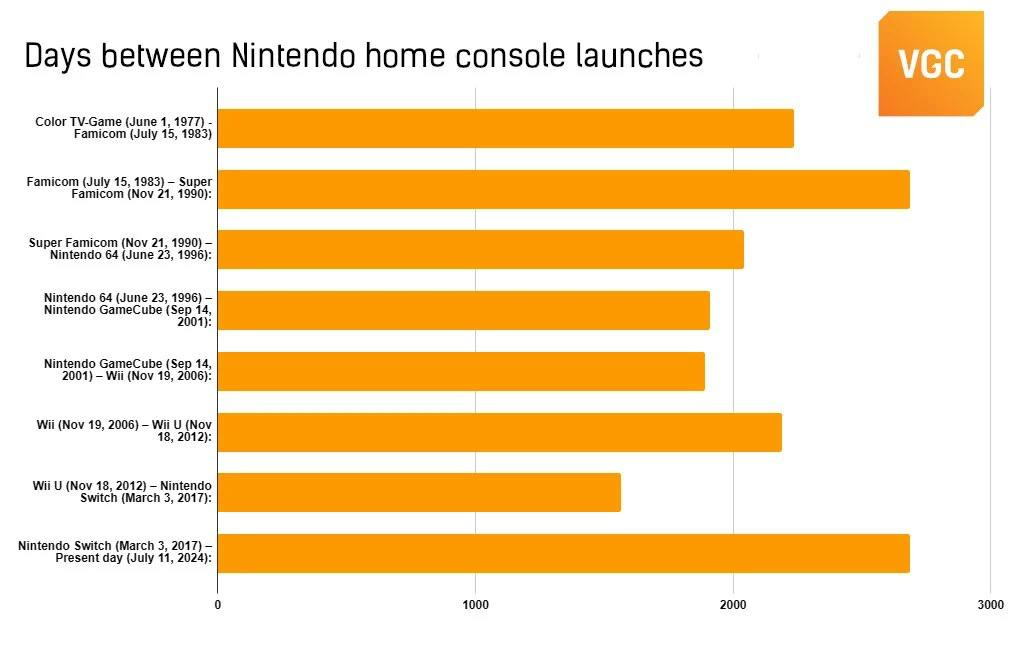

Nintendo Switch - the longest-lasting home (?) console in Nintendo's history

The VGC portal compared the time intervals between the releases of Nintendo consoles. Only the release date of a new generation was considered.

Since its release on March 3, 2017, the Nintendo Switch has been on the market for 2695 days. The previous record belonged to the Famicom (2686 days), which was replaced by the Super Famicom.

The shortest lifespan was with the Wii U - between the console's release and the appearance of the next system, 1566 days passed.

However, the Game Boy holds the record for Nintendo among all consoles (including handhelds). The console remained on the market for 4352 days until the Game Boy Advance was released.

Nintendo's most successful system in history - the Nintendo DS - was on the market for 2288 days.

Sensor Tower: Mobile Games by Korean Developers Worldwide

Over the past 3 years, the revenue share of games by Korean developers in the global top-100 charts has averaged 6%. In the first half of 2024, it increased to 6.5%. However, the record remains for the second half of 2021 - during that period, the share of Korean games in the top 100 by revenue almost reached 8%.

One of the factors for growth in 2024 was the release of Dungeon Fighter Mobile, which became a hit in the Chinese market.

The South Korean leaders in revenue in the first half of 2024 are Dungeon Fighter Mobile, PUBG, and Goddess of Victory: Nikke. The list includes 4 casino games - 1 from DoubleUCasino and 3 from Netmarble.

In terms of downloads, games by Korean developers have shown growth since the second half of 2022. They grew from a 1% share in the top 100 downloads in the second half of 2022 to 5.5% in the first half of 2024.

The success of Supercent in the hyper-casual and hybrid-casual project markets is helping South Korean developers bite off a market share in downloads. Of the top-10 downloaded games by Korean developers, 6 are from Supercent. PUBG is also performing well.

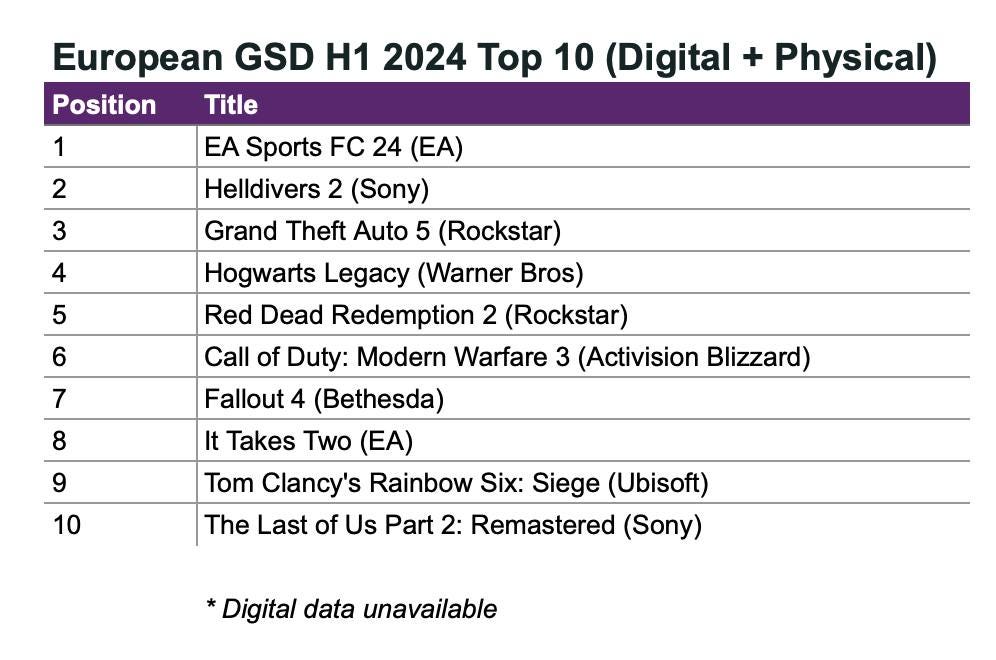

GSD & GfK: PC & Console Games Sales in Europe in June 2024 and H1'24

The analytical platforms report only the actual sales figures obtained directly from partners. The mobile segment is also not considered.

H1’24 Results

Almost 80 million copies of PC and console games were sold in the first half of 2024. This is 1.6% less than in the same period last year.

Only 2 games from the top 10 for the first half of the year were released in 2024 - Helldivers II (2nd place) and The Last of Us: Part II - Remastered (10th place).

❗️Palworld is not on the list because the company does not share sales data with GSD. Therefore, actual sales may be higher.

In the first half of 2024, console sales fell by 24% year-over-year (YoY). Total sales amounted to 2.2 million devices.

PlayStation 5 sales fell by 16%; Nintendo Switch - by 32%; Xbox Series S|X - by 37%.

Sales of accessories also dropped - by 8.4%.

June’24 Results

In June, 11.3 million copies of games were sold - 19% less than a year earlier. But it's important to note that last year, Diablo IV and Final Fantasy 16 were released in this month.

Sales of EA Sports FC 24 in June were 7% better than FIFA 24 sales a year ago. This is likely related to the Euro 2024.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Sales of Elden Ring increased by 454% thanks to the release of the DLC Shadow of the Erdtree. The game ranked second in the June chart.

Luigi's Mansion 2 HD is the best-selling new release of June. The game ranked 7th, with only physical sales counted (Nintendo does not share digital sales). However, the initial sales of the game were only a third of the initial sales of Luigi's Mansion 3 in 2019.

In Europe (excluding the UK and German markets), just over 300 thousand consoles were sold in June. This is 24% less than a year earlier.

PlayStation 5 sales in June fell by 10%. The decline is more noticeable on other platforms.

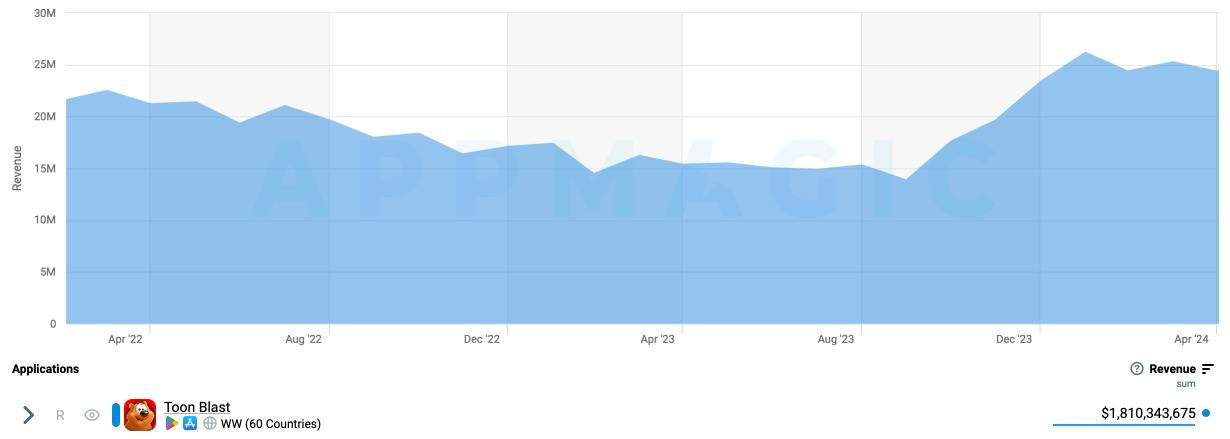

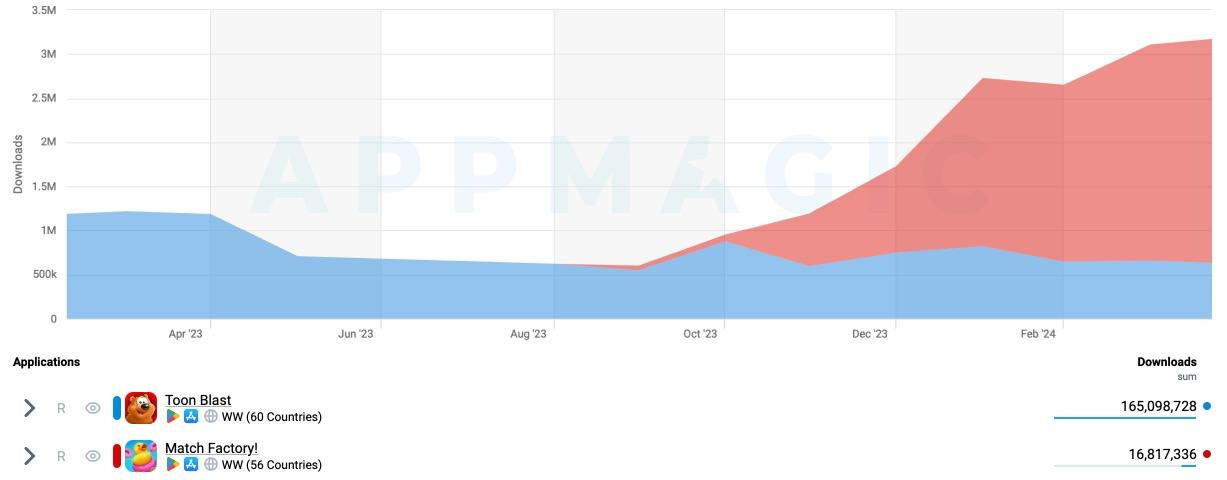

AppMagic: Peak Games Earned Over $5B - and Returned to Growth

97% of the company's revenue came from two projects - Toon Blast (60%) and Toy Blast (37%).

In October 2023, Toon Blast returned to growth. Monthly IAP revenue (after platform fees and taxes) increased from $13 million to $26 million and seems to have reached a new plateau.

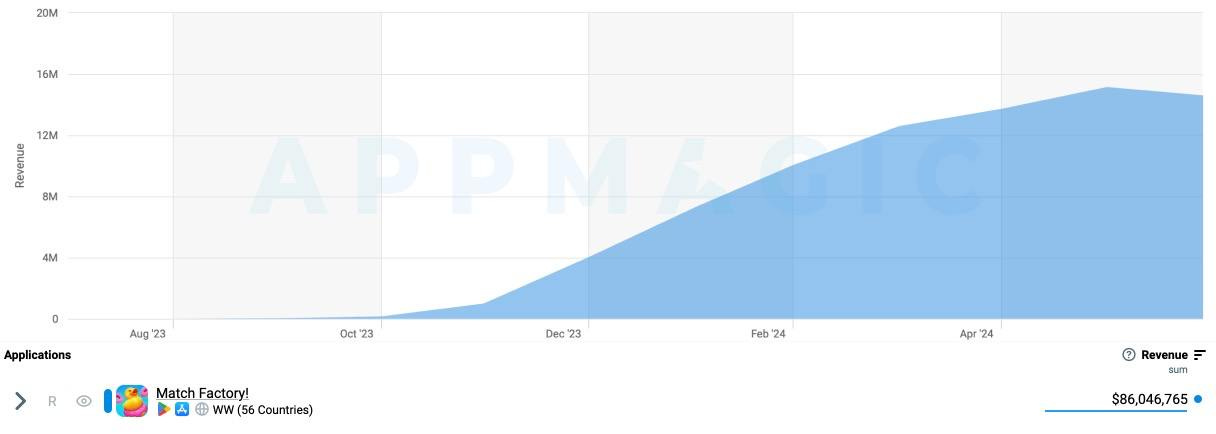

Another factor contributing to the return to growth was the release of Match Factory! in September 2023. The game reached a level of $15 million in monthly IAP revenue (after taxes and fees).

❗️In reality, the company's revenue is even higher because advertising revenue is not being counted.