Weekly Gaming Reports Recap: July 29 - August 2 (2024)

Sensor Tower shared the mobile gaming market outlook in 2024 and beyond; Newzoo shared the top games of June & Q2'24; Niko Partners shared insights of the Japanese and South Korean markets.

Reports of the week:

Sensor Tower: Mobile Gaming Market in 2024 & beyond

Newzoo: Top-20 PC/Console Games of June 2024 by Revenue and MAU

Newzoo: PC/console games performance in Q2'24

GameDiscoverCo: In which countries do owners of successful games on Steam live

Niko Partners: The Gaming Markets of South Korea and Japan Grew to $30.1 Billion in 2023

AppMagic: Top Mobile Games by Revenue and Downloads in July 2024

Sensor Tower: Mobile Gaming Market in 2024 & beyond

All revenue figures are gross, including platform commissions.

Overall State of the Mobile Gaming Market

In 2023, IAP revenue from mobile games decreased to $76.7 billion (-2% YoY). The market has been declining since 2021, but it is still 22% higher than pre-pandemic 2019.

Sensor Tower expects growth in 2024, with revenues reaching $78 billion (+1.6% YoY). By 2028, mobile game revenues are expected to exceed $100 billion, with a compound annual growth rate of 6.8%.

The USA remains the largest market by IAP revenue, with Americans spending $22.2 billion on in-game purchases in 2023, which is plateaued compared to 2022 but 38% higher than in 2019. By 2028, IAP revenue in the USA is expected to reach $33.5 billion.

In 2022 and 2023, IAP revenue from iOS games in China amounted to $15.1 billion.

❗️Sensor Tower does not account for revenue from Android stores in China. In reality, the Chinese market is likely larger than the American one.

In 2023, IAP revenue in Japan fell to $12.5 billion (-13% YoY); in South Korea, it dropped by 7% to $4.8 billion.

❗️Sensor Tower also does not consider payments outside of platforms.

Sensor Tower forecasts that all key mobile markets will grow over the next five years.

Honor of Kings retained the top spot in revenue over MONOPOLY GO! in 2023. The game has earned over $15.5 billion in its lifetime, with over 99% of that amount coming from China. The fastest-growing projects are MONOPOLY GO!, Honkai: Star Rail, and Royal Match.

Genres

Revenue from casual games grew by 8% in 2023, reaching $28.6 billion. This accounts for 38% of the total market volume.

Hybrid-casual games grew by 30% in 2023, reaching $2.1 billion.

The share of mid-core game revenue has been declining over the years. In 2020, they accounted for 66% of the market, but by 2023, this had fallen to 59%. Revenue decreased by 9% in 2023, while all other categories grew. Hyper-casual projects grew by 8%.

The strongest growth was seen in card/board games, which grew by 18% (thanks to the success of MONOPOLY GO!); puzzle games showed significant growth (+10% YoY), largely due to the success of Royal Match.

Revenue from action games, sports games, racing games, and tabletop games grew by 7%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The biggest declines were seen in shooters (-13% YoY); lifestyle projects (-11% YoY); RPGs (-10% YoY); and strategy games (-10% YoY).

Mobile Gaming Trends

In 2023, puzzles earned more than $10 billion from IAP purchases for the first time. The strongest growth was in Match-2 projects (+77% YoY); merge games (+36% YoY); Match-3 (+13% YoY); and hidden object games (+9% YoY). Only the blast games segment fell (-18% YoY).

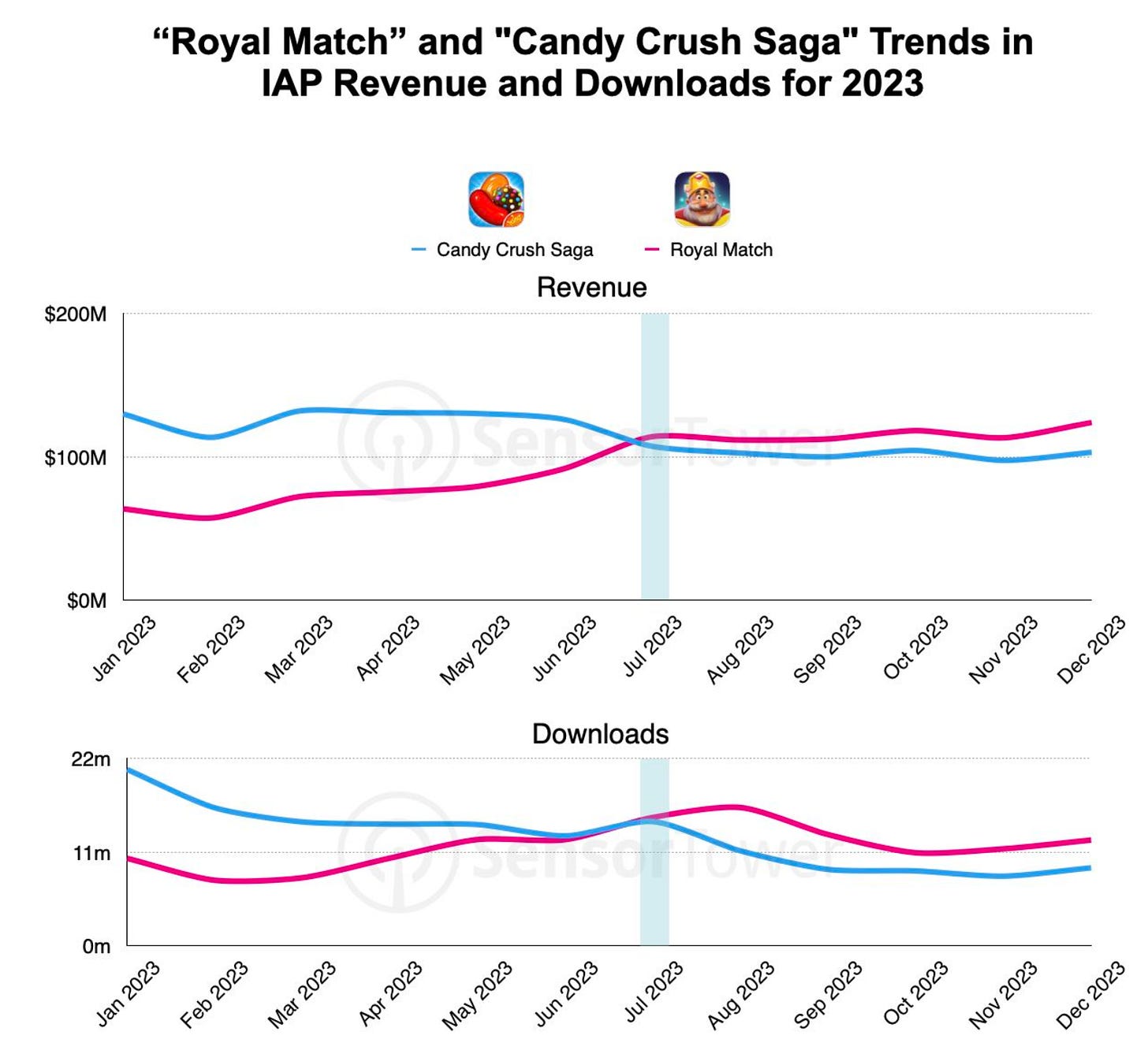

Royal Match surpassed Candy Crush Saga in revenue for the first time in 2023. Since June-July 2023, the game has also been leading in downloads.

MONOPOLY GO! boosted the board games segment, with the project's success allowing the genre to grow by 18% in 2023. In the USA, the genre grew by 21% YoY. The USA's share of the board games segment is 54%.

According to Sensor Tower, MONOPOLY GO! earned more than $1.2 billion from in-game purchases in 2023, with the project's MAU exceeding 17 million people.

❗️Hasbro recently reported that the game surpassed the $3 billion mark.

RPG revenue continues to decline for the second consecutive year. The 10% drop worldwide is largely due to a 17% revenue decrease in Japan (the main market for the genre). However, declines were also seen in South Korea (-11% YoY), the USA (-7% YoY), Taiwan, Hong Kong, and Macau (-7%). In China, the iOS genre remained flat, with a decline of only 0.2% in 2023.

Despite the decline in the RPG genre, many strong projects were released in 2023 - Honkai: Star Rail; Justice Online; Goddess of Victory: Nikke; Chang’an Fantasy; Night Crows; Pixel Heroes. These projects were among the top revenue growth leaders in 2023.

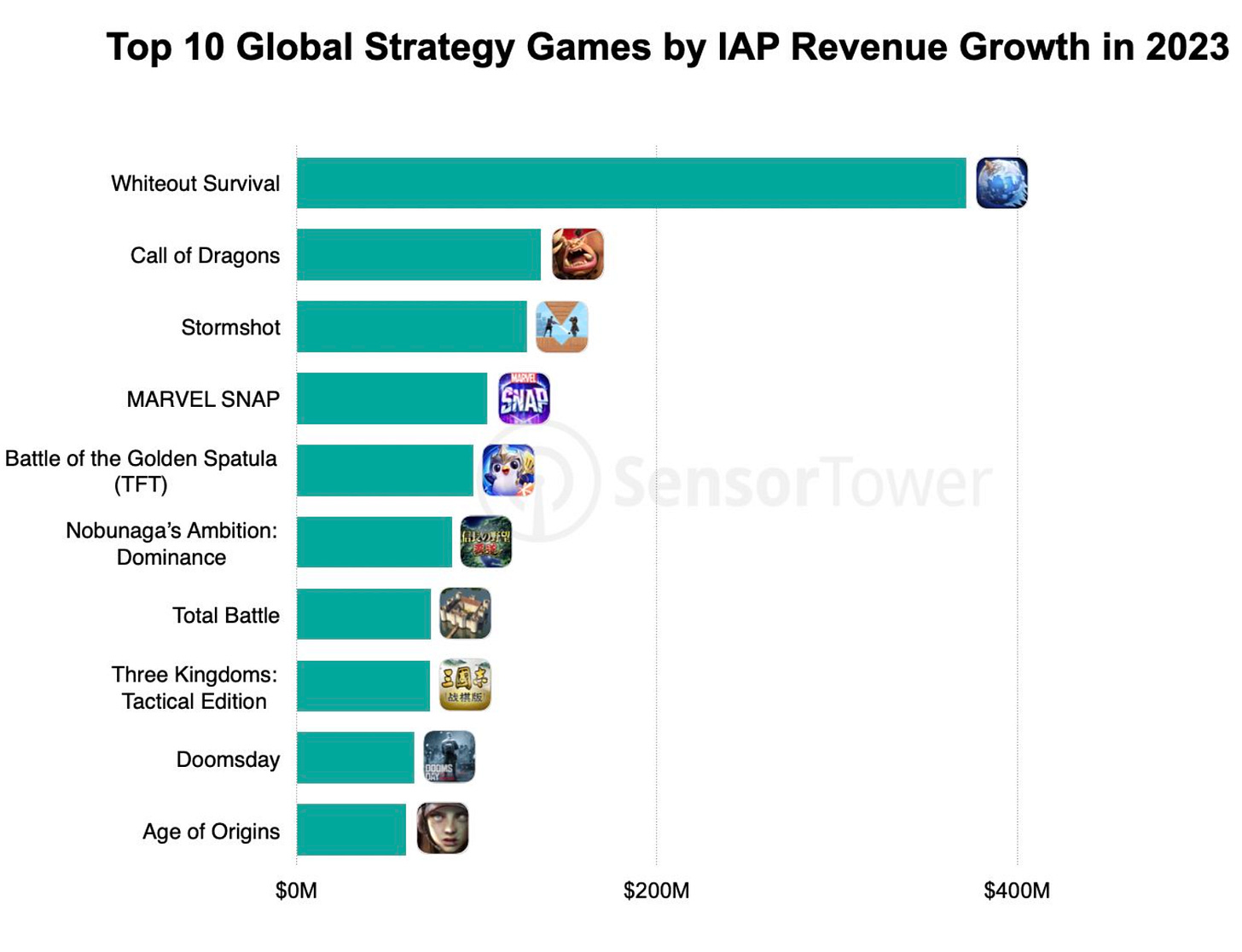

A similar trend is seen in strategy games. The genre fell by 10% in 2023, to $14.8 billion. However, its revenue is still 22% higher than in 2019. 4X strategy games account for 47% of the genre's total revenue ($7 billion in 2023, but a 14% decline compared to 2022). MOBA games fell by 2%; real-time strategies by 4%; card battlers by 5%; and build & battle games by 15%.

Whiteout Survival stands out among competitors. The game earned $370 million from IAP in 2023, making it the fastest-growing game in the genre.

Markets in Japan and South Korea

Monster Strike, Pretty Derby, and Fate/Grand Order are the top-earning games in the Japanese market. However, Honkai: Star Rail is the fastest-growing game in the country by revenue. Japan accounts for 21% of the game's total revenue, making it the largest overseas market for the game. Goddess of Victory: Nikke is in second place, with a revenue growth of 182% in 2023.

In South Korea, the top revenue earners are Lineage M; Odin: Valhalla Rising, and Night Crows. In 2023, MMORPGs in the country earned $1.9 billion, accounting for 40% of the total market. Night Crows was the fastest-growing project by revenue, earning $180 million.

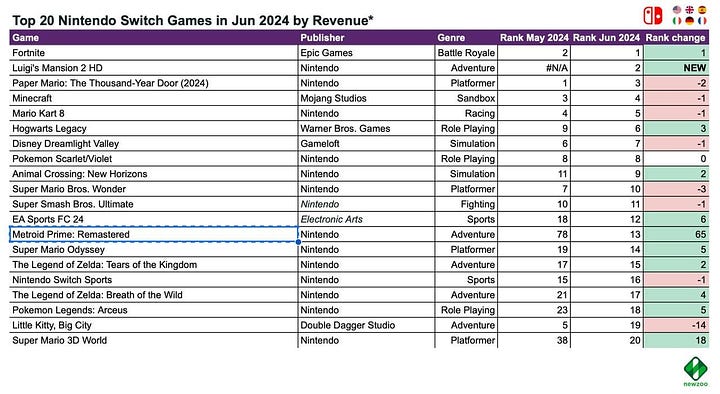

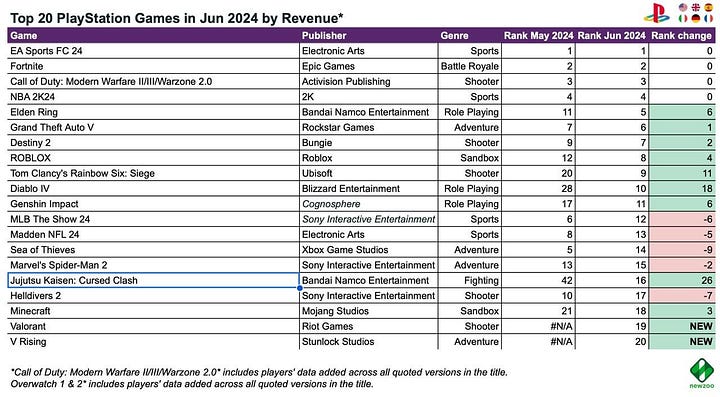

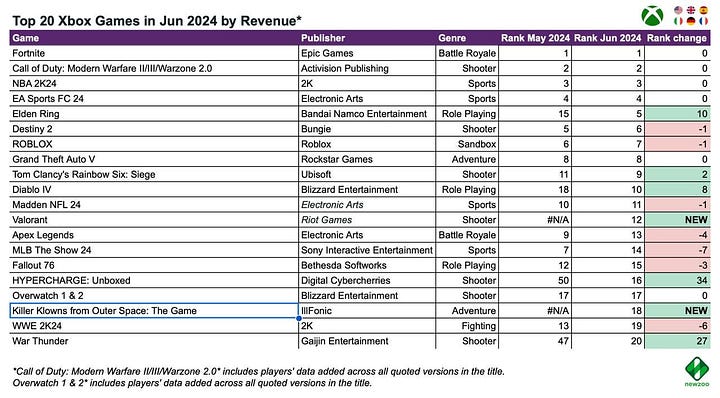

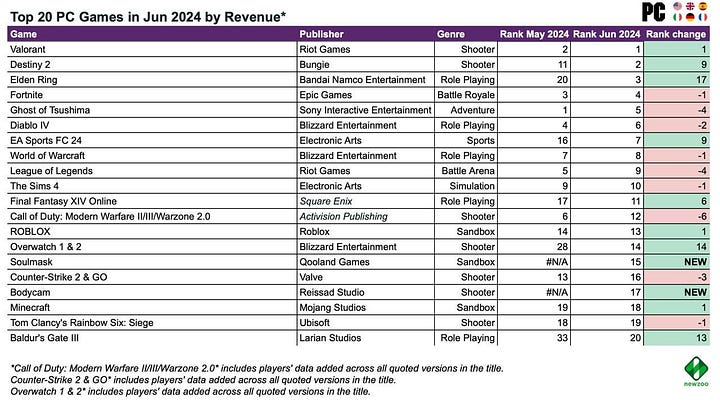

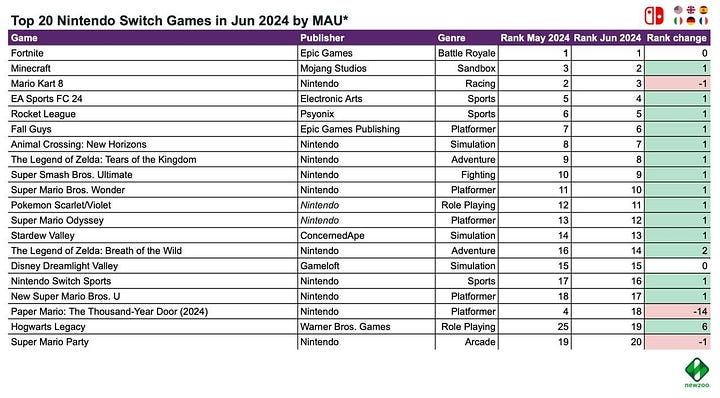

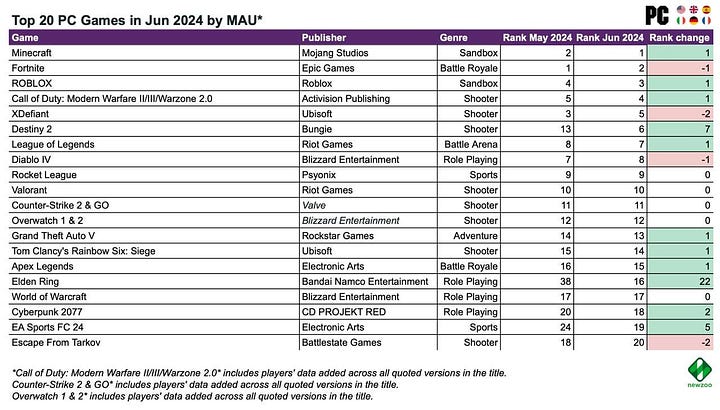

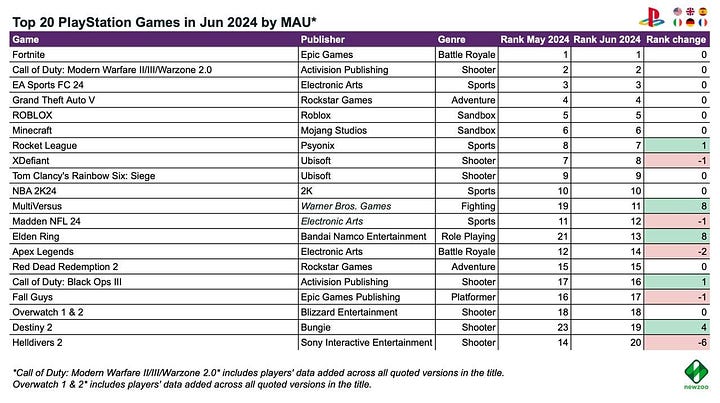

Newzoo: Top-20 PC/Console Games of June 2024 by Revenue and MAU

Newzoo takes data from the USA, UK, Spain, Italy, Germany, and France.

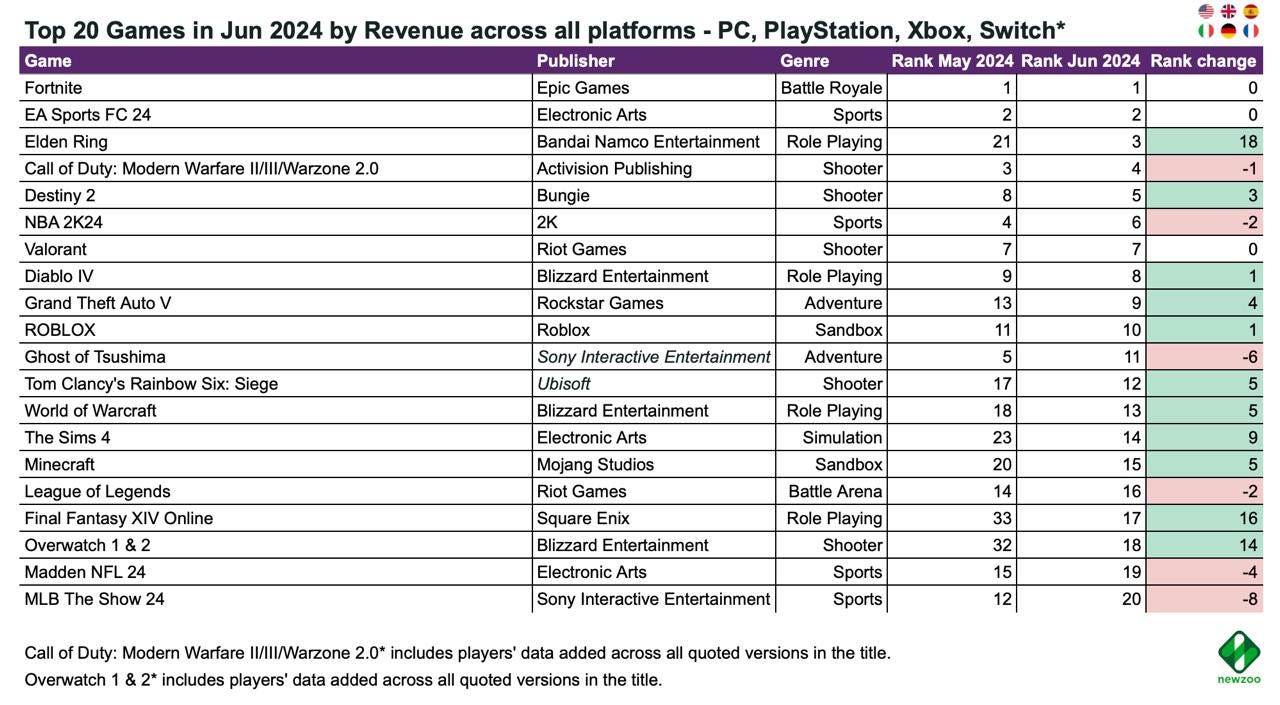

Revenue - All Platforms

Elden Ring showed the biggest growth among all projects in the top 20 due to the release of the Shadow of the Erdtree expansion. The game ranked 3rd in revenue in June.

The first two places are held by Fortnite and EA Sports FC 24.

Helldivers II dropped out of the top 20. The revenue of Final Fantasy XVI Online and Overwatch increased significantly.

Revenue - Individual Platforms

On PC, the highest-earning game was Valorant. Soulmask (15th place) and Bodycam (17th place) entered the top 20 for the first time. Baldur's Gate III returned to the top-20.

On PlayStation, the fighting game Jujutsu Kaisen: Cursed Clash jumped into the top 20 by revenue in June. Valorant and V Rising entered for the first time. Helldivers II dropped to 17th position (previously 10th last month).

On Xbox, Valorant and Killer Klowns from Outer Space: The Game (18th position) entered the top 20 by revenue for the first time. HYPERCHARGE: Unboxed and War Thunder showed strong revenue growth.

On Nintendo Switch, everything is relatively stable. Fortnite rose to the first position; Luigi's Mansion 2 HD took second place. Metroid Prime: Remastered had an excellent month, jumping to 13th place on the chart.

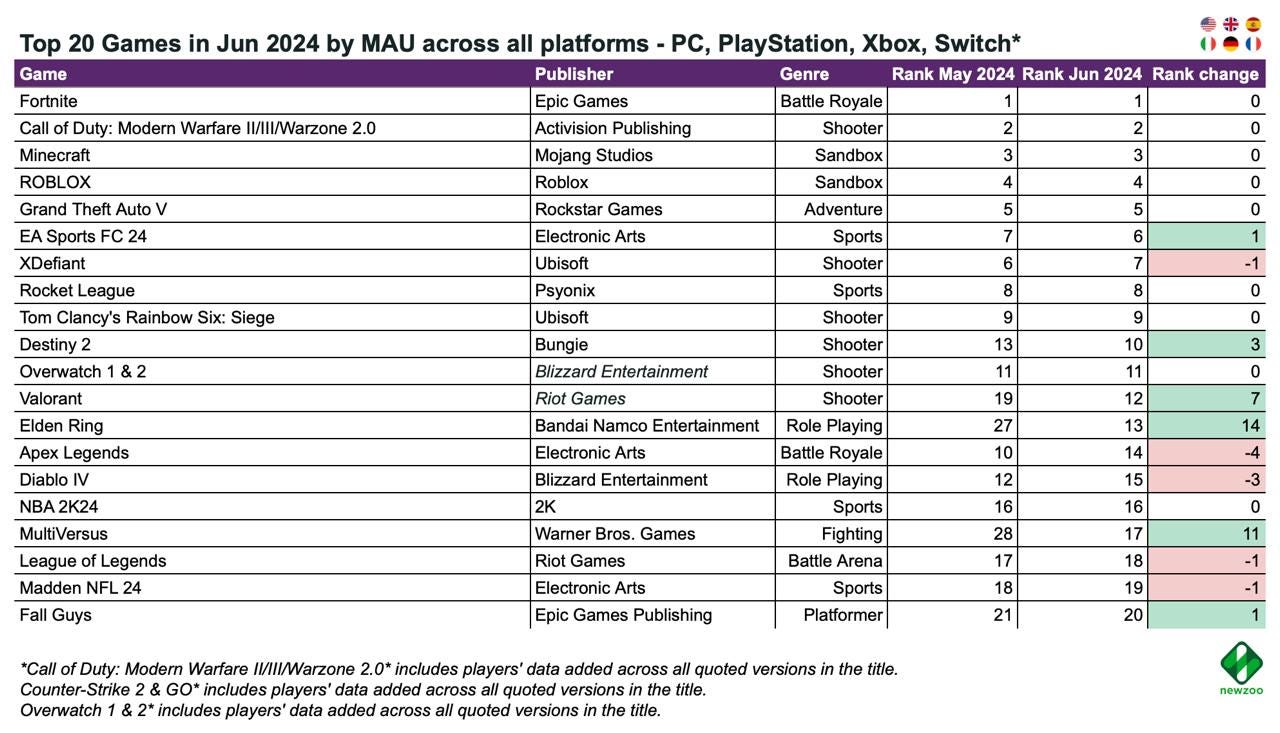

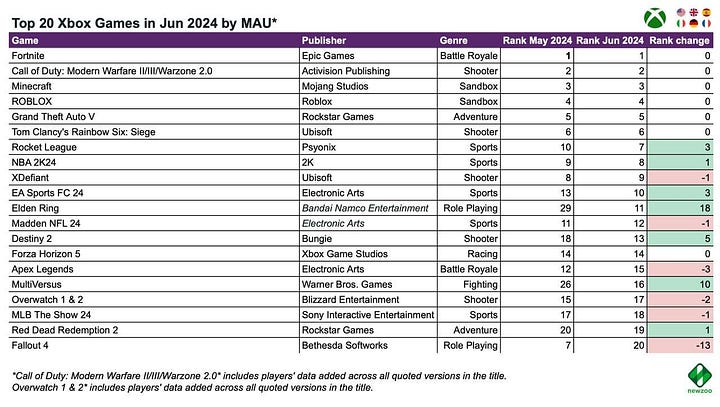

MAU - All Platforms

The situation with MAU is stable. Elden Ring and MultiVersus re-entered the top 20. Otherwise, there are no surprises.

Fortnite, Minecraft, Call of Duty, EA Sports FC 24, Grand Theft Auto V, Roblox, and Rocket League are the games showing the highest MAU on all platforms where they are present.

XDefiant is worth keeping an eye on. The game maintained a top-10 position by MAU on all platforms in June. This is a significant achievement in the modern market, despite the game not appearing in the revenue charts.

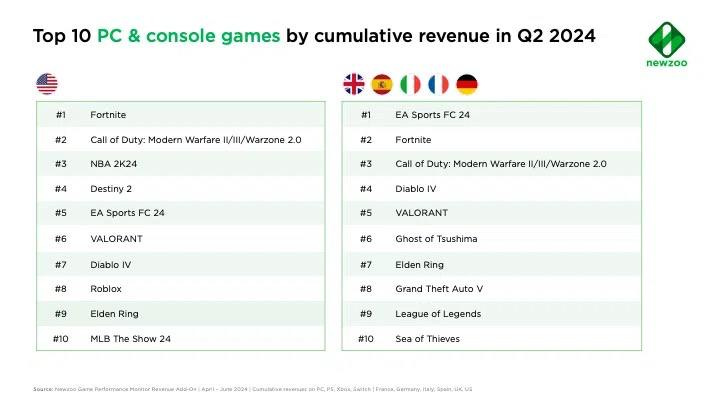

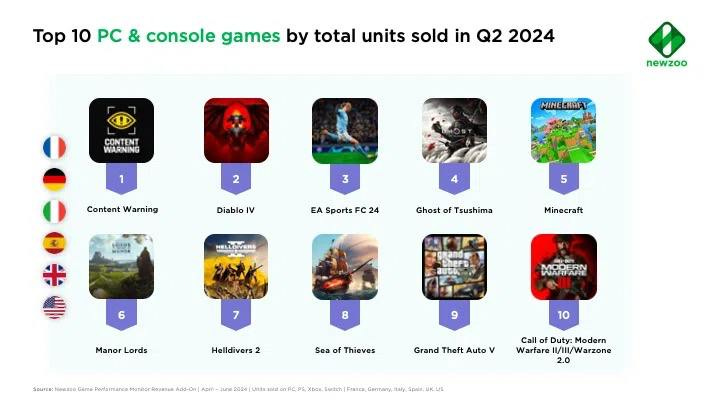

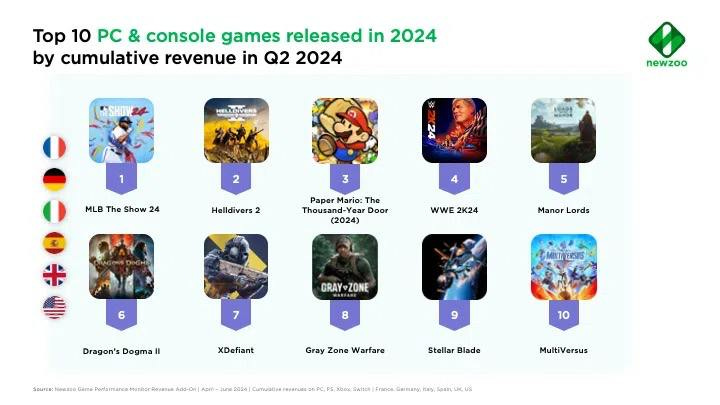

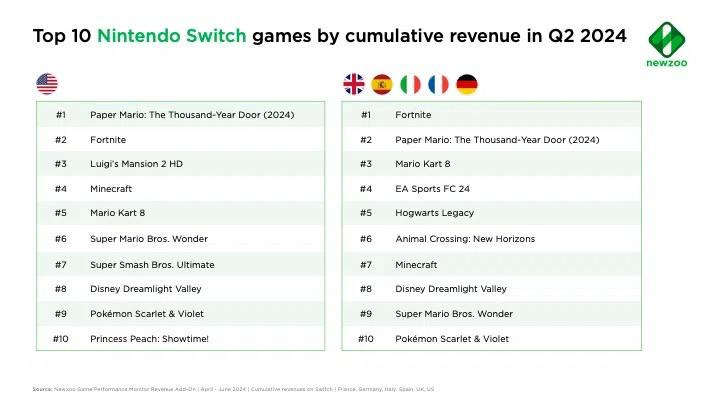

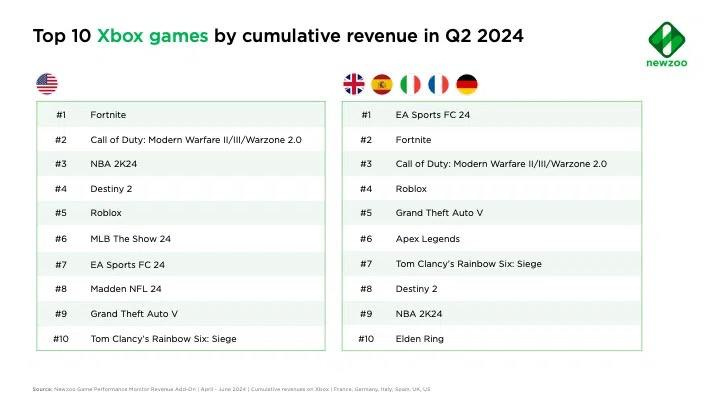

Newzoo: PC/console games performance in Q2'24

Newzoo takes into account data from the USA, UK, Spain, Italy, Germany, and France.

Fortnite, EA Sports FC 24, and Call of Duty (MW2/MW3/Warzone) were the leaders in revenue for the second quarter across the six tracked markets. Elden Ring finished the quarter in 8th place, and Ghost of Tsushima in 10th. Together, these two projects accounted for 4.2% of all gaming revenue for the quarter.

Fortnite - 10% of all gaming revenue in Q2’24; EA Sports FC 24 - 7.4%. However, if we look only at the European market, EA Sports FC 24's share rises to almost 25%.

Content Warning, Diablo IV, and EA Sports FC 24 were the leaders in the second quarter by the number of copies sold. However, it's not entirely clear if free copies of Content Warning were included. In any case, the game sold over 1.5 million copies across the six markets.

Among games released in 2024, the leaders in cumulative revenue in Q2’24 were MLB: The Show 24, Helldivers II, and Paper Mario: The Thousand-Year Door. Also on the list are XDefiant (7th place) and MultiVersus.

Game revenue ranking by platform

Nintendo Switch - Fortnite accounted for 15.6% of all game revenue on the Switch in the USA in the second quarter. Paper Mario: The Thousand-Year Door also performed well.

PC - Valorant leads in revenue in Europe (7.2% of all revenue in Q2’24); Fortnite leads in the USA. Ghost of Tsushima accounted for 6% of all PC sales in Europe and 4% in the USA by the end of the second quarter.

PlayStation - In the USA, Fortnite, Call of Duty series games, and NBA 2K24 lead. In Europe, EA Sports FC 24 is at the top. Sports games on PS accounted for 21% of all gaming revenue in the USA. In Europe, football and basketball games accounted for 36.8% of all revenue.

Xbox - The situation is similar to what we see on PlayStation. Sports games account for 19.9% of revenue in the US market and 43% in the European market.

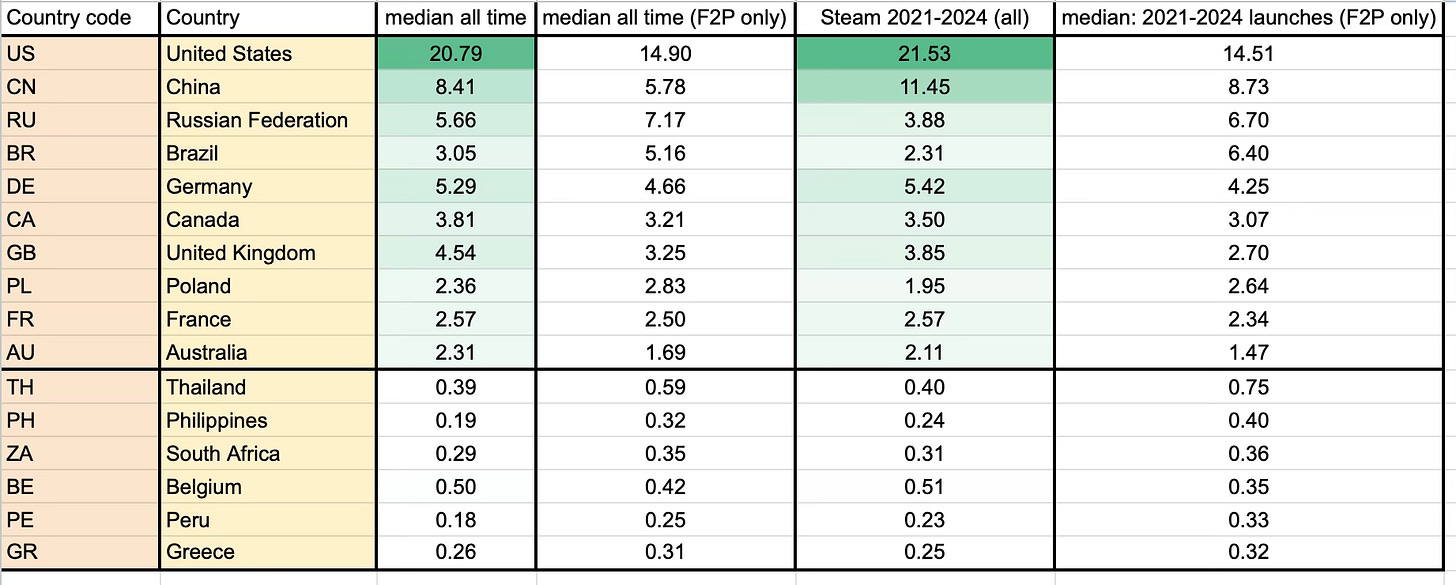

GameDiscoverCo: In which countries do owners of successful games on Steam live

Successful games are considered projects with more than 100 thousand players.

20.79% of players in "hit" projects are from the USA, 8.41% from China, and 5.66% from Russia. This is the median figure over time

However, if we only consider launches from 2024, we can see that the share of the USA has grown (to 21.53%); China has grown significantly (to 11.45%), and Germany has risen to third place (5.42%). Russia shows a significant decline (to 3.88%); the share of the UK decreases (by 0.69%) and Canada (by 0.31%).

❗️GameDiscoverCo notes that the figures for China may be underestimated due to market specifics.

However, if we are talking about F2P games, the situation changes dramatically. The median percentage of players in the USA for F2P projects is 14.9%; for Russia - 7.17%; for China - 5.78%; for Brazil - 5.16%. Overall, the share of players in free-to-play games is higher in developing countries.

You can have a deep dive using this spreadsheet, carefully prepared by the author (thanks, Simon!).

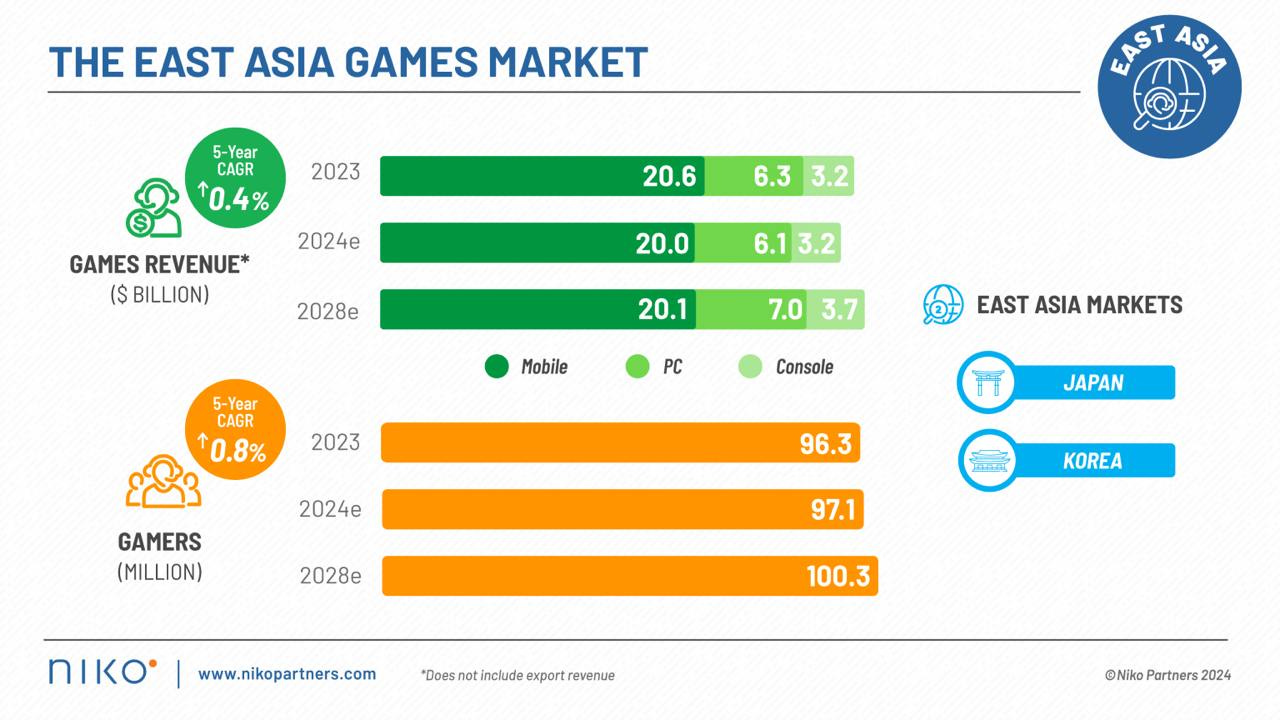

Niko Partners: The Gaming Markets of South Korea and Japan Grew to $30.1 Billion in 2023

Japan and South Korea in Niko Partners' taxonomy are classified as East Asia.

Market Condition

Growth compared to last year was 1%. However, Niko Partners expects a decline in 2024 by 2.9% to $29.2 billion.

The future outlook is conservative. It is expected that by 2028 the market volume will be $30.8 billion. The average annual growth rate will be only 0.4%. The markets have reached their maturity.

❗️Niko Partners notes that Japan is experiencing a correction after the rapid growth of the industry during the pandemic. Moreover, the weak yen exchange rate affects market forecasts in dollars.

Mobile remains the largest segment, accounting for 68.4% of the region's total revenue. However, over the years, this share will decrease. Consoles and PC will show growth.

In 2023, there were 96.3 million players in Japan and South Korea (+1.7% YoY). In 2024, the number will grow by another 0.8% to 97.1 million. By 2028, the number of gamers will reach 100.3 million (average annual growth rate - 0.8%).

Japan and South Korea show astronomical ARPU figures - $312.71 in 2023. This figure is expected to decrease to $307.04 by 2028.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

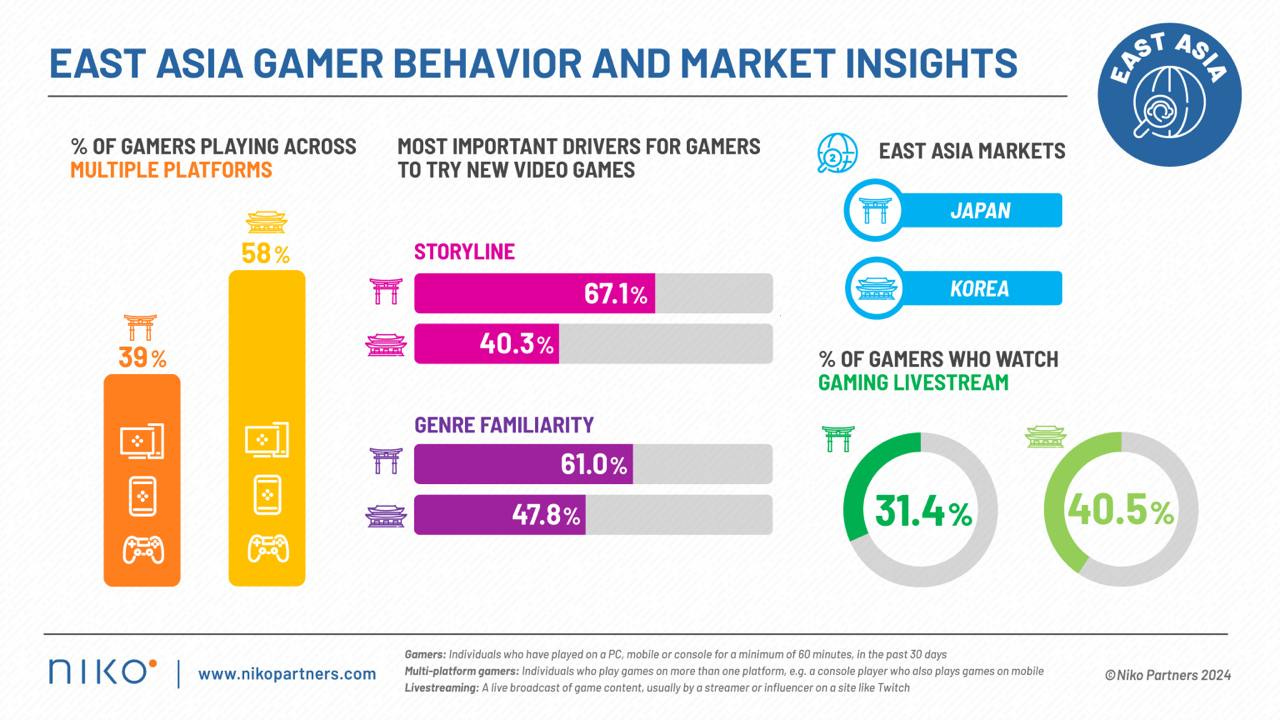

User Preferences

39% of Japanese and 58% of Koreans play on two or more platforms. Niko Partners notes a significant increase in the number of mobile gamers in Japan who have switched to consoles; their number has increased by 30%. In South Korea, PC users have started playing on other platforms more often.

Despite the stagnation of the Japanese market, Niko Partners expects an average annual growth of 8.8% in the PC segment and 2.5% in the console segment in the country over the next 5 years. In South Korea, the annual growth of the console market will be 3.4% over the next 5 years.

Japanese (60%+) and Koreans (40%+) want games in familiar genres and with a good storyline.

31.4% of Japanese gamers and 40.5% of South Korean gamers watch streams.

YouTube is the main channel for consuming gaming content, used by more than 90% of the audience in Japan and South Korea. However, it is important to consider local platforms - SOOP (AfreecaTV) in South Korea and NicoNico in Japan. They cover more than 20% of the gaming audience and are focused on gaming content.

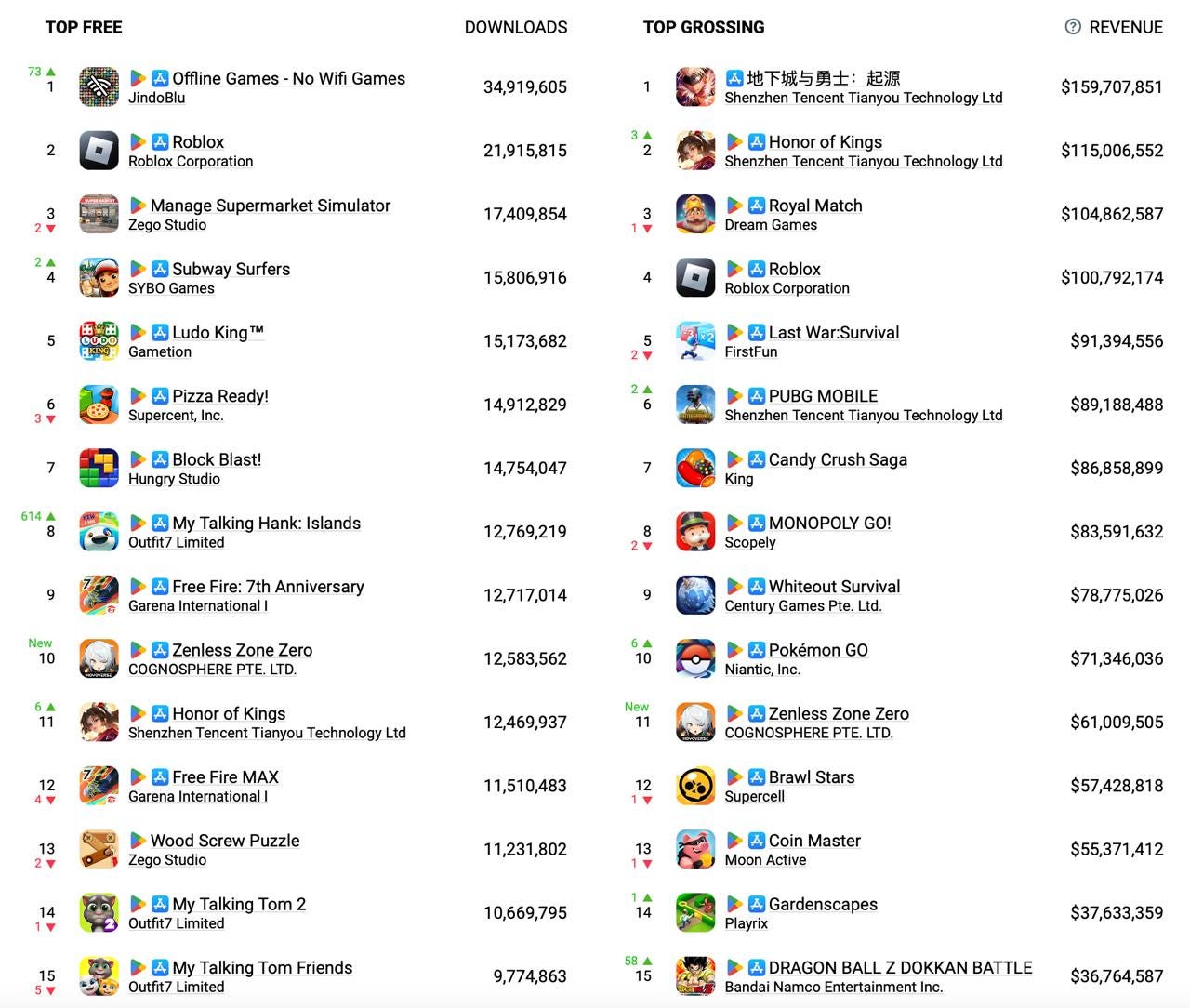

AppMagic: Top Mobile Games by Revenue and Downloads in July 2024

AppMagic provides revenue data net of store commissions and taxes.

Revenue

Dungeon Fighter Online appears to be the new leader for some time. The game earned $159.7 million in July - slightly less than the previous month, but still significantly ahead of the second-place Honor of Kings ($115 million). In both cases, this revenue comes from iOS China (96% of Honor of Kings' revenue comes from the country).

Pokemon GO! surged into the top 10, doubling its earnings from the previous month and earning $71.3 million.

Zenless Zone Zero narrowly missed the top 10, earning $61 million in July. Incidentally, this is miHoYo's highest-earning game of the month.

Downloads

The leader in downloads for July was Offline Games - No WiFi Games with 34.9 million installs. This is a collection of simple games that, as the name suggests, do not require the internet.

My Talking Hank: Islands shot into the top 10, with downloads increasing almost tenfold. According to platform data, the game was initially released in 2017; however, according to the developers, it entered soft launch on November 9, 2023, on Android, with a full release on July 4, 2024. This explains the surge in downloads.

Zenless Zone Zero made it into the top 10 in terms of downloads. The game was downloaded 12.5 million times in July.