Weekly Gaming Reports Recap: June 2 - June 6 (2025)

Top mobile games of May by AppMagic; new transmedia results highlighted by Sensor Tower, and other interesting numbers of the week.

Reports of the week:

AppMagic: Top Mobile Games by Revenue and Downloads in May 2025

Games & Numbers (May 21 - June 3, 2025)

Ampere Analysis: The Gaming Market in 2025

Alinea Analytics: Top Steam games in May 2025 by copies sold

Niko Partners: Asian and MENA Markets to Reach $96 Billion by 2029

Sensor Tower: The Impact of Film Adaptations on the Metrics of the Games they’re Based On

AppMagic: Top Mobile Games by Revenue and Downloads in May 2025

AppMagic provides revenue data after deducting store commissions and taxes. Revenue from Android stores in China is not included.

Revenue

Honor of Kings maintains its leading position in the revenue charts. In May, the game generated $184.2 million—97% of this amount came from the iOS version in China. It is worth noting that in the US, the title has been earning over $1 million per month for several months now. A significant portion of downloads (25%) in the last month came from Indonesia, but revenue in that country remains low.

For the first time in several months, a new release has entered the top 10 in terms of revenue. This is SD Gundam G Generation ETERNAL by Bandai Namco Entertainment—a tactical RPG based on a popular IP. In April, the game generated $43.9 million, with most of this revenue (71%) coming from Japan.

It has been a good month for Brawl Stars—the game earned $39 million, its best result since the beginning of the year.

Gossip Harbor: Merge & Story continues to scale steadily. The game generated $42.3 million in May—a new record for the project.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Downloads

There are three new projects in the top 15 by downloads. All of them are related to the Brainrot Animals trend (the one with Tralalero Tralala and other characters).

Meme Merge: Drop Puzzle—14.1 million downloads. In this game from Vietnamese Bravestars Publishing, players merge meme characters. Merge Fellas(11th place—10.6 million installs) has a similar theme, but the developers did not limit themselves to Brainrot Animals.

12th place—Brainzot Tip Tap Challenge, again from a Vietnamese studio. This is a collection of mini-games about Brainrot Animals.

Meanwhile, the top of the chart remains unchanged—Block Blast! is in first place (35.6 million installs), followed by Roblox (22.7 million), and Subway Surfers in third (15.5 million).

Games & Numbers (May 21 - June 3, 2025)

PC/Console Games

Total sales of all games related to the Pokémon universe have exceeded 489 million copies. Next year, the number will likely be even more impressive.

Sales of The Witcher 3: Wild Hunt have reached 60 million copies. It took the legendary game 10 years to hit this milestone.

Cyberpunk 2077: Phantom Liberty has sold over 10 million copies. Back in January 2024, it was reported that the expansion had sold 5 million copies.

More than 10 million players have played Atomic Heart. This number doesn’t equal sales, since the game was available on subscription services.

The Nioh series has sold over 8 million copies. 90% of all sales come from the US and European countries.

Total sales of Sifu have reached 4 million copies. The game was released on February 8, 2022.

33 days after launch, sales of Clair Obscur: Expedition 33 reached 3.3 million copies. Time to make a wish.

More than 3 million people played DOOM: The Dark Ages in less than a week. This is the biggest launch in the series’ history.

Elden Ring Nightreign sold over 2 million copies in its first 24 hours.

More than a million people played Revenge of the Savage Planet two weeks after launch. The game was available from day one on Xbox Game Pass.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The cozy adventure from Level-5, Fantasy Life i: The Girl Who Steals Time, sold over half a million copies in its first 3 days.

Cash Cleaner Simulator sold over 100,000 copies in a week. By release, the game had 42,000 wishlists.

JDM: Japanese Drift Master from Polish studio Gaming Factory earned $1.2 million in its first 5 days on sale. $2.9 million was spent on development, and $268,000 on marketing.

Gothic 1 Remake has over 1 million wishlists — a solid achievement for a cult project.

Quarantine Zone: The Last Check has attracted more than 650,000 wishlists. The game went viral online, with TikTok videos racking up millions of views. Release is planned for September 2025.

The King is Watching is actively gaining wishlists. More than 200,000 people have already added the game to their wishlist. There’s no exact release date yet.

Mobile Games

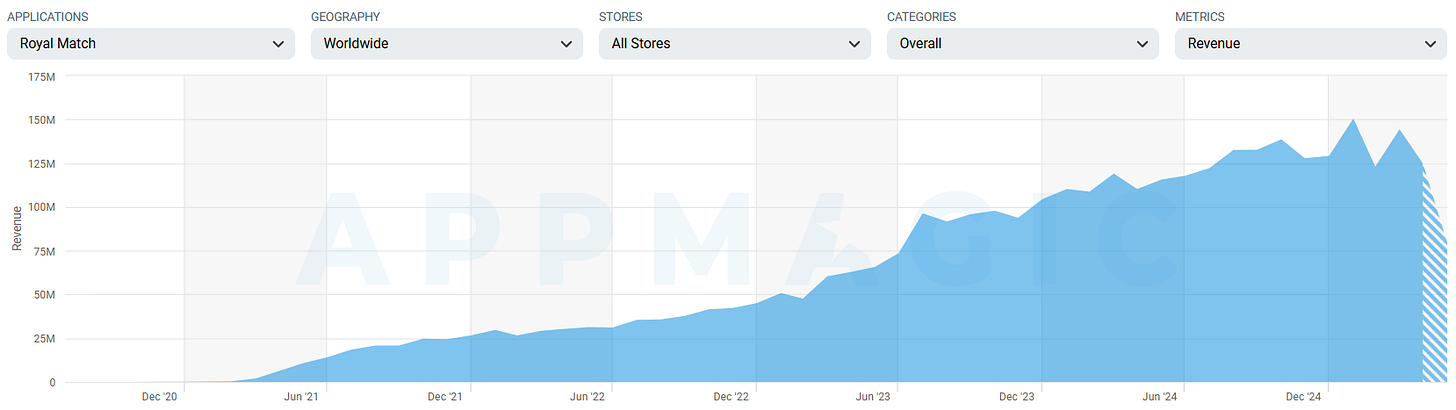

AppMagic reports that players have already spent over $6 billion (Gross) in Royal Match. The US accounts for 54.5% of all revenue. Since launch, the game has been downloaded over 351 million times.

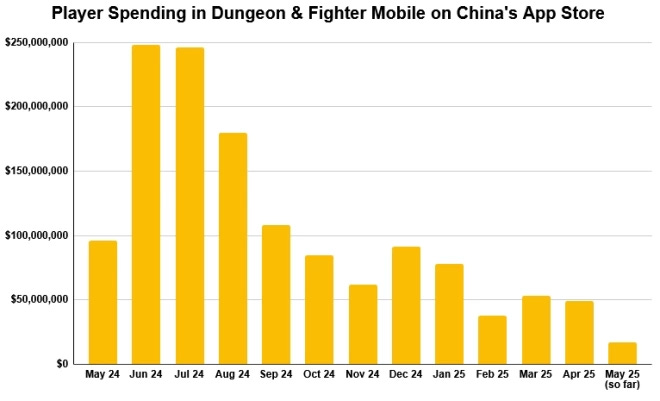

Dungeon & Fighter Mobile earned more than $1.3 billion in its first year on the Chinese App Store. The project’s actual revenue is significantly higher.

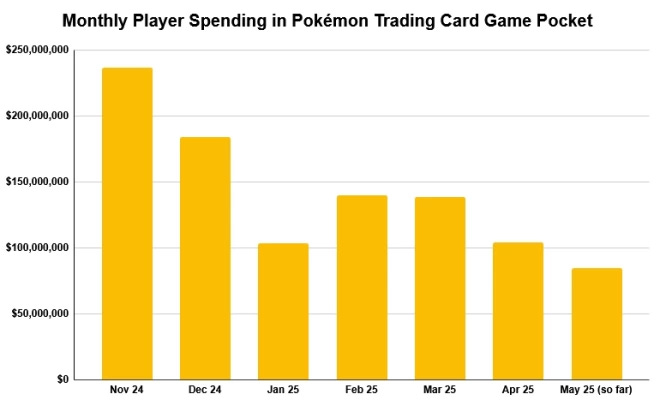

Pokémon TCG Pocket surpassed $1 billion in gross revenue 204 days after release. According to AppMagic, the project hit this milestone 78 days faster than Pokémon GO.

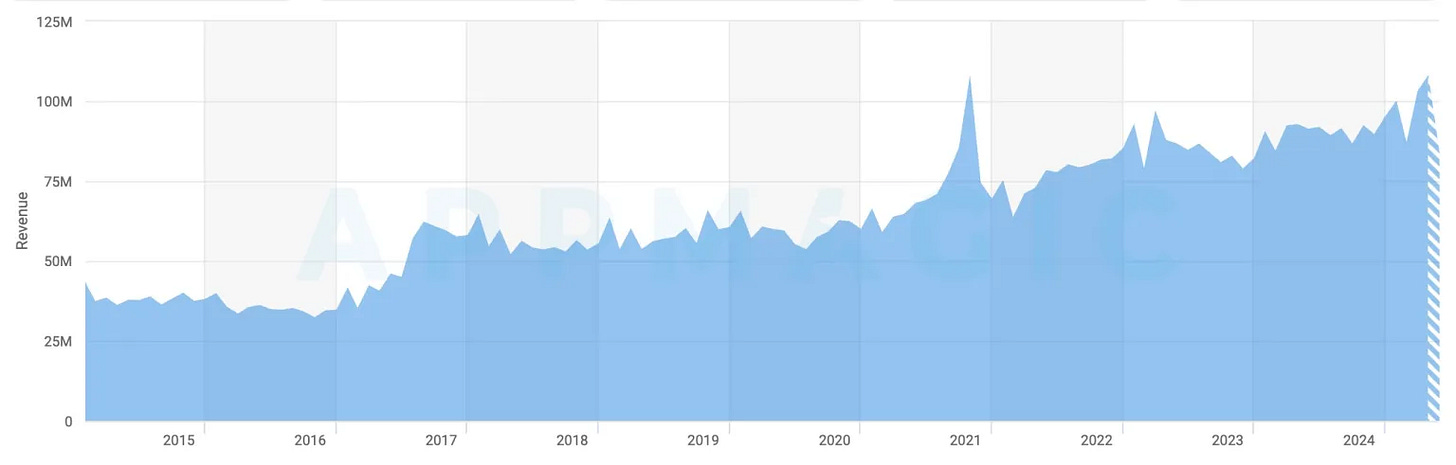

Candy Crush Saga posted its second-highest monthly revenue ever in April 2025. The game made $108.25 million after taxes and fees. The only higher month was October 2021, by $38,000. Numbers from AppMagic.

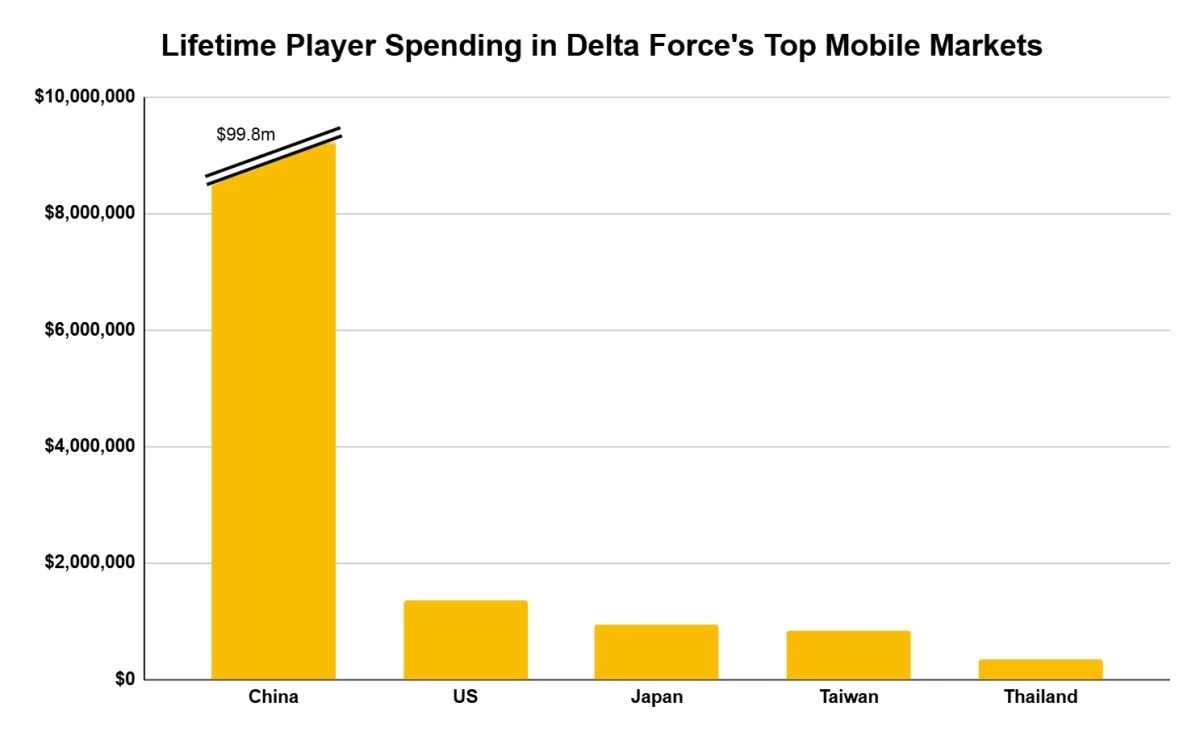

Delta Force surpassed $100 million in mobile revenue. $72.9 million was earned before the global launch. The overwhelming majority of revenue comes from China.

Blood Strike by NetEase Games has been downloaded over 100 million times. The game launched in Southeast Asia in October 2023, and its global release was on March 21, 2024. The game is also available on PC. According to AppMagic, it has earned nearly $23 million before taxes and fees.

A new mobile basketball game from NetEase Games—Dunk City Dynasty—attracted over a million users in its first 5 days. The game is available in the US and several Southeast Asian countries.

UGC

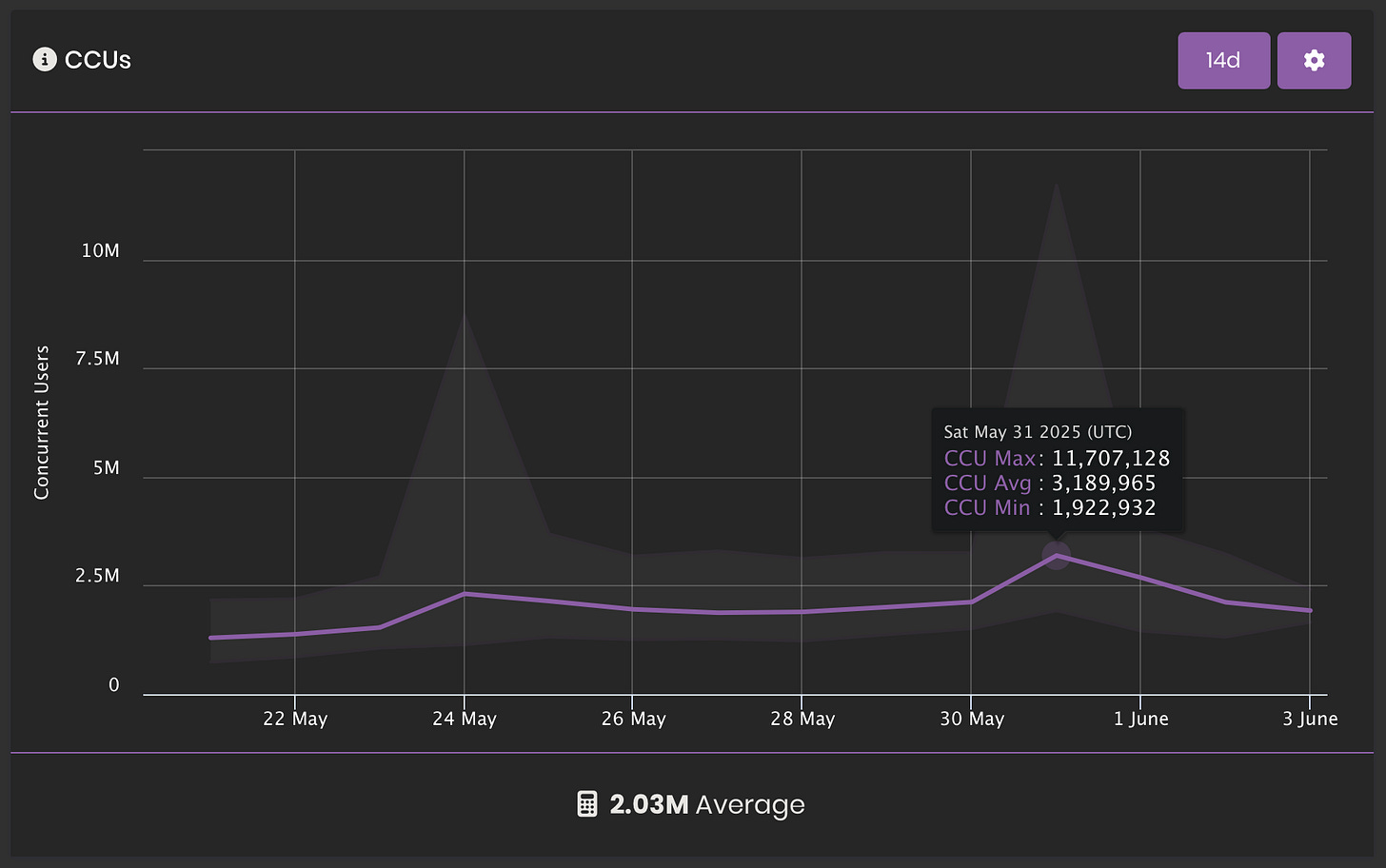

The CCU of the new Roblox hit Grow a Garden reached 11.7 million people on May 31. For comparison, on that day, there were fewer people in all games on Steam.

Ampere Analysis: The Gaming Market in 2025

Market State

At the end of 2024, the gaming content and services market reached a volume of $199.4 billion (+3.5% YoY). Despite growth, it’s important to account for inflation—in real prices, the market hasn’t grown as significantly.

Analysts at Ampere Analysis anticipate modest growth over the next couple of years — 0.9% in 2025 and 2.2% in 2026. The total market volume is expected to reach $205.7 billion by the end of 2026.

The mobile gaming market grew by 4.1% YoY in 2024. Its share of the total market remains at 58%. The forecast for growth in the coming years is 2-3% per year.

The fastest-growing segment in 2024 was PC, with 5.7% growth. However, in absolute numbers, it is still smaller than both the mobile and console markets. Ampere Analysis is optimistic about the future of the PC market, noting its global reach.

The console segment did not show growth in 2024. It is expected to stagnate until 2026 (when GTA VI is anticipated to launch). The release of Nintendo Switch 2 and increased game sales for it are not expected to significantly boost the revenue of the segment.

❗️Console sales figures include subscriptions—PS Plus and Game Pass. The VR segment includes purchases of VR games, and the cloud segment includes subscriptions to cloud gaming services only.

Ampere Analysis highlights the impact of the GTA VI delay. They believe that 21 million fewer game copies will be sold on PS5 and Xbox Series S|X, console sales will drop by 700,000 from the initial forecast, and the total shortfall in the console segment will be $2.7 billion.

In-app purchases accounted for 77% of all game payments in 2024. This figure has remained stable since 2019.

Over the past few years, spending on subscriptions has noticeably increased. Physical game sales, however, are declining—Ampere Analysis believes that by 2026, physical games will make up just 2% of total revenue.

The Asia-Pacific region is the world’s key market. It is almost twice as large as North America ($92.9 billion vs. $57.7 billion), and growth is expected in 2025.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The North American and European markets are projected to decline by 0.4% YoY in 2025.

The MENA region is expected to see the strongest growth, 6.3% YoY in 2025.

Investment Climate

Early-stage investment activity is slowly recovering. However, Ampere Analysis notes that the volume of deals has significantly decreased from the record highs of 2021 and 2022.

Attention Economy

There is widespread discussion about games competing for time with other forms of entertainment. The Ampere Analysis report is no exception.

Despite the gaming market being larger than other entertainment markets, subscription services for TV series and movies are close behind. Additionally, as the youngest form of entertainment, games have the highest percentage (21%) of people who do not interact with them at all.

Growth Points for the Gaming Industry

Ampere Analysis believes that by 2030, 103.1 million Nintendo Switch 2 consoles will be sold worldwide. Between late 2026 and 2028-2029, the active audience for both Nintendo Switch consoles will be around 130 million.

Nintendo is significantly behind Sony and Microsoft in terms of revenue share from in-game purchases and DLC. Sony is the leader (65%), Microsoft has 31%, and Nintendo has only 4%.

At the end of 2024, 4.1 million Steam Decks were sold worldwide. This number is expected to grow to 7.9 million by 2027. Supporting portable PCs in your games should not be ignored if technically possible.

Web games, web gaming platforms, and D2C (direct-to-consumer) platforms could bring mobile games an additional $3.7 billion, excluding China.

❗️Growth here is real thanks to new platforms. D2C does not expand the audience but allows for more efficient conversion.

From a regional perspective, Ampere Analysis recommends paying attention to the MENA region (especially Saudi Arabia and the UAE) and Southeast Asia.

The US Market and Growth Opportunities

The number of gamers in the US has decreased by 21 million since its peak in 2021. In 2021, 67% of the country’s population (223 million) played games; in 2024, this figure is 59% (202 million people). Despite this, the US market has grown in volume compared to 2021.

Ampere Analysis highlights the young female audience in the US (ages 16-24). There are 16 million in this group. 82% of them play games (compared to 93% of males in the same age group). They play an average of 4 hours less than men and spend 50% less.

In addition to young audiences, there are 33 million American gamers over 55, 32% of the total population over 55. The number of people in this age group is expected to grow by 2030.

UGC (user-generated content) and platforms like Roblox, Fortnite, and Minecraft play a major role in attracting young audiences. Over 35 million US gamers are under 16.

63% of all Roblox players in the US are over 13. Conversely, 37% are under 13.

❗️There has long been a debate about whether Roblox players transition to more “serious” games. Ampere Analysis analysts believe that owners of major gaming brands should start engaging with audiences on UGC platforms.

Possible Content Strategies on the Modern Market

Ampere Analysis believes that the key factor in the current market is the speed of development and time-to-market. Long-term projects are expensive to develop and often miss market opportunities.

There is no recipe for successful games on the modern market. There is also no clear recommendation on whether to make single-player or multiplayer projects—different countries have different attitudes toward single-player games, for example.

What attracts attention is the use of local myths and stories. It seems audiences have an appetite for atypical narratives.

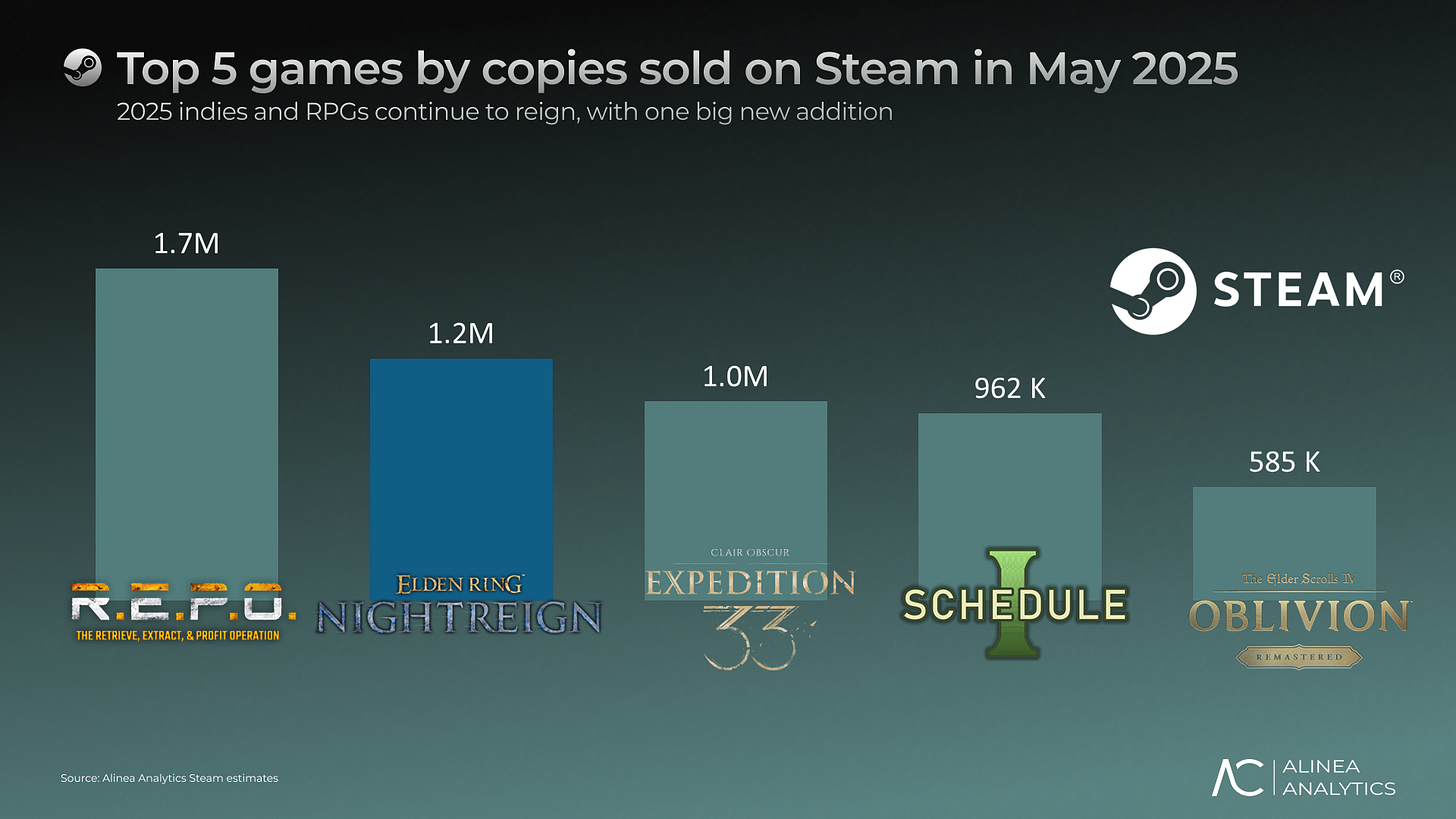

Alinea Analytics: Top Steam games in May 2025 by copies sold

R.E.P.O. returned to the top sales spot in May—the game was purchased 1.7 million times. In April, first place went to Schedule 1 (4.7 million copies sold). As of now, R.E.P.O. has sold 14.4 million copies on Steam, totaling $113.6 million (Gross). Over a quarter of players are from the US, with Russia in second place (9%). Less than 5% of players are from China, since the game still lacks Chinese localization. Meanwhile, the game has 3 million wishlists.

In second place is Elden Ring Nightreign—1.2 million copies sold in two days on Steam ($48.5 million gross revenue). Across all platforms as of June 5, over 3.5 million copies have been sold, with 1.7 million on Steam. 80% of Elden Ring Nightreign buyers on Steam also own the original Elden Ring.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Clair Obscur: Expedition 33 was bought 1 million times in May, more than in April. Currently, the game has over 1.8 million copies sold on Steam ($69 million gross revenue). The US and Japan account for almost half of the users.

Total sales of Schedule 1 have reached 8.2 million copies ($126 million gross revenue).

The Elder Scrolls IV: Oblivion Remastered was bought 585,000 times in May, with total Steam sales surpassing 2 million ($84 million total).

With the launch of the Heart of Democracy update, Helldivers II surpassed 1 million DAU for the first time since early 2024. The game was purchased 537,000 times on Steam in May, and total platform sales reached 11.8 million. The developers also benefited from a discount, offering a 20% discount with the update’s release.

V Rising crossed the 5 million copies mark on Steam—in May, the game was bought 446,000 times.

The only new release in May is FANTASY LIFE i: The Girl Who Steals Time, a cozy simulator from Level-5. The game was bought 429,000 times (8th place), and was extremely well received in China—almost half of all users are from there.

Nostalgia is a strong sales driver, as shown in the chart. Black Mesa (384,000 copies) and Battlefield 1 (355,000 copies) suddenly made it into the May top 10. The latter, however, was priced at $1,99 at the start of May, and a major content pack (They Shall Not Pass) was given away for free.

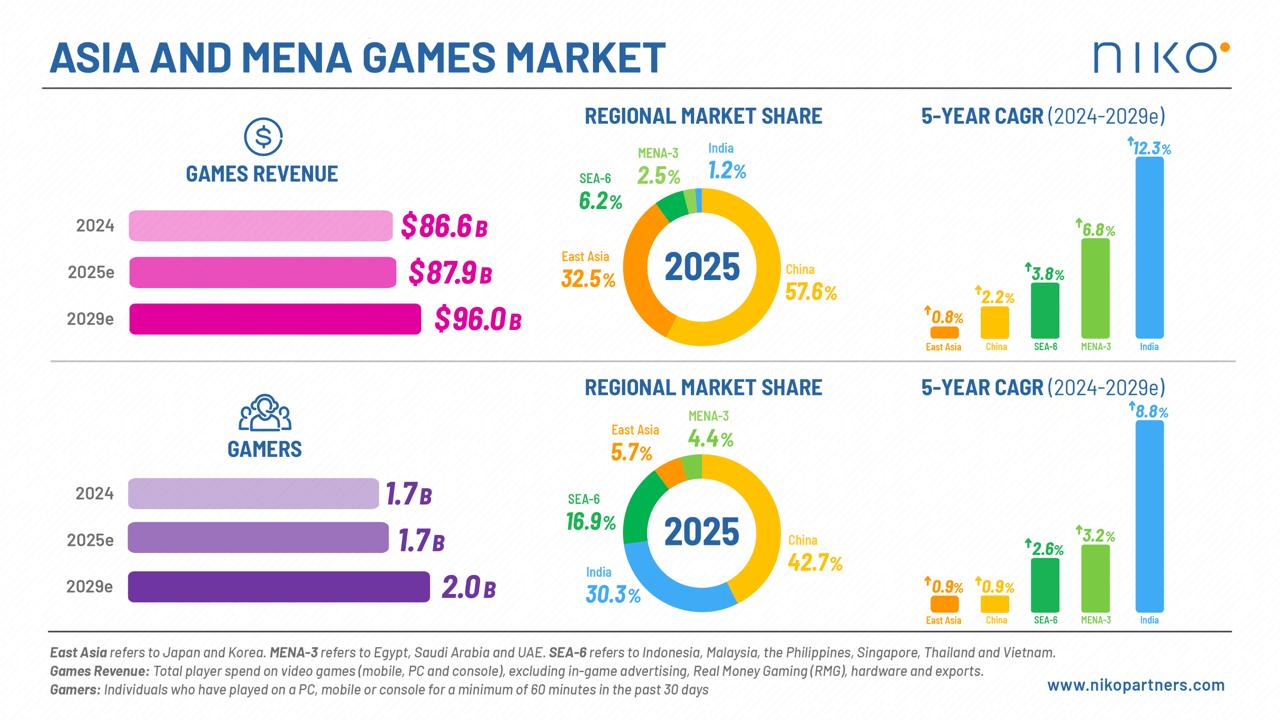

Niko Partners: Asian and MENA Markets to Reach $96 Billion by 2029

The total volume of the Asian and MENA markets in 2024 amounted to $86.6 billion.

Niko Partners forecasts an average annual growth rate of 2.1% through 2029. By the end of 2029, the market volume is expected to reach $96 billion.

Player numbers are also expected to grow—by 2029, there will be 2 billion players in these regions. This is more than the combined total of the rest of the world.

By the end of 2029, the largest Asian countries—China, Japan, and South Korea—are expected to account for 88.7% of the total revenue in the Asian + MENA regions.

India leads in forecasted average annual growth rate both in revenue (+12.3% YoY) and in player numbers (+8.8% YoY). Over the next five years, the country is expected to add 250 million new players, reaching a total of 724 million. In 2025, India will account for 30.3% of all players in the regions considered, but only 1.2% of revenue.

Thailand is the largest and fastest-growing market in Southeast Asia. By 2029, its volume will reach $2.4 billion.

The MENA-3 countries (Saudi Arabia, UAE, and Egypt) are projected to grow at 6.8% annually until 2029, according to Niko Partners. ARPU in the UAE is expected to surpass $100 in 2029.

The share of the female audience is actively growing in the markets under consideration. For example, in the MENA-3 region, the share of women has reached 37%, and in India - 40%. Previously, their share was less than 20%.

❗️Niko Partners notes that despite stagnation in 2024, the Asian and MENA markets are poised for development. The share of paying users is growing, the female audience is becoming more engaged, eSports activities are popularizing games, and the launch of new consoles may attract the traditionally mobile audience of these countries to the PC/console market.

Sensor Tower: The Impact of Film Adaptations on the Metrics of the Games they’re Based On

Minecraft

In April, a successful Minecraft film adaptation was released—the movie grossed over $900 million at the box office. As for the games, the release had the following impact: on mobile devices, IAP revenue grew by 44%, and console game sales in April increased by 36%.

There was also a positive effect on DAU—it grew by 9% on mobile devices and by 41% on consoles.

❗️However, the chart shows that DAU quickly returned to previous levels. On consoles, this metric even dropped below prior periods.

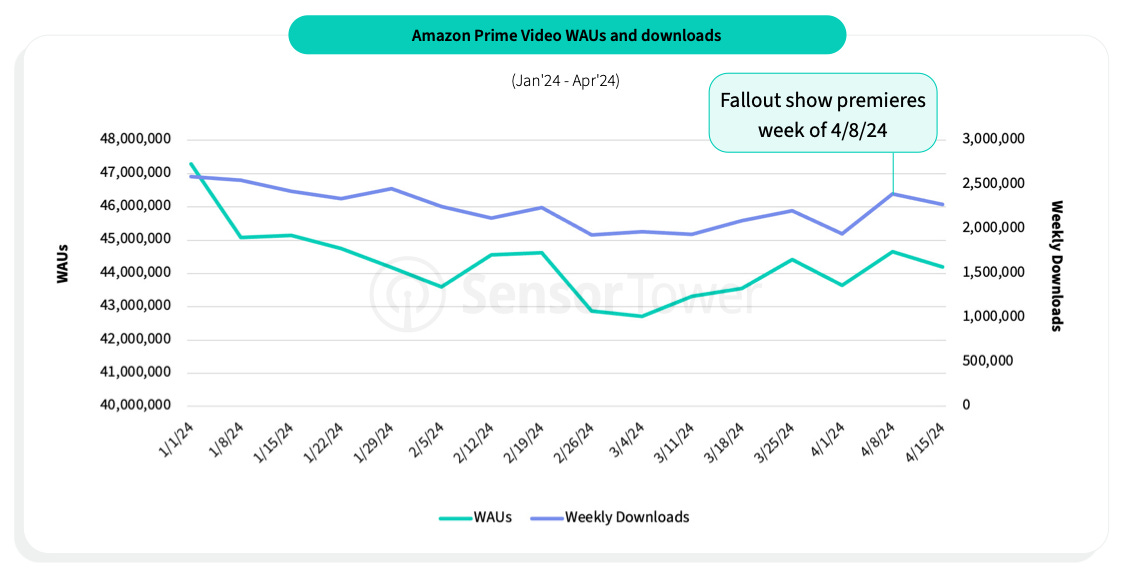

Fallout

The release of the Fallout series coincided with a 23% increase in Amazon Prime Video app downloads.

For the mobile game Fallout Shelter, the series premiere resulted in a 150% increase in IAP revenue and a 77% increase in DAU.

On PC, Fallout 3 sales jumped by 125%, and Fallout 4 by 410%. DAU for PC projects grew by 110%. However, it’s important to note that this growth was driven by a significant discount, so the net monetary benefit was smaller.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Interestingly, DAU for Fallout 3 and Fallout 4 was 225% above average figures, even 20 weeks after the show’s release. This suggests that the TV adaptation succeeded in bringing back old users and attracting new ones.

DAU in Fallout Shelter stabilized at +26% above previous values several weeks after the show’s release.

Notably, a week after the Fallout series premiered, Amazon increased its desktop video advertising budgets in the US by 20 times. Half of this spend was directed to gaming platforms (IGN, Twitch, Gamespot).

The Last of Us

The release of the second season of the series helped significantly boost DAU for both the first and second games. However, the direct impact on sales was weak—The Last of Us: Part II did see a sales uptick after the show’s release, but it was minor.