Weekly Gaming Reports Recap: June 16 - June 20 (2025)

Appfigures shared numbers of the Mobile market in 2025; Nintendo Switch 2 initial sales numbers & more.

Reports of the week:

Console sales in Russia increased by 29.5% YoY in 2024

Nintendo Switch 2 sets unit sales record among consoles

Ampere Analysis: 13M Nintendo Switch 2 units will be sold in 2025

Games & Numbers (June 4 - June 17, 2025)

Alinea Analytics: Wuchang: Fallen Feathers – New $100M+ Hit from China?

AppFigures: Mobile Gaming Market in 2025

Console sales in Russia increased by 29.5% YoY in 2024

Russian retailer M.Video-Eldorado shared statistics on console and gaming device sales in the country. Many companies have left the country, so devices are now delivered through parallel import.

Game console sales grew by 29.5% in monetary terms compared to 2023. The total sales volume reached 31.67 billion rubles, up from 24.46 billion rubles.

❗️At the average exchange rate, sales amounted to $358.7 million in 2024. In 2023, it was $305.8 million.

The number of systems sold has remained at the same level for a couple of years. In both 2023 and 2024, 1.45 million systems were sold.

PlayStation 5 is the most popular system in the local market. Its market share in monetary terms grew from 63.7% in 2023 to 71.6% in 2024. In units, sales increased from 18.6% in 2023 to 29.5% in 2024.

Xbox Series sales in dollars fell from 16% to 8.9%. In units, the share decreased from 7.1% to 4.8%.

Nintendo Switch sales in units grew from 4.5% to 4.9%, but in monetary terms, fell from 6.5% to 5.3%.

Steam Deck is the leader among all systems in terms of sales growth in the Russian market. In 2024, sales grew by more than 70%. According to the retailer, 43,000 devices were sold in Russia in 2024.

Nintendo Switch 2 sets unit sales record among consoles

On June 11, Nintendo announced that Nintendo Switch 2 sold over 3.5 million units in its first 4 days.

Famitsu reported that in Japan, the console sold 947,000 units in its first 4 days. That’s three times more than the original Nintendo Switch. The Nintendo Switch 2 launch is now the largest in Japan’s history. Previously, the record belonged to PlayStation 2 (630,000 units during its launch period).

Finally, Nintendo Switch 2 launched more successfully than any previous Nintendo system in the UK. Exact numbers weren’t given, but in its first week, the original Nintendo Switch sold 80,000 units, and the Nintendo 3DS sold 113,000 in the UK. However, that’s still less than PlayStation 5 or Xbox Series S|X in the country.

Ampere Analysis: 13M Nintendo Switch 2 units will be sold in 2025

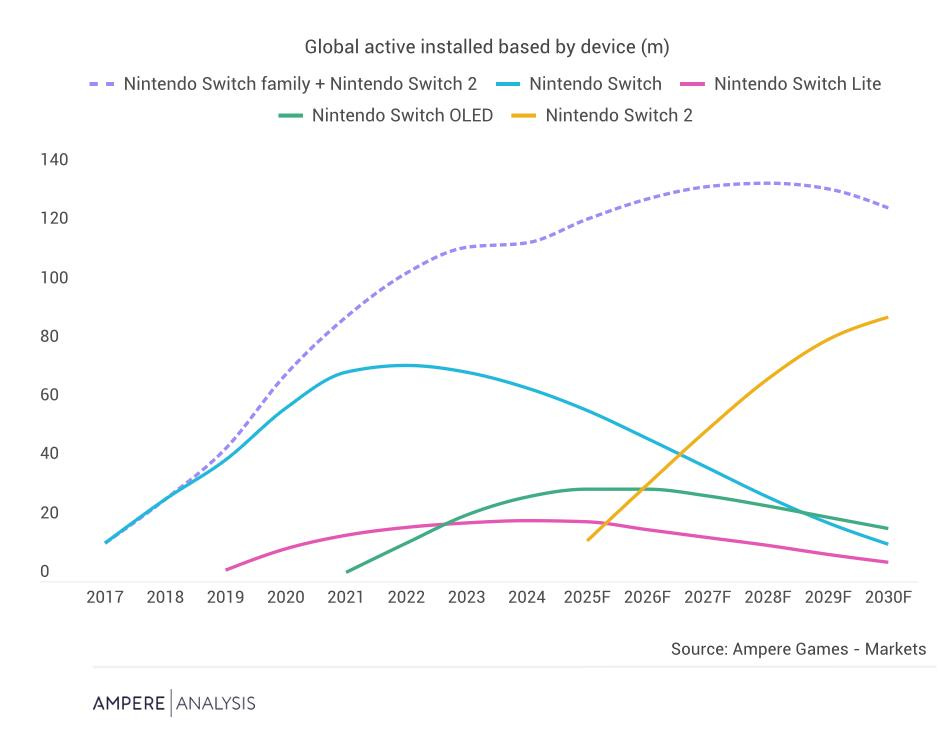

The company forecasts that 13 million units will be sold by the end of this year. By the end of 2026, 32.2 million, by the end of 2027, 51.2 million. And by 2030, 104.3 million. The launch is expected to be faster than the original system, but total sales won’t reach the numbers of the original Nintendo Switch.

The active user base is expected to peak in 2028, with more than 130 million active users.

Ampere Analysis believes that Nintendo Switch 2 buyers will spend over $2 billion on games for the platform in 2025. In the next couple of years, this figure will grow to $7–8 billion. Most of this spending will go to Nintendo’s games.

Games & Numbers (June 4 - June 17, 2025)

PC/Console Games

Global sales of Street Fighter 6 have reached 5 million copies.

Within 4 days of release, Elden Ring Nightreign sold over 3.5 million copies. This was officially announced by the developers.

Stellar Blade sales have surpassed 3 million copies. In the first 3 days of sales on PC, the game was purchased over a million times. Published by Sony, Stellar Blade became the company’s most successful single-player game on Steam by CCU, with over 192,000 people launching the game simultaneously.

The story-driven Under the Waves, published by Quantic Dream, has sold over a million copies. It took the game almost two years to reach this milestone.

9 Kings from Hooded Horse sold over 250,000 copies in its first week.

MindsEye – a game from a former GTA producer – approached release with 300,000 wishlists. The launch flopped, the game has 38% positive reviews, and the online player count dropped to 200.

Mobile Games

Sensor Tower shared that by mid-June, users had spent more than $650 million in Love and Deepspace. Only the App Store and Google Play are counted. In May 2025, China accounted for 48% of the project’s total revenue, with the US in second place at 19%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

According to AppMagic, Wuthering Waves earned $317.3 million on mobile devices in its first year. The first $100 million was reached in less than two months.

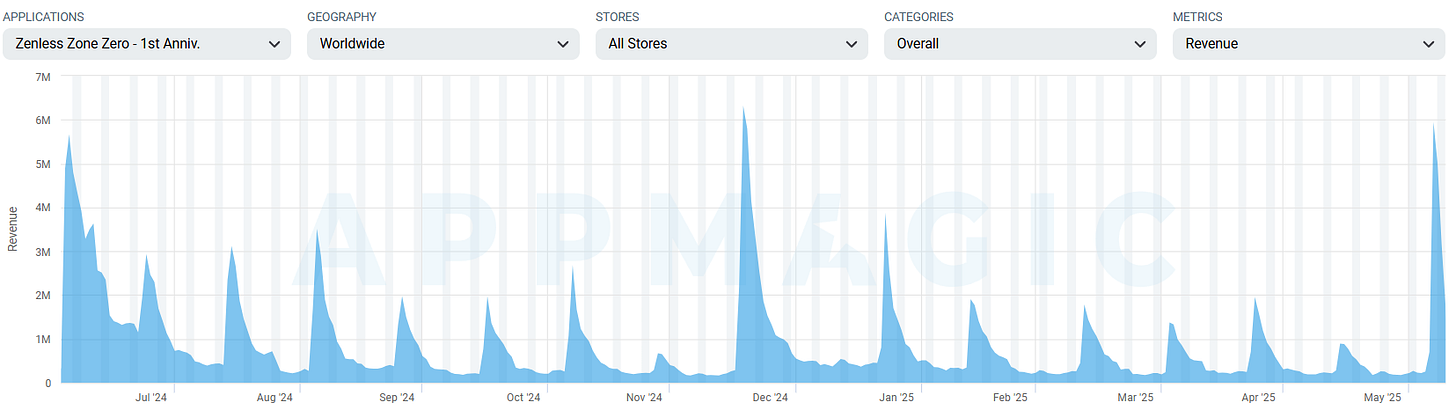

AppMagic reports that daily revenue for mobile Zenless Zone Zero increased 31-fold on June 6, up to $5.95 million in Net Revenue, thanks to the anniversary celebration.

In the first 7 weeks after launch in China, Squad Busters earned $472,000 Gross Revenue in the Chinese App Store. Figures from AppMagic. In the first week, the game earned 64% of that – $303,000.

Magic Chess: Go Go from Moonton Games surpassed 30 million installs. By launch, the project had over 20 million pre-installs.

After Fortnite returned to the App Store, the game was downloaded 2.8 million times in 19 days.

Platforms

Nintendo Switch 2 sold 1.1 million systems in the US during its debut week. This figure does not include sales from the My Nintendo Store. This is a historic record; the previous one belonged to PlayStation 4.

Since its launch in August 2024, the Epic Games Store has been downloaded 40 million times. The company aimed to reach 100 million installs by the end of 2024.

Other

Summer Game Fest 2025 was viewed over 50 million times. The main show peaked at over 3 million concurrent viewers, up 89% from last year.

Alinea Analytics: Wuchang: Fallen Feathers – New $100M+ Hit from China?

The company analyzes the project’s metrics shortly before launch.

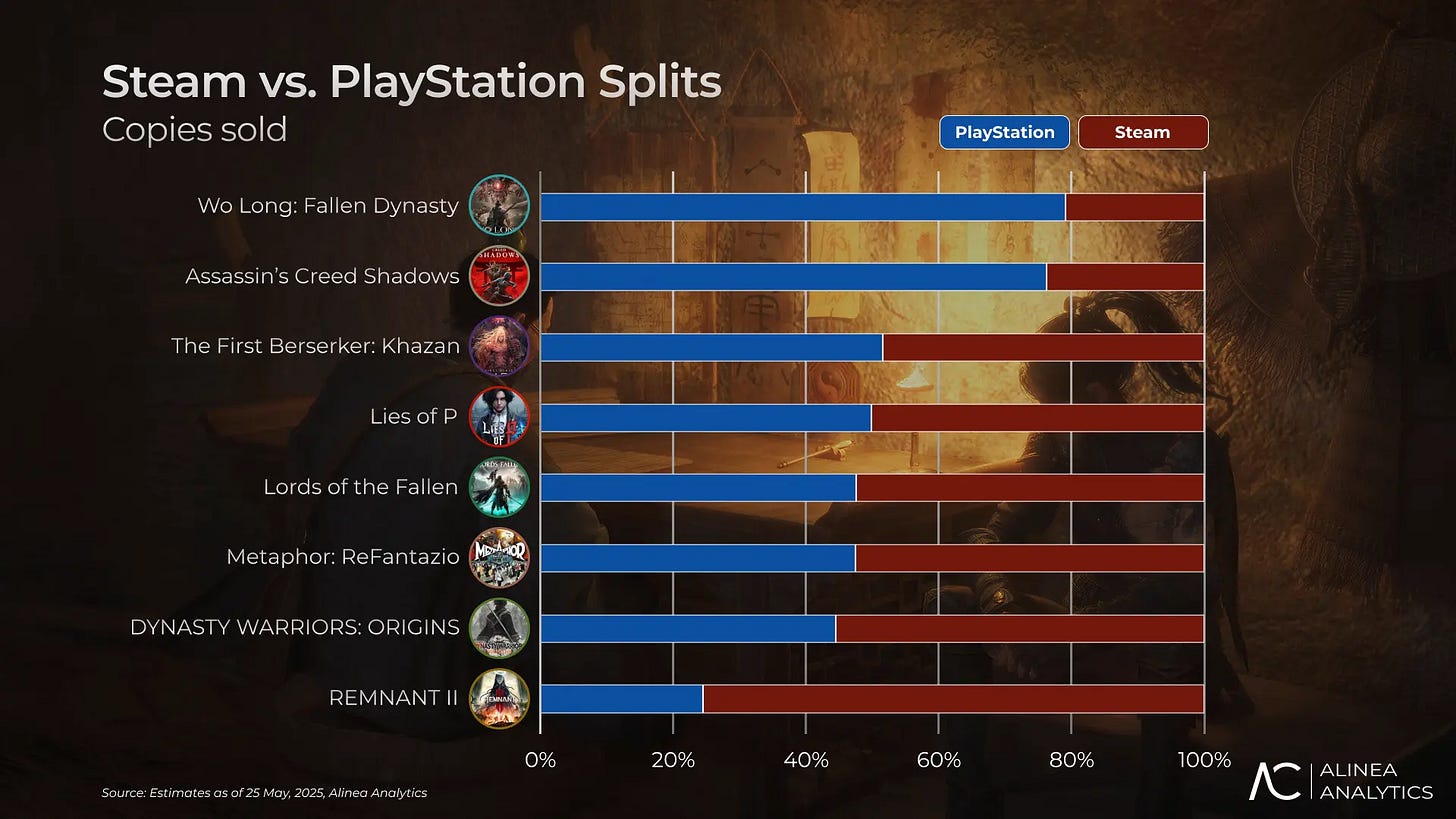

About 60% of players who wishlisted Wuchang: Fallen Feathers have also played Black Myth: Wukong. According to Alinea Analytics, Black Myth: Wukong has sold over 15 million copies on Steam, 6 million on PlayStation, and more than 4 million on other platforms (mainly WeGame). Interestingly, over 40% of Black Myth: Wukong’s audience played for more than 50 hours, which is a very high engagement rate.

Why is this important? Wuchang: Fallen Feathers is targeting the same audience.

Overall, the Souls-like genre has grown significantly in recent years. Before Elden Ring’s release, the genre generated up to $50 million per month; after its release, monthly revenue consistently exceeded $100 million, with spikes up to nearly $600 million thanks to the launch of Black Myth: Wukong.

The genre’s MAU (monthly active users) exceeds 30 million.

On Steam, there have been 30 single-player games that have earned more than $10 million in gross revenue. Of these, 27 are paid, 2 are free, and 1 is a paid DLC. Nineteen reached this milestone in the first month after release.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Wuchang: Fallen Feathers Status Two Months Before Release

$3.4M is the median pre-order revenue. Wuchang: Fallen Feathers has already reached $2M.

In terms of pre-order revenue growth, Wuchang: Fallen Feathers is outperforming similar projects.

❗️I disagree with the benchmarks against Assassin's Creed: Shadows, Ghost of Tsushima, or Metaphor: ReFantazio. Don’t think they represent the audience.

53,000 followers is the median. Wuchang: Fallen Feathers already has 123,000.

Wuchang: Fallen Feathers is ahead of other comparable projects by this metric. Only 10 projects in history have launched with more than 200,000 followers—Wuchang: Fallen Feathers has every chance to join this category.

The median wishlist top position is 19. Wuchang: Fallen Feathers is currently at position 49.

The median price is $49.99. The project will launch at the same price point.

Alinea Analytics believes the project could earn more than $30 million gross in its first month on Steam alone. In the first year, this figure could reach $60 million.

A large number of sales could also occur on PlayStation. It’s realistic for the project to sell over 500,000 copies on the platform in its first month. As with many other cases, the game will be available on Xbox Game Pass from launch.

Wuchang: Fallen Feathers is generating significant interest among PlayStation players in China. The game’s pre-orders are outpacing Death Stranding 2: On the Beach, for which China was the second-largest market for the first installment.

According to Alinea Analytics, the game’s development budget is around $30 million.

AppFigures: Mobile Gaming Market in 2025

The company analyzed the top 1,000 highest-grossing projects of 2024 across more than 100 markets. All revenue numbers in the report are Gross.

Market Overview

USA ($20.8 billion), China ($13.4 billion – iOS only), and Japan ($8.9 billion) are the world’s leading mobile markets by IAP revenue.

India (7.5 billion downloads), Brazil (3.5 billion downloads), and the USA (3.3 billion downloads) lead in installs.

AppFigures estimates the mobile gaming IAP market at $65.7 billion.

Global IAP revenue grew by 3.8% in 2024, from $63.3 billion to $65.7 billion.

The US market, in turn, grew by just 0.05% – from $20.7 billion to $20.8 billion.

Downloads are declining. The market fell by 6.6% in 2024, from 46.2 billion installs to 43.1 billion.

The US is ahead of the trend. Downloads in the country dropped by 11.1% – from 3.6 billion to 3.2 billion.

The number of new releases in 2024 on the App Store and Google Play decreased by 43.2%, from 222,000 apps to 126,000.

There’s also a continued annual decrease in new projects earning $1M+ per year. In 2022, there were 686, in 2023 – 603 (-12.1% YoY), and in 2024 – 399 (-33.8%). Launching in the modern market is getting harder.

Speaking of new launches - Fable Town, a Merge-3 title I have the pleasure of working with at MY.GAMES, scaled to $5M lifetime revenue since global launch in late-2024. Quick numbers:

$5M lifetime revenue (and scaling)!

2 million installs.

#2 by installs in the merge-3 genre as of May 2025.

440k MAU.

95k DAU.

All of this, with sustainable ROI-efficient spend. The game has been developed and published in collaboration with MGVC Publishing (part of MY.GAMES).

Drop me a line if you want to discuss mobile publishing!

Interestingly, the number of days needed to reach the first $1M since 2022 has dropped almost threefold. Previously, achieving the milestone took an average of 273 days, but in 2024, it’s only 106 days.

❗️This signals a more aggressive marketing approach in today’s market. As soon as developers see scalable metrics, they try to seize the moment.

Competition is rising – the number of available mobile games in 2024 in mobile stores grew by 23.1%, from 320,000 to 394,000.

On average, one user brings $1.52 (+11.2% YoY) IAP revenue per install. In the US, this figure rises to $6.43 (+11.1% YoY).

Looking at the 1,000 top-grossing projects in 2024, the leaders are games released in 2022 (they earned $5.7 billion). Second place – games from 2015 ($5.4 billion); third – games from 2018 ($4.8 billion).

Market Leaders

Tencent is the global revenue leader by a wide margin. The list includes 4 Chinese and 3 American companies – these countries can be called dominant in the mobile market.

Honor of Kings, Monopoly GO, and Royal Match are the highest-grossing projects in 2024.

Download leaders – Subway Surfers, Roblox, and Block Blast!. It’s remarkable how long Subway Surfers has managed to stay relevant.

Top New Releases

Among games released in 2024, the most notable are Dungeon & Fighter: Origins (despite being released only in China and South Korea), Pokémon TCG Pocket, and Whiteout Survival (?).

❗️Whiteout Survival had its global release in 2023; its inclusion in the chart is a mistake.

Still, it doesn’t change the fact that among the successful games of 2024, only titles from Asian developers are present.

In 2024, considering the 1,000 top-grossing projects, midcore projects took 50% of the chart, casual games – 32%, casino – 11%, racing and sports – 7%.

❗️Important – this is not about revenue share, but about the number of projects in the top 1,000. In other words, 500 games in the top 1,000 by revenue are midcore.

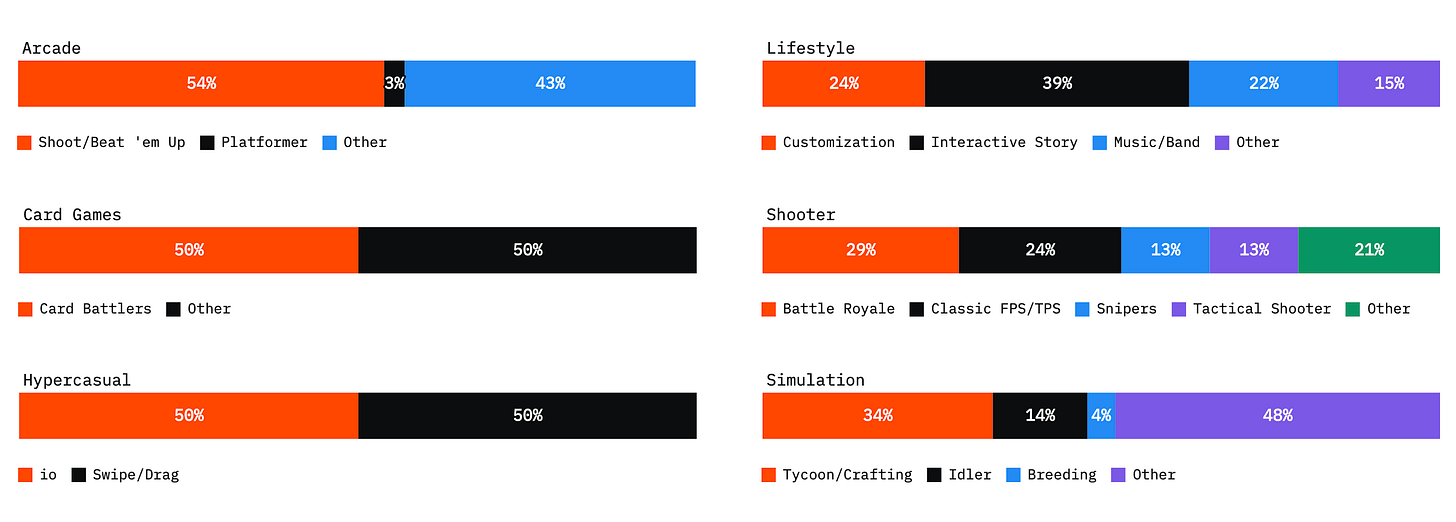

RPGs accounted for 33.7% of all projects in the top 1,000 in 2024, puzzles – 16.3%, strategies – 11.6%.

❗️That is, there are 337 RPGs in the top 1,000. This does not mean they account for 33.7% of revenue.

The most popular RPG subgenres in the top 1,000 are MMORPG (22%), Action RPG (21%), and Idle RPG (15%).

Among puzzles, Match (38% of all releases), board games (13%), and, surprisingly, mahjong (8%) dominate.

In strategies, the lion’s share goes to strategy battlers (46%) and 4X strategies (35%).

Fastest Growing Global Markets

Brazil ($574 million – +47.3% YoY), Mexico ($345 million – +47.1% YoY), and Poland ($330 million – +42.4% YoY) are the fastest-growing markets of 2024.

Singapore ($291 million, -19% YoY), Malaysia ($286 million, -17.5% YoY), and Hong Kong ($779 million, -15.7% YoY) are the leaders in decline for 2024.

❗️It’s surprising to see so many Southeast Asian countries in the decline ranking. Recent reports from various sources, on the contrary, indicate that revenue in these regions is growing rapidly.

Regions leading in per capita spending on mobile games – Hong Kong ($104, -15.7% YoY), Taiwan ($94, -0.4% YoY), and South Korea ($68, +1.3% YoY).

User Habits

AppFigures provides an interesting chart showing the overlap between the audiences of top-grossing games of 2024 and non-gaming apps.

There are a few interesting points – League of Legends players use TikTok less than users of other games. But they exercise more (or at least download fitness apps). Gardenscapes users are more likely than others to study foreign languages on Duolingo.

In 2024, Brawl Stars held several IP collaborations. All shown in the material shown had a positive effect on revenue. The Godzilla collab increased revenue by 86% compared to the previous 4 weeks; SpongeBob – up 68%; Toy Story – up 22%.

How top projects monetize

The chart is obvious, but all top-grossing projects in the top 500 sell currency with consumables and have limited-time offers. In 2024, 60% of the top-grossing games in the top 500 featured Rewarded Ads.

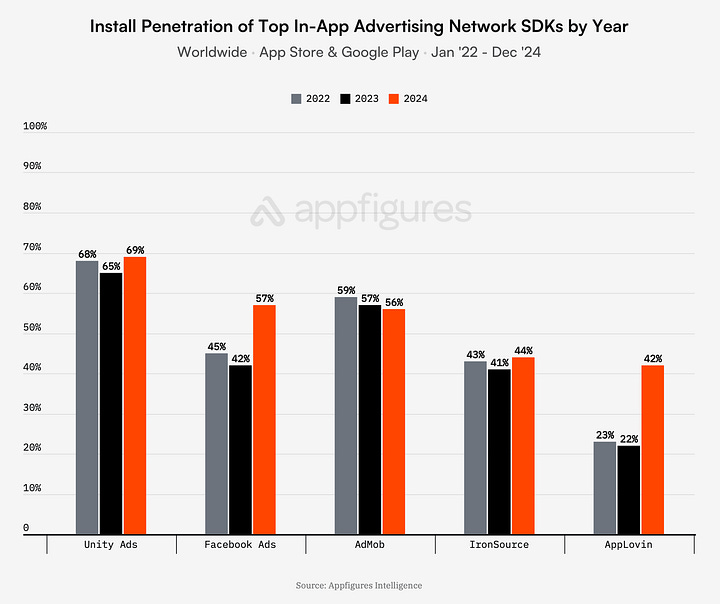

AppLovin has significantly expanded its market presence over the past couple of years – SDK penetration increased from 23% in 2022 to 42% in 2024. Facebook Ads also grew (from 45% in 2022 to 57% in 2024). The leader is Unity Ads – 69%.