Weekly Gaming Reports Recap: June 23 - June 27 (2025)

MENA-3 market research by Xsolla with Niko Partners; Newzoo highlighted top games of May 2025 & revised the 2024 report.

Reports of the week:

XSolla & Niko Partners: MENA-3 Market Research

Alinea Analytics: Over 45% of Elden Ring’s Steam audience has 100+ hours in the game

Newzoo: Top 20 PC/Console Games of May 2025 by Revenue and MAU

Newzoo has once again revised its 2024 report - it's final now

XSolla & Niko Partners: MENA-3 Market Research

General Market Characteristics

According to Niko Partners, there are over 400 million Arabic speakers worldwide.

The study focuses on three key countries in the region (MENA-3) – UAE, Saudi Arabia, and Egypt. The total market size in 2024 is $2 billion (+4% YoY). By 2028, the market is expected to grow to $2.7 billion, with a CAGR of 7.2%.

❗️The authors note that these three markets represent different aspects of the Middle East: Saudi Arabia is the regional leader; Egypt has a large population but weak payment metrics; the UAE has a small population but strong payment metrics.

Saudi Arabia is the revenue leader in the MENA region. In 2022, it surpassed $1 billion, and by 2027, it will reach $1.5 billion.

The number of players in the MENA-3 countries will reach 82.7 million by 2028. In 2024, there were 70.3 million players. As of last year, only 51% of the total population in these three countries played games, leaving significant room for growth.

UAE has the highest annual ARPU among the three countries – $84.6. The lowest is in Egypt – $3.5.

Audience in the MENA-3 Region

Over 60% of players in the MENA-3 countries are aged 18 to 35. In reality, the share of young players is even higher, as the study did not survey those under 18.

Saudi Arabia and the UAE boast almost 100% internet penetration. Even in Egypt, internet coverage exceeds 70%.

94% of players in MENA-3 countries play on mobile devices. 49% on PC, 34% on consoles. This is a major difference from other emerging markets, like India, where only 6-7% play on PC and consoles.

The share of female gamers in the MENA-3 countries is growing rapidly. It increased from 32% in 2022 to 38% in 2025.

The average monthly salary of a gamer in the MENA-3 countries is $2,166. Excluding Egypt, it’s $3,137. As disposable income grows, so will in-game spending.

Only 4% of surveyed gamers in Egypt earn more than $900 per month. In Saudi Arabia, it’s 86%; in the UAE, 96%. Premium games and subscriptions perform best in the UAE and Saudi Arabia.

61% of surveyed players in the MENA-3 countries play on two or more platforms. 16% play on mobile, PC, and consoles.

56.5% of multi-device players regularly switch between platforms.

Players in the MENA-3 countries spend an average of 10.2 hours per week gaming. In Egypt, 31% of all players spend more than 13.25 hours per week gaming.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

63.4% of all respondents have spent money on games.

Monetization of Players in MENA-3

61% of mobile gamers in the selected countries and 56% of PC gamers prefer the F2P model with in-app purchases.

Saudi Arabia leads in premium games (26% of players prefer such games).

67% of the MENA region’s population lacks proper access to banking products or rarely uses them. For example, in Egypt, credit card penetration is only 2.8%. Even in Saudi Arabia and the UAE, the rates are low – 25.4% and 26.8%, respectively.

In Saudi Arabia, the Mada payment service is popular (93% penetration). PayPal (52%) is more popular than credit cards in Saudi Arabia. Only in the UAE does the payment infrastructure resemble that of the West.

53% of players in the MENA-3 countries have made purchases on game websites, bypassing standard payment methods. Egypt has the highest share, over 60%.

Reasons for such purchases vary. For some, it’s faster (40.7%); some get access to familiar payment methods (37%); some buy outside standard stores for extra rewards (35.9%) or discounts (34%).

Overall, the main motivation for purchases outside usual app stores in the MENA-3 countries is financial. 40% said they would buy items in webshops if prices were lower. Bonuses for purchases are also a key motivator.

When people in the MENA-3 region were asked what would make them start spending on games, 43.9% mentioned low prices. It’s difficult to determine how much discounting would actually benefit.

Alinea Analytics: Over 45% of Elden Ring’s Steam audience has 100+ hours in the game

According to Alinea Analytics, the number of Elden Ring players has surpassed 36 million. The game has generated over $2 billion in revenue.

15.7 million players, 43% of the total audience, are on Steam. This is the game’s largest platform. PlayStation is second (13.2 million), and Xbox is third (7.4 million).

FromSoftware continues to expand the franchise, having released Elden Ring Nightreign (the game has sold over 2.4 million copies on Steam alone as of early June).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Despite the game’s difficulty, 10.9% of PlayStation players and 10.2% of Steam users have unlocked all achievements. Among Xbox players, only 3.7% have done so.

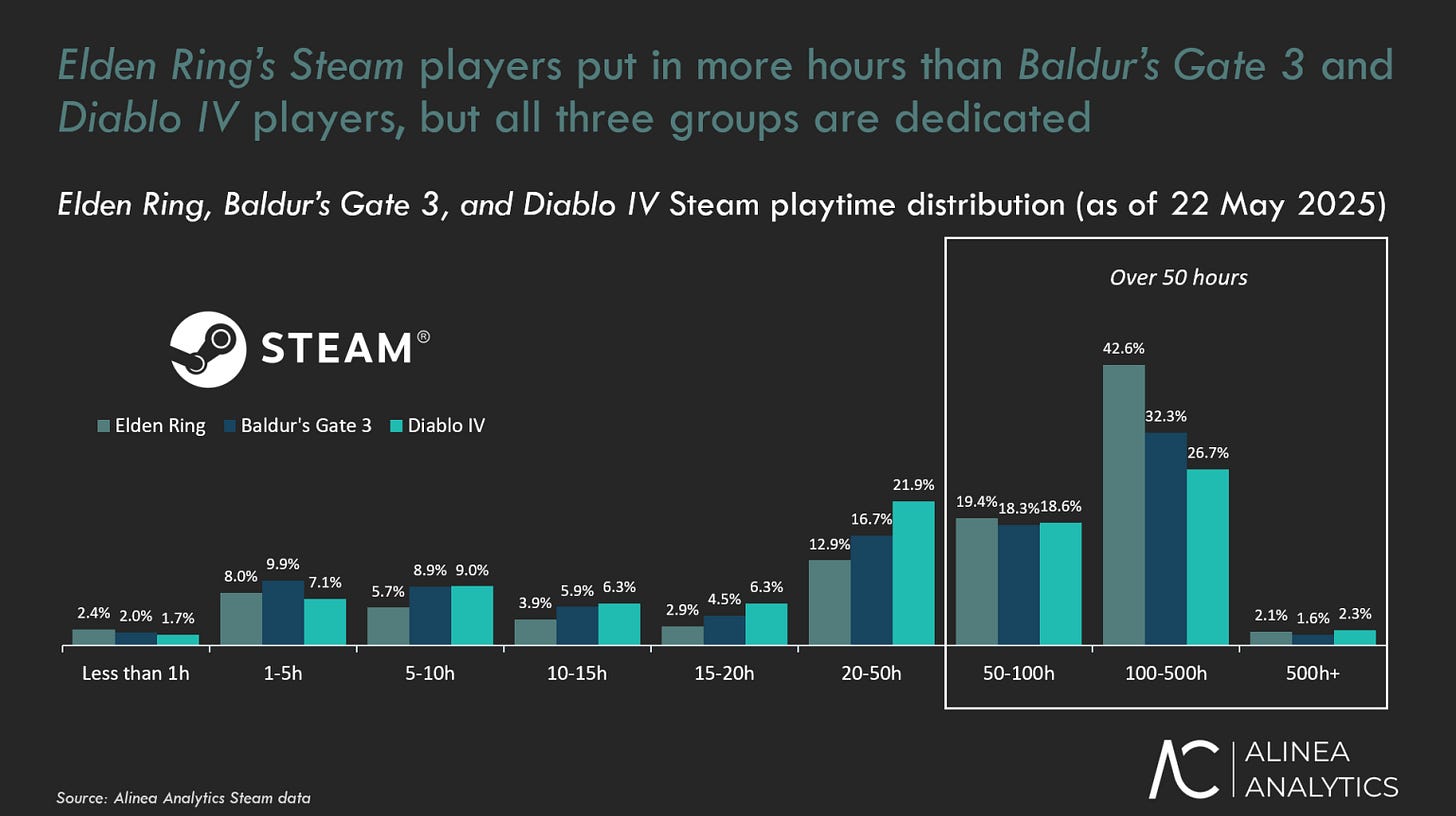

Two-thirds of Elden Ring owners on Steam have played more than 50 hours. 44.7% of the game’s audience on the platform has played for over 100 hours. On PlayStation, this figure is slightly lower at 36.4%.

Nearly 700,000 people on PlayStation and Steam have more than 500 hours in Elden Ring. These are outstanding numbers.

However, among major RPGs, Elden Ring is not the leader in long-term user retention. The leader is Diablo IV, with 2.3% of its audience having played for more than 500 hours.

Newzoo: Top 20 PC/Console Games of May 2025 by Revenue and MAU

Newzoo tracks the markets of the US, UK, Spain, Germany, Italy, and France.

Revenue – All Platforms

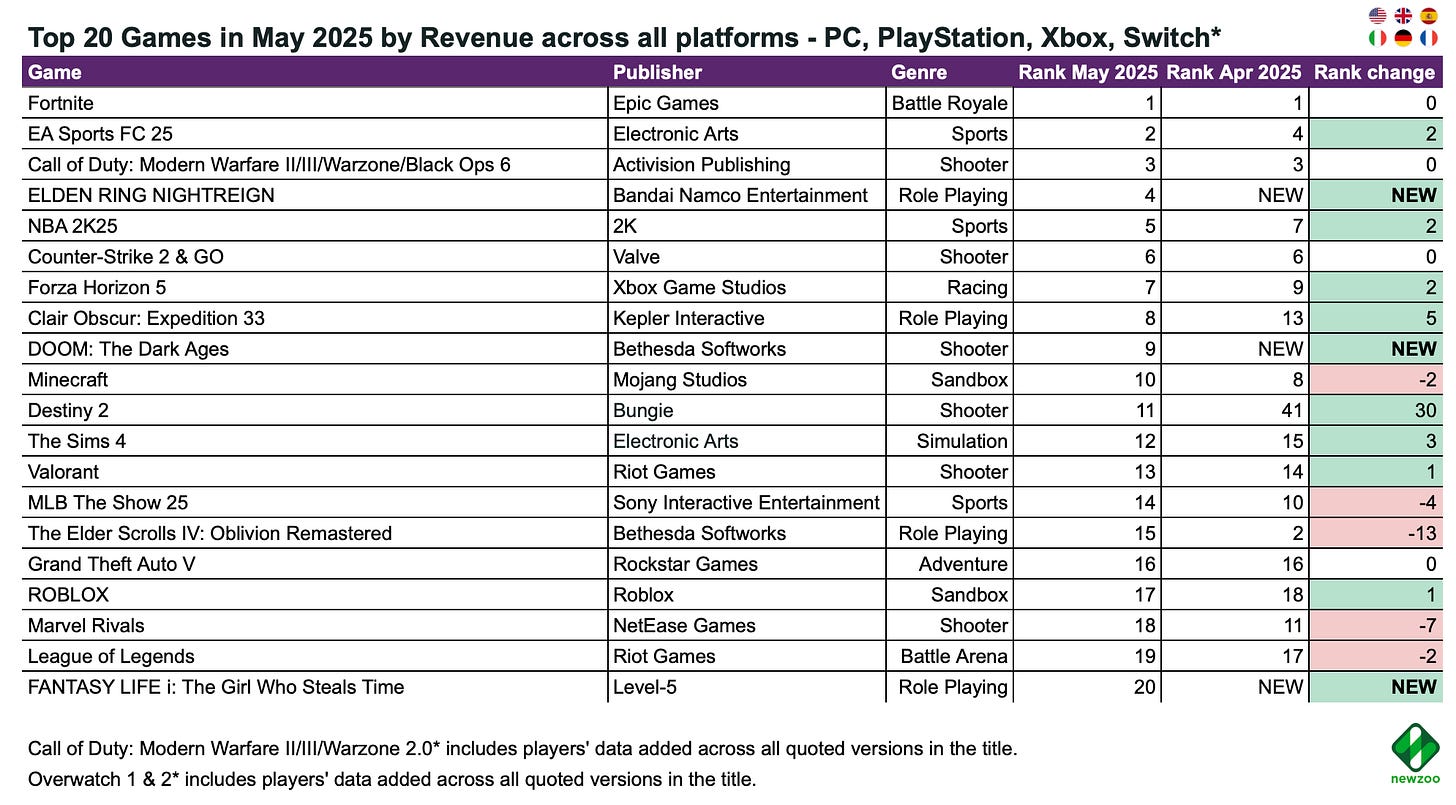

The May revenue chart features three newcomers: Elden Ring Nightreign (4th place), DOOM: The Dark Ages (9th place), and FANTASY LIFE i: The Girl Who Steals Time (20th place).

According to Newzoo estimates, Elden Ring Nightreign sales exceeded 3.5 million copies across all platforms in the six reported markets.

Notably, Clair Obscur: Expedition 33 returned to the top 10—the game’s revenue grew in the reported markets after a drop in April.

The biggest jump in the top 20 by revenue came from Destiny 2—up 30 positions to 11th place. This is due to the start of pre-orders for the new major expansion, The Edge of Fate and Renegades, in May.

Revenue – Individual Platforms

On PlayStation, the dynamics mirror the overall trends. The only difference is the appearance of F1 25 in 15th place.

On Xbox, there are a few more new titles. In addition to the aforementioned F1 25, RoadCraft by Focus Entertainment entered the platform’s top sales, taking 18th place. Clair Obscur: Expedition 33 is absent from the charts, since it’s available via Xbox Game Pass.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

On PC, it’s worth noting the return of Helldivers II to the top 20 (in 19th place). The latest update—Heart of Democracy—had a positive impact: at launch, the game saw its highest CCU since the start of 2024.

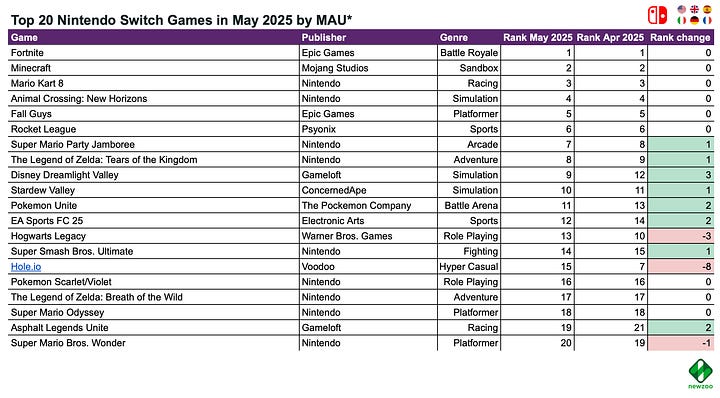

On Nintendo Switch, there’s only one newcomer—FANTASY LIFE i: The Girl Who Steals Time. Ten out of the top 20 games are from Nintendo itself, which is actually fewer than usual.

MAU – All Platforms

May’s MAU rankings are a bit more active than usual. DOOM: The Dark Ages reached 16th place (Game Pass was a factor). On PC, Elden Ring Nightreign also entered the top 20.

Interestingly, Star Wars: Battlefront II returned to the top 20. First, May 4th occurred. Second, EA supported the event with major discounts on the title. The game is available for $3.99, a 90% discount, until June 26.

Helldivers II, following the successful update, also climbed to 14th place in the MAU rankings across all platforms.

Newzoo has once again revised its 2024 report - it's final now

Newzoo released a forecast adjustment in March this year, and since then, the outlook for the market has improved.

2024 Updated Results

After all revisions, Newzoo’s final figure for 2024 is $182.7 billion (+3.2% YoY). The initial projection was $184.3 billion, later adjusted down to $177.9 billion. The final forecast is lower than the original expectation but higher than the Q1’25 revision.

The strongest growth came from mobile games, up 5.5% YoY to $100.3 billion. The increase was driven by the US and European markets, as well as a 3.1% rise in China’s mobile market.

PC is the second-fastest growing segment, up 4.4% YoY to $39 billion, helped by Steam’s growth in China.

The console market in 2024 is estimated at $43.5 billion, down 2.5% YoY.

The active VR device user base reached 28.6 million by year-end, but game spending dropped 3.6% to $1 billion.

Across Newzoo’s tracked markets, user time spent in games grew 6% in 2024.

The Chinese market grew 5.6% YoY in 2024, driven by PC revenue growth, Blizzard’s return, increased console popularity, and mobile segment gains.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Forecast to 2027

Newzoo projects that the 2025 games market will reach $188.9 billion.

The market is expected to grow at a 3.3% average annual rate through 2027.

By 2027, the market is expected to reach $200 billion.

PC market growth is forecast at 3% per year, supported by rising popularity in Southeast Asia and Japan, a growing user base, higher game prices, and increased engagement from Gen Z and Alpha players.

The console market outlook is more optimistic. Newzoo analysts expect 5.6% annual growth from 2024 to 2027, driven by the Nintendo Switch 2 launch, GTA VI release, rising game prices, and more premium monetization releases.

Mobile is expected to grow 2.4% per year through 2027, supported by regulatory changes, D2C growth, higher publisher margins, and greater reinvestment opportunities.