Weekly Gaming Reports Recap: June 9 - June 13 (2025)

ESA shared the annual report about the American gamers; Sensor Tower highlighted the Southeast Asia Mobile market in 2025.

Reports of the week:

ESA: The American Games Industry in 2025

VG Insights: Elden Ring: Nightreign sold over 4 million copies in its first week

Alinea Analytics: PlayStation Top 10 in May 2025 by Copies Sold

Sensor Tower: Southeast Asia Mobile Game Market in 2025

ESA: The American Games Industry in 2025

General Market Overview

In 2024, American consumers spent $59.3 billion on games.

$51.3 billion was spent on content, $4.9 billion on hardware, and $3.2 billion on accessories.

Call of Duty: Black Ops 6, EA Sports College Football 25, and Helldivers II were the top-selling PC/Console games on the US market in 2024.

MONOPOLY GO!, Royal Match, and Roblox were the leaders in mobile revenue.

American Gamer Profile

23% of the entire US gaming audience is under 18. Meanwhile, 28% are over 50.

The average age of an American gamer is 36. On average, they have been playing games for 18 years.

The younger an American is, the more likely they are to play games for more than 1 hour per week. Among children and teens under 17, this is 84%; among older groups, it’s 60%.

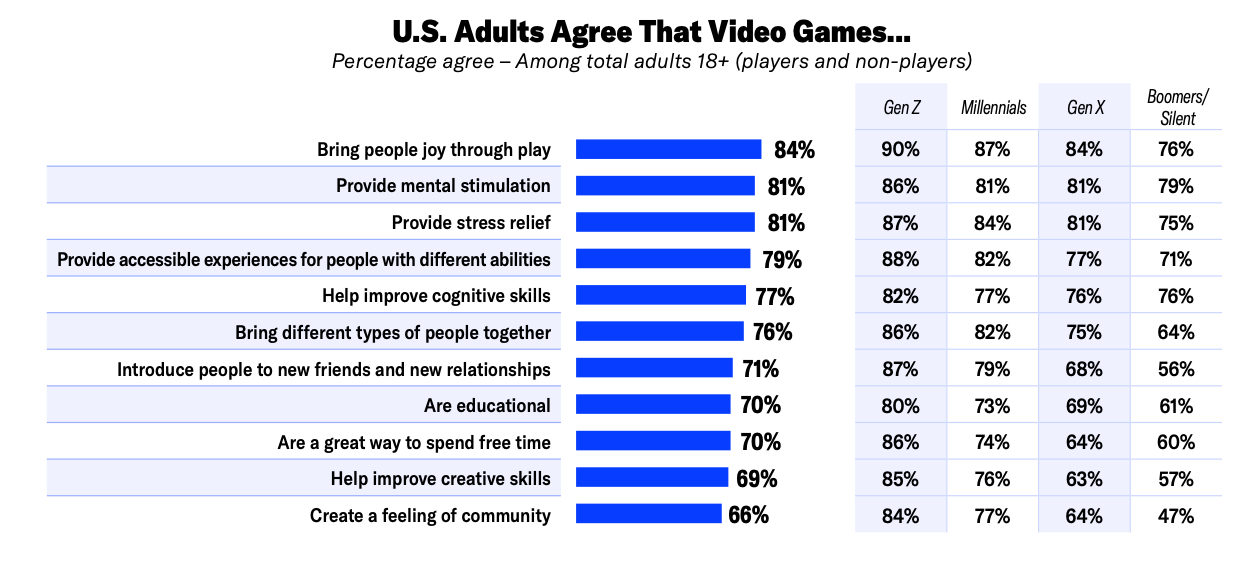

Adults believe games bring joy (84% of respondents), stimulate brain activity (81%), and help cope with stress (81%). Overall, most Americans over 18 highlight a large number of positive effects from gaming.

They also believe games help develop problem-solving skills (78%), teamwork skills (69%), as well as adaptability and resilience (60%), among others.

83% of all US households played games on at least one device in the last 12 months. The most popular platform is mobile devices (72%), followed by PC (54%), consoles (42%), and VR devices (12%).

ESA also conducted an individual survey among players over 8 years old. Mobile devices lead in popularity (82%), followed by consoles (47%), PCs (45%), and VR devices (10%).

It’s commonly believed that younger generations play predominantly (and almost mostly) on phones. But the charts show that Generation Alpha are the most active console gamers, with 69% of this generation playing on consoles in the US.

Women (and girls) play games on PC and consoles less often than men (and boys)—the difference is almost 1.5 times. However, they play on mobile devices more frequently.

Social Effect of Games

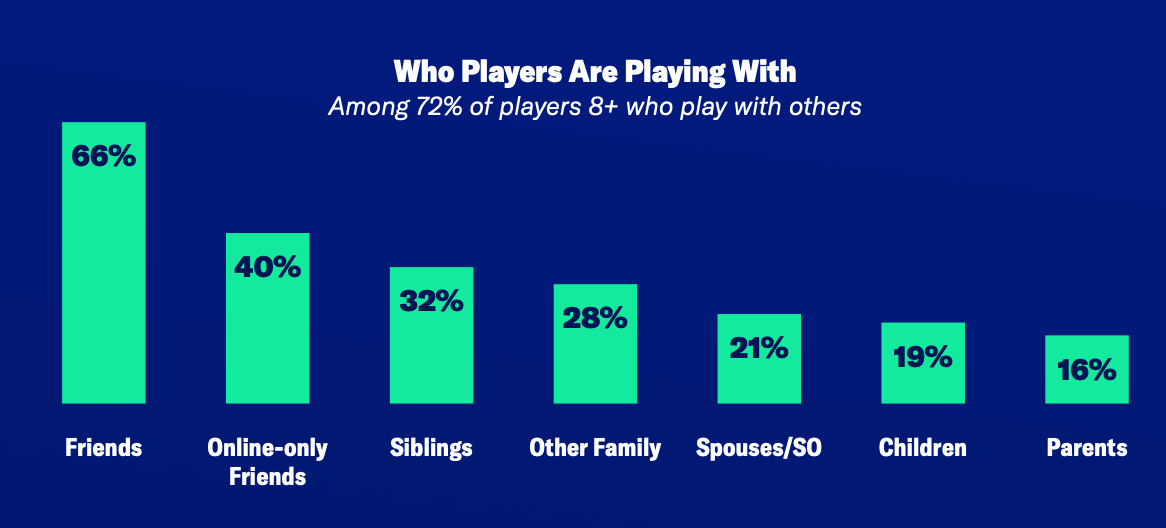

72% of players over 8 years old play games with someone else. Most often (in 66% of cases), it’s real-life friends; in 40% of cases, friends met online; and in 32%—siblings.

79% of Generation Alpha and Z representatives play with their friends. 56% of Generation Alpha play with their parents.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

72% of users use in-game communication tools. Most often, these are text (used in 57% of cases) or voice (used in 52% of cases) chats.

84% of parents are aware of the ESRB rating. And 78% use it when making purchases.

Out of 4,861 games rated in 2024, 88% were marked E, E10+, or T (E—for all ages, E10+—for children over 10, T—for teens, equivalent to 13+).

86% of parents have used parental controls for their home gaming system at least once.

70% of parents would prefer their children play games rather than spend time on social networks. 67% of parents believe games are more beneficial than social networks.

Game Accessibility

49% of users with various disabilities noted that overall game accessibility is important.

Among the most popular accessibility settings are the ability to adjust text size (50%), difficulty level (39%), camera (35%), and enable subtitles (35%).

VG Insights: Elden Ring: Nightreign sold over 4 million copies in its first week

Steam accounts for 58% of game sales. PlayStation accounts for 30%, while Xbox accounts for 11%. One percent is missing due to rounding.

85% of users who bought Elden Ring: Nightreign also own the original Elden Ring.

36% of all early sales came from the US, 9% from China, 7% from Germany, 5% from the UK, and another 5% from Japan.

The average playtime in the first week was 16 hours—a very high figure.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The project’s success wasn’t hindered by mixed launch reviews (as of writing, already 78% of reviews are positive). The developers quickly released post-launch patches and fixed the most critical issues.

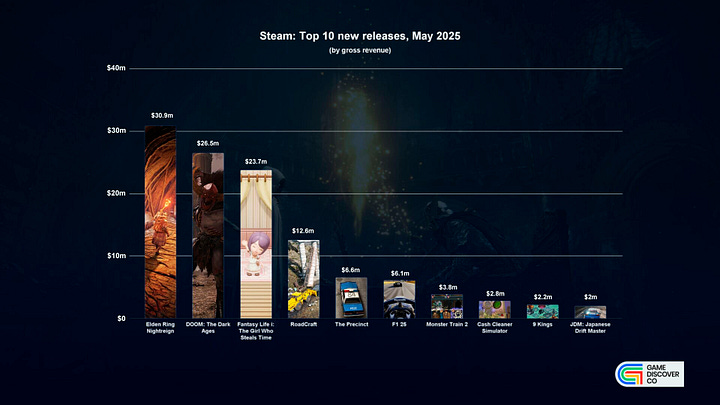

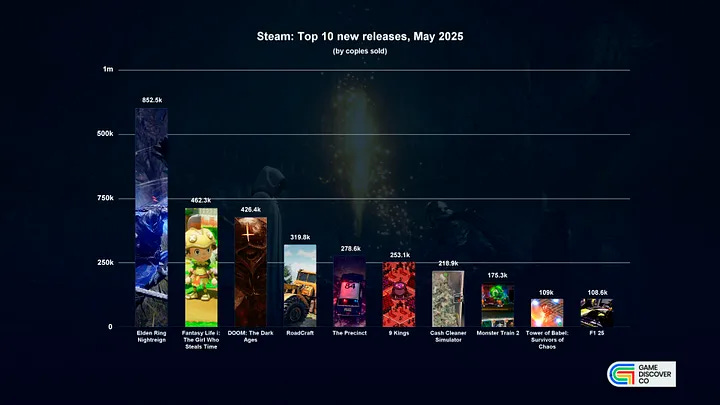

Simon Carless from GameDiscoverCo calculated that Elden Ring: Nightreign was the most successful new Steam release in May, both in terms of copies sold (852,500, according to the service) and gross revenue ($30.9 million). And that’s despite launching on May 30.

Alinea Analytics: PlayStation Top 10 in May 2025 by Copies Sold

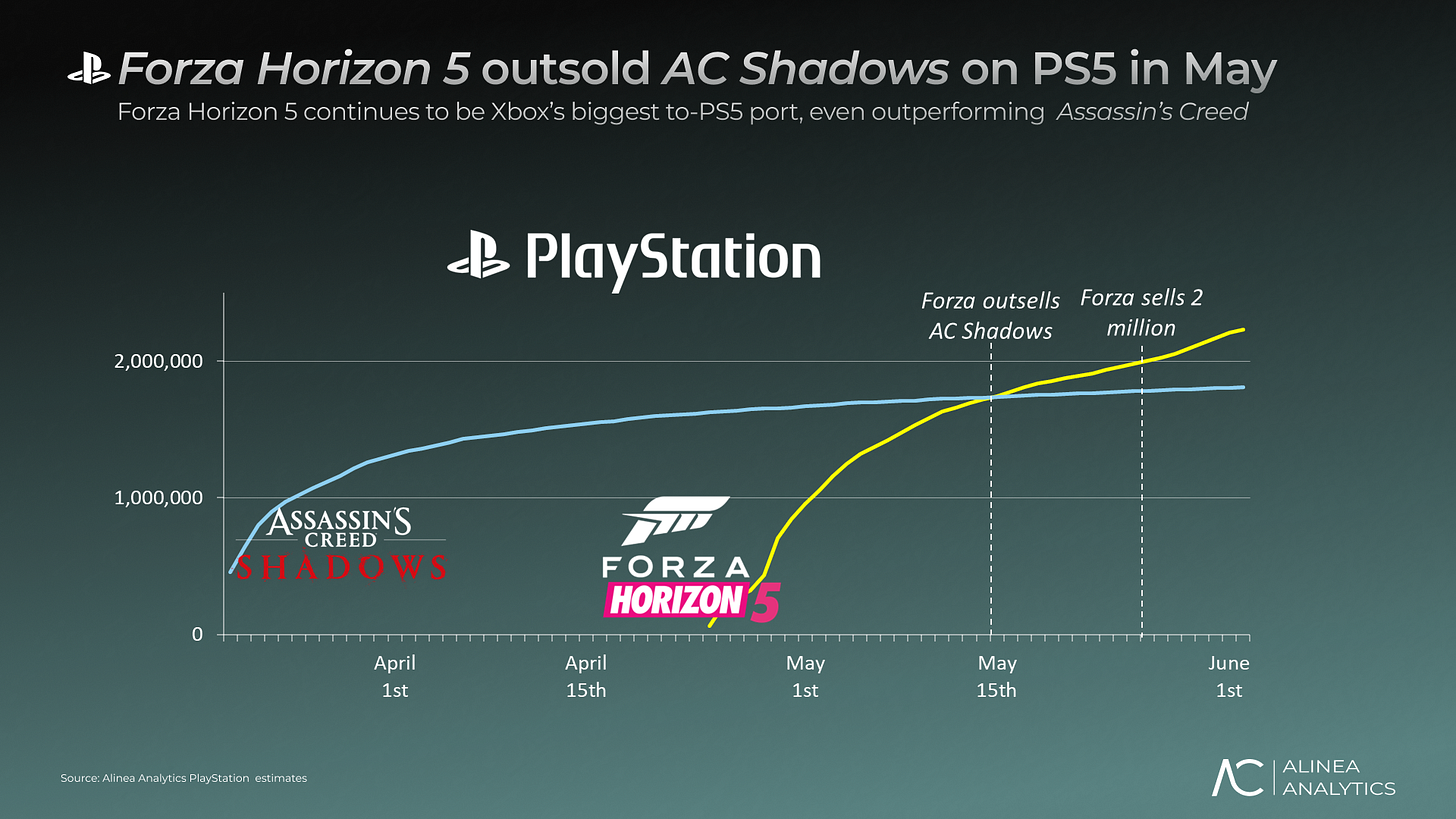

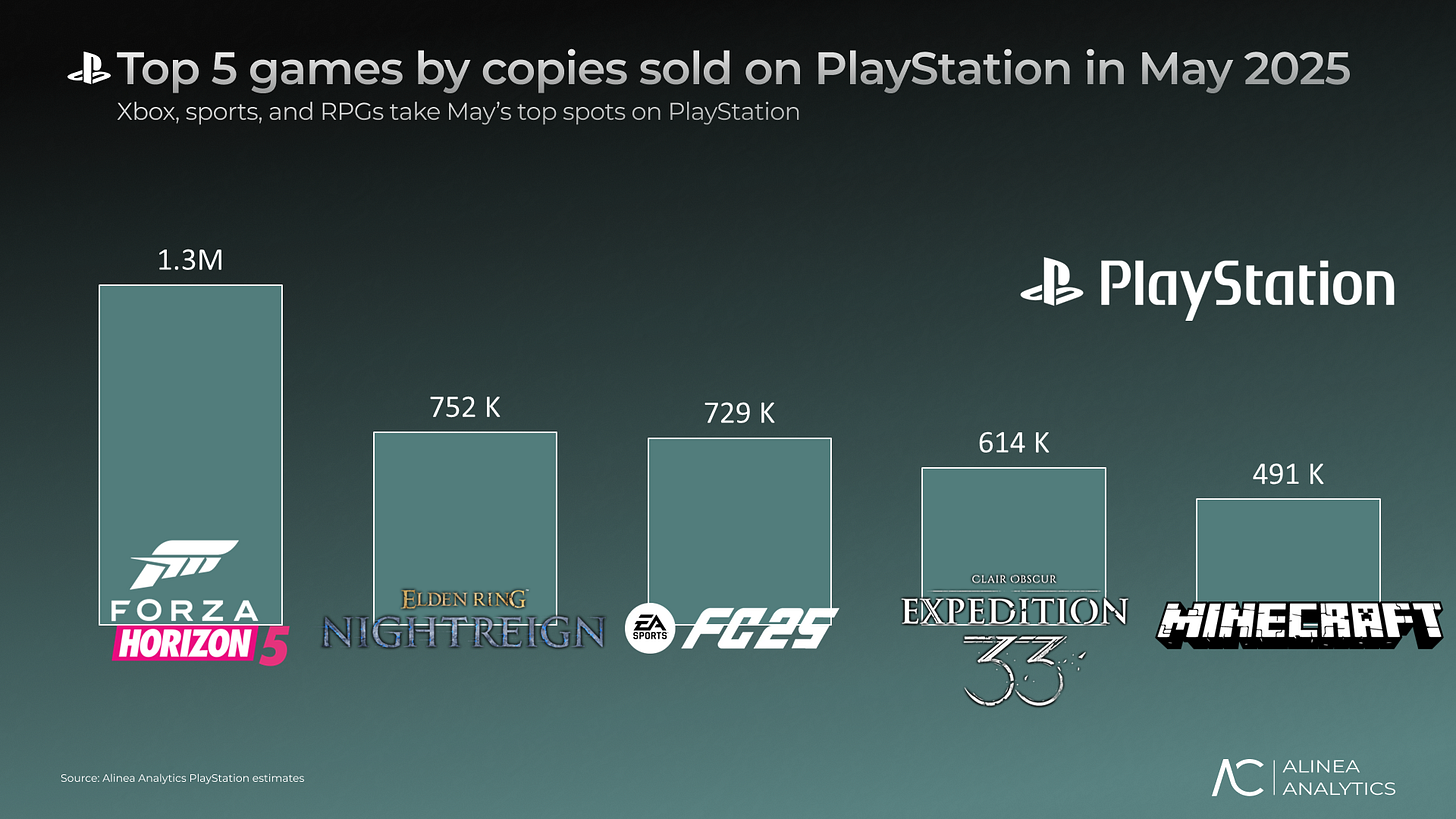

Forza Horizon 5 was the best-selling game on PlayStation in May. It was purchased 1.3 million times in a month—total sales on PS5 reached 2.2 million copies, and total revenue surpassed $100 million. 28% of Forza Horizon 5 owners on PlayStation also played Gran Turismo 7, and 54% played The Crew 2.

Forza Horizon 5 surpassed Assassin's Creed Shadows in PlayStation sales. The latter stalled at 1.8 million copies. In April, the game was 5th in sales, but in May it dropped out of the top 10.

Elden Ring Nightreign debuted at #2 with 752,000 copies sold in 2 days. 85% of buyers also own the original Elden Ring. 38% of sales came from the US, another 13% from Japan—these are the project’s largest markets.

Total sales of EA FC 25 on PlayStation reached 18 million—in May, 729,000 copies were sold amid an 80% discount. Interestingly, 61% of EA FC 24 owners have not yet purchased the new installment. But this could be because the previous game was included in the PS Plus subscription.

Clair Obscur: Expedition 33 finished the month with 614,000 copies sold. On PlayStation, the game’s run has already exceeded one million copies.

Minecraft was purchased 491,000 times in May, a figure achieved thanks to the movie release. In total, the game has sold 350 million copies—a truly remarkable number.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Grand Theft Auto V, even with the new installment on the horizon, continues to sell well (437,000 copies in May). At the end of April, the game left PS Plus, resulting in a 100,000 unit sales jump.

DOOM: The Dark Ages seems to have launched less strongly than many expected. In May, the game was purchased 270,000 times on PlayStation. The total player count surpassed 3 million, but most of them downloaded the game for free via Xbox Game Pass.

The Elder Scrolls IV: Oblivion Remastered was purchased 190,000 times in May—the game is ranked 10th.

Microsoft games accounted for 44% of all top-10 copies sold on PlayStation in May. Who could have imagined this a few years ago?

Sensor Tower: Southeast Asia Mobile Game Market in 2025

General Market Overview

In Q1'25, the region ranked second globally by downloads, accounting for 1.93 billion installs. This represents a 3% quarter-over-quarter increase.

❗️However, Sensor Tower is being a bit misleading here—comparing a region to individual countries isn’t entirely accurate.

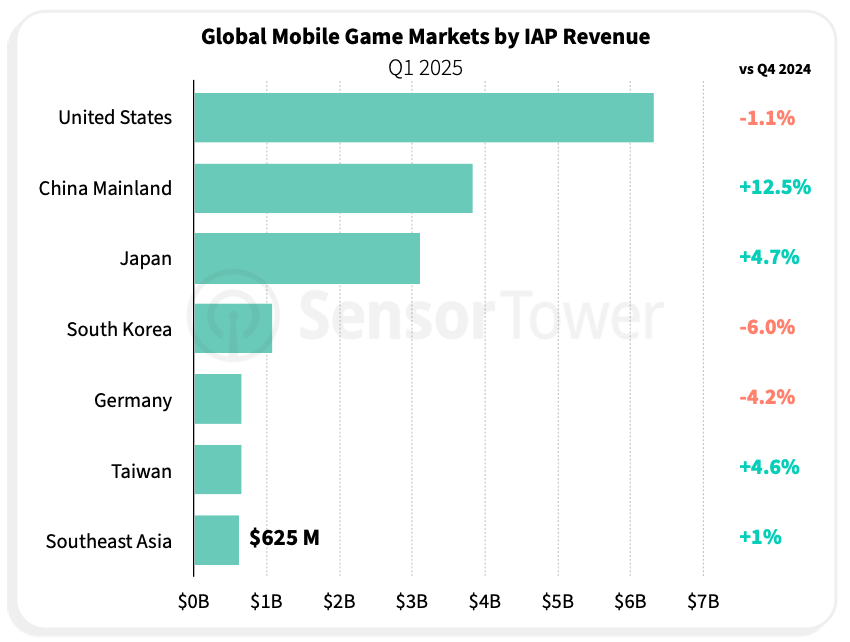

Southeast Asian users spent $625 million on games in Q1'25, up 1% QoQ. This is the seventh-highest figure worldwide, and again, it’s a region being compared to individual countries.

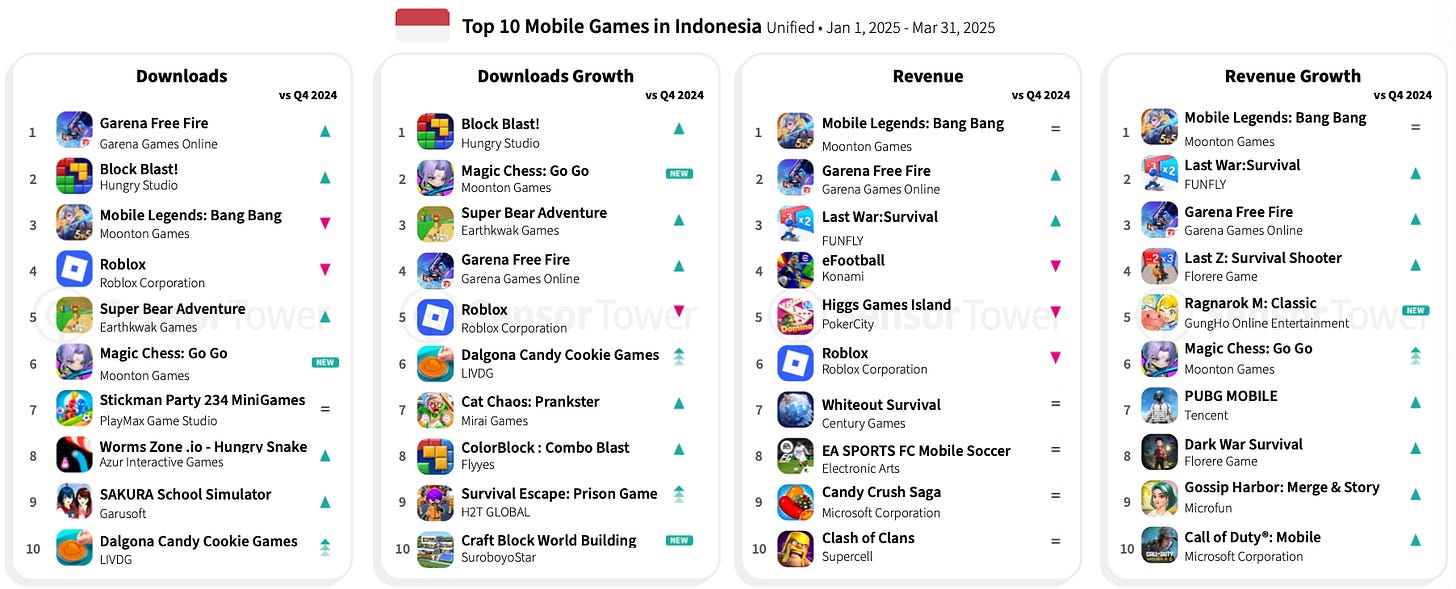

Indonesia leads Southeast Asia in downloads. In Q1'25, Indonesians downloaded games 870 million times (+9% QoQ). The Philippines is second with 366 million installs (-1% QoQ), and Vietnam is third with 329 million installs (+2% QoQ).

In terms of revenue, Thailand leads with $162 million (-6% QoQ). Indonesia is second with $118 million (+1% QoQ), and Malaysia is third with $103 million (+7% QoQ).

❗️Note that this is only about IAP purchases. D2C payments, which are quite common in Southeast Asia, aren’t reflected in these stats.

Looking at the most popular genres in Southeast Asia, platformers/runners (+16% QoQ), simulators (+0.1% QoQ), and arcade games (+12.2% QoQ) lead in downloads.

For revenue, 4X strategy games (+17.6% QoQ), MOBA (+20.1% QoQ), and MMORPG (-17.1% QoQ) are on top.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Top charts in Southeast Asia are quite stable. Hyper/hybrid casual projects lead downloads, mixed with Battle Royale, MOBA, and 4X strategy games.

For revenue, shooters and Battle Royale, as well as 4X strategies, are clear leaders. 7 out of the top 10 games are either developed by Chinese companies or owned by them. 9 out of 10 in the top 10 are Asian companies, with the exception being Coin Master from Moon Active.

❗️Western companies face a cultural barrier when entering the Southeast Asian market. For Asian companies, business in the region is more familiar and accessible. Business relationships in the region are also heavily based on personal connections.

Major Southeast Asian Markets

Indonesia

Top genres by downloads in Indonesia: simulators (+4.9% QoQ), platformers/runners (+38.2% QoQ), and arcade projects (+18% QoQ).

For revenue, MOBA (+32.7% QoQ), 4X strategy (+21.1% QoQ), and sports games (-22.6% QoQ) lead. Battle Royale shows significant growth (+50% QoQ).

New projects in Indonesia in Q1'25: Magic Chess: Go Go entered the download rankings, and Ragnarok M: Classic led in revenue.

Thailand

Top genres by downloads: simulators (-14.1% QoQ), platformers/runners (-18.6% QoQ), and sandbox projects (-17.5% QoQ).

For revenue, realistic sports games (-7.8% QoQ), MMORPG (-27.4% QoQ), and 4X strategies (-5.6% QoQ) lead in Thailand.

In Q1'25, Go Go Samkok and Papa Restaurant (casual simulators), as well as Ragnarok M: Classic, entered the download charts. For revenue, new entries include Ragnarok M: Classic and Dragoon Academy from Korea’s NewCube Games.

Vietnam

Platformers and runners (+3.2% QoQ), simulators (-6.7% QoQ), and other arcade games (+9.1% QoQ) lead in downloads. For revenue, 4X strategies (+51.5% QoQ), MMORPG (+8.2% QoQ), and Squad RPG (-1.8% QoQ) are on top.

Vietnam is a unique market for downloads. Roblox leads, and Trò Vẽ Vui Tuổi Thơ—a local casual game—leads download growth. Last War: Survival is also rapidly growing in downloads.

For revenue, Last War: Survival and local RPG Big Bang Thời Không are leaders.

Philippines

Top genres by downloads remain platformers/runners (+6.8% QoQ), simulators (+0.7% QoQ), and various arcade projects (+9.6% QoQ).

For revenue, MMORPG (-19.7% QoQ), 4X strategies (+18.7% QoQ), and MOBA games (+19% QoQ) lead.

The Philippine market is more dynamic than others. Five new projects entered the download rankings (Magic Chess: Go Go, Hapunan Horror Game, I Am Security, Good Coffee, Great Coffee, Color Game-color game), and two Ragnarok series games (Ragnarok M: Classic, Ragnarok Idle Adventure Plus) led in revenue.

Local Operation of Mobile Legends: Bang Bang

Sensor Tower highlights Mobile Legends: Bang Bang from China’s Moontoon Games as a successful example of regional operations.

The team adds localized content, characters inspired by Southeast Asian cultures, hosts tournaments, and actively engages with the community. This has kept the game in the top 5 for both revenue and downloads since 2017.

Mobile Legends: Bang Bang’s developers work not only with the audience but also with influencers. Their strong local presence - with offices in Indonesia, Malaysia, Singapore, and the Philippines - helps a lot.

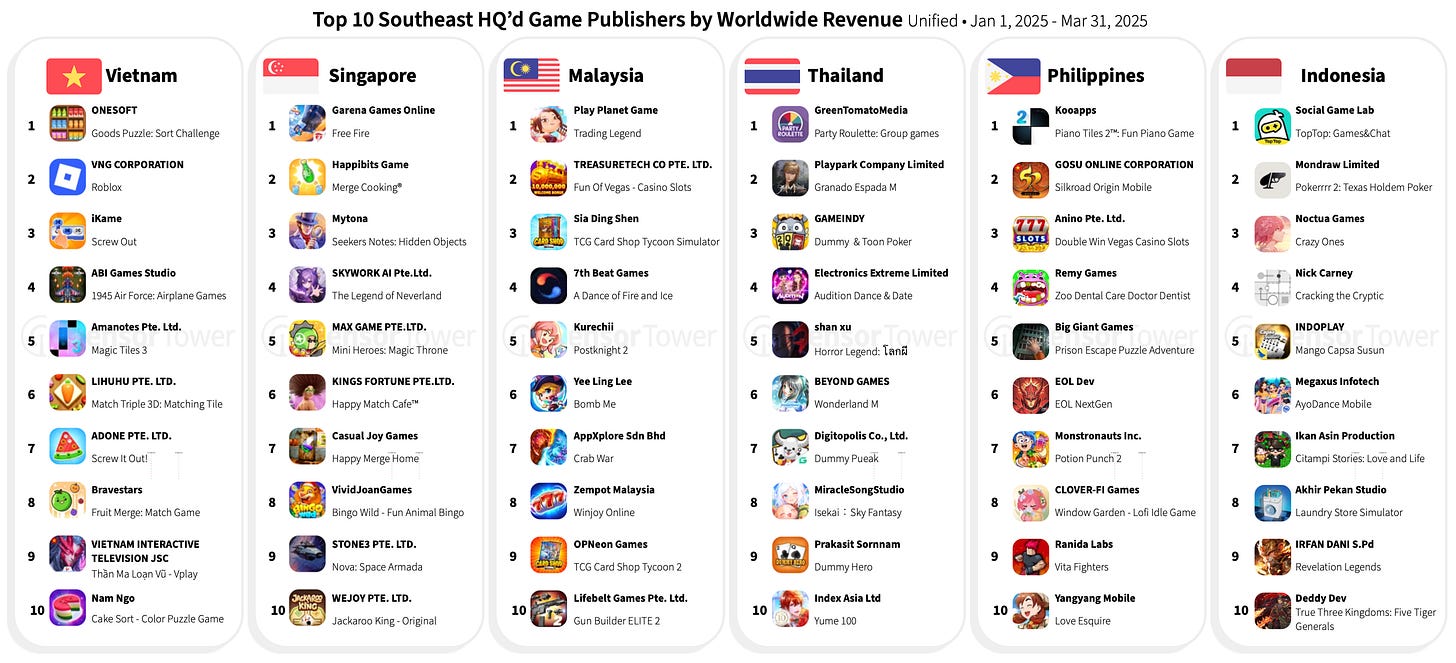

Southeast Asian Publishers

In 2024, games from Southeast Asian publishers were downloaded 5.8 billion times, more than publishers from China, Cyprus, or the US. Again, Sensor Tower is comparing a region to individual countries.

Vietnamese publishers deserve special mention: 3 of the top 15 publishers in 2024 are from Vietnam.

Vietnamese publishers also performed well in Q1 2025. One project (456 Run Challenge: Clash) made the top 10 overall downloads, and two others (Survival Escape: Prison Game and Prison Survival: Tap Challenge) led in download growth.

Sensor Tower notes that Vietnamese developers are quick to create projects based on popular trends, helping them gather large amounts of organic traffic.

Singapore and Vietnam are the two engines of Southeast Asian game development. Other countries lag behind their neighbors.