Weekly Gaming Reports Recap: March 31 - April 4 (2025)

Big industry survey by Pocketgamer; Chinese became the largest language on Steam; the top mobile games of March.

Reports of the week:

GameDiscoverCo: Steam refunds research

Valve: Chinese language surpassed English in popularity on Steam in 2024

AppMagic: Top Mobile Games by Revenue and Downloads in March 2025

modl.ai: The state of QA in modern game development

Pocketgamer.biz: Trends in the Mobile Gaming Industry (Winter 24/25) - sponsored by Neon

GameDiscoverCo: Steam refunds research - sponsored by Neon

GameDiscoverCo surveyed over 150 developers in 2024. 67.8% of respondents had already released a game on Steam; 17.5% were in Early Access; 14.7% had released in Early Access but had since reached version 1.0.

The average refund rate across projects was 10.8%. The median figure was 9.5%.

Early Access projects are refunded slightly more often, but the difference is not dramatic.

Games launched directly as version 1.0 have a median refund rate of 8% and an average of 10.3%. Early Access games have a median refund rate of 12.4% and an average of 12%. Games that transitioned from Early Access to version 1.0 have a median refund rate of 10.4% and an average of 11.4%.

❗️GameDiscoverCo notes that the metric considers returned copies, not monetary value.

A word from the newsletter sponsor

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

People are more likely to request refunds for expensive games (over $30). The least refunds happen with cheap games (under $4.99—likely because players don't bother with such small amounts) and those priced between $15 and $19.99 (possibly due to high-quality indie projects in this range that players want to support).

As expected, the refund rate decreases as a game's rating increases.

GameDiscoverCo also highlights that higher average playtime correlates with fewer refunds. Niche genres (e.g., puzzles and visual novels) have below-average refund rates compared to the market overall.

Valve: Chinese language surpassed English in popularity on Steam in 2024 - sponsored by Neon

The company revealed new data about the platform at GDC '25. Simon from GameDiscoverCo shared the slides. A full recording of the presentation, with more data, will be released soon.

Chinese became the most popular language on Steam (33.7% of the audience), surpassing English (33.5% of the audience). Russian is in third place (8.2%).

In 2024, 2,897 new games were released in Early Access on Steam.

A word from our sponsor

Neon is the direct-to-consumer partner you can trust. We know the games industry is a tough business. That’s why we work closely with our clients, offering hands-on assistance, dedicated player support, transparent pricing, and reliable technology that delivers real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because we are invested in their success. If you need a partner who puts your business first, visit Neon to learn more.

Meanwhile, the percentage of Early Access games out of all releases in 2024 decreased. Overall, since 2013, it has ranged from 13% to 19%.

Over 14,000 games on Steam are currently in Early Access. 28% of the most successful releases in 2024 started in Early Access.

More than 50% of games are in Early Access for less than a year.

AppMagic: Top Mobile Games by Revenue and Downloads in March 2025 - sponsored by Neon

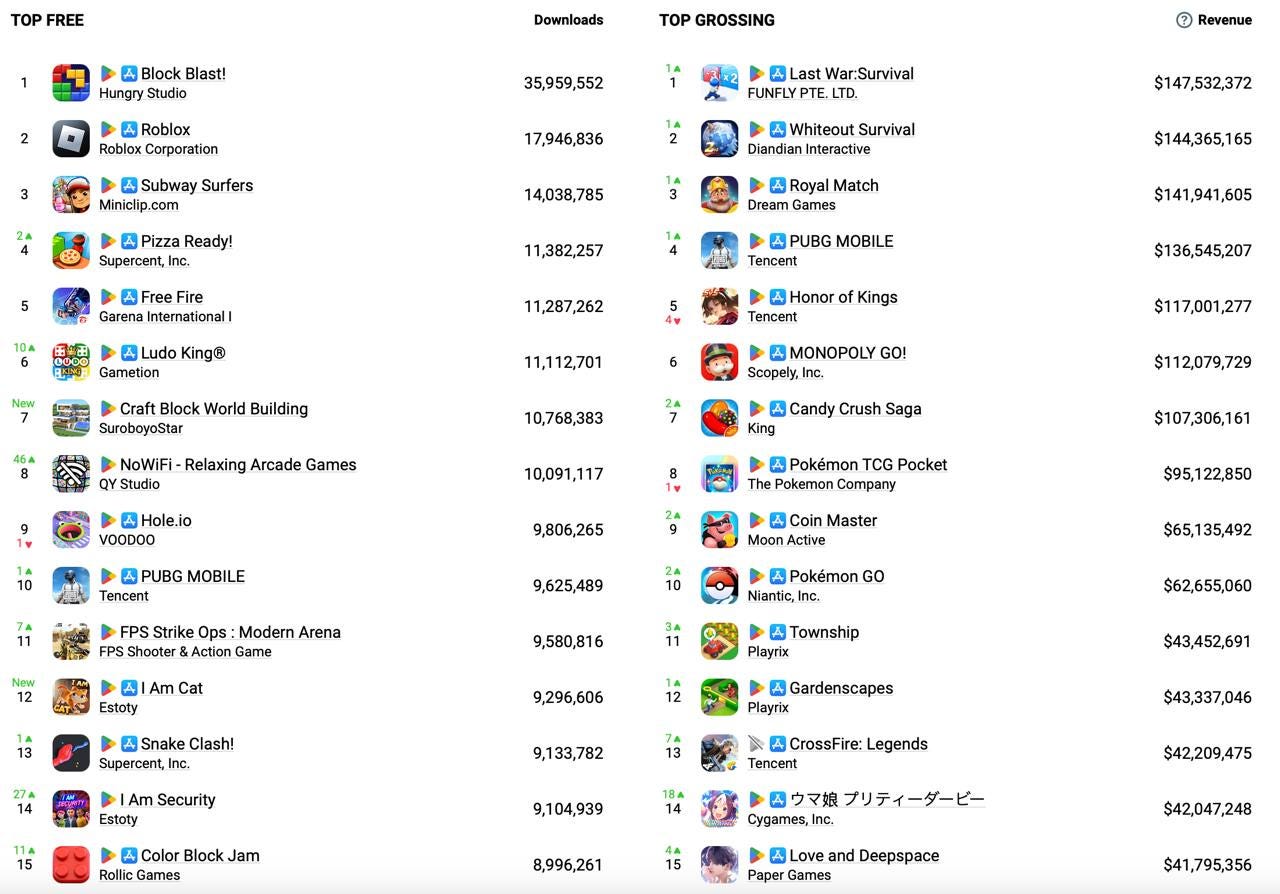

AppMagic provides revenue data net of store fees and taxes. Revenue from Android stores in China is not included.

Revenue

For the first time in a long time, Honor of Kings ($117 million) is not among the top three earners, ranking fifth.

The top spot went to Last War: Survival, which generated $147.5 million in March.

Following closely are Whiteout Survival ($144.4 million), Royal Match ($141.9 million), and PUBG Mobile ($136.5 million).

A word from our sponsor

Neon is the direct-to-consumer partner you can trust. We know the games industry is a tough business. That’s why we work closely with our clients, offering hands-on assistance, dedicated player support, transparent pricing, and reliable technology that delivers real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because we are invested in their success. If you need a partner who puts your business first, visit Neon to learn more.

CrossFire: Legends achieved $42.2 million, marking its best March performance since its 2015 launch.

Uma Musume: Pretty Derby celebrated its anniversary with $42 million in revenue, placing it in the global top 15 despite earning exclusively in Japan. However, the overall revenue trend for the game is negative.

Downloads

The top three most-downloaded games remain unchanged: Block Blast! (35.9 million installs), Roblox (17.9 million), and Subway Surfers (14 million).

Two newcomers entered the top 15: Craft Block World Building (10.8 million installs, ranked 7th) and I Am Cat (9.3 million installs, ranked 12th).

Notably, I Am Cat is a mobile port of a VR game that reportedly earned around $100 million.

modl.ai: The state of QA in modern game development - sponsored by Neon

The newsletter sponsor is Neon - a high-performance direct-to-consumer solution built for games.

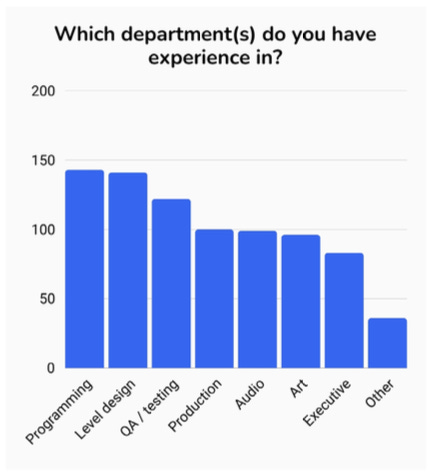

In September 2024, the company surveyed 303 U.S.-based developers from diverse backgrounds to better understand the role of QA in modern development.

QA in Modern Development

94% of developers reported implementing QA automation into their processes. This does not yet include AI solutions. Among them, 39% noted a high level of automation (more than half of all processes).

70.3% of developers have never released a bug-free game. The remaining 29.7%, it seems, struggled with QA efforts.

A word from our sponsor

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

Half of the developers are either unsure or disagree that QA budgets are growing proportionally to market demands.

Only 23% of developers stated they completed all necessary QA work before releasing a game.

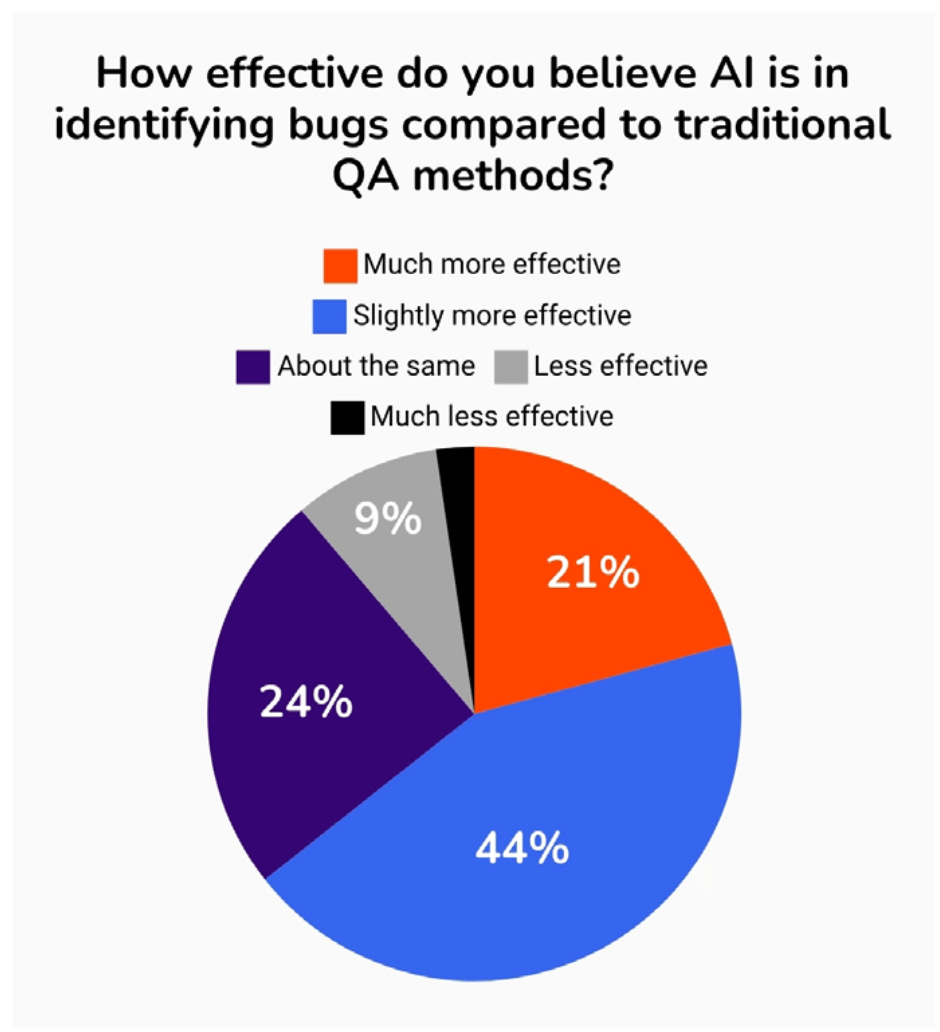

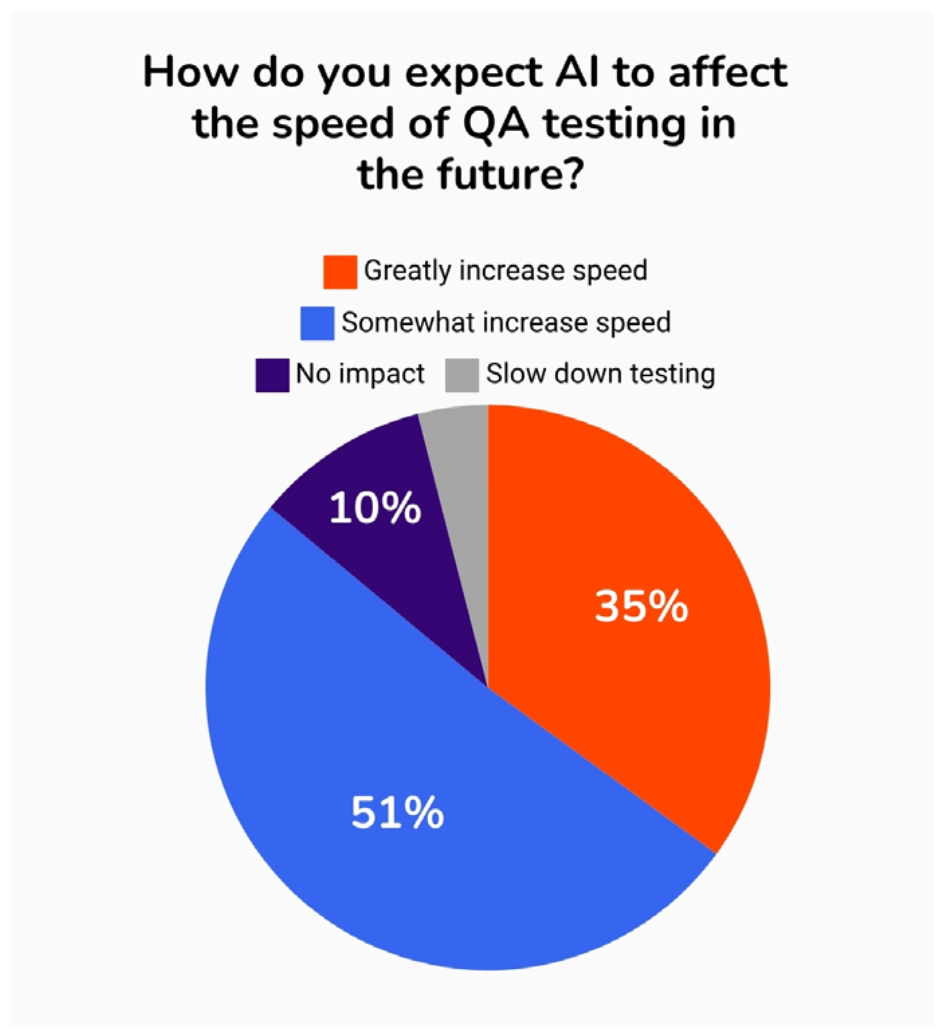

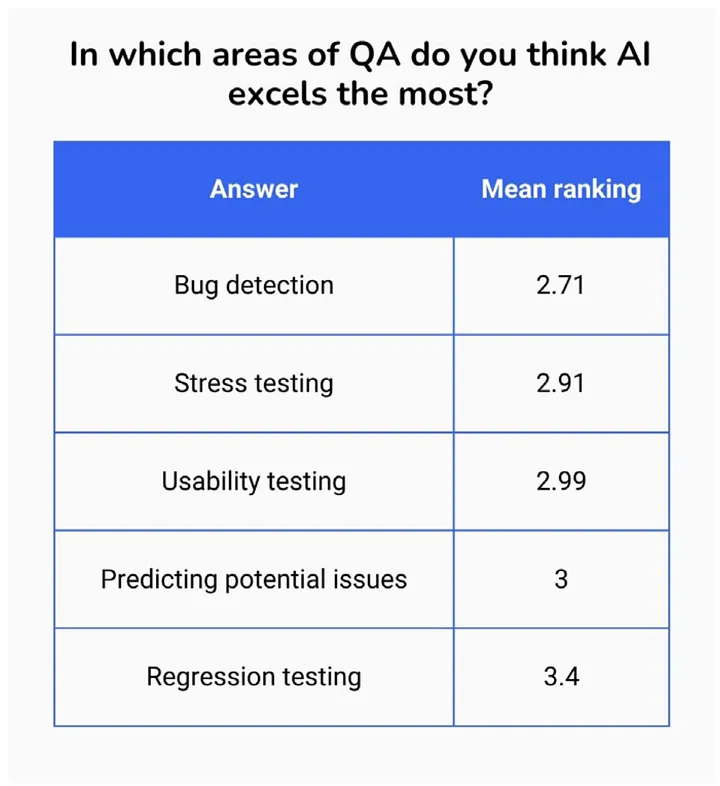

The Role of AI in Modern QA

94% of developers believe AI will play an important role in QA in the future.

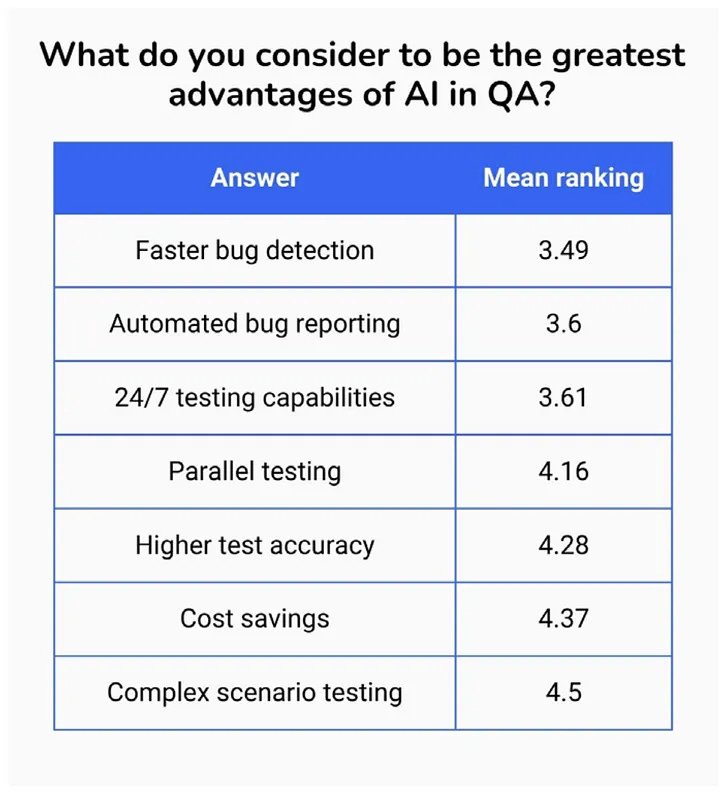

Key benefits of using AI in QA include: faster bug detection; automated problem reporting; 24/7 testing capabilities.

65% of developers think AI is better at detecting bugs than traditional methods.

86% believe AI will speed up QA testing in the future.

Industry readiness for AI

87% of studios feel ready to integrate AI into their QA processes.

55% of studios expect positive effects on QA costs after adopting AI solutions.

Trust issues persist. Only 16% fully trust AI results. 10% do not trust them at all.

Skepticism arises from the lack of human intuition, risks of inaccuracies, and inconsistent results from AI systems.

A word from our sponsor

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

51% of respondents expressed interest in working at studios that use AI for QA processes.

The main challenges with AI adoption are the complexity of setup; high costs; and resistance within teams.

AppMagic: Top Mobile Games by Revenue and Downloads in March 2025 - sponsored by Neon

AppMagic provides revenue data net of store fees and taxes. Revenue from Android stores in China is not included.

Revenue

For the first time in a long time, Honor of Kings ($117 million) is not among the top three earners, ranking fifth.

The top spot went to Last War: Survival, which generated $147.5 million in March.

Following closely are Whiteout Survival ($144.4 million), Royal Match ($141.9 million), and PUBG Mobile ($136.5 million).

A word from our sponsor

Neon is the direct-to-consumer partner you can trust. We know the games industry is a tough business. That’s why we work closely with our clients, offering hands-on assistance, dedicated player support, transparent pricing, and reliable technology that delivers real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because we are invested in their success. If you need a partner who puts your business first, visit Neon to learn more.

CrossFire: Legends achieved $42.2 million, marking its best March performance since its 2015 launch.

Uma Musume: Pretty Derby celebrated its anniversary with $42 million in revenue, placing it in the global top 15 despite earning exclusively in Japan. However, the overall revenue trend for the game is negative.

Downloads

The top three most-downloaded games remain unchanged: Block Blast! (35.9 million installs), Roblox (17.9 million), and Subway Surfers (14 million).

Two newcomers entered the top 15: Craft Block World Building (10.8 million installs, ranked 7th) and I Am Cat (9.3 million installs, ranked 12th).

Notably, I Am Cat is a mobile port of a VR game that reportedly earned around $100 million.

Pocketgamer.biz: Trends in the Mobile Gaming Industry (Winter 24/25) - sponsored by Neon

The newsletter sponsor is Neon - a high-performance direct-to-consumer solution built for games.

Respondents profiles

More than half of the survey participants are representatives of small companies (up to 30 employees). 21.7% of respondents work in companies with over 201 employees. Compared to previous years, there has been an increase in representatives from small/medium-sized businesses and large companies.

According to the 2024 survey results, 38.6% of respondents work in companies older than 10 years. The number of young companies (up to 5 years) has decreased compared to previous years.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

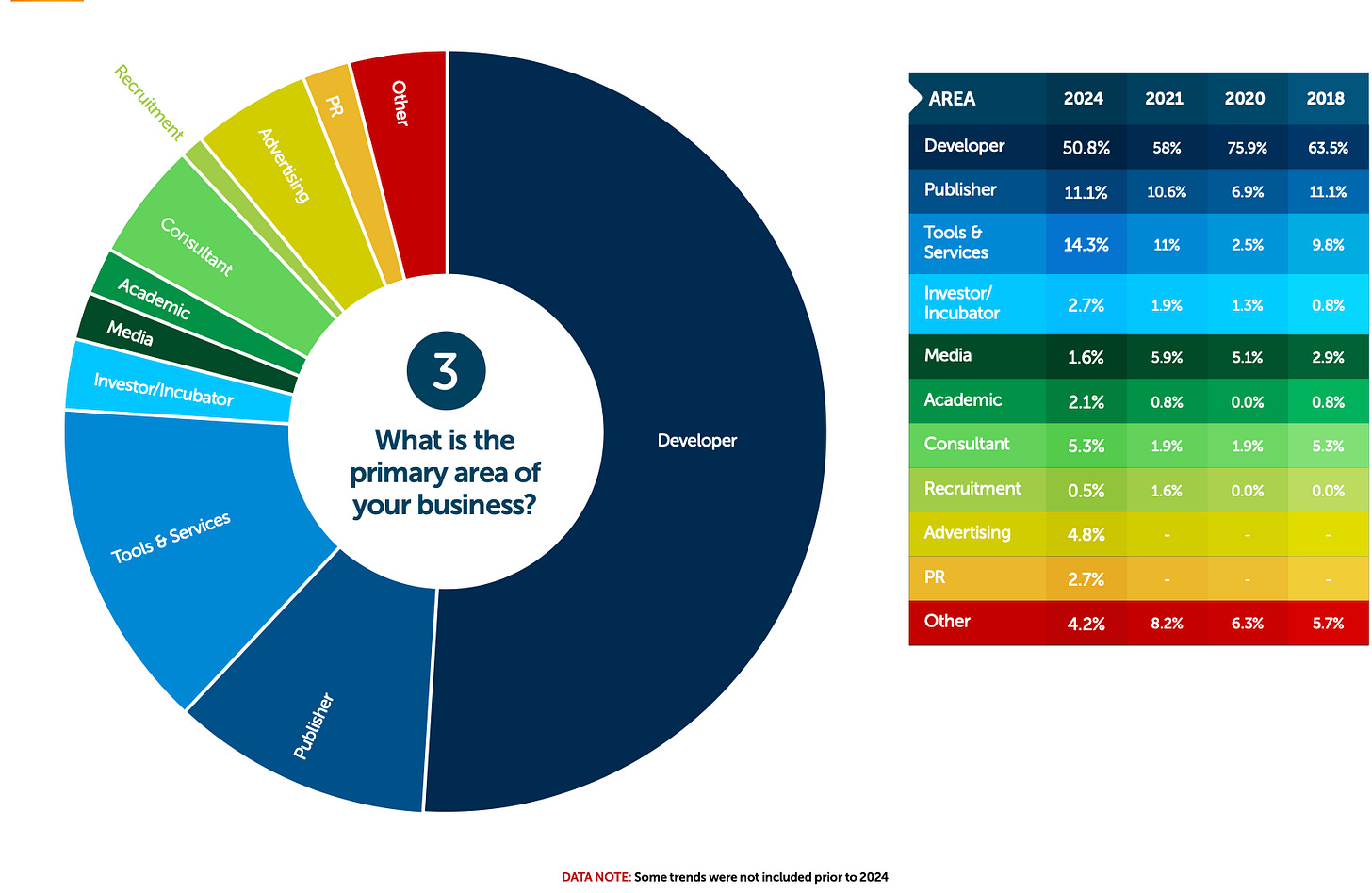

50.8% of all respondents represent gaming companies. Many respondents are from service companies (14.3%) and publishers (11.1%).

Although most respondents are from Europe, the UK, and the USA (78.9%), the sample is international. However, it should be noted that the survey results primarily reflect the Western gaming industry.

Platforms and products

Mobile platforms (Android and iOS) have become even more dominant platforms, according to feedback (which is logical given the survey's focus on predominantly mobile developers). Overall, interest has increased in almost all platforms except Mac devices.

Among those experimenting with new platforms, 53.3% are trying out innovations in cloud gaming or streaming services. 44.8% are working on XR/VR/AR projects, 35.2% on blockchain products, and 28.6% on CTV games.

❗️This question was optional, so the responses are not representative of all participants.

40.2% of developers did not release a single game in the past year. The number of such developers has significantly increased compared to, for example, 2018 but shows little difference from 2020-2021.

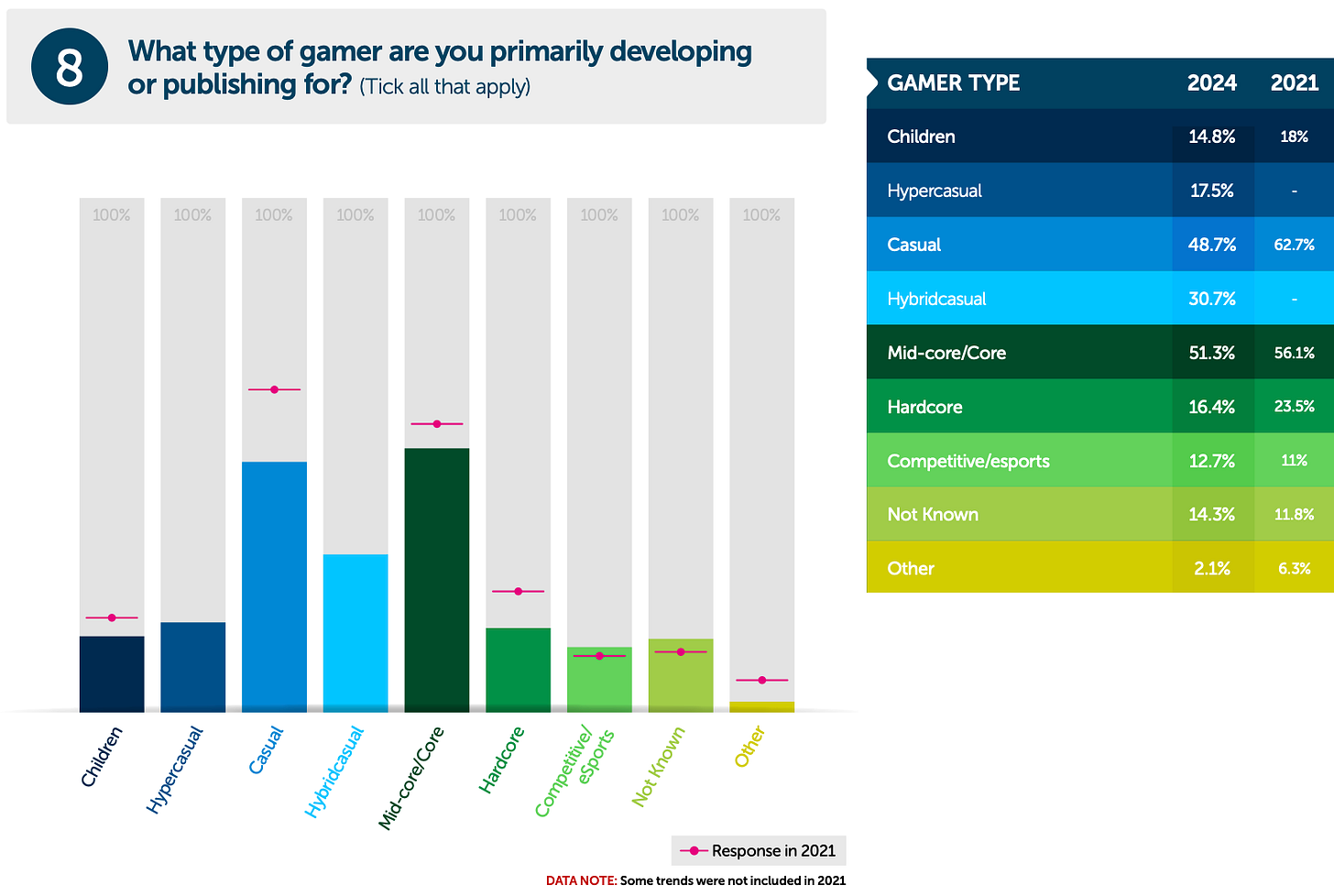

Compared to 2021, developers have been working less on casual projects and children's games. However, hyper-casual and hybrid-casual projects have taken a larger share, likely drawing some developers away.

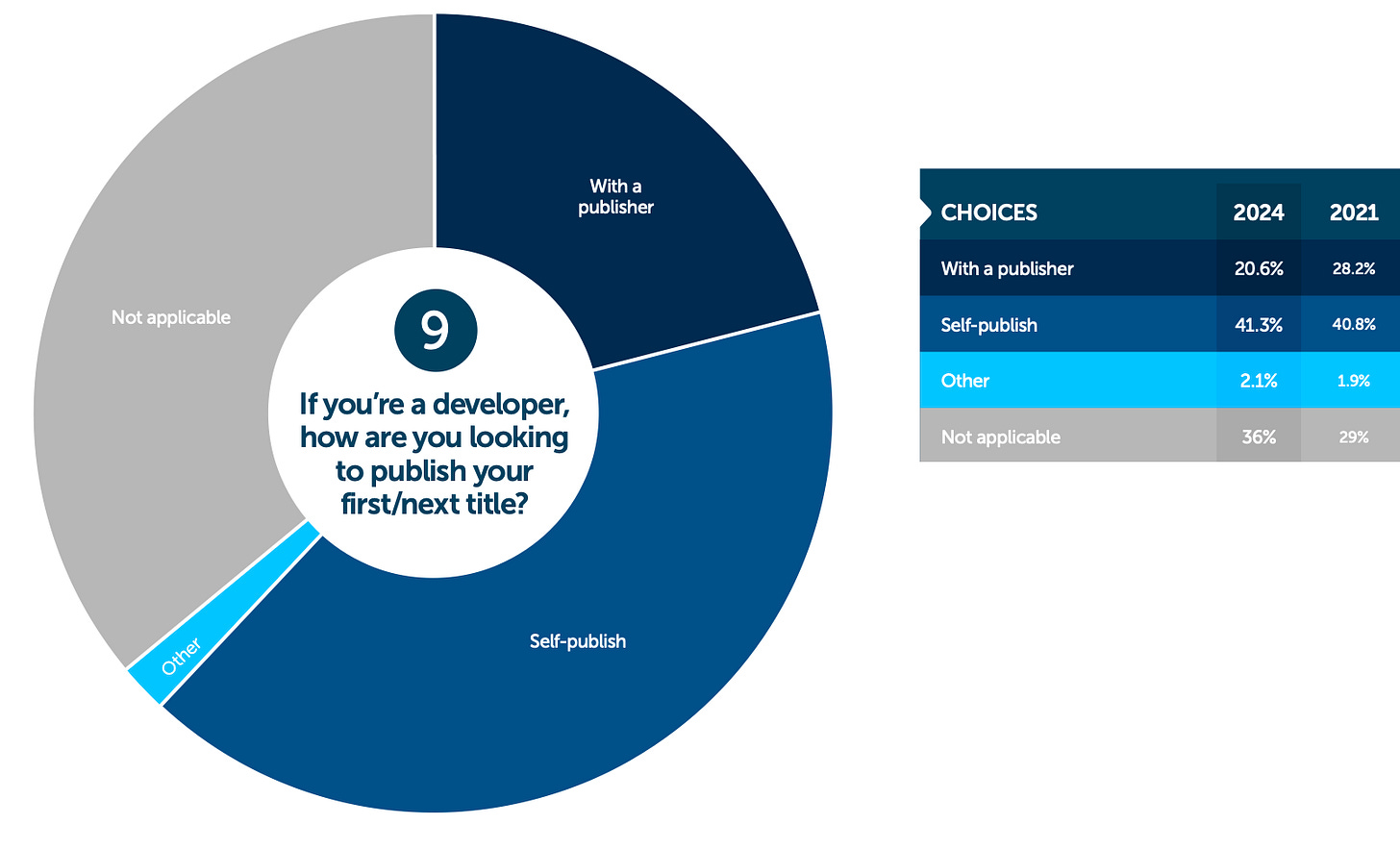

Developers have been working less with publishers compared to 2021. While one might assume that self-publishing has increased, the difference is minimal.

Business Models and Finances

59.3% of developers monetize through in-app purchases; 40.2% use rewarded video ads; 39.2% rely on video ads within games. These are the most popular monetization methods.

44.3% of developers have a development budget under $1M. 39.1% of respondents chose not to answer this question.

More than half expect profit margins below 20%. Meanwhile, 9.4% believe their company's profit margin will reach between 50% and 100%.

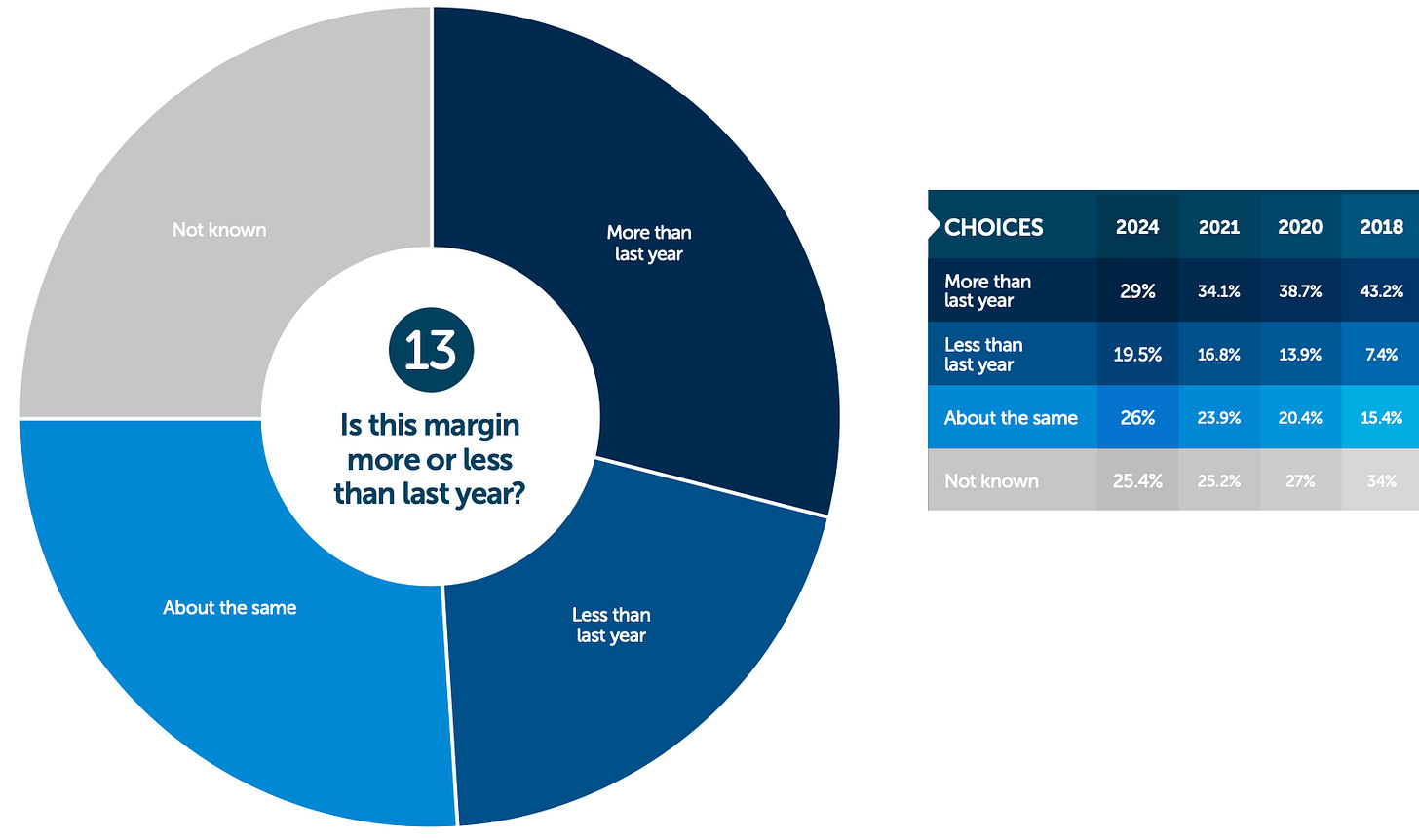

29% reported that their profit margins improved by the end of 2024. Another 19.5% reported a decline; for 26%, margins remained unchanged.

68.4% of respondents have an annual marketing budget below $500K. Only a small portion operates with significant marketing budgets.

Trends and opinions on the mobile gaming industry

Layoffs (56.7%), rising UA costs (52.2%), App Store regulation changes (41.8%)—these are key trends for mobile developers in 2024. In fourth place is Unity's monetization model change (36.6%).

Given that most survey participants are from Western countries, it is logical that they emphasized the importance of Western markets. Interestingly, there is little overall interest in Africa as a market, along with lower rankings for Latin America, India, and Southeast Asia.

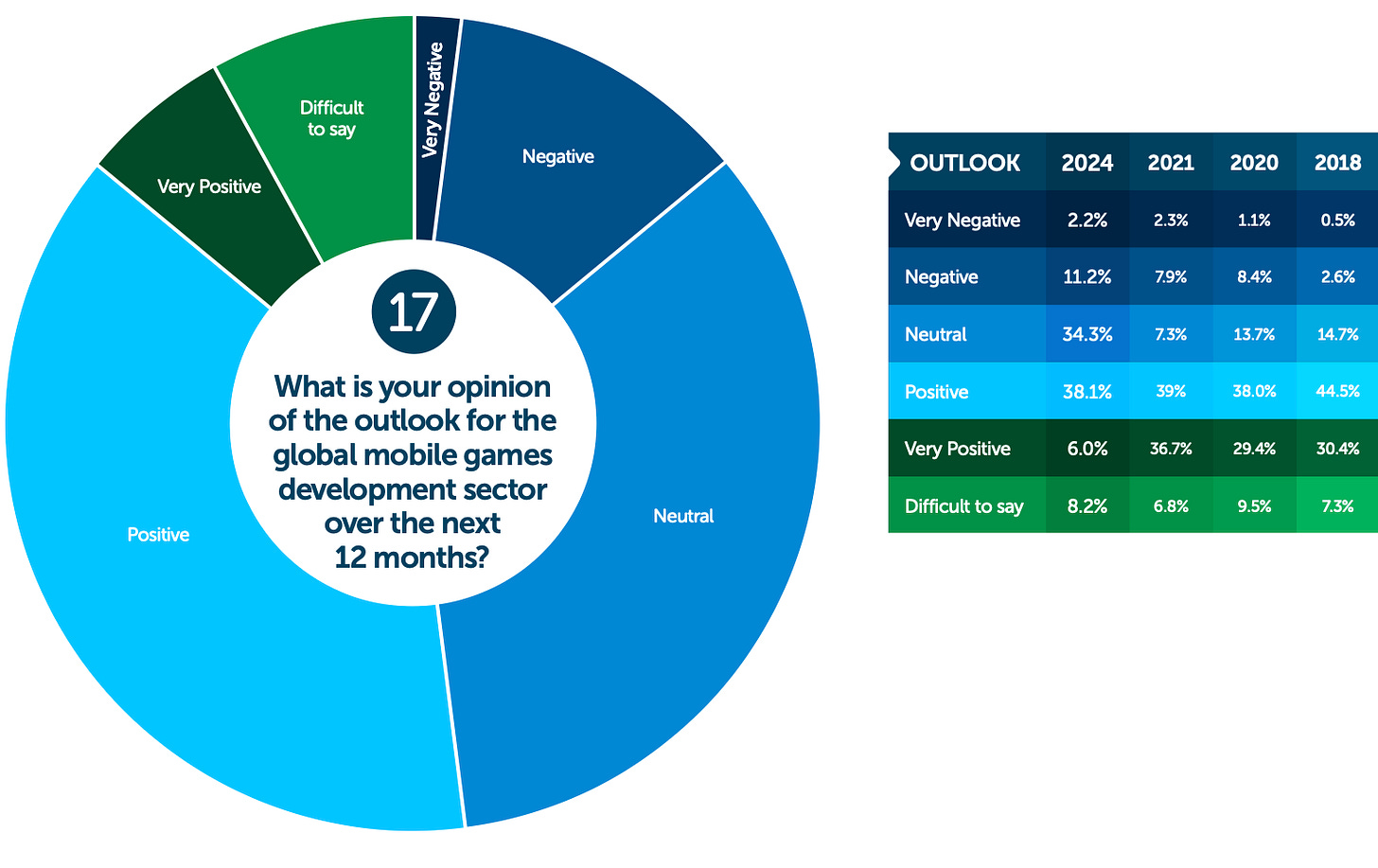

Respondents are generally optimistic about the future of the mobile market (44.1% believe changes will be positive).

The main threats to the mobile market are rising UA costs (64.2%), increasing marketing expenses (44.8%), and growing development costs (43.3%). In general, everything seems to be growing except revenue.

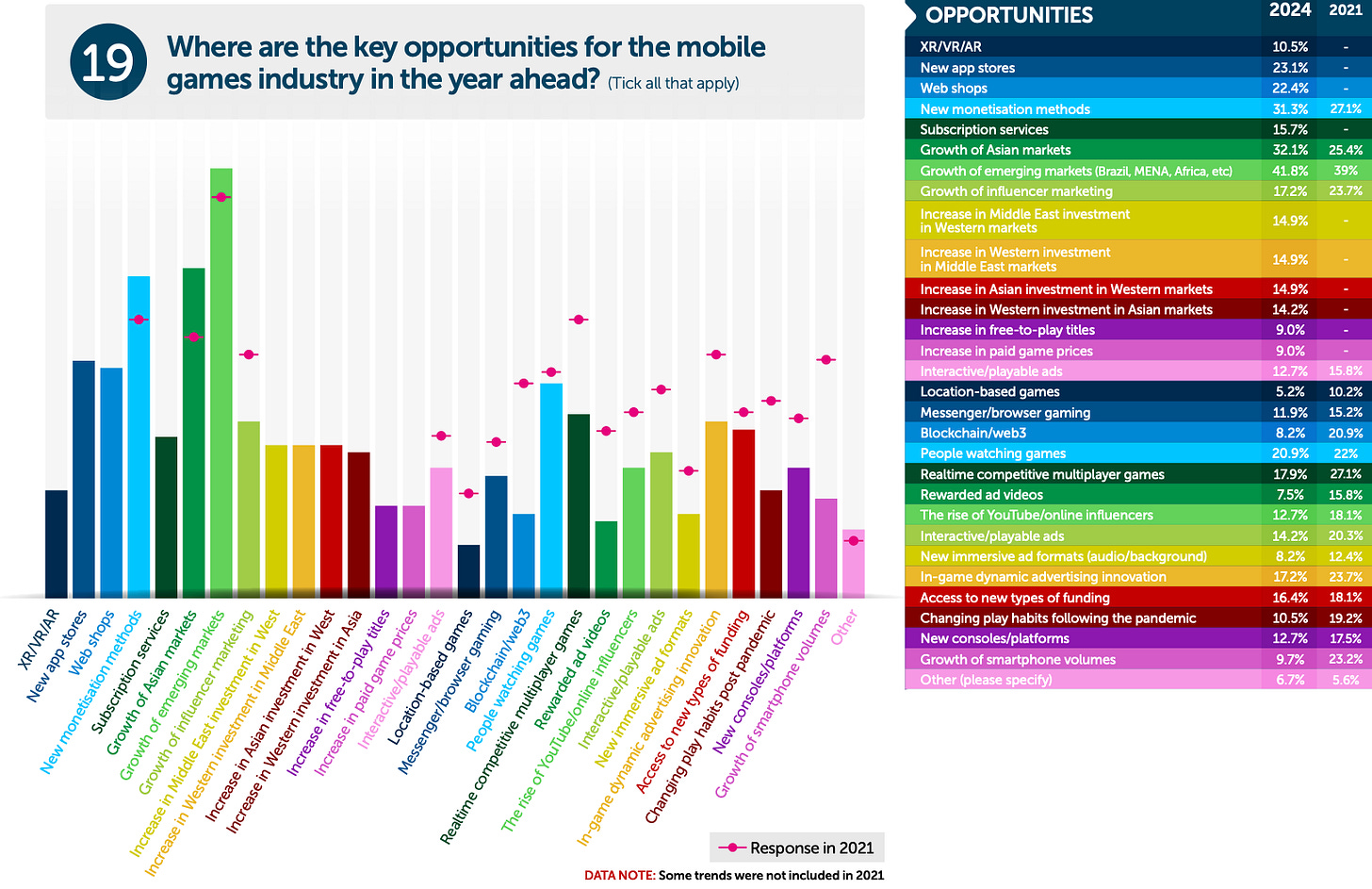

In this challenging situation, most developers see opportunities in emerging markets (41.8%), growth in Asian markets (32.1%), and new audience monetization methods (31.3%).

Compared to 2021, developers now place greater emphasis on game quality.

56% identified revenue as the primary KPI for their mobile products over the next year; for 50.8%, it is retention; for 47.8%, DAU is key. Notably absent from the list are ROAS/ROI metrics.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

Social media (70.9%), paid UA (55.2%), and influencer marketing (52.2%) are among the most interesting channels for developers looking to grow their audience in the coming year.

65.7% of respondents use Unity; 22.4% use Unreal Engine. It can be confidently said that despite controversial monetization decisions, Unity remains a market leader.

People attend industry events primarily for networking (88.3%), attending talks (53.1%), and seeking partners for investments or publishing deals (~31%).