Weekly Gaming Reports Recap: March 17 - March 28 (2025)

Big Unity gaming industry report; the German market declined in 2024; the US market in the first months of 2025 has a negative trend as well.

Reports of the week:

Newzoo & Carry1st: African Gaming Market is growing at 6 times faster rate compared to worldwide numbers

Unity: The Gaming Industry in 2025

Circana: The US Gaming Market in February'25

Games & Numbers (March 5 - March 25, 2025)

StreamElements & Rainmaker.gg: The Streaming Market in February 2025

game: The German gaming market declined in 2024 - sponsored by Neon

Newzoo & Carry1st: African Gaming Market is growing at 6 times faster rate compared to worldwide numbers

According to the companies' research, the African market reached $1.8 billion in 2024, which is a 12.4% increase from the previous year. The average global growth rate is 2.1% YoY, meaning Africa's growth rate is 6 times larger.

The total number of gamers in Africa reached 349 million in 2024. Most of them play on mobile devices (304 million). In 2024, this figure increased by 32 million, representing a 10% YoY growth in the audience.

Meet the content sponsor - Neon!

Direct-to-consumer is one of the biggest opportunities in gaming today, and many studios are making the move. But with so many vendors claiming the same benefits, and the complexities of payments, security, and optimization, it’s tough to know who to trust. That’s where Neon stands out. Our webshop, checkout, and merchant-of-record solutions are not just feature-rich. They deliver real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because our tech drives better conversion rates, incremental revenue, and higher profit margins.

But performance is just one part of the equation. We take partnership seriously by offering expert guidance, hands-on assistance, 24/7 player support, and the transparency studios need to navigate DTC with confidence. There are no hidden fees and no unreliable timelines. Just a team that is committed to helping you win. If you are ready to maximize your success, visit Neon to learn more and book a demo.

Mobile games account for about 90% of the region's total revenue, approximately $1.6 billion.

Egypt ($368 million), Nigeria ($300 million), and South Africa ($278 million) are the largest markets in the region.

Eritrea and Niger are the fastest-growing countries in terms of revenue in the region.

Unity: The Gaming Industry in 2025

Back from the GDC - and straight to the important reports!

Trend 1: Developers are Reducing Expenses—and Risks

45% of developers are trying to use tools more efficiently (and use tools to increase efficiency). 24% note that they focus more on achieving results through operations and additional monetization.

The majority of developers—62%—prefer to develop existing projects. 23% plan to move into new genres; 10% plan to make games in the same genre, and 5% want to build their own IP.

The request for what should change in the industry is diverse. There are calls for more advanced end-to-end technology stacks (55%), better tools (51%), and larger audiences (44%).

Emerging markets where surveyed developers see the greatest growth are Latin America (55%) and Southeast Asia (24%).

Brazil, Mexico, India are leaders in the list of most interesting countries for developers.

55% of developers plan to support their projects with content after release. 27% do not plan to do this (likely premium games developers), and 18% are still unsure, as it depends on the project's success.

A word from the newsletter sponsor

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

Trend 2: Studios are experimenting with multiplayer gaming experiences

58% of developers are working on projects with full multiplayer capabilities. 32% are making single-player games with network functionality. 6% are working on cooperative projects that allow play on a single screen. Only 4% of developers do not see multiplayer in any form in their projects.

Multiplayer projects are being made by teams of all sizes. 20% of teams with 1-2 people include multiplayer functionality in their games.

Unity highlights the genre diversity of multiplayer projects. There are more multiplayer shooters or adventure games, but this is due to the overall number of games in these genres.

Studios are experimenting with multiplayer formats. 69% of teams offer asymmetric multiplayer in their projects.

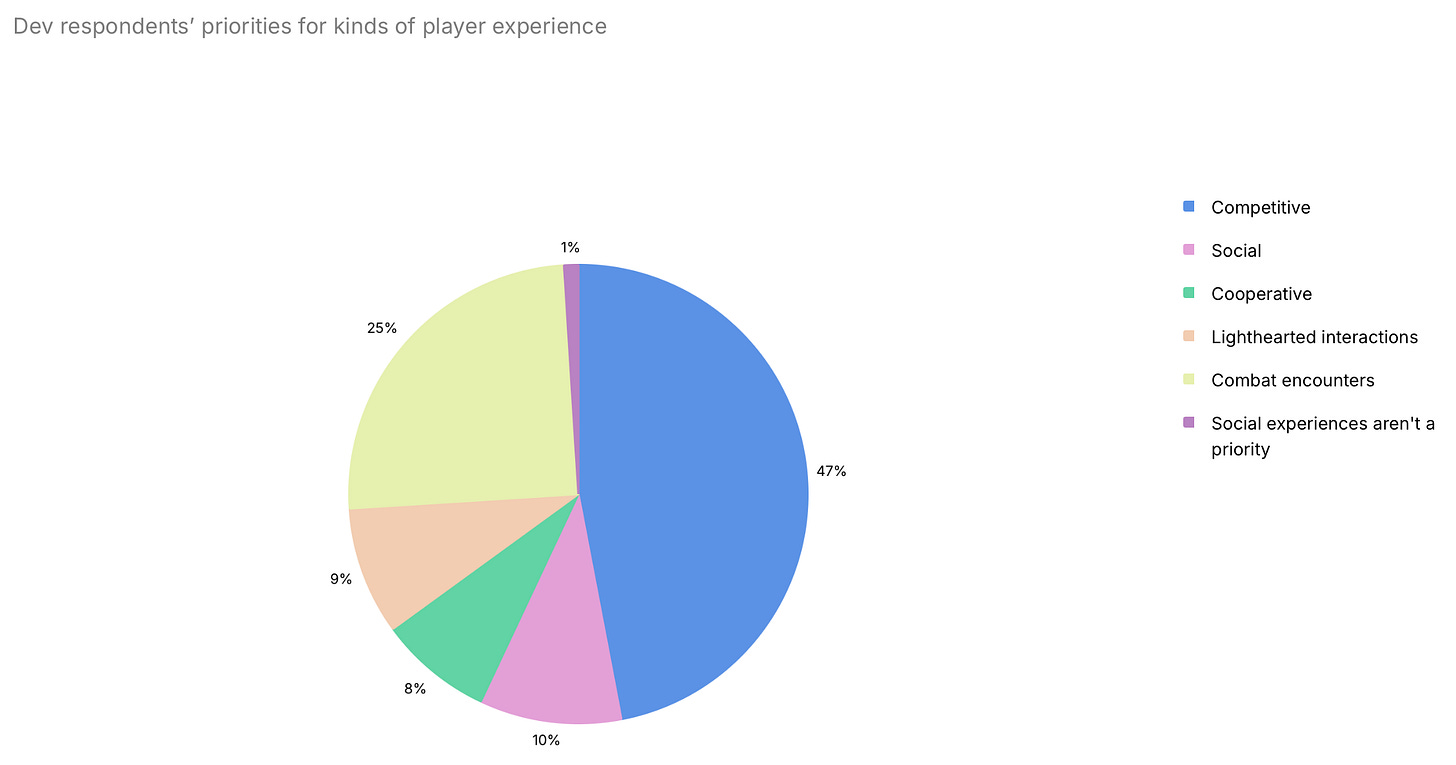

47% of the multiplayer experiences created by developers are competitive. Multiplayer today is about both shared experiences and socialization.

Developers believe that in 10 years, users will be playing RPGs, strategies, MMOs, MOBAs, and shooters.

Trend 3: Studios continue to work with proven platforms

Mobile devices and PCs are the most popular platforms for developers regardless of studio size. Console releases, however, depend directly on the size of the studio. 84% of large companies release games on consoles, while only 19% of studios with fewer than 10 employees do.

Developers believe that most of the money (84%) is on mobile devices and consoles.

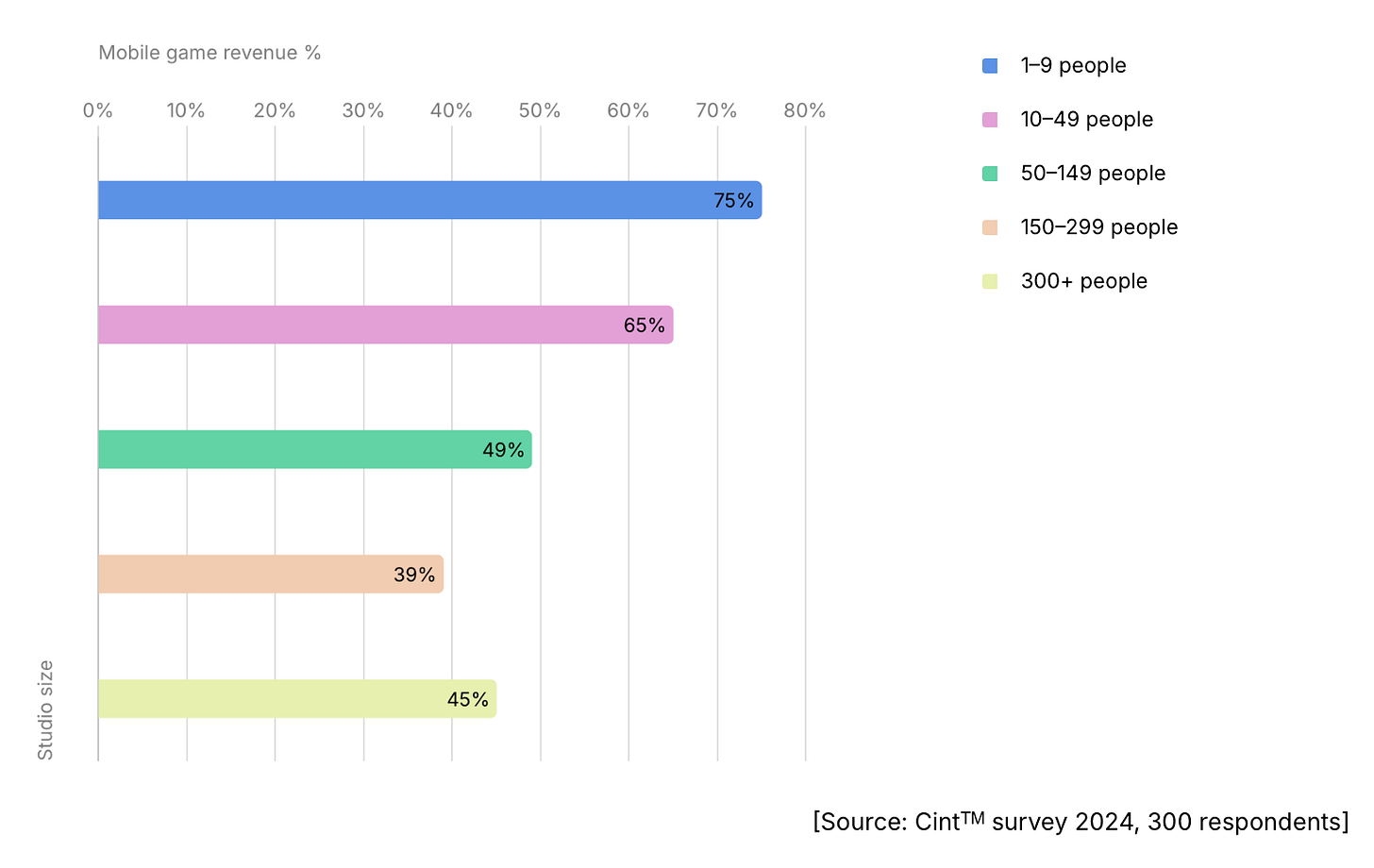

Mobile revenue often accounts for the largest share among small studios.

The situation with console revenue is the opposite. The larger the studio, the more frequently console revenue has the largest share.

❗️Picture has a mistake - it is about console revenue.

Only 11% of developers plan to make games for web platforms, so despite overall positivity, web games are not yet mainstream.

Most of those making web games plan to release them within the next 18 months.

Developers who do not plan to release projects for web platforms are concerned about technological limitations and limited browser support. There are also questions about mobile device support.

Trend 4: Games are getting larger

The median build size on Unity over the past three years has increased by 67% to 167MB.

32% of developers noted that people are spending much more time playing games; 56% saw a small increase.

Developers use different strategies to retain users, but the most effective (and complex) way is producing new content.

A word from the newsletter sponsor

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

Trend 5: Developers are seeking for a new technological solutions

In addition to the challenges of finding a unique game idea, 21% of developers get stuck in R&D for a long time; 20% have problems releasing projects on time and with the right scope. Another 15% face issues with tool management.

Developers actively use live ops tools. It's surprising that only 25% use Unity's advertising and monetization tools.

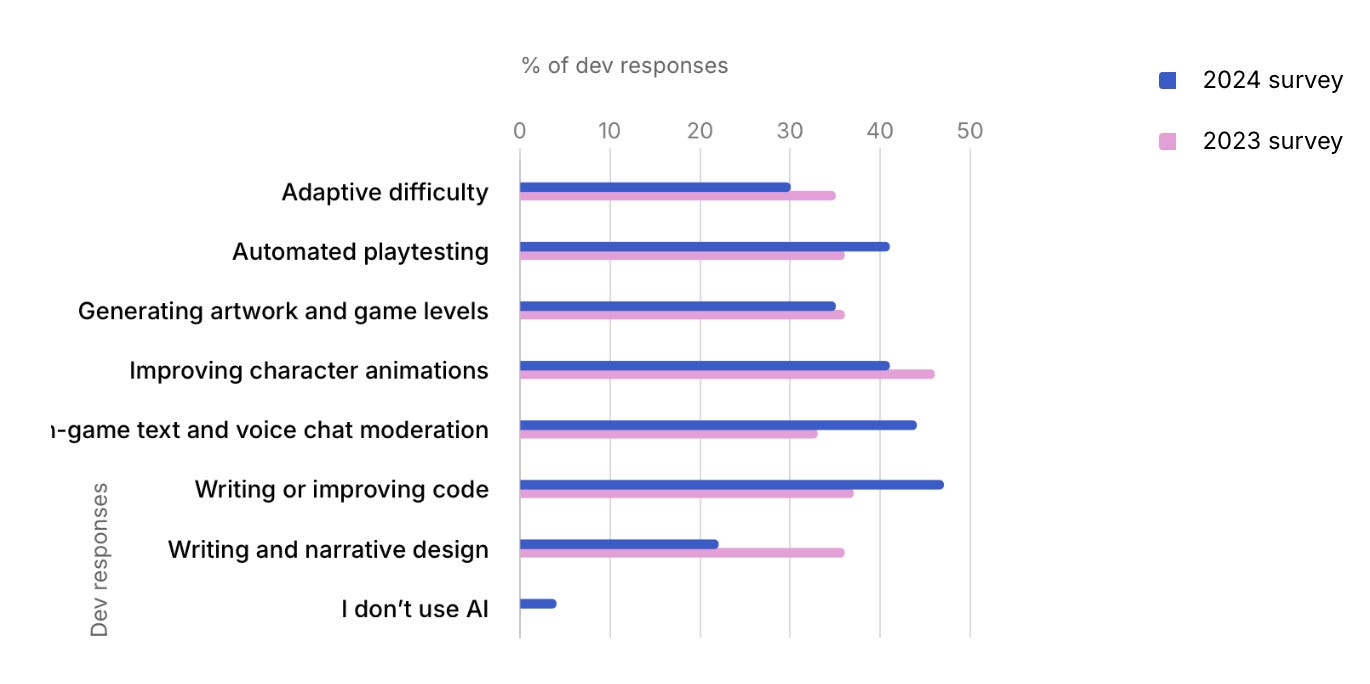

79% of surveyed developers have a positive attitude towards new AI tools.

Only 4% of those surveyed noted that they do not plan to use AI tools in 2025.

Despite the growing popularity of AI tools, most developers continue to use old and proven tools.

Circana: The US Gaming Market in February'25

Overall market condition

The overall results for February 2025 were 6% worse compared to February 2024. Revenue decreased from $4.795B to $4.507B.

Hardware sales fell the most, by 25% (from $341M in February 2024 to $256M in February 2025). This is the lowest figure since February 2020.

PlayStation 5 was the best-selling console in February, followed by the Xbox Series S|X.

A word from our sponsor

Neon is the direct-to-consumer partner you can trust. We know the games industry is a tough business. That’s why we work closely with our clients, offering hands-on assistance, dedicated player support, transparent pricing, and reliable technology that delivers real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because we are invested in their success. If you need a partner who puts your business first, visit Neon to learn more.

After 52 weeks on the U.S. market, PlayStation 5 sales are 7% ahead of PlayStation 4 sales. Xbox Series sales trail Xbox One by 19%.

Accessory sales dropped by 8% (from $238M to $220M).

PlayStation Portal continues to lead the list of top accessories by revenue.

Gaming content sales decreased by 4% (from $4.217B to $4.031B).

If we consider the results for the first two months of 2025, the gaming market revenue is 11% lower than the same period in 2024 ($9.02 billion vs. $10.116 billion). Hardware and accessory sales fell the most.

Games sales

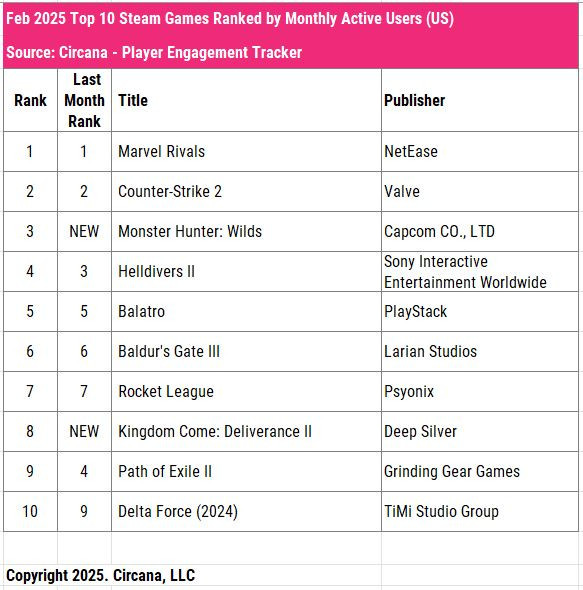

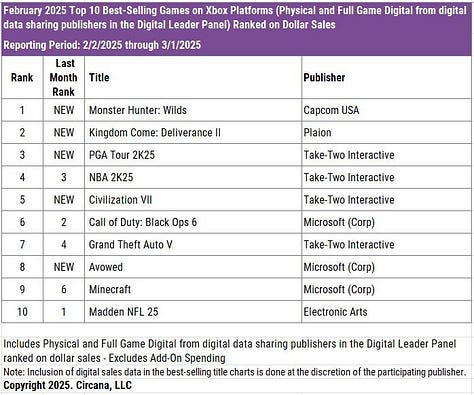

February's top new releases include Monster Hunter: Wilds, Kingdom Come: Deliverance II, Civilization VII, PGA Tour 2K25, Avowed, and Like a Dragon: Pirate Yakuza in Hawaii.

For the first two months of 2025, the top three sellers are Monster Hunter: Wilds, Kingdom Come: Deliverance II, and Civilization VII.

Monster Hunter: Wilds became the best-selling game in February and for the year on the U.S. market in just one day. This applies to all platforms - PlayStation, Xbox, and Steam. Over half of its sales in dollar terms were on Steam. The game earned more in one day than Monster Hunter: Rise did in all of March 2021.

It's worth noting the success of Kingdom Come: Deliverance II - the game launched five times better by revenue than the original, which was released in February 2018.

On mobile platforms, MONOPOLY GO!, Royal Match, and Last War: Survival are leading. Sensor Tower provided the data. Last War: Survival saw a 17% increase in IAP revenue in February.

Additionally, February became the first month in history when two games from the same IP (Pokémon GO and Pokémon TCG Pocket) entered the top 10 mobile chart in the U.S. by revenue.

Platform rankings

The sales rankings on PlayStation and Xbox are quite similar. There are differences in positions (Call of Duty: Black Ops 6 sells better on PlayStation because it's not available by subscription). Also, Avowed made it into Xbox's top-10 list, while Like a Dragon: Pirate Yakuza in Hawaii made it onto PS.

The Nintendo Switch is different. It's worth noting the successful launch of Civilization VII and of Yu-Gi-Oh!: Early Days Collection.

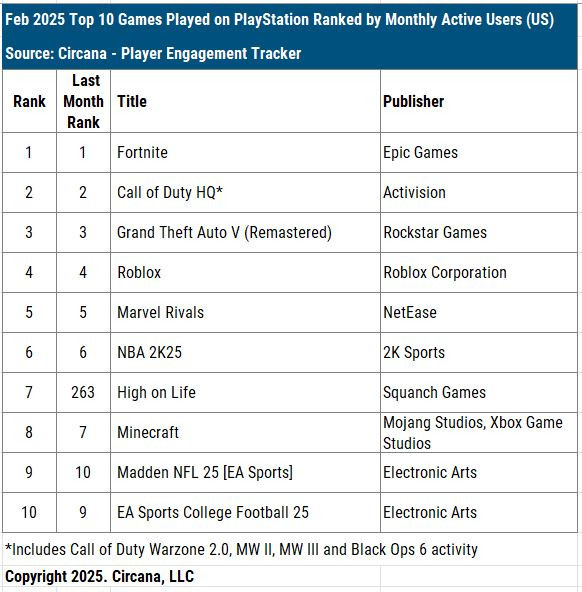

The MAU charts on PlayStation and Xbox remains stable. Projects from subscriptions (High on Life on PS and Avowed on Xbox) made it into the top 10. Monster Hunter: Wilds will likely appear in March's rankings, as it simply didn't have enough time to establish itself in February.

On PC, the picture looks different. It's worth noting the long-term success of Marvel Rivals - it seems safe to say that the game has found its audience.

Games & Numbers (March 5 - March 25, 2025) - sponsored by Neon

The newsletter sponsor is Neon - a high-performance direct-to-consumer solution built for games.

PC/Console Games

RuneScape has reached a revenue milestone of $2 billion. Over 300 million players worldwide have played the game. The first version of the project was released in 2001 as a browser game.

The Final Fantasy Pixel Remaster series (re-releases of classic Final Fantasy games from the first to the sixth) has been purchased over 5 million times.

Split Fiction sales exceeded 2 million copies in a week. The game is very popular in China (at least on Steam). It reached its first million copies in two days.

The indie horror game R.E.P.O., according to VG Insights, was purchased 2.7 million times on Steam within a month of its release. Developers earned $20.3 million. The game is currently in early access.

The audience for Cities: Skylines exceeds 45 million people. This amount has played the game since its release on March 10, 2015.

A word from our sponsor

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

Over 3 million people have played The Outlast Trials since its release.

Over 2 million people have played Assassin's Creed Shadows. This includes not just sales, as the game is distributed for free as part of the Ubisoft+ Premium subscription.

The audience for Predecessor has surpassed 2 million people.

Mobile Games

Honkai: Star Rail, according to AppMagic, has surpassed $2 billion in revenue on mobile devices. It took less than two years to achieve this.

Blood Strike from NetEase earned $22.9 million in its first year. The game has been downloaded over 60 million times. 30% of the project's revenue comes from the U.S., and it also performs well in emerging markets.

In its first week after release, Mo.co earned $570,000 in gross revenue. The game was downloaded 2.5 million times. Data is from Sensor Tower.

Games from Supersonic have been downloaded 6.2 billion times over five years. The studio shared this figure.

Downloads of all Netflix games have reached 300 million installs. GTA: San Andreas has the most with nearly 40 million.

Pokémon GO, nine years after its release, has over 20 million weekly active users. About half of the players log in every day. This data was shared in the context of a deal with Scopely.

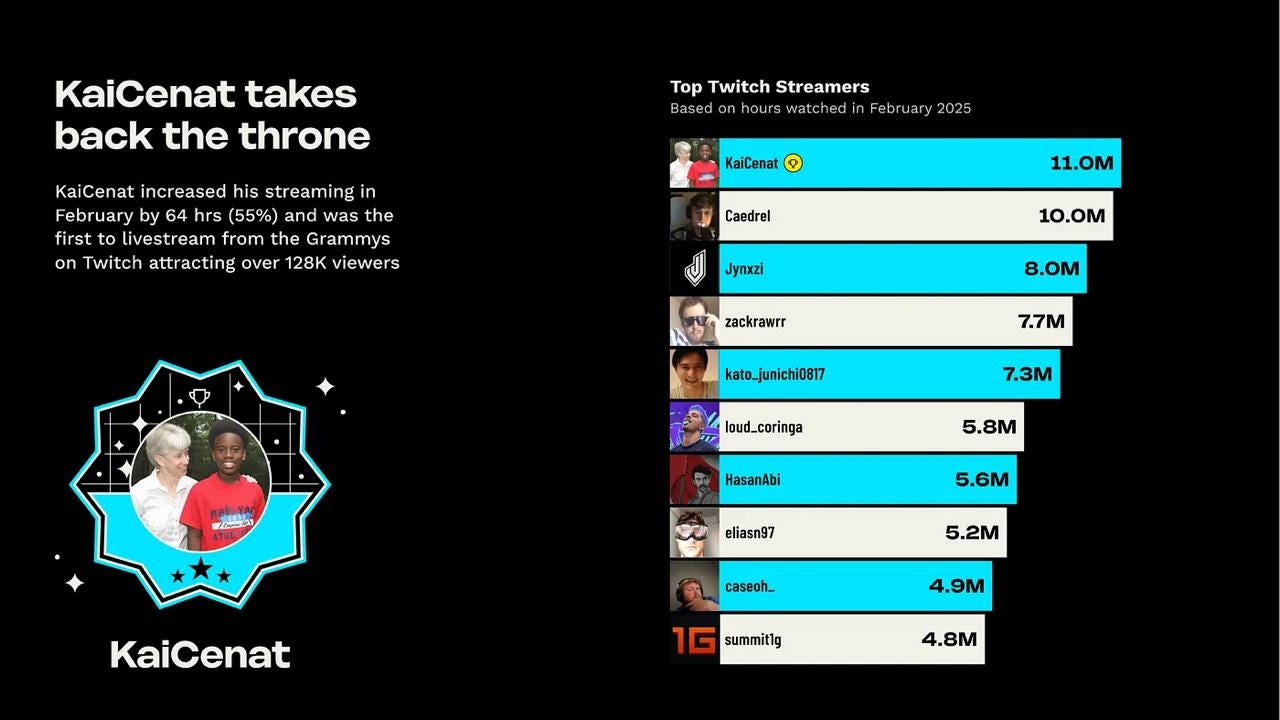

StreamElements & Rainmaker.gg: The Streaming Market in February 2025 - sponsored by Neon

In February 2025, daily content views on Twitch remained at January levels, with 57 million hours per day.

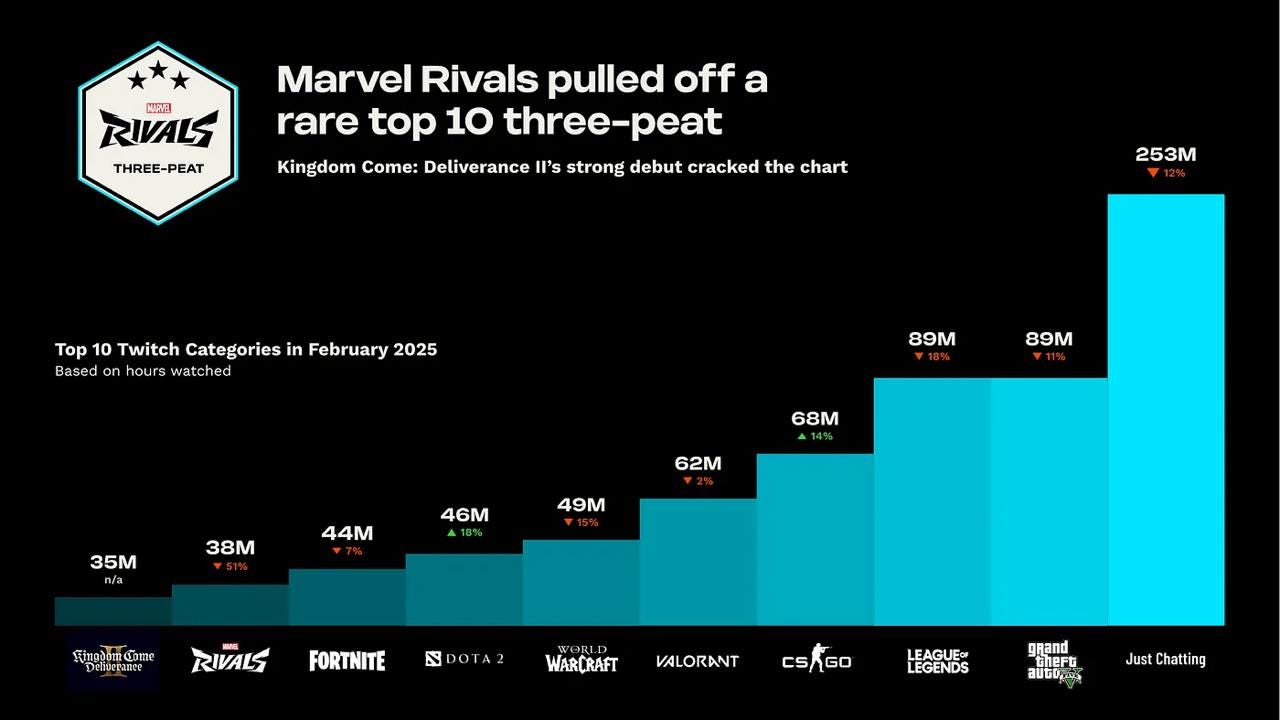

Marvel Rivals maintained its position in the top 10 by viewership for the third consecutive month—a feat most recently launched projects have not achieved, typically lasting only two months. Although the project's viewing hours dropped by 51% compared to the previous month, this is a significant achievement.

A word from the newsletter sponsor

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

Grand Theft Auto V (89 million hours), League of Legends (89 million hours), and Counter-Strike 2 (68 million hours) were the most popular games on Twitch for the month.

Notably, Kingdom Come: Deliverance II also performed well, with 35 million hours of viewing and a spot in the top 10.

game: The German gaming market declined in 2024 - sponsored by Neon

The newsletter sponsor is Neon - a high-performance direct-to-consumer solution built for games.

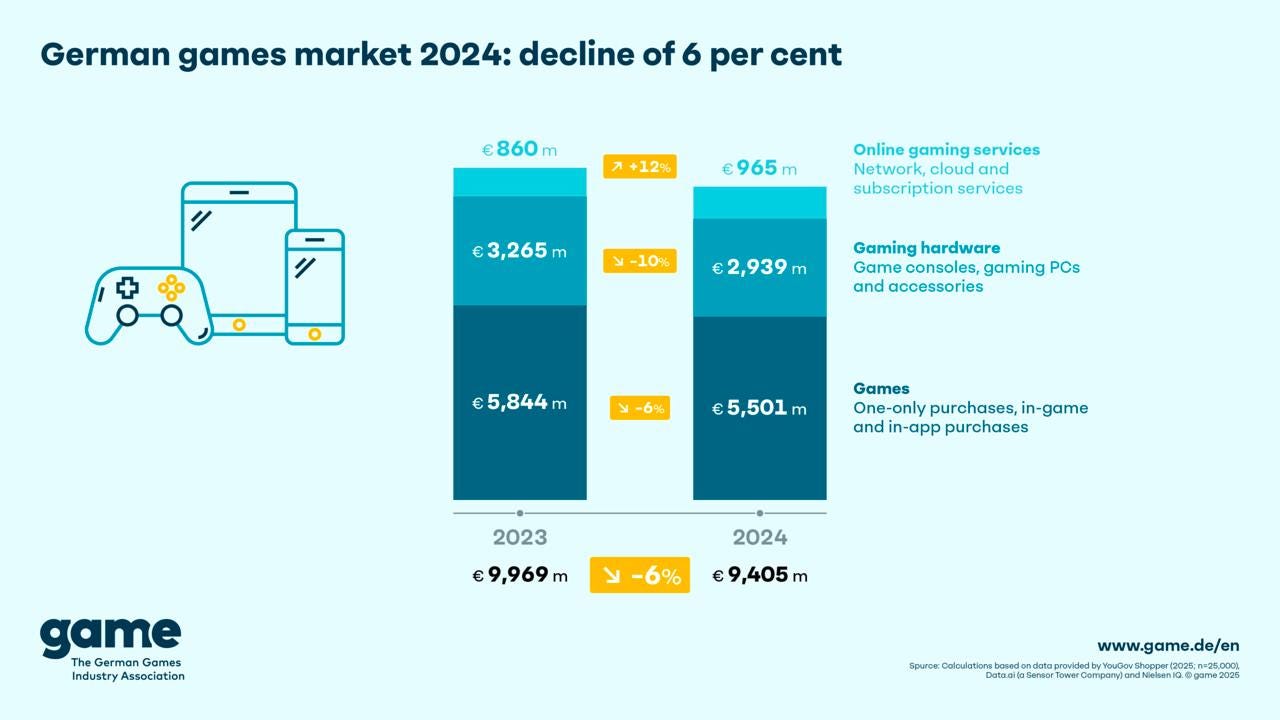

The total market volume was €9.405 billion at the end of 2024. This is 6% less than in 2023.

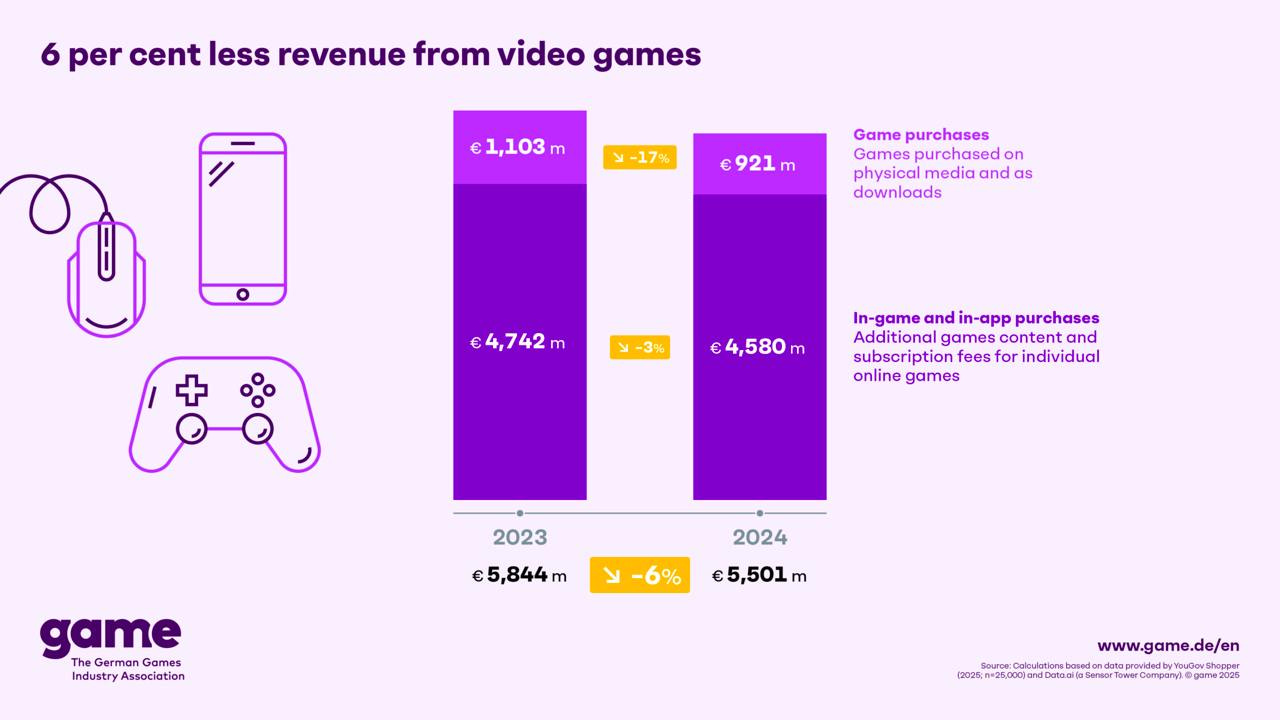

Game sales fell by 6% to €5.501 billion (€5.844 billion in 2023).

Sales of games dropped the most, by 17% to €921 million. Revenue from microtransactions decreased less sharply, by 3% to €4.58 billion.

A word from our sponsor

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

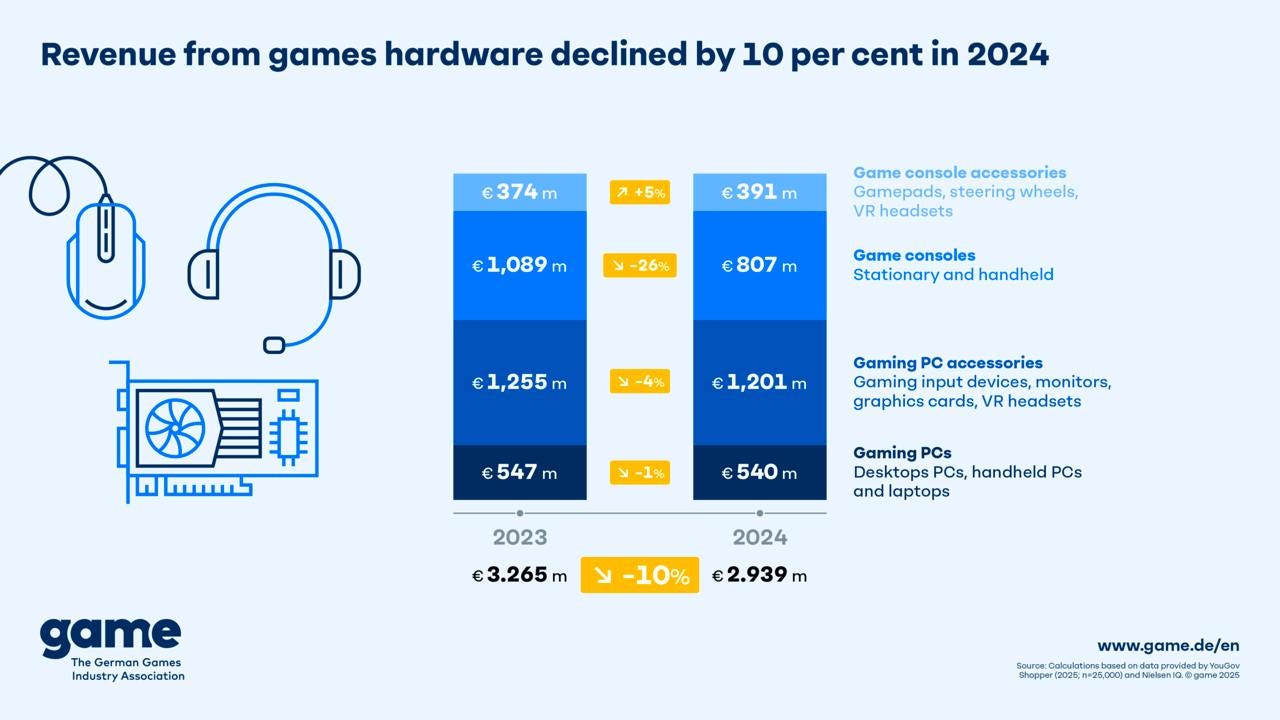

Sales of gaming hardware decreased from €3.265 billion to €2.939 billion, a drop of 10%.

The only segment that grew was the sales of console accessories, with a 5% increase to €391 million.

Sales of gaming consoles fell by 26% (from €1.089 billion to €807 million). Sales of PC accessories decreased by 4% (from €1.255 billion to €1.201 billion). Sales of gaming computers dropped by 1% (from €547 million to €540 million).

On the positive side, subscription service sales grew by 12% to €965 million.