Weekly Gaming Reports Recap: March 3 - March 7 (2025)

Top February titles by Appmagic; How Gamers Watch YouTube in the US; and SocialPeta research of Mobile Marketing in 2024.

Reports of the week:

AppMagic: Top Mobile Games by Revenue and Downloads in February 2025 + Partnership Announcement for March

Games & Numbers (February 19 - March 4, 2025)

Big Games Machine: How gamers watch YouTube in 2025 in the USA

SocialPeta: Mobile Game Marketing in 2024

AppMagic: Top Mobile Games by Revenue and Downloads in February 2025 + Partnership Announcement for March

Before we start, I’m happy to announce that Neon - the D2C platform built for games, will sponsor the March articles on the GameDev Reports. Thanks for the support! Now - a word from a partner.

Direct-to-consumer is one of the biggest opportunities in gaming today, and many studios are making the move. But with so many vendors claiming the same benefits, and the complexities of payments, security, and optimization, it’s tough to know who to trust. That’s where Neon stands out. Our webshop, checkout, and merchant-of-record solutions are not just feature-rich. They deliver real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because our tech drives better conversion rates, incremental revenue, and higher profit margins.

But performance is just one part of the equation. We take partnership seriously by offering expert guidance, hands-on assistance, 24/7 player support, and the transparency studios need to navigate DTC with confidence. There are no hidden fees and no unreliable timelines. Just a team that is committed to helping you win. If you are ready to maximize your success, visit Neon to learn more and book a demo.

And back to our topic (though, I hope, you’re seriously considering D2C or doing it already, it’s a great additional value to the business). We’re here to learn about the top performers in February 2025 on Mobile. AppMagic provides revenue data after deducting store commissions and taxes. Revenue from Android stores in China is not included.

Revenue

Honor of Kings repeats its January success. In February, the game earned $190.2 million.

Last War: Survival takes second place in revenue ($155.7 million), followed by Whiteout Survival in third place ($122.6 million).

Pokemon TCG Pocket returned to a positive revenue trend - in February, the game earned $90.4 million compared to $66.2 million in January.

Against the backdrop of its 10th-anniversary celebration, Dragon Ball Z: Dokkan Battle's revenue grew significantly. In February, the game earned $53 million - a record since July 2020.

Pokemon GO also shows good results - after January's revenue decline, the project returned to the top 15, earning $41.27 million.

Downloads

Block Blast! (27.6 million downloads) remains the leader.

February saw many newcomers in the top 15. 456 Run Challenge: Clash 3D climbed to 3rd place - a hypercasual game based on "Squid Game" from Vietnamese Amobear Studio. The game was downloaded 12.7 million times.

100+ Offline Games No WiFi Fun also returned to the top 15 (9.5 million installations, 8th place) and Extreme Car Driving Simulator made it to the list (8.8 million installations, 13th place). Interestingly, Extreme Car Driving Simulator was released in July 2014, but set a download record in February 2025.

Games & Numbers (February 19 - March 4, 2025)

PC/Console Games

According to GameDiscoverCo, Monster Hunter Wilds sold over 4 million copies on PC and PlayStation 5 within its first few days. As of March 2, the game generated over $150 million in revenue on Steam, including $69.1 million on its debut day. During the weekend, the game reached a peak concurrent player count of 1.384 million.

Tekken 8 has sold 3 million copies. Bandai Namco Entertainment says that the game is outperforming its predecessor in sales.

The developers of Pacific Drive announced that the game has sold 1 million copies, a milestone achieved in one year.

The indie horror game Mouthwashing reported reaching 500,000 copies sold.

NetEase revealed that the audience for Marvel Rivals has surpassed 40 million players.

The audience for NetEase's Where Winds Meet reached 15 million users. The game is currently available only in China on PC and mobile devices.

Palworld reached 32 million players in its first year after release on PC, PlayStation, and Xbox. This number doesn’t reflect sales, as the game was included in Xbox Game Pass from launch.

Sponsored

Neon is more than just another DTC provider for games. Our webshop, checkout, and merchant-of-record solutions are designed to attract players, increase conversions, and build long-term loyalty. The result is higher revenue and better profit margins. That’s why top studios like Metacore, PerBlue, and Space Ape choose Neon. If your direct-to-consumer strategy hasn’t come together or isn’t delivering the results you need, we can help. Visit Neon to learn more.

The beta of Mecha BREAK hit a peak of 317,000 concurrent users (CCU) on Steam, though the project received negative reviews overall. Most criticism came from China (73% of reviews were negative), while English-language reviews were 80% positive.

over the hill gained over 200,000 wishlists within a month. In its first five days alone, it accumulated its initial 100,000 wishlists.

Mobile Games

Gross revenue for Last War: Survival surpassed $2 billion as of February 15, 2025, according to AppMagic. In January alone, the game earned a record $212 million (gross).

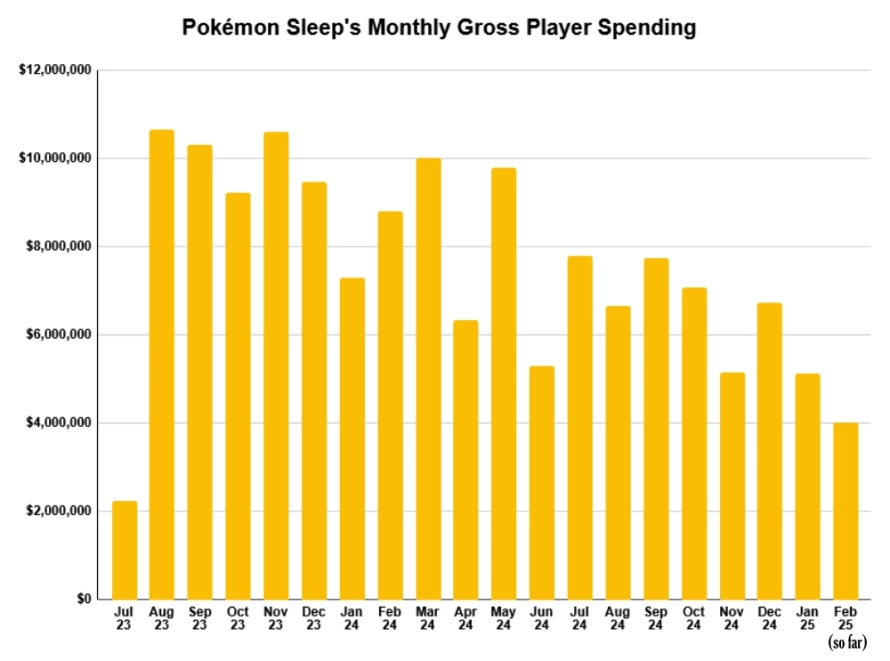

Pokemon Sleep reached $150 million in revenue; however, its revenue trend is declining.

Pokemon TCG Pocket has been downloaded over 100 million times, as announced by the developers on their X account.

Candy Crush Solitaire generated $379,000 in revenue during its first two weeks post-launch, according to AppMagic. This figure is before taxes and platform fees.

Gaming Platforms

Steam set a new CCU record with 40 million users online simultaneously. Of these, 12.6 million were actively playing games at the time.

According to IDC estimates, Valve sold over 4 million Steam Deck units over the past three years. In total, portable PCs (including Steam Deck, Asus ROG Ally, Lenovo Legion Go, and MSI Claw) have sold a combined total of 6 million units.

Big Games Machine: How gamers watch YouTube in 2025 in the USA

The survey involved 1050 players from the USA who watch YouTube for more than 30 minutes per week. An equal number of men and women participated in the survey. For most respondents, mobile devices are the main platform (35%); PlayStation comes second (28%); Xbox is third; PC is fourth (13%).

Users have different genre preferences. The most popular genres among respondents are action (37%), puzzles (23%), sports games (23%), RPG, fighting games, simulators, and strategies (19% each).

The survey showed that young people watch YouTube the most. 45% of respondents watch 1-3 hours of gaming streams on the platform per week. 16% spend more than 4 hours watching gaming streams.

The most popular categories among users are guides or tutorials (47%), reviews (40%), and compilations of funny or cool moments from games (40%).

Users aged 18 to 24 are 2.5 times more likely to watch "Let's Play" videos than players aged 45-55.

Sponsored

Neon is the direct-to-consumer partner you can trust. We know the games industry is a tough business. That’s why we work closely with our clients, offering hands-on assistance, dedicated player support, transparent pricing, and reliable technology that delivers real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because we are invested in their success. If you need a partner who puts your business first, visit Neon to learn more.

Compilations of funny/cool moments are more popular among the female audience. Men, on the other hand, are twice as likely to watch esports videos.

21% of respondents mainly watch only streamers who create content for games or genres they're familiar with. The majority of respondents watch diverse streamers producing different types of content.

The survey also showed that men are slightly more interested in gaming news and reviews, as well as esports competitions, than women. Women, in turn, are more likely to watch VTubers.

When choosing a content creator, people rely on the type of content or genre the person works in (49%). For 45%, the creator's personality is important, 40% look at the quality of videos, 36% pay attention to how well the creator plays. Reputation (34%) and relatability (33%) are also important.

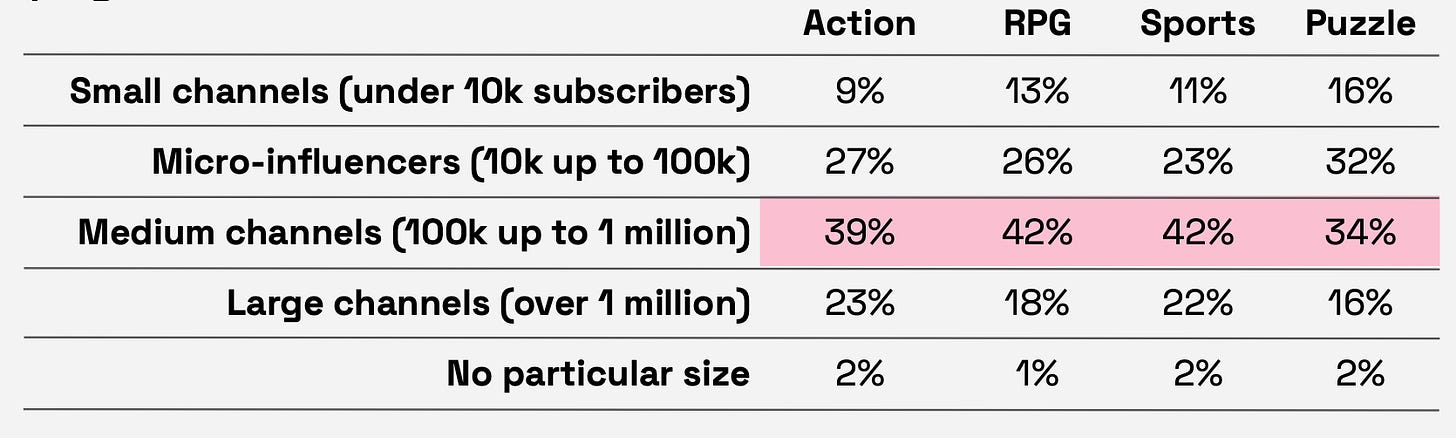

Audience size, as it turned out, is not very important to people. Most people indicated they prefer to watch medium-sized creators (from 100 thousand to a million subscribers) and micro-influencers (from 10 to 100 thousand subscribers).

Small channels are equally popular among both casual YouTube audiences (those who watch gaming content less than 2 hours a week) and YouTube enthusiasts.

Large YouTube channels are generally more popular among fans of action and sports games. This might be because these genres typically have a wider audience, making it easier to gain subscribers.

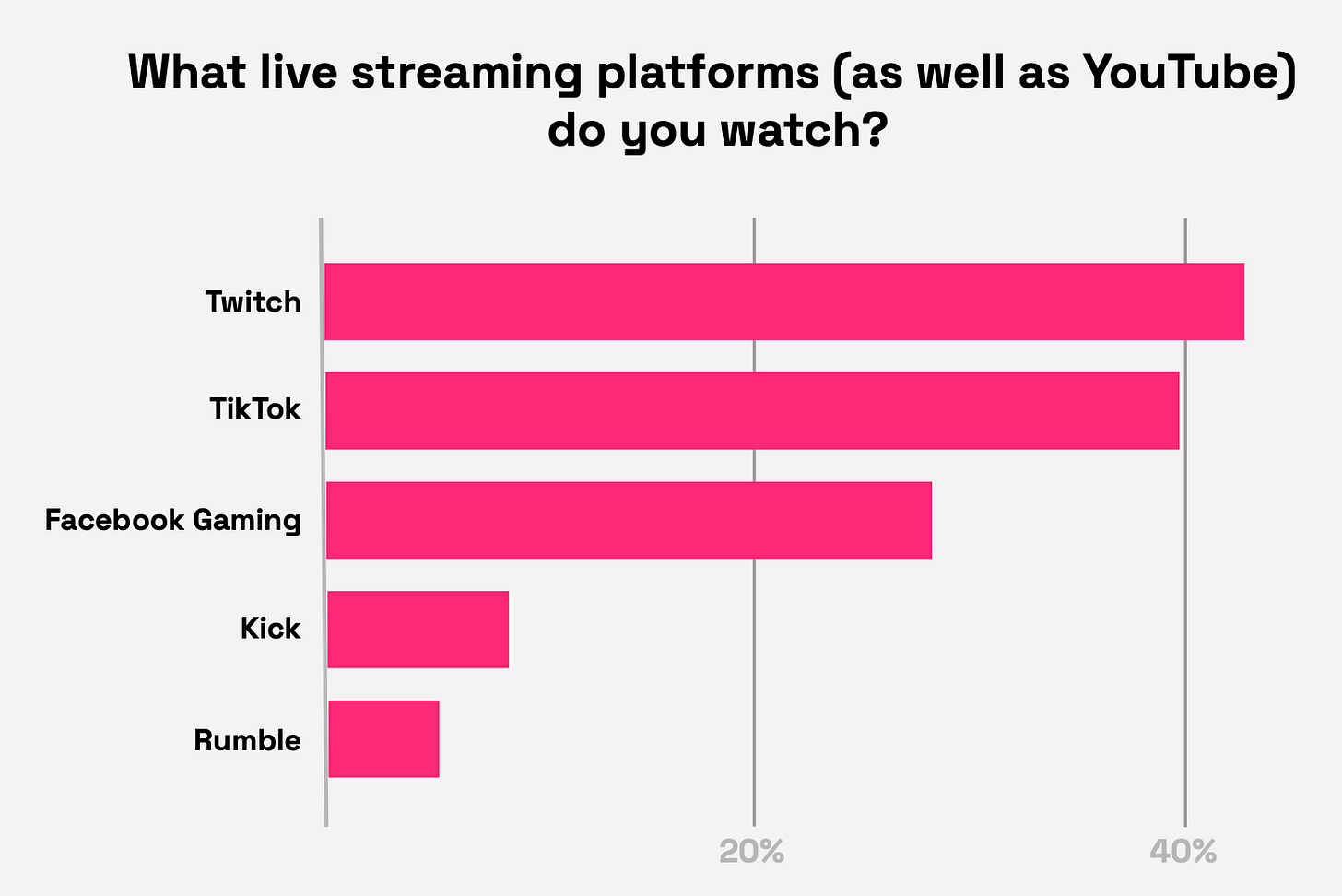

8 out of 10 gamers watch live streams. Among the audience aged 18 to 24, it's 9 out of 10.

As the survey showed, people of all genres like to watch streams. Though, they are least popular among players of puzzles, simulators, and strategies.

The influence of TikTok as a platform for watching gaming content is increasing. TikTok has closely approached Twitch (a platform specializing in this) in terms of popularity.

46% of people who named PlayStation as their main platform watch live game broadcasts on TikTok. The platform is also popular among the female audience - 41% said they watch live broadcasts there.

SocialPeta: Mobile Game Marketing in 2024

General Market Overview

In 2024, the number of advertisers in the market increased by 60.4% to 259.7 thousand companies. The growth was stronger only in 2023 (+70.1% YoY). SocialPeta expects this figure to grow even more in 2025.

The number of creatives grew by 15.4% and reached 46.2 million.

The average monthly number of advertisers in the mobile gaming market in 2024 increased by 34.7% to 66.1 thousand publishers.

At the same time, the share of new advertisers significantly decreased compared to 2024. Activity is mainly concentrated among already established companies.

Sponsored

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

Throughout 2024, the share of advertisers with new creatives increased. The share of new creatives from the total volume within the year amounted to 52.2%.

Most advertisers are in the casual segment (27.2% of the total), casino (21%), and puzzles (11.6%). Most creatives are produced by casual project authors (30.6% of the total volume), puzzles (12.2%), and RPGs (12%).

The USA is the region with the largest number of advertisers, while Hong Kong, Macau, and Taiwan are the countries with the highest average number of creatives per advertiser.

Android accounts for 74.2% of all advertisers, while iOS accounts for 25.8%. Interestingly, iOS has a higher share in some genres (board games, adventure).

Android accounts for 72.3% of all creatives on the market. The share of new creatives is almost equal between iOS and Android—49% each.

In 2024, the share of video creatives decreased (from 74.1% in 2023 to 67.2% in 2024), while static creatives increased (from 21.6% in 2023 to 27.5% in 2024).

❗️ This may be related to AI adoption.

Nevertheless, video ads remain leaders in terms of impressions volume.

Most video creatives on the market are between 15 and 30 seconds long. Most static images in advertising are square-shaped.

Leaders in 2024

Royal Match, Roblox, Last War: Survival—top-3 by IAP revenue in 2024.

Leaders by downloads—Garena Free Fire, Roblox, and Subway Surfers.

Leaders in advertising on iOS are unusual: RummyCircle, MONOPOLY GO!, and Pesta Ludo.

On Android, too, there are unexpected names among advertising leaders—Jewel Abyss, The Grand Mafia, and Block Blast!.

Glaciers Game, Rollic Game, and Phantix Games—most active advertisers in the mobile market in 2024. Out of 20 companies, 11 on the list are from China; if FunPlus is included, then it’s 12.

Marketing Trends in Key Regions

The USA is the only region where the number of advertisers decreased in 2024; however, the number of creatives grew, with casual games accounting for 35% of all creative volume.

Southeast Asia is growing rapidly in terms of advertisers—their number increased by 41.8% in 2024. SocialPeta notes that casino ranks second among advertisers in this region; other Asian countries are also growing but at slower rates.

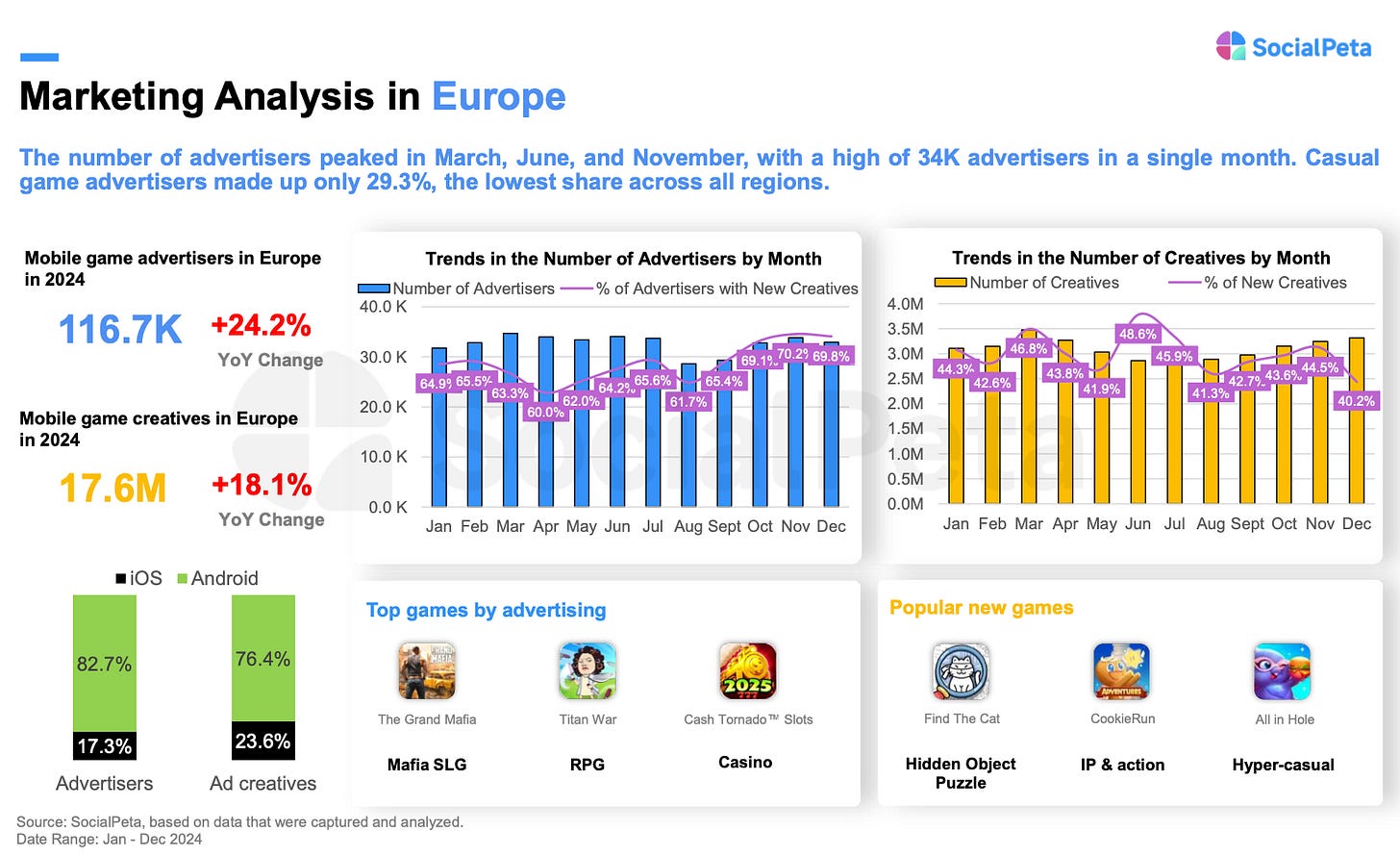

The number of advertisers significantly increased in Europe (+24.2% compared to 2023), and almost as much growth occurred in creative numbers over 2024 (+18.1%, totaling 17.6 million).

Sponsored

At Neon, customer satisfaction is at the heart of everything we do. We are committed to providing our clients with not only top-tier technology but also the hands-on support they need to succeed. Our dedicated team works closely with studios like Metacore, PerBlue, and Space Ape to ensure they get the most out of their direct-to-consumer strategies. With transparent pricing, 24/7 player support, and a focus on performance, it’s no wonder our clients rave about their experience with Neon. If you want a partner who delivers results and a truly supportive relationship, visit Neon to learn more.

The Middle East advertising market lags behind Southeast Asia or Europe regarding growth metrics.

Latin America also shows growth both in creative numbers (+35.5% YoY) and advertiser numbers (+6.2%).