Weekly Gaming Reports Recap: March 10 - March 14 (2025)

Newzoo corrected the 2024 results once again; ERA released a huge report about the UK entertainment markets (including gaming).

Reports of the week:

ERA: The UK Entertainment market in 2024 - games are no longer the largest segment

Newzoo: The Gaming Market in 2024-2027

Niko Partners - Forecast for Asia and MENA Markets in 2025

ByteBrew: What time do mobile users play Games

ERA: The UK Entertainment market in 2024 - games are no longer the largest segment

The company has shared preliminary figures previously, but now it has released a full report. The report includes data from 2015 that cover video, music & gaming segments, and I will focus on the gaming market figures.

Overall state of the Entertainment Market in the UK

The UK's combined market for music, video, and games reached £12 billion in 2024. The market has been growing since 2015.

For the first time since 2015, games are no longer the largest segment of the market. The gaming market decreased from £4.828 billion in 2023 to £4.615 billion in 2024. The video market leads with £5.002 billion in 2024.

The share of games in the UK's overall revenue decreased from 48% in 2015 to 38% in 2024. Meanwhile, the share of video content revenue grew from 34% to 42%, and the music market's share increased from 18% to 20%.

Sponsored

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

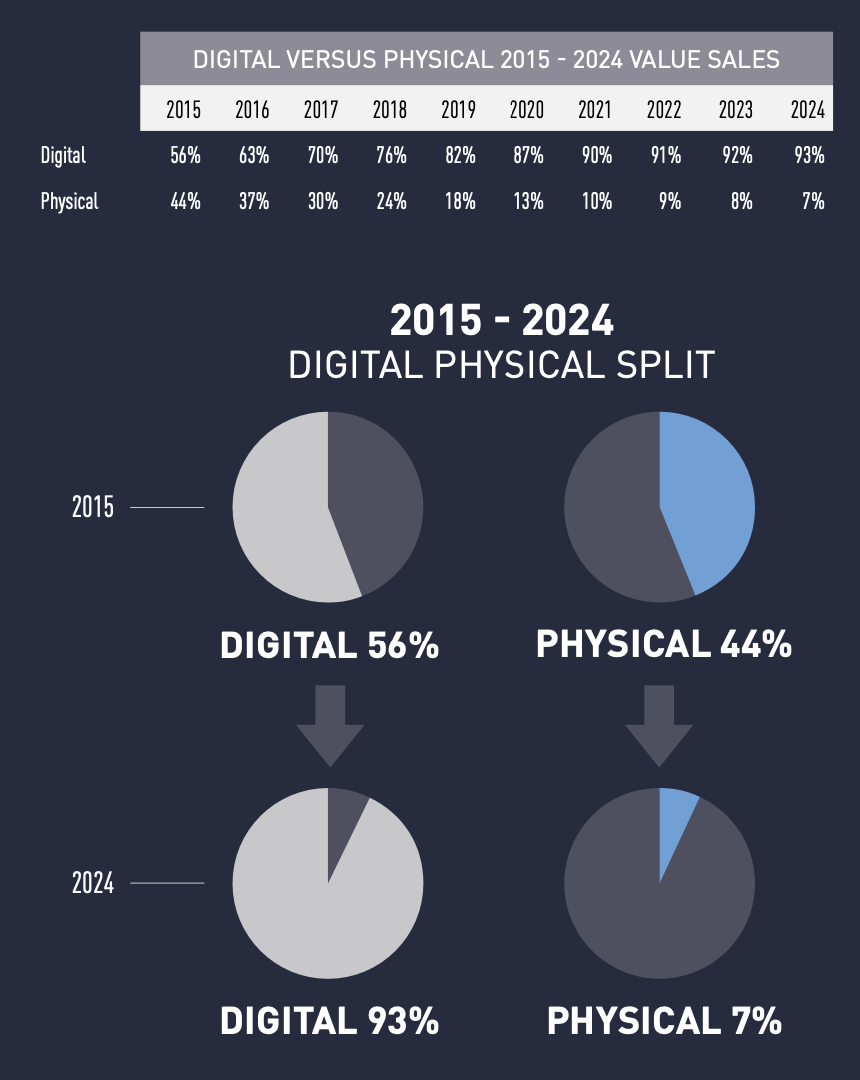

The growth in the UK's entertainment segment occurred due to digital content. In 2015, physical distribution accounted for 44% of sales, but this figure dropped to 7% in 2024.

£9.32 out of every £10 spent by British people on entertainment goes to digital content.

Digitalization had the most significant impact on the video market, with only 3% of sales coming from physical copies in 2024. In games, physical sales accounted for 7%, and in music, 14%.

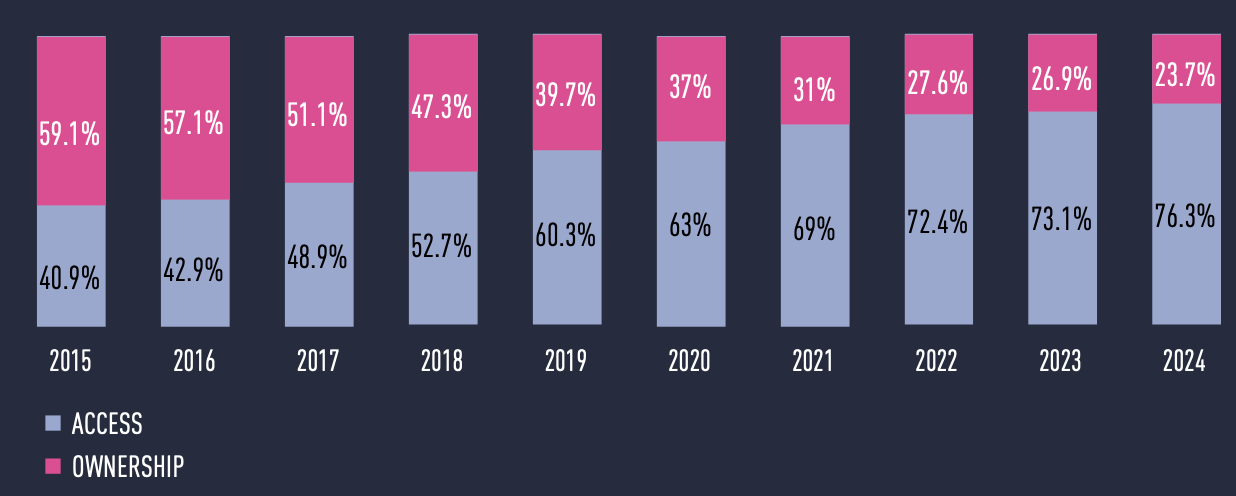

With the rise of digitalization, the share of revenue from subscription services also grew. In 2024, they accounted for 76.3% of the entire entertainment segment's revenue in the UK.

❗️ERA also provides figures for the gaming market, noting that 55% of the UK gaming market's revenue comes from content rental. The company includes the entire mobile market, including microtransactions, in "rental." I don't entirely agree with this approach, so I won't highlight these figures.

The number of retailers selling entertainment content in the UK has significantly decreased since 2015, with music stores being the most affected.

People in the UK are spending more money on leisure, both at home and outside.

However, British people spend only 3% of their funds on games, music, and video entertainment. The largest share goes to food and drinks (39%).

Gaming industry in the UK in 2024

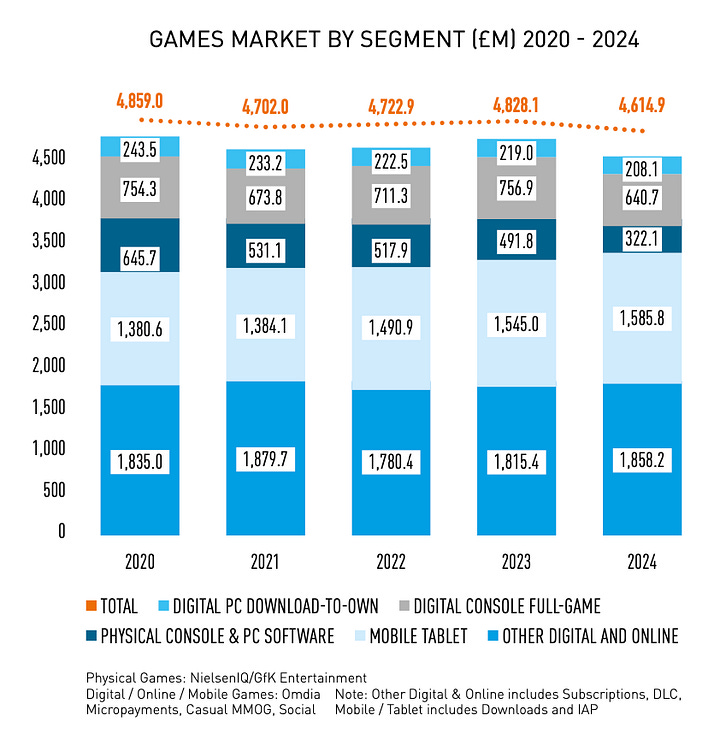

The overall gaming market size decreased by 4.4% to £4.61 billion.

Digital content sales decreased by 1% to £4.29 billion. Physical sales fell by 34.5% to £322 million. Retail sales of gaming hardware decreased by 25.5% to £693 million.

36.2% of British gamers play on mobile phones; 24.9% on home consoles, and 18.8% on PC.

PlayStation Plus (53.6% of respondents use it) and Xbox Game Pass (33.6%) are the most popular subscription services in the market.

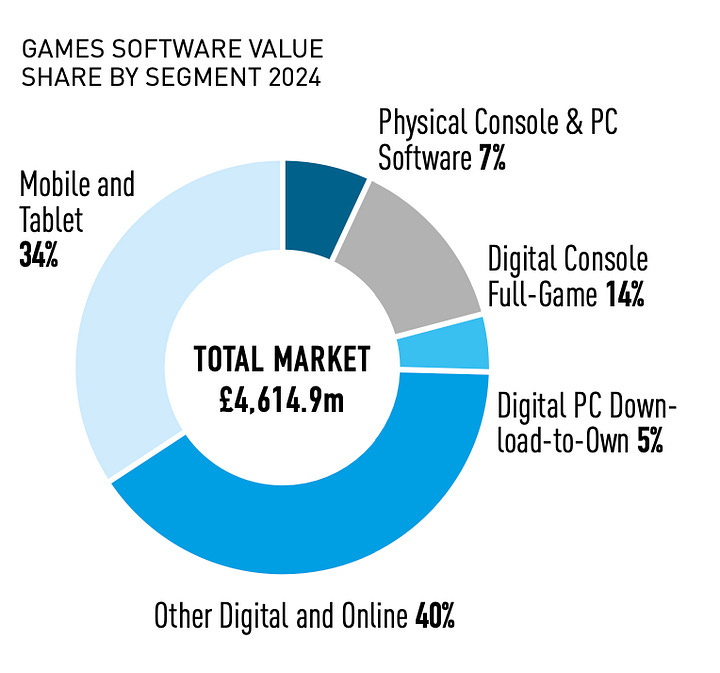

A significant portion of the UK gaming market's revenue comes from subscriptions and microtransactions in PC and console games—40%. Mobile game microtransactions are second in revenue at 34%.

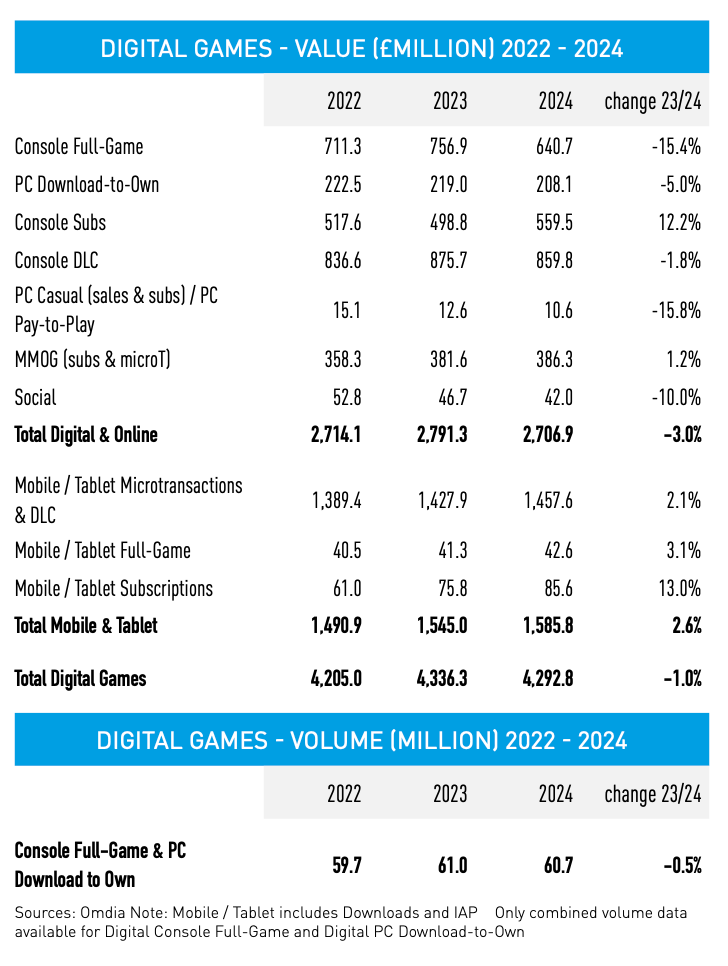

Digital Gaming Market in the UK

In 2024, spending on console subscriptions increased by 12.2% to £559.5 million.

Console game sales declined the most (by 15.4%), as did casual PC game sales (by 15.8%). The latter is a smaller segment, but poor console game sales resulted in over £100 million in lost revenue.

The mobile segment performed well in 2024, growing by 2.6% to £1.585 billion. Revenue from microtransactions increased by 2.1% (to £1.457 billion); full game sales rose by 3.1% (to £42.6 million); and subscription revenue grew by 13% (to £85.6 million).

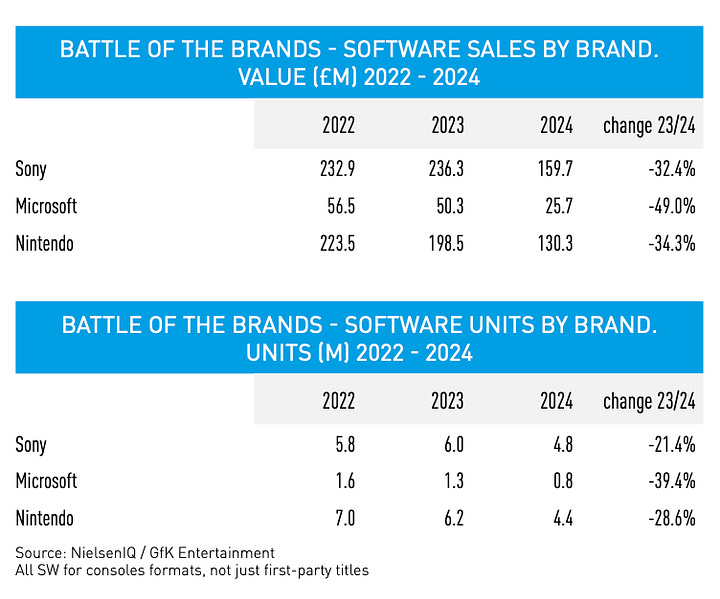

Physical Gaming Market in the UK

Home console sales in the UK fell by 34.9% in monetary terms and by 26.4% in unit numbers in 2024.

Physical game sales decreased by 34.5% in monetary terms. The PlayStation 5 accounted for 41% of all sold copies, and the Nintendo Switch accounted for 40%.

Retail gaming revenue plummeted in 2024, even compared to the negative trends of recent years.

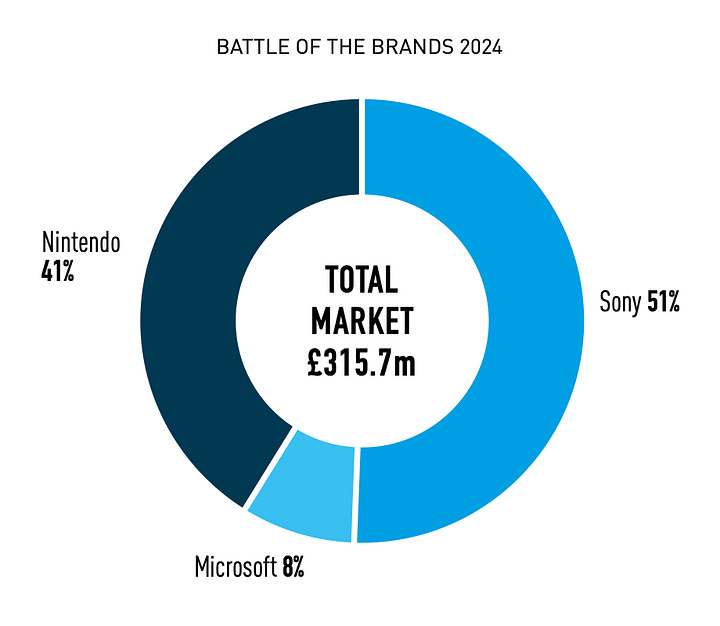

Looking at game sales, Sony holds 51% of the UK market, Nintendo has 41%, and Microsoft has 8%.

In hardware sales, the PlayStation 5 was the leading console in the UK market in 2024, accounting for 60% of all sales. The Xbox Series had 22%, and the Nintendo Switch had 18%.

One of the few bright spots in 2024 was the accessories market. Revenue increased by 13% to £602.7 million, and the number of units sold rose to 11.4 million (a 4.9% increase).

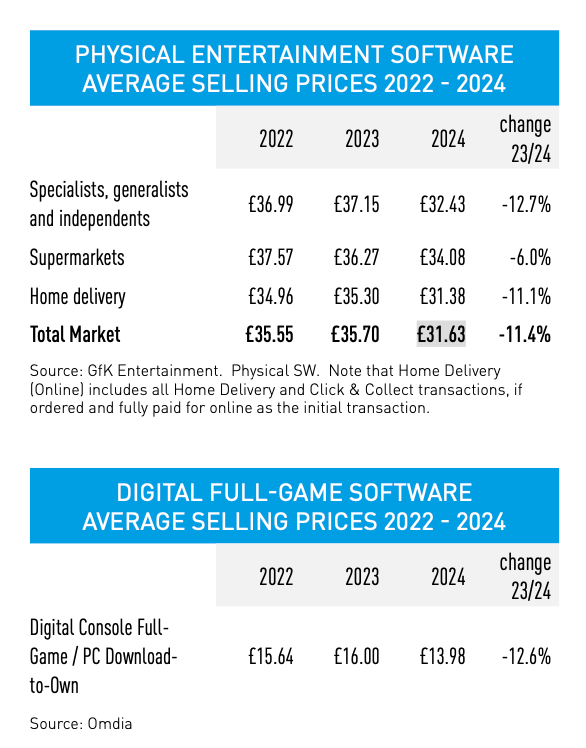

The average price of a physical game copy in 2024 decreased by 11.4% to £31.63. The average cost of a digital copy fell by 12.6% to £13.98.

❗️It's important to note that predominantly major releases (with high prices) are sold in physical format, while digital formats offer more price diversity.

Sponsored

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

2024 charts in the UK

EA Sports FC 25, Call of Duty: Black Ops 6, and Hogwarts Legacy were the best-selling games of 2024. Notably, Hogwarts Legacy had less than 50% digital sales.

The DualSense controller was the best-selling accessory in the UK market by a significant margin.

Newzoo: The Gaming Market in 2024-2027

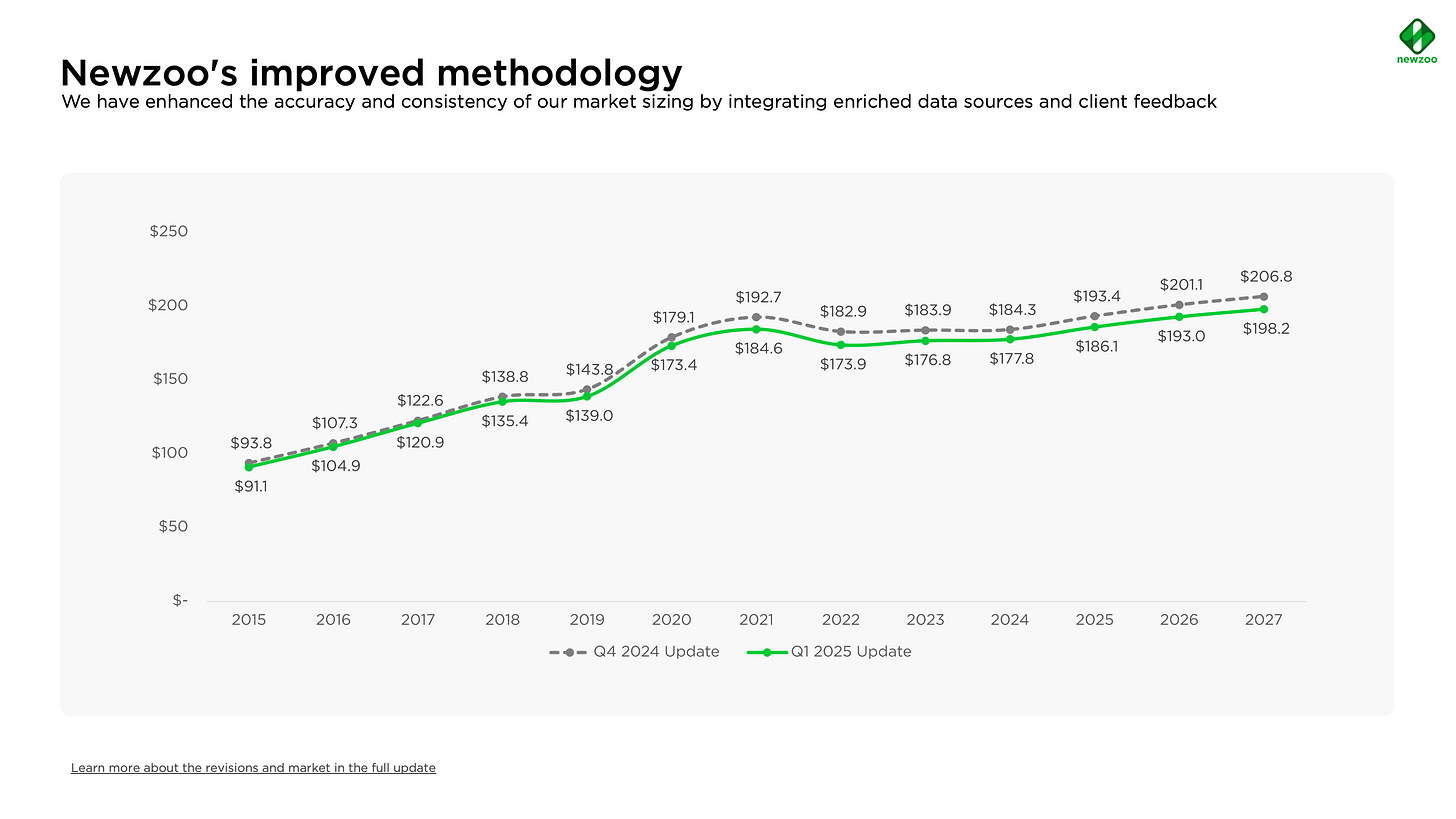

Newzoo updated its data collection methodology in Q1'25 and increased the number of sources. The figures should now better reflect reality.

Market - adjusted figures

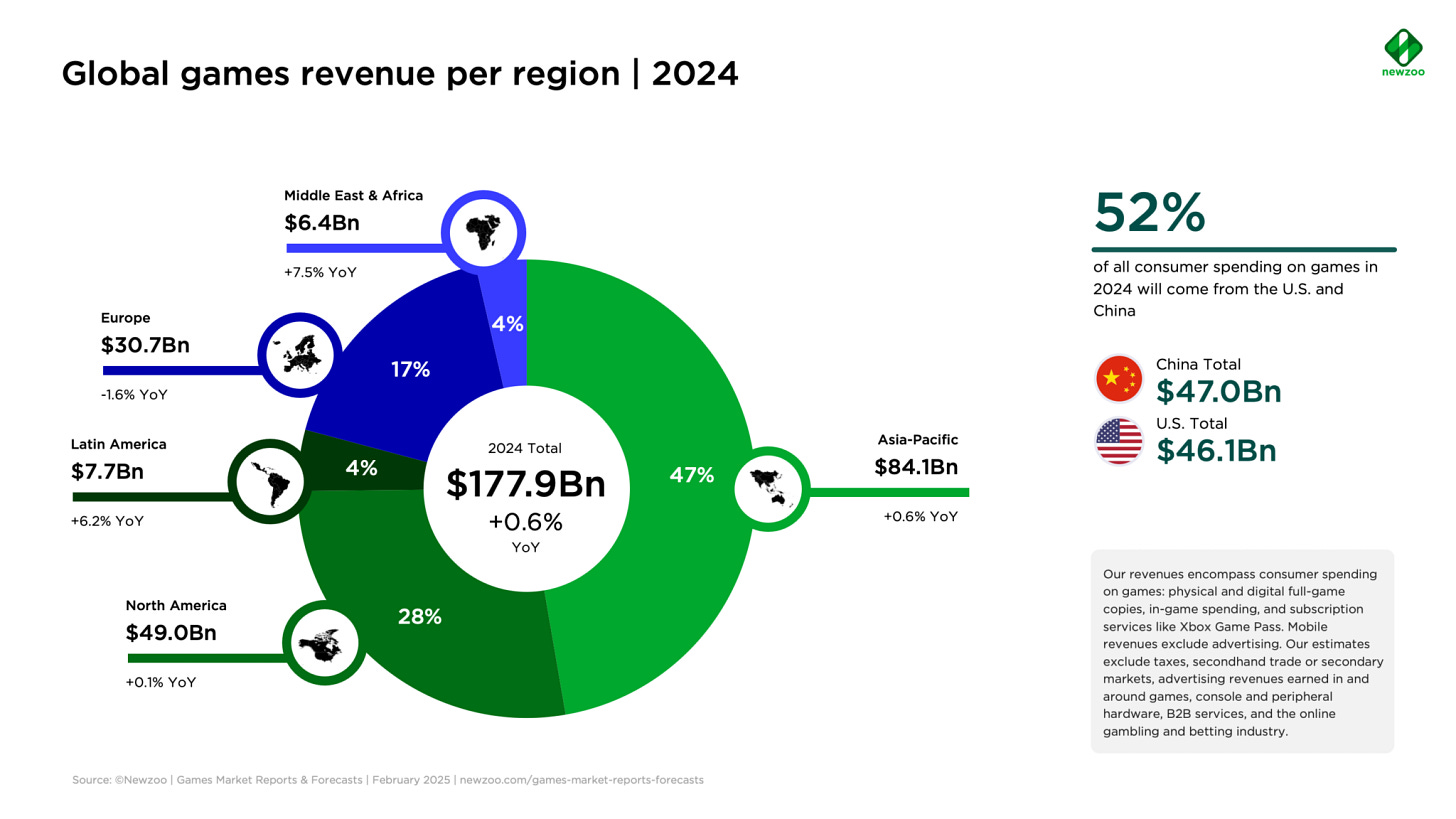

The gaming market's volume was $177.9 billion in 2024 (previously reported as $184.3 billion).

PC revenue decreased by 10% after adjustment (from $41.5 billion to $37.3 billion); console revenue decreased by 15% (from $50.3 billion to $42.8 billion); mobile revenue increased by 6% (from $92.5 billion to $97.6 billion).

Sponsored

Neon is a DTC platform built for game studios and publishers, making it easy to sell directly to your players to drive incremental revenue and higher profit margins. We’re excited to introduce Neon Loyalty, our powerful new loyalty solution, enabling game devs to reward and retain their most valuable players, while growing overall spend. With Neon Loyalty, developers can effortlessly create custom loyalty programs offering tier-based perks, personalized rewards, and exclusive benefits, driving deeper player engagement, higher spend, and sustained revenue growth, all seamlessly integrated with your existing Neon webshop or checkout experience. Check it out.

In 2024, the market grew by 0.6% compared to 2023. Considering global inflation, real revenue decreased.

The mobile gaming market grew by 2.8% due to the recovery of Western markets. The console segment fell by 3.9%. The PC market grew by 0.1%.

By the end of 2024, 52% of the total market volume came from China ($47 billion) and the U.S. ($46.1 billion). 47% of all revenue came from the Asia-Pacific region.

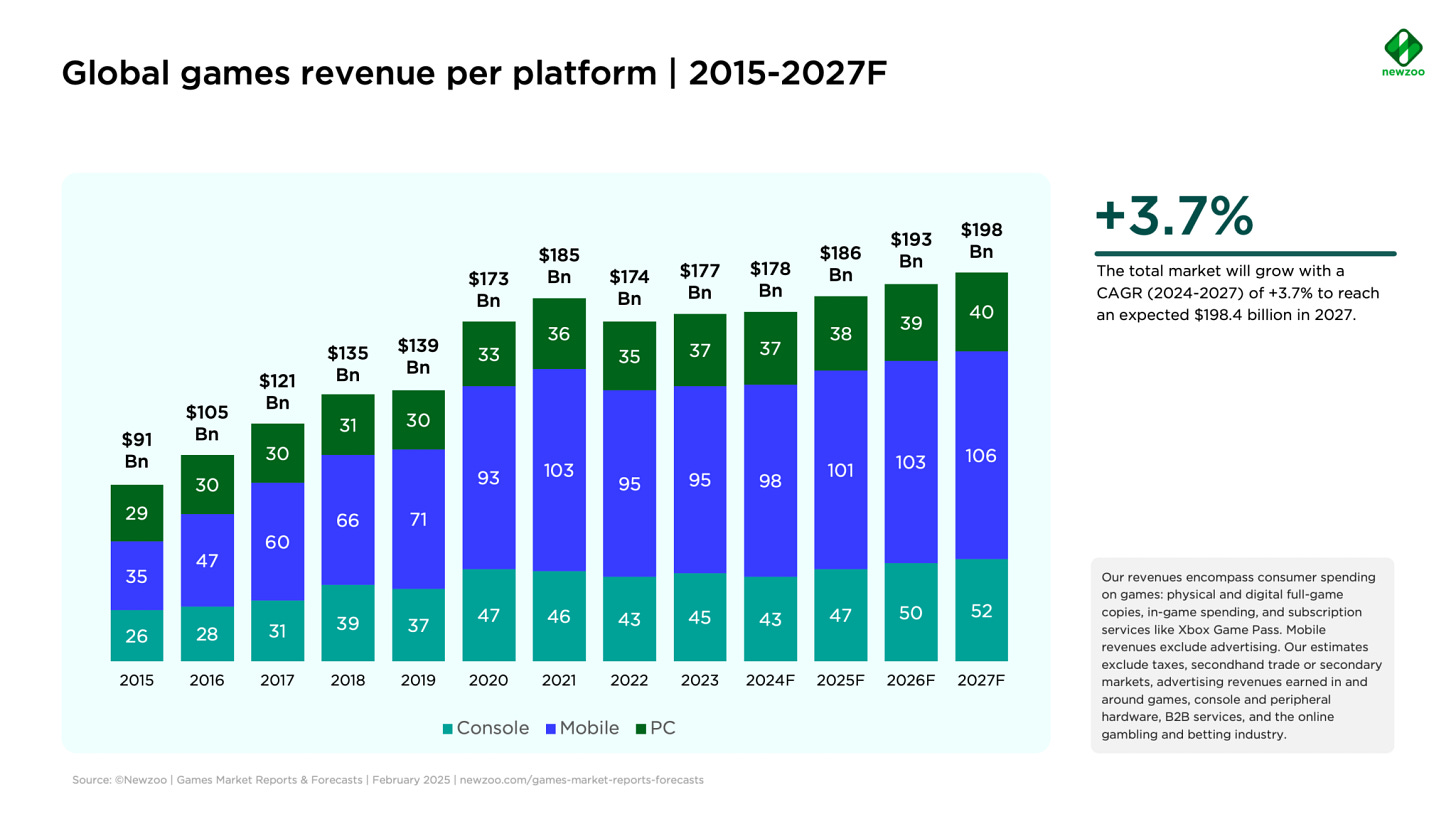

Forecast to 2027

Newzoo estimates the gaming market's annual growth prospects at 3.7% per year.

By 2027, the gaming market should reach $198B. Previously, Newzoo forecasted a volume of $206,8B.

The PC segment will grow largely organically. Newzoo notes that D2C payment methods are a potential growth point for the mobile segment. Companies will be able to pay less to intermediaries, resulting in more investment in user acquisition. The most obvious growth point for consoles is the release of Grand Theft Auto VI, which will lead to a large number of players transitioning to new consoles.

Niko Partners - Forecast for Asia and MENA Markets in 2025

The total size of the Asia and MENA markets is expected to reach $89 billion in 2025. These countries are home to 1.76 billion gamers.

Niko Partners forecasts that China's gaming market will reach $50 billion in 2025, with two-thirds of this generated by mobile games. The PC/console segment will continue to grow actively.

Thailand's market will reach $2 billion, India's market will reach $1 billion (+14.7% YoY), and the Philippines will surpass $500 million in revenue.

Niko Partners believes that major Asian markets (Japan and South Korea) will not grow in 2025. Positive figures will be seen only in 2026.

Meet the content sponsor - Neon!

Direct-to-consumer is one of the biggest opportunities in gaming today, and many studios are making the move. But with so many vendors claiming the same benefits, and the complexities of payments, security, and optimization, it’s tough to know who to trust. That’s where Neon stands out. Our webshop, checkout, and merchant-of-record solutions are not just feature-rich. They deliver real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because our tech drives better conversion rates, incremental revenue, and higher profit margins.

But performance is just one part of the equation. We take partnership seriously by offering expert guidance, hands-on assistance, 24/7 player support, and the transparency studios need to navigate DTC with confidence. There are no hidden fees and no unreliable timelines. Just a team that is committed to helping you win. If you are ready to maximize your success, visit Neon to learn more and book a demo.

More than one billion gamers in Asia and MENA watch gaming and esports streams, which is one of the main ways to discover new projects and markets in these regions.

Niko Partners expects the console segment of the market to outpace the growth of mobile and PC segments in 2025. Two reasons for this: Grand Theft Auto VI and Nintendo Switch 2.

Analysts at the company are confident that tariffs on products from China will not affect gaming consoles.

The company also shared the accuracy of its forecasts for previous periods. Niko Partners overestimated the mobile market but underestimated the PC market.

ByteBrew: What time do mobile users play Games

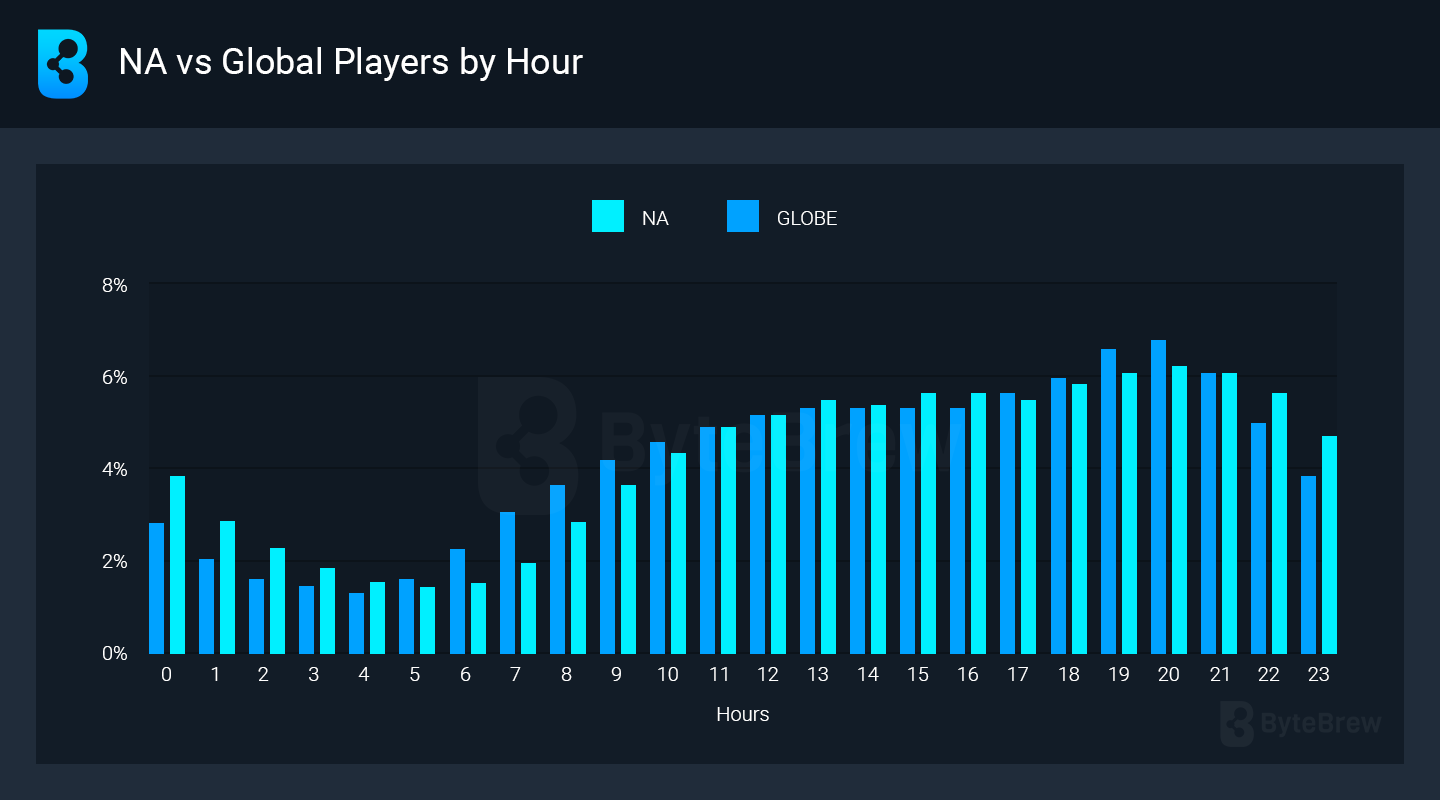

The analytics platform analyzed over 1 billion active users across 185 countries. For regions, data variability is +/- 1 hour of timezone.

Peak user activity occurs at 8 PM, with the least activity at 4 AM.

The company recommends launching in-game events between 2 PM and 4 PM UTC, as users are most active during this time.

User Behavior in North America

In North America, the most active hours are from 7 PM to 9 PM.

Compared to the rest of the world, North American users play 40% more often between midnight and 2 AM.

Meet the newsletter sponsor!

Neon is the direct-to-consumer partner you can trust. We know the games industry is a tough business. That’s why we work closely with our clients, offering hands-on assistance, dedicated player support, transparent pricing, and reliable technology that delivers real results. Studios like Metacore, PerBlue, and Space Ape choose Neon because we are invested in their success. If you need a partner who puts your business first, visit Neon to learn more.

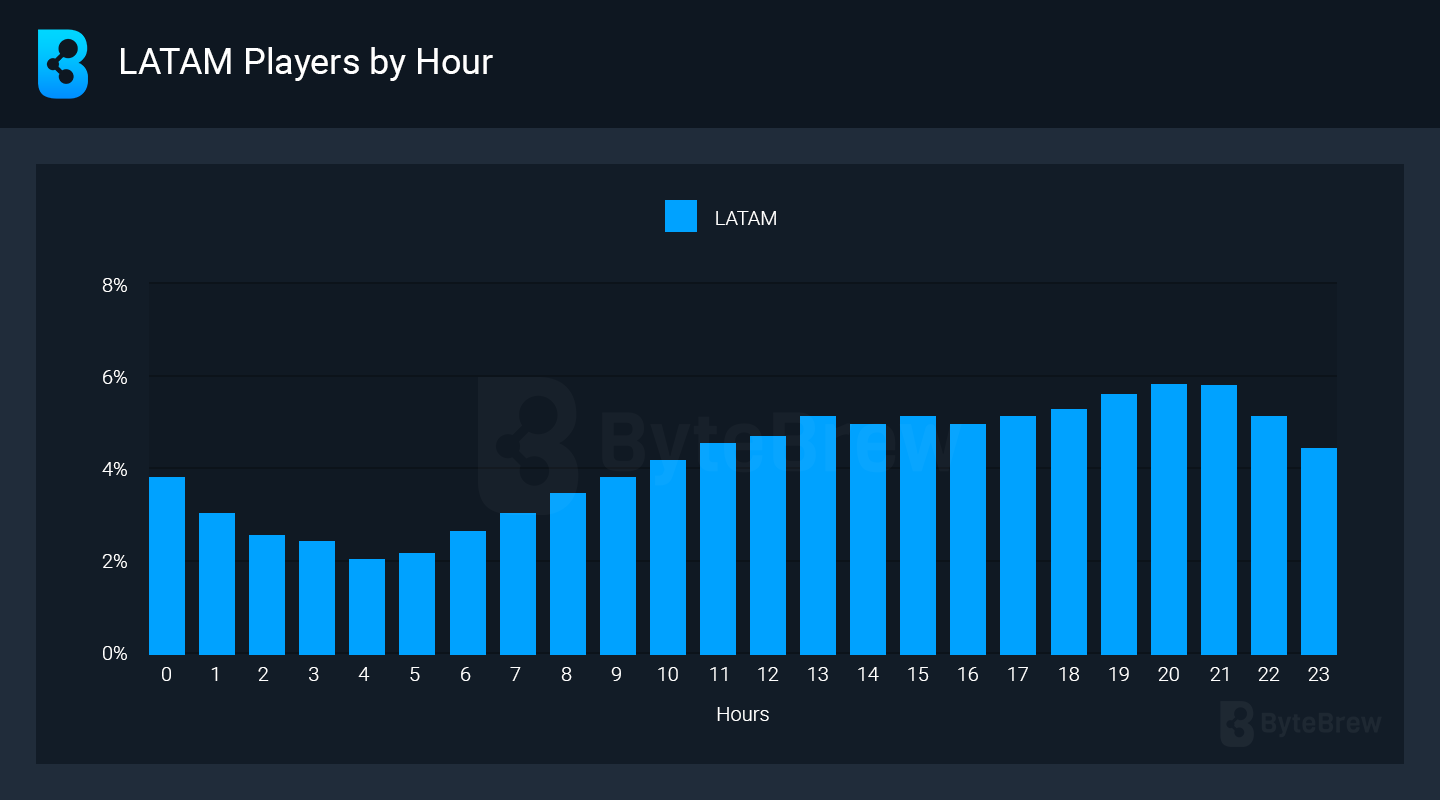

User Behavior in Latin America

In Latin America, user activity increases in the early morning hours, starting around 5-6 AM.

In Latin America, 65% more people play during late-night hours (from 1 AM to 4 AM).

User Behavior in the EMEA Region

Players in the EMEA region play significantly less at night and in the morning compared to global trends.

From 4 AM to 7 AM, user activity in the EMEA region is 46% lower than global trends.

User Behavior in the Asia-Pacific Region

The peak activity hour in the APAC region occurs earlier than in other regions, at 7 PM.

During peak hours, Asian users play 7.2% to 10% more than in other regions. They are also more active from 6 AM to 7 AM (by about 27%). This is offset by reduced activity during late-night hours (from midnight to 2 AM).