Weekly Gaming Reports Recap: May 19 - May 23 (2025)

US market status in April by Circana; long-tail sales on Steam by GameDiscoverCo.

Reports of the week:

GameDiscoverCo: Games' long tail revenue on Steam in 2024

Games & Numbers (May 7 - May 20, 2025)

Circana: The US gaming market continues declining in April'25

GameDiscoverCo: Games' long tail revenue on Steam in 2024

Simon Carless and his team calculated how first-week sales on Steam compare to first-year sales. GameDiscoverCo already conducted a similar study in April 2024, which included over 100 games. This time, the study covered all games released on Steam in 2023.

Lethal Company (first-year revenue 507x first week), Class of ‘09: The Re-Up (first-year sales 106x first week), and Pizza Tower (first-year sales 22.5x first week) are the games with the longest revenue tail among all new projects in 2023.

If you look for patterns, the long revenue tail is mostly found in viral projects and in games with co-op and multiplayer modes that are supported by streamers.

❗️It’s important to note that the projects above are not the top earners, but those with the highest first-year to first-week revenue ratio. For the most part, these are indie projects that weren’t widely known before launch. It’s much harder for AAA projects to achieve such multipliers.

The more pre-orders a project has, the lower the first-year to first-week revenue ratio. The size of the potential audience also affects the ratio.

Projects that failed to meet audience expectations have poor ratios. Notable examples: Redfall and Payday 3.

The median first-year to first-week revenue ratio among all games released in 2023 is 2.64x. For projects that sold more than 1,000 copies in the first week, the median increases to 2.69x.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

In the April 2024 survey, the median ratio was 3.16x. This may be due to sampling specifics.

The highest long-tail revenue ratio is seen in projects with sales over 10,000 but under 50,000 copies - 3.6x. The lowest ratio is in projects that sold over 100,000 copies in the first week - 2.61x (this is directly related to pre-orders).

If you look at units sold instead of revenue, the situation is similar. The median number of copies sold in the first year compared to the first week ranges from 2.68x (for projects with 100,000+ first-week sales) to 3.77x (for projects with over 10,000 but under 50,000 first-week sales). The difference in ratios between revenue and units sold is about 5-7%.

GameDiscoverCo looked at projects priced over $4.99 and that sold more than 100 copies in their first week on Steam, and prepared benchmarks. There’s a 50% chance to sell 2.47x your first-week sales in the first year. There’s only a 5% chance of selling 9.67x more than your first week.

Games & Numbers (May 7 - May 20, 2025)

PC/Console Games

In its latest financial report, Electronic Arts announced that Split Fiction sales have nearly reached 4 million copies.

Clair Obscur: Expedition 33 sold over 2 million copies within 12 days of release.

The Citizen Sleeper series has attracted over 2 million players. Some projects in the series are free, so it’s hard to judge commercial success.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The new GTA VI trailer is breaking records. On its first day, it was watched over 475 million times across all platforms. Spotify also reported that streams of the trailer’s music (The Pointer Sisters - ‘Hot Together’) jumped by 182,000%.

Mobile Games

Roblox earned $1.04 billion in Q1 2025. The project’s DAU reached 97.8 million, a 26% year-over-year increase. Users spent 21.7 billion hours in-game (+30% YoY). The number of paying users grew by 29% YoY to 20.2 million.

Royal Kingdom surpassed $100 million in revenue — this figure includes the soft launch period. According to AppMagic, the project has been growing for 6 consecutive months.

Grunt Rush by Steer Studios surpassed 1 million installs. For many developers at the studio, this is their first commercial project.

Platforms

According to Joost from Superjoost, in 2024, Valve earned $3.2 billion in Steam commissions. This represents the highest amount in the past 10 years.

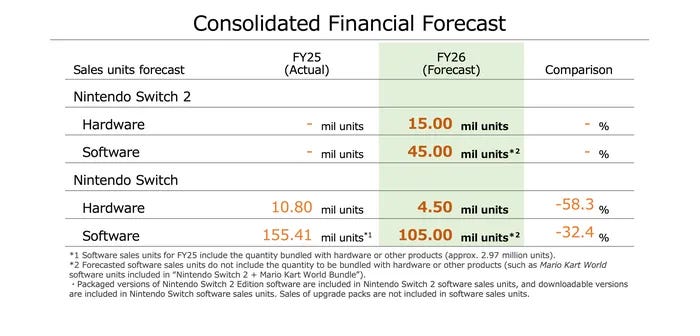

Nintendo plans to sell 15 million Nintendo Switch 2 units in the first 9 months. The plans are confirmed in the annual report.

Circana: The US gaming market continues declining in April'25

Overall market status

The U.S. gaming market continues its negative trend from recent months. Sales in April reached $4.1 billion, down 3% year-over-year.

Content sales declined by 2% YoY to $3.7 billion. Growth was seen in non-mobile subscriptions (+18% YoY) and digital game sales on consoles (+16% YoY).

Consumer spending on gaming hardware fell 8% YoY to $186 million, marking the lowest dollar amount since July 2020.

PlayStation 5 dollar sales dropped 5% in April, but the system still leads in both revenue and units sold. Nintendo Switch sales fell 37%, while Xbox Series S|X grew by 8%.

Spending on accessories in April declined 2% YoY to $166 million. DualSense Midnight Black was the top accessory of the month.

In the first four months of 2025, total industry revenue is 8% behind the same period in 2024. Aggregate user spending for this period reached $17.8 billion.

Game Sales

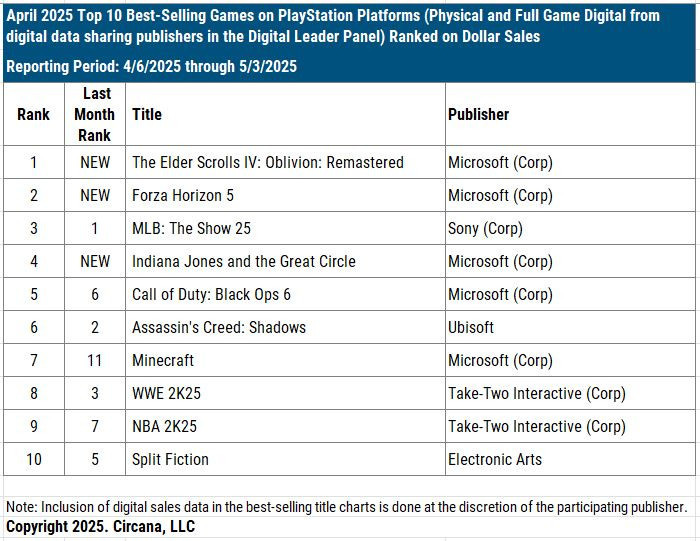

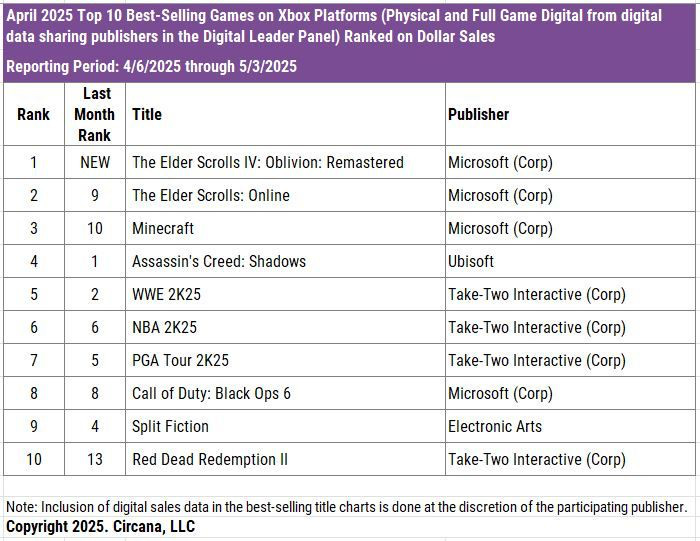

The Elder Scrolls IV: Oblivion Remastered was the best-selling game in April. Forza Horizon 5 (boosted by its PlayStation 5 launch) ranked second, and MLB: The Show 25 was third (digital sales on Nintendo and Xbox not included).

Oblivion Remastered immediately became the third-best-selling game of 2025. It sold more copies in April 2025 than the original did in its first 15 months after the 2006 launch, and earned more revenue in less than a month than the original did in its first 14 months.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Four of the top five best-selling games in April in the U.S. were published by Microsoft.

Indiana Jones and the Great Circle saw a significant sales jump, leaping from 118th to 6th place, thanks to the PlayStation 5 release.

Clair Obscur: Expedition 33 did not make the top 20. The absence is due to the publisher not providing digital sales data to Circana; physical sales placed it at 22nd on PlayStation.

Top mobile projects in the U.S. in April were MONOPOLY GO!, Royal Match, and Candy Crush Saga.

Mobile game revenue dipped slightly in March, but leaders continued to perform well. Gossip Harbor: Merge & Story was the fastest-growing, with revenue up 9.8% in April.

Platform Rankings

Five of the ten best-selling PlayStation games in April in the U.S. were published by Microsoft. This benefits both companies: Microsoft expands its audience, while Sony profits from commissions and strengthens its platform position.

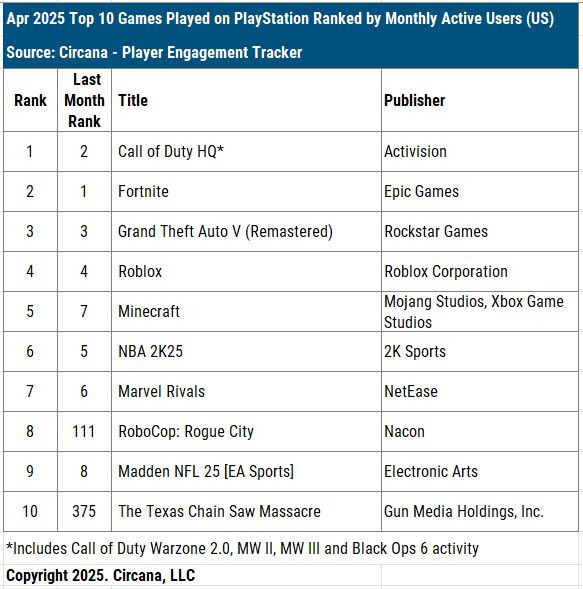

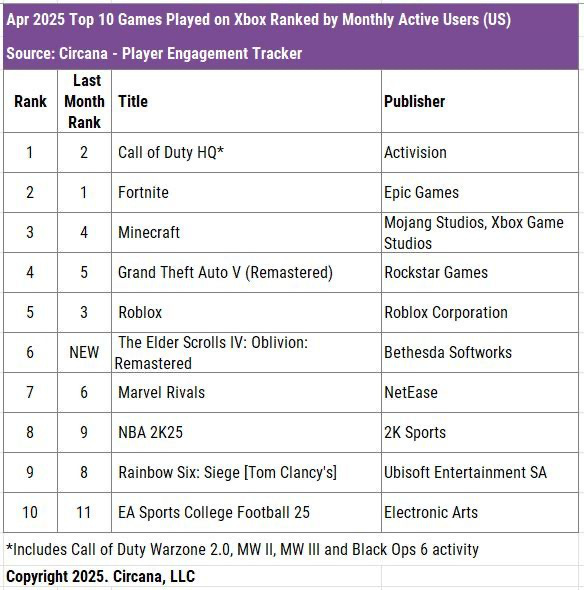

Call of Duty HQ led MAU (monthly active users) on both PlayStation and Xbox. RoboCop: Rogue City and The Texas Chain Saw Massacre saw strong MAU growth due to their inclusion in PS Plus.

On Xbox, The Elder Scrolls: Online jumped to 2nd place in sales, and Minecraft to 3rd.

The Elder Scrolls IV: Oblivion Remastered entered the Xbox MAU ranking, having launched day one on Game Pass.

On Nintendo, the only new top-10 entry was The Hundred Line: Last Defense Academy; otherwise, the chart was stable.

Steam’s top MAU titles were Schedule I, R.E.P.O., and Counter-Strike 2. Oblivion Remastered debuted at 5th, and Path of Exile II performed well in April.