Weekly Gaming Reports Recap: May 26 - May 30 (2025)

A comprehensive report on US mobile users from Mistplay and AppsFlyer, as well as Newzoo's coverage of the top-20 PC and console titles in April.

Reports of the week:

Mistplay & AppsFlyer: Players in Mobile Games in the US in 2025 & Loyalty Index

Newzoo: Top 20 PC/Console Games by Revenue and MAU (April'25)

Mistplay & AppsFlyer: Players in Mobile Games in the US in 2025 & Loyalty Index

Mistplay surveyed 4,500 mobile players in the US over the age of 18.

AppsFlyer provided engagement and monetization metrics in the US for 2023 and 2024. Each metric (D30 Retention, Average Spend Per User, D30 Spenders, Time to First Purchase) was indexed relative to the best result in the category, then genres were averaged across all four metrics for each platform. After that, the result was averaged across platforms—this is how the loyalty ranking was created.

GameDev Reports is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Paying users are those who have made purchases in the last 6 months.

The report also introduces 5 user personas, each matching a set of genres these users typically play.

Loyalty Ranking in 2025

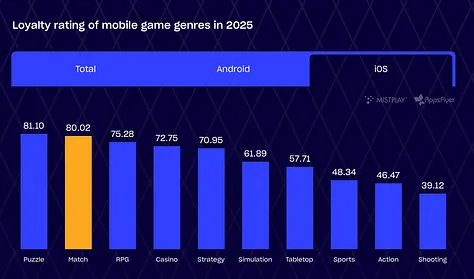

Loyalty index leaders are puzzles (85), RPGs (75), and strategy games (71).

On Android, the top 3 are puzzles (88.04), board games (75.17), and RPGs (74.04). On iOS—puzzles (81.1), match games (80.02), and RPGs (75.28).

Looking at individual metrics, board games lead in D30 Retention on Android. On iOS, match games are in first place.

For ASPU (Average Spend Per User), strategy games lead on both platforms.

Puzzles lead on both iOS and Android in terms of the number of payers on day 30 and time to first purchase.

Factors Influencing Installs and Playtime

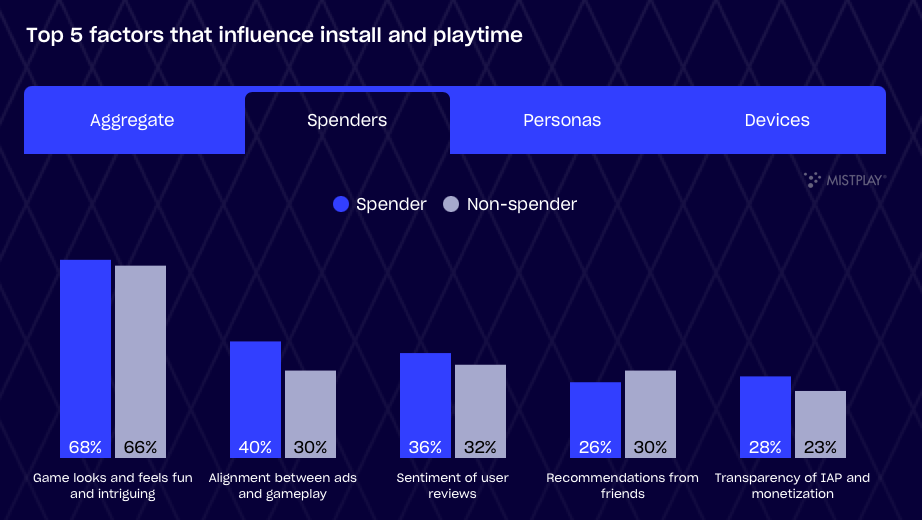

The key factor influencing downloads and user engagement is interesting gameplay, noted by 67% of respondents. Also important are ad-gameplay consistency (36%), reviews (34%), friend recommendations (27%), and transparency of in-game purchases.

For paying users, ad-gameplay consistency is slightly more important.

By device, gameplay matters more to Android users. Surprisingly, for them, it’s almost twice as important that ads show the actual gameplay.

Most users want tangible loyalty bonuses (67%). Next are additional in-game resources (57%), exclusive items (50%), and VIP events.

49% of users have played their favorite game for over a year, 38% for less than a year. 10% play for less than a month, and 3% for less than a week.

One might assume loyalty programs are especially important for paying users, but in reality, there’s almost no difference from the average.

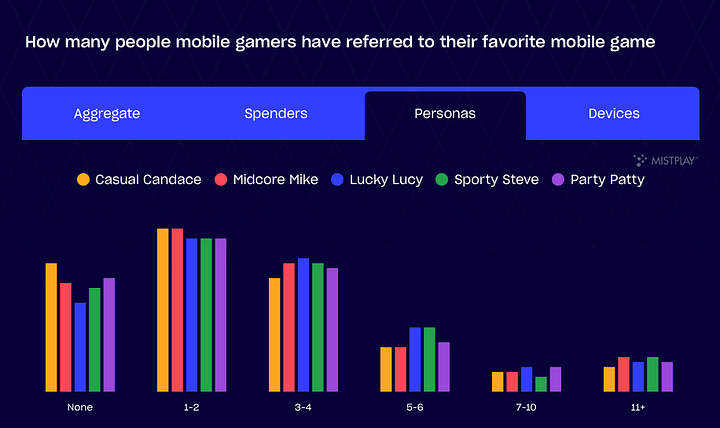

Most users recommend their favorite games to 1–4 people. 28% don’t recommend their favorite games to anyone.

Monetization Metrics

Puzzles lead all genres in average share of payers on day 30 (7.06% on Android and 7.82% on iOS).

It’s also notable how much the share of payers on day 30 has grown: Android (+89% YoY), iOS (+253% YoY) compared to 2023. This suggests updated monetization mechanics are working.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The number of payers in action games on iOS has nearly doubled. However, in strategy, RPG, and simulation games, the number of payers has decreased.

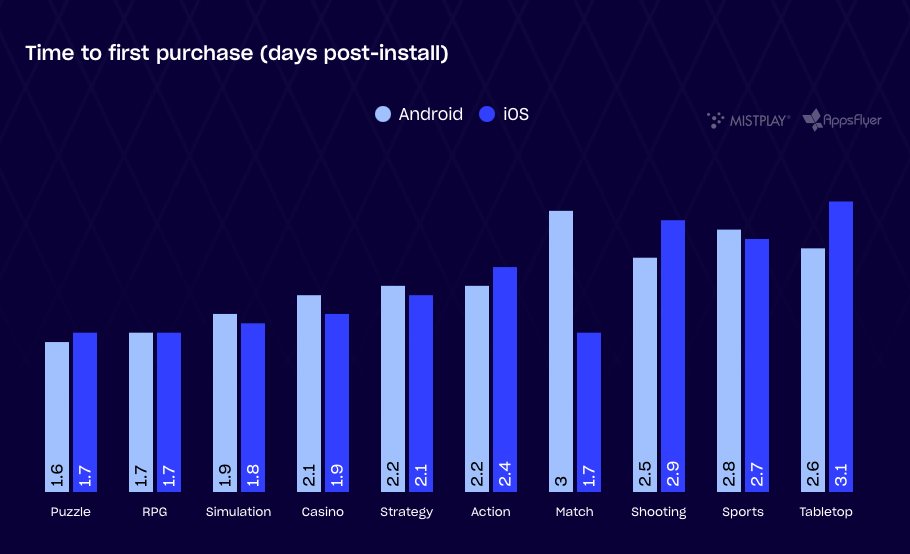

Users make their first purchase fastest in puzzles (1.6 days on Android; 1.7 days on iOS), RPGs (1.7 days), and simulations.

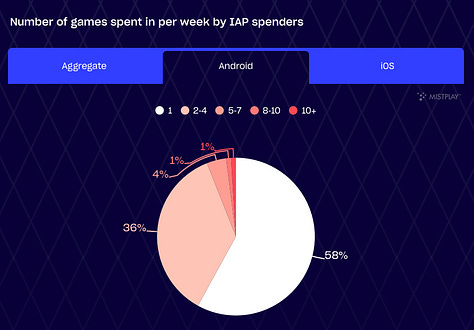

Most paying users (56%) play only one game. On iOS, this percentage is slightly lower (44%).

27% of paying users on iOS play more than 5 games a week. On Android, this figure is much lower—6%.

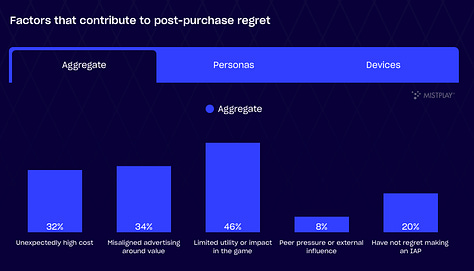

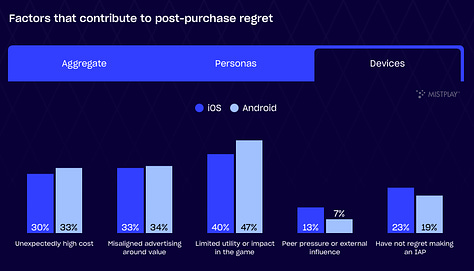

The most common reasons for regret after IAP purchases are limited impact on gameplay (46%), mismatch between value and ad promises (34%), and too high a price (32%).

Engagement Metrics

Highest D30 Retention by genre is in board games (5.09% on Android and 8.13% on iOS). Next are match games, puzzles, casinos.

Genres leading in sessions per user per day are strategy (over 4 sessions/day), match, and RPG.

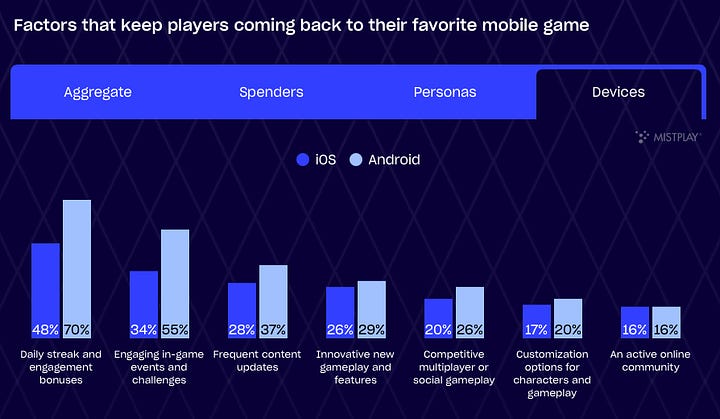

Most common reasons users return to their favorite mobile games are to get engagement bonuses (64%), in-game events (50%), and frequent content updates (34%).

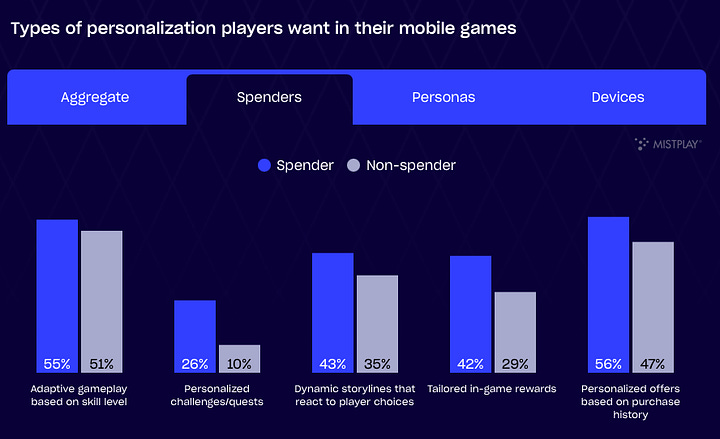

54% of users would like to see adaptive gameplay that adjusts to player skill. The same percentage would like unique personalized quests. 41% want to influence the storyline, and 39% want to receive personalized in-game rewards.

Newzoo: Top 20 PC/Console Games by Revenue and MAU (April'25)

Newzoo tracks the markets of the US, UK, Spain, Germany, Italy, and France.

Revenue – All Platforms

Three new titles entered the top 20 for April: The Elder Scrolls IV: Oblivion Remastered (2nd place), Clair Obscur: Expedition 33 (13th place), and RuneScape: Dragonwilds (19th place).

Forza Horizon 5 saw a significant sales boost, jumping to 9th in the charts thanks to its PlayStation 5 release.

There are two indie games in the top 20 sales for April: Schedule I (5th place) and R.E.P.O. (20th place).

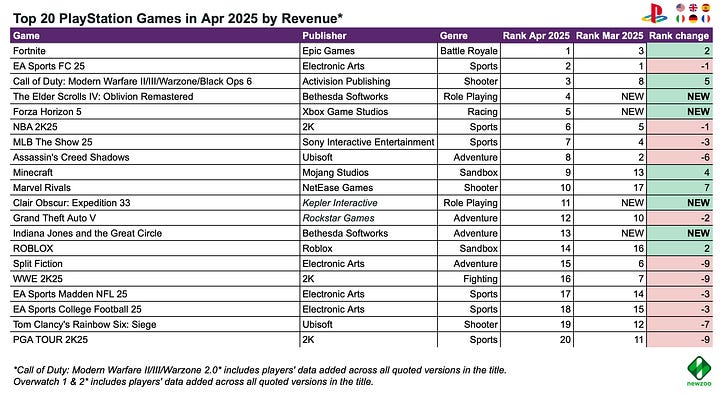

Revenue – Individual Platforms

Microsoft projects dominate PlayStation chart. Three out of four new entries are from Microsoft studios: The Elder Scrolls IV: Oblivion Remastered (4th place), Forza Horizon 5 (5th place), and Indiana Jones and the Great Circle (13th place). Clair Obscur: Expedition 33 was the only new non-Microsoft game in the list.

On Xbox, there’s only one new entry in April’s chart: The Elder Scrolls IV: Oblivion Remastered.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

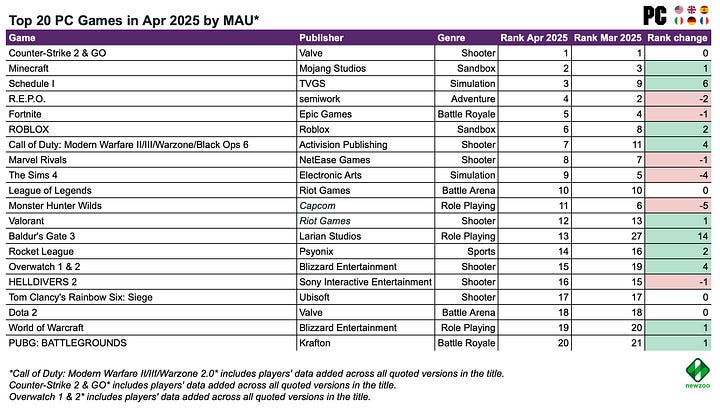

On PC, The Elder Scrolls IV: Oblivion Remastered (2nd place), RuneScape: Dragonwilds (9th place), Clair Obscur: Expedition 33 (14th place), and The Last of Us: Part II (16th place) are new games in the top in April.

No new entries in the Nintendo Switch chart for April.

MAU – All Platforms

The Elder Scrolls IV: Oblivion and its remaster are counted together in Newzoo’s methodology, causing the game to skyrocket by 12,285 positions to 14th in the ranking.

The leaders remain the same: Fortnite, Call of Duty HQ, and Minecraft.

Thanks to PS Plus, The Texas Chain Saw Massacre (16th on the PlayStation ranking) and RoboCop: Rogue City (17th) climbed in the rankings. On Xbox, for the same reason, South of Midnight reached 16th place.