Weekly Gaming Reports Recap: November 3 - November 7 (2025)

October performance on Mobile (by AppMagic) & PC/Console (by GameDiscoverCo); Kickstarter insights & more!

Reports of the week:

AppMagic: Top Mobile Games by Revenue and Downloads in October 2025

GameDiscoverCo: The State of Steam Wishlist Conversions (2024–2025)

Games & Numbers (October 22 – November 4, 2025)

Adjust: The Mobile Market of Türkiye in 2025

Kickstarter in 2025 and before

GameDiscoverCo: Top releases of October 2025 on PC and consoles

AppMagic: Top Mobile Games by Revenue and Downloads in October 2025

AppMagic reports revenue figures net of store commissions and taxes. Revenue from Android stores in China is not included.

Revenue

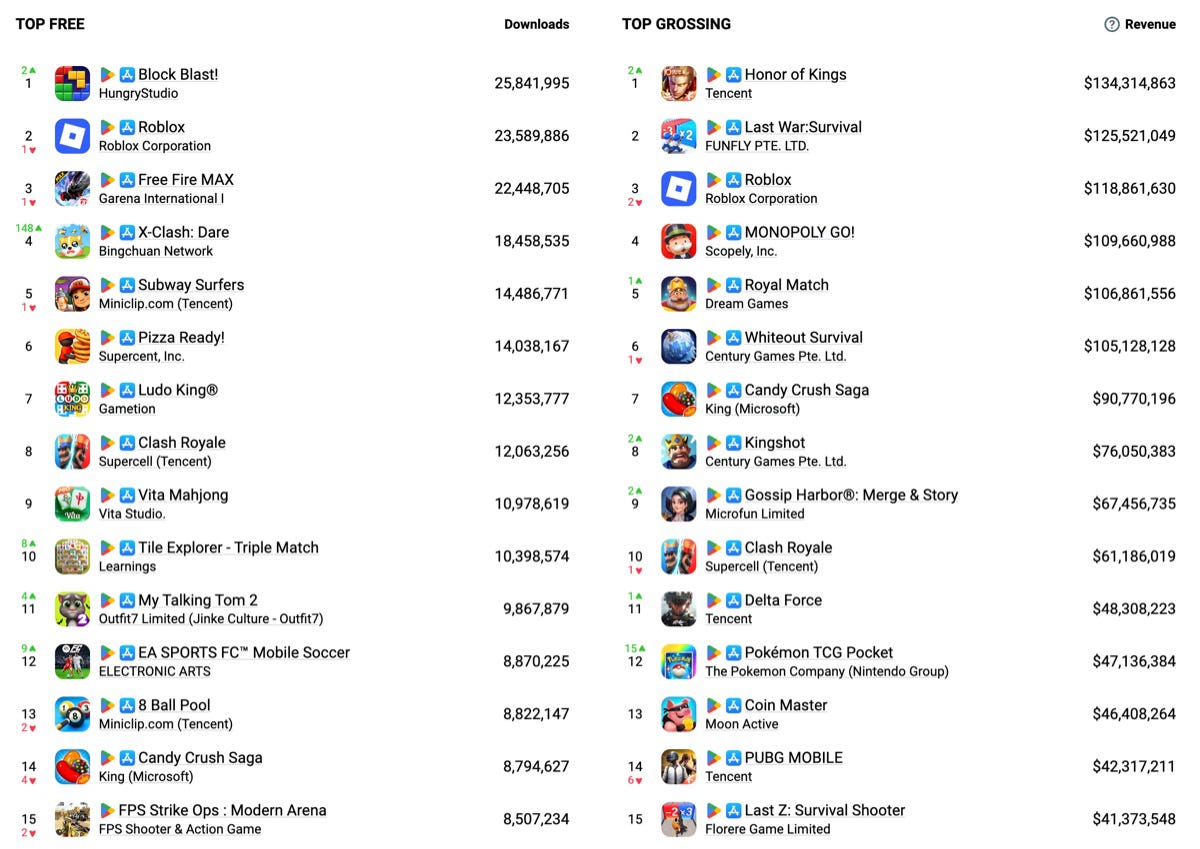

Honor of Kings returned to the top of the revenue chart, earning $134.3 million in October. 98% of all revenue tracked by AppMagic came from the Chinese iOS version.

Last War: Survival ($125.5 million, #2) and Roblox ($118.8 million, #3) both maintained strong results.

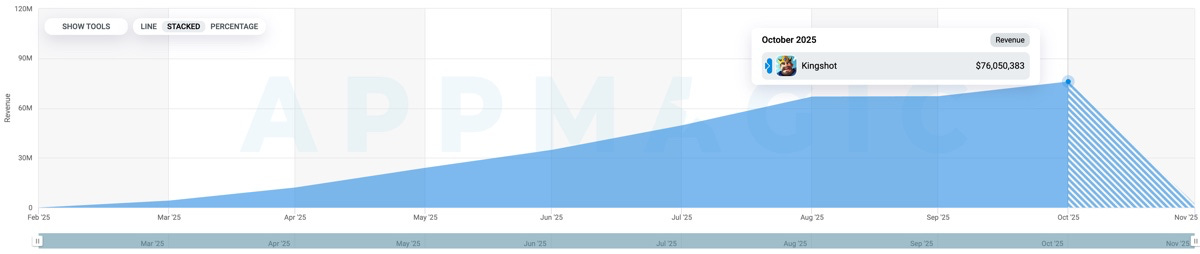

Kingshot had an excellent month, generating $76 million in October - the best in the project’s history.

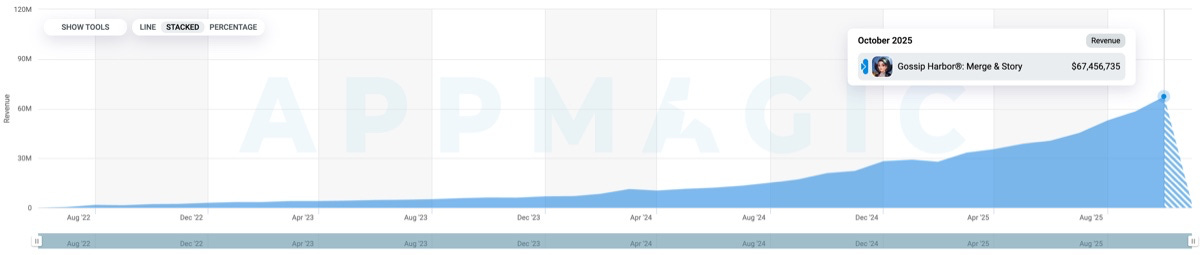

Gossip Harbor: Merge & Story entered the top 10, earning $67.4 million in October - also a record high. The project continues to show aggressive growth, with a revenue curve any studio would envy.

Delta Force performed well ($48.3 million, with 97% from Chinese iOS), as did Pokémon TCG Pocket ($47.1 million, boosted by a successful update).

A word from our sponsor

Launch a fully branded web shop for your game in just one day with Xsolla’s Storefront - powered by AI for lightning-fast, 5-second site generation and simple drag-and-drop customization. Create native, game-like player experiences at any scale, localize instantly into 26 languages, adapt pricing for every region, and apply geo-restriction controls.

Effortlessly A/B test offers and layouts, go live with one click, and track results with built-in analytics for maximum player engagement and revenue growth.

Webshops are fast with Xsolla - join now!

Downloads

Block Blast! (25.8M installs), Roblox (23.6M) and Free Fire MAX (22.4M) were the most downloaded games in October.

X-Clash: Dare was the breakout hit of the month in downloads. It’s a 4X strategy title, but its visual style and ad creatives are mimicking the “Save the Dog” title. Despite high download numbers, its October revenue was just $1.5 million.

GameDiscoverCo: The State of Steam Wishlist Conversions (2024–2025)

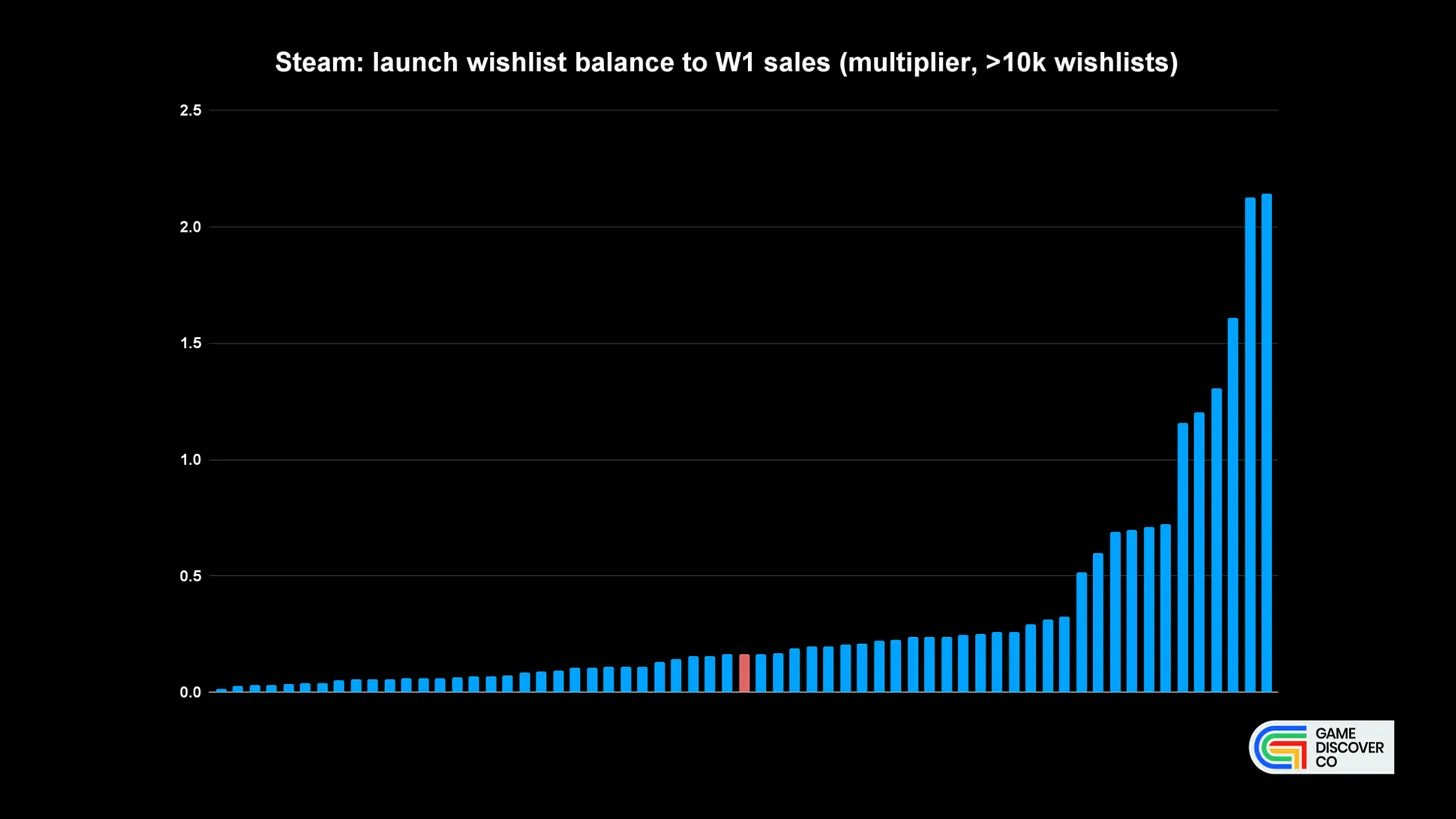

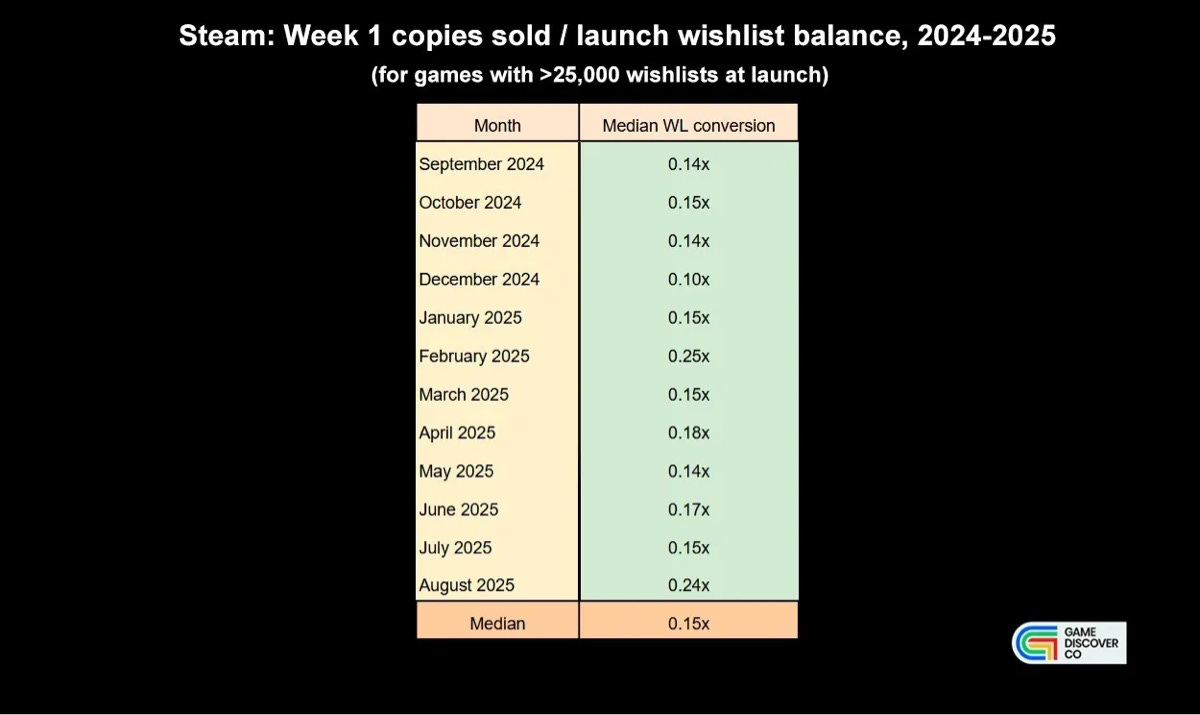

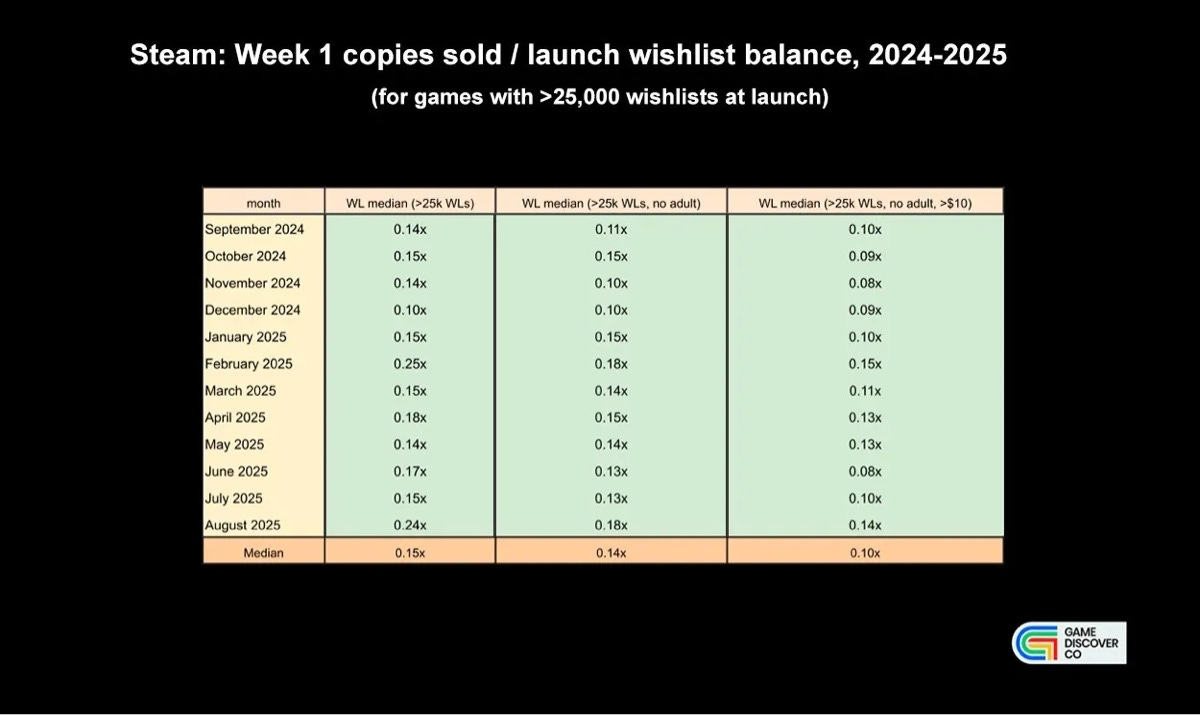

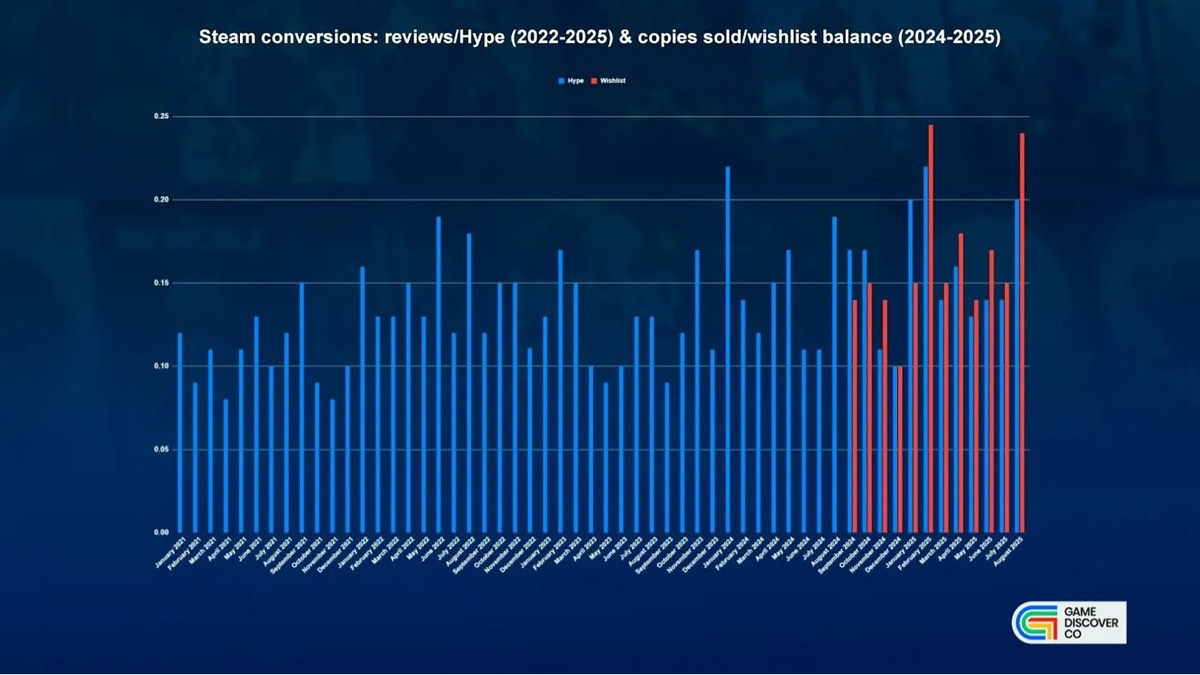

The report analyzes wishlist-to-sale conversion rates during the first week after launch over the past two years. The data includes all purchases, both from players who had wishlisted the game and those who hadn’t.

❗️GameDiscoverCo notes that fluctuations in the data are significant, with conversion rates varying by an order of magnitude between projects.

The median conversion rate for games with over 25,000 wishlists at launch in the past year is 0.15× (meaning roughly 15,000 first-week sales per 100,000 wishlists).

For titles priced above $10 at launch, the median conversion drops to 0.10×.

NSFW games convert better than the market average. Excluding them lowers the median from 0.15× to around 0.14×.

A word from newsletter sponsor

Transform your online store into an LTV powerhouse with Xsolla’s LiveOps tools - run dynamic, segmented campaigns to drive an 80% repeat purchase rate, and boost player retention by 15%+ using in-game synchronized offers and loyalty shops.

Time-limited promos, login bonuses, and referral programs can lift player engagement and help grow ARPPU by 20%+, all through an intuitive interface built for fast campaign launches, deep personalization, and maximum revenue impact.

GameDiscoverCo doesn’t observe a long-term decline in conversion rates - rather, it’s simply becoming harder to gather wishlists due to rising competition.

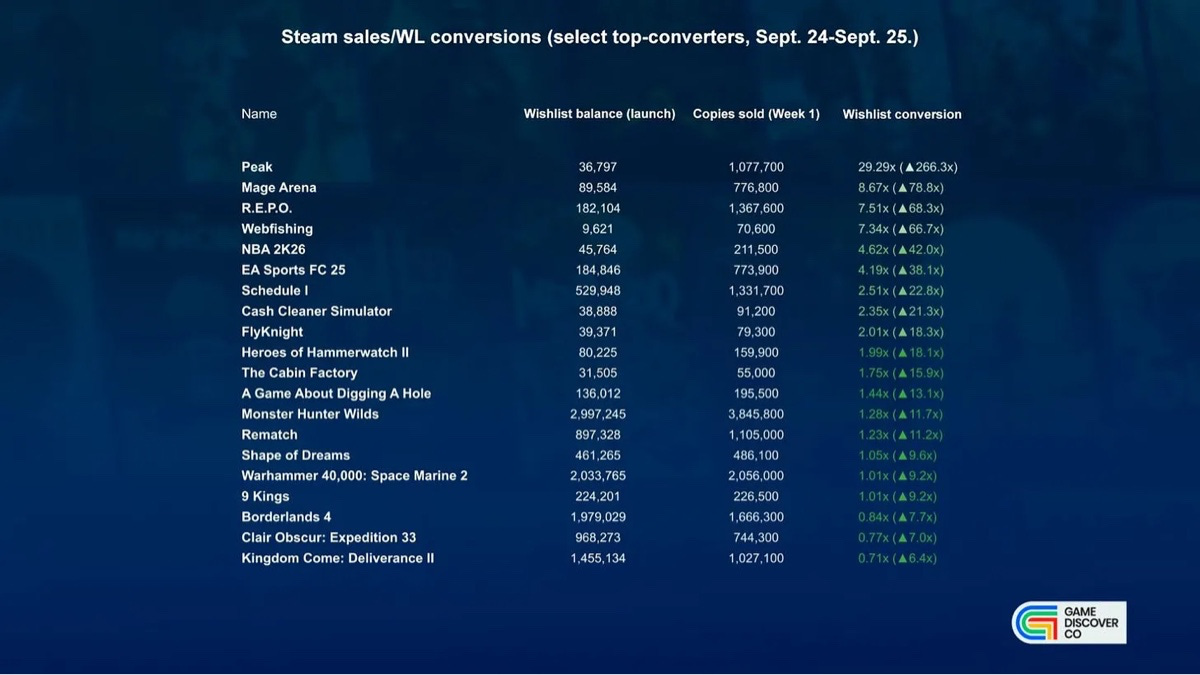

The most successful games between September 2024 and September 2025 achieved far higher conversion rates than the median. The dataset includes both AAA titles (which players may preorder instead of wishlisting) and viral indie hits (often purchased immediately without being added to wishlists).

Top-performing games by conversion include Peak (29.29× conversion), Mage Arena (8.67×), and R.E.P.O. (7.51×).

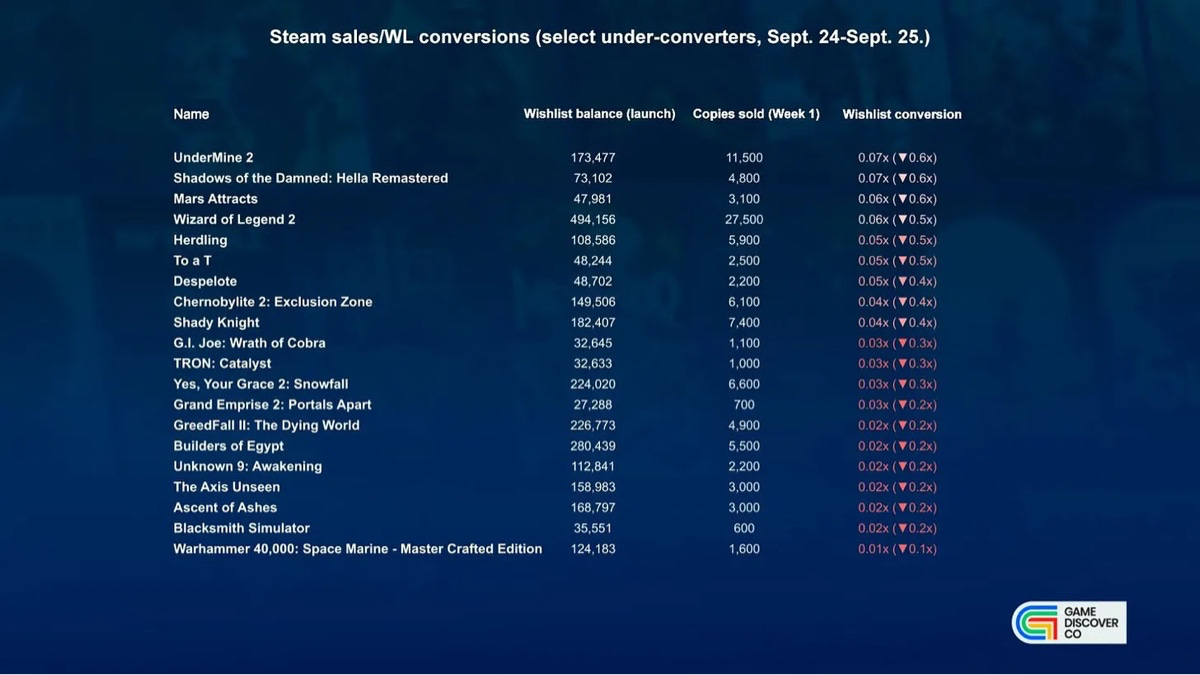

It’s also revealing to look at games that underperformed relative to expectations. These titles had a median user score of 67% (Mixed) in their first seven days, versus 91% (Very Positive) for higher-performing games.

The average pre-release period on Steam was 411 days for underperforming titles, compared to 214 days for those exceeding expectations.

Games & Numbers (October 22 – November 4, 2025)

PC / Console Games

Pokémon Legends: Z-A sold 5.8 million copies in its first week, according to The Pokémon Company. The figure includes both physical and digital sales. Despite the impressive result, the game’s launch performance trails behind recent entries in the series.

Escape from Duckov sold over two million copies within two weeks of release.

The new “friendslop” hit RV There Yet? has sold more than 1.3 million copies. The studio’s community manager said on YouTube that over 300,000 copies were sold overnight.

A word from our sponsor

Maximize your game’s global revenue with Xsolla’s Global Payments - offering seamless, localized checkout in multiple languages and integrating 1,000+ local payment methods to boost conversion rates.

Protect your income with advanced machine-learning anti-fraud, cross-game blocklisting, and 3DS 2.0, while Xsolla handles tax, compliance, support, refunds, and chargebacks for you. Deliver a smooth, secure payment experience optimized for all devices and expand your reach with confidence!

Make payments easy with Xsolla!

Ball X Pit sold more than 400,000 copies in its first week, peaking at over 34,000 concurrent players.

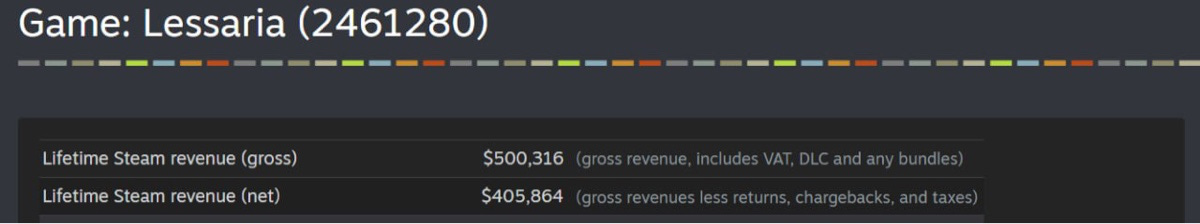

Lessaria: Fantasy Kingdom Sim, released on October 20, generated over $500,000 in revenue within a week and a half, selling 35,700 copies. The developers spent less than $200,000 on production.

Mobile Games

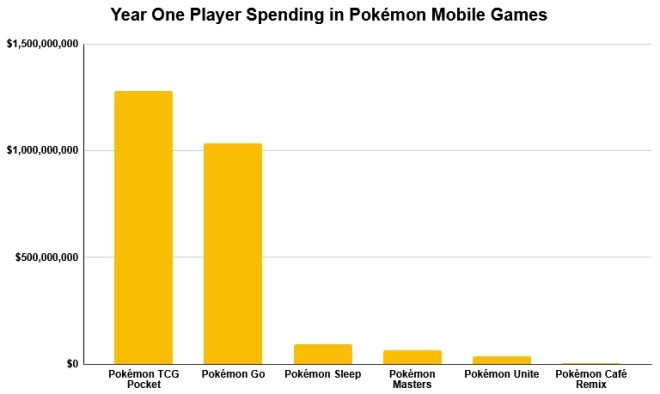

According to AppMagic, Pokémon TCG Pocket earned $1.3 billion in its first year - surpassing Pokémon GO, which made just over $1 billion in its debut year. The game has been downloaded more than 150 million times.

Platforms

Roblox shared its Q3 2025 results: DAU across all markets surpassed 151.5 million (+70% YoY). In the quarter, the platform recorded $1.9 billion in net bookings and $1.4 billion in revenue.

Events

Gamescom Asia x Thailand Game Show 2025 attracted just over 206,000 visitors, including 5,590 B2B attendees. The event featured 294 exhibitor booths.

Adjust: The Mobile Market of Türkiye in 2025

To prepare the report, Adjust analyzed data from 5,000 partner apps collected between January 2023 and July 2025.

Mobile Market Overview

By the end of 2024, Turkey ranked 8th globally in mobile app downloads (3.66 billion) and total time spent in apps (101.5 billion hours).

By 2029, Turkey’s mobile app revenue is projected to reach $1.65 billion.

Mobile Games Market in Turkey

In 2025, mobile game revenue in Turkey will reach $427.5 million, nearly half of the country’s total video game revenue.

A word from our sponsor

Xsolla recently released the global gaming market map, which covers more than 200 regions.

This is a gigantic work, see what’s inside:

Main market numbers (population, gaming revenue, distribution of revenue by platform, and much more).

Top video game genres.

Recommendations for game localization.

Largest game development studios & games from the region.

Cultural considerations & local holidays.

Top streaming platforms, influencers,and local shows.

Salary benchmarks for the gaming industry.

Payment data, tax information, and legal considerations.

So far, it is the most comprehensive database of the gaming market I’ve seen so far (excluding my newsletter, of course, ha-ha).

200+ countries covered, and there is a very sweet opportunity to download the data for the pitch in the .pdf format (based on the market).

Games from Turkish studios attract over 30 million local players and hundreds of millions worldwide. The country’s most prominent developer is Dream Games (Royal Match).

Installs and Sessions

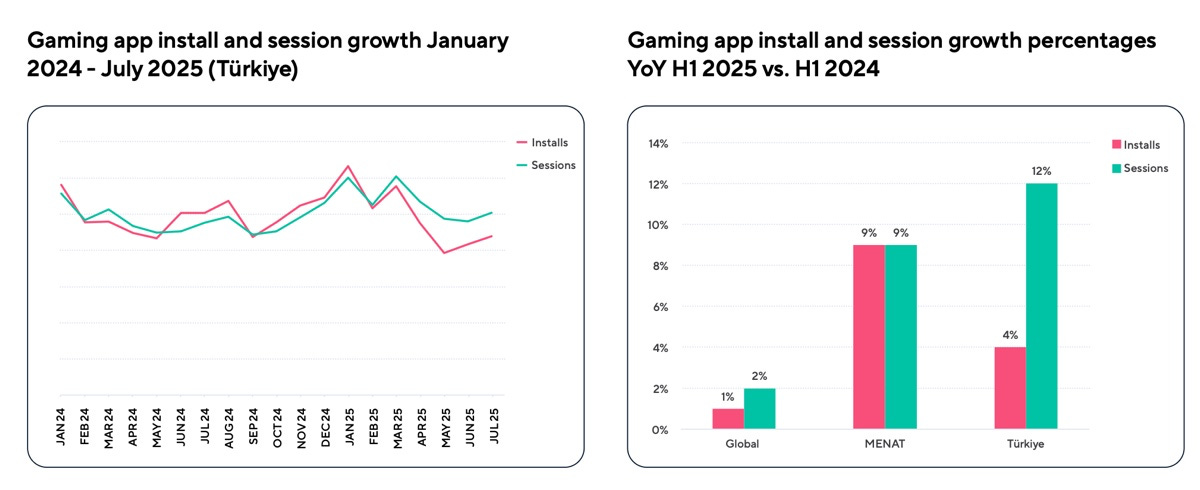

Mobile game installs in Turkey grew 12% YoY in 2024, while sessions increased 8%.

In the first half of 2025, installs rose 4% YoY, and sessions grew 12% YoY.

For comparison, the global market saw +1% growth in installs and +2% in sessions, while the MENAT region grew 9% across both metrics.

Peak months were January (+23% installs, +9% sessions) and March (+12% and +10%, respectively).

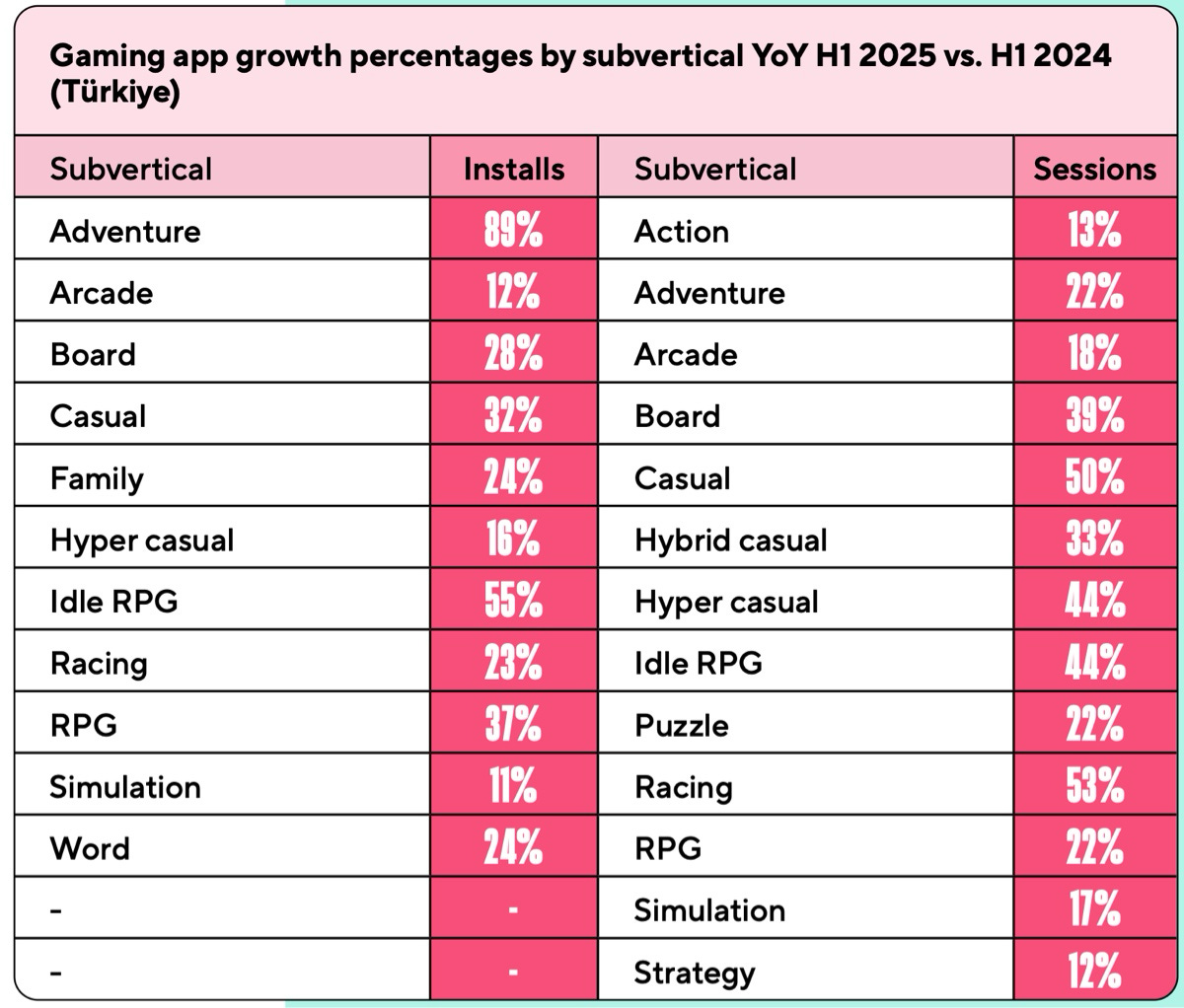

By downloads, the strongest growth came from Adventure games (+89% YoY), Idle RPG (+55% YoY), and RPG (+37% YoY). By sessions, the top gainers were Racing (+53% YoY), Casual (+50% YoY), and Hypercasual with Idle RPG (+44% YoY each).

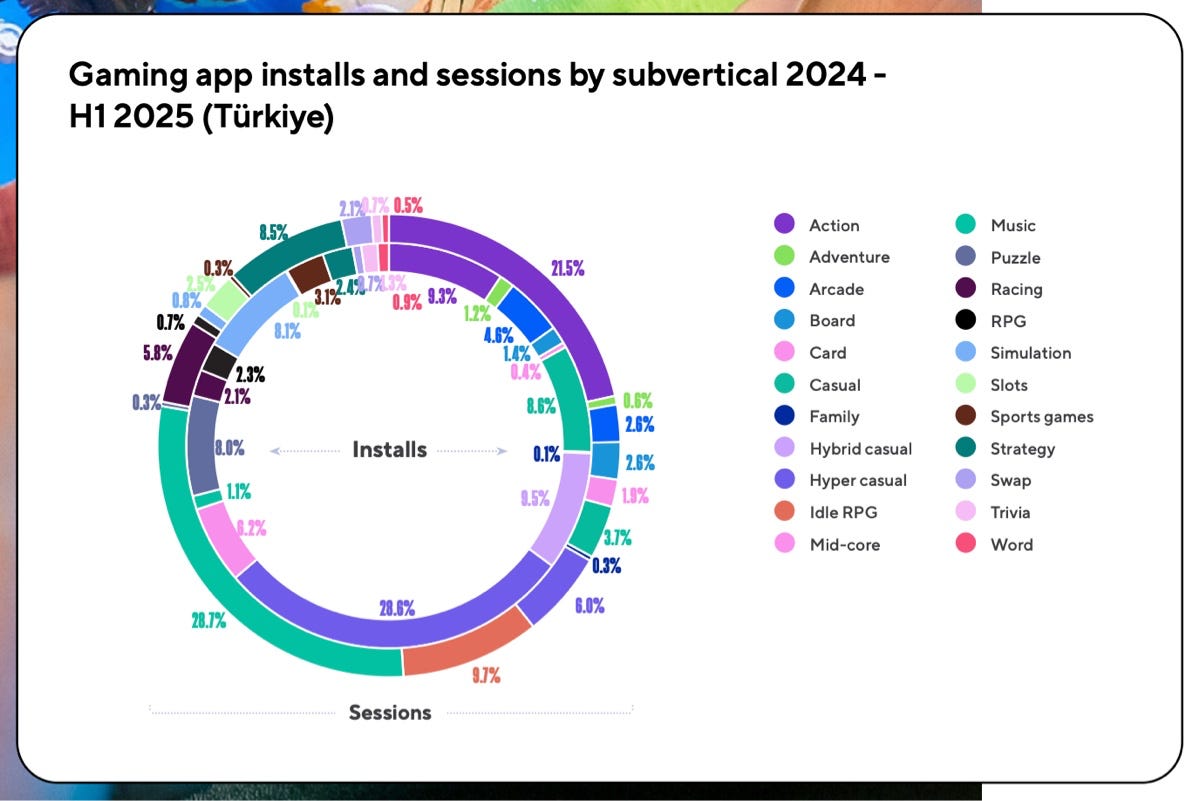

Leading genres by downloads: Hypercasual (28.6%), Hybridcasual (9.5%), and Action (9.3%).

Leading genres by sessions: Music (28.7%), Action (21.5%), Idle RPG (9.7%), and Strategy (8.5%).

Session Length and Retention

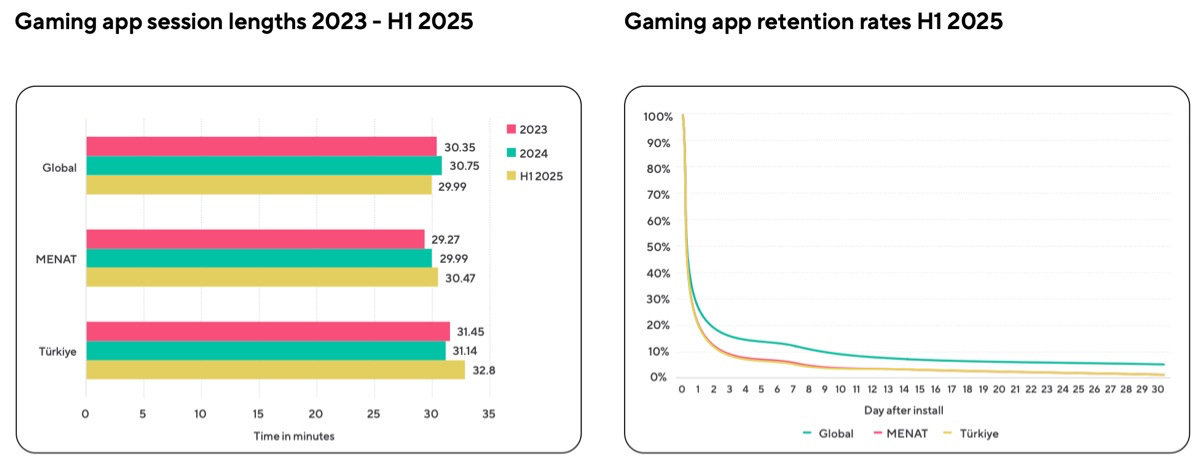

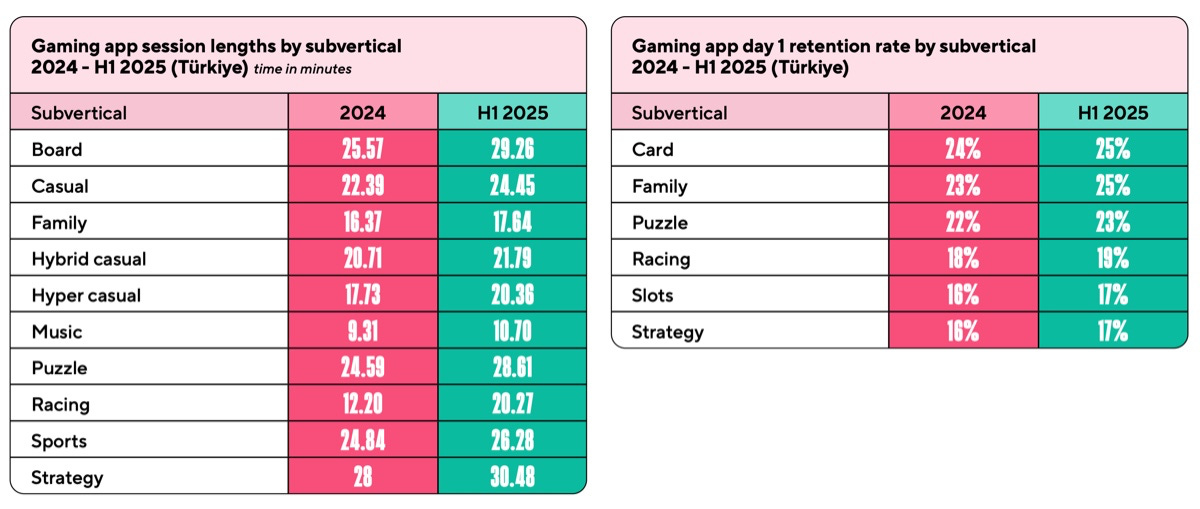

The average session length in H1 2025 was 32.8 minutes (31.1 minutes in 2024; 31.4 in 2023). This exceeds both the MENAT regional average (30.5 minutes) and the global average (29.9 minutes).

Retention rates in Turkey during H1 2025 were: D1 – 19%, D7 – 5%, D14 – 3%, D30 – 1%. By comparison, global benchmarks are D1 – 26%, D7 – 12%, and D30 – 5%. In other words, games in Turkey retain players less effectively than the global average.

The longest average play sessions were in Strategy (30.5 minutes), Board (29.3 minutes), and Puzzle (28.6 minutes) games.

The best Day-1 retention was seen in Card games (25%), Family games (25%), and Puzzles (23%).

Kickstarter in 2025 and before

The report was prepared by Dmitrii Filatov, Co-Founder & CEO of Narwhal.ax. It’s based on data from 17,000 campaigns in the Video Games category since 2009.

In total, video game projects on Kickstarter have raised $377 million across 5,526 campaigns - an average of $68.2K per campaign.

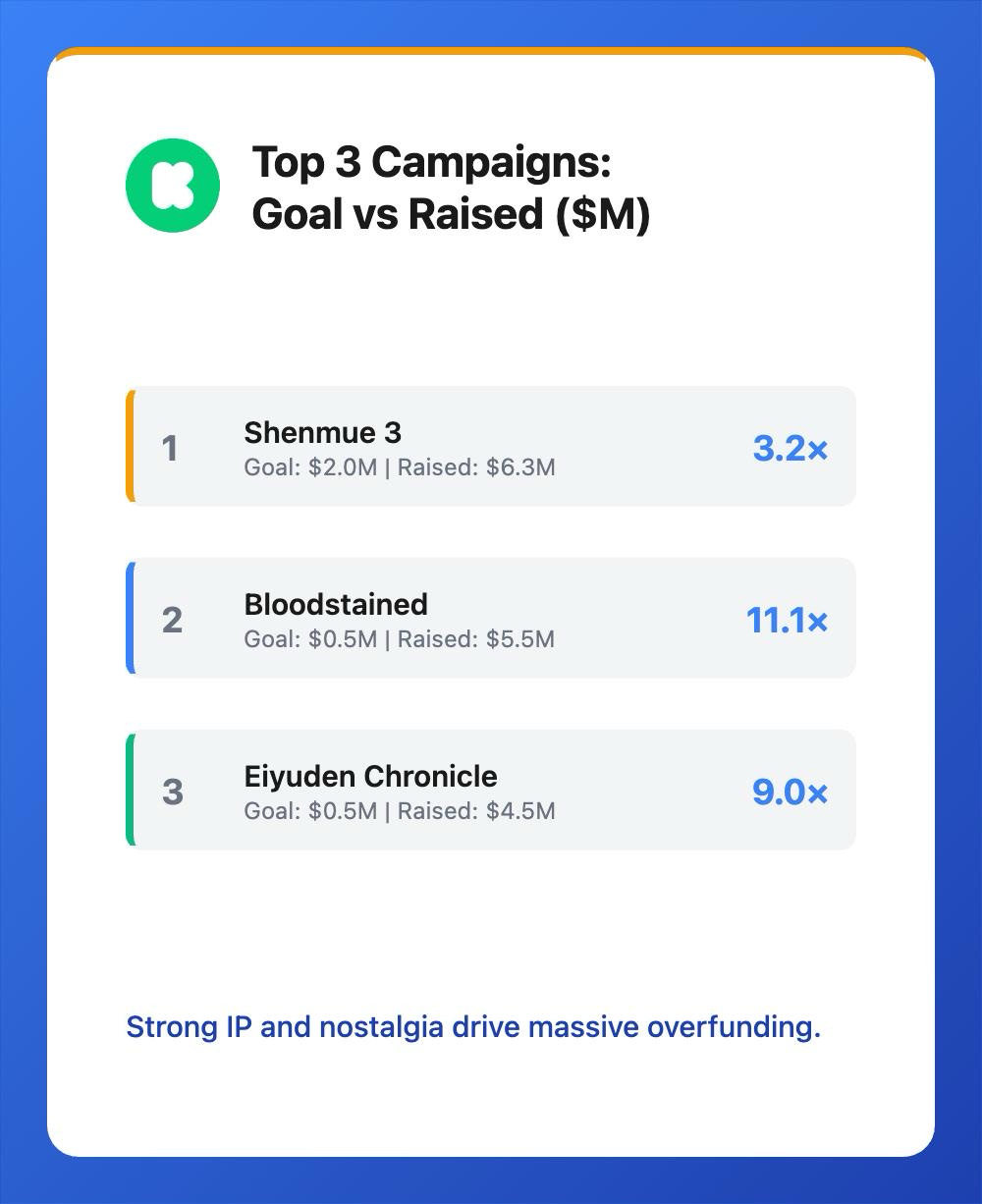

Dmitrii notes that the golden age of crowdfunding on the platform is long gone. In 2012–2013, games raised $98 million - 26% of the all-time total. Between 2012 and 2015, 19 of the top 30 most successful video game campaigns took place.

By the end of 2024, games raised $25.2 million in total funding. At the peak in 2013, that figure reached $51 million.

Competition hasn’t eased, however. In 2015, there were 1,366 campaigns totaling $43.8 million; in 2024, $25.2 million was spread across 1,335 campaigns. In other words, the number of campaigns dropped by just 2%, while total funding fell 43%.

None of the 15 campaigns aiming to raise $2.5 million or more was successful. However, projects with targets under $1M tended to overperform - for example, Shenmue 3 ($6.3M raised, $2M goal), Bloodstained: Ritual of the Night ($5.5M raised, $500K goal), and Eiyuden Chronicle: Hundred Heroes ($4.5M raised, $500K goal).

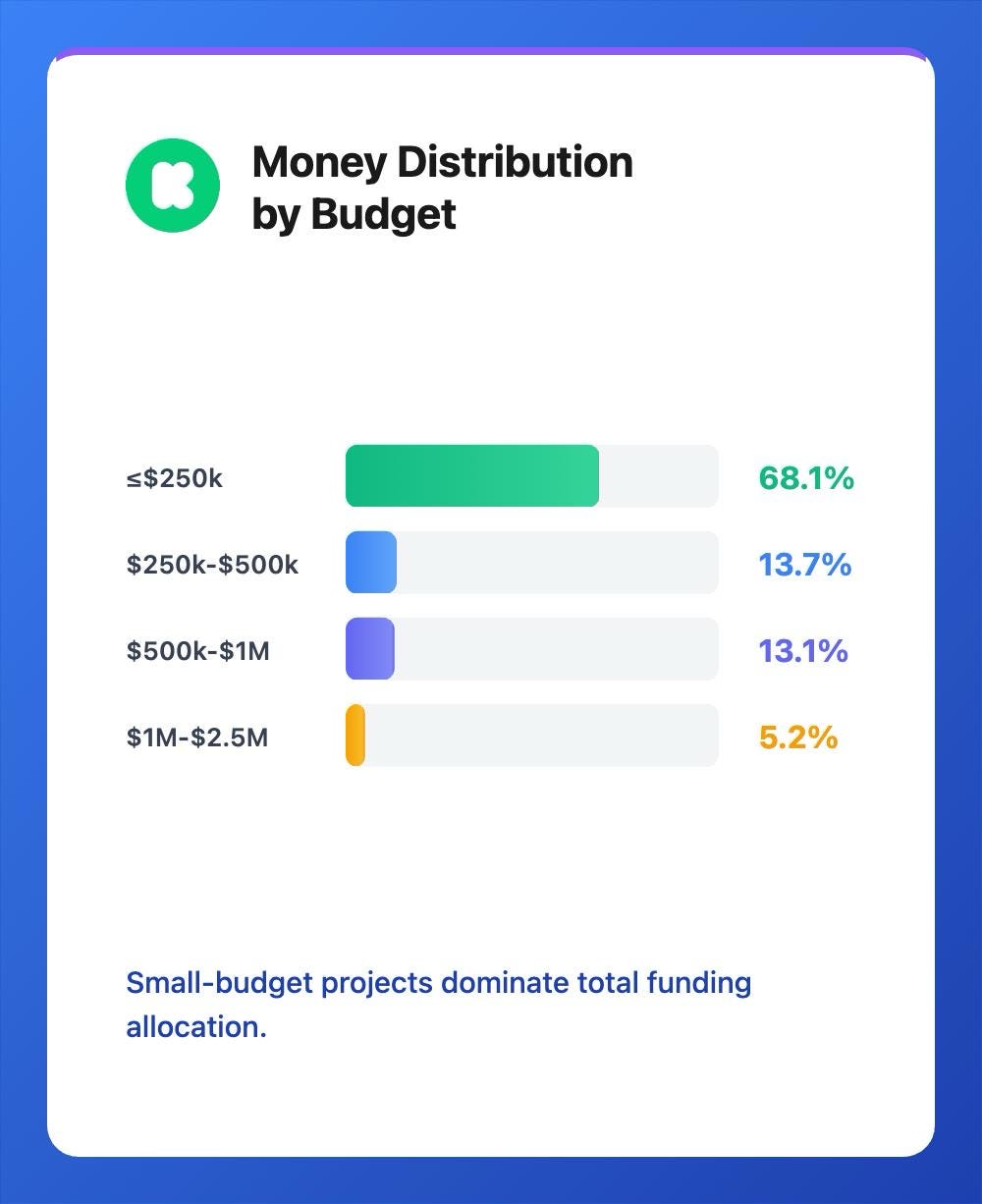

81.8% of all funds raised came from campaigns with goals of $500K or less, and 68.1% from campaigns under $250K.

A word from our sponsor

Transform your online store into an LTV powerhouse with Xsolla’s LiveOps tools - run dynamic, segmented campaigns to drive an 80% repeat purchase rate, and boost player retention by 15%+ using in-game synchronized offers and loyalty shops.

Time-limited promos, login bonuses, and referral programs can lift player engagement and help grow ARPPU by 20%+, all through an intuitive interface built for fast campaign launches, deep personalization, and maximum revenue impact.

PlayWay is the most successful publisher on the platform. It has launched 32 campaigns, 31 of which were successful (the only failure occurred in 2014), raising a total of $889K.

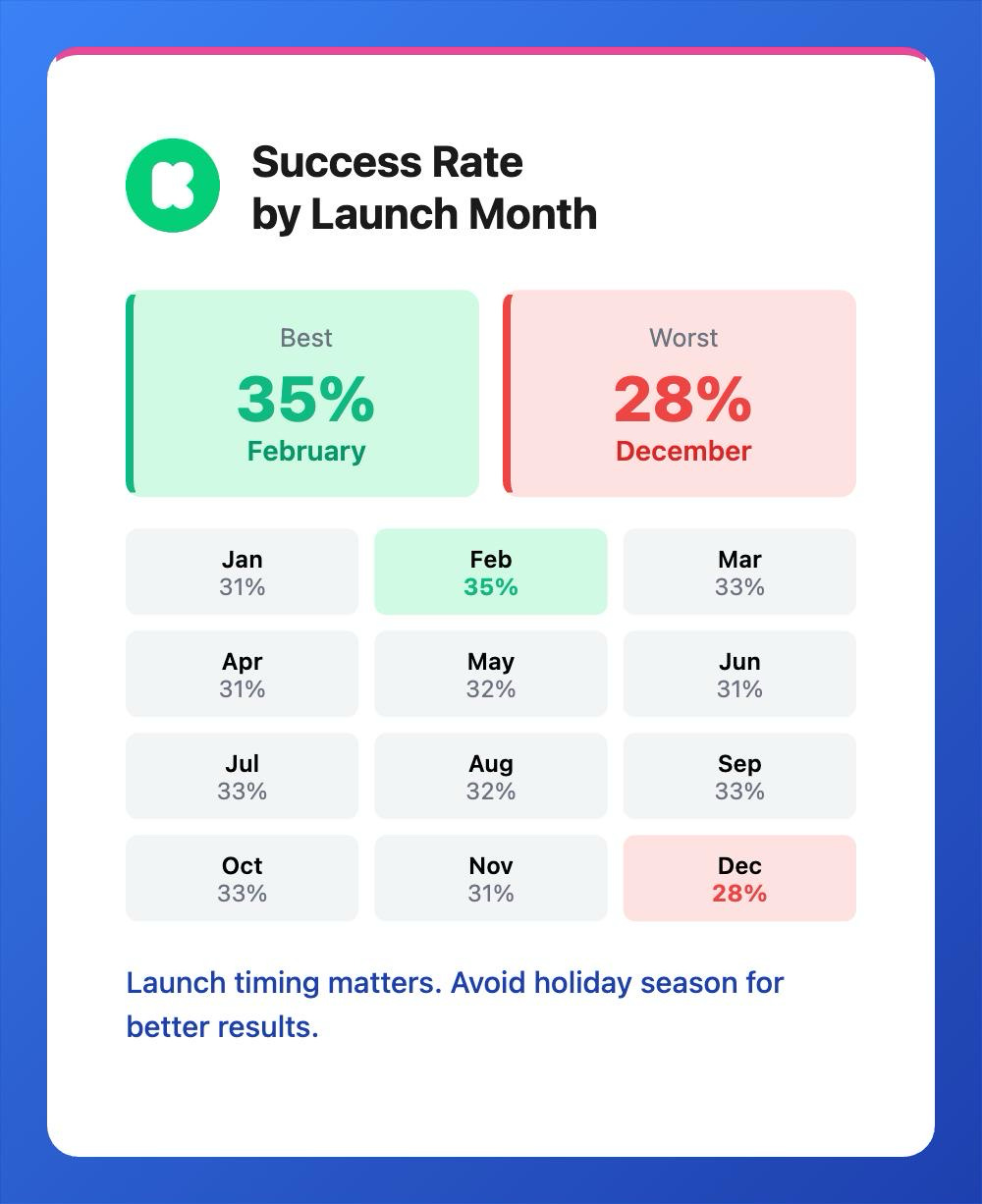

Statistically, December is the worst month to launch a campaign (success rate - 28%), while February is the best (35%). The overall average success rate is 32%.

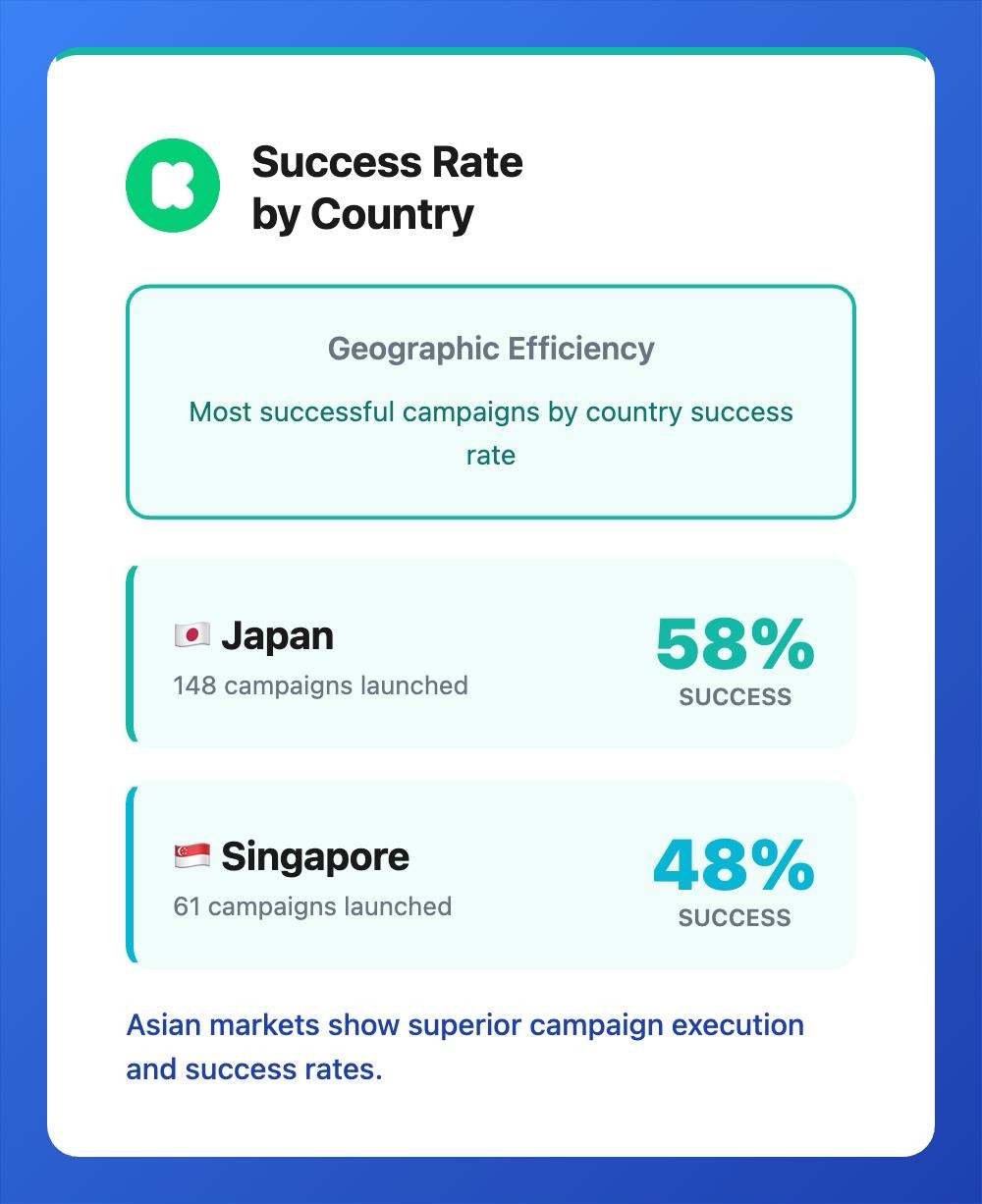

Japanese companies are the most successful on Kickstarter, with 58% of their 148 campaigns funded. Singapore follows with 48% success across 61 campaigns.

Projects from the U.S. have raised the most money - 67% of all funds. U.S. campaigns account for 55% of total launches. Among the top 30 campaigns, 80% (23 games) are American, followed by 4 from the U.K. and 3 from Japan.

GameDiscoverCo: Top releases of October 2025 on PC and consoles

A small announcement before we start - I’ll get some time off in the next couple of weeks to recharge. Expect me back with new, interesting reports on November 24!

Top New Releases on Steam - Copies Sold

Battlefield 6 was the biggest hit of the month, selling over 7 million copies on Steam by the end of October (including 2.5 million pre-orders).

RV There Yet? (1.7 million copies) and Escape from Duckov (also 1.7 million) ranked second and third among new releases by units sold on the platform.

ARC Raiders sold 1.5 million copies on Steam in October, just within its first two days.

Dispatch sold over 830,000 copies on Steam in its first week, and more than 1 million copies in total.

Top New Releases on Steam - Gross Revenue

Battlefield 6 generated $424.9 million on Steam in October, making it the clear revenue leader.

ARC Raiders ranked second with $55.3 million (again, in just two days).

Digimon Story: Time Stranger placed third with $37.9 million in revenue.

Top Steam Games in October - Copies Sold

(F2P releases excluded)

Battlefield 6 sold 4.7 million copies on Steam in October.

It’s notable to see Megabonk (2.2 million copies - over 3 million total), RV There Yet? (1.7 million), and Escape from Duckov (1.7 million).

Hogwarts Legacy sold 890,000 copies in October thanks to a $9 discount.

A word from our sponsor

Xsolla helped Second Dinner to build a fully branded Marvel Snap webshop with the support of personalized promo code redemption, welcome bundles, web-exclusive offers, live-ops tools for segmented targeting, timed rewards, and event synchronization. Not mentioning the full coverage of payments from more than 200 countries!

Check the webshop experience & get in touch with Xsolla if you want the same!

Top New Releases on PlayStation, Xbox, and Subscription Services

On PlayStation, Battlefield 6 sold 4.6 million copies in October.

Ghost of Yotei also launched strongly with 2.7 million copies sold (34% from the U.S., 13% from China, 5% from Japan).

ARC Raiders ranked third on PlayStation 5 with 498.9K copies sold in the first couple of days.

Dispatch sold just 78.9K copies on PlayStation - 10 times less than on PC.

Among new PlayStation Plus titles: Goat Simulator 3 (+1.9M players), Alan Wake II (+1.2M), and Cocoon (+300K).

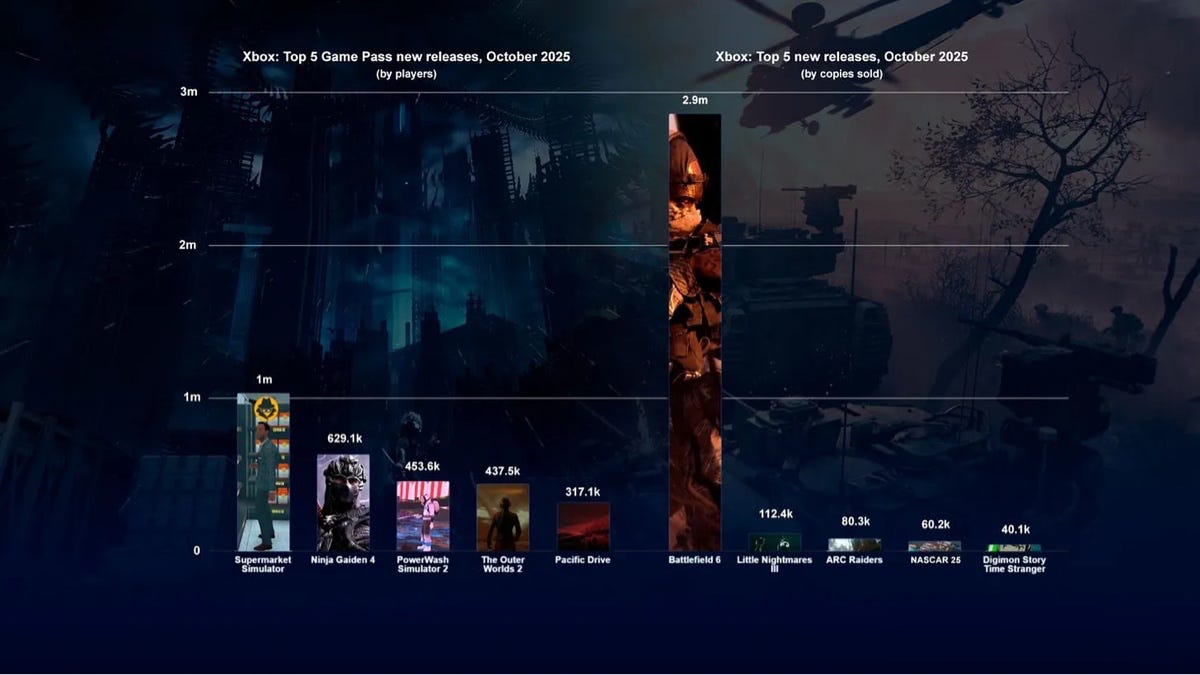

On Xbox Series S|X, aside from Battlefield 6 (2.9M copies), ARC Raiders performed modestly with 80.3K copies sold - six times less than on PlayStation.

Top new Game Pass titles included Supermarket Simulator (+1M players), Ninja Gaiden 4 (+650K), and PowerWash Simulator 2 (+453.6K).

On Nintendo’s eShop, Pokémon Z-A sold over 1.1 million copies in October. Super Mario Galaxy + Super Mario Galaxy 2 sold more than 500K copies during the same period.

Notable 3rd-party releases in the eShop are Ball X Pit (124K copies) and Plants vs. Zombies: Replanted (77K).

These mobile game revenu numbers are always fasinating to track. AppLovin's AI engine has been crushing it in user aquisition efficiency lately. The way they optimize ad placment for mobile games is changing the whole monetization landscape.