Weekly Gaming Reports Recap: November 25 - November 29 (2024)

Game7 Research & Naavik released the largest Web3 research of the year; Circana revealed the October 2024 data for the US; Dataspelsbranschen released a report about the Swedish game industry.

Reports of the week:

Circana: The US gaming market returned to growth in October 2024

Games & Numbers (November 13 - November 26; 2024)

Dataspelsbranschen: The Swedish Gaming Industry in 2024

Game7 Research & Naavik: Web3 Games in 2024

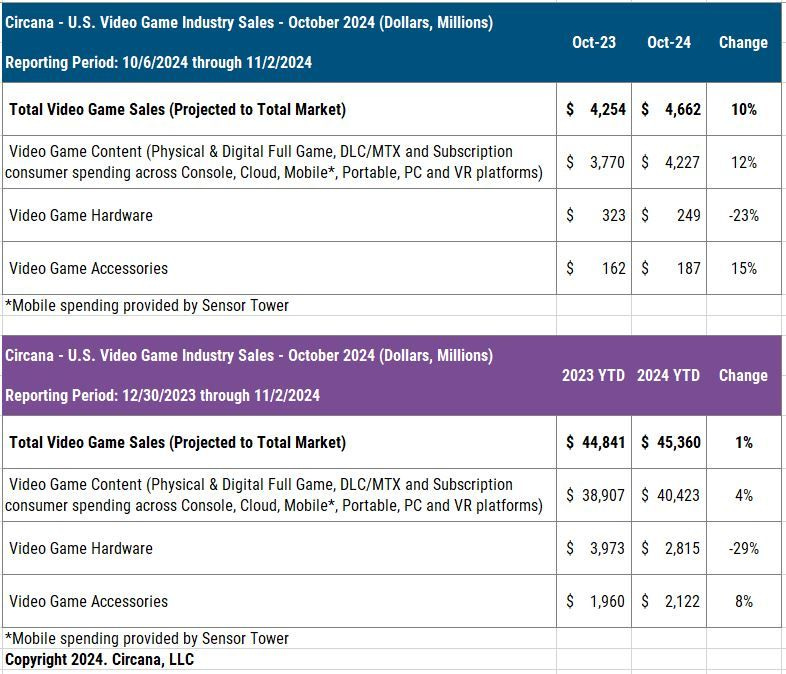

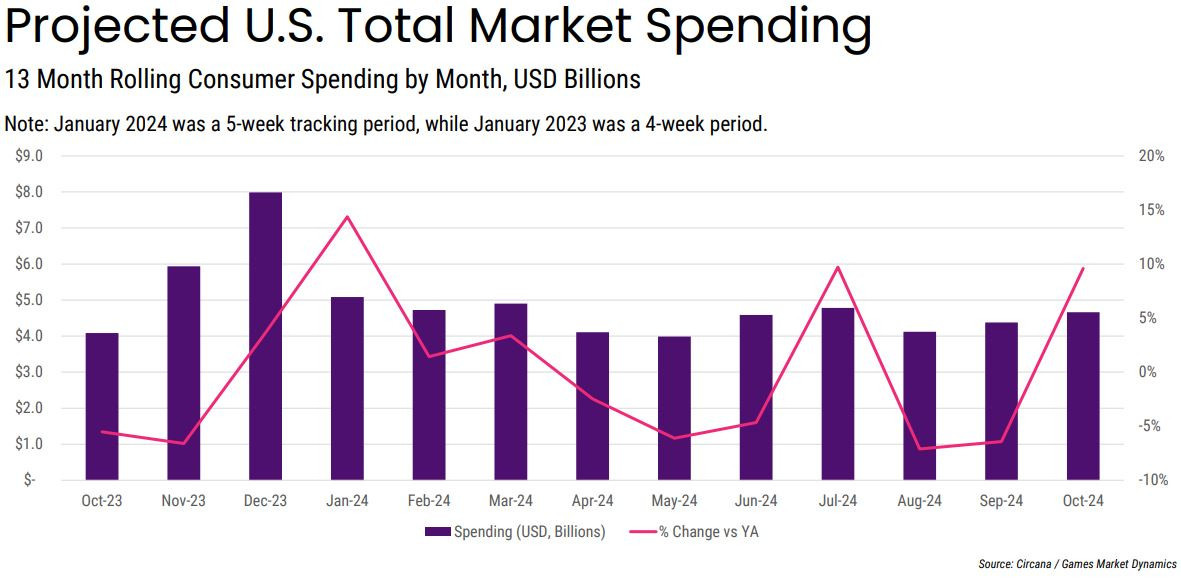

Circana: The US gaming market returned to growth in October 2024

Market status

Overall market revenue increased by 10% compared to October 2023. Games and gaming content sales grew by 12%, and accessory sales increased by 15%. However, gaming hardware sales were 23% lower than last year's figures.

Considering the growth in gaming content sales, spending on console games saw the most significant increase, rising by 27% year-over-year (YoY).

In dollar terms, the best-selling accessory in October was the PlayStation Portal.

Sales of the Nintendo Switch fell by 38% compared to October last year; PS5 sales dropped by 20% YoY; and Xbox Series S|X lost 18%. Nevertheless, the PS5 remains the best-selling system both in terms of units and dollar value.

Spending on gaming subscriptions in the country rose by 16%, with most of the growth attributed to Game Pass subscriptions.

For the first ten months of 2024, the American market showed results of 1% better than the same period in 2023.

Game Sales

The growth in game sales is largely attributed to the launch of Call of Duty: Black Ops 6. Last year’s installment was released in November, so we can expect a decline next month. The game topped the October chart and immediately became the third best-selling game of the year. Sales of Call of Duty: Black Ops 6 in dollar terms for the first two weeks were 23% higher than last year’s Call of Duty: Modern Warfare III.

82% of all console sales for Call of Duty: Black Ops 6 were on PlayStation.

Dragon Ball: Sparking! Zero ranked second in October sales and fourth for sales in 2024. After a month of sales in the U.S., it is the best-selling Dragon Ball game in dollar terms on the market. Among all games released by Bandai Namco Entertainment, it trails only Elden Ring and Dark Souls III.

The remake of Silent Hill 2 placed third in October sales. It shows the second-best sales results in series history, behind only the original Silent Hill 2.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

MONOPOLY GO!, Royal Match, and Roblox remain leaders in the U.S. mobile market. However, revenue for MONOPOLY GO! in the U.S. fell by 20% in October, and results compared to May-June this year are 50% worse.

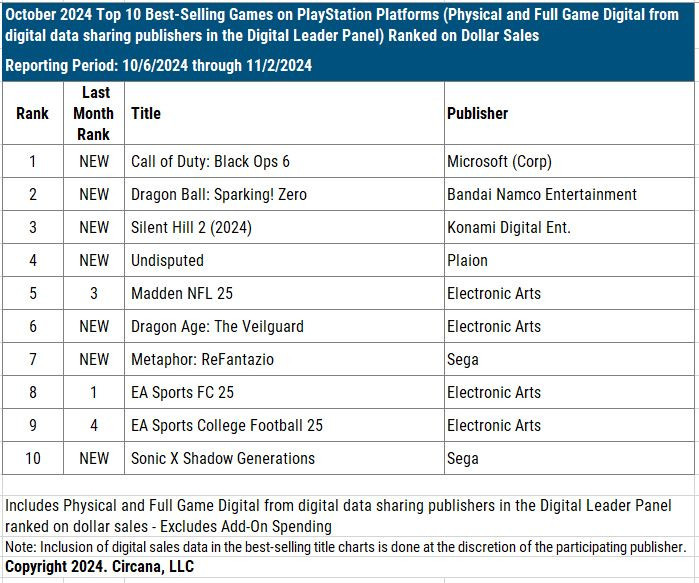

Platform Rankings

In October on PlayStation, there were seven new releases on the sales chart. Among those not named are Undisputed (4th place), Dragon Age: The Veilguard (6th place), Metaphor: ReFantazio (7th place), and Sonic X Shadow Generations (10th place).

In terms of Monthly Active Users (MAU) on PlayStation consoles, there were three notable changes: WWE 2K24 reached 4th place; Dragon Ball: Sparking! Zero appeared at 6th place; and the remake of Dead Space entered at 10th place.

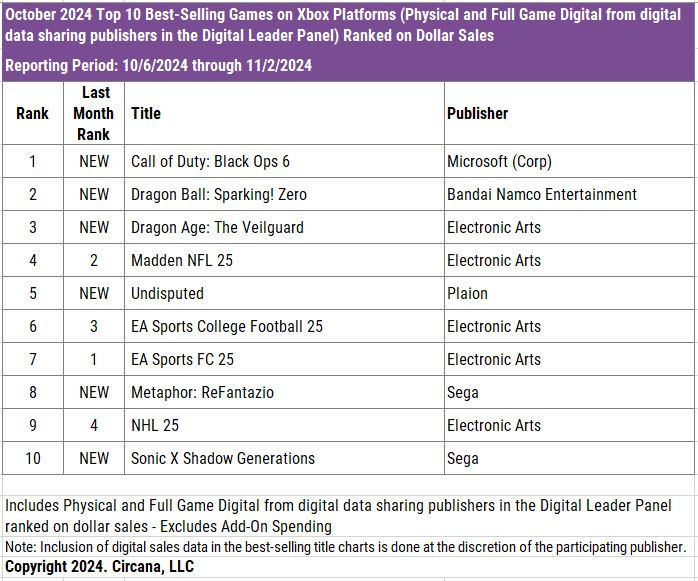

On Xbox Series S|X, a similar situation exists, except that there is no Silent Hill 2 on their chart, because there is an exclusivity deal with Sony.

The MAU ranking on Xbox saw little change from last month. Sifu reached 9th place due to its inclusion in a subscription service.

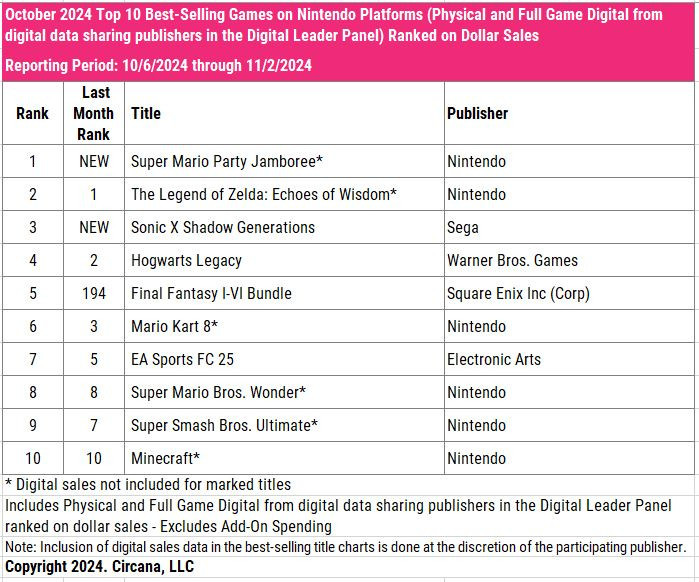

On Nintendo Switch, there are two new entries: Super Mario Party Jamboree and Sonic X Shadow Generations.

There are few changes in Steam's MAU ranking. The top spots are held by Counter-Strike 2, Deadlock, and Helldivers II. Throne and Liberty climbed to 4th place; TCG Card Shop Simulator reached 6th place.

Games & Numbers (November 13 - November 26; 2024)

PC/Console Games

Over 15 million people have played Helldivers II since its release. Sony reported that 12 million copies were sold in May in 3 months. Given that the game hasn’t appeared in subscription services, 15 million players equals 15 million copies sold.

Call of Duty: Black Ops 6 is the largest entry in the series in history by number of players, hours played, and matches played in the first 30 days after release. The game’s appearance in subscription services contributed to this.

Starfield’s audience exceeds 15 million people. In June, Todd Howard reported 14 million users.

More than 6 million people have played Sea of Stars. This figure doesn’t reflect sales as the game was available through subscription services.

Farming Simulator 25 was purchased more than 2 million times in its first week.

S.T.A.L.K.E.R. 2 was purchased more than a million times in two days after release. This is considering that the game appeared in Game Pass at launch.

Wartales by Shiro Games has surpassed 1 million copies sold on Steam alone. The game is also available on consoles, but sales there are not reported.

CD Projekt RED revealed that The Witcher III: Wild Hunt has sold more than a million copies in South Korea. The game’s total sales have long exceeded 50 million copies.

Frostpunk 2 has sold over half a million copies in less than a month after the release. Sales leaders are China (24.2%), USA (18.5%), and Germany (7.2%). 48.7% of sales were for Deluxe editions.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Slay the Princess has sold over half a million copies. It took just over a year to reach this mark. The game was made by two people, a married couple.

Baldur’s Gate III in 2024 performed better in some metrics than in 2023, according to Michael Douse, Publishing Director at Larian Studios. The average daily peak online grew by 3% compared to 2023; the average DAU increased by 20%; and the number of Steam Deck users increased by 61%.

Dying Light: The Beast has good prospects. In less than 3 months after its announcement, the game has collected over a million wishlists. This is better than all other games in the series.

Mobile Games

Pokemon TCG Pocket has already earned more than $120.8 million since its release, according to AppMagic. It took 3 weeks to reach the first $100 million. The largest market is Japan (42% of revenue), followed by the USA (28% of revenue).

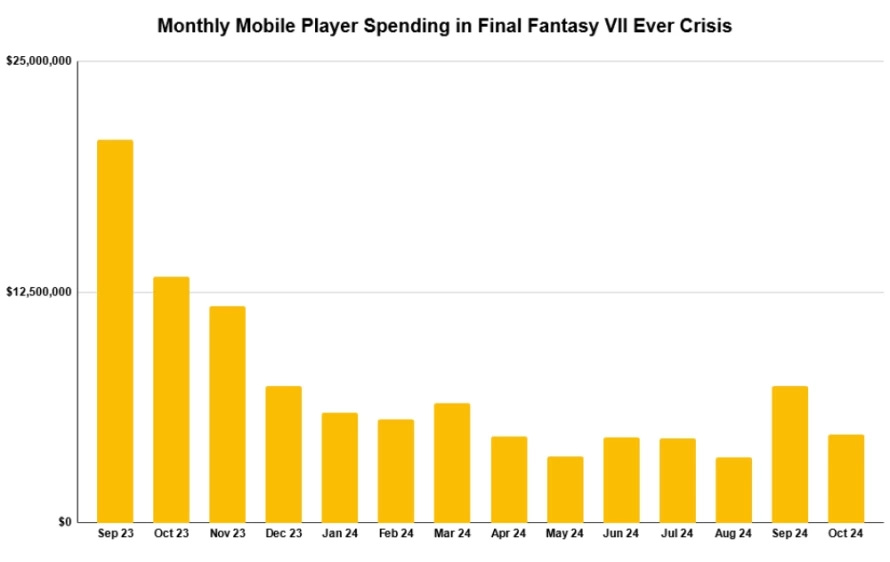

Final Fantasy VII: Ever Crisis has surpassed $100 million in revenue, according to AppMagic (the service calculates Net Revenue, after taxes and commissions). However, the game’s trend is rather downward.

Solo Leveling: Arise has achieved a similar result. The game, released on May 8 this year, has surpassed $100 million in Net Revenue on mobile devices. Additionally, the game is available on PC. Netmarble reported that the game has been downloaded more than 50 million times across all platforms.

Dataspelsbranschen: The Swedish Gaming Industry in 2024

The company publishes its reports at the end of the year, covering the full data from the previous year. Thus, this year’s report contains data for the completed 2023 year.

By the end of 2023, 1010 gaming companies were operating in Sweden - 8% more than in 2022. And almost twice as many as in 2019.

81% of Swedish companies have fewer than 5 employees. Only 3% of studios have more than 50 employees.

Sales of local companies in 2023 grew by 6% in local currency; 1.5% in USD; but fell by 1.5% in EUR. Their total revenue amounted to €3.11 billion.

The net income of Swedish gaming companies decreased to €98 million.

Swedish companies, and their foreign subsidiaries, earned around €7.95 billion in 2023. This is 4.5% more than in 2022.

The revenue of 23 public Swedish companies amounted to €5.6 billion in 2023.

MY.GAMES (that’s where I’m working!) opened a mobile publishing division with a focus on scaling titles. We’re already working with Fable Town ($300k revenue first month after the release); Battle Prime (4x Revenue growth); Days After (30% increase in active users after the deal). And we have more exciting titles in our pipeline.

So, feel free to write directly to me or send a message to publishing@mgvc.com if you have a mobile game that you want to get to a new level. We’re working with stages starting from the soft launch, and prefer titles with a significant chunk of IAP revenue. Cheers!

King, Mojang, and Paradox Interactive are the country’s largest companies by revenue. The largest amount of employees has Ubisoft, King, and EA DICE. Financial results are for 2023, so Arrowhead Studios is not on the list.

The largest Swedish companies with foreign subsidiaries are Embracer Group, King and Stillfront Group.

Game of the Year according to local industry representatives is Helldivers II.

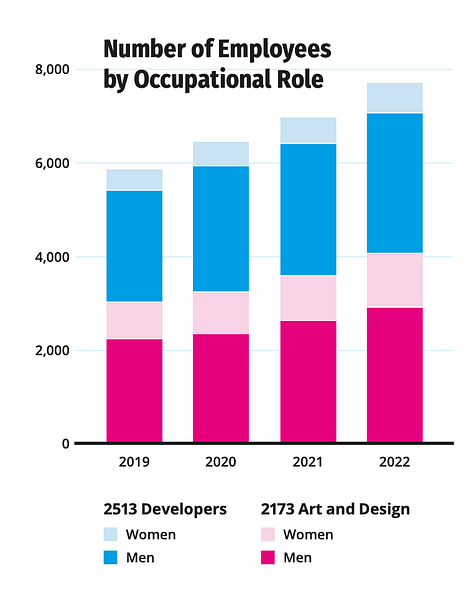

The number of women in the Swedish gaming industry increased to 23.7%. 9,089 people work in the country - 8% more than in 2022.

In 2023, there were 7 investment deals in the Swedish gaming industry. However, for the first half of 2024, 16 transactions have already been publicly announced. If we consider all deals, Swedish companies were sellers in 12 cases and buyers in 11 cases.

Swedish gaming companies paid over €470 million in taxes for the 2023 fiscal year.

Game7 Research & Naavik: Web3 Games in 2024

The companies studied over 2,500 games; 1,500 rounds and more than 100 blockchain ecosystems; using closed and open sources. Data was collected from September 30, 2023, to September 30, 2024.

Web3 Gaming Ecosystem

The number of announced games in 2024 decreased by 36%. At the same time, the number of closed projects also reduced - by 84% at once.

The report authors note the growing popularity of the Play-to-Airdrop (P2A) model, where players must participate in playtests or reach leaderboards to receive rewards.

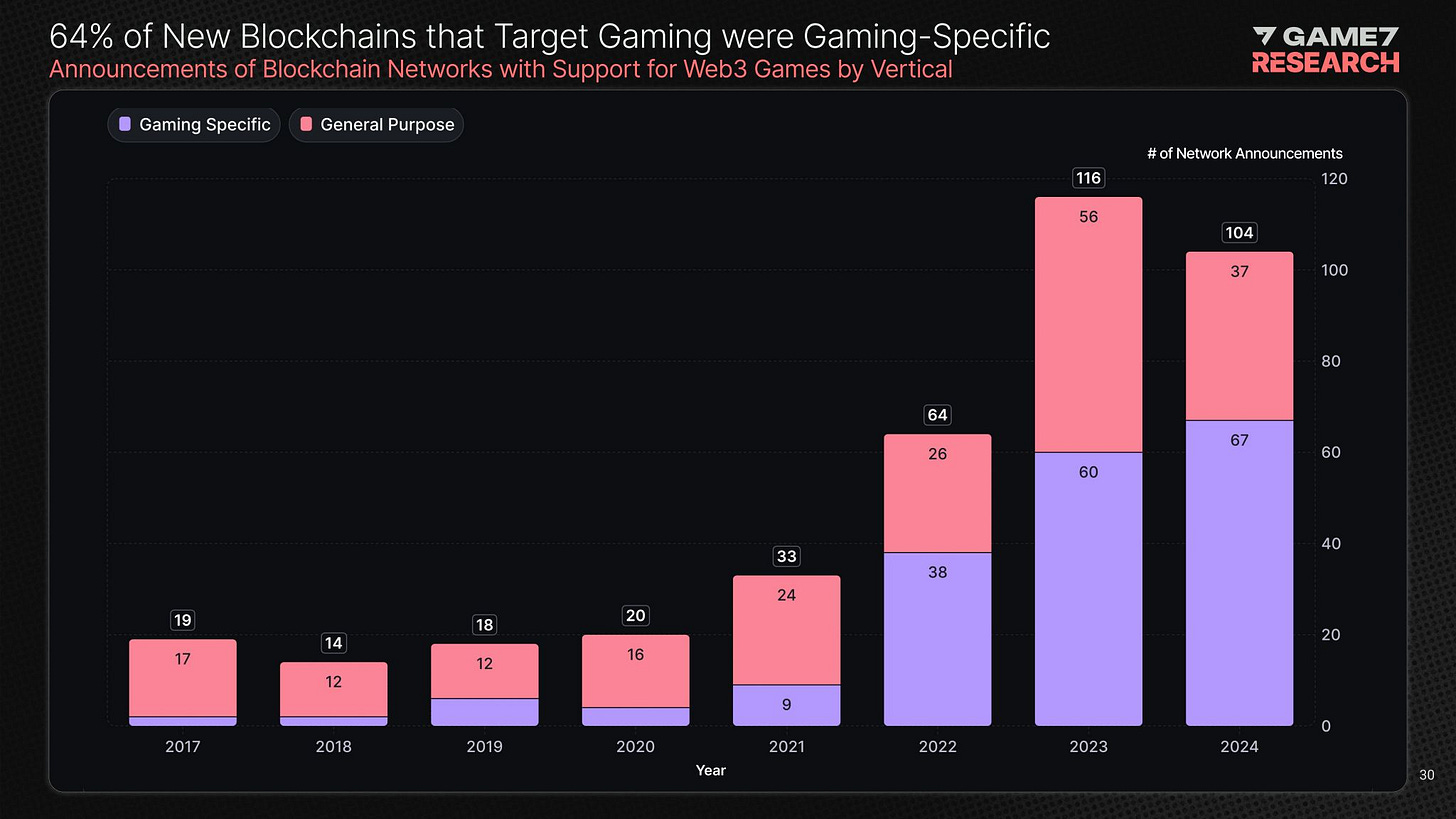

Market players continue to be more interested in launching their networks than launching their games, based on the dynamics. This is likely related to the desire to control and scale business. And, of course, with the possibility of earnings.

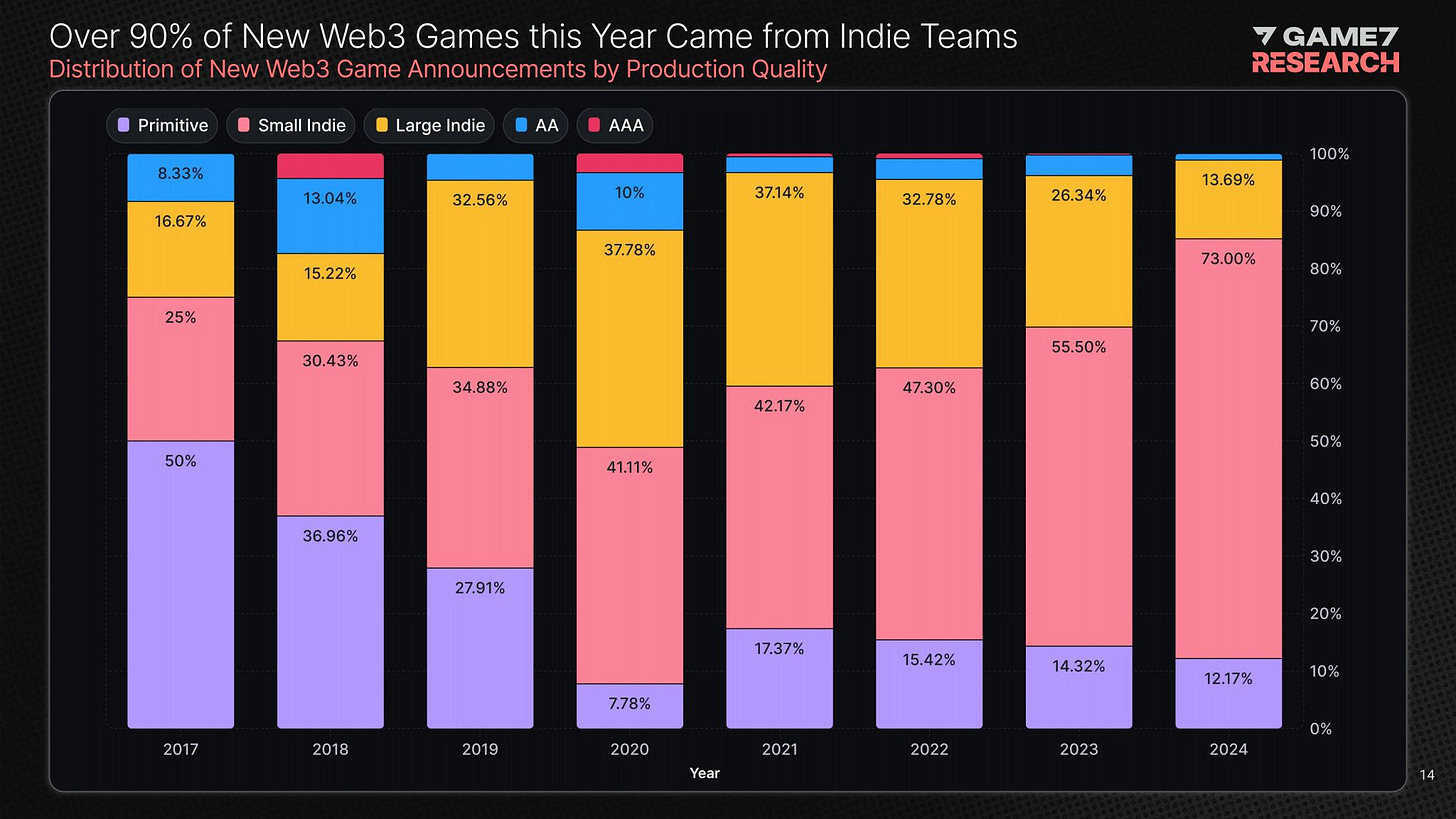

98.86% of all Web3 games are indie, according to Game7 Research classification. Primitive - projects at the "concept verification" stage. Small indie - games made by small teams without external funding. Large indie - games that received up to $10M in funding. AA - games with budgets from $10 to $25M. AAA - games with budgets from $25M.

In 2024, there were more developers from North America; the number of Web3 project creators from Latin America increased. At the same time, the share of APAC developers decreased significantly.

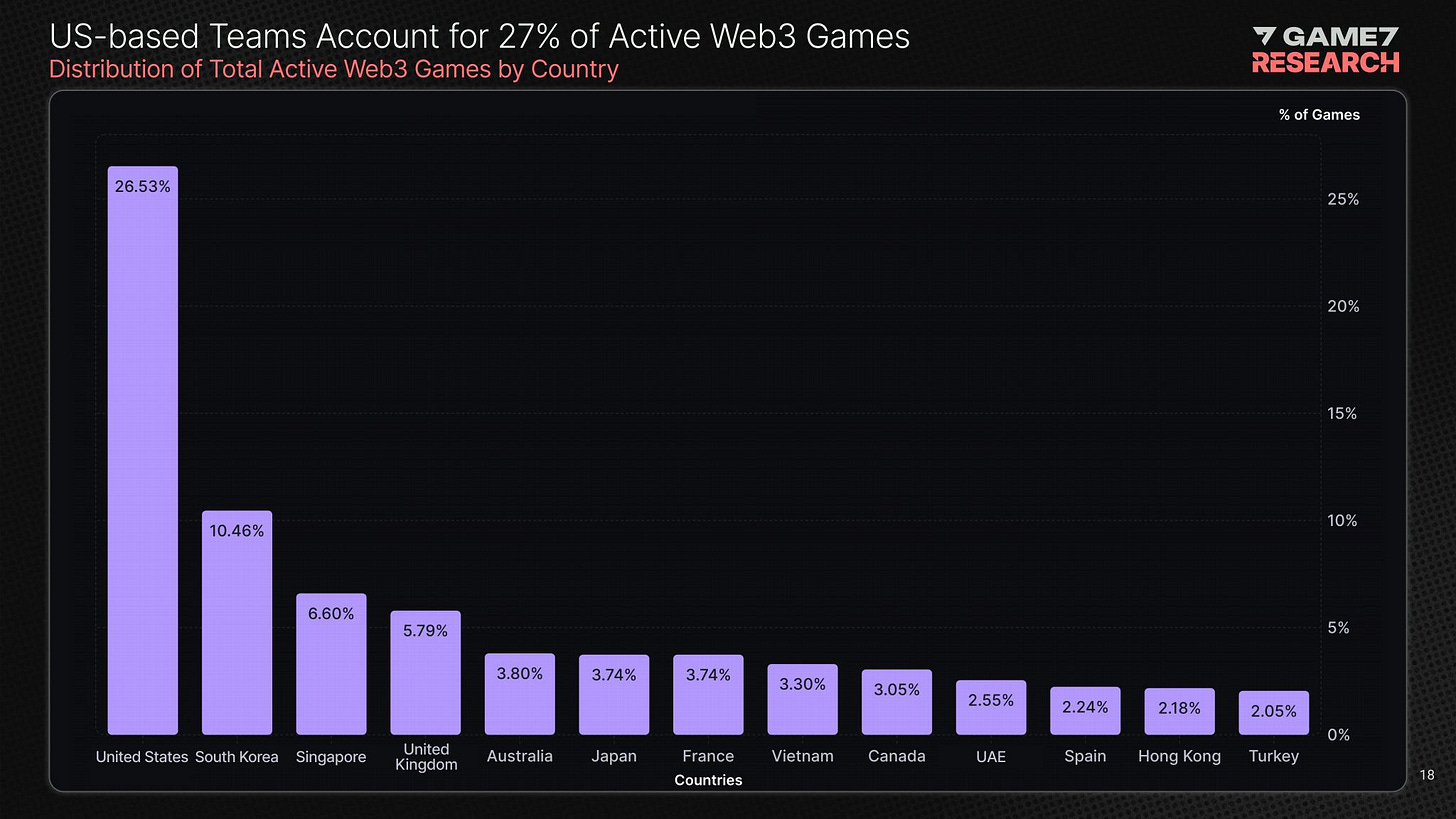

However, if we consider all active Web3 studios, most of them are located in the APAC region (38.8% of all developers). North America is in second place (35.6%).

If we look at active games, most of their developers (26.53%) are based in the USA. The country leads by a large margin.

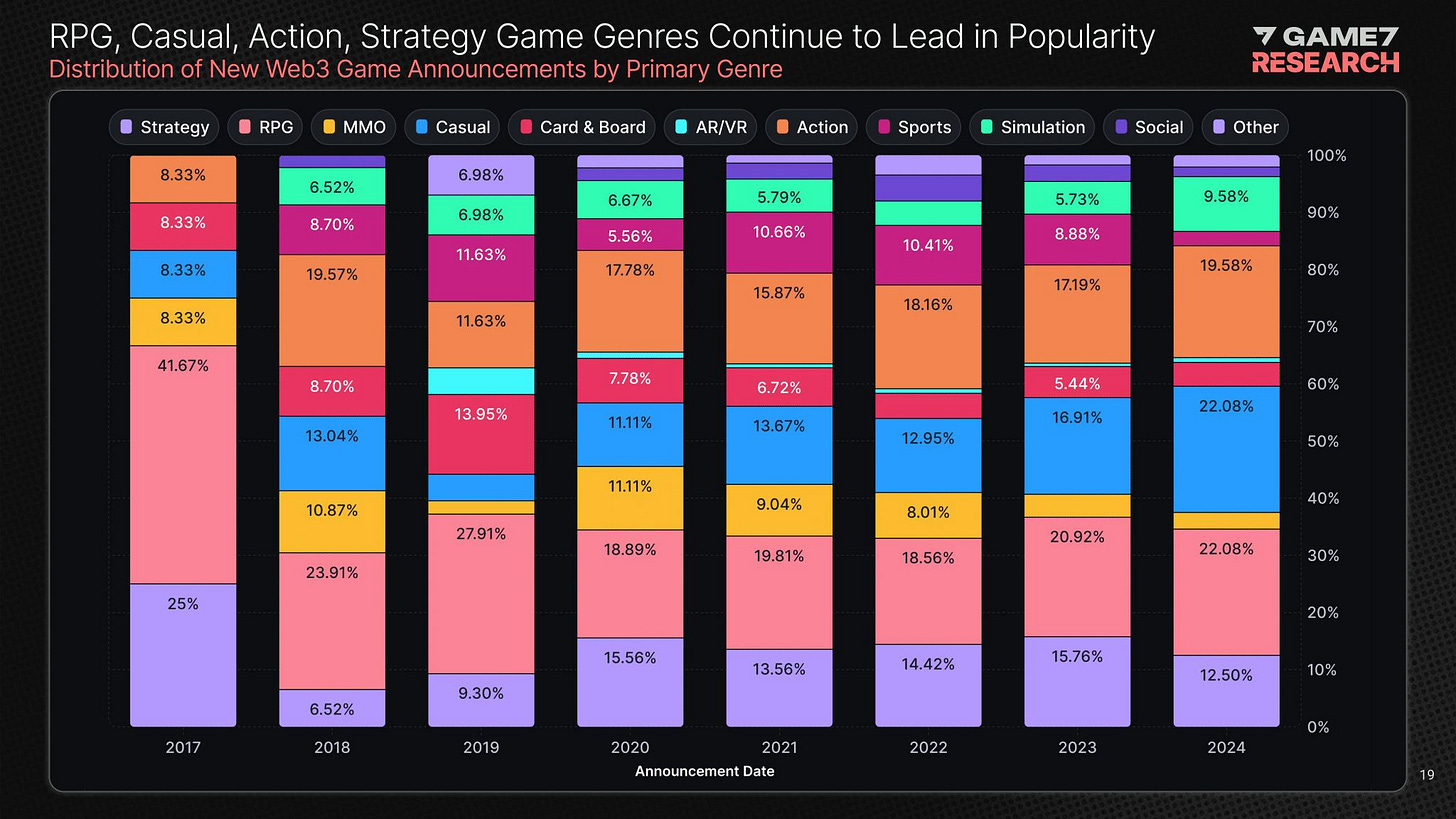

Regarding genres, there's a noticeable increase in interest in casual games (the share of announced projects has doubled over 4 years). The number of Simulation games has increased.

❗️I've heard the opinion that the Web3 market is now returning to simpler games to reach as wide an audience as possible.

Only 45.3% of announced Web3 games are currently playable. 65.7% of all announced projects still don't have Web3 integration.

Platforms and Distribution

Telegram is the breakthrough of 2024 in terms of platforms. In 2024, it took a 20.86% share. Many developers are using Telegram to bypass platform restrictions.

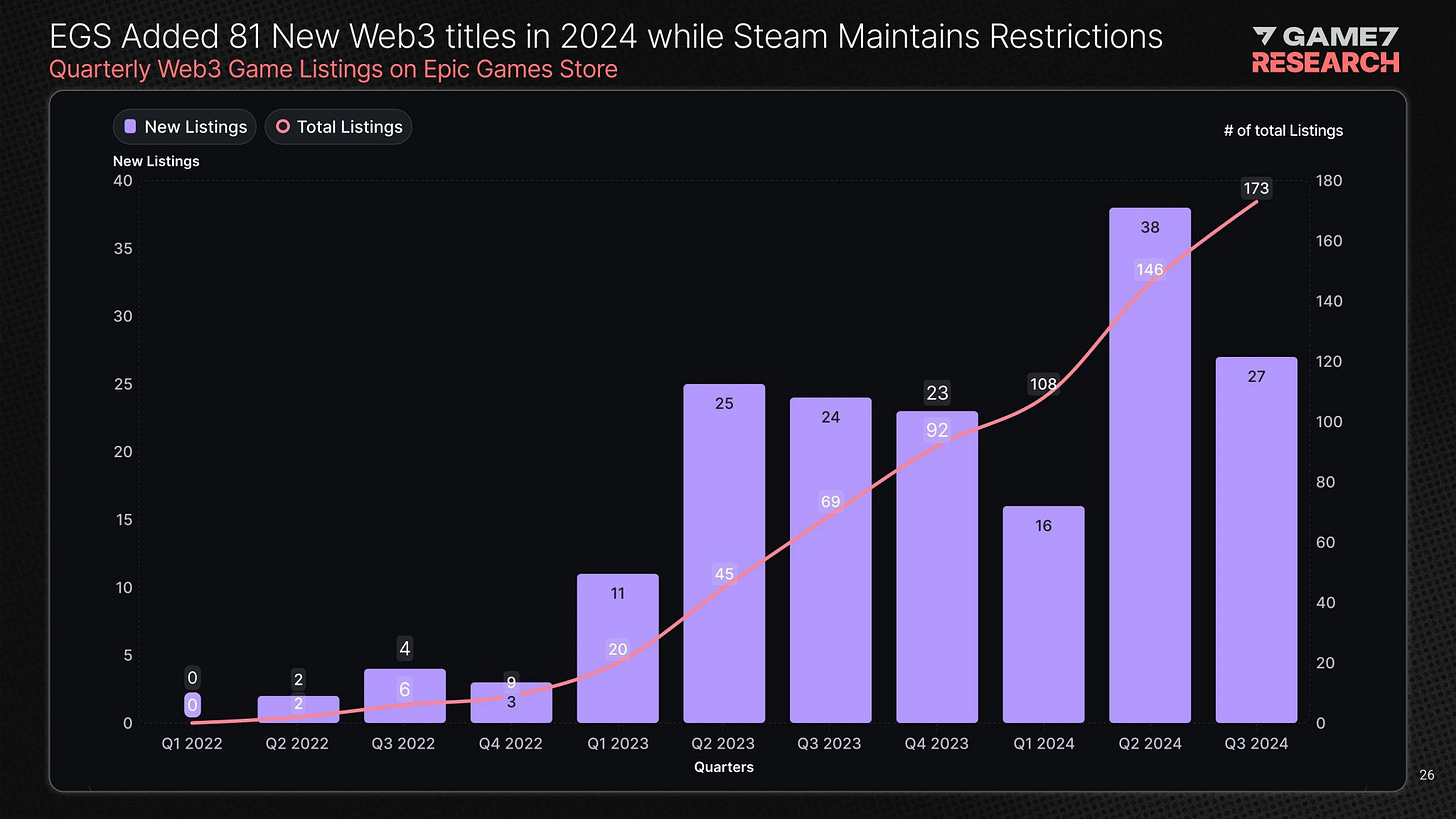

In the Epic Games Store, 81 new Web3 games were added in 2024. Industry representatives also have hopes for the launch of the mobile EGS.

The recent launch of Off the Grid demonstrated that Web3 projects can be launched on consoles, despite the non-native integration of Web3 elements.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Blockchain Technologies

In 2024, 104 new blockchain networks were launched. 67 of them are focused on games.

The majority of launched networks are Layer 2 (35%) and Layer 3 (41.67%).

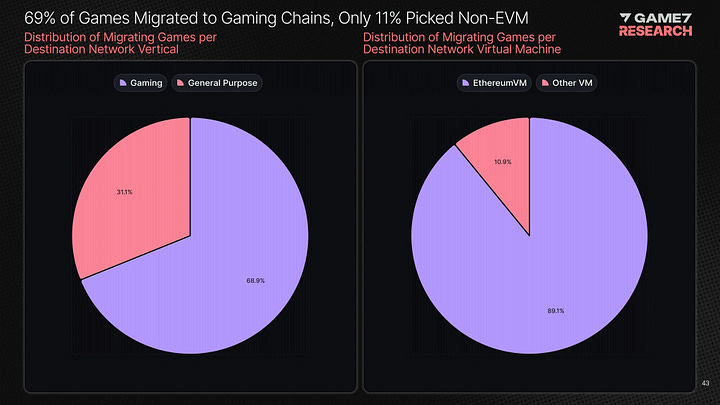

57% of Web3 games announced this year chose to use Layer 2 (42.86%) or Layer 3 (14.29%) networks.

EthereumVM remains the foundation for smart contracts in the gaming environment - it's used by almost 70% of projects.

Blockchain Ecosystems

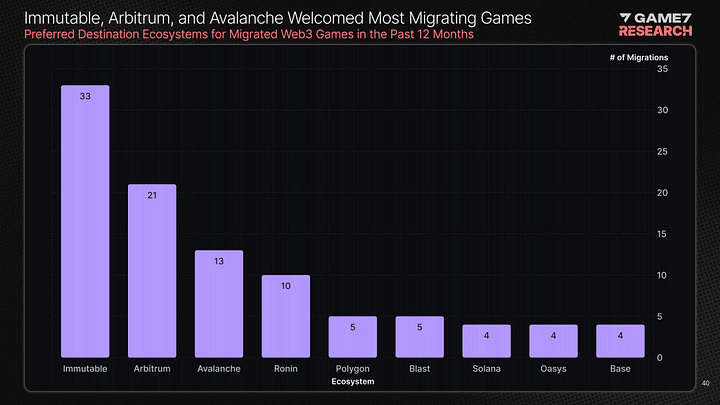

Over the past year, Immutable, Arbitrum, and Ronin have grown the most.

23 gaming blockchain networks of levels 2 or 3 were built on Arbitrum Orbit in 2024.

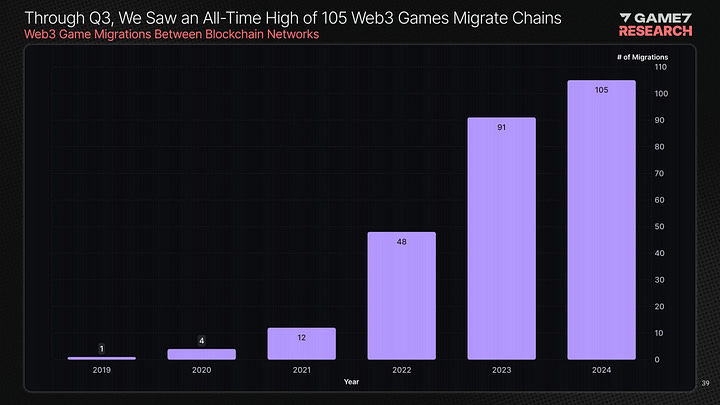

It's evident that in 2023 and 2024, developers began actively migrating to new blockchains. In 2024, there were 105 migrations, with Immutable, Arbitrum, Avalanche leading.

The largest number of migrations came from Polygon (more than a third of the total).

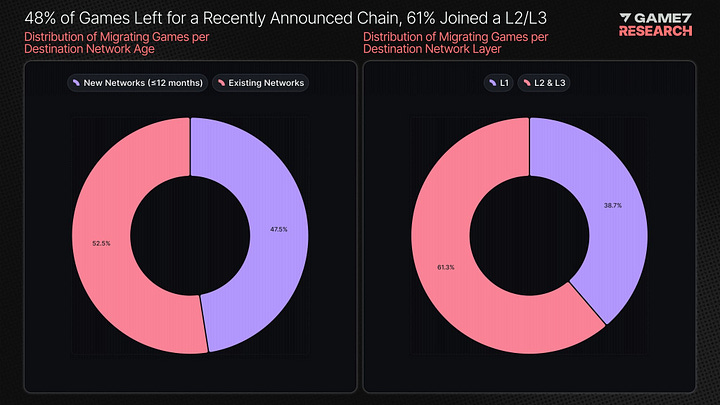

48% of games switched to a new blockchain. 61% joined L2, L3 blockchains.

Funding and Tokens

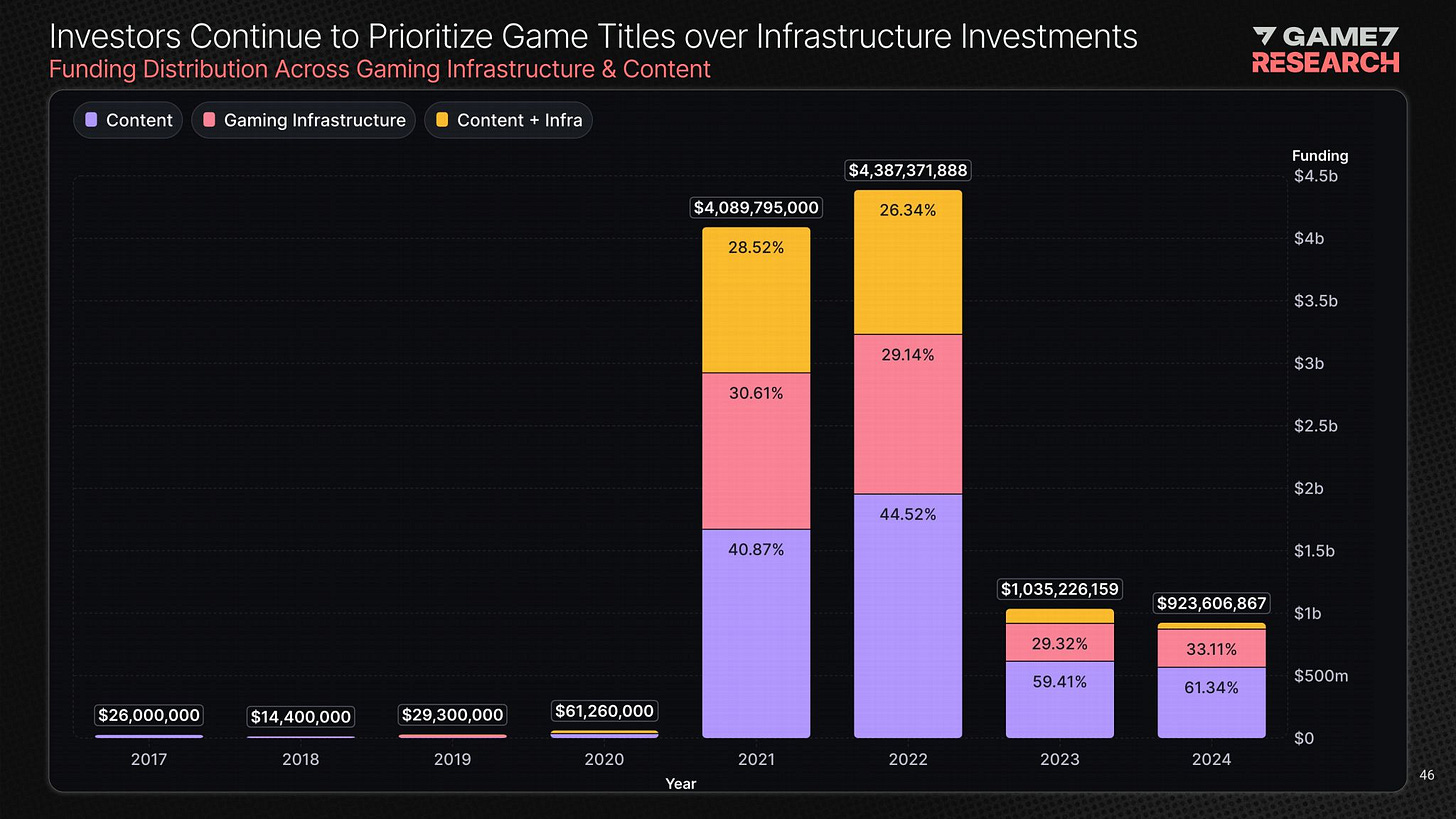

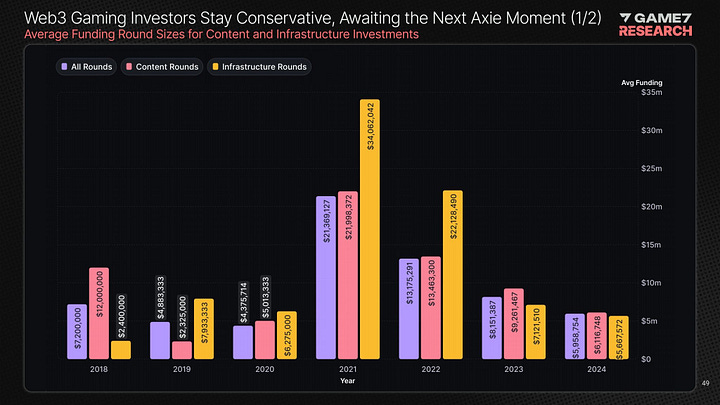

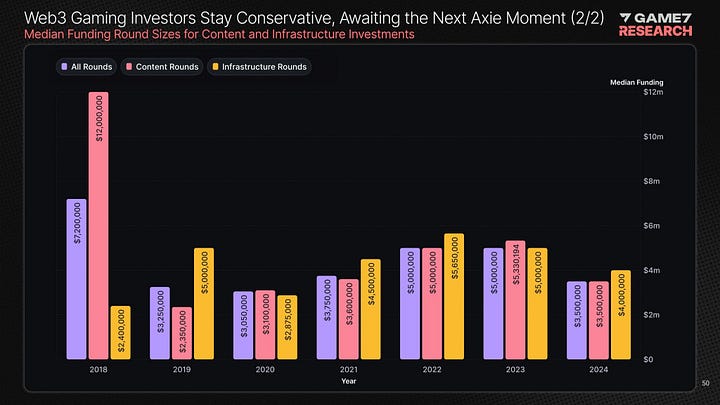

Funding for Web3 gaming projects decreased significantly compared to 2021 and 2022. The number of deals in 2024 increased, but their volume decreased.

Investors still prefer to invest in games - they account for 61.34% of all funds. 33.11% is spent on infrastructure.

Over the past 12 months, the most funds were invested in action games (31.04%), RPGs (15.23%), and casual games (13.84%). The graph shows a noticeable increase in the popularity of action games and casual projects.

When considering investments in ecosystem products, investors are most interested in gaming blockchains (27.49%). As well as user engagement tools (17.58%).

Average and median round sizes continue to decline.

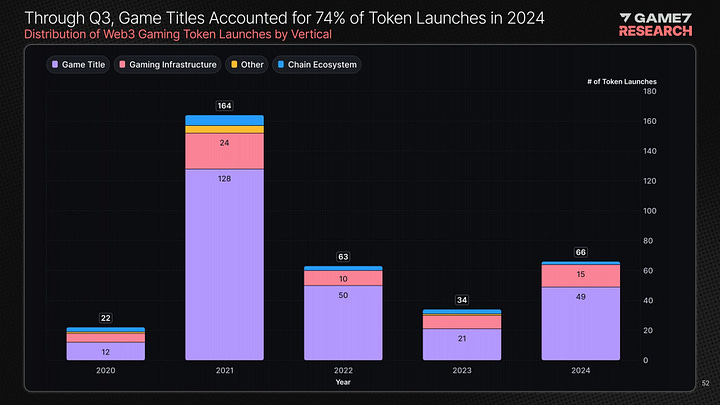

The number of tokens launched in the last 12 months increased by 200% compared to 2023. 74% of all launches occurred in Q3'24.