Weekly Gaming Reports Recap: November 4 - November 8 (2024)

New mobile games by revenue & downloads by AppMagic; Chinese gaming industry results in Q3'24; SocialPeta Southeast Asia market trends & more.

Reports of the week:

AppMagic: Top Mobile Games by Revenue and Downloads in October 2024

SGDA: The Gaming Industry in Slovakia in 2024

Ipsos & Video Games Europe: How children spend money in Games in 2024

Circana: Gamers in the U.S. in 2024

AppMagic & MY.GAMES: 4X Strategies in 2024

SocialPeta: Mobile gaming marketing trends in Southeast Asia in 2024

Chinese gaming market sets revenue record in Q3'24

Unity: User preferences during Holiday season in the USA

AppMagic: Top Mobile Games by Revenue and Downloads in October 2024

AppMagic provides revenue data after store fees and taxes.

Revenue

Honor of Kings returned to a stable first place in revenue, earning $152.9 million in October after store fees and taxes. Historically, all revenue came from China, but now it’s 97%, with the second-highest revenue market being the U.S. ($660,000).

Royal Match had its best month ever, earning $123.9 million. Last War: Survival is third with slightly over $117 million.

Interest in MONOPOLY GO! is declining, with the project’s revenue hitting its lowest point since August 2023. It fell to 8th place in the charts.

Downloads

The new downloads chart leader is Mini Games: Calm & Relax from Vietnamese studio Rocket Succeed Together, with 36.5 million downloads. The game went viral on TikTok. The studio’s previous successful project was Stick Hero: Tower Defense.

Consistently high in downloads are Block Blast! (24.8 million), My Supermarket Simulator 3D (20 million), and Roblox (15.3 million).

At 6th place, the Tik Tap Challenge by Pakistan’s XGame Global launched with 13.5 million downloads.

Perfect Tidy by Vietnam’s ABI Game Studio saw significant growth in downloads, with 11.1 million in October.

SGDA: The Gaming Industry in Slovakia in 2024

Revenue for Slovak gaming companies decreased to €70 million in 2023 from €77.1 million in 2022.

A modest growth is expected in 2024, with revenue projected to reach €70.3 million.

The number of industry employees also fell from 1,080 in 2022 to 1,017 in 2023, with 69 gaming companies currently operating in the country.

Women make up 21% of employees. 9% of the workforce are foreigners.

Among respondents, 30.4% reported the most difficulty in hiring programmers, 15.9% in finding game designers, 14.5% in finding artists, and 13% in locating PR and marketing specialists.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The top 10 largest Slovak companies account for €58.6 million in revenue, about 83.5% of the country’s total. The largest company is Pixel Federation; significant contributions from QORPO, Nine Rocks Games, Superscale, and STUDIO 727.

46% of the country’s gaming companies are based in Bratislava, while 20% are in Košice.

In 2023, local developers released 80 proprietary games and contributed to 157 external projects.

Currently, 310 games are in development, with most targeting PC (72.5%), followed by mobile (31.9%). Approximately 23.2% of projects are planned for Xbox and 18.8% for PlayStation.

Ipsos & Video Games Europe: How children spend money in Games in 2024

Ipsos conducted a survey of 2,772 parents or guardians on the topic of children’s spending on games, focusing on Europe.

As of 2023, 76% of parents reported that their children do not make in-game purchases. 18% know that their children make purchases, and 6% do not monitor this aspect.

The most popular purchases, at 38%, are items that directly impact gameplay, making this the top category of purchases. Following this are cosmetic items, which account for 30%. Loot boxes, under regulatory scrutiny in many countries, are less popular.

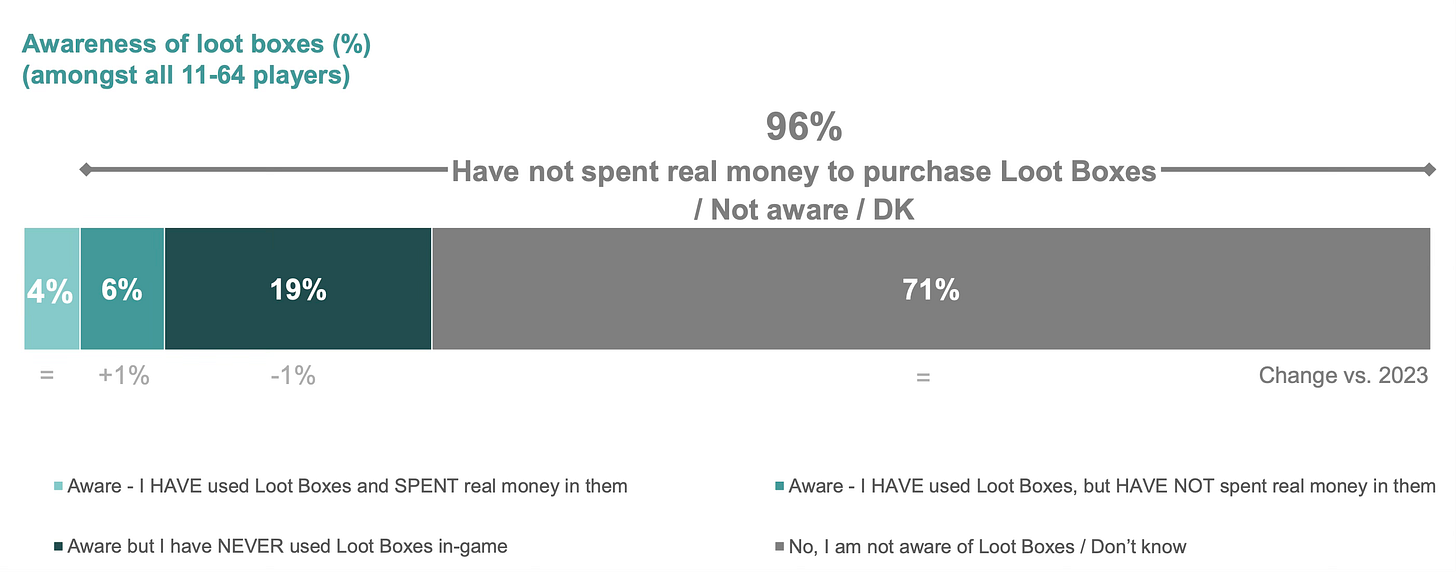

❗️There is a methodological question here: some parents may not realize that items affecting gameplay or cosmetic items are often sold through loot boxes. This is supported by the fact that 71% of respondents are unaware of loot boxes.

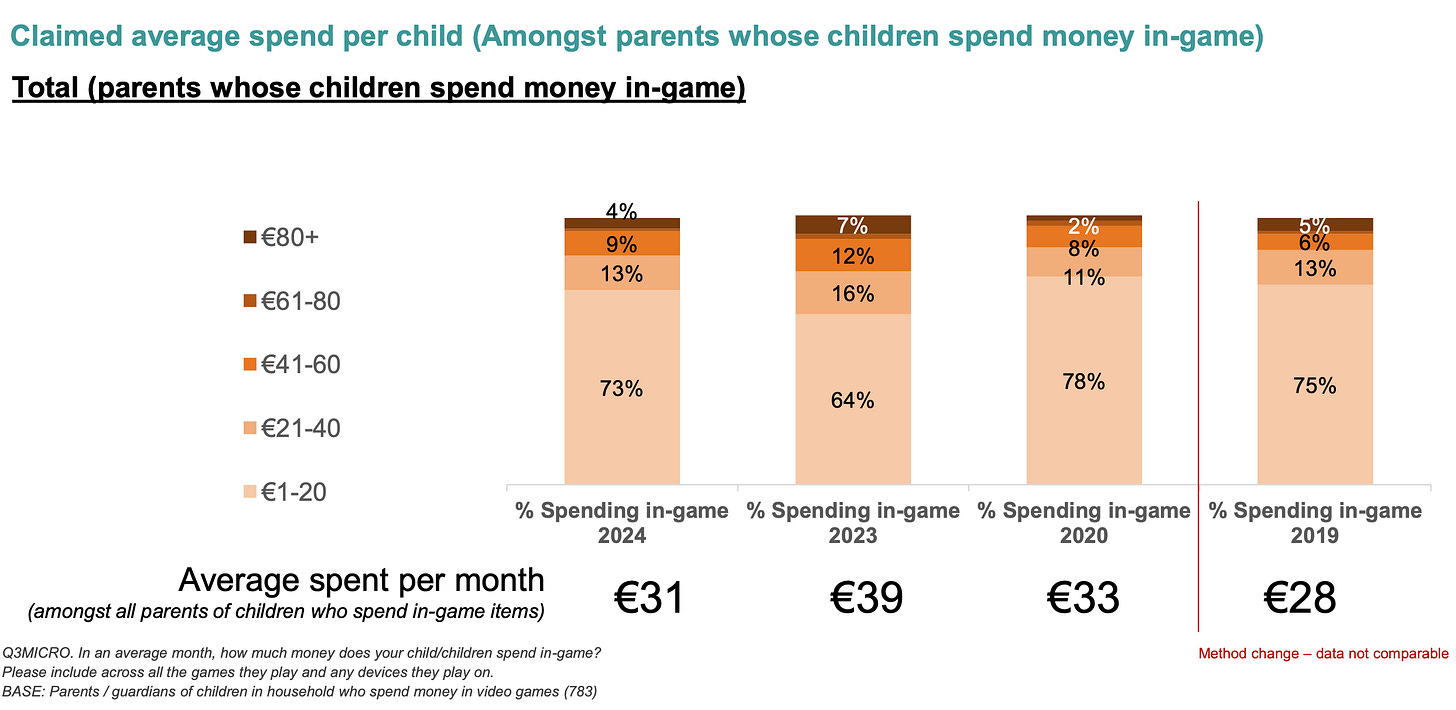

Parental spending on children’s in-game purchases has dropped to €31 per month, down from €39 the previous year. The study did not investigate the reasons behind this decrease.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The percentage of parents with an agreement with their children regarding in-game spending has slightly decreased from 76% in 2023 to 73% in 2024.

95% of parents actively monitor how their child spends money on games.

Circana: Gamers in the U.S. in 2024

The company surveyed 5,100 active gamers in the U.S., aged two and older. For minors between 2 and 10, parents or guardians responded with assistance from the children. Gamers were defined as individuals who had played on any device in the past month, with the survey conducted in May–June this year.

71% of U.S. residents play games, a decline from 74% in 2020 but still higher than 67% in 2018.

There are a total of 236.4 million players in the country.

On average, gamers spend 14.5 hours per week playing, an increase of 1.8 hours from 2022, with more time dedicated to mobile and console gaming.

People over 45 represent the largest gaming demographic in the U.S., accounting for 37% of all players. This segment has the highest proportion of women and a growing interest in console gaming. Although engagement has decreased, spending in this group remains on the rise.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Generation Alpha (ages 2 to 12) is playing games less than before, down 6% from 2022. However, Circana analysts note that this group remains highly valuable in terms of both engagement and spending.

65% of the population plays on mobile devices (unchanged from 2022); 36% play on PCs (a decrease of 4% from 2022); 35% play on consoles (unchanged from 2022); and 13% play on other devices, such as VR or handheld systems, which have increased by 2% since 2022.

Among active gamers, 92% play mobile games; 51% play on PCs; and 50% play on consoles.

16% of all U.S. gamers are “super gamers,” totaling 38.3 million (up from 36 million in 2022). This highly active group, primarily aged 13 to 34, plays on the largest number of platforms and spends the most money.

The average American gamer spent $56.20 on games in the past six months, although 46% of gamers made no purchases during this period.

AppMagic & MY.GAMES: 4X Strategies in 2024

Market Overview

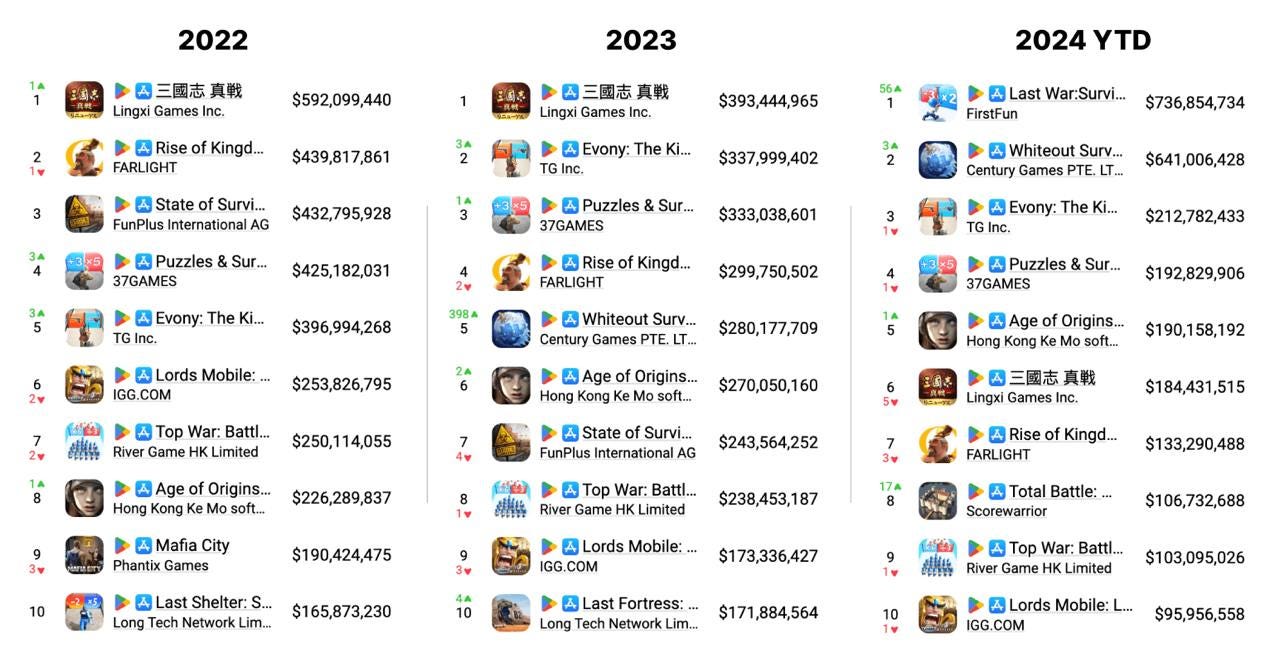

By the end of 2023, 4X games earned $5.8 billion after store commissions and taxes. This represents 10.2% of the total volume.

4X strategies were downloaded 632 million times in the same year. The Revenue per Download (RPD) was $9.2.

As of September 2024, two 4X strategies are in the top 5 by revenue - Last War: Survival ($105 million in September) and Whiteout Survival ($90 million in September).

AppMagic and MY.GAMES analysts specifically note that the 4X strategy market is dynamic. Firstly, there is constant rotation in the top 10 by revenue. Secondly, in the first 3 quarters of 2024, 58% of revenue came from games outside the top 5.

The genre, however, is not without its problems. The main issues are long development times, high CPIs, and difficulty in user retention.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Changes in 4X Strategies in Recent Years

Projects have started choosing more popular settings more often. There are more games in zombie and post-apocalyptic settings.

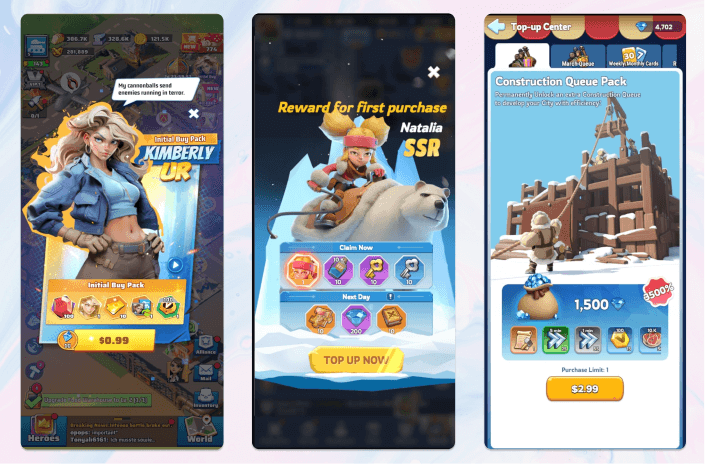

Developers have updated their approach to visual style. The graphics have become more casual, and the UI/UX has been simplified.

There’s a greater focus on the female audience. This is manifested in adding social mechanics, customization, and less focus on violence.

Casualization. Hypercasual and casual mechanics are used in UA and FTUE to make the player onboarding process easier.

The authors of the material highlight 7 signs of a more casual approach:

Simplification of combat mechanics - less focus on individual units, and more on the overall strength of the army.

Reduced focus on PvP and minimizing punishment for attacks by other players.

Clear goal-setting for users - the player is guided step by step.

Accelerated dynamics - manifested, for example, in the speed of marches.

Greater focus on socialization. To the extent that in Last War: Survival, a message is automatically written for a new alliance member.

Moving away from serious tones to casual graphics. The trend started with Lords Mobile and Rise of Kingdoms; now it’s harder to find a 4X strategy with a serious visual style.

Greater focus on personalization.

SocialPeta: Mobile gaming marketing trends in Southeast Asia in 2024

The number of active advertisers increased by 9.5% in 2024 compared to the previous year.

63.8% of advertisers in 2024 released new creatives every month. This is 0.8% less than the year before.

The average monthly share of new creatives is 39.6%. This is 1.5% more than the previous year.

The largest number of advertisers in the Southeast Asian market are in casual games (28.4%), casino (13.9%), and puzzles (11.3%). The fastest-growing categories in terms of advertisers are casual games (+1.4% YoY) and RPG (+1.1% YoY). Most creatives are for casual games (29.6%), RPG (16%), and puzzles (10.7%). The highest growth is shown by RPG (+3.8% YoY) and SLG (+1.7%).

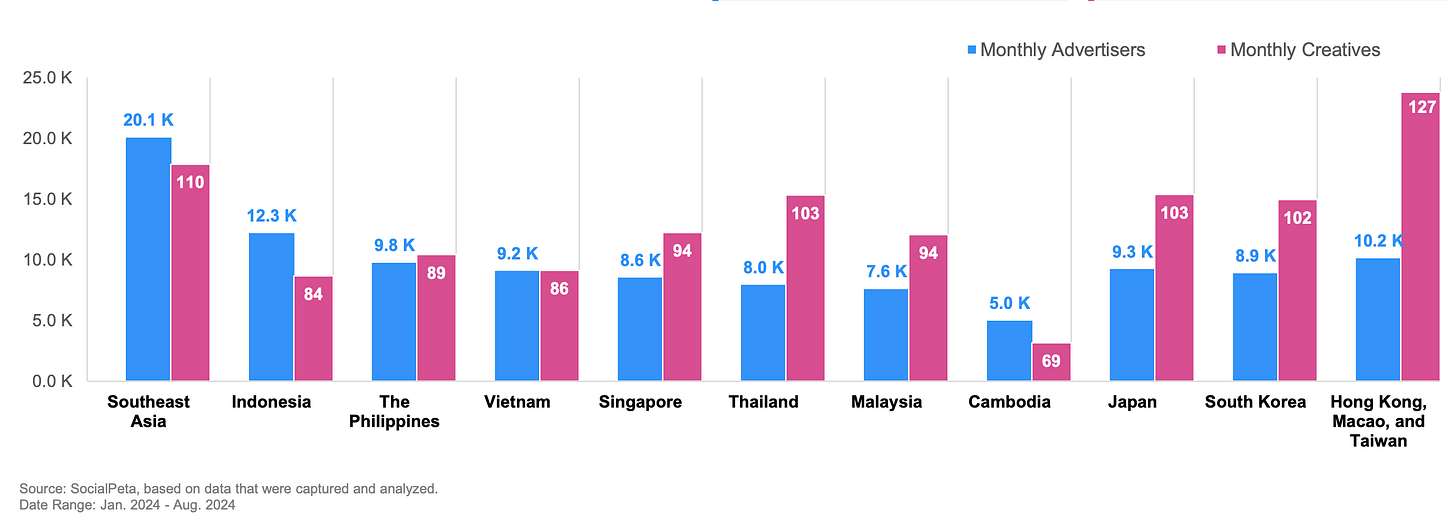

The largest number of advertisers are in Indonesia, the Philippines, and Vietnam. The highest average monthly number of creatives is in Thailand, Singapore, and Malaysia.

75.5% of advertisers are on Android; significantly fewer on iOS - 24.5%. In some countries (Indonesia), the share of iOS advertisers has fallen below 20%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

65.8% of creatives in the region are video; 31.7% are static images. Compared to the world, the popularity of video creatives in Southeast Asia is higher.

The leaders in advertising activity on iOS are Pesta Ludo: Permainan Papan; Draconia Saga and Legend of Mushroom. On Android - Bắn Cá Vui, Braindom and Draconia Saga.

In creatives, companies actively use AI; make references or collaborations with IP; use mini-games; show gameplay with comments from real people or actors. The use of cosplayers is also popular.

Chinese gaming market sets revenue record in Q3'24

The state-affiliated Gaming Publishing Committee of the China Audio-Video and Digital Publishing Association reported on the success.

Gaming market revenue in Q3’24 in China reached $12.9 billion (91.8 billion yuan). This is 8.95% more than in Q3’23.

$10.2 billion in Q3’24 was earned by games made by Chinese developers.

Mobile games earned $9.24 billion - +1.2% YoY.

The growth is associated with the release of Black Myth: Wukong, which gained wide popularity in the country.

Chinese developers in Q3’24 earned $5.17 billion in foreign markets. Thanks to Black Myth: Wukong, this figure grew by 21% YoY.

Unity: User preferences during Holiday season in the USA

The company surveyed 4,094 people in the US over 18 years old. I’m publishing only the part related to games.

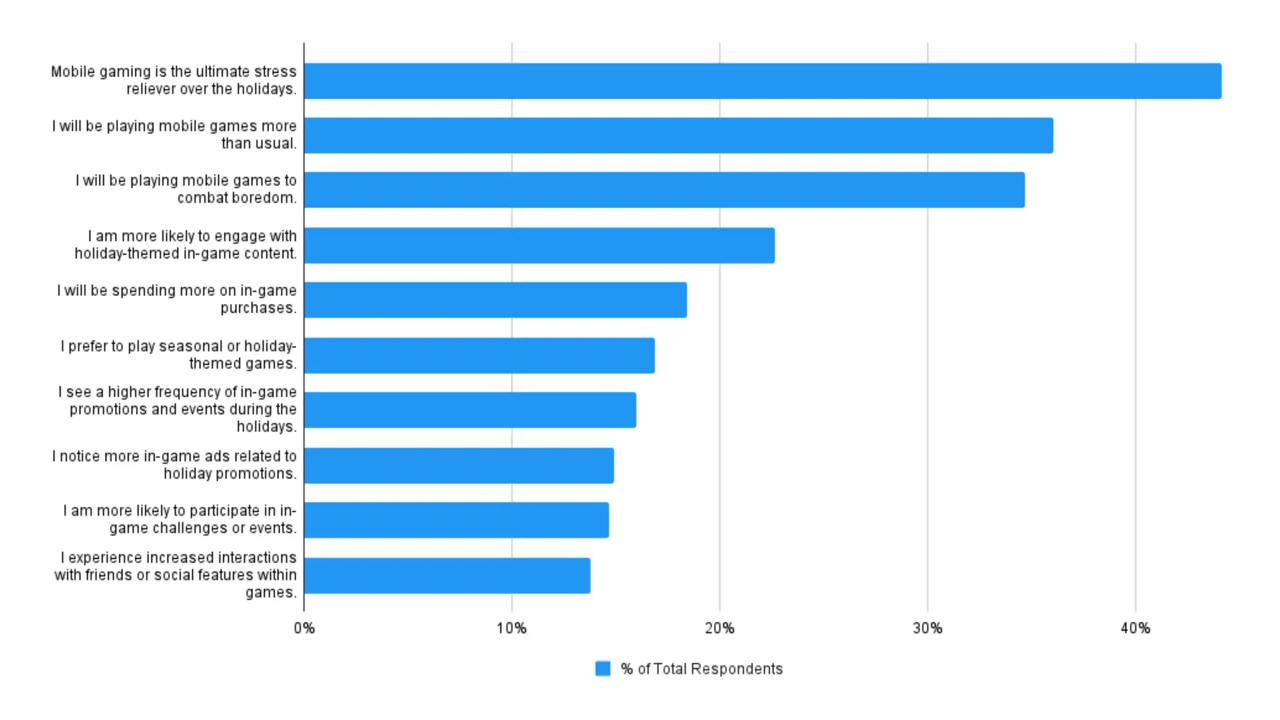

44% of respondents noted that games help relieve stress associated with the holiday season.

35% of users indicated that they will play mobile games during the holidays to avoid boredom.

The younger the person, the more likely they are to play more during the holiday season. 37% of Generation Z representatives stated plans to play more. Among baby boomers, this figure is 12%.

33% of Generation Z; 44% of millennials; 46% of Generation X and 37% of baby boomers indicated that they will play 3 or more hours during the holiday season.

18% of respondents noted that they plan to make more purchases during the holiday season.