Weekly Gaming Reports Recap: October 14 - October 18 (2024)

Indie games in 2024 research by VGI; Gaming Investment market in Q3'24 by InvestGame; the US market in August by Circana & more.

Reports of the week:

Circana: U.S. Gaming Market Declined by 7% in August 2024

Games and Numbers (October 2 - October 15, 2024)

InvestGame & GDEV: The History of Web3 Gaming Investments

Video Game Insights: Indie Games on Steam in 2024

InvestGame: Gaming Investment Market in Q3'24

Circana: U.S. Gaming Market Declined by 7% in August 2024

Market Overview

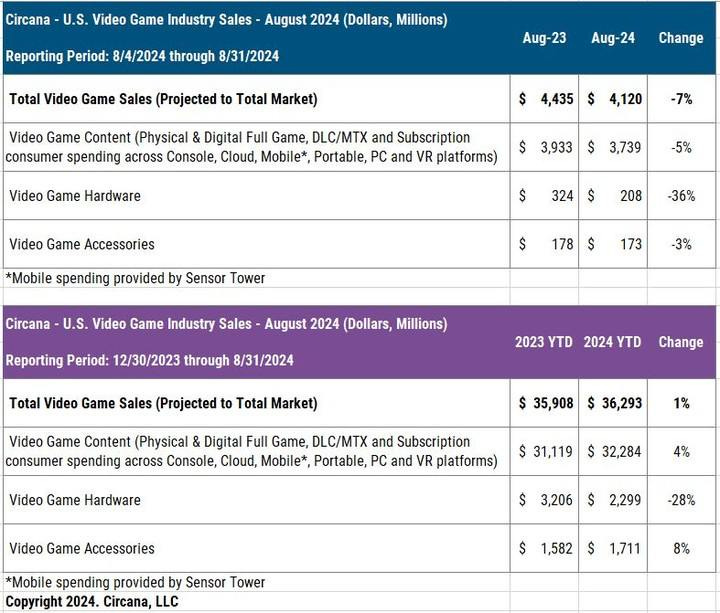

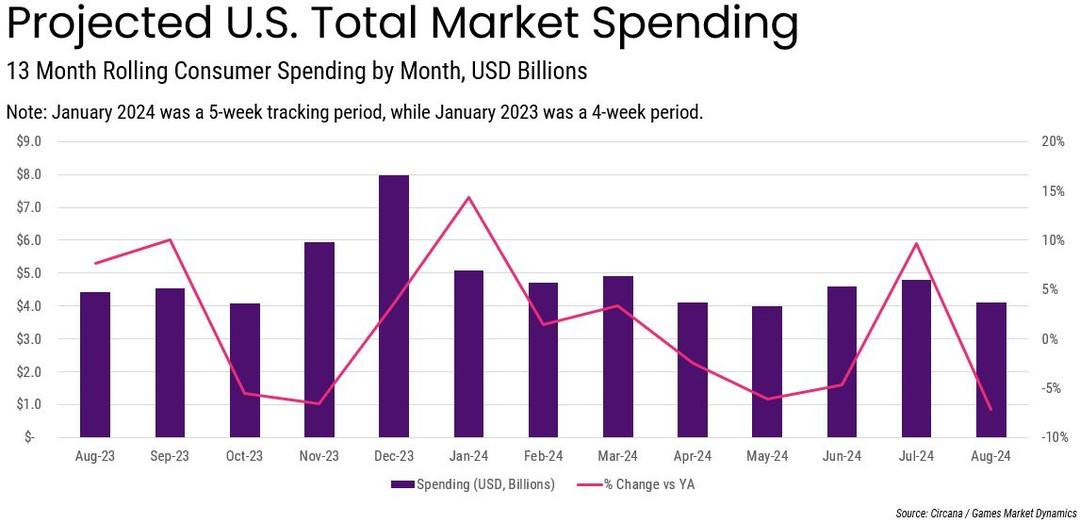

American consumer spending on gaming products in August reached $4.12 billion, down 7% compared to the previous year.

While mobile market revenue grew by 5%, it wasn't enough to reverse the negative trend. Total content sales dropped to $3.739 billion (-5% overall).

Hardware sales plummeted by 36% year-over-year. All consoles declined at least 34%, with the biggest drop for the Nintendo Switch (-41% YoY). The PS5 was the best-selling system in both revenue and unit sales.

Accessory sales decreased by 3%. PlayStation Portal sales (and the category of Remote Play devices) increased, though it’s unclear what other devices contributed besides Sony's. Gamepad sales fell by 10%. The DualSense controller was the top seller in terms of revenue, while PlayStation Portal led the category over the first 8 months of 2024.

As of August 2024, the U.S. market size stood at $36.3 billion. For the first 8 months of the year, results are 1% better than the same period in 2023. There was growth in content (+4% YoY, thanks to the mobile market) and accessories (+8% YoY). However, hardware sales were down 28% compared to 2023.

Best-Selling Games

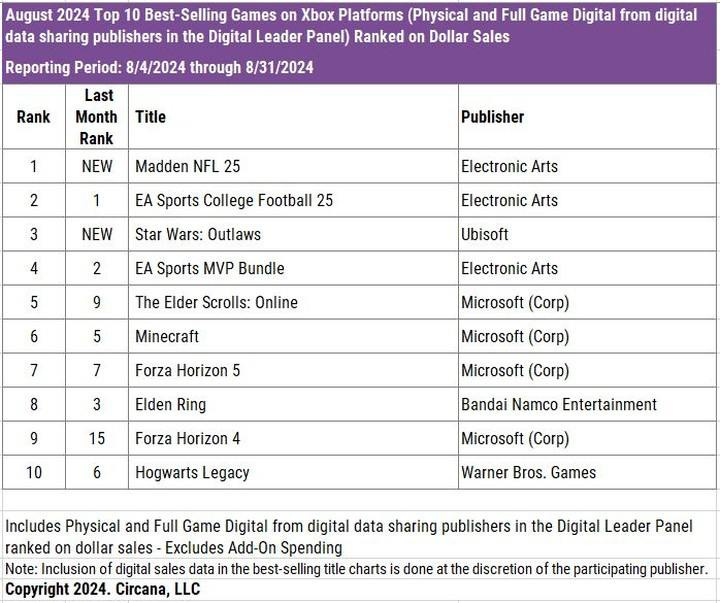

Madden NFL 25 debuted at the top of the U.S. market. This marks the 25th consecutive year that the game has been the best-selling title in August, starting with Madden NFL 2001 in August 2000.

❗️Black Myth: Wukong did not make the chart because the publisher chose not to share digital sales data—only physical copies were considered. However, the game ranked 12th in MAU in the U.S.

Second place went to EA Sports College Football 25, third to Star Wars: Outlaws (new release), and fourth to the EA Sports MVP Bundle (which includes Madden NFL 25 and EA Sports College Football 25). It was an exceptionally successful month for EA.

Other new releases in the month included Visions of Mana (10th place) and Gundam Breaker 4 (11th place).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

For overall 2024 sales, EA Sports College Football 25 leads, followed by Helldivers II and Call of Duty: Modern Warfare III. Although Madden NFL 25 launched recently, it has already climbed to 12th place.

The top mobile games in August were MONOPOLY GO!, Roblox, and Royal Match. Sensor Tower analysts noted that MONOPOLY GO! revenue was down 32% compared to its peak in March 2024, but it still managed to top the chart.

PC/Console Charts

On PlayStation, three new games entered the top 10: Madden NFL 25 (1st place), Star Wars: Outlaws (3rd place), and Visions of Mana (10th place).

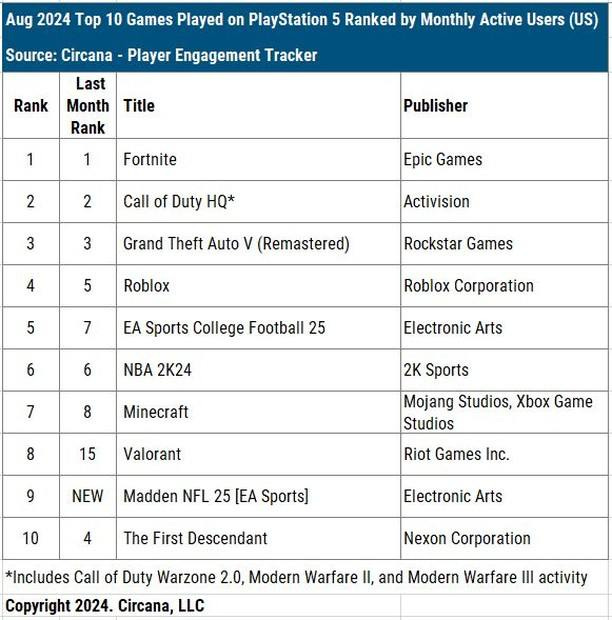

There were also changes in the MAU ranking. Valorant climbed to 8th place, and Madden NFL 25 debuted at 9th. The top spots were still held by Fortnite, Call of Duty, and GTA V.

The Xbox sales chart almost mirroring PlayStation’s, except that Visions of Mana didn’t make the list.

The top MAU game on Xbox was Mafia: Definitive Edition, which joined Xbox Game Pass on August 13.

Only physical copies are counted in the Nintendo Switch sales charts, and there were no major new releases.

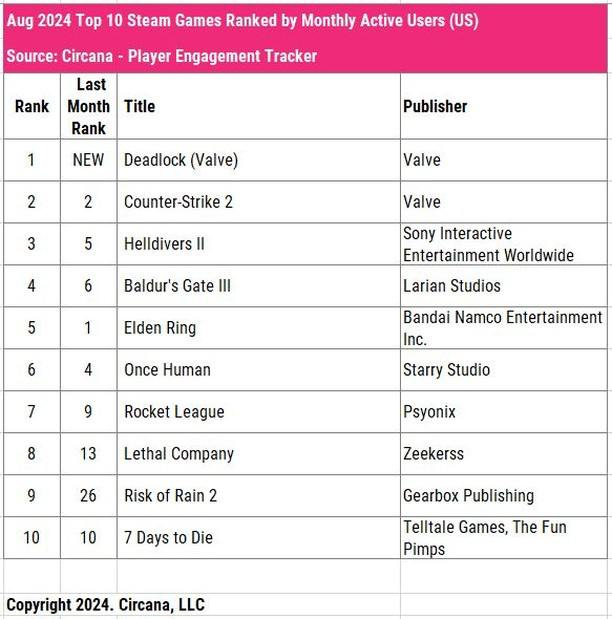

Deadlock became the MAU leader on Steam in August in the U.S., even though Valve did not heavily promote the game. Risk of Rain 2 climbed to 9th place.

Games and Numbers (October 2 - October 15, 2024)

PC/Console Games

The Tomb Raider series has sold over 100 million copies. The series will celebrate its 28th anniversary on October 24.

The development of Black Myth: Wukong cost $42.4 million, as reported by a Game Science representative at the Global Digital Trade Expo. The company also utilized tax credits amounting to $3.96 million. This figure does not include marketing expenses.

Total sales of Detroit: Become Human have surpassed 10 million copies since its release in 2018.

Hooded Horse shared its portfolio results for the last 12 months. The company's games have sold over 4.5 million copies, and their wishlist count has exceeded 9.5 million. The top sellers are Manor Lords (2.5 million copies), Against The Storm (1.2 million copies), and Workers & Resources: Soviet Republic (600,000 copies). The most wishlisted games are Falling Frontier (600,000 wishlists), Nova Roma (350,000), and Super Fantasy Kingdom (250,000).

According to Niko Partners, Palworld has been purchased by at least 5 million people in China, making it a top-3 market alongside Japan and the US.

Metaphor: ReFantazio, a new RPG from the creators of Persona, launched with great success, selling over one million copies within 24 hours.

Insider Gaming reports that Star Wars: Outlaws has barely exceeded 1 million copies sold a month after its release.

Crime Scene Cleaner sold 355,000 copies on Steam within 60 days of its release, generating $5.4 million in revenue.

The peak MAU for Fortnite was 110 million, as Tim Sweeney shared, during the last holiday season.

More than 3 million players joined the new MMORPG Throne and Liberty from NCSOFT and Amazon Games within its first week.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

More than half a million people played Tiny Glade within two weeks of its release, according to a post from the developers.

According to VGI, Deadlock has already surpassed 3.5 million wishlists.

Mobile Games

According to Niko Partners, Genshin Impact has surpassed $5 billion in gross revenue in China.

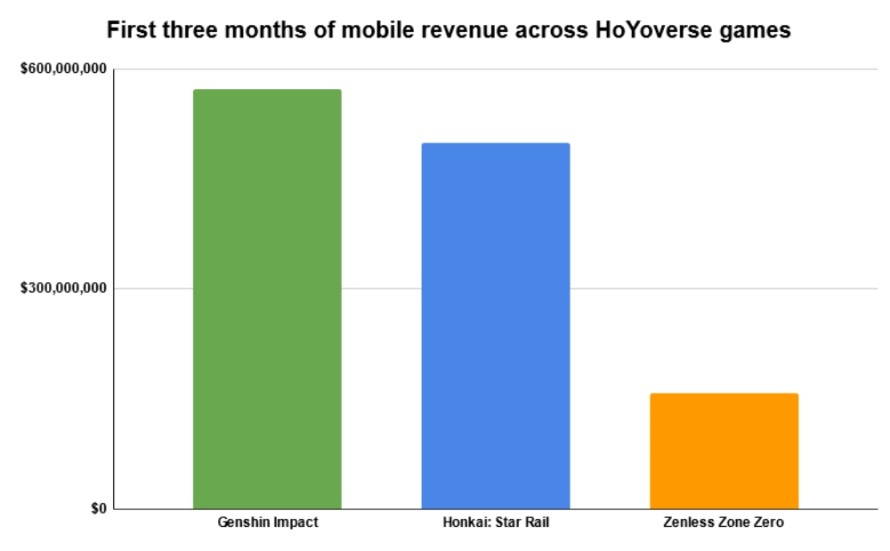

Zenless Zone Zero generated over $150 million in mobile revenue in less than three months since its release. In comparison, Genshin Impact earned $572.1 million and Honkai: Star Rail $498.4 million in the same period.

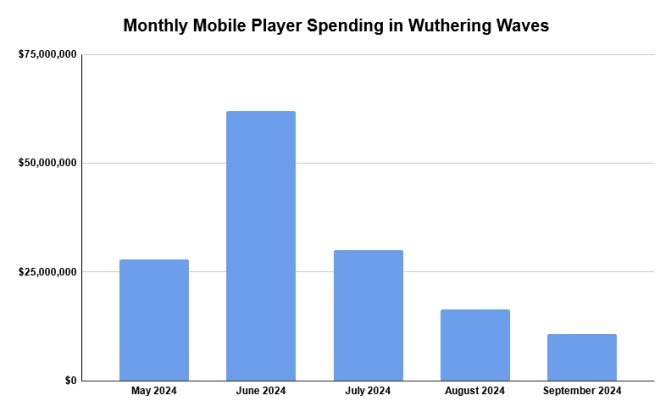

Wuthering Waves has earned more than $150 million in its first five months. China and Japan account for 23% of this sum, South Korea 17%, and the US 15%. However, the game's trend appears to be declining.

India is the second-largest market for PUBG. In 2023, it accounted for 10.8% of the game's total revenue, while the US took the top spot with 20.4%. KRAFTON has earned over $200 million from the game in India.

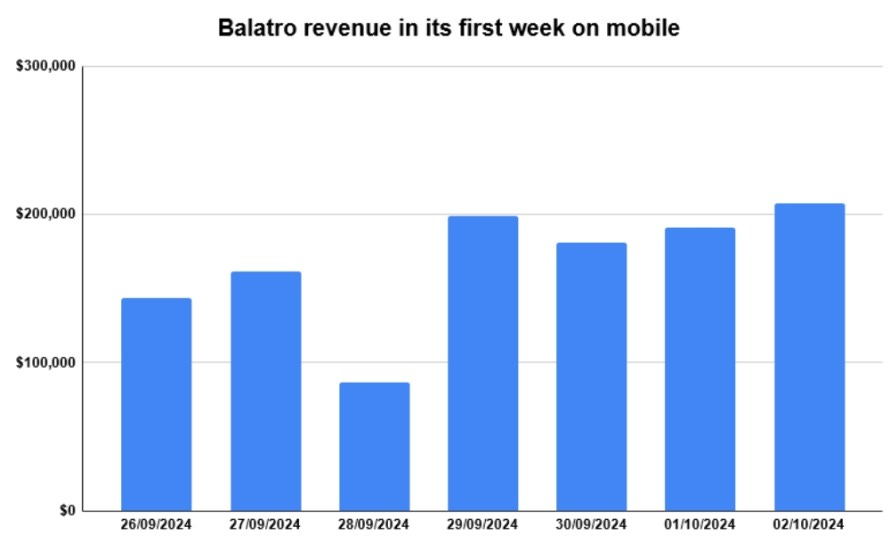

The net revenue for Balatro on mobile devices approached $1 million within its first seven days, according to AppMagic. It was previously reported that the game was purchased over half a million times, with 60% of the revenue coming from the US.

Platforms

Epic Games Store attracted 70 million players in September.

Transmedia

The Fallout series has been watched by more than 100 million people worldwide.

InvestGame & GDEV: The History of Web3 Gaming Investments

InvestGame only considers private investments; public offerings and token sales are not included.

Market Overview

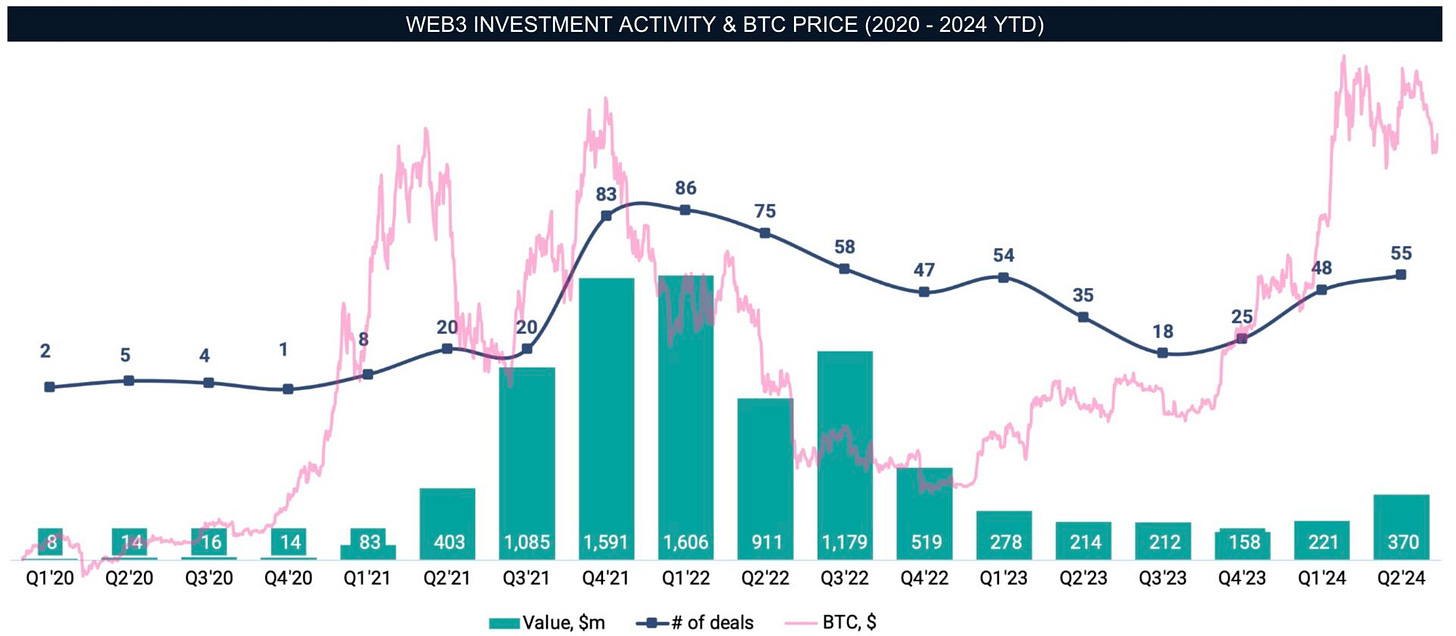

A surge in investment activity began in late 2020 and early 2021, coinciding with the rapid rise in Bitcoin's value.

The peak of investment activity occurred in Q1 2022, with 85 publicly announced deals totaling $1.6 billion.

After that, the market declined, accompanied by significant events: in March 2022, the Ronin network from the creators of Axie Infinity was hacked; LUNA crashed in May 2022; and the crypto exchange FTX shut down at the end of the year. Business activity reached its lowest point in Q3 2023, with 18 deals worth $212 million. The lowest point regarding money invested was in Q4 2023, at $158 million.

There is no direct correlation between Bitcoin's value and business activity in the market. Since late 2023, Bitcoin's value has steadily increased, but the Web3 investment market hasn't followed suit, indicating deeper fundamental issues.

Web3 Market Investment Structure

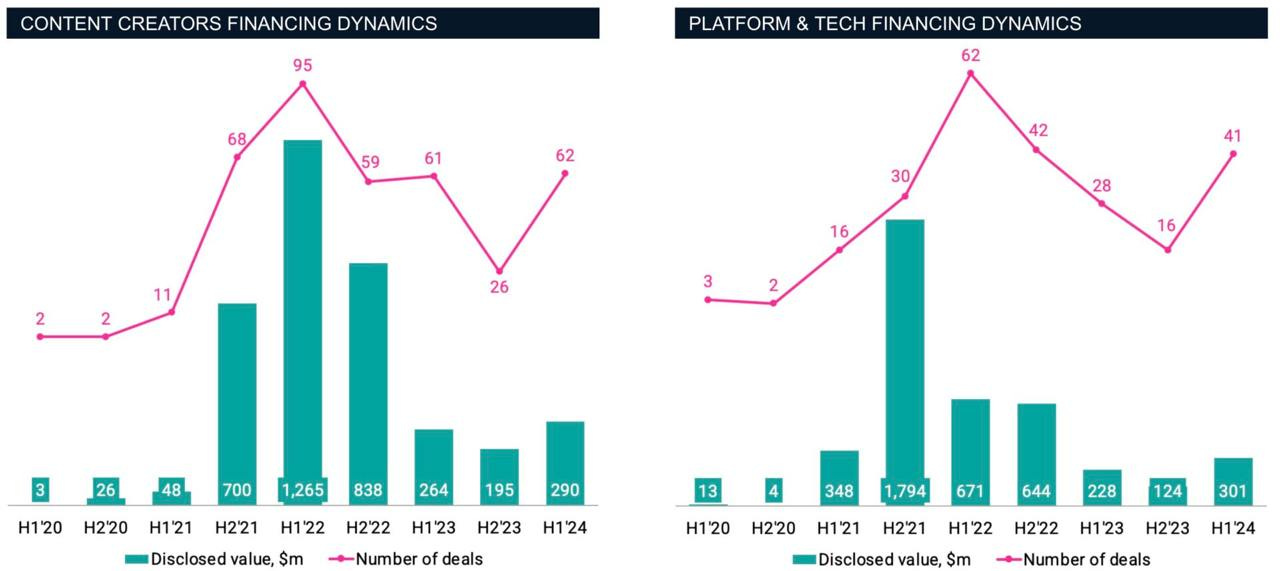

Crypto gaming startups can be divided into two categories: content (games) and platform/tech developers.

In 2020, there were 9 public deals (4 content-focused, 5 platform-focused) totaling $46 million.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

In 2021, the number of publicly announced deals increased to 125 (79 content-focused, 46 platform and technology-focused), with a total deal value of $2.9 billion.

The peak of Web3 startup deals occurred in 2022, with 258 deals (154 content-focused, 104 platform-focused) totaling $3.418 billion.

The most notable VC deals during the market's peak were Forte, Sorare, Yugulabs, and Mystery Labs, which attracted nearly $2.4 billion, accounting for 30% of all investments in crypto gaming startups from 2020 to 2024.

Most Active Investors

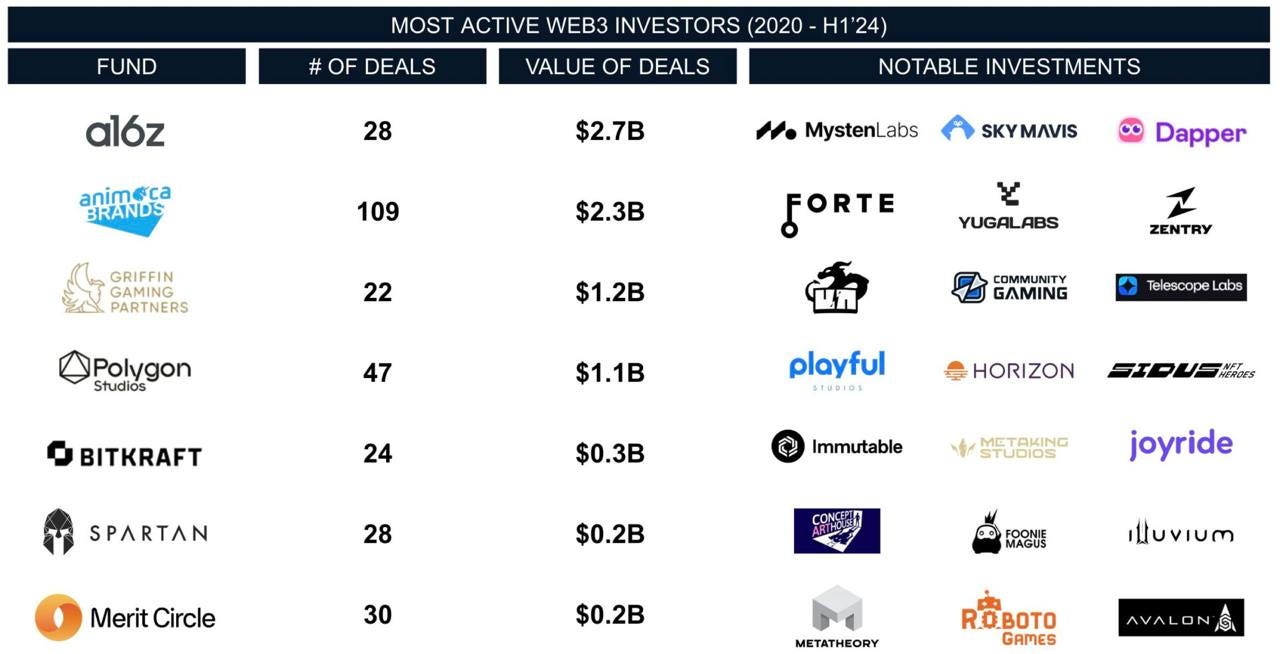

Animoca Brands is the most active crypto investor in terms of the number of investments (109 disclosed deals), with a total investment of $2.3 billion.

However, Andreessen Horowitz (a16z) holds the record in terms of deal value, with 28 deals totaling $2.7 billion.

Other notable investors in the market include Griffin Gaming Partners (22 deals worth $1.2 billion) and Polygon (47 deals worth $1.1 billion).

Exits

Many crypto companies have attracted venture investor interest, but there have been relatively few M&A deals due to the industry's early stage and the need to deliver on promises.

The largest deal was the acquisition of SundayToz by Wemade for $115 million.

Animoca Brands has conducted at least 6 M&A deals, but their values remain undisclosed.

Between 2020 and 2024, InvestGame tracked a total of 33 M&A deals worth $146 million.

Video Game Insights: Indie Games on Steam in 2024

Market Overview

99.9% of all games released on Steam are indie games.

As of the end of September 2024, indie games account for 58% of all copies sold on Steam, which is a record high since 2018.

In terms of revenue, indie games also make up 48% of all money generated on Steam. The previous record was in 2022 (32% of all revenue). This means indie games earn as much on Steam as AA/AAA releases.

The most successful indie releases this year include Black Myth: Wukong (20.6 million copies sold), Palworld (20.1 million copies), Manor Lords (3.3 million copies), Enshrouded (3 million copies), and Content Warning (3 million copies).

❗️VGI notes that the concept of "indie games" is becoming increasingly blurred in today’s market. The quality of these games can match that of AAA releases (Black Myth: Wukong), and what appear to be indie projects may actually be backed by large companies (Dave the Diver). For VGI's criteria on indie games, see here.

Indie Market Growth

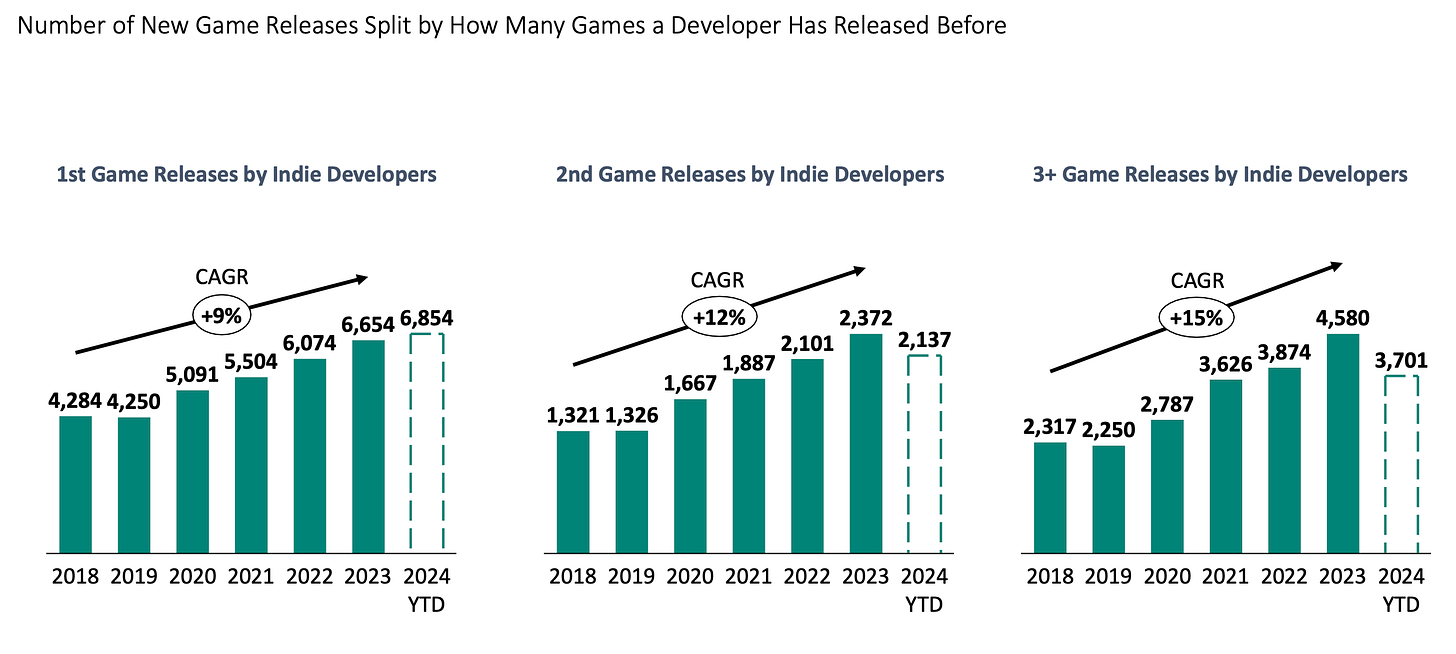

The average annual growth rate of the indie market by the number of games was 11% up to 2024. In 2024, the number of games is expected to be 18% higher than the previous year.

The average annual growth rate in terms of copies sold was 5% until 2024, and in 2024, this figure is expected to increase to 33% year-over-year (YoY).

Revenue grew at an average rate of 16% annually from 2018 to 2023. In 2024, revenue growth is expected to reach 82% YoY.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The majority of revenue in 2024 came from two projects: Black Myth: Wukong ($1 billion) and Palworld ($500 million). All other indie games released in 2024 earned less than Black Myth: Wukong alone ($800 million). Indie games released before 2024 accounted for 43% of all revenue.

❗️If we exclude Black Myth: Wukong, the market growth in 2024 would be 11%—lower than the average annual rate from 2018 to 2023.

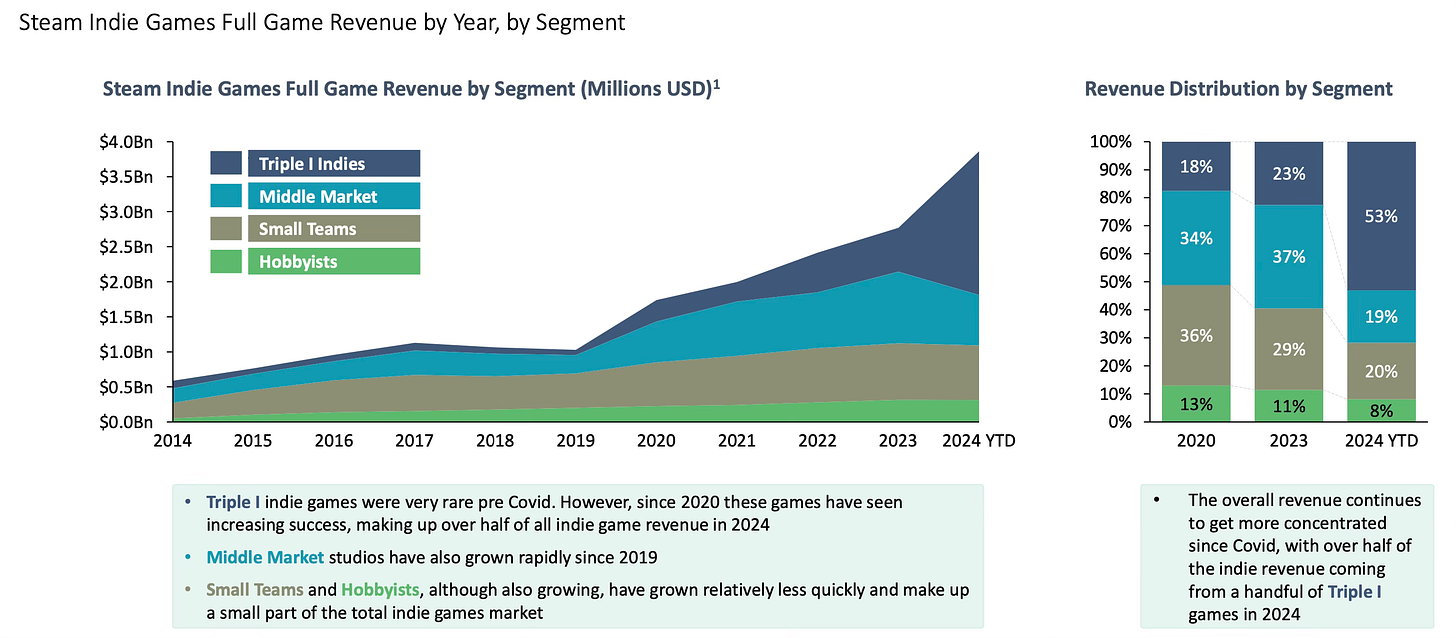

Indie Market Segments

VGI identifies four main groups of indie developers: Triple-I (50+ people; 1M+ copies sold; $50M+ revenue), Middle Market (15-50 people; 200,000 - 1M copies sold; $10M revenue), Small Teams (3-15 people; 20,000 - 200,000 copies sold; $1M revenue), and Hobby Developers (1-2 people; 2,000 - 20,000 copies sold; $50k revenue).

The most significant growth in the number of released games since the start of the pandemic has been among Triple-I developers. There has also been an increase in projects from mid-sized developers.

In terms of revenue, Triple-I developers are capturing an increasingly significant market share. As of 2024, games from these developers account for 53% of all revenue.

State of Indie Teams

Indie developers are actively gaining experience. The number of teams releasing their second and third games is growing (+12% and +15% CAGR, respectively).

According to statistics, each new game tends to be more successful than the previous one. The second game, on average, sells 40% better, and the third game sells 24% better than the second. The hits of 2023-2024 (Palworld, Baldur’s Gate III, Lethal Company, V Rising) were not the first games from these studios.

InvestGame: Gaming Investment Market in Q3'24

InvestGame is the only source in the industry covering all investments happening in gaming. And they never fail. Subscribe!

❗️Smart people told me, that “Minority M&A” is when you’re buying the major enough stake to dictate strategic decisions, yet you don’t have the majority part of the company. It’s something new to me.

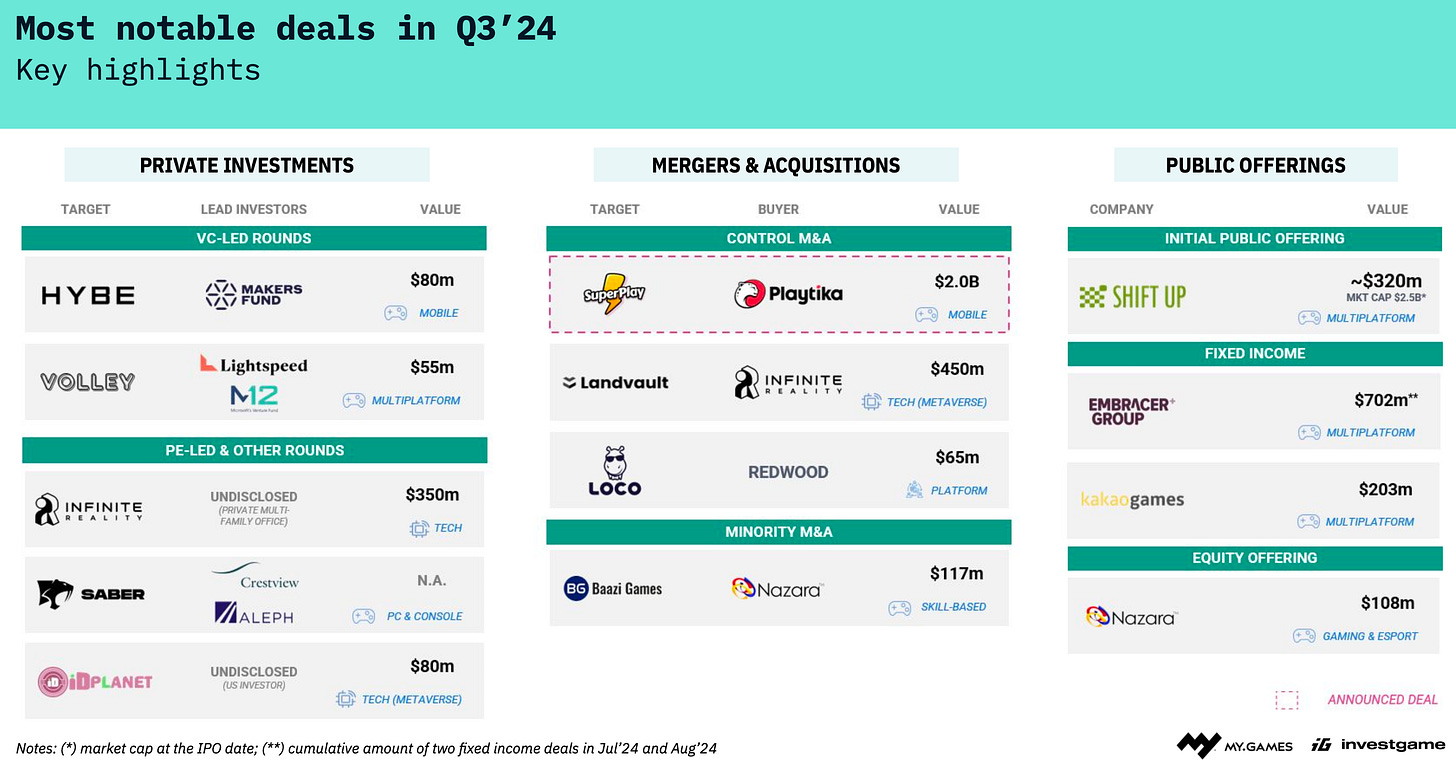

Private Investment

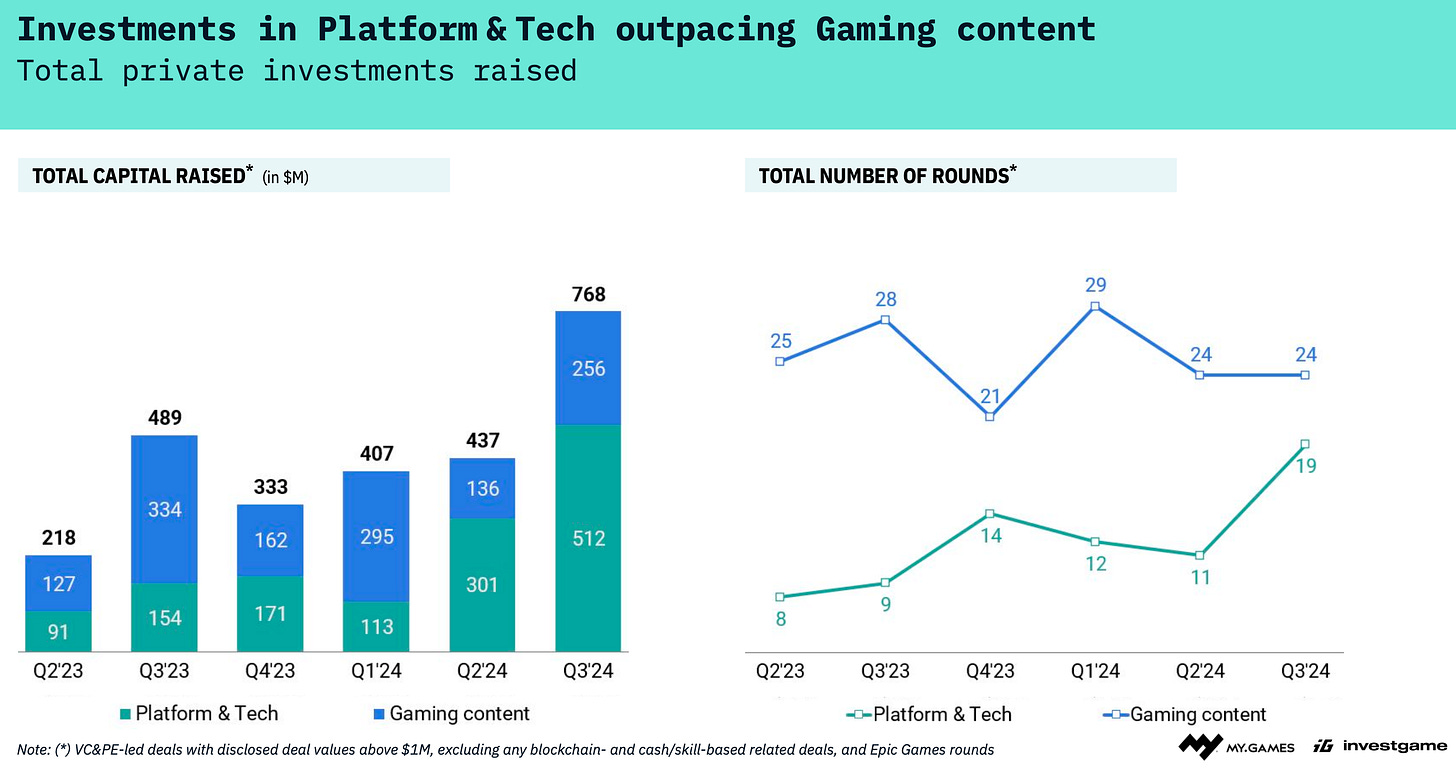

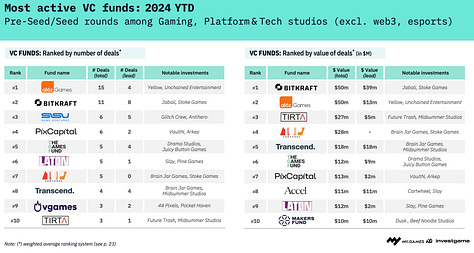

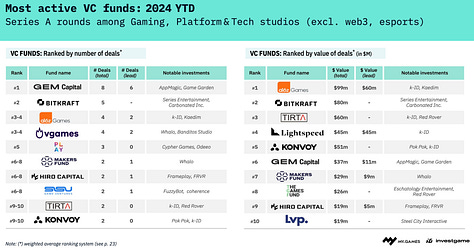

In the third quarter of 2024, there were 119 deals (compared to 88 in Q3 2023) totaling $1 billion (compared to $0.8 billion in Q3 2023). Investment activity is approaching the levels of the peak year of 2021, but the deal sizes are significantly lower.

Overall, after a decline from the peak levels of 2022, the market has stabilized. However, the volume and number of deals in 2024 are generally higher than those in 2023.

Investments in Content Companies

Focusing on early-stage deals with content companies, the number of rounds and investment volumes are decreasing in 2024. Most deals are still in seed and pre-seed rounds, although Series A deals had a significant share in Q3 2024.

There are major issues with late-stage funding for gaming companies. In Q3 2024, the total volume of such investments amounted to $151 million, spread across five deals.

The most active early-stage investors include a16z Games, BITKRAFT, SISU Game Ventures, TIRTA, GEM Capital, and vgames. For Series B and later stages, the leaders are Lightspeed Ventures and Makers Fund.

Since the beginning of 2020, corporate VC funds have played a significant role in deals. In some quarters, they accounted for the majority of transactions.

The main regions for venture investments in Q3 2024 were North America (13 early-stage deals, 3 late-stage deals) and Europe (10 early-stage deals, 1 late-stage deal, 3 deals involving corporate VC funds).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Investments in Gaming Platforms and Technology

Investor interest in technology startups has increased in Q2 and Q3 2024.

❗️InvestGame doesn’t include blockchain or skill/cash-games startups.

The deal volume was $301 million in Q2 2024 (11 transactions) and $512 million in Q3 2024 (19 transactions), which is 2.5-3 times higher than investments in content.

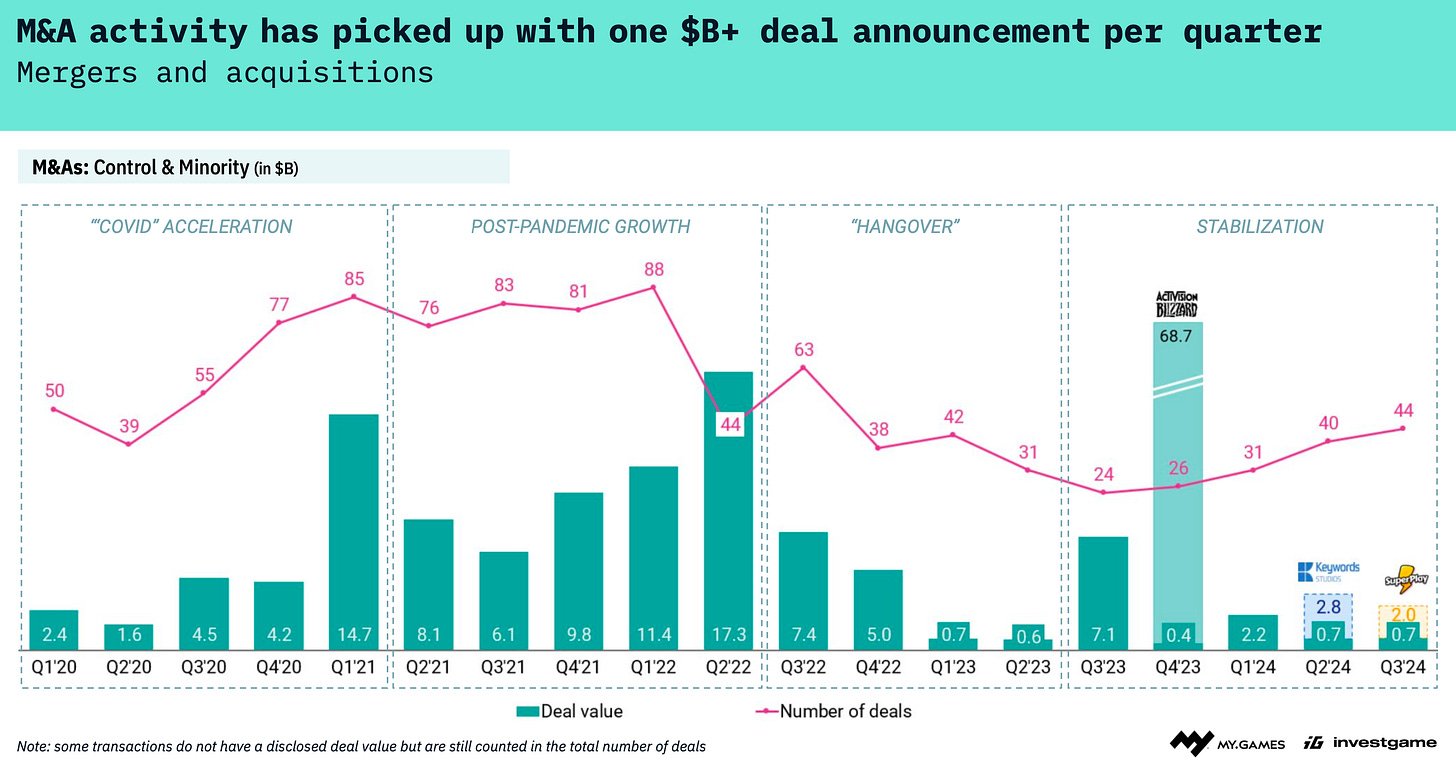

Mergers and Acquisitions

There were 44 M&A deals in Q3 2024 (compared to 24 in Q3 2023), but their total volume—$0.7 billion—is significantly lower than in previous years.

The number of M&A deals has been increasing in 2024, with at least one significant deal each quarter. In Q2 2024, it was Keywords; in Q3 2024, it was SuperPlay.

Public Offerings

In Q3 2024, 13 companies went public, with total IPO volume reaching $1.4 billion. This is more than in Q3 2022 but less than in Q3 2023.

The market for public offerings remains challenging. However, for the first time in two years, a gaming company, South Korea's ShiftUp, went public.