Weekly Gaming Reports Recap: October 28 - November 1 (2024)

Southeast Asia Mobile Market is declining by revenue according to Sensor Tower; there are more & more games on Steam; majority of top-earning games in the US implemented web shops.

Reports of the week:

How to Market a Game: The number of Games Released on Steam in the first 3 quarters of 2024 is significantly higher compared to 2023

Games & Numbers (October 16 - October 29; 2024)

Newzoo: Top 20 PC/Console Games of September 2024 by Revenue and MAU

Circana: Best-Selling PC/Console Games in the U.S. by Year in the 21st Century

AppCharge: 72% of the top-earning Mobile Games in the U.S. have webshops

Mistplay: Mobile Gaming Growth Report (2024)

Sensor Tower: Mobile gaming market in Southeast Asia in 2024

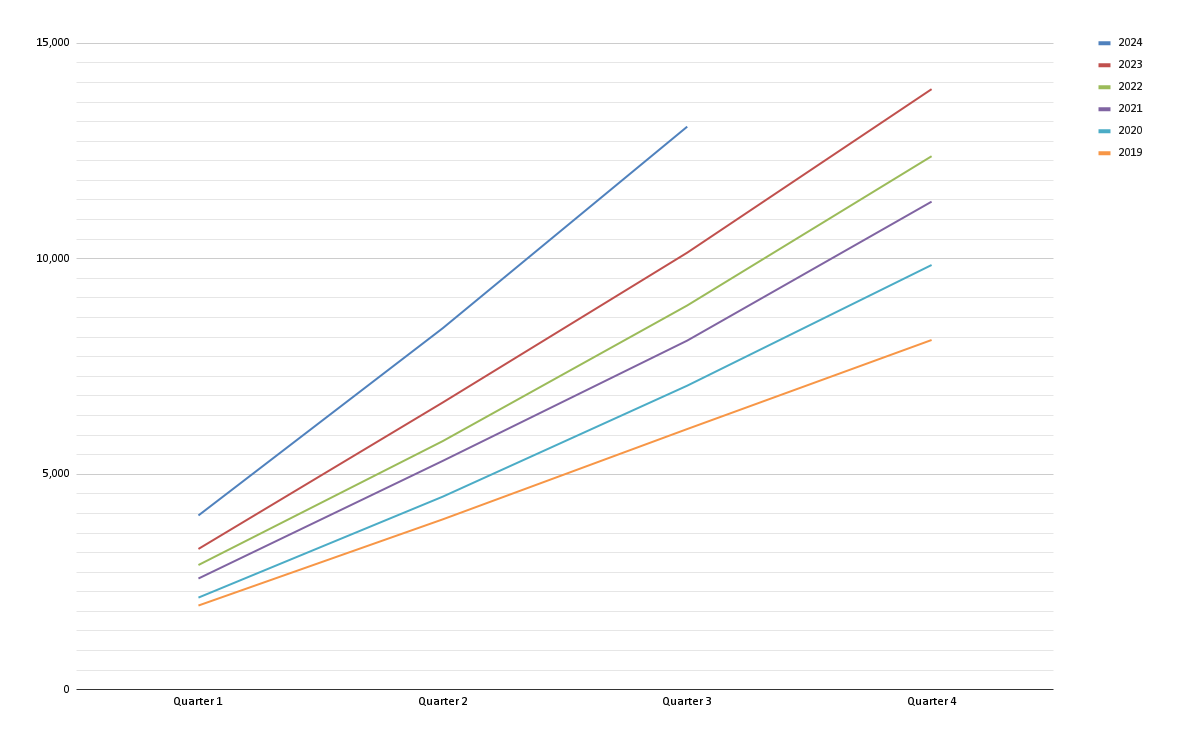

How to Market a Game: The number of Games Released on Steam in the first 3 quarters of 2024 is significantly higher compared to 2023

According to Chris Zukowski’s methodology, projects with over 1,000 reviews on Steam can be considered successful.

With three months left in the year, 13,065 games have already been released in 2024, only 870 fewer than in 2023. If the trend continues, the total number of games on the market by the end of 2024 will increase by 28.92% compared to 2023.

As of October 1, 2024, 348 games have surpassed 1,000 reviews, 267 of which are considered indie projects.

In 2023, 415 indie titles crossed the 1,000-review mark. So far, the likelihood of success has decreased when comparing the number of “successful” projects to the total number of games released.

49.8% of games received fewer than 10 reviews. 78.5% have fewer than 50 reviews, likely meaning sales of less than 1,500 copies.

In 2024, the number of projects achieving some level of success (50+ reviews) is higher.

36 games released in Q1-Q2’24 reached the 1,000-review mark in Q3’24. Generally, the first month sets the sales trend, but among these “late-blooming” successes, most are horror games, followed by simulators and hidden object games.

❗️Chris notes that if you’ve gathered a large number of wishlists but they didn’t convert to sales at launch, there’s a high chance that commercial success isn’t likely. Similarly, for projects with low initial sales and few wishlists, success is also unlikely.

Games & Numbers (October 16 - October 29; 2024)

PC/Console Games

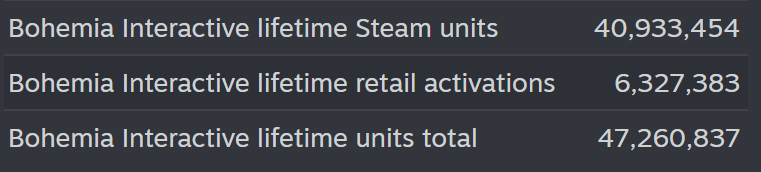

Bohemia Interactive games have sold over 47 million copies, with almost 41 million sold on Steam.

It Takes Two has been purchased more than 20 million times.

Over 10 million people have played Dead Island 2, though this includes users from subscription services, not only direct sales.

Total sales for the Resident Evil 4 remake have exceeded 8 million copies, achieving this in a year and a half.

Dragon Ball: Sparking Zero sold 3 million copies within 24 hours of its October 7 release.

Warhammer 40,000: Space Marine II has surpassed 4.5 million copies sold. The id Software veterans who led the development reported this as their most successful launch.

Silent Hill 2 sold over 1 million copies in its first week, with higher sales in Europe than The Callisto Protocol and Alan Wake 2. In European countries, 78% of sales were for the PS5 version.

According to Insider Gaming, Prince of Persia: The Lost Crown sold around one million copies, below management’s expectations. Rumor has it that the development team faces layoffs.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The indie boxing game Undisputed, created by a team with no prior video game experience, has sold over 1 million copies.

Sonic x Shadow Generations sold more than 1 million copies since its release, counting both physical and digital copies.

The indie horror game Crow Country sold 100,000 copies.

Peak CCU for the indie project Liar’s Bar exceeded 100,000 players.

Mobile Games

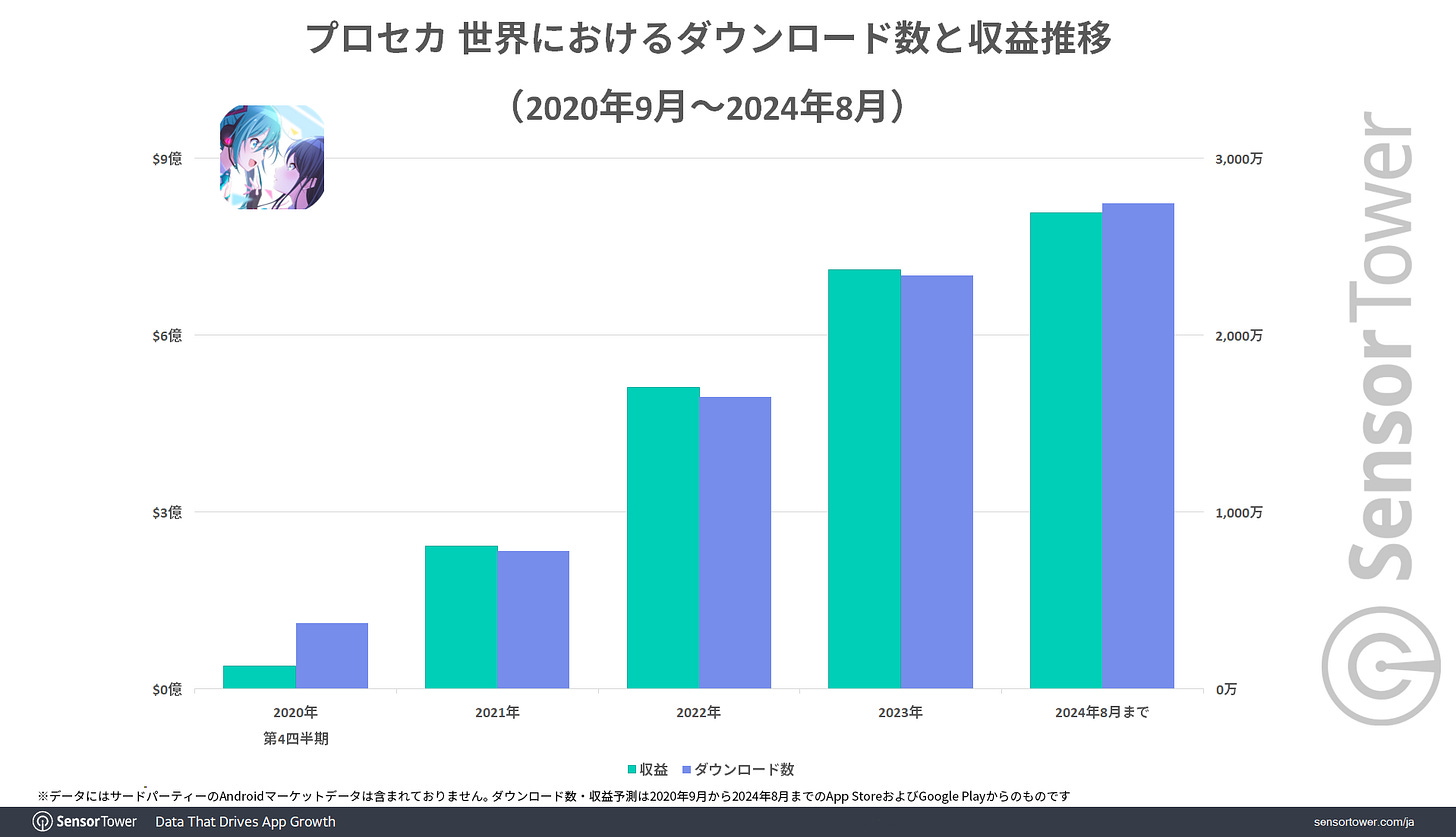

According to Sensor Tower, Hatsune Miku: Colorful Stage! has generated over $800 million in revenue over four years, contributing more than 50% of SEGA’s mobile revenue. The iPad version alone accounts for a significant 18% of total revenue.

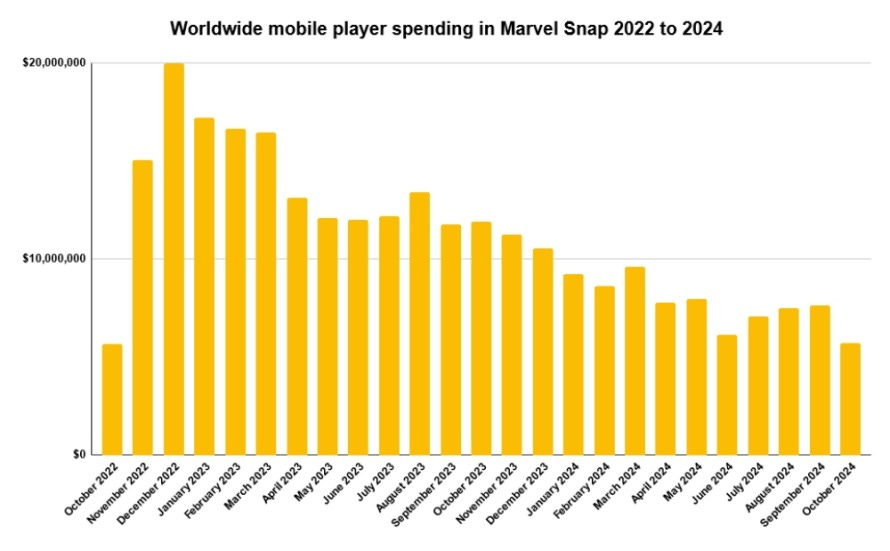

In its two years, Marvel Snap has earned over $275 million solely on mobile devices, though its second-year revenue dropped by 40% from the first.

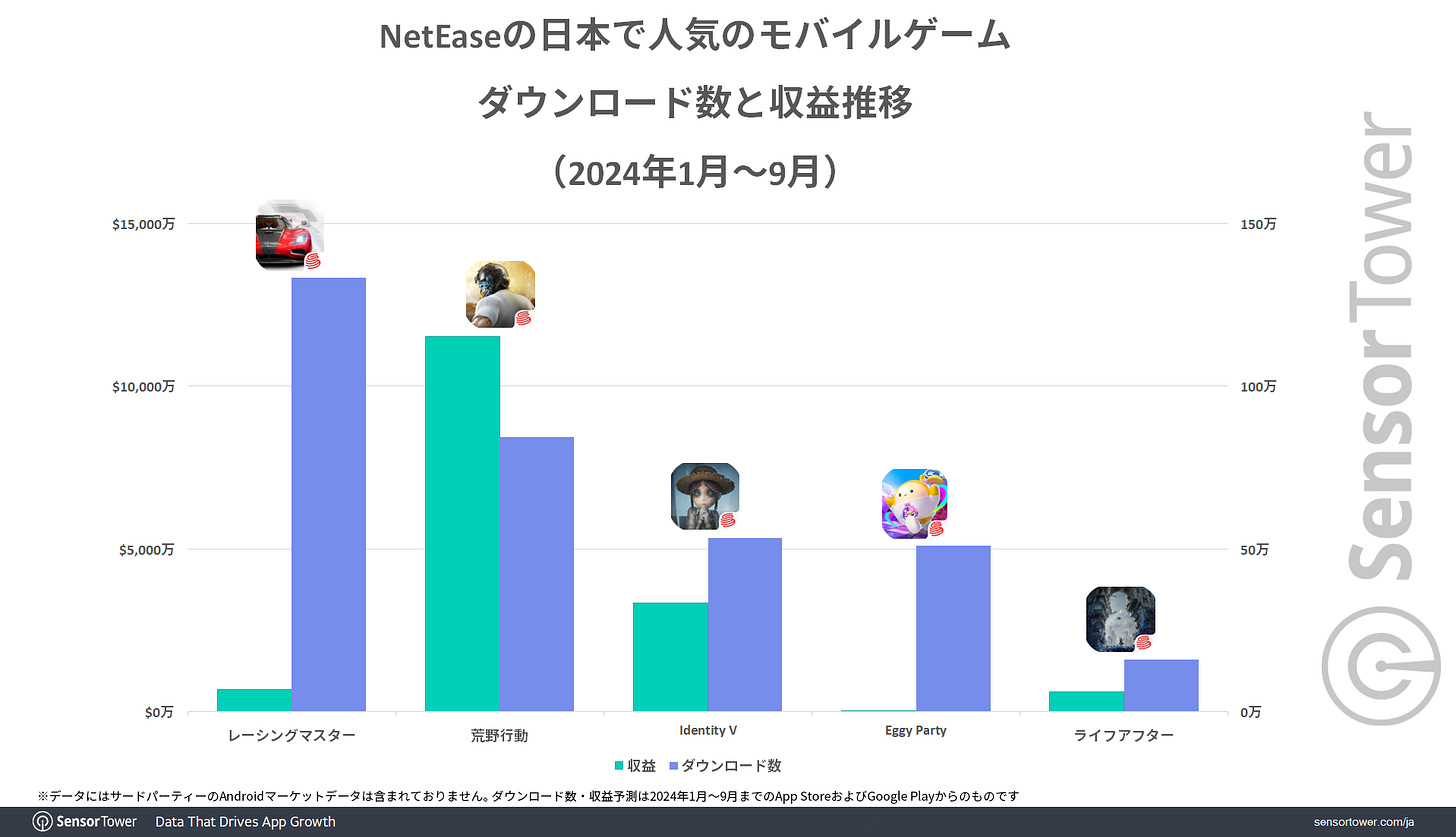

Racing Master by NetEase, launched in Japan in August, has already surpassed $100 million in revenue. It ranks as NetEase’s top-downloaded game in Japan but remains below top revenue records.

Trickcal Re: VIVE, initially launched in 2021 and re-released in 2023, shows promise in the Squad RPG market. The game has generated over $15 million in South Korea alone, with $4.5 million (30% of its total revenue) earned between September 26 and October 15. BiliBili is currently working on an international version.

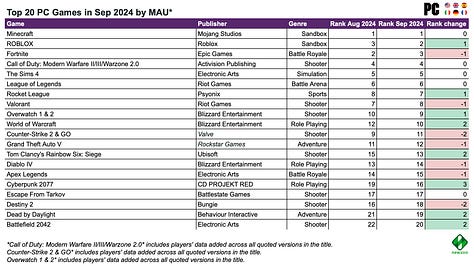

Newzoo: Top 20 PC/Console Games of September 2024 by Revenue and MAU

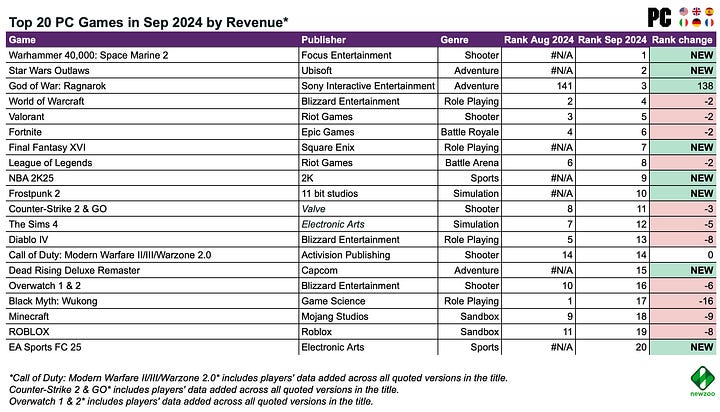

Newzoo tracks the markets of the United States, United Kingdom, Spain, Germany, Italy, and France.

Revenue - All Platforms

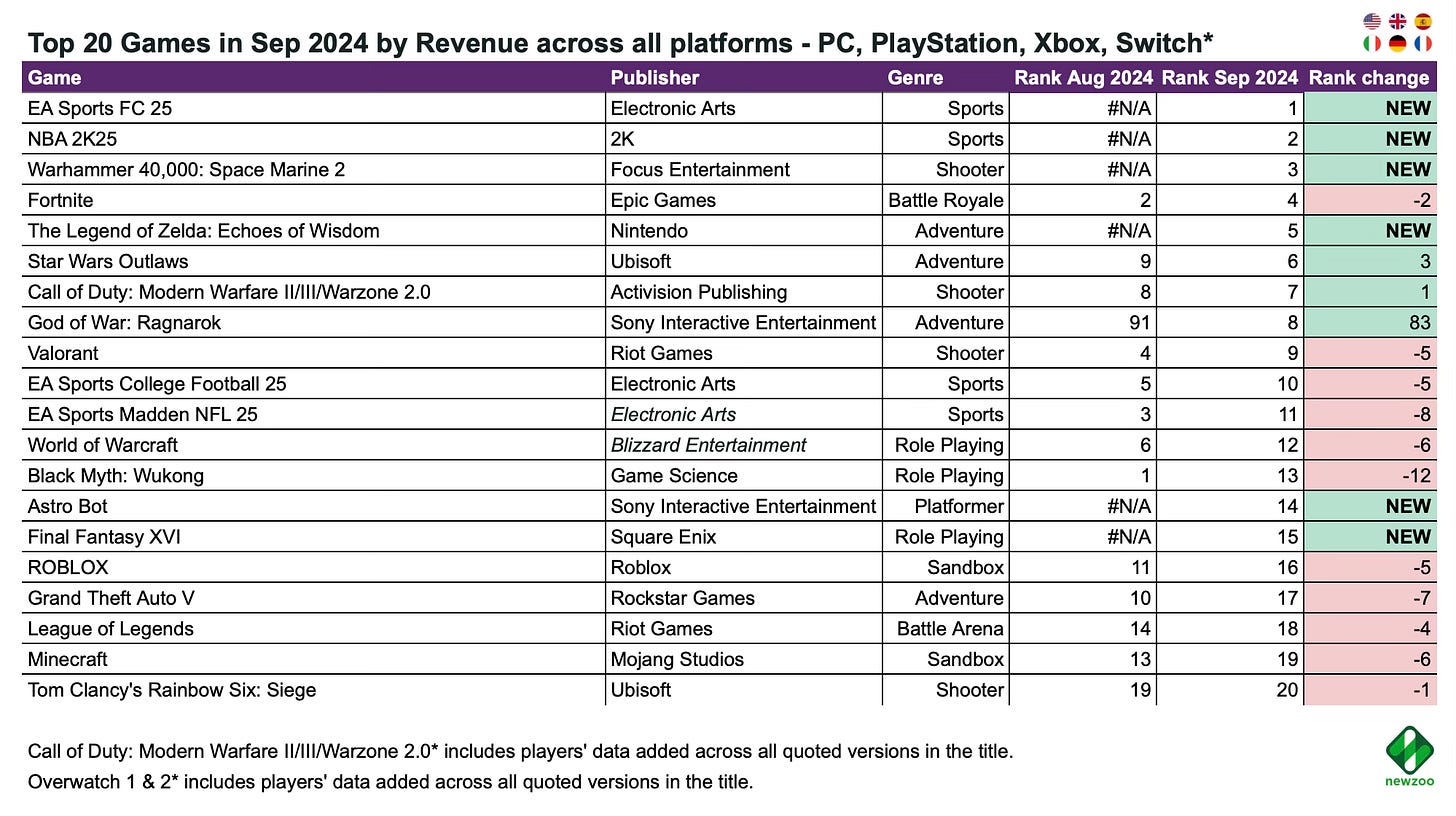

Five new releases entered the chart in September: EA Sports FC 25, NBA 2K25, and Warhammer 40,000: Space Marine 2 (top three spots). The Legend of Zelda: Echoes of Wisdom took 5th place, and Astro Bot reached 14th. Final Fantasy XVI ranked 15th after launching on PC following a period of exclusivity on PlayStation.

God of War: Ragnarok climbed to 8th in revenue after its release on PC.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Black Myth: Wukong, the breakout hit of August, started strong in 3rd place.

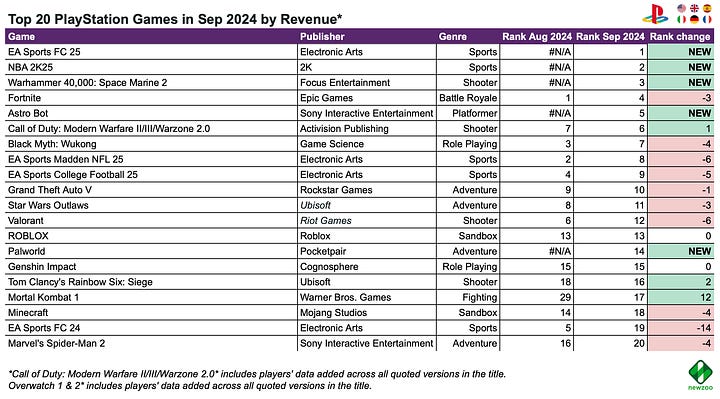

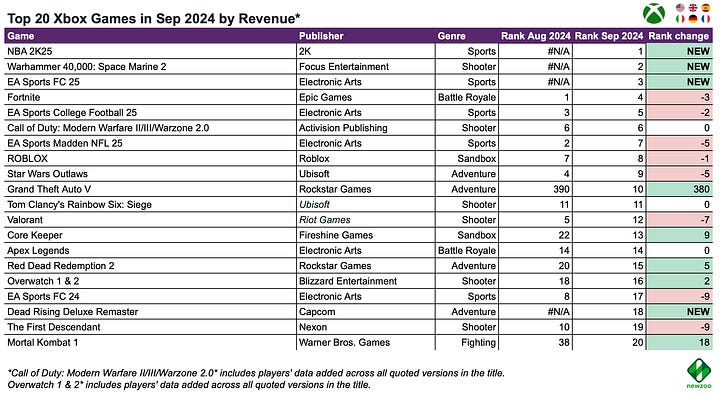

Revenue - Platforms

Warhammer 40,000: Space Marine 2 and surprisingly Star Wars Outlaws led sales on PC (Steam). This is notable, given the news of weaker sales for Star Wars Outlaws. Other strong performers on PC included Final Fantasy XVI (7th), Frostpunk 2 (10th), and Dead Rising Deluxe Remaster (15th).

Astro Bot secured 5th place in PlayStation revenue. Palworld, debuting on PlayStation, came in at 14th.

On Nintendo Switch, The Legend of Zelda: Echoes of Wisdom held the top sales position, typical for Nintendo games. Interestingly, Disney Epic Mickey: Rebrushed ranked 7th on Switch but didn’t make the top 20 on other platforms.

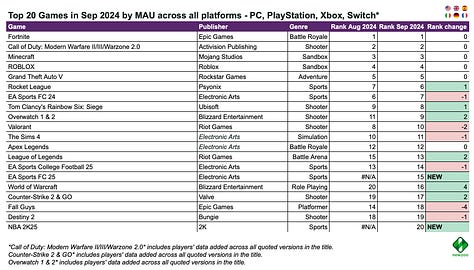

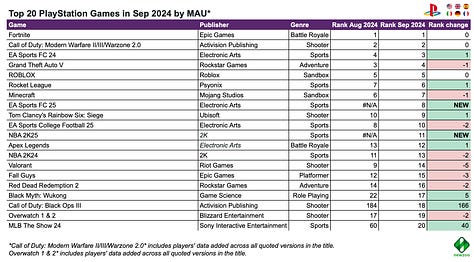

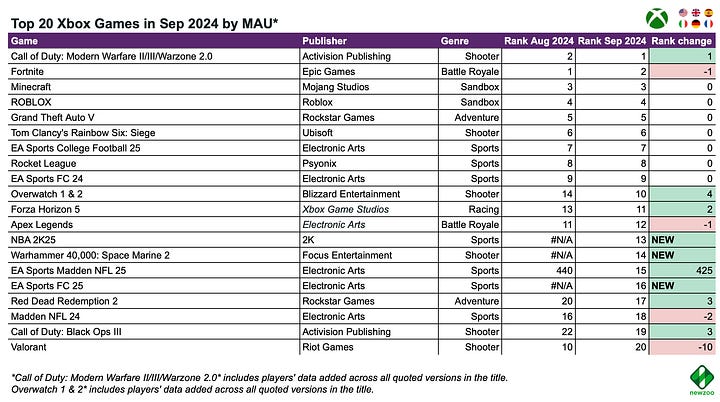

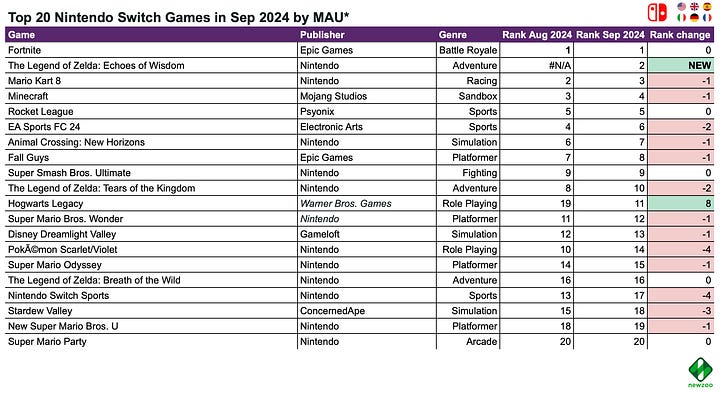

MAU - All Platforms

Two new titles appeared in the MAU ranking: EA Sports FC 25 and NBA 2K25, with annual franchise turnover.

Call of Duty: Black Ops III re-entered PlayStation’s top 20 MAU list, likely as players revisit it ahead of a new series installment.

On Xbox, Warhammer 40,000: Space Marine 2 made the top 20 for MAU, although it didn’t achieve this on other platforms.

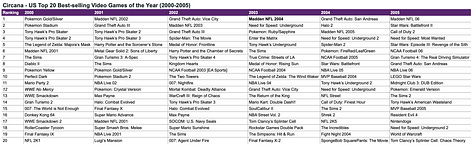

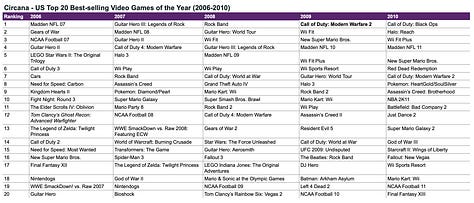

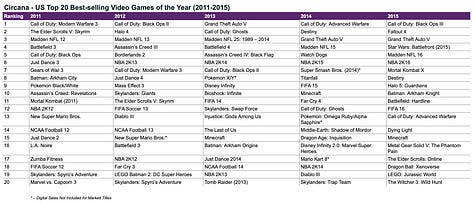

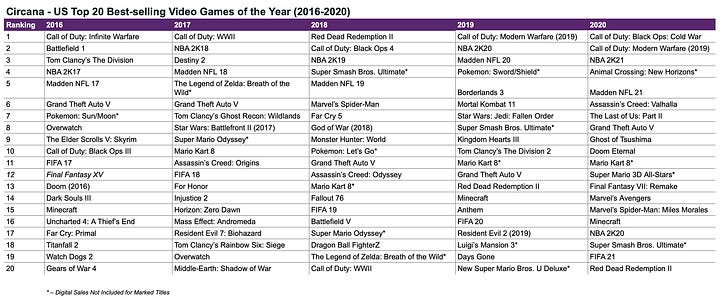

Circana: Best-Selling PC/Console Games in the U.S. by Year in the 21st Century

The Call of Duty series has topped the charts most frequently, claiming the first spot 12 times over the last 23 years.

Madden NFL is another standout series. Since the beginning of the century, its games have been in the top spot four times and have never fallen out of the top 20 in sales. Moreover, for the past 22 years, Madden NFL games have not dropped below the fifth spot in the charts.

Grand Theft Auto games have claimed the top spot three times: Vice City (2002), San Andreas (2004), and GTA V (2013).

Call of Duty games haven't managed to hold the top chart spot for more than four consecutive years. The series topped the charts from 2009 to 2012, until GTA V broke the streak. Red Dead Redemption II interrupted in 2018, and in 2023, Hogwarts Legacy took the lead. If history repeats, Call of Duty should return to the top in 2024—unless adding the game to Xbox Game Pass affects its sales.

From 2007 to 2009, music games thrived, with several entries from Guitar Hero and Rock Band in the charts—even the niche DJ Hero made it into the top 20. Those were the days!

AppCharge: 72% of the top-earning Mobile Games in the U.S. have webshops

The company identified the top-earning games on iOS in the U.S. using Sensor Tower.

100% of social casino games in the top 20 by revenue in the U.S. on iOS use web stores. High ARPU in these projects and an established VIP support system contribute to this penetration.

30% of casual games in the top 20 have web stores. Compared to social casinos, AppCharge attributes the lower penetration to the impulsive nature of purchases in the casual genre and the lower ARPU.

80% of strategy games in the U.S. top 20 have web stores.

75% of action games in the U.S. top 20 have launched web stores for their players.

Mistplay: Mobile Gaming Growth Report (2024)

Mistplay analyzed 3,000 users from Tier-1 Markets (US, Canada, United Kingdom) in Q2 2024 who used Mistplay. Paying users are defined as players who purchased within the last 30 days at the time of the survey.

Mistplay studies user behavior during the early days of their engagement with a game, specifically from discovery up to the 7th day.

How users discover games

The top source (67%) is in-game ads. Second (37%) is searching in app stores, and third (25%) is recommendations from friends.

The most popular alternative channels include social media ads (18.9%), Google Ads (18.4%), and offerwalls (16.1%).

The most popular social platforms where users discover games are Facebook/Instagram (64.8%), YouTube (41.2%), and TikTok (22.6%).

Ad Creatives

Users report encountering several issues with ads: they don’t like the ads (48.5%); there are too many ads (48.26%); ads are of poor quality (41.69%); and the games are not unique (36.39%). These are the most common problems.

The preferred ad formats are ones that showcase real gameplay (47.5%) and interactive ads (35.5%). Other types of ad creatives are less popular with audiences.

Brand collaborations appeal to only 1/5 of users. They are the least interesting to casual players but most appealing to fans of sports games.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

ASO Optimization

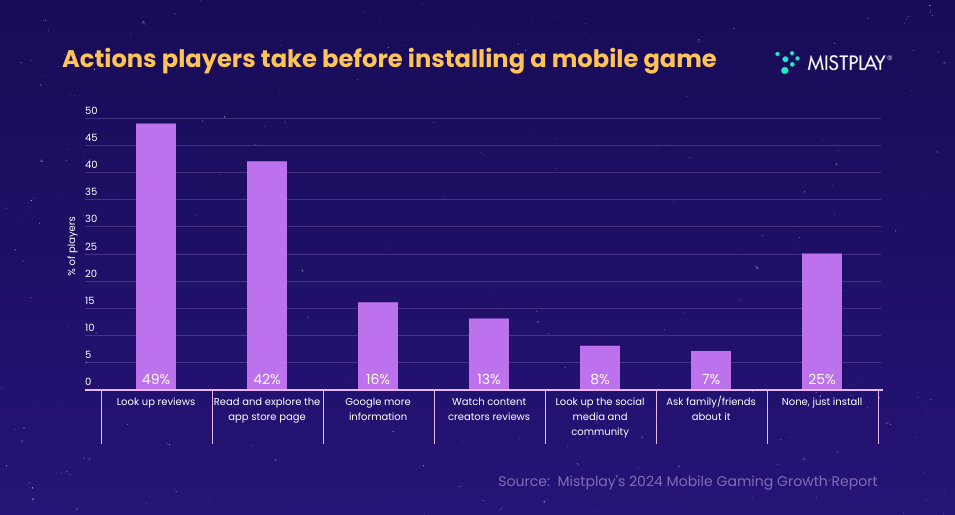

75% of users check the game’s page before installing it. 48.6% look at the ratings, and 42.4% read the description.

Around a quarter of users say that the developer’s brand and the game’s brand influence their decision to install the game.

Visuals and screenshots are the most important elements users consider. Following that (in descending order of importance) are the game description, title, rating, trailer, user reviews, price (if the app isn’t free), app size, number of downloads, chart position, and awards.

Player Behavior in the First Days of Gameplay

The main reasons players stay after their first session include enjoying the gameplay mechanics (69.2%), a strong sense of progression and rewards (67.1%), appealing visual style (45.2%), ads matching the gameplay (40.6%), and a well-balanced experience (39.8%).

The main reasons for leaving a game are pay-to-win mechanics (77.18%), too many ads (71.85%), and misleading ad creatives that don’t reflect real gameplay (66.17%).

The key mechanics for bringing back lapsed users are rewards or discounts for returning users (51.96%) and releasing new content (49.18%).

Alternative User Monetization Methods

17.19% of paying users have bought subscriptions in the last six months; 12.87% have purchased paid games; and 8.1% of users bought in-app purchases (IAP) via web shops. 3.37% bought merchandise, 2.08% supported developers through crowdfunding, and 1.68% purchased NFTs.

Most users (59.4%) are not interested in web shops. 14.3% have used them before.

42.2% of users have played games based on IP, and 53.5% of players made purchases in games because of brand collaborations.

Sensor Tower: Mobile gaming market in Southeast Asia in 2024

Market Overview

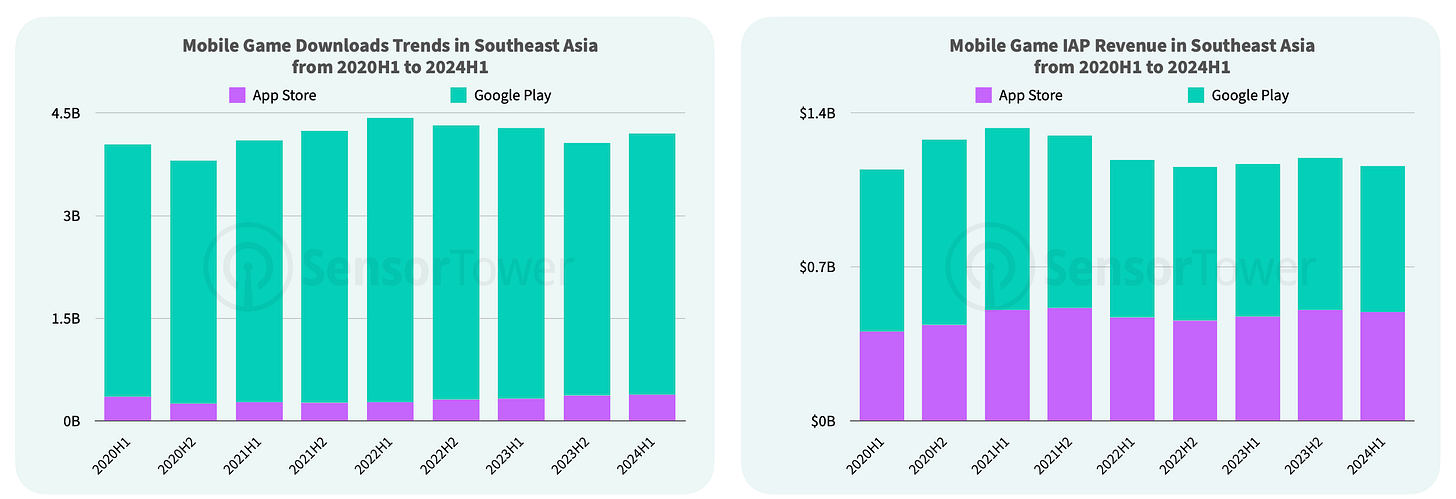

Game downloads in Southeast Asia increased by 3.4% in the first half of 2024 compared to the second half of 2023, though they decreased year-over-year. The total volume reached 4.2 billion installs, with 91% coming from Google Play.

Revenue declined by 3% compared to H2 2023, amounting to $1.16 billion—similar to the first half of 2020. Out of the total revenue, 57% was generated by Google Play.

Genres and Countries

From January to August 2024, downloads grew most in the strategy (+14% YoY), simulation (+11% YoY), RPG (+7% YoY), and shooter (+6% YoY) genres in Southeast Asia.

Sport games (+39% YoY) and puzzle games (+6% YoY) shown the largest revenue growth. Core genres declined, with strategy dropping by 3% and RPG by 9%.

Indonesia was the only Southeast Asian country to see download growth from January to August 2024, with a 10% increase, leading also in absolute installs.

For in-game revenue, Thailand (+10% YoY), Indonesia (+1% YoY), the Philippines (+3% YoY), and Cambodia (+6% YoY) showed growth, while Singapore (-14% YoY) and Malaysia (-8% YoY) faced significant declines.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Most Popular Games

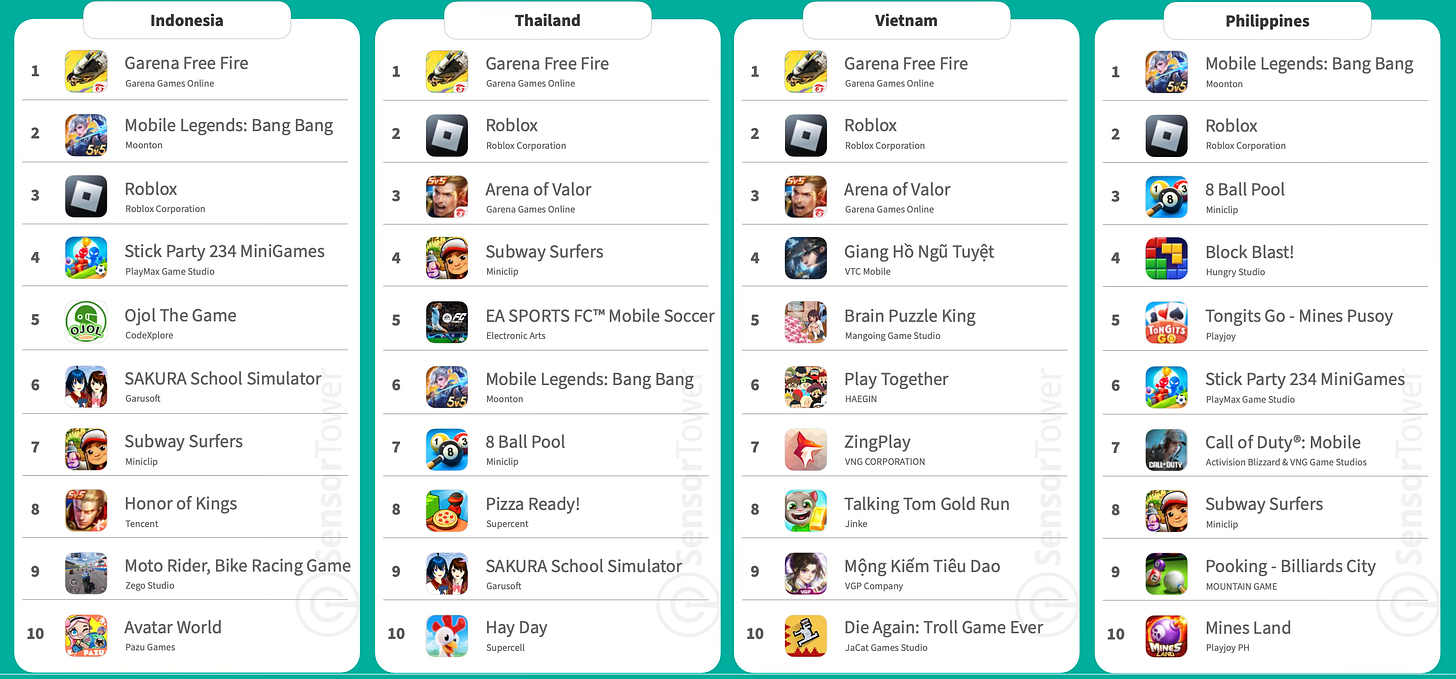

The top games by downloads include Garena Free Fire (+54% YoY from January to August 2024), Mobile Legends: Bang Bang (+45% YoY over the same period), and Roblox.

Leading in revenue are Mobile Legends: Bang Bang (+6% YoY from January to August 2024), eFootball 2024 (+90% YoY for the same period), and Garena Free Fire.

Legend of Mushroom is one of the top performers in revenue growth, earning $11 million in the region from January to August.

Examining download and revenue rankings highlights the diversity within Southeast Asia. While shooters and MOBA are popular throughout, there are unique preferences; for instance, Coin Master is a revenue leader in Vietnam, while two MMORPGs dominate in the Philippines.

Case Study: Honor of Kings

In mid-June, Honor of Kings launched a renewed push for global expansion, specifically targeting Southeast Asia. By July, it had become the most downloaded game in the region.

In July, 51% of the game’s downloads came from Indonesia, with an additional 11% from the Philippines. Marketing materials were localized for the region's countries.

![COD] What's that one game series you just can't seem to get enough of? : r/CallOfDuty COD] What's that one game series you just can't seem to get enough of? : r/CallOfDuty](https://substackcdn.com/image/fetch/$s_!wJAL!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fcb78e790-be51-43ae-8312-d9a257e54758_1400x788.png)