Weekly Gaming Reports Recap: September 2 - September 6 (2024)

Aldora is the new market research company -with the first report, RPGs are declining in South Korea; Sanlo revealed a big research on web shops on Mobile.

Reports of the week:

AppMagic: Top Mobile Games by Revenue and Downloads in August 2024

Aldora: The Gaming market will reach $250.2B in 2025

Games & Numbers (August 24 - September 3; 2024)

Stream Hatchet: Streaming of Mobile Games in H1'24

game: The German Gaming Market declined in H1'24

Sensor Tower: RPG Revenue Declines in South Korea

Sanlo: Mobile Web Shops in 2024

AppMagic: Top Mobile Games by Revenue and Downloads in August 2024

AppMagic provides revenue data net of store commissions and taxes.

Revenue

Honor of Kings returned to the top spot in revenue ($162M in August), surpassing Dungeon Fighter Online ($116.9M).

Whiteout Survival saw a significant increase in revenue in August, earning $91.3 million. This is 16% more than the previous month. Overall, since its launch in February 2023, the game has shown a positive revenue trend. From March to May 2024, the game plateaued at $62 million, but as seen from the numbers, this was successfully overcome.

AFK Journey launched in China, with August revenue exceeding July's figures by 10 times ($4.6 million compared to $43.4 million). 42% of the game's August revenue came from China; 23% from South Korea; 10% from Taiwan. The game jumped 161 positions in the rankings, reaching 13th place.

Downloads

The download charts remain stable. In first place is Offline Games - No WiFi Games (21.7 million downloads); in second is ROBLOX (20.9 million downloads); and in third is Subway Surfers (15.2 million downloads).

My Supermarket Simulator 3D surged to 9th place in the chart, with 10.4 million downloads. The leading countries are Indonesia, Russia, and Turkey.

Aldora: The Gaming market will reach $250.2B in 2025

Aldora is a new company founded by Joost van Dreunen, co-founder of SuperData Research.

Joost is also running a great Substack channel, which I’m subscribed to and enjoying. It’s here:

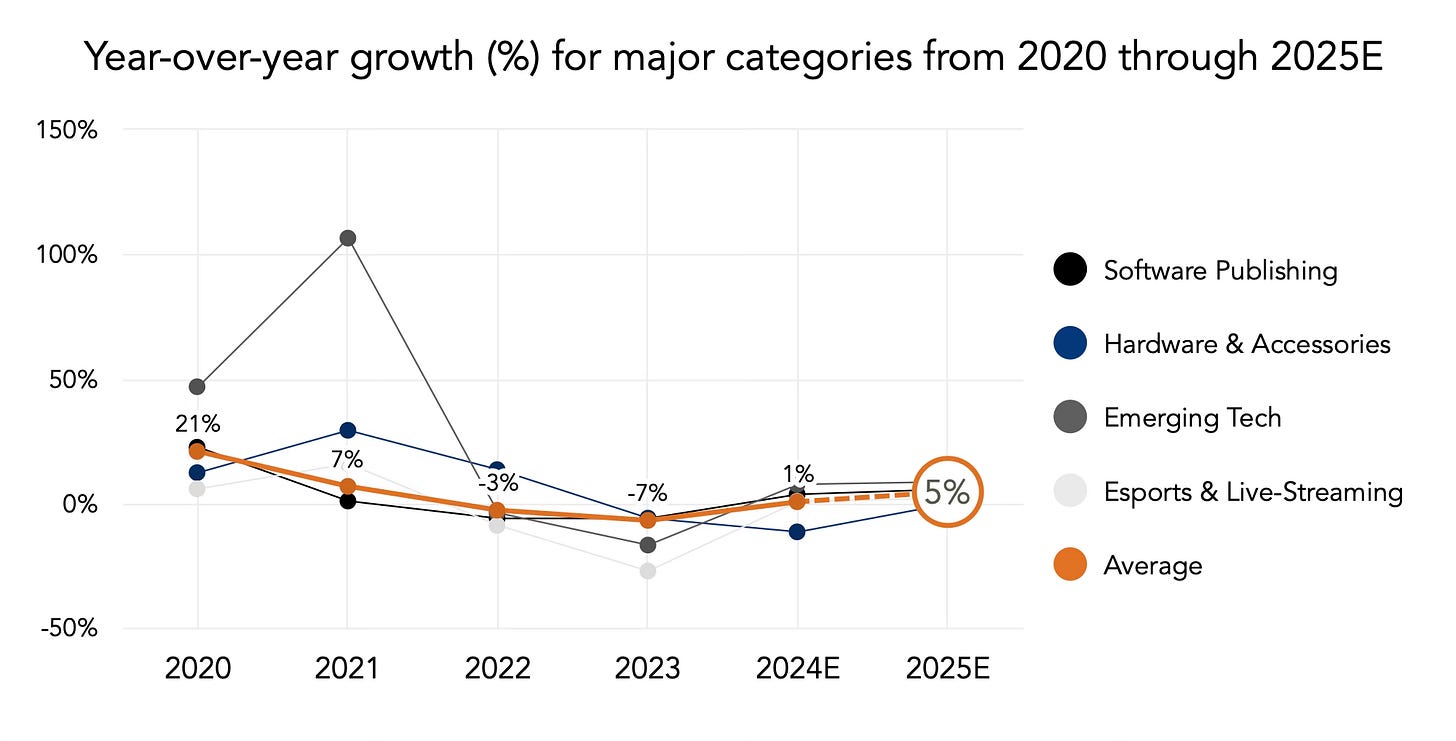

The company estimates that in 2025, people will spend $250.2 billion on interactive entertainment (+4.6% YoY). This figure includes game sales, gaming hardware, accessories, eSports, and live streaming. The forecast for 2024 is $239.2 billion (a growth of 0.6%).

Game sales in 2024 will reach $186 billion (+3.6% YoY). The PC segment will see the highest growth (+4.2%, up to $31.4 billion), followed by mobile games (+3.6% YoY, up to $109.3 billion). In third place in terms of growth are consoles (+3.1%, up to $44.9 billion).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

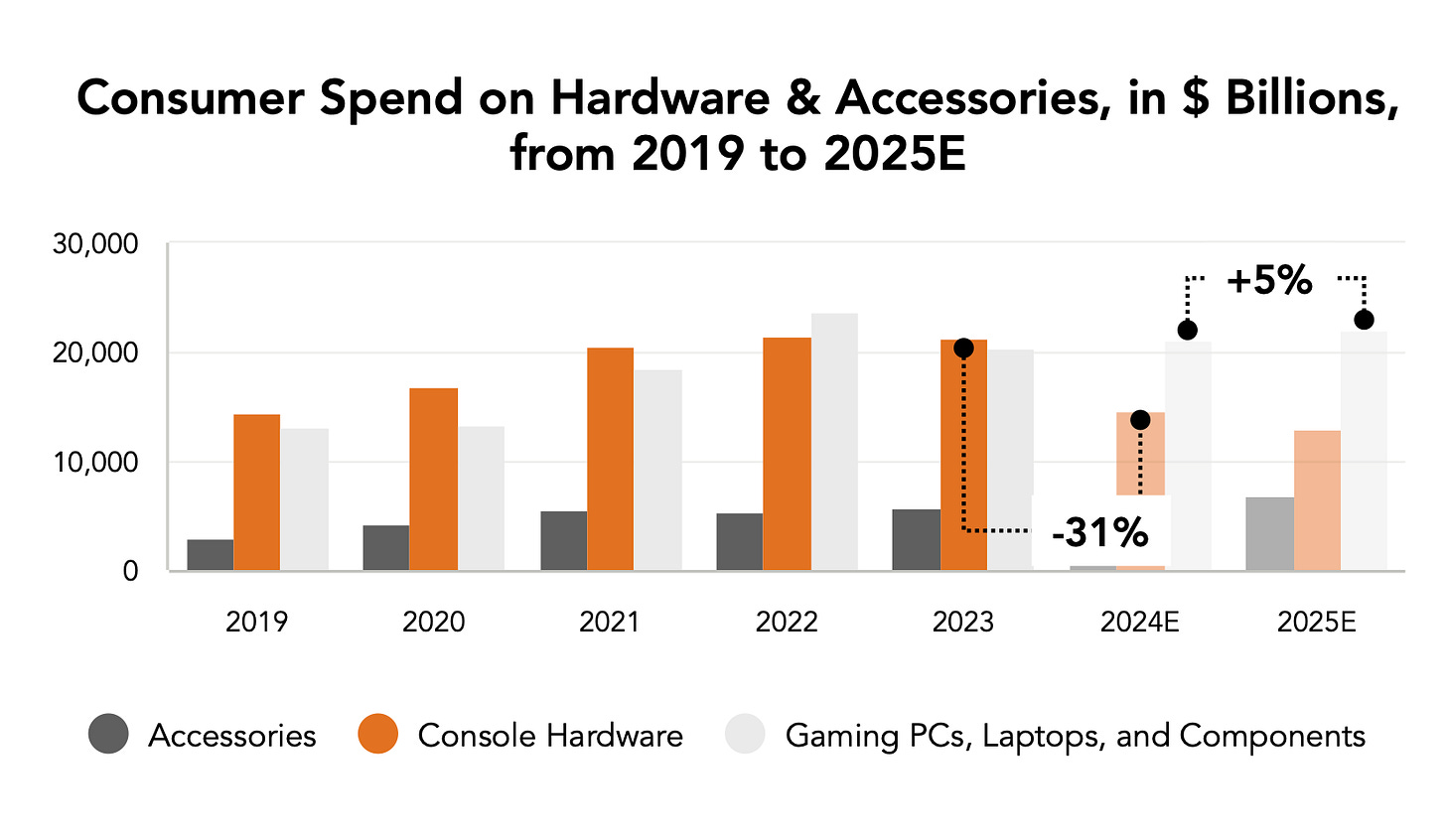

Sales of gaming hardware are expected to decline by 31% YoY in 2024. The peak of sales was in 2022 when $21.4 billion was spent on gaming consoles and accessories. Aldora believes this signals that the current console lifecycle is nearing its end. The PC and laptop market remains stable. However, accessory sales are expected to grow by 5% in 2025.

Innovative technologies have not yet gained a significant share of the gaming industry. The VR market is projected to be worth $3.3 billion by the end of 2024, with an expected growth of 11% in 2025. The blockchain gaming market is expected to reach $651 million in 2024 (+21% YoY), but market leaders (Animoca, Sorare) are seeing revenue declines. The web gaming market is expected to show modest growth in 2024 (up 3%, to $2.7 billion).

By the end of 2024, the streaming market will be worth $4.3 billion. This is 1% more than last year but significantly less than the peak of $6.62 billion in 2021. Despite this, leading streaming platforms (Twitch) remain unprofitable.

The eSports market continues to struggle. In 2024, its value will be $173 million (-3% YoY), and in 2025, Aldora experts expect a decline of 8.3%.

Games & Numbers (August 24 - September 3; 2024)

PC/Console Games

Steam set a new record with 37.2 million concurrent users on the platform.

Crime Scene Cleaner sold over 200,000 copies in less than 2 weeks.

Valve’s Deadlock is gaining popularity. The game hit a new peak of 171,000 concurrent users. It’s still in closed beta. According to VG Insights, the game has over 1.5 million wishlists.

GameDiscoverCo estimates that Black Myth: Wukong has 3 million buyers on PS5, with 2 million in China.

Over 19 million people have played Control. This doesn’t reflect sales since the game has been available on subscription services.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

The mobile game CarX Street has launched on Steam. The game had 600,000 wishlists at release. Unlike the mobile version, the game is sold for $19.99 with no microtransactions. The mobile version has been downloaded over 50 million times.

Mobile Games

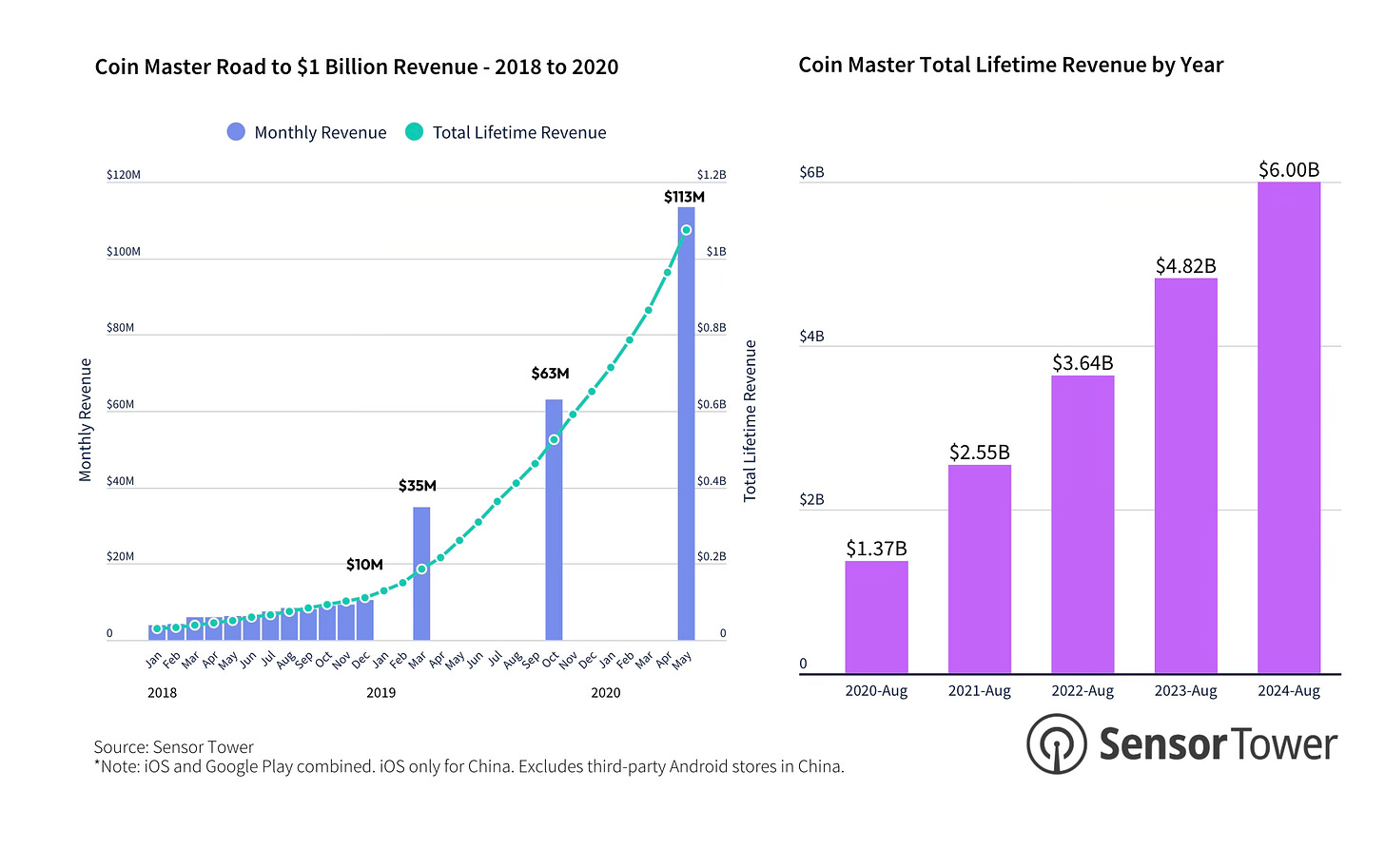

Sensor Tower reports that Coin Master has surpassed $6 billion in revenue. The game has an interesting history. It was nominally released in 2012 but didn’t receive any support until February 2016. By December 2018, the game was making $10 million a month. In August 2020, Coin Master had a total revenue of $1.37 billion. By August 2024, the developers managed to increase it more than fourfold.

Merge Mansion by Metacore has earned $500 million in 4 years of operation, with 55 million downloads during that time.

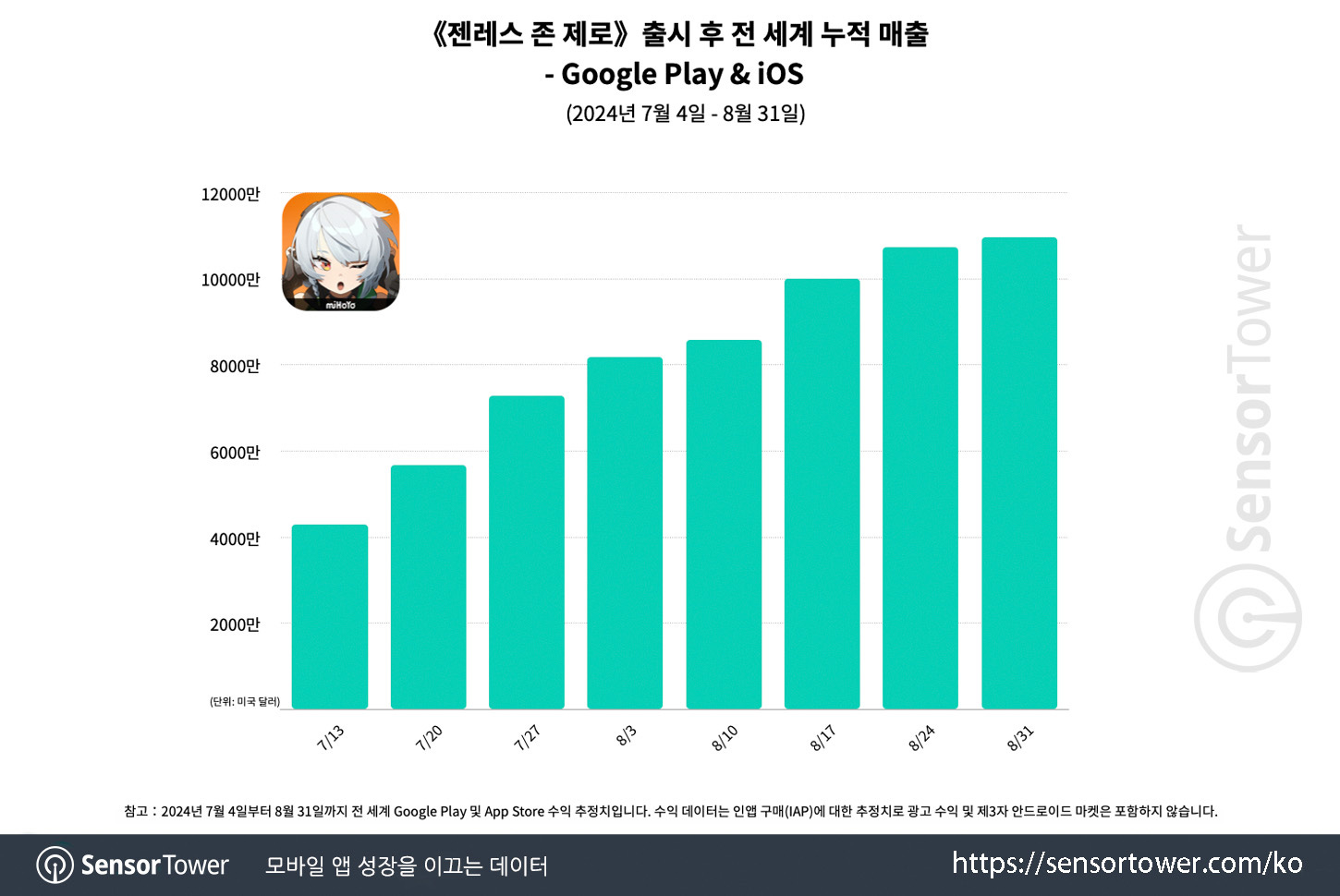

Sensor Tower reports that Zenless Zone Zero reached $100 million in revenue faster than any other game released in 2024. The main regions are China (39.7% of revenue), Japan (27.7%), the USA (10.1%), and South Korea (9.1%). The RPD in South Korea is $14, second only to Japan. Note that Sensor Tower does not account for PC and console sales, so the actual revenue of the game is even higher.

Goddess of Victory: Nikke launched a collaboration with Evangelion, resulting in the project’s revenue doubling on the day of the update's release. According to AppMagic, the peak gradually normalized afterward.

Other

More than 335,000 people from 120 countries attended Gamescom ’24 this year, which is 4.6% more than last year.

Stream Hatchet: Streaming of Mobile Games in H1'24

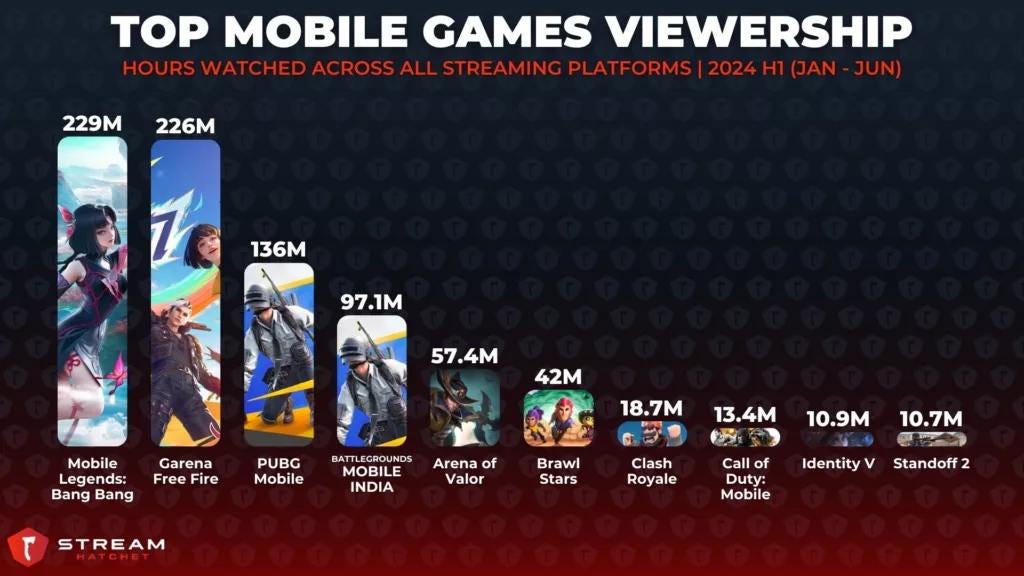

We're not used to seeing mobile games at the top of streaming platforms. But that doesn't mean people aren't watching them. Stream Hatchet has gathered information on the most popular mobile games and genres on streaming platforms.

Mobile Legends: Bang Bang (229 million hours watched) and Garena Free Fire (226 million hours) are the two clear leaders in the mobile market. Interest in these two projects is actively supported by esports tournaments (for Mobile Legends: Bang Bang, 54% of the views come from tournaments).

❗️There is no correlation between a game's popularity on streaming platforms and its revenue in the mobile market. Titles like Honor of Kings, MONOPOLY GO!, and Royal Match are absent from the top lists.

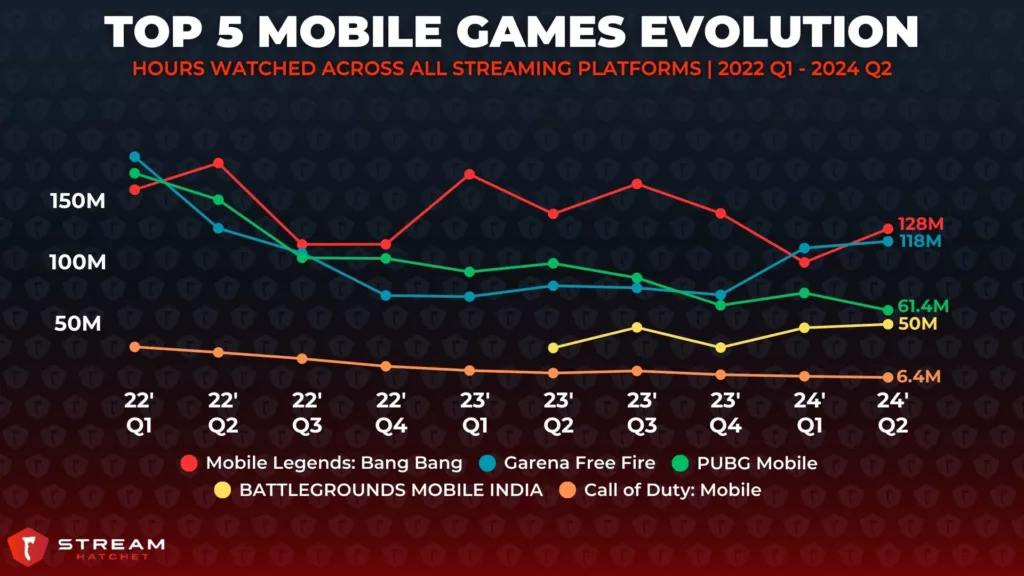

When considering the top 5 mobile games by viewer interest, only two leaders have managed to maintain their positions since Q1'22. Call of Duty: Mobile is showing a negative trend, and PUBG Mobile has lost 65% of its viewer interest since Q1'22. However, it's worth noting the rising popularity of Battlegrounds Mobile India.

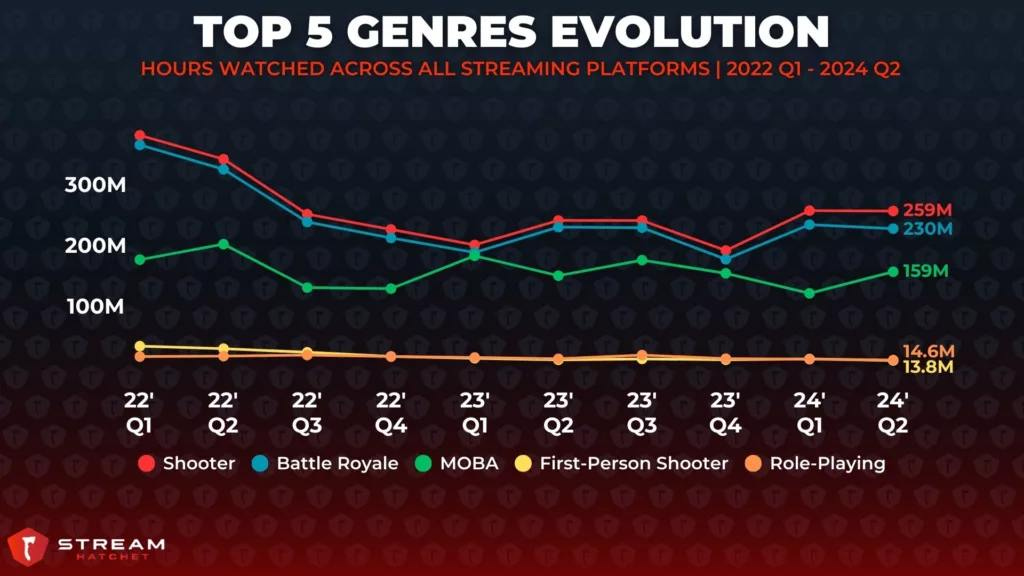

The most popular genres for streaming in the mobile market are shooters (259 million hours watched in Q2'24); Battle Royale (230 million hours); and MOBA (159 million hours).

game: The German Gaming Market declined in H1'24

Data provided by GfK and data.ai (Sensor Tower).

For the first time in a long while, the German market showed negative results in the year's first half. Revenue for H1'24 amounted to €4.3 billion, which is 6% less than the same period in 2023.

Sales of gaming hardware decreased by 18% (from €1.43 billion to €1.177 billion); sales of gaming content fell by 4% (from €2.693 billion to €2.589 billion). The only segment that grew was online services, including various subscriptions, which increased by 25% (from €413 million to €516 million).

In the report, the German association highlighted the social significance of games. 16M Germans made new friends through games.

78% of German players reported that games help them better understand history; more than 70% noted that games are crucial for building social connections.

67% of Germans believe that the local gaming industry should be independent and competitive on international markets.

Sensor Tower: RPG Revenue Declines in South Korea

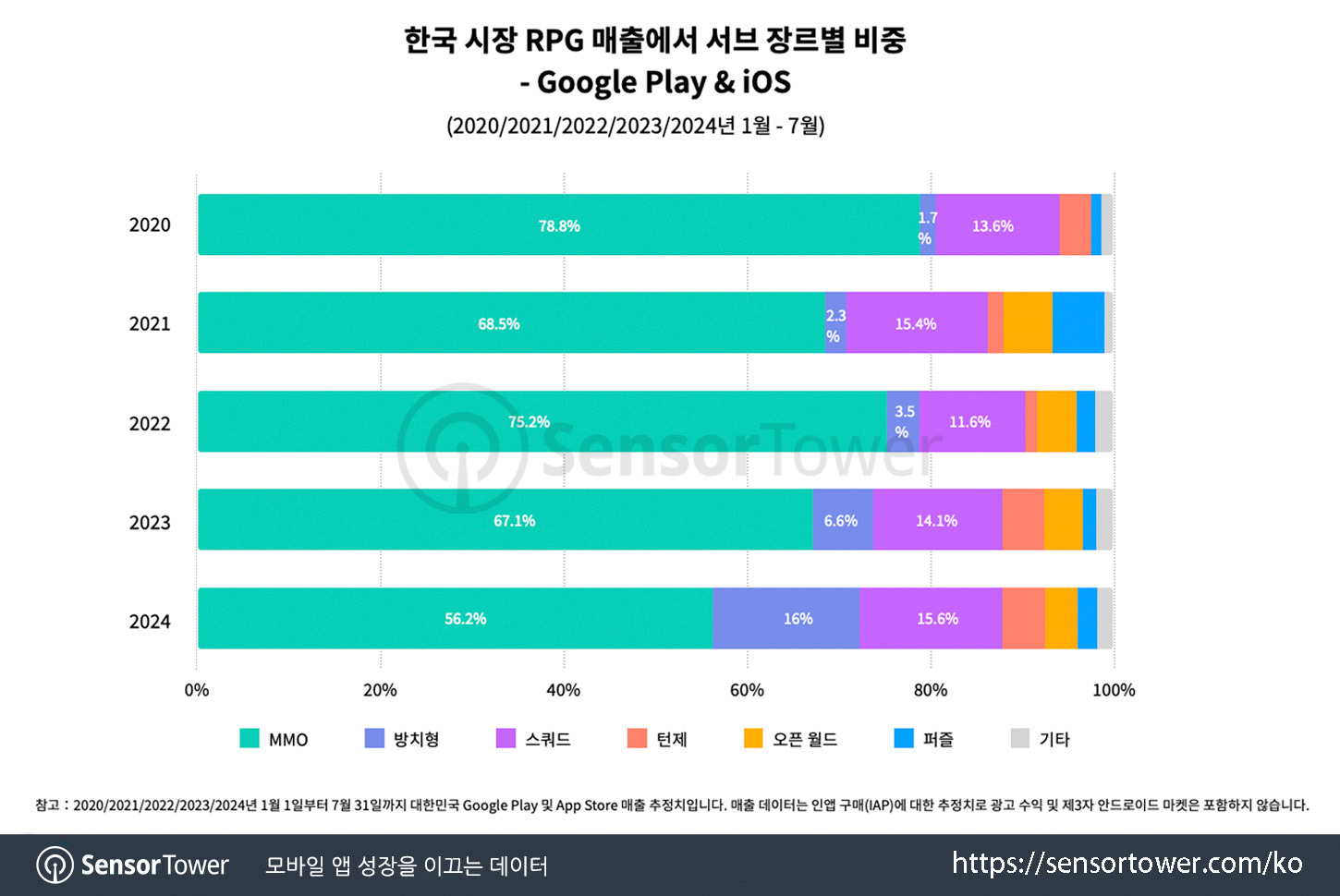

The share of RPGs in the revenue structure of the South Korean mobile market has been declining since 2022. In May 2024, their revenue share fell below 50% for the first time in recorded history.

MMORPGs are significantly losing popularity. Their revenue share in the RPG genre was 78.8% in 2020, but by 2024, it had decreased to 56.2%.

Meanwhile, the Idle RPG segment is showing significant growth. In 2020, they accounted for only 1.7% of the genre's revenue, but by 2024, this had risen to 16%. Squad RPGs also hold a considerable share (11-15%). The launch of Honkai: Star Rail and Reverse: 1999 contributed to the share of turn-based RPGs growing to 4.7%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

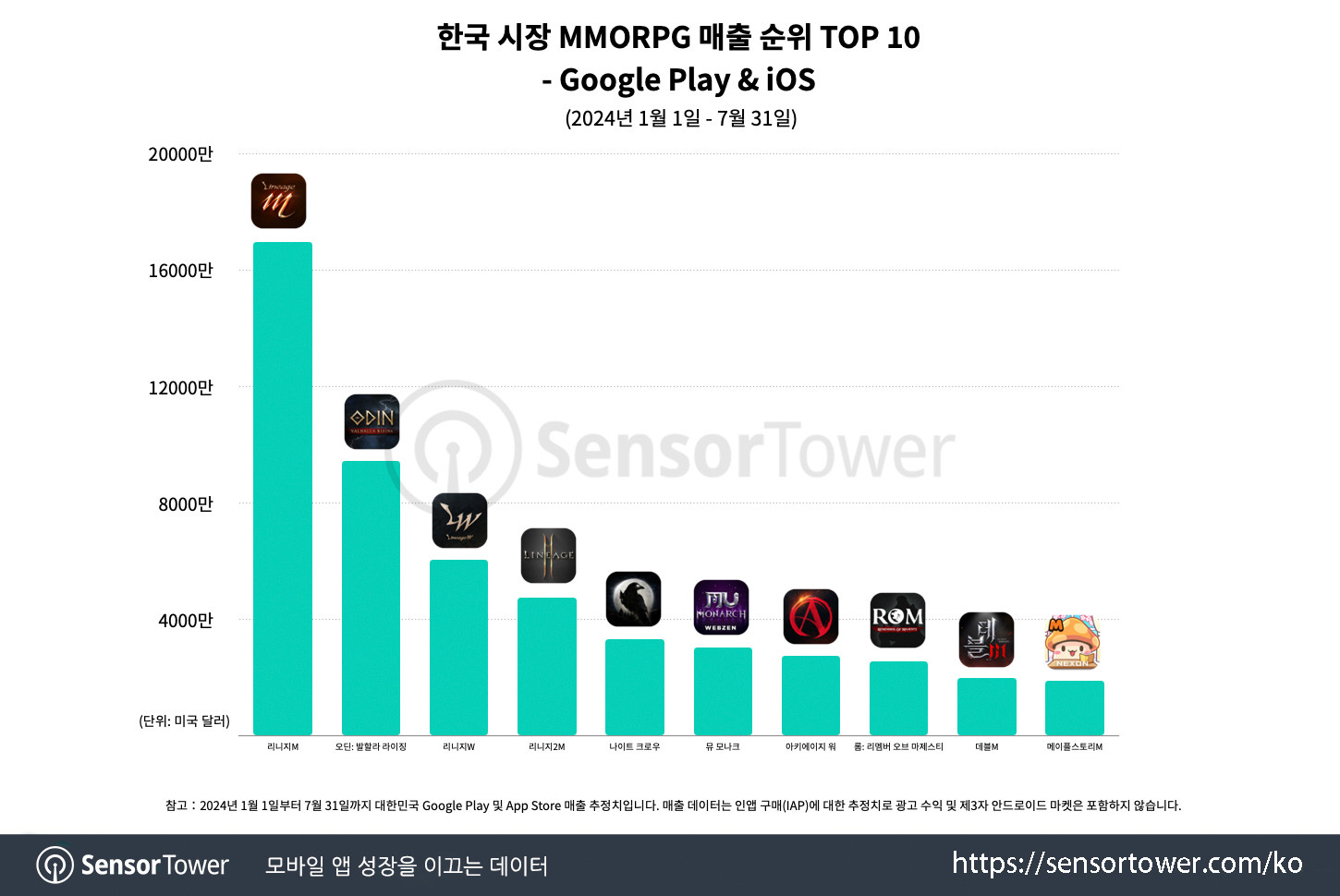

Despite the significant decline, MMORPGs still dominate the South Korean market. In 2024, four MMORPG projects made it into the top 10 (compared to 7 in 2023, 5 in both 2021 and 2022, and 7 in 2020). Lineage M, Odin: Valhalla Rising, Lineage W, Lineage 2M, Night Crow, and MU Monarch are the most popular MMORPGs in the country.

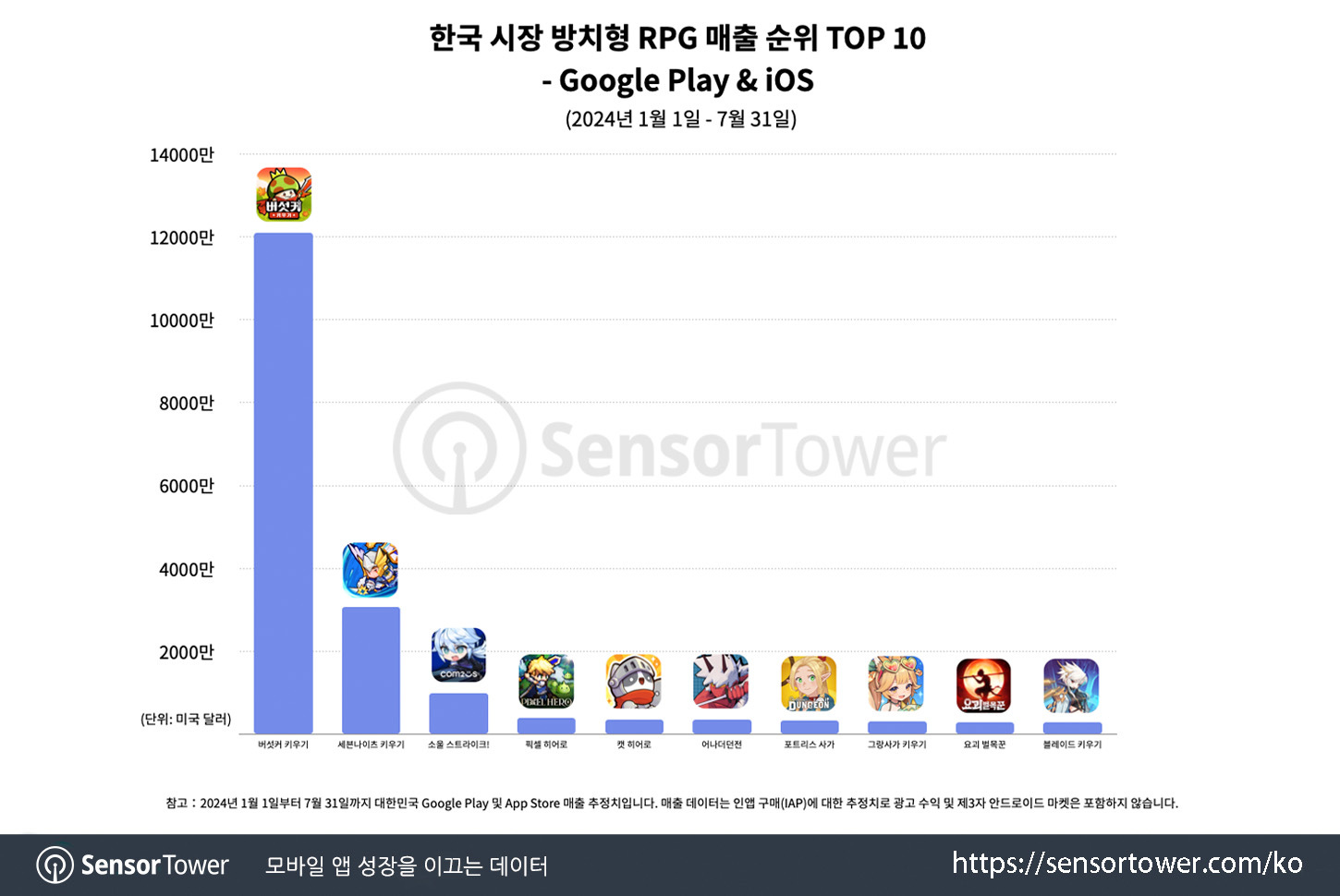

Legend of Mushroom became the third highest-grossing game in South Korea in the first half of the year, and it is by far the most popular Idle RPG.

Sensor Tower notes that user habits limit MMORPG growth. In Idle RPGs, people spend less time—5.21 sessions per day with a total duration of 50.42 minutes. In contrast, people spend 135 minutes per day in MMORPGs (5.4 sessions). People simply don’t have enough time for other games. Additionally, the Idle RPG audience is slightly younger (32 years old on average versus 36 for MMORPGs), and there is a higher percentage of people under 25 years old (16% versus 10% for MMORPGs).

Sanlo: Mobile Web Shops in 2024

The company surveyed 5,050 mobile players in the USA, Canada, the UK, Germany, and Japan. 52% were women; and 48% were men; the survey was conducted among players who played mobile games at least once in the past 30 days. 85% of respondents made at least one transaction in mobile games in the last 12 months.

❗️Sanlo is a company that provides web shops to gaming companies.

81% of respondents stated they are aware of the existence of web shops in some mobile games. The same percentage mentioned they had visited web shops.

Among those aware of web shops, 36% learned about them through in-game promotions; 28% through social media; 26% from friends or family members; 7% from community or forums; and 2% from industry news.

77% of respondents said they had made purchases in a webshop.

90% of those who have already made a purchase noted they would continue to do so in the future.

However, when it came to preferences and where it is more convenient to shop, 75% of users said they would prefer to make purchases in the App Store or Google Play. People don’t like to change their habits.

Among those who make purchases, 18% of users stated that they hadn’t made a transaction in a web shop because they were unsure of its legitimacy. 17% said they didn’t see an offer worth paying for. 6% noted that it was more difficult to purchase in the webshop. 2% could not figure out the authorization process; the same percentage said the payment process was too slow and/or lengthy.

For those who don’t pay in web shops, the reasons are as follows: 41% are unsure about security; 31% face payment method issues; 28% don’t trust the authenticity of the webshop; 26% don’t see value in paying through a webshop; 20% prefer app stores for convenience; 12% note difficulty in navigation.

53% of users said they could be motivated to make purchases in web shops by discounts and special offers; 50% by gifts and bonuses; 37% by loyalty programs; 36% by exclusive items; and 19% by simplified navigation. 6% said none of these factors mattered to them.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Digital payment methods (PayPal, Amazon Pay, AliPay, Google Pay, Apple Pay) are convenient for 45% of the audience. Next are cards (39%), online banking (11%), and cryptocurrencies (2%).

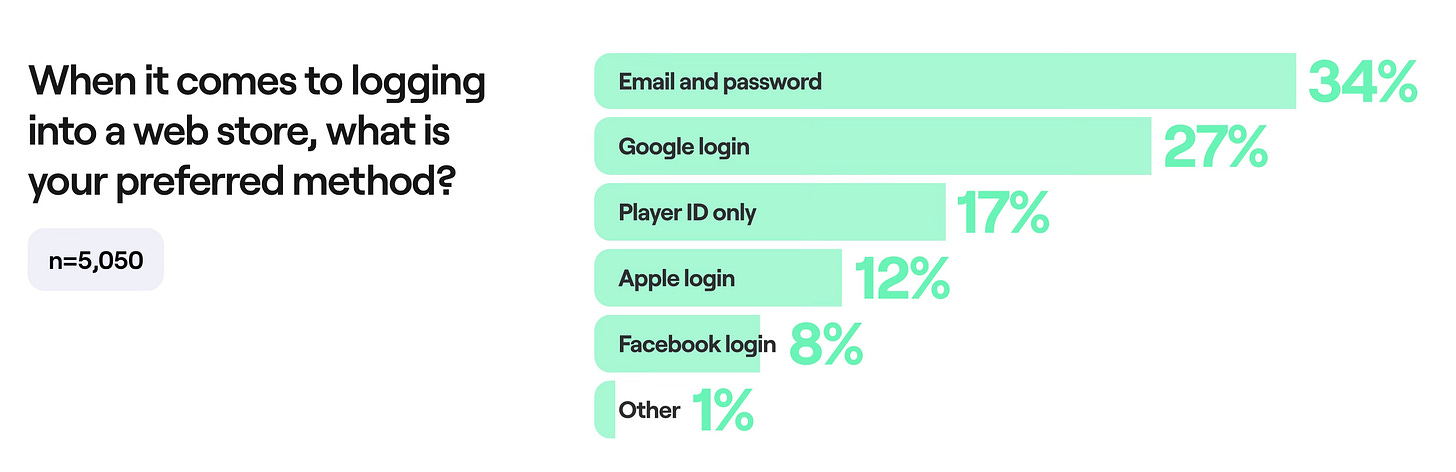

People still find it most convenient to log in with email and password (34%). Following that is Google authorization (27%), Player ID (17%), Apple (12%), and Facebook (8%).

Statistics show that most of the audience is unaware of the 30% commission on the App Store and Google Play.

26 mobile games in the top 100 by revenue have integrated web shops. These include Honor of Kings, Brawl Stars, Coin Master, Pokemon GO, PUBG Mobile, Call of Duty: Mobile, and Garena: Free Fire.