Weekly Gaming Reports Recap: September 22 - September 26 (2025)

Chinese Gaming Market data by Niko Partners; Top-20 PC/Console titles in August by Newzoo; and Steam data in 2025 delivered specifically by Valve.

Reports of the week:

VideoGamesEurope & EGDF - Facts about the European Game Industry in 2024

Valve: Steam in 2025

Newzoo: Top 20 PC/Console Games by Revenue and MAU (August’25)

Games & Numbers (September 10 – September 23, 2025

Niko Partners: Chinese Gaming Market in 2025

VideoGamesEurope & EGDF - Facts about the European Game Industry in 2024

Before we start, I’m happy to announce that in the upcoming months, the newsletter will be powered by Xsolla! It’s a big step for the newsletter, and I appreciate the support of the Xsolla team, their belief in the work I do!

For those who don’t know, Xsolla is a global leader in video game commerce that empowers game developers and publishers to promote, distribute, and monetize their games with ease. From launching a custom web store in just a few clicks to providing secure payment solutions across 1,000+ methods and 200+ regions, Xsolla offers all the things needed to grow a gaming business worldwide. Check the new website to see how it works!

The content of the newsletter won’t change, and I will continue to cover the gaming market numbers as usual. Thanks to Xsolla for the support in these endeavors! ❤️

In the report, survey data is used (1,000 people offline per year; 1,000 people online per month). It also includes data from GSD, which accounts for both physical and digital actual sales, reported by developers and publishers.

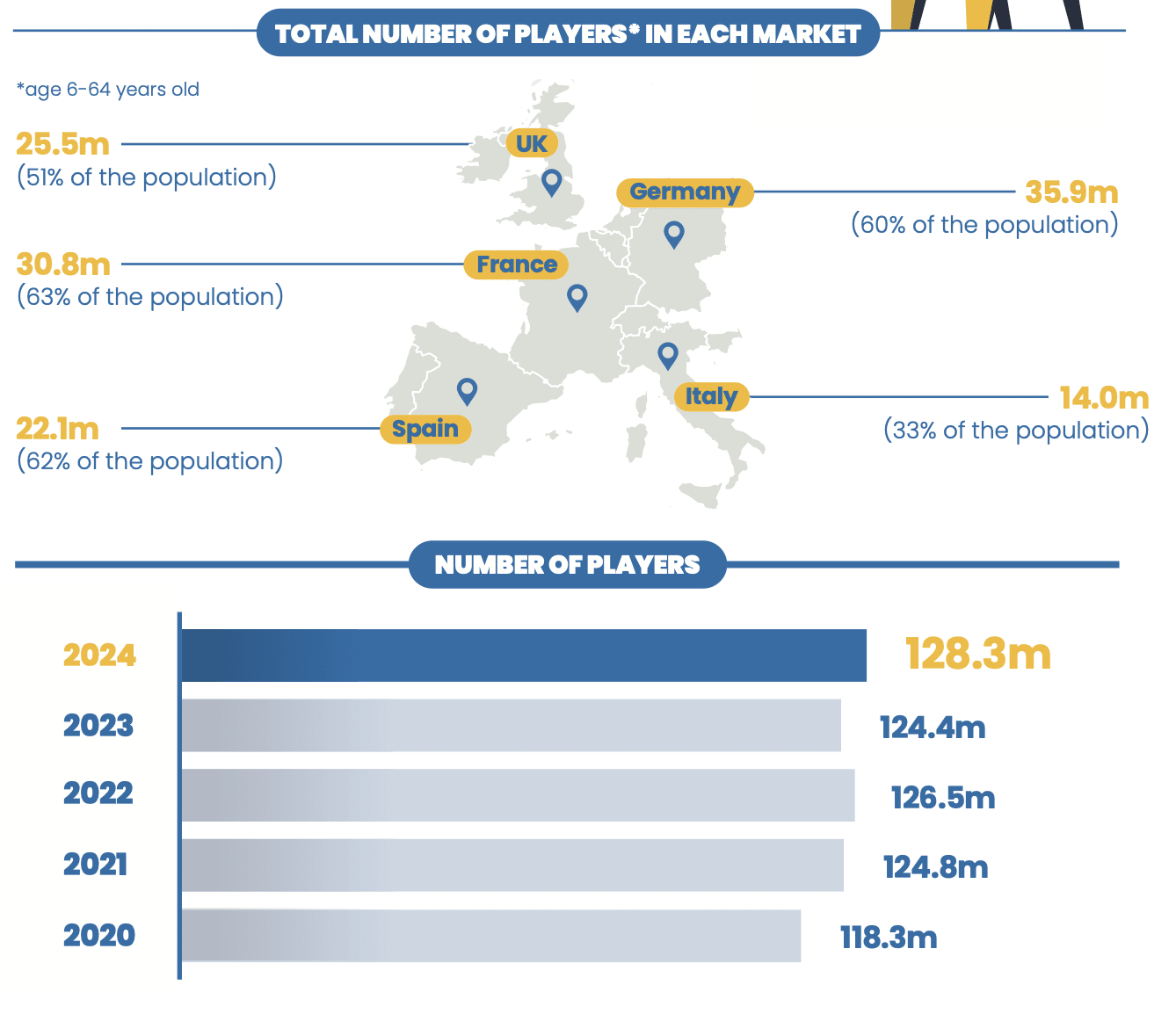

European Players

54% of Europeans aged 6 to 64 play games. 75% of people in Europe over 18 play games.

The average age of a player is 31 years old.

The total number of players in Europe reached 128.3 million. This is a new record and the largest figure in the last 5 years.

France has the highest percentage of its population playing games - 63% (30.8 million people). The lowest among Central and Western European countries is Italy, with 33% of the population (14 million people).

45% of all players are women. The average age of female gamers is 32.

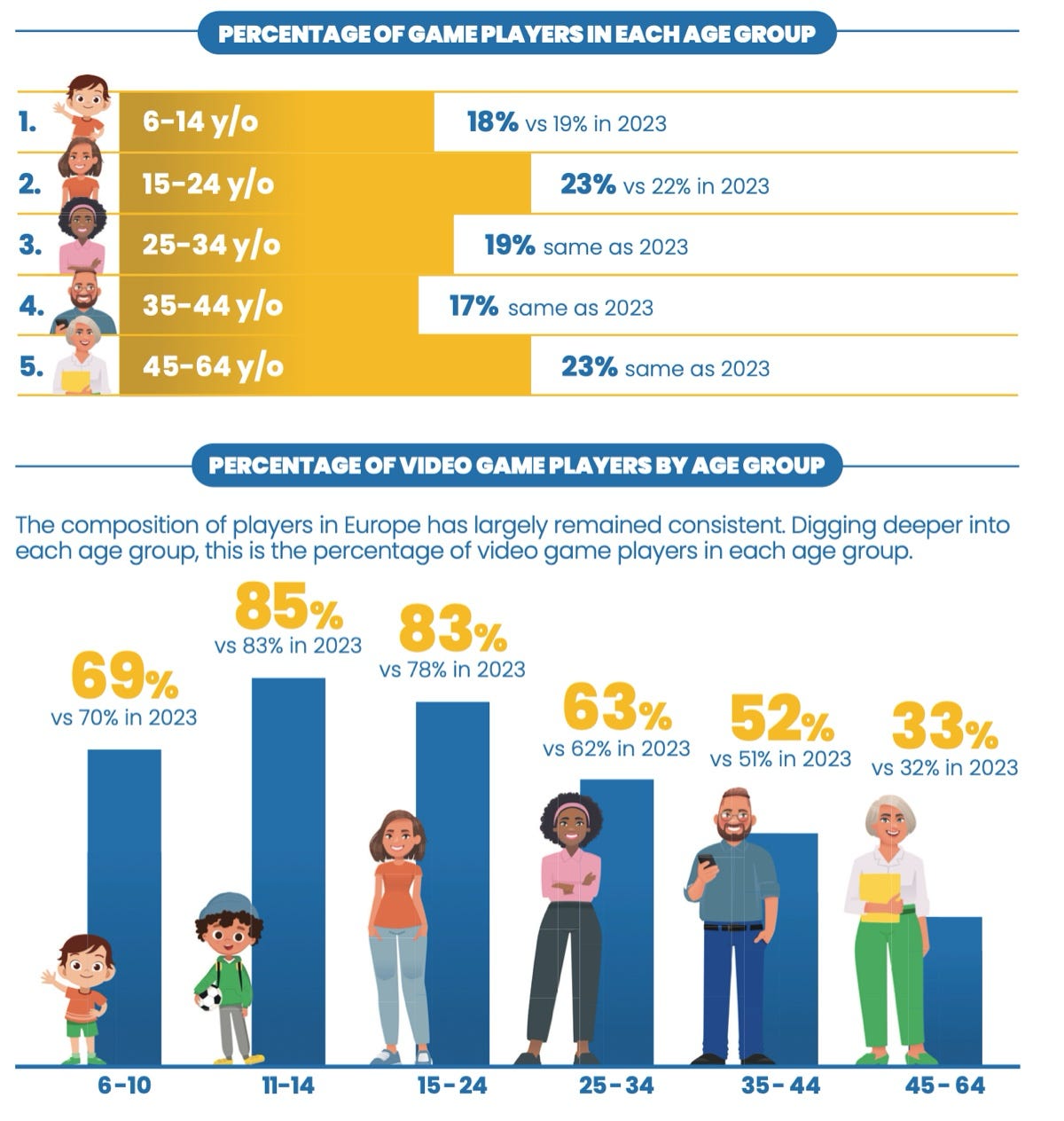

The age composition of players has hardly changed compared to 2023. There are 1% more players aged 15–24 and 1% fewer players aged 6–14. Overall, gaming penetration is growing across all ages except the 6–10 segment.

75% of players in Europe spend at least 1 hour per week playing. 15% play less than 1 hour, and 10% play just a few times a year (almost not at all).

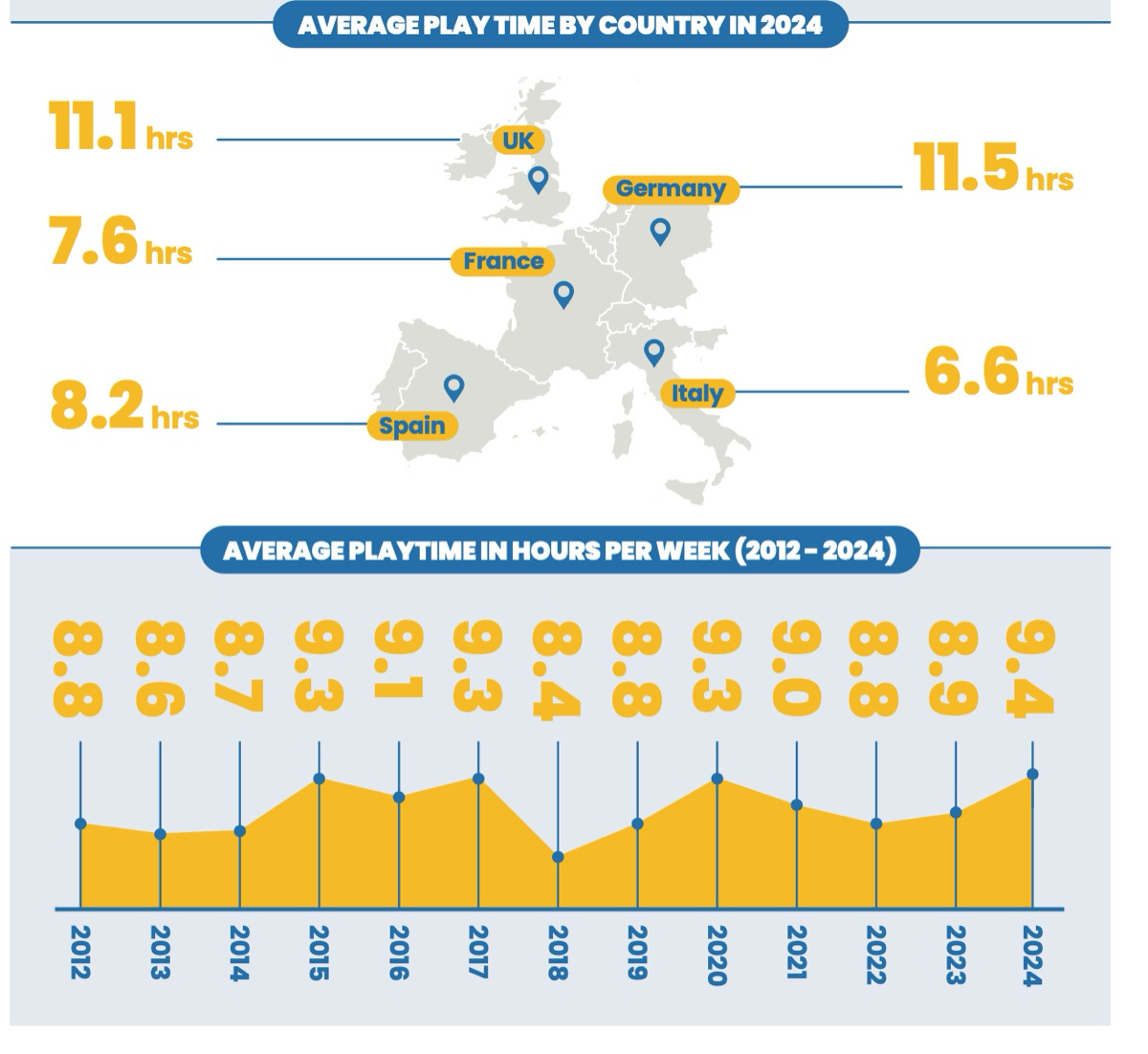

The most active players are in Germany, averaging 11.5 hours per week. Italians play the least, averaging 6.6 hours per week.

Interestingly, 2024 set a record since 2012 (when tracking began) for average weekly playtime. People now play an average of 9.4 hours per week.

Games are still behind other media. People spend more time on social networks (16.75 hours per week) and watching television (23 hours per week).

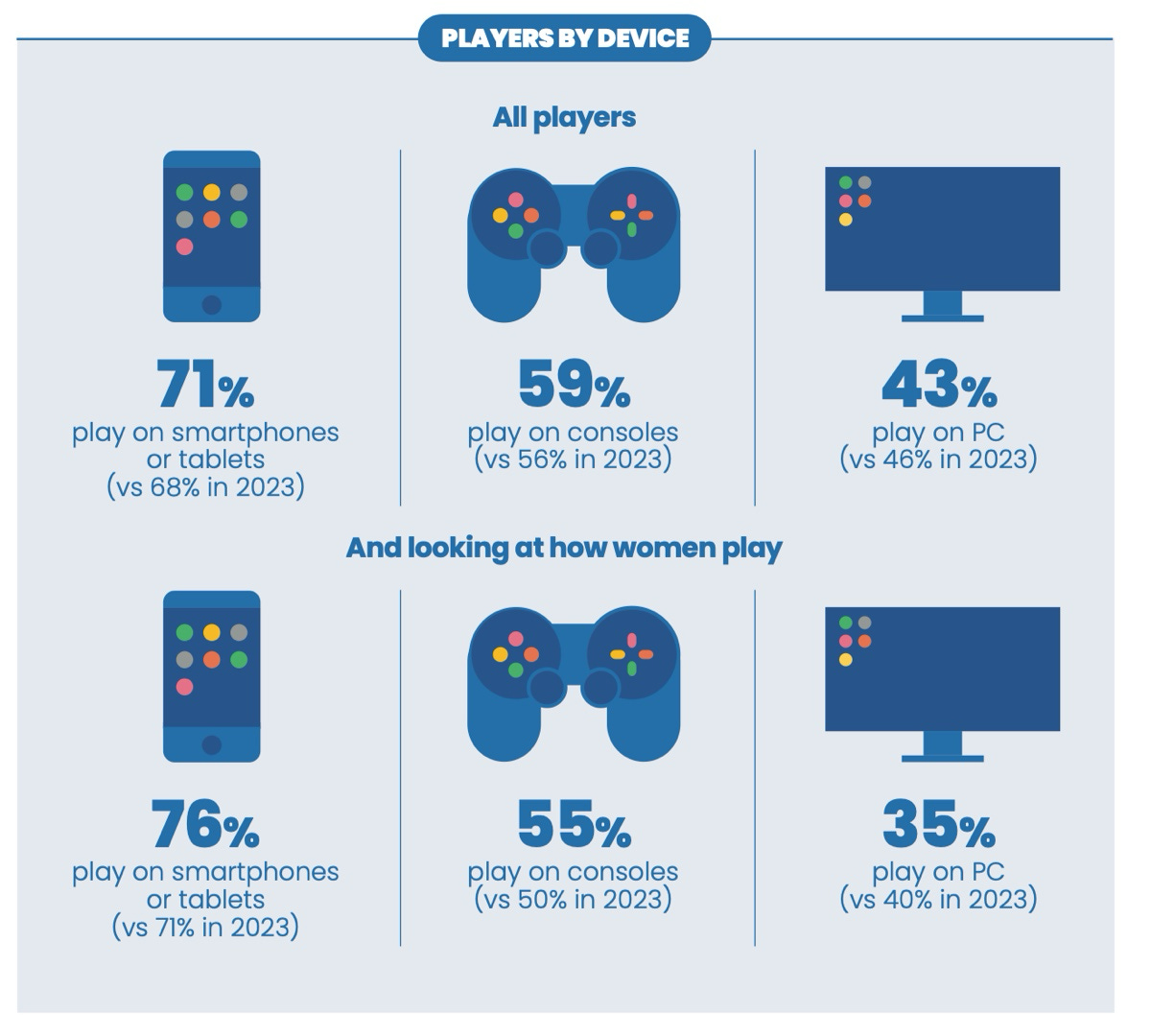

People played more on smartphones and consoles in 2024 compared to 2023, and less on PC. Interestingly, this contrasts with the growing PC platform revenue.

Top mobile genres in the 5 biggest European markets are puzzle (25%), RPG & strategy (17%), and word games (17%). On consoles, players mostly play racing (31%), sports (28%), and adventure (28%). On PC, adventure (23%), shooters (20%), and strategy (20%) dominate.

74% of people say games are a good way to “stretch the brain.” 67% say games help them distract from daily problems. 68% say games help cope with stress. 75% agree that games are entertainment for all ages.

The Game Industry in Europe

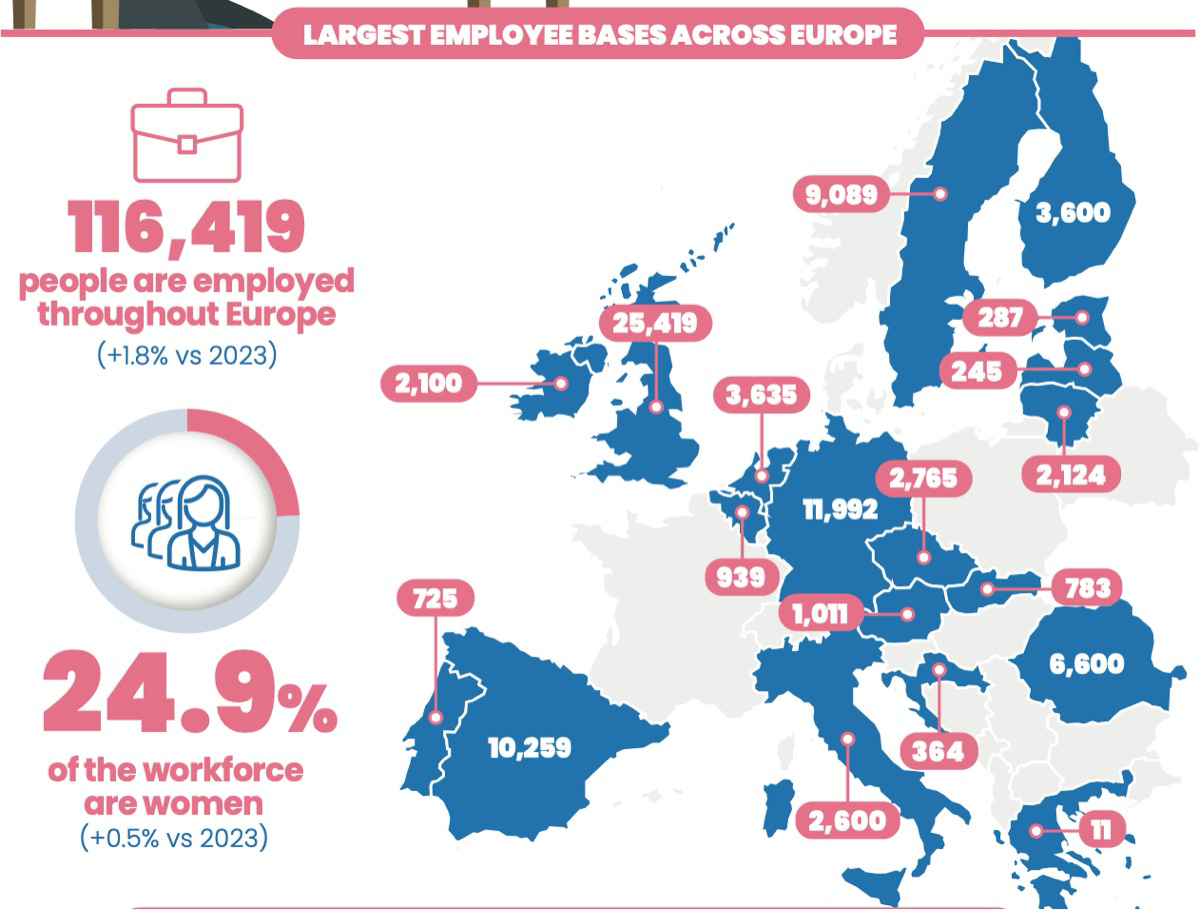

As of the end of 2024, 116,419 people work in European game companies. This is up 1.8% from 2023. This confirms recent reports stating that most layoffs affected U.S. studios.

24.9% of all employees in Europe are women.

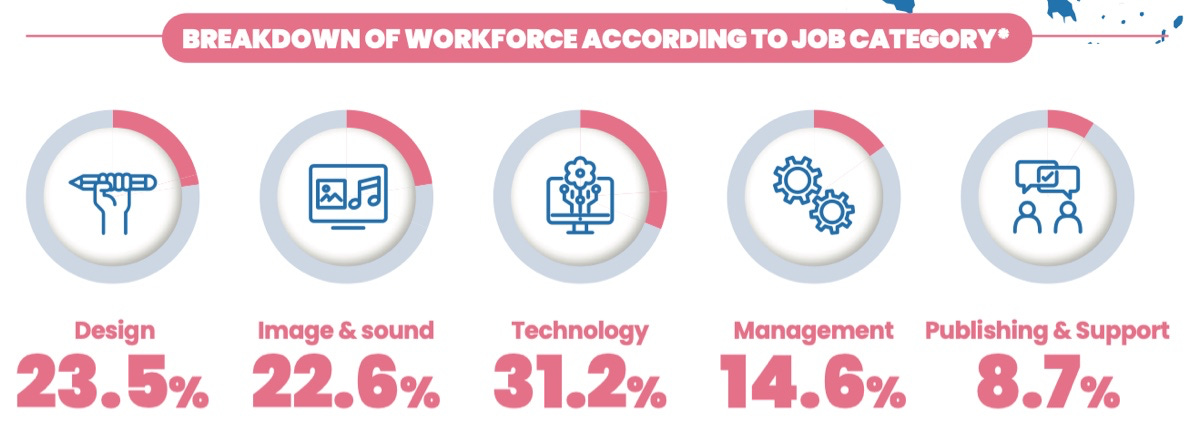

23.3% of all employees are in management, publishing, or customer support. The rest are directly involved in development.

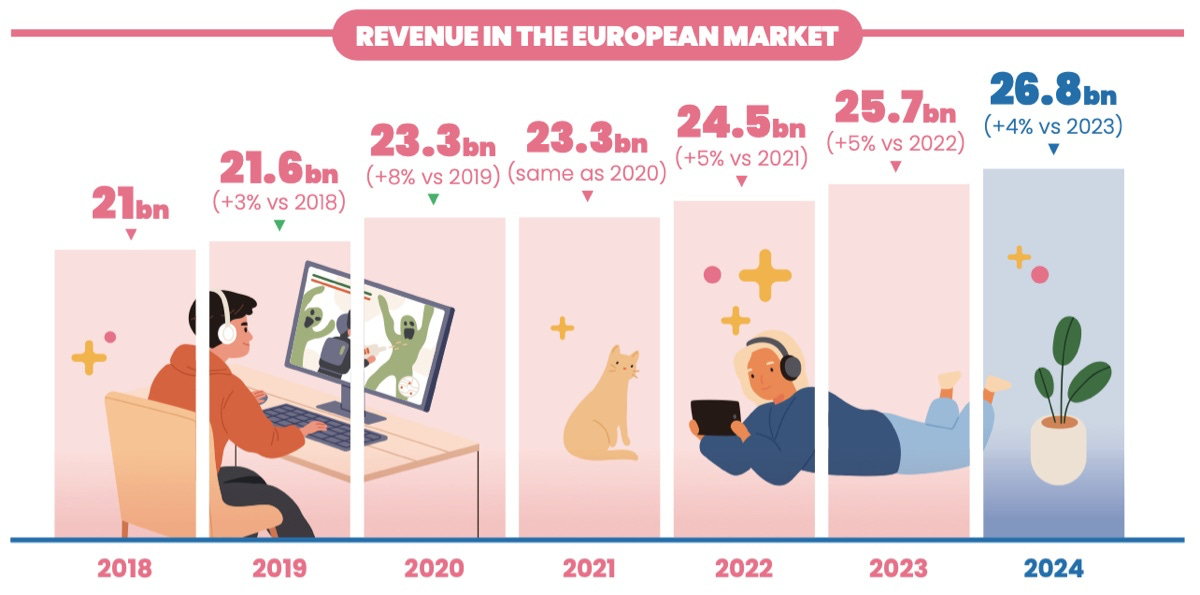

Revenue of the European game market continues to grow. In 2024, the European markets reached €26.8 billion (+4% YoY).

Mobile’s share in revenue grew (44% vs. 41% in 2023), while PC (15% vs. 14% in 2023) and streaming services (4% vs. 3% in 2023) also increased slightly. The share of consoles decreased (38% vs. 41% in 2023).

Digital revenue share continues to grow (90% in 2024 vs. 85% in 2023). Accordingly, physical distribution revenue was 10% in 2024. Digital segments on PC, consoles, and especially mobile keep growing.

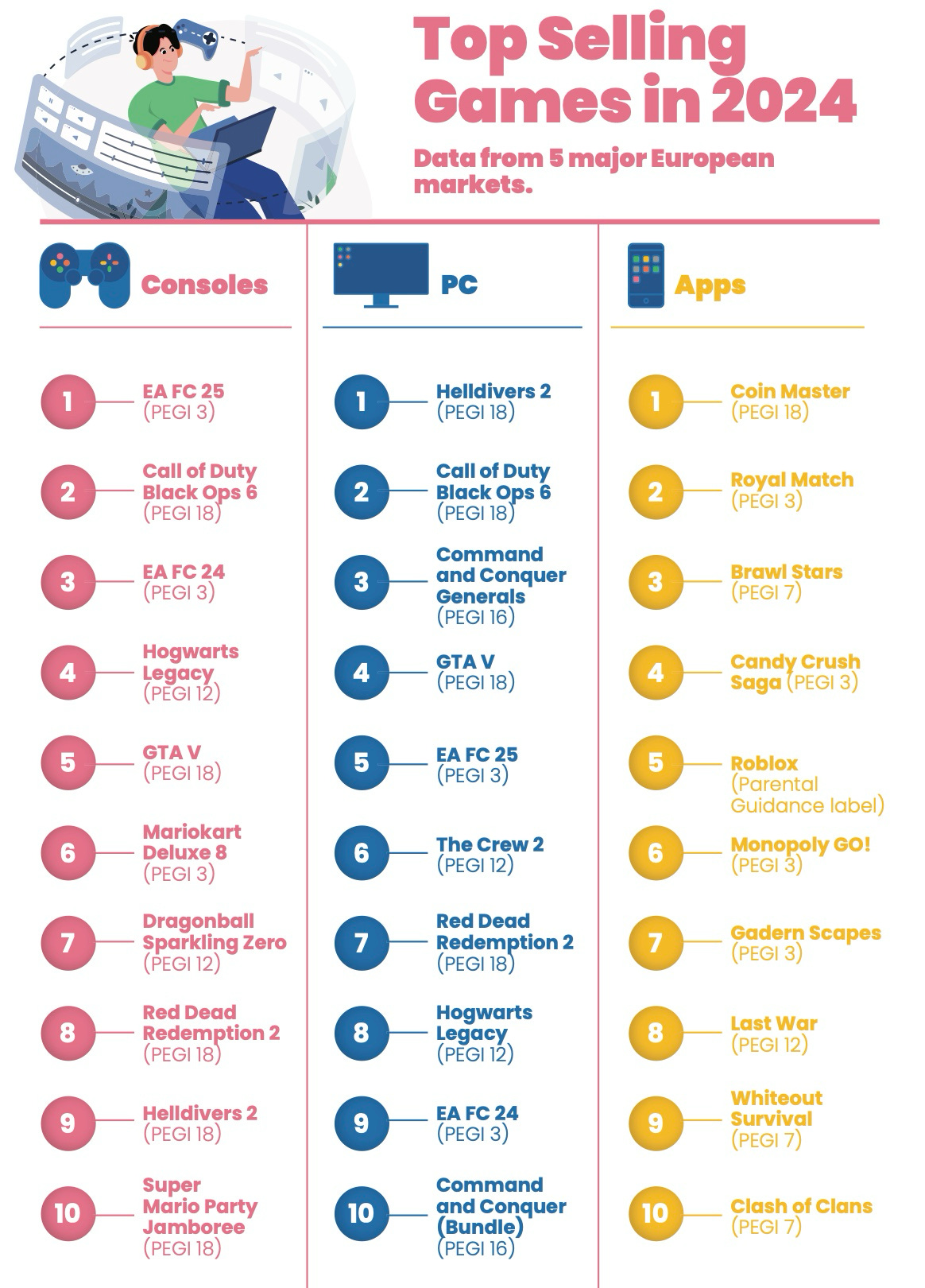

Top console hits in 2024: EA FC 25, Call of Duty: Black Ops 6, and EA FC 24. On PC: Helldivers 2, Call of Duty: Black Ops 6, and C&C Generals (surprisingly). On mobile: Coin Master, Royal Match, and Brawl Stars.

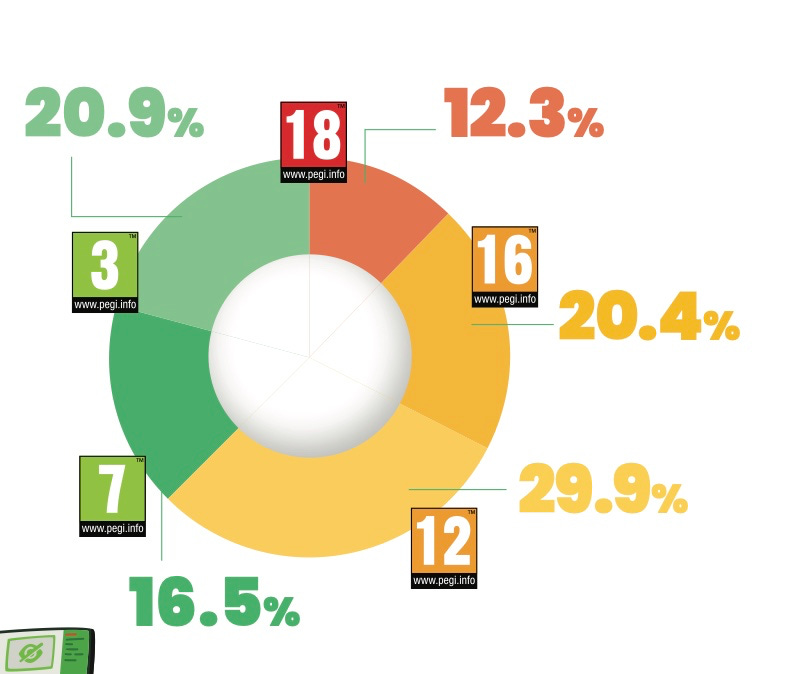

On PC and consoles, 12.3% of games released in 2024 were aimed at audiences over 18. Most projects (67.3%) had a PEGI rating of 3–12 years.

According to the report, 80% of parents make game purchase decisions for their children based on ratings.

Kids and Games

95% of parents actively monitor how their children spend money in games.

76% of parents say their children do not buy in-game content. An interesting number, considering Roblox stats.

Children’s spending in games dropped by 21% compared to 2023.

Valve: Steam in 2025

Erik Peterson from Valve shared the latest platform numbers at Gamescom’25.

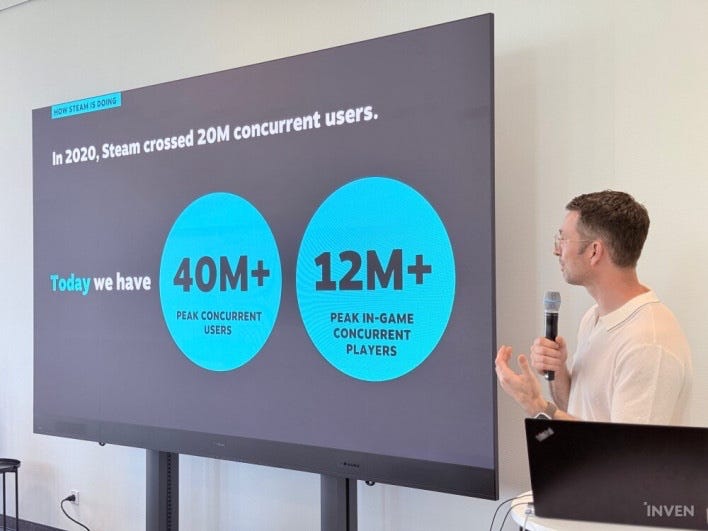

As of August 2025, Steam’s record was 40 million CCU on the platform and 12 million CCU in games.

From 2020 to 2025, the fastest audience growth came from Japan, Brazil, China, Germany, and the USA.

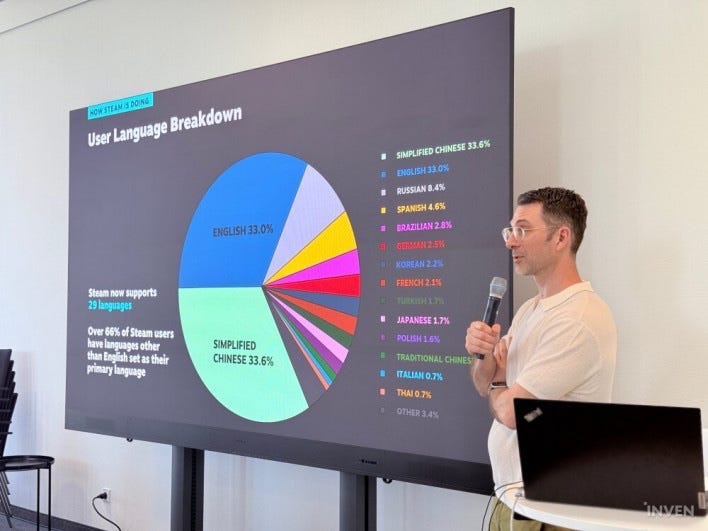

Simplified Chinese (33.6%), English (33%), and Russian (8.4%) are the most popular languages on the platform.

From August 1, 2024, to August 1, 2025, Steam saw an average of 109,000 new buyers each day, making their first-ever purchase.

That’s more than 75 new paying users per minute.

Sales events continue to perform well on the platform. Revenue from the Spring Sale grew by 19%, and from the Summer Sale by 8%. This is compared to the previous year, with full-price game sales excluded.

In 2024, more than 540 new games crossed the $250,000 revenue mark within their first 30 days (including pre-orders). In the same period, 224 games earned more than $1 million.

Looking at the top 100 most successful projects over the past 4 years, more than half of them are priced under $50, and a quarter are under $30. This shows that not only big AAA blockbusters succeed on the platform.

Over 500 projects earned more than $4M (Gross) in 2024. That’s almost double compared to 2020.

By the end of 2025, Valve expects nearly 20% more games to hit this milestone.

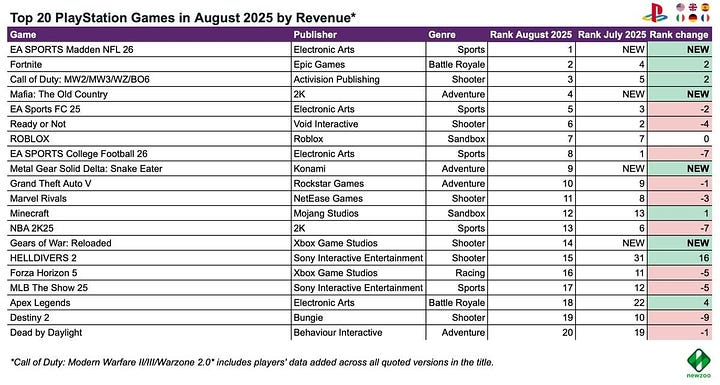

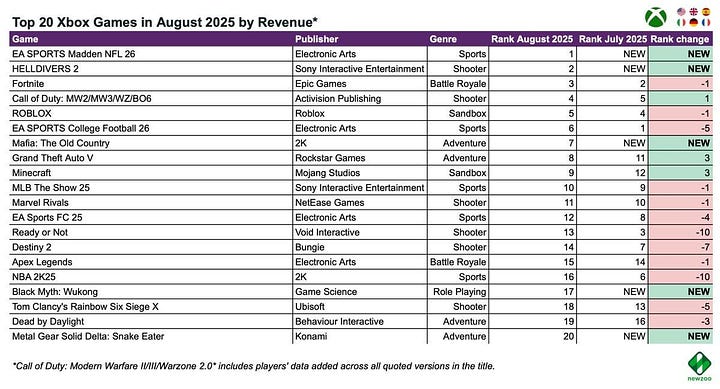

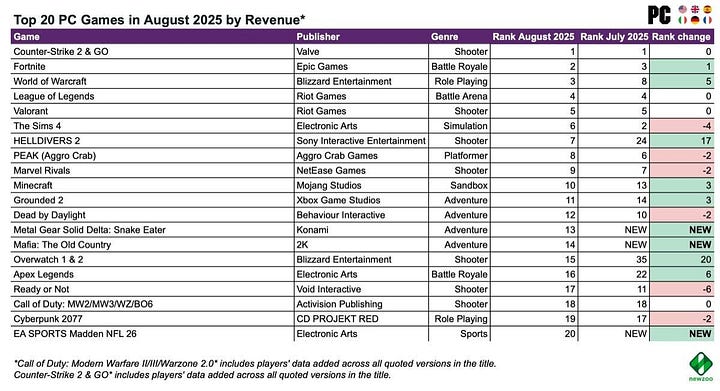

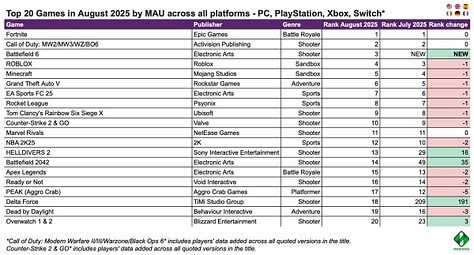

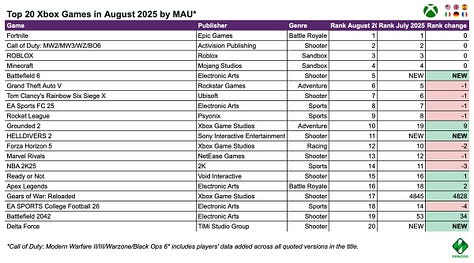

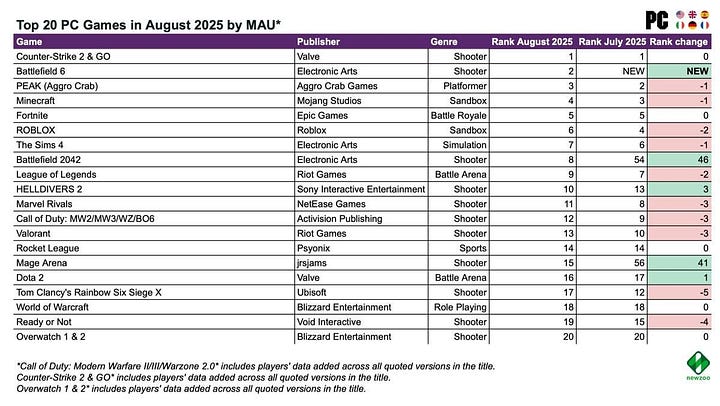

Newzoo: Top 20 PC/Console Games by Revenue and MAU (August’25)

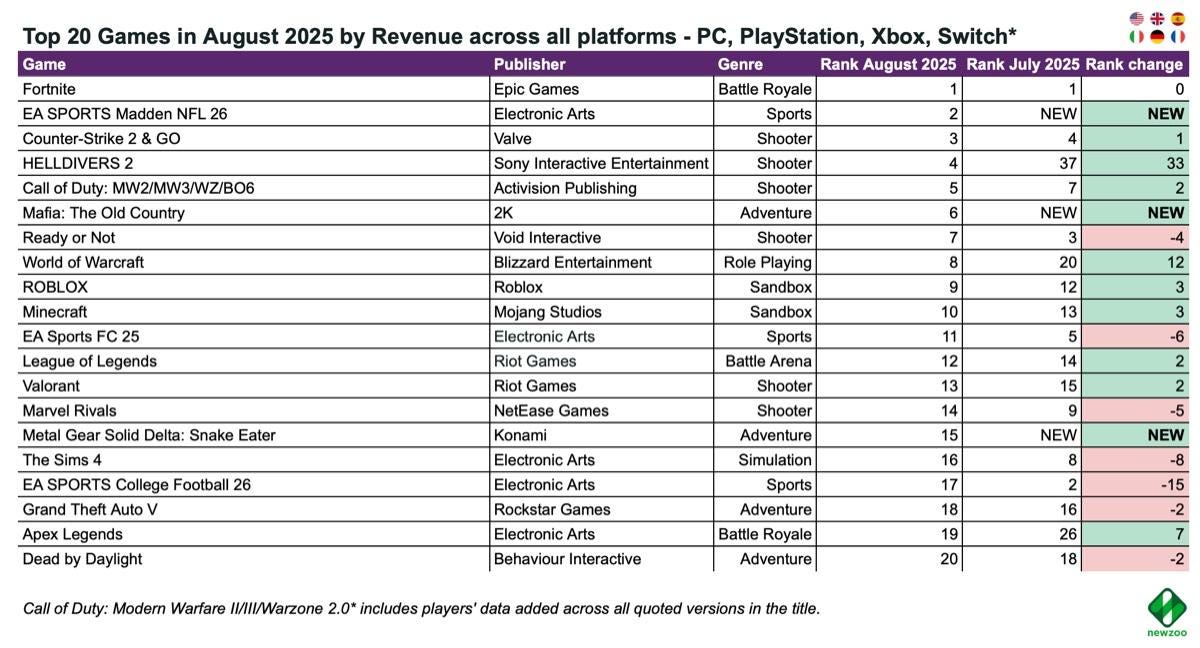

Newzoo tracks the markets of the US, UK, Spain, Germany, Italy, and France.

Revenue – all platforms

In August, three major new entries hit the top 20: EA Sports Madden NFL 26 (2nd place), Mafia: The Old Country (6th place), and Metal Gear Solid Delta: Snake Eater (15th place).

Mafia: The Old Country earned about two-thirds of its revenue on PlayStation, driven by player preferences on the platform and its audience size.

World of Warcraft jumped up 12 spots to 8th place, thanks to the start of preorders for The Midnight expansion on August 19.

Apex Legends returned to the top 20 following the Showdown update.

Revenue – individual platforms

Helldivers II had a strong debut on Xbox, taking 2nd place by revenue in August, behind only EA Sports Madden NFL 26.

On PlayStation, Gears of War: Reloaded launched in 14th place. Not the strongest debut, but the magnitude of games is quite different.

Nintendo Switch saw three new entries in the top 20: Tiny Bookshop (3rd place), EA Sports Madden NFL 26 (10th place—highlighting very different audience preferences), and Story of Seasons: Grand Bazaar (15th place).

MAU – all platforms

There was unusually high movement in the MAU rankings. First, Battlefield 6 entered the overall chart in 3rd place—and that’s just the beta. On the back of its popularity, Battlefield 2042 also climbed back into the top 20.

Delta Force launched on consoles, pushing it into the overall top 20. Helldivers II also spiked in activity, boosted both by its new update and Xbox release.

On Nintendo Switch, there was one new MAU entry - Tiny Bookshop.

Games & Numbers (September 10 – September 23, 2025)

PC/Console Games

Over 20 million people have played Dead Island 2. This number includes both sales and players who downloaded the game via PS Plus or Xbox Game Pass.

Sales of Clair Obscur: Expedition 33 have reached 4.4 million copies. This is not an official number; it was mentioned during a stream.

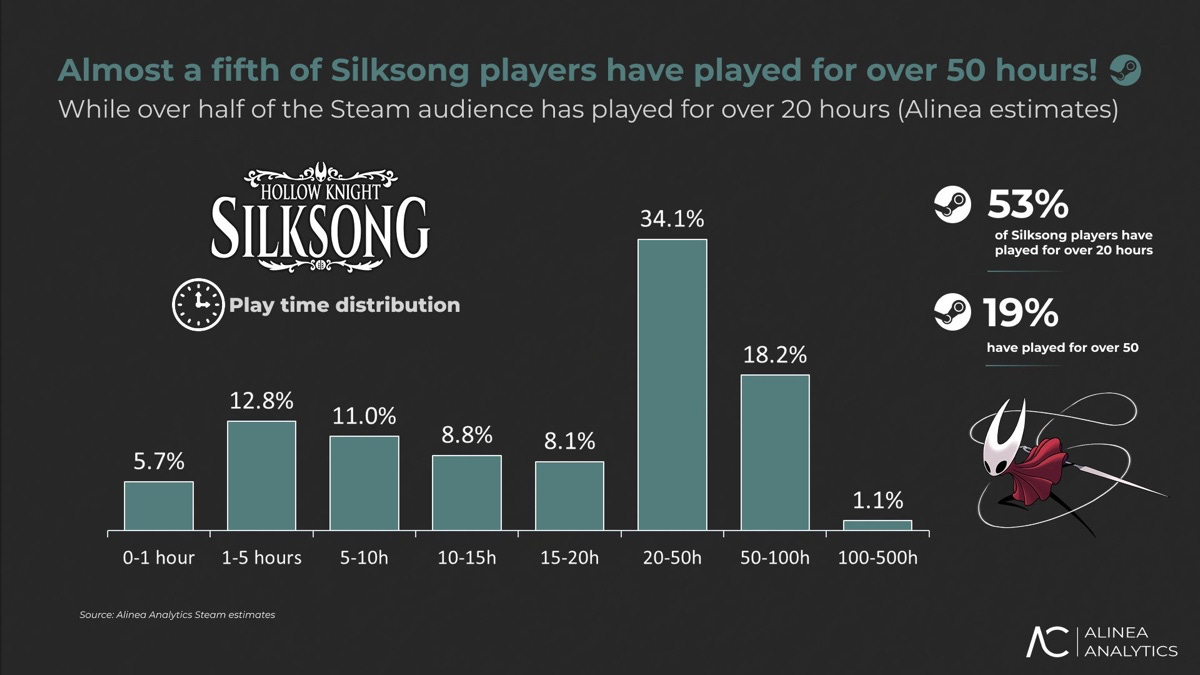

Hollow Knight Silksong has been purchased more than 3.5 million times on Steam; overall, more than 6 million people have played the game (including Game Pass players). More than half of the Steam owners have spent over 20 hours playing. Data from Alinea Analytics.

Over 3 million people have played Outward, released in March 2019. The developers shared this in their YouTube blog.

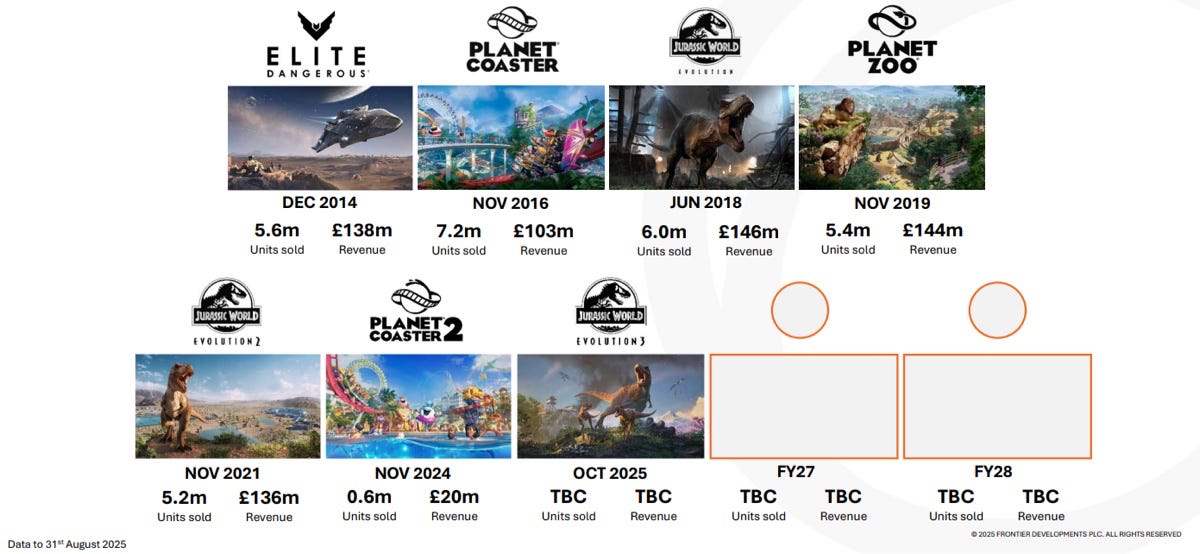

Frontier Development disclosed the sales of their projects. The most successful game is Jurassic World Evolution (6 million copies, £146 million in revenue). Elite Dangerous brought in £138 million (5.6 million copies).

According to Alinea Analytics, more than 2.5 million people have played Borderlands 4 since release (1.3 million copies on Steam). The project has already generated over $150 million in revenue. More than half of users on both Steam and PlayStation are from the US. Rumors suggest the development budget was around $200 million, with over 500 thousand pre-orders on Steam at launch.

Shape of Dreams, released by Neowiz, sold more than 300 thousand copies in a week. The game was developed by a team of 4 people.

The Crew series has been played by more than 50 million people. The first installment was released in December 2014.

More than 2 million users played skate. in early access within the first 24 hours. However, the project is facing issues – positive reviews on Steam are barely above 50%.

Dying Light: The Beast had a strong launch – on Steam, peak CCU reached 121 thousand players. Not a record for the series, but still very solid numbers.

Mobile Games

In its first year, Fable Town, developed by Reef Games and published by MGVC Publishing (MY.GAMES), earned more than $9 million. The game was downloaded 3 million times. Its current MAU has surpassed 500k, while DAU is at 100k.

Over 100 million people worldwide have played MaskGun – a first-person shooter by Supergaming. The game launched in 2019.

Niko Partners: Chinese Gaming Market in 2025

Market Figures

By the end of 2024, the market size reached $49.2 billion. This is 3.6% higher than last year.

Niko Partners expects that by the end of 2025, the market will grow to $50.7 billion. By 2029, it is projected to reach $54.8 billion with a CAGR of 2.2%.

At the end of 2024, there were 722 million players in the country — twice the population of the US. This number will grow to 753.7 million by 2029 (CAGR – 0.9%).

ARPU of Chinese players at the end of 2024 is $68. By 2029, this figure will rise to $73.

Growth will be driven by mobile and PC segments. A strong contribution is expected from Nintendo Switch 2, the launch of next-gen consoles, the rise of premium PC games, and the increasing popularity of Mini Games.

Xsolla recently released the global gaming market map, which covers more than 200 regions.

This is a gigantic work, each market has:

GameDev Reports - powered by Xsolla is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Main market numbers (population, gaming revenue, distribution of revenue by platform and much more).

Top video game genres.

Recommendations for game localization.

Largest game development studios & games from the region.

Cultural considerations & local holidays.

Top streaming platforms, influencers, local shows.

Salary benchmarks for the gaming industry.

Payment data, taxes information, and legal considerations.

So far, it is the most comprehensive database of the gaming market I’ve seen so far (excluding my newsletter, of course, ha-ha).

200+ countries covered, and there is a very sweet opportunity to download the data for the pitch in the .pdf format (based on the market).

Player Survey

This section contains results from a survey of 1,058 Chinese players.

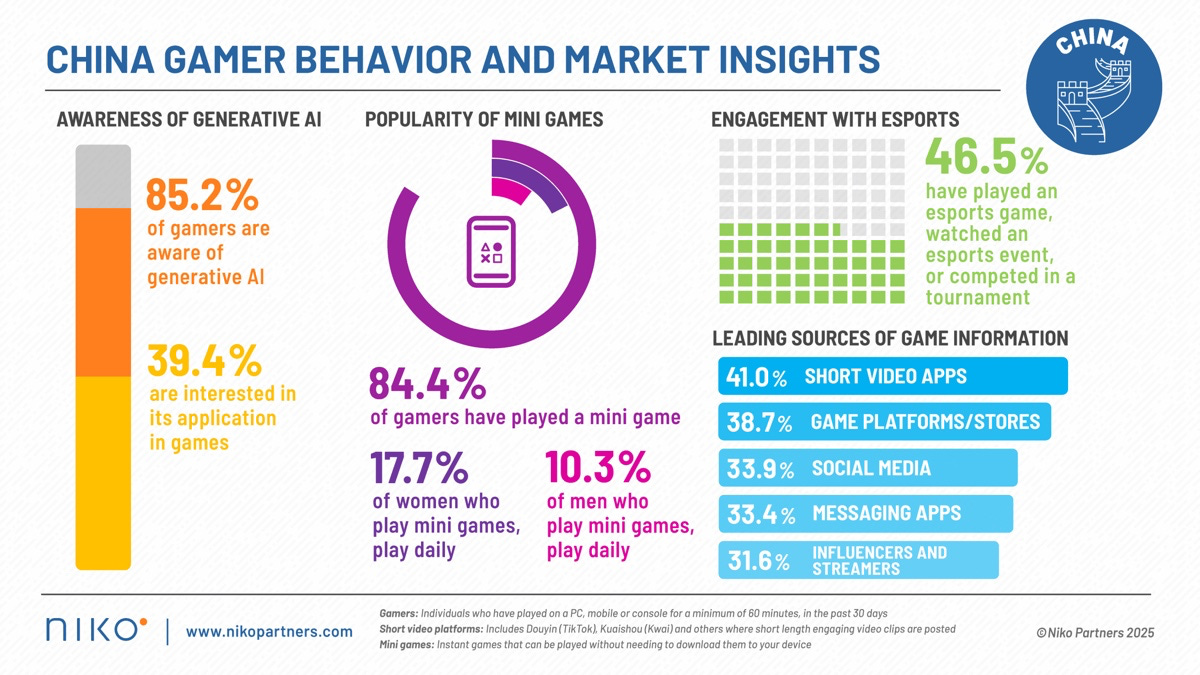

Chinese players are interested in generative AI. 85.2% are familiar with this technology, and 39.4% are curious about its applications in games. According to Niko Partners, more than 60% of Chinese developers use generative AI in their projects.

Mini Games in China keep growing. 84.4% play them. 17.7% of women play mini-games daily, compared to 10.3% of men. Currently, this segment generates about 10% of total gaming revenue.

41% of users in China discover new games through short video platforms, 38.7% follow platform recommendations, and 33.9% get information from social media.

46.5% of players in China engage with esports in some way. Every fourth player in China actively watches influencers.

11 of the top 20 games in Chinese streaming platforms are either released by overseas developers or based on major IPs. Niko Partners also highlights the popularity of games that have not been officially released in the market (for example, Apex Legends).