Weekly Gaming Reports Recap: September 30 - October 4 (2024)

Bain & Company shared the outlook for 2024, the top mobile games of September with the help of AppMagic, PC market is on the rise in Japan.

Reports of the week:

Mintegral: Media Buying in Mobile Games in H1'24 in the US

Games & Numbers (September 18 - October 1; 2024)

Bain & Company: The Gaming Industry in 2024

AppMagic: Top Mobile Games by Revenue and Downloads in September 2024

StreamHatchet: Co-op Games have doubled in popularity among viewers over the last 2 years

Kadokawa ASCII Research Laboratories: The Japanese Gaming Market Grew in 2023

Mintegral: Media Buying in Mobile Games in H1'24 in the US

The US market ranks first globally in the number of gaming advertisers and second in the number of ad views. Southeast Asia ranks second after the US in the number of advertisers and first in ad views.

The number of advertisers in the US market increased by only 0.25% since 2023. However, the percentage of new advertisers decreased by 29%.

The number of ad creatives in H1'24 grew by 0.46% year-over-year (YoY). The share of new creatives dropped by 12%.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Regarding ad views in the US in H1'24, puzzle, match-3, and simulation games lead the way. At the same time, there is growth in sports games (+6 positions), shooters (+4 positions), and RPGs (+3 positions).

Video ads are the most popular format in the US. Playable ads are most frequently used in hyper-casual projects (13%), shooters (9%), and action games (8%).

The popularity of playable formats increased from 3% in H1'23 to 7% in H1'24.

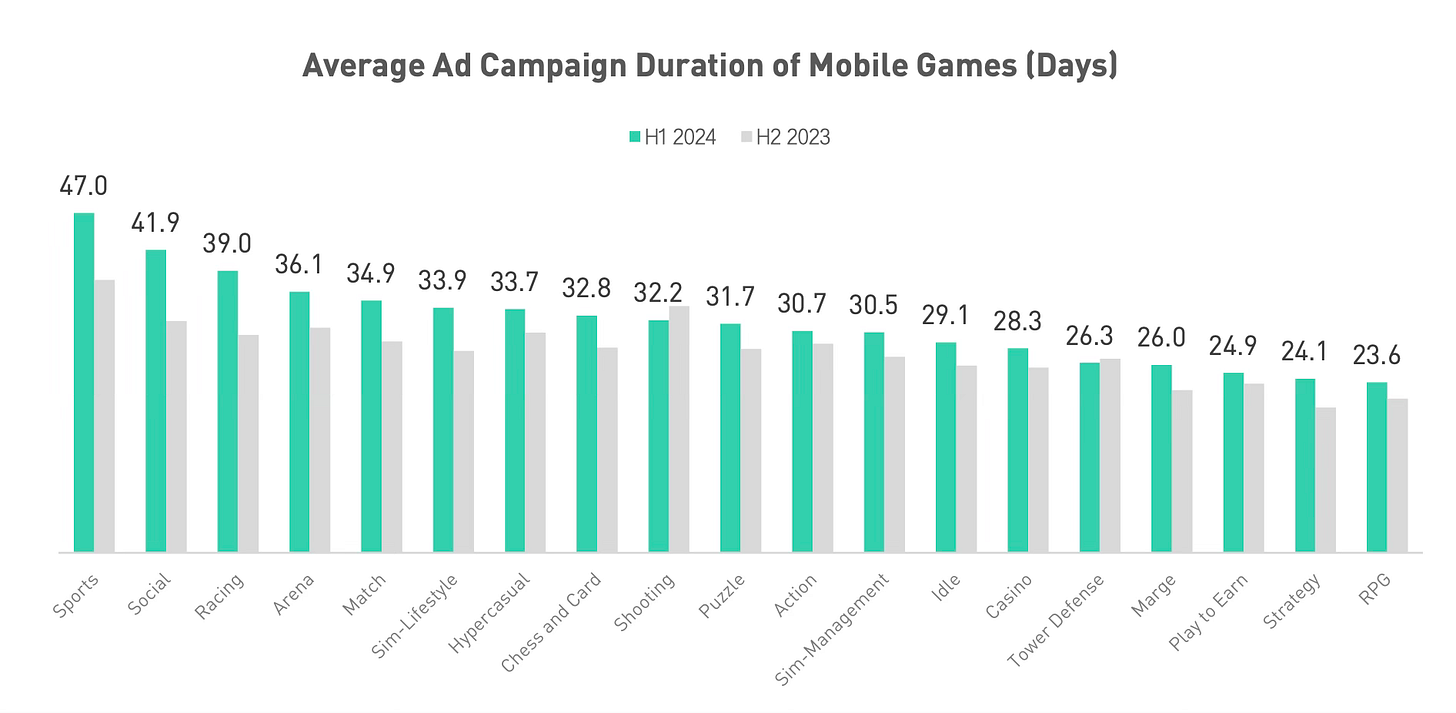

The longest ad campaign durations are seen in sports games (47 days), social games (41.9 days), and racing games (39 days). The shortest are in strategy games (24.1 days) and RPGs (23.6 days).

Games & Numbers (September 18 - October 1; 2024)

PC/Console Games

According to VGI estimates, Black Myth: Wukong is the best-selling game on Steam in 2024, with over 20 million copies sold.

More than 14 million people have played Football Manager 24. This number reflects player counts, not sales, as the game was available through subscription services.

The total sales of Ghost of Tsushima exceed 13 million copies. Recently, Sucker Punch announced a sequel to the series: Ghost of Yōtei.

Warhammer 40,000: Space Marine 2 is the second most successful new release in the European market in 2024. According to GSD, only Helldivers II performed better.

The meditative platformer GRIS, published by Devolver Digital, has been purchased over 3 million times since its release in December 2018.

Manor Lords has sold over 2.5 million copies since its release on April 16, 2024.

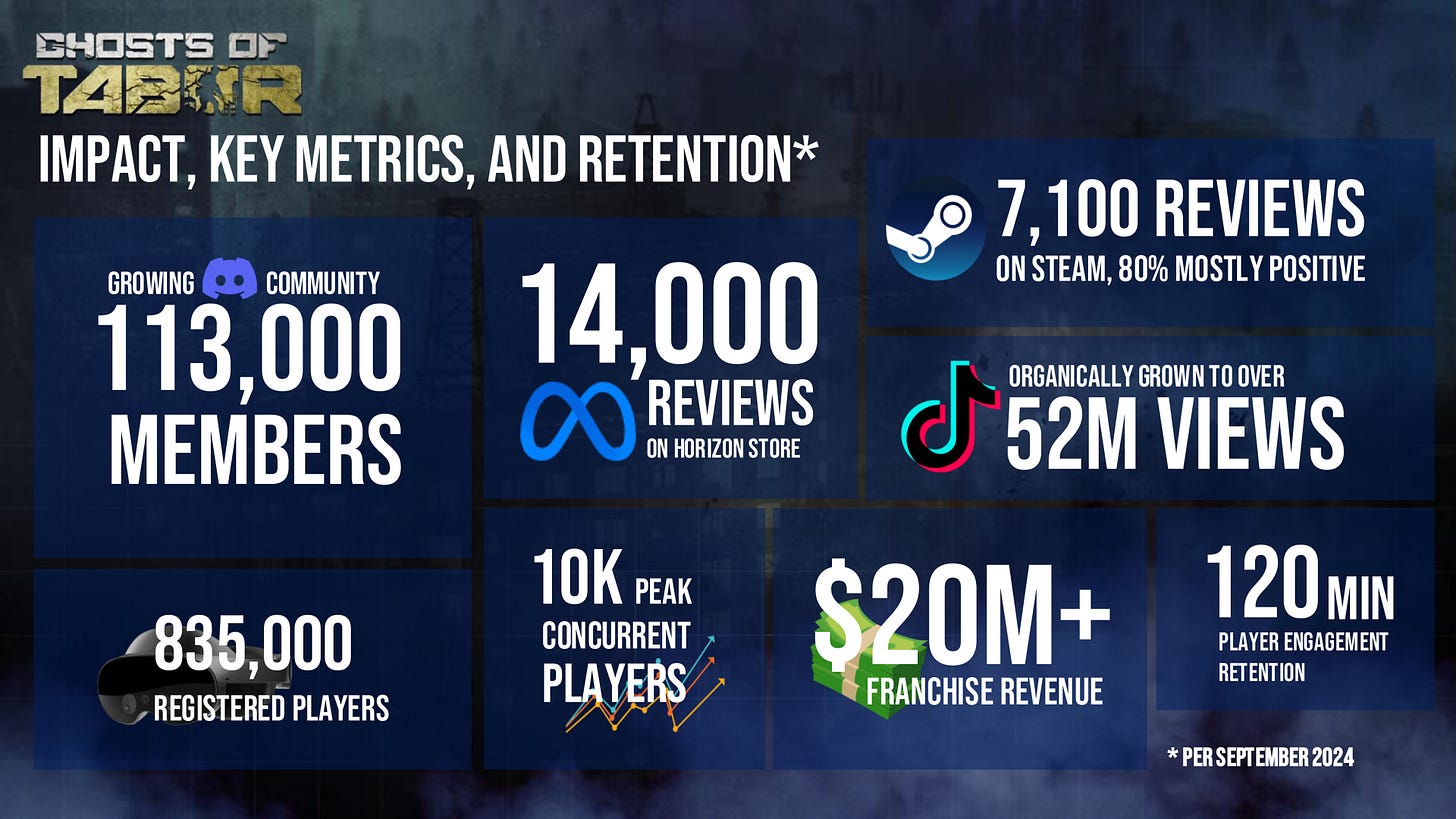

Revenue from the VR shooter Ghosts of Tabor has surpassed $20 million, as reported by the developers themselves.

Players have purchased Dome Keeper, published by Raw Fury, more than 1 million times.

In the first 3 days of sales, Frostpunk 2 sold 350,000 copies.

Sales of Dragon Age: Inquisition has exceeded 12 million copies. While many considered the game a "commercial failure," the studio disagrees.

Ampere Analysis estimates that Star Wars: Outlaws sold 800,000 copies in its release week. Ubisoft has not officially disclosed the numbers.

More than 40 million people have played Respawn Entertainment’s Star Wars Jedi franchise. These numbers reflect player counts, not sales, as the series' games have appeared in subscription services.

The number of players in Core Keeper has reached 3 million. The game launched in Early Access in March 2022.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Mobile Games

On September 28, Genshin Impact celebrated its 4th anniversary. According to AppMagic, the game has generated $6.3 billion in revenue on mobile platforms. In its last year, it earned $931.4 million, the lowest annual revenue to date. However, this does not account for some users who may be migrating to PCs and consoles.

Dungeon & Fighter: Mobile earned over $808.9 million in China alone and only on iOS, according to AppMagic. On its best revenue day (June 22, 2024), the game made $9.9 million. In September, the game averaged $5 million per day.

Revenue for AFK Journey in less than six months has amounted to $158.3 million, according to AppMagic. Most of the revenue (over 70%) now comes from Asian regions, and in the first four months after launching in the West, the game earned $71 million.

Pokemon Sleep generated $120 million in revenue over 14 months. 74% of all revenue comes from Japan, and 13% from the US.

Final Fantasy VII Ever Crisis has been downloaded 9 million times in a year. In addition to mobile platforms, the game is also available on Steam.

Platforms

The mobile version of the Epic Games Store has been downloaded more than 10 million times. It was released in August 2024.

Bain & Company: The Gaming Industry in 2024

Consulting company Bain & Company has prepared a comprehensive report on the gaming industry in 2024, analyzing player habits, distribution, marketing, and business aspects.

Players and Their Preferences

Bain & Company surveyed over 5,000 people from six different countries.

According to Bain & Company, the gaming industry in 2023 was valued at $196 billion. This is more than the combined revenue of video streaming ($114 billion), music streaming ($38 billion), and movie theater earnings ($34 billion). By 2028, the industry is expected to grow at an average annual rate of 6%, reaching $257 billion.

52% of respondents play games regularly.

Nearly 80% of young players (ages 2 to 18) spend 30% of their time on games. Among those older than 45, the percentage of such engaged players drops to 31%.

Young users spend a large portion of their budget on games. In absolute terms, players aged 25 to 34 lead in spending. This age group also spends the most on entertainment in general.

Gamers not only play games—they socialize, discuss games, buy game-related merchandise, and watch videos. The more involved a player is in these side activities, the more they tend to spend in the games themselves.

79% of users play content created by other players, while 16% participate in creating content themselves.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Almost 70% of gamers play on at least two devices. For 48% of the audience, it's important to be able to play with users from different platforms and carry over their progress. This is reflected in game development, as 95% of studios with more than 50 employees are working on cross-platform support for their games.

Game Distribution

Despite the growth in absolute sales, console penetration has not changed in the past 10 years, even though the gaming audience has significantly increased.

41% of users are interested and willing to pay for a single platform to consolidate all game content. Another 48% are also interested but are not willing to pay for this solution.

Marketing in Mobile Games

67% of players say they consume other forms of media (such as TV shows or movies) while playing games.

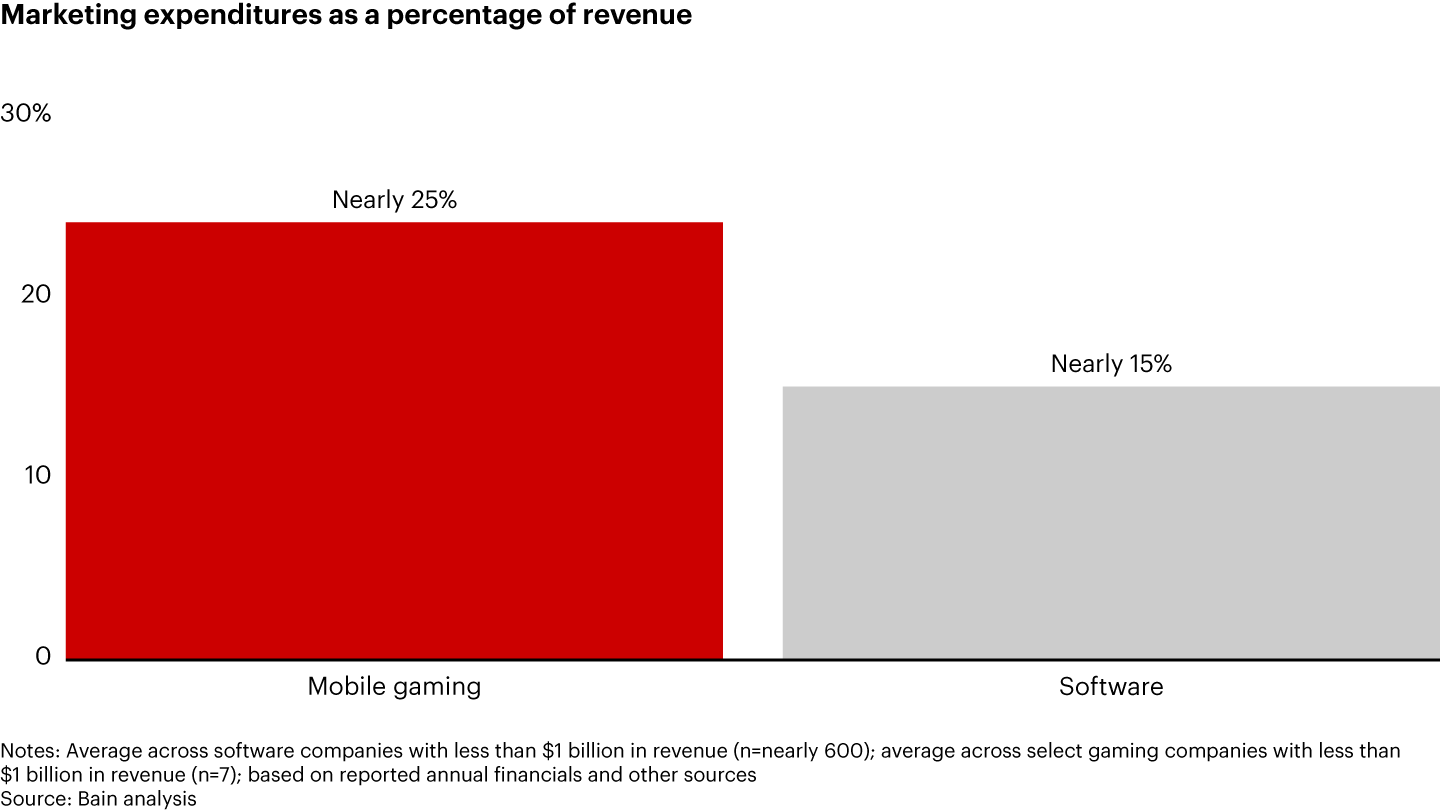

Gaming companies with annual revenues of less than $1 billion spend an average of 25% on marketing. Some companies spend even more. This is significantly higher than in software companies in general.

The mobile gaming market is a much riskier business for companies with annual revenues under $10 million. The likelihood of revenue decline over a three-year horizon is much higher here (55-70%) than in software development (10-20%) or retail (10-25%).

Changes in Gaming Companies Over the Last 10 Years

Over the past 10 years, the demand for specialists in security, data, animation, LiveOps, and project operations has grown significantly. These roles were hired, on average, twice as often as other types of specialists. This indicates changes in how games are developed and operated.

Large companies have grown by an average of 6% annually in revenue over the past 10 years, but their workforce has grown by 7% annually. This suggests a weak correlation between the number of employees and business efficiency.

AppMagic: Top Mobile Games by Revenue and Downloads in September 2024

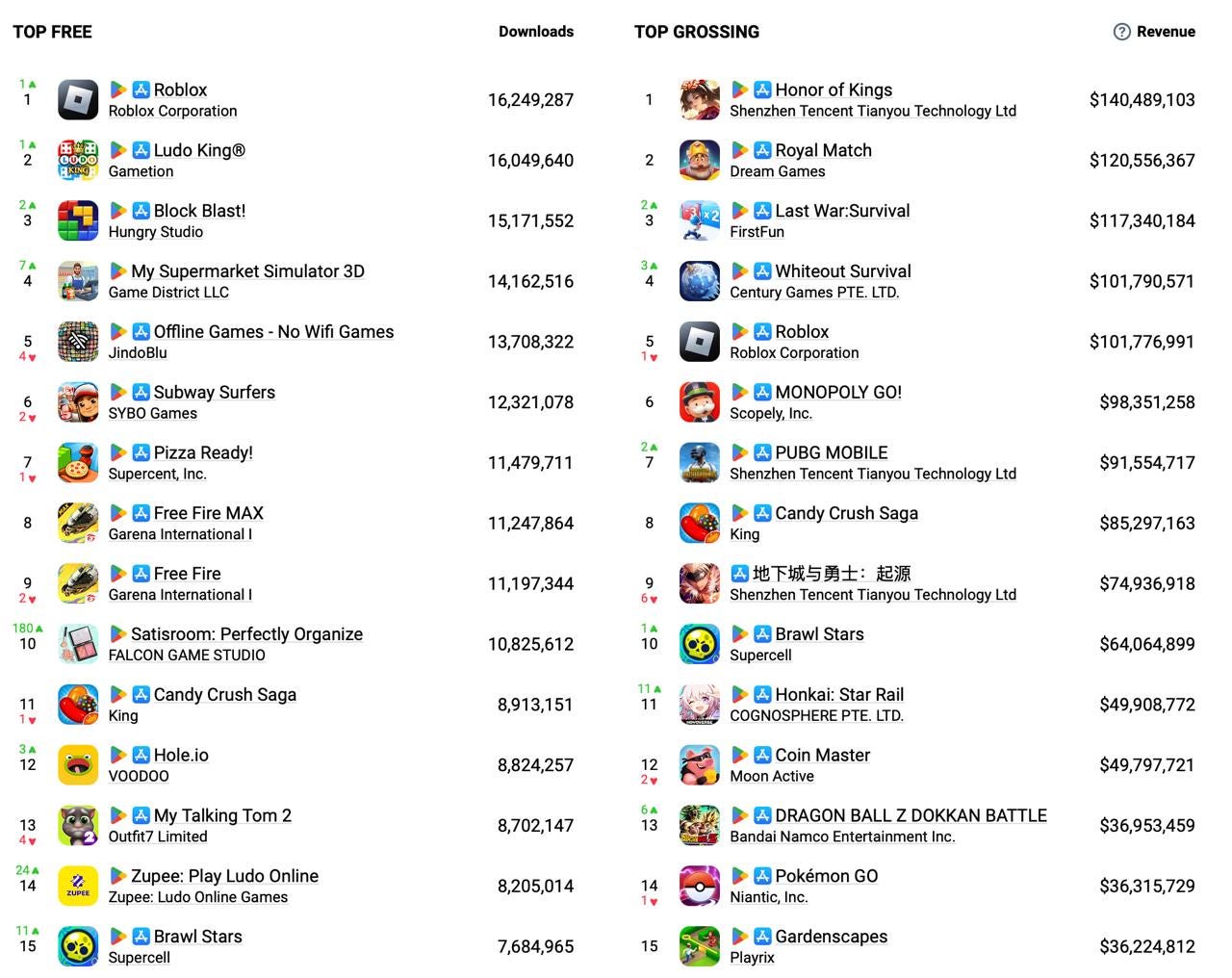

AppMagic provides revenue data after store commissions and taxes are deducted.

Revenue

Honor of Kings returned to the top spot, earning over $140 million in September. 97% of the revenue comes from China (without accounting for Android versions).

Last War: Survival continues to grow in revenue. The game earned $117.3 million in September—the best result since its launch. 31% of the revenue comes from the US, 24% from Japan, and 15% from South Korea.

Whiteout Survival is following a similar but slightly more modest trajectory. The game earned $101.7 million in September, also a record.

Dungeon Fighter Online continues to decline in revenue. The game dropped to 9th place in the chart, earning $74.9 million.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Downloads

The top ranking remains mostly unchanged. In first place is Roblox (16.2 million downloads), followed by Ludo King (16 million), and Block Blast! (15.1 million).

Satisroom: Perfectly Organise saw a significant rise in downloads, with 10.8 million in September. It’s a soothing game where players organize items, clean up chaos, and remove dirt. The top download markets were Brazil, Mexico, and Indonesia. In terms of revenue, South Korea leads with 36%.

StreamHatchet: Co-op Games have doubled in popularity among viewers over the last 2 years

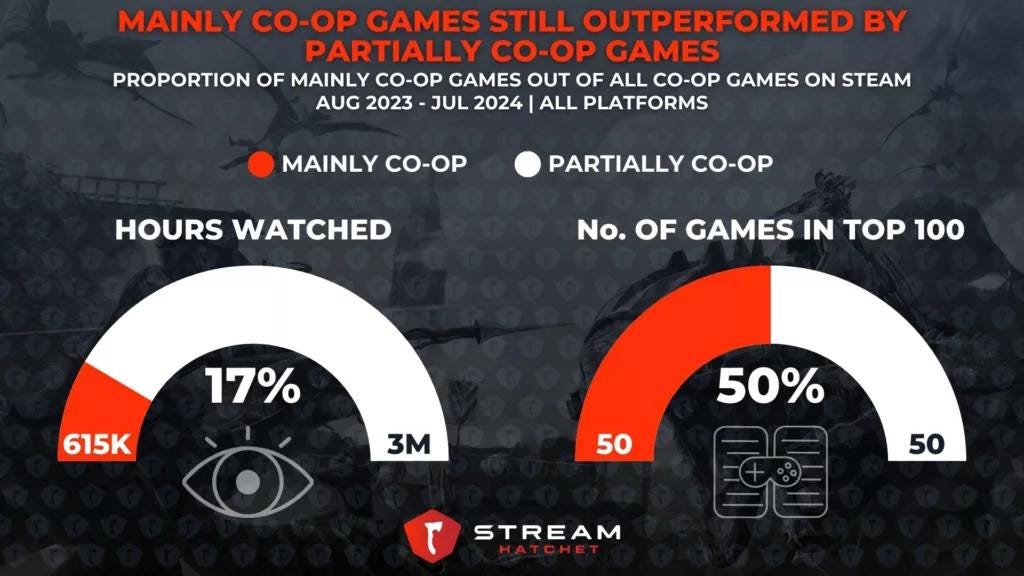

The company defines co-op games as those where cooperative gameplay is the core feature. The study included games with the "co-op" tag on Steam and excluded games with the "PvP" tag.

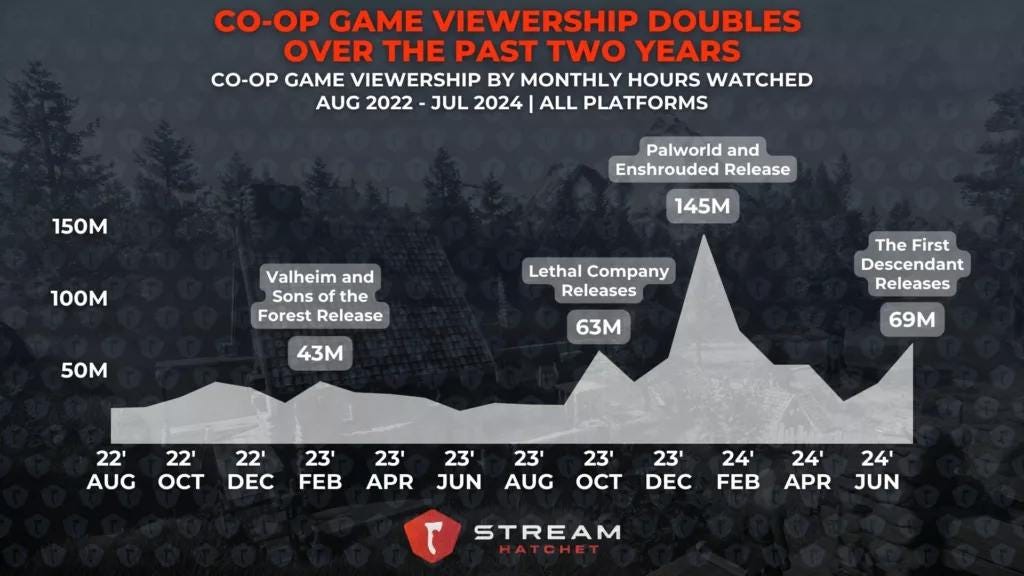

The number of hours spent watching co-op games has roughly doubled since August 2022. This is largely due to the release of major co-op titles like Lethal Company, Palworld, Enshrouded, and The First Descendant.

❗️It would be interesting to see data from 2019 to account for pandemic-related figures.

The top co-op games by watch hours over the past year are Palworld (111 million hours), Lethal Company (97.8 million hours), Monster Hunter: World (63.4 million hours), ARK: Survival Evolved (59.9 million hours), and Helldivers II (45 million hours).

The most popular co-op genres are action (296 million hours), shooters (165 million hours), simulators (161 million hours), and RPGs (161 million hours).

StreamHatchet also looked at projects with "partial co-op." This includes games like Call of Duty (with its zombie mode), Granblue Fantasy: Relink, and other titles where co-op is present but not the main mode. When looking purely at viewership, 83% of views still come from these types of games.

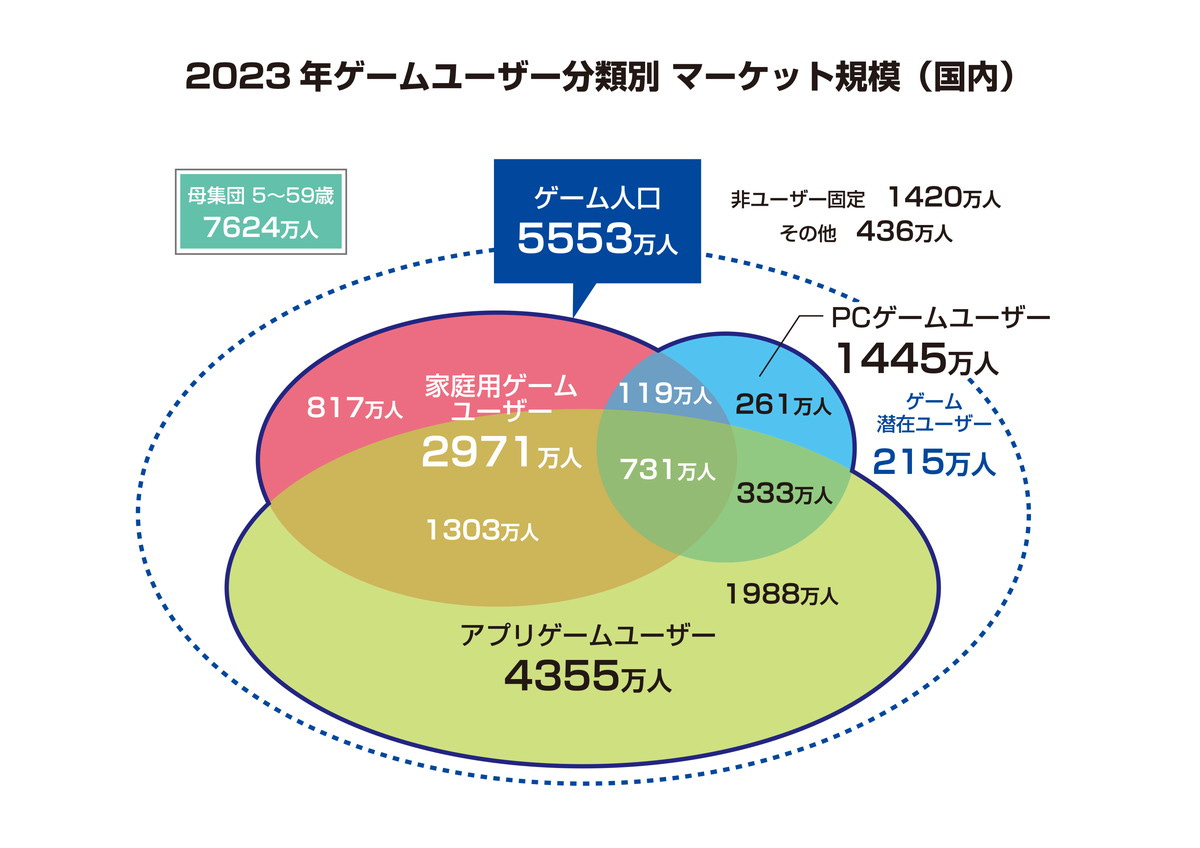

Kadokawa ASCII Research Laboratories: The Japanese Gaming Market Grew in 2023

Sales of gaming consoles in Japan grew by 27.5% year-on-year in 2023. This growth was driven by increased sales of both the PlayStation 5 and the Nintendo Switch (despite being near the end of its lifecycle).

Console game sales also increased. However, the most significant growth was seen in PC games, which rose by 24.9%.

Revenue from mobile games fell by 0.7% in 2023. But due to the strength of the PC/console segment, overall sales of gaming content for the year increased by 3.9%.

The number of active gamers in Japan grew by 2.8% in 2023, reaching 55.5 million people. The number of mobile gamers increased by 10%, while console gamers grew by 4%.

❗️It’s important to note that the increase in mobile gamers may be due to users playing on an additional platform.