Weekly Gaming Reports Recap: September 1 - September 5 (2025)

AppMagic edition - top games of August + deep casual mobile market overview.

Reports of the week:

AppMagic: Top Mobile Games by Revenue and Downloads in August 2025

AppMagic: Mobile Casual Games in H1’25

AppMagic: Top Mobile Games by Revenue and Downloads in August 2025

AppMagic provides revenue data net of store commissions and taxes. Revenue from Android stores in China is not included.

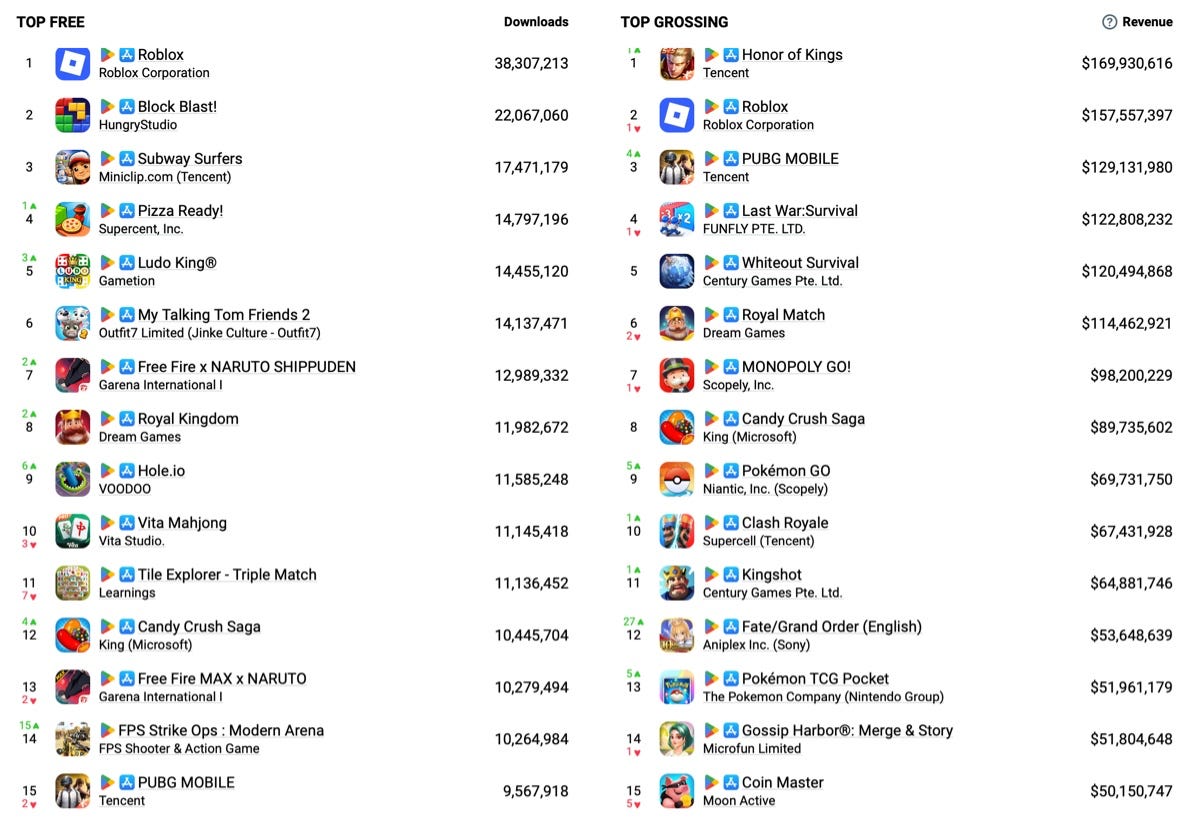

Revenue

Honor of Kings returned to the #1 spot. In August, the game made $169.9M. 97% of all revenue came from China.

PUBG Mobile entered the top 3 with $129.1M. This is the game’s best result since January 2023. These numbers do not include revenue from the Indian version of PUBG Mobile, which is operated by KRAFTON.

Pokémon GO grew further in August, reaching $69.7M. The game climbed 5 spots to enter the top 10. This is the best revenue result since July 2024.

Kingshot continues to scale, hitting $64.8M in August. Almost half of this revenue comes from the US, which is the game’s biggest market. South Korea comes second, followed by Japan.

Fate/Grand Order keeps proving its incredible longevity (it launched 10 years ago). In August, it generated $53.6M, the highest revenue since August 2022. The game’s anniversary is celebrated in August, and it looks like both developers and players went big for the 10-year milestone.

Downloads

Downloads charts this time have fewer new things than usual. The top 15 doesn’t include any new titles, with the usual leaders on top: Roblox (38.3M downloads), Block Blast! (22M), Subway Surfers (17.4M).

Worth noting - FPS Strike Ops: Modern Arena has been consistently pulling strong install numbers throughout 2025 (over 10M). The developer’s account also features 9 other shooters in different settings.

AppMagic: Mobile Casual Games in H1’25

AppMagic counts only Net Revenue from IAP. Web shops and Android sales in China are not included.

Market Overview

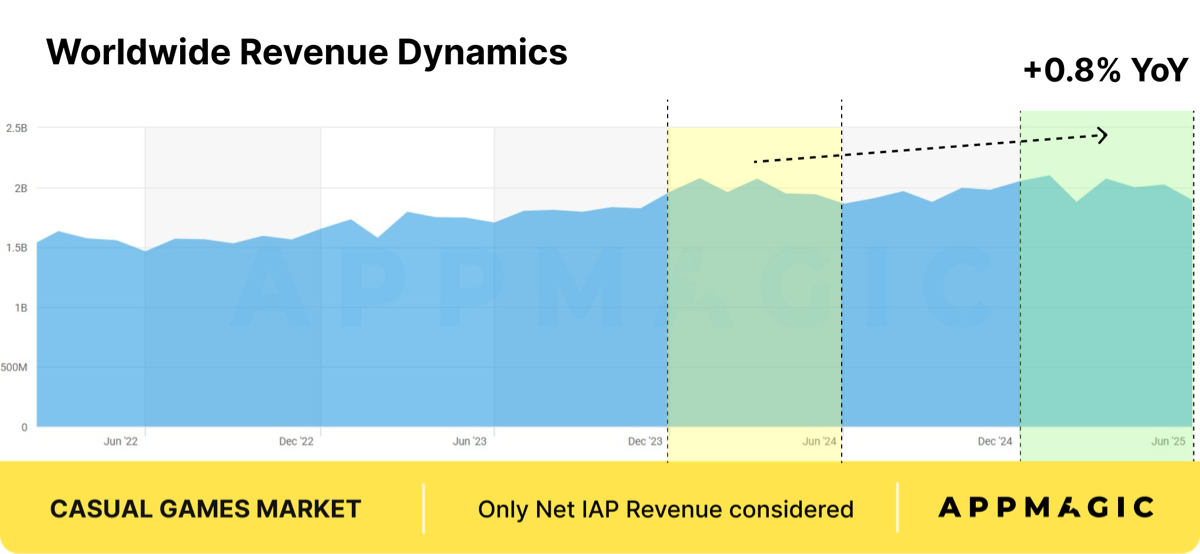

According to AppMagic estimates, casual games revenue in H1 2025 grew by 0.8% YoY to $12B. Downloads jumped by 5.8%.

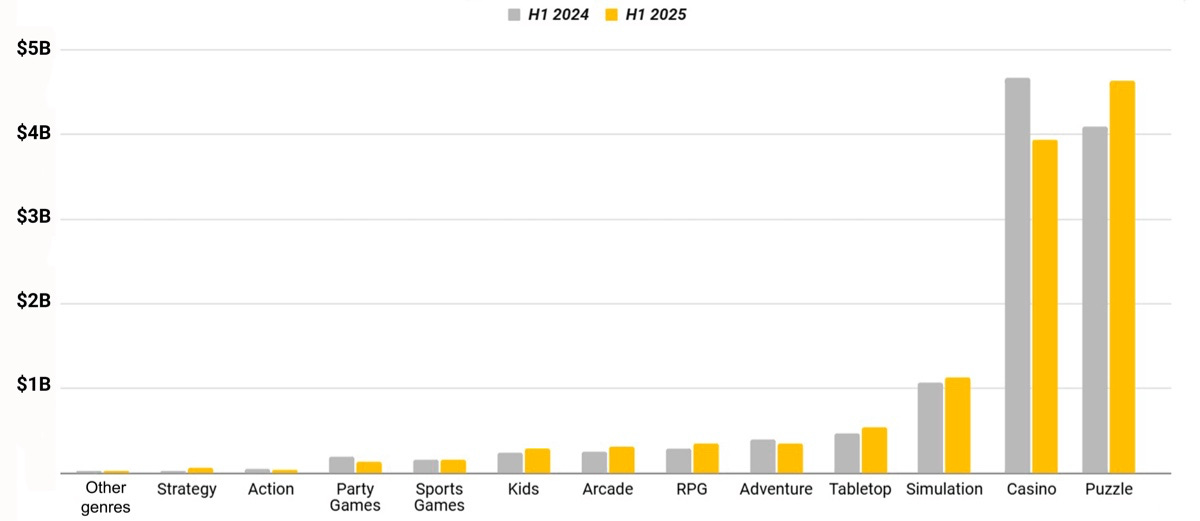

72% of total revenue ($12B) comes from two genres – Puzzle and Casino. Simulation is the third by revenue (8%).

73 out of the top-100 grossing casual games in H1’25 belong either to Casino (41) or Puzzle (32).

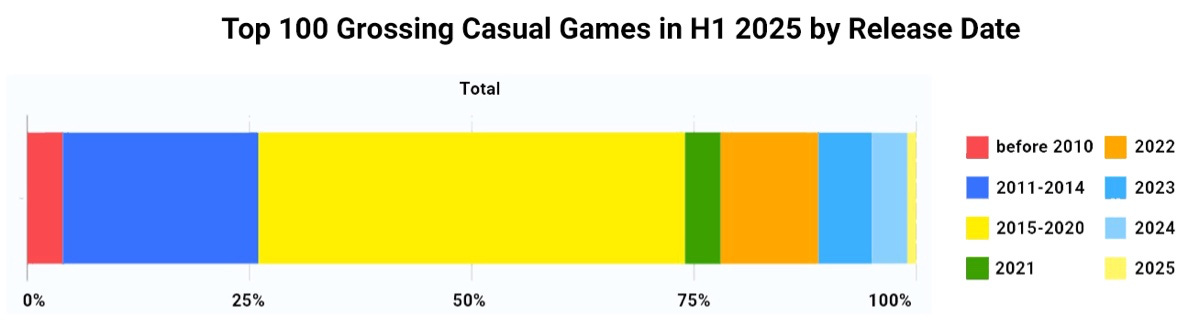

The issue isn’t just genre dominance. More than half of the top games were released between 2015 and 2020. Only 11% of the top 100 have been launched since early 2023.

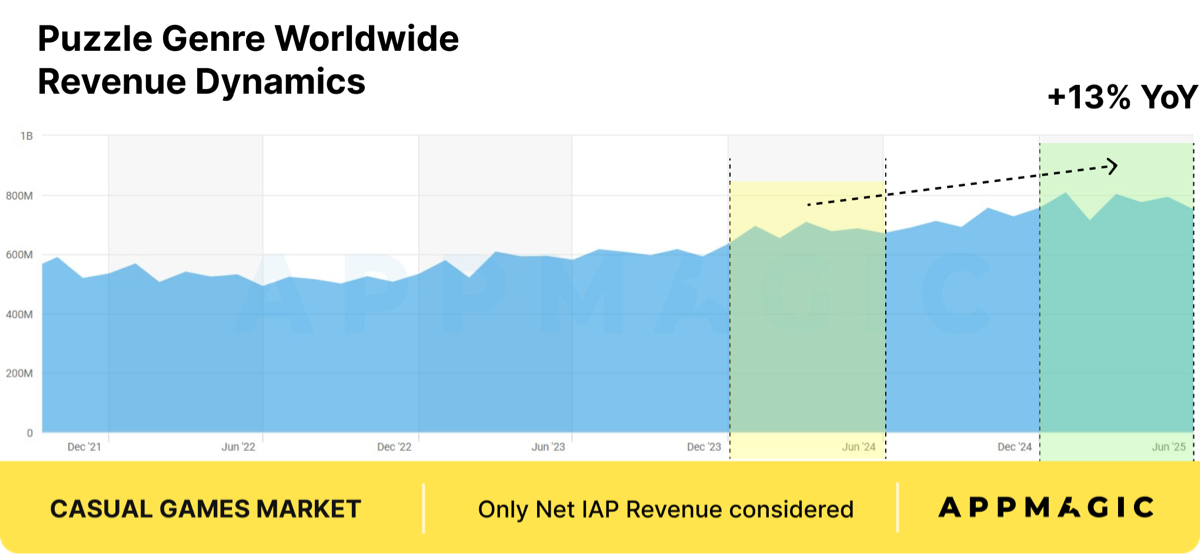

Puzzle

Puzzle has been the dominant casual genre for years. In H1’25, it reached $4.6B (+13% YoY).

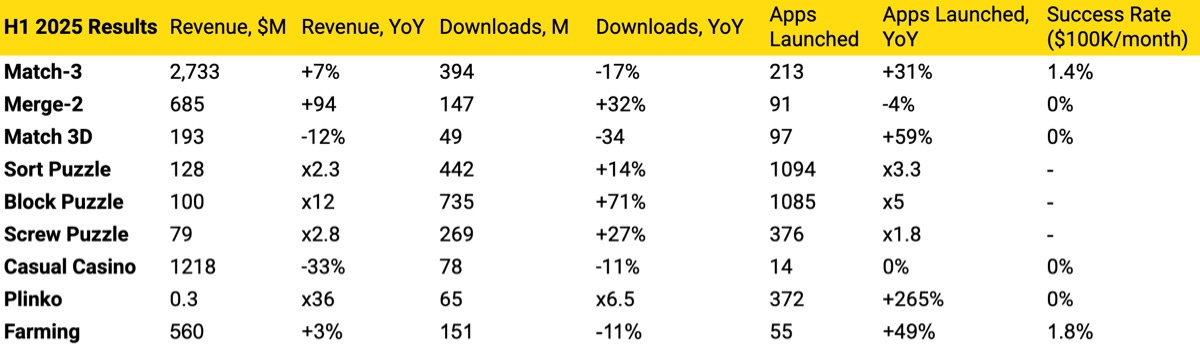

Key subgenres:

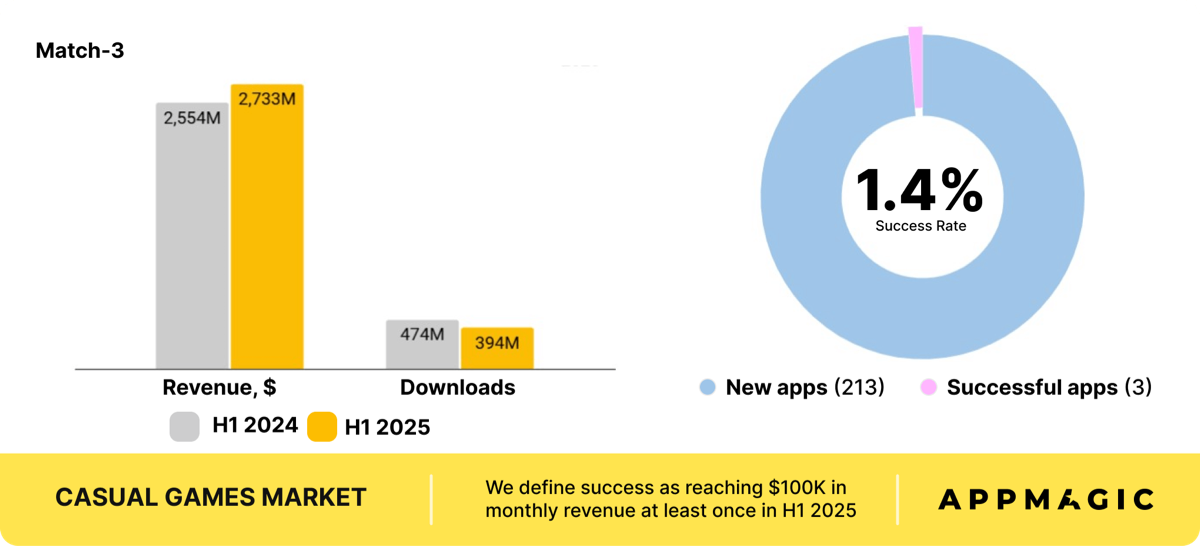

Match-3: $2.7B revenue (+7% YoY), 394M installs (-17% YoY)

Merge: $850M revenue (+62% YoY), 287M installs (-3% YoY)

Match-2 Blast: $282M revenue (+4.6% YoY), 28M installs (-47% YoY)

Match-3

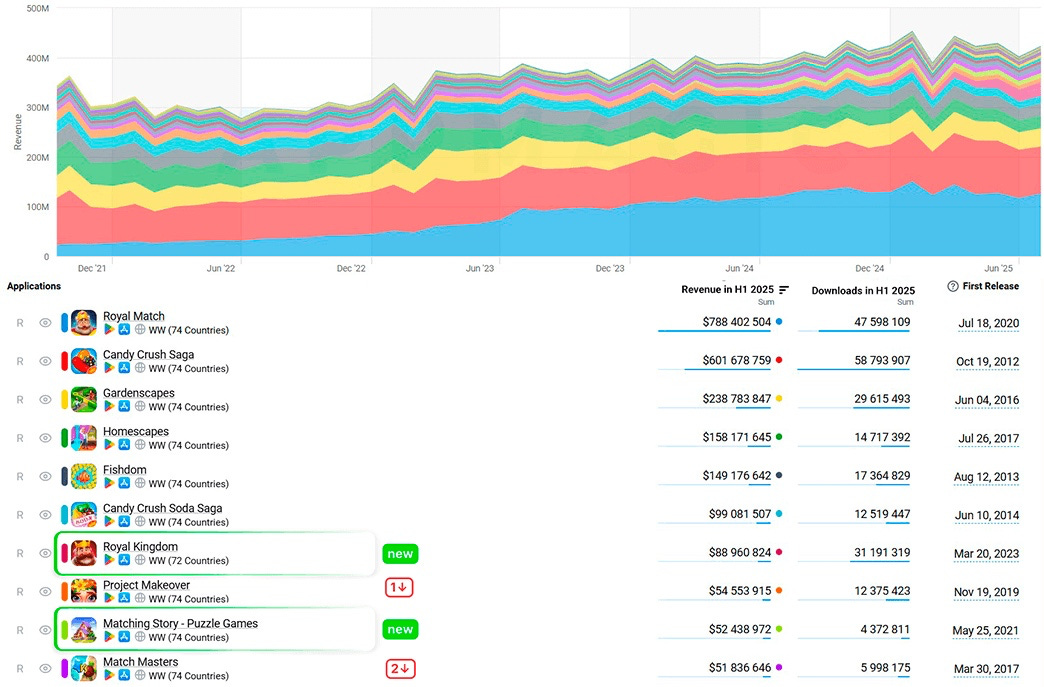

Revenue growth driven mainly by Royal Match ($788M, +15% YoY) and Candy Crush Saga ($602M, +11% YoY).

In fact, Candy Crush Saga set an all-time IAP revenue record in H1’25 (since data collection began in 2015).

These two titles account for more than half of the total Match-3 revenue. Without them, Match-3 revenue growth would be just +1% YoY.

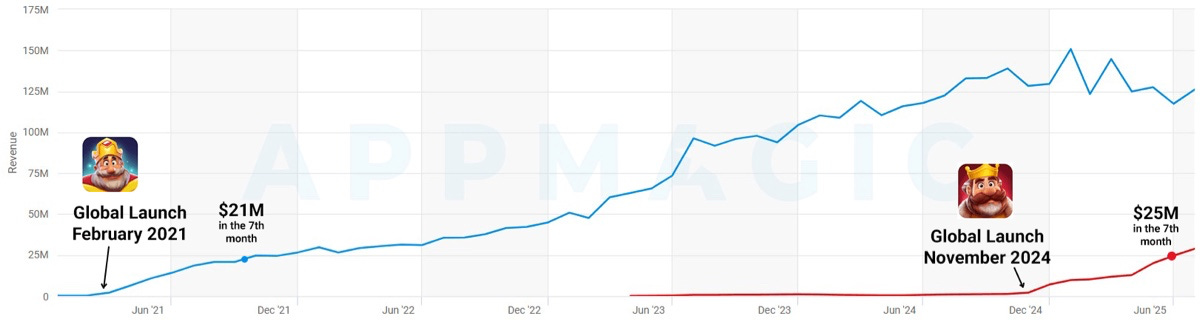

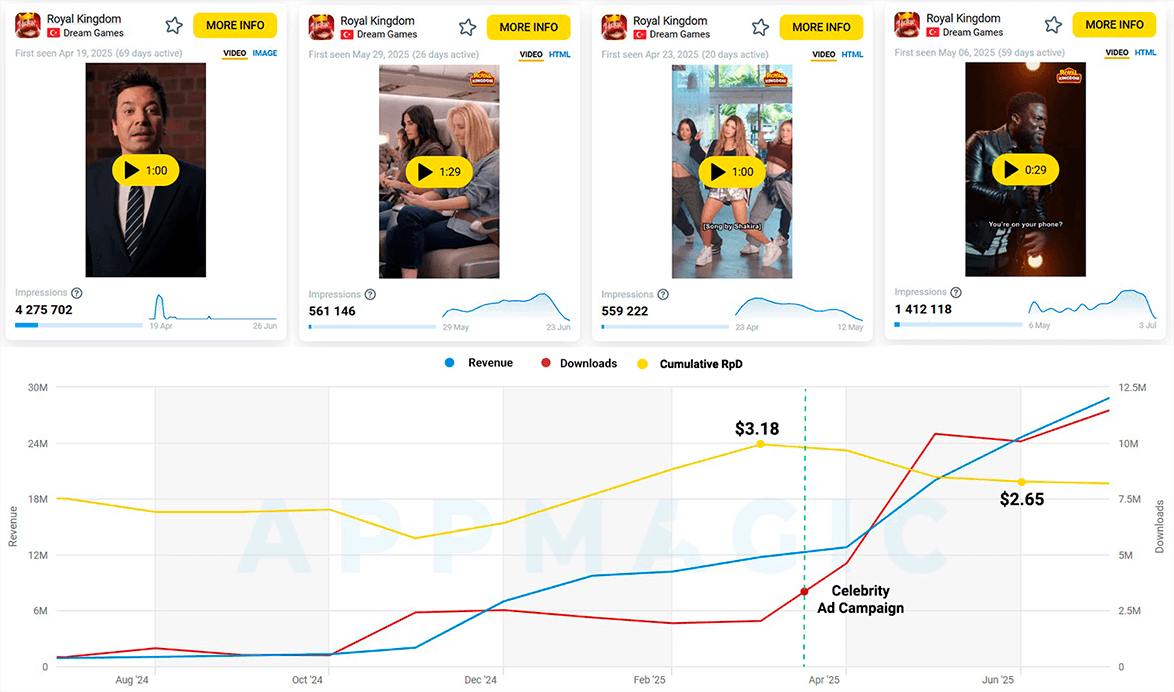

AppMagic highlights Royal Kingdom’s rapid scale-up. The game already hit $98M. In its 7th month post-soft-launch, it brought in $25M vs. $21M for Royal Match in the same timeframe.

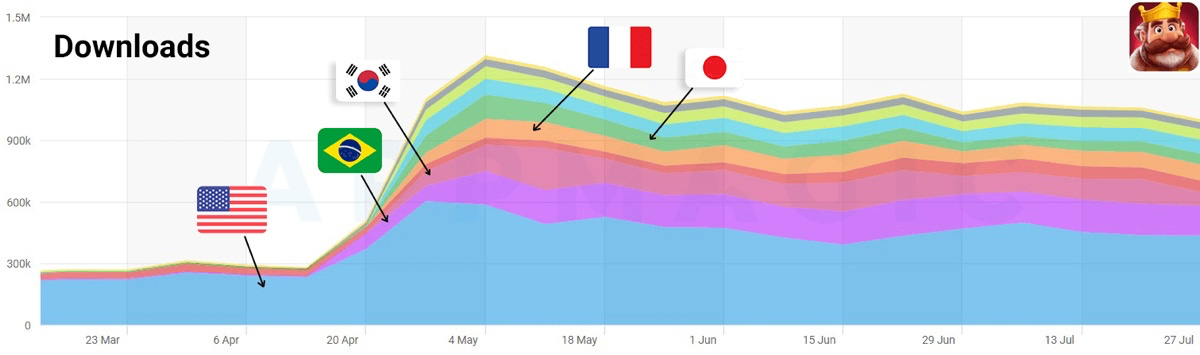

Growth is fueled by product improvements and heavy UA spend from Dream Games. Downloads spiked to 4.6M in April (from 2M in March), peaking at 10.4M in May. In April, a high-profile celebrity campaign featuring LeBron James, Shakira, and others was launched.

However, after the UA push, RPD dropped from $3.18 in March to $2.65 in June. AppMagic explains this as higher install volume from low-LTV regions, while US RPD remained stable.

Only 3 new projects in H1’25 crossed $100k monthly revenue out of 213 launches. Match-3 Success Rate = 1.4%.

Games to watch: Austin’s Odyssey (Playrix), Matching Story: Puzzle Games (Vertex Games), Match Villains (Good Job Games).

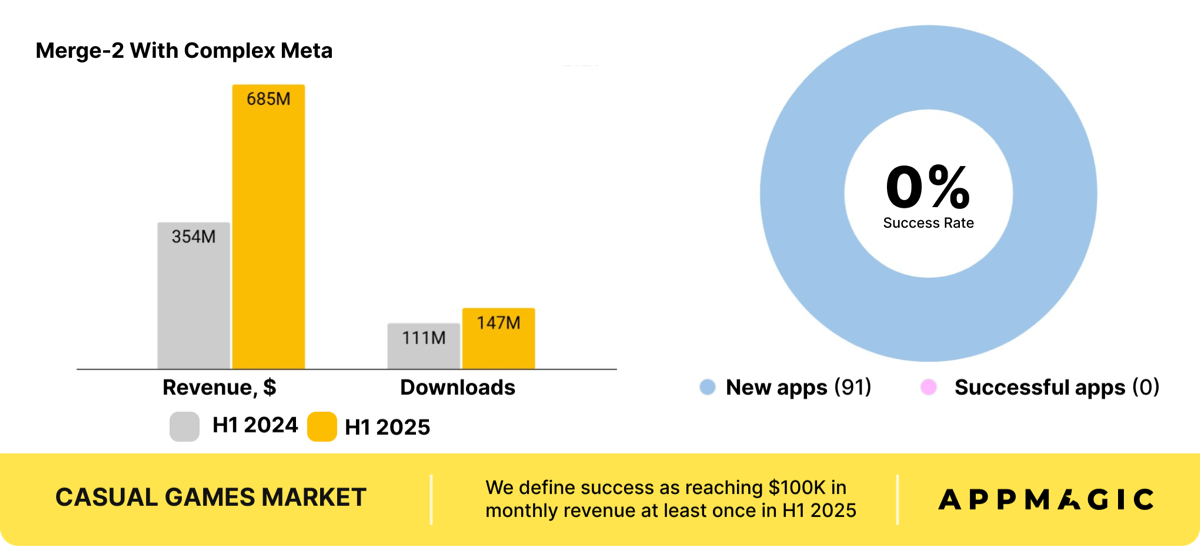

Merge-2 with Meta

Revenue rose +94% YoY to $685M in H1’25.

Installs up +32% to 147M. RPD rose from $3.2 (H1’24) to $4.7 (H1’25).

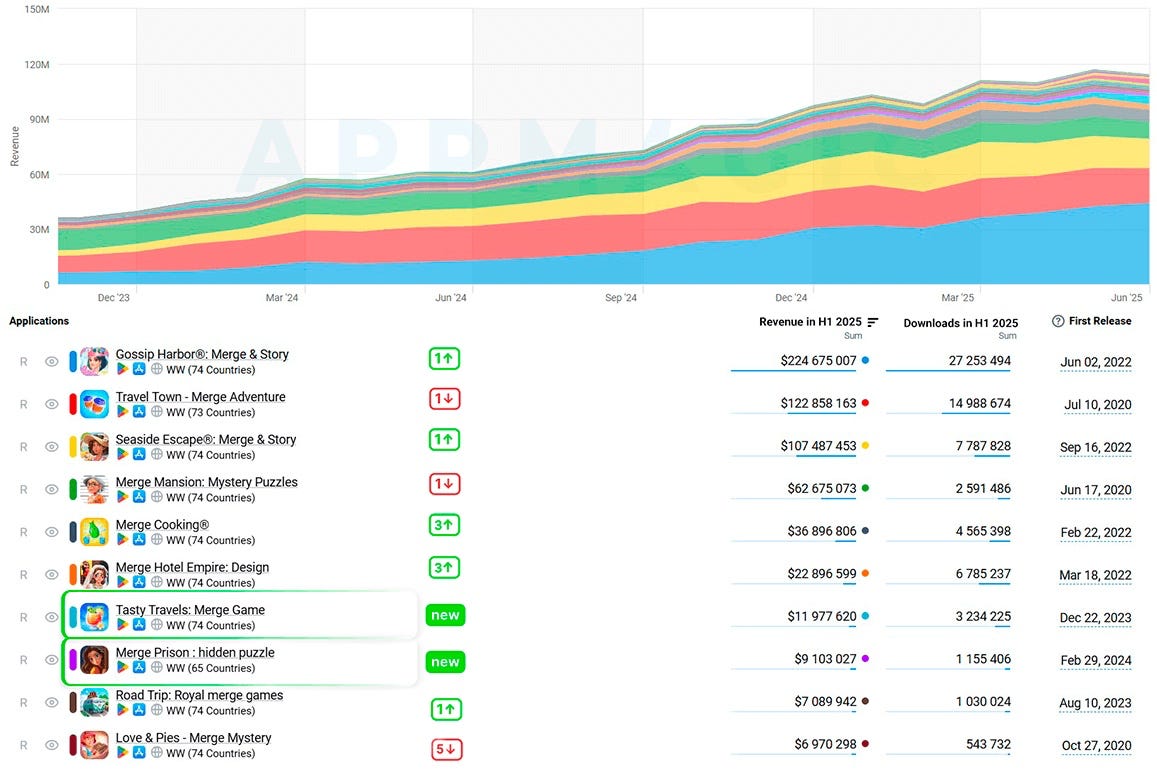

Top ranks show no newcomers breaking through: none of the 91 launches in H1’25 surpassed $100k monthly Net Revenue.

Still, some shifts at the top: Tasty Travels: Merge Game and Merge Prison: Hidden Puzzle entered the top-10 for the first time.

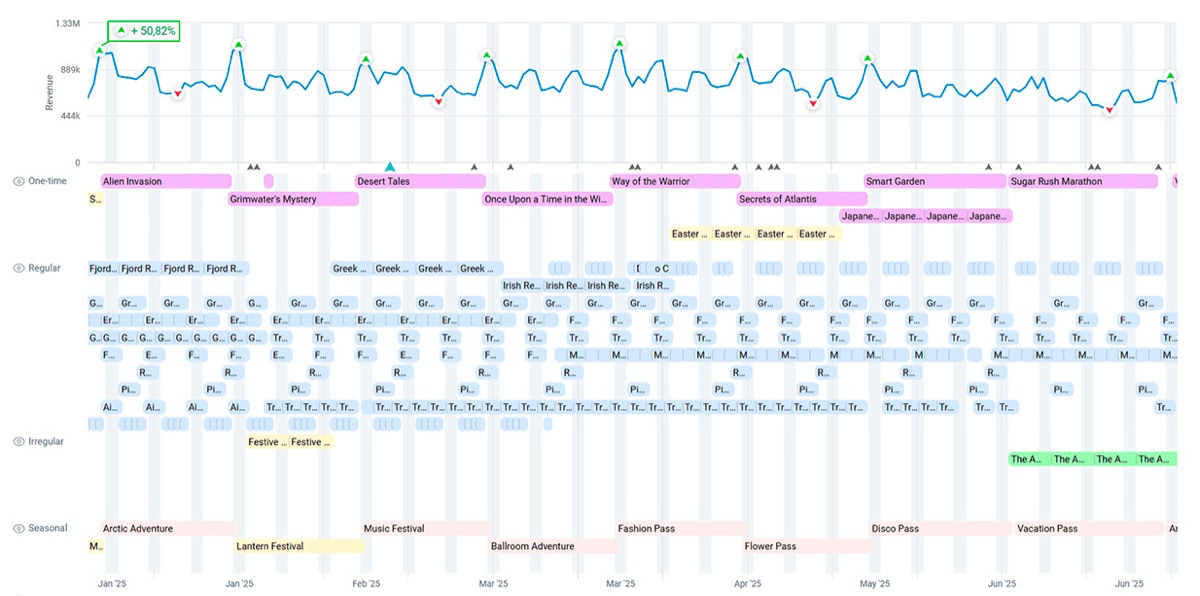

AppMagic highlights Gossip Harbor’s strong live ops strategy, securing #1 revenue spot in H1’25.

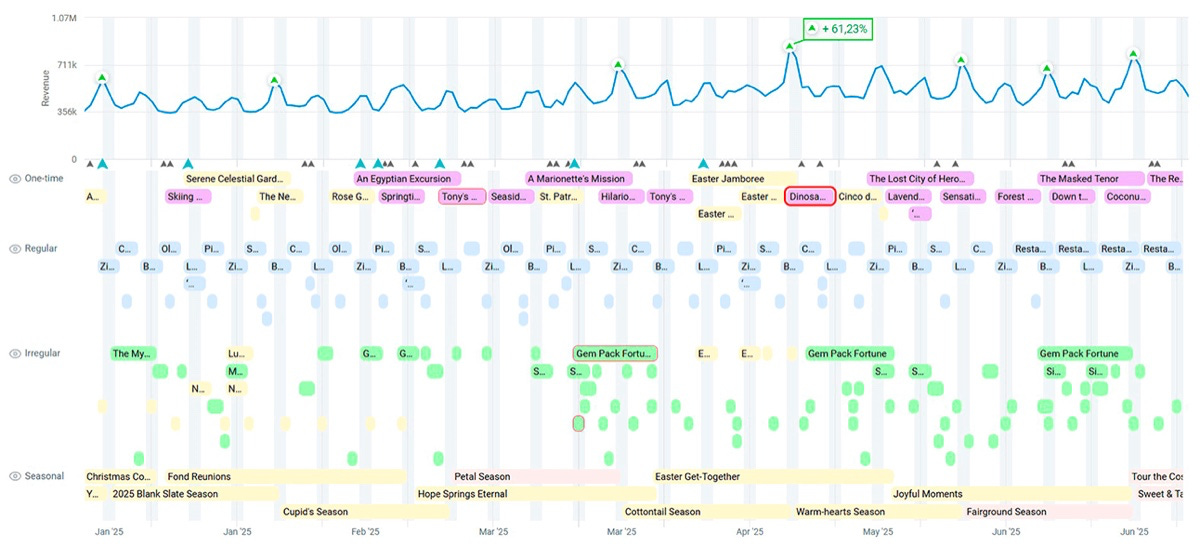

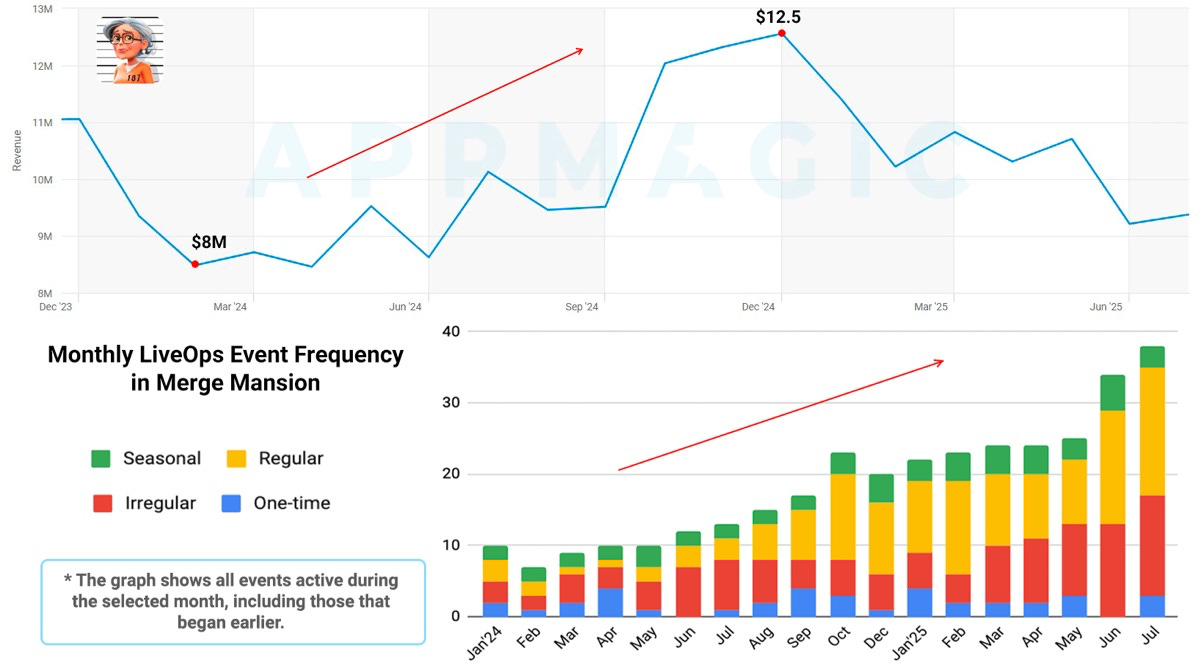

Merge Mansion tripled event frequency to boost decline, spiking revenue by up to +50%. But recent efforts are less effective; revenue reverted to early-2024 levels. The reason, probably, is in the fact that players got used to constant content drops.

Games to watch: Tasty Travels: Merge Games (Century Games; rising fast), Flambe: Merge & Cook (Microfun; new title from market leaders).

Match 3D

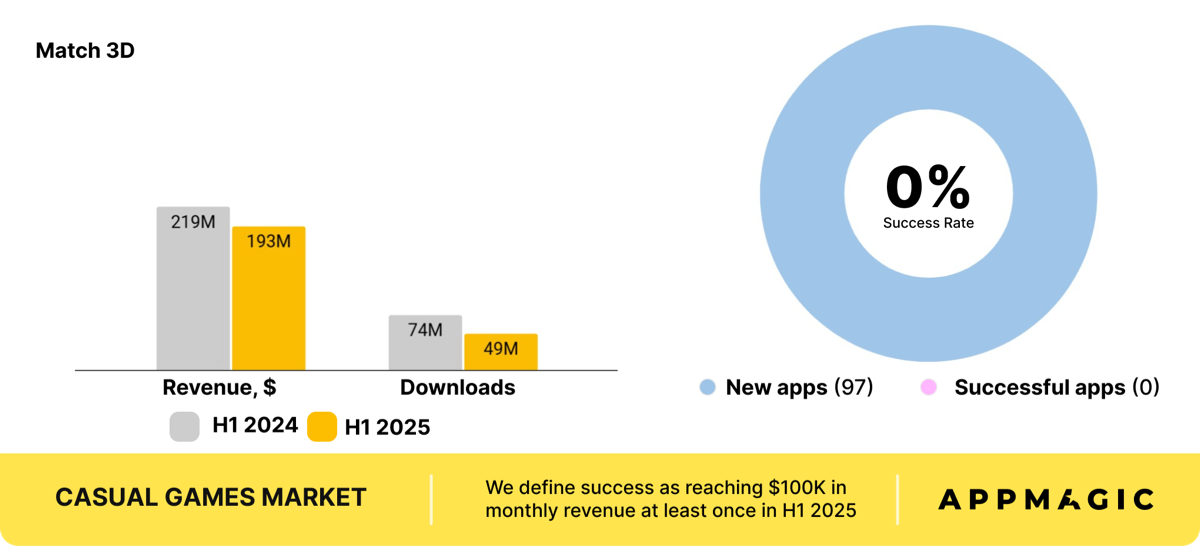

Hyped in 2024, underperformed in 2025. Revenue fell -12% YoY to $193M, installs down -34% to 49M. None of the 97 new projects hit $100k monthly.

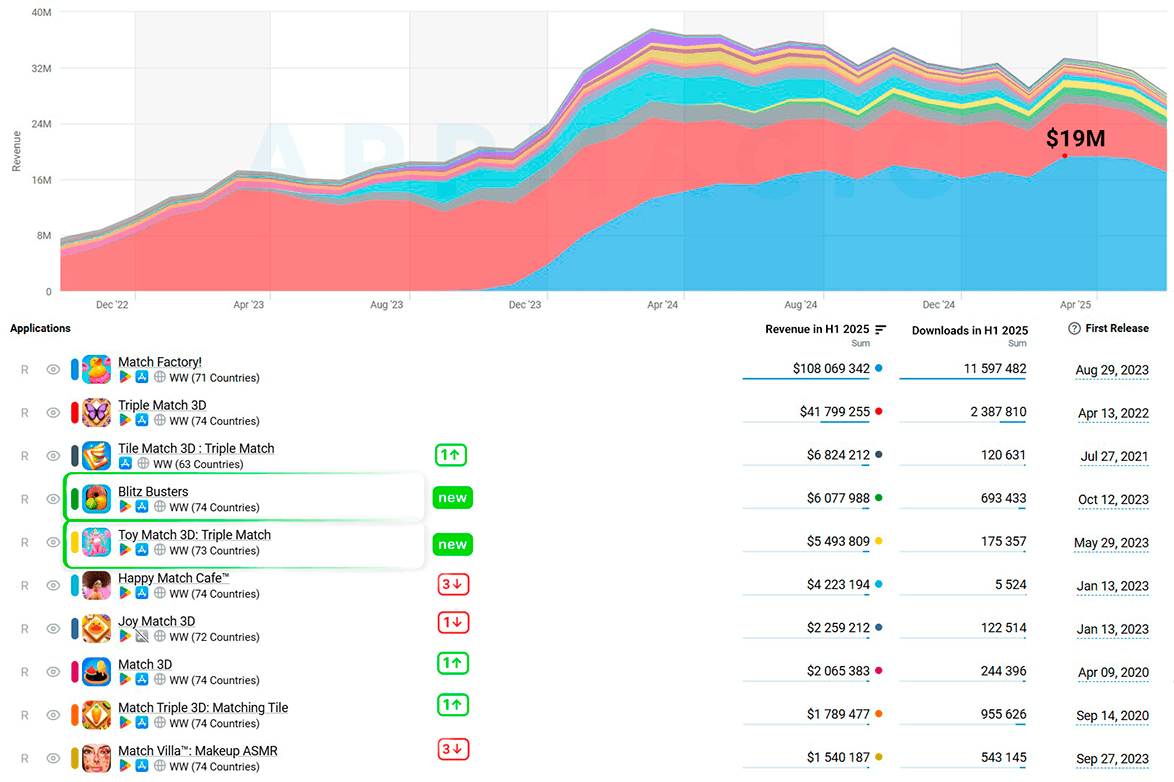

Match Factory! leads with 56% share, hitting $19M monthly revenue – a record for Match 3D.

Triple Match 3D: 22% share; all others combined: 22%.

Games to watch: Blitz Busters (Spyke Games), Toy Match 3D: Triple Match (PLAYNEXX) - RpD in US are $13 and $27 respectively; plus interesting newcomer Box Jam! - 3D Puzzle (Playoneer Games).

Aside from the main topic, AppMagic prepared a useful IP collaboration map on Figma with 50 collaborations that took place in 2025. Have a look!

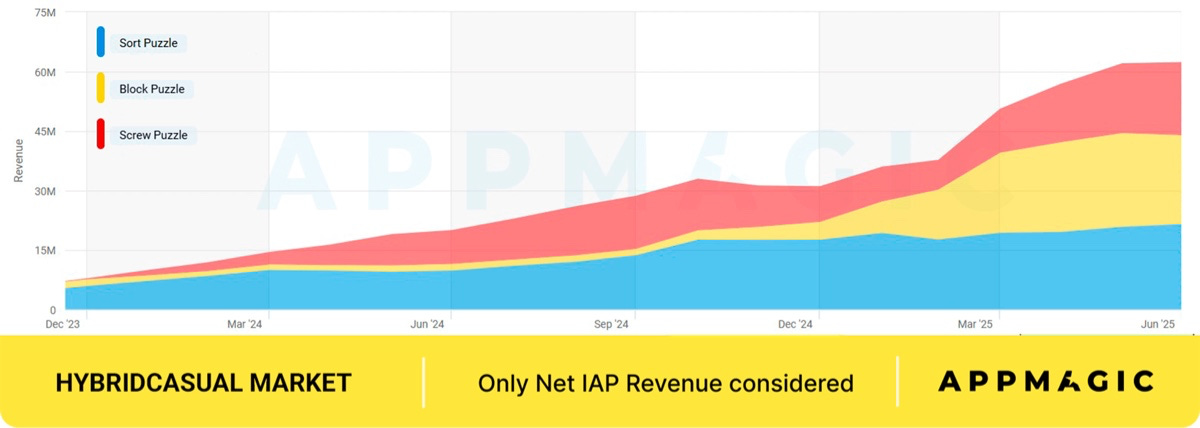

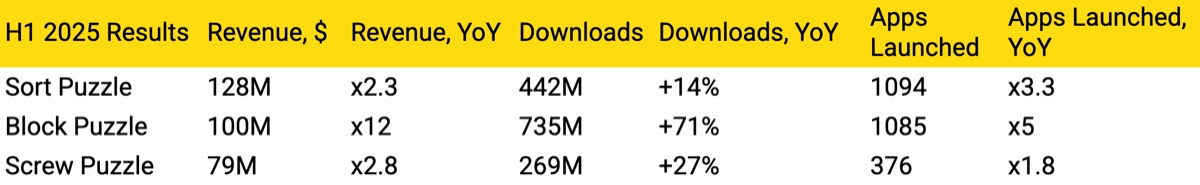

Hybrid-Casual Puzzles – Screw, Sort, Block

Block Puzzle revenue x12 YoY; Screw Puzzle x2.8; Sort Puzzle x2.2.

❗️Ad monetization plays a bigger role here, so AppMagic notes the $100k IAP benchmark isn’t as relevant.

Over 2.5K projects launched across these subgenres in H1’25 (376 Screw Puzzle, 2,000+ combined Sort & Block).

Revenue growth outpaces installs: Block Puzzle installs +71%, Screw Puzzle +27%, Sort Puzzle +14%.

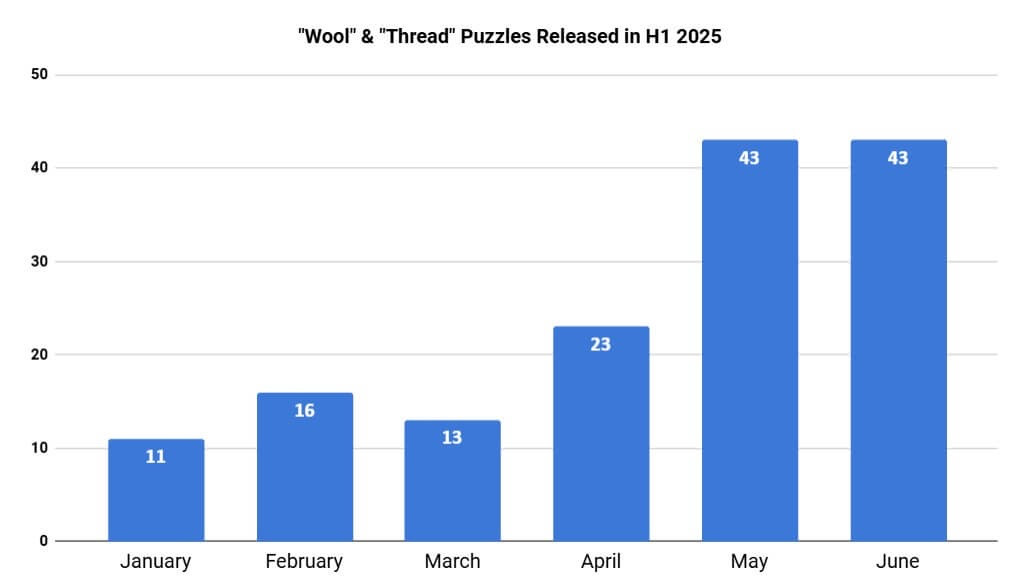

Subgenres are actively experimenting and adopting successful approaches. The recently released Wool Sort was downloaded over 7 million times in Q2’25.

The game swapped bolts for yarn and added metaprogression where players knit pictures. The number of released projects that adopted this idea has already exceeded 100.

Games to watch: Cube Busters (Spyke Games; rising), Knit Out (Rollic; top-5 revenue), Wool Craze - Yarn Color Sort 3D (SparkWish).

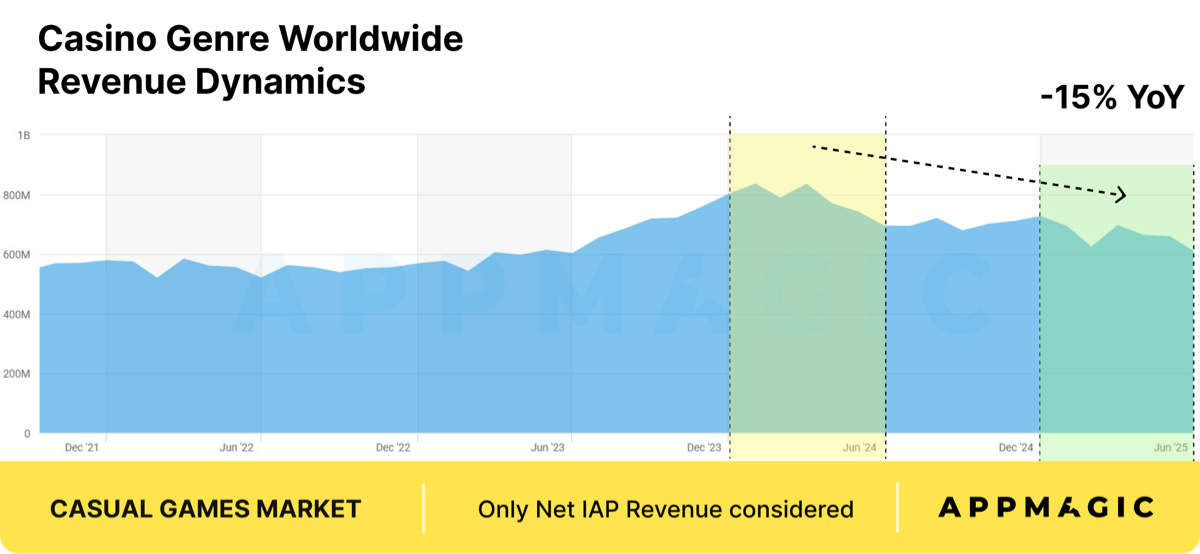

Casino

#2 genre after Puzzle. Revenue dropped -15% YoY to ~$4B Net IAP in H1’25.

Largest subgenres:

Slots: $1.6B (-7% YoY), 245M installs (-8% YoY)

Casual Casino: $1.2B (-32% YoY), 78M installs (-12% YoY)

Card Gambling: $455M (+6% YoY), 229M installs (+8% YoY)

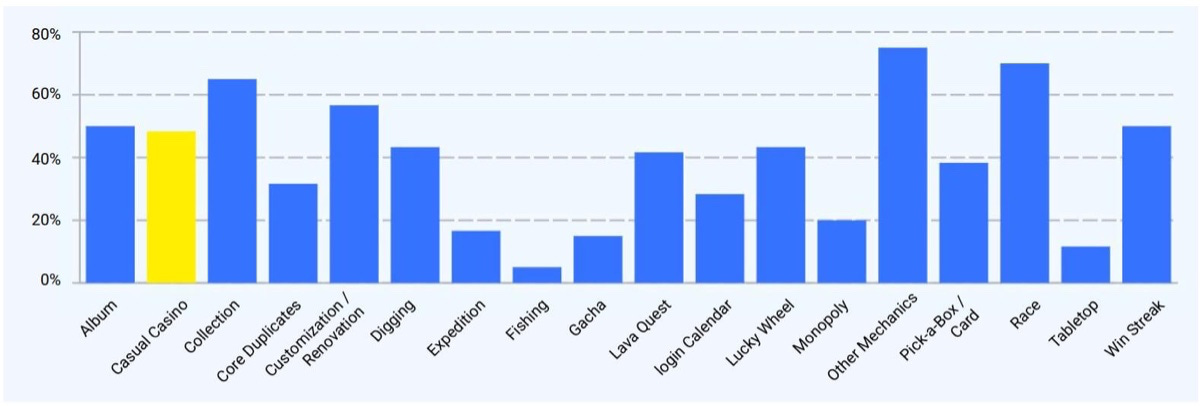

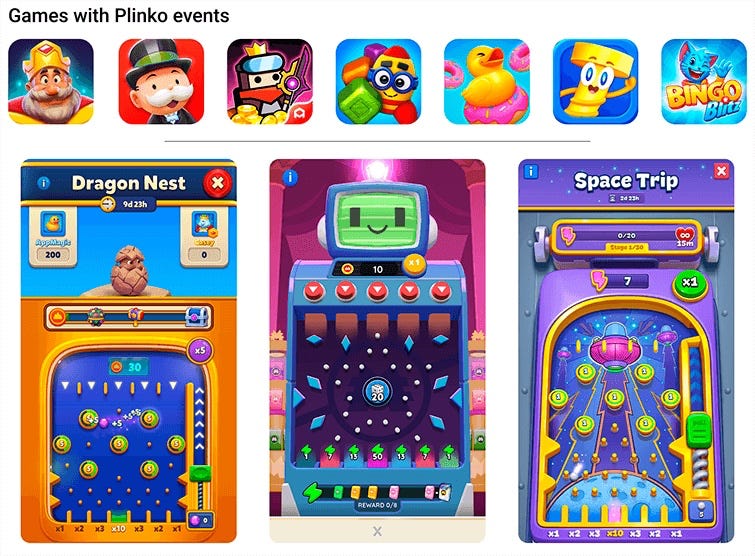

AppMagic highlights an interesting trend: casino mechanics (dice, slots, Plinko) increasingly used in live ops across non-casino genres, and sometimes even spun out into standalone games.

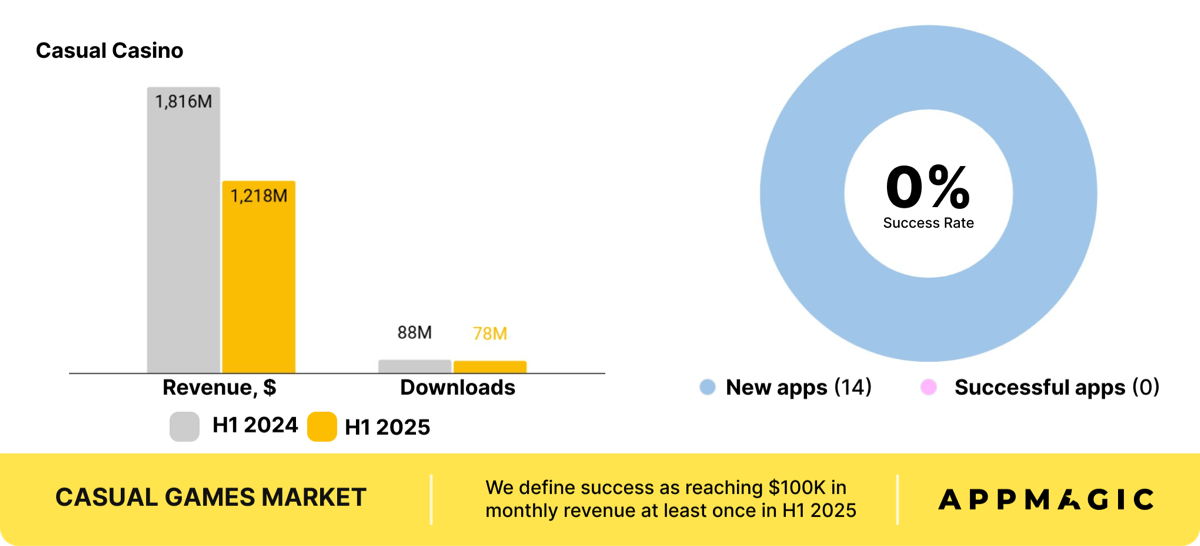

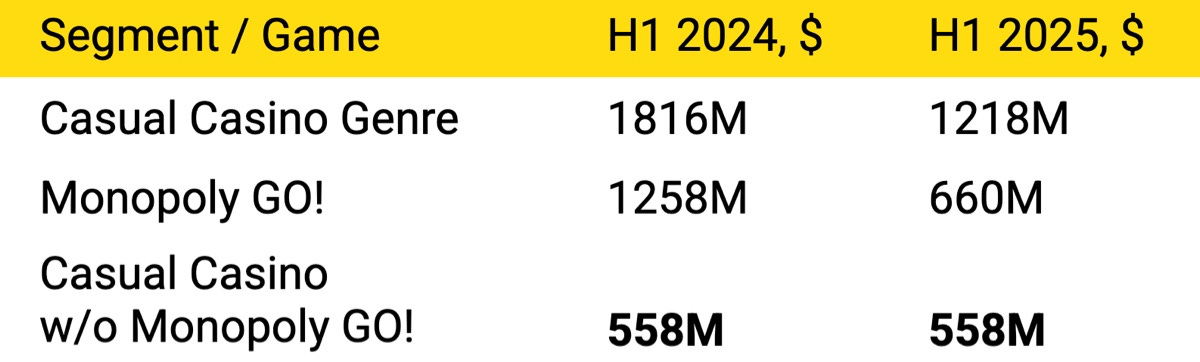

Casual Casino

Revenue -33% YoY to $1.2B, mainly due to Monopoly GO!. In H1’24 alone, it earned $1.26B (more than entire subgenre in H1’25).

Excluding Monopoly GO!, subgenre revenue is flat YoY.

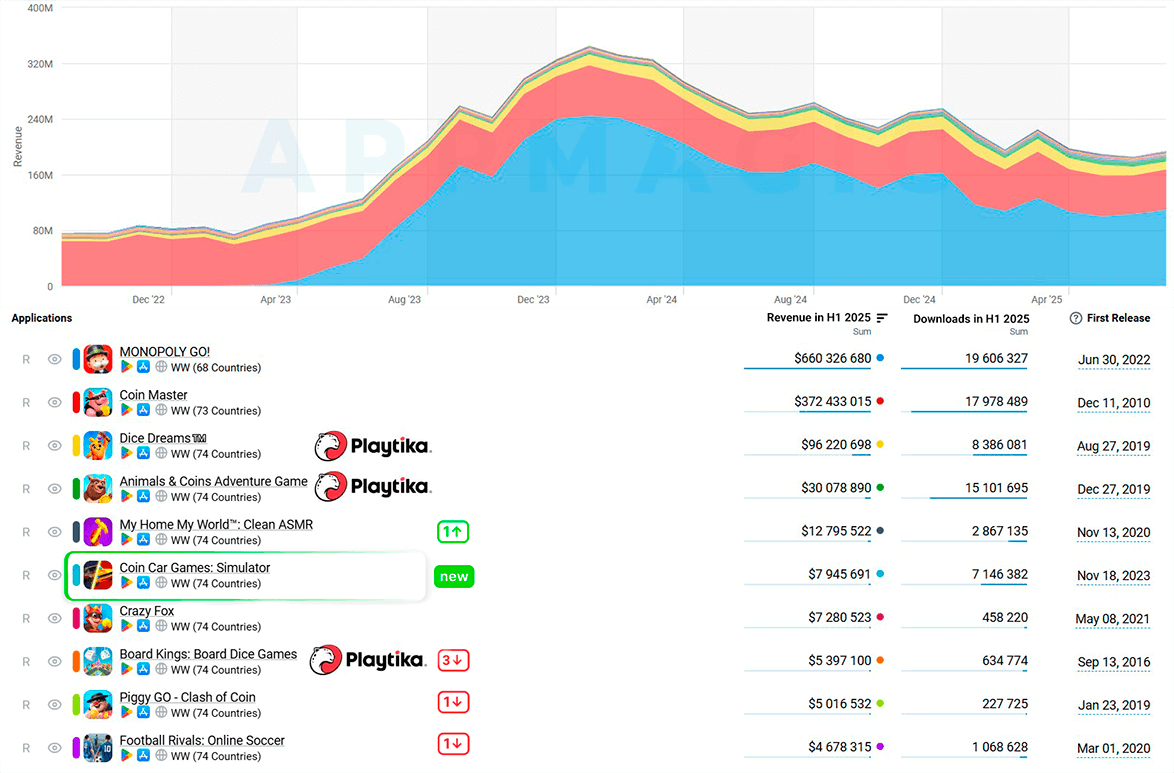

Playtika has reinforced its position in social casino. It acquired InnPlay Labs (Animals & Coins) in Sep 2024 and SuperPlay (Dice Dreams) in Nov 2024. By H1’25, combined brought in $136M (+5% YoY).

However, Playtika lost one long-running top-10 hit (Pirate Kings fell out). It was replaced by Coin Car Games: Simulator, targeting “male slots” with inspiration from Chrome Valley Customs.

Out of 14 new 2025 launches, none surpassed $100k monthly Net Revenue.

93% of revenue is concentrated in top 3 titles.

Social casino may not grow much in revenue but still influences other genres. As an example, Carnival Tycoon blends tycoon with social casino, already at $40M lifetime.

Games to watch: Coin Car Games: Simulator (Celestial Roads; only new entry in top-10), Top Tycoon: Coin Theme Empire (BeheFun Games; hit $1M in July 2025).

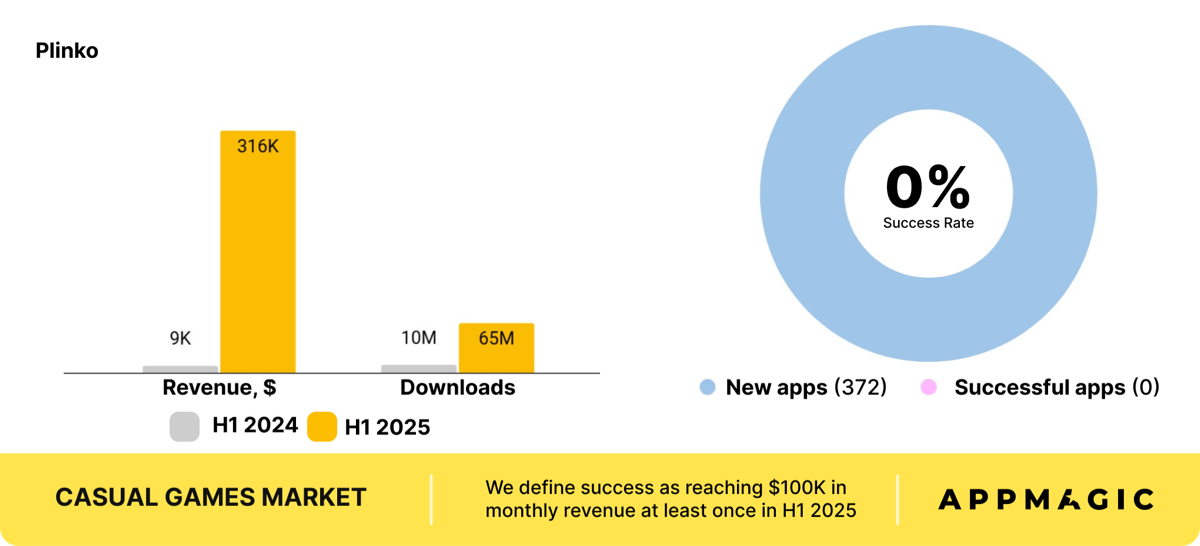

Plinko

Plinko = gameplay where a ball drops onto a peg board and bounces into prize slots at the bottom.

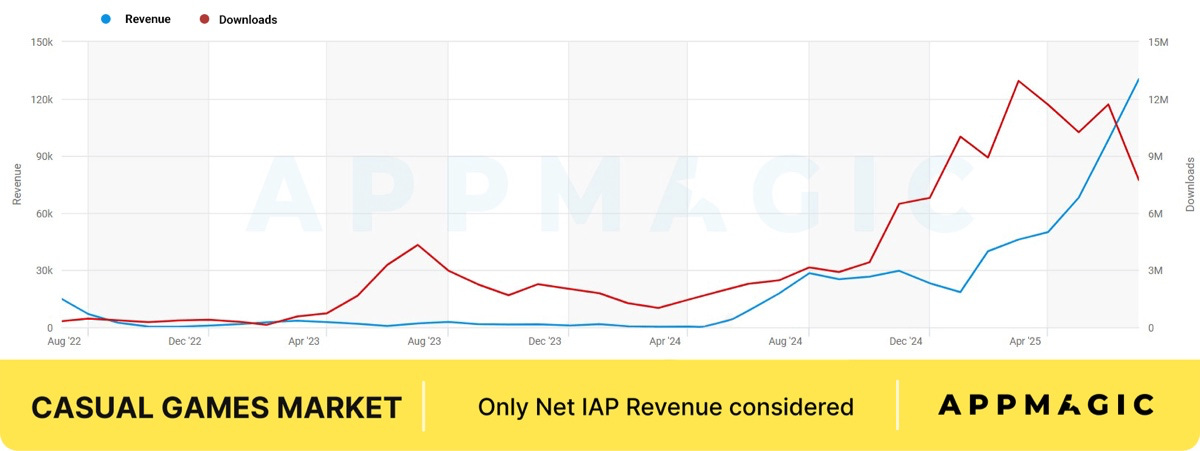

For years, Plinko Galaxy was the only monetizing title. In H1’25, revenue hit $316k (+3,600% YoY), installs x6.5 to 65M.

Mechanic has been popular in live ops for years, now emerging as standalone games.

That said, the subgenre’s growth isn’t coming just from new casual players suddenly drawn to the mechanic. One notable newcomer, Drop Balls x1000: Drop & Win, is a straightforward Plinko game and looks a lot like Plinko Galaxy. But they’re targeting different player bases: Drop Balls x1000: Drop & Win goes after India and Pakistan, while Plinko Galaxy is positioned primarily for the UK and Australia.

Subgenre likely won’t get huge, but still viable for steady earnings in niche markets.

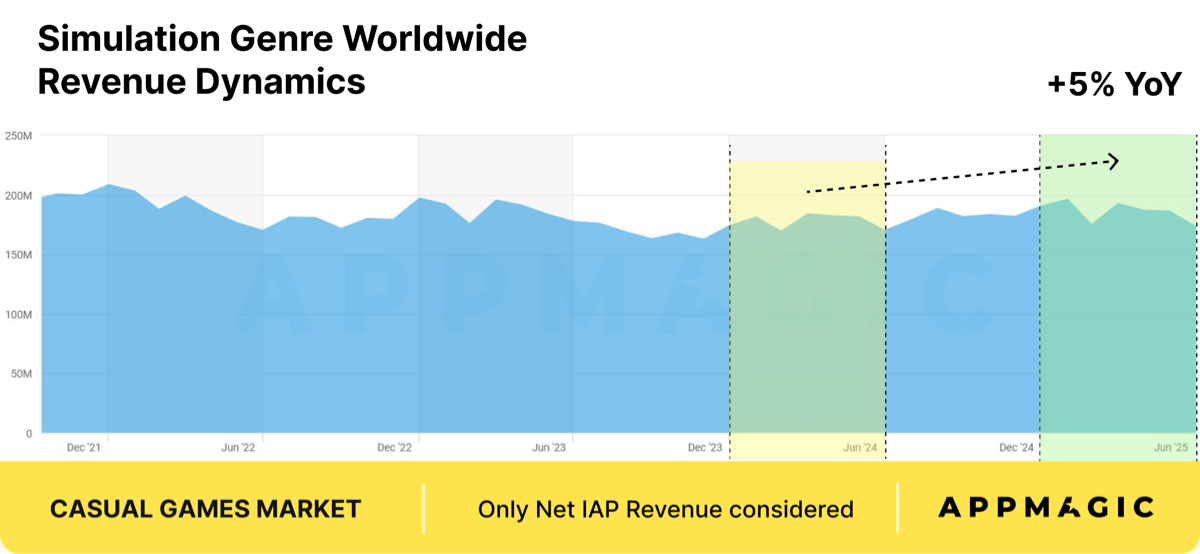

Simulation

Simulation ranks #3 in IAP revenue among casuals: $1.1B in H1’25 (+5% YoY).

Largest subgenres:

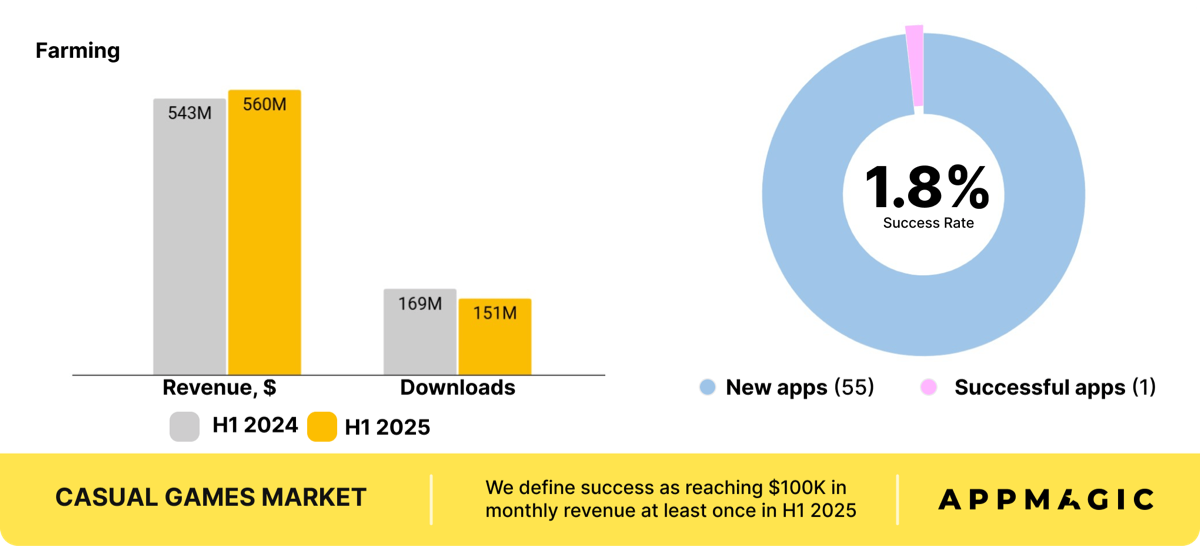

Farming: $560M (+3% YoY), 151M installs (-10.5% YoY)

Time Managers: $85M (-2.6% YoY), 261M installs (-2.6% YoY)

Life Sims: $80M (+30% YoY), 148M installs (-3% YoY)

1411 sim projects launched in H1’25, but only 55 were farming games (the dominant revenue driver). Just 0.4% of new games hit $100k monthly revenue.

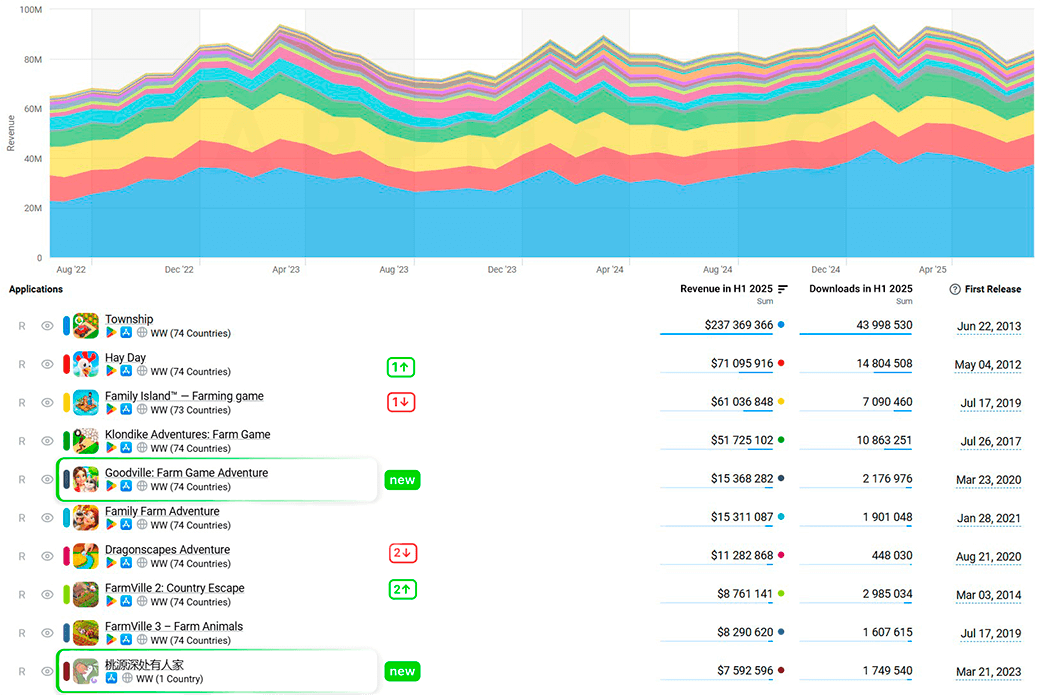

Farming

Revenue +3% YoY to $560M. Installs -10.5% to 151M.

One of the oldest & most stable (if conservative) casual subgenres.

8 of top-10 farming titles launched between 2012–2020.

Township dominates with $237M in H1’25 (42% of total). In January 2025, it also hit a personal monthly record: $43.6M.

Hay Day hit $12.6M in April 2025 – best since 2017.

AppMagic analysts note that success is tied to aggressive live ops. Township frequently integrates Match-3 events (a natural move for Playrix).

Only 1 of 55 new farm sims in 2025 passed $100k monthly Net Revenue.

Games to watch: Goodville: Farm Game Adventure (Goodville AG; steadily growing), Sunshine Island: Farming Game (Goodgame Studios; launched in 2023, recently reaching $1M monthly revenue).