Weekly Gaming Reports Recap: September 15 - September 19 (2025)

Finnish Game Industry status; most successful games (historically) on PlayStation platforms & hybrid-casual overview by AppMagic.

Reports of the week:

AppMagic: Top-10 Hybrid-Casual Games in Q2’25

Circana: The most successful projects in the US on PlayStation platforms

Neogames: Finnish Game Industry in 2025

AppMagic: Top-10 Hybrid-Casual Games in Q2’25

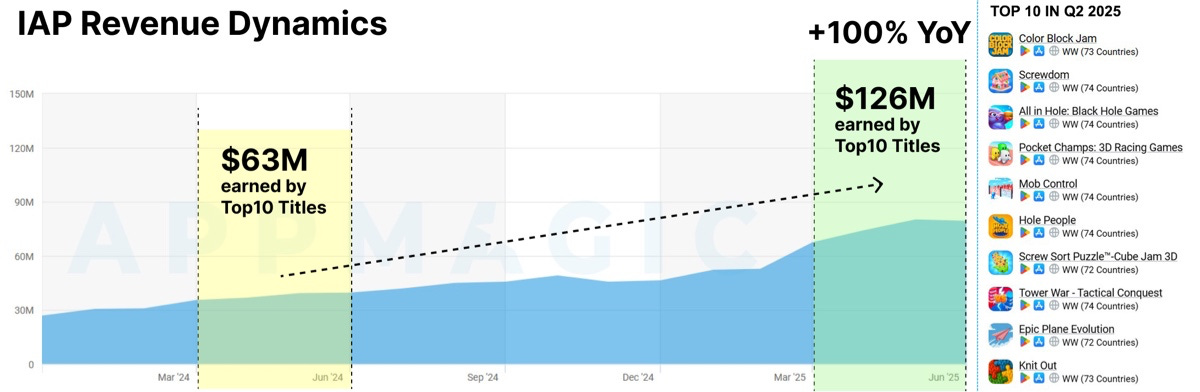

AppMagic notes that the hybridization of the hypercasual market is in full swing. IAP revenue is actively growing. To avoid limiting the sample in terms of taxonomy, AppMagic sorted the top 10 among hypercasual and hybrid-casual projects by revenue. Data is presented for Q2’25.

Top-10 highest earning hybrid-casual games in Q2’25

In Q1’25, hybrid-casual projects grew 67% YoY in IAP revenue. In Q2’25, the trend accelerated — growth doubled (+100% YoY), with the top-10 projects generating $126M in Q2 2025.

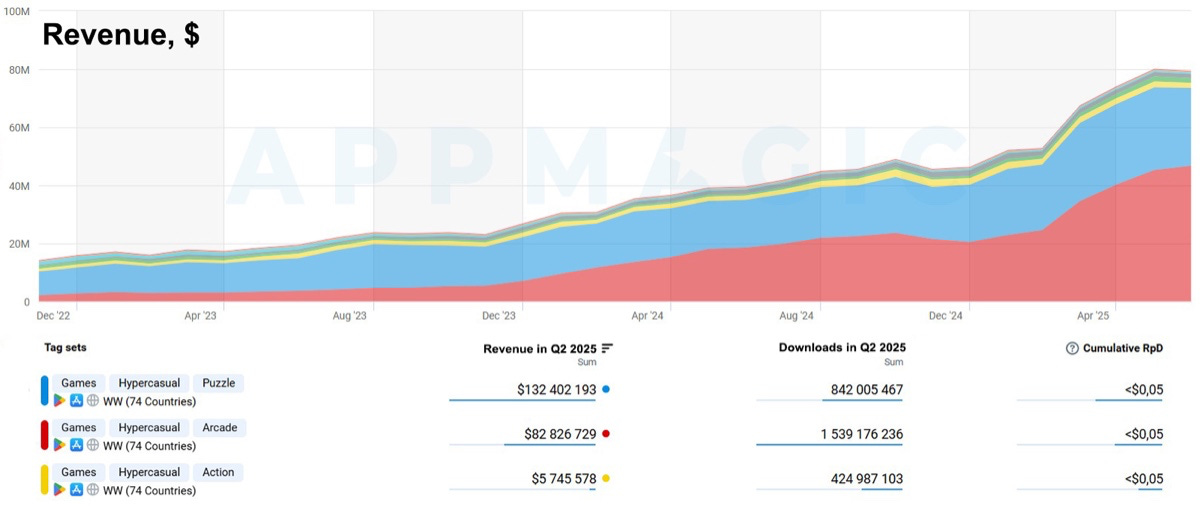

In Q2’25, hybrid-casual puzzles accounted for more than 50% of all revenue in the top-10. The second largest revenue segment is arcade (35%+). Next are action games (2% of total revenue).

All 3 genres (or subgenres) are growing. Hybrid-casual projects in Q2’25 saw 137% YoY growth in revenue; arcade grew 67%.

9 out of 10 projects in the top 10 are either puzzles or arcades. Block Puzzle - Color Block Jam; Screw Puzzle - Screwdom, Screw Sort Puzzle™ - Cube Jam 3D; Sort Puzzle - Knit Out, Hole People; arcades - All in Hole, Pocket Champs, Mob Control, Epic Plane Evolution. And Tower War represents hybrid-casual strategies.

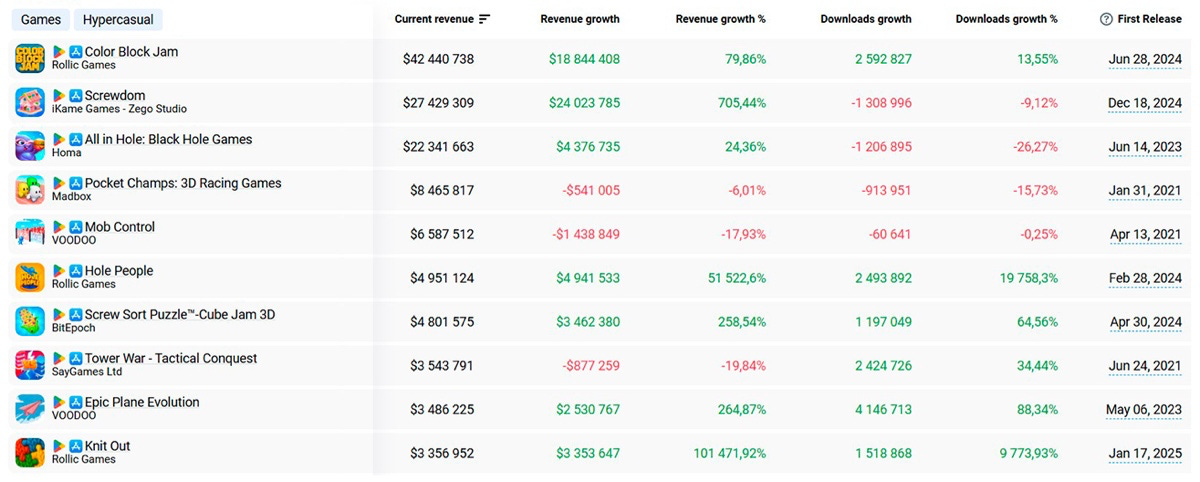

Hybrid-Casual Segment Leaders

The top earners in Q2’25 are Color Block Jam ($42M | 21.8M installs); Screwdom ($27.1M | 13.1M installs); All in Hole ($22.3M | 3.4M installs); Pocket Champs ($8.2M | 4.9M installs); and Mob Control ($6.5M | 24.3M installs).

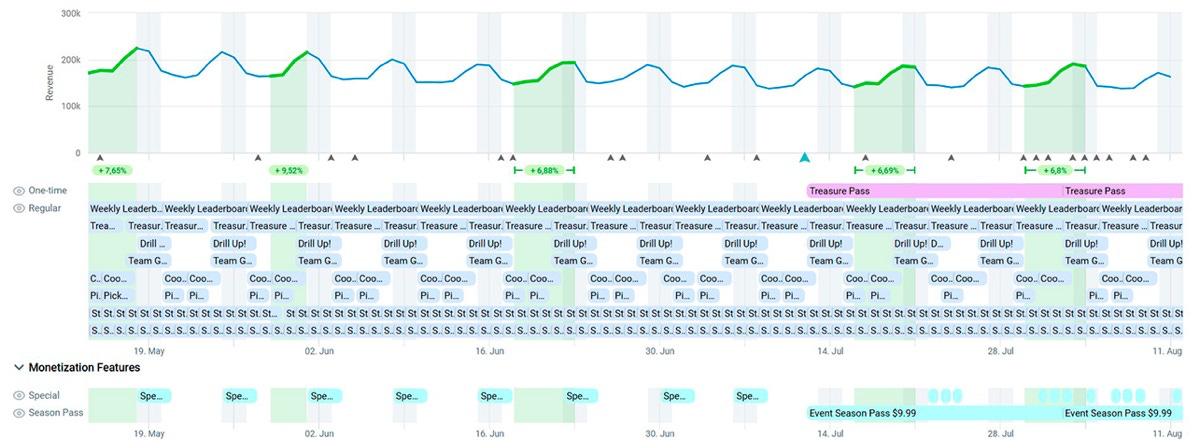

Among all projects, AppMagic highlights Homa’s All in Hole. The project has active live-ops (not typical for the segment) and the highest RpD among all projects in the ranking.

Rank 6–10: Newcomer Zone

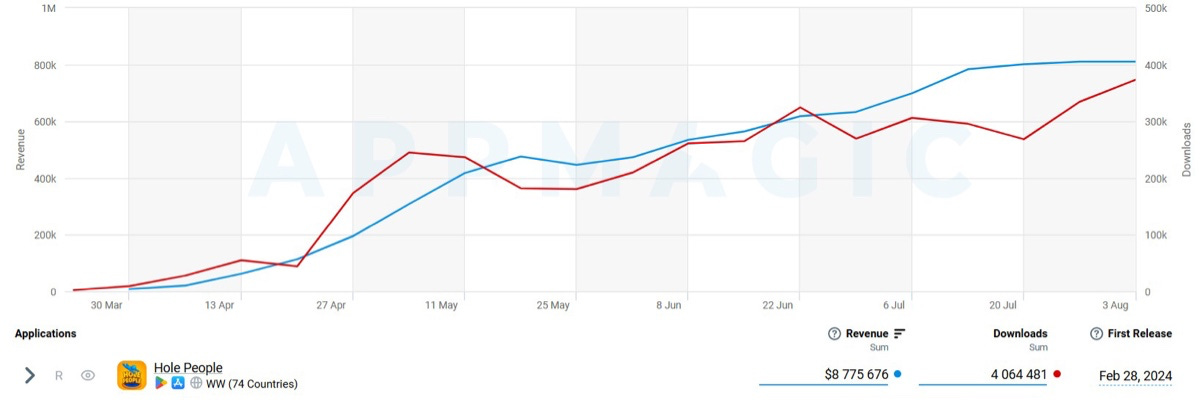

Hole People (Rollic) — $4.9M | 2.5M installs

A traditional Sort Puzzle, but Rollic added complexity to the core gameplay. Colors block each other, increasing the role of strategy.

The game follows Rollic’s traditions: increasing difficulty curve (though less than in Color Block Jam), replayable failed rounds, and active support.

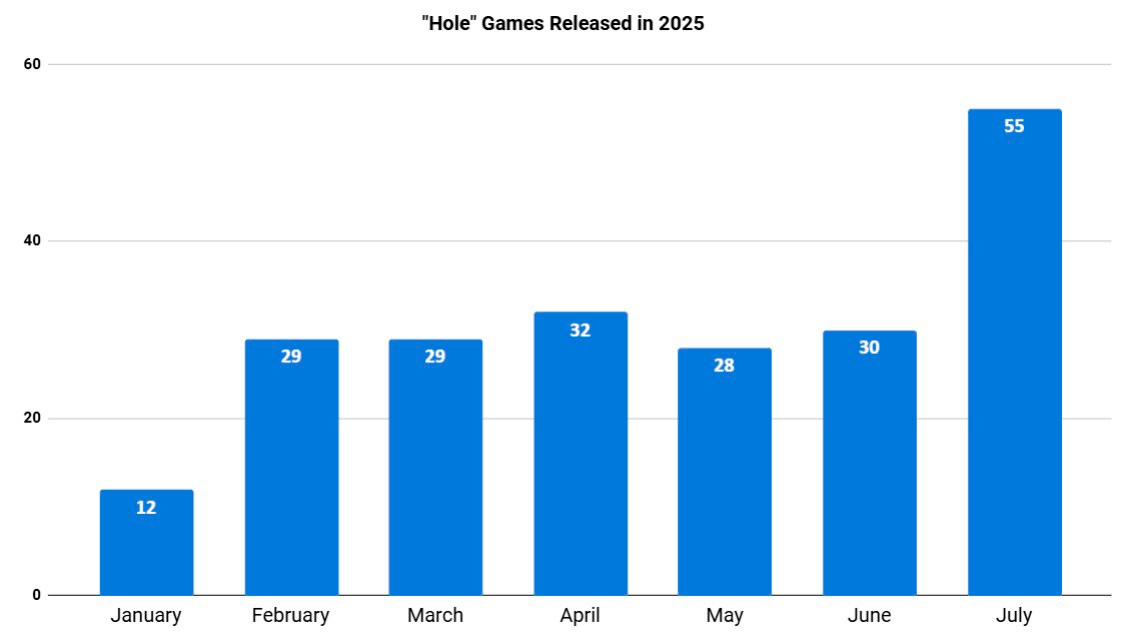

Competition in the genre is fierce. From Jan–Jul 2025, 215 new games launched with “hole” in their keywords (vs. 15 in the same period of 2024). Likely not all represent the genre, but many do.

Monetization relies on Battle Pass, ad removal offers, and fail-level offers. The last two bring in ~30% of monthly revenue. In July alone, they generated ~$1M.

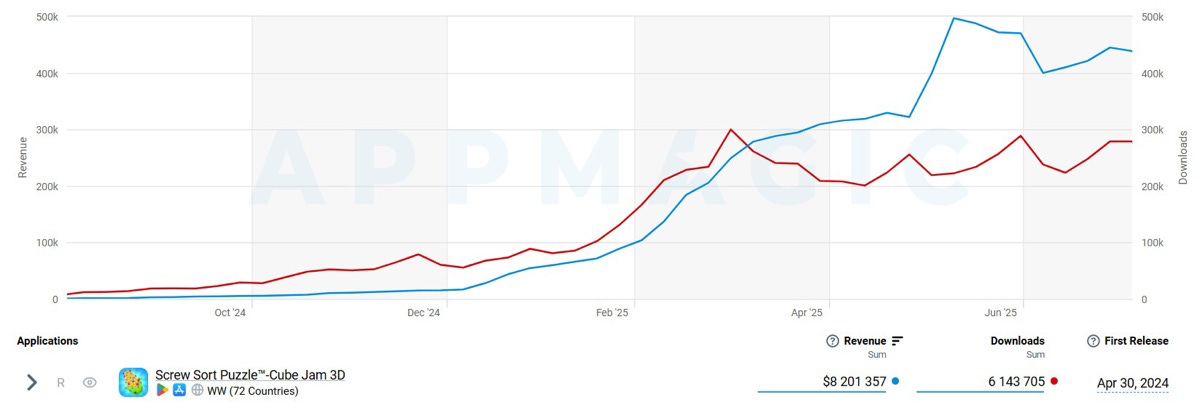

Screw Sort Puzzle - Cube Jam 3D (BitEpoch) — $4.7M | 3.1M installs

In Q2’25, revenue grew 258% YoY, while downloads plateaued.

The main differentiator is its 3D perspective.

The team experiments with both core gameplay (e.g., boosters like in Royal Match) and monetization. Recently increased the fail-offer price (from $4.99 to $5.99). Experiments with pricing include scaling piggy banks ($1.99–$14.99).

Economy is carefully tightened to grow ARPPU, but players are rewarded with lots of content via live-ops: leaderboards (daily/monthly), daily roulettes, milestone events, challenges, etc.

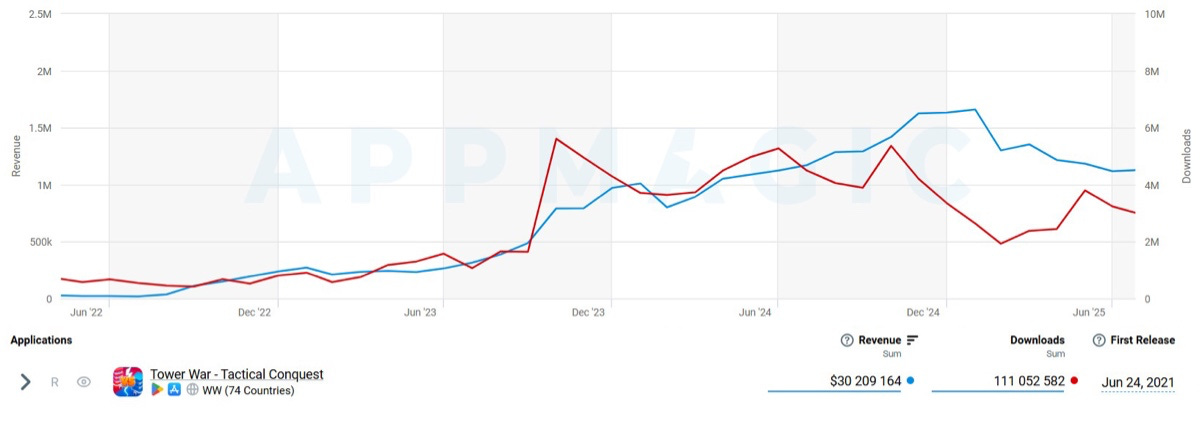

Tower War - Tactical Conquest (SayGames) — $3.5M | 9.5M installs

Launched back in 2021, but still relevant. Devs actively support and even update core gameplay to stay competitive.

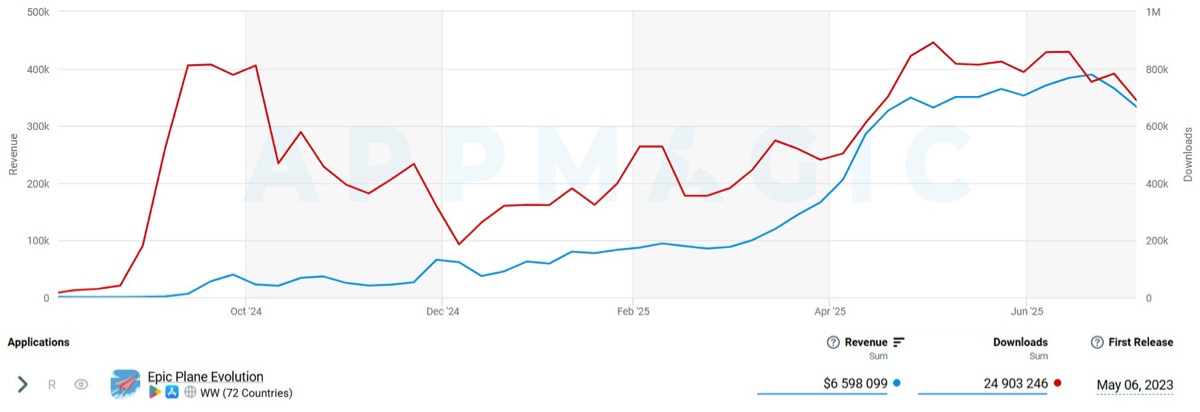

Epic Plane Evolution (Voodoo) — $3.5M | 8.6M installs

Grew 265% vs. last quarter, mainly from the U.S. market.

Voodoo transformed it from a hypercasual ad-driven game into an IAP-heavy project. Key change: ticket system, each plane launch costs 1 ticket.

Also revamped pricing, raising IAP pack prices by more than 2x.

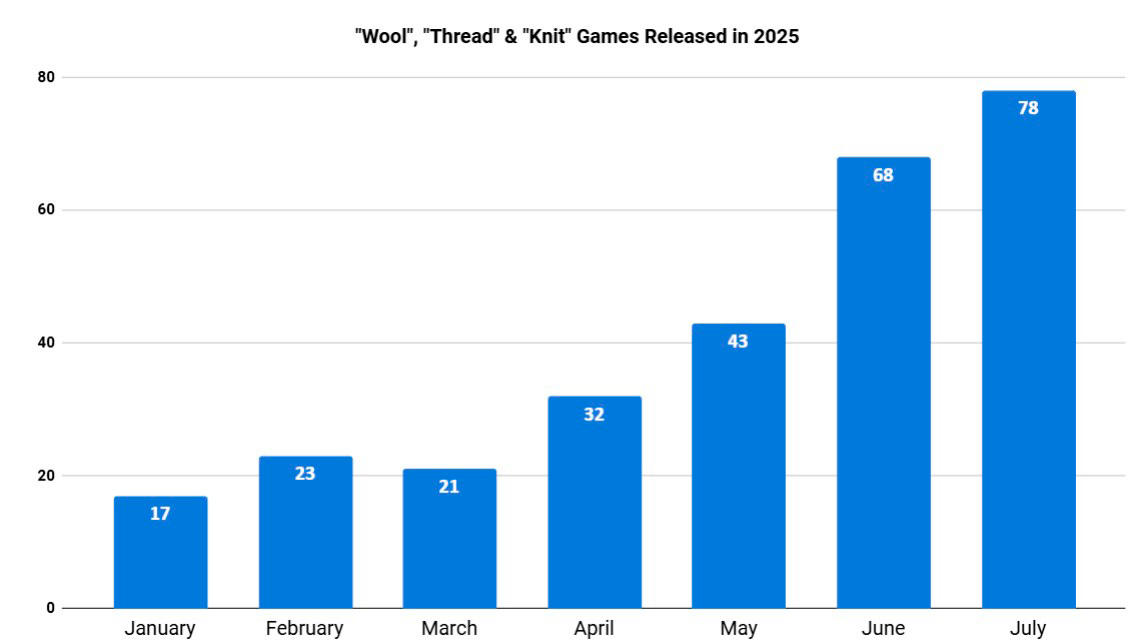

Knit Out (Rollic) — $3.4M | 1.5M installs

Despite fierce competition, Rollic pushed the game into the top 10. From Jan–Jul 2025, 280+ games launched with “wool,” “thread,” or “knit” in keywords.

Core gameplay hasn’t changed much. Strong execution of quality, balance, and live ops (publisher has big experience).

Recently launched Thread Pass (battle pass) already contributes 5–7% of monthly IAP revenue. Key money-maker is the fail-offer.

Circana: The most successful projects in the US on PlayStation platforms

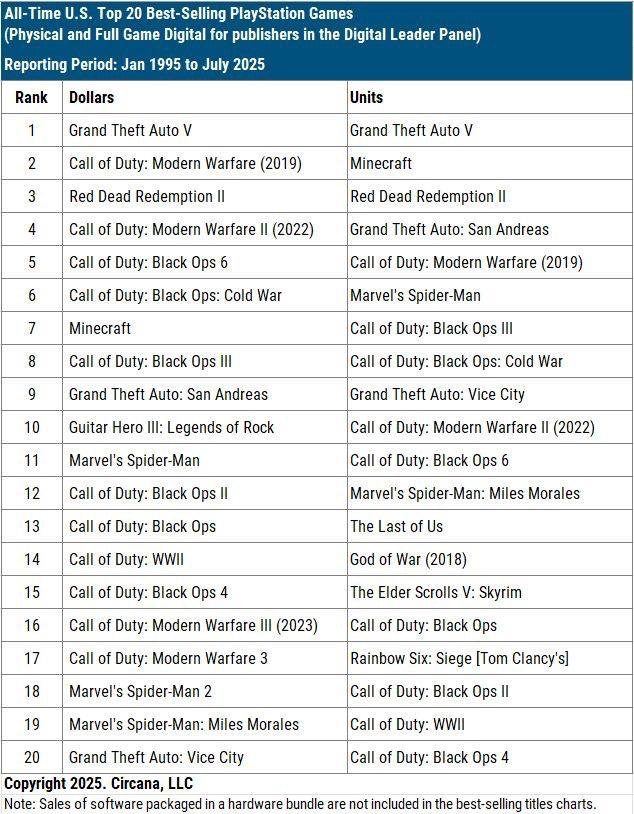

The first PlayStation launched in the US on September 9, 1995. In the 30 years since release, Grand Theft Auto V became the most popular game both by revenue and by copies sold.

In the top 20 by revenue, there are 11 Call of Duty entries; 3 GTA entries (plus Red Dead Redemption II). And three Marvel’s Spider-Man games from Insomniac Games.

By copies sold, Call of Duty’s dominance is smaller – only 9 titles in the top 20. But The Last of Us, God of War (2018), The Elder Scrolls V: Skyrim, and Rainbow Six: Siege make an appearance.

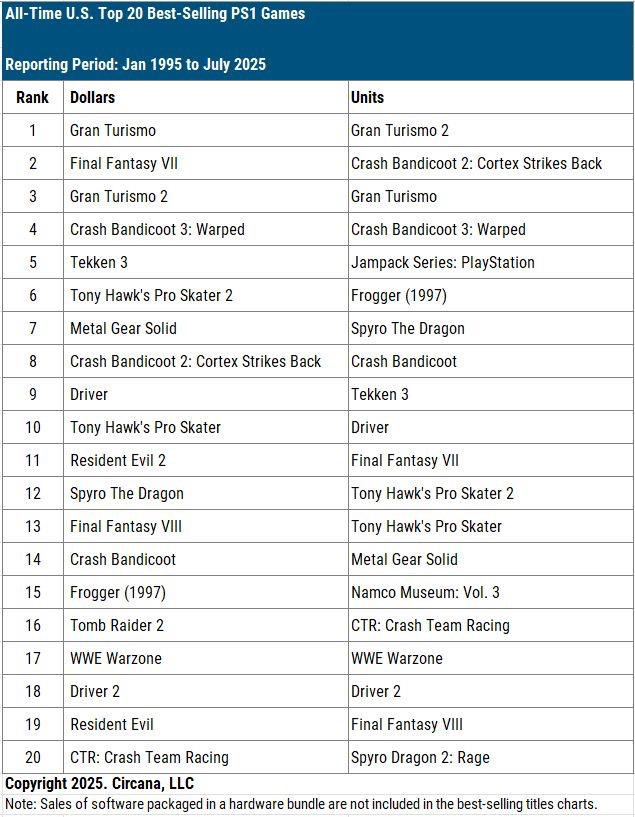

For those who want a bit of nostalgia – take a look at the first PlayStation charts. Gran Turismo, Final Fantasy VII, Gran Turismo 2 lead by revenue; Crash Bandicoot 2: Cortex Strikes Back is in second place by copies sold.

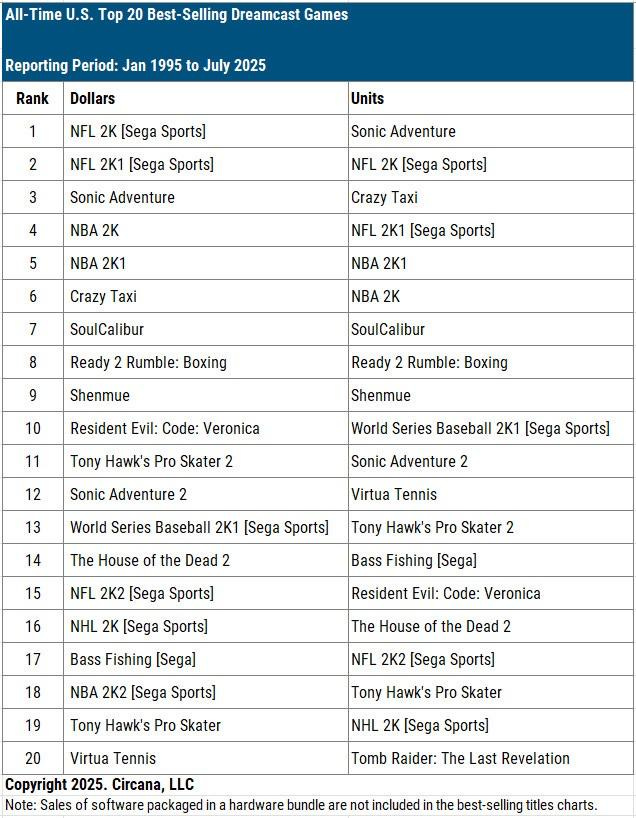

On Dreamcast – a flood of sports games (NFL, NBA, World Series Baseball, Tony Hawk’s Pro Skater). In fact, sports games make up more than half of the list, both by sales and by revenue.

And the top 20 on SEGA Saturn is very unusual. Few people remember Daytona USA nowadays, but it was number 4 in sales. Those were the times!

Neogames: Finnish Game Industry in 2025

71 game studios took part in the survey and report preparation (26% of the total number in the country), employing 3,160 people (86% of the total workforce in Finland). The report uses complete or partial factual data from 141 Finnish game companies.

Financial Performance

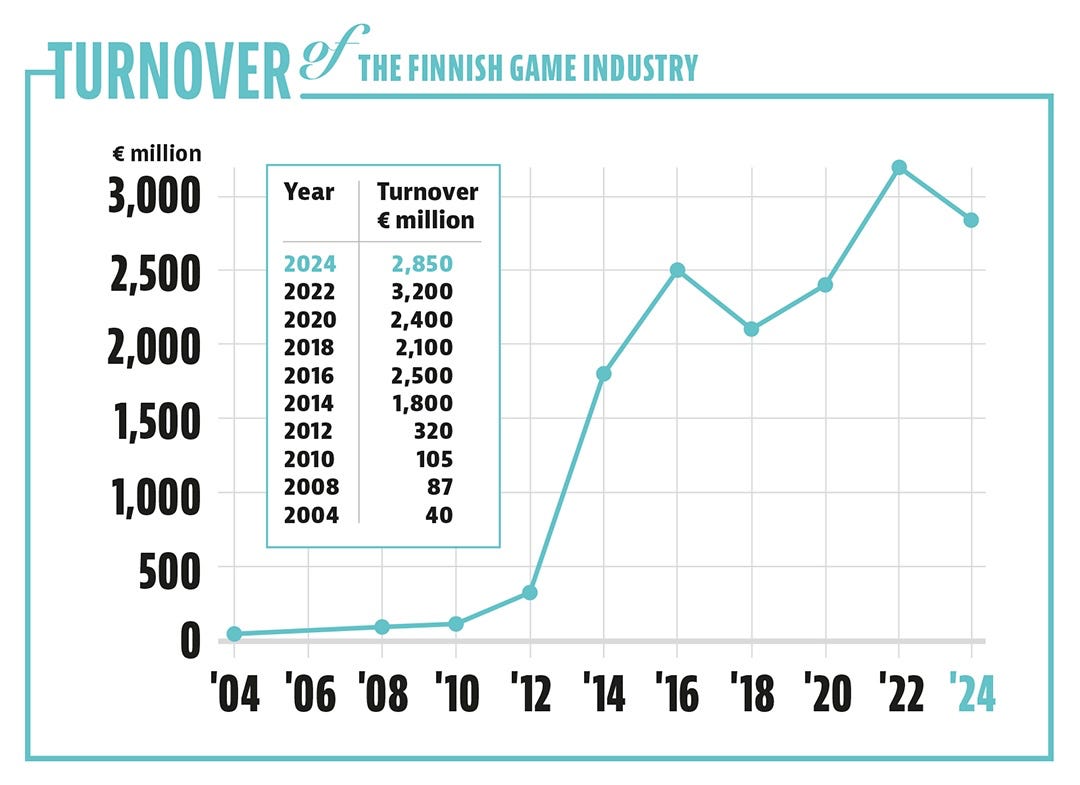

In 2024, the turnover of the Finnish game industry amounted to €2.85 billion. This is a decrease compared to 2022, when turnover exceeded €3 billion.

❗️The report notes that calculating calendar year results has become more complicated, since many companies now use a fiscal year from April to March.

In 2023, Finnish companies earned €800 million in net profit. In 2024, that number dropped to €400 million.

Over the last 12 years, Finnish game companies have paid €3.5 billion in taxes. During this period, their total turnover exceeded €28 billion.

Investment in Finnish game companies has decreased. In 2023–2024, they received €128 million in funding, compared to €300 million in 2021–2022 (including Supercell’s €150 million credit line for Metacore).

The number of companies with annual turnover above €100 million has remained the same. However, in the last 2 years, the number of companies with turnover above €1 million fell from 45 to 37.

Finnish Studios

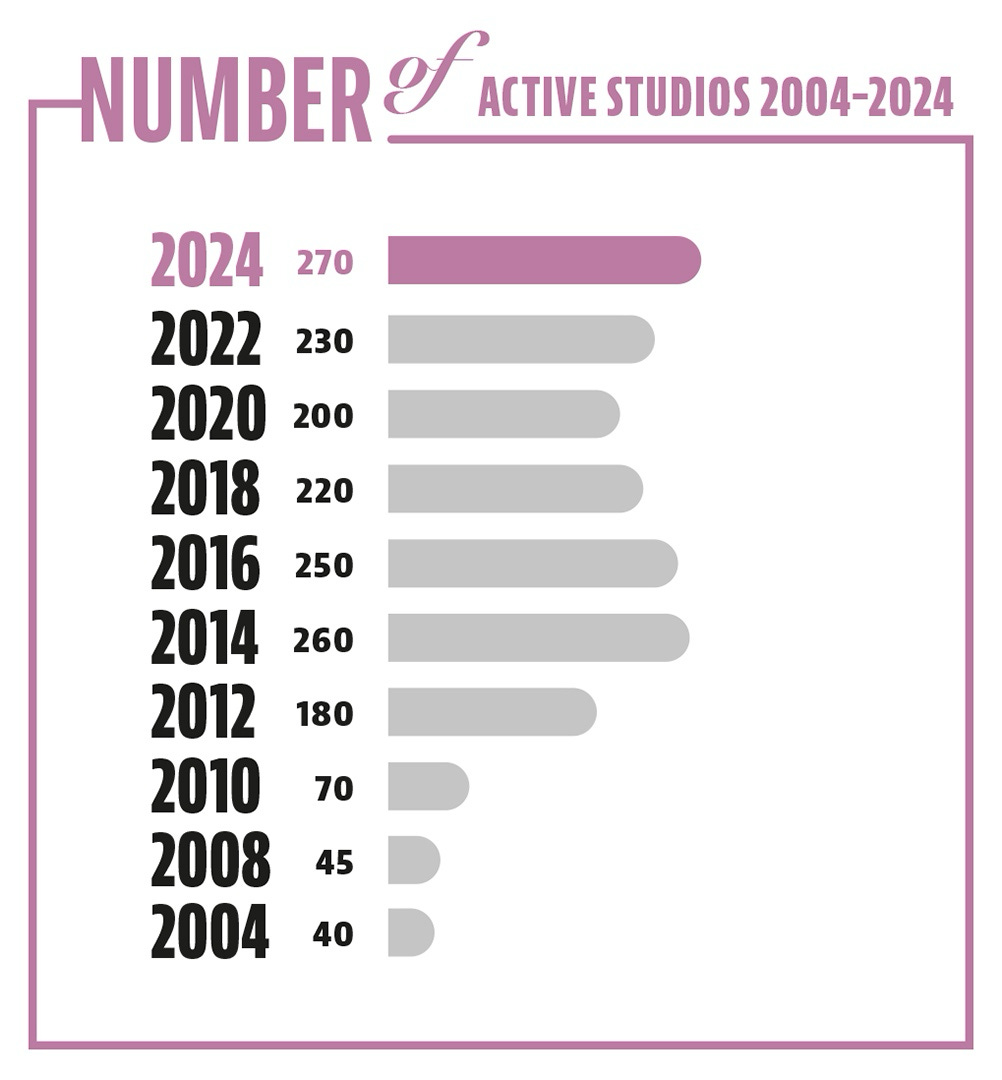

At the end of 2024, there were 270 active studios in Finland. At the end of 2022, there were 232. The number of companies grew despite the state of the industry and macroeconomic trends.

40 of them were founded in 2023–2024.

In 2004, Finland had only 40 game companies (already quite a lot for that time). 10 of them are still active.

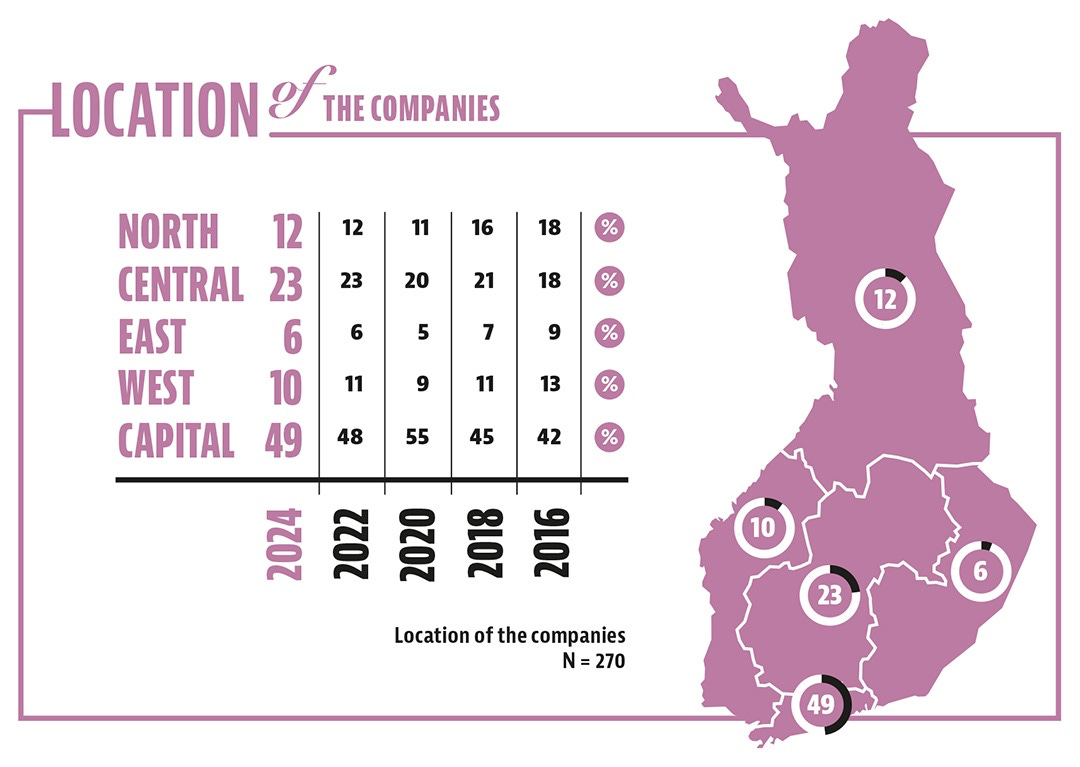

Nearly half of all Finnish studios are concentrated in the capital region, which also accounts for 97% of industry turnover.

Game Industry Workforce

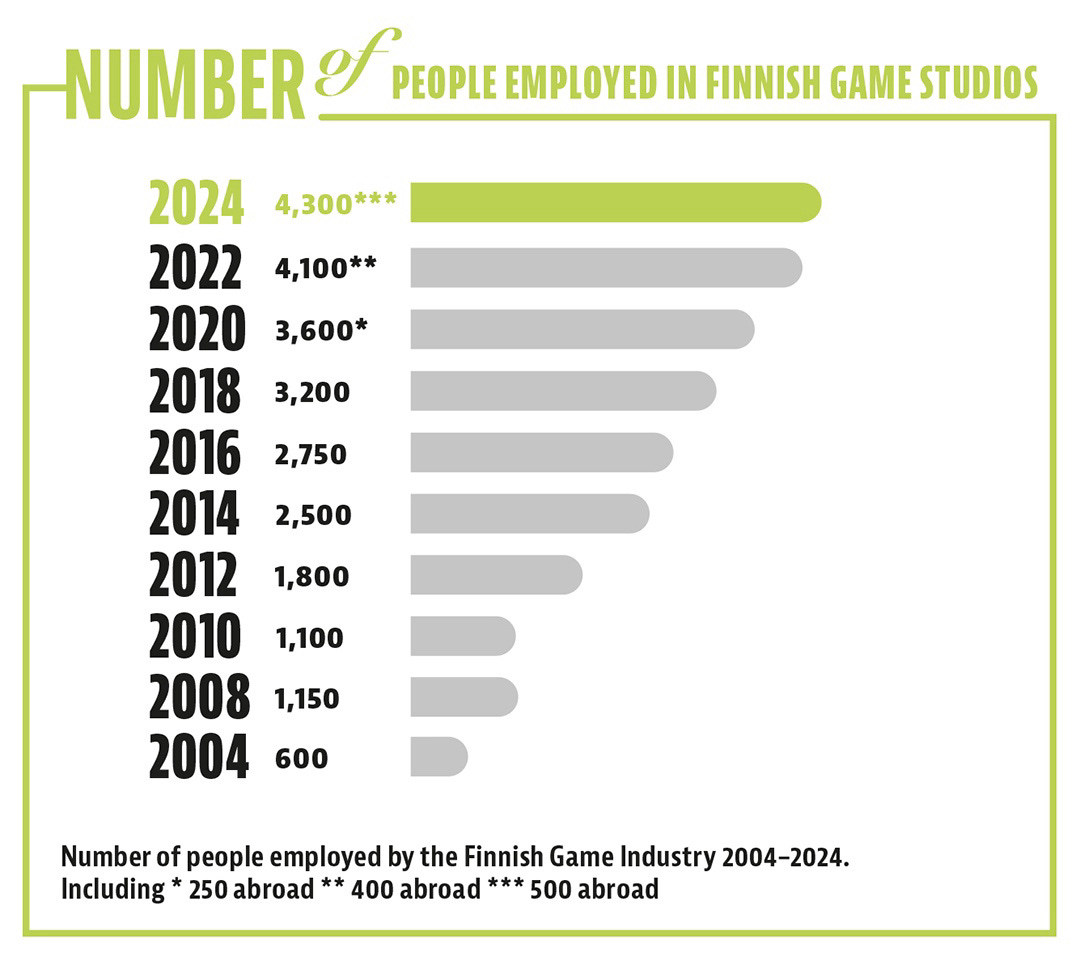

At the end of 2024, 4,300 people were employed in the Finnish game industry.

Of these, 3,800 work in Finland and 500 in international branches of Finnish studios.

24% of the workforce are women.

The average team size in a Finnish game company at the end of 2024 was 20, compared to 23 in 2022.

35–37% of employees by end of 2024 were expats.

Actual workforce growth was slower than the optimistic forecasts of the previous report. Over the next 2 years, Finland is expected to see between 450 and 1,000 new industry jobs.

24% of employees primarily worked remotely by the end of 2024, compared to 35% in 2022.

Released Games

Finnish game companies launched 120 new titles in 2023–2024. Only 10 were released on mobile.

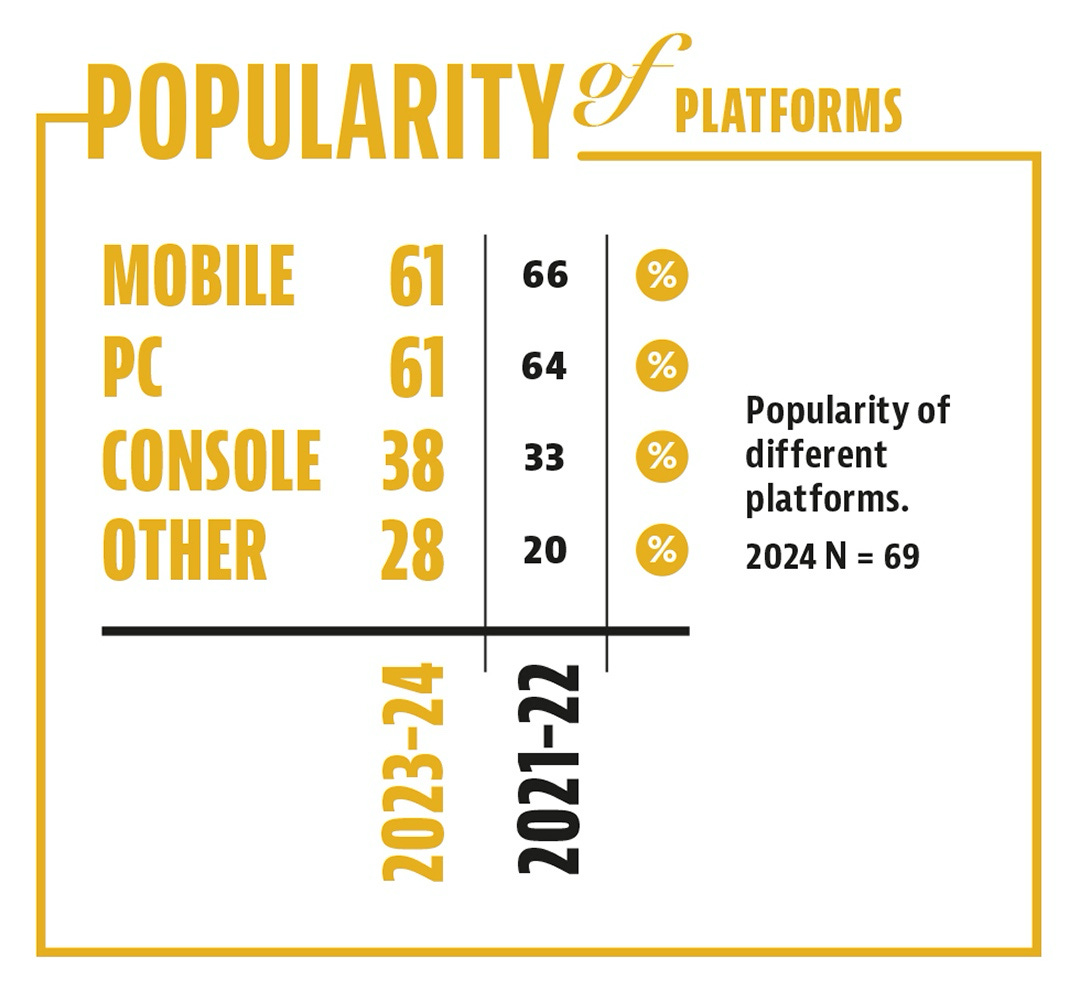

Mobile remains the main revenue platform for Finnish studios, but its dominance is decreasing. Interest in consoles and alternative platforms is growing.

58% of surveyed studios are developing projects for at least two platforms; 23% are targeting three or more platforms. Only 20% are making a mobile-exclusive title.

Web games are gaining popularity. 14% of studios plan browser support, double the share from 2021–2022.

The most notable games from Finnish studios in 2023–2024 include Alan Wake II (Remedy), Squad Busters (Supercell), Cities Skylines II (Colossal Order), and Pax Dei (Mainframe Industries).