Weekly Gaming Reports Recap: September 9 - September 13 (2024)

Japan market is declining, according to Sensor Tower; more than 80% of opened game vacations are opened in Europe, US, and Asia; Niko Partners shared the status of Gulf countries.

Reports of the week:

Niko Partners & Saudi Esports Federation: Gulf Countries Market, User Preferences, and Localization

Perforce & JetBrains: Gaming Technologies in 2024

Famitsu: The Japanese gaming market in August 2024

Amir Satvat: Data on job openings in the gaming industry

Sensor Tower: The Japanese mobile gaming market declined in H1'24

Niko Partners & Saudi Esports Federation: Gulf Countries Market, User Preferences, and Localization

The report focuses on the Gulf Cooperation Council (GCC) countries – Bahrain, Kuwait, Oman, Qatar, KSA, and the UAE. The total population of these countries is over 60 million, with 57% of that number being in Saudi Arabia.

General Market Information

In 2023, there were 33.7 million players in the GCC countries, with total gaming revenue amounting to $2.24 billion. The annual ARPU across all platforms was $66.34. Saudi Arabia accounted for 49.5% of the income and 61.7% of the gaming population in these countries.

Niko Partners forecasts that 2028 gaming revenue in these countries will reach $3.24 billion (+7.7% CAGR).

The number of players in the GCC countries will increase to 38.9 million by 2028. This will represent a 2.9% growth per year. ARPU will reach $83.3.

The leading countries are Saudi Arabia and the UAE. Together, they will account for approximately 80% of all revenue.

There are currently 420 million people in the world who speak Arabic, making it the 5th most popular language globally. It is an official language in 25 countries. For comparison, the population of the USA is 331 million people.

Player Profile

In December 2023, Niko Partners surveyed 1,225 players from the GCC countries.

69% of gamers in these countries are male.

62.3% of respondents are under the age of 34.

91.7% play on mobile devices. 61.9% on PC; and 55.3% on consoles. People also said they play on Smart TVs (24.6%) and VR (10.1%).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

56.6% of respondents earn less than $30,000 a year. However, 9.4% earn more than $100,000.

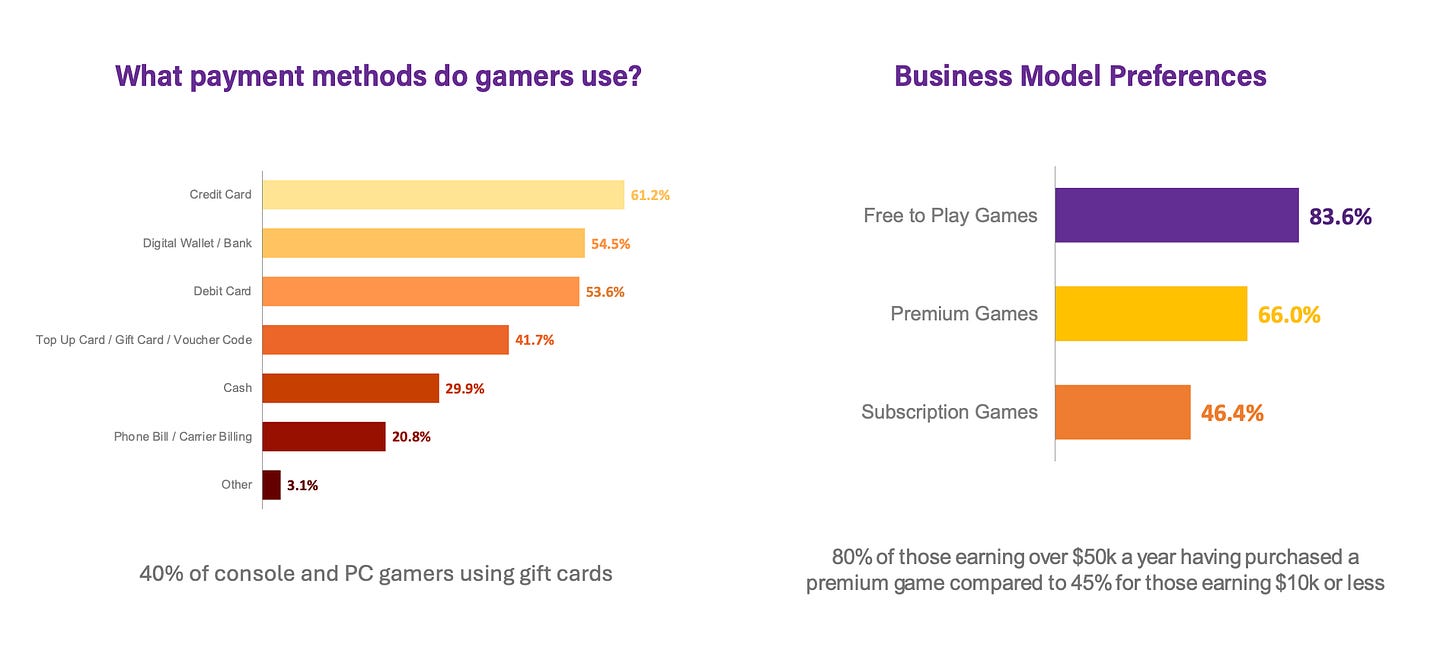

Most players prefer F2P games (83.6%). Next come premium games (66%).

The most popular payment methods in the country are credit cards (61.2%), digital wallets (54.5%), debit cards (53.6%), gift/top-up cards (41.7%), cash (29.9%), and payment via phone (20.8%).

Sports games (57.9% play), fighting games (53.8%), and action games (53%) are the most popular genres in the country.

Preferences of GCC Players

40.9% of players consider Arabic localization important. But for the rest, it's not a concern, as they can comfortably play in English.

However, 75% of players believe that seeing elements of Arab culture in games is important.

Perforce & JetBrains: Gaming Technologies in 2024

The companies surveyed 576 people from 64 countries across 6 continents. One-third of the respondents work in non-gaming industries (automotive, healthcare, finance). Companies were interested in how gaming technologies are used beyond the gaming industry.

53% of small and medium-sized studios face funding issues, while only 7% of large companies have this problem.

However, large companies more frequently encounter challenges with effective collaboration (34% vs. 15% in smaller companies); the pace of innovation (26% vs. 14% in smaller companies); and talent retention (20% vs. 10% in smaller companies).

The main collaboration issues highlighted by respondents include working with large files (38%), difficulties in reusing assets (29%), time zone and remote work problems (29%), and providing feedback on assets (26%).

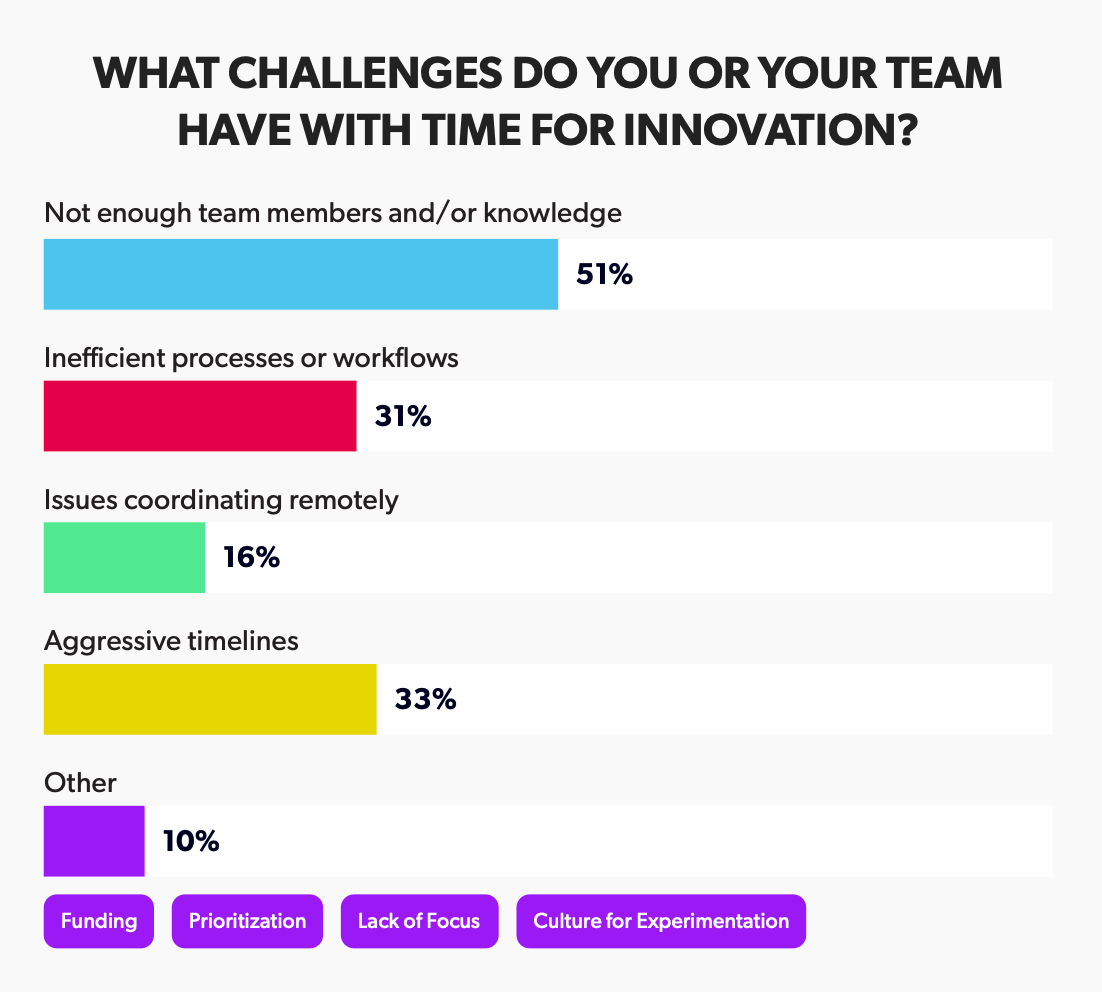

The main innovation constraints are a lack of people or knowledge (51%), tight deadlines (33%), inefficient processes (31%), and coordination issues in remote work (16%).

63% of companies use Unreal Engine, making it the most popular engine. 47% use Unity, 11% use their own engine, and 9% use Godot. In non-gaming industries, Unreal Engine is used by 51% of companies, while only 16% usage of Unity.

Unreal Engine's popularity is roughly equal among small to medium (66%) and large studios (59%). Unity, however, is used more by smaller companies (52% vs. 30% in large companies). Larger developers more frequently use their own engines (27% vs. 10% in small studios).

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Perforce Helix Core (51%), GitHub (42%), and GitLab (15%) are the leaders in version control services.

Version Control (69%), Google Drive (43%), and Network File System (NFS) with simple email (20%) are the top tools for asset storage.

Jira (39%) and Trello (24%) are the leaders in project management software.

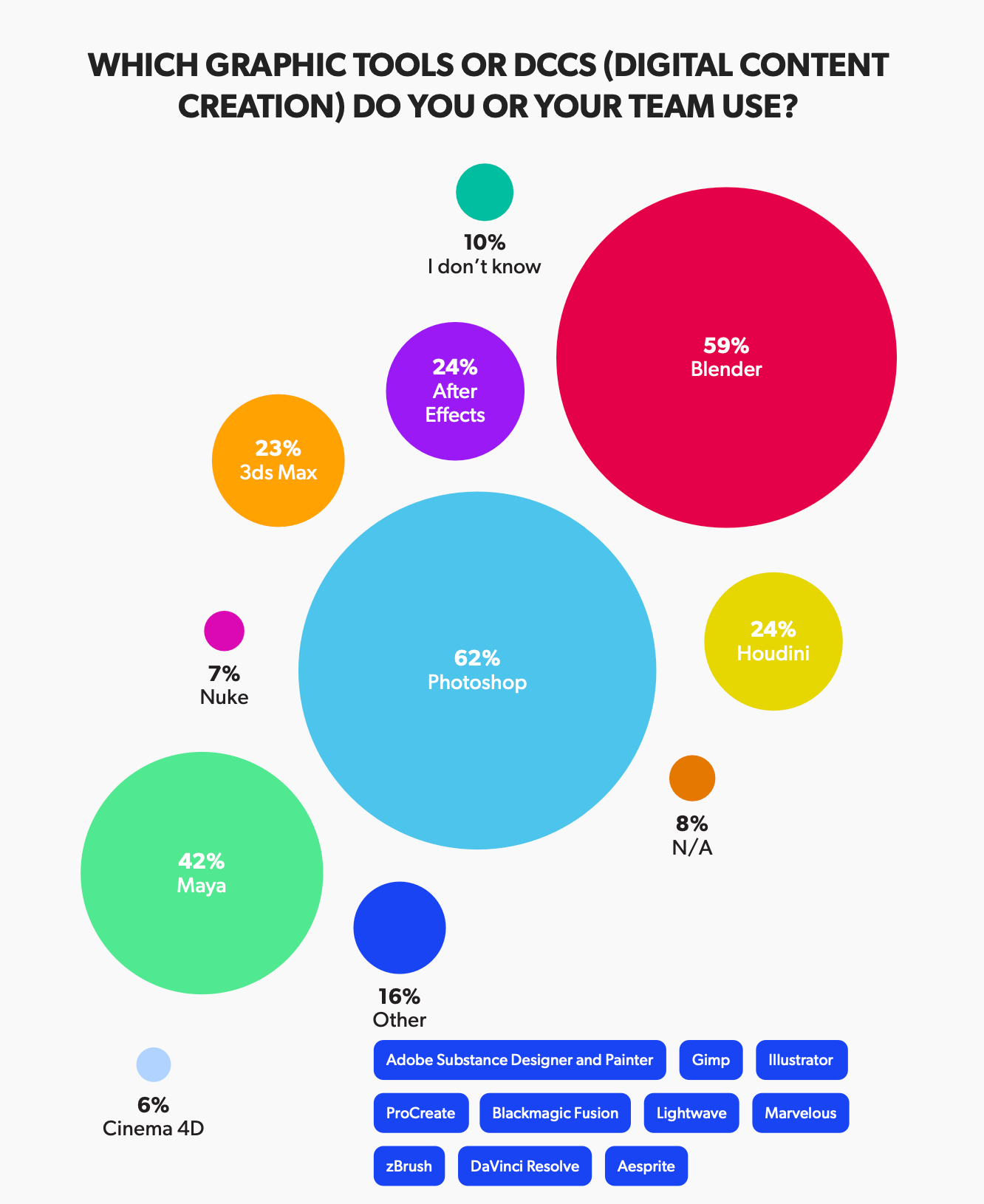

Photoshop (62%), Blender (59%), and Maya (42%) are the industry leaders in graphic tools.

AI tools are also gaining popularity, with the leaders being ChatGPT (47%), GitHub Copilot (18%), and Midjourney (15%).

AWS (30%), Microsoft Azure (18%), and GCP (9%) are the leaders in cloud hosting.

Famitsu: The Japanese gaming market in August 2024

Famitsu only takes physical sales into account.

Game Sales

Powerful Pro Baseball 2024-2025 remained the leader in August. The game was purchased by 76,000 people on Nintendo Switch and PlayStation 4. Combined physical sales of the project have surpassed 336,000 copies over six weeks. Its predecessor, eBaseball Powerful Pro Baseball 2022, sold 259,000 copies in the same period.

Otherwise, August turned out to be a calm month. Mario Kart 8 Deluxe returned to second place (50,000 copies). Nintendo Switch Sports climbed to third place—baseball was added to the game.

One of the few new releases of the month, That Time I Got Reincarnated as a Slime ISEKAI Chronicles, ranked 8th with the Nintendo Switch version (23,000 copies). The PS5 version sold an additional 6,000 copies.

In August, Nintendo accounted for 40.9% of all physical sales in Japan (¥2.3 billion - $16.1 million). Konami had 16%.

In terms of platforms, the Nintendo Switch dominated with 88.1% of the total market. 883,789 games were purchased for this system in August.

Hardware Sales

Unsurprisingly, the Nintendo Switch was the best-selling console of the month, with 228,000 sales.

The PlayStation 5 sold 104,000 units in August.

Amir Satvat: Data on job openings in the gaming industry

Amir Satvat analyzed 95-99% of the open positions. It is unclear over what time period the sample was taken, but the database includes a total of 14,162 job openings.

❗️Amir helps people in the gaming industry find jobs—more details can be found on his website.

86% of all open positions do not offer remote work options. Only 14% of positions provide this opportunity.

Asia (32.5%), Europe (28.3%), and North America (22.9%) lead in the number of open job positions. Only jobs that do not offer remote work were considered.

The countries with the most job offers for gaming industry workers are: USA (16.4%), China (13.9%), UK (7.4%), Canada (6.3%), and Japan (4.2%).

At the city level, Shenzhen (6.7% of all job openings) and Shanghai (4.4%) are the leaders in terms of the number of open positions. They are followed by Montreal (3.6%), Tokyo (3%), and London (2.7%).

The full database is available via the link.

Sensor Tower: The Japanese mobile gaming market declined in H1'24

Sensor Tower only considers Gross IAP revenue.

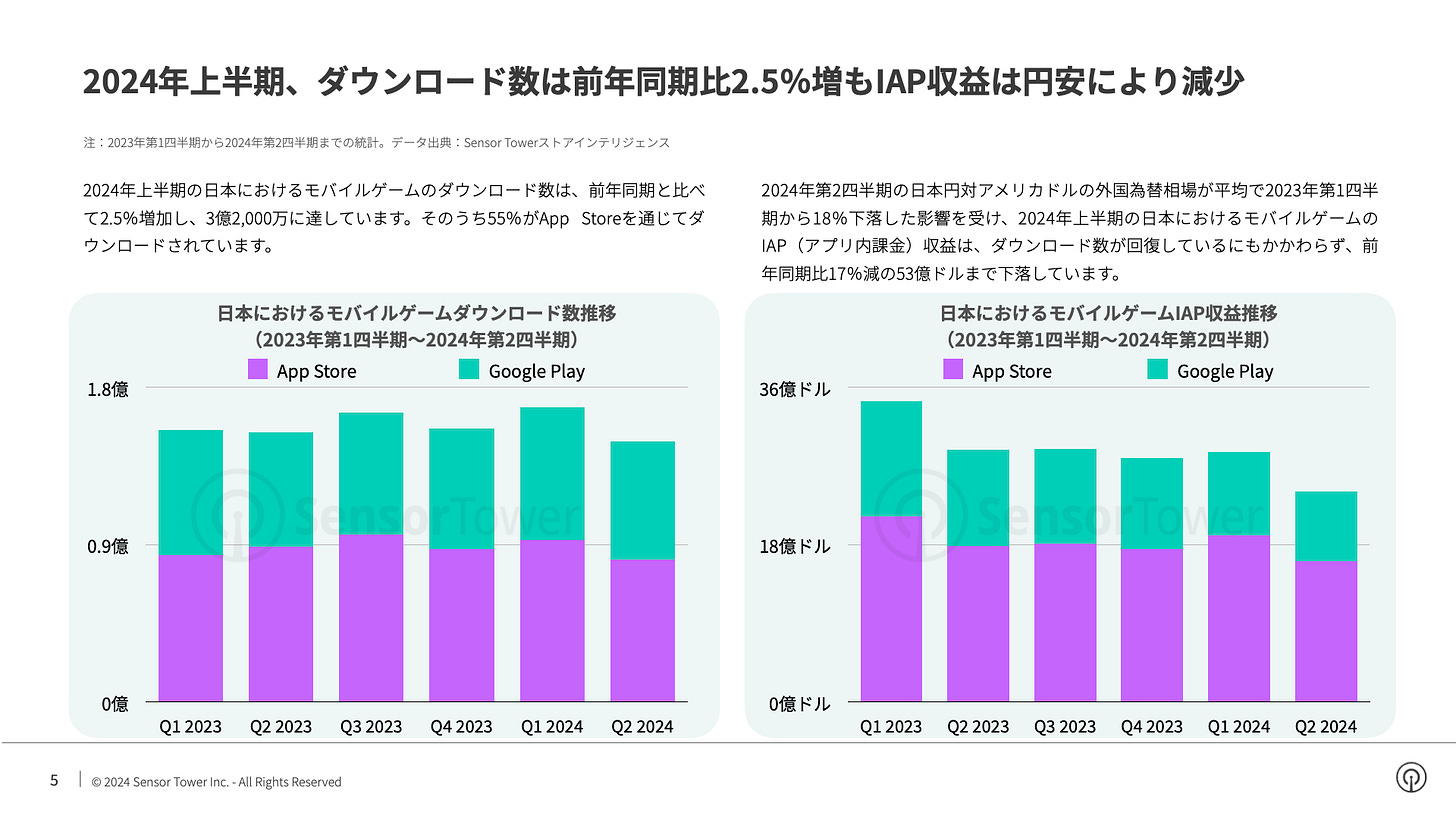

Revenue from the Japanese market in dollar terms dropped by 17% in the first half of 2024, down to $5.3 billion. The wakened yen caused this.

Game downloads in the first half of 2024 increased by 2.5%, reaching 320 million. 55% of the installs came from the App Store.

The biggest mobile games in Japan from January to July this year were Monster Strike (over $290 million in revenue during the period; cumulative revenue over 11 years – more than $11 billion), Umamusume: Pretty Derby, and Puzzle & Dragons.

There is one newcomer in the chart – Legend of Mushroom, which earned over $100 million in the 4 months after its release. At the end of May, Bandai Namco Entertainment also launched The Idolmaster Gakuen, which topped the monthly ranking. However, the project has not yet entered the top 10.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Bandai Namco Entertainment became the most successful mobile publisher in Japan. Its revenue grew by 3.5% in the half-year to $390 million. Outside its home country, the company earned $270 million over the same period. Konami ranks second in revenue, and mixi is third.

Dragon Quest is the most popular IP in the mobile market. Games from this franchise earned $170 million in the first half of the year. However, when it comes to individual games, the leader is Umamusume: Pretty Derby (over $160 million in revenue; total project revenue is nearing $2.5 billion).

Japan accounts for 49% of all revenue from 3D anime games.