Weekly Gaming Reports Recap: September 8 - September 12 (2025)

Two big reports of the week - Newzoo released their annual State of the Market & Moloco shared the report for the Mobile market state in 2025.

Reports of the week:

Games & Numbers (August 27 – September 9, 2025)

Newzoo: The Games Market in 2025

GameDiscoverCo: Top releases of August 2025 on PC and consoles

Moloco: Mobile Games in 2025

Games & Numbers (August 27 – September 9, 2025)

PC/Console Games

Void Interactive reported that Ready or Not on consoles surpassed 3 million copies sold. Total sales of the project have reached 13 million.

In the past six months, Cyberpunk 2077, with the Phantom Liberty expansion, brought CDPR $72.2M. Over the same period, The Witcher 3, with its expansions, generated $17.1M. Both projects grew 2% YoY in revenue.

Gears of War: Reloaded also sold more than 1 million copies. The series debuted on PlayStation consoles for the first time.

In its first month and a half, The King is Watching sold 300,000 copies.

According to Alinea Analytics, in the first couple of weeks after release, Black Myth: Wukong sold around 100,000 copies on Xbox. A relatively small number, considering total sales exceeded 25 million.

Hollow Knight: Silksong entered Steam’s top-20 games by CCU. The peak CCU reached a little over 587,000 players. In 2025, only Monster Hunter Wilds had more.

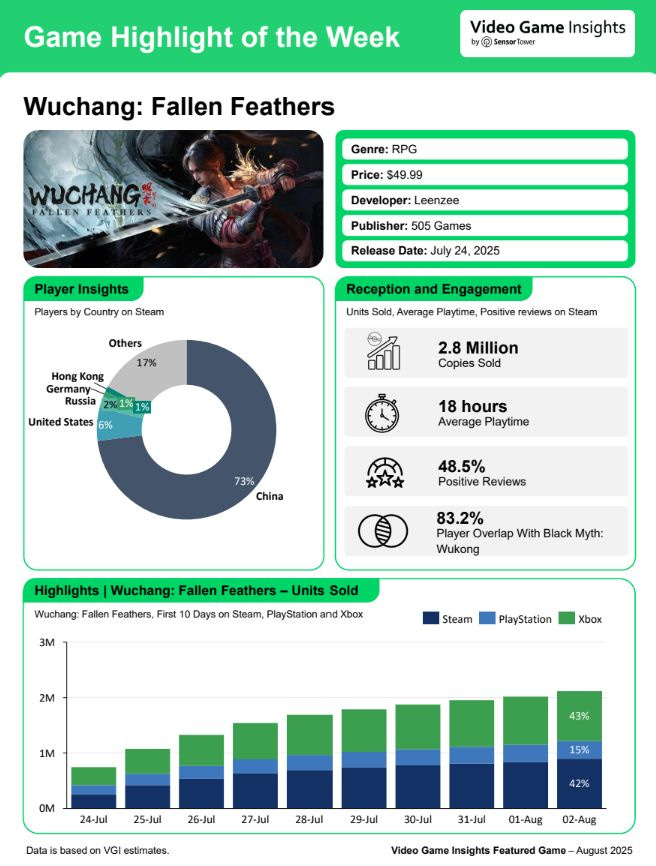

According to VG Insights, Wuchang: Fallen Feathers reached 2.8 million players in its first month. These are not sales, since the game has been available in Xbox Game Pass since day one.

Heroes of Might & Magic: Olden Era was added to over 750,000 wishlists. The game is scheduled for release this year.

The developers of Of Ash and Steel, inspired by “Gothic,” reported reaching 200,000 wishlists.

Mobile Games

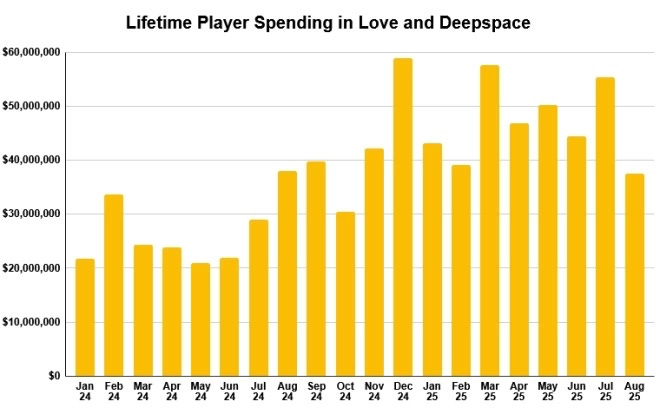

Revenue of Love and Deepspace on App Store and Google Play passed $750M (Gross). It took the game 19 months to hit this milestone. According to AppMagic, the project ranked second in revenue among new mobile releases of 2024, making over $400M in its first year. Only Dungeon & Fighter: Mobile made more.

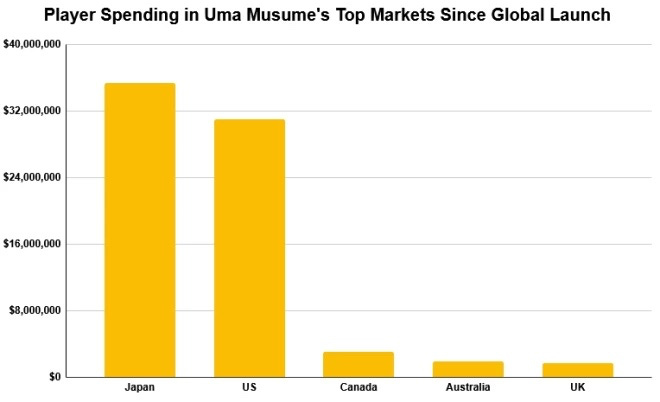

Uma Musume: Pretty Derby made $46.8M from international markets in its first two months. That’s 57% of the project’s total revenue. Japan remains the main market, but in the past two months, the U.S. has been catching up quickly.

According to Sensor Tower, Shadowverse: Worlds Beyond earned over $30M in its first month on App Store and Google Play. 90% of revenue came from Japan. The game was downloaded 1.2 million times in its first month.

Game of Thrones: Legends earned $24M in its first year. The first million was reached within 14 days.

Destiny: Rising was downloaded more than 1 million times on the App Store in its first 6 days. The game launched on August 28, 2025.

Publisher FreePlay announced that the total download count across its portfolio reached 2 billion.

UGC

Roblox set a new CCU peak record with 47.4 million players. The platform has a new hit — Steal a Brainrot.

Conferences

Gamescom 2025 reached 357,000 attendees from 128 countries. However, organizers count each daily ticket activation as one attendee, so the actual number of unique visitors is lower.

Newzoo: The Games Market in 2025

Newzoo has released its key report covering the numbers, trends, and results of 2025. The report will be updated as new data arrives.

The report does not include the hardware sales.

Overall Market State – Revenue

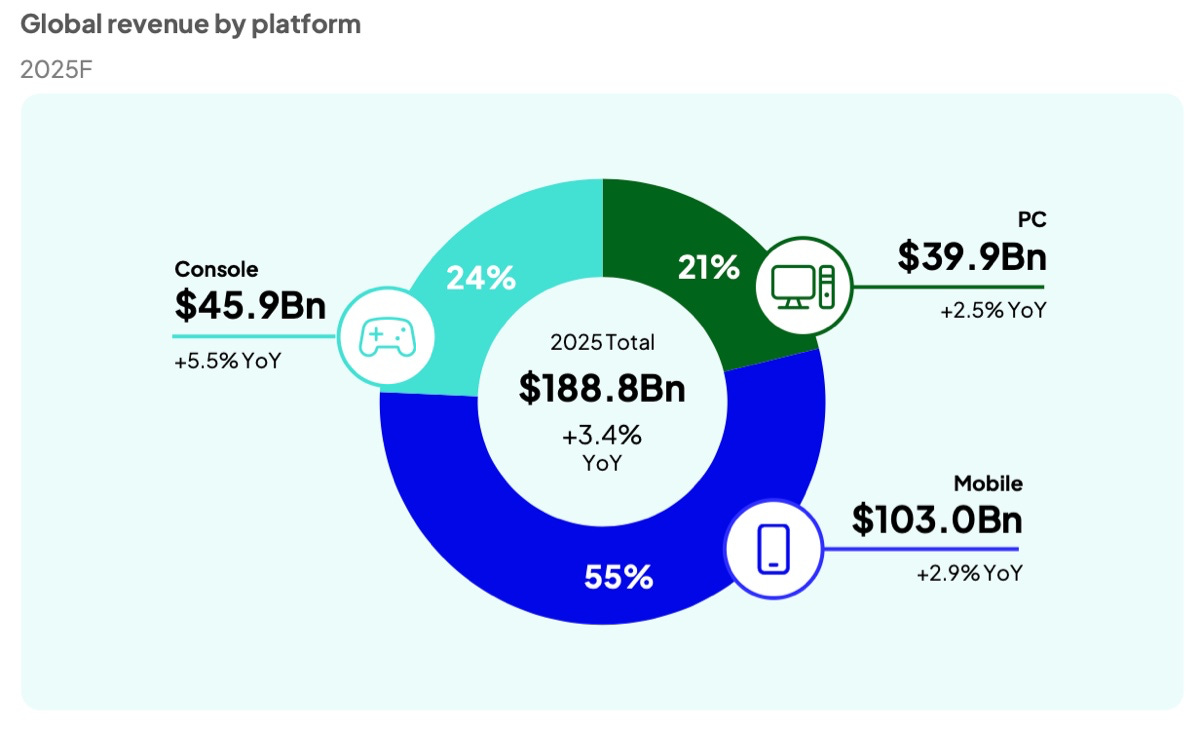

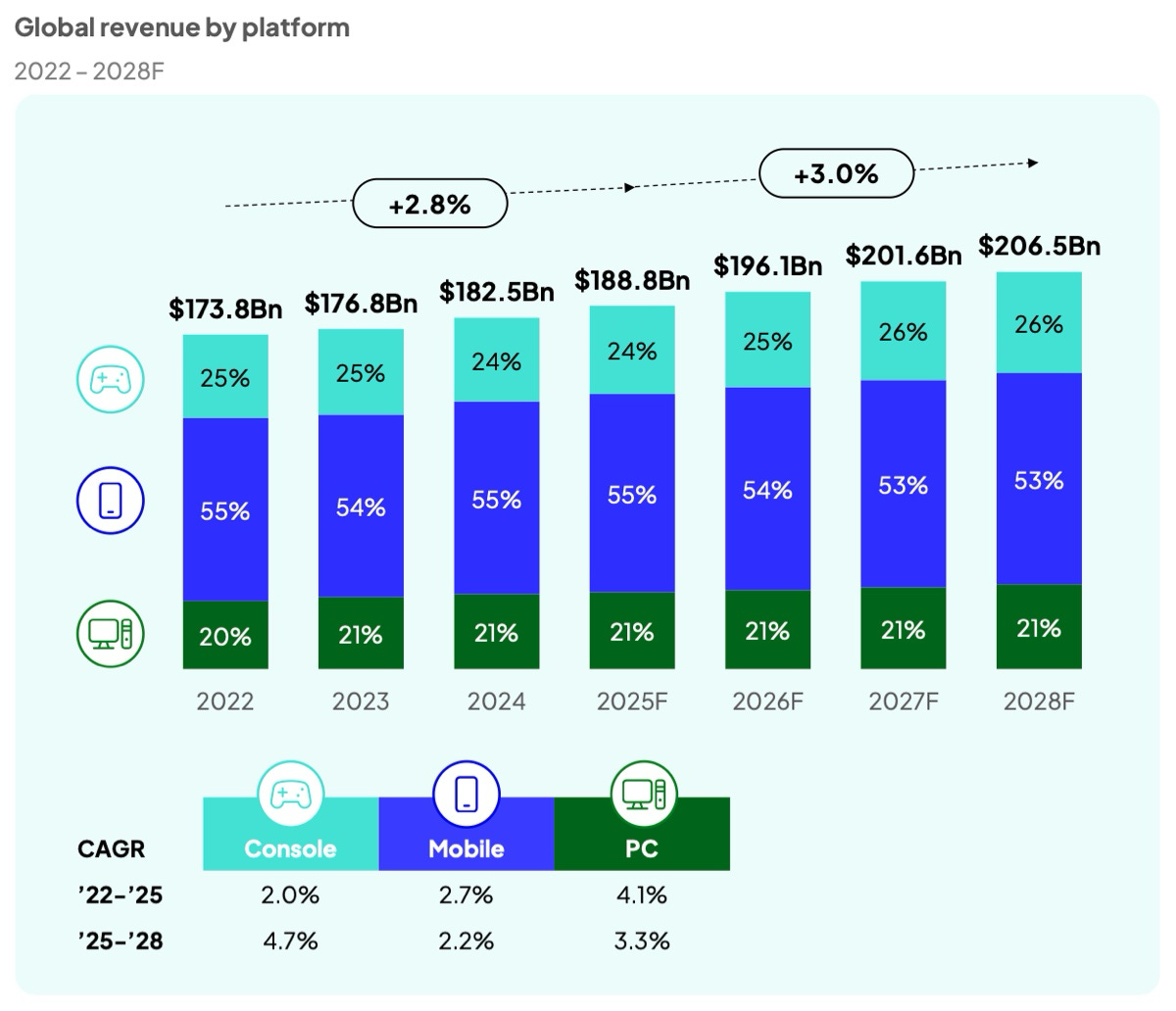

Total games market revenue in 2025 will reach $188.8 billion, which is +3.4% compared to 2024.

The console segment is projected to grow the fastest, with +5.5% YoY to $45.9 billion. Newzoo attributes the growth to the launch of Nintendo Switch 2 and a general rise in prices.

Sports games continue to grow and make strong revenue on consoles. By the end of 2025, Newzoo forecasts $10.6 billion in revenue (console-only) with YoY growth of +3.5%.

The mobile market will increase by +2.9% and hit $103 billion.

Newzoo points out that the mobile market is undergoing structural changes. D2C payments are reshaping revenue composition for devs and publishers, but not driving overall segment growth.

Roblox continues strong growth on mobile.

RPGs, one of the largest mobile genres, are struggling. In 2025, the genre will generate $18.7 billion, down –14.7% YoY.

PC market revenue will reach $39.9 billion (+2.5% YoY). Growth is seen in both player numbers and revenue in China (+3.1% YoY) and Japan.

❗️Steam Deck and other handhelds are counted as part of the PC segment in Newzoo’s classification.

Part of PC market growth comes from stronger releases in H1’25 vs last year — Monster Hunter Wilds, Kingdom Come: Deliverance II, Assassin’s Creed Shadows. 2024 hits like Palworld and Helldivers 2 also add to the pool.

Newzoo notes that PC shooters will bring in $9 billion in 2025. That’s –5% YoY.

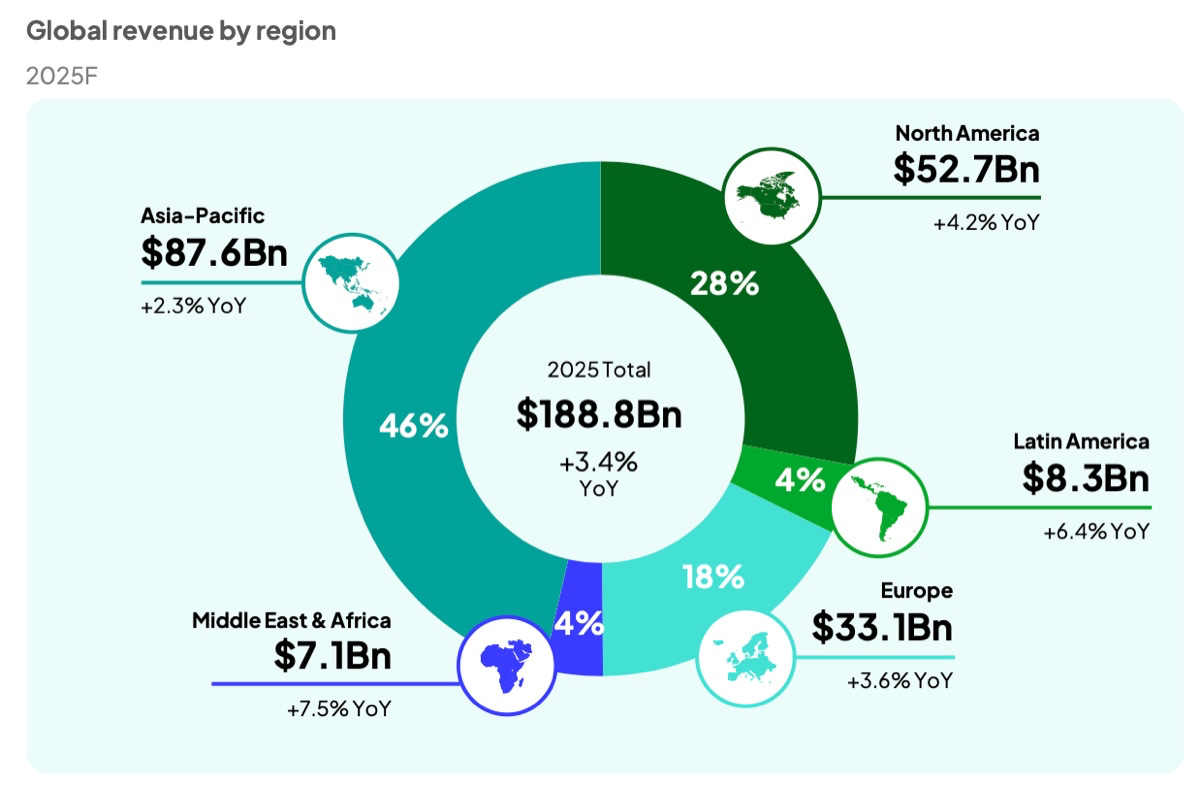

46% of global revenue comes from the Asia-Pacific region ($87.6 billion). But the fastest growing region is MENA, expected to hit $7.1 billion in 2025 with YoY growth of +7.5%.

Overall Market State - Players

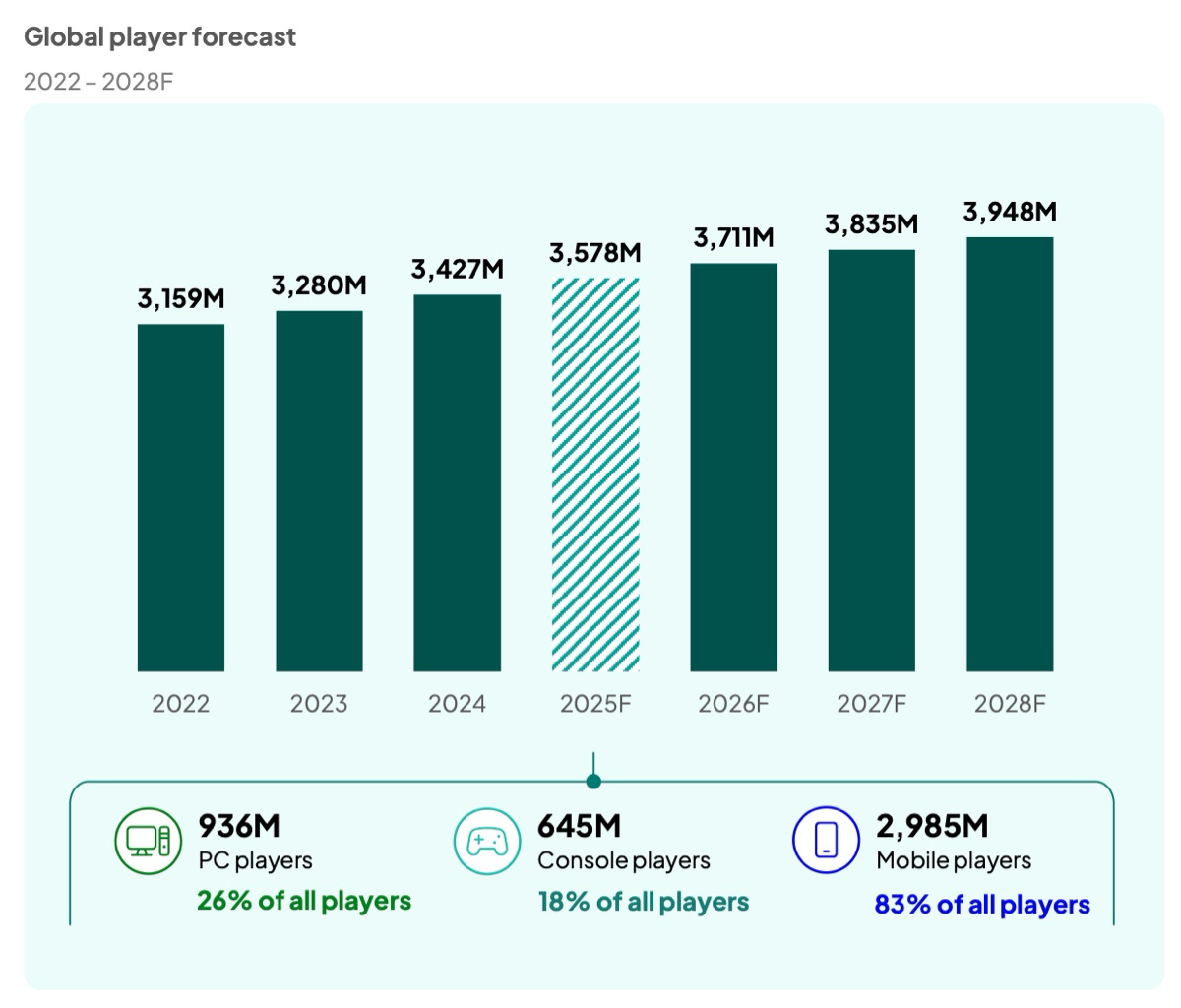

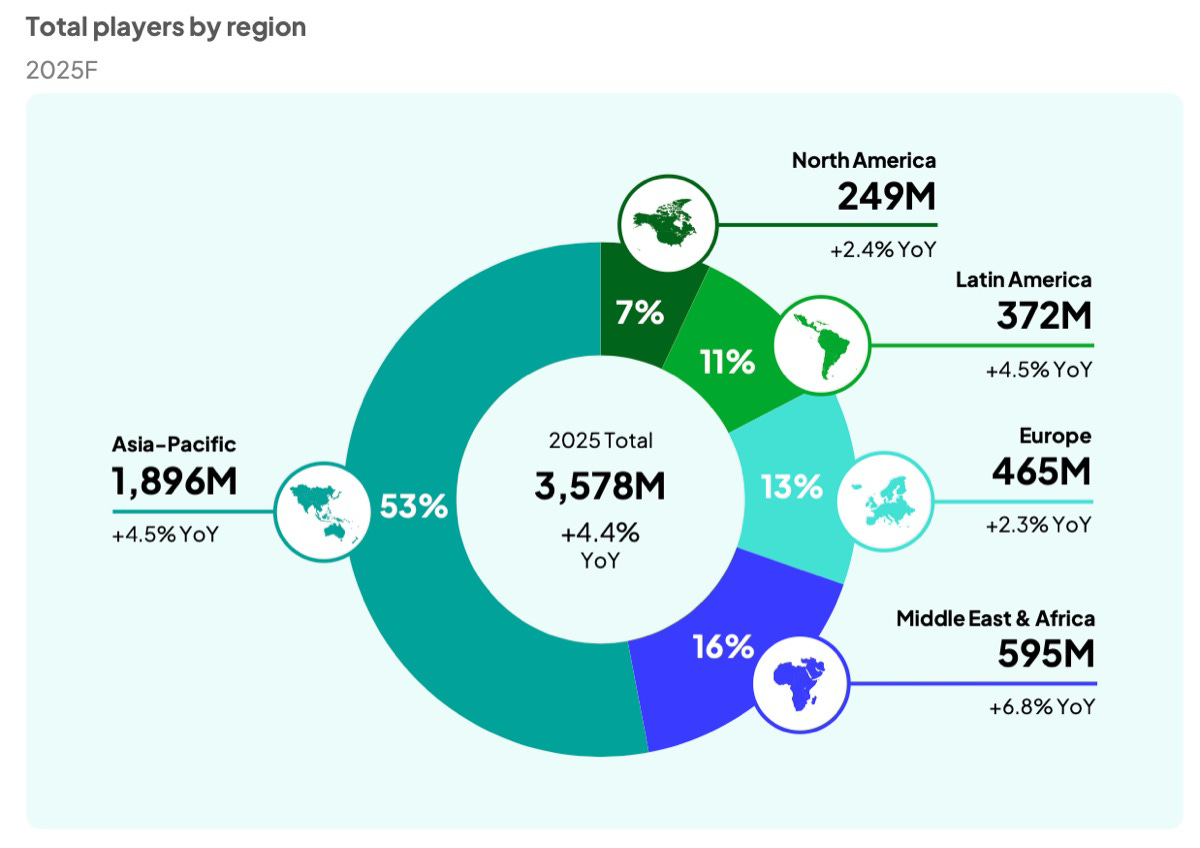

Global players in 2025 will reach 3.578 billion (+4.4% YoY), or 61.5% of the world’s population. By 2028, Newzoo expects this number to approach 4 billion.

The number of Mobile players is expected to reach 2,985 billion (+4.5% YoY); PC players: 936 million (+3.1% YoY); Console players: 645 million (+2.5% YoY).

Mobile player numbers are rising in Canada, much of Europe, and Oceania. Newzoo points to two interconnected trends: first, iOS is losing share in both emerging and developed markets (including the US); second, Chinese smartphone makers (Xiaomi, Realme) are rapidly expanding across Europe, MENA, and Southeast Asia.

53% of all players are in Asia-Pacific. Fastest growth comes from MENA (+6.8% YoY). Latin America’s growth is mainly driven by mobile and PC.

Gen Alpha players (born after 2010) are becoming a larger share, especially on PC.

Steam continues to grow faster than the overall PC player base.

1.6 billion people (+4.9% YoY) spent money in or on games in 2025. That’s 44% of all players.

The paying player base is growing faster than the overall player base. The average annual spend per payer is $119.7 across all games.

Impact of Release Dates, Early Access, release tactics

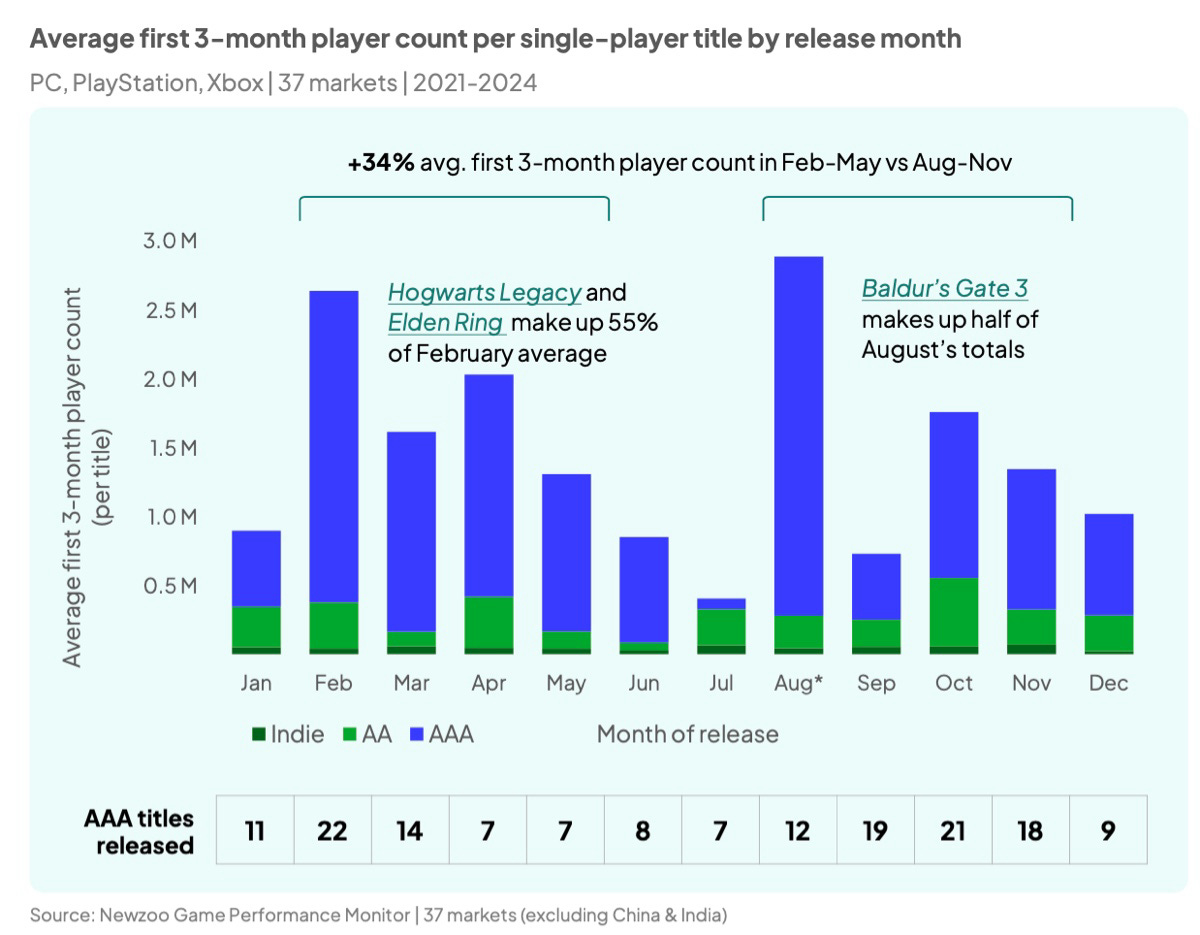

Newzoo analyzed single-player launches from Jan 2021 – Dec 2024. A launch counts as first release on any platform. Titles launched on Xbox Game Pass within 3 months of release were excluded. Pricing categories: indie ($30 or less), AA ($31–50), AAA ($51+).

Success was measured as the average number of players in the first 3 months post-launch.

Traditional AAA release windows are February–March and September–November, these months have the highest release density.

Interestingly, Feb–Mar releases averaged 34% more players than Aug–Nov ones.

Exceptions skew Baldur’s Gate 3 accounted for over half of the Aug AAA average. Without it, August drops to October’s level.

Similarly in February, Elden Ring and Hogwarts Legacy made up 55% of total engagement. Without them, February numbers fall in line with May.

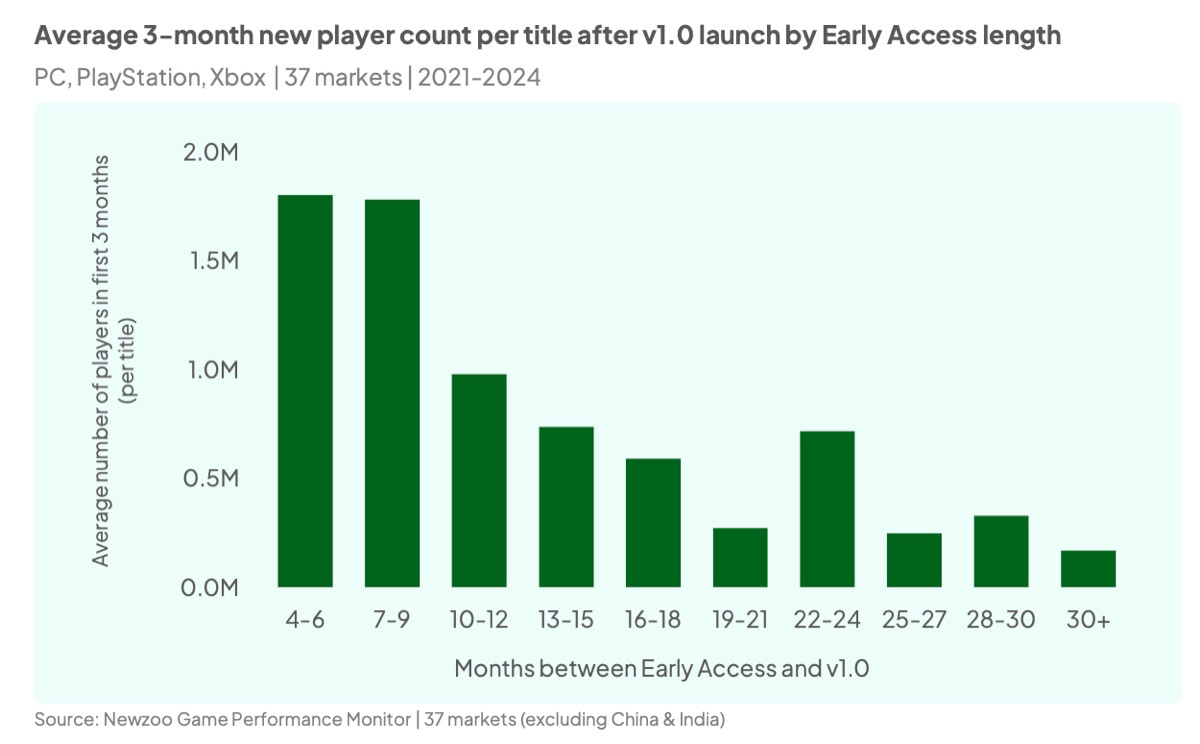

Early Access in Steam works best if limited to about 6 months. Longer Early Access runs saw weaker 3-month post-launch player counts, likely because the audience had already played enough.

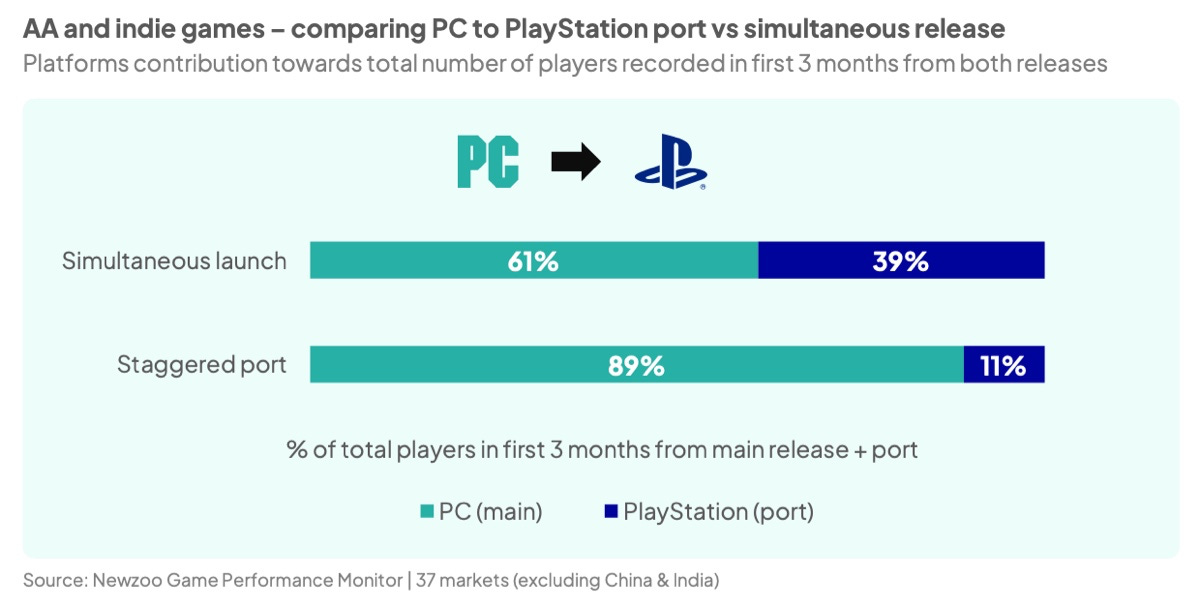

Newzoo compared simultaneous multi-platform launches with staggered ones (indie & AA in this case).

When launched simultaneously, PC made up 61% of the audience in the first 3 months. If console releases were delayed, PC’s share jumped to 89%. Console players generally show less interest in late-arriving projects.

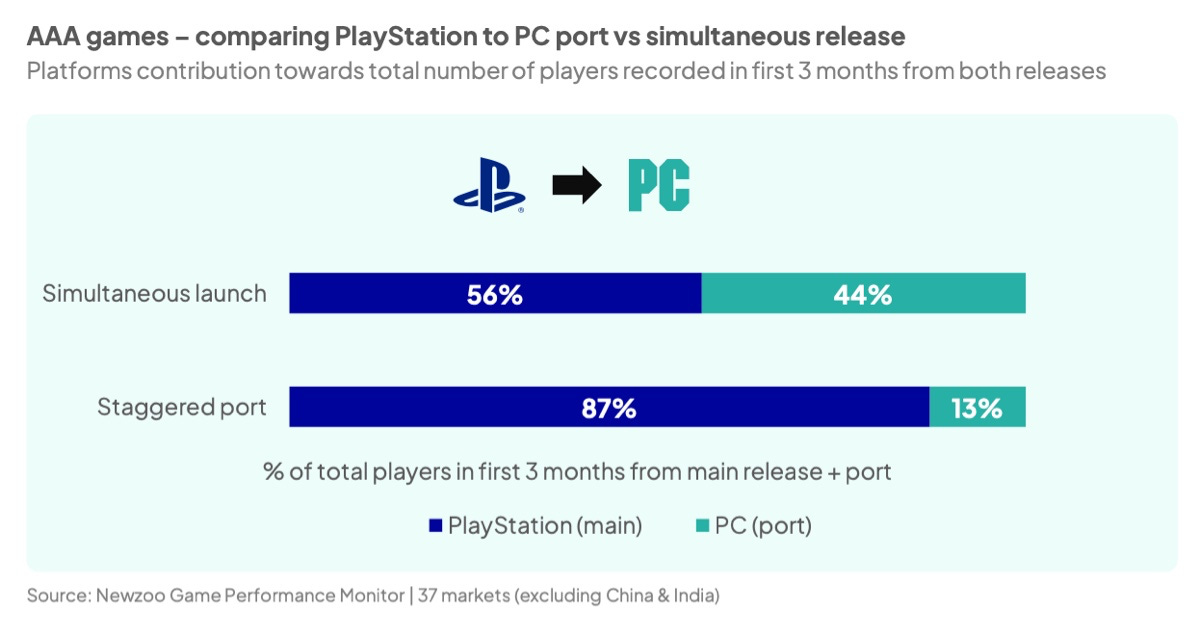

The reverse also applies: for PS games ported to PC. If simultaneous, 56% of the audience is on PlayStation. If PC is delayed, 87% of the audience stays on consoles. This covers AAA games (as they’re typically moving from PlayStation to PC).

❗️Newzoo covers only PC and PlayStation cases, since most Xbox releases launch on PC day-one, leaving too small a sample.

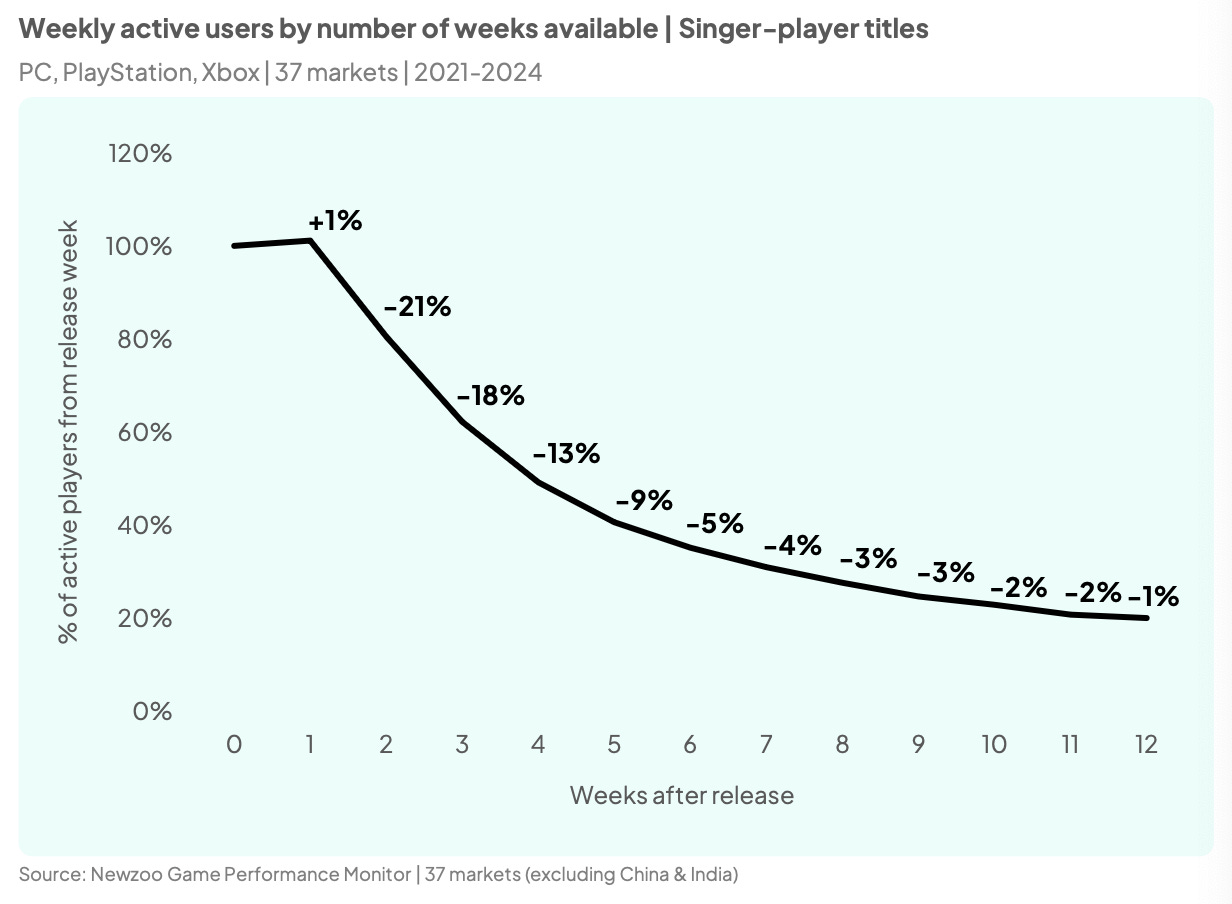

Player interest in new single-player games typically lasts 1–2 weeks. After that, engagement drops sharply (around –60% by week 5). Post week 12, retention declines at –1% per week. Metrics are based on % of active launch-week audience remaining.

GameDiscoverCo: Top releases of August 2025 on PC and consoles

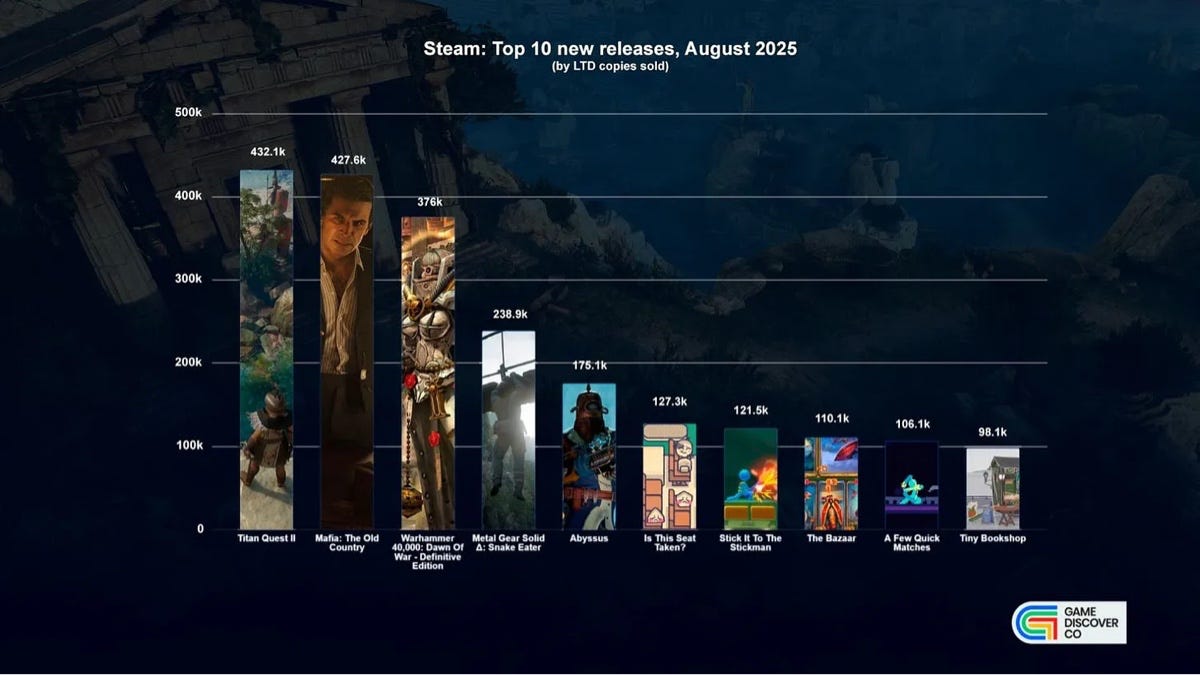

Top new releases on Steam - copies sold

Titan Quest II (432.1K copies), Mafia: The Old Country (427.5K copies), and Warhammer 40k: Dawn of War - Definitive Edition (376K copies) were the leaders in Steam sales by copies in August.

On consoles, Mafia: The Old Country sold over 700K copies. Apparently, players feel this is the kind of game best experienced on the big screen.

Metal Gear Solid Delta: Snake Eater launched on Steam with 238.9K copies sold. But it had only 5 days in August.

Interestingly, two games from the Stickman universe (if you can call it that) made it into the top 10 by units sold in August: Stick It To The Stickman (121.5K copies) and A Few Quick Matches (106.1K copies). Both are budget projects, of course, but the story is notable.

Top new releases on Steam - Gross revenue

Unsurprisingly, the expensive projects (Mafia: The Old Country - $18.8M Gross Revenue; Metal Gear Solid Delta: Snake Eater - $14.9M Gross Revenue) and Titan Quest II ($9.4M Gross Revenue) took the top spots.

Interestingly, as GameDiscoverCo points out, Gears of War Reloaded did not make the Steam top 10 in August. The updated version was sold only 55K times, hurt by the lack of split-screen and the earlier availability of remasters.

Top Steam games in August - copies sold

F2P releases are not counted.

Peak continues to sell amazingly well. In August alone, it sold 3.7M copies. Mage Arena is also showing great results with 1.2M copies sold.

Thanks to a 65% discount, many people (830.8K) bought Cyberpunk 2077. Helldivers II also saw sales growth thanks to a Halo ODST collab.

Battlefield 6 was pre-ordered 751.6K times in August. Meanwhile, Battlefield 2042 was bought 775K times, and the 95% discount did the trick.

Top Steam games in August - Gross revenue

GameDiscoverCo includes F2P project revenue in this chart.

Counter-Strike 2 ($154.8M revenue) was the absolute leader in August (and not only August).

PUBG: Battlegrounds is also doing well ($56.7M). EA already made $52.6M on pre-orders for Battlefield 6.

Marvel Rivals kept its top-5 position, earning $22.5M in August.

The mobile game Uma Musume: Pretty Derby made it to 10th place on Steam in August, earning $13.6M.

Top new releases on PlayStation and Xbox in August

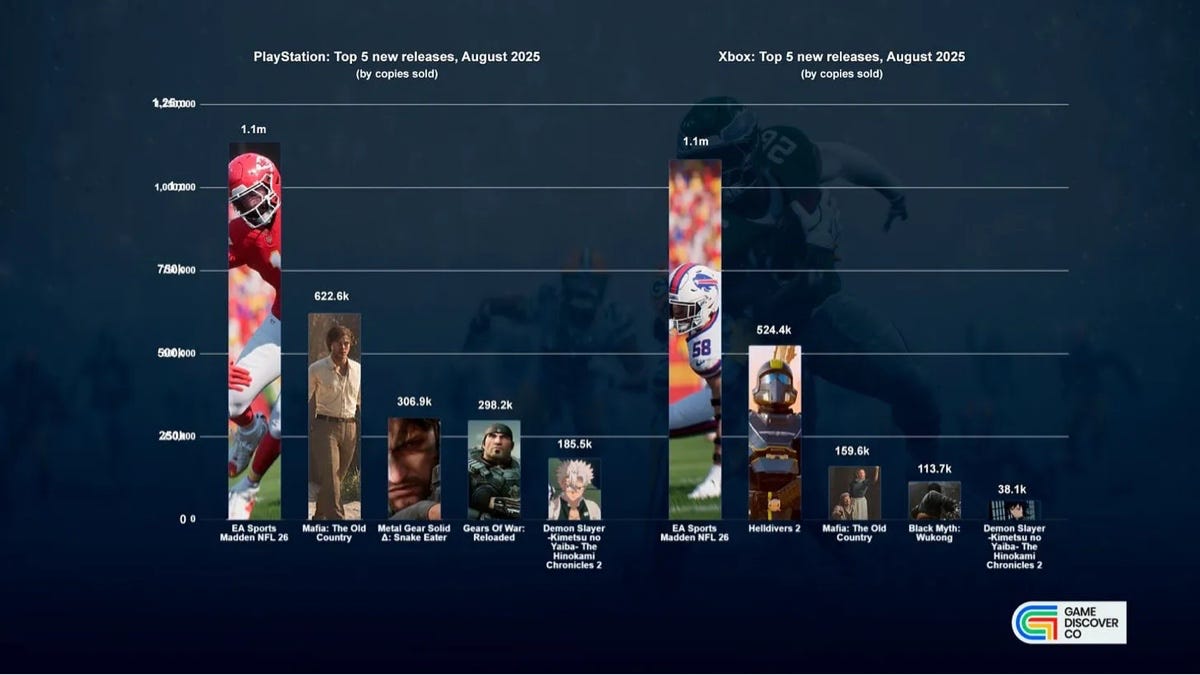

EA’s Madden NFL 26 sold 1.1M copies on each console—the biggest August release. 95% of all sales came from the U.S.

On PlayStation, Gears of War Reloaded arrived and sold almost 300K copies in August. On Xbox, Helldivers II launched and gained over half a million new players.

Moloco: Mobile Games in 2025

Sample: 100 top-grossing publishers, accounting for about 50% of global IAP revenue. The company collected data over 24 months, tracked 4 billion installs, 65 million purchase events, and $8 billion in IAP revenue.

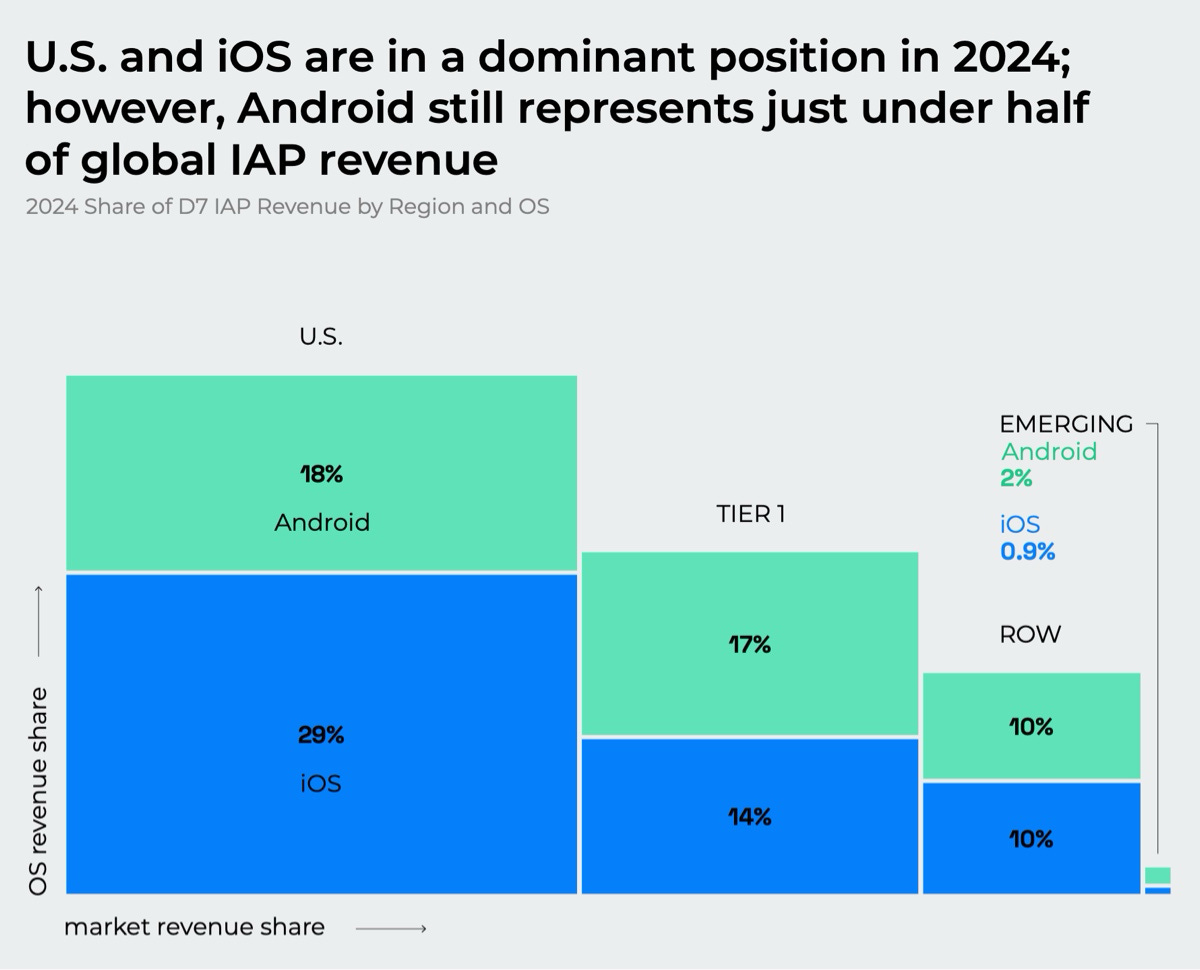

The US accounts for 45% of global mobile IAP revenue. In Tier-1, Moloco included countries with a high number of payers and high ARPPU (Japan, South Korea, Germany, etc.), making up 32% of the global IAP market. Emerging markets, with high downloads but low payer counts and ARPPU (India, Brazil, Mexico), account for 3%. Finally, the Rest of World category makes up about 19% of the volume.

Mobile Market Overview

Moloco data is based on the top-100 gaming advertisers on Moloco. Companies not using the channel are excluded.

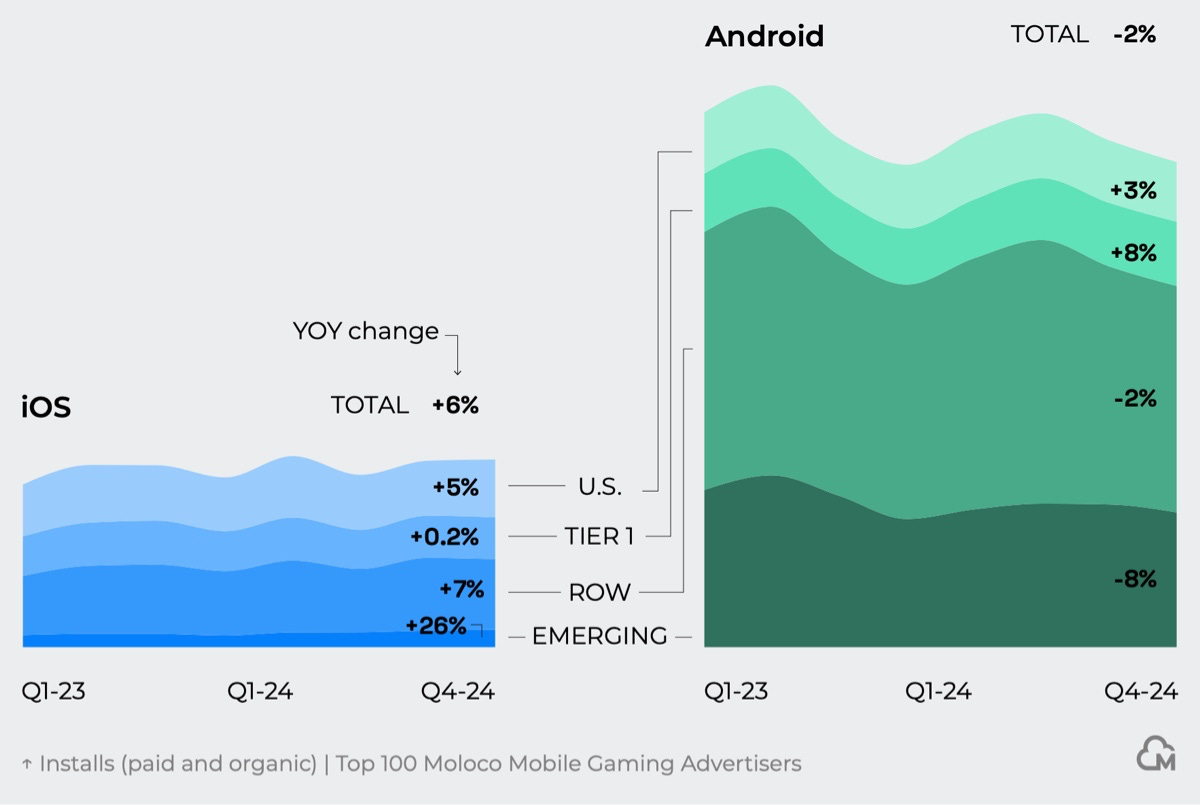

iOS downloads of the top-100 gaming companies spending on Moloco grew by 6% YoY. The strongest growth was in emerging markets (+26%). RoW countries grew by 7% YoY, and the US by 5% YoY. Tier-1 markets showed the weakest dynamics (+0.2% YoY). These numbers differ from overall industry download trends.

On Android, downloads dropped by 2% overall, mostly due to emerging markets (-8% YoY). Tier-1 countries grew by 8%, and the US by 3%.

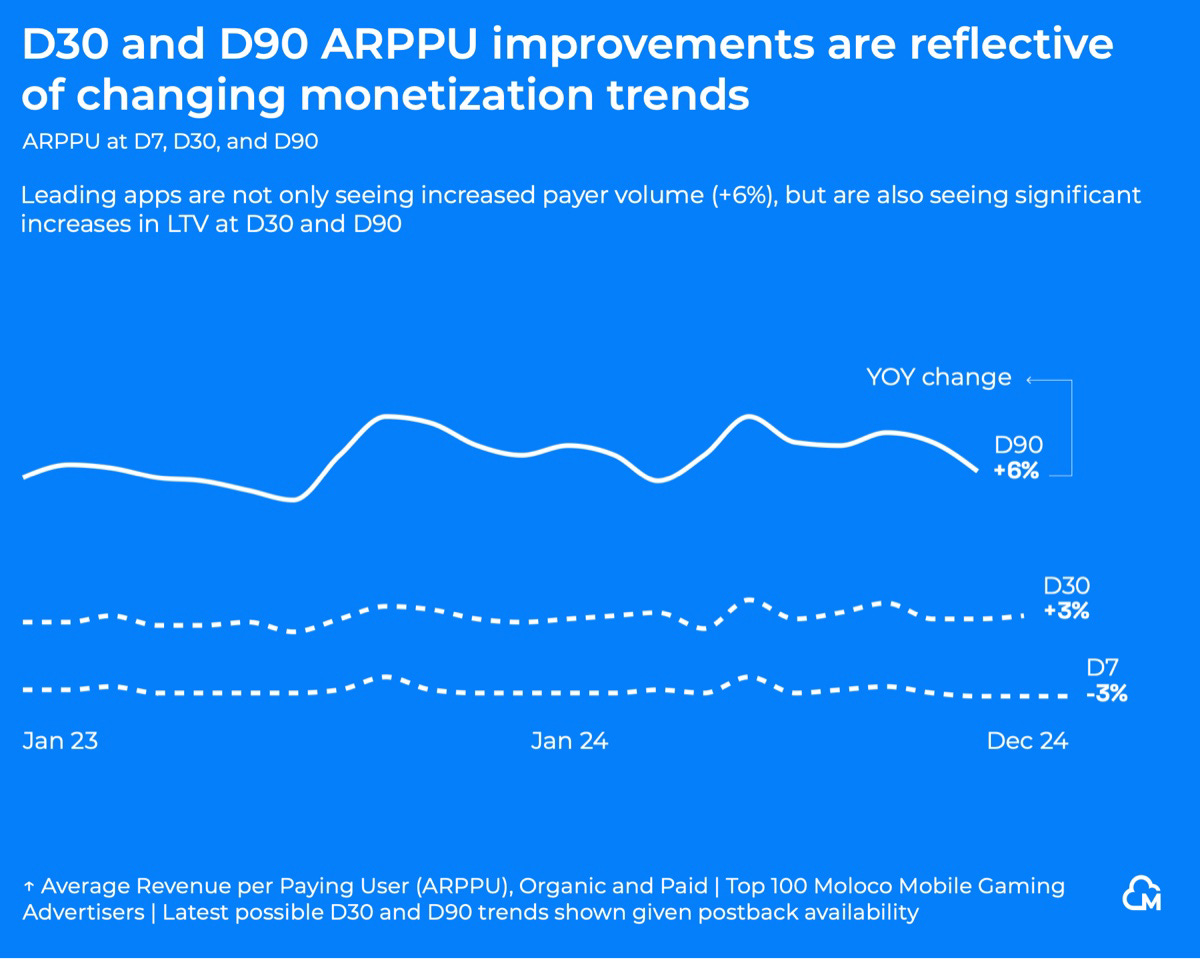

D7 ARPPU fell 3% YoY in 2024. But D30 ARPPU rose 3% YoY, while D90 ARPPU jumped 6%.

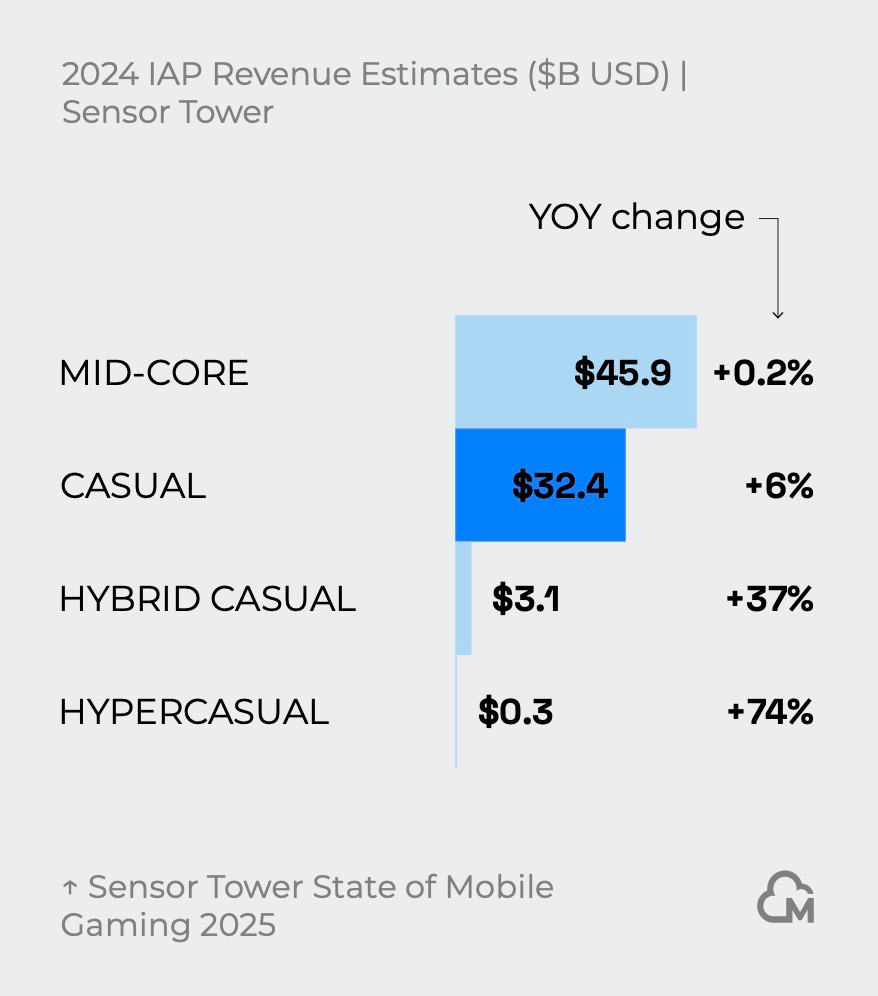

According to Sensor Tower 2024, midcore games remain the largest IAP segment ($45.9B revenue, +0.2% YoY). Casual games grew strongly ($32.4B, +6%), while hybrid-casual showed explosive growth ($3.1B, +37% YoY).

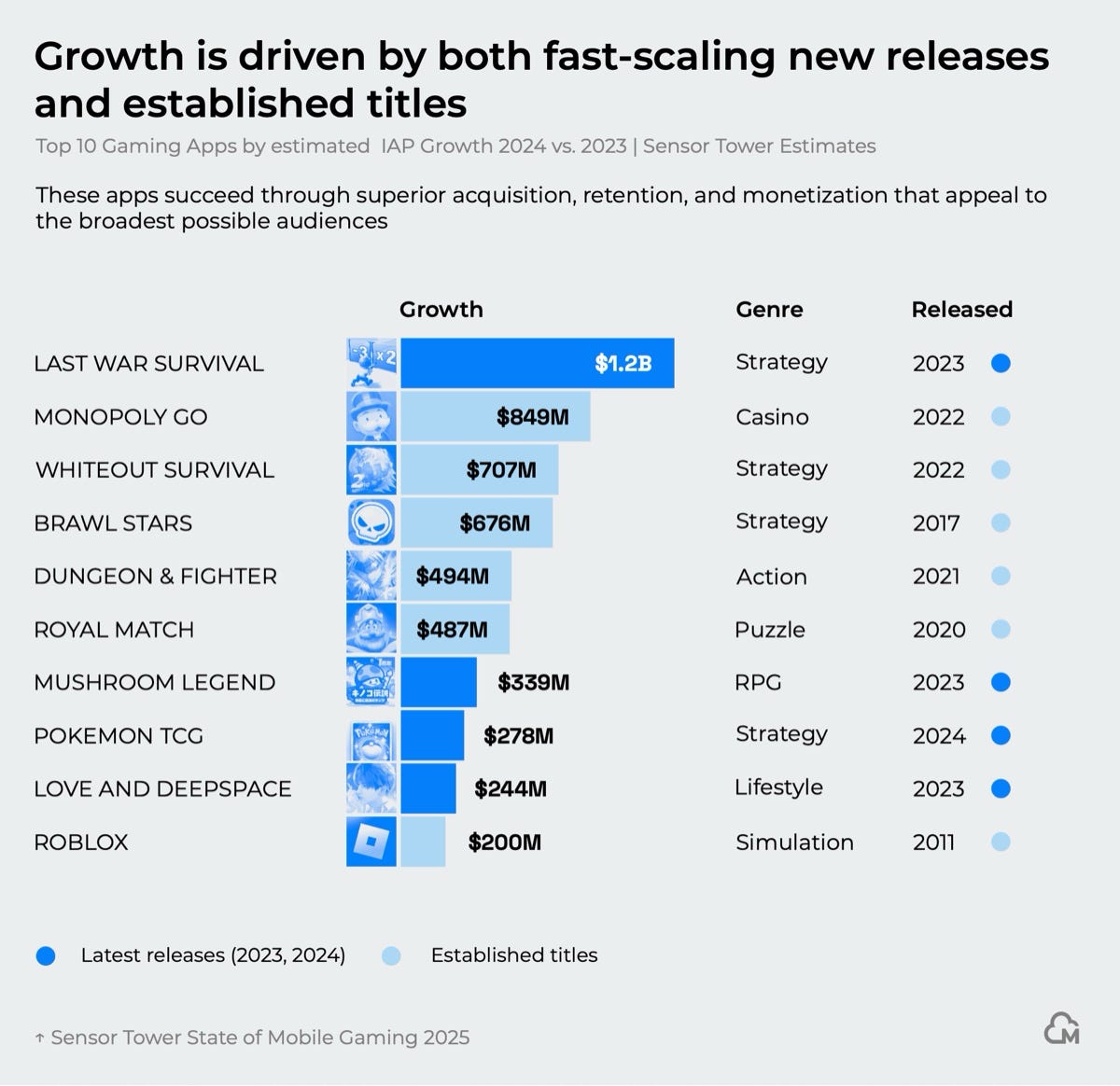

The strongest revenue growth in 2024 came both from new launches (Last War Survival, Mushroom Legend, Pokemon TCG, Love and Deepspace) and established hits (Monopoly Go, Whiteout Survival, Brawl Stars, Dungeon & Fighter, Royal Match, Roblox).

Paying User Behavior

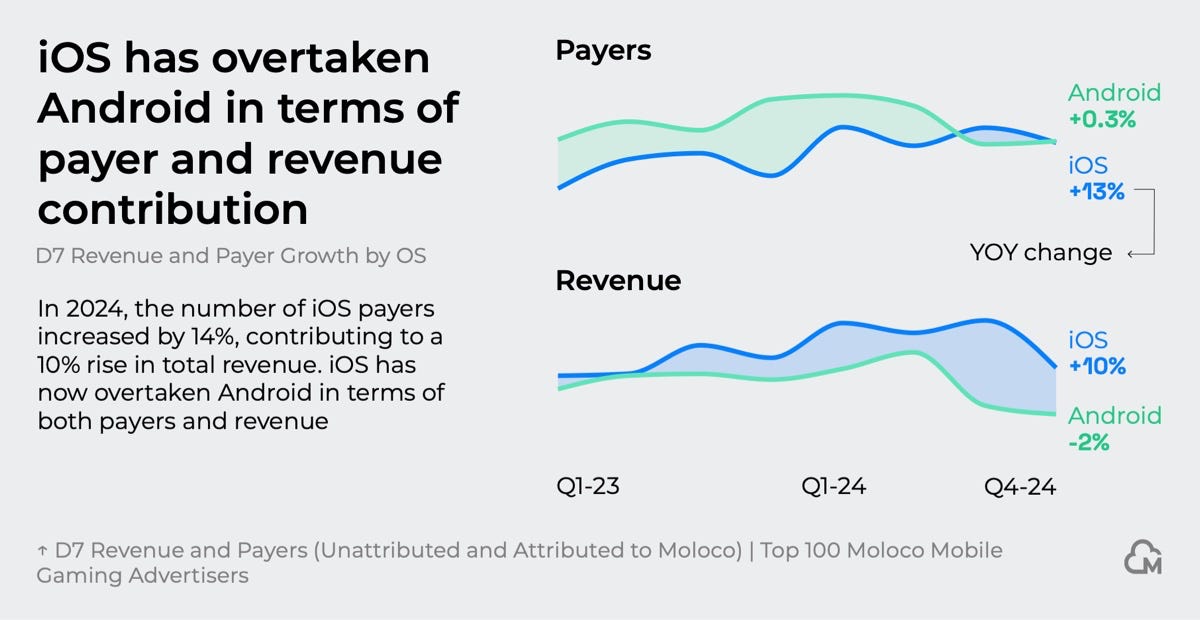

The number of paying iOS users grew by 13% in 2024, surpassing Android (which saw a slight +0.3% increase YoY).

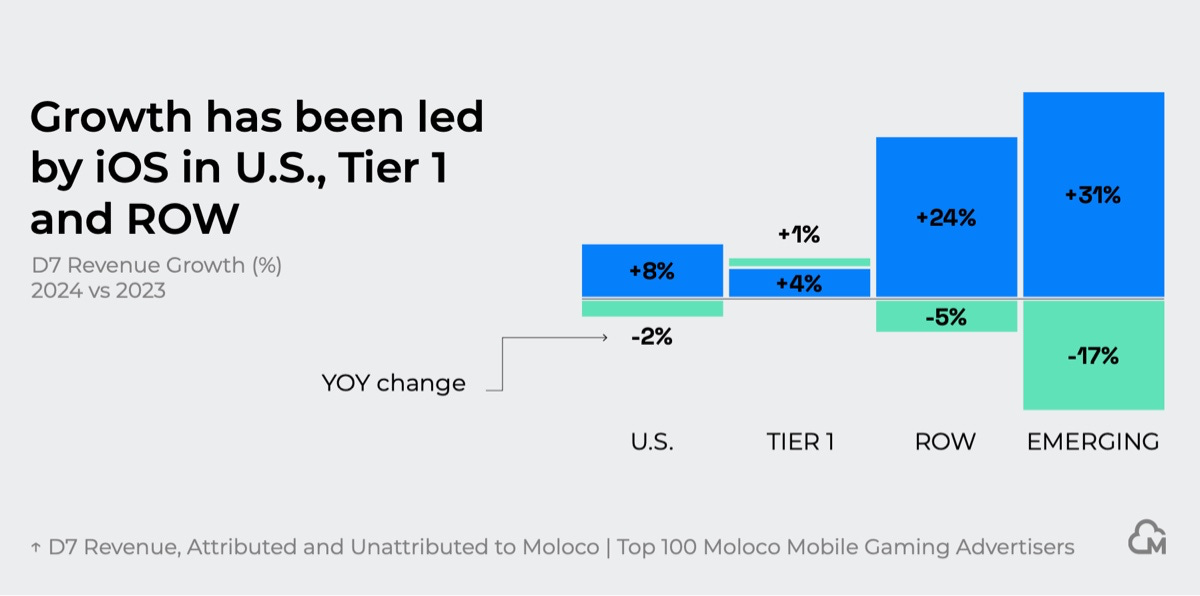

iOS growth was driven mainly by the US (+11% YoY) and RoW countries (+19% YoY). Emerging markets grew 39% in payers, but their revenue share remains small.

In revenue, iOS has long outperformed Android. In 2024, Apple’s platform grew by 10%, while Android slipped 2%.

User Acquisition

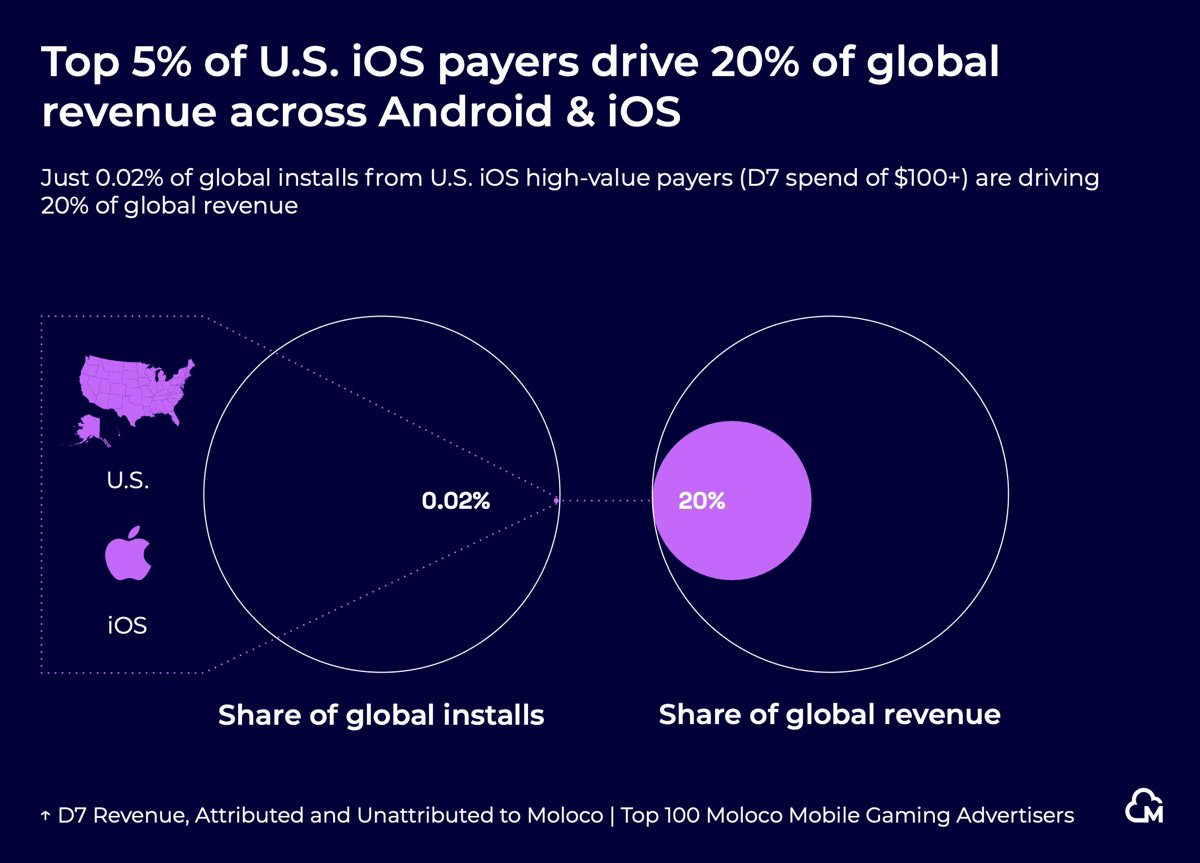

The top 5% of iOS users in the US generate 20% of the entire gaming IAP market. They represent just 0.02% of total installs in the country. These users typically spend over $100 by D7.

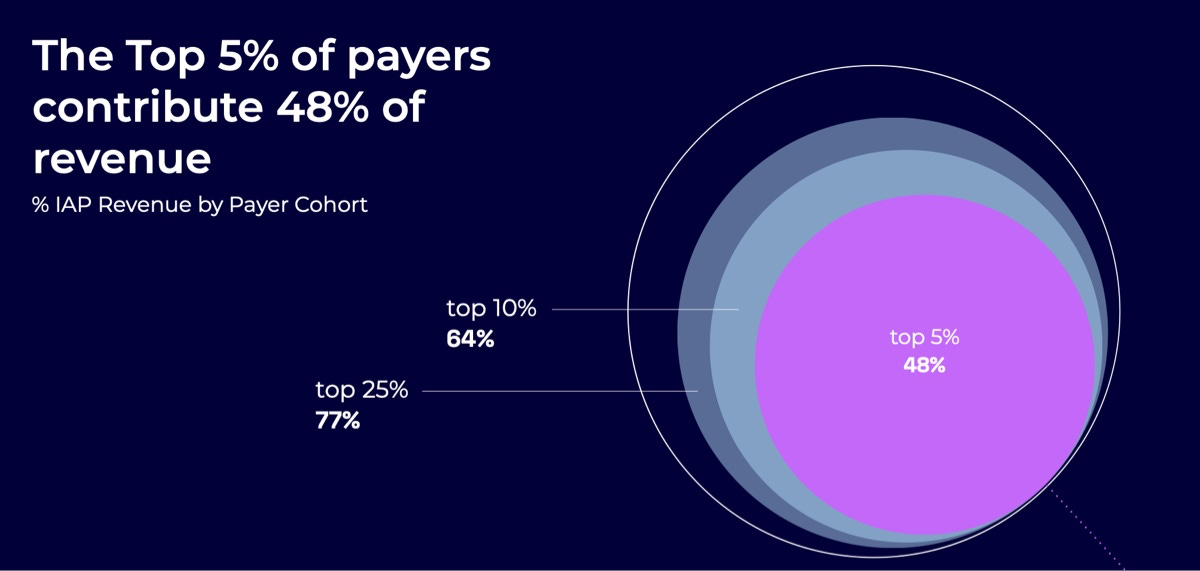

Globally, the top 5% of players generate 48% of total IAP revenue. The top 10% account for 64%, and the top 25% for 77%.

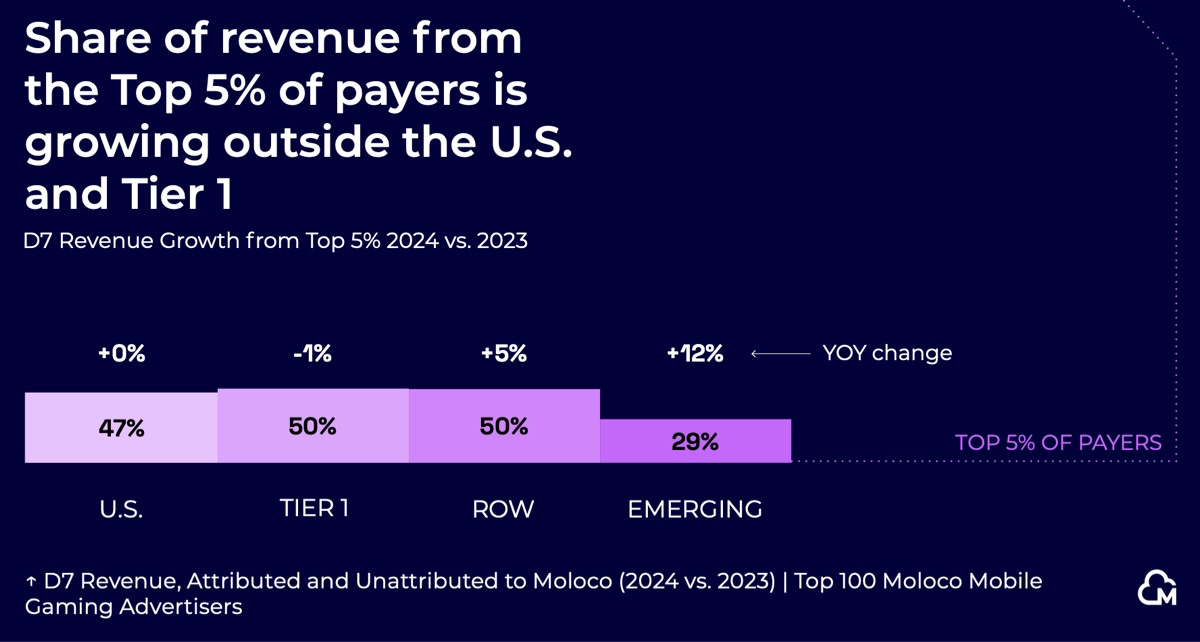

The share of “whales” in global revenue is growing, especially in emerging markets (+12% YoY) and RoW regions (+5% YoY).

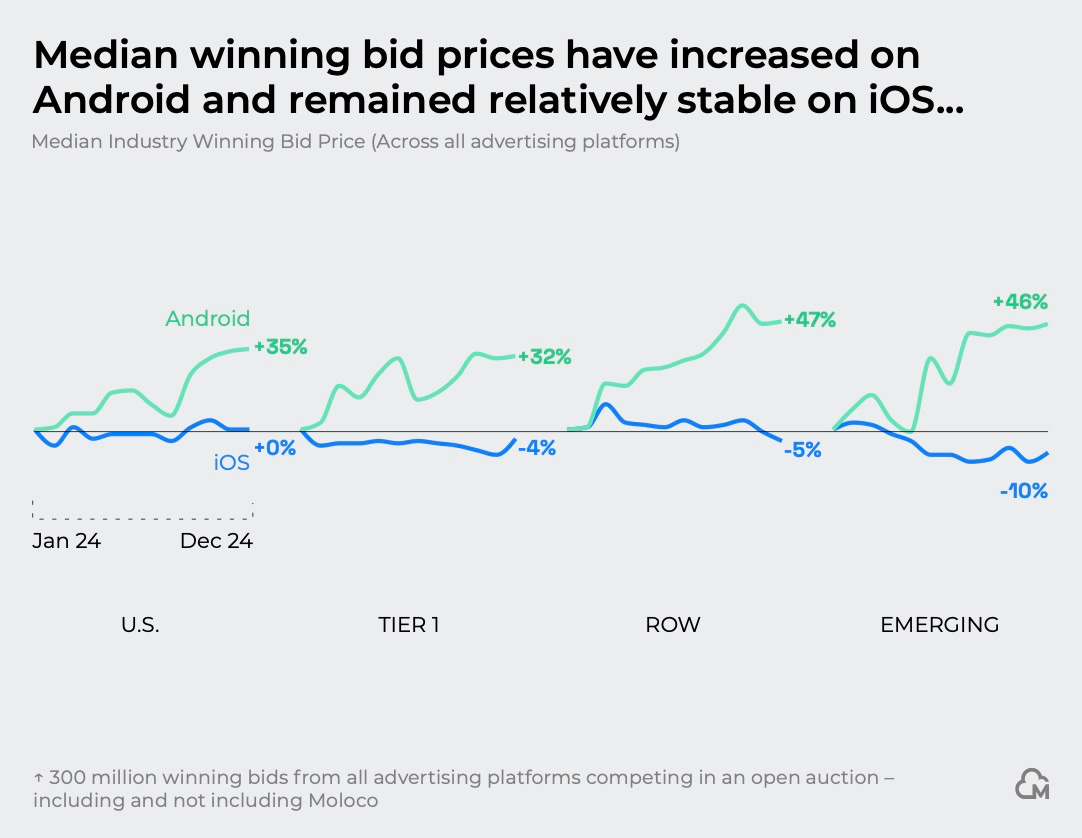

Auction competition on Android rose sharply in 2024. Median winning bids in Tier-1 increased 32%, and as much as 47% in RoW regions.

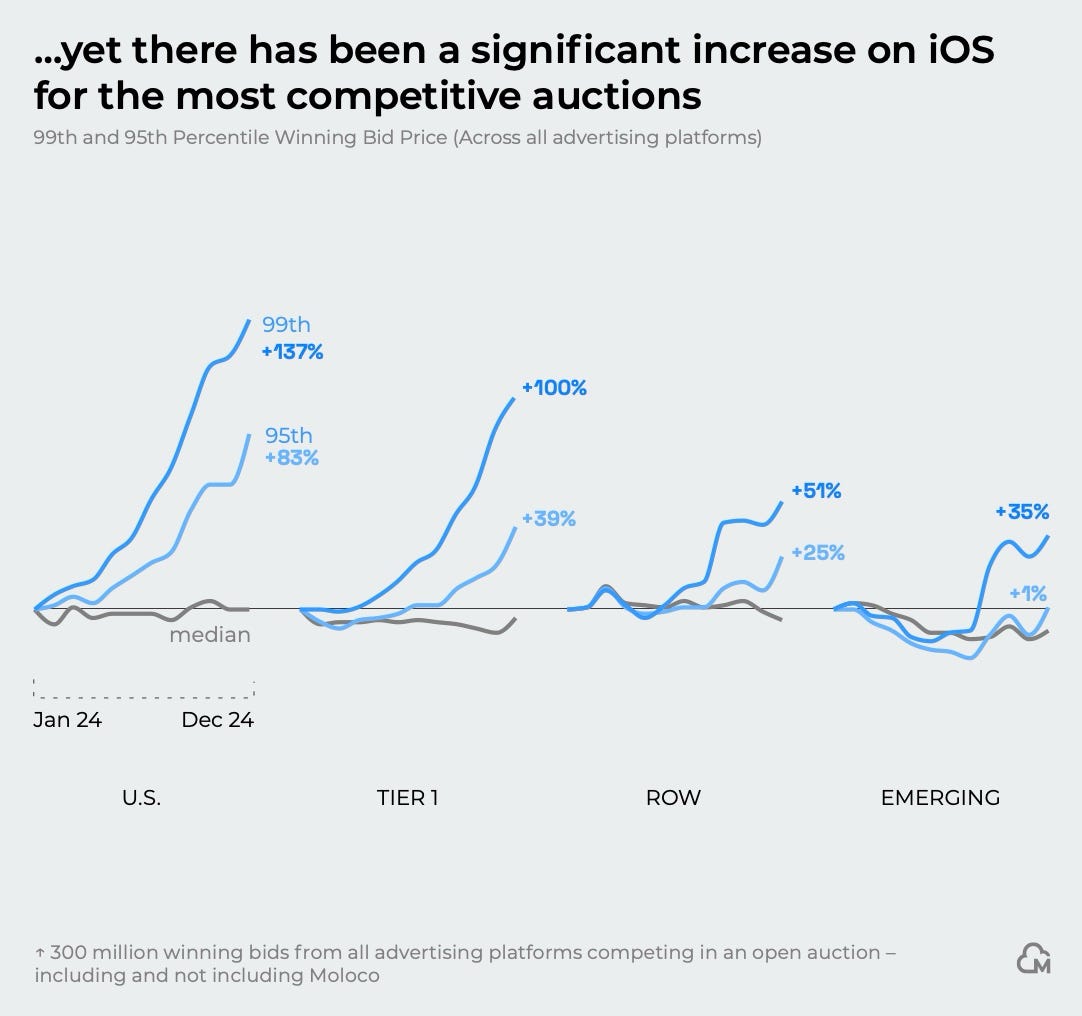

On iOS, there was slight cooling overall, but competition for top-paying users in the US (the top 5%) rose 80–140%.

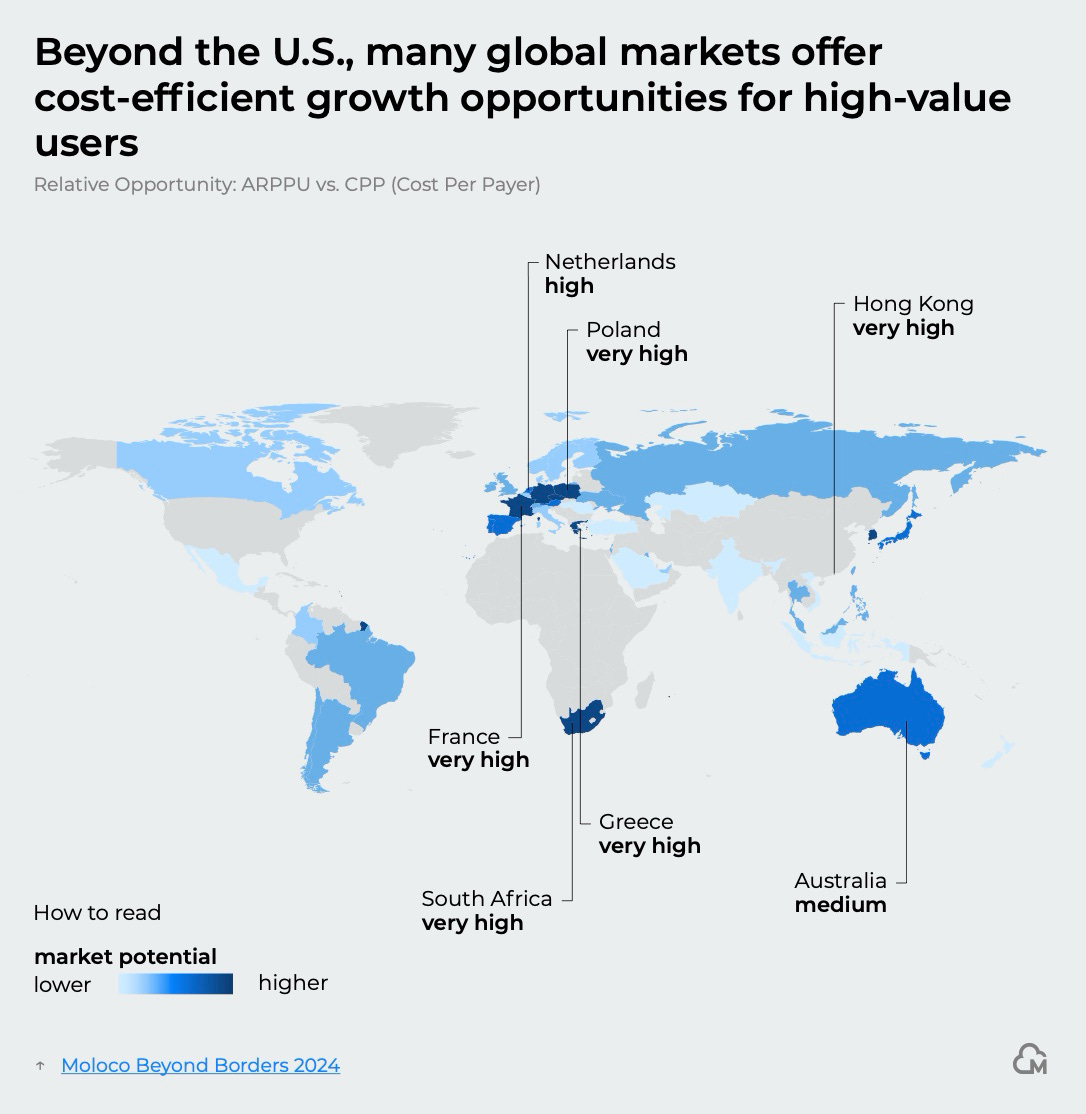

Moloco notes that with rising competition, many companies are shifting budgets to other regions. Poland, France, Greece, South Africa, and Hong Kong are highlighted as high-potential markets, based on ARPPU-to-CPP ratios (Cost Per Payer).

Marketing Strategies of Top Performers

Moloco analyzed the approach of the top-5 advertisers on the platform out of 100.

These advertisers achieve higher D7 retention compared to others (by as much as 10–20%). Their users spend more (+22%) and complete more repeat purchases (+10%).

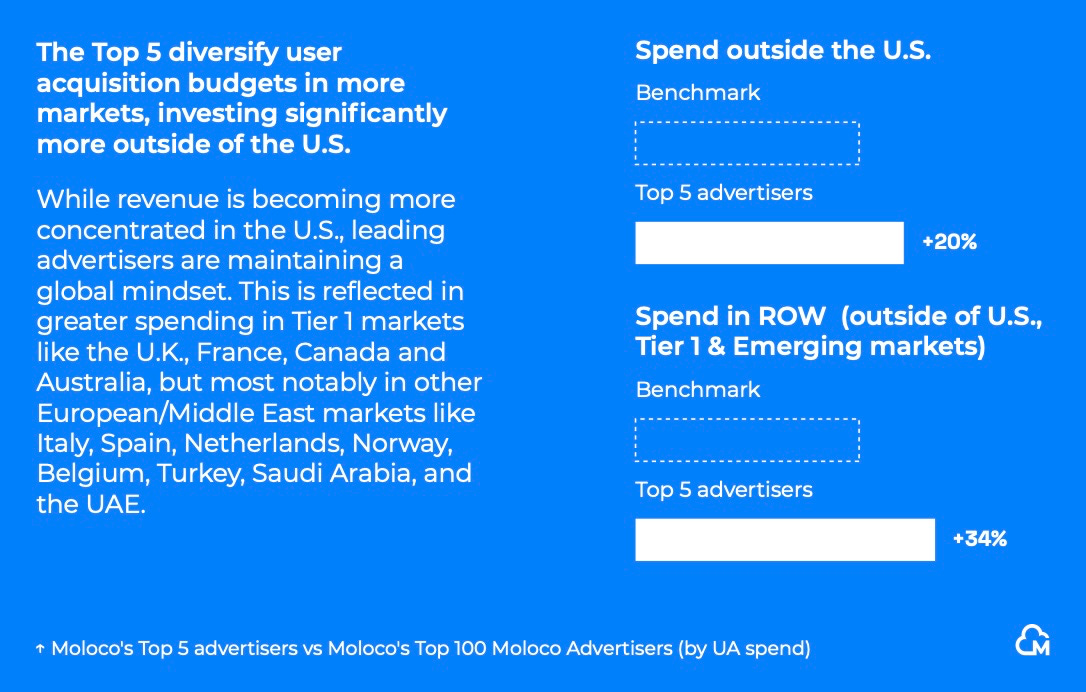

The top-5 invest more outside the US (+20%) and 34% more in RoW countries.

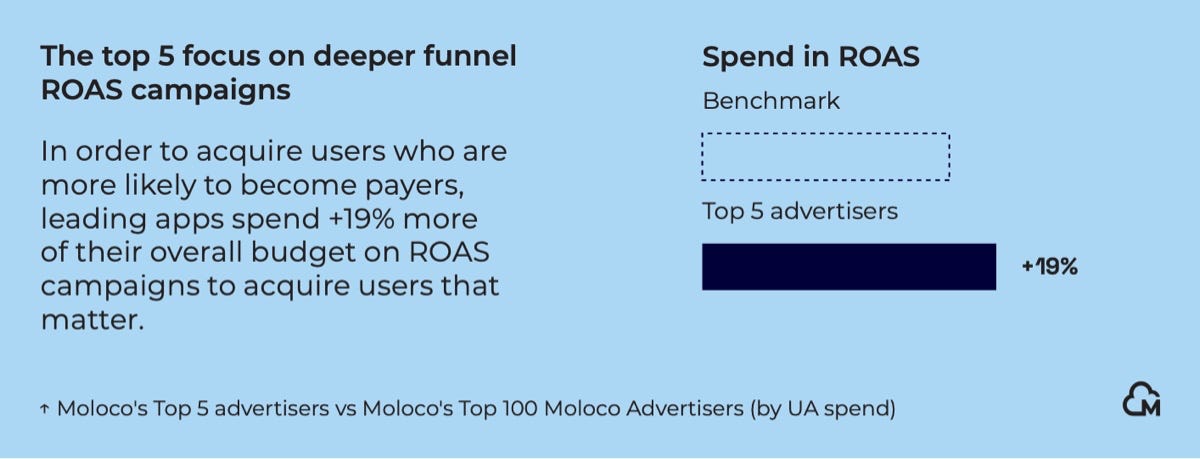

They spend 19% more on ROAS-optimized campaigns.

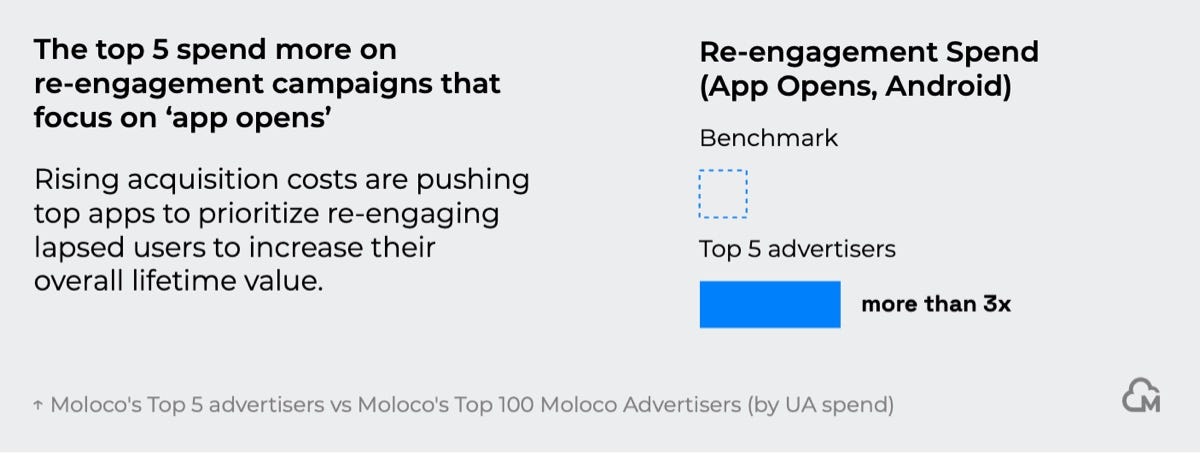

They are 3x more active in re-engagement campaigns, focusing on relaunching their games.

They spend over 5x more on campaigns with Playable creatives.