Weekly Gaming Reports Recap: September 16 - September 20 (2024)

Large AppMagic report of the casual mobile market; the European gaming market has shown growth in 2023 according to the officials.

Reports of the week:

VideoGamesEurope & EGDF - European Gaming Market in 2023

Games & Numbers (September 4 - September 17; 2024)

AppMagic: The casual games market in Tier-1 West countries grew in H1'24

VideoGamesEurope & EGDF - European Gaming Market in 2023

Data for the report provided by GSD, Gametrack, and EGDF.

European Market

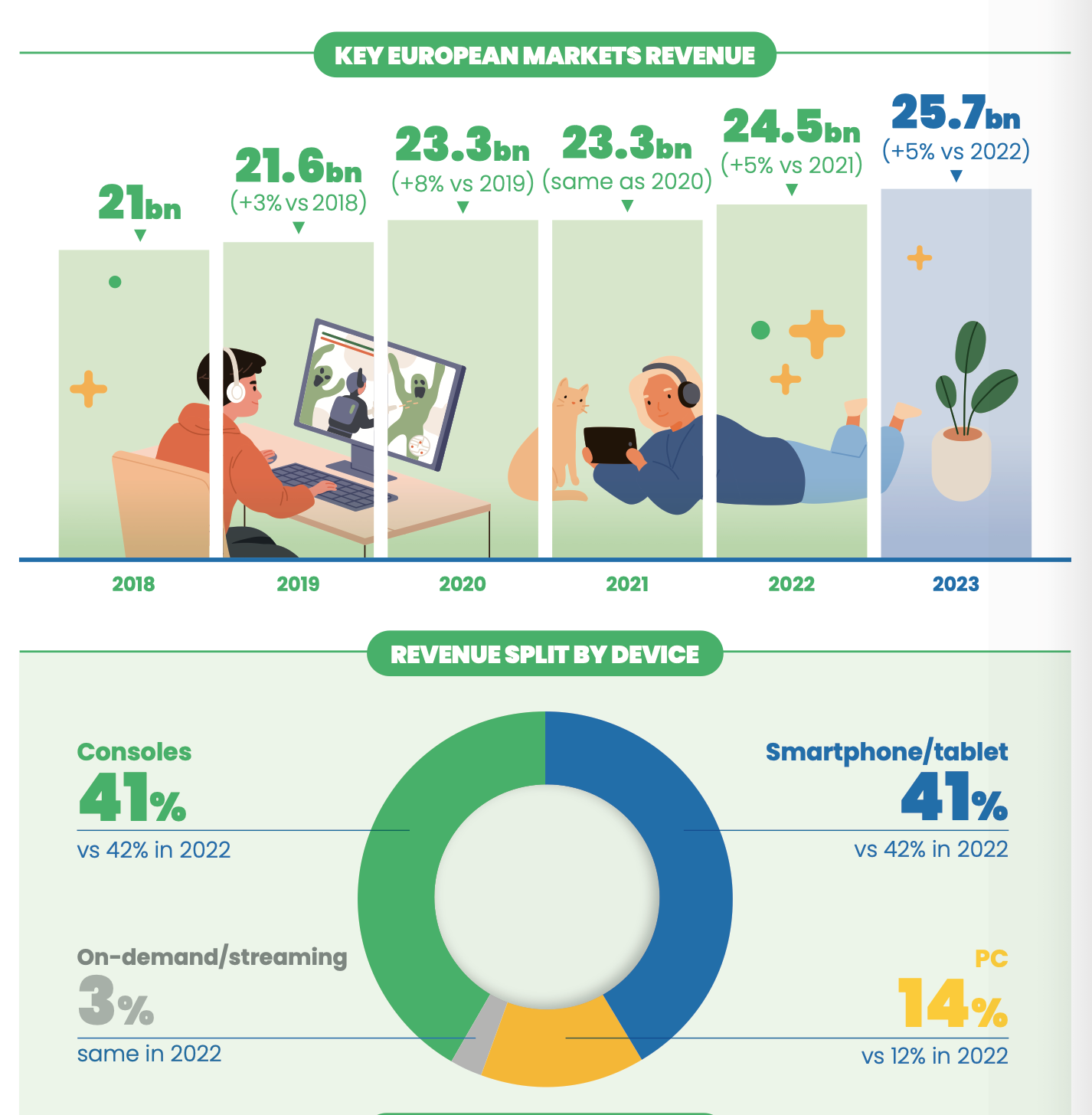

The European gaming market in 2023 earned €25.7 billion (5% more than last year).

41% of the revenue came from consoles (compared to 42% in 2022); 41% from mobile devices (after 42% in 2022); 14% from PC (compared to 12% in 2022); and 3% from streaming services (the same as in 2022).

The share of digital sales in Europe continues to grow. In 2023, the distribution was 85% digital and 15% physical sales.

The best-selling games in 2023 in Europe were EA Sports FC 24, Hogwarts Legacy, and Grand Theft Auto V.

European Gamers

53% of Europeans play video games. 75% of this number are adults. The average age of a gamer in Europe is 31.4 years. Compared to 2022, there are now more people aged 15 to 44 playing games.

The main devices for gaming are smartphones (68% compared to 69% in 2022), consoles (56% compared to 59% in 2022), and PCs (46% compared to 48% in 2022).

It is estimated that the number of players in the five largest European markets in 2023 was 124.4 million. This is less than in 2022 (126.5 million) and 2021 (124.8 million).

43.5% of European gamers are women. On average, they play 6.7 hours per week.

The average number of hours spent gaming per week in Europe is 8.9, and this figure has remained about the same since 2012. Europeans spend significantly less time on games than on social media (16.3 hours per week) and watching TV shows and series (24 hours per week).

Work in Europe

114,400 people work in the European gaming industry. 24.4% of employees are female, a 1.3% increase compared to 2022. For instance, in Sweden, 44% of all new hires in 2023 were women.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

31.2% of all employees hold technical positions; 23.5% are in creative roles (creative directors, game designers); 22.6% are in artistic roles; 14% are in management; and 8.7% work in publishing, business development, and other related activities.

Games & Numbers (September 4 - September 17; 2024)

PC/Console Games

Sales of Black Myth: Wukong surpassed 18 million copies in just two weeks. This was reported by Daniel Wu, one of the founders of Hero Games, the largest shareholder of the game's developers. According to him, the game's development cost $70 million and took 6 years.

Street Fighter 6 sales reached 4 million copies across all platforms. The total sales of the series as of the end of the first half of 2024 stand at 55 million.

Sales of Warhammer 40,000: Space Marine 2 are approaching 3 million copies, earning more than all other Warhammer universe games combined in 2023.

Harrison Froschke, Senior Product Manager at Blizzard Entertainment, revealed on his LinkedIn the revenue of Diablo IV. The game has surpassed $1 billion in earnings, with $150 million coming from microtransactions. Blizzard had officially reported that the game earned $666 million in its first 5 days of sales.

More than 1 million people have played Citizen Sleeper. The studio and publisher (Fellow Traveller) proudly shared this on their social media.

Released on August 15, shapez 2 has already sold 260,000 copies. In the first week, the game was purchased 70,500 times. It launched with 330,000 wishlist entries.

Earth Defence Force 6, released in September 2022, has sold 550,000 copies in two years.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

Mobile Games

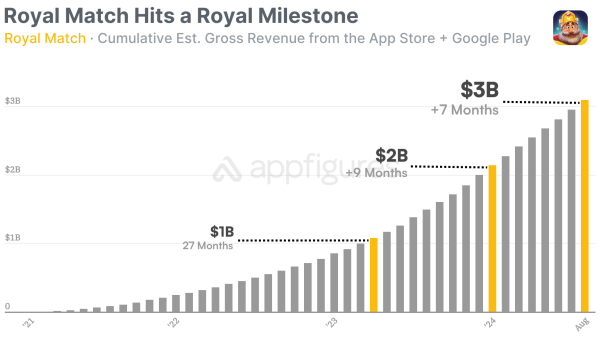

According to AppFigures, the gross revenue of Royal Match has reached $3 billion. The previous billion was achieved in January this year, and the game has surpassed 300 million downloads.

Sensor Tower reports that The Last War: Survival has earned over $900 million since its release. 30.4% of that amount came from the US, 22.9% from South Korea, and 12.4% from Japan. The RPD (revenue per download) in South Korea is $53, the highest among all countries. Additionally, The Last War: Survival accounts for 30% of the revenue from strategy games in South Korea.

In its first year, Monster Hunter Now has earned over $225 million, according to data from AppMagic.

Trivia Crack by Etermax has been downloaded more than 800 million times. It took 11 years to reach this milestone.

Using AppMagic, Mobilegamer.biz found that games from Netflix Games have been downloaded more than 210 million times. The leader is GTA: San Andreas with 25.2 million downloads.

Infinity Nikki by Infold Games has surpassed 14 million pre-registrations. The game, in addition to mobile platforms, will also be released on PlayStation 5 and PC.

AppMagic: The casual games market in Tier-1 West countries grew in H1'24

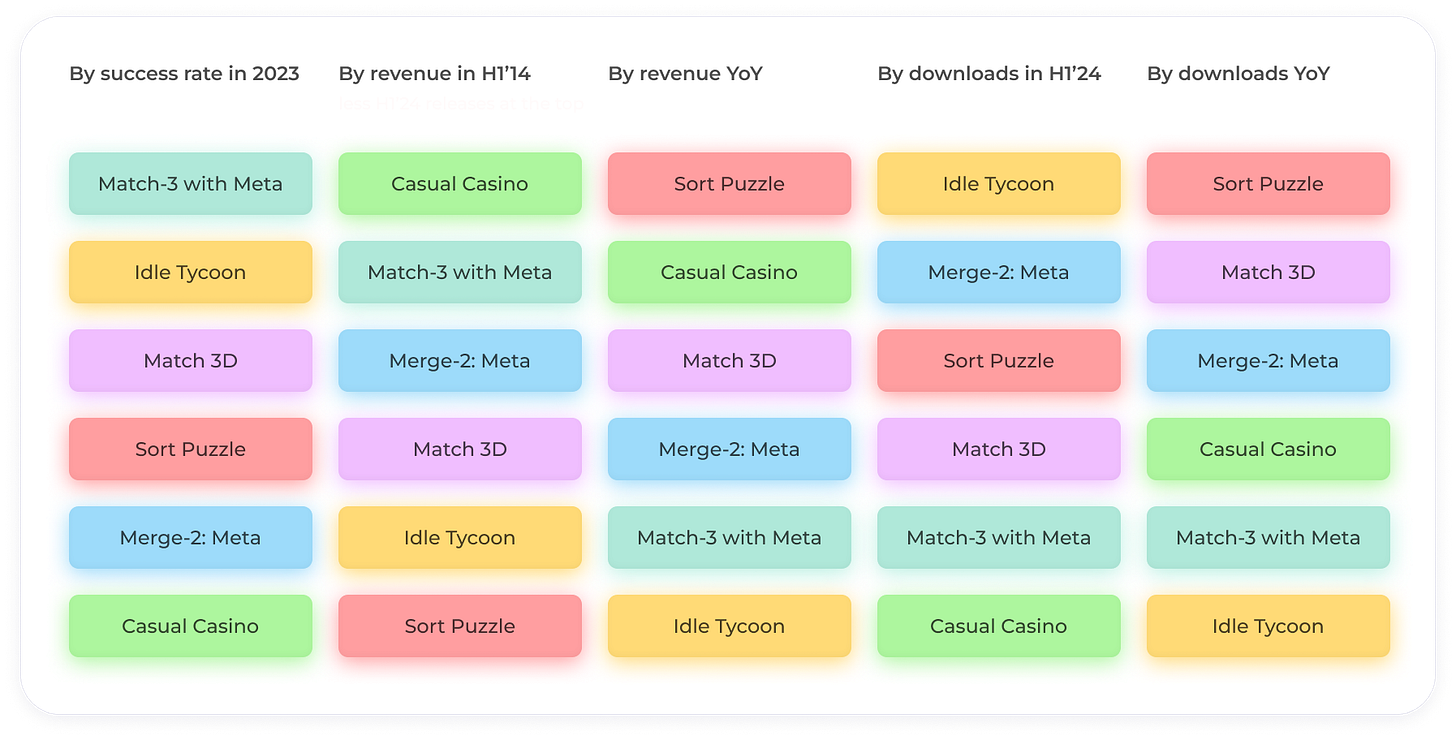

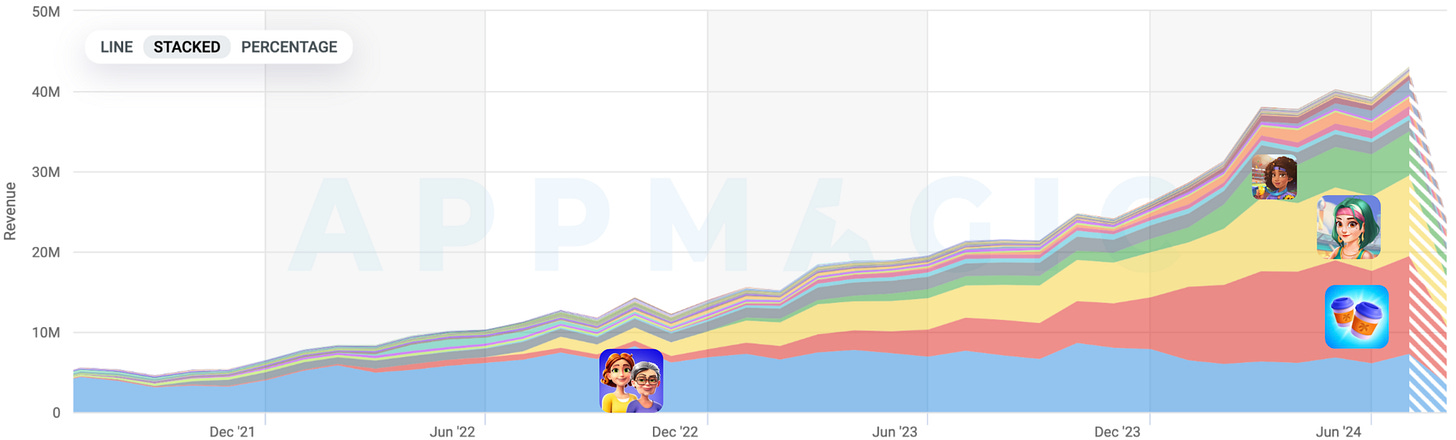

The analytical platform took a closer look at the genres Merge-2, Match-3, Match 3D, Sort Puzzle, Idle Tycoon, and Social Casino (Casual Casino according to AppMagic’s classification). The Tier-1 Western countries include the US, UK, Australia, Canada, France, and Germany.

Casual games in Tier-1 Western countries earned $7.2 billion in the first half of 2024. This is 11% more than in the first half of 2023 ($6.5 billion).

Match-3 with meta

In the first half of 2024, games in this genre earned $837 million (9% more than H1'23 - $768 million) in Tier-1 Western markets. However, downloads dropped by 23% – from 61 million in H1'23 to 47 million in H1'24.

24 new games in this genre were released in the first half of 2024. Two were successful, with a Success Rate of 8.3%.

❗️AppMagic considers a game successful if it earns more than $50,000 per month.

Revenue growth was largely driven by Royal Match, which is increasing its RPD in the West. Recently, new social features, new game mechanics, reworked old mechanics, and new events were added to the game.

❗️AppMagic analysts note that revenue growth despite declining downloads is a typical story for the modern casual market. Attracting players has become more challenging and expensive, so companies are focusing more on retention and monetizing existing users.

Among the highest-earning games in the genre, three new projects have emerged: Mystery Matters, Chrome Valley Customs, and Piggy Kingdom. However, Chrome Valley Customs is declining, and Forza Customs has not caught up to its competitors. On the other hand, Truck Star is performing well, but its results are not yet sufficient to enter the top 10 (currently earning $1.2 million a month and growing).

Merge-2 with meta

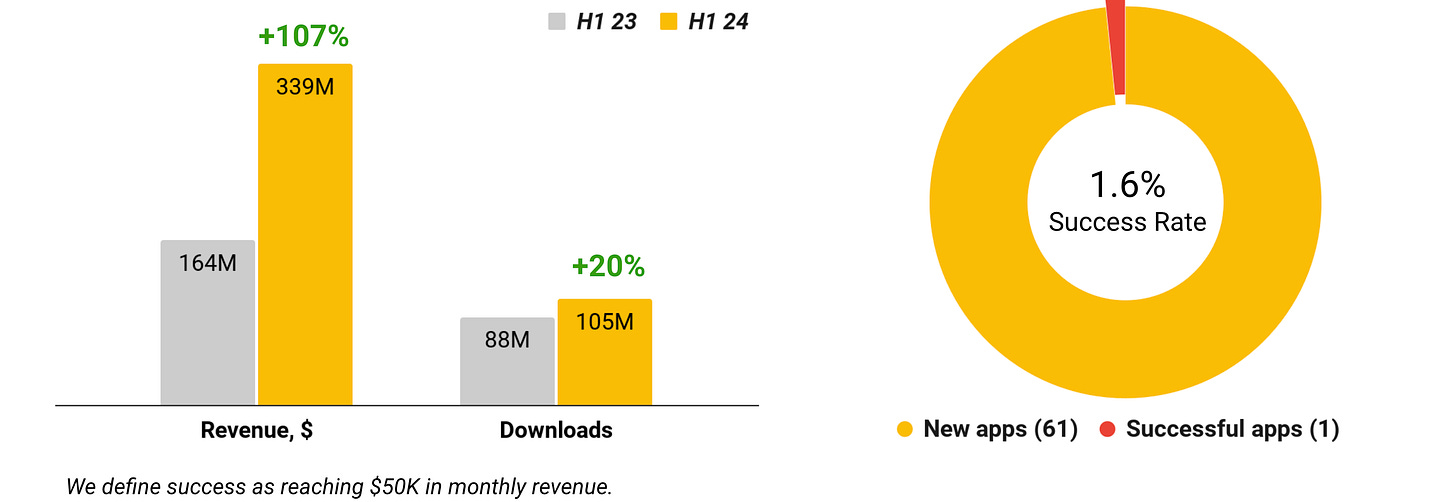

Revenue from projects in this genre increased by 107% in H1'24 – from $164 million last year to $339 million. Downloads grew by only 20% (from 88 million to 105 million).

❗️The main reason is that the revenue leaders are well-established games like Travel Town, Gossip Harbor, and Seaside Escape. For example, Travel Town saw a significant increase in both event frequency and variety in H1'24.

61 projects in this genre were released in H1'24, and only one game is earning more than $50,000 a month – Merge Prison: Hidden Puzzle from Hong Kong’s Blue Ultra Game. Interestingly, the game’s setting is a prison. The Success Rate for the genre is 1.6%. This is better than in all of 2023, during which no "successful" projects were released.

Three new projects entered the top 10 in the first half of the year: Adventure Island Merge, Road Trip: Royal Merge Games, and Taylor’s Secret: Merge Story. There were also changes at the top – Merge Mansion was dethroned from the first spot, for instance.

Consider subscribing to the GameDev Reports Premium tier to support the newsletter. Get access to the list of curated articles & archive of Gaming Reports that I’ve been collecting since 2020.

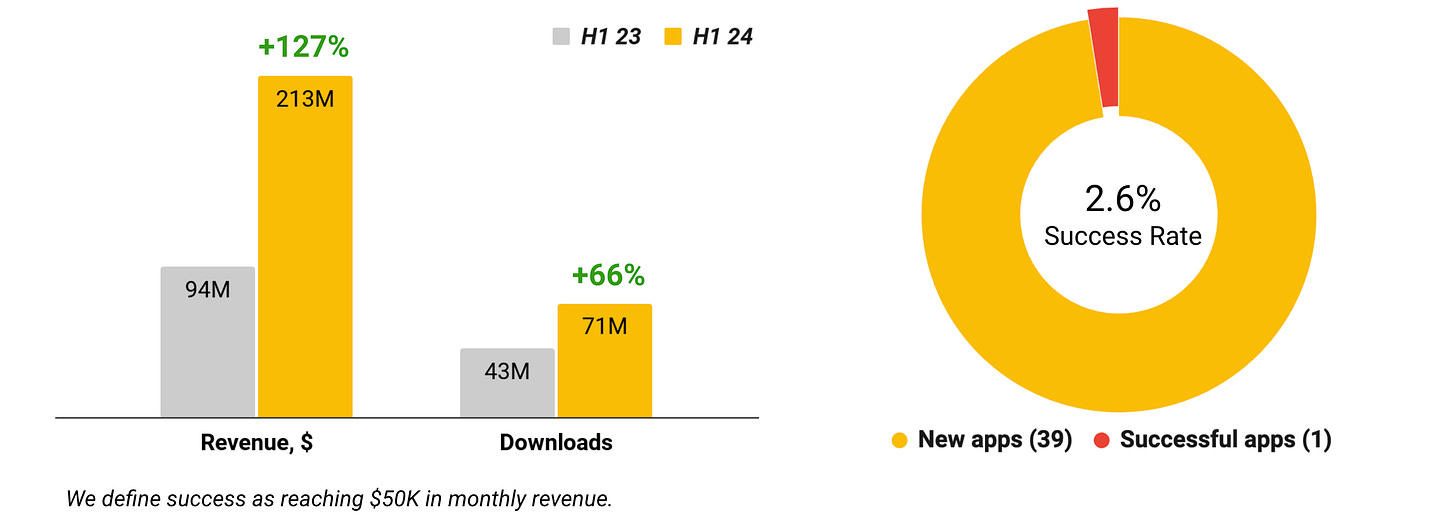

Match 3D

Revenue for the genre grew from $94 million in H1'23 to $213 million in H1'24, an increase of 127%. Downloads also grew significantly, by 66%, from 43 million to 71 million.

In H1'24, 39 new projects were released in the genre, one meeting the success criteria (Success Rate – 2.6%). This was Match Rush 3D: ASMR Care.

The genre’s growth is largely driven by new projects. The previous genre leader, Triple Match 3D, is stagnating. Match Factory! (over $100 million in lifetime revenue) and Happy Match Cafe (over $44 million in lifetime revenue) are growing. In the H1'24 top 10, in addition to Match Factory!, there are three other projects: Joy Match 3D, Match Frenzy – Test ASMR, and Match Villa: Makeup ASMR.

Idle Tycoon

Genre revenue fell from $157 million in H1'23 to $127 million in H1'24, a 19% decline. Downloads also dropped from 333 million to 266 million (-20% YoY). It’s important to note that H1'23 was the genre's peak, largely thanks to Frozen City.

In H1'24, 91 games were released, three of which crossed the $50,000-per-month revenue mark. Success Rate – 3.3%.

Only one new game entered the top 10: Idle Outpost: Business Game.

❗️AppMagic analysts note that Frozen City has entered the operational stage. Both downloads and overall revenue for the game have dropped significantly, but RPD continues to rise. In June 2024, the game earned $3.75 per acquired user.

According to AppMagic, the Idle Tycoon genre is overheated. There is intense competition, and leaders don’t stay at the top for long, while no one has yet managed to reach a significant revenue plateau.

Casual Casino (Social Casino)

This genre includes Coin Master, MONOPOLY GO!, Dice Dreams, and similar projects.

Genre revenue grew by 146% in H1'24 – to $984 million from $400 million the previous year. This is largely thanks to MONOPOLY GO!. Downloads grew by 3% – from 37 million to 38 million.

In the first half of 2024, 11 games were released in the genre. None have yet reached the success criteria.

MONOPOLY GO! accounted for 63% of the genre’s revenue in H1'24, Coin Master for 24%, and Dice Dreams for 9%. The remaining 4% was shared among other games. One newcomer to the top 10 in the first half of the year is Age of Coins: Master of Spins.

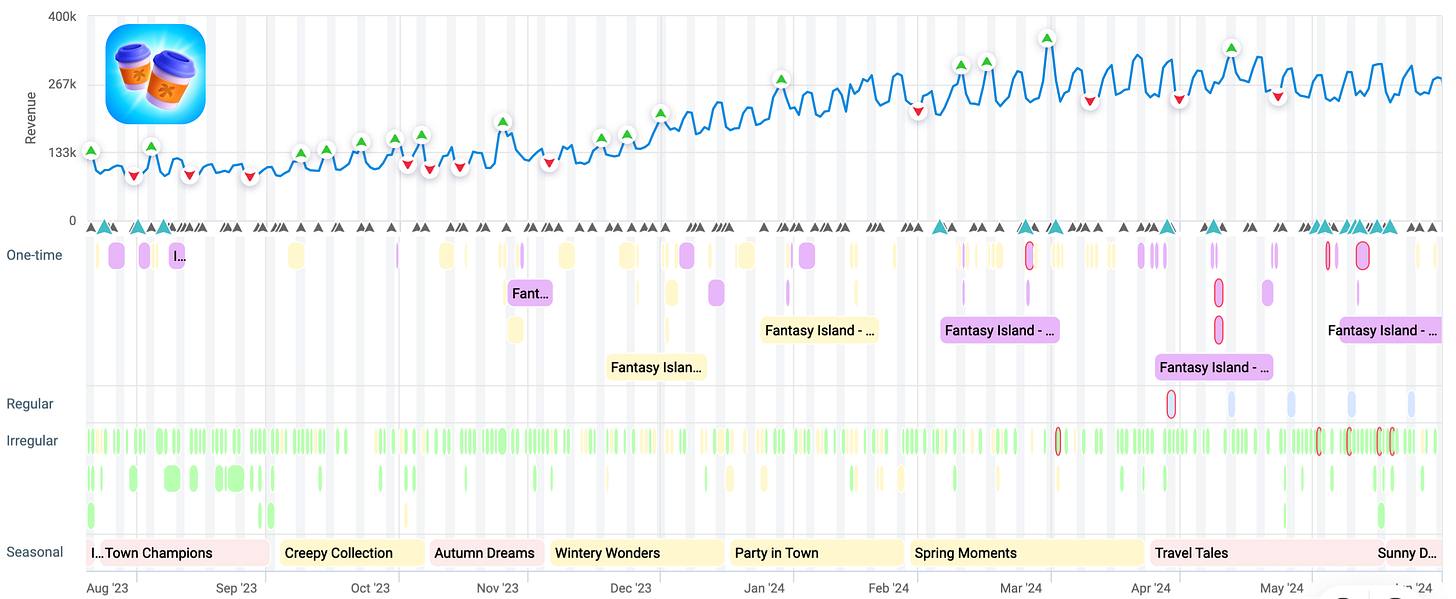

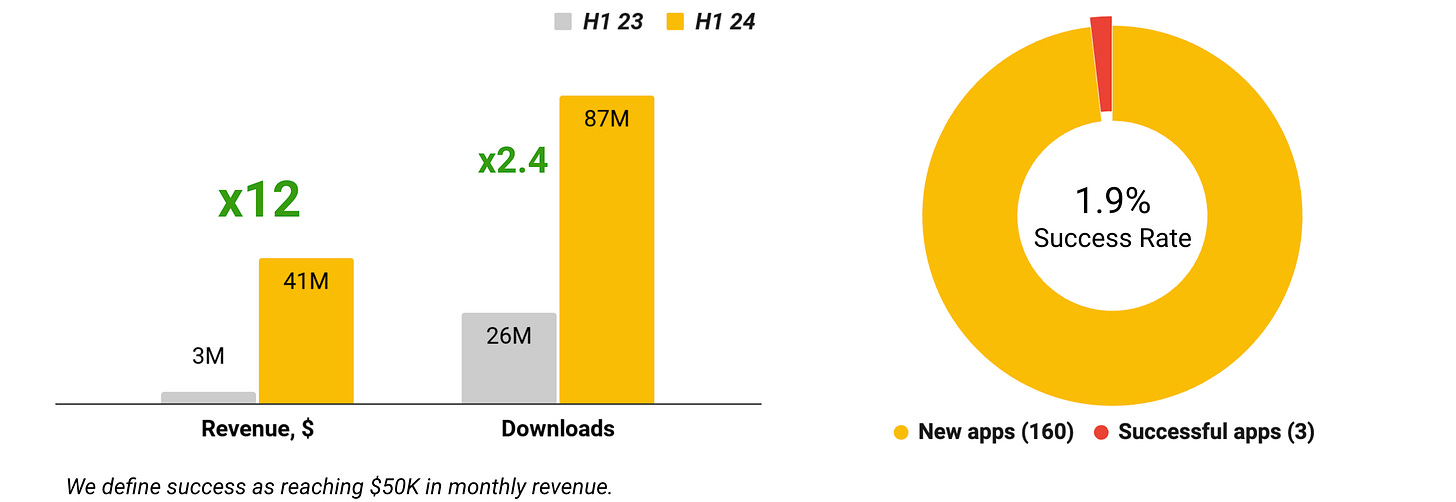

Sort Puzzle

Genre revenue grew 12-fold in H1'24 – from $3 million to $41 million. Downloads increased 2.4 times – from 26 million to 87 million.

160 new games were released in the genre in the first half of the year, three of which crossed the $50,000-per-month revenue mark. Success Rate – 1.9%.

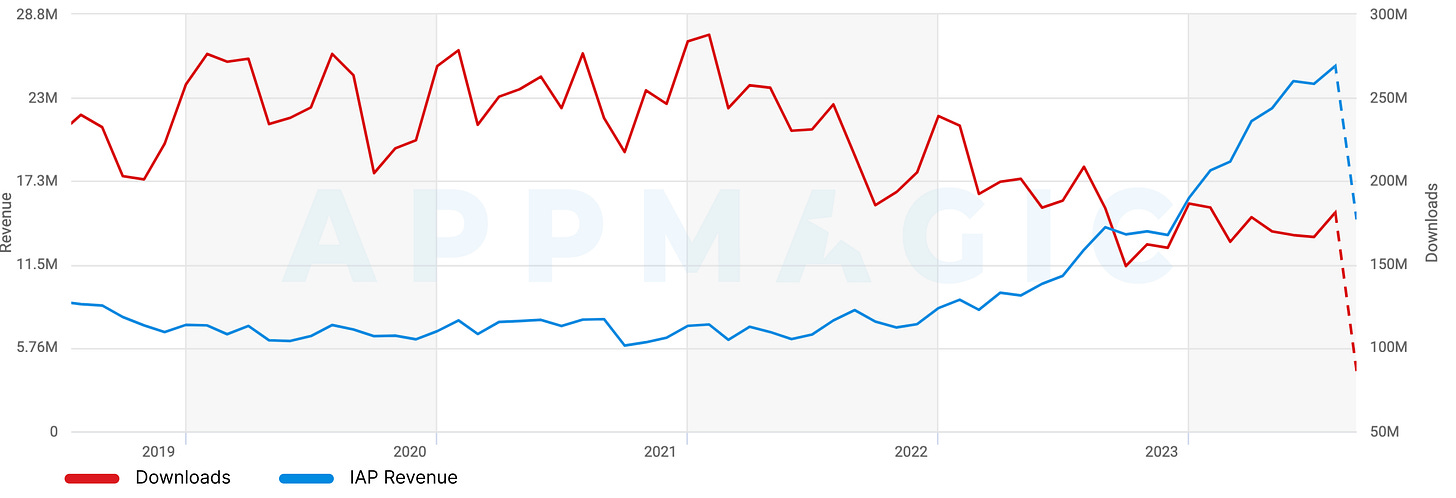

The genre emerged relatively recently. In H1'24, seven new projects entered the top 10. The genre is at the intersection of hyper-casual and casual genres, and the data shows that downloads have started to fall while IAP (In-App Purchase) revenue has sharply increased.