InvestGame: Gaming Investments in 2023

The comprehensive report also covers the AI, blockchain, and eSports transactions.

Private Investments

In 2023, 403 deals were made totaling $2.7 billion. This marks a 4-fold decrease in volume compared to the previous year and a 36% decrease in the number of deals.

Speaking specifically about developers and publishers, in 2023, there were 136 deals (+23.6% compared to 2022) in the early stages totaling $511 million (-70% compared to 2022).

In later rounds, there were 12 deals in 2023 (30% less than in 2022) totaling $367 million (2.4 times less than in 2022). This also covers only deals with developers and publishers.

Moreover, in January 2024 alone, two major deals occurred - a $1.5 billion transaction between Disney and Epic Games; and a $110 million round for Build a Rocket Boy.

InvestGame experts note that in 2024, we may see an increase in deals in later rounds, as well as the closure of companies that received investments in 2020-2022 (companies that fail to show results and/or cannot attract additional funding due to high valuations from previous rounds).

Corporate investment funds are more inclined to engage in joint deals with VC funds, which helps reduce financial risks.

The USA, Western Europe, Asia, and the MENAT region are the most active markets in terms of VC deals.

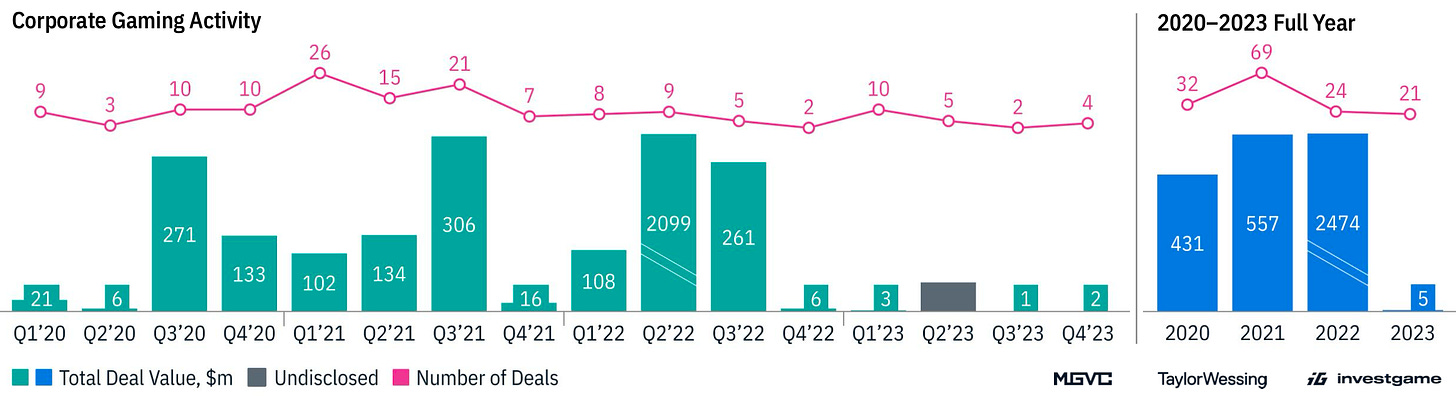

M&A

Taking into account the Microsoft and Activision Blizzard deal, the volume of M&A deals in 2023 amounted to $78.2 billion. This is almost twice the amount in 2022 ($40.8 billion). Excluding this deal, there were M&A transactions worth $9.5 billion in 2023, 4.3 times less than the previous year. The number of deals dropped from 231 in 2022 to 121 in 2023.

InvestGame's forecast for 2024 is an increase in business M&A activity. For instance, a deal has already occurred between CVC and Haveli to acquire Jagex.

Overall, large companies ended 2023 confidently, setting an optimistic tone. However, recession risks, platform regulations, and state interventions (such as laws on loot boxes) could impede growth.

Public Offerings

In 2020-2021, the gaming market witnessed a boom in public offerings amid active industry growth. However, in 2022, the situation changed drastically due to macroeconomic crises and corrections. Only 23 companies conducted public offerings, raising a total of $3.6 billion (almost 7 times less than in 2021).

Signs of improvement appeared in 2023. There were 43 public offerings (almost double the previous year) totaling $4.2 billion (+16% compared to 2022).

InvestGame believes that companies are increasingly considering public offerings. There's likely pent-up demand that could materialize if the industry situation improves.

AI Investments

Since 2020, there hasn't been a single quarter without deals with companies specializing in AI. However, the number of deals in 2023 doubled - 57 compared to 28 in 2022. Yet, the total investment volume hardly increased - $545 million in 2023 compared to $519 million in 2022. This refers specifically to AI solutions for games.

Investments in Platforms and Technologies

The number of deals in technological and platform solutions plummeted by 40% in 2023 to 82. Investments in platforms remained roughly the same ($0.6 billion compared to $0.7 billion in 2022), while investments in technological solutions plummeted 16 times from $7.9 billion in 2022 to $0.5 billion in 2023.

It's worth noting that the Unity merger with ironSource ($4.4 billion) occurred in 2022.

InvestGame analysts believe that the consolidation of the technical gaming market is nearing its end.

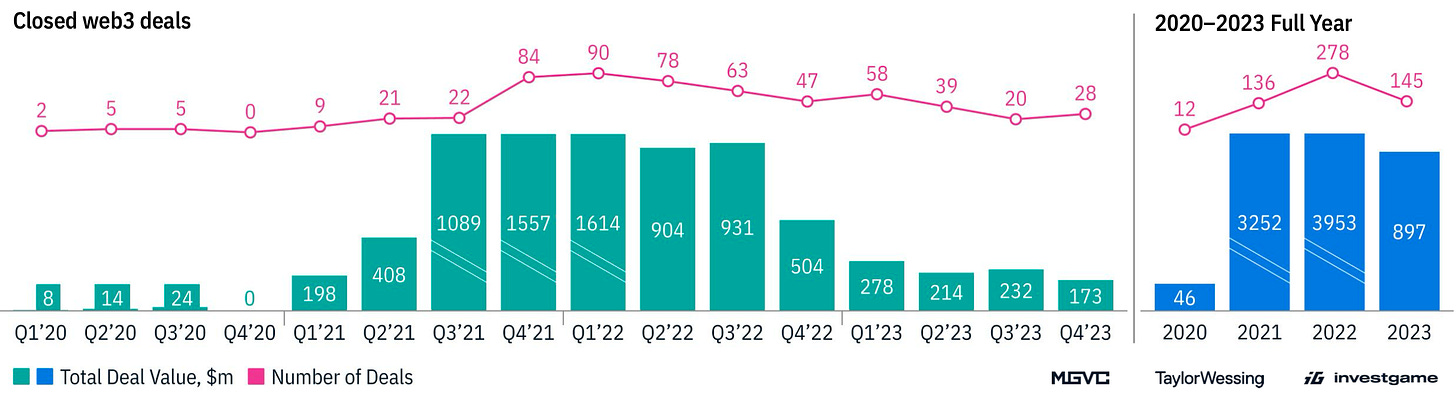

Blockchain Investments

The number of deals nearly halved from 278 in 2022 to 145 in 2023. The investment volume dropped almost 4.5 times from $3.95 billion in 2022 to $0.9 billion in 2023.

Nevertheless, InvestGame notes a positive trend. The market in 2023 is significantly higher than in 2020. Overall, the gaming Web3 market is becoming niche, with fewer developers, investors, and smaller checks.

Esports Investments

The number of investments in esports decreased by 20% in 2023 (37 deals). The investment volume dropped by 4.8 times to $471 million.

Despite esports existing for a long time, companies still struggle to establish an effective business model for fully monetizing their audience.

2023 was indeed a bad year for the video game business in general, a ton of layoffs and a decrease on investment.

Given that the number of total deals isn't drastically different. What would you attribute as the main reason for the reduced total value of deals? Is it just a lower perception of potential ROI on game projects in a post COVID industry?